If it continues, “we expect to see an even greater cooling of the housing market than previously forecast”: Fannie Mae.

By Wolf Richter for WOLF STREET.

We just knew this would be coming, given the sky-high home prices and the spike in mortgage rates: Homebuyer sentiment deteriorated further to a new low.

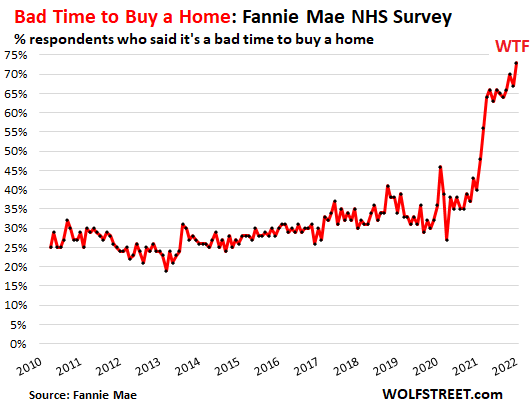

The percentage of people who said that now is a “bad time to buy” a home jumped to 73%, another record-worst in the data going back to 2010, according to Fannie Mae’s National Housing Survey for March, released today. Sentiment started to deteriorate sharply in February 2021.

“If consumer pessimism toward homebuying conditions continues and the recent mortgage rate increases are sustained, then we expect to see an even greater cooling of the housing market than previously forecast,” Fannie Mae said in the report.

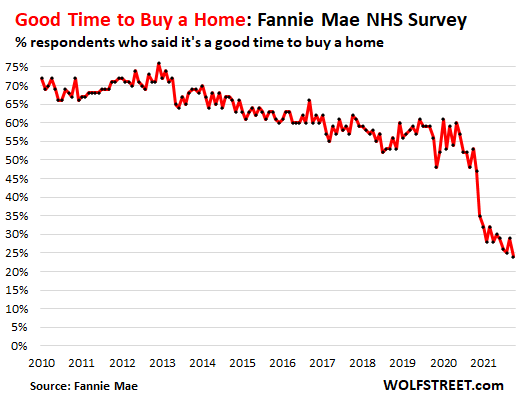

The percentage of people who said that now is a “good time to buy” a home plunged to a record low of 24%.

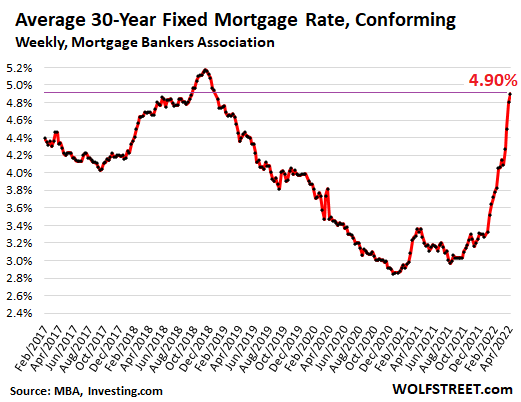

The combination of ridiculously spiking home prices and mortgage rates that the Fed is now trying to push up further in order to tamp down on the ridiculously spiking prices is toxic for potential homebuyers. The average 30-year fixed mortgage rate, according to the Mortgage Bankers Association’s weekly index, jumped by nearly 2 percentage points from September last year, when mortgage rates were still near historic lows:

Economy is on the wrong track, bigly: Inflation?

“This month, we also saw a survey-high share of consumers expecting their financial situations to worsen over the next year; this was especially true among current homeowners,” the report said.

Inflation, which is souring consumers’ mood all around, may have something to do with it: The percentage of consumers who said that the economy is on the wrong track jumped 5 percentage points to 73%, according to the Fannie Mae survey, up from 51% in March last year. The surge of the wrong-trackers started in May as consumers became aware of their nasty new companion in daily life: the worst inflation many people have ever experienced as adults.

The percentage of people who said that the economy was on the right track fell 3 percentage points to 21%.

“These concerns, together with the run-up in mortgage rates since the end of 2021, will likely diminish mortgage demand from move-up buyers – and fewer move-up buyers mean fewer available entry-level homes, adding to the rising-rate challenges for potential first-time homebuyers,” the report said.

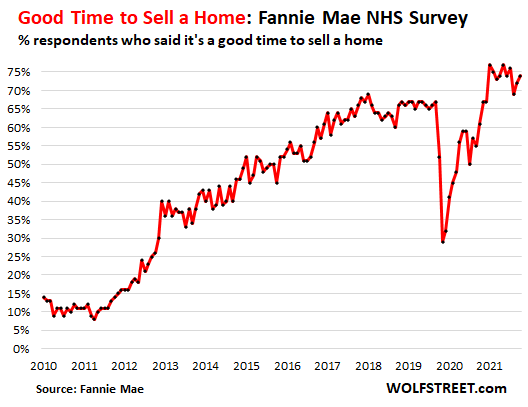

But it’s a superb time to sell a home.

Given the sky-high prices and the still very low supply, and the ease with which a house can still be sold without jumping through all kinds of hoops, the percentage of people who said that now is a “good time to sell” rose to 74%, in the same record-lofty range since June last year. So… Just do it! Put it on the market… before everyone else does.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

If we have some sort of housing bust/correction….

Who will get bailed out this time??

Mortgage insurance companies??

That seemed to be the new trend….0% down but hey, I’ve got mortgage insurance, so we’re good.

I don’t know what is left of the private mortgage insurance industry. During the Great recession, PMI went under. I suspect its demise encouraged lenders to be more careful. As for the government insurers such as FHA, I suspect that Congress would bail them out and they would continue to make low down payment loans to unqualified borrowers.

PMI went under?

Did you confuse PMI with AGI?

The 25% who says it’s a good time to buy must all be realtors, mortgage brokers, and…Lawrence Yun. Probably Putin, too.

Investors in China will need to get bailed out, including I suspect, two companies whose names start with “B.” With non-working vaccines, Omicron is already eating their economy, but it is not the last variant that will hit the world.

The CCP’s tradition of corruption means that I will bet that the reserves of food that they bought “coincidentally” before their ally’s invasion of Ukraine may have been resold or not fully bought (with some CCP member pocketing the difference) or poorly kept and soon spoiled. Thus, a lot of ultrarich crooks who have companies dependent or invested in China are now shilling for the CCP: e.g., one billionaire’s company actually claimed that Evergrande was ordered to demolish over a dozen apartments when it was actually ordered to demolish over a dozen apartment BUILDINGS, with hundreds of apartments each.

If they do not shill for China, their investments in China become worthless, so watch out for CCP linked shills trying to get you to unknowingly “gift” your money to China — gift it, because you will never get it back. (The retirement of the baby boomers also will mean that the cost of capital and demand will both decrease each year for some years, particularly because even NATO countries now recognized China as a future aggressor, to China’s prejudice.)

Correction: …the cost of capital will increase soon as more baby boomers retire and pull out of riskier investment more and more….

I have houses. I won’t sell. What would I do with the money? Put it in federal reserve notes declining 15% a year? Put in bonds that got hammered 20% this qtr, worst in 40 years? Put in stock valued at 25x earnings? It’s all rented. And if it goes down 10% or 20% I win.

I here that non-fungible tulips are a great investment.

Bill has it right

I’m closing on 2nd of 3 houses – 1031 from investment property

I have no intention of selling

I’ll collect rents until ???? 10 years, 15 years ???

then invest returns into something else

I have not been able to find a better investment than rental RE, everything considered.

Maybe I am just not smart enough to see the other possibilities.

Are you not worried about another rent moratorium?

But I have a property management company do all the work, plus I have invested in an area with low vacancies, good rents, and appreciating values.

If I could find a better investment I would move.

My worry is government taking away my investment by rent control, tenants rights, capital gains taxes, etc.

Baron,

Yes I am worried. But so far so good. All I had were some vacancies, no deadbeat tenants. I plan to convert every apartment to condo so I can sell individually, if I have too.

Maybe invest in some AirB&B?

If landlords are demonized to the point that no wants to be a landlord, where will all the rental housing come from?

The issue with being unpopular is the potential for the mob to turn against you in terms of the laws and regulations that might be passed or enforced.

You realize that as things collapse, all you will be left with is non-evictable squatters? The Covid response set precedent for the next crisis. And yes, you will still be responsible for fixing things they break in a timely manner.

we live in landlord favorable state of Arizona

all during covid I have 1 deadbeat covid tenant(evicted in 2021)

out of 70 units

and I’m FULL with no vacancies thanks to exit of Californians

that is good! Does Bill Gates own the seeks though?

50%?

Put it in short term bonds that have already been hammered and now pay 2.5%. Lots of option value there.

Where I am, rental net yields are less than the dividend you can get on a FTSE100 fund. Unless you’re a sucker for punishment, why would anyone want to have to manage a rental when they can just sit back and collect dividends with their money spread across a range of businesses and sectors?

Rentals at current prices only make sense as a leveraged capital gains play, but the potential returns don’t match the huge risk you’re taking buying in at current levels.

I also think rental owners do not realise how massively exposed they are to millennial voting preferences. As to corpses of millennial and gen Y homeownership dreams pile up outside the housing ponzi, there is a huge risk they just vote to ‘fix’ the problem with massive taxes on multiple properties etc. You can say it’s unfair, communist etc etc, but that won’t make the problem go away.

It’s not just taxes. It’s also future rent control which I think is far more likely.

I also agree with the above post on relative yield. All real estate is local but rental yields need to be noticeably higher to offset time commitments and higher risk.

Jon W, which market is this? This sounds a little overly pessimistic on the rent side and a little overly optimistic on the dividend side.

In SLC, the bubbliest of bubbly, you can find a house listed for rent at $2400. You can than switch to houses for sale and find the exact same house listed for sale with a computed monthly payment for the average American at $3600 a month. Not including utilities or in actuality maintenance costs which have also surged.

I have been watching rents and the days of 10-15% increases is coming to an end rather quickly in this area. Landlords have better start thinking if they want to hold on to houses in this environment, where the chance to sell at a top is slowly fading into the darkness. It seems Bill has made up his mind to hodl. Diamond hands for all of these landlords. Very millennial of him.

I used to be in London which has had 3.7% gross yields (!) for quite a while now. I moved to a second tier city and yields are approaching London here as well now (can’t tell you what London is anymore, but it’s probably even lower as rents have fallen and prices have gone up).

Most of these properties are flats and have very high service charges (maybe 10-15% of rent). If you get a managing agent they will take 12-15%. So ignoring any maintenance, which is also expensive, you’re looking at a net yield of ~2.7% as a passive investment. Then you have transaction costs, which are huge if you want to enter/exit the investment (stamp duty ~7%, agent and conveyancing fees).

As I said FTSE100 is still paying out something like 3.5% so I just don’t understand how these prices can be underpinned, except as a leverage capital gains play. But buying into that is a whole different animal, yet rental investors seem to be happy to dump their entire life savings into this as they seem to believe there are no risks in the property market any more.

I agree with Jon. I’m a stock and bond investor and there are plenty of places to compound at 10%+. I have looked at rental properties and granted I’m not as experienced I can’t get anything to pencil out north of 10% IRR on a 20 year hold and that was before the gap up in rates.

Well, I don’t know squat about stocks and bonds.

But I did reinvest my RE portfolio just over 5 years ago, before the big run up in prices.

My equity has been generating 6% NOI and 15% appreciation every year.

No idea how long it will last.

SilentC said: ” I’m a stock and bond investor and there are plenty of places to compound at 10%+ ‘

———————————————————-

and the top three are?

Forget about equity right now. It’s about cash flow.

Most of the mom and pop landlords are not that sophisticated to think about these issues.

Good points though.

Best time to sell the rentals i think.

Jon, best comment by far! Every time I read one of Wolf’s housing articles, I think Millennials just need to start passing more pro-tenant laws and higher taxes on real estate investing. When your house makes more than you do, it’s time to get people back to producing something of value to the economy. BTW, San Diego just passed a moratorium on no-fault evictions (aka when the tenant is current on rent but the owner wants to kick them out to raise rent or sell).

Everybody is a genius during a bull run. The question is how are they positioned for when the bull runs the other way. Leverage magnifies changes in both directions.

Molo-

“When your house makes more than you do”

Nicely phrased.

In these times there’s more important preparations to be made than earning comped buffets in the housing casino while your nest egg erodes. Early birds are always rewarded for thinking ahead realistically, latecomers pay through the beak. Or go wormless.

Yes, huge concern.

If all of your houses are rented and you’re cashflow positive, then you’re probably fine, although rent decreases are not unheard of if we end up in a recession.

I think the bigger issue is people sitting on their old house after buying their new house, taking on the carrying cost for a few years because they expect further capital gains. Many house rentals don’t even cover the mortgage but people do it because of the 20% capital gains that have become the norm for the past couple years.

Those people are in for a world of hurt when the market turns. Cashflow negative *and* asset price depreciation is painful, especially with leveraged mortgages that means a 20% decline wipes out all of your equity. A stock declining 20% is not the same as a mortgaged house declining 20%. The leverage can yield >100% losses

Lune, one thing with a rent decrease is that the lower your basis in the property is, the more you can handle a rent decrease. If the rent can cover the mortgage, taxes, insurance, and maintenance, then it’s just cutting into profits. Tighten the belt a little, but you won’t be getting foreclosed.

Wolf’s mentioned it a few times, but there’s also a wildcard in the short term (VRBO/AirBnb) market. Seems to me that there are a lot of recent entrants, and these people are very much going to be in trouble if the rental market falters. Someone who’s owned their condo for 10-20 years can sustain a valuation drop and can probably drop their rental rates and not hurt too much. Otherwise, these 2nd home owners better be able to make up the gap or a bunch of vacation homes will be hitting the market.

the VAST majority of condos are grossly under funding their reserves. Assets depreciate and ignoring them can cost your life. See, e.g., Champlain Towers. There’s only so much road and can to kick before people have to pay scores of thousands of dollars to pay for deferred maintenance. The buyers market is mostly ignorant of this and people are going to be foreclosed for non payment, and them mortgage foreclosure. This market is ready for these elements to kick in, and many will be bought out imploded and rebuilt, and that’s if they’re lucky…

The other very large wildcard for the short term rental market is local government regulation. Here in Colorado many of the mountain towns have implemented significant limits on property use for short-term rentals. So the wild west of vacation rentals a few years ago is over. This is also true for tourist oriented cities elsewhere, especially in California. It’s likely to become a bigger problem as the backlash against short-term rentals in ski towns and tourist towns increases as fewer and fewer locals can afford rent. This will affect property values in these places. This doesn’t apply everywhere but it’s big deal in tourist towns.

1031 the properties to a location where you can make more rent and buy additional homes? Example sell in Southern California (high taxes/crazy prices) and buy in Orlando. Thoughts?

Yes, if you are going be a real estate investor go to where the money is.

Carefully, with low LTV ratios.

I’m hard working middle class median income. I don’t own house yet, because the prices are high and it’s cheaper to rent. I have some cash aside. When it blows as much as I think and expect, and when you raise my rent again, I’ll buy in a second. Who will you rent your houses then, your rich buddies or the crackheads on unemployment? Good luck!

If only investors felt the same…

That’s what doesn’t make sense about this analysis.

Wolf knows how markets work.

The “orderbook” needs to be emptied at a certain price before prices go down.

As far as I can tell, there’s still plenty of institutions with access to free money coming off the presses at the Fed, who are putting orders into the “orderbook” and will do so as long as income from perspective rents will overcome interest payments.

Wolf wraps up saying that supply is still very low, which anyone from high school econ would be able to tell you means the prices are not coming down.

Geoff,

Despite all the hype in the media headlines about investors, even the NAR’s data shows that investors (cash buyers) have been roughly stable:

“All-cash sales accounted for 25% of transactions in February, down from 27% in January and up from 22% in February 2021.”

What people who just read the media headlines, without reading the articles, don’t know is that the big investors, such as BlackRock and pension funds, do NOT buy individual houses but buy entire portfolios of RENTAL properties – they’re already rented out — including entire subdivisions of BUILT TO RENT homes that are already rented out, and they buy entire apartment buildings, FROM OTHER BIG INVESTORS or from PROPERTY DEVELOPERS.

These are investors selling to other investors!

And the iBuyers such as Opendoor, they’re flippers, they buy and sell. That property shows up on the market again.

You’ve got to read the entire articles in the media, and not just the headlines!!!

Well, that partially answers the question I left under your previous housing article, asking what would cause hedge funds to stop sucking up starter homes. Thank you. I knew they bought in large bundles, but I always thought these were foreclosures that might have been made available to first-time buyers, not currently rented homes.

I just wish they weren’t in it at all. Similarly, that no one had conceived of Airbnb. I think about Lake Tahoe where I lived a couple of decades ago. It was expensive, but people who worked there could actually afford to live there. Now, the whole place is short-term rentals, pricing out the locals.

The City of South Lake Tahoe banned STR homes in all but the core area as of the first of this year. Measure T allows a few strict exceptions but for the most part all residential areas are done with it.

AirBnb itself was a wonderful concept in that it allowed your average homeowner a chance to rent out unused rooms in case they were traveling to earn a little extra money. However, it got bastardized by the same financial wizards who ruined everything else.

One of my brothers just finished a 2 year stint traveling around the country towing a huge RV. Now he’s renting a new home in South Carolina just a few doors down from his son. The neighborhood is new, still under construction, and 100% rental build-to-rent. Over 30 houses now. The site can hold almost 100. It is nicely located, walk-friendly, and great for retired folks. I suspect Blackrock owns it under a different name. I can see this type of thing getting a lot bigger.

roddy6667,

Build-to-rent is the hottest move in RE right now. BlackRock is unlikely to own this development yet, though it might buy it. BlackRock and other asset managers and pension funds buy from the developer after the development is finished and mostly rented out. They’re looking for predictable income streams and ROI.

Roddy, We are in our late 70’s and own our Texas home outright. If one of us were to need to go into assisted living, or worse, a nursing home, this house would be sold in a heartbeat and the cash used to pay the medical costs and rental of an apartment for the one of us that is still on their own.

I suspect that many older retirees are thinking the same thing: Using the house equity to fund future medical as Medicare does not cover long term care. Some people do have LTC insurance, but that payout does not cover everything.

On that note about BlackRock, et Al buying up bunches of rentals, here’s a micro-look:

Here in one small-ish Colorado Springs neighborhood there are roughly 30 homes for rent (3&4BR SF) out of maybe 38 total for rent that were bought by Invitation Homes in the past 3-9mo. These ~30 homes are priced really aggressively and sitting a while, inching down there prices every we k or so. Which tells me their profit margins are tight. Not sure how this will affect long-term rental market here. They’ve got their 4Bed 2,000 sqft rentals priced at around $2300-$2500/mo, whereas I rent my 5 Bed, 3500 sqft house a mile away for $2675 (down from an initial listing of $2895.

And don’t forget Zillow shut down its whole flipping operation (in shambles), five months ago.

I don’t think too many players have better mass, near real time data on the SFH market than Zillow.

Wolf, I love you work (and contribute monthly) but….in some markets like FL AMH and Tricon and others borrow at 1%, Joe and Suzie Sixpack pay 4.8%. They can’t compete. Until 2008-now it wasn’t cost effective to buy individual homes and manage them. Now? They package them up and manage them all or spin off 100, 500 w/evr into a vehicle and hawk them: “US single homes in hottest markets, turnkey rentals YUGE returns* (conditions apply like the 80% LTV we just mortgaged them at). Anybody smell 2008-2012,13, 14???

In my area sales are still booming but I suspect at least some of the activity is to lock in rates – primarily people who were waiting for the bust but got rabbit punched by inflation.

Lots of buyers still have rates that were locked some time ago. The lock period can be 90 days or longer.

Yes but are those rates locked in “bigly”?

And now they have a unique opportunity to lock in a historically high price!

at least until the next round of economic stimulus…

They are also locking in a payment they can afford now.

This is where the last puff is coming from. People who have rates 3.x% rates who have a month or two to buy or else they’re above 5%.

That’s $1,000/mo difference on a mil; $500 a month on 500k savings for the next 30 years or until they move again.

A bidding war between two people in that position will push a price up pretty quickly.

On the coasts, homes could drop 30% and still be at 2019 price levels. Seems the Fed would have no concerns about that. Only a very small number of homeowners would be underwater.

maybe SO, maybe NO bobr:

Last time around on this cycle, houses on canals with no bridges to the GOM listed for well over $800K in ’06/7 were auctioned off for $200K a year or so later,,, and to be sure, the $200K probably made at least some ”profit” for the folks who had owned them for eva,,,

Austin, Tx just added 150 listings in the past 24 hours. Ground zero?

Depends on overall supply, but more importantly how many on an average day are put up for sale.

Is it 120? No big deal.

Is it 20? That might be something to look at.

The average price in Austin is $550K, about 10X the average wage. We know people there and the only reason they can afford it is because they bought a few years ago, before the big run up. They know the 1-3X increase in home values is unsustainable and are feeling the pain of the increased RE taxes. One guy commutes from the outskirts of Houston to Austin, the unseen cost of home ownership.

The irony is that there is an absolute ton of raw, flat land to the N, E, and S of Austin (W has use restrictions that are quite possibly 75% phoney baloney).

But so long as every idiot wants to crowd into downtown or a handful of other dense spots (literally and figuratively), prices get stupidly goosed.

It is like people don’t get that “work from home” can be 90% as easy 15 miles out as .15 miles out. If you are only commuting in once a week or every two weeks, maybe paying 50% as much for housing makes sense.

It is like these people have never heard of Google Maps.

Hell, the huge Oracle campus is already in the E/SE corner of Austin.

I wonder if it is the California transplants who simply cannot stand to have savings who insist on overpaying for housing.

Oops…meant Tesla campus rather than Oracle (although Oracle has property out that way too).

I differ significantly from your viewpoint. Land is the least of our worries. Urban zoning is where we should focus. It is a nightmare and needs to be reevaluated entirely in this country. People crowding into dense, well-connected, and habitable locations should be the goal. Economies of Scale.

We are sold on the idea of living in our 4000+sqft homes that are not connected by any decent public transport, and people wonder why so many are antisocial. Most of us live in these suburban hellholes.

All of the cars commuting into cities cause horrific traffic, pollution, unsafe roads for pedestrians and bikers, etc. Outrageous parking lots that stifle the utility of entire blocks. Less sense of community and originality. Our European and Japanese counterparts enjoy interesting, dense, clean, safe, pedestrian/bike-friendly, and outdoor living spaces that we don’t. Oh, and it’s a fraction of the cost most times. Between car insurance, gas, parking, maintenance, etc., most people would be better off with a metro pass or something similar. All thanks to the lobbying of the auto industry many decades ago. I could only imagine what high-speed rail could have done for this country.

Or, if urban and suburban planning had incorporated walking/biking trails and lanes throughout the city or town that enabled people to more easily and safely get around without using a car.

There is a rail trail being developed about 1/2 mile from my house. When completed, it will extend over 25 miles and cross over a 4 lane highway. From my house it is about 3 miles to the bank, post office, restaurants, and numerous retail establishments, which I can easily bike ride in about 15 minutes, not that much longer than it takes to drive.

The trail is flat, paved, shaded, and travels through woodlands, wetlands, and farmland. There are safe and well-marked crossings over roadways. It is frequently used by people walking, cycling, jogging, skate boarding, walking dogs, pushing strollers, and even the occasional person in a wheel chair. It is an extremely pleasant and relaxing way to travel, not to mention healthier than driving a car!

Jay, I live in one of those “suburban hellholes”.

After years of living in cities, under the exact conditions you describe, I’ve never been happier than I am right here in suburbia.

It’s quiet, clean, and safe. People are friendly and have respect for each other. They wave and say hello. I can hear the birds in the morning and insects at night. I can wash my car in my driveway. I can send my kids to a school where they’re taught good values. I can leave my front door unlocked and my package on the porch without worry.

I work from home, but I’ve never had closer friends than I do now. I never knew my neighbors in the city, but I know people here on a personal level. We go to the pool together, have barbecues, attend church, you name it.

I haven’t worn a mask anywhere since mid-2020, nor really paid much mind to COVID, and somehow I never got it. There is fresh air, space, and liberty here.

You can keep your urban utopia. I’ll stick to my suburban hell.

My Zestimate would buy a small studio in Wolftown ;-)

Sell ? To whom ?

Lincoln Park, one of the few decent liveable areas of Chicago is full of foreclosure notices.

If your house is paid for then 2.1% IL property tax on your shack which appreciated from $50K to $1.5M in the past 15 years will kill you.

If your house is not yet paid for, well, as RR used to joke, “We’re from the Government, We’re here to help !”

FHFA:

4/6/2022

Foreclosure Suspension for Borrowers Applying for Relief through the Homeowner Assistance Fund

Meaning – Die Another Day (or Month… or Year…)

This bad LSD trip will never end 😁

Not even California housing in good neighborhoods appreciated this quickly over the past 15 years.

If you prefer cold hard facts:

PROPERTY TAXES STILL ROB ‘HOME ALONE’ HOUSE

It is the house from “Home Alone” (1990) movie, 671 Lincoln Ave,Winnetka,IL (Chicago North Side)

You may also look up much more modest house from the movie “Risky Business” (1983) with action taking place in Chicago suburbs.

Jordan’s house in Highland Park seems like a steal now at $15M. Think about what it would cost to build right now. $100k per year in taxes and maybe another $50k in landscaping/upkeep. Pocket change.

That home alone house paid 32K in property taxes last year! Absolutely ridiculous.

Illinois has plenty of corruption to fund, as well as massive pension obligations, which puts property owners on the hook for brutal taxes.

As more and more people just give up and leave, the burden grows on those that stay. It will get worse before it gets better.

To make matters even worse, Southeastern Conference universities are poaching the best and brightest from Illinois with cheaper/better deals than they can get in state. And, when they graduate, they don’t return.

Hal-

“As more and more people just give up and leave, the burden grows on those that stay.”

Good insight.

Lael Brainard wrote an paper several years back on “first mover advantage,” and it’s affect on market prices.

She was referring to money market fund mutual fund liquidations, but your comment makes me think the term might equally apply to residential relocations.

Hope the powers-that-be don’t consider imposing “gates” on neighborhoods the way they talked about applying “gates” to money market funds!

And due to pressure from Occupy Herbstreit, all SEC QB’s have to earn the same…But but but: “…if you move from IL, you best leave your librhul values at home” Grady Judd, Sheriff, Polk County FL. More alien abductions from trailer parks than any county in the US/

Inventory still low, few new homes being built (supply chain, labor availability).

Interest rate rises are intersecting with a longer term low inventory issue. Prices will not drop.

Sir John Templeton:

Arguably, the greatest investor of 20th century, once said the four most expensive words in investing are “This Time It’s different.”

Or

“It can’t happen here”.

Beardawg-

“Prices will not drop.”

Should the reader add “ever” to your statement, or do you mean “yet.”

I think that’s the question posed by the article.

Ever – at least not by any appreciable amount, like say 5-10% max in some spot markets, and even then, only for a short time – like the SF condo breather which lasted as long as an eye blink.

Waiting for the drop which does not come is losing equity to the market. That said, rents still lag prices, so unless planning to be somewhere 7 years or longer, renting works.

Bubble talk.

4+ years is a breather???? (SF condo prices have been flat for that long)

I don’t know what kind of hopium you’re smoking, but prices are ALREADY down 10% in some markets. You’re delusional. You wouldn’t happen to own rental houses, would you? Of course not…

Beardawg-

If a steak dinner or equal value is on the line, I’ll take that bet.

I’ll bet him $10,000 held in escrow. Wolf can manage it.

Your post reminds me of the one in a prior topic saying the same thing for SF.

It’s not a mechanical or linear outcome. If it was, no trend would ever change.

The housing bubble is a psychological outcome. So was the housing bust during the GFC. During housing bubble 1 leading up to the GFC, people collectively took leave of their sense to believe that buyers who were actually awful credit risks were credit worthy, institutional buyers duped themselves into believing garbage credits were “AAA”, convinced themselves that paying unprecedented prices were somehow “bargains”. The same thing is happening now.

The bust happened because people collectively changed their mind, on all of the above.

Except for your ” housing bubble 1″ part AF, I agree, like totally, with the rest of your comment.

For me, and my dad, housing bubble 1 was in 1956 when WE, the family WE, lost the farm and one of the houses WE had built, in order to keep the house WE had ”grown into” with a couple more kids, etc., after building our ”dream” house…

And so it goes, per Kurt Vonnegut,,, eh?

“hi ho and so it goes”

John H

Will take that bet. ;-)

2025 being the line of demarcation ??

Don’t know where you call home, but we can iron out the logistics when it is time to pay up.

I have a different look.

People don’t want to buy since they sense something is wrong? Not only with America, but the world?

I am not going to get Political, but if one listed all the bizzaro things happening, would you want to buy an expensive home?

Rent may be a waste, but you are free to move far easier than owning.

This time is different :-)

1) The old timey 3-6-9 rule tried to answer the RE question: is it wiser to rent the house or rent the money to buy the house.

annual rent / purchase price = 3% Do not buy

annual rent / purchase price = 6% Borderline

annual rent / purchase price = 9% Buy

Comment: in this sad year of 2022, where can you buy a liveable house selling for 11 times the annual rent it tosses off?

2) Another fun falacious RE rule for goldbugs: denominating houses in gold.

Buy RE when the average house sells for 100 ounces of gold (as in 1935 and 1980)

Sell RE when the average house sells for 500 ounces of gold (as in 1971 and 2001)

Comment: 100 ounces x $1950/ounce = $195k. 500 ounces x $1950/ounce = $975k.

Hadn’t heard either of those before. Like ‘em! Thanks.

Interesting perspective. NSA, where did you get the gold to housing references?

I’ve commented on the gold/house ratio here multiple times, to explain why gold is relatively overpriced.

Housing is in a bubble yet still relatively cheap versus gold.

Have no fear bl@crockman is hear

Looking at price is only one factor.

You have to look at other things as well.

You know financial aspects such as: real estate taxes, transaction costs, employment, and housing alternatives such as renting.

And other non-financial factors such as: regulations, crime, and of course politics.

Sizing up of all them I don’t think that buying real estate in the USA is a good deal no matter what the price or interest rate.

If I buy a house in Crook Cty, Il a 500k house will cost avg of 10k in taxes/year. Over 30 years that 300k I’ll never see again, just to pay for racist and misogynistic cops, poor school system, and high crime.

Well, don’t live in Illinois, right?

Vote with your feet.

I am trying to convince my extended family to move to Barbados.

Barbados?

Nice place. Been there, but……………..

Didn’t they just leave the Commonwealth and become an independent country free from all that stuff such as British Law?

Given the trend of countries that end that relationship, you’d probably be better looking at some other places.

Lots of really cheap real estate compared to the USA and minimal taxation including RE taxes all over the West Indies.

If you go there what you give up is mobility and a host other things you take for granted in places with larger populations.

You know big hospitals, a choice of shopping areas, education, and mix of ethnic diversity.

What you get is great weather (except for those big winds that happen once in a while and destroy 90% of the place), beautiful beaches and oceans, a laid back lifestyle except when one of those things erupt (volcano) and bury half the island such as recently in St Vincent or Montserrat in the recent past.

Rent in Barbados and own a boat. Leave whenever you want.

“Rent in Barbados and own a boat.”

Not sure about the immigration possibilities when renting there an how much the rent is for a decent place anymore.

By boat if you mean power boat you’d have to be quite rich to be able to fill a power boat now with diesel. Probably cost you more than US$1000 to fill a decent sized boat now, but I guess if you can fork out US$500,000 for a decent boat then that doesn’t matter, does it…………………………

I agree.

The Social fabric of America is negative.

I am waiting for that Lehman-like moment and curious which company will be the poster child. Maybe a tech company this time?

Tesla.

Softbank?

I vote some huge private equity thing that no one has heard of yet.

Citi

If you are referring to a tech company becoming financial insolvent, none are systemically important like Lehman in 2008.

There may be a non-financial company out there somewhere, but I can’t think of one now.

NOT SO FAST AF:::

Reading that there are approximately $600 Trillion of ”derivatives” of clearly unknown unknowns of reason, rationality and responsibility ”out there” these days should,,, ABSOLUTELY should put at least extensive shudders, if not shutters on each and every small time investor…

OF COURSE the Wolfster cannot make an article including his wonderful charts about this because they, the unknown unknowns are and cannot be known…

CLEAR ENOUGH for now???

CRAZY times for sure,,, but this is NOT exactly NEW news to be sure.

AND leads one to wonder how SO many apparently otherwise rational folks continue to ”invest” in SM and SO many other types of NOT BASED in REALITY

”paper only products.”

Yes, hidden derivative exposure by a non-financial is a possibility.

Any company in fact, it’s bankruptcy would grab major headlines, and changed investors’ mood.

Pets dot com wasn’t important either but it was the poster boy of that crash

I put my bet on a Cloud Based Data Storage company.

One with beautiful applications.

Deuscht Bank

TNX is close to topping for now…

my bet is oil drifts back down to 85, commodities get hit before May so a .50 raise will do trick and then quarter points thru summer…

they will say it was raising rates that did it but it will be the trading pits and commodity shorts via blackrock pushing the game

Lol, no. Just no. Shorting commodities with this global dynamic? Hope you made your will out!

Judy,

Yep, all it would take is an attack on a Saudi oil instalation or a big earthquake in any major US county, or a big solar flare or an invasion by the little green men……………….

Or Ukrainian farmers not planting much crop for some unknown reason…

The trendline is at 74 for oil. 74 seems more likely than 85 if the Ukraine war ends.

The oil producing countries can’t feed their populations if it gets too low…thus 85?

There will be no “soft landing” to escape the negative consequences of two decades+ of an unprecedented financial mania and 13+ years of a fake economy.

All these surveys seem to be predominantly attracting those who missed the boat and don’t own RE.

If this was the best time ever to sell why isn’t anyone selling. And if this was the worst time to buy why is every listed home getting sold within hours at 50% above listing price.

If demand exceeds supply prices will go up that’s simple math. House supply is historically low and not enough houses can be built in good neighborhoods near work and life as there are no land available. Higher inflation will keep reducing the value of USD so assets will keep appreciating. This can only stop if FED find rates passes inflation which FED will never do so forget about any RE crash. Those waiting will keep renting forever.

Kunal,

“If this was the best time ever to sell why isn’t anyone selling.”

Oh lordy. They ARE selling: In Feb, the seasonally adjusted annual rate of sales was over 6.0 million, well above pre-covid levels. Don’t you ever read anything here? Just trolling for the heck of it?

Another sarcasm Kunal?

Never predict what FED is going to do. OK?

“If demand exceeds supply prices will go up that’s simple math.”

It’s such simple math it really has no bearing on what is happening right now. Things aren’t happening in a vacuum and while there will continue to be more people who need/want their own home than there are properties the relative demand can easily shrink so the same pressure and quick turnover no longer exists. We’ve had more demand for homes than we’ve had supply for decades but havent had a direct correlation in pricing because its not a simple relationship like that. Raising rates also changes the actual, real world amount people can borrow to buy so while demand may remain strong that demand may be at a much lower price point. Then there’s just the overall mood and emotions of everyone given the economic climate. People don’t make the most rational decisions, they make emotional ones that are mostly guided by prudence and if the feeling becomes things are getting tight it has a domino effect. It would seem you are ignoring the larger economic picture.

Here in So Cal I’m noticing a bit more houses coming on the market. It’s probably because its spring time, and maybe some people are thinking house prices have peaked or soon will peak.

The City of South Lake Tahoe banned STR homes in all but the core area as of the first of this year. Measure T allows a few strict exceptions but for the most part all residential areas are done with it.

I keep hearing that over 2 million people are pouring into the U.S. every years–legally and illegally. The logic is that the will keep up the demand for housing.

But how many of the new immigrants speak the language, have skills, and would survive without government handouts? Can they actually buy all these expensive homes? At the same time, the U.S. native population is dying out with births having been reduced to 52/1000 women since many men can’t afford to get married and have kids.

My guess is that there are lots of variables that could cause a deluge of new homes on the market in the next twelve months. Flippers who have been waiting for everything from garage doors to windows need to sell before rates go up much higher. That will bring down the comps. The home owners on the fence will join in right after those flippers when they see home prices dropping.

Former Federal Reserve Bank of New York President Bill Dudley says the Fed “hasn’t really accomplished much yet” with its efforts to control inflation, and will need to tighten financial conditions to push bond yields higher and stock prices lower. “If financial conditions don’t cooperate with the Fed, the Fed’s going to have to do more until financial markets do cooperate,” Dudley, a Bloomberg Opinion columnist. said on Bloomberg Television. Dudley’s opinions are his own.

Population argument is a rationalization. Just because people (supposedly) need something doesn’t mean they can afford to buy it or will be able to do so.

You keep hearing? I keep hearing that there are idiots on the internet making up statistics. In fact over 90% of the factoids on Facebook are produced out of thin air from Russian bot farms. Yes, I made that last one up. See it’s easy to make your own facts and live in an alternate reality!

Here’s a conspiracy for you:

BlackRock, and their buddies, buy up every home they can, with 0.1% money from their friends at the FED.

The Government, (x-BlackRock employees), open the borders to let millions in.

The Government rents these homes from BlackRock so as to house the millions they let in, who have no jobs, have no money, and have no place to live.

Everybody is happy. (Remember, “everybody” is: The Government, Immigrants, and BlackRock)

As it’s more a global economy do you think this will effect the UK housing market? I’ve just listed my house at… What is equivalent to 9 times the average local wage! People seem to be thinking,” if I don’t buy now I will never get another chance” . To me it sounds like an imminent collapse but I’m a bit concerned being 100% cash. Thoughts?

Got to figure out when you are likely to need the money. If you think you the opportunity is going to be within the next five years then I would probably do a mix of t-bills and 2 – 3 year treasuries to try to pick up a little return.

I live in Markham, Canada and homes sell for about forty times the average yearly wage. The overall property market sells for about thirty five times the average yearly wage.

forty times!!!!!!! Shit the bed!!!!! For want of a better phrase :D That is absolutely mental. What wage multiple do the lenders go by for mortgages?

Markham is (or at least was) a really nice place. Last there in 2008 though.

What makes a place “nice”?

You’re asking a question where the answer is a qualitative personal preference.

By my standards, it is “civilized”. This as opposed to most large US cities which contain isolated islands of civility substantially surrounded by a sea of barbarism. (Markham is a suburb of Toronto.)

Let me put it this way for you. There are a lot of people worldwide who would move there if permitted and could afford it.

By comparison, there is no surge of people clamoring to move hardly anywhere in the Middle East, most of Asia, and Africa.

This confused me:

1) ” …consumers expecting their financial situations to worsen over the next year; this was especially true among current homeowners”

Huh? The people holding the most appreciating and inflation-resisting asset are the most worried?

2) ” … the percentage of people who said that now is a “good time to sell” rose to 74%…”

Huh? These folks are anxious to switch, all-in, into the most inflation-exposed asset, with huge prices for their own housing ahead? Makes sense only if there is a stiff recession ahead. I am wary of trying to market-time with a house, if that is my biggest asset, where I live.

phleep,

These are “sentiment” indicators, just like the broader consumer confidence measures.

#1. Inflation. If you have to stretch every month to make the mortgage payment, inflation is going to make it even more difficult because everything else gets more expensive and you have less money left over for mortgage payments. This can be VERY stressful.

#2. If I could/wanted to sell, now would be a great time to sell; it’s a great time to sell so I might put my rental properties or second home or third home on the market. I know lots of people in the second category. They could put those homes on the market in a minute. They don’t live there and wouldn’t even have to move.

Capital Gains would be a good reason to think twice about selling rental properties..

RIP the guys who invested in MBS. Who are they apart from the Fed (=taxpayer)? Pension funds?

YuShan-

Add bond mutual funds.

These are used in 401k’s as the 40% part of the 60:40 “conservative” mix, as an alternative to money market and GIC type alternatives.

Perversely, they SEEM most attractive AFTER they have run up, if one judges them by past return (which most employee’s do).

This provides an excellent opportunity to buy high and sell low, which is most likely to unfold in upcoming months fund returns are reported to employees. Please pardon my cynicism.

Bond mutual funds are purchased by individual investors outside of 401k’s too, of course, in IRA’s, individual taxable accounts, and “managed fund portfolios.”

In general, the entire TINA 60:40 thing could turn into a disaster with both bonds and stocks going down and rampant inflation on top of that. This strategy has reached the end of the road.

When the mania ends, “investors” will find themselves indexed to an unprecedented bear market and someone will ride it all the way down.

Is it true that at the current pace and timing of Fed balance sheet reduction, that they will sell at a loss?

Does anyone understand that dynamic more specifically? TIA

That is quite possible. But the also made massive profits in earlier years, so that may give them some cover.

Not sure how many have seen the chart showing ratio of financial assets to GDP hitting 6.2 : 1 with this round of Fed easing. Long term trend is 3 :1 and going from 3 to 6 is a one time tail wind that can’t be repeated. Buyer of financial assets beware with with long term real GDP growth under 1.5%. Even Dudley is trying to warn that the asset bubble is too big.

It’s worse than the data implies.

The only reason the “long-term trend” is even 3:1 is because the asset mania has lasted for over 20 years.

A more reasonable comparison would be valuations between maybe 1960-1990.

OF COURSE ”it’s” worse than the data implies OS and AF:

because, 1st, the data only can cover the knowns and known unknowns.

To put it simply, ”retail” investors in SMs, etc., are just another form of the ”suckers” that every con person, at least for the last couple hundred years have identified as their prey.

In Canada clueless Canadians watched home prices peak about a month ago as no one listed. For signs are going up in the Chinese neighbourhoods. Incoming air pocket as the April 7th budget was also negative for Chinese buyers.

That’s why in my home town, we have 2500 Chinese students and growing, who will go to college, get permanent residence then buy a home for the family..

Is Homebuyer’s Pessimism something like Consumer Confidence? Low consumer confidence has not hamstrung consumers in the past. Why? Because they are muppets!!!

I think the job market is still buoyant enough to support the current market. Wait till there’s a food shortage though, people will realize they can’t eat bricks.

How can it not be 100% say its a bad time to buy? Regardless of any kind of bias, what rational person looks at this backdrop and says, yeah its the perfect time to jump into that lava

Trust fund kids listening to the RE agents dancing on TikTok. At least, the ones I know.

Money flows from its undeserving owners? If only.

Lily, i am directly connected to these types of kids and you couldn’t be more right. These families can be morons (not all are) buying whatever, whenever. BUT, they don’t care, because this inflation does not touch them.

Ace, the future of America depends on the blissfully ignorant spendy sect of the upper middle class.

Bless their slippery hides.

Hm, maybe someone who thinks that the dollar is *really* going to take a pounding, and that owning real estate might be a relatively safe harbor from rampant inflation? I’m not sure I’d buy that argument, but I would consider it to be rational.

i might consider that rational if we were talking about huge plots of arable farmland, but a hyperinflationary situation will destroy the single family home market as well.

I’m no currency pro, but it seems to me, Europe’s mess means it can’t raise rates much. China is stimulating. It’s all relative. USA raises rates, so people buy dollars and US bonds. So US dollars start going up?

My response to these contingencies is to hold dollars and real estate. And a net short position on stocks.

The future of the US Dollar has never been brighter.

We’ll just need more of them to buy anything, LOL

buy USD, sell RE and short stocks !

The same “rational” people that have been saying it’s a bad time to buy for the last 5 years and missed the boat, the dock and the marina.

Yeah no cccb. This is after a 20 percent yoy gain and spiking rates.

10 year US Treasuries have moved up nicely to just under 2.70% and will be rapidly rising to well over 3.00% bring up mortgage rates to well over 6.00% which will bring some reasonability and normality back to the US housing markets.

Consumer borrowing in U.S. surges by a record $41.8 billion – Yahoo

Well… Consumer borrowing rose just $10 billion not seasonally adjusted, and massive seasonal adjustments pushed that increase to $41.8 billion seasonally adjusted.

This does not include housing debt. This is revolving credit, auto loans, and student loans. Auto loans are spiking because prices have spiked, and people have to finance a whole lot more to buy a vehicle. The vehicle unit sales are down, but price spikes are so big that all the dollar figures show growth, including auto loans.

Fed’s Bullard: Rates may still need to rise 300 basis points – Yahoo

And that’s still 4% behind inflation. Almost halfway there, Bullard, keep going.

*Can people let go of their largest asset in a hyperinflation?

*The replacement cost of each house is still increasing rapidly.

*Corporate buyers of homes will do so with the 30yr at 4.75% and inflation now reported at 7.9% and will be reported near 10% in a few days.

*Idle money still a big loser to inflation

Interest Rates: How This 1000% Increase Will Overwhelm… Everything?

2-Year U.S. bond: Look at this dramatic rise in yield in just six months

Ben Bernanke bankrupt 1/2 of the home builders during the GFC. And now there’s a labor shortage, not enough plumbers, electricians, carpenters etc.

Investors are canvassing homeowners with offers to buy their homes through blanketing the mail. There’s a severe affordable housing shortage.

“severe affordable housing shortage.”

Yes, that’s what you get from reckless monetary policies (QE & interest rate repression) that inflate asset prices, including home prices, out the wazoo.

The last housing bust made housing a lot more affordable — and the Fed hated it. Are you ready for more affordable housing in the future?

*The Fed has taken 2.7 Trillion of MBSs off the market.

*Many recent home purchasers have record low rates on their mortgages.

*Replacement cost of a home continues to soar with the inflation.

*Hyper inflation makes the owner keep his house, rather than have money in the bank.

* Corporations are geared up to continue to buy residential real estate.

Thus, Individual buyers may halt and give pause, but the supply will still be sparse IMO.

The real estate market is broken…..by the Fed and, as you say

“reckless monetary policies”. They skew all they touch.

Mr. Richter, are you implying “more affordable housing in the future?”

Can this way overpriced housing market crash hard already? It’s only been a decade with last 2 years going absolutely insane.

While sentiment is this bad, I just wonder who are all the jerkoffs that are still buying over stickers as I continue to see from Zillow or Redfin sold listings in Socal…

There has to be a sucker on the side of every good deal. Ask current buyers why they are buying and they will recite a ton of RE platitudes, unsupported assumptions, and generalizations at you.

every time i see some fool write “inventory is still low” (most of the mainstream media), i know i’m dealing with an economic ignoramus.

to repeat, there is no such thing as “high inventory” or “low inventory” in a vacuum. it’s all a function of price and consumer mentality. if people are buying up houses to keep them empty because they are counting on 20% gains just from them sitting there, they won’t sell, and we’ll never have enough houses for everyone who wants them to actually live in. that means we’ll have “low inventory.” once people aren’t convinced that this will capital appreciation will happen, they’ll rush to list and “get out.” now suddenly, we have “high inventory.”

House in my neighborhood,on market 2 weeks unheard of

One in mine for a month now and price has been reduced from $499 K to $449 K. It’s about 2,800 SF and in very nice condition. 55+ community too.

The interesting thing to me, a layperson, about the housing market and other bubble markets is the SIZE of the bubbles. I mean, home prices could crash pretty significantly (25%-50%), and they would still be expensive as hell.

Same thing with the stock market. For example, the Russell 2000 could lose 25%-50% of its value, and it would still be above where it was 10 years ago.

I may not fully understand how this all works, though, so if I’m wrong.. please be gentle.

No, you are not wrong.

That’s why this is the greatest asset, credit and debt mania in the history of human civilization.

Just wonderful for us personally.

We had been planning on downsizing in 2020. Instead we cocooned not wanting persons unknown tromping through our house.

So we are now planning on doing it in 2022.

What great timing we have. Not!

What’s probably going to happen is that you’ll see a short spurt of buying activity as folks try to purchase houses before their rate locks expire.

Most rate locks are for 60 days, give or take 30 days. Remember though that the rate lock has to last through closing, which typically takes 30-60 days from purchase contract acceptance.

I think the really unexpected factor in all of this has been just how quickly mortgage rates shot up once the Fed started to reduce their purchases of MBSs. Most “experts” were not predicting rates to get to 5% until the end of 2022. As such, the swiftness of the move up in rates will probably lead to negative affect the housing market quicker than assumed; probably within 2-3 months.

Rental prices are increasing about as fast as home prices; just not enough supply…might as well buy and take advantage of the equity you gain each year going forward rather than just throwing away an additional 10-20% on increasing rents each year.

rents are not going to continue increasing. there simply isn’t the money to pay for it. look at the numbers that came out regarding household finances yesterday.

all of the supposed “excess savings” is gone.

How is throwing away money on rent any different than throwing away money on interest payments? Answer: it’s no different.

The only relevant question is, will home prices continue to appreciate? In a rising rate environment, prudent investors won’t take that bet.

The issues are different for cash buyers. If you sell your equities and buy a rental you really don’t care about the market value of the home, only the rent payment. News they cut dividends on Wall St surreptitiously. The consensus for some version of hyperinflation suggests rents and home prices (inflation) will outstrip equity returns (and dividends – remember the nifty fifty?) And Wall St can cut dividends even while interest rates are dropping. High (mortgage) interest rates also have a disinclining effect on competition in rental markets, fewer people becoming over leveraged landlords. Ergo once the market shakes out the weak hands, there is little if any downside. The argument against being a landlord is a surge in progressive politics, rent control and governmental policies which undermine capitalist underpinnings in the housing industry. The news right now is all about the reactionaries, that’s not where it’s at, and never has been.

After 70 plus years of investing…….its the same story every time.

Right now……I feel like a guy surrounded by bad guys……..but I hear the sound of a cop car in the far distance. Everybody will be bold and brave until the sound of that car is about a block away……then its run like h—.

Most rentals are going to measured against prime plus 3. So if those rates hit 9 to 10…….good luck justifying a return of 8 with all the risk and work. Prices will drop like a rock. As those investors get the hint and sell in order to snap up bonds. Real estate is over priced……unless you believe in hyper.

Inflation in this country might be ongoing……but hyper…….who has the strongest military, technology, energy sector, agriculture, location geographically, weather, natural resources, political stability………

Its the USA almost every time when discussing the bigger countries.

No hyper………long term real estate will always make sense but be prepared for a shake, rattle and roll the next five years as the brakes take effect.

“If consumer pessimism toward homebuying conditions continues and the recent mortgage rate increases are sustained, then we expect to see an even greater cooling of the housing market than previously forecast,” Fannie Mae said in the report.”

Fannie Mae stock is now trading @ 78 cents, don’t you get delisted if the price goes too low?

They should have been de-listed before when they couldn’t produce financials because of all the fraud. Prior execs forged a bunch of numbers to get big bonuses, the fines were much smaller than the bonuses I believe.

Franklin Reins.

Who are these 1 out of 4 who think it’s a good time to buy?? Would it be even better if prices and interest rates are higher?? /sarc

In US mortgages are tax deductible, aren’t they. So you Americans may have a cushion.

In regions with surplus houses, it may crash but not otherwise. In my opinion, the housing market seems to be too tight with no oversupply for it to crash . AirB&B has replaced prostitution economy in some areas of the world so I don’t believe it would crack that easily.

The time for investing in or flipping houses is over though even if real estate does not crash because the costs and risks are too high now. Real estate is not a liquid asset and it has many associated costs. I will never consider it as a viable investment option.

‘The percentage of people who said that now is a “good time to buy” a home plunged to a record low of 24%.’

The same percentage of people who are selling a home.

Coincidence? I think not.

The problem with this topic is that first time homebuyers are pessimistic because they haven’t saved money for a decade and worked at generating income. Those people are competing with people that have ample cash, who will continue buying at higher prices while they ignore mortgage rates. The Fed can only move rates so far before they destroy their MBS money creation machine so the housing market isn’t changing anytime soon, in fact it will rise all year, but I obviously at a slower rate. Increased rates will be an opportunity for first time buyers to save more money.

You’re wrong in assuming that only home buyers were asked. This is a housing survey that went to current homeowners and renters, both.

I find it rather fascinating that no one realizes how we no longer have private property in the US. In my area, with 1.09% property tax before assessments(highest assessments in the nation btw), if you buy an average home for say $2 million dollars. . . you’re left holding a tax burden of $20,000+ forever! You don’t own a thing, the state owns it.

To tell the truth, the real estate market is really unstable and frequently we can observe huge price spikes, but these statistics truly amazed me. It is so sad that we have achieved another record-worst in the data going back to 2010 because this situation entails really negative consequences and can affect a lot of people. Of course, different factors affect forming of such a “bad time to buy” a home and it is really difficult to predict what will be waiting for us next in this sector, but I really hope that we will see a great breakthrough which will increase the purchasing power. From my point of view, everything has its positive sides and it is important to take advantage of this situation, selling your house in a profitable way because everything favors it. No matter what, I really hope that the economy will normalize and develop, accepting positive dynamics.