And it has nothing to do with supply chains. Dear Fed, go have a look at the fruits of your labor.

By Wolf Richter for WOLF STREET.

Market rents for single-family houses and apartments are going haywire, one of the salient features of the current inflationary environment. It has nothing to do with supply-chain snags and factories in China and Russia’s invasion of Ukraine or the price of commodities. This is an inflationary phenomenon that has taken on a life of its own. Landlords – some of them giant companies – believe they can jack up rents, and the giant companies among them tout their ability to do so in their earnings calls. And tenants are paying those higher rents. This is another glaring sign that the inflationary mindset has taken over on both sides. And rental inflation is now in full blowout mode.

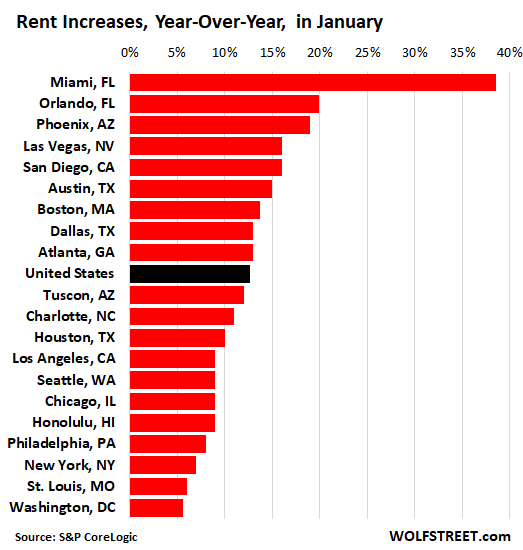

Rents of single-family houses across the US jumped by 12.6% in January, according to S&P CoreLogic today, based on the repeat-rent method, which tracks rents of the same rental properties over time.

That 12.6% spike was the fastest meanest year-over-year spike in the data going back to 2004, and the 10th month in a row of record rent increases. Rent increases varied by market and maxed out in Miami with a ridiculous 39% spike year-over-year:

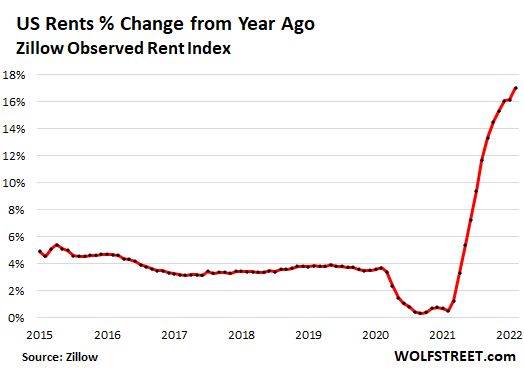

Apartment rents are in full blowout inflation as well. The Zumper National Rent Report, which tracks apartments in multi-family buildings, and does not include single-family houses, found that asking rents across the US for one-bedroom apartments spiked by 12.3% in February, compared to a year earlier, and that the median asking rent for two-bedroom apartments spiked by nearly 14%.

Zillow’s Observed Rent Index, which tracks apartments and single-family houses, spiked by 17.0% from a year ago, by far the highest in the data going back to 2014:

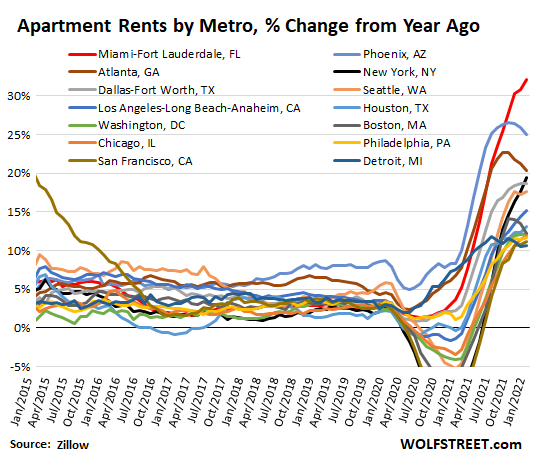

All of the largest 14 metros experienced double-digit year-over-year rent spikes in February. The craziest spike occurred in Miami (+32%, red line), followed by Phoenix (+25%, blue line), and by Atlanta (+20%, brown line). The smallest spike of the largest 14 metros was in Detroit (+11%).

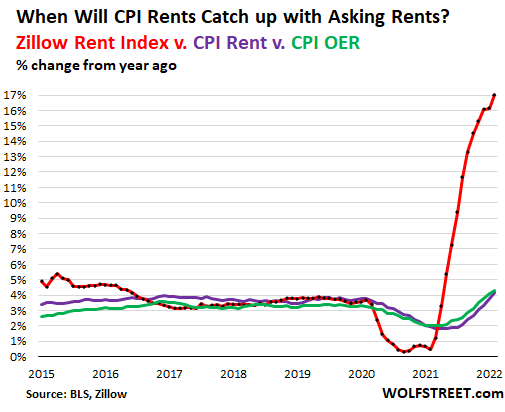

The inflation measure CPI is just starting to pick up the market rent increases. The two measures in CPI that track housing costs in apartments and single-family houses – “Rent of primary residence” and “Owner’s equivalent rent of residences” – have started to rise, but they’re lagging market rents. They will, however, catch up partially with market rents over the next two years and will put large-scale upward pressure on CPI (here is my discussion of this phenomenon).

Those two CPI measures (green and purple lines) have both passed the 4% mark. And they have a long way to go, in comparison to Zillow’s Observed Rent Index (red line):

Rent spikes like this are manna for landlords – asset holders, the Fed’s primary beneficiaries – but have devastating consequences for the people who can least afford them.

Granted, many well-to-do people are renting for various reasons, and high-end luxury rentals are a big business. But the vast majority of renters who get hit by those kinds of rent increases have to tighten their belts and spend less in other areas. But prices in other areas are now spiking too, leaving these people in a tough situation.

The Fed, the most reckless Fed ever, has been touting its money-printing and interest-rate repression orgy as a way to help the lower end of the labor market, which is of course nonsense, but it has enriched the asset holders, including via higher rents on their properties. But the consequences are now everywhere, and they’re real and they’re huge, and dear Mr. Powell Sir, go have a look at rents chewing up those people. This rent inflation now is a national fiasco.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

They don’t care, and I’m not being flippant.

peasants WANTED and GOT $15 min wage

WE GOT HIGHER RENTS

In the time it took for wages to go from $5 to $15, houses that were $40K may have gone to $400K. Increased wage levels at the base have an effect on purchases of goods and services directly. But insanely increasing valuations in land are due in their entirety to speculative wildcating, and you can put the blame for that on everyone involved in the real estate game, Everyone! Disarm that group, and the government waste game dries up too. Don’t ban the bankers…put them in regulatory chains and force them to do what they should have been doing all along. And then close the damn borders to China!

Lest not forget the invasion of precursor chemicals that created poison drugs that took hold in failing industrial and manufacturing towns . The blind dumbed down public educational moras took no responsibility and everyone found a scapegoat in a pharmaceutical. Trickle up, each penny increase at a time. Many padding their pockets while crude armys again amasses their firepower and destroys untold housing units worldwide. Return on investment ?

They got Chinese guys with thick accents delivering duffel bags of cash to show to prospective homeowners in Toronto, but if a Canadian was to try and withdraw C$5,000 at one time at the bank, they would get flagged and have their transaction put in a database for future FINTRAC compliance.

Regulation will never solve the effects of money printing.

What kind of regulations do you think will offset it?

I blame the Fed for the acute crisis. Longer term, though, I blame restrictive zoning for not allowing enough housing to be built. That is the ultimate underlying cause.

Great article Wolf but the vast majority of these comments are trash. I don’t usually comment of other peoples comments but come on..

Jas,

SOME comments are “trash,” and the one you replied to by joedidee might qualify (I’m not really sure what it says). Many comments are great.

It is nice to read others ideas even if I don’t agree. They certainly were worth more than your complaint.

It is true that Rome wasn’t built in a day, but Rome didn’t die in a day either. Alaric conquered a hollowed-out rump of the once mighty Roman Empire.

The USA, a once powerful industrial empire which generated wealth by creating value, has been on the path of money/credit creation of the illusion of wealth.

The working class is now heavily government and services. This took a generation to kill off the value creators.

I once thought it was possible to reverse this decline, but the City State of Washington DC is still partying – until the last conjured or borrowed dollar is wasted.

Ultimately Rentiers need tenants with viable incomes. Look to Rome 300 AD. That is where the only path leads.

Jas, you’re too cool to be here.

And, I thought I was the only obnoxious one here, geesh.

It sounds like the ‘Revenge of the Landlords’ after months of non-paying tenants. Or more like ‘Dog Eat Dog’,

“Some of the giant companies – believe they can jack up rents, and the giant companies among them tout their ability to do so in their earnings calls.”

The richest always have the final laugh.

Again, whether they say it or not, earnings reports are not about new production, they are about the ability to gauge someone where it hurts. This year it’s about inflation and the glorious opportunities thereof.

Seems to me a few simple regulations would fix most of the complaints being voiced here.

1. Mortgages must be held a minimum of 5 years before they could be sold off.

2. Interests rates on mortgages must be CPI + 3% (at least ) when the mortgage is made.

3. Only citizens are allowed to own real estate.

Agreed.

Landlords are exploiting a captured market.

Houses now too expensive to be an alternative.

Not a pretty thing.

Leases should likely be for longer than a year, perhaps several.

A myriad of statutory constraints to benefit the tenant are needed.

Wrong. The “ peasants “ are the source of all wealth. A national rent strike will set the parasites, I mean landlords, right. Besides, how do you explain massive rent increases in areas with criminally low minimum wages, like Nevada ?

Northern Nevada delusions of real estate grandeur are quite the spectacle to behold.

Based on the marketing/gaslighting party that continues to be peddled by any & every City Govt that’s salivating to be the next big global destination at any cost to the resident average Joe, that outcome seems more likely with each passing month. I mAy just agree with you General Strike, for this situation of rampant dissonant ethics is truly backwards bonkers.

(Sorry for the word pasta, I shall see myself to bed!)

Don’t forget to plant a foot “anchor” on the floor. Helps stop the room from spinning.

Why is it that everyone wants to blame the low wage earners for all the economic problems in this country??? Never mind the TRILLIONS printed to enrich the wealthy … No, blame the poor people who (***gasp***) want $15 dollars an hour. The nerve of them!

I will make them care :-]

You are a light in the darkness, Wolf. Your even handed reporting on public data releases is a tribute to journalism.

More specifically, I often see you defend the integrity of the data being released with respect to the underlying data collection methodology, which is why I think you are one of the fairest journalists out there.

My rent went up 15% this year. Apartment management told me how they were being “benevolent” by not raising it by 19% as per the market and that I should be grateful instead of complaining.

Did not find significantly better deal, so chose to stay to avoid move hassle.

If you owned the Apartment Building, what would you do?

Marcus Aurelius,

You are correct. When property values increase, so do property taxes. These get passed on to the renters.

Granted, they probably didn’t go up 15%, but they went up.

The county were I live is super quick to increase property taxes, very slow to lower them when values drop. And, yes, they do drop here cyclically.

I got lucky, only 4% increase. I like the area I’m in and would hate to have to reconsider. There is a new train station connecting my area to a major downtown city coming in a few years. I’m hoping to be locked in on some real estate at non-bubble prices by then.

I might also add that the cost of maintenance items (wood, glass, hardware, paint, plumbing supplies, wire, carpeting, etc.,) have gone through the roof. Even a lowly toilet flush valve that used to be $6 is now $13 for the exact same thing (I take the guts out of them and replace the worn parts inside the housing… so they’re not “new” or “improved” as the parts are interchangeable).

I bought a 5 x 5′ sheet of 9 ply cabinet grade 1/2″ birch plywood. A few years ago, they were $40. Last week, they were $95 each – limit 4.

Then there’s the property taxes, increased cost of labor (if you can find it), trip charges, fuel surcharges, pool chemicals (if so equipped) when added all together paint a bit of a different picture. One can say “but my landlord didn’t do anything to my unit and still raised the rent”. However, the landlord doesn’t know when or if the roof will leak or someone flushes a small car down a toilet.

So, while it sounds like “gouging” on the surface, it does have some basis in reality for the property owner. I do know that the costs of maintaining this pile of bricks and sticks have increased – and the labor is static because I do most of the work myself.

The last graph is just scary. It portends, Wolf, a future graph you’ll produce late this summer showing huge spikes in grain / food costs. At some point, we just need to start calling the FED and Congress the village clowns. There’s no one with any real backbone in any key positions within the government.

We very well might get to a FED funds rate of 1.5% before this entire thing rolls over which is utterly embarrassing, given that we all know what comes next: QE, deficit spending, rent & mortgage forbearance and God knows what else these clowns can dream up.

“It portends, Wolf, a future graph you’ll produce late this summer showing huge spikes in grain / food costs.”

Forewarned is forearmed (or, at least, fore-prepared).

We’re stocking up….

While admirable Wolf, you are too small of an empire for them to notice and get bothered. How can you become bigger?

Kunal,

My site is very specialized. And I’m just the little guy spinning my wheels. But… Lots of people in finance read my stuff. People in the financial media read my stuff. People in government read my stuff. Some of the people at the Fed read my stuff, and I’ve had contact with a few of them. A lot of times, I see my stuff pop up in the financial media a few days after I published it, but they’re doing their own wording and don’t give me credit. Occasionally, one of my themes becomes a polite softy question during the FOMC press conference. I live for those moments :-]

Wolf’s aim is true, and his work takes on far more importance than1,000s of politicians and CEO’s who are working hard to put the financial world in reverse.

One true observation can gain a lot of traction, but an army of scammers, media fools, cronies, speculators, and Wall Street wannabees will try to prevent it. It’s a David and Goliath scenario.

Seeing your influence in the world is a nice feeling.

RTGDFAs folks.

I think the Wolf needs an online forum (like one in my website), so we can really echo his voice on the streets.

If I knew how to set one up I’d have offered already, buy if Wolf agrees and anyone here is willing, what do you all think?

Cassandra utters an unpopular prophecy. Nobody wants to hear.

And if everyone here were to call their congress people and complain about the measly .25% hike vs ungodly 8.0% inflation (the absurdity), maybe , maybe….. Squeeky wheel?

One might also consider the effect of Air BnB and similar residence to vacation rental companies on housing supply. Barcelona, Spain had similar rental spikes.

The FED is too corrupt to change.

Agree , Politicians and Feds are a complete fiasco.

Until Russia and China force a new world order by war

The Fed clearly doesn’t care about rent increases. It’s being tracked with useless polls such as owners equivalent rent, which greatly understate actual inflation, and the Fed knows it. Thus, rent inflation, unlike 1,000 statistics they closely monitor, is not something they care to monitor.

The Fed does not care because a renter’s pain is a landlord’s gain. High rents support high housing prices, which increases the wealth effect and spending of the wealthy, a small portion of which might trickle down to busboys and car washers. The condition of lower classes is irrelevant to the economy in the Fed’s view.

In the Fed’s view, lower classes are oil for the machine, which generates output for the upper classes. In modern times, oil has been improved by technology and can last a long time and absorb a lot of dirt before it has to be changed.

They don’t.

Everyone at the cocktail parties they go to think they are doing a great job.

As a small “mom and pop” landlord, we raised rent by approx 2.5% this year based on the FEDs target inflation rate (haha). We do that for our very good tenants so they will stay ( and we get less calls) and we always try to fix any issues immediately. My concern is that we will be forced to raise rents much higher to cover costs such as taxes, sewage and trash fees which we cover as part of the rent. For example our township trash contract went from $55 to $65 a quarter (3 mo) which isn’t large as a dollar amount but as a percent it 18% ouch. if we see similar increases in sewer fees, taxes and the price of items we do provide or maintain (such as furnace filters etc). We will have to push for higher rents, which we don’t want to do.

Of course, you should to be able to cover expenses and a fair profit. Why else would you be a landlord?

It’ll be interesting to see how the rent control experiment progresses in Minnesota

“Saint Paul voters approved an actual ordinance that is likely the strictest rent control in the nation, if not the world. Rent increases on every rental unit and all renters are capped at 3% a year, irrespective of inflation or other factors. The 3% limit also applies to a vacant unit after a tenant moves out, which means that a landlord cannot charge a new tenant more than 3% over what the prior tenant was paying. In other words, the amount of rent a landlord can charge applies to the unit, rather than individual leases. Unlike most rent control ordinances, the St. Paul law does not make an exception for new construction—it applies to every rental, no matter its age.

Landlords can disregard the 3% limit to cover increased property taxes or health and safety improvements, via an as-yet undetermined “reasonable return on investment” review process. Renovations and other general improvements likely would not qualify, nor would costs incurred to ensure habitability of units.

The final details and implementation of the Saint Paul rent control ordinance are being worked out. The ordinance takes effect May 1, 2022.“

From Nolo article by Cris Bartl, entitled Rent Control in Minnesota (Minneapolis and Saint Paul)

Price controls always lead to shortages through lack of investment. Why as investor take the risk? Be ready for poorly run and maintained public housing.

I’m guessing there will be less apartments built in St. Paul.

Is that good?

IF the ordinance ”sticks” JH, it will cause less new construction AND inevitably less proper maintenance of existing to the point that what are now OK places will become slums or worse.

Seen exactly this in other places, including NYC, London, and Berzerkeley over the years.

John H,

On 6 December 2021, the developer of a 304 unit apartment complex in St Paul with “affordable housing,” Bob Lux, lost one of the equity partners (investor with $23 million cash), and the project is on hold; after three years of planning. On the southwest corner of Lexington Parkway & University Avenue; next to the Light Rail line and I-94 — a major transit corridor

Why? Because of what the voters in St Paul did in November.

Lux said, “Barring a substantive change to the ordinance, I would estimate the likelihood of the project moving forward (with that level of affordability) at less than 10 percent.”

Other projects are also stalled out while the effects of the referendum vote are being looked at by investors/developers.

Even if the state were to subsidize housing production you’d end up with distortion if certain areas in actuality appreciate faster than the controls allow. A more optimal arangement would be to subsidize renters, and take state control of housing, profits on rents being used as a non-market distorting tax; this is effectivily what Singapore does.

There is no need to wonder.

It will have the same effect it always does.

Fewer units will be built.

Existing units will fall into disrepair (regardless of what regulations require) and any area with a concentration of units will turn into a slum.

Landlords do not exist to function as a social services organization to provide anyone with affordable housing.

No, there is never something for nothing.

I’m a renter now too.

Sounds like a very efficient policy: in one swipe it screws the rich landlord, and the city’s renters (at least those who haven’t already secured their rental unit yet).

Now if they can somehow encourage criminality by entirely defunding police, St. Paul will really thrive!

Slum neighborhoods just like in DC when they went to rent control. Good landlords sold move out and slum landlords moved in.

I’m curious…

Was St. Paul even remotely concerned about making the landlords whole who lost a lot from rent moratorium…

Two sides to every story…

Rent control either seems too excessive or too liberal.

Liberal CA has a state rent control law:

AB 1482 restricts the allowable annual rent increase to 5% plus a local cost-of-living adjustment of no more than 5%, for a maximum increase of 10%. The law is retroactive, calculating the starting rent from March of 2019. There is no maximum rent or limit on how much landlords can raise rents between one tenant and the next.

When inflation is at 2%, then a cap of 7% increase in rent seems excessive.

When inflation is at 7-10%, then a cap of 10% seems too little.

They should have tied it to a CPI inflation number with an allowable increase.

There is no effective way for local governments to target the negative impacts of the Federal Reserve’s misguided policies. The impacts of inflation are amorphous and over-arching.

These St. Paul legislators would provide better service to their constituents if they traveled to Washington and spent a week on the doorstep of the Fed, protesting inflationary policies. A small group of St. Paul legislators with T-Shirts and signs might spark a national anti-inflation movement on the Fed’s doorstep.

With reported inflation at 8%, or 15% once you eliminate the nonsensical adjustments, it’s only a matter of time before the Fed is facing a populist movement. Which politicians are going to lead it? It takes a ballsy MF’r to kick it off.

Re CA AB 1482

Surprisingly, the AB 1482 exempts “mom and pop” landlords so is really targeting corporations;

A property is exempt if the “owner is not any of the following: (1) a real estate investment trust, as defined by Section 856 of the Internal Revenue Code; (2) a corporation; or (3) a limited liability company in which at least one member is a corporation.”

More building work for us cheesers on the other side of the river.

“Land lords do not exist to function as social services….”

Businesses and Corporations do not exist to function as social services.

Who is to provide Social Services……the Government that people are taught to hate?

Devil take the hindmost…that’s REAL ‘Freedom”…..they are all “lazy” anyway, right?

Besides, there isn’t enough “top quality” lifestyle to go around…..not when there are so many pigs around.

I just love the rationalization here;

“I’m not a pig, I work hard for all my “big pile of stuff”…..the government is fucking things up…..not the “entrepreneurial spirit”….that’s a good thing, look at all the great shit it’s produced in spite of the nasty government”

One of the problems I see with rent control is that if it is “unreasonable” the rental property could shrink as landlords sell their property rather than rent it. The result is even fewer rentals, exacerbating an already dire situation. The solution?

$10 dollars in 3 months is $3.33 per month.

Take a copy of the bill to each tenant. Show them they will be paying $3.33 more. There is no reason to raise their “RENT”, just the government fees.

Ask them who they voted for.

I’d give a stink eye to any landlord that asked me such a question. If you’re being flippant to make a point, OK. But don’t ask your tenants that question.

My comment looped around nicely and landed on the comment it was based on. Cool!

Watch out for those damn commies MA, they are everywhere……still. And they are after YOUR PILE of “stuff”!

Forget minimum wage, set a Constitution Max net wealth with a kick ass militarized IRS…a playing field with BOUNDARIES…wow, what a novel sorting concept!..$10-15M…..inflation adjusted, of course, (don’t want anyone cheated out of their environment destroying pool or 3500+ sq ft house(s).

You still think it makes a difference? How old are you? You haven’t figured it out yet? Jesus…

Apparently being a debt peon isn’t enough. Now they want you to be a rent peon. You can never own a home, with a garden and some trees. Instead you’re hobbled with a huge monthly cost that you can never get out from under and your many neighbors annoy you all the time.

In the meantime you’re constantly, aggressively, and fraudulently weaseled into spending money on things you don’t need, can’t use, and don’t want. The things you do need all cost more unless they’re out of stock.

Will the extraction never end?

Not if they can help it. After all they make a good living putting others into destitution.

Nope, the only way that we will get our lives back is by revolution with the question being will it be peaceful or not? Too many people are being crushed so something will happen soon.

There is a lot of pent up anger in Canada. But they are not dealing with it directly at the source.

Instead, they park trucks at hospital routes in Ottawa, while the Prime Minister and the corrupt politicians who don’t care about the real estate bubble are a few blocks away.

You look like a fool trying to make a negative example of the truckers in a discussion about revolution. This isn’t your reddit echo chamber.

“There is a lot of pent up anger in Canada.”

It would be great if regular Canadians could gather the wherewithal to march in protest. But no, too polite (‘sheepish’).

I would be surprised if that ‘pent up anger’ is ever unleashed. Too much putty and not enough backbone.

Maybe that is why ice hockey is so popular in Canada — an acceptable means to vent one’s frustration about life.

:)

MiTurn,

As a kid growing up in the Twin Cities, ice hockey was my one true love and focus. Skate really fast, and hit the opponent as hard as possible the second he touches the puck. Every other sport seemed boring.

Playing outfield in a baseball game? Nope, I’ll take my naps lying down rather than standing up.

By the way, the last time a team from Canada won the Stanley Cup, it was 1993. Perhaps, deep down, this is a source of their “pent up anger?”

Dan Romig,

Here too! Bloomington…hockey in the winter, baseball in the summer.

Aside from money “printing”, the government will continue to decrease housing affordability through intentionally lax immigration policy and border enforcement. More future voters from countries with populist politics who will support “free” benefits feeding at the public trough.

‘More future voters from countries with populist politics who will support “free” benefits feeding at the public trough.’

You’re blaming the poor for the sins of the rich.

Your overlords thank you.

Birthing children into a world glaringly without the economic prospects to support them is a responsibility your supposedly sinless poor should own up to, on their side. The blame game is so weak.

The planet is too crowded with humans by grotesque orders of magnitude already. Every resource is stressed to the limit. You want to crank it tighter while claiming some sort of moral high ground? And what, solve it by displacing the elites (who have always been there in every system, commies included)?

I’m not an overlord, I’m a person who declined to have children on moral grounds. I live my opinions. For the sake and benefit even of folks as benighted as you.

The rich thank you as they don’t want more poor people having babies as well.

All that welfare they’ll need, you see.

Yes, there are enoigh people on this planet. I’m not having kids. I can barely take care of myself. But I’d like to live in a society thaf gave a damn about its people. That ain’t the American way though.

“For the sake and benefit even of folks as benighted as you.”

So much hostility. Not that my comment was directed to you.

You’ll be pleased to know the mass die-offs are expected to start ramping up around 2030, given present trends. Liquidation of unproductive assets, you see.

heeee’s SO baaack!

but unamused you used to CAPITALIZE your “U.”

x

Not if Disney+ has anything to say about it!

Today’s subscription-based economy does feel like services hoping you sign up and forget about them so that they get theirs one way or another, whether the service is used or not.

Wow, all these streaming services are kinda like gym memberships, huh?

The lifestyle I ordered is presently in stock. I can’t get curbside pickup because they have to deliver it on a flatbed truck. I imagine they’ll set it next to the pool with a forklift.

dear Unamused… oh SO good to see you punching left and right you’re so BACK! whew.

“apparently being a debt peon isn’t enough” / i think the homeless industrial complex is turning into too much of a “thing,” too. it was inevitable when they made more money off a man by keeping him imprisoned.

x

I don’t understand the 39% annual increase in Miami rents.

Having cultural roots in Western states, I have no experience related to Miami life.

Seems like living in the similar tropical environment of Thailand is about one fifth as expensive as Miami.

Rent increases are a supply and demand problem. You can’t raise rents on your apartment building if the building next to you is 25% vacant. You can’t raise rents if there are new [vacant] apartments getting built all around you.

You can raise rents if there 10 people looking for a place to rent and there are only 8 vacancies. The 8 people who really really want housing will bid the rents up.

Rent control will just reduce the present/future supply. Apartments get converted to condominiums and sold and new apartments don’t get built.

If there is a shortage of housing you can either increase the supply [density] or reduce the demand.

It really is that simple.

Sorry Econ 101 man, but it’s not that simple. You have to factor in the cost of capital. Because of the Fed, money has been getting cheaper for decades, lowering the cost of borrowing and blasting asset prices to the moon.

The Fed now owns 24% of all mortgages. Remove this socialist intervention, have the Fed sell three trillion dollars worth of MBS to “the market” — and housing would become affordable everywhere — very quickly.

No. It really is that simple.

You still an imbalance of supply and demand. More and more people and less and less building material [land, lumber, water, power, etc] means more expensive housing.

Even if you eliminated money and went to a barter system, the price of scarce commodities like housing would go up in relation to other more common commodities, like barrels of apples.

Look, the supply of housing is not, and cannot, grow as fast as people can have kids and pour across the border. Again, if you have 10 people competing for 8 houses, there is going to be a shortage. Even if government owned and controlled all the housing in the country and gave it away for free, there would be more demand than supply.

Going vertical [density] is expensive. Going laterally [sprawl] is expensive.

Building housing is just very expensive [look at “low income” housing in Los Angeles going for 800k each]. Getting rid of the FED [which I agree with] is not going to change that. Changing building and zoning codes will help a little in the short run, but not a lot in the long run.

You could see this coming decades ago. I did.

“It really is that simple” uttered as a statement in any economic analysis is usually a red flag that there is a problem with the models being used and that, in fact, it is not that simple.

Joe in LA and LK:

You can say that 2+2=4 is simple without getting into the theory of mathematics.

I agree that around the perimeter of an economics question there a lot of complexity.

But my degree from UW is in Philosophy and Economics and I was taught that you could teach a parrot Economics if you could teach him to say “Supply and Demand.”

Another simple example.

What is the value of P.

3.14?

3.14……..out to infinity?

I try to stick to what is important and not get lost in minutiae.

Now do International Political Economy.

Enlightened One said he started from nothing and is now worth $20M….must know something about finance (or cheating people) in the USA, I’d wager.

It is called massive immigration.

Want to stop this accelerated rent increase? Stop immigration.

Those not in this country legally, return to their country.

Those on “visas”, please return to your country.

Now you will have your affordable rents, but can you do the above?

Marcus, legal immigration slowed down to a trickle in 2020/21 as housing costs shot to the moon. Border crossers mostly pile up eight to a room so they’re not the ones pushing prices up. What’s more, during the same period we had excess deaths and fewer births than expected. This increased demand is not based on demographics but on fiscal stimulus and therefore is a bump and it will turn into a lull in the near future.

“Rent increases are a supply and demand problem.”

Well, no, that’s not how inflation works. In a store, there are dozens of the same item, and there are hundreds more in the supply chain, and the store still raises the price. That’s how inflation works. Inflation works just fine in gluts.

Wolf, I am flattered you posted a reply. I am working off my tablet. Typed out a long reply and then one mistake deleted it.

Short version.

Basically, I am not talking about inflation, I am talking about supply of housing vs demand for housing. In this sense inflation is irrelevant.

If the FED raises interest rates, yes, demand will fall and prices will flatten or drop slightly. But so will incomes. Some buyers who are getting ready to buy will get laid off or get a pay cut. The relationship between houses and cars, barrels of apples will stay basically the same. But increasing the supply of housing is much much more difficult than building more cars or growing more apples.

Think of it this way. Example, suppose median income is 100k a year and median house price 1 million. Depression hits. Median income falls to 50k, median house drops to 500k. The house is still 10 times your income, but now your interest rate is higher. Are you better off? House prices fell but did it solve the problem?

Houses where I live have doubled in 2-4 years.

Why?

Because Microsoft/Google/Amazon/ Facebook have brought 10″s of thousands of new homebuyers and there is no land to build anywhere near that many new houses.

Supply and demand.

it’s very simple. a lot of people have vacationed in miami beach or palm beach over the years, especially during the winter, and have liked what they have seen.

there was also a lot of desire to live in tropical getaways, but there just weren’t the jobs in miami to support it.

over the past two years, many people were promised that they could work remotely for the foreseeable future. some companies said as far out as june 2022.

so what happened? many people living in cold climates moved to miami, figuring they’d live there for a year, and then figure things out.

but while some jobs have moved to miami, most have not. so this might be the one type of inflation that is “transitory.” as people are required to go back to their new york, boston, dc, or chicago offices a few days a week, the money generated by those jobs disappears, and the miami real estate market once again has to price itself based on what miami income can support.

and miami income can not support current prices.

Most people in Miami are poor or at least were. There is a lot of foreign money though. It is correctly called the financial capital of Latin America.

Yes, it’s the Capitol of Capital Flight from Latin America, and has been for decades, a major reason for it’s evolution from a politically-contested state to an increasingly Republican one.

right, but the foreign money manifests itself in sale prices, not rents. that’s why for many years, cap rates were abysmally low, and it was much cheaper to rent in miami than to buy.

the rental demand is domestic.

I lived in South Florida from mid 1992 to mid 1994. It was expensive even then.

I rented a studio apartment in Hialeah near Miami Lakes on NW 67th avenue. It’s on the border on Dade and Broward counties. The street had a row of nice complexes but mine was the cheapest and wasn’t that nice. I put up with it since I traveled most of the time. I lived there for about a year.

My rent was somewhat over $400 for about 250 SQFT. 1BR apartments down the street were in the $800 range.

dp,

The old adage is that the Miami area is the northernmost city of South America…

Which is actually pretty accurate…

The real money is further north around the West Palm Beach area…

Thailand has a wonderful culture. They also have a retirement visa for outsiders who would like to live there. The financial requirements are low. The official name is the “Non-Immigrant O-Long Stay Visa”. Google it.

Putting $30,000 in a Thai bank? Are you kidding?

Is that all? Huh. Maybe I will have Thai Food tonight.

The average Miami winter temperatures are in the 70’s during the day. There is excessive heat and humidity in the summer. American expats retiring in Thailand do not have access to Medicare healthcare providers as Medicare only pays U.S. healthcare providers. Miami has a Hispanic Republican mayor. The Cuban American community does not trust communism.

I’m sure Jerome Powell and his 1/4 point rate hike tomorrow will fix this.

Standard (old) Plumber’s Guarantee- “We repair what you’ve fixed.” Powell’s sure a goooud fixer…doesn’t break a sweat.

Some say Joe will be begging him for more hikes. Still waiting.

The rent is too damn high! This suck for those starting out.

Here is an explosive and controversial question.

Where are the 2 Million, a year, new immigrant living? Are they having a problem with housing? Are they the ones homeless in the tents?

Who is homeless in the tents?

Where are the 85,000 Afghanistan refugees living? What are they paying for rent, and a car, and A/C and their iPhones as well. I don’t read about them complaining.

I am having a hard time figuring out where all these millions are living and how they can afford the $1,200 a month apartment rent or the $1 Million, average, home in California.

Dare to explain?

*sniff sniff*

Smells like conspiracy theory. Just based on everything happening the last two years I cannot see 2 million new immigrants moving to the US. I see that on here a lot with zero evidence to support it.

Just returned from Mexico ,at resort locals make 100$ every 2 weeks ,minimum wage ,great people .told me they can’t survive without tips ,most raising families,saw a tv ad for washer dryer 18,000 pesos quit crying life is good here, FOR NOW

Refugees in America get freebies from the govt, allocated for that purpose. They get cash, housing, medical, education, all for free. Americans in need get homelessness and poverty. And you voted for it.

Get ready for next bunch from Ukraine to contribute to the higher rents. And for more tents housing your former American neighbors.

Agree with one qualification.

No vote can change US foreign policy. It’s completely outside voter control. Since at least the Clinton administration, there hasn’t been a dime’s worth of difference between the two parties.

Disagreements between the two parties are primarily on cultural issues.

There is absolutely no division in support for the Empire.

TESTIFY!

x

Some of them are sharing housing.

My assumption on the recent Afghan “refugees” (like this is actually verified correctly) is that it’s on the taxpayer’s dime, again.

“Who is homeless in the tents?”

Meth addicts. Google “Sam Quinones” and track down one of his articles on “the new meth”. This is all gonna be a fun ride…

While drug addicts are a big part of the homeless population, they are mostly well adopted to street life.

The real homeless epidemic is now among the elderly, especially unmarried women. Women are traditionally low wage earners and have neither savings nor high retirement income. Many are the “invisible homeless” living in vans or cars. Our govt always has money for wars and refugees, but not for the needy at home.

Yeah people, stop mail ordering your brides. Buy American.

I was talking about people who graduated high school and college but I’ll give it a shot.

I think immigrants have extended family to live with. The gov’t require the sponsor/host to earn a good wage.

Homeless in tents are typically mentally ill.

I didn’t see the news following up on the refugees. I thought all were flown out to nearby countries and not straight into the USA.

When times are bad, people will move back in with their parents or bunk up w/ several roommates. I’ve seen a street lined up with downtrodden RVs.

Oil prices have gone down!

COVID is coming back again! (Sewage testing across the USA show a sharp increase in viral loads, which has been a warning sign of spikes in infection rates).

New COVID BA.2 variant coming soon to a neighborhood near you!

China locking down more cities because of COVID! (51 million locked down now) – supply chain disruptions coming soon too!

Stock market hit a Death Cross!

Always look upon the bright side of life …..

In the past, I would have thought the conditions we are seeing now would have triggered a revolution.

But nothing is happing. What has happened to us?

Was there a revolution during the Great Depression?

Only in local places and usually by labor trying to organize, etc.

”Hoovervilles” appeared in many places too.

How some ever, this was still a time when cops and hired thugs thought nothing of killing protestors outright, knowing full well the courts would find a way to let them off — in most cases.

That this kind of treatment was still going on into the sixties for various minority groups and even some white folks in places is well documented.

courts still find ways to let cops off. it’s just now that the corruption is less blatant, and the judges dress their decisions in fancy language like “qualified immunity.”

There was !

They called it ” The New Deal “.

Google “bonus army 1932”

The dictionary says the following about revolution: “forcible overthrow of a government or social order, in favor of a new system.”

When I think revolution, I think big scale, widespread. Local stuff don’t really count. That’s like equating a couple of demonstrations, heck what we saw back last January to a “revolution”, which is nonsense.

The answer to “what has happened to us” is nothing. Heck that’s the wrong question to ask. The fact of the matter is America has always been a class based society, so no revolution will happen EVER.

saying that something, anything, will not happen EVER is just silly.

In the US, you cannot be Pro-Revolution and Pro-Democracy at the same.

The US is a Democracy/Republic. The way to change government is by voting.

The way to cause a revolution is to convince a minority of voters that the democratic election was rigged. A better-armed minority would then be able to overthrow a democracy. This typically then involves installing a dictator and not allowing a voting to resume in order to stay in power.

In 1932, there wasn’t a revolution but a strong socialist was elected President for 4 terms. That is how a Democracy should work. Hoover did not insist the election was rigged in 1932 and allowed a democratic transition of power.

No. Revolutions were brewing from left and right, but FDR halted them by SOLVING THE PROBLEM. No president since FDR has solved any problems. We only make things worse now.

Wonderful read on electing a president to spur change is Joe Steele by Harry Turtledove.

I found it thought provoking.

Yes, the revolution was on the streets of Chicago, New York, Boston, New Orleans, etc. The rise of the biggest crime families in the world. Their children work on Wall St. now.

Oh there was plenty of anger, riots, marches and demonstrations back during the Great Depression. FDR was trying to save democracy from imploding when he put forth his economic and social plans.

I think the economic squeeze we are seeing play out now (via rampant inflation) is driving a lot of the crime and social unrest.

My city has seen a huge uptick in car jackings, thefts, murders and general mayhem and violence.

At least we have a FED that takes it seriously by cranking up the FFR to aggressively fight inflation……… damn dicksquirts

There was a big Vets Hooverville just outside DC around ’33. Cops shot a few, but they stayed. Finally MacArthur, Eisenhower, and Patton ordered/led an Army charge that routed them all and burnt the entire place down. That ended that.

Naturally they found a scapegoat who “F’d up their orders” and got no blemishes on their own careers, and went on to fame.

The rest were just big landowner (by the sheriff and lots of deputized people) shootings for vagrancy and whatnot in counties all over the damned country. Had some in Silicon Valley when it was just fruit trees.

Rich people have always been evil, how else could they get rich?

The only revolutions I see in Canada were when planned tuition increases affect university students in Montreal. Quebec has the cheapest tuition rates in Canada.

The rest of Canada blindly adopts the American consumer culture and while the working poor and working class are suffering right now, those who own homes, about 50% of the population are doing fine with the real estate bubble doubling, tripling and even quadrupling their home equity in a few years.

The working poor get a kick in the face by the Toronto Police if they ever congregate.

Perhaps the problem is that at the moment unemployment is too low to get a revolution started.

Even though a large part of the population don’t feel they have a stake in the system anymore, they simply need to work too hard to get by. There aren’t enough idle hands that have time to revolt. So we need a wave of defaults to bring that about.

The provincial government is trying to defund disability payments covertly, privatize healthcare and use that money to bail out the developers and give freebies to the rentier class.

The disabled can’t fight back, and dying Canadians are good for a government which wants to brown nose the billion dollar developers who fund anti-migrant movements, while relying on foreign capital to buy their properties.

It happens when people no longer have anything to lose .simple or taxed to oblivion

The RENT . . . is too damn high!

I have seen a lady interviewed a few times that focuses on the residential housing market. She says there is a glut of multifamily homes in the pipeline in the smile states or sand states as she calls them. She thinks there is going to be too much supply very shortly.

This plus a lot of the rent increases is due to supply constraints.

With the latest housing price boom/bubble, I wonder how many condo rental units were taken off the market by speculators who bought properties for flipping (not renting)?

In other words, we should be looking not just at the rental prices but also at the rentable housing stock, market volume, etc.

So basically we’re in a supply deficit, with higher prices leading to people “collecting” housing units as investments. That’s now driving both higher rents and as much construction as the manufacturing / lumber industry can support. But when the house prices peak and roll over, which they will as interest rates rise, it will no longer pay to sit on empty houses. And then all the hidden supply will come out of the woodwork, the new construction will come online, and both rents and housing prices should plummet like they did in 2008-2010. But it could take a few years yet to play out.

Agree. If the Fed would just let market forces work and stop trying to prevent any and all recessions, things could reset. Extra home supply would get dumped on the market at fire sale prices. It’s the forest fire analogy. We won’t let any fires start to clear the excess fuel until eventually there’s a fire so big it melts everything in its path.

This will get me moderated yet again but I think all the anti-everything drugs over the years to mask any and all health ailments eventually leads to something so big it stops the world for two years (so far). It’s all the same problem, no accountability, no discipline, no character anymore. We need a thoroughly soul sucking depression to fix it, so no good options left unfortunately. We now return you to your regularly scheduled programming.

Biden said in the SOTU he had a better idea to control inflation – which is to control costs. Brilliant. That’s why he’s President and Wolf Richter isn’t.

Didn’t Nixon try that? I don’t think it worked out too well.

In our area, small volume landlords are struggling to recover from the deadbeat tenants who did not pay rent and could not be evicted over the last 18 months.

It would have been irrational for them to pay. Also landlordism ain’t exactly hard work; basically just grifting a free house out from folks with unreliable income.

Totally wrong.

Our rental house was paid for by then less than grifting, by NOT doing things.

Like spending that money on movies, dining out, travel, fancy cars, lawn services, etc.

So we still had that money, and we could buy the house.

We do not owe that house or its use to anyone else.

I should have been more precise. Landlords typically make an initial investment, but if over thirty years they recover the cost of the house in rents they’ve managed to grift the cash equivalent of a free house worth of value off of those with unstable incomes. It’s sort of like having someone pay for a house but then taking it back once they’ve paid in full.

Regarding the first part of my comment of course no one is entitled to a house you’ve paid for, but given that there was a policy saying there would be no consequences for not paying what idiot would pay? My point was not to make a value judgement (people should operate in their own interest) but to redirect blame to the policy makers and away from “dead beats” (where that seems to mean people with bad credit).

Landlords are not grifters.

If landlords disappeared and there was no one to make investment in rental housing, there would be nowhere for renters to live.

Landlords provide a service to those who cannot afford the cost of homeownership or prefer the convenience of renting.

I’ve been a small “Mom” landlord for over 30 years (1-3 units). A lot of the time it’s not much work and the income can be good, but then sometimes it’s a lot of work and expense.

And dealing with tenants sucks. They usually, but not always pay their rent on time, their vehicles leak on your property, they paint and make a mess, they are FILTHY and leave crap behind, they bust up your property, they smoke when the unit is non-smoking, they bring in pets or roommates that aren’t on the lease, they fail to pick up after their pets or they have accidents even though every pet owner claims they are responsible and their pets are well-behaved (no more dogs!), etc. And these are the average ones!

And then the incompetent government decides to impose an eviction moratorium without putting a rental assistance program in place, which disproportionately affected the Mom & Pops, and landlords are forced to tolerate squatter(s) on their property.

When you pay a mortgage, taxes, and expenses for a property for many years and put hundreds if not thousands of hours of sweat equity into that property and deal with the tenants (small landlords can’t afford a property manager), then you can be a landlord too!

In my semi rural area two different developers have started clearing land for about 100 single family homes each next to me. The developments are about 1 mile apart.

One of them I heard was a four year project. Two hundred new homes in the $300K to 400K is a lot for our small town. Plus this is just one side of town. Construction is still hot here.

The last time they did a 100 home development near me was at the run up to the housing boom. They got the infrastructure in, but things went bust before the houses were built. It all set there for about 10 years, but has been built out in the last five years

Are these independent local developers or brand name regional/national builders?

I’m in a rural area where the custom home building has been wide-open since 2017, and nobody builds housing developments here. You buy the lot and go find your builder to use your cash or credit to build your home. And people continue to beat down the builder’s door to get a home built.

Approximately 3-5% of the homes built each year are spec homes and it’s rare for a builder to have two spec homes going at once.

What part did lost rent from the illegal, CDC directed(!!!!) rent moratorium play in the need to make up for never paid rent by raising rent on people who can pay?

Americans have very strong values. We value immigrants and refugees of any age flowing in uncontrolled by the millions as long as they can pay for their cartel pass into the USA. We value welfare, this is why the federal government rents hotels and apartments for the newcomers. We also value that every person needs their own place. This is why we have section 8 for people who have been here for a long time. We will not force a grandmother on welfare to move in with her children, we will provide an apartment just for her! We are also sick and tired of these run down flea bag mom and pop landlords, which is why we have created these huge interstate businesses to own and operate our rentals.

Now a few people, those with jobs, are going to have to pay a little higher rent due to the influx of people and all the upgrades these great landlords have done for them. This is not really a big deal. Think on the positive! Think of the great businesses on wall street you are supporting!

I hear you! This keeps the wages super-low too. And it keeps the lower middle class on down growling at each other and fighting for scraps. We must preserve the big skims for the connected few!

I think the sudden, huge surge in rents has much to do with the need to make up for never paid and never will be paid rent due to the illegal CDC directed rent/eviction moratorium.

Would anyone mind explaining to me how do asset holders exert influence over the fed? Is it just the standard (multi-billion dollar) process of paying off congress to obtain favorable appointments? If so why have they seemingly been more or less capable up until now?

If you seriously want an answer to this question I would suggest reading “Davos Man” by Peter Goodman,

I’ll give it a look thanks!

Whose been capable? The FRB?

They look like geniuses because of the mania and the loose credit standards that cause it. “Printing” does nothing for actual prosperity.

This is greed. The society is going feudal with the landowners extorting the labour of the peasants.

Adam Vaughan and the Canadian government refuse to stop the runaway rent and home prices, while in the USA, high rents are “free market capitalism” while the Federal Reserve has to bail out mortgage bonds when there is a recession.

So we are now allowed to build auxiliary living units (small rental house or apartment) in our backyards here in California. My house has a big yard that could easily accommodate this, and is in a very desirable part of town that would be easy to rent out.

Ms. Sea and I talked about this idea but we concluded that since in our California city, it is almost impossible to evict people for anything (including disturbance, drug use, and non payment of rent as most landlords found out the last two years) and since it is pretty much illegal to select good tenants who are not trouble makers and can pay the rent (that’s now ‘racist’ you know in California), that it was not worth the hassle and grief to get something built and rent it out. Oh and there’s new rent control legislation on top of that too now coming down the pipe.

Even though they would be our close neighbors and we own the property, as a small landlord we’d have no rights to peace and quiet nor a steady income even in our own yard.

So we decided to forget it, we planted a garden instead. Its not just worth the hassle and risk. A couple other houses on this block are also intentionally vacant as investments for future sale because renting them out is now too much of a pain and too much of a risk under the current rules. .

Sea;

That is as perfect an explanation of why there is a shortage of rental housing as I have ever heard.

“So we decided to forget it, we planted a garden instead. Its not just worth the hassle and risk.”

No one is obligated to be a landlord. When you make being a landlord so miserable that no one wants to do then you end up with….no rental housing.

I am ready to bail by converting my apartments to condos and selling out. And since they are are close to a small university when they are gone there will be that much less student housing available.

That is as perfect an explanation of why there is a shortage of rental housing as I have ever heard.

Really? There’s an estimated 40,000 vacant units here in San Francisco. This in a small town area wise (49 square miles). These are presumably “investments” held by whom?

How does this fit into the equation?

Socialist state !

Yeah, if you had the wrong renters, they would probably sue you for something like abuse and own both your houses in the end.

Yep, exactly. In California its too easy to get sued for abuse or a million other things by tenants or their ‘advocacy groups’ and it is hard (read: expensive) to defend against.

You’ll probably win in the end, but it costs too much and is just not worth the hassle.

And the tomatoes we have grown this past year instead are very tasty, and don’t make noise nor cause trouble :-)

Exactly. Same situation in Seattle. Severe housing shortage with the tech people flooding in and zoning preventing enough new housing from being built. About three years ago the city passed an ordinance authorizing ADUs but not many have been built. Over the past few years, though, the same kind of laws you describe have been enacted making it so a landlord has little control over he/she rents to. I had considered buying a house and building a ADU to help me afford to buy in this high priced market but decided it was too risky for the same reasons you describe. And people here wonder why the ADU ordinance did not produce that much extra housing…

As I’ve posted before, the condo market here in Swampland is booming. Reason: Single family homes and townhouses have become unaffordable. Condos are the only game in town for new entry level home buyers. Add in retirees who don’t want to maintain a home and want to simplify their life. And now we have the gas prices over $5/gallon which makes moving back into the city for attractive. Over the past decade the low interest rates encouraged investors to buy 4 unit buildings and convert them to condos. So the supply is abundant. So the bottom line is these make good investments to buy or to rent out, the latter even more so with the shortage in housing and the rents spiking up by double digits.

Yep. City where I live said every new sfh has to have 3 car garages.

That pretty much means all new homes will be at least $500k Average family income in my state is about $65k.

Thus I see the same thing coming…..condos.

It’s interesting that New York City is pretty far down on the list, showing “only” a 10% year-over-year increase. My personal observation as to why rent inflation is not as high in NYC as it is elsewhere is that the rents here are already high enough that they’re slowing the uptake of rentals that come on the market.

Around where I am, I see multiple apartments sitting on the market far longer than they did a year ago. I think people are tapped out. Also, it could be that last year people were flush with stimulus money and today, not. Also, I see much more churn than there was last year, when admittedly the pandemic was still in full effect.

So what I see here in NYC is that more people are moving out of their apartments and then these units are sitting on the market longer than previously. I wonder if this means that we’ve hit some kind of ceiling.

I did not receive a penny of stimulus money. Nothing. Nada.

I know that checks went out, but I heard “$1400” or so. Maybe more than once (?). I have no idea (not a recipient), but I repeatedly hear that phrase “flush with stimulus money”.

How the heck are people suddenly rich or investing in stocks or whatever with $1400? What am I missing here? Did the government send out $100,000 checks I didn’t hear about or what?

I get the “cumulative” effect (that lots of checks flooding the system add up / boost the economy), but how was this life-changing on any individual basis?

You’re not missing anything. We received about $5K in total over the two years of stimulus. We bought tires, fixed the car, a mattress, and extra food. It was nice getting the extra help, but we are far from rich from it.

The resentment on the part of people with high incomes who can afford anything they need is off the charts. They overlook the fact that the money was simply a refund of taxes already paid by the people who received it.

I don’t think Hal intends to resent those who received stimulus money.

He’s implying that too many people think there’s so much inflation going on, such as rents being up 20% and cars selling for $10,000 over MSRP because people got a few thousand in stimulus checks.

That last $1400 check was all but gone from the economy by the end of Spring 2021.

Not for everyone by a long shot. About half the population doesn’t pay any federal income taxes and many of them already received “refunds” from refundable credits.

Getting a refund of FICA taxes doesn’t count, unless you are going to tell me their SS benefits are going to be cut for it.

Petunia,

The sad thing is that a household that makes $65,000 in income and got $5,000 in stimulus checks, is now down more than $5,000 in “real” income (loss of purchasing power of their income) every year due to inflation.

It was the other business stimulus that is the missing variable. PPP loans allowed many businesses to borrow money, at very low interest rates, to “keep businesses running” during COVID that inadvertently added to a huge influx of money in the markets. Many used the PPP money for normal HR operations and diverted planned HR funds to invest into the markets. Banks are sitting on some of the biggest surplus of reserves ever seen in the economy. They simply have not loaned out the money due to the FED intervention. Needless to say it is those corporations that are making a huge change in the markets.

Some were laid off due to COVID and made more money on unemployment (including the extra COVID unemployment) than they did when they worked. Add in no need to pay rent and many were swimming in money.

Lots of PPP loans were scammed. Some people got caught, some didn’t. Many of these “forgivable” loans were in the $Millions$.

People got ppp “loans”, either with legit business or made up a fake one. Then they spent the money on cars, vacations, RE and various other goodies. Uncle scam forgave those loans for the most part, but a few got busted and you can Google it for some examples. I took a vacation last spring to Florida and I would estimate at least a quarter of those traveling at the time were flying on ppp money. I learned of this by just overhearing conversations of those seated around me.

You had to have a legit business for at least a year or two to receive a PPP loan. I think a lot of the scams came from those businesses who actually didn’t need it or took advantage of it. It wasn’t hard to do that apparently.

Pete Buttigieg came today and said inflation is not permanent. Inflation is permanent, in the sense that prices are not going to go back down to pre pandemic level. This guy is delusional. Fed is still singing the transitory song, not directly though.

Guys like him along with fed members should resign immediately for making such ridiculous statements. All costs have inflated like there is no tomorrow and energy cost increase now will add more fuel to the fire. These guys are probably living a sheltered life and does not have to deal with day to day pain or ordinary Americans. At my farmers market farmers were tearful last week because gas prices are at $6 and economy is slowing down so they are really cornered, and these guy come out makes such stupid statements.

“Pete Buttigieg came today and said inflation is not permanent.”

With comments like that, this fellow proves that he has a bright future in the federal government. Presidential material, I say…

/s

So, overnight our Sec. of Transportation finds himself becoming an expert on Economics & Finance, saying that the rising inflation is ‘transitory’.

Seems oblivious to the fact that Powell and Yellen and others before him had to eat their transitory words. And the fact that inflation has doubled since Mr. Powell had the first ludicrous thought that it was to be transitory.

Does not bode well that any right decisions will be made by this administration to remediate inflation..

The Sec of Transportation doesnt know the difference between an entrance and an exit.

In an attempt to perhaps show off his knowledge, he may also be mixing up Public Transit, which he’s actually overseeing, with Inflation Transit :)

You’d have to be crazy to be a landlord in today’s environment. Government imposed rent moratoria and city imposed rent controls abound plus lots of dead beat renters to deal with. You could not pay me enough to be in this business.

I’ve said as much many times here.

Rent moratorium is another arbitrary expropriation of private property.

It’s not the only one and won’t be the last either, as evidenced by the most recent Russian sanctions.

Rent CPI behavior vis-a-vie Zillow’s index is perplexing… during the first half of the pandemic Zillow rent index went down 4% and CPI rent tracked down by 2%.

Second half of the pandemic Zillow went up 17% and CPI 2%. Although they are computed differently, one would assume the relative rates of changes in the two indexes would be similar regardless of the direction of of the move. Instead, when Zillow went down, CPI went down half as much but went Zillow went up, CPI only went up by like a tenth as much of the Zillow move.

This seems very fishy… why would there be so much bias on the down side than the up side?

The CPI index is VERY slow in picking up changes. In addition, it isn’t based on market rents (asking rents) but on rents actually paid by tenants, including in rent-controlled apartments, where rent changes very little. So it will always move less than asking-rent measures.

This dude next door to me is renting a house just like mine for $2,500/month. The lot alone is worth $675K. The rents are way behind the housing prices by a gigantic amount. Using rents as they are used to weigh the CPI as is done is a good way to understate inflation. It serves the government’s interest to screw over savers and retirees even more that they already are.

The electorate will have to be patient. The Gov’t at their convenience will direct the electorate on whom or what is to blame for everything destroying their economic future. Other pressing matters however are of much more dire need of their attention.The electorate must remember that freedom has a high price and rents like gasoline are not sheltered from that cost.

Wolf,

With the 30 year fixed approaching 4.5%, do you think interest rates will be the catalyst to bring down these ridiculous prices? Thanks.

We have a massive inflation problem that won’t go away overnight. I don’t know how long it will take before it calms down. That depends on the Fed, and the Fed is getting a little more hawkish about it (see today), but it’s so far behind the curve that it might not catch up for years. We’re already seeing the impact of 4.5% mortgage rates on the number of mortgage applications, which are lower than a year ago. But investors are still piling into the market.

Thanks, Wolf :)

I just listened to a radio show an the host made a good comment.

He does not see how raising interest rates will solve a supply side constraint inflation issue. Sure…rates an slow demand for some things but when supply in constrained, people will still buy something they need like food and shelter.

Maybe things like housing will drop but that will not help most families bottom line. They still need to eat and buy food and pay rent.

Either high prices will get more oil producers to drill and produce more oil, farmers grow more crops, lumber jacks cut down more trees, etc. Raw material inflation typically is not solved with rate increases?

I am still getting calls from investors regarding buying a house. I wonder with the stock market downturn this will actually spur more investing in housing as people do not want the risk but with rates way lower than the rate of inflation, buy assets with debt and pay with cheaper dollars later.

just thinking out loud.

If the stock market tanks and credit does not freeze up with it at the same time, housing could be a temporary beneficiary.

However, that’s very remote longer term. The US has both a stock and housing mania and both are contingent upon the bond mania. Stocks indirectly due to TINA, corporate interest expense, and loose credit generally. Housing on low interest rates and ridiculously low credit standards.

it isn’t just rising rates that matter but credit conditions. Tightening credit to anything close to normal historically will cause all three components of the mania to crash or implode.

As for renting, yes, people need a place to live but needing something doesn’t equal being able to pay for it.

The more likely way rents will decline is through a deep economic contraction when credit conditions noticeably tighten. The economy goes into recession or depression, marginal landlords and homeowners default or sell out of fear, and renters lose their jobs or take enforced pay cuts.

ru82,

Services = 70% of the economy. There are no supply chains in services. That’s where inflation is now getting hot.

Rents exploding….

Are Blackrock and Blackstone and the others upset? Guessing no.

Is this connected to the weird move by the Fed to suddenly buy MBSs and essentially lend money to the real estate market at record levels below inflation, and end up owning 24% of all residential backed mortgages?

What is the Fed doing in the mortgage markets at all? In 2006 they owned no MBSs.

“This rent inflation now is a national fiasco.”

Added to gasoline and food. (lumber, fertilizer, copper, etc etc)

The paltry, meager, meaningless rate hike that is being endlessly discussed will do NOTHING.

Thank You for this great website!

Look to the UK and Japan for a few possible versions of our future, the UK more open (to being nannies and accountants and real estate agents for flight capital), Japan for a closed off, aging version.

“This rent inflation now is a national fiasco.”……says Mr Wolf

No….

I think it is best described as a National Scandal…..a fiasco implies it was an accident or due to someone being incompetent…….

I’ve been warning for years that rent control was coming to a city or town near you, and now it’s here. Get ready folks, those high rents have created a wave of resentment that is going to spread far and wide. You can add the entire states of CA and FL. Others to follow.

I suspect there will be many creative ways of dodging rent controls that will be found…

Most laws that are written of this nature leak like a sieve…

Actually, the first that comes to mind is that I “loan” you X amount of money on a 12 month promissory note with 12 equal payments…

And you can live in my rental for free…

Jus’ thinking out loud…

As I said, there are ways…

When excessive rent control eliminates the possibility of profit or owner control, there will be less available rental units. They will be sold, turned into short-term rentals (airbnb, vrbo etc,) have family moved in, or just left vacant. Lots of other creative ways to make money off of real estate without having tenants.

All of these will result in less housing for rent and an increase in the rents of the remaining units.

Actually most rent control laws cover all units not owner occupied or occupied by close family members. The loan scam won’t cover it.

COWG

If it were a SFH, I would ONLY offer a tenant a Contract for Deed vs monthly rent. That way, the “tenant” owns the property as long as monthly payments are made. If payments stop, eviction / foreclosure follows.

I sold all my rentals a couple years ago and carry the notes on them. However, even back then, rental regs were getting out of control. I was already getting to the mindset of selling Contract for Deed only.

Not if it’s not “officially” for rent…

But that’s nit picking on my part…

I get what you’re saying, but I still think there would be ways around any rent control laws…

Plus a law that’s unenforceable, isn’t really a law… I don’t think there’s enough government to enforce that , which would rely on voluntary compliance…

If someone was renting a place and squealed on a landlord, guarantee you they would be looking for a new place to live…the only thing they will win is the opportunity to look for a new place to live…

And that ain’t gonna happen…

Cowg,

You obviously never lived under rent control. You may choose not to rent the place, but you will never be able to evict any tenant who is paying the controlled rent or a tenant who has cause not to pay. Don’t even try withholding services, because you will lose the property through fines.

I think short term rentals will suffer under rent control as well. Hotel owners have good reasons to ally with renters on the issue.

Rent control….that that could really effect housing and so called investors.

But….will they actually impose rent control on single family homes our just go after big apartment complexes?

It is easy to enforce rent control on a 400 unit apartment complex in contrast to tracking down 400 mom and pop landlords?

Yes P, you have been one of the voices in the wilderness with re Rent Control.

How some ever, you have apparently not seen the latest attempt, by the saintly city of the tpa bay area, by the rent control advocates.

One recently elected city commish guy tried for it to help his constituents severely impacted by the recent obscene rises in rents, but was shot down by the city employees who know about the state limits on such socialism, so it went NO where at all…

While I am not any kind of advocate for public control of housing,,, it certainly seems to me that the very best approach would be to help any and all folks to OWN their homes.

Friends who died in their very long term NYC rent controlled apts were never happy there, and I suspect lack of maintenance, proper heat, etc., etc., were a major part of their angst, no matter how relatively cheap their rent.

The original rent control in NYC was bad because the increases were too low. Rent stabilization was better because the increases were tied to expenses and inflation. I lived under both in NYC.

The failure in Tampa will be revisited very soon. I know professionals in FL who can’t afford the rent anymore and they have had enough too. It’s not a poor people who don’t vote problem anymore.

The government “helping” people to own their own homes?

Look at the cost of homeownership now. The primary reason it is unaffordable is first, because of ultra-loose monetary policy. And second, government lending programs.

If the government didn’t distort the cost of money and didn’t guarantee loans, the cost of mortgage credit would have to reflect the actual risk.

If it did, mortgage rates would be a lot higher and home prices would be lower.

What the government and housing “advocates” call “affordability” is actually the opportunity to be a debt slave and buy a lottery ticket to a windfall by participating in a housing mania.

What I described for housing equally applies to student loans and medical care.

There are a lot of home buying assistance programs that were implemented recently.

– One is for $15k for new homebuyers.

– Another is 5% down payment if you are within 120% of your average earnings for you metro.

Ok looks like we the ordinary people have a problem.. But what is the solution?

Rate hikes and QT, plus a few other things, as spelled out here:

https://wolfstreet.com/2022/03/12/why-this-is-the-most-reckless-fed-ever-and-what-i-think-the-fed-should-do-to-reverse-and-mitigate-the-effects-of-its-policy-errors/

“They all had the politics of horse thieves. He believed in the Republic as a form of government but the Republic would have to get rid of all of that bunch of horse thieves that brought it to the pass it was in when the rebellion started.

Was there ever a people whose leaders were as truly their enemies as

this one?”

― Ernest Hemingway, For Whom the Bell Tolls

There has always been violent protest in the the US, mostly by the working class.

The original protest was the Boston tea party. No taxation without representation.

“ There has always been violent protest in the the US, mostly by the working class.”

Which has accomplished what…

BTW, your Boston Tea Party example was not a protest, but a rebellion…

Protests will get you on TV today…

Rebellions will get you killed…

It was a peaceful Rebellion.

well, it might be needed to cleanse the pigmen out of the system….personally I would have no problem joining since these corporate slave owners need a whipping….

The Fed’s hike of .25% today will do effectively nothing to remedy this price surge. As expected.