Why is anyone still short these metals?

By Wolf Richter for WOLF STREET.

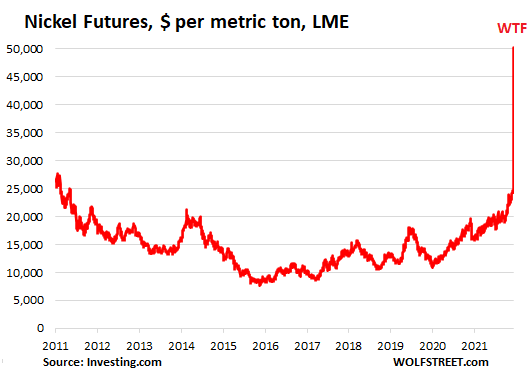

The price of nickel futures today spiked by over 93% intraday from Friday’s close, to just over $56,000 per metric ton at the peak, an all-time record, and then settled down a bit and is currently at $50,271 per metric ton, up by 73% in one day on the London Metals Exchange, the biggest spike in the history of the futures contract going back 35 years.

Last week, nickel already jumped 19% as futures speculators reacted to the sanctions that caused banks and metals suppliers to reduce their exposure to Russia, and as shipping companies avoided Russian ports.

Russia is a large producer of nickel, supplying about 6% of global demand, according to Bloomberg. Over 70% of the nickel production is used in stainless steel. And 7% goes into EV batteries, where demand is growing in leaps and bounds. But EV batteries use highly pure “Class-1” nickel, of which Russia’s MMC Norilsk Nickel PJSC produces 17% of the supply.

“Liquidity deteriorated dramatically in the nickel market overnight as sellers rushed to the sidelines, leading to sharp price jumps between trades as short-position holders scrambled to buy back positions,” Bloomberg reported.

Which raises another rhetorical question: Why would anyone at this time still be short any of the metals that Russia produces with all this chaos going on?

“Plus, bullish investors in China are piling into nickel on the Shanghai Futures Exchange,” Bloomberg said, citing Wang Yanqing, an analyst with China Futures Co.

The previous record of $51,800 per metric ton was reached in April 2007, during the mother of all nickel spikes, when the price surged from $10,000 per metric ton in October 2005 to $51,800 in April 2007, and then crashed back below $8,000 by December 2008. These commodities price spikes are madness. And they can go crazy for months, but they cannot last long term, as the 2007 episode has shown.

Other commodities went bananas too, but to a slightly lesser extent today, including wheat in reaction to the chaos around the supply from Ukraine and Russia, and of course crude oil where futures of WTI spiked and briefly hit $130 overnight, before settling down a little.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf,

Please adjust the nomenclature before the crazy speculator types make bananas go to heck in a straight line, thus breaking one of the fundamentals of Wolfstreet.com

Thanks again for your charts and especially your commentary in this crazy crazy time.

LOL, need that one! You really brightened my day. Thank you.

Dr. Mike

Kyle Bass bought $1M worth of nickels. At the time the (debased from silver) melt value of the copper-nickel coin was 6.8 cents.

That was 2011. Melting coins was made illegal years before so I don’t know what his end game is, but I’m sure he figured that into the equation. If nothing else, he can sell his nickels back to the Fed, incurring several carrying costs such as inflation, storage and insurance.

To buy that many nickels Bass had to go to the Fed. When they asked him why he wanted $1M in nickels he replied, “I like nickels”.

The melt value of those nickels today is $1.9M

That’s it, i’m going to hold out for 9 ¢ when spending my nickels!

So he made 90% since 2011. And nickel is up 73% just today. And it’s not clear how to get out of this trade. Brilliant.

I have no idea who this Kyle Bass fellow is, but my stash of old Canadian 100% nickel 5¢ coins are worth 17.54976 cents each today. More than 3 times what they cost. Just one advantage of being on the border.

Worth as is on Ebay?

I sold Amazon put today for 4 times what I paid for it a month ago.

Bass made a fortune in CDS on subprime mortgages. So far he’s tried a other similar bets on Japanese and European debt crises without much success. He got crucified shorting the yuan in 2017. His hedge fund performs miserably.

I don’t know how he plans to unload the nickels. But if you can’t melt US currency why is there a market for junk silver based on melt value?

It is illegal in the US to melt down US coins, but not in other countries.

Silver alloy objects…get a percentage of the .999 fine price for .925. Candlesticks, flatware, jewelry, etc. I know, who’s melting colonial silver down? Probably no one, but that’s the price set to “recycle”…not the added value if sold in antiques or collectables area.

People buy junk silver as a hedge against civilizational collapse.

Sure, you can buy teeny tiny silver rounds from private mints, but after TEOTWAWKI spending them is a headache because of fakes.

Junk silver is easily recognizable — it’s US coinage with a date prior to 1965. Easily recognizable and harder to fake than coins from Billy Bob’s Mint.

In short, nobody buys junk silver expecting to melt it, or to sell it for melting into jewelry. They sell it because it’s the most well-known small-value precious metal coinage.

I had a few bags of silver half dollars sold and melted and assayed by Handy & Harmon in Connecticut back in 1981 when silver first went nuts. H & H didn’t blink an eye back then for the purchase from me.

Because junk silver is not govt coinage.

Trivia re silver: Franklin Mint is both the largest seller of silver ‘collectables’ AND the largest buyer of it for melt.

More trivia: there was a legal mint near here on VI making coins. They could have a face value but not Queen’s image.

Because govt can legally melt coins

I find this latest post by WS to actually frighten me.

I was in a 7-11 and noticed a large cup of coffee was $2.39. That struck me due to my rants about the 1929 10 cent dime being equal to this $2.39, but, what scared me was later sitting in my car and putting together the coins, in various denominations, to create this $2.39.

I wanted to see what it looked and felt like.

A handful of metal for a cup of coffee. That got me to thinking. Hmmm. In 1964 people started taking the old dimes out of circulation. Is it time to take nickels, quarters, out due to the Nickle prices?

Is inflation, and our “Roman Style’ debasement of our coins, so bad that we now need to consider nickels, today, equivalent to the silver dimes of 1964?

This is madness. I remember visiting a country in my youth were the “change” was not coin. It was paper. Like a 5 cent paper note rather than the nickel coin we are familiar with.

That is the future? Metal, copper, and nickel and zinc won’t be used for coin? We will have paper notes for that?

This is scary. So, I, being a nut-job, have told the family: All change must be emptied out at night and put into the empty 5 gal water jug. Now it’s time to hoard nickels.

“The problem with socialism is that you eventually run out of other people’s money.” ― Margaret Thatcher

This also apply for empires.

Policing world is not cheap.

Rentiers may also in the end run out of other peoples money…

That line was STOLEN from Alexander Dumas;

When asked what BUSINESS was he said, “Business? It’s simple. It’s other people’s money”.

He was a successful business man and easily an 0.01 per center of his time, among other things.

I get VERY tired of pointing out Thatcher’s rip-off of his line, and all the BAD things that began when she and Reagan “did their thing in 1980….not the least of which was deficit spending. Many charts, S&P, incarcerated Americans, and even Wolf’s income and wealth inequality charts really took off then.

What was so good about that?

I also hate constantly pointing out that that there is NO NOBEL PRIZE FOR ECONOMICS. Nobel family hates it but can do nothing, so far.

It bolsters the credibility of those with definite agendas, best example of which is the contrived “Chicago School of Economics” that produced Milty Friedman who gave fake Nobel credibility to “SUPPLY SIDE” Econ…lapped up by Reagan and Thatcher’s masters (who started the Chicago School, anyway)

AKA….

TRICKLE DOWN.

Sams,

Rentiers DID run out of money in the GFC….but the game since Reagan is to dump any business screw-up cost on the government, which is really a lot of what this site is all about.

Not FN investment tips for the 90% and UP.

Clad dimes and quarters (those since 1965) are mostly copper.

Under your scenario, assuming coinage continues to circulate at all. coin denominations will be larger, not made out of paper.

That’s what’s happened elsewhere with high inflation.

I don’t remember the country, it may have been France, but while there, I noticed the lightness and cheapness of the coin. (It might have been the Italian Lire coin…sometime in the late 50’s early 60″s? Made of Aluminum?).

Even at that young age, I remember looking at it and bouncing it around thinking something is wrong. Something is not right. Now I know.

Large coffee for $2.39? Around here a small coffee goes for $2.79. You have a bargain there fella.

Anthony,

Our local Wallyworld has a McDonalds on site. A small cup of coffee (far superior to 7-11 dishwater) is $1.00 with free refills…80 cents if you are over 60 and ask for a senior coffee.

Congrats on discovering Grasham’s law. Well done.

I just looked it up – apparently it’s Gresham’s law, with an ‘e’, not with an ‘a’

Digital money

When bananas go bananas…we will know we are deep in trouble.

Yes we Have No Bananas.

But unobtainium futures look good

Because every fking aspect of Western capitalism is leveraged, producers are long physical delivery and short futures to hedge prices.

Well, commodities are getting Gamestopped.

Even Putin’s gone WTF-Gamestop. Everybody’s grasping at chips with white knuckles. And brass knuckles.

That’s the problem with unregulated and undirected capitalism….it requires a LOT of growth merely for growth’s sake……

Which everyone knows is also the “ideology” of a cancer cell.

All you wealthy “investors” should also note that a poor person with NO money to invest has only ONE choice, INVEST IN FAMILY……and forcing that on them obviously does not help the overall situation at all.

CONSTITUTIONAL MAXIMUM NET WEALTH, and an IRS that is part of the military and operates bounty hunter style. Think Special Ops air dropped on secretive and uncooperative banks.

The military has all the power, anyway, along with some of the intelligence agencies. Trust me, I have a lot of relatives in their employ as a result of a powerful lobbyist uncle’s “connections”…..yeah, “the swamp”.

I forgot to mention some that are just rich and contribute to corporate lobbyists, or just PACs, visible or not.

But these folks mostly just get law written, which in general means nothing to the military, they have their OWN LAW.

The rest is just a crazy dog and pony show and a bunch of WORDS and -ISMS.

Lincoln was right, all the money in the hands of a few does not make for a stable country.

Somebody please take away NBay’s crackpipe.

Legitimate hedge…..deliver. If you can get into delivery position.

This guy Rowen gets it. It’s not that “crazy” speculators were shorting, though I’m sure a few were. It’s that metals companies guarantee their operations will be profitable by locking in prices for a few years down the road.

But now suddenly their russian supply is cut off. That leaves them with a naked short position. Which puts you out of business if the price moves too far too fast. The big investment banks make large investments financing this just to tie up the commoditiy and control the markets.

NASDAQ taken out today and shot (-3.61 %).

We didn’t quite make it out of WTF-land.

It might be another leg of that, if a tipping point is reached in various punters’ accounts.

The first adventure of Powell in the book Trillion Dollar triage is him bailing out depositors in a failing New England bank who held accounts above the insurance amount. I.e., the rich, who took the haircut risk but got bailed out anyway. Insiders first! Now: it’s a new chin-check! I don’t think there’s enough air-money in the barn to do it globally in THIS rodeo. It isn’t 2008.

Despite everything.

The Nasdaq is still green from a year ago.

2banana

But the WHINING is unrelenting…..

Barely

CAPE ratio for the USA is still north of 34 (astronomically ridiculously high historically) as of today at market close.

So still a long long long ways down to go before ‘normality’ is reached..

No kidding.

NASDAQ was hardly “shot” today. This percentage decline in the S&P or Dow might make the top 100 but not particularly high on the list.

The S&P dividend yield (using SPY ETF as a proxy) closed today at 1.36% and this is after a 12% decline.

That’s about the same as the March 2000 dot.com peak.

Let that sink in.

To my knowledge, the only lower dividend yield in history anywhere was Japan in 1989 but that one was localized, of much shorter duration, and despite the ridiculous overvaluation, didn’t have anywhere near as many exorbitantly overpriced individual stocks with large market caps.

Just remember the FEDERAL RESERVE ….

FORCED INVESTORS TO TAKE MORE RISK….as admitted in “The Power of the Federal Reserve” documentary (PBS) and mentioned in the book “Lords of Easy Money.”

When they pounded down the long end with that intention, they also abrogated their THIRD UNMENTIONED mandate…”promote moderate long term interest rates.” (hence the “dual mandate” game”) (1977 Federal Reserve Act)

The wisdom of that mandate was to PREVENT just what they did, and they slipped the duty, ignored the rules.

When they FORCED (Fisher’s word) the investor to take more risk, the Fed altered, on their own….reasonable risk/return calculations and Price to Earnings ratios.

Remember this.

The Federal Reserve has also been infected by manic psychology. FOMC members don’t exist and operate independently of society.

That’s what led them to bail out LTCM in 1997, lower FFR to 1% in response to the dot.com bubble, implement QE and ZIRP in response to the GFC, and then throwing the “kitchen sink” in response to COVID.

Regardless, the “reason” doesn’t matter. The end result is going to be the same where most Americans are going to end up poorer or a lot poorer.

Those who attempted to speculate due to TINA will often and maybe usually find they will be worse off than if they had stayed out of the stock market entirely.

From one manufactured crisis to another.

I’d rather own nickel than an NFT right now.

I can sell you a NFT of a nickel for $50,000.

I’d rather own A nickel than an NFT.

I’m waiting for the real price discovery on the true metal ;)

If commodities are still spiking we have a long time before that trickles through to the regular economy. Could be at least 1 more year of not transitory higher than 2x the fed target inflation.

Time to hoard bananas 🍌🍌🍌

Now that is funny.

We should only make Green EV batteries only if they are recyclable.

And the cost of recycling should be added to the price of the battery.

They are. And an industry is starting to build up around it. For now, there are just not a lot of 8-yaer-old or 10-year-old EV batteries around to be recycled.

Loved my Leaf! Looking forward some day to switch from my Rav4 Hybrid to a full on EV. We need to get recycling done properly.

I doubt it will work out very well for where ever we ‘produce’ and ‘recycle’ EV batteries. The pollution ‘we’ create over ‘there’ doesn’t count, right?

Yogi Berra: “A nickel ain’t worth a dime anymore.”

Well, the times they are a-changing, that’s for sure.

I used to tease the kids at my investment company…….Now…..is the time to buy!……….NA!

Except for the most long term of the long term…….Sell before its too late.

an aside-nickel as a strategic metal was in such demand for the war effort that the US minted ‘nickels’ from silver alloy in 1943. (a perhaps more interesting/puzzling aside was the German effort at introducing COUNTERFEIT nickels (they still show up occasionally, looking very worn with a ‘soapy’ feel to them) to the domestic US currency supply during WWII-one whose strategic thought process still eludes those who study the matter…).

may we all find a better day.

In 1943, pennies were made from steel instead of copper alloy.

And they had a thin coating of zinc applied so they wouldn’t rust! That’s why they looked similar to silver.

1) The “War nickels” have an approx. 35% Silver content. They can be purchased today and preppers are buying them.

2) The Nazis also counterfeited British and US paper money. Damn, I wish I could have been one of their smurfs.

Actually, the change to silver alloy nickels began mid 1942 and continued through 1945. They were produced at a loss during the war years, but we had a couple billion ounces in reserve from excess purchases after using silver for coinage until 1964.

Panama-thanks for the deeper dive…

may we all find a better day.

Silver nickels have a large mintmark on the reverse above the dome of Monticello. Occasionally found in circulation. Like 40% silver JFK halves, they don’t sell very well, compared to 90% and Morgan or Peace dollars. I found several dozen in roll-hunting through some 370 rolls of nickels, before the bank cut me off. There were wartime nickels struck in the “normal” cupronickel alloy in error, like the rare copper wartime pennies that were supposed to be steel. Valuable and collectible today. Hennig counterfeit nickels are highly sought by collectors. That millionaire stash weighs 100,000 kilos, 25k nickel and 75k copper, presenting a formidable storage chore. If my math is correct. A collector i know has over 600,000 wheat straw Lincoln pennies in a barrel in his machine shop, it’s a disease. Silver’s not a monetary metal in the US anymore, so legal to melt, not much point in doing so tho. In 1853, Congress acted to reduce the amount of silver in the coinage when it’s melt value exceeded it’s face value, to prevent hoarding/export and encourage circulation and domestic use. Until 1857, foreign money such as Spanish 8-reales were legal tender in the US. This interfered with the seigniorage of the government, and as soon as hard money that was acceptable to foreign creditors was being minted here, it became the only approved money acceptable for domestic use too, choking development in cash-poor rural and frontier areas. Circulating Nickel production in 2016: 1546.56M. 2017: 1373.28M. 2018: 1256.4M. 2019: 1094.89M. 2020: 836.16M.the trend is my friend. Nickel should be demonetized soon at these prices.

rick m-thanks to you to, as well, illustrating, again, that human nature seemingly can’t resist the debasement of anything…(in the quest to acquire more of that which can be debased…).

may we all find a better day.

The futures market is the least of the problems for commodities. The big problem is the underlying (real) physical market. That is when countries and economies start fighting over limited supplies of wheat, nickel, oil, aluminum, etc….The poor countries will lose. They say the US is trying to “open up” Venezuelan crude…..or do they just want to get rid of sanctions so they can take Venezuelan crude away from the regular poorer customers in the Caribbean, Central and South America? It’s going to get nasty out there.

Exactly. This is why the futures markets are going insane. We have a world demand of 100 million barrels of oil per day. You subtract Russia’s 10 million. Now you have a bidding war where 10% can’t get any. The price will rise until 10% of people/businesses have to drop out of the auction. Poor people get hit the hardest. The people who make $12 an hour (before tax!) aren’t going to pay $5 to drive to work.

Now repeat that for metals and maybe even wheat and fertilizer. I doubt gov’ts have a clue about this. It’s all just oops, and who can I blame to save myself come election time.

Well, the war over natural resources may have started. Or the control of these resources. The war in Syria was by some dubbed the great pipeline war. A war about who that should control future pipelines from the gas fields in the Persian Gulf to Europe. Now, the war did not work out as expected to some participants, so no pipelines are constructed for now.

I have seen the war in Ukraine dubbed as the second pipeline war. Some of the gas pipelines from Russia to Europe go there.

Ukraine has some gas resources themselves and is one of the large exporters of corn and wheat. Could it be that the war is also about the control of these resources?

Lithium is up 600% YOY so good luck on EV cars being the answer over petro if market speculators have anything to do with it. Nickel Metal Hydride Batteries will get the hit on cost now.

Commodities are starting to look like last year’s stock market. Should have sold Amazon, buy nickel. Should have sold Tesla, buy wheat. But Starbucks? Just stick with real coffee, the commodity is up 75% YOY.

The engineered inflation is forcing China to change its export model.

Russia threatening to cut off Nord Stream *one* tonight according to UK newspapers.

Is that the only means of NG supply to Germany, or there other pipelines? Are any of the other European NG supply lines available to Germany?

There are other pipelines to Europe. There are LNG terminals. There are coal terminals. There is a bit of NG left in the North Sea. 22% of Europe’s energy comes from NG. Russia supplies 40% of their NG.

Russia may export nickel to China or one of the other nations freely trading with Russia. Lithium is in short supply, but the chip shortage restricts EV production. Teslas 3’s are back ordered; a 6-12 month wait as of 12/29/21.

So what are the odds that the largest two exporters of coal and nickel going offline at the same time, as both commodities are critical to Europe diversify from Russian energy?

“Why is anyone still short these metals?”

It’s a lottery ticket on the chance that Putin takes the Mussolini express… and ends dangling from a lamp post. There are billions of people around the world wishing it would happen.

Thanks for your down-to-earth take on this. I’m quite relieved to see that not everybody is taken in by the propaganda machine.

The London Metal Exchange has introduced **emergency measures** in the aluminium, cobalt, lead, nickel, tin and zinc markets. Among them, the LME has set limits on the nearest-term spreads and…..

“allowances for holders of some short positions to avoid delivery of metal”

I wonder who that might be?

An exchange that doesn’t require physical delivery is an exchange that can’t deliver the metals….what a scam changing the rules halfway through the game.

Capital controls to protect the criminals in their failed Ponzi.

What a joke.

Nothing to see here , carry on Market operating as markets supposed to operate!!

HAHAHAHA

we’re Not allowing the deliveries of your physical metals “ well because we don’t have them you Mugs “ !!

Now what can you do about it?

Call the Regulator if you IS NOT HAPPY!

We don’t give a rat’s arse.

That’s the Fiddler’s newly invented capitalism for you, once they start losing , CUE TANTRUMS ( we are Not playing this game anymore).

Spare a thought for the market participants who’re losing a shit load of profit due to LME TANTRUM CENTRAL!!!

Only a year or so ago we were looking at WTF charts of Fed balance sheets, money supply and stock prices. Now we’re looking at WTF charts of consumer and commodity price inflation.

Just a coincidence, I’m sure.

If the Fed WANTED TO promote inflation, would they have done anything different?

QE

Record low rates

Giant balance sheet holdings

Massive jump in the money supply

Lending money to the mortgage industry well below the inflation rate

Then Powell points to “bottlenecks” as the cause. Come on man!

The “get me all you can at that price” caused the bottlenecks. Everyone seemed to have seen inflation coming except the “experts”.

As Thomas Sowell said…..”What is more idiotic than to place critical decision making in the hands of those who pay no consequence for being wrong?”

And as I say, “In a system that boasts of “checks and balances”, who checks the Fed?”

Nickel rock resources

Only a 10 million market cap

NICL on Canadian exchange

And NIKLF on USA otc exchange

Zinc acting up tonight

Russia is also the fourth biggest producer of silver and third biggest producer of gold.

Soon expecting news about hedge fund blow ups

Not a hedge fund though…

https://wolfstreet.com/2022/03/08/nickel-futures-spike-ridiculously-trading-halted-in-short-squeeze-on-chinese-tycoon-facing-billions-in-losses/

No worries, it’s transitory like all the other commodities up 30-100% in the last year.