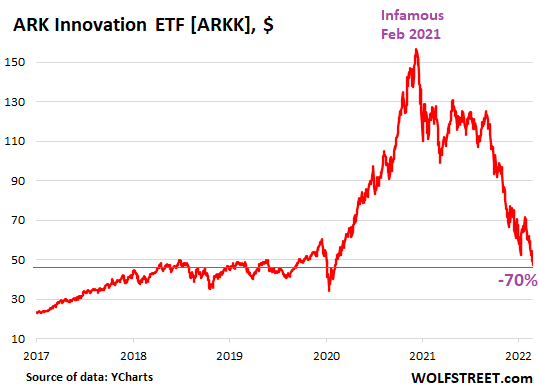

But the mayhem started beneath the surface in Feb 2021.

By Wolf Richter for WOLF STREET.

Stocks on Friday turned Thursday’s blistering beautiful rally into a miserable dead-cat bounce. And it put some marks into the sand.

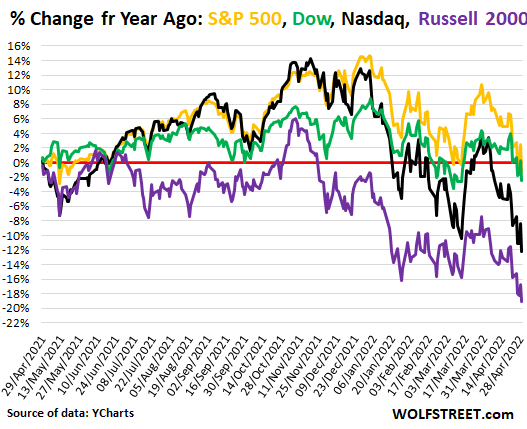

The S&P 500 Index dropped 3.6%, the worst drop since June 2020. The index is down 14% from its 52-week high and has turned red year-over-year (-1.2%). For the first four months this year, the index is down 13.3%, the third-crappiest beginning of a year, after 1932 (-28%) and 1939 (-17%).

The real fireworks took place at the Nasdaq, whose composite index plunged 4.2% and is now down 23.9% from the its intraday high in November, and down 11.7% year-over-year. For the month of April, it dropped 13.5%, the worst month since October 2008, which was the month following the Lehman bankruptcy.

The Dow Industrial Average dropped 2.8% today and is down 10.7% from its high. And it’s now also red for the past 12 months, at -2.6% year-over-year.

The Russel 2000 fell 2.8% today, is down 24.2% from its high last November, and is now 17.7% in the hole for the 12-month period.

This chart shows the percentage change of the four indices over the past 12 months since April 29, 2021, with all four indices ending today below the red line (data via YCharts):

The biggest stocks are falling apart.

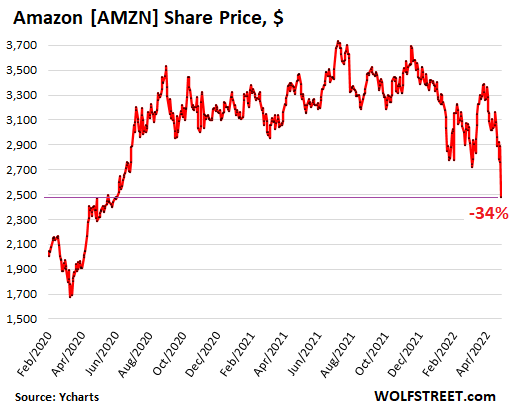

Today’s hero was Amazon [AMZN], which plunged 14% today. Last night, it had reported a big loss, slowest revenue growth since the dotcom bust, and rip-roaring expenses, topped off by nauseating guidance. It is now down 34% from its closing high in July 2021, despite a huge bout of financial engineering announced in March: a 20-for-1 stock split and a massive share-buyback program, just now when it lost money:

The biggest stocks that were able, by their sheer heft, to cover up the mayhem beneath the surface after February 2021 have now let go.

I threw in the N’s because they were once part of the infamous FANGMAN stocks., percent change from high, and date of closing high:

| $ today | % today | % from closing high | Date of closing high | |

| Netflix | 190.95 | -4.6% | -72.5% | 29-Oct-21 |

| Meta | 200.47 | -2.6% | -48.0% | 1-Sep-21 |

| NVIDIA | 186.40 | -6.2% | -44.5% | 29-Nov-21 |

| Amazon | 2,485.63 | -14.1% | -34.3% | 13-Jul-21 |

| Tesla | 870.76 | -0.8% | -30.0% | 4-Nov-21 |

| Alphabet | 2,309.00 | -3.7% | -24.4% | 2-Feb-22 |

| Microsoft | 277.52 | -4.2% | -20.6% | 22-Nov-21 |

| Apple | 157.65 | -3.7% | -13.8% | 4-Jan-22 |

As a sign of our times, Microsoft peaked in November to the day when CEO Satya Nadella dumped half of his Microsoft shares with totally impressive prescience, and it too has now let go, and he sure knew when to dump the shares into someone else’s lap.

The mayhem beneath the surface started in Feb 2021.

The market started falling apart beneath the surface in February 2021, and soon there was utter mayhem beneath the surface, with dozens and dozens of IPO stocks and SPAC stocks and other highfliers getting systematically and brutally wiped out by 70%, 80%, 90% or more from their ridiculously overvalued peaks.

From stocks that had recently gone public to stocks that had been around for a while but had been discovered by the stock jockeys during the pandemic were taken out the back and shot – I covered some of them in my Imploded Stocks. This is the dotcom bust all over again, only much bigger and much worse.

But the big ones kept the show going and covered up the mayhem beneath the surface. Then last Fall, the big ones started giving in, one after the other, starting with Facebook that tried to divert attention from its problems by uselessly changing its name to Meta. And one after the other they began to wobble, stumble, and plunge.

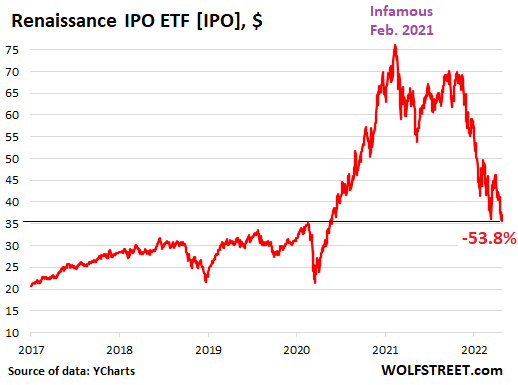

So this has been in the works for over a year, and it took out the smaller most speculative and most ridiculously overblown highfliers first, so well summarized in the ARK Innovation ETF [ARKK] and the Renaissance IPO ETF [IPO].

The ARK Innovation ETF, which tracks the biggest hype-and-hoopla stocks, dropped 3.6% today and is down 70% from its high on February 16, 2021. Yes, that February, when it all started coming apart:

And the IPO ETF fell 3.9% today and is down 53.8% from its peak on February 16, 2021, yup, that one.

But “Nothing Goes to Heck in a Straight Line.”

That’s the WOLF STREET dictum. There will be a bounce. Dip buying is alive and well when the price is low enough. Dip buyers that didn’t get out of the way fast enough this year got carried out on stretchers. Turns out, dip buying profitably is a lot harder in a down market than in a relentless bull market.

Thursday’s huge rally lasted one trading day and ended at 4 PM, and afterhours it was already a mess, following Amazon’s earnings report. Thursday was a classic dead-cat bounce, powered by widespread short covering and dip buying. And dip buyers, if they weren’t able to sell yesterday, got knocked around today.

Nevertheless, they will still be trying to buy the dip and drive prices up for a little while, and it can happen any day because nothing goes to heck in a straight line.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“But the mayhem started beneath the surface in Feb 2021. ARKK now -70%.”

Is Cathie Woodshed even showing her face in public anymore?

Yes. She said she’s right, and the rest of the world doesn’t get it.

I hate it when reality doesn’t agree with me too.

She’s a business genius. She figured out a product to sell to people with no knowledge of markets or economics and milked it. Not commenting on the ethics but I’m pretty sure she knows exactly what she is doing

I didn’t know who you were referring to, but I did a keyword search with her name along with bitcoin and learned ALL I need to know about her investment advice:

Cathie Wood Says Bitcoin is Worth $1 Million – April 20, 2022

@Winston – In 2020, when oil was $40 she said oil was going to drop from $40 to $12.

@SilentC

“She figured out a product to sell to people with no knowledge of markets or economics and milked it.”

That product is social media.

No wonder she is buddy buddy with E.Musk. They both can sell ice to eskimos just by tweeting.

I take it Cathie Woodshed is fairly young and has never felt or understood the power of inflation, (her investors are understanding it now). The sad thing for them is that the power of inflation is really just starting……

It’s only a short while ago that I posted something like this……though I can’t remember the exact words ….ha ha

You can do without Apple and buy a cheaper phone, You can live without microsoft upgrades or anything new that it contains, you can give up netflix (and now Amazon Prime). You are unlikely to afford a new electric or an ice car for a while (so there goes Nvidia), you can easily dump google search and go for something like Startpage or whatever to avoid being tracked, You can dump Tesla, as you can buy good Chinese made electric cars, like the MG, doing the same distance or more, for half the price (but they may also be too much for most people, including me, at the moment)

and finally..you can give up using Amazon (bit of a prophet there lol)……

and that is the power of inflation.

I take it Cathie Woodshed is fairly young and has never felt or understood the power of inflation

> She is 66. She absolutely was of age in the 70s and graduated from USC in 1981. Maybe he only thing she learned from 1970s California was the power of cults.

Anyone else notice that she speaks with a similarly low, bass loaded, voice of conviction as Elizabeth Holmes..?

phleep

Ha ha, is she the same age as me….? Well I remember in 1974 as a pint of beer went up nearly 100% in one year…these are lessons you remember….maybe she had servants who went shopping for her so she didn’t notice the price rise??………. lol

Loose money leading to pricy beer and Cathie Wood. Love’s little nightmare, like.

Sounds like Google has the best prospects of the bunch?

Just last month on March 1st, she bought 9.4 million dollars worth of Shopify shares for close to 700 dollars a share. Shopfiy is worth 426 dollars a share today. Whoopsie.

ARKK is helping people build generational wealth by transferring moolah from ARKK’s investors to ARKK’s trading counterparts.

Alex Vieira is the investor who initially pumped that stock through his artificial intelligence computer program for trading. He was the one who initially pumped Beyond Meat. With his money Shopify can make massive swings up or down if he’s trading it. Canadians are worse than broke and if our housing market collapses in price no one will have any money for anything. Our housing market is just entering the freefall stage.

@SocalJim –

Viewing ARKK as a “distribution” tool – a way for elites to offload their turd stocks to noobs – that theory explains a lot!

There are other such vehicles out there – the IPO and SPAC frenzy.

Whenever you’re buying shares, one should ask “why is the other person selling?”, as well as “who will buy these from me later, and why would they want to pay more than me?”

66? She’s a merely a fall chicken

In her defense ARKK is 128% higher than it was seven years ago… which is not bad. A few dividends along the way as well.

People who bought at the beginning (in 2014) or any time up until the pandemic started haven’t lost any money in ARKK .

That said… professional investment advisors aren’t supposed to be cheerleaders. They are supposed to tell us what to get out of as well as what to get into.

SpencerG,

“In her defense ARKK is 128% higher than it was seven years ago…”

Yes, the sell-off is still very young. So be patient. There is a good chance that a number of her current holdings are going to zero.

Here’s a quick refresher on averages. Say a person makes the following return year after year: 1500%, 2000%, 5000%, 6000%, -100% for an average of 2880% a year, should you invest with him/her?

The answer is probably no. Why? See that -100% at the end? That means he/she has lost all the moolah.

But if you were to multiply the stock price times the invested capital, you would see she lost way more money than she every earned.

She got into a huge bull run and thought she was a genius. Sounds more like an amateur.

@gametv

Any gambling monkey can pass himself as stock picking genius in a crazy doped bull market.

Kathie should run for the senate, she’d fit right in.

Fuel for the next bear market rally.

Pure wisdom dispensed daily.

There is little doubt that the markets are going lower.

There are times when it can be profitable to babysit the markets.

I’m guessing none of her “investors” recognize a mania.

It would also help if the theme of the fund was actually right. None of the firms I recall in the fund are “disruptors”.

More like a bag of hot air.

She was on CNBC yesterday defending buying more telecom. Who knows, it may be a great company in the long run, but there’s a lot of blue water before you can swim to the island.

I find it pathetic that any media source reports on what been going on in the stock market as a collapse. Most stocks in this country are over valued by a factor of 10. Any company that has a PE ration greater than 5 is overvalued. The fact that any company has profits which allow them to advertise tells you that we as consumers must demand with our wallets all corporations reduce their prices to the point where they have nothing left over after expenses to pay for 1 dollar of advertising. Wake me when every stock in the market is less than they were in December of 2009. Everything since then has been artificially inflated and must be allowed to fall back to that price and stay there for decades.

Sounds like she has a mental illness instead of an opinion on the market.

In case you didn’t know, she is a Christian fundamentalist. The claims that her funds are “God’s work” and that God helps her make the stock choices.

Must be the 1st testament God who has no qualm dealing out punishments 🌩

You always know it’s a con when they start talking religion.

So true!

I wonder if the religion stuff is a result of all the drugs she probably took while in California during the drug frenzy in college at that time.

She probably saw God a few times back then.

I was on Haight St spr66-spr67. Naturally everyone wanted to see God, but I never did. I did have a few of what we called “rebirths”, though. A good one could last 3 days, most were shorter. And it was the bunch that got terrified from their trips that turned to Jesus or one of many other cults.

You just had to accept whatever your mind conjured up as being ok. That’s where Keasey got the phrase “acid test”.

At the apex of corners 3 & 4 of the last lap of the Kilometer Time Trial on the velodrome, “God” appears. Problem is, you’re seeing stars by then and the only focus is keeping on the black line and bringing it home.

When you get it right, that’s how it’s supposed to be.

Lmao

“God’s work” “God helps her pick stocks”

Would make TOTAL sense to any Calvinist, whether they knew enough to realize they were a Calvinist or not….and that’s the real problem with that worldview.

Bill Hwang from Archegos (which blew up spectacularly last year) is also another fervent believer in Divine Investing.

I believe someone said this of Michael Milken (the junk bond guru): “he could have been a preacher”.

Men of God and Men of Money make strange company.

They should not mix – Jesus and the whip in the Temple area

What does the future hold? I’m not buying any dips for quite a while.

Don’t know anything about buying any “dips”…

But I would suspect relatively soon, you could rent them pretty cheap by the hour….

Markets are seriously in denial to think things will be back to “normal” soon. The fed hasn’t even started attacking inflation. Russia is gonna be bogged down in Ukraine for 20 years. This should now be assumed with their statement that Ukraine is riddled with WMDs that they will have to carefully hunt down.

You don’t fight the fed. That’s supposed to be rule 1 of investing. Even with major crashes in 2001 and 2009, with a housing crash to boot — few seem to remember the pain they felt.

The speculators who said the FED would never raise are now betting on – or should I say praying for – a Powell pivot, which is kind of like Charlie Brown waiting for The Great Pumpkin.

Lucy keeps offering the football and Charlie keeps trying to kick it and winding up on his arse.

A Powell put is dependent on the ability of the Fed to do QE again . When inflation is running so high, QT not QE is likely .

Is the Fed unhappy that some of the fluff has been taken out of the market . No.

If the market really crashed , there would be a good chance that the Fed wound step in, but that is nowhere near current levels

Hard to know for sure…the Fed folded like a dollar store lawn chair after the mkt lost 20% in the Fall of 2018 (10 yr Treasuries had barely topped 3% then).

In a lot of ways the Fed has made itself into a one trick pony (this pony has one trick) and despite inflation now, it is hard to be confident of the Fed showing backbone/adaptability today…after 20 yrs of demonstrating their opposite.

I wouldn’t be surprised if the fed changes its inflation target to something higher so they can avoid interest rate hike or qt. They’ll come up with some bs about the transition to green energy, post Covid life, growing population, etc as a reason for the “natural” rate f inflation needing to be well above two percent.

“You don’t fight the fed.”

OK to fight the BOJ who said they will ignore economic realities and buy all the ten years necessary to keep the rate at .25%?

Central bankers ignore economic realities. (transitory?) And when they do, you can call they wrong, and act accordingly. IMO.

The Fed is the cause of all the speculation/insanity. Cranking out money and credit beyond the growth of the economy is criminal.

“Too Big to Fail” would have been a great marketing term for the Dinosaurs when the meteor hit.

So where can we expect a bottom? Dow 30,000? What will the signs be that we have hit it? Once we have hit it and know, how much of the gains following said bottom will we have already missed?

It’s not the bottom you have to worry about but bumping along the bottom for thirty years like Japan…..

“Bottom?” This thing is just getting started. How about DOW 7,500?

Depends how far in the future.

Ultimately, a lot lower than 7500, though it may be in price adjusted terms.

Look at the S&P 500. A 14% decline isn’t anything out of the ordinary historically but the dividend yield on the SPY ETF today is 1.41%.

If it were double, it would still be historically low, compared to what is actually normal pre-late 1990’s.

Low interest rates (the bond mania) have only been one of many rationalizations for the stock market mania, all under “it’s different this time”.

With rising interest rates, “investors” are going to “break-up” with TINA. The romance is on the way out.

The presumed end of the bond bull market means that interest rates are on a multi-decade path to blow right past the 1981 high.

Since the actual long-term fundamentals totally suck, there won’t be anywhere near enough real growth for dividends to be even close to competitive with much higher rates.

This is only one many negative fundamentals coming up. The rest have been in plain sight but ignored for years because that’s what happens in manias.

All the shortcuts and free-rides taking have piled up like a mass of junk in a car’s back seat, and suddenly the brakes are hit and all that stuff comes cascading chaotically into the front seat ….

Agreed! We’ve got to find that lurking recession before we start worrying about a bottom. Let JPowell get the funds rate up to at least 2%, let him run off about $800B from his balance sheet, and have housing decline 5-10%, then I might pop up a look around for a bottom. Until then, it’ll be a long slog downward.

A bottom..

Maybe when the CAPE ratio reaches somewhere between 10 and 19?

(right now, even with today’s decline we are still at a nosebleed 32)… so a very long long ways down still to go..

Of course if the fed chickens out, pivots and decides to starts printing again, then all bets are off, its ‘to the moon’ again.

Its depression, but it really is all in the Fed’s hands now, with all the QE and interest rate suppression, it has become a command-and-control stock market, not a free market given the fed’s hand has been massively tipping the scales since 2009.

The bottom will be whenever the FED decides it is the bottom and restart QE and printing again… that could be in 6 months, or could be in 5 years.. who knows..

Thats a whole lotta faith in the Fed.

But the Fed cannot beat reality – the Fed is finished.

First goes the petrodollar as commodities get tied back to gold.

Then its hyperinflation in the US.

Grab some popcorn, and watch the Fed try and control the price of money then.

Everything points to hyperinflation starting early in 2023.

Nah, but everything points to much higher interest rates in 2023, and much lower asset prices.

No hyperinflation in the US by the standards usually used here anytime soon, not even close.

It’s never happened – not even once – in any country where the majority of “money” is actually credit. That’s the reality.

Every example typically used here (like Weimar Germany and Zimbabwe) didn’t have a functioning credit market.

That’s why they printed. There is no point in destroying both the currency and the credit market when interest rates are so low. It’s idiotic and no central bank or government is going to voluntarily do it.

Somewhere below 1500 on the S&P 500 and 4000 on the NASDAQ, without a severe recession. Lower than that with one.

4000 on the NASDAQ ha ha ha Tell me you don’t know what you’re talking about without telling me you don’t know what you’re talking about.

Tony,

You may be too young to have been around during the dotcom bust when the Nasdaq shookalacked 78%.

So let me do the math for you: if the Nasdaq shookalacks 78% again this time, from the high of 16,212, then it would kapfloomph to 3,564.

Wolf:

Good, very good to see you have grasped and understood the wonderful inputs from MAD magazine to which I subscribed for many years AFTER leaving my teens…

Too bad it’s gone, far damn shore…

VintageVNvet

Just acquired a copy of “Spy vs Spy: The Complete Casebook” (classic). P.S. “Dead Cat Bounce”, my favorite stock market term. (no offense to any cats out there reading this).

Your arrogance shows your ignorance of economic history and how the world actually works.

Tony… don’t let the Doomsayers get you down. In 1999 the P/E ratio for the NASDAQ was 175X and for the NASDAQ 100 it was over 100X. Currently those figures are 22.6X and 30.01X.

That said, the likelihood is that the FED will drive prices lower as it snuffs out inflation. Valuations are still well above their historical averages. So now is a good time to lower your exposure to the stock market.

> So where can we expect a bottom?

That’s the 64 trillion dollar question. Guess it right, and have cash ready for it, and you can be comfortable for a long time.

Is it 1987, 2000, or 2008? Or (gasp) 1929?

I don’t think it is 1987, or 2020 (stark v-shape, with Fed put). But every time has a few different factors.

Who will step up? JP Morgan (the man) is dead and now, maybe the fed is, functionally. Musk is no JP Morgan.

“Is it 1987, 2000, or 2008? Or (gasp) 1929?”

Or is it Janet Powell morphing into Irving Fisher before our very eyes?

Stay tuned ……

The current environment is a lot worse than 1929.

It’s the worst in the history of the country. It’s just not evident yet to most “investors” because it never is at market tops.

The grasshoppers are desperate to get out and dance in the consumer sunshine. I am with the ants, scurrying around the bunker, tightening down and storing resources.

The stock market will retrace two thirds of its losses later this year. They’ll lie about the inflation rate leading into the midterm elections and the U.S. dollar will fall. August to the end of December this year should do well. I would take profits long at the end of December. Long term the U.S. dollar will rollover and die. The stock market long term will only go up because of a dollar collapse.

Tony, I love that at least someone here isn’t all gloom. Historically, I know how to tell we’ve hit bottom. It’s when I chicken out and increase my cash position, and thereby start missing the gains. I agree with everyone else here that things are extraordinarily bad. I just think the Fed will start printing like crazy to try to monetize into a soft landing.

About 1/2 through a recession.

DOW 31,732 or DOW 31,688 and a rally to DOW 35,371 by the end of this year

Brian Hill,

“So where can we expect a bottom? Dow 30,000?”

There are people who still have a “DOW 10,000” hat somewhere in a drawer, and some of them fear that their hat might become fashionable again :-]

During the dotcom bust, the Nasdaq plunged by 78%.

Agggghh. With DOW at 10,000 and the inflation at the grocery store, my retirement portfolio might be able to buy me dog food :P — if I am lucky, I can get the free-range stuff for older dogs. ~Brian

My portfolio is key word. Whomever lost on a portfolio? No one, that’s who.

Anyone who hasn’t moved their retirement equities mostly into cash is playing with fire.

I would guess the most near-term bottom will be where the bottom was in March of 2020. When we get there, I have no idea, but I won’t be buying until then.

Agree with you YW, but only in the short term.

Other than short term, with the fundamentals SO sorry, as many on here have commented:

Dow below 18K, S&P 1500, nas ducks, don’t know because never existed in the decades I was ”investor” in SMs before getting out when realizing that NO Matter what I did, the SMs were going to do ”their thingy” to my clear detriment as a small investor, etc., etc.

Mine too. March 2020 is the nearest strong support technically.

It’s also potentially “cheap” enough based on the currently inflated fake lagging fundamentals to attract a lot of “bargain” hunters.

My broker manages over 6 Billion, so he’s a man to listen to. He said last week that if the S&P broke through 4170 it had a further 3-8% downside. Thanks to his advice I’m sitting on a pile of cash waiting patiently for bargains.

8% below S&P 4170 isn’t even close to a bargain.

It’s still a moon shot nose bleed level.

Ask your broker what HIS investments are in. I’ll bet he says real estate and treasuries.

Secular bear markets last 1-2 decades: 1929 & 1969 are the two others in the past century.

More like Dow (DJIA 30) 3,500.

Bottom? In 2009 it was when Warren Buffet bailed out Goldman Sachs — almost to the day. The gov’t bank bailout was 4 months earlier. Right after that there was another rapid move down in stocks.

This time I think it will be when rate hikes slow the economy down enough that inflation is back around zero.

Good thing I own a few shares of SARK. That has to be the most hilariously appropriate way to short this ridiculous casino. Cathie is getting a bit long in the tooth, but still has the stones to appear on CNBC.

CNBC will buy her lunch to be interviewed. Plus pay her travel expenses.

A guy I know, that is now long dead, was interviewed on CNBC years ago about the amendments to the Clean Air Act. That’s the comp.

Plus talk condescendingly to her. I’ll give her this much, she is quite brave and doesn’t get flustered by the bullying I’ve seen of her on CNBC. Sarah in particular must be hard to answer but CW does act with grace under fire.

I just wish she’d revisit her convictions a lil in this market and help her shareholders money from plummeting on the daily. There are some ways she could improve performance.

The darlings are being escorted out into the street after the night of hard partying.

Breathtaking. Amazing what a difference six months has made. Regime change?

Financial scandals next. Those swimming without gear are tossed up gasping on the beach. Politicians will pontificate.

Even a few who seemed to walk on water (or at least talk in ponderous Zen koans) may be struck by lightning. I just hope the popcorn isn’t popping for me.

Ask not for whom the corn pops. It pops for thee.

Plunged, dipped, sank… Wolf is a great writer but he needs some new descriptive words for these chaotic markets. Here’s a few possibilities coined by the late great Don Martin, cartoonist for the late great Mad magazine. Microsoft stocks Skazooched today while Amazon went Thwak and Intel got Skazooched. Meanwhile, GE Shares Gaplorked early before Glinging, then ending with a Ploof! Tesla rolled over with a Gaggak-Thoof and then from there it was pure Foomadooma. As for Meta, Gaah! Spoosh! Thak! Judging by after-hours trading, tomorrow looks like Splabadap day for the DOW.

Sorry, it’s late.

All new to me – Brilliant onomatopoeia.

I’ve always wanted to use that word!

Actually that was great DB. No apology necessary. I remember Don Martin but hadn’t thought about him or his cartoons in a long time. This skazooching is just getting started. The market will continue to go THWAP!

Don Martin! Yes. And the great Gahan Wilson. Both back in the day.

“Poit” – best Don Martin descriptive ever. Saw it when I was like 13 years old. I felt so dirty !!

We can give Cramer some new sound effect buttons. One sounding like a world of tinsel and razzle-dazzle melting and falling off a cliff ….

Faceplant. Nextsplixed. Mrsofty

Nvdiblah rottenaapled ENRONED

AmaDone? And the new verb my trader friends use. You have been

Toonced! I shake my head at oooo

14 % down. They forget the 100 percent up in 18 months and the

700 percent lift in the last 12 years

Of fed engineering. Moral hazard has a steep price

Spiltkuppad may work best over here in the UK.

“Dip buyers that didn’t get out of the way fast enough this year got carried out on stretchers.”

Hilarious stuff. Wolf could do stand-up.

In April 1981,

Dow was 777, gold ~ $800, silver $50+, 10 year Treasury 15.4%, dollar unquestionably the world reserve currency.

Fast forward 41 years to 2022:

Dow 32,882, gold $1896, silver $23, 10-year 2.89%,

dollar sort of the world reserve currency.

Fast forward another 41 years to 2063:

Maybe, not out of the question, that–

Dow 777, gold ???, silver ???, 10 year Treasury 15.4%,

who has the world reserve currency?

gold price has been illegally manipulated for a long time, on behalf of the dollar

Look at what gold buys in tangible goods. It isn’t relatively cheap, not even close.

The ridiculous supposedly unmanipulated prices I infer from your sentiments imply that it should be possible to buy tangible goods (like cars and houses) for a small fraction (in ounces of gold) versus any time in the past.

As an example, the average priced car now sells for somewhat more than 20 ounces of gold now, can’t remember exactly. This isn’t out of line with what it took to buy a Ford Model T prior to 1933. I think the low was 13 ounces in 1926 but it had been noticeably higher earlier even after mass production started.

Regardless, the modern car is a lot better than any Model T.

If gold is worth $5K or $10k because this supposed manipulation ends tomorrow, this means it will be possible to buy a car for four or eight ounces.

Gold is expensive historically, a psychological premium. An argument can be made that it deserves an above average premium due to the credit mania but claiming it’s significantly underpriced isn’t supported by its historical relative value.

Oh yeah? How much is pristine condition Model T today?

$13,000 for a 1927.

Hopefully by then everyone will be imprisoned for creating ponzi’s not just Bernie Madoff. Ponzi’s destroy the world and the future. Over the last 14 years we’ve seen what ponzi’s accomplished.

There really is only one question left at this point: Who’s gonna blink first, the BTFDers and “VTSAX and Chill” crowds or Chairman Powell? All else is practically irrelevant.

Powell has his eye on inflation and protecting the US dollar as a viable currency at this point, not on bubble stock prices. Speculators are on their own. The Powell Put is gone.

For once I agree 100% with you.

I had a bunch of errands to run yesterday and it was like a scene in a movie. I saw a few houses I was interested in go up for sale. Checked them online, sold in the 2010s for all around 150-250k. None of them less than a million. The most obscene: tax appraisal in 2018 for 89k. Sold in 2015 for 150k. On the market for 1.35 million. Needs some minor work as well.

Literally every single place I went in the chattering and gossip of the people were about renters getting shafted for 1k month rent increases, landlords going to month to month rents since they are selling their properties, people talking about spending 40k dollars on off road UTVs, middle aged housewives besmirched with a shit eating grin bragging about their house being their ticket to retirement at 50 years old. All three people adjacent to me at the barber shop bragging about their new toys, how much everything costs (woe to them of course) and the housing market they’ve gotten rich off of.

Meanwhile my company (service industry trucking/contracting) is being beaten and flogged to the point I’m down from 50 hours a week on average last year to 25-35 hours. Stock market getting their comeuppance. Housing market seems to be at critical mass.

The masses are still gobbling away at the trough but there isn’t the farmer dumping out bags of feed on their head anymore. They’ve yet to realize what is soon to come. The Fed is backed into a corner, they’ll save the people that matter to them, us peasants wrapped in our gold dyed linens will be swept away once more. If only I was lackadaisical enough to enjoy the party while it was going. Oh well, at least I won’t cry when the repo man takes my 2023 model V8 12mpg diesel dually and 1.5 million dollar starter home.

@ Trucker Guy –

Where is this market you speak of?

Relative appreciation is an interesting thing to watch. Sounds like the market you discuss went up between 4x and 6x since 2010. California, which was once a highflier, didn’t go up nearly as much. Lakewood, CA hasn’t gone up 2x in that time period.

North Idaho/Spokane area.

Most of the counties locally have seen steady 30% gains each year with some hitting 40% according to realtor/Zillow data which should probably be taken with a grain of salt. Realtor shows Pend O’Reille county WA at 74% year over year.

Of course that is just the general market. I only look at the low end. Such as trailers, cabins, and general crap shacks since I live alone and won’t have a family, I don’t want more than 2 bedrooms.

Said shit holes have tripled or quadrupled in under 5 years. It’s a hot trendy area. There’s no reason an 1890s cabin that is off the grid with a blue tarp on the roof and the foundation is literally stacked up rocks should be selling for 250k but hey, I saw a bidding war on one last year.

It’ll will crash. It has to. Given the brain power of the local populace up here; sound financial decisions are few and far between. I wonder if there is regional data on ARM mortgage usage.

But yeah, people saying housing had doubled in a couple years aren’t capturing the whole story. As Wolf has shown with construction, the lower end has been gutted. So what little is left for sale on the lower end is insanely over priced.

If anyone was to buy in this market, you’d be a fool to do so, but even more of a fool to spend 400k on a trailer in the boondocks when you could spend 600k and get at least a house on a slab near town. But, people buy based on monthly payments. I’ll keep sitting on the sidelines.

My FOMO and emotions make me annoyed with the situation but I think about turning loose a down payment on something 4x over priced with the subsequent decades of payments and I feel like vomiting, then I get the warm cozies knowing I have no skin in the game.

With the new rising rates, I’m priced out of the market now anyways. Nothing I can do but hope it crashes. If it truly is different this time I’ve already missed the bus due to my age and the opportunity wasn’t there to begin with. I have a CDL, have been homeless, have lived out of vehicles, have money in the bank to last for a few years without working, have nearly no possessions. Something, something you don’t lose the game if you never played it to begin with. The collapse of the consumer economy doesn’t hit you hard if you aren’t a part of it. I’ll be fine, and in the 99% chance it all comes crashing down like it always does, I’ll be like a vulture ready to feast on the corpse. Being a truck driver, I already smell like one and am antisocial. And truck stop food is about on par with rotting carrion.

@ Trucker Guy-

Thanks and good luck to you.

A lot of the price-rise has been from Californians cashing out and moving north. But the root cause is the FED/Banking cabal in there continuous effort to make us all debt slaves.

As the prices in Oregon and Washington have moved up, a lot of Californians are looking to other states. I now hear a lot of talk about Texas and Tennessee.

@Trucker Guy, Spokane has one of biggest RE bubbles in the entire country. However, inventory is up nearly 50% YoY in a matter of weeks there – also one of the highest stats in the country. Seems like the rats are jumping ship. So hang tight, wouldn’t surprise me if is one of the first markets in the US to crash.

Trucker Guy,

What’s going on in trucking industry these days? I’ve heard tons of new authorities being granted in past few months and demand has gone down.

What is that doing to prices in your industry these days?

Thanks for the insight.

I know two mid twenty people looking to buy their 1st home over the past year.

One has bid on 16 homes. Current house is priced at 350k. Relator said to bid at least 50k over or you will not get it.

The other person has bid on 5 homes. Just lost out on a a $245k home after bididng 264k. She was told she was not even close in the running.

Both are getting totally frustrated.

Mr Wolff comments about Ms Woods being right and sellers of her companies wrong sounds just like 1999 dot.com bust talk.

I would consider myself a terrible investor very fearful and not seeing trends.

I don’t understand the USA ability to maintain and grow economy over a 40 year period with a few recessions along the way with rural America and industries moved overseas over time.

Maybe the debt bubble and the fact that irrational behavior can last a lot longer than I can imagine.

I want the future to be bright for my children and grandchildren with cheap energy and housing and opportunities in abundance for those with the fortitude to seek out those opportunities.

Having witnessed in awe as Mr. Wolff has provided in his info feeds of facts the greatest transfer of wealth ever witnessed probably for centuries.

I have frequently been told that if one gives 1 million to the masses that money will end up in the hands of the rich which this latest “most reckless FED ever” has accomplished.

Thanks again for the facts!

> irrational behavior can last a lot longer than I can imagine.

Welcome to the world as I fundamentally see it: at its core, one succession of that after another. It WILL last longer than I can imagine, longer than my life (or anyone’s).

I can think of two thought regimes: one the US postwar view (I was raised in) which expects a sort of rationality from the world and a march of “progress” (and is urged by our instincts, on the road to having children, hopes for them, etc.). The other, I think people right after WWI experienced, maybe Vietnam war, and to some degree me, was, irrationality is the core reality. Chaos of any duration and intensity is possible. And at points, impenetrable: inherently incalculable. As thinkers, Mandelbrot and Taleb go there.

I am long volatility. I make money when the chaos happens, like now.

How do you go long volatility?

VIX ETFs

ARKK is the equivalent of a bad bank.

I told everyone to buy the inverse ark fund when it came out. Timestamped. Like I said those fake apple earnings even to this day irks me. I took every variable into account worldwide and their earnings should have fallen 12 percent for the quarter.

ARKK is just a very bad and volatile ETF (Extreme Trash Fund).

Apple is like Tigers Woods in golf. He gets all the drops other players would never get you know behind a tree and some fake drop and what do you know no tree. Same with Buffett just because of his name. I know Apple’s first quarter earnings earning were bogus. Everyone and their mother knows it. Everyone is asking themselves how could that be after their earnings were released? Corruption to the nth degree.

the only question that matters is; will the fed defend the dollar and let everything crash or will they punt and start printing again? If Powell and Co. have bought into Schwabs great reset where” you’ll own nothing and be happy”then maybe they will let everything crash and bankrupt the over leveraged .If that is so then they must crash housing as that’s the most leveraged. Hence rates will go higher than most think.

I have been actually thinking about it… don’t have a definitive answer, but it certainly smells of it.

The Fed has no interest in abolishing the $, not until they are ready for it, and they are not. It’s their monopoly.

So rationally you would think, the housing can go to hell and everything else. Things will get cheaper then they start printing the $$$ again and buy it the dip or whatever you want to call it.

What a shame that the sole question and focus isn’t, where will the next productivity come from?

Are we that far gone?

How will the governments of the world pay the interest on their national debts, if interest rates double? Sanctions and conflict brought chaos to the energy, fertilizer and grain markets.

David Hall,

The higher interest rates apply only to newly issued bonds. The existing bonds won’t change until they mature and need to be replaced. All those 30-year bonds out there with their low coupons won’t change for many years, same with 10-year and 7-year and 5-year notes with years of remaining maturity.

Only about 13% of securities outstanding are short-term bills, and their interest rates will change roughly with the rate hikes.

So at first, there will be relatively little impact. The big impact on interest rates immediately is the surge in the overall debt!

Thanks for the response.

Thirty year mortgage rates are 5.4%. Most people will sell their homes and pay off their mortgages in less than ten years.

Some corporate or muni bonds are callable and will be paid off before their maturity date.

On the other side, the effect is the opposite, though. If/when inflation returns to more moderate levels, governments will be paying higher rates on older debt.

SS: The foreclosure avalanche has started with 181% surge to highest levels since March 2020…

In March 2022, foreclosures surged 181% to highest levels since March 2020, with Chicago, New York, LA and Houston lead the pack. Some eight months after a nationwide moratorium on foreclosures expired, foreclosure filings soared to the highest level since 2020.

Last month, 33,333 properties across the US faced foreclosure, a 181 percent jump from March 2021 and 29 percent pop from February, according to a report by foreclosure tracker Attom. The first quarter saw 78,271 properties with a foreclosure filing, a 39 percent from the previous quarter and 132 percent from last year.

SoCalBeachDude,

“The foreclosure avalanche has started with 181% surge…”

You clearly just read a headline without looking at the actual data. The data comes from ATTOM, and I get it in the email.

This surged was from record lows (near zero) and foreclosures are still near record lows.

So patience! Foreclosures won’t be a problem until home prices sink enough to where troubled borrowers can no longer sell the home and pay off the mortgage.

Right now, with home prices having spiked this far, borrowers who cannot make the mortgage payments can sell the home, pay off the mortgage, and walk away with a bunch of cash. So those foreclosures that are taking place are very few and are special cases.

“Foreclosures won’t be a problem until home prices sink enough to where troubled borrowers can no longer sell the home and pay off the mortgage.”

Which may not be very long at all. Because I think the first foreclosures will be the most recent buyers who did the dumbest thing ever and bought at the pinnacle peak of the biggest real estate bubble in history. I can imagine vast swaths of them being 20% underwater in a matter of months. #gettinguglyoutthere

Being underwater alone is not a problem, just numbers on a page.

Well, until someone loses a job….

Those recent buyers won the house contest though 🤣🤣🤣

DC : “Foreclosures won’t be a problem until home prices sink enough to where troubled borrowers can no longer sell the home and pay off the mortgage.”

Don’t worry the Government can buy the foreclosures up for all the immigrants coming and get them Jobs and food stamps & save the mortgage lenders from embarrassment and invites to

Hi End Events and drinks with the fed at the watering hole

While still low as you stated, there was indeed a 181% surge in foreclosures just as that article stated.

Jim Cramer will be sh$iting in his pants Monday morning as he has to explain to his audience why he has been so wrong on everything, especially tech stocks. He may have total diahrea, and will be advised to bring a change of pants just in case. He was on yesterday telling his audience on CNBC that the Fed was not responsible for inflation. What a f$ckin moron.

Cramer has been through this rodeo before. I imagine he sleeps like a baby. Has the ice veins of a true huckster. He’ll always just wave his hands and redirect toward the next big thing, and never admit he is wrong. Those types seem pretty prevalent as centers of attention (and, shudder, “leadership”) these days.

Behind every such “leader” is a fanboy cult.

Misread it at first as a ‘fanboy clit’ and somehow it served the context just as well.

Yes he doesn’t strike me as a guy prone to being plagued with guilt and remorse.

Anybody whose mouth moves faster than my ears can listen and comprehend, I tend to ignore….

Hence my preference for written word…

COWG,

Agreed. That is one reason, in part, why I don’t listen to podcasts.

I’m probably the only one here who was banned from the library in the fifth grade as I read too much. It is nice to hear there are others who like the printed word over a nonstop talker. As for Jim Cramer I have never understood his draw. Anyway thanks to all as you send me to the dictionary and to an acronym site to understand some words.

I watch Cramer as sheer slapstick entertainment, as a contrary indicator, as a sign of how ludicrous modernity has become. He is buzzing around like an insect sped up.

Cramer invest his money in index but shill stocks to earn his money

5 million a year ,yes man to cnbc

Just like FOX, masses looking for confirmation of what they already want to think and hear.

I’m fascinated by so many of my otherwise smart friends and family who are shell shocked that the market is dropping. They didn’t listen to me for over a year saying that valuations were grotesque, but were convinced it would just keep going up.

Same goes for housing prices, no matter how often I explained basic math around interest rates.

I don’t understand how this collective delusion took over so much of America.

Indeed, all to many people are entirely lost in hopium fantasies and delirious and inane false perceptions rather than dealing with actual real fundamentals such as PE multiples and mean pricing. No, folks, it’s not different this time!!!

The delusions come straight from the top. The USA has been borrowing and spending like a drunken sailor for 50+ years on the back of the dollar printing. When that ends, America will come back to its senses.

Neural chemistry. “Success” mutes the risk response. Source of many a great cartoon. Maybe based on being engineered as energy-conserving (i.e., lazy): when stuff is (seemingly) good, I don’t work so hard to look for bad. I eat everything I can find and spawn offspring. Life looks like a big buffet and frolic session. Until it looks like a hall of whirling knives.

This is ~correct.

It is intellectual laziness and greed.

Then, when they know better fear. Like deer in headlights.

…and so rolls the wheel of human history…

may we all find a better day.

“ I’m fascinated by so many of my otherwise smart friends and family who are shell shocked that the market is dropping. They didn’t listen to me for over a year saying that valuations were grotesque, but were convinced it would just keep going up.”

Fascinated !?

Hell no, not me…

I’d be taking inventory of all their crap to see if there was anything I wanted…

Have discussed the fancy stuff we want to pick up from liquidations. We are expecting some deals.

There’s going to be a fire sale on RVs, trailers, cars, trucks, boats, side-by-sides, snowmobiles, etc. Due to medical regulations, some consumer items cannot be re-sold, such as chest “enhancements” and tooth veneers.

RVs and boats seem destined for a scalping. Both require excessive amounts of fuel to use, and extremely high maintenance and storage costs.

Sell the RV’s and trailers? Where are they gonna live after the foreclosures?

Giant liquidation sale. Everything’s gotta go. How low does it go?

All of the pandemic gains in stocks and RE will be wiped out, guaranteed. How far below that we go remains to be seen but it will be significant and painful for many. Lots of layoffs coming too.

On important matters, it’s ultimately because most people prefer to remain ignorant and/or believe a lie.

The unpleasant truth that their life is going to be turned “upside down” financially is contrary to their personal preference.

Even here, plenty of sentiments that financial markets are going to tank.

It almost never translates into posters acknowledging that there are going to be noticeable tangible declines in most people’s living standards.

It’s Even the minority view of the end of the mania is overwhelmingly in the abstract.

Einhal

The American people are by and large Lemmings. There was an old video game in the early 80’s by the same name. I used to play it on my Apple IIe. They don’t read history books or read any books at all for the most part. They have no ability to do independent critical thinking. They parrot all the bull s$it that they hear from the mainstream media, corporate hucksters and financial advisors. They make their investment decisions based on all of this faulty information. When they lose their money they will all sound like whining dogs.

It is amazing to me that nobody in the establishment-pandering financial media doesn’t seem to understand that these are short covering rallies on the way to a grinding re-setting of equity valuations.

Yes but the real question is: are we going to see a Y2K type Nasdaq retracement? I recall it was something like 5300 to under 2K.

And the DJI went from ~8000 to ~12000 and back.

The only thing I don’t understand is why the dollar is so strong…

Don’t know about Cramer the clown but there will be many still to happen Depends

Moments for retail investors Might be a good time soon to buy alcohol and MJ stocks ;)

I’ve stocked up on the booze miniatures. If barter becomes popular you can barter the minis easily.

OTOH if you have a fifth you’ll need to sell it in its entirety because no one will trust an opened bottle.

I think the miniatures will be more fungible. And if things never get that bad, you can drink the booze. I considered tobacco but it goes stale and I don’t smoke.

Anyone can grow MJ. It’s a freaking weed that grows anywhere.

That is the great thing about booze- unopened, it lasts as long as you can live.

booze can and does ”evaporate” through the cork, even with all the modern plastic in place…

seen in recently with a bottle that goes to the one last standing of the three musketeers of my two best friends from 6th grade

holder sent us current photos after someone commented the bottle looks like it has lost some in the last couple decades

NOT suggesting anyone should drink it sooner rather than later… LOL

I had full size Absolute bottle for few years, but when I eventually decided to drink it, I found the about 1/10 of it had evaporated. I suspect that manufacturers don’t seal them for such a long storage. I suspect your minis will suffer from the same problem – unless you find a way to completely seal it.

Otherwise you advice is good – minis will indeed go well in barter trades IMHO.

The bottle of my favorite bourbon has the same issue. That stuff seems to evaporate through the glass. It’s down to one-third now. I’m shocked, shocked, shocked that there is evaporation going on in here! Everyone out at once!

Don’t buy in plastic bottles,they begin to leak ,also keep them out of sunlight

Yeah Wolf, my bottle of rum seems to be doing the same thing. Hahahaha

Cmoore,

I agree! And why the Euro is falling against it?

Cleanest dirty shirt.

So when the cleanest dirty shirt is on fire, what then? Break out the mini liquor bottles and MJ inventory?

But yeah, China looks so weird and messy right now. Capital flight there, Xi getting sclerotic and weird? Europe hanging on by its fingernails. The yen going down ….

Cleanest of the dirty shirts I guess?

If by dollar you mean DXY, it’s strong because it’s a relative measure against other currencies while the CPI is effectively the measure of the dollar vs goods and services. The DXY is mostly comprised of the British pound, the Euro and the Yen. Eurozone is experiencing pretty bad inflation and they’re still printing. The bank of Japan came out Thursday and said they will print to infinity and beyond.

The dollar will continue to strengthen on the DXY until these other central banks reverse course. The DXY strength is a very bad thing for the global economy and that in itself will most likely cause a global liquidity crisis.

Exactly right. The stronger the dollar gets the closer we are to a true crisis. Currency traders apparently believe that Jerome is going to battle inflation. I think he raises rates a few times before the economy goes under and then he stops or retreats completely.

Do you suppose he has had a clean backup plan worked out a long time ago? I mean what are his probable retirement and chill options. Genuinely curious.

I want the USD’s exchange value to absolutely soar.

I see it as the last chance to have the option of maintaining purchasing power elsewhere outside of speculation.

Haven’t decided where I might or can move yet though.

Yes, cleanest dirty shirt. I looked at it and can confirm: it’s filthy and it reeks, and it has this horrible ring around the collar, but then I looked at the NIPR-and-nutball currencies (EUR, YEN, et al), and I had to call in the bio-hazards team to remove them.

Is that DXY or your laundry? 😛

There is no other currency that can even remotely challenge the US Dollar and that is becoming more the case every single day.

Have you heard that central bank of Israel has reduced USD share in their foreign exchange reserves ? And Israel is a very close ally of US. Perhaps this fact points to the fate of USD in the future – it will remain the dominant world currency but its share will be declining more and more.

Hmmm, I’m wondering which currency they chose to replace there USD reserves?

British pound, Australian dollar, Canadian dollar, yen and yuan.

Japan , Euroland and Britain are dependent on energy and food imports , which are going to be short supply because of the sanctions regime vs Russia. The US is a large food and natural gas exporter and only a small oil importer

Defense spending in Euroland is going to explode. The US is a large exporter of weapons

dollar is strong because us is raising interest rates compare to Europe or Japan.also some capital is fleeing to US from Europe because war.it is really simple and looks it can continue for couple of years or so .you can expect much stronger dollar before gets weaker.

It depends on the currencies we’re comparing the dollar to, it’s going up against some but falling against others. A big chunk of the overall DXY gain is utter collapse of the ruble and almost all currencies are appreciating a lot against it, and that distorts total numbers and relative comparisons. Then the BoJ and ECB are not yet raising rates (QE still ongoing) and BoJ still committed to very easy monetary policy compared to the rest of the world, deliberately to stoke inflation. If anything dollar is gaining much less than what I would have expected vs yen and euro given that difference, it’s gained by not really all that much. (The energy prices in Europe issue is a red herring–Putin’s bungling mess is causing food and energy prices to rise everywhere including in the USA, and since Americans do much more driving and eating–all that obesity–than Europeans, if anything the total food and energy inflation is hitting us harder, it’s a global pool for those commodities.)

But the USD is falling against some other currencies. South Korea’s central bank has been a lot more aggressive in fighting inflation so the won is doing relatively well. RMB is up and down but China has been tougher about inflation fighting for the yuan. Then of course Canada and the Bank of Canada ahead of us with that 50 bp rise. Nothing too mysterious about it. And in general with this inflation the true purchase power of the dollar is falling fast relative to things like commodities in general.

Miller, be careful who you call obese. According to the CDC:

The US obesity prevalence was 42.4% in 2017 – 2018.

From 1999 –2000 through 2017 –2018, US obesity prevalence increased from 30.5% to 42.4%. During the same time, the prevalence of severe obesity increased from 4.7% to 9.2%.

Obesity-related conditions include heart disease, stroke, type 2 diabetes and certain types of cancer. These are among the leading causes of preventable, premature death.

The estimated annual medical cost of obesityexternal icon in the United States was $147 billion in 2008. Medical costs for people who had obesity was $1,429 higher than medical costs for people with healthy weight.

So, almost half of the Wolf St. readers may be obese. We can thank McDonalds, et al and remember that the wonderful Mr. Buffett and Munger own scads of Coke, Kraft Heinz, Sees, Dairy Queen… they must not lose sleep over obesity.

Good one HN:

Was definitely getting to the obese state at end of 2020 called ”covid fat” by the better half!

Book at local library, ”Fast, Feast, Repeat” was SO good I ordered half a dozen to share, and took the suggestions to heart: lost 25 pounds in 2021!!!

And now, slowing down the losses, aim to drop ONE# per month in 2022 and am on track, so far..

It is definitely a really really difficult challenge for those of my ”elderly” years, far shore.

Good luck and God Bless to all.

You have it backwards. People aren’t obese because Kraft, Dairy Queen, etc. are everywhere. Kraft and Dairy Queen are everywhere because people are obese. America has an obesity culture.

Body mass index is not accurate for all. Some athletes with very low fat percentages, but high muscle mass, calculate as being borderline obese.

But in general, adults in the USA do not have good fitness or a good ratio of muscle to fat. There’s a Mickey D’s by my home and I ride by it on my bicycle frequently (Coming home, at speed, when the wind is SSE). The drive-through is always, I repeat always, backed up, and cars exit to merge onto MN Hwy 55 next me, I see the reality of many people’s existence. It ain’t pretty.

“Judge not, lest ye be judged.” I have heard it said … But to be honest, these drivers look like they are moving towards death as fast as I’m riding. To each their own, eh?

The USA is fat with debt, fiscally speaking. I do judge that with disgust and contempt.

Full disclosure: I have, in the past, been overweight and not as health conscience as I am now. It is not a sin to be in that state.

But the national debt is a sin. Interest rates have been kept low for many reasons by the Fed, and $3 x 10^13 is one of those reasons. If rates were where they NEED to be now, Uncle Sam’s monkey would not be supportable to be carried on the backs of the citizens of my country.

That pisses me off!

Obesity transfers expenditures from productive things to remedial things. It raises the cost of my being in an insurance pool: it makes me poorer. It burns more fossil fuels and degrades the environment (not to mention all the food wrappers everywhere). I was a smoker, a drinker and other things and I dealt with it the way I regard as the true American way: I fixed it, whatever it took. Without a dime spent by anyone else. I was temporarily somewhat overweight while quitting smoking. I would never talk like this unless I’d been there, or somewhere similar.

Least dirty shirt, Cmoore …

400 PhD’s can surely engineer our Soft Landing. You can’t convince me that these well educated wizards gave no thought to hoovering all that money created during the pandemic. Could Taleb be right?

4000 software engineers surely couldn’t crash a Boeing 737 either….

Jus’ sayin’….

COWG,

That’s what everyone though at first. So, to make a point, they did it again.

Condolences to the Richter family, from a long ago event.

Sometimes, life throws curve balls at you.

Economists live in a fantasy world of economic theories.

As Taleb himself has written!

You should see the Cathie Wood/ARK Invest staff’s posting at their website. Still saying TSLA will eat the whole world at vast valuations. You’d think it was 2020. All made to look neat in a spreadsheet you can download and tweak yourself.

there ”used to be” some rule, similar to Murphy’s, etc., that went something like, ”the intelligence of any group goes down according to the inverse of the number of people in that group…”

4 some reason, it certainly appears to be continuing to be true, no matter what ”advanced degree” people may have actually earned through rigorous academic focus and productivity.

and will always remember reviewing a hundred or more ”monographs” approved for PhD awards, almost all of which had ”conclusions” that were absolutely NOT supported by the so called research data IN THE paper…

This was over 50 years ago when there was still at least some semblance of ethics in most universities.

VVNV-well said. my observation has been that true ‘hands-on’ experience has been culturally devalued to the point where it’s something to be avoided at all costs and, if absolutely necessary, shoved off onto someone/somewhere else (hearkening back to the ‘American Vision’ of the ’90’s where services could and would replace our actual industry because we owned and would always maintain our lead in ‘intellectual property’ going forward…).

may we all find a better day.

No, 91B20, it wasn’t different long ago. Read Thorstein Veblen’s “Theory of the Leisure Class”. Manual labor was always derided. Did the Pharaohs have a hand in building the pyramids?

How-good point re: Veblen, but for a brief moment in the U.S. emerging from the Gilded Age to around 1980 when organized labor seriously began to disintegrate and it was felt EVERYONE needed to go to college in order to make a decent life for themselves, ‘working-class’ wasn’t a perjorative…

(when i say ‘hands-on’, i mean actual, floor-up working experience with that which is being administered/managed, be it the trench being shoveled, what passes the retail counter, assembly of a vehicle, industrial corporation, et al…).

may we all find a better day.

How-…have always wondered if the Pharoah’s ‘help’ pool might have been smaller/less-willing if mass entertainment existed?

again, a better day to all.

91B20, there’s a story that the workers on the great pyramids actually felt “blessed” and joyfully did the work. Undoubtedly there were many slaves (if not all of them, actually), but many may have been conned into thinking they were serving their god.

I get your point that the college degree may have partitioned “hands on” work from managerial fluff or financialization.

Quit using big words like ethics. No one knows what you mean.

There is no “master plan”.

Having a PHD doesn’t mean you have a clue how the real world works.

There is no evidence whatsoever that these supposed wizards can successfully “manage” any economy.

Their impotence will be blatantly evident when market sentiment turns completely against them. No one ever makes equivalent claims for the wizards running the central banks of a country like Argentina.

The only actual “tools” they have ever had are currency debasement and borrowing from the future. Nothing new about that.

“Having a PHD doesn’t mean you have a clue how the real world works”

Obtaining a phd is a long process that typically requires the immersion into academia, immersion into whatever theories they have at the moment, and (in case of many scientific fields) strict compliance with these theories. This not only prevents phd aspirant from obtaining a real life experience, it actually makes this experience a negative asset for phd aspirant. As a result, many scientific fields today from closed groupthink groups, not unlike religious cults. This sometimes leads these groupthink groups to start a quest to re-do the reality (external to this groupthink group, and contradictory to group’s beliefs) to be more aligned with groupthink groups’s views (not unlike the quest that religious cults often do to alter the reality to comply with their delusional beliefs).

How many PhD does it take to screw in a light bulb?

Answer: due to high cost and low supply, there are no bulb to replace with

Three. One to hold the bulb. Two to turn the ladder.

Everyone misses the elephant in the room, the “man behind the curtain”. This is ALL purposeful managed decline of the dollar as reserve currency and reduction of the standard of living for the typical US citizen. The fix is in for CDBC’s. They desire control of peoples lives they can’t obtain as long as cash is around.

CBDC can arrive irrespective of debasement.

All I see here is business as usual.

Inflation is how the West works. That’s nothing new.

Every cycle the wealthy rinse the poor through privatise the profit socialise the debt, because government enable it which encourages more of it.

But that is the depth of their end game, shafting you for your hard earned and making sure you keep quiet about it.

If enough people cared it’d end tomorrow… but apathy seems ingrained in the USA.

Still too comfortable?

Good article. Interesting that there’s never any comments re Fisher Investments. They appear to be another version of the Fidelity or Vanguard ideas but without their own branded funds. What do they actually do besides collect fees/commissions on account churn.🤑🤑

They run an effective marketing and sales program. That is one thing they consistently do well. Never mind that you could do just as well on your own. Now just sign here……

I see them differently than Vanguard. Vanguard puts you in a fund with expenses as low as they can get them. Also I believe the ownership structure for Vanguard is unique, where the interests of the fund holders are aligned with the managers.

Fisher puts your money in a vehicle where they siphon off 1% of your assets yearly, in advance on a quarterly basis, regardless of how that vehicle performs. Up, they get 1%. Down, they get 1%. In advance.

1) For entertainment only : yesterday SPX big red on the same volume,

a higher low, inside Feb 24 fractal zone, inside Apr 16/20 BB #1, under a flatbed green cloud.

2) SPX dma20 and dma50 will invert next week. No good.

3) SPX weekly : a smaller bar on higher volume, inside a green

cloud. Something is wrong.

options :

4) A bullish option : IMF student loans jubilee (not to Ukraine) might

send SPX higher to wave 2 in the next few months.

5) A bearish option : 3of 3 next.

6) SPY PnF x3, 3.333 accumulation might send SPX to a new all time high, at least 110 points up.

7) We don’t know what will happen next, all we know is that lately :

Everything is “REAL” to bend JP will.

1 through 6 are mostly gibberish. No 7. is the KEY (We don’t know what will happen next).

Gibberish: not to him.

Sounds like the Oracle at Delphi: obtuse and portentious. But there is truth in labeling: “For entertainment only”

I take it in that vein. Like music is merely candy-coated noise, and (per Taleb’s mockery) sports merely tamed randomness.

It seems like the majority of people here seem to have a perverse delight in predicting collapse and asset deflation. Obviously that means that most of you guys don’t have many assets to worry about. But I understand the predicament of millennials and younger here not easily being able to buy a home or get ahead, and asset deflation could be beneficial in the long term. My only comment is: be careful what you wish for.

Hi Tony.

Not taking perverse delight on my part, but it seems that for many acquaintances as long as their financial accounts are doing great, then all is right in the world, no matter how messed up it is for everyone else.

I see that also.

Tony

It’s about evenly divided among the commenters.

Some want a financial apocalypse as ” some men just want to watch the world burn”. You know, financial preppers types.

The rest are the sane ones.

Couple of things. While some of it is pure wanting to see others suffer, for a lot of others, it’s a lot more complicated.

a) There are a lot of people who have seen the American dream being pulled away from them, with reasonably priced assets going to the moon before they were at a place in life to buy them. It’s understandable that those people want an opportunity to buy houses for less than a million dollars for a shack or stocks for less than a 50 P/E.

b) A lot of people, even those who do have assets, recognize that the current situation is sustainable, and want it to correct before things get worse. An asset mania is not an economy, and the sooner it collapses, the better off we’ll be in the long run. These are the “rip the bandaid off” people.

c) A lot of others are tired of smug people bragging about how brilliant they are for having gotten lucky and bought assets right before the Fed started printing. A lot of people want to see them humbled up a bit.

Some people just want the world to be rational.

I’ll settle for less irrational.

Einhal

I think in (b) you meant “unsustainable.” Good descriptive categories. I think I am both (a) and (b) in your categories. As for the smugsters – I have been in that position a couple times and was not a braggart – but I understand the emotional need to be one. Therefore, as long as the smugness is tame, I am OK with those folks. You gotta celebrate your skill…OR….luck.

No delight here.

I just know what exists now is the greatest mania in the history of human civilization. It’s totally obvious.

I also know that the modern world has been living under extended fake prosperity (the entire 21st century) as a result of this mania. There is never something for nothing.

You can do the math from this combination.

The 21st century has been unique in its ability to create this false prosperity in that you had a rapidly growing developing world willing, in the short term, to produce stuff cheaply for the West. You can think of it almost as a form of apprenticeship, in that they were willing to trade their labor for less than it’s worth in exchange for a “seat at the table” if you will. Now that living standards have risen in China, and probably will in India and Bangladesh and other developing nations in the next decade or two, the days of the developing world being willing to fill our gullets with nearly free stuff is over.

This doesn’t just mean manufactured goods, but our debt and currency as well. Once that ends, that means we’ll have to start producing what we consume, and won’t be able to buy it cheaply or borrow the money with which to pay for it.

Einhal, sounds like an imbalance is being corrected. Now, if we can just move forward as a nation, without reinstalling an oligarch, there may be light at the end of the tunnel that we haven’t even had to travel through: until recently, we’ve benefited from the years of cheap labor.

Tony-

Apocalypse narratives are traditional and attractive, and for these reasons ubiquitous. They offer a cleansing of the past, cosmic justice, and an opportunity for rebirth. They exist in a lot of different times and places and fields of study and rhetoric, their form morphing to match their milieu. I hate myself for quoting the Doors, but “… the future’s uncertain and the end is always near.” Narratives are very meaningful to people on an individual basis because they give a sense of order to an otherwise chaotic existence. Conversely, the comfort they provide encourages biased interpretations of new or existing data. It’s getting wild out there, and I imagine it’s going to get wilder by the day; yet, I’ll take the under on an apocalypse of any form – might be the safest bet in history. It feels sad, though, like betting against your team in the big game.

Well said, PP. Lest we forget, in the early years after the crash of ’29 and the subsequent economic depression, the thinking in the upper echelon was confident that a “cleansing” was due. So, the Fed of that time felt there was no need to intervene and wanted to let the “purification” take place.

PPidjun-

“Apocalypse narratives are traditional and attractive…”

I’ve seen it referred to as “imminentizing the eschaton.” Wonder if this executive order remains in effect?

“Following a nuclear attack on the United States, the U.S. Postal Service plans to distribute Emergency Change of Address Cards.”

– FEMA (Federal Emergency Management Agency) under Executive Order #11490, 1969

My issue is that all of this hubris has made things that shouldn’t be volatile, volatile. Housing, food, energy, transportation, etc.

Lauren-realtime physical supply and demand will always induce volatility. How much volatility depends how much societal attention/remedy/meddling is paid to the logistics, from source to end user…

may we all find a better day.

@ Tony –

talking assets, aside from dollars ……………….

Some might have a delight in asset deflation because cheap assets are more easily obtainable. Yes, the less assets you hold the more you might like to see them drop so you can obtain some.

Asset holders benefit from inflation, money printing, FED manipulation and interest rate suppression, and money making money. Hence the average wealth of the 1% at $34,000,000. How much of that is from the manipulation, dollar printing, and interest rate suppression ………………… for that matter, just call it what it is, suppression of the non-owning class (or thin-owning class).

So, the non-owning class should wish for a good deflation. It’s not perverse. It’s self interest. No more perverse that the desire of the one % to hang onto what they have.

cb

Well-stated. Self-interest, whether Ayn Rand style or in any other form, is natural and understandable.

When the smoke clears from this manipulated, inflated, mysterious everything bubble, there will be perceived winners and losers. Winners will gloat, losers will hate, but for the most part, everyone will “stay in their lane,” and life in the USA will still be a viable and enjoyable journey for (almost) all.

Thanks Beardawg –

I’m really not a fan of self interest, though I understand it and it’s necessity on some level. Much of it has been used to justify greed and psychopathic tendencies. I find Ayn Rand quite despicable.

Tony, if you’re referencing this: the fact is that “deflation” is dramatically worse, for everyone, than “inflation”. One is tolerable, or, at times, dangerous; the other is economically deadly. Except, of course, for vultures, those with money only.

HowNow,

You’re comparing 2% inflation to 30% deflation. Now compare 5% inflation to 5% deflation. Both are bad, but neither one of them will cause an economic nightmare. Both have their beneficiaries and their victims, with working people generally being the victim of inflation, and debtors being the beneficiary of inflation. And the opposite for deflation.

Ideally, you’d have 0% over the long term, with slight inflation followed by slight deflation. Why should we allow the Fed to decide in which direction the wealth transfer goes? Why do we need to coddle debtors at the expense of working people???

0% Inflation will keep everyone honest, and on a level playing field, and the only way to get there is to have slight inflation and slight deflation taking turns.

Respectfully, I disagree. At 5% inflation vs. deflation, no sweat. But at 10% deflation (vs. inflation), or worse, the deflation will cause much more damage. Going out to 20% deflation/inflation, lots of homes will be underwater as many buyers buy with 3% & 10% down payments, while buyers with 20% down have lost their equity. We’ve seen 20%+ home price appreciation, annually (?) and no one (except renters) are singing the blues.

Yes, you mentioned some of the REAL benefits of deflation though you’re confusing asset price deflation with consumer price deflation. Home prices dropping 30% from here would be a GOOD thing. That should be the goal of monetary policy at this point, unwinding the crazy runups over the past 3 years. There is a housing crisis because of those home price increases, if you haven’t figured this out yet. And solving that housing crisis by causing homes to become cheaper would be a good thing. People who bought 3 years ago will be just fine. And people who bought in 2021 and in 2022 so far, well, they won’t be able to sell for many years, but they’ll be making the same mortgage payments at historically low mortgage rates for years, and so what? They will be just fine. They will learn that a home is an expense, not a highly-leveraged speculative profit-guaranteed bet. This whole idea that home prices must be artificially inflated at all costs is just plain nuts. And after they have been artificially inflated, it’s a good thing when the market is allowed to take them back down.

HowNow said: “We’ve seen 20%+ home price appreciation, annually (?) and no one (except renters) are singing the blues.”

———————————-

Anyone who doesn’t own is crying the blues. Who wants to pay more. Also, savers should be crying the blues, because that broad based 20% house appreciation is no more than a reflection of money debasement and interest rate suppression, Corrupt to the core.

WOLF