Businesses are confident they can pass on higher prices, plus some, to consumers.

By Wolf Richter for WOLF STREET.

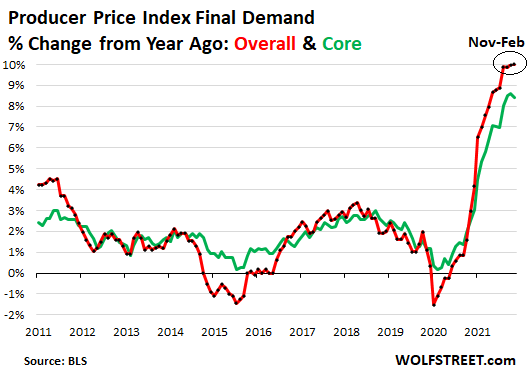

The Producer Price Index for Final Demand tracks the input prices for consumer-facing industries whose output prices are then tracked by the Consumer Price Index which, WHOOSH, hit 7.9% in February, the worst since 1981. Today, the Bureau of Labor Statistics released the PPI Final Demand for February, which jumped by 0.8% in February from January, and by 10.0% from a year ago.

This marks the fourth month in a row that producer price inflation clocked in at around 10%, and all four months were by far the worst in the data going back to 2010 (red line). And it does not yet include the spike in fuel prices following Russia’s invasion of the Ukraine. That’s still to come.

Without food and energy input costs, the “core” producer prices rose by 0.2% for the month and by 8.4% from a year ago, now in the 8.5%-range for the third month in a row. This includes final demand for services, which rose 7.8% year-over-year (green line):

That the PPI for Final Demand has now been stuck at about 10% for four months in a row shows that producer price inflation is becoming entrenched at historically high levels.

Some components will rise while others will fall in a game of inflation Whac-A-Mole, particularly in the volatile commodities-based components for food and energy. But the persistence of this double-digit PPI inflation is quite something, compared to prior periods.

The companies that are having to pay those higher prices are going to pass them on to consumers and other businesses. Passing on higher prices, plus some, is now all the rage, and everyone knows it, and everyone does it, because consumers are still willing to pay whatever, and businesses are also willing to pay because they know they can pass on those higher costs.

And these double-digit producer price increases will provide further upward pressure on consumer prices going forward.

Over the past two years, the Fed has pissed away every good opportunity to end its money-printing spree, reduce its balance sheet, and start hiking short-term rates, before it ever got this far. Instead, it did everything it could to fuel inflation and created ridiculous excesses in asset prices, that have now started to come apart.

The Fed is meeting today and tomorrow and will decide to do way too little, way too late, to engineer some kind of soft landing that it actually could have engineered starting 20 months ago. Now inflation has become a raging fire at all levels, including with producer prices, and the Fed is just now trying to figure out how to pump less gasoline on the fire. Read… Why This is the Most Reckless Fed Ever, and What I Think the Fed Should Do to Reverse and Mitigate the Effects of its Policy Errors

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

To decide between a 0.25% and 0.50% interest rate increase with the PPI at 10%.

“The Fed is meeting today and tomorrow and will decide to do way too little…”

I imagine them sitting on la-z-boy recliners, sipping champagne and hee-hawing

plus lobster and filet mignon to follow …..

They may as well cut the rates. They’re idiots.

Funniest comment.

About spewed my coke.

Wish they were idiots. This is all coldly calculated.

Sad and malicious combined.

Next is QE at 0.40% and other such breathless moves as he bows to a portrait of Erdoğan.

Even if the Fed gets their way, and inflation “subsides” to their illegal target of 2%, the 8% stays!!

That means, with compounding, the Fed’s dream scenario is in nine years the dollar will be worth 30% LESS

and that is IF inflation reverts to 2%….which is highly unlikely.

And that is a Fed that is mandated to “stable prices”?????

Violation of duty, violation of oath of office, violation of the American People who work/earn/save and turn the lights on and fill the shelves of this nation. SHAME on POWELL and the Fed people.

This is “race to the bottom”….and now petro transactions moving off the dollar….

The Fed cant control that…

Paging Paul Volcker.

The FED – this cabal of evil – have screwed things up so badly for the working man that his greatest hope of survival is actually an economic depression that leads to a wipeout in asset prices, including shelter, so he can buy in at a level that allows sustenance instead of a lifetime of debt servitude. Think about that – a roaring economy no longer benefits the working person, so they are left praying for a deflationary depression to actually better their lives. When that’s as good as it gets, you know you’re well and truly f***ed.

Yep

The greatest hope is an economic depression.

So true. I think the only reason people have any hope at all is they tell themselves that their 800k house will be worth 2 million in 5 years. And bitcoin to the moon! How else do you justify carrying that kind of mortgage?

They’re not even talking about rates, they’re discussing their golf handicaps among other things. They might even decide to drop another load of fuel on the stock market – no rate hike this meeting “because Ukraine uncertainty.”

I am, in a very practical and definitive way, poorer because of this inflation. And the wife and I are feeling it.

Tighten those belts, further austerity ahead (for me, anyhow).

we all are…

So are most Americans and they destined to become poorer or a lot poorer in the future.

“You will own nothing and be happy about it”

– unelected central planners of WEF who have no mandates whatsoever, yet hold an enormous say in your life.

Not true. Trudeau is a WEF wunderkind.

MiTurn

Any holder of dollars is PUNISHED and intentionally so.

“When central planners decide, they intentionally assist one group and harm another” F A Hayek

It seems they decided in 2009….though Bernanke “promised” QE was short term….

We who expected the Fed to stand to their post, do their prescribed duties….lose.

Those who KNEW THEY WOULD NOT…win.

So, “who knew”? Who decided?

“Businesses are confident they can pass on higher prices, plus some, to consumers.”

They can keep dreaming and go bankrupt for all I care, because I won’t be buying. I have already stripped back my insurance coverages to the bare minimums (like no more uninsured motorist coverage) and other spending. Shop more at Aldi’s and only buy bogo stuff from Publix the major grocery chain here.

Aldi has gone up in prices. The 5lb bag of natural cane sugar has gone up from 3.29 to 4.19, as the frozen fruits have also gone up abt a dollar more. Bacon is 3.00 more. Sheesh. My Aldi bill is 15.00-20.00 higher per visit.

If you are in the US, sugar quotas determine the price of sugar cane.

And Ukraine of course, is no longer exporting sugar.

1) You do not need Sugar. It is a slow acting poison. Save $4.19 by not buying it and the future health care costs.

2) Fruit is not good for you, especially if you are of Northern European decent. If you agree with Evolution, you should only eat the 4 berries. Tropical fruit was not a staple of most Europeans until 1500’s, and is not healthy.

3) Now, Bacon. That’s God’s gift to people.

what is interesting is 10% number is reported by the media as “good numbers that will please the stock market” and they were right ! markets loved the number – as I continue to be gobsmacked by the world I am living in !

That’s because news doesn’t correlate to market action the way most people believe.

Market participants interpret news as good or bad based upon their current sentiment. Most of the time, markets go up, regardless of specific news events since there is always some “good” or “bad” news every day.

For Exhibit A, look at the market action on February 24, the day of the Russian invasion. Prices fell steeply at the open and then regained the entire loss and then some.

There was no “news” that “caused” the change, especially since no one had a clue what was happening there.

This example is a microcosm of how any market acts, as no supposed fundamental event ever bought a single share. The accepted belief in causality only makes sense in a world populated by robots.

In looking at a long-term chart, most people wouldn’t even recognize the supposed events associated with bear markets. They usually lack familiarity but even if they didn’t, there is no consistent correlation.

As an example, the 1987 crash occurring in a single day without any identifiable cause was bigger than the 4+ month decline following Pearl Harbor. How does that fit the conventional narrative?

The real difference now is that we have been living through a mania this entire century. The actual economic fundamentals are mediocre to terrible while only appearing to look positive due to a fake economy and an asset mania. The societal fundamentals are even worse.

In a mania, the actual negative fundamentals are ignored. When this mania ends for good, bad news actually currently in plain sight will supposedly come out of the woodwork as a “surprise”.

Augustus, thank you explaining this to people. Markets are driven by SENTIMENT. Period. Sentiment itself is quite hard to explain (your Feb 24th example is spot on), but there are ways to track it and understand where we are in the cycle (EWT is the best I know).

Right now it’s bear porn everywhere and the fundamentals are becoming worse and worse. But sentiment is bottoming, and everyone is going to be flabbergasted at the rally we will get this year to new ATHs.

The fundamentals are eroding as Wolf is so adept at analyzing, . But please people, understand that fundamentals will get worse and worse while price makes new highs. All it will take right now is a bit of a good news on the Russia/Ukraine front to send the markets on a blow-your-pants-off rally. Why? Did the fundamentals change? No – the sentiment changes.

Eventually we will peak of course. Only when it finally turns it will be different and all the BTFDers will get destroyed (I realize NQ is down 20%, but that is nothing compared to what will occur in a year or two – after it’s recovered and made new highs).

“But sentiment is bottoming, and everyone is going to be flabbergasted at the rally we will get this year to new ATHs.”

Not that you’re wrong, but where did you get your crystal ball?

To this day I still believe I caused the ’87 crash. Hadn’t bought a stock long in over two years at the time and picked 10:20am the day of the crash to buy Dow Chemical.

They said…. 10% was below analysts expectations….

That is such BS. I didnt hear anyone predict higher….

This is just like the “earnings beat” game…..

And we didnt get the full blast of the Ukraine effect….

My suspicions is that the Fed meeting today leaked….(can you imagine? Yellen’s internal investigation still going on?) and the 1/4pt …………….

1/4pt really? is in the decision.

WHY effing bother? 10%…1/4pt?

The Fed is doing it just so they can say they did something or at least they’d tried. LMFAO!!! What a sad, bad joke!!!

We’re swapping out the “Fancy Feast” for generic dry…

For you or for your pets?

We have no pets…

Once had a cat we named “t-bill” for the amount we spent on Vet bills.

If that was more than 2 years ago, you would be shocked at the price increase since then. Shocked I tell you.

Its shocking and sickening that US Govt is doing this to most of its citizens, 90% of them. 10+% inflation and Govt still printing and spending like there is no tomorrow. A sane and responsible Govt. would have raised the rates to 10% and keep it there till inflation goes away.

It is nothing short of criminal to do what id being done by US Govt. – stealing from ordinary citizens and giving to the wealthy.

Pelosi and Biden say…..and I suspect they really think in their minds that spending will cure inflation.

The WSJ today had an article that said $5 Trillion is yet unspent of the bills passed….

yippee

“Its shocking and sickening that US Govt is doing this to most of its citizens”

It’s not the US government. It’s the Fed, and that is owned by the major banks.

Elected officials are at most the lapdogs of such corporations, because that’s where the campaign contributions come from. Functionally the US is an oligarchy, not a democracy, although for some reason they’ve decided to maintain the pretenses a little longer.

Many politicians in Washington actually believe the theories promoted by economists even though those economists can’t prove that their theories work as advertised in the real world. That fact should be obvious to those politicians because we have so many conflicting schools of economic thought.

If you dare question economic orthodoxy, you’ll get pilloried. Krugman was, just today using the Putin-induced crisis to push the Fed to hold the hike to 0.25% I was heckled for suggesting this was farcical. Who are we to question “Doctor” Krugman and his Nobel prize. Don’t you realize that we know much less than economists, who are infallible. This is the kind of contemptuous nonsense that will continue to drive working class voters away from the current party’s base, except they won’t realize it because they’re too smart to realize that the average working person doesn’t need to actually understand economic theory when they feel it acutely when inflation eats everything.

Just a note, there is no Nobel prize in economics.

Its “The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel”, awarded by Sveriges Riksbank, not the Nobel institute and not one of the Nobel Prizes endowed by Alfred Nobel in his will.

The “Nobel Price in Economics” is put bluntly awarded by one of the FED’s subsidiaries.

Don’t be Confused. Economics turned into the propaganda arm of the Financial Industrial Complex in the 1970s. It’s become weirdly mathematical, poorly supported by evidence, if at all, and most of it is junk. I’ve dabbled in economics and mathematics for years and years, so I’d know.

It’s a rather large discussion. As for politicians, well, half of them at the national level in the US are irredeemably corrupt and only survive by gaslighting their constituents for the benefit of campaign contributors. No help there.

Most of what we are feeling now was from what the Fed was doing about 9 months ago. They have loaded at least first half of 2022 with a lot of inflation and we have to assume that was the plan. My guess is they wanted a hot economy so they can get in as many hikes as possible before economy rolls over in a recession.

Been seeing several places 30 year Treasury is in a very long down channel that’s going to keep going lower. We are close to breaking out, but my guess is 30 year will be lower in 6 – 9 months, but I am not confident enough to put money on it.

I believe this economy resembles the late 70s in more ways than you can imagine. Just before Volcker was appointed this guy Miller was head of the Fed. His only experience in finance was managing a golf cart leasing company. Even Carter had to get rid of him. He was so late to the game that inflation was double digits before he woke from his nap.

Now we have

1. Rising gas prices, Rising food prices, Rising commodity prices

2. Rising interest rates

3. Rising asset prices

4. Foreign War in Ukraine

5. Rising cost of constructing new homes

This is like the jimmy Carter economic stew on steroids.

Next are price controls on gasoline at the pump and gas lines.

Next up, WIN buttons! That worked so-o-o well last time…

Swamp

One very STARK DIFFERENCE

In the 70s and early 80s, the Fed fought inflation….

Whip Inflation Now.. (WIN)

See any buttons now?

This Fed outwardly PROMOTES inflation, and though advertised 2%, this is still contra to their mandates.

It is clear that no one is watching this Fed…everyone is in on the “get rich game” (Pelosi…”there is a floor under the stock market) Nice to know…who told you, and when?

Next up is food rationing at Grocery stores.

2 years ago Costco limited Toilet Paper to one package. One.

It is going to feel strange when the signs go up, above the baked beans, macaroni and cheese, Corn Flakes boxes, etc:

“LIMIT ONE”

And, that is assuming the store isn’t already completely EMPTY.

We can live with inflation and growth. The China shutdown is worrisome. US capacity is too thin. Growth without inflation we revert back to the bubble economy, inflation without growth (temporary) is unpleasant for everyone except suppliers. We have a recession and consumer demand recedes, but the problems are not consumer problems. Gov spending will bail us out.

“Gov spending will bail us out.” Is that sarcasm or conviction?

If not sarcasm, who is ‘us’? Hasn’t the unrestrained government spending done enough damage already?

First, only an economy dependent upon debt and government spending requires inflation for growth. The existence of both is analogous to the behavior of a crack addict. It’s what monetarists and (neo-Keynesians might believe but that’s another consideration entirely.

Second, not sure what bubble economy is supposed to mean but Japan’s bubble economy was due to their asset mania. The US has been in one this entire century, to one degree or another.

Third, to your point, believing that more government spending is the solution is absurd. Wealth and prosperity do not originate from unproductive spending which is the lopsided proportion of the budget.

Increased prosperity requires real production. There is almost no actual investment in the government budget.

What progressives typically term government “investment” is spent on income transfers or programs such as “education”. This is outside the scope of this blog but suffice it to say, I’d perform a complete radical overhaul on the current system.

Government also can’t “:print” or bring into existence by decree natural resources, skilled labor, and intellectual property. It takes actual work to do that.

“Increased prosperity requires real production.”

Not exactly. Increased prosperity requires increased productivity, and for that you need real production. Productivity is pretty flat these days, and virtually all the benefits of previous gains have gone to the top for decades.

Prices keep rising though, and the difference has been made up with debt, trillions of it, and those proceeds have also gone to the top, because money flows uphill.

People are okay with it so long as they can feed their neurotic need to feel “special” by buying overpriced homes, vehicles, and vacations on credit. Meanwhile the middle class is getting liquidated and poverty is increasing.

Those who have power in the world want it to be this way, and they can’t be bothered with my complaining about it.

Went shopping at the grocery store today.

A bag of Doritos that was C$3.49 is now C$5.99. I tried to get the store name brand, but that too increased by 30% to 50%.

Lays big bag (15 oz?) of potato chips is $4.22 at Walmart (WM). WM house brand (Great Value) of the same size bag of chips is $2.32. Guess which one they were out of.

Anthony A.

Why are you eating all that junk food in the 1st place???

Didn’t buy, cost too much, had day old “discounted” donuts instead for $1.99.

Then there really IS a “chip shortage!”

Gen Z

Inflation just starting

And if you are Gen Z as noted…

tell your friends their future is being emptied out by massive debt creation…(21 Trillion in 12 years), future wealth pulled forward….and that money is being used to bid housing and stocks away from any reasonable entry point…for your GenZ

YOUR MONEY …your future…is being used against you…IMO

A game the people who control the Fed are playing…..you lose.

Gen Z

Junk food. Don’t buy it.

But Diritos are covered in super-flavor powder from a flavor lab. Just try it

Plus the bag size is decreasing so “now with less detremental effects”

I’ll probably wait until I reach 25 when the blood test results show elevated blood sugar levels, fatty liver and high triglycerides like we were conditioned to follow by our elite overlords.

Doritos? You would spend C$3.49? (What’s that in American? $1.50?)

There is your problem. Eating junk. Eating a slow acting poison.

Stop eating that horrid “non” food and achieve 3 goals:

1) Save C$3.49

2) Save your health’

3) Now have C$3.49 for Gas (Sorry, petrol).

I wonder how many people, who waste money on real junk, complain about Gaz prices, or make fun of me and my Ram Hemi Pick-up? One “man’s” Doritos is another mans Gaz.

M&M’s are still the same price they were about 5 years ago for a one kilogram bag in Ontario, Canada. $9.97 at Walmart. Maybe its because the Chinese don’t eat sugar so demand is way down for chocolate.

We see some input prices stabilizing but now the freight/fuel costs are keeping the momentum up. Just like that $6.00 per gallon, there WILL be a wall at some point. My wall for some reason is a $10.00 Smirnoff rocks. Now they are $12.00 with a Tito’s at $14.00. I told my wife that’s it, I’m bringing a flask to top off. I thought for sure she would freak out if her friends saw my abhorrent behavior. She told me to make sure I bring enough for her:)

Well if the price of gold and silver crater as the Fed is supposed to increase interest rates by one quarter of one per cent and the stock market goes up, well that is just plain insane.

The stock market should be falling like a rock and gold and silver should be soaring.

Prices of all sorts of goods here in the grocery stores are going up 10, 15 or even 20%.

So maybe time to to start buying the things that are on sale especially silver.

I think it was pretty clear gold popped because of the war. I sold 75% of my gold mining shares when the war ran the price up. I will probably buy back after they announce a truce. Didn’t sell the physical though. Physical is a vote of no confidence in the Fed.

There are really only five jobs in the economy…stock breeder, stock trader, bean counter, cavalry, and shit shoveler. The top three count on the fourth to keep the fifth from ever realizing how much power they wield. It’s a “free economy” under the waiving flag of “capitalism” until the rabble gets restless and demands better, then the troops are told to go out like pale riders and carry the flag of despotism. Thankfully, we have Powell thinking straight and wirking hard to drive this economy right off the cliff. Maybe then we can enjoy the long overdue civil war that’s bound to be. A nation once again.

BuySome-

Humor and Truth forged into Poetry

Hey Wolf,

Wondering if you’ve read Charles Goodhart’s book

The Great Demographic Reversal: Ageing Societies, Waning Inequality, and an Inflation Revival

I think it’s right up your alley. It speaks to why this inflation may have been brewing for so long. He presents the events surrounding the COVID pandemic as an inflection point for inflation that was bound to occur anyways due to global demographic changes. He duly admits of course to all the things you noticed about the recklessness of the Fed’s money printing as a big kick off the cliff in this respect.

He has seen patterns in globalization of labor and general stripping the bargaining power of labor as very deflationary on a grand scale since the 90’s but those trends had been gradually reversing leading to this time.

Interesting stuff.

I agree with this article except that the FRB could have engineered a soft landing by taking a difference course of action.

There is no soft landing from the biggest asset, credit and debt mania in the history of human civilization. It’s worse now versus March 2020 but the mania was still the biggest in history up to that point.

This mania doesn’t exist just in the US but is global and the US economy doesn’t exist in a vacuum. The debt mania is the most distorted part and it’s infected every economy of consequence on the planet to one degree or another.

They are milking the current unbacked fiat debt generating system for all it’s worth. We are definitely in the fourth quarter, but it’s hard to know if it is nearly over or we are going into overtime.

At some point it will not make any sense if they keep going. A basic house will be $2 million and you will finance it with a 1% loan and a 30 year Treasury will be 1/2%.

Stay home, grow your own veggies, hunt for squirrels, and chop wood for the heating stove. This will neutralize most inflationary pressures in your life as you joyously revel in living below Powell’s 2% average inflationary benchmark.

JJ

Of course all the people who live in cities and suburbs can do this. /s

Great advice – Let’s ALL become Amish at best or hillbillies at worst.

Hey now, I bet if everyone earnestly tried to follow my advice it would kill inflation faster than Paul Volcker could say “sasquatch”!

Inflation would be over in a month if nobody borrowed another dime and lived off their income.

Tell me where it’s legal to do that.

I heard that even in rural America, the cops go after people who collect rain water and rear chickens in their backyard. The system is designed for people to CONSUME while the elites get richer.

Many rural places all over USA are still actually working day to day within the policy of, ”live and let live” GZ.

Not going to say exactly where, but have visited farms and other ”growers” from coast to coast and mostly in what is referred to these days as ”flyover” country in the last 20 years with folks who say they haven’t seen any GUV MINT people in decades…

Course they know they are on their own IF something evil does come that way, so, equally of course, they all have and know how to operate appropriate personal protection tools,,,

May be one reason that ”statistics” show ”crime” is MUCH lower in rural areas, but not, ”per capita.”

Smart not to disclose. I know the states you are referring to. Glad that Big Gov hasn’t reached those parts yet.

In Canada, many of the DINK couples have bought and priced away the locals in small towns.

I’ll take the soup line over hunting squirrels.

Based on their public remarks, it feels like a large portion of the FOMC is still hoping this will go away on its own.

Inflation might not mater that much if the US starts delivering Jets to the Ukraine we shall see. A nuclear war should have a decisive effect on Inflation I expect let alone the stock market .No doubt the overall economy has had an effect on the entire world and no doubt J.Powell has a place in all that.

The Fed is losing control.

The fact the petro dollar is fading is a tip off.

Scared European money that bought treasuries and US stocks might not have found a safe haven.

The hypnotism …. and there is no other term that describes it better…..is in full play.

NO ONE would have guessed even a paltry 1/2 pt reaction to a 10% PPI …and coming off of .05%….would be a decision. How about a surprise 1%?

Margin call. Time to show cards. Meanwhile Marie Antoinette Powell and company are floating ever further away from reality on a magic bubble. And these “heroic” lemming- consumers are dancing to that tune. I feel like I am trapped in a mad theme park.

Yep. A mad theme park….where gravity doesnt apply…where mirrors are considered reality.

Markets often move opposite of what conventional wisdom might suggest, at least for a while.

This, the first tightening, with markets in nosebleed territory, a Fed trying to engineer a soft landing by allowing the bubble to deflate slowly, may backfire.

With a 1% hike, the markets may rally.

With a 0.25% hike, the markets may fall.

Seems bizarre, but expecting the unexpected can help you react.

One thing Wolf has documented extensively: you can bet that asset valuations will be lower in the future. And interest rates higher.

These times remind me why Julia’s Ceaser was truly one of a kind. He came to Rome, kicked out the money-lender rats and abolished public debt for the people. Today’s equivalency of abolishing the fed and abolishing all people’s personal debt.

Truly a man of honor.

“For let the gods so speed as I love

The name of honor more than I fear death.”

“Today’s equivalency of abolishing the fed and abolishing all people’s personal debt.”

So, about this “abolishing personal debt…” Do people who have no debt get the equivalent in the form of a check or something? For instance, an indebted person owes $60,000 on a truck and $480,000 on a shack, but another person has no debt and is in a rental. Does the person with debt just get a free truck and house, and the other person gets nothing? Do expand, because this is seeming to be grossly unfair and inequitable on the surface.

Everyone gets a trophy’

Everyone gets invited to Jimmy’s bday party

Everyone gets their college debt forgiven

Government spending eases inflation

Debt is good

Lenders are slaves to borrowers….

Inflation compensation checks next? /s

The only solution to too many freebies is more freebies? Underpriced debt transfers risks beyond the debtor, who meanwhile plans to keep the upside for the debtor’s self.

Very very poor planning and poor choices of the person with no debt.

The debt free are failures and need to acknowledge their personal responsibility that led them to grief.

Failure has never felt so good. I’ve been living and breathing failure ever since 2008 and planned ahead for my failures while in my early 20s.

Its not over yet.

Today’s debtors are reliant on forgiveness …..

The Fed and Treasury bailed out the “boys” in 2008..

College tuition debtors waiting for forgiveness..

Next will be credit card debtors….

It all works when their is a “God of Forgiveness” like the Fed

“Very very poor planning and poor choices of the person with no debt.

The debt free are failures and need to acknowledge their personal responsibility that led them to grief.”

This is probably the dumbest comment I’ve ever seen on this site. If somebody actually believes this, their parents were failures.

DC

It’s ok.

We know you aren’t overly bright.

Still nailing those 2 x 4s, eh?

Depth Charge-

I’ll second that.

“This is probably the dumbest comment I’ve ever seen on this site. If somebody actually believes this, their parents were failures.”

In response to:

OutsideTheBox

Mar 15, 2022 at 7:00 pm

Very very poor planning and poor choices of the person with no debt.

The debt free are failures and need to acknowledge their personal responsibility that led them to grief.

Harry Houndstooth,

It’s funny… in this particular thread, I have no idea anymore what is sarcasm, and what is serious. It all has fused into one. At first, I thought this line by OutsideTheBox was blatant sarcasm — “The debt free are failures and need to acknowledge their personal responsibility that led them to grief” — but reading all the responses that took it seriously, I’m not sure anymore. Maybe it wasn’t sarcasm. Good lordy, too much work for my brain this late at night :-]

“We know you aren’t overly bright.”

You know I’m smarter than you which is why you chase after my comments and try to insult me all the time. You’re intimidated and envious. I’ll take it as a compliment.

“acknowledge their personal responsibility”…echoes of the Soviet interrogators…”Confess, Comrade, Confess. Bam!”. So now it’s plainly obvious that the ones cloaking their fake economy under the stolen label of capitalism are nothing more than the same Bolshevik pigs who were willing to grind millions into the dirt to keep themselves in the glorious splendor of their Motherland. Ah, yes, the same kind who create the likes of Mr. Putin and leave the world to deal with his wonderful vision of unity. Let’s not forget how they also brought us the CCP that so willingly weaponized Covid by pretending nothing was wrong. Confess, comrades, confess!

Hey I thought it was a funny comment but ya forgot the /s

“Only you can prevent forest fires”

Read this as /sarc too Wolf… but like all great /s, it cuts to a painful truth.

Is everyone around here sarcasm impaired?

That’s exactly why Caesar *did not* eliminate debt.

Caesar stood by a decree he made in 49 BC rejecting quite decisively the cancellation of all debts (Cassius Dio, Historia Romana 42,50,2-5; Suetonius, Divus Iulius 51). Caesar explained that he had to borrow to fund the war and it was unethical for him to cancel all debts since he himself would benefit.

“Truly a man of honor”

James,

Yeah…whatever happened to him?

Neither. Abolish the fed and all debt. We go back to sound money basics. This system if you can even call it that is a Pyramid scheme which is why boomers are so in defence about it simply because they were the first generation in on the scheme.

But don’t celebrate just yet the Corporation has plans for you guys too. This is a game that only the Corporation wins. Everyone else is expendable. Welcome to America.

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children wake up homeless on the continent their Fathers conquered.”

So when you “abolish” the Fed, do all the people without debt who hold serial numbered notes that they worked to earn get to claim their share of the newly downward price adjusted assets that are ultimately fall back in the hands of the 12 reserve banks? Or were you thinking the debtors get to keep their unearned assets free? Need to know before I take an inventory of things that can be used to kill. I’ll happily exchange notes for ass-sets, one way or another.

But if the debt were abolished, savers wouldn’t be able to “back up the truck” and buy that low-risk, something-for-nothing, government-issued debt at an attractive interest rate.

Don’t you love excluding energy input costs from PPI? I guess I can exclude the fuel cost surcharge from my UPS bill.

Next time you get a utilty bill, tell them you’re a banker and will gladly fork over what is their’s after deducting your percentage for handling fees. If they don’t like being robbed, tell ’em to get their own printer and threaten to call your own buddies at FBI, Secret Service, CIA, and NSA. After all, the whole damn world owes bankers free money due to their special abilities to bum off of those who earn it.

Will the Fed raise 0.5% to set the tone? Maybe….

Wolf-

It’s interesting that inflation as seen as a problem for the little people while the fat cats like inflation. In most of history it’s actually been the opposite.

Debtors love inflation, because it means they can pay their debts with less valuable dollars down the road. Meanwhile, holders of those debts hate inflation for the same reason.

The bottom part of American society typically has a negative net worth: more debt than assets. And the rich part of society has more assets than their debts. So wouldn’t it make more sense that inflation is helping poor people and hurting the rich bond holders? I’m not trying to play some sort of jujitsu to minimize people’s pain. But if the average middle class person is spending say 30% of their take home pay on their mortgage, and 5% on food, then a 10% salary hike, while technically less than inflation, actually leaves him better off because it makes his mortgage easier to pay, and that’s a much bigger part of his monthly expenses than food and gas.

IOW, you have to see what part of a person’s budget is truly subject to inflation, and what part isn’t. I’d assert that for most Americans between the 20-80th percentiles, debt repayment, in the form of credit-card debt, student loans, mortgage, and auto payments all consistent a far higher share of their expenses than things like food and gas. The former are fixed expenses that are easier to bear if inflation leads to higher nominal salaries. The latter are worse if that nominal increase doesn’t keep pace. But on balance, people are left better with inflation than without.

This isn’t a recent phenomenon. Take William Jennings Bryant’s famous speech “Ye shall not crucify mankind on a cross of gold”. When our currency was backed by gold, inflation wasn’t the norm, indeed deflation was common, and farmers, stuck with massive loans on their farmland were unable to pay their debts. Bryant was advocating for minting silver-backed currency as a way to increase money supply to deliberately stoke inflation, since that would inflate away farmers’ debts, while leaving their rich debtholders with less valuable dollars.

Bottomline is, I think it’s not so simple as to say inflation hurts poor people more than rich people. Most of the time, it’s actually opposite.

This squares with my historical understanding of the effects of deflation and inflation across the income and wealth distributions. I don’t find that this perspective gets much traction among those commenting here, however.

There was another reason for Bryant’s speech.

There was a serious lack of “money” for trade, etc.

Silver would serve as coin better than Gold. Originally, we used Spanish Silver coins and the Constitution clearly states that money can only be COIN made from Gold and Silver.

Farmers simply had no money.

Paper can not be “money” for those 2 reasons. It is not coin and it is neither Silver or Gold. This is why, if you take a look at your paper “money”, it has 2 glaring clues: It is called a “Note” and no where on it does it say it is a United States Note or dollar. It is not United States – American money. Somebody is running it off a printing press and it ain’t Americans.

Simply, it is not money. Legally? it is counterfeit. Those silver dimes and quarters that hoarders and preppers are buying is America’s legal money and just may be the thing to own. Ironically, that is called “Junk Silver” while it is the most legal, proper, honest, and constitutional of all our “money” floating around.

You are right that current PAPER, as you call it, is not money.

Although, it is not COUNTERFEIT.

Current paper is called CURRENCY, not money. There are no real money nowadays, only currencies. And they are quite LEGAL.

Very bad take. Where is 10% salary boost coming from? The poor spend 100% of their income on housing, food, and then some. What income does not cover then they use debt like credit card debt. So even if they get a modest raise that does not cover inflation they are still in the hole. Paying off debt with more debt. To say the poor are not effected by inflation as bad as the rich is a horrible take.

King Canute ordered the rides to obey him. Somehow Mr. Powell and the USA have pulled this off. Seemingly.

“I Tremble for My Country When I Reflect that God is Just.” — T. Jefferson

Or even, I suppose, when i reflect that mean reversion happens.

Little by little until, all at once. They can, until they can’t – I wouldn’t want to drive a fancy car in the future street – psych ops fail badly, because just plain folk ain’t really stoopid

“Passing on higher prices, plus some, is now all the rage, and everyone knows it, and everyone does it, because consumers are still willing to pay whatever…”

Hmmm, wonder why. From opb.org, just released:

“Oregon will get another $16M for rent assistance program”

————————————————————————————

“An eleventh-hour announcement by the federal government means Oregon can keep its emergency rental assistance program open for applications one more week — potentially helping 2,200 more households.”

Oregon has been paying for homeless junkies to stay in motels for years. I don’t even like stopping for the night there anymore. It’s really unfortunate when you pull in for the night after paying almost $200 for a room to find the parking lot crawling with tweakers out for a smoke break, eyeing your truck and tools as potential targets.

If you need a free room and your own private bathroom for the night, the next time you pass through, look me up. You will not have to worry about your truck nor your tools. Far-suburban Portland.

Inflation would be over in a month if nobody borrowed another dime and lived off their income.

“Inflation would be over in a month if nobody borrowed another dime and lived off their income.”

True but then everyone has been taught to borrow and live beyond their means.

The difference between 1980 and 2022…..

In 1980 there was great inflation to some degree in order to put the boomer generation to work…..but their inheritances were saved by Paul V when he brought interest rates up to offset the inflation. The boomers got the jobs…..and their inheritances…..at a later date.

Today there is great inflation to some degree in order to put the millennials to work…….but their inheritances are being destroyed. They got their jobs but when the time comes for them to inherit…….its going to be reduced substantially.

Sure hope the generation after the millennials like to work……

The difference between 1980 and 2022 is that America still manufactured a lot of its own goods. Most kids between 18-24 worked. Those days they had something to work for like a car, a college education, or home. Everything is priced out of their range. So what do they work for? Experience? Ha! It is a sad world when corporations do not understand their lowest paid are they drivers of the economy.

“get hands down different with driver

bow help?”

The difference is in the 1980s, we had a Fed that FOUGHT inflation..

Now we have one that PROMOTES inflation…..and when it runs hot, they watch the fire.

“The Fed is meeting today and tomorrow and will decide to do way too little, way too late, to engineer some kind of soft landing that it actually could have engineered starting 20 months ago.”

Looks like the Fed had less confidence than you that it could have engineered a soft landing 20 months ago. Otherwise it is most likely they would have gone for it. Especially when you can again show the world that you are King Kong!

Nope. The Fed wanted to enrich the asset holders by inflating asset prices to the max – and now that scheme has blown up.

Is it ever likely that this petrified Fed will ever muster the courage to hike 50-100 bps if this inflation continues?

This inflation is really proving a mean fella, who does not dance to the Fed’s tunes. Makes me happy indeed!

Companies expect to be able to pass cost rises (+some) to customers. But this is only possible if debt keeps expanding at record pace. Profit margins are the mirror image of total (consumer + gov) debt expansion.

However, with consumer confidence at very low levels, you would expect consumers to retrench. And high inflation will put pressure on governments to reduce spending too, especially relative to the ultra high spending of the past two years.

So it remains to be seen if there will be enough credit expansion to keep supporting the current ultra high profit margins. Therefore, companies may be overestimating their earnings power at the moment. The rearview mirror may not be a good reference now.

LukeShan, you underestimate the Power of the Collusion Side. [Insert black gloved hand outstretched with palm up.] The emperor, nee-Powellpatine, may decide to administer the outer systems himself should the regional governors fail to keep order. He’s near to completion of a new death star, built at very favorable rates. Soon, all shall be his. Bwahahaha!

Correction: not mirror image, I meant positively correlated, which is the opposite of a mirror image of course. But the point remains: total credit expansion (private + gov) drives corporate profits.

You’re right. The future for us young people is bleak unless there is an economic collapse and recession to get rid of the excess inflation.

And there will be one, or more for you GZ!

Always has been, in spite of the attempts by the oligarchy or rich folks or, whatever you might want to call ”them.”

Been a her and his story buff for many years now, including reading recently, “The Rise and Fall of the BRITISH Empire” by Lawrence James. That reads almost like a novel, but covers very well the situation in mid ’50s when between the losses of India and Egypt the British demise accelerated, and the effects of that were still affecting HUGELY ALL the ”classes” of Britain I visited in 1970,,, HUGELY as in what WE the PEONs can expect going forward here in USA as well as in most if not all of the world.

”Hang in there” and keep your powder dry, and you will be able to buy RE and other tangible assets for pennies on the dollar, the real reason the FED was started in the first place, i.e. to keep WE Peons from doing that!!!

True.

Milton Friedman taught me that if the FED could have stopped the money printer, inflation wouldn’t be a problematic issue as what we have today.