Despite the jump in tax refunds, crucial for down payments, used car & truck retail sales fell, and auction prices dipped as price resistance set in.

By Wolf Richter for WOLF STREET.

The number of used vehicles sold retail by dealers in March fell by 15% from March last year, according to estimates by Cox Automotive, based on its Dealertrack data. Blame slow tax refunds? Blame the unsustainable crazy price spike? So let’s see.

Tax refunds are crucial to the used car business this time of the year. They make great down payments. And the whole industry counts on them and parses them.

Based on IRS data through April 1, the IRS issued $204 billion in refunds, up by 13.4% from the same period last year, with 98% being direct-deposited into the taxpayers’ bank account, and so they already got this money.

The number of refunds issued rose 1.7% from a year ago, to 63.36 million refunds through April 1. The average refund amount jumped by 11.5%, to $3,226, a great down payment for a car.

So, 1.7% more people received their refunds than last year at this time, and they received much bigger refunds on average, making for potentially more and bigger down payments – and that’s why the number of used vehicles sold in March should have at least matched last year’s total. But sales fell by 15%.

And that’s where the crazy price spikes come in. The entire industry has been shaking its head about them: That retail customers paid those prices though there was plenty of supply; that dealers then bid up prices at wholesale auctions to ridiculous levels, knowing that they could pass on those prices to retail customers and make massive per-vehicle gross profits; and that lenders accepted the ridiculous collateral values and lent. And everyone, astonished as they were about this bizarre phenomenon, played along for as long as possible.

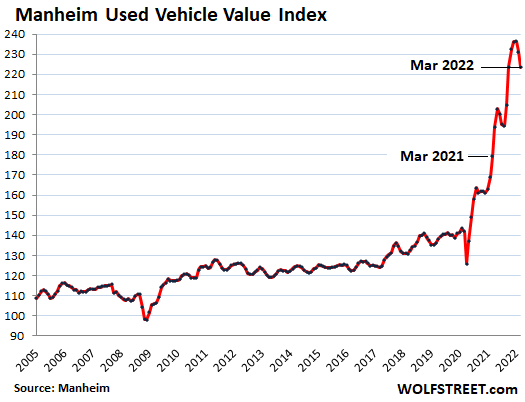

But in March, wholesale prices of used vehicles that were sold at auction fell 3.3% from February on a mix-, mileage-, and seasonally adjusted basis, according to the Manheim Used Vehicle Value Index. Manheim, a unit of Cox Automotive, operates wholesale auto auctions around the country and online, that handle around 8 million vehicles a year.

Compared to March last year, which was already in the middle of the spectacular price spike, prices were up by 24.8%, a huge ridiculous jump, but it was the smallest year-over-year jump since August 2021.

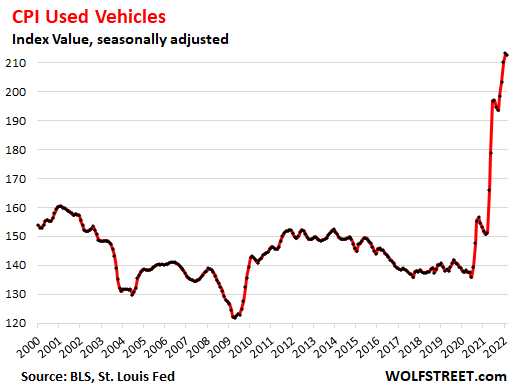

It takes about a couple of months for wholesale price changes to show up in retail prices as tracked by the Consumer Price Index for used vehicles.

The March CPI will be released next week. In February, the used vehicle CPI was up 41% from a year ago, which prior to this era was an all-time fantastical record spike. But there was already a slight dip from January:

That used vehicle sales — in terms of the number of vehicles sold — are down despite the jump in tax refunds shows that there is growing, though still feeble, resistance among retail buyers to those all-time fantastical record price spikes.

The high-pressure steam was starting to hiss out of the market in November, which became apparent in the underlying metrics, and those metrics weakened further in December. In January wholesale prices were flat for the first time since August, seasonally adjusted. And in February, prices dipped 2.1%, seasonally adjusted. And now in March, they dipped 3.3% seasonally adjusted.

Not seasonally adjusted, the index rose 0.6% from February, which is below the normal seasonal increase from February to March, the tax-refund season.

Manheim’s Three-Year-Old Index, which is not seasonally adjusted, had dropped 5.9% from the beginning of the year through week 10, a far deeper drop than in prior years back through 2014. Over the past four weeks, it increased by 1.2% but remains down about 4.5% for year so far. And even the $204 billion in refund tax dollars that have now flooded the land have barely moved the needle.

And there is another underlying metric that points at price resistance: The average daily sales conversion rate at Manheim auctions in March, at 57.1%, was below the normal level for this time of the year. For example, in March 2019, it averaged 62.7%, according to Manheim. The lower-than-normal conversion rates started last November and indicate that buyers have more bargaining power, that there is less interest and less competition for vehicles at those prices.

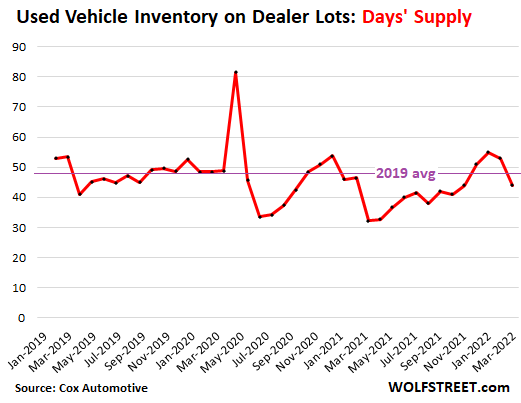

And there is plenty of supply of used vehicles on dealer lots. At the end of March, dealers ended up with a supply of 44 days, up from 32 days a year ago, according to Cox Automotive. By comparison, the average supply in 2019 was 48 days (purple line):

Price resistance means it will be harder to maintain the sales volume at those ridiculous prices. Lower – though still ridiculously high – retail prices would increase sales volume. But the limit will be supply. There is plenty of supply at the current sales volume. But a higher sales volume would exert more pressure on supply.

And used vehicle supply is constrained by the reduced production volumes of new vehicles over the past two years. The chip shortages continue to hamper production this year. Big fleets, such as rental companies, feed the used vehicle market with millions of vehicles a year, but they’ve had trouble getting new vehicles, and they’re hanging on longer to the vehicles in their fleets. And the number of new vehicles sold plunged 26% in March compared to a year ago, and so trade-ins are down — another major source of used vehicles. So used vehicle retail prices may finally drop but are unlikely to plunge all the way back to earth in this crazy environment.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It will take a while, but if the bond bull market since 1981 and the bond mania covering a good part of the 21st century is over, the easy financing supporting these prices will end.

I anticipate a mammoth flood of cars/trucks/RVs/boats/toys coming onto the market as this fake economy rolls over. None of this was sustainable.

2nd on that. Around my part of town there is an amazing amount of over priced iron of all types driving around. So much of it is dependent on an ever increasing ability to keep paying more for the newest and greatest.

100%. I saw this coming late last year (with the rise in fuel prices) and dumped my gas guzzling truck and boat for ten of thousands more than I’d paid in 2019.

Boats are starting to become plenty available again. When I sold mine, I was the ONLY boat for sale in a 50 mile radius. There is now plenty of supply, and I suspect it will continue to grow as people realize how much work they are and money to own.

The guy who bought my 10y/o boat used a 7 year loan.

Which shows that this entire charade is a giant credit bubble. A 7 year loan on a 10 year old boat – brilliant. That is a financial product that never even existed in the past.

All of these forbearance programs and payment “pauses,” etc., are not to help the borrowers, they are schemes to keep this giant financial fraud going. The companies who lent the money are allowed to still consider the loans “performing.” The whole system needs to collapse. This is nothing like free market capitalism.

The two best days of your life… The day you buy your boat and the day you sell it.

Natalie Wood would have wished her husband sold that boat sooner, if only she knew what was going to happen. Maybe Robert Wagner never sold it even after the tragedy. I don’t know.

No one ever explains that a boat is a hole in the water that you try to fill with money – until it’s too late.

This great economy is fully sustainable!!! The greatest ever in the history of americaa!!! I, Jay Powell, Chaor of the federal reserve bored of the United state of America, have declared to ensure this with!!!!!!

Watching a national car auction on tv record prices for classic cars ,rich people think there good investment,hahaha,until there’s no fuel . Tha world is changing

Most don’t even drive those expensive classics. The game is to wait a while and auction it off again for a higher price.

Sort of like bitcoin, then?

(Except you can have keys made if you lose them…)

Especially with front running stock trades as a side hustle.

I’ve been looking for a new car for 3 years. I finally find something I like and nobody has it in stock. Guess I’ll have to keep the 25 YO honda going a while longer.

It’s so hard to find anything. CVTs have eliminated many japanese models from consideration. Others have reliability problems with the dash electronics. Still others have drive trains with turbo 4s, engine stop/start, or cylinder de-activation. No thanks.

Toyota makes a solid CVT.

I believe Toyota CVT is licensed to Ford as well.

The first CVTs weren’t very good; Toyota started using them, and we use a 2017 Pathfinder with one in it, and we tow a 4.5k lbs trailer with it. Love it. And it’s been good to us so far. I would not touch the older CVTs though. Tons of people driving the 2017-2020 gen Pathfinders: no general issues as of yet. For what it’s worth. Only time will tell.

For what it’s worth: some of the current CVT’s are manually shiftable as well, like the 17 Murano with a fairly stout 6 that we had. Not awesome on gas usage, though.

…My point being that you can override the balky CVT for getting up hills and so on.

I rented a Chevy Malibu (not by choice) a month ago. It had this HORRIFIC start-stop feature.

At first I didn’t know what the hell it was. At every stop light, etc, the car would sputter, and jerk, and lurch.

Luckily my son explained it to me. Who the F would buy this piece of crap.

I drive a 20 year old Chevy Tahoe so I don’t have that feature. But a friend of mine drives modern German cars… and she specifically is going backwards in time to get a BMW that does NOT have that feature. She had to explain it to me.

My 2016 BMW M4 has the option of stopping the engine when it is at a stop light; in neutral; and the clutch is not engaged. Put your foot on the clutch, and the engine restarts. Put it in 1st, let out the clutch, and away you go.

I prefer not to use this option, and it’s easy to set the controls up to keep the car at idle when waiting at a red light.

The feature that I do like using is the rev-matching when down shifting. Two of the three engine modes, ‘Efficient’ & ‘Sport’, have the computer blip the revs as you move the gear lever towards the intended gear. In ‘Sport Plus’ mode, the engine’s revs are controlled by the gas pedal.

SpencerG, your friend may want to reconsider her options.

Our 2021 Hyundai Tuscon small SUV did not come with the auto stop/start feature. Not all cars come with that as standard.

C’mon Dan, you must be making Stirling Moss and all the old sports car racers of that vintage roll over in the grave: ”double clutch and hit the gas slightly in the middle” is how the non synchronized transmission were downshifted, and worked just fine for the synched ones also.

Course that was ”back in the day.”

VintageVN,

I was wondering if, and who might critique me for liking to have a computer help me downshift.

Yeah, I can heel & toe. But the last time I set it at Sport Plus was driving back home from Charlotte, NC on US Hwy 25 nearly a year ago.

Dan Romig…

According to what the BMW dealers told her last summer, the 2022 models will no longer have the option to disengage that feature. Apparently BMW used to be able to turn it off for you permanently (which I think is what you are talking about)… then that became illegal and now you have to remember to hit a button to override it every time you start up the car.

Just, “having at ya” Dan,,, really appreciate your posts/comments on here as you appear to be the ”motor head” dude that my various bros in laws and best friends were, RIP!

Keep on keeping on, and I will try my best to be the very best ”NEO LUDDITE”,,, etc.

But only at times, because WE, in this case the family WE really appreciate the advantages of the best of the tech that keeps coming to our lives, and, as you illustrated very clearly, a LOT of that tech does ”help”,,, WHEN IT WORKS!!!

I’ve driven a BMW with that. It worked pretty seamlessly. I’m not sold on the need for it, though. Unless you’re a taxi driver who’s constantly in city traffic all day, I doubt it really saves that much gas for the average driver.

MA – I completely agree. rented a Malibu a year ago. The start-stop thing was really jarring. I had the car 2 days and was so glad to get rid of it. I would never buy a car that had that “feature”. My question is, why? Why is that even a thing? Who TF thought that was a good idea?

My mechanic/ shop manager bother in law who has a Nissan, says ignore the service manual.

Car manuals say to change the CVT oil 90,000 miles, big mistake change oil (not flush) every 30,000, they will last a lot longer.

Ruble has recovered all its losses. South Africa, India, China, Hungry, and others are starting to pay for energy in non dollar denominated currencies. Other commodities soon to follow.

Bond Bull to continue and keep rates down in Europe and U.S.?

The Ruble rally RUB/USD from 0.0072 to 0.012 is almost back to the 0.13-0.14 baseline. Markets are driven by waves of fear and greed. IMHO it is likely to go back down.

Putin’s daily atrocities in Ukraine (targeting fleeing civilians at the Kramatorsk railway station and an unexploded rocket with “FOR CHILDREN” painted on the side) are sure to drive more isolation and sanctions upon Russia. Uncle Joe quickly replaced the S300 antiaircraft system given to Ukraine by Slovakia with a Patriot system complete with the U.S. military to operate it. This is just the beginning. If Putin’s goal was to prevent further expansion of NATO, it completely backfired. Finland, and now Sweden are sure to join.

The only way this war is going to stop is for Russians to remove Putin. Now, Muscovites are missing McDonalds on date night, but the pain level will be driven upward until they rise up and remove Putin. My Ukrainian wife has siblings and family in Moscow. They complete believed that Ukraine committed these atrocities to make the Russian army look bad. We are showing them the truth, which they dare not share.

In the Russian occupied areas of Donbas in eastern Ukraine, the young men are forced into military service and (according to US military intelligence) will be the ‘canon fodder’ to push further into Ukraine. Uncle Joe and eastern European countries are facing the stark reality of Putin’s desire to rebuild the Soviet Union.

Consider for a moment the chances of the Ruble going higher, above the value before the invasion. Slim to none.

I have a Russian friend. She’s college-educated, a cosmopolitan who has lived in the West, and she doesn’t support the war…BUT she sends me pages and pages of what she calls “evidence” that Ukraine is blowing up its own people with the help of the U.S. in order to escalate the conflict. I’m perfectly willing to accept that the media slants things for its own benefit to make profits. Still, this belief of hers that we, the U.S., are behind the war and single-handedly drove Putin to invade, is really disturbing. I no longer know how to respond to her except to say “thanks for the info, I’ll have a look.”

The one thing I do agree with her on is that the world is headed for a complete economic breakdown in the next year or two and it will be difficult to decide where to put your money, where it will be safe, which currencies/banks will tank and by how much. She’s telling everyone to diversify their cash holdings as much as possible.

I realize this is a long way off from talk of used cars. I was lucky enough to buy my compact SUV, just 2 years old, from Avis in the middle of the pandemic before the price melt up. It was a sweet deal 35% below Blue Book. We’d been without a car for years, which makes caring for an elderly parent problematic. Couldn’t have bought it if it weren’t for those stimmies, though, so I’m grateful.

>BUT she sends me pages and pages of what she calls

>“evidence” that Ukraine is blowing up its own people

>with the help of the U.S. in order to escalate the conflict.

Indeed, that is incredible in the age of the Internet.

Will all due respect, rather than trying to be polite, you should try to convince her of the truth of what’s going on there. Then she might spread that to others. This war’s an information war, to some extent.

So Used Cars are finally dropping That means “Used Homes” should follow correct ?

but Used Money is being used up except for Guys like Powell as he has so much of it now does not matter correct ?

The Guys & Gals who don’t have Extra used Money don’t matter correct ?

I can’t see how an almost doubling of mortgage rates is not going to cause massive pain in the “Used Homes” market.

And the FED hasn’t even gotten started raising rates and unwinding their balance sheet. If they are to be believed, a house price crash of 60% seems minor.

I am counting on it.

In my view, for the next 3-4 months we’ll continue to see the bond / mortgage markets right-sizing (i.e., higher yields with lower prices) as the FED moves into QT through rolling off bond maturities & outright selling. As usual, the FED is slow poking QT with its three month phase in to $95B.

Moreover, the banks & investors are going to demand higher yields & much lower prices than what the FED paid for those assets. So IMO, that’s what’s driving treasuries & mortgage rates higher. They all know the dirty little secret: well above average, 2%, inflation is here to stay. The new long-term normal is probably 3 to 4% over the next 10 years.

The loss of jobs is always what comes last, so over the next six months, all these signs of slowing car, house & appliance sales will lead to an eventual building of job losses by the end of the year. Keep in mind, it’s a lot easier for companies to fire employees who work from home.

As for larger tax refunds, I doubt that metric. Most anyone with kids already got 1/2 of their refunds over the later part of 2021, so those people’s refunds will be notably lower this spring.

They will flip over ,weak hands always do I’ll always take common sense over phd,s

I am counting on it.

I think there is a time lag. I saw payment on median priced home is up $500 plus and median rent around $200 year over year. Going to start to bite when added to food, gas and electricity increases. Probably why student loans are still being can kicked.

Got to think this is going to be a humdinger of a hard landing.

These Used Car CPI charts are just ridiculous! This shows once again the enormous damage that “stimulus” has done to the economy.

Creating extra demand for goods just when supply of goods was limited by lockdowns etc was just plain stupid. If anything, they should have done the opposite. If people can’t spend, then don’t pour extra money in the economy. That’s why we now have inflation hell!

It has also caused bad investment in extra capacity that was only viable due to this artificial bubble that is now collapsing. I read an article about the smaller new trucking companies now facing trouble. They massively overpaid for trucks bought during the bubble. Now that things are starting to normalize (or worse, we are probably heading into a recession), freight rates are falling while they get squeezed by higher fuel and maintenance cost and massive depreciation of the resale value of the trucks. Many will go bust.

“At least the half of all economic history is concerned with the tragi-comedy of governments getting into debt by extravagance […aided by CB policy – JH] and trying to get out by fraud. A good deal of the other half is concerned with individuals attempting to do the same thing.”

– Freeman Tilden, A World in Debt

Sort of sums up both the past idiocy of Fed’s prolonged ZIRP and the consumer’s debt led spending binge on used cars, etc., etc.

More likely Asia ,China starting to cut us off ,we’ve been bully on the block to long fighting back say goodbye to your lifestyle

Thank you! This information is timely and important.

Today I was driving in a fairly middle class East Bay area and I noticed I was surrounded by three Teslas, three Audis, and one Cadillac. This started last year. Global pandemics sure create a lot of new “wealth” for some reason…

That aside I hope the chip shortage results in less screens and tablets discordantly stuck on the dashboard. My Civic is the last of the knobs and I’ll never sell it.

Cars go to zero,without fuel ,maybe u can push it downhill but otherwise useless

Porsche is developing a synthetic fuel that is carbon neutral, don’t give up on ICE’s yet.

Porsche is trying to keep its 911 series alive for as long as possible, a huge money-maker over the decades, now that its own EVs are blowing it away. I heard the head-guy some time ago saying that the 911 will remain ICE for lovers of the 911, and when ICE is no longer viable, the 911 will cease production. It will not be converted to EV. Porsche’s EV models are entirely new models.

Also a few tidbits I’ve heard on the auto dealer grapevine:

Buy new if you can; used isn’t worth it.

Some people actually are indeed speculating in and flipping used cars.

Some dealers are concerned that they will be accused of price gouging in future litigation.

Curious about the comment “future litigation”. If there was no fraud, undisclosed “add ons” (see Napleton FTC settlement), allegations of “racism”, I don’t see what the grounds for a lawsuit are. Two parties enter into a purchase agreement mutually acceptable to both parties. Contract is signed. Funds exchanged. End of story. Gouging? Show me the muzzle print on their forehead forcing them to sign. There is no legal protection for being stupid.

Speculating and flipping used cars: Sure. State laws often stipulate how many vehicles one can sell in a year without a dealer license. Some states are very restrictive and the more generous ones have a limit of @ 10. After that, you have to have dealer’s licenses, salesperson licenses, a place of business, and other requirements (insurance for one). If you bodge together a car and sell it, you have liability – especially if the vehicle is dangerous, someone gets injured, and it can be proven you knew of the problem. Your personal liability umbrella (if you have one) won’t cover you because it’s a business venture. Private party sales are risky – for both sides. “As is – as shown” is meaningless if you fail to disclose known defects. A visible dent doesn’t require disclosure. A bent frame does.

“ Private party sales are risky – for both sides. “As is – as shown” is meaningless if you fail to disclose known defects. A visible dent doesn’t require disclosure. A bent frame does.”

Interesting…

I can see that if the buyer was not given (or discouraged from) an opportunity to have an independent inspection…

But if the buyer chose not to have an inspection, would it not be buyer beware…

And the seller held harmless…

Private party sales that are being flipped: the flipper may pay with cash and not register the car (change title). They simply resell the car and the new buyer may register from the first owner’s title.

New car lots are still mostly barren. As long as this situation continues, used car values are going to remain high.

I don’t think this will resolve itself until car makers can produce enough new cars to meet demand.

At this point, the semiconductor shortage spouted by the car manufacturers is a total red herring. EVERYONE has slowed production to some extent or another, which all by itself creates relief if there still were chips shortages, which they’re aren’t by and large. But, almost every car manufacturer has intentionally slowed production, because they’re in the process of setting up a new sales model that’s going to be the way they sell electric cars in the future:

Just in time delivery – You configure your car online or with a dealer. They offer you discounts for doing so, including a slightly better trade-in discount than in the past. Within three years, you’ll be having a chat bot session online to configure your car and line up your loan. They then deliver your car within 30 days. The days of seeing a couple hundred cars on lots is gone the way of the dodo bird. The dealerships of the future will be much smaller and relegated primarily to assisting you with your order & servicing your vehicle.

They keep blaming chip shortages which is absolute hogwash. And it goes without saying that the slowdown in production is due to their fully expecting a slowdown in car sales which is now fully underway. Dealerships themselves are smart enough to lower their allotments due to this reason.

Jay,

You’re simply wrong about the issues of the chip shortages for auto makers (and other manufacturers). But if that’s what you believe, fine with me.

I believe manufacturers will go to Tesla model ,no dealers but then warranties come into question

I don’t think legacy dealers can be eliminated involuntarily under current state franchise laws.

My recollection is that many were bought out during the GFC but don’t remember the specifics of the franchise contracts.

Manufacturers cannot go the “Tesla model” unless they introduce an entirely new brand of vehicles.

Tesla operates under specific amendments in many states. Other states (I think Texas is one) specifically bar direct to customer sales. Funny that Tesla moved their HQ to TX who bars them from selling direct to Texans….

What the average Joe fails to consider is the tremendous amount of capital it would take to build service centers around the country. No manufacturer wants to fool with that…. and Tesla is a key example of why. Go read the horror stories of customers trying to get spare parts or repairs made other than “parts canon repairs”. How do you feel about a $22K bill for a new battery because you hit a piece of lumber on the road and it broke your coolant tube on the battery pack? Oh.. and that’s not “warranty”. Then try to get said battery pack.

Then there’s the employee costs, inventory costs, liability, etc., ad nauseum.

As far as buyouts (AF): The franchise agreements contain specific language as to how a manufacturer must treat a canceled dealership/franchise. They manufacturer has to buy back the parts, special tools, provide “going concern” compensation, buy back any *new* vehicles (including demos on MSO’s but under 6,000 miles, prior model year vehicles on open MSO’s, etc.). Truth be known, the manufacturers usually cajole a bordering dealer into buying up all the inventories so they don’t have to deal with it. IIRC, the manufacturers also have to provide service outlets and parts availability for 10 years after the sale of the last MY vehicle produced. That’s often done through their other brand outlets (if any). Saturn, Oldsmobile, Pontiac, Plymouth, Mercury, are all examples of that.

Dealerships aren’t like closing down a bagel shop. Lots of moving parts, lots of state and federal laws, lots of contract gobbledygook. And lawyers. Lots of lawyers.

My favorite thing about Tesla service is their mobile service people. Only had to have any maintenance 1 time for a sensor fix. It was simple to schedule and the convenience of home service is hard to over state. If they can be rooted out of the US, dealers ultimately won’t be missed.

An economic depression will resolve the supply problem.

The upcoming declining living standards will also noticeably increase the age of used cars.

Here,Here

Don’t you mean hear hear?

Yep. Looking at new car dealer sites for “new inventory” you’ll see plenty of vehicles, BUT, they’re all stock photos. They don’t have any of them in stock.

“Inventory” used to mean “we have this”. Not anymore.

@Hal: Everything I see has “in transit” in a little box so you don’t see it before you drive in.

The IRS refund data is interesting, I was expecting the advance payments made in late 2021 to reduce what was paid out in Q12023.

Q12022 not Q12023

Tax CPA here. So many one time give aways this year. Dependent care credit massively higher. EIC rules expanded to so many more people. Child credit higher dollar amount and higher income threshold so even paying half between July and December not causing issues.

Now my clients with investments all owe huge. Not since 2000 or 2008 have I seen this. Lots of money needs to be made liquid in next eight days to pay big bills.

Mark-

Great post.

Lumpiness of cap gains makes sense but completely forgot about it.

I suppose that effects 2022 estimated payments for many too?

What you are describing is disguised welfare. The concept of tax “refunds” to those who pay no income taxes is farcical.

No, I don’t believe in corporate welfare either, starting with professional sports teams.

Mark,

It’s always interesting when big tax bills come due, especially when you use the word huge…

‘The concept of tax “refunds” to those who pay no income taxes is farcical.’

Many corporations find it remarkably profitable.

u

AF is a Calvinist.

That explains his doom style bias.

af, many poor people i used to work with would get excited by “taxes” because it meant a huge “refund” far in excess of what they paid. you know something is wrong when half the country sees taxes as a positive for their cash flow.

Not necessarily… I believe the advance part of the tax credit was for only half of the expected annual amount. Given that the total credit was doubled, then the remaining credit amount would’ve stayed the roughly same compared to previous years (or could even be higher actually if people ended up getting a larger amount at filing because their reconciled tax situation showed they were eligible for it at filing but not based on previous tax years’ situation).

1) Will used cars prices finally plunge – no way.

2) Can we have a recession in 2022/23 – the economy is too strong.

3) Since 2008, with zero rates, companies cannibalized themselves,

piling debt and liabilities for div and buyback and executives perks. Many zombie companies debt and liabilities are over 80%. Some, like MCD, have negative equities. Payback.

4) For almost two decades SPX osc around a Lazer, up and down

in and out. For entertainment only :

5) SPY monthly log : Jan 2004 high to May 2006 high. // parallel

from Aug 2004 low.

6) Can SPY hit the Lazer in 2022 : yes !

7) Can SPY cross it, as it previously did in 2008/09, 2014, 2018 and 2020 : yes !

8) Can we have a deep recession : yes !

9) Can the zombies go bk : yes !

> Many zombie companies debt and liabilities are over 80%. Some, like MCD, have negative equities.

In the early 60s there was the famous M&M theory — one of the cornerstones of modern finance. It said capital structure (as funded by debt or else equity) doesn’t matter to the value of a firm. This sort of flimflam was put forth as a basis for all sorts of mischief and would be long discredited I believe, but for the Fed put. The Fed put deepened the rot until now the whole ramshackle mess can be not only stress-tested but tested to destruction.

The rest of the world may be too broke, or off on some other tangent, to fun the Fed put effectively, some sunny day. The printing presses will whirr on an empty (plastic-strewn) beach, signifying nothing.

The mania of which the FRB put is one rationalization.

Oracle is another company with slightly negative equity, with a market cap of over $200B.

Under modern bubble finance, balance sheet is ignored until the company is at perceived high risk of being cut-off from the credit markets and defaulting on its debt.

It’s all about earnings, even though it’s only an accounting entry and not even real money. Dividends are totally pathetic (justified by TINA due to the bond mania) and most earnings get buried in the balance where it cannot be monetized by most shareholders and never sees the light of day.

Distressed debt has become a high art, and the industry is sharpening its claws to extract huge value on the way down.

The contrarian saying about being fearful (or at least cool-headed) when others are greedy, applies, and not just to investing. Being calm and steady when others are manic has meant being calm and steady again when the downturn happens. Things balance out, hopefully not on my neck.

So glad I stayed at the edge of all of this, as in 2008. Sound basics meant continuity across the board, of personal life and finance. Wasn’t having kids, incurring debt, buying exotic “assets.” Didn’t receive excess stimmies and the ones I received, I saved. Kept he mileage low and the car running nicely. Extended lines of supply have a tendency to break (as true in Kyiv in 1941 as now).

Things must be good in economy,Buffett has let purse strings loose ,buying 1 company and investing in others glad I OWN this investment,free manager ,simple really

Not have children?

Sad.

Having and loving children is the meaning of life.

Not having kids, and probably never having them, as in my case, doesn’t have to be a sad thing at all. My life is an example of that. Life meaning can be found in other places, as, in my unusual case and life, a spiritual journey to self-actualization and a singing/songwriting voice.

What I chose, benefits YOUR children. And everyone;’s quality of life. I think, enjoy your choices, and I will mine.

My road to meaning (I might have said salvation, not sure) is infinitely steep and hard. I like it like that. My gods are harsh.

Each to his own, that is the beauty of our system. Sad so many are so consumed with kvetching.

What’s doubly sad is that people like you, Phleep – intelligent, eloquent – don’t have children and cracker-barrels, like a Margorie Taylor Green, have any at all.

I absolutely agree but not everyone is blessed with children no matter their desire.

I have 1 adult child but won’t be having any grandchildren, which is just fine with me, in fact I encouraged it. Kids are great, but I’ve done my child-rearing stint, and have no desire to spend another minute doing more of it.

Not only is there is more meaning to life than replicating ones genes, but I think we live on an infinitely fascinating planet in an amazing universe. And frankly the state of this planet we are bequeathing future generations does not bode a promising future for them.

Confiscate Man. U

Repo everything.

To paraphrase Andrew Mellon: Repossess labor, repossess stocks, repossess the farmers, repossess real estate. Repossess ridiculous new over-featured cars. It will purge the rottenness out of the system. High costs of living and high living will come down. People will work harder, live a more moral life. Values will be adjusted, and enterprising people will pick up from less competent people.

Repo Man is always intense.

Repo Man in the sky?

p

Look ! Another Calvinist !

Which leads to Calvinist bias.

The biggest issue I see with new cars is the push to everything electronic, trying to mimic smart phone experience onto the car. This is a big mistake: you cannot let a critical tool, which is the car, be crippled by reliability issues that plague devices like cell phones. This will come to a head someday, and both the manufacturers and consumers will pay for this (we are already, actually). We, the consumer, should push back and tell manufacturers: “we don’t need gimmicks in a car; we just need it to reliably take us from point A to point B and back”. I don’t know if we will ever be able to achieve this; only if several car manufactures go under will they reconsider.

Your comments represent the viewpoint of the few Luddites out there.

Truth is that most consumers gladly pay for those smart features. If it weren’t so then car makers wouldn’t put them in cars.

There is an optimum amount of complexity in a product before diminishing returns appears. I have 30-year old Hondas and Mazdas, and they have onboard computers and a lot of relays and such, but they rarely give me problems. I don’t want a vehicle any more complicated than they are! When I think back, the most reliable vehicles I’ve ever owned were ones from the ’50s and ’60s with few or no optional features.

Another luddite here. I love driving my mid-2000’s Subaru. I like a well-designed mechanical vehicle that I can physically engage with and press buttons and open my own freakin’ hatch, thank you very much!

I don’t want an LCD, satellite radio, bluetooth, GPS, kill switch, beeps and flashing lights, etc. although if other drivers find this useful, they can have it.

Not sure all these features are making people better drivers or not, but watching them try to get in and out of parking spaces I wonder and they have back up cameras!

The manufacturers put them in there so they can sell the cars for a higher price. Not the customers

I don’t want to drive a phone mascarading as a car either. I don’t want 3 $500. computer modules between the brake light switch and the brake light. And I don’t think it’s a good idea to have collision avoidance computers on cars, it just encourages people to not watch the road and play with their phones.

ABSOLUTELY D,,, WE, that would be the family WE in this case got right to the end of the purchase of a PLUG IN HYBRID,, and then we saw the apparently NOT optional HUGE screen clearly obstructing our view forward and was told we could not buy the vehicle without it…

That was THE END of that purchase attempt…

Probably certifiable as “”NEO LUDDITES”” and now, thanks, we will wear that label proudly, especially when it comes to vehicles that should be a device to get us from here to there and back with the minimum impact on our budget, not to mention our planet,,, which these modern vehicles are having a ton of challenges IF you include the cost/environmental impact of these high tech additions, etc…

BTW, we put the $$ into upgrades/maintenance of the old sedan, and then purchase a couple other older vehicles and are still $$$ ahead that went into the ”powder” waiting to buy the TIPS when the interest rates reach appropriate levels FOR US.

Ilan is buying 15% of Wolfstreet, making Wolf a billionaire.

Big$$Mike counterattacked.

Returned to U.S. for a month after being away four years. Same old on the road, buzzing freeways, hyper American empire culture. TV in motel screaming 300 words per minute to buy prescription drugs, hype sports, culture star memes, etc.

Thank God my tasks were completed and I didn’t have to stay, invest in an automobile, and other basics of middle-class American life. As the empire gets more gritty, and permeated with fraudulence, will there be contemporary version of the storied hobo train-hopping era? In 2018, “Railroad trespassing fatalities in the U.S. reach 10-year high.”

Happy to be back in a country where there is some semblance of grass-roots national unity. Culture warriors should think about what they are missing.

What country did you expat to?

I think he’s in Thailand.

And to drifterrprof’s credit, he’s got a situation different than if you or I just dropped in to live there…

His wife is a Thai National, if I recall…

He’ll correct me if I’m wrong…

Yeah, I’m in Thailand. I lucked out in marrying a Thai woman who is a retired educator like me. I live in her house and yard, which has her beautiful botanical flower garden and large vegetable growing plot.

She does almost all the driving in her car :))). And the best thing is her non-reactive personality. Not submissive, but Buddha-like ability to just let things pass like water off a duck’s back. Which exposes all my emotional faults.

And of course, besides her delicious fusion cooking, there is her traditional Pad Thai (rice noodles topped with stir fried eggs, tofu, tamarind sauce, red chili pepper, etc., served with bean sprouts, chopped roasted peanuts, lime wedges), Tom Yum (spicy soup – Thai hot peppers – with shrimp), Som Tum (green papaya salad), Massaman Curry (Thai curry soup of Muslim origin: coconut milk, roasted peanuts, *potatoes*, cardamom, cinnamon, tamarind sauce). Fresh coconut milk from her coconut tree a key to many dishes.

I was going to work a couple more years. But after getting married, retirement lured me. In retrospect, it was a great decision, because I was unaware of how stress on the job can impact health and shorten one’s life.

> will there be contemporary version of the storied hobo train-hopping era?

My valley here is full of them. Urban So-Cal. They are sleeping under the freeways and in the few open spaces, even as these are paved and ruined for wildlife and humans, oh, I mean, made into “luxury” housing that looks like the old Warsaw ghetto. Only far less taste in the architecture, chock-a-block alongside the freeway. I hope they have good streaming TV in these units an oxymoron) because what is outside their windows is grim. Maybe their dope is “good.”

2008 was good, slowing the ruination of this place by 5+ years.

With much more aggressive rate hiking being recorded daily in the news by the Too-Little/Too-Late Fed, this is another ingredient to buying a depreciating asset that loses 10% to 20% the minute it is driven off a lot. I like used vehicles, esp. compared to the also ridiculous Average Transaction Price of $46,000 in January, 2022 for new vehicles. Out of control, out of sight.

However, the often justified argument of buying a new vehicle to obtain better overall gas mileage with $4 to $5 gasoline is stymied by these acquisition costs since a 3-year old used vehicle with a 4 cylinder ICE engine and even 40kmi. plus on the odometer will pretty much match the latest and greatest in MPG. Many most modern vehicles have so many complicated electronic systems on them, telling you when to brake and possibly blow your nose, that I know auto repair shops, other than dealerships, that do not have the test equipment or tools to work on many of them. Over-engineering at its worst which just added to not only a higher acquisition cost by a higher cost of ownership.

So if the average selling price for a USED vehicle is in the high $30k to low $40k range for 1 to 3 year-old rides, where is the bargain??

Prices will come down in the months ahead. Higher financing rates are a given, credit conditions will tighten with a softening economy, rampant inflation will guarantee this event, and chips will eventually move more new vehicles into the marketplace as competition.

Most economists and financial analysts do not see the recession building under their feet. Some on Wall and Broad would not see one if it was speeding at them at 90 miles an hour with high beams on. Why? Against the best interests of the financial services industry to be negative on near-term economic prospects because they benefit by keeping the Vegas investors (also know at the sheeple ) at the casino table as long as possible. But more and more signs are pointing to a significant economic slowdown leading to recession, a cruncher.

A few drops of rain often turn into a torrential downpour, stay alert, stay wary.

i think a lot of this stems from the fact that the government’s policies over the past two years were great for the upper middle class and above. so the wall street “analysts,” ceos, and other people from the upper middle or above look around, see all their friends doing great (high stock portfolio, lots of real estate equity, etc.) and assume everyone else is too.

it’s delusion rather than outright dishonesty.

@Jake: I think you’re on to something. There’s a kind of delusion that makes one think that dishonesty (for lack of a better word) is the right thing to do.

Great post

Why would anyone lower prices when they don’t have to?

to…

Because demand starts to fall away for numerous reasons coming to a venue near all of us, then they have to if they want to get vehicles off their floor plan financing monkey.

Most of the people are not being cars or homes but buying monthly payments.

Rates go up then something needs to give up either prices or peoples wages go up.

Chris,

They sell at the highest possible price, as we can see. The highest possible price is where you can still but barely sell what you want to sell. And they will lower prices if they cannot sell enough at current prices. That’s the market dynamic. Now sales are already down 15%. So they have run into some price resistance. And the highest possible price is likely to come down some in order for sales volume to hold up.

CNBC: 10-year yield notches new 3-year high after surge this week on Fed’s tightening plan…

The 10-year rate hit a fresh 3-year high on Friday as investors continued to digest minutes from the previous Fed meeting.

The yield on the benchmark 10-year Treasury note traded above 2.7% on Friday, near its highest level since March 2019 as it continues its jump following recent comments from the Fed. The 2-year rose about 5 basis points to 2.516%.

The yield on the 30-year Treasury bond advanced about 6 basis points to 2.746%, while the 5-year rate climbed 6 basis points to about 2.75%. Yields move inversely to prices and 1 basis point is equal to 0.01%.

One year T Bills are yielding slightly over 2%. This is way better than most CD’s are offering.

1 year yield is slightly LESS than 2% = 1.77% Friday at the close.

The 2-year is at 2.53%

I bought a one year T Bill in my Schwab IRA about a week ago that yielded slightly over 2%. I believe the yields are bouncing around these days.

I’m waiting for the higher yields later this year to add to my stash of treasuries. (come’n FED, get those rates up!)

Buy quality. It lasts. And when it has lasted long enough, it becomes classic. And no, my chauffeuse does not want to talk to you.

Ford, and the world Fords with you. Rolls, and you Rolls alone.

I’m sure I’ve mentioned this before.

“ And no, my chauffeuse does not want to talk to you.”

Dude,

Siri talks to everybody… :)

Angela doesn’t want to talk to you. Siri doesn’t talk to Tom.

If you’re going to buy a used car you should talk to Carfax, learn how to negotiate and how to walk away.

The parts dealers and mechanics are making good money. Just look at their stocks.

I am actually not surprised that used vehicle prices have gone down and time on the lots has gone up. Every used lot that I pass has a bevy of pickup trucks on it.

That may have worked for dealers LAST March… but this March with gas prices skyrocketing (and not looking like they will come down any time soon) that is the wrong direction for consumers to take… and dealers.

The used car lots are jam packed around here too (north side of Houston, TX). Lots of big trucks on them.

Gives me hope. Need to add at least 1 truck to the business.

From rust country. So we like to buy used trucks out of texas.

Driving inland to the mountains here in Maine the used car dealer lots were packed – mostly with what looked like late model pickups, I have been doing this drive roughly monthly, and post-covid these lots cleaned out and have had very little stock. In contrast the two Ford dealers I pass had very little stock in their big, mostly empty lots.

I’ve always had a full size pickup truck… my latest has mileage around 27 and it works for me. I’ve always been a cheap skate with gas (even when gas was cheap), so this latest fuel drama doesn’t bother me that much. I don’t use the truck for projects as much as I used to, but it comes in handy. In America, pickups will always survive. And I will keep this one… even when I buy my next vehicle which will be electric.

Price of diesel fuel is up 114%, and gasoline up 64% in three months time! Kind of shocking. (Diesel, airplane fuel and heating oil have gone up much more.) Will consumers have any money left to buy replacement vehicles? Will the value of big SUVs and pickups go down?

Car dealers and parts manufacturers are big political contributors. That’s because they make plenty of money, live very well in their communities, have lots of cool stuff, and plan on keeping it that way forever. EV’s and Teselon notwithstanding, the dealer model isn’t going anywhere. It’s been around almost as long as the electric starter and the service station. It’s arguably easier to sell a gallon of gas than the car it goes into, yet the vertical integration of the petroleum industry hasn’t been easy or uniformly successful for the big oil-producing countries or the multinationals they “hire” to bring it to market. I don’t know the history of automobile manufacturers’ attempts at direct marketing, but the state legislation suggests that someone was worried about it, either preemptively or in response. Building cars seems like a very different business than selling them. If Ford or GM had seen a profit in end-user sales after WWII they had the money to buy or the muscle to shove into the states that mattered to the industry, unions lost no posterior epidermis, and would have probably gained coattails membership, then local politicians would have found it harder to get campaign funding from Detroit than the local Miracle Mile. Didn’t happen. Manufacturers did get into financing, GMAC, etc. There’s car dealers all over the world, none of whom are broke and missing meals. They’re not giving up their rice bowl because a car has no tailpipe. My guess anyway.

good comment/post rm,,,

after my very best bro told me a TON about his experience as a dealer for one of the big 3 until his bookkeeper purloined $8ooK and he had to sell out and sell some of his farm to pay off, I was much more clear about the dreadful relationship between legacy manufacturers and their dealers, many of whom would be best catagorized as ”captive” in spite of their financial independence.

NOT a good thing for dealers according to what he told me of his experience.

IMHO, the ”dealer” model will not last much longer in the world today…

Especially with front running stock trades as a side hustle.

Our local Ford dealer gave us $48,000 to walk away from a 2019 Expedition Max Platinum with 101K miles on it.

The vehicle was in excellent shape and executive-driven and corporate maintained. I wouldn’t give you $40,000 for it at retail pricing—more power to the dealer to make money on it. Carvana and the like offered $36-37K for it.

Did you trade for a new vehicle, or was this an outright sale without the purchase of a new vehicle?