Shares collapsed by 68% since November. $205 billion evaporated. FANGMA without the N.

By Wolf Richter for WOLF STREET.

The final N in the erstwhile glorious FANGMAN – Facebook, Amazon, Nvidia, Google, Microsoft, Apple, Netflix – has now earned itself a spot on my growing “Imploded Stocks” that I discuss periodically for the amusement of those who’ve been through this during the dotcom bust and know viscerally how a stock market bubble ends.

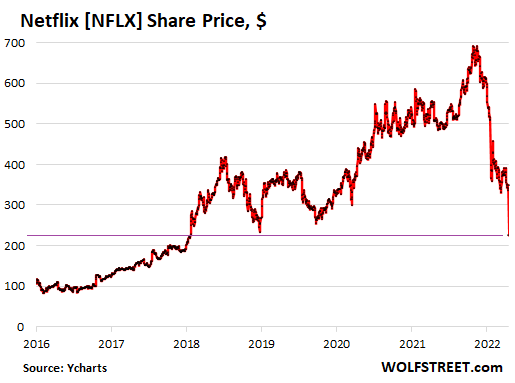

Shares of Netflix [NFLX] plunged 35% today, following its dismal quarterly earnings report last night, and closed at $226.19. Three months ago, after a dismal earnings report, shares had plunged 24%. Another earnings report is coming up in three months. Since their high on November 17, 2021, in just those five months, shares have already collapsed by 68%, and are now back to where they’d first been in January 2018. The stock is now on the verge disproving the WOLF STREET dictum, “Nothing Goes to Heck in a Straight Line”:

The biggest culprits were a loss in subscribers for its streaming services globally (-200,000 subscribers), particularly in the US and Canada (-640,000 subscribers) and Russia where it suspended operations (-700,000 subscribers).

To top it off, it said it expects to lose an additional 2 million subscribers in the current quarter (Q2), while analysts were expecting growth of 2.55 million subscribers. Gone are the days when the company grew its subscribers at a rate of 25 million a year. Now it cannot even hang on to them anymore.

Subscriber-growth-come-hell-or-high-water had been the name of the game for Netflix, given that it sells subscriptions. And now that idea of subscriber growth just collapsed.

OMG, competition!

As cause for this subscriber fiasco, it listed every imaginable problem in the world, from “increasing inflation” and “sluggish economic growth” to Russia’s invasion of Ukraine, to, well, competition.

Turns out, competition “is creating revenue growth headwinds.” It said that “over the last three years, as traditional entertainment companies realized streaming is the future, many new streaming services have also launched.”

And the shares of its competitors also got roughed up a little today on fears of dropping subscribers:

- Paramount Global [PARA]: -8.6%

- Roku [ROKU]: -6.7%

- Warner Bros. Discovery [WBD]: -6.0%

- Walt Disney Co. [DIS]: -5.6%

- Amazon [AMZN]: -2.6%

- Comcast [CMCSA]: -1.5%

- Apple Inc. [AAPL]; -0.1%

If you don’t know what to do, do two U-Turns.

Netflix is going to combat those evils of competition and subscriber losses with two possible strategy changes: A potential dive into advertising and a crackdown on password sharing.

The company said that it is considering a move into advertising, which is precisely what CEO Hastings had spurned and brushed off all these years. Hastings said in an interview that they would try to figure it out over the next year or two.

In terms of the crackdown on password sharing, Hasting said that they have been working on it for two years. In its letter to shareholders, Netflix said that an estimated additional 100 million nonpaying households are using the accounts of its 222 million paying subscribers. The crackdown on password sharing would be an interesting turn of events after having for years blown off this well-known issue as largely irrelevant.

Hilarity broke out among analysts.

After the stock collapsed by 68%, and not a second earlier, analysts fell all over each other downgrading the stock and cutting their price targets. You just cannot make this stuff up.

They all should have put a sell rating on the stock in November to get their clients out of it in time. Anyone who took these analysts seriously before today got cleaned out by events. For example:

UBS analysts cut their rating on the stock to neutral from “buy” before the collapse, and they lowered their price target from $575 to $355 a share.

Pivotal Research cut its rating on the stock two notches, from buy to sell, and skipped neutral, and more than halved their price target from $550 to $235.

Wells Fargo analysts lowered their rating on the stock to equal weight from overweight, and slashed their price target by half to $300.

J.P. Morgan analysts, pointing out that “there’s not much to get excited about over the next few months beyond the new, much lower stock price,” lowered their rating to neutral from overweight, and more than halved their price target from $605 to $300.

The evaporated $206 Billion.

In dollar terms, the market cap of Netflix plunged to just $100 billion today. Since the peak in November, $206 billion have evaporated. This is money that shareholders thought they had and now don’t have. So we have to begin dismantling the erstwhile glorious FANGMAN. Now it’s just FANGMA without the N.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Once they no longer allow password sharing, I will cut them off. There are many other options.

So you are stealing from them, or enabling others to do so, and if they don’t allow that, you are “cutting them off.” Good one. That’s brilliant. How did you come up with that revelation ?

Oh God, not with the “groomer”…

We share a Netfix password with my daughter. We pay for two users ($17.99/month). They allow this. I don’t know what their issue is as they have this in their subscription menu.

10-4 AA,,, WAS very similar for many years with this company in the focus of WS today…

While WE the PEONs can at least continue to hope all works out ”fair” for companies and consumers,,, in this case especially,,, they appear to be trying to ”Have IT both ways” which will never work long term, in spite of the clear record of many companies having it ”their way” and as such, ”both ways” for some period of time.

Old Abe, had it right with his dicta, ” You can fool most of the folks some of the time, all the folks, ditto,,, but you cannot fool all the folks ALL the time.”

Many of OUR manipulators these days do NOT seem to grasp this very basic concept, but that may only mean they, the manipulators they, think they can get away with their theft for eva,,, and are willing and able to take that risk.

Hey Wolf, are you tolerating homophobic hate speech on your comments now? “Groomer” is about as neutral a term as “kike.”

To be fair, one of the pillars of Netflix’s business model for growth was uncontested affordability. That password sharing grey area was a big reason for that affordability. It has become more so when Netflix started to hike the prices annually. Netflix understood more than anyone else how important that was to their growth story (that’s why they did nothing to stop it). It was that growth story that inflated the stock and made the Netflix people a lot of money. So it was an unwritten consent by a very willing Netflix to turn a blind eye on account sharing. From that point of view, it is hardly “stealing” from Netflix.

But now they are forced to consider banning this practice because reality of their unsustainable growth story finally hit a wall: reduced affordability (due to price increases to finance ever growing cost of content creation), competition and unprecedented rate of decay of content in the streaming world. When it takes an evening or a week for a subscriber to finish a series or movie, how many more that are not total crap can you make? And it’s not just about the amount of money you can throw at it — good content requires time and inspiration.

Lol I used to have a bunch of ppl on my account now I’m back on the torrents ho ho ho a pirate’s life for me. Kidz, piracy is not stealing. Sharing is caring. The corporate entertainment complex may crash and burn for all we care. Ho ho.

Obviously you forget it, but Netflix themselves actually encouraged password sharing. They have always done so….. despite what their terms of service has always stated.

Netflix themselves tweeted out “Love is sharing a password” back in 2017….. and it wasn’t even valentines day.

But sure, be a corporate shill….

Absolutely. I barely watch nflx anymore. Will be an easy plug to pull.

I’m with you Ace. This was a long time coming for Netflix. They used to make good quality shows, that were well acted and produced. Then, they got greedy and started to pull the plug on shows that were popular but supposedly cost too much to make, meaning actor raises. They replaced good shows like Glow and Mindhunter with crap teenage drama shows. Just o jump on the next Bandwagon and make that extra buck.

I am pulling the plug after this.

I’m glad you chose Fangma instead of the alternative…🫢

The other N is also in a huge bubble territory. Unrealistic PE ratio and growth expectations. Soon within 2 years there will be a glut of semiconductors given the massive investments everyone is making. And data enter folks are all doing their own custom silicon for AI and cloud. Crypto mining is already stalled. Autonomous driving silicon will be a commodity shortly like other automotive silicon. Nvidia can easily drop by 80% and still be expensive.

Maybe like the early 80s, there may be corporations with falling market caps, on the block for sale. Cash (or credit) rich buyers can do lots of M&A.

Maybe Musk’s doings with Twitter are a sign. He has been resurrecting some of the rhetoric of 80’s raiders, and later activist buyers.

I bought some PayPal today.. I’ll buy Netflix and Facebook too. Nothing wrong with these companies in the long run. I actually hope they fall further so I could buy more.

No, nothing wrong other than still being ridiculously overpriced.

Netflix is a company with current P/E of 22 and 3X+ revenue. They have never paid a dime in dividends and shareholders have seen nothing since the company went public. Earnings aren’t even real money either. It’s only an accounting number.

Its valuation is based upon an asset mania. Yes, still.

The biggest problem with the Netflix business model is the inferior revenue stream for the same assets versus traditional media.

With the traditional model, you sell a series or advertising. With film releases, there are ticket sales, DVD (or downloads now), followed by pay TV.

Streaming constantly needs more content to grow or even keep subscribers but the incremental revenue from a series or film is unquantifiable.

How many subscribers did they get and keep from a series like “The Crown”? (This is an example only.) It’s a series that cost them boatloads of money.

On a constant treadmill to create more intellectual property content but the current business model falls apart as soon as subscriber growth flatlines.

To generate meaningful growth, Netflix needs to either raise the monthly fee, add the advertising option as indicated, or find a way to keep their subscriber base while spending a lot less money on content.

It’s a matter of opinion but when I subscribed to the service, I considered most of their content garbage anyway, not substantially different from the channels on cable not worth watching. It’s just a lot cheaper.

I’m definitely not going to be jumping in with both feet.

I hope they drop another 50% from here.

Thing is, these are still solid companion and 5years from now they will probably be higher than they are now.

One could argue FB is cheap at “only” 15 times earnings

How long before Netflix announces share buy backs?

And they have $15B in long-term debt, with significantly higher borrowing costs staring them in the face for at least two years. And any debt that matures that they have to roll over will have higher carrying costs as well. I hope they follow through with the ban on password sharing and tanks the stock even more.

I would love to buy in at a price below $100, say $75. But, I think they need to go down the path of the google model but try to hammer out an ala cart deal and start offering live streaming, which is where the market is heading.

Netflix could be a major player in the space against Google TV & Hulu TV. IMO though, they can’t just sit back and be an on-demand only player. I’d love to be able to add ESPN for $10-15 a month during college football season.

They have the reach to offer this to Disney with their 200M vs 100M subscribers.

@Augustus Frost

Excellent points on the traditional model vs streaming model. What you described has been called by some people as “rate of decay” of content. In the streaming world, that rate of decay is an achilles’ heel.

“To generate meaningful growth…”

Or expand their business, such a videogames.

Mike, inside the Metaverse I’m accumulating as much Meta as I can get my hands on.

I still say one of the biggest falls will be Tesla. They are priced as if they are going to sell 20 – 40 million cars per year on a price to sales basis. Seems unlikely, but a lot of people have gotten rich by riding it up.

The whole solid state battery revolution is going to be 3-5 years before it really goes mainstream. I would hope that Tesla has the engineering path figure out how to keep their battery tech on par or they have a skunk works solid state project inhouse. If so, then they’re well positioned.

Be that as it may, Tesla, must transition at some point and offer lower costs vehicles, specifically a sedan. They’ve talked about releasing something that’s being designed out of China. If they can release a $25K compact sedan by late next year, they will have a chance to stay very competitive. Their vertical integration of their battery tech / giga factories is a major cost saver as the market transitions over the next 10 years.

But for now, I do agree their stock is overpriced, given how competitive the landscape is going to become over the next 2 years. And if companies like Solid Power & Quantum Scape nail the solid state batteries, then this could spell bad news for Tesla. For now, though, I do think they stay the darling of the EV industry for about another 18 months, by which time they’ll have to spell out how competitive their new 4680 battery is against solid state batteries or let investors know what their next big idea(s) is.

The chip shortage and the car buying mania are really a god-sent for Tesla. Otherwise, competition would have been much fiercer and much sooner.

After China saved it from collapse, Tesla seems “to walk on water”, just like its CEO does.

This is one that I will hazard a guess will come back. Some companies are like that… just part of the culture. Like Chipotle after the Salmonella AND Norovirus outbreaks.

The valuation is not based upon the cultural appeal. It’s based upon the asset mania.

Look at the price of the “Nifty 50” stocks prior and subsequent to the 1973-1974 bear market. Many were equally if not more so part of the culture then, and now. Like Coca Cola. Others are gone, like Eastman Kodak.

The DJIA fell 45% into the double bottom in October and December 1974. It took well over a decade for those I once tracked (including the above two) to recover, in nominal dollars. This was also during a period of rising stock prices where revenues and profits also increased, the entire time.

These culture stocks (and the stock market as a whole) are far more overpriced and the economy is in much worse shape today.

Wolf should set up a “deathwatch” page for all the high PE, high mkt cap stocks who really don’t have much of a technological moat.

There would be some prominent names on that list…

LOL. It can take longer than you think to get a company on a “deathwatch” to actually expire. I remember reading a Mutual Fund advisor recommending the shorting of Blockbuster Video… in 1992! The advisor/analyst thought that Cable TV would eventually kill off the video store business model… and he was right… eventually.

SpencerG,

Wasn’t thinking of deathwatch in terms of company going totally BK…was thinking in terms of insane PEs of 90 collapsing to semi-rational 30 (or lower) but taking 65%+ of huge mkt caps/shareholder wealth with it.

73 74? Holy cow!

The DJIA had Avon, International Harvester, Gulf and Western (?), etc….

and the Dow was about 600….

a trip down memory lane

In “Sleeper” Woody Allen’s character (unfrozen after 200 yrs) remarks about how his Polaroid stock must be worth millions.

Implosion lists are somewhat interesting but dancing on a grave AFTER the fall is not actionable information. I’d rather read about stocks to short. Where was the prediction that NFLX was going to crater?

In addition, one or two quarters doth not a trend make. Look at the price drop in AMZN during the dot com bust, down to single digits. Would you have left it to die in the street?

“Where were the predictions…”

Very, very few companies with revenues in the billions are going to be able to justify absurd PEs+ (40+, if that)…basically they had to reach so much of their potential mkt in order to reach billions in sales, they can’t possibly maintain the growth rates implied by ultra high PEs.

*Especially* if they don’t have some serious technological moat to keep out competitors.

Really, unless the affected companies are pretty tiny, PEs much in excess of 40+ are much more a product of shareholder paint huffing hype (and ZIRP desperation) than they are anywhere near a realistic appraisal of ultimate corporate financial results. Such numbers just don’t work 90%+ of the time.

Ultra high PE company shareholders behave like every human being on the planet will buy their dog food…twice…and that there will never, ever be another dog food company.

Kodak isn’t gone completely. KODK was reborn, and there’s a spinoff as well I think.

Widsom Seeker

Kodak was briefly turned into a meme stock before re-collapsing. It also got into hot water with regulators of its fake crypto announcements-with-stock-grants.

This is a fun one from the archives:

https://wolfstreet.com/2020/07/29/thezoohasgonenuts-kodak-after-crypto-scheme-in-2018-caused-its-stock-to-surge-300-before-recrashing-gets-trump-pump-worth-2190-before-recrashing/

Including this chart before the re-collapse:

Why is Apple on the FANGMAN list? It’s been teeter tottering within 8% of its high the past several months

The FANGMAN were the glorious stocks that drove the market. Now we’re starting to remove the letters as the stocks plunge. The N is the first letter to go. The As are still in the FANGMA though.

Ohhh gotcha thank you

Also, the big T is still there.

The FANGMAN predates the time when T was big enough. Someone here pointed out that FATMAN should be the new thingy. I while back, I coined FANGMANTIS.

The issue we now have is that two of these outfits changed their names, and the old acronyms don’t really work anymore.

So FANGMAN should be MANAMAN… now MANAMA. Then if the first M falls off, it’s ANAMA, then NAMA, then AMA then MA…

HummunnaHummannaHummanna???

may we all find a better day.

Can’t wait for next months margin debt report.

I can hardly wait, with very clearly ”baited breath” for the clearly coming reports from WS,,,

As far as I can see by reading many other ”reports” from other sources,,, most of them are just ”shills” and have nothing,,, as in NO thing to say to help us old and elderly folks figure out how to ”invest.”

VVNV-why you, and i, and many, many others refer to each other as “…old chum…”.

may we all find a better day.

FB / Meta / Facebook is down over 50% from its peak, including the incremental 7% plunge happening today.

I don’t think FB driving the market higher anymore.

I suppose it could still drive the market, though … in the other direction.

Amazon will be interesting to see… just saw a list of 5000 AWS IPs scraping our sites…So anyone with a credit card can rent AWS servers… Kinda like renting out a hotel room to Heisenberg to cook the blue stuff.

There was a lady in Washington state who recently dropped her cell phone in an outdoor pit toilet facility in the mountains. She dismantled the toilet and tried fishing it out with a dog leash. When that didn’t work, she somehow used the dog leash as a safety line and lowered herself in the hole a bit. Of course, the leash broke and she feel head first into the pile and was stuck in there for hours until an emergency crew arrived.

What does that tell you about the perceived value of iPhones in our society? She’s probably proud of herself for getting the phone out.

If she’s a young female, she can dress up scantily and provocatively and wheedle the young, mostly male Apple store techs into a free phone.

I wasn’t there, but I know it’s been done.

Be a lot more fun than falling in the loo, too…

The world can live pretty easily without Netflix.

It doesn’t really have to – Netflix has no magic tech monopoly.

There can (and will be) hundreds of Netflix competitors – that is kinda the late dawning awareness that helped power Netflix’s price collapse.

For comparison, note how 1 million websites drove standard advertising CPMs from $10 to $1 (and below).

Competition squashes margins.

But 90 PEs suggested that Netflix had discovered the secret to pooping gold.

It didn’t.

Awhile back Netflix realized it had to differentiate by content: big headline shows. But the era of free stimmies money and staying home meant the competitive forces were not prominent. Customers curled up and bought many services.

If there are consolidations now, that go deep, it could mean downsizing. As in, loss of redundant jobs.

If your “moat strategy” is to simply spend tens of billions (with “meh” outcomes)…that’s a “bold move, Cotton”).

If blindly flinging billions around automatically accomplished anything, the US would currently be a glowing galactic empire, instead of a rotting husk bled to death by long entrenched political interest groups feeding off the decaying corpse.

“Spending money” per se is not a competitive advantage…only outcomes matter, whether they cost a dime or a dollar.

Streaming *technology* is universally available (note, Youtube) and the future may be a bazillion “content networks/libraries” paying for pretty low cost streaming carriage.

Really, the “atomic unit” of visual media is the individual movie/series/episode and whatever fee/ad revenue that atomic unit can gin up.

“Studios/networks” will probably persist due to risk spreading/economies of production scale and economies of capital raising.

But with the “broadcast access” barrier to entry lowered so much (streaming) there should be many, many, many more of them than historically.

The same way 25,000 newspapers/magazines turned into 1 million websites.

N is for NVIDIA, not for Netflix. NVIDIA will join the imploded list sooner or later.

FANGMAN has two Ns.The first is for Nvidia.

I don’t think the world can handle

FAGMAN…

It won’t. It’s already FANGMA. If the next N goes, it’s FAGMA

The beauty of economic statistics, you will eventually find a data set to support any point you are trying to make.

The BRIC isn’t doing too well either.

I thought it was FATMAN; Facebook, Alphabet, Tesla, Microsoft, Apple, Amazon, Nvidia.

NVIDIA makes graphics cards that are popular with crypto coin miners. If crypto starts looking like a loser, that’s when NVIDIA may take a plunge.

Also that ASIC (Application Specific Integrated Circuits) mining now is way faster and leaving GPU mining trailing, so unless Nvidia can quickly get into ASICs and master them too, its on a losing path.

It has begun developing its own TPU in this category, but that might be a long shot gamble..

Thank you for saying that. I agree with you. I was trying to develop a “Crypto Strategy” earlier this year and did a bunch of research into Crypto Mining versus Staking. It is really amazing how fast the GPU market ran up in the past couple of years… and how fast it is about to collapse.

If staking overtakes mining then Nvidia is toast. Why spend a crap ton of money on mining when you can do Proof of Stake with a cheap laptop?

It’s both cheaper and more egalitarian.

RTGDFA

The new acronym of recommended stocks.

LOL. This acronym can never be unseen.

AGREE, like totally dude!

And that’s EXACTLY ( or close ) why WolfStreet needs to have a ”clickable” list of acronyms, eh?

If possible, make each of the ones on the list automatically highlighted and active in at least each article, maybe even every comment ??

So that those of WE the PEONs who might be entering or already well along with CRS ( Can’t Remember ”Stuff” ) or advancing into CRFS (the F for ”familiar” or something) can refer to those acronyms when reading Wolf’s Wonder!!!

Thank you for your help with this matter.

Of course: Roku, Tesla, Google, Disney, Facebook, Apple

Password sharing also has a subscriber upside easily overlooked.

Sharing can be to spread the cost. If it can no longer, participants may balk at the now higher cost for each of them

Or it is shared and the paying person who is not eatching sufficient to justifies, keeps the subscription knowing e.g. the child who went to college is still watching. But if no longer, why keep? Plenty of alternatives that are cheaper

With “221 million paying subscriber households and 100 million nonpaying subscriber households” A business should just do the cold hard calculations of maximum subscriber upside.. What if they dropped the price 50~66% while cracking down on password sharing and be X% successful? What if they raised the price instead and leave the password sharing alone (and it increase X%)? If adding ad service to supposed premium paid subscriber service is a sin (cable died), what if they create a free service with Ads, like Youtube Regular?

Finally, if Netflix lost 200K subscribers globally, but 700K lost was from turning off the TV in Russia, it meant globally it had 500K new subscribers. Perhaps Netflix shouldn’t have pulled out of Russia, there’s nothing related to national security I can see from Netflix continuing TV service in Russia (though quite possibly it could just be turned off from the other side)

There may be no national security aspect to trade with Russians but there is certainly a financial penalty that can be brought down on ANY company’s head for doing so right now. If the American government doesn’t wallop you… the Russian government will.

I can’t see why the Russian government would wallop Netflix or most of the foreign services for that matter.

As with many other companies, it was a PR move by Netflix. Wonder if they still think it was worth it.

“Finally, if Netflix lost 200K subscribers globally, but 700K lost was from turning off the TV in Russia, it meant globally it had 500K new subscribers.

NO. You didn’t read the other part: It lost 640k subscribers in the US and Canada.

And it estimates that it will lose 2 MILLION subscribers this quarter.

How many of those 221 million paying subscribers watched tonight’s nightly news and said “I can share my password!?”

“Sharing can be to spread the cost.” —

We just had that *exact* conversation about the value of the various services – Amazon, Netfilx, Disney+, etc. – that we share with our son. Conclusion, Amazon’s gone, others will be whittled down in the next few months.

My two TVs are 9 & 11 year old Panasonic plasma sets. I watch a lot of sports. As I watched Arsenal beat Chelsea this afternoon, the picture coming in from USA Network and streamed through Hulu via a ROKU device was very clear @ 1080P — the limit my sets have.

But for those with newer 4K sets, and especially the OLED, QLED & Neo QLED, the game was broadcast in 4K via three sources. DIRECTV, YouTubeTV and FUBU. It will be interesting to me to see when 4K becomes more standard with other streaming services for major international sports.

Netflix is not in on the game of HighRes video transmission of Premier League matches. Why not? I have never used Netflix BTW.

Up until recently, when an event was on broadcast TV, it was the most clear picture. But no longer. Now the picture is better with my ROKU device streaming from a few source providers that play at 1080P.

In the Twin Cities from the broadcast towers & free:

Public TV = 1080I (interlaced)

CBS station = 1080I

ABC station = 720P (progressive scan rate which is double the rate as interlaced, but not as many lines across the screen)

Fox station 720P

NBC station 1080I

It seems to me that the future for streaming is higher video quality. That does require good internet & WiFi source though. US Internet has a fibre optic line directly to my home underground with 500 Mbps @ $60 per month (my plan) or 1 Gbps @ $70 per month.

The technological advancements have been awesome. No more worrying about weather issues with my Dish TV satellite of a few years ago!

One of these days, I’ll upgrade to a 55″ 4K NeoQLED, but not until there’s more programs in 4K. Are you listening Netflix and other providers?

500 Mbs for $60 per month is a good plan, copper coax can handle that connection. BTW, I use the 50 inch NeoQLED (Samsung) for my computer display and TV streaming, both at 4k.

I got one of these at 50″ arriving tomorrow. Stupidly smashed my 8 year old Panasonic with my camera’s tripod.

Hope the replacement is as good as and lasts as long but doubt it.

You won’t believe the improvement! 😉

Dan some OTA TV stations are now broadcasting in 4k using ATSC 3.0 (they call it NextGenTv) in addition to their ATSC 1.0 HDTV standard. Some of newer TVs are now coming out with the ATSC 3.0 tuners. for example the Sony XR75X90J model has it.

Here’s the link to the 4k stations in your area: https://www.watchnextgentv.com/markets/st-louis-mo/

There is only so much of streaming bs that is nothing more than a pile of steaming bs. Everybody wants to sell you a service on a service you are providing to them to sell to you. Can’t find anyone that wants to work on my Snapper Mower, except moi. It’s an f’ing wasteland and it needs to be trimmed.Netflix is a a good start.

Carb trouble?

Yeah, from a Californian: DD doesn’t eat enough carbs. Needs to bliss out a bit.

What

LOL… John Oliver did a sketch a couple years ago calling on Holloywood to stop creating new streaming channels and listing 20 or so of the BS streaming that are out there. The punchline was when he said to the audience “the last two are FAKE channels that we made up… and you didn’t even notice!”

Netflix and Paramount are paid for by several Cellular companies, such as T-mobile, as a benefit to its cellular subscribers.

Netflix could have come up with a way to prevent sharing of passwords. The fact that they didn’t shows what a s$ithole company they are. Just look at their board of directors. All losers.

I suspect a lot of their subscribers do so FOR the ability to share with others….cutting it out just might lose them even more customers.

The content on Netflix is so bad if it was free I wouldn’t even watch it. IPTV has much better content and live television from around the world if you can speak other languages.

I watch the foreign content almost exclusively, it’s the American content that is unwatchable garbage.

I also.

A lot of people use vpn’s and live very close to each other. That’s likely the two reasons.

“FANGMA without the N.”

I think it is safe to say “FANGMA without the F & N” following the market cap loss of both Facebook and Netflix combined.

Wolf has shown how many stocks have been wiped out so far this year (some by over 90%). This is a repeat of 2000, when we had momentum stocks like Cisco and Intel carrying the whole market to hide the ugly truth beneath.

CSCO fell from $82 to $8 back then. It’s still lower now. It’s grown the whole time, makes big money, has a decent balance sheet, and pays a decent dividend by today’s standards.

It’s a solid business making something actually useful, as opposed to current “disruptors”.

If CSCO still sells for less now (noticeably less) 20 years later during the biggest asset mania ever, what’s going to happen with these overpriced bags of hot air when the asset mania crashes?

(It’s a rhetorical question.)

CSCO’s main business since Chuck Robbins took the CEO spot is stock price manipulation (see buybacks) and they, too, are now betting the farm on a software and licensing subscription model. Most of the growth numbers they report on subscriptions are forced on buyers with an initial hardware purchase or seeded in by sales as incentives, but the actual paid renewal numbers are grim.

Netflix only allows a certain maximum number of simultaneous streams (2 to 4, depending on the subscription plan). Given that they impose this limit, why should they care who is doing the actual streaming?

Plus, this sharing is not new… been around for years. Seems like a poor excuse for the fact that they have simply reached their limits of growth.

I agree! Given the limits on simultaneous streams, cracking down on sharing is not related to cap on product delivered.

I will terminate my longstanding membership if I can’t share will a couple less-well-off relatives or friends.

Besides, in my old age, almost all fiction plots (drama, science fiction, etc.) seem repetitive, boring, propped up by violence and fashion model actors (instead of the old character-based actors back in the day).

I’m going to start trying to get through a list of Netflix documentaries, nature films, etc. in anticipation of terminating my subscription. For example: “Downfall: The Case Against Boeing”

I agree.

Netlfix may lose money if customers move back to 2 streams instead of 4 streams.

I suspect not many households need 4 independent streams in one physical house location. If they do, there is something wrong with the family.

Good thing I didn’t buy it when Cramer told everyone to back in January (?). Hardy har har…

I am showing current price to sales at 3.4 so it’s not dirt cheap. Price to Sales could be less than 1.0 if it’s a competitive industry.

No one is talking about Netflix’s idiotic woke programming. No one wants to watch this BS.

Anthony,

Let me put some numbers to your statement that “no one” is watching Netflix.

They have 221 million paying subscriber households and 100 million nonpaying subscriber households (password sharers), for 321 million households that are regularly watching Netflix content. If each household has 2.3 people on average, you might multiply 321 million households by 2.3 to get 761 million people who are watching it more or less often. 761 million people are a lot more people than “no one.”

You may hate it. Other people love it. Just because you don’t watch it, doesn’t mean no one watches it. That’s a common fallacy to extrapolate from your own preferences to everyone else.

BTW, if you don’t watch it, how would you know that you hate it, or what its content is like?

Imagine how much worse the results would have been without Midnight Mass and Squid Game.

In all seriousness, the password shares might be higher, a lot higher in my experience. Hight inflation is making people very creative (I will buy you a 6 pack every month if you share your password).

In yesterday’s call, they said that a global crackdown on password sharing is coming. Makes sense from their point of view, but I think that will actually cause even more people to unsubscribe.

As a longtime Netflix subscriber, I mainly use it in combination with certain programs for language learning. They have some good content, but other companies have good content too, and it’s not the content on Netflix is so MUCH better than the other guys. If they are thinking of cracking down, they should think of lowering their subscription price.

Very sound argument, Wolf. Maybe its associated with the name but I have to chime in and say I do extrapolate my own preferences to everyone else sometimes (especially for millennial generation consumption behavior) . It’s funny to hear see you call that out here.

And I can’t type. It’s funny to see you call that out here*.

Everything I don’t personally like or understand is “woke”

:-)

Thanks for the laugh.

😂

or: everything that makes me uncomfortable by challenging my own biases or by denouncing injustice that does not concern me, is “woke”.

No one goes to that restaurant anymore. It’s too crowded.

Gomp, was just about to toss that immortal Berra-ism in here, meself…

may we all find a better day.

Thank you, Wolf!

This does remind me of the 2001 Tech Bubble. Back then companies like Apple also plunged 80% but recovered quickly (within 4 years) because they did have a dedicated following and were profitable. Many did not recover and many no longer exist.

Netflix has a great idea and it still has a very large customer base but competition is fierce. Can they innovate like Apple, or will they join the thousands that will be wiped out?

I am watching closely. I wouldn’t want to miss another Apple

“No one wants to watch this BS.”

We DO watch it !!! Meaning me & my HS and service buddies.

Wokeness absolutely deserves to be watched, in small doses yet on a regular basis. Exposure to germs strengthens one’s immune system.

Let’s elaborate…

Muggeridge’s Law is the proposition that it is no longer possible to parody political correctness/wokeness because REAL political correctness is now just as ridiculous as the satirical version.

Malcolm Muggeridge was the editor of the British satirical magazine Punch in the early 1960s. When Nikita Khrushchev visited Britain, Muggeridge made up a list of the silliest places the Soviet leader could visit. At least half the places on the list were in Khrushchev’s actual itinerary.

There will be no comic strips depicting Pelosi taking knee in Kente cloth, or Lloyd Austin wearing space visor, or Joe Biden making sideways sashay – because original photos ARE the comic strips.

Same with woke TV. Goes down smooth with Coors or Miller Light 😁

What is “woke programming”?

To some people, “woke” explains all the ills of the world.

“Whatever it is, I’m against it!” – Groucho Marks, in “Horsefeathers”.

Sadly improving the video quality does not improve content quality. I haven’t had cable for 15 years.

Good point. But sports with athletic women in Lycra looks better in good video quality.

Just saying’ …

So true!

‘Larry Flint’

🤣LOL😅

To be a bit more serious, most sporting events look great with the equipment that’s used in broadcasting today.

Super slow-motion during the World Series with ball spin coming from the pitcher to the bats’ oscillating as the baseball hits them is neat to see. And slalom skiers in slow-motion with the skis getting pounded by the ruts in the turns they navigate also needs to be seen to be appreciated for what they do.

When you think about how far some of the cameras are from the action, and how sharp the picture is on your TV from that distance, it’s remarkable how the technology is now.

Watch Formula 1 from Imola, Italy this weekend, to see the sidewall flex that also oscillates over the curbs in close detail when the cars blast through corners at the insane lateral G forces for another good example.

There is huge money in the video rights and sponsorship contracts at these events too. Sports is business and athletes’ competition added together when you think about it.

The micro face twitches and wild iris dilations of the fired executives could be fun to watch too. Eyes roll upward to a sight of the disappearing third vacation home. Resignation sets in (the rat stops fighting the experimental stream of water). The AI can do the commentary now.

Sort of like THX 1138 (the novel anyway, remember those?) opening with the guy pleasuring himself watching a robot beat someone.

Don’t worry ….. the Netflix/Hollywood nephews are gearing up to improve their “content”.

They’re gonna make Dr Zhivago, Ordinary People, Lawrence Of Arabia, On The Waterfront, The Pawnbroker, The Hours etc. Any minute now ……

You’ll see ha

We do like Netflix but their pricing has changed.

Were not looking to move for now.

Nothing exciting except “the low share price” (!). Thank you JP Morgan; if you liked it at $700…

JPM is just an errand boy, sent by grocery clerks, to do the chores of capitalism. The customer is king — king of self-delusions and pulling onto himself a yoke of serfdom he needn’t do.

The Hangman came and took away an N.

The next letter will be F.

Do you think Netflix has the right to hook people up, letting them watch family friendly TV shows, making them watch season one and season two and then when they are hooked then suddenly in season 3 Netflix swaps narrative and make viewers watch kissing guys with each other?Consumer should have the right to chose the type of content they want to watch. If they do not get that right, if they get silenced, and tricked over and over again, then it is not a democracy but more like a large scale human experiment, enforced by a very few. These activists, or communists are pushing a rouge ideology (that does not apply for the majority) too strong and as a result of that Netflix is slowing down…

“… a large scale human experiment, enforced by a very few.”

Ground control to Major Tom. Come back to earth. If you don’t like the videos, don’t watch them. Watch the videos you do like. This is just entertainment, and there are a gazillion videos. Surely you can pick 30 videos a year out of the gazillion that you do like, and if not from Netflix, then from somewhere else. There are more choices than you can shake a stick at.

“Ground control to Major Tom. Come back to earth. ”

That’s pretty good Wolf!!! I you offer that saying on a mug I will buy it.

“kissing guys, “communists”, “activists” = “rouge ideology”

LOL

keyboard errata for the best laughs

LOL!

The “French Fungus” of the 1960’s movie, “Z” is still infecting minds today!

Rouge ideology?

Are the guys kissing each other wearing too much rouge or something?

Mike…

Consumers should have the right to choose the content they pay for….

I agree. Cable bundling keeps certain networks afloat that normally would fail. Ala carte would be ideal……

The impetus to keep the bundling seems to be a bit of social engineering.

Which networks would fail if cable was ala carte and unbundled?

As long as the customer has the right to walk away, turn the show off, this is the core value of a free country. Consumers got bundled with all sort of things — like marriage, kids, compulsory military service (earlier), etc. A family is a massive bundling of parts that change over time. Like citizenship. To me that is a core story of the 20th century, but of history. There are frictions with the “subscribers” of those things. Guess what: don’t buy in. Then you can ala carte everything.

The fantasists just want to punish the bundlers, ex post. The bundlers BTW are called “leaders.”

That’s why I don’t like the term for consumer end users, “users.” That is flattery and manipulative word choice. They are not the users in this picture. They are the followers who grumble about every little shift in the regime they toil under. It has NEVER been different.

Netflix is a rat experiment and guess who the rats are?

“Consumer should have the right…”

Scary words, usually followed by the speaker citing a benefit that the speaker wants for himself, which benefit should be paid for by someone else.

Coercion and/or regulations are frequently involved… possibly a new government agency.

Many of the gay men I have met have been very right wing. No need to worry about communists there.

I’ve been asking Netflix to bring back “Death of Stalin” every week since Russia invaded Ukraine.

Youtube has an incredible array of Russia content, including along with nonfiction, the “Great Patriotic War” movies their public has been awash in for years. (It will translate in real time to English subtitles — sometimes laughably.) Free with advertising. All you need do is dispense with the never-satisfied treadmill to see more micro-resolutions of things. Which is a sideshow anyway. Grainy old war films have plenty of information.

We should make a checklist, Wolf:

FANGMA

F – Facebook, Stock down by 47% from the peak

N – Netflix, stock down by 68% from the peak

Only Facebook and Netflix get bloodshed. I didn’t see a big crash for other 4 stocks. The big crash is long due.

When the Fed raise interest rate by 0.75% (0.5% for sure) plus QT in May, do you expect there will be a bigger crash (or correction) on the FANGMA stocks?

“I didn’t see a big crash for other 4 stocks. The big crash is long due.”

Look at Microsoft and Google stock buybacks. That’s all you ever need to know.

A group of former intelligence and national security officials on Monday issued a jointly signed letter warning that pending legislative attempts to restrict or break up the power of Big Tech monopolies — Facebook, Google, and Amazon — would jeopardize national security because, they argue, their centralized censorship power is crucial to advancing U.S. foreign policy.

Amazing stuff. Say bye bye to Lina Khan.

“A billion bloodshot eyeballs staring at flashing pixilated screens….that’s the message” – M. McLuhan

We have degenerated from figures dancing on hillsides, to eyes peering in the dark

— A paraphrase of Jim Morrison

Unlike Jim, I took that to heart, and in my mid-60s, still literally dance on hillsides. And subscribe to none of the above. And read 2-3 books per week. And read wolfstreet, best website out there.

What I don’t understand is why these companies feel they need to constantly grow. Perhaps 220 million people is the best they can do and they should run a profitable company based on that number of people. Keep the price static growing with inflation, make programming based on the subscription revenue and start giving dividends.

“What I don’t understand is why these companies feel they need to constantly grow.”

Because the must grow to increase their earnings per share in order to increase their stock price. Their so called “investors” demand that.

They have been buying their own stock to game earnings per share (Like IBM), but now they are billions in debt and interest rates are going up. That’s how years of ZIRP and NIRP will eventually blow up the stock market as well as pension funds.

CEO incentives to grow company,get rich via stock options, They we’re illegal,but brought back ,

I guess I’m just getting old, but I dropped Netflix a long time ago. I thought most of the offerings were trashy, offensive garbage.

I know there’s a market for that, but not everyone is interested.

Netflix and the others just can not keep good content coming…..agreed.

“ Netflix and the others just can not keep good content coming”

You are wrong….

Isn’t there like 1600 Batman movies now…

I rest my case….

And how many James Bond movies? And Spiderman…..

Now maybe Reed and his wife won’t be able to afford to aid George Soros in electing super liberal District Attorneys, many being recalled.

Still….. a 23,000% price increase from its beginnings is still a huge success

Well, in 5 months, you gave up two-thirds of all the majestic gains since the beginning.

Stocks can always go up many thousands of percent, but can only ever fall 100%.

And don’t forget those huge gains unusually go to the insiders and venture capitalists. Many others have to lose their shirts for that “huge success” to come about.

If you look carefully at the NFLX chart in Wolf’s post above, you’ll notice how the price surged from $500 around February ’21 to the $700 peak in November.

I’m wondering if many of the smaller cap imploded stocks Wolf showed elsewhere had their peaks taken out in February ’21 by sellers rolling over the cash into FAANG stocks in hopes of more stability, only to start being mauled again in November.

I was early to abort, doing it a few years ago. I had been a subscriber for over 10 years. The price kept going up but the offerings weren’t getting any better. When I realized it had been almost 6 months since I had watched a thing, I was done.

DC… absolutely dead on regarding the content. I’m one of those who has been a subscriber to the DVD rental service for 20+ years. Why you ask? The depth of the content and the ability to find, get and watch back catalog of actors and directors 😇😇

It, ”The depth of the content and the ability to find, get and watch back catalog of actors and directors ” WAS great back in the day, eh IT?

Now, almost every movie ”out of copyright” can be found with a little digging into various now available for free streaming ”archive” type websites.

And that will continue IMO, at least until we all get the implants to our brains to be able to see whatever movie, etc., that has ever, ever been on the net,,, and whenever we wish to see it…

”Forensic Mining” of the internet is leading the way to that world,,, and won’t it be fun, eh

“In dollar terms, the market cap of Netflix plunged to just $100 billion today. Since the peak in November, $206 billion have evaporated.”

$206 billion is a shitload of money. Almost a quarter trillion in lost market cap in less than 6 months. WOW.

“$206 billion is a shitload of money”

The fact that most of it disappeared so quickly means it was never any real money to begin with. It was just an illusion of wealth that the Fed had created, and sold to you.

With a nice wealth transfer to the nimble few. Some “value” to subscribers meanwhile.

Netflix need to enter the metaverse, to revive their stock price. Let’s call it Metaflix. Next-gen content for next-gen Web 3.

Bill Ackman just existed his Netflix position with a 450 million dollars loss. His fund just turned negative for the year.

BIG OUCH!!!

Exited. Not existed.

How can Ackman hold on with so many losing ventures? Oh, I know. It is the central modern phenomenon: the latest iteration of talkative rock star with breathless fans throwing money.

Ackman is a mere mini-Musk.

He’s a smooth operator…….(sung by Sade)

It’s the money manager curse that their time horizon for performance has to be a few quarters so they don’t get fired. I think it’s one of the advantages of managing your own money as there are not many people investing who make decisions on longer term fundamentals.

It used to be that you looked at a 10 year Treasury and used that plus 3 or 4% for a long term investment hurdle rate. Now people shoot for 3% or 4% per month. It’s just gambling.

I want to be like Bill Ackman or any of these big whale hedge fund guys…losing hundred of millions with no repercussion and still be view by the mass as some inverting genius. Another case in point, Masayoshi Son, another genius for good at sending money to money heaven.

Here I am sweating over losing couple of thousands when my trade or 401k go south…

Phoenix-to paraphrase R.A.Heinlein:

“…have you ever noticed that someone who goes broke in a big way never seems to miss a meal while the poor guy who’s shy a slug has to pull his belt in another notch?…”.

may we all find a better day.

Netflix data rates on non-4k are really poor these days.

Mushy quality even at 1080p, not nice.

It used to be sublime.

Very sad to see Netflix get it so wrong.

The questions you need to ask are things like what do people do when inflation is running over 8% and are feeling broke.. Well, its easy to downgrade(or maybe upgrade) to a cheaper phone and get rid of your apple..(like the 145 million Russians now have to as Applepay is turned off and the stores have closed) Its easy to get rid of netflix, et al. It’s easy to put off buying anything containing microsoft. It’s easy, if you are now the new poor, not to buy bitcoin or a super expensive electric or ice car and so goes the chip company Nvidia. It’s easy to not buy stuff off Amazon or to buy their prime service and just stick with basic goods (like food) from Aldi or Lidl…..

Because it is all so easy,( and that is just the USA) you can see where a stock market correction could come from………..

When an economy is doing well and salary rises in a competitive employment landscape rise, which drives demand side inflation, then fine… you cool it down with higher borrowing costs… or enterprise relieves the supply constraints.

But this time is different.

Inflation caused by supply shocks (self inflicted really as they were all policy driven), without equitable pay rises… and then tightening economic policy to combat it.

Look out below.

A few rich people still living it up, don’t make a healthy economy.

I have to add something, after I listened to all the farming channels….that mainly point out we have a world wide vast shortage of fertilisers (in all its forms), shortages in seeds and basic farm weed killers/ insecticides. The food we eat today was produced, mainly in 2021, before fertiliser rose in price by well over 100%,( if you can get it, especially as huge amounts come from Russia.) Without nitrogen fertiliser (produced from expensive Natural Gas) wheat crops usually half. So, we will see by December the effects and any food price rises. It could be goodbye Netflix….

Agree. Food inflation will be mind blowing….

Curiously, the govt is still paying farmers for idle land.

That’s the govt for ya.

Between food and energy stresses, are we experiencing the beginnings of a longer term commodity up-cycle?

That, plus up-rate cycle spells Tech-wreck II .

[cue: FANGMA receding into setting sun horizon]

I struggle to call food price inflation, inflation, for these reasons.

Wheat isn’t really food. It’s edible but not really preferable for our bodies. It’s cheap carbs.

Just because it’s a staple doesn’t mean it can’t or shouldn’t suffer from fluctuations in price.

Farmers still get yield without ‘fertilisers’, but fertilisers can be anything, like sewage, manure, whatever.

We could increase yields by just farming more land at lower more sustainable intensities.

The lack of preferred fertilisers is caused by government policy, not prevailing market issues.

Germany has the sense to not cripple its economy over Russias war in Ukraine, other countries governments appear to wish misery on Russian and non-Russian average people in a supposed effort to ‘stop putin’… in reality it’s just artificial inflation targeted on the majority.

All this assumes alternative suppliers and sources won’t now be viable and be coming on stream.

Ie, the UK has viable pot ash reserves aplenty that can probably now be mined feasibly with vast profit margins due to the price rises. I believe the UK crown estate will benefit hugely from these supplies under the UK coastal regions.

Supply and demand.

Governments have cut out a lot of supply.

Now new supply will take up the market opportunity.

Competition will bring prices down.

Was it ever any different?

All I see here is governments meddling heavily in supply and demand and causing all this action, but markets will work to balance it.

What will be telling is if government keep meddling to limit supply… Tin foil hat time.

Or just create a veg patch in your garden and enjoy carbs with fibre and vitamins!

Kenny Logouts,

You keep forgetting the demand aspect of inflation: we now have the most grotesquely overstimulated economy, after two years of $4.65 trillion in money printing, interest rate repression, and about $5 trillion in deficit spending from the government.

All this money was created and thrown out there into the economy that is now looking for a place to go, and it broke the physiological wall against price increases — and the inflationary mindset took over. This is now everywhere glaringly obvious, among consumers, corporate, and government.

That’s the demand-side of inflation, and the psychological aspect of inflation. The only way you can crack down on it is by reducing demand and breaking the inflationary mindset. Massive rate hikes to make it very expensive to borrow to buy or finance anything, and large-scale financial losses in the markets will do that. It really works. But dilly-dallying around makes the problem much worse.

I disagree. When all the items in the basket are going up it’s from too much money being printed. If the money supply is flat then people have to forgo consumption of some items to afford the highest priority items even if there are supply bottlenecks.

It was a policy choice in dealing with the Pandemic. I think policy makers tend to do what is easy today and deal with the consequences later. The high inflation is the later.

OS-it appears that the can is now so dented that its altered aerodynamics may seriously affect the delta-v potential of the next kick…

may we all find a better day.

I cannot fathom the amount of hate and sneering thrown at Netflix in this thread; lots of poseurs and precious sneering princesses here, I’d say.

Sure, it has lots of dross as filler, like most streamers, but it also has more quality content than I can find time to watch, even with my limited social life, so at 7.99€ per month it’s an absolute steal. And the stock is overpriced but since apart from a lone spike in 2021 Netflix does very little share buyback, how is its high-flying stock its fault?

Oliver –

Seems like you might be processing with selective attention. For me, the amount of hate and sneering in this thread seemed relatively minimal, compared to the standard intensive hate and sneering characteristic of the American spirit these days.

“ I cannot fathom the amount of hate and sneering thrown at Netflix in this thread; lots of poseurs and precious sneering princesses here, I’d say.”

Oliver, LOOK !!! A Squirrel!!!

You guys seriously need to cut down on your screen time before you get cataracts or something.

I’m ready to dump DirecTV. 867 channels and there’s nothing on because the decent content has been scattered off to assorted streaming services, leaving little behind besides crap reality teevee, CNN, and reruns of ‘Rawhide’. The Science Channel avoids science like The Plague, not that anybody avoids The Plague anymore.

Entertainment stock speculation lacks any appeal. Having shorted the daylights out of bubbles ahead of the dotcom and GFC busts, naked, I don’t need the money. They come like water, and like wind they go.

I’m not about to waste my evenings off chasing down streaming services. I’m going to put the antenna back up, borrow DVDs and Blu-Rays from the local library, and join a gym and a softball league. I could use the exercise.

Ah, my sinuses just cleared up. I’m sure that’s significant.

You still have DirectTV? AOL too? Damn!

I’m bored with my toys. I need fresh toys.

Powered hang glider…. with an iPad for watching Netflix… trying to stay on topic …

Pal messed up his knee first time on powered hang glider. Then again, should have tried it sober. His overamped cerebral function liked to think it could manipulate things as if they were cartoons. Sort of a human problem.

phleep, you are definitely on a roll this morning! Add something special to your coffee?

“Evaporation”.

Sing to the tune of Carley Simons ‘Anticipation’.

There is nothing physical about American business anymore, when the stocks fall, the digital deficit and stimulus money just evaporate on the computer screen. Wealth is real in the U.S. as long as it doesn’t evaporate.

I do think we have went overboard on digital entertainment at expense of being able to produce real necessary goods like housing or practical medical care. It’s a little funny that the unreal meta is replacing the unaffordable real.

Comes the backlash to real things. “Analog” stuff, from a digital POV. I foresee lots of countries suddenly getting a tight grip on their chips in the game: physical commodities. Mexico I hear is advancing legislation to nationalize lithium. All those fancy consumer gizmos have such precarious supply chains. That drama aint over.

Could seem nice to a holder of commodities in the market (as my oil fund has been a godsend lately). But nationalizations also mean cancelled contracts.

OS-makes me wonder what percentage of the national GDP is provided by the entertainment ‘industry’ (reckon it’s part of ‘services’?). Might be illuminating when contrasted to the portion held currently by the production of consumable/durable goods…

may we all find a better day.

Brant Lee-

That sounds vaguely like the song sung by gold enthusiasts.

Yearning for the tangibility, indestructibility and permanence of a metal money.

Maybe it’s just me.

Yep…Never seen the series The Royals. The only royals I see are on my sovereigns.

John H,

Nah, I’m not promoting gold as most people see it as bars and rounds same as silver. Or paper contracts. But for those who have saved coins like silver dollars and silver eagles, the prices have doubled in 2 years literally to $40+ and still heading north. Not bad.

Netflix could always merge with Meta or Twitter and change its name to MetaFlix or TwitFlix.

I owned shares in the predecessor to Netflix. A company called USA Video Interactive on the Vancouver stock exchange. This was the year 1997 also the year Futureway communications started. Right stock but wrong timing as the price of bandwidth didn’t fall fast enough and USA Video Interactive went bankrupt.

And yet the Stock Market goes up, indexes seem to recover very quickly. That leads me to wonder if when something falls the “money” isn’t lost nor evaporates, but simply moves to something else? All that liquidity just sloshes from one thing to another. As long as no one opens the lid and removes any of the market liquidity from the big financial jar( where would you put lickity/sticky/liquidity anyways), does it just stay there, one stock going down/Dow becoming is just another stock or a bunch of them going up/Nasdup. A beep and a bop, a bop and a beep….maybe the stock market is just a giant kaleidoscope, more amusement than reality…..

“ That leads me to wonder if when something falls the “money” isn’t lost nor evaporates, but simply moves to something else? All that liquidity just sloshes from one thing to another”

I think you’ll discover the answer to that in the tax code….

MW: Netflix shares fall another 5% early Thursday after Bill Ackman dumps stake and New Constructs predicts a further 50% decline

NFLX -5.45

Looks like CNN+ is the next casualty.

CNN is part of Warner Media which was acquired by Discovery and is now Warner Brothers Discovery [WBD] which is listed in the table in the article above and which is down 14% yesterday and today, mostly because of the Netflix morass. Not sure much CNN weighs in Warner Brothers Discovery, but it certainly didn’t help today.

DM: The most busted name in news! CNN+ streaming service is shut down three WEEKS after $300m launch because only 150,000 people signed up: 200 reporters and big name hosts like Chris Wallace and Eva Longoria are left in lurch…

Warner Bros Discovery is expected to shut down CNN+ after the $300million streaming service failed to take off. Bosses at the media conglomerate were said to be ready to can the struggling venture after less than a month because a mere 150,000 signed up. Staffers were reportedly set to hear the news during an ‘important meeting’ at lunchtime on Thursday. The move is a major embarrassment for the network after it being unveiled to much fanfare only a month ago. It also raised pressing questions about the decision making at the top of the company, with about $300million being blown on launching the streaming service.

$300M? They could’ve just given it to Bill Ackman and got the same result!

HBO Max reported good results as part of the AT&T earnings, +3M subscribers I read. So Netflix’s problem might just be HBO. HBO does seem to have the “must see” content these days, NFLX tries hard but their stuff is mostly lame. TBH I’ve thought about dropping NFLX for HBO, but like someone said above, my phone company subsidizes my NFLX sub so it doesn’t cost me much.

I saw this coming since they lost Disney and Marvel stuff, it was about time. Been waiting for a while for this to happen.

Are there any other up-and-coming overpriced, inconvenient, redundant tech fads I should know about? Any techniques for preemptively dodging them would be helpful.

I already have a computer and a phone and don’t need to pay double to drive one just so the spam/junk mail/robocall industry can harass me in stop-and-go-traffic.

I don’t dare retire because I’ll never hear the end of it from the millions of Medicare supplement plan providers.

Or is it billions? I forget.

Blockchain and NFT are 90% scams and overvalued until they are not. Heck make it 99% for NFT and is not just 100% but the 1% margin of error.

Susan Webber says cryptocurrencies are prosecution futures, but that’s probably just wishful thinking.

Their original content enterprise is at fault. The Hollywood system always managed to promote less costly productions as B movies and still make their bottom line. Then there were video royalties, which no one imagined would happen. Then Clint Eastwood’s Malpaso came, and left town, and he was hugely successful, by streamlining the process. These guys are more like Charles Foster Kane figuring out how many years they can run the newspaper without going broke. They don’t care. Is there really a market for that much content, (yes but probably not US viewers, and what about the Meta verse) If the consumers and the producers are aligned they will do just fine.

@AB – “If the consumers and the producers are aligned they will do just fine.” There’s the key right there – alignment. The model T, the 747, the iphone to name just a few are examples of alignment, between producer/product and consumer. Netflix is flailing in part because it is badly out of alignment. Excellent insight as always!

Looks like people started to count money and look at expenses finally.

I’m in adtech industry for long time, can try to guess what Q1 results for the rest of FANGMAN will look like

nvidia – terra incognita for me

FB – might have another “Netflix” moment in Q1, DAU-MAU loss in Emea market after it was labeled as an extremist organization in Russia, plus headwinds from privacy oriented ads monetization

Google – ad market looks strong and solid, but after 2021 where the sky was the limit for the growth, performance will be stable, but with very moderate growth, with careful outlook for Q2

Microsoft – will be very good, at least someone have to shine :)

AMZ – mixed, cloud up, but some softness in retail

Apple – might disappoint. Profit (not revenue) from apps can be down, plus very moderate hardware sales. At least looking at our ad sales, there is now more demand from retail, and businesses need more ads when there is a need to prop up sales – sign of weakening demand of non-services spend by customers

Thanks, for the insight, OM! Sounds right to me. Msft has an incredible VR system that is just entering the design community right now.

Not sure if it’s big enough to run with this crowd, but Zoom has had a similar decline, down 45% since Jan 1 and over 80% in 18 months.

As my (young and beautiful) friend asked me one day. Where did the money go?

It disappeared baby, it grew wings and flew. Never to come back.

That’s the nature of assets: their valuation is a pie in the sky…until no more.

The charts are amazing. You wake up one day and you’re poor.

Wow.

A bunch of mentally ill people led by a sociopath runs a company into the ground. Who could have seen that coming? Seen this movie a hundred times.

Speaking as a former Netflix customer:

I originally signed up back when it was DVD’s-by-mail. They had an excellent selection and the service was really convenient. Netflix added streaming, and while we had the Internet connection to handle it, their selection of content on streaming was so limited that we rarely found something we wanted to watch.

When Netflix split the two services and forced you to either double your monthly cost or pick one, we chose the DVD’s.

That continued for a couple more years, but Netflix stopped maintaining their DVD library and fulfillment slowed waaaay down, so we dropped Netflix completely.

I’ve gone back and looked at Netflix several times over the years, but have never found enough content I wanted to watch to justify the cost.

These guys are getting greedy. After Amazon’s recent increase in the cost of a Prime membership, I cancelled that as well. I’ll likely still buy from Amazon, but the extra discipline of accumulating $50 of merchandise in the cart before placing the order will likely be good. Not that I’ll buy extra stuff to hit $50, but rather won’t place an order until the stuff I need exceeds $50.