Two elephants in retail: A historic spike in prices of goods and seasonal adjustments as the Pandemic upended seasonality.

By Wolf Richter for WOLF STREET.

The two big elephants in retail sales over the past 12 months, and particularly this January, were horrendously spiking retail prices of goods and seasonal adjustments when the pandemic upended normal seasonality. A month ago, these seasonal adjustments caused December retail sales to drop sharply, amid a lot of hand-wringing about the health of the consumer. But not-seasonally adjusted retail sales, as I pointed out at the time, spiked to high heaven, testifying to the will of consumers to spend money like a drunken sailor.

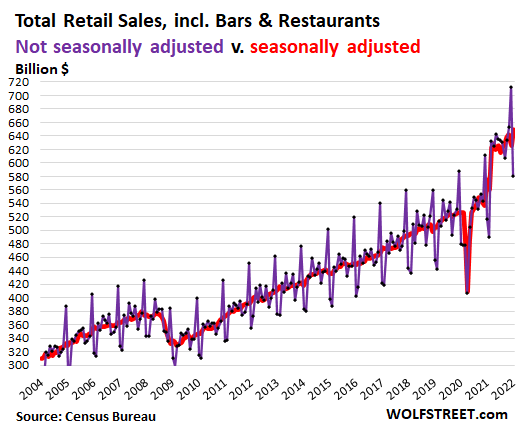

In January, retail sales always plunge after the holiday binge, in part because people return the stuff, and returns count as negative sales. And in January 2022, not-seasonally-adjusted retail sales plunged by 18.5% from December, to $581 billion, according to the Census Bureau today. But this plunge was smaller than the past 11 Januaries that averaged 20.4%.

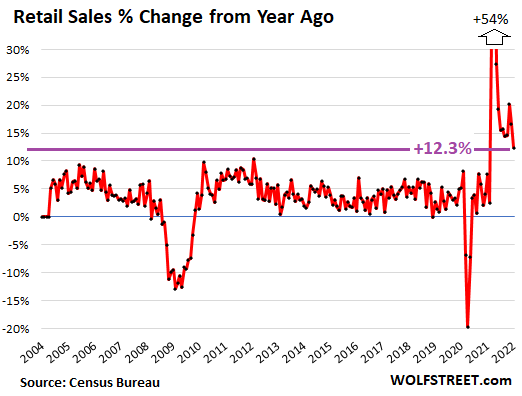

Compared to January 2021, which eliminates seasonal issues, retail sales jumped by 12.3%. In December, retail sales had jumped by 16.6% year-over-year. Every month since March 2020, retail sales jumped by the double digits. These are huge and unprecedented year-over-year increases:

Seasonally adjusted, retail sales jumped 3.8% in January from December, to $650 billion, after having dropped 2.5% in December (red line).

Not seasonally adjusted, sales dropped 18.5% in January to $581 billion (purple line), but that was a smaller drop than in most prior Januaries. Compared to January 2021, sales were up by 12.3%, and compared to January 2020, by 21%! Note the seasonal regularity in pre-pandemic years, and how the pandemic has upended that pattern – and shifted it higher:

How much of the 12.3% jump in sales year-over-year was due to price increases?

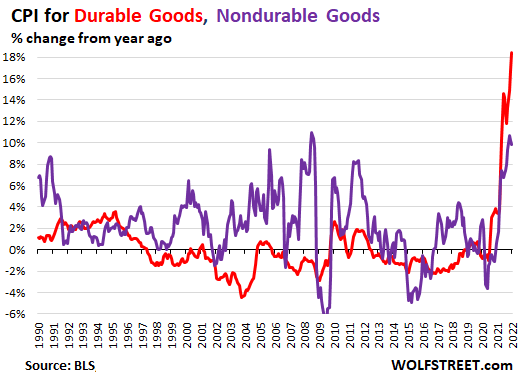

Retail sales are sales of goods. Services, such as haircuts, insurance, transportation services such as plane tickets, rents, etc. are not included in retail sales. Products that retailers sell can be grouped into two categories: durable goods (vehicles, auto parts, appliances, building materials, electronics, etc.) and nondurable goods (mostly stuff bought at the supermarkets and at gas stations). And inflation has been spiking ridiculously in both durable goods and nondurable goods.

Durable goods CPI in January spiked 18.4%, highest on record going back to the 1950s (red line). These are the price changes that inflate retail sales at auto dealers, ecommerce operations, home improvement stores, etc.

Nondurable goods CPI spiked by 9.8% in January (purple line). These are the price changes that inflate sales at gas stations and at stores that sell food, beverages, and household supplies:

New & Used Vehicle and Parts Dealers: Spiking prices hide decline in unit sales.

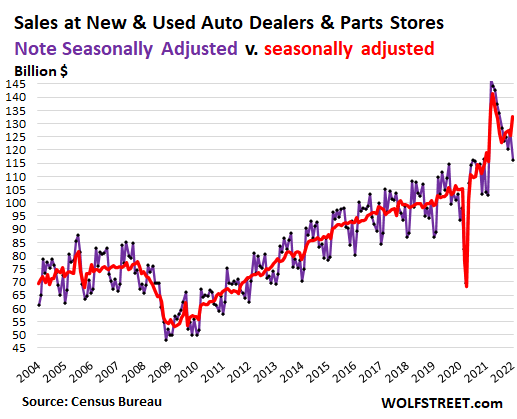

Sales at new and used vehicle and parts dealers, on a seasonally adjusted basis, rose 5.7% in January from December, to $133 billion. Not seasonally adjusted, sales fell 8.9% for the month to $116 billion. This is the largest retailer category, normally accounting for over 20% of total retail sales.

Compared to January last year, sales were up by 11.4%, and compared to January 2020, by 24.4%. These are huge year-over-year sales gains, where the spike in prices and the shift to higher-end models overcame the plunge in unit sales, caused by the collapse in inventories of new vehicles due to the semiconductor shortage:

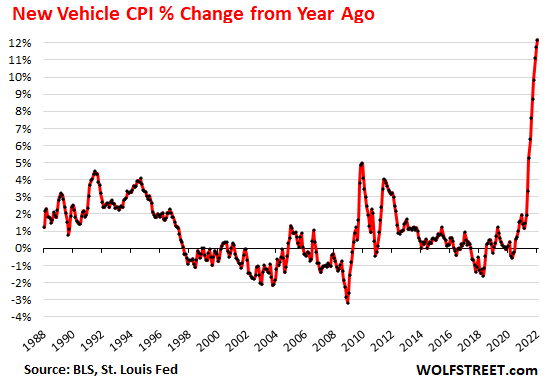

But crazy price spikes covered up plunge in unit sales: New vehicle prices spiked by 12.2% in January year over year, according to the CPI for new vehicles:

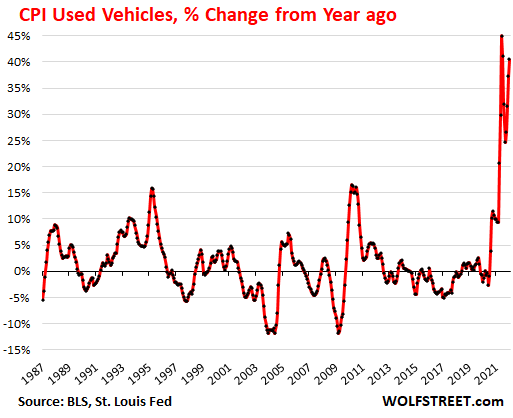

Used vehicle prices spiked by 40.5% year-over-year, according to the used vehicle CPI:

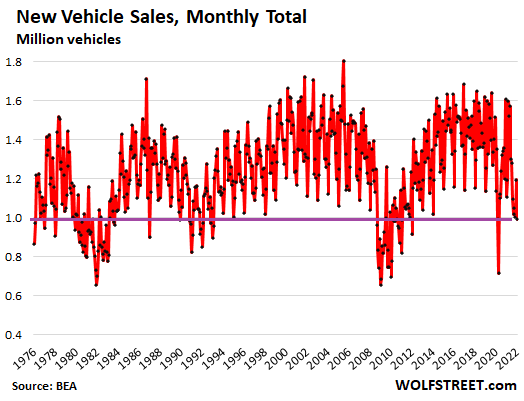

But the number of new vehicles delivered to end users plunged by 10.4% from January 2021, and by 11.1% from January 2020, to 991,200 new cars and trucks, amid widespread shortages leading to above-MSRP prices at new-vehicle dealers. This was toward the bottom of the four-decade range:

The other retail categories in order of sales volume.

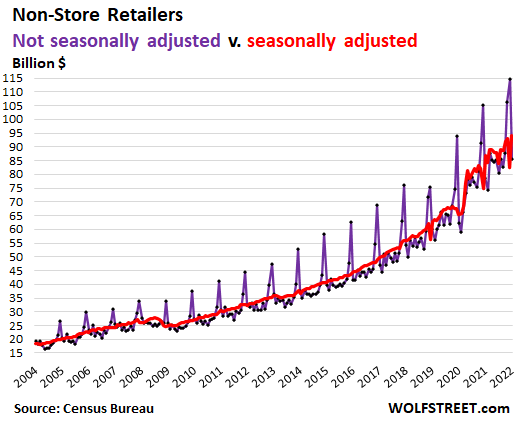

Sales at ecommerce and other “nonstore retailers” jumped 14.5% in January from December, to $94 billion seasonally adjusted.

Not seasonally adjusted, sales plunged 25.4% to $86 billion. January is the month of returns, and returns are booked as negative sales, but it happens every January, and so seasonal adjustments try to iron them out. Year-over-year, sales were up 8.9%, and compared to two years ago, sales were up 38%.

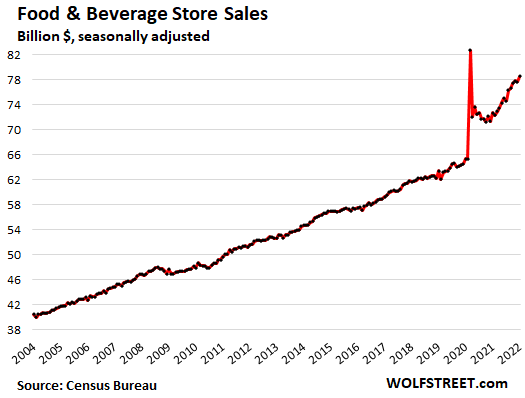

Food and Beverage Stores: sales rose 1.1% for the month, seasonally adjusted, to $79 billion. Year-over-year, sales jumped by 8.0%, nearly all of it due to higher prices, as the CPI for food-at-home jumped by 7.4%. Compared to two years ago, sales rose 20%:

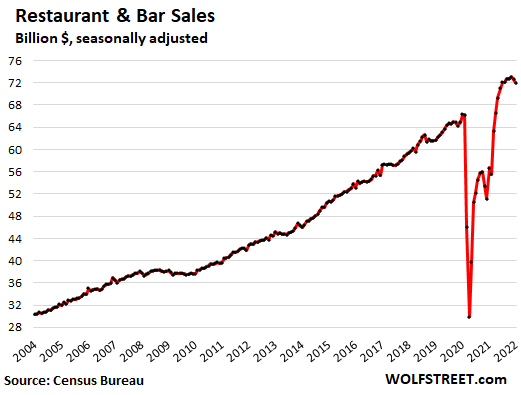

Food services and drinking places: Sales dipped 0.9% for the month seasonally adjusted, to $72 billion, the second month in a row of declines as some people pulled back from eating out due to Omicron. Year-over-year, sales were up 27%, and compared to two years ago, sales were up 8.6%, amid massive price increases: the CPI for food-away-from-home jumped by 6.4% year-over-year:

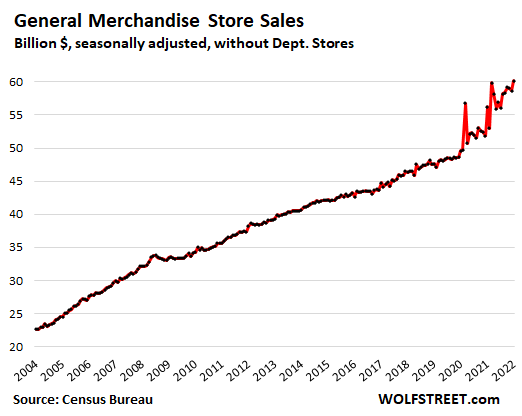

General merchandise stores: Sales jumped 2.5% for the month to $60 billion, seasonally adjusted, up 6.9% year-over-year and up 21% from two years ago. Walmart and Costco are in this category, but not department stores.

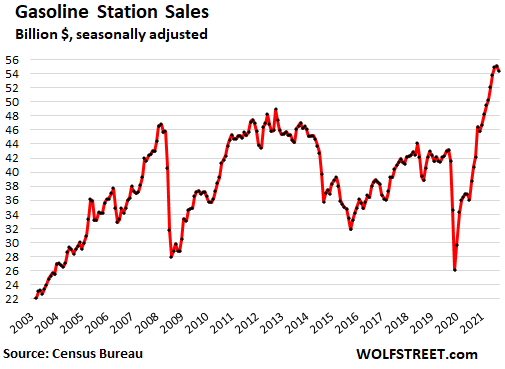

Gas stations: Sales fell 1.3% for the month, to $54 billion (seasonally adjusted), pushed down by a decline in gasoline prices from December of 0.8%. Year-over-year, sales at gas stations were up by 33%, powered by a 40% year-over-year jump in gasoline prices.

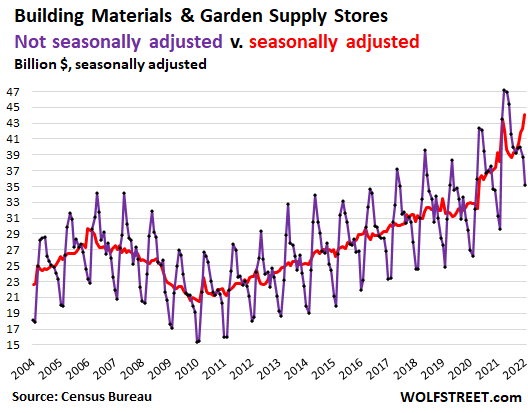

Building materials, garden supply and equipment stores: Sales rose 1.3% for the month, to a record $44 billion seasonally adjusted, up 12.7% from January 2021, and up 30.5% from January 2020.

And just for fun, the actual sales, the not seasonally adjusted sales dropped by 9% in January from December, as they usually do, with Januaries and Februaries marking the seasonal trough (purple):

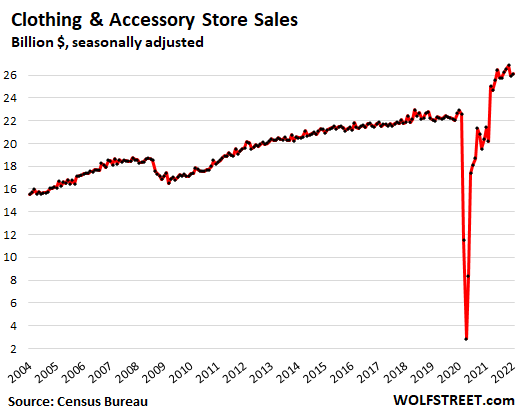

Clothing and accessory stores: Sales rose 0.7% for the month, to $26 billion, seasonally adjusted, up 22% year-over-year, and up 14% from two years ago:

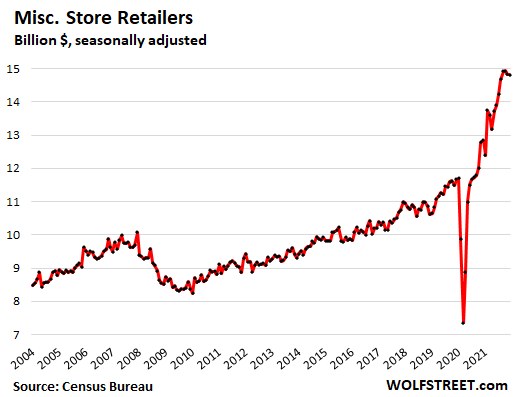

Miscellaneous store retailers, which include cannabis stores: Sales dipped 0.1% for the month from a record, to 14.8 billion (seasonally adjusted), up 15% from a year ago, and up 27% from two years ago. This category includes specialty stores for cannabis products, beer brewing supplies, telescopes, art supplies, etc.

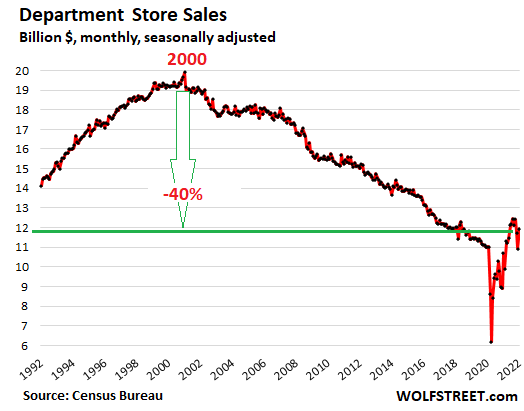

Department stores: sales jumped 9% for the month, after having plunged 7.0% in December and 6% in November, to $10.9 billion (seasonally adjusted). Compared to January 2021, sales were up 11% and compared to January 2020, sales were up 8%. Alas, sales are down 40% from the peak in the year 2000.

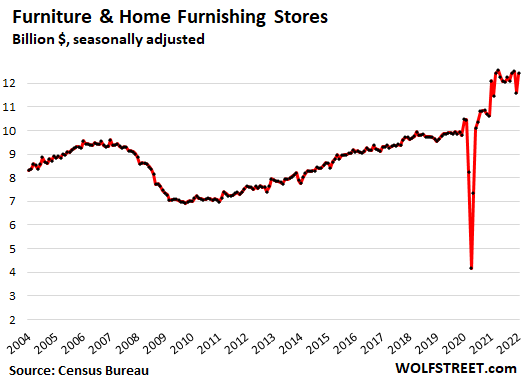

Furniture and home furnishing stores: Sales rose 7.2% for the month, to $12.4 billion (seasonally adjusted), up 2.7% year-over-year, and 19% over two years:

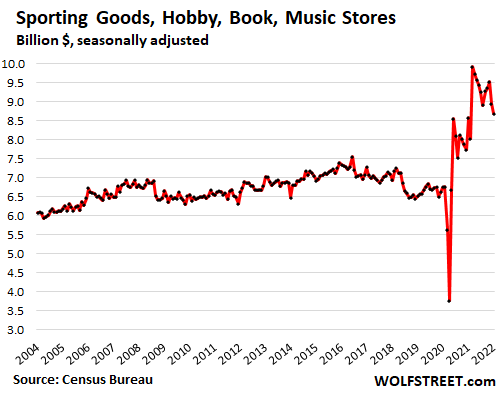

Sporting goods, hobby, book and music stores: Sales fell 3.0% for the month, to $8.7 billion (seasonally adjusted), but were still up 1.3% year-over-year, and 28% over two years:

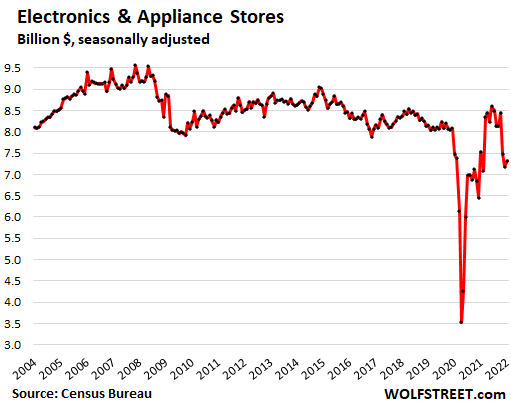

Electronics and appliance stores: Sales rose 1.9% for the month, to $7.3 billion, down 3% from a year ago, and down 2% from two years ago. Consumer electronics and appliance sales are vast, but much of it is sold online and at other retailers, such as Costco, Walmart, and Home Depot, with specialty brick-and-mortar stores, such as Best Buy’s stores, on their way out.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Leave drunken sailors alone.

They spend cash, have a good time, tip well, do some singing and return to the ship broke.

But with zero debt.

And they sure don’t spend other people’s money.

LOL.

life is the art of imagining that reality is a world that doesn’t exist.

Debt is the vehicle.

Propelled by hope, a roll of the die.

If I could bank “hope” I’d be richer than Musk…

True that!

And not worrying about debt allows easier access to the fantasy

It’s a tough act to follow

Seasonally adjusted reality

Who could have guessed that drunken sailors would ever be paragons of virtue when compared to peers in polite society? My, how times have changed.

I’ve spent some of the best years of my life being a drunken sailor. I prefer calm inlets to the open ocean…

OutWest,

I still can’t figure out what to do with drunken sailors. Especially early in the morning.

Plan for a Brunch?

“I still can’t figure out what to do with drunken sailors. Especially early in the morning.”

Do drunken Marines count? The real enemy: “Shore Patrol”…

Thanks for the support! I’m a sailor. In fact, I’m on a ship now in the South China Sea repairing an undersea cable. It’s true, when sailors get drunk they usually PAY CASH and don’t go into debt like the federal government. Sailors also are also on the gold standard. The reason many traditional sailors have a gold ear ring is in the event of a disaster at sea, if their body washes up on a beach, the gold ear ring is payment for someone to bury the sailor. Sailors know that a gold ring would pay for a burial 500 years ago and would pay for a burial today.

Free money handouts are mostly done. Now comes the reckoning. Liquor store sales are down ~30%. Time to get your home security setups in order.

The hot consumer good of the moment among the guys in and around my shop are shield kits you install on your vehicle to protect the catalytic converter from thieves. I expect such things will be a growing part of the consumer goods mix.

Liquor store sales are down because I cut back on my drinking. Don’t worry – it’s a Chipotle Moment. As soon as I can lie on the floor without holding on I’ll be back doing my own version of God’s work – provided your God is Bacchus.

And buy a bigger dog…

I once had my house broken into…the idiots were such lowlifes, that they actually stole and carried 2 cases of 24 cans of soda to drink with the liquor they stole.

Yes they were caught the next day.

Wolf,

Thank you. I am with you on preferring to look at actual numbers; like $581 billion spent on retail sales in December 2021 versus “Seasonally Adjusted” $650 billion.

Question: How much did consumers spend on retail buying in December?

Answer: $581 billion.

See how easy it is?

My brain is not programmed to be seasonally adjusted; it works on what data it has.

Example:

It’s a nice day today in Minneapolis, “Seasonally Adjusted.”

Actually, it’s mid-February today in Minneapolis.

Good one DR!!

It’s a nice day in the saintly part of the TPA bay area too,,, not seasonally adjusted, the temp hit 80 degrees F this afternoon, briefly,,, followed by, we can hope, a cooling off to the ”average” this evening of a low of 60…

These charts really do make me want to elect THE Wolf as chair or something of at least the Council of Economic Advisors,,, WOWZA!!!

Dan Romig,

The month is January. The first paragraph was kind of confusing because it also referred to December, where the opposite had happened. I have now cleaned this up a little to avoid that confusion.

OK,

Like I said, “My brain is not programmed.” Usually, it works.

It was working. There’s an old programmer term for what happened. You were “looping”.

Dan

I prefer to look at numbers also. The Federal Reserve bequeathed 4.5T $ to 100 richest people in the world in order to combat the corona virus. Oh my.

The military budget is 1T $ per year. They’re giving it away just to get rid of it.

The most interesting thing about economic numbers is that no one, except Wolf, pays any attention to the larceny that is being committed right in front of us. Our savings are being stolen while we pretend that there is a competitive economy.

585B $ is chump change.

The Federal Reserve is the internal lobbying group for the banking industry. The military is the lobbying group for the MIC. The FCC is the internal lobbying group for the internet and phone oligopolies.

Everyone is allowed to organize except labor says the Supreme Court, internal lobbyist for the United States Chamber of Commies,

Fools earn their place. Heroes earn it back.

Love is discriminitating.

Wisconsin’s favorite son, Joseph McCarthy would have a field day rooting out communists among the American executive cohort that replaced the center of American manufacturing prowess to China.

The soulless got their way. And now we are expected too adapt and not resist.

Why not Moscow. Not allowed.

dang that’s a good one !!

Only item of importance you left out is that the USA ( and certainly others ) ”military” is, in fact, the ultimate foundation of the overwhelming ”force” that keeps WE the PEONs in our place(s).

At this point for many of us the money is just theoretical digital numbers, while the threat and reality of violence is right in our face each and every day.

dang

don’t forget the FDA CDC and the drug industry

Retail sales because wages are moving up rapidly, especially for degree holders and skilled labor.

Housing is getting hotter and hotter … the 4.0% conforming and 3.5% jumbo have done nothing to slow down the market. Folks, we are seeing historic demand right now.

Now, if the Ukraine situation would settle down, the equity markets will start grinding higher again. 4 or 5 25bps rate hikes are not a problem for this economy, especially since the fed will let some securities roll off their books.

The fed will not start selling securities, nor will they let all securities roll off their books. That is a political fact.

The Fed CANNOT let “all” securities roll off because it must have enough assets to balance its liabilities (mostly currency in circulation and reserves). The reverse repos, also a liability, will vanish when it starts QT and the reserves will shrink, but currency in circulation will continue to grow, and that’s already over $2 trillion.

The Fed threatens to open a can of whoop ass on inflation, eventually, while they top off the wall street punch bowl, worrying that they may puncture the asset balloon before their client banks are positioned to prosper.

What makes you so sure that reverse repos will vanish. A shiny quarter vintage 2022 is what I would wager those reverse repos are here to stay and be tapped 3x during the next years of attempting to right the US financial system

That’s what happened last time too, 2017-2019. It’s logical.

If the Fed unwinds its balance sheet by $1.5 trillion, the most useless excess $1.5 trillion in cash will disappear first, which is now stored in reverse repos, earning 0.05%. Reserves come somewhat in parallel but will be slower in coming off. Once the RRPs are gone, the reserves will decline faster. Reserves pay 0.15%. This is exactly how it happened in 2017-2019 until the repo market blew up. These are the two liabilities accounts at the Fed where the excess cash in the market and banking system gets stored. And that’s what you will see shrinking first.

lol. it’s lawrence yun again.

This guy makes Lawrence Yun look sober.

Demand is always booming when you think you’re the penultimate greater fool.

Have you been reading this site lately? Spending is declining adjusted for price changes, not increasing. Median incomes declined last year, adjusted for price changes.

“Real” median income and household net worth have flatlined since the late 90’s by the government’s own data. This is with a fake economy and the biggest asset mania in history. Most people (including “middle class”) are either treading water financially or becoming worse off since 2000.

The only reason I can see why you continually write posts contrary to what most people experience is because you live in a “bubble world” where your peer group is in a similar situation to you. Everything is great for you, so it must be good or great for most.

The actual US fundamentals (economic and societal) are mediocre to awful, depending upon the time horizon someone uses.

A crack-up boom (what we have now) doesn’t change it because it’s fake.

This economy has been kept afloat by government defect spending for 10 years. Subtract out the deficit and there is no GDP growth at all.

Just saw the stats that the average new mortgage amount 25 years ago was a little over $100,000 and now it’s over $400,000. Fed has helped facilitate turning USA into an over indebted no growth financially and politically unstable country.

We are in a slow period in real estate markets, there is still very little supply and yes, fools who believe that because housing prices shot up, they will continue to buy for a while.

This mess is going to unfold over a longer time period than the 2008 crash, because the source of this mess is government debt. The big difference is that high inflation prevents the government from using the old playbook – they cant just move to QE.

5 percent mortgage rates will slow demand, and then inventories will build.

You really believe wages are rising???

SocalJim

The housing market is completely distorted by the rampant speculation and purchase of second and third homes, and by investors and foreign buyers scooping the remaining properties for all cash and renting them out. The 1st time home buyers are getting crushed by all of this and will no longer be homeowners. To portray this as a hot housing market like you realtors always do is missing the big picture.

So nominal retail sales boomed last year, but what is the increase net of price changes? I see the data above in car sales, I guess we can adjust it by the CPI, which would still show a healthy “real” increase.

Questions:

1. If we accept this as real growth, is it sustainable?

2. Is it real? CPI uses methodologies that seem to skew lower the true increase in prices.

Please read the part about durable goods and nondurable goods inflation. All retail sales are either durable goods or nondurable goods.

Of course, Wolf has illuminated the path to riches.

For those of you who bought SRTY below 50, please note the Russell 2000 recent highs: 2/9/2022 2103.80 & 2/15/2022 2086.10, which is lower.

Agrees consumers spent like drunken sailors,but now free handouts are over sure hope they don’t return to a sinking ship

1) Great charts. Thanks. We must be in 1982. There are no sign of recession. SPX sag to refueled the tank. This 14Y bull market have 5 more years to run. This correction is almost over.

2) People are depressed and confused. Buy the “dip” next week.

3) Options, for entertainment only : SPX might form a RS1 under the daily cloud, and RS2 above a flatbed cloud.

4) This double hump H&S might start a deeper correction.

5) SPX might jolt straight up to 5K in short covering.

6) The dbl hump H&S might be a failed H&S. F is A.

Confusing

For a brief moment there, I thought he was referring to a double hump camel! Then I woke up!

I’ll take the “under” on five more years.

I also agree. I will take the under on five more years as well.

Not even close to 82. PE of the SPX in 82 was 8 compared to 30 X now. Stox, currently, are sporting a duration of 50 years.

Got me at #6.

My curiosity to understand it is subordinate to my contentment at reading it as gibberish.

“might,” “might be”

Might be an double pirouette of DNA angels formation. Or its inverse. Yeah right.

ME, I enjoy your stuff sometimes. Sometimes, to my tin ears, it is indistinguishable from fancy noise. Maybe your programmer needs to tweak you a bit!

I heard nothing other than JP Morgan’s “they will fluctuate.” Actually, less than that: more noise.

ME recently states explicitly that his musings are for entertainment only p leap!!!

Taken in that vein, I have found them vastly amusing, at times;;; other times just a tad bit too obscure with the head and shoulders and other such arcane now vintage dicta.

“This 14Y bull market have 5 more years to run. ”

The FED will be ending its accommodation. That is the end of the drug infused stock market. The consumer is being eaten alive by inflation as shown by our kind host. Consumer sentiment does not support your thesis.

So if demand is steady, and prices are up, so total spending is up, that must mean the suppliers aren’t supplying to take up the slack?

Or where’s all the competition that normally drives prices down?

Wonder why that’s not happening if there’s clearly money to made?

Of all the initials you could have chosen….

Ha !

I thought it WAS you so you could argue with yourself :)

where’s all the competition that normally drives prices down?

Algos can undercut each other or instead (I speculate), maybe price-fix, in a sense, float prices along within narrow (elevated) ranges? A nod and a wink to one”s competitors without overt price-fixing (which is illegal) would keep everybody in those elevated ranges? Would be easy to set that electronically. Anyway you can only cut margins so much if your inputs are dancing upward. But a background of oligopoly would make whatever degrees of gaming it that easier. Maybe correlates with lobbying $ flowing to that other DC?

If everybody has a passive index mutual fund/ETF, the point is to maximally hoover up cash to the whole matrix from the plebes.

Make the whole national government an insurance policy/put for home and stock ownership. That’ll work, until it doesn’t. Dribble out enough for the working class to recycle the cash into the hoovering mechanism? A few of my favorite things.

In the long run, we’re all dead. Thank you, Lord Keynes.

If the homework brings you down, then we’ll throw it on the fire and take the car downtown. — David Bowie

good start p leap;

how some ever, it is really apparent that WE the PEONs will need to take back our individual, local, and even state powers from the federal GUV MINT, and sooner rather than later IF we want to keep any semblance of the freedoms formalized in our Constitution.

Starting with at least a couple of amendments:

1. ALL federal and all other GUV MINT employee, elected or otherwise, individual benefits to be EXACTLY THE SAME as they are for ”private” individuals: this MUST include Retirement — SS and ONLY SS and Medical — Medicare and ONLY Medicare.

2. Term Limits at each and every level of GUV MINT.

3. Public and ONLY public financing of every level of elections.

4. CONCISE and completely transparent rules for electioneering communications, including written statements from each candidate outlining their commitments to WE the PEONs.

WE have allowed a very small and very corrupt group, at many levels, to establish a very privileged GUV MINT ”special class” that is completely against both the spirit and functionality of democracy, and it needs to stop.

VVN, nice thoughts, but it will never happen.

I heard that Germans are stocking up on sausage and cheese to prepare for the Wurst-Käse scenario.

Made my day, lol

The economy is going from Baden-Baden to Wurst.

Haha oxymoron- best wurst joke.

Now I’m hungry…

Drunken Micks in seedy areas of Boston (Congress Street, Fort Point) are often heard singing the popular sea shanty “What Shall We Do with a Drunken Sailor ? ”

Suggestions are endless and often made on the go.My favorite is:

-Keelhaul him till he’s sober

To “keelhaul” means dragging the victim through the water under a ship’s keel, either across the width or from bow to stern. As the keel of a ship was often encrusted with barnacles, this punishment could leave a man almost flayed or drowned.

That’s something skipper Powell should consider ASAP 😁

Mutiny! Sedition!

I read in an article the other day by a paranoid on the edges of the internet that centered on inflation as the ultimate goal of the Fed.

This writer seemed to believe in a major conspiracy amongst world banks to weaken the political position of the global middle class. That is to make us rent slaves and to cause widespread dependence on the state for food and security using rampant inflation as the catalyst.

The sad part is, the way this is being mishandled by the Fed, a little part of me gave the article some credence.

Nah,there is no central banks conspiracy.You may visit BIS (Central Bank of Central Banks of which US Fed is just a part) website and read their white papers.

Like kittens chasing their tails,inventing new mathematical model every week,probably thinking that they rule the world…

FUBAR: Fucked up beyond all recognition.

Retail sales are so screwed up by the lack of chips…..who knows.

The big items like cars are sitting awaiting chips for delivery.

Well……at least in just 7 trading sessions the fed is out of the bond market…….really…….naw…….JP is one tricky bastard…….he has a 1.6 trillion reverse repo to unwind. There is no end to his bag of tricks…….

Middle America…….god help you. The generation of Joe DiMaggio died a long time ago and they were replaced with folks that would run their mothers over to get her estate. They have the warmth of a King cobra.

Fred F.-from personal experience, it’s long gone beyond ‘would’, they are. (Akin to a ‘…i’ll be winning the lottery…’ mindset. ‘…Bootstraps? We don’t need no stinkin’ bootstraps…’ ).

may we all find a better day.

Wolf, what fraction of retail sales are durable vs. non-durable?

So January retail sales in dollars were up 12.3% since last January.

And retail sales are x% durable and (1-x)% non-durable, for some number “x”.

So then Retail inflation is “x times 18.4%” for durables + “(1-x) times 9.8%” for non-durables.

If x = 0.3, that is if retail sales are 30% durables, then the entire 12.3% increase in retail sales is due to inflation!!! That’s the textbook definition of stagflation.

If durables are more than 30%, then inflation dominated and unit sales are in decline: inflationary recession.

Even if durables are only 10%, the inflation effect is 10.6% year over year and the 12.3% gain in dollar sales is only 1.7% after inflation. That’s weak growth… weak enough to still be called stagflation.

Bottom line: We’re either in stagflation or an inflationary recession.

I dunno, congress is buying $30 million worth of crack pipes!

Maybe we are in a crack up boom?

Good points WS… here’s a link to Non-chained Durable Goods.

https://fred.stlouisfed.org/series/PCEDG

$1988.2B

And here’s the Non-Chained Nondurable Goods.

https://fred.stlouisfed.org/series/PCEND

$3559.5B

So if I’m reading what you are saying we had 5547.7B in total sales and durables were 35.8% of that, so you are saying this is technically a inflationary recession?

WolfGoat,

Slow down, apples-and-oranges trap ahead, annualized.

The data you cited are from PCE (consumer spending), and not retail sales. And these are “seasonally adjusted annual rates,” not monthly like retail sales. So remove the seasonal adjustments for December (January hasn’t been released yet) and divide by 12, which would give you an approximation of the December figure not seasonally adjusted. Which you cannot really do.

Everything changes from December (biggest month of the year) to January (worst month of the year), including the composition of durable v. nondurable goods sales.

So this is truly an apples and kumquats trap :-]

Thanks Wolf, trying to learn this Macro-Economic stuff, and you are a wiz!

Wisdom Seeker,

I don’t know. The problem here is that this data is by type of retailer, not product. For example, “general merchandise stores” (Walmart et al) sell durable goods (TVs, furniture, etc.) and nondurable goods (food, household supplies, etc.). So the retail data doesn’t give me this distinction.

The consumer spending (PCE) data does give us that distinction, but it’s durable goods spending compared to all consumer spending, and it’s “annualized rates,” etc., so it cannot really be compared.

Wisdom Seeker,

And we will get January consumer spending (PCE) data shortly, so make sure to read my article about it, because I WILL discuss “real” spending on durable goods, nondurable goods, and services, along with “real” income, etc. One of my classic series.

But also note, that “real” consumer spending (PCE) data is not adjusted for CPI, but for a version of the PCE price index.

Throw in the differentials for demographic income groups a then you get a pile of bs that the majority are left to fight over. Right.

Yep, individuals will be able to see whether they’re getting ahead or having to cut back, and it’s going to be much harder for those who don’t have a cushion.

Meanwhile, the inflation will completely confuse the economists, who can’t measure it accurately and don’t have the tools anymore to do unit accounting to corroborate the dollar accounting.

Businesses will be able to do some unit accounting but most won’t be able to distinguish shifts in sales mix from more general trends.

We’re not just up a creek without a paddle – it’s foggy, the canoe is leaking and there’s a roaring sound in the distance…

Sales are usually measured in dollars, not units. Inflation makes a retail business look better, when it may be making less profit. A business has expenses and overhead which is affected by inflation. The automotive industry is one that uses units, but most retail is so mixed that it is hard to make meaningful measurements. When I was at J.C. Penney, the company would often tout its latest monthly sales figures (in dollars), but they were less than inflation.

Put it on the credit card

U.S. household debt increased by $1 trillion in 2021, according to the Federal Reserve Bank of New York. The biggest annual increase since 2007.

Two reasons credit debt is up:

1. Thanks to Biden-flation, stuff will be far more expensive in six months when you need it. People know this and are stocking up, to either save money, resell things or, in some cases, default on credit cards.

Better to be broke with closets full of things you need and a huge bill you are never going to pay, than to have a lower bill, pay more in the future and maybe get cut off by cc companies.

Many younger people have few compunctions about screwing credit card companies because they know they’ll never be able to buy a house, attend college or build equity in anything. Bad credit? They don’t need credit to share a house or pay cash for what they must have.

People naively believe that the credit reports are only used for granting credit. They are not. Many companies use credit reports, as part of their employment screening process, to determine if someone is suitable for employment. The reports that the reporting agencies provide employers are “dumbed” down – missing a lot of specifics – but still provide a window into the applicant’s financial behavior.

There are also “tenant credit checks” as part of the application to rent an apartment.

Or buy a car. Or get a credit card.

So, paying “cash”…. might not be as easy as they think (and many large rental companies/agents/management companies won’t accept “cash”…. and eventually they may grow up and want to live like an adult.

The biggest portion of the increase was in mortgage debt, which makes sense, having to finance the biggest increase in home prices ever.

Credit card debt still runs below 2019 levels.

“Credit card balances increased by $52 billion, the largest quarterly increase observed in the 22 year history of the data.” We sure are trying to get back to those levels!

MattyR,

Don’t drag braindead headlines into here. Your quote refers to the Q4 2021 revolving credit (such as credit cards) increase from Q3. The chart below from my article (monthly, not quarterly) shows seasonally adjusted and not-seasonally adjusted revolving credit: in December 2021, revolving credit was below where it had been in 2017 and just a tad above 2008, despite 13 years of inflation and population growth.

At least read my stuff about this, before you drag this BS into here:

https://wolfstreet.com/2022/02/07/consumers-did-their-part-borrowing-more-to-buy-much-less-what-happened-with-auto-loans-is-truly-amazing/

I appreciate the feedback Wolf. In retrospect it was a bit lazy to post a quote without any commentary or explanation. The quote was pulled directly from the Q4 NY Fed Report on Household debt. I’m sure many news outlets grabbed that as a buzzy headline. My intent was to comment on the high nominal quarterly growth in short term credit, not to imply that it was at an all time high nor suggest that it compares to housing or autos in terms of overall debt balance or growth.

Wolf-

As the Fed has both grown and evolved, especially since WWII, systemic debt has ballooned.

Is it relevant, for example, that household debt to GDP was

~ 38% in 1960

~ 49% in 1980

~ 72% in 2000

(From Debt and Deleveraging, McKinsey Institute, 2010, p. 59)

…and is around 80% now, per FRED?

I know this is ancient history in today’s economic discussion, but it seems both alarming and pertinent to the discussion about how central banking has screwed up our financial world.

“As the Fed has both grown and evolved,”

A slow expansion of powers, self authored, with a growing disdain for its mandates/directives/agreements that allow their existence.

Time for a Taylor Rule type approach.

It would seem to me to be a case of keeping up with the Joneses. Watching people around keep spending money they don’t have via credit provokes those around to also remodel, get that new vehicle, take that trip they can’t afford and beg/borrow/steal when they are hit with an unexpected cost like high wind damage to a roof, a divorce or accident. And don’t even think about what would happen if mild/medium layoffs happen

“…divorce…”

Expect a major uptick when this whole shithouse melts down.

“When poverty walks in the door, love flies out the window.”

Try divorcing in a down housing market. Last big downdraft (GFC) people got stuck living together post-happiness. Wherever love went, assets and liabilities matter then. My dumb luck was to do it is in rising market. Sorry if that seems cold. But I’m like Brer Rabbit dancing off through the briar patch, grateful for what I have (house) and what I don’t.

It’s an amazing coincidence how so many people who are (close to) broke still seem to be able to buy things I can (and do) do without.

AF-a sentiment i’ve held since around 1980…

may we all find a better day.

If you look at it in percentage-growth relative to GDP or relative to our existing debt, it’s not as bad as it was then. So … good news?

To me its a question of possible reversion-to-the-mean.

But, which “mean?”

It is unfortunate that all of my comments are being blocked. I had more spot on predictions than anyone else on this site. I called the housing years ago … single family in the suburbs. Spot on. I called the super rally on the stock market in early 2020. Spot on. I called the stock market to flatten out because of inflation … a little early but spot on. I called the supercharged spring real estate market we are seeing now. Spot on. And I also called the Ukraine situation as being the driving force behind market moves. As you can see, that is also correct. So, if your ego is so weak that you can not stand someone else who is smarter than you on market calls, then the HELL with you. You don’t deserve to even see my comments any more.

SocalJim,

BTW, FYI, just as an aside, you completely and totally and ridiculously got covid wrong. According to you in March 2020, it was supposed to be over by summer 2020, hahaha. But OK, no biggie.

You got moderated a few days ago because of your repeated war mongering, WW3 BS, and for your efforts to blame Biden for Putin’s moving 150,000 troops to the border of the Ukraine. Commenting guidelines paragraph number #4 and guideline #10:

https://wolfstreet.com/2017/10/07/finally-my-guidelines-for-commenting/

If you back off that nonsense, you’re good to go.

The sad thing is that this stupidity has helped zoom up inflation…..

Why aren’t you a billionaire yet? You’re never wrong

Realtor shill.

Wow, I got muted for merely sharing my opinions on ICE vs EVs, yet you’re allowed to blast Wolf with both barrels like this?

“All animals are equal, but some animals are more equal than others.”

I got my comment referred to as a “hissy fit” because I pointed out continual concentration in the residential real estate market, promoted by abnormal rate structure in which 30yr mortgages are 3.5% below inflation….courtesy of the Fed.

It’s better to spend time more productively than bitching online about things out of our control. Commenting is a guilty pleasure and Wolf sometimes serves as a check on overconsumption with his deletions – it may be irritating to be on the receiving end, but look at all the time he just freed up.

SoCal-in the face of such outrage you’ve apparently forgotten that you’re always free to start your very own blog.

Or, in the words of the great ‘Scoop’ Nisker of bygone KSAN days: “…if you don’t like the news, go out and make some of your own…”.

may we all find a better day.

OK, so now what are the current odds that the Fed adjusts interest rates before March 16?

Or have they already started to sell assets during this “black out period” between Jan 25 and Mar 16?

All of this spending and pent up demand is reversion to trend. The precarious economics of lockdown, stimmies, education-debt vacation, and inability to travel guided US consumers to decrease their non-housing debt in 2020. Now the consumer has room to run to get their credit card balances back up to trend, plus the cash-out refis of the past 20 months, plus the inflated paper wealth in assets are really giving consumers a moment to spend.

I think inflation may have started off as a supply side issue due to slashed purchasing forecasts by tentative companies coming out of 2020. Now, it is pretty clear that the consumer demand is there. They are buying regardless of price even for products without chips. Take for example Nike: in fiscal 19 they had a GM% of 44.7, in fiscal 21 they had a GM% of 44.8 (10bps), for the last two quarters they’ve had GM% of 46.5 (170bps) and 45.9(110bps). In North America specifically, “Gross margin increased approximately 430 basis points, primarily due to lower other costs, higher full-price ASP, reflecting lower discounts.” Why mark down your stock if the American debt slave will gladly pay full price?

Now it’s not too hard to see where this could go. Consumers will be settling down in their new 30-yr fixed at 3.15, driving their 6-yr 4WD fixed at 4.76, and paying for their new kicks months later at 18.26, happy as can be. 90 day delinquencies are bottomed out at the moment, so things must be good. Maybe this inflation is secular and the economy grows for the next decade or two and consumers stay happy.

Alternatively, their student loans resume in May and somehow their new budget just doesn’t quite work anymore. Their credit cards are maxed since they paid full price for their Nikes in January. The office reopens and boss needs them here M-Th, so they think about downsizing to a crossover. The chip shortage resulted in a dearth of used cars available, but somehow the dealer can still undercut the price on their gas guzzler. And now the Fed has hiked 8 times and all they can really afford is a new mortgage with a higher rate and the same monthly on a smaller house.

Everything will be fine except the market is in an itsybitsy little gully right now.

MattyR. Love the optimism. Great read. You paint a fairly accurate possible outlook. All is going well until something goes *pop*. Regardless if that is a job change, emergency expense, new tax bill, more inflation, re-finance at higher rates, medical procedure…etc

A friend of mine led me to the debt consoldiation and living the debt free way. However he recently admitted that he too is back on the credit card band wagon. Trip to Hawaii ($8k), new roof ($5k) and cars that have near 200k miles on them. He is earning more that ever but wife chose to stop working.

My debt all-in (house included) is less than 2 percent of my net worth. I love the sleep-well side of the eat well-sleep well equation. Have weathered a couple downdrafts without a minute of lost sleep. Lots of assets gathered while the need was not obvious, now no need to elbow through the throngs to overpay for stuff.

Who spends 8k on a trip?!?!? 😬

“Who spends $8K on a trip?”

Not hard to do. Look at the price of a Courtyard Inn in LGB, CA. March check in date $379 per night plus taxes. For a Courtyard. Not on the beach. Adjacent to the ‘hood.

Wow, this friend is probably lying. Only 5K for a new roof?

Does he live in a 300 sf home? lol

A new asphalt shingle roof around here in Texas on a 2,000 SF bungalow casts $12,000 +. Maybe he forgot the “1” in front of the “5”?

I had estimated $20k for his roof. The home is a 3/2 with a good footprint. I don’t know if we was downplaying it because of the people at the Superbowl party and not wanting to be embarrassed. He is the one who asked for me to guess how much. I suspect it was much more than $5k. The point was that he is back to spending money like a drunken sailor and taking on credit like a FED member. This was the man who taught me to be financially frugal. Times change people

The economy was mediocre in February 2020, then we had the lockdown which created a temporary depression in economic output, and this hole in economic activity was filled with unprecedented deficit spending and “printing”.

No. there is nothing organic about this economy. It’s all fake.

that’s what’s so pathetic about the comparisons to the roaring 20s post ww1 and the boom of the late 40s and 50s after ww2. the economies boomed then because of economic activity from the war effort and from our manufacturing base.

you don’t grow an economy by printing trillions and handing it out for people to buy stuff made overseas. that’s not an economy, and it’s not “wealth.”

The economy was going into the gutter prior to the Feb 2020 DROP. The rates had inversed. The QE had started before COVID hit US hard. China has used force majure based on

From late 2019 new reports-

10-year Treasury note broke below the 2-year rate early Wednesday, an odd bond market phenomenon that has been a reliable, albeit early, indicator for economic recessions.

The yield on U.S. 30-year bond also turned heads on Wall Street during Wednesday’s session as it fell to an all-time low, dropping past its prior record notched in summer 2016.

the inflation was not a supply side issue except for a few months at the beginning. it’s because of excessive demand caused by over stimulation. that’s why people are paying full price.

The things that you have to have utilities food, gas etc went up too. Those things don’t give you a choice. The cost value of going out to eat has changed, but that’s a choice.

right, because it’s all interrelated. to use an example, if companies are selling more boats and rvs because of the “wealth effect,” that’s more energy consumption, leading to higher energy costs.

the point is, exceeds demand caused by overstimulation in the “wants” ultimately leads to higher prices in the “needs.”

Building supply stores sales would probably be higher if they actually had full shelves. Every time I send crew there to get stuff I have them take pictures of the empty shelves so I can explain to my customers why we didn’t come back with what we needed or simply wanted.

What kind of products are you not getting?

LOL. I read this after reading Tyler Cowen’s article at Bloomberg Quint about how some economists think inflation is all in our heads… if we expect high inflation then we will get high inflation… and if we expect low inflation then we will get low inflation.

So those giant signs at the gas station telling me that gasoline costs twice as much as it did in November 2020 are just a figment of my imagination apparently. As is the rest of Wolf’s “DATA” presented here…

they do have a point. inflation to a large degree is a self-fulfilling prophecy. people expect high inflation, and thus buy things they don’t need at the moment at prices higher than they would have paid previously, because they’re concerned that if they wait, prices will continue to go up. people paying these higher prices causes a change in behavior among other people, who then do the same, and here we are.

Agree with Jake W.

Expectations, about your own future needs and about how you think your neighbor will react to rising prices and/or shortages, lead to heightened demand and (still) higher prices.

It is, at least partly, “in our heads.”

While I agree that there is SOME truth to that… it is far too easy.

Example 1) Gasoline prices go up without anyone giving any thought to what their neighbors will do… or how long the price hikes will last.

Example 2) Last October I complained on FB to my friends that the price of a can of Black Beans had gone from 88 cents to a dollar at Walmart. Last week it was $1.24.

There is no doubt that there is such a thing as an “inflationary spiral”… we saw that in the late 70s. But sometimes inflation is just inflation.

but the point is that people are buying those beans at $1.24, or they wouldn’t charge that. and people are buying those beans at those prices because they are stocking up, worried that it’ll be $1.99 next month. that’s what an inflationary spiral is.

Spenser G.-

In your example 1: “ Gasoline prices go up without anyone giving any thought to what their neighbors will do… ”

The gas lines in 1973 during oil crisis were ALL ABOUT trying to figure out what your neighbors would do: a)would you direct neighbors get to the gas station and drain its 5000 gallon tank before you got your; and b) would our world neighbors in OPEC curtail petro shipments.

Sigh.

1) Prices of oil went up in 1973 for the same reason that prices went up last year… a CARTEL engineered a shortfall in supply. That is what ALL cartels try to do. It has/had nothing to do with whether or not you beat your neighbor to the pump in a given week.

2) Black Bean prices are not going up because people are suddenly willing to pay 40% more for them. They are going up because either there is a shortage of them (drought?), prices to deliver them to market are higher, or both. The fact that people have the money to pay that 40% extra may be a relief to the Black Bean farmers (and Walmart)… but the price isn’t going up because there are no alternatives and thus consumers are compelled to pay more for them.

Maybe both of these will prove “transitory”… I hope so. But this inflation has hit too suddenly for people to think they are competing with their neighbors. So far people are NOT changing their buying behaviors… but that could change. People are still acting as if inflation will be low even when they can see for themselves that it is the highest it has been in two generations.

SpencerG,

“…if we expect high inflation then we will get high inflation…”

Actually, there is a lot of truth to it – but not in the way you expressed it. It’s not that inflation is a “figment of my imagination,” but that inflation is in part a psychological phenomenon. Inflation can only thrive if there is a widespread “inflationary mindset,” as I have been calling it since about January last year.

What triggered this was when I saw what was going on in the used vehicle market, which showed a fundamental shift in how consumers and businesses (dealers in this case) thought about higher prices. It just suddenly took off. I have written about it many times.

For most consumers, buying a vehicle is a discretionary purchase – most consumers can wait a year or two and just keep driving what they have, but no, they’re out there paying totally crazy prices to buy something they don’t need, but want.

Sure, there are some that total their cars and need another one, but of the 20 million used vehicles sold retail per year, those totals are minuscule. So if 5 million potential buyers had decided to just outwait this craziness, the whole price spike we saw would have never happened. But no. Consumers bought no matter what the price, and dealers, knowing that they could sell these cars at ridiculous prices, went to the auction and bid up wholesale prices to ridiculous levels and passed those higher prices on to consumers with a huge profit on top, and consumer were eager to pay, because they wanted the vehicle, and had the money, or could borrow the money cheaply, and thought that prices would even be higher in the near future…

This is the inflationary mindset. It’s a mass-psychological phenomenon, and it’s one of the preconditions for inflation to thrive. It set in last January, from what I could tell.

If consumers went on a buyers’ strike, it would be over. And the Fed can push consumers to go on a buyers’ strike by raising rates sharply, and by causing asset prices, including housing, to tank, and by labor demand to shrink just enough to end the labor shortage. Consumers would think twice about paying higher prices, they’d stop buying discretionary items, and they’d change brands, stores, and products to chase after lower prices, which would end the fertile feeding ground for inflation.

I completely agree that what you are describing is the inflationary mindset. But I disagree that we are there yet. As you said yourself, car UNIT sales are down. Most people don’t need a car this month or this year so they are waiting. Because of the shortage of chips the car manufacturers have a shortage of cars to sell… so they are able to get more for them temporarily from the people who need those vehicles NOW.

Let’s see how this plays out when there is no shortage of cars on the lot for people to buy. I have said here before “Inflation doesn’t normally fix itself.”

But in this case I highly doubt that car prices are going to be sticky as the pandemic shortages unwind. I also don’t think the Saudis are going to be able to make these gas prices stick… already the frackers are adding new oil rigs and it won’t be long before OPEC countries start to cheat at these prices. As to Black Beans… who knows?

In other words, the new and used car price inflations are “transitory.” True enough.

Said another way, “Nothing goes to heck in a straight line.” (Can’t remember where I heard that line…!)

I am still not convinced Fed is going to be in a hurry to crush inflation back down to 2%. I like what Peter Schiff says if they really wanted to fight inflation they would have started last summer. There are a lot of news articles out there today about how the Fed is going to get really tough on inflation. Think they are trying to jawbone it down.

John H and Old School…

Good comments from both of you. I disagree a bit though.

1) Yes, I doubt the things that have gone up by 40% will stay that high. Oil, Used Cars, Black Beans, etc. To quote a MBA professor I had once “Profits attract competitors like Blood attracts sharks.” In each of these cases someone will try to fix whatever the underlying problem is and profit from holding those prices as long as they can.

So to some extent this is “transitory”… but when ALL groceries are up 7.5% those prices are probably going to stick. Same for everything else… it is not like used car dealers can give away cars for the next year to even out the prices they got this past year. Oil frackers have no interest in driving the price back down to $45 a barrel.

As to the Fed just trying to jawbone inflation down… that was last year when they had rose-colored glasses on about “transitory” supply chain issues. NOW they are fully aware that their own personal reputations are on the line if inflation becomes permanent. They couch it as “the Fed’s credibility is on the line” but the truth is that Powell and the rest are fully aware of why the history books record Volcker and Greenspan as renowned Fed Chairmen while Arthur Burns and William Miller are considered failures.

I think a lot of the auto phenomenon was also due to opportunity transactions…

If I had a 2-4 year auto and were offered 40% more for it, why not? Especially if I came out the back side with a pocket of cash and a new or newer car with a modest increase in payments…

Or if I had another car, sell it outright for cash or dump the payment, and pocket some cash and wait for some normalcy to buy again if I needed to…

I do think the opportunity transactions will run their course soon as the majority have been completed…

The problem with that “modest increase in payments” is that the term just got extended 2-4 years simply by financing the new vehicle. You already had paid equity and were 2-4 years closer to “owning” the car. Now, not so much. Especially if you overpaid for the new car.

The depreciation monster doesn’t stop. Right now, it’s a phenomena that can go away as fast as it came. Imagine depreciation returning to it’s norm – and a reduction in “market value” because the vehicle was never worth what you paid for it to begin with. That’ll leave a mark.

EK,

“You” know that and “I” know that, however, I don’t think “they” care about it…

That cash made a whole bunch of deals work that wouldn’t have otherwise…

Besides it’s just a theory, eh?

Pure wisdom dispensed daily. If anyone thinks they can pay for a newsletter or subscription service to get better financial or investment advice than obtained on this site, you are wrong.

Valentine with Claudia Zahn.

This is a quote from Lawrence McDonald’s The Bear Trap Report: Speaking of the ‘’ Growth’’ in the economy in Dec.

‘’The economy grew in large measure because of a COLOSSAL inventory build, which is a fancy term for businesses hoarding inventories, which in turn is caused by inflation. It is cheaper and safer to buy inventory now rather than later —- 4.9% of the 6.9% GDP growth was caused by panicked businesses hoarding inventories in a desperate attempt to front-run inflation and escape the worst of the nightmare supply chain. And it is that very same inflation that has made the American consumer, and voter, so pessimistic. The question begged is: if businesses are hoarding, are consumers hoarding as well? The answer? Of course, consumers are hoarding. This in turn implies that if businesses and consumers had not hoarded, then GDP would have been negative in the 4th quarter. This sums to a classic stagflationary economy.’’

If this is the case, then if the Fed tries to slow down an economy by raising interest rates, in an economy that is already really heading for a recession, won’t they make it much worse. And if they try to raise rates moderately, will that really do anything to tame inflation. I read somewhere that only rates greater than something like 7 percent actually has had an effect in the past to tame this inflation mindset, because people adjust their inflation mindsets to small incremental increases in interest rates. But rates like these would bankrupt most borrowers, perhaps even including governments.

Phillip,

“’The economy grew in large measure because of a COLOSSAL inventory build, which is a fancy term for businesses hoarding inventories, which in turn is caused by inflation.”

Why are you dragging this braindead shit into here??? At least read my article about this situation. What is it that compels commenters who don’t read my articles to drag braindead shit from somewhere else into here?

Below is my chart of Q4 GDP inventories. Inventories are far below where they should be though thankfully they rose a little to reduce the shortages that this economy is struggling with:

https://wolfstreet.com/2022/01/27/year-of-distortions-shortages-inflation-trade-deficits-and-hyper-stimulated-growth-ends-with-a-bang/

Wolf, I feel bad for you. Every single time a reader goes straight to the comment section and dumps garbage there, it’s like you have to expend all this energy to explain…

When in reality you could just respond by saying READ THE ARTICLE (RTA).

…or RTFA

RTGDFA

Although I appreciate Wolf able to point to past well-written and indepth articles to support his points. Bringing a cannon to a gun fight.

LK,

RTGDFA… my kinda language. I’m gonna steal it from you and stick it into the WOLF STREET lexicon :-]

Phillip

Why would anybody quote anything from Larry McDonald author of the book “A Colossal Failure of Common Sense” . He goes on and on about how the government should have bailed out Lehman Brothers at the taxpayers expense. Screw him and screw Lehman Brothers. They deserved to go bankrupt and I would lose one night’s sleep over it. Wasted my time reading his book.

H-O-A-R-D-I-N-G

Interesting article from Yra Harris at Notes From Underground, yesterday.

The comments on Yra’s articles are almost as interesting as from the community here….

“Notes From Underground: Is It George Bailey or Henry Potter?

Bank of England Governor Andrew Bailey made a ridiculous comment almost two weeks ago and I’d be remiss not to mention it. Bailey issued his own FORWARD GUIDANCE on how to slow the pace of inflation. He suggested that people refrain from seeking big pay raises. It’s astounding that a sitting member of the G-7 Finance Group has the temerity to restrain the AVERAGE WORKER while promoting QE policies that have stoked a serious rise in asset prices for those who own antique autos, stocks, precious metals, art, multiple homes and any other asset class on the planet.”

TG

“QE policies that have stoked a serious rise in asset prices for those who own antique autos, stocks, precious metals, art, multiple homes and any other asset class on the planet.”

….except for Houston real estate, it would seem from Wolf’s article above!

FF rate what would it be?

Past Hx

2000: Fed raises to 6.5%, breaks the dot-com bubble

2008: Fed raises to 5.5%, breaks the housing market

2018: Fed raises to 2.75%, breaks the stock market first, the economy and the repo market after

2022: bond market ?? the bar is getting lowered tp prevent bubble burst? some speculate it will be less than 2%!? How can they control if inflation is already 7.5%!

Wall St wants the cake and eat it too!!

The two year T-bond interest is 1.52%.

The three month T-bill interest rate is 0.38%

The 2018 sell off was short.

The NASDAQ QQQ is in correction territory.

Warren Buffett did not sell all his KO stock even though the growth slowed.

David Hall

Bear mkt always starts at the peak of ‘good’ news and NOT bad

Fed could do turnaround in late 2018 but now inflation is 7.5% unlike 2.0% in 2018!

– there is no bear mkt, without corrections first! read mkt history!

“Policy rates are at the zero bound and the Fed is still buying assets when GDP growth is 6.9%, CPI inflation is 7.5% and unemployment is 4.0%. Is this rational monetary policy or are the lunatics running the asylum?’

(h/t Philip Marey at Robobank)

Way before any “economists” got wind of the inflation raging in the streets of America, the consumers sensed and witnessed weekly price increases, and shrinking packages.

They decided to buy what they need >now< figuring prices would soon cut them out of the market.

Not sure when, but inflation WILL stop the spending. The curtailment of consumer spending starts at the lower incomes and spreads upward over time. It is a matter of how hard inflation rages, and for how long, that will determine the depth of the coming recession.

Good luck to us all, this is going to be a wild ride.

I do not know how much of this is inflation and that does not matter anyway, sales are sales. My takeaway is that the consumer is going to “bop till they drop”. There is a significant number of consumers who rationalize their spending as “better buy it now before it’s gone or higher in price”. Life style adjustment to inflation ain’t reflected in these data sets. Consumer sentiment survey was considered horrible. Looks like that survey is butt wipe when you are looking at these results.

Unless I see a big drop in consumer spending, I don’t see any big impact.

People are still spending like crazy buying expensive homes, vacations, cars, toys etc. It means they have lot of money. Maybe be because of low rates or stimulus.

US economy is driven 70% by consumer spending and looks like they have lot of gas to go. Don’t see this spending slowing down.

Buy now and save!

Ah, Wolf. I thought you had a bit of civility, but I was wrong. You don’ t have to post my reasonable counter argument to your comment, since it is your site, and your prerogative. Though I can see your sycophants are free to post. But I think I shall no longer bother reading your site. There are enough rude insulting people on the Internet that I cannot in all conscience bother to support your site, even if it is just by being another set of eyeballs for your sponsors.

After posting some BS that I spend time shooting down, it’s the end of the discussion. BS only leads to more BS. At that point, you need to let it go.

Then arguing with the moderation and calling other commenters names isn’t exactly helping your cause. But OK, I’ve moved on.

Phillip, tell me… what other site is better than this?

All internet comment sections are the same.

But seriously, where else are you going to get this good of economic data and the (mostly) intelligent conversation in comments? There’s far worse out there.

I value everyone’s opinions here, even if it is wrong. Because posing wrong positions gives people the opportunity to correct, and that in and of itself is also valuable

Fed is trapped. Fed is out of control but pretend they are in control!

There are also rumors for the bar for Fed’s put, now 3800-4000!?

The value of financial assets is now more than 6x US GDP!

Mkt cap to GDP is over 220%.

Fed’s dilemma : Control- inflation, yields, and the market. Only one of three possible but NOT all 3! Balance sheet tricks like twist or overnight rep have no influence to control inflation.

We will soon have rising unemployement, rising interest rates, rising double digit inflation, seasoned with an energy crisis. An economic stew, and according to the “Gipper “who once said about Carter’s economy a stew that is turning the nation’s stomach. ENJOY.