Mad scramble to lock in rising mortgage rates? A few markets went raging-mania hog-wild. Others not so much. In two, prices dipped again.

By Wolf Richter for WOLF STREET.

The Bank of Canada’s interest rate repression and QE during the pandemic have done a marvelous job on Canada’s epic housing bubbles that had started to wheeze. But crazy money-printing fixes everything.

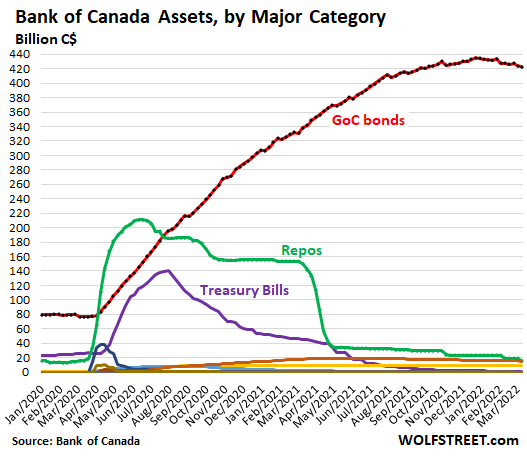

But having gotten increasingly nervous about the raging-mania it fueled, the Bank of Canada started to exit some of its money-printing programs in early 2021, including its repos and short-term Canadian Treasury bills, and started tapering its purchases of Government of Canada (GoC) bonds. Since peak-balance sheet in March 2021, its assets have fallen by 16%, to C$484 billion. And on March 2, the Bank of Canada hiked its policy rate by 25 basis points. So what we’re looking at now is quantitative tightening:

Yields jump.

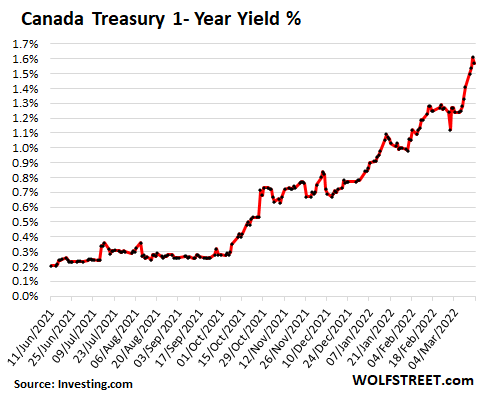

The Canada 10-year government bond yield jumped to 2.18%, nearly a percentage point higher than last fall. And the Canada Treasury 1-year yield jumped to 1.57%, up from 0.25% last fall. Shorter-term yields are important because of the large share of variable rate mortgages in Canada. Even Canada’s “fixed rate” mortgages are fixed for only a certain number of years, such as five years fixed, after which interest rates are reset.

And it seems, people were scrambling to buy something, no matter what the price, to lock in whatever mortgage rates they could still get before they rise even further (data via Investing.com):

Home prices spike ridiculously, jump, limp, or drop…

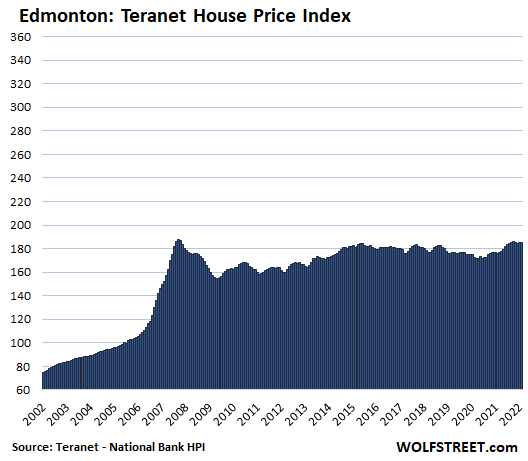

In two of Canada’s 11 largest markets, home prices dropped in February (Ottawa for the sixth month in a row, and Quebec City for the second month in a row), according to the Teranet-National Bank House Price Index, released today. In two other markets, home prices remained nearly flat (Calgary and Edmonton); and then there were some markets where prices went raging-mania hog-wild, such as in Hamilton.

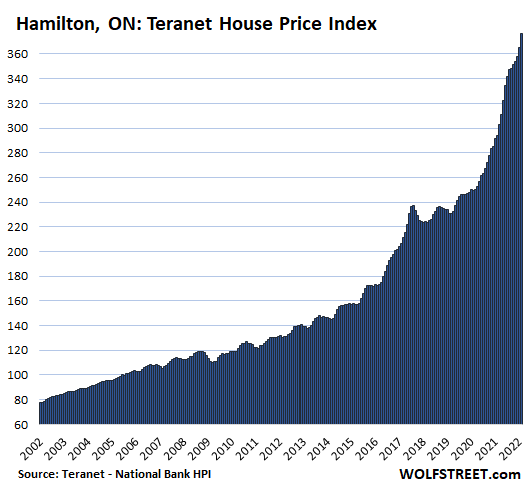

Hamilton, Ontario, has become the number one most splendid housing bubble in Canada, surpassing Vancouver and Toronto. House prices spiked by 1.9% in February from January, and by 20.8% year-over-year, with the index being up 375% from January 2002.

Note how house prices dropped in late 2017 and then wobbled along the flatline until May 2020, when the BoC’s reckless money-printing and interest-rate repression kicked in and fired up prices like never before. Ah yes, the miracles performed by reckless central banks.

Now, the money printing has ended and interest rates are rising, and home prices are sky-high, so let’s see where this will be going over the next few years. I mean, this is a ridiculous chart:

House price inflation. The Teranet-National Bank House Price Index, configured as a three-month moving average, is based on the “sales pairs” method that tracks the price of the same house each time it is sold over the years. In other words, the index tracks how many Canadian dollars it takes to buy the same house over the years, which makes it a measure of house price inflation.

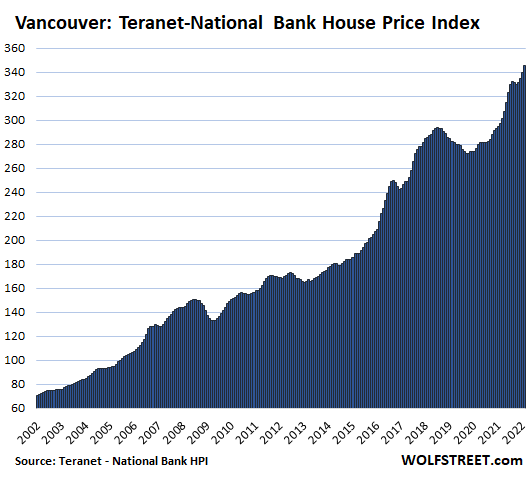

In Greater Vancouver, house prices spiked by 1.8% for the month, and by 16.4% year-over-year. Prices had started to drop in the second half of 2018 and kept wheezing along until the BoC’s reckless monetary policies bailed them out:

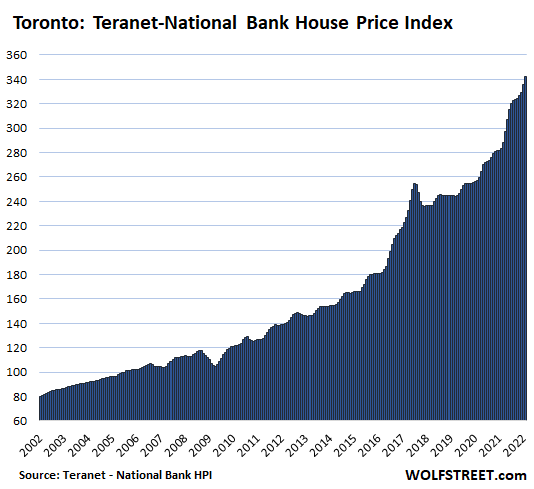

In the Greater Toronto Area, home prices jumped 1.9% for the month and by 20.8% year-over-year. There too, we see how the spike in 2017 unwound and how prices kept wheezing along until the money-printing miracle kicked in:

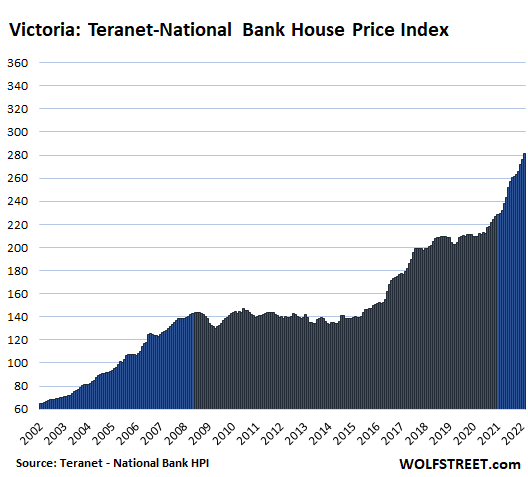

In Victoria, house prices jumped by 1.9% for the month, and by 22.5% year-over-year. Here too, prices had flattened from mid-2018 until the reckless money-printing by the BoC fired them up again:

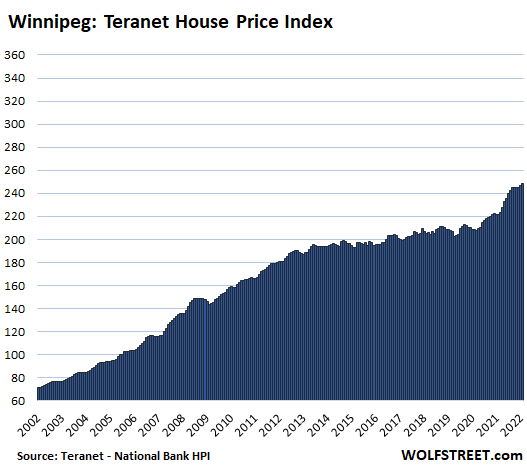

In Winnipeg, house prices rose 0.5% for the month and 12.1% year-over-year. The BoC’s miracle-cure pulled house prices that had essentially gone nowhere for seven years out of their slumber. But it now appears to have run out of steam:

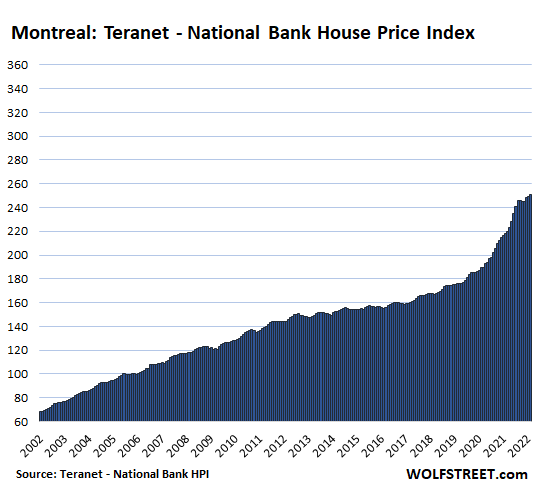

In Montreal, house prices rose 0.5% for the month and jumped 15.0% year-over-year:

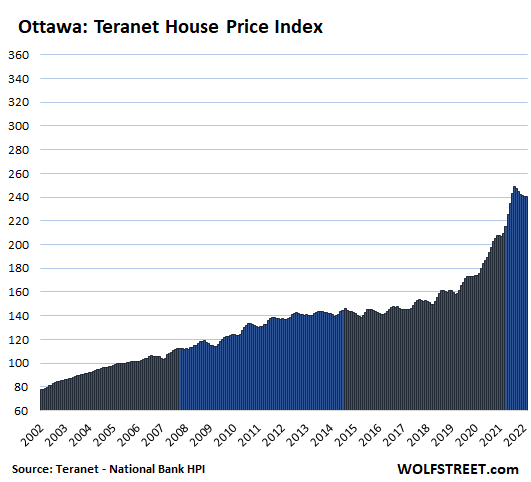

In Ottawa, house prices declined 0.2% for the month, the sixth month-to-month decline in a row. But prices were still up 16.2% year-over-year:

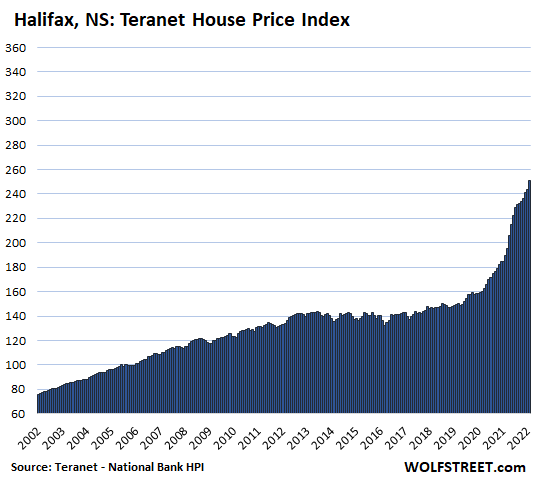

In Halifax, house prices spiked by 3.0% for the month, and by 32.5% year-over-year, the 10th month in a row of year-over-year price spikes of around 30%:

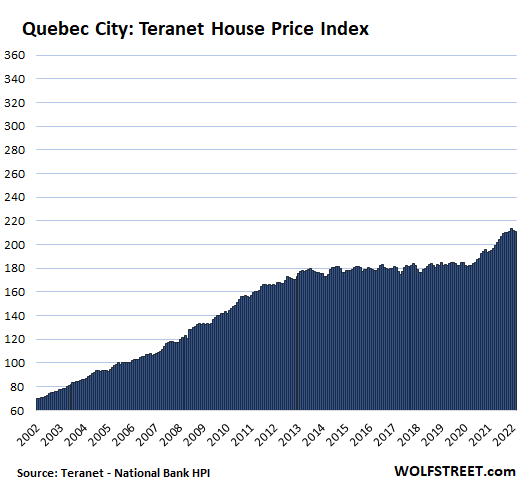

In Quebec City, house prices fell 0.4% for the month, the second month in a row of declines, whittling down the year-over-year gain to 8.3%:

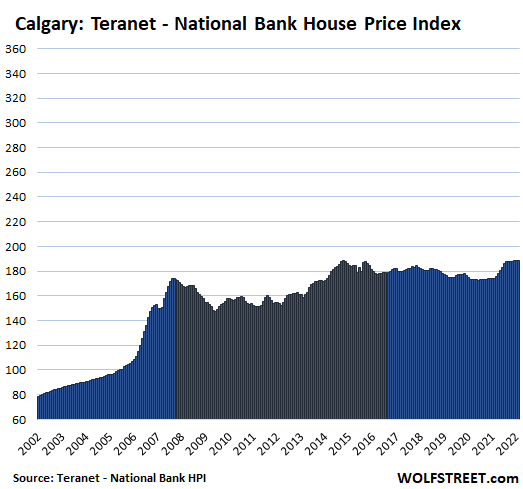

In Calgary, house prices were essentially flat for the third month in a row, which whittled the year-over-year gain down to 8.3% year-over-year. The oil boom-and-bust town had a phenomenal housing boom that ended in 2007. And today, the index is just barely above where it had been 14 years ago:

In Edmonton, Canada’s other oil-boom-and bust town, house prices have remained essentially flat for the seventh month in a row. Year-over-year, prices were up 5.2% but remain below the highs of 2007:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Looks great. What about Alaska house prices. Are they exponentially up?

Alaska is a tiny market. There only about 300,000 houses in the entire state.

Can’t they build more igloo with all that ice?

And have SoCal Jim sell them to Eskimos with prime credit.

Hey Alaska will be prime real estate eventually with global warming… Hmm kinda like Canada… Investors are always forward-thinking aren’t they.

Alaska is not in Canada. This article is about Canada.

Putting our house up for sale. 4 bedrooms, 2 baths built in 1977. Vancouver Island mill town. Real estate said to list it for $739k. It’s absolutely insane prices here. Locals with 2 good incomes are priced out, mostly cash buyers from bigger cities

prices in cda perfect example of a bubble ! major cities in cda , avg mortgage ,, over 1mm only supported by 1.5 % mortgage rates,,

Don’t worry.

When you’re disabled fighting a war thousands of miles away, or lose your job, the provincial government will cut your social assistance benefits to enrich the rentier class even more.

Actually the Canadian Military is the highest paid in the world. I was recently medically released and have 2 years at 90% of my Military pay to get better and back into the work force. Also have over 40k (80k if I had served over 10 years) that I could use toward education if I chose. Have another 28k for education that needs to be used during the 2 years. Also have priority hire for government jobs. Canada is pretty good to it’s disabled and medically released troops.

It doesn’t appear that your war chest would even make a dent in purchasing a house. Do you have a high paying job lined up to afford shelter?

A relative of mine offered above asking for a home in Timmins Ontario. Cash offer 300k cad rubles. Offer was turned down.

If gold takes off, Timmins real estate will be a gold mine.

Gold took off what are you on about?

Most Americans felt that they are getting richer as their house price increases.

Now inflation seems to be outpacing housing bubble. I wonder how long will it take for them to realise that the house did not grow and because everything else is getting much more expensive, they are actually getting poorer.

Its the dollar becoming dust, the house never went up in value 😉

In the meantime, they all have a place to eat and sleep with a roof over their heads. It’s a home first, an investment second.

House prices rose 24% nationwide in Oz. Think about that. Nearly a quarter of the price of a house has been just this year. Of course the RBA has no plans to stop that party as they are the biggest beneficiaries of this perversion.

The amount of times I hear some worker who should have been retired already brag that “the house I bought in the 1990s for C$150,000 is now worth a million” while working a minimum wage hourly job is a meme at this point.

Like, if the home you paid for C$150,000 has increased nearly ten times in price, why take away the job of a younger person by bragging about it at work? Liquidate and retire already!

Ok, so you liquidate. Where do they go to live now that they have the cash in their pocket? Another house, which costs just as much? Or perhaps a tiny house? Or maybe a condo/apartment? BTW, have you ever lived in an apartment complex? (Nasty, if you get lousy neighbors. Make sure you get a top floor unit.)

Most people don’t want to leave their lifestyles so the ones I’ve talked to (like my Canadian cousin whose house appreciated exactly as you point out) would rather stay in their house, and then pass it along to their relatives after they pass.

Canadians are stuck between a rock and a hard place. Sell the house but all the gains go toward the next one 💸

Some people have cashed in and did well. I know one person who got a house, a car and extra cash from selling in Vancouver and buying way out of the city.

Exactly. This is why the housing market is such a wheeze.

Do they think the rich would give everyone bars of gold worth $1mm? Instead they get a piece of paper that says “hey you’re a millionaire” that cannot be realized as they have to live somewhere.

The only people who are really effected are land speculators on the upside and young people on the downside.

Mexico

Nothing went up ,except printing of money gold buys same suit in 1929 as it does today ,deflated currency’s Bahahaha

Maybe they’re trying to get in under the wire before rates go higher.

OTOH, higher rates are likely to depress prices and if you can pay cash, the higher rates are a gift.

0.25% higher rate with no QT will cause prices to inflate further. When inflation is at 8%, the 4.25% mortgage gives you a 3.75% return, even when house prices don’t go up.

However there is both a Fed put and a Govt put on house prices, so they never go down and should keep going up.

In essence, US is all in on Housing, and housing markets can only correct when whole US is going bankrupt, not because of dollar debt that we can print, but because we no longer manufacture stuff and may not have anything to offer in lieu of imports.

Turn your housing charts upside down so you can see your fiat dollars denominated in houses. This is a replay of the 1970s…the flippers, no money down real estate courses are all back again. The only thing missing is a Wade Cook comeback…..oh wait, the former Tacoma taxi driver turned real estate guru died in 2021.

Central Bankers SKEW all they touch.

Just like the stock market, the mantra will be to now DEFEND those spikes…

It seems the job of central bankers, in their minds, is to keep all charts moving low left to upper right.

Bankers do not conduct behavioral research experiments on lab rats. They’re much less interested in theory than in practical financial applications.

And Canada is light years ahead of the Fed in normalizing fiscal policy.

Compared to the USA, we had to be…our debt compared to the size your population is outrageous.

From article: “Even Canada’s “fixed rate” mortgages are fixed for only a certain number of years, such as five years fixed, after which interest rates are reset.”

I was told by a Canadian friend that the Canadian government has “helped” homeowners when mortgage rates exceeded a certain level, effectively subsidizing both the homeowner and the bank when market rates rise.

Can anyone verify this? Mortgage subsidization of this sort would allow both the borrower and the lender to disregard the risk of rising rates. What could go wrong?!

If true, it would provide a partial explanation for WR charts above, no?

You got it right. Insidious, isn’t it?

Unamused-

Do you know if the homeowner’s aid payments a one-time response to the GFC, or part of an ongoing relief facility.

If the latter, then your description as “insidious” is correct — especially if/when mortgage rates rise in earnest.

And property taxes? How are they assessed? At the local or provincial level? And with values busting upward, I assume the tax burden on all of this new ‘wealth’ increases too?

Assessment happens at the provincial level in most cases (including Ontario). In Ontario it’s done by a Crown corporation, MPAC. The municipalities then decide the tax coding that results in your property tax bill. Other than Toronto, every other municipality has only property tax as the sole method of taxation. Reassessment happens in a 4 or 5 year interval and then is phased in through the remaining years and the biggest contributor to the assessed value is what other similar properties sold for nearby, so expect assessments to increase soon…

10-4 stpdude:

Before the guy who worked out the property tax caps for california came to FL and was able to do the same, God Bless him, and may he RIP,,,

Many and way too many old folks who had been in their HOMES for ever,,, were driven out by the increases in the property taxes because someone, usually someone from far and farther away, came in and built a ”McMansion” next door and the property taxes of the old folks went to ”heck, in a close enough to straight line” to drive them out…

”CAPS” on taxes, ALL taxes and any other GUV MINT fees, etc., etc., should absolutely be in place for WE the PEONs who have worked all our lives to at least try to help make things better for everyone…

Certainly WE can debate WHEN, what age, etc., such caps are applied, and IMHO, so far,, FL is doing the best job with what they can do,,,

VERY likely the proximate reason SO many folks of all ages are moving to FL these days.

Comments on here re really crazy property tax increases in other locations, even Texas, eh

IMO, many states really need to do some ”constitutional” efforts to help their old and older folks stay in their long term homes until THEY choose to move on,,, certainly seems to me it would help everyone.

There are ten year mortgages in Canada but the rates for them tend to be a rip-off so very few opt for them.

There is no such thing in Canada. The only thing they did was lean on the banks to offer 6 month deferrals during the start of the pandemic. There is no mortgage helper and never was.

6) Ukraine RE is very different from US and Canada, it’s all prefab.

No paper walls, no wooden floors.

Michael, where’s 1 through 5?

Got deleted because of war mongering by a couple of items. Commenting Guideline #10

https://wolfstreet.com/2017/10/07/finally-my-guidelines-for-commenting/

1) to 5) ==> was deleted because of peace mongering

Love telling the site owner that he’s wrong about his own guidelines or how he frames them.

Ridiculous and childish.

Banking is conquest by other means.

The problem with military conquest is that it results in severe reduction in the value of the conquered assets. It requires the control of armies, which is vastly expensive, but it does not require the cooperation of the conquered. Short-term ROI is normally very low, except for the armaments industries.

Finance, by comparison, only requires control of the currency and preserves the value of conquered assets. It can entice and coerce cooperation of the conquered through many branch offices and online services for your convenience. Finance can be weaponized, and ROI is scalable.

You may wonder why I don’t start my own blog to chat about these and similar issues. I’d still be unamused but would expect it to be suppressed. Besides, I’m lazy.

Not completely true.

Financialization has gutted the US and British economies at minimum. UK worse than US.

It doesn’t matter what GDP is reported, as that’s not entirely real production. Most services reported as part of GDP do not represent actual production. GDP is only an estimate of the financial value of monetized economic transactions.

So yes, elites can “conquer” a society through financialization, but they are left with a shadow of what it once was.

It’s the reason why once this mania ends, it will be obvious that most Americans are actually poorer or a lot poorer that appears now. The standard of living for most Americans will decline or collapse with a return to “normal” credit conditions and the end of artificially cheap money.

“Not completely true. Financialization has gutted the US and British economies at minimum.”

Don’t you wish you had a ‘delete’ button?

Why would I want to delete my post when it is accurate?

“Why would I want to delete my post when it is accurate?”

Because it’s not accurate. Look up the definition of ‘gutted’ and get back to us. Thanks!

Wolf, I love your blog. Read you religiously.

In your view is there a better than even chance in hell, given the last decade of next level insanity, that any or all of the CDN housing market will ever mean revert?!

Looking at the charts, I’m not sure what the mean is. But it will revert to something. It has done so before in the 1980s (predates the charts), and it will do so again.

Thanks Wolf (and others for your comments). I share your thinking, Wolf. The bubble has gone on for so long the mean is now hard to distinguish from the bubble. A handy chart when compared to incomes:

https://nationalpost.com/news/canada/canadas-unhinged-housing-market-captured-in-one-chart

Keep up the amazing work.

I hear the Canadian govt is now actively courting the Taiwanese to buy themselves a Canadian passport through investment in Canadian real estate or bonds. The quota is something like 600K new immigrants a year.

So the answer to your question is, real estate is not dropping there anytime soon. Neither is the number of homeless Canadians.

Canada will be reunited with the motherland eventually, under the One China policy 🤣💀

Have them bring their chip fabs with them, too.

I hate to interject but the sole driver of Canadian home prices was and is the Chinese buyers. They buy no matter what the price is. So if something happens to Chinese real estate back in China all the margin calls come in and some of the real estate in Canada will have to be sold. The housing market in Canada can only revert to the mean if something unforeseen happens to China.

Really?

You are partially correct.

If you keep all the variables constant, but change one at a time, you will see that the global driver is the “reckless FED” , meaning low, very low interest rate across the globe.

How does it work if they, planned or circumstantial, default in China and then the delinquents skedaddle off to their homes in Canada?

If that’s the case … with Evegrande why aren’t we seeing any impact to our housing market yet?

I live in Calgary and houses are selling fast with lots of bidding going on. So-called “investors” seem to be a big part from what I hear. So, the craziness has taken off here. The chart above seems out of date.

Home prices can only spike in Alberta if buying comes in from out of the province. There’s no one to rent to and all the property managers are crooks. Oil is a rigged commodity and all the rigging is to the downside not to the upside. We all remember how Trump would get on the phone and by the afternoon the bottom would fall out of the price of oil. You have to remember this is the 2020’s where everything is rigged. The world economy would fall apart if they let oil rise in price so all the people who rig everything will rig the price of oil down.

Alberta will re-boom with oil and the rest of the country will deflate as usual IF and a big IF they go through with the rate increases.

Unless you are into housing or the oil business coming up, many will be in deep trouble and I doubt any government will want to deal with the fallout unless oil money flows back to gov’t.

The price of Canadian housing is the result of a credit mania. not the supposedly mechanical decisions of the Bank of Canada. It’s not a formula where someone pulls a lever “A” to get result “B”.

The Bank of Canada cannot “print” prosperity any more than the US FRB. Moreover, the Bank of Canada has also been infected by the credit mania. It’s not like they live in some alternative reality like the “metaverse”.

When the credit mania ends, housing prices go with it. If the Bank of Canada tries to stop it, they can only succeed in destroying the currency and housing will lose real value anyway.

I happen to live in Canada and in a city that’s 98 percent Chinese. I can tell you for a fact the only driver of the price of real estate is the Chinese both local and abroad. If you factor the Chinese out of the equation home prices in Canada would sell for much less than they sell for in America. No one of Earth could tell me I’m wrong on that call.

My comment didn’t address your claim.

Chian has its own credit and real estate mania but even if it did not, yes, there are enough potential wealthy buyers in a country of 1.4B to distort the price of housing in a single city, especially when I can infer the population is insignificant.

Australia here. We invented this stupid crap. It has been going on here for thirty years. Long before any Chinese investors turned up. No, make no mistake, this is our own corrupt politicians who are perpetuating this outcome. They are massively enriching themselves from it and it’s all legal. After all, those very same politicians could ban foreign ownership of residential property, but they don’t because that would stop the artificial increase in land values, thus hobbling their own leverage gained with increasing land values. Also, those high land taxes and stamp duties are propping up their retirement funds. If you want to see who is responsible, follow who makes the greatest gain from the scam.

I am interested in your 98% Chinese in a city.

Please tell us what city this is.

See my comment above.

Canadians live on HELOCS that’s what keeps this game going. You take on a bigger mortgage than you can handle then you buy everything else with your line of credit secured to your house. The bank told me years ago I could take out 85% of my equity as a HELOC

They will only succeed in destroying the value of their own ill gotten gains. That’s why all the foot dragging on raising rates.

Note: Most canadian communities allow seniors to delay property taxes adding a to unpaid taxes when house is sold.. Rates charged on unpaid balances are super low. A good deal for seniors who cant pay.

Housing prices are dependent on the the financial strength of renters. First, renters in poor condition cannot pay rent. Second, renters in poor condition cannot buy houses.

As inflation, rising interest rates, and wealth concentration eat away the purchasing power of renters, what do you think will happen to home prices? Throw in a recession, then rerun the numbers to reflect job losses.

In normal times and normal markets you would be right. But these are not normal times or markets. The Canadians are selling their country to Asians. And in America the one percent are stealing it with our own money.

You forget virtually all the buyers are Chinese and many of them just leave what they buy empty with no renters in them. You have to live in Canada to understand.

I would assume the regular people should be pissed off – can you tell if anything is “brewing”?

The truck protest in Canada was about many things including housing. The govt imposed financial sanctions on the protesters and now they are more pissed off than before.

Your arrogance in this matter is astounding.

There are main root causes (usually one) with contributing causes (CC).

The Chinese buyer is but a CC.

Calgary market was not flat in February as the article suggested.

I am looking a new report from RBC. There was %4.9 price increase in the month of February.

Edmonton market was not flat either.

Median prices are VERY volatile (go up and down a lot) because they are skewed by changes in the mix of higher end v. lower end units and some other factors. If you’re looking at median prices, you need to look at the long-term chart to get the trends.

This data here is based on “sales pairs” — meaning price changes of the same house over time. Also note, as I pointed out, this data here is a three-month rolling average to iron out the very month-to-month volatility you’re pointing at.

Great article. Fine analysis backed with solid information. Thanks

1) Oil shortages, Wheat shortages, Soybean shortages…Canada is booming.

2) USD is getting stronger.

3) In 1984, when USD peaked, before the Plaza accord, Soybean prices peaked as well.

4) When we, US, produce most of the commodities, like in 1984, there is no divergence between high commodity prices and the strong dollar.

5) The Wimmer inflation might tarnish CAD.

6) Canadian RE might deflate in real terms by the strong USD and the inflation accumulation..

7) The Wimmer inflation might send IWM to it’s 2020 Anti bubble Backbone ==> Feb 28 low/ Mar 3 high 2020, to 154.20/ 143.91, closing two

gaps below.

The Weimar inflation will drive the Canadian dollar straight up and the U.S. dollar straight down.

8) China is losing it’s appetite for Taiwan.

9)

10) When the 5y/10y invert MOS & NTR might sink.

It is ironic that our left leaning government wants to borrow and spend, which is causing inflation that is benefitting the rich and increasing inequality.

We need spending cuts to balance the budget, The top marginal rate is 55% there is no more tax to collect.

The most amazing thing to me, in Canada, is the total acceptance of this by the majority of Canadians.

It’s very clear the government is acting to prop up prices. They target immigration numbers by lowering standards, so it’s not about skilled workers. The numbers are in advance of the building targets, thereby putting more and more pressure on housing stock.

What can you do in a country of people happy to be stiffed?

Leave. That’s what I’m planning to do.

We’re born here, but furious to be priced out of owning our own home here. I’ve had it with the idiocy in Canada, especially politicians and BoC – the housing Ponzi will one day collapse, as will our currency and financial system, but I won’t wait any longer.

Planning our departure as soon as our younger one finishes high school — will take our skills and our mostly-educated kids to greener pastures, where we can afford the cost of living and a home of our own.

And good luck suckering in more immigrants – do Canadians really think people will continue to come here when the cost of living is insane, and there’s no way to get ahead?

Same here, I am leaving Canada. I moved to Vancouver, BC during the Olympics, about 10 years ago. Canada’s standard of living and sky high cost of living just kept getting worse in comparison to the US even though the the US is going down the toilet. Still, my family is moving back to the US in the next year or so. Canada is racing to the bottom faster than the US.

And I’m taking my decades of IT experience with me back to the US. Canada will keep losing highly skilled people at this rate.

The bubble has been fed by the fact that central banks have printed 40+% of all dollars in existence in the past 12 months

Until they retract some of that money using some form of QT you can expect runaway prices with the lack of supply because of Covid.

What a mess!

Been reading these articles for many years and yet prices keep going up. Maybe time to accept this is not a bubble and just the way the system was intended to work.

In Canada, prices didn’t go up in the 1980s. Not at all. Pretty rough. Ripe for the next one now.

Another housing slump happened from 1990-97. A big drop in 1990-91, then a slow, agonizing decline for another 5 years.

Multiple drivers in Canada.

Besides low rates (big factor) we have:

– Immigration – 1%/year added from outside of Canada – new demand – its about 1,000 people a day needing a new house EVERY DAY. (would be about equal to about 10,000 a day in the US)

– Internal migration. Sell house in Toronto (prices driven up by immigration) for $2 million and buy in Kitchener or Hamilton for $1 million (about a one hour drive). Prices in Halifax are being driven up by folks from Ontario. (I mean Hamilton is not seeing those kinds of increases from pure Hamilton demand – I mean we are talking about HAMILTON, for crying out loud – it is out of towner arriving with their gains from selling their urban bungalow).

– WFH. Big driver in smaller markets. Then if you want a real shock look at cottage prices!

Maybe things are starting to slow. I’m seeing houses stay on the market for more than a week now. Unheard of in the last few months.

I think Gravenhurst is the most overpriced city in all of Canada now.

Very few rich Chinese are coming to Canada. The rich Chinese stopped coming here around 2016. The rest of the ones coming to Canada are all penniless.

Love your articles, but i wish you would put the Units on your axis. What’s the Units on the y-axis please? Thank you.

John,

The house price charts are an “index,” so the units on the y-axis are “index values.” The index was set at 100 for January 2000 in all charts. A value of 300 today indicates that prices tripled since January 2000.

That this is an “index” is in the title of each chart.

It’s similar to the S&P 500 Index, which also has index values on the y-axis. All indices are based on this principle of index values on the y-axis.