“It could be a bumpy time”: Kansas City Fed President.

By Wolf Richter for WOLF STREET.

Quantitative Tightening, the opposite of QE, is now part of the Fed’s plan. Likely to start this year, it’s going to be more and faster than last time, according to the last FOMC meeting: The Fed would be “significantly reducing” the assets on its balance sheet, and over the longer term get rid of its $2.66 trillion in mortgage-backed securities (MBS). The rhetoric has focused on just letting maturing securities roll off the balance sheet without replacement.

Turns out there is a discussion underway at the Fed to sell securities outright in order to steepen the yield curve and get rid of the MBS entirely – unlike during the last episode of QT in 2017-2019, when the Fed just let maturing securities roll off passively.

Selling securities outright has now been officially put on the Fed’s table by Kansas City Fed President Esther George in an interview with the Wall Street Journal, published today. She’d already indicated in a speech that she was worried the Fed’s gargantuan balance sheet could repress long-term yields, even as the Fed raises short-term rates. Selling securities outright would:

- Loosen the stranglehold that the Fed’s gargantuan balance sheet has on long-term yields, allowing those yields to rise and thereby steepening the yield curve, even as the Fed raises short-term rates;

- Give the Fed more control over what comes off the balance sheet, such as shedding MBS entirely that would otherwise linger on its balance sheet for many years.

Some morsels of what Esther George told the WSJ:

“With a $9-trillion balance sheet pushing down on long-term rates, we’re going to have to face some considerations: How much downward pressure [should be applied], what [are the] implications for the yield curve, for risk, in terms of how that balance sheet affects the economy?”

“We’ll have to consider both of these tools [rate hikes and QT] in tandem.”

“The goal is to get to a primarily Treasurys portfolio [and shed the MBS]. So I don’t think I would rule out asset sales as we think about the way we have to talk about removing accommodation.”

“That doesn’t mean in March we’re going to have to say, ‘Let’s start the sales.’ What I’m trying to talk about here is this balance sheet is significant, and we will have to think about its implications for the unwinding of accommodation, just as we think about short-term interest rates.”

“If you look at the transcripts for meetings going back to 2012 and 2013, you will see there was an explicit recognition that introducing quantitative easing was going to complicate monetary policy. So I don’t think we can avoid the complexity that has come with a decision to deploy this tool.”

“What you don’t want to do is oversteer here. You are going to have to be thoughtful about the interaction of these two tools [rate hikes and QT].”

“I don’t think we can just focus on one and then say now we’ll turn to the other. I think it is going to be more complicated to think about what is the interplay here that we’ll have to take into account.”

“The alternative is trying to be more aggressive on the balance sheet and get a shallower path on interest rates. If you have to push interest rates, then what I think about is, what are you doing to the yield curve?”

“Right now, the signals coming about the need to remove accommodation are beginning to get priced in, in various ways. When you’re seeing various markets react to that and as that reality gets closer, it’s why I also said in my remarks that it could be a bumpy time, because you are going to see investors trying to reprice, and you’re going to see these term premiums adjust.”

“It does mean you’re going to have to think about what role the balance sheet is playing. We talk a lot about its benefits, but I don’t think we should assume because something has benefits it doesn’t have costs [costs such as creating the greatest Wealth Disparity ever, Wolf Richter adds]. And that is just a complicating factor, but an important one that we have to take into account.”

“I said in my speech that our policy is out of sync with where we are. I don’t think you can look at 7.5% inflation and a tight labor market and think that zero interest rates are the right calibration.”

“It is always preferable to go gradual, and I think given where we are, and the uncertainties around the pandemic effects and other things, I’d be hard-pressed to say, we have to get to neutral really fast. I think what is important to me is that’s our long-run aim and that we begin to systematically move in that direction.”

“Whether you call it slamming on the brakes or racing to the finish line, it’s probably going to be reasonable given where the economy is and given how much accommodation is out there.”

And to conclude…

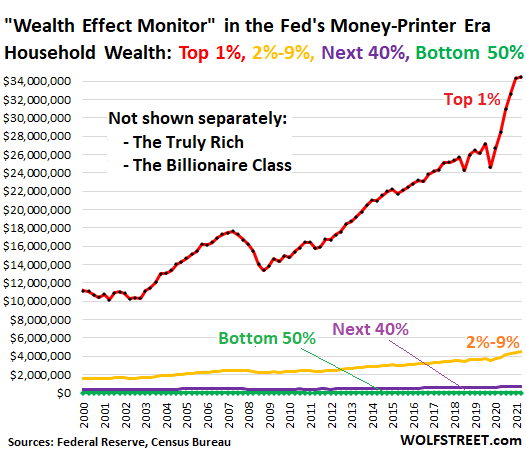

Here is my “Wealth Effect Monitor,” detailing some of the costs of the Fed’s policies, namely the greatest wealth disparity ever, based on quarterly data from the New York Fed about the wealth distribution in the US:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf,

Amazing article, as always. I wanted to ask you about the Fed monitory policy to broaden my knowledge:

1. Given how high the inflation is, will Fed have to potentially sell it’s MBS holdings at loss so that the buyers get higher yield? I don’t think many inverstors would buy the MBS at 2.5-3% rate. This would mean FED will lose the money and will “write off” the losses?

2. I remember you mentioned that all interest that FED receives from it’s holdings goes to the Treasury. Does that mean that if Treasury issues a bond at 5%, and FED buys it, this 5% yield will be transferred back to Treasury, i.e. it is essentially interest free for Treasury to borrow from FED directly?

Thank you for your educational articles!

Bull&Bear,

1. The Fed has been selling MBS in the market for years on a small scale. “Small value exercise” it calls this. It’s announced on the New York Fed’s schedule. The idea is to keep its systems operational. Nothing has been decided how it would do that in the future with larger amounts. But anytime anyone sells any bond, the counterparty expects to make money on that deal somehow. They’re not buying unless they can see how it would make them money. Depending on how much the Fed paid for these MBS, the Fed might make or lose money on them.

The Fed only holds government guaranteed MBS, and there is no credit risk for the Fed or for the future buyer. They trade similar to Treasury securities.

2. Yes. And that show is getting unwound.

How much does the secondary market alter the pricing mechanism? How is it selling bonds at below par is going to raise yields. The price of steak should be higher, I think we should sell all our government surplus hamburger?

Eleven years ago, shortly after the onset of QE 2, Ben Bernanke gave us his definition for “monetization” of the debt,

What we’re doing here is a temporary measure which will be reversed, so that at the end of this process, the money supply will be normalized, the Fed’s balance sheet will be normalized and there will be no permanent increase, either in money outstanding or in the Fed’s balance sheet.

At the time, The Fed’s balance sheet was approaching $2.5 trillion. Today, it stands at nearly $9 trillion, more than triple the figure from a decade ago.

And so it only seems fair to ask, ‘Is it monetization yet, Dr. Ben?’

Yes, the Fed has been holding “specials” a small scale sale to get an idea for demand before the larger scale selling of treasuries and MBS. The Fed, going forward, will sell longer dated treasuries to maintain their desired yield curve. They will use this to balance the effect of increasing the Federal Funds rate. The big question is the neutral rate which is a moving target. I will go on record here stating the Fed will stay below the neutral rate.

I think that the Fed is doing alot of talking to try to jawbone interest rates higher in the hopes that it can cool inflation, but has barely been reducing QE, yet the long term yield curve is rising rapidly.

What I think is that the Fed/Treasury is in a very dangerous place. As noted in previous Wolf articles, from February of last year to end of 2021, the Fed was using excess money in the general account to fund the deficit. And that triggered massive inflation.

But now they need to both end QE and also sell 250 billion per month of Treasuries to finance the deficit. So I think that ending QE and selling 250 billion of Treasuries per month to fund the government is enough to cause long term rates to skyrocket. This is a process that takes time. The Treasury had been starving the markets of issuance for the better part of a year, so it will take several months for the cumulative effect of those additional sales to begin to dry up and overwhelm the demand. Keep in mind by ending QE, they are also drying up demand.

I also think that the psychology of investing in Treasuries will change. In the past, the rotten yields could be justified because the investor was constantly having the value of the Treasury driven higher by the falling rate environment. That is what caused Treasury ETFs to deliver better returns than the current yield. But that process is now moving in the opposite direction. The higher Treasury yields will now reduce the value of bonds by more than the measly interest rate. When you also consider the inflation rate, you have a double whammy to investors.

I think that this actually gets out of control very soon (3-6 months). High inflation will make it impossible for the Fed to step in and buy bonds to prevent the collapsing Treasury market. There will come Treasury auctions with very little demand. The recent Treasury auction had alot of demand, and that might continue for a few months, as the higher rates are drawing in demand, but my guess is that initial interest in higher rates will fall later, as investors see that the yields keep rising rapidly.

The one and only factor that is offsetting this is all the negative rate bonds around the world. Investors will sell those off first and buy Treasuries. As Treasury yields rise, the comparative yields will favor US Treasuries. So I see global bonds beginning to sell off hard as investors flee those securities. The ECB continues to hang onto QE, it will be interesting to see if they are able to maintain that stance with rising inflationary pressures.

Geopolitical tensions over Ukraine and Taiwan are the one reason bond yields might remain suppressed. An invasion of Ukraine is a risk, but Taiwan will be the big issue after the Olympics are over.

Great comment mate!!

Makes alot of sense to me

Doesn’t the feds print currency out ot thin air? If so then how can they lose a penny if they buy things with counterfeit currency?

Sell assets outright? Let’s GO!

This tightening cycle is going to be STEEP

Hilarious state of equity mkts today!

Stocks were a shitshow of vertical buying and selling panics. Mounting tension overnight sent futures down hard, then they ripped higher on Lavrov’s “diplomatic” comments. Stocks dumped after Bullard’s hawkish comments, then were bid into the European close. Then Zelenskiy joked about Putin invading on Wednesday and stocks puked again, only to rebound when it was made clear he was being ironic, leaving Nasdaq around unchanged and the red of the majors in the red

(bloomi)

There have been no steep declines or advances this year. The point moves seem large but that’s a reflection of the index level.

I don’t have a list but none of these moves would make the top 100.

The BBC and DC are saying Putin may invade the Ukraine on Wednesday.

If that actually happens, there could be some interesting changes to markets.

I believe Putin’s main agenda is to diminish the trust and confidence that westerners have in their governments, civil services, and media.

Russia is saving up mistrust in the mid-trust bank, so when Russia does do something, it will be dismissed for weeks as the usual highly pitched bitching from hysterical political operators and captured media, the intelligence services are just useless as ever, and the warmongers are up to their usual warmongering.

So, in my opinion, the entire pandemonium are going beyond what Putin expected of them.

The Russians will pull their troops back, “because the planned exercise is now completed”, and a fresh batch memes will pour forth from SoMe warriors mocking the media and government officials.

Oh, and, Stocks will drop because this was unexpected.

I’m hoping for war but my luck has been terrible since 1984. That probably means no war ever.

Tony, why are you hoping for a war? War has no winners and a lot of innocent people die.

fajansen,

Western governments have already done more than Russia can ever do to reduce trust.

The inmates are truly running the asylum and the insanity is hardly limited to monetary policy, not by a long shot.

Yes, so far it’s been an orderly decline.

This seems like a good moment to point out that the S&P500 is below it’s 200-day average again. I wrote an article on this which Wolf posted a couple of weeks ago.

The Wild Bull hasn’t gotten free of the hibernating bear yet.

I haven’t rechecked all the historical predecessors that were in the article, but the second drop below the 200-day rules out all the most bullish case ones.

Perhaps this new dip is just a retest of the January low, and it holds. But personally I’m not betting on that outcome, because the Fed is up the Wazoo without a paddle right now.

Augustus Frost

Just one day, doesn’t make history!

It is the furious volatility, in response to various news bulletins, that’s the point.

Furious volatility is a rare opportunity offered to exploit to nimble, experienced option traders!

NOT the retail investors. For them it is just a noise, right?

Retail are in options now. They are happy like swine in a lake of mud!

“Hilarious state of equity mkts today!”

Agreed. While it can be excruciating to watch Mr. Powell in action, watching the markets is a different story.

If a person says that he would do something tomorrow, something that he was supposed to do last year and was reminded many times to do it, would you believe him?

Fed kept jawboning same for years and then reverted course in 2020 even before interest rates could go over inflation rate.

Leo1992,

The Fed has never once jawboned about selling securities outright — until now.

When it actually did QT in 2017-2019, it expressly said that it would NOT sell bonds outright, and it stuck to it. QT happened by just letting maturing bonds roll of the balance sheet. The Fed did everything during QT that it said it would do. I tracked this and reported on it monthly, and sometimes more often. You must have missed it.

And back then, during QT, inflation was below the Fed’s target. Now inflation is 7.5%. Huge difference.

James Bullard’s comments today summarizes it, perceived loss of credibility.

They may (and probably) don’t care about the public (composed of faceless individuals they don’t even know) but do care about “losing face” with their peer groups: Wall Street, the economics profession, and maybe other central banks. They also hate lopsided negative media coverage.

It’s only normal to avoid being universally disliked too. They aren’t robots.

I see the following comments, then, as the Fed’s way of “kissing and making up” with their Wall Street Best Friends:

“It is always preferable to go gradual…”

“What you don’t want to do is oversteer here. You are going to have to be thoughtful about the interaction of these two tools [rate hikes and QT].”

“Right now, the signals coming about the need to remove accommodation are beginning to get priced in…”

“We’ll have to consider both of these tools [rate hikes and QT] in tandem.”

“The goal is to get to a primarily Treasurys portfolio [and shed the MBS].

The Fed is telling Master Wall that: 1) Get ready, and start pricing in our asset sales, NOW! 2) We’ll not be jacking up interest rates beyond a mere 0.25% at a time, since we consider our asset sales to be “tandem” hence equally impactful (though in the end, expect a large holding of Treasuries to still be on the rolls) and 3) Prepare more private funding to scoop up these government-backed MBS, just as the cash cow retail end of RE sales starts to flatten and lose its luster as a growth area (due to higher mortgage rates).

The Fed will NEVER get “ahead” of inflation by using interest rate hikes alone. The Good Old Days are gone; they “can’t” focus on rates alone anymore! And it’s telling the world not to expect that to happen. Shedding MBS is supposed to do half of/equal amounts of the heavy lifting required for correction.

And in the meantime, when you see persistent rampant inflation over the next few years? Yeah, that’s where we’re at. So sorry, Main Street, but it is what it is.

Besides: you always knew the Pecking Order in this society! Master Wall ALWAYS eats first!

The only real decision here is what kind of disaster do you want as a result. There is no way out of this without extreme pain. Anyone who thinks you can reverse 30 years of lowering rates, boomer stock and bond purchasesduring their productive years, and Fed balance sheet bloat without reversing everything those phenomena produced is certifiably insane.

MG

Investors and Wall St had all the FUN for the last 13 yrs, front running and tail winds by Fed’s perpetual PUT along with Trillions of ‘easy-peasy’ money printed out of thin air!

Now is that KARMA is biting back , real hard! Piper was always waiting on the other end but conveniently ignored by Policy makers, Politicians, regulators and CBers including our FED!

I for one, is so glad that this unbelievable, surreal bull mkt, lacking any iota of fundamentals has come to an end!

What you sow, you reap! Why surprise?

MG,

Tend to agree.

By letting ZIRP go on for 20 years (more or less, on and off, mostly on…) the Fed has created an almost wholly fictive macroeconomy, where companies that would have died off incrementally at 4%+ financing rates, over years…are now going to implode in a much more compressed fashion as they have to try and roll over their huge debt loads at slightly more honest rates.

(This is assuming that the Fed has found its nads after 20 years…which seems like a dicey assumption. The Fed shrieked like an 8 year schoolgirl when stock mkts fell 20% in late 2018…from their *all-time, Fed fuelled, paint huffing highs.*

Think we’ll see Fed profiles in courage when 20% of *actual businesses* go full BK because they have to refinance at 5%+, after 20 yrs in lotus land? The Dems will be screaming the Fed is run by White Supremacist Russian Fascist Lizard Space Aliens).

As a young person born in the early 2000s, I don’t care about a Boomer’s stock portfolio, home price or retirement fund. They made money printer go brrr to get rich and retire in Thailand (pricing out the locals there), and we young people own nothing are definitely not happy.

I can assure you, you are NOT alone! Young folks are starting to understand the math, for real…

Zillow had our house at about 1% increase a year, for many years. Then up 50% in the last two years. Thank the horrifically incompetent government for handing out trillions of dollars, to everyone, not just people who were told they could not work. Plus 50% on top of normal unemployment. Free stuff is never free.

Or as a Texas Instruments engineer once told me

“Linux is free… but it’s going to cost you!”

Yep looking forward to the rug pull. And it is coming.

I will be happy to dispense free advice on how to cope with a sudden loss of purchase power due to arbitrary state policy changes.

Well what is advice

I was 23 years old in 1978, working in operational banking but on the career path. You ain’t seen nothin’ yet.

Look at the charts. The number of boomers with a big stock portfolio is far and few if they are not in the 1% or the top 9%. The median boomer stock portfolio is $72k. Not a lot to retire on. The average boomer stock portfolio is probably $500k or more. So the top 9% really skew the average.

If the government needs income. There is your target. There have been so many loopholes for the top 1% to shield their wealth it is not even funny.

When the top 20 Hedge Fund manager in the U.S. average a $1 billion a year in earnings by just pushing paper around….somethings wrong.

Do a little searching and you’ll find that the majority of boomers are not in good shape going into retirement. For example, from thebalance:

“An April 2018 Gallup poll found that 41% of people plan to work past age 65—a 27.5% increase from 1995 when Gallup starting tracking this sentiment. Why the change? Because upcoming retirees haven’t saved enough for retirement.”

According to a recent study, 45% of baby boomers have no retirement savings. For those with something saved, the median balance for those born between 1948 and 1953 was $290,000. For those born between 1954 and 1959, they had saved around $209,000.

So, you think 45% of boomers who have nothing saved are the ones who made the money printer go brrr? You want to trade places with the median boomer retirement savings of $290,000? Get a clue, bro.

Also, I would wager that not many of the American upper class retire in Thailand. The man reason many of us with modest savings retire here is because the culture is so nice. It’s ridiculous to say that us long-termers are “pricing out the locals.” We contribute solid money to the normal economy, unlike the sex-holiday or lo-ball drunk vacationers.

lol. That “Thai Expat Boomer” comment above seems to have really hit a nerve with someone. Don’t worry, no one here would accuse you of being wildly successful. But the size and rapacious tendencies of your generation is a major source of many/most of our problems, and will be for decades to come.

You like to pick and choose segments of a generation, because you are a member of the Me Generation sensitive to any criticism of your life-choices, but that’s not how generations work, bro.

All the Fed leaders following the Ancient Greenspan were/are Boomers. All the Presidents/Congressional leaders/almost all the state leaders this 21st century were/are boomers. Wall Street is positively dominated by Boomers. If you watched the Super Bowl, you’d find two Boomers still clinging to their announcers jobs well into their 70s 80s, way past time to to retire. The same is happening all across our country: the generation with the best positions/possessions are taking those positions/possessions to their graves, if possible. And damn the rest of us.

Need higher taxes, more investment in education? Boomers are going to veto all that: they can, since they will have the collective voting clout, and they “don’t need” all that taxation. Is it a coincidence that the stupidest money booms in world history started just as the Boomers were hitting their prime (late-Reagan) and now grow even more monstrous just as the vast majority of Boomers get set to retire this very decade?

I don’t think so. But it is time for you to think about this: what is going to come after the Me’s, after they’ve gorged their fill? Not everyone can abandon their country and find “bennies” in cohabitation with the locals in their new adopted country, “bro”. Many are left dealing with the wake your generation stirred up, whether or not you intend to live with its consequences.

lol – who’s sounding more triggered? My citing of statistics that indicate most boomers are not set up well for retirement? You dodge facts an just spew emotional screed.

Your raging on with theoretical generalizations about a previous generation is amusing:

“But the size and rapacious tendencies of your generation is a major source of many/most of our problems, and will be for decades to come.”

The growth and rapacious nature of the American empire, it’s militaristic enforcement (installing dictatorships, etc.) and economic hegemony (to profit American oligarchs) over the rest of the world — not a product of the boomer generation, happened long before. Having lost that global advantage, the American empire is turning inward and ripping off its own citizens.

In fact, there were enough boomers not comply with going to war for the military-industrial complex, that it has lost power over the years to exploit the world.

You think your generation will not have the same filthy rich 1% exploiting the lower 50% in the same way? Pick up a clue and walk with it, bro.

Retired principals take away jobs from younger teachers in Toronto while getting a six-figure pension.

It’s not ok for the younger generations, but Ok Boomer.

GenZ:

You do realize that the very same complaints were voiced by the dreaded “Boomers” in the early 1970’s. My wife, who graduated with a degree in English Lit and Education, ran directly into the tenure wall…. and could only find part time employment due to “old geezers that wouldn’t let go”, despite her being goaded into education because there was a projected “teacher shortage”. Yes, we paid back her student loans. I didn’t have any because my parents financially prepared for sending us to university. And, in the event that you think I was “privileged”, we lived in a 900 square foot one bath house.

This “career blocking” is nothing new.

“More taxes for education”? From my perspective, there’s plenty of money for “education”. However, there’s not enough money for both education and bloated administrations. The high school that I went to had two counselors, one dean of discipline, a principal, and a vice principal for a school of 700 kids. My kid’s school (in the early 2000’s) had one principal, a room full of counselors, and 6 vice principals for a school of 1,000. There’s the problem…. not the lack of funds. Our stadium was some bleachers in a field… not a pro-grade facility. Said “stadium” was maintained by kids doing Saturday detention and the fields prepped by the coaches and students. Certainly, technology has added to the cost of education – but should also produce superior results because the material is available 24/7. Go ask a current H.S. graduate about things like personal budgeting, making change without a calculator, and how our republic (U.S.) works. You’ll be stunned at what they don’t know. They cant differentiate between democracy and “mob rule”.

The thing that I believe is missing in today’s world are the lessons taught by prior generations that actually lived through devastating times. My parents and grandparents lived through the Great Depression, two world wars, rationing, the influenza outbreak (both of my parents were orphaned as a result)….. The funny thing was that I never blamed my parents for electing Richard Nixon and the skalawags that were sent to The Swamp at that time – and there were plenty. And, by the way, Nancy Pelosi is not a Boomer. She was born in 1940 – Baby Boom began in 1946. Many of you weren’t independent adults when the GFC hit.

While my kids frequently point out to me that my opinions are “outdated”, I caution them that the same ethics and morality do apply – from way back when to the current situations. Read history. Watch how propaganda works. There’s much to learn.

The difference is that people seem more willing to tolerate corruption and participate in it actively if it benefits them.

Burr path not followed by all Boomer..

Many of us screwed too we are..

.. just sayin, youngin.

Quite Blaming Boomers and learn your generations. Z-X-Silent Generation. Whose is running the country.. McConnell, Pelosi, Biden and Trump. Which generation are they.. the sneaky “Silent Generation”. This Boomer who graduated HS in 74, college 80, (remember that double recession 80 and 82) bought their first house in 84 , lost their job 7 months pregnant in 87 whose children never went to college under 529 plans. We have refinanced raises, and suffered through many recessions. We came into 401k plans late and lost defined pensions plans early. Our children are having children just as late as ours and our young millennial children have high interest rate college loans and have had the imperfect timing of swine and covid flues. And their parents were kicked to the curb sooner. And the generations before us our parents and there parents never had any assets to inherit. The silent generation and their x and z offspring have it all.

Gen Z,

Funny you should say, my boomer friend is over in Thailand right now checking it out for retirement considerations. Correct me if I am wrong, big part of the draw is excellent medical at a decent price.

That is true you should not worry about us boomers, we’ve had our day. But it wasn’t all roses for us back then. I remember in the 70’s and 80’s as a professional working in engineering and my wife an account, I could not afford a house either. Prices back then skyrocketed month after month as well in between booms and busts with super high interest rates. I ended up building one instead, and we did not have a kid until the house was built and I was also in my late 30’s by then, my 30year fixed take out loan was 12%, (until Volker fixed things!).

My wife stayed home with the baby for four years and no paid family leave back then.

The one kicker that you have that I see makes it much harder for your generation is the very high cost of College, that could set you back a decade, even longer if you pick the wrong major.

Good luck!

GZ as a person born in the early 2000’s, you’ve barely had a chance to accumulate much of anything anyways. You’re either just finishing college, starting to approach journeyman status in the trades, or are working some crap jobs in restaurants and retail.

I’m sick of this whole generational finger pointing BS. The shitestorm regime we’re living under has its genesis in the 1980’s when Ronnie Raygun and Maggie Slasher kickstarted the Neoliberal world order, deregulation, union busting, un taxing the wealthy, and financialization. These arsewipes were the so called “silent generation”, but that’s really not important.

What is important to consider is that these paradigmatic pendulum swings can take a long time to play out. Consider how long Roosevelt’s new deal steered US politics (for instance).

We might be swinging back the other way now. Alternatively we could also be heading for a further rightward swing into full scale Fascism if certain Republican politicians (looking at maggots like Harley, Green, Jordan, Cruz, Tucks, etc) have their way

It would be nice to see the people who got a free ride since 1982 (penniless 9 to 5er’s) get flattened with rising interest rates. Hopefully the pendulum can swing back the other way after 40 years of misery for the wealthy.

The big question is how does the government continue to finance itself with interest rates much higher? I personally think we are going to hit a crisis point and a balance budget solution will be forced on the government. We might even be forced into a position where we both cut spending and raise taxes to the point where there is a surplus, so we are able to allow debt to get retired, thereby avoiding higher interest rates.

10+ years of ultra low rates, with nothing to show for it but ‘WTF’ inflation and debt.

Did you see Wolf’s chart for the 1%? There is definitely something to show for it.

It’s mostly fake wealth which will evaporate in the upcoming historical bear market, no matter what they do or don’t do.

In Toronto, the 1% take the ladies on yachts and dinner dates which cost C$5,000 a plate. There is definitely paper gains for the 1%, if they sold early to the middle class bagholders.

Augustus Frost

Fake wealth???

Not to those who cash out NOW and wait for the completion of ;reversion to the mean’ If one remains greedy and wants to keep riding. they deserve the coming hair cut!

Over valuation and under valuation are part of mkt history of over 200 yrs! Investors who recognize this and act accordingly. will keep most of the profits. Others, NOT!

We know at some point in time all ponzi’s implode with the Chinese and Hong Kong real estate market being the biggest ponzi of all time.

Sunny,

Yes, fake wealth. I’m aware that a few have cashed out. You didn’t tell me anything I didn’t know before.

Most who comment here write as if when this mania crashes, the richest are going to keep most of what they have.

There is no basis to believe that because they aren’t actually that smart and there is no one they can collectively unload the bags of hot air they currently own.

Would love to see that chart at the next Fed Hearing

Did you say ‘Fed Hearing’, or ‘Red Herring’?

I’d prefer ‘dead’ herring .. hooked&gutted.

though sharks would be more apt, actually.

Jeff D

Yep

Many are saying, Mission Accomplished!!!

Powell’s speaking fees will be enormous.

I am cynical to a fault. The old adage of shit in one hand and hope in the other and see which one fills up first is my mantra. I do not disagree with Wolfs sober analysis and I am rooting for his sober analysis and not my cynical view from over a decade of financial repression.

Re- Esther George’s comment:

“It is always preferable to go gradual…..important to me is that’s our long-run aim and that we begin to systematically move in that direction.”

It’s always been relatively easy to enact rate suppression, and mighty difficult to stop. This bout began over a decade ago, and like a toddler putting off bedtime, we are still debating with ourselves about timing.

Funny too, the longer the kid stays up, the worse the tears when sound policy is finally applied…

So much verbosity, pontification by FOMC memembers especially Kansas City Fed President Esther George: Trapped, confused and incoherent1!?

Could be this, could be that!?

Not to over steer- need to be thoughtful – going to be complicated – could be bumpy time- prefer to go gradual – have to get to neutral really fast-

I think what is important to me is that’s our long-run aim and that we begin to systematically move in that direction.”

OMG!

Talk of finesse in JAW BONING!

Get QT started and rise rates – Rest is BS!

sunny129,

This Fed LOATHES to surprise markets. Everything will be signaled way in advance, in bits and pieces. There will be more bits and pieces of selling securities outright. This is an explosive issue, and the Fed is going to take its time communicating it. It doesn’t want the markets to go down all the way in one day. As she said, “gradual” is the key :-]

Wolf

‘Fed LOATHES to surprise markets’

I don’t disagree.

But does it matter, at this point?

Inflation rate 7.5% with all the businesses raising prices or cutting sizes and portions. Labor wage is bound to increase. Declining labor participation continues. Boomers retiring every week and withdrawing their investments in the mkt. Supply chain squeeze persists. Covid is still withus.

Esther’s wishy-washy statements doesn’t evoke any confidence, just display of their incompetency, confusion and incoherency.

Where is the sense of urgency of the situation? Fed still keeps buying MBSs and Treasuries this month and the next! Ironically Bullard is the only one raising hell there, today!

Question is who is really minding the store! Just sad!

“‘Fed LOATHES to surprise markets’”

But I will guarantee you…..not everyone will be surprised when it happens….and that is why the Fed should be reshaped….

too much latitude….

*Money supply should only expand to meet GDP demand

*Fed Funds should be CLOSELY tied to inflation.

If those two guard rails were in place, and honored, we wouldnt be where we are now……

The internet is rife with more reports of now Powell trading and other staffers…

what brings credence is the reluctance of the release of key documents…

and the no penalties for the “three amigos” Fed govs that were ejected

I personally think that everyone one this board is far underestimating how rapidly interest rates are rising even with the current QE that the Fed is still engaged in.

We have had a falling stock market, which for small cap and high P/E stocks has actually been very aggressive. Yet, bonds are falling (yields rising). Typically, bonds would be rising during heavy stock market declines.

I think we are headed toward a debt crisis cliff. Rates punch right through long term uptrend lines in bond prices in the coming months. That means that bond ETFs display bearish trend lines and alot of investment advisors flip out of their bullish stance on bonds and just try to unload it. The Fed will end QE, but not even begin QT and the rates will be exploding.

Everyone keeps forgetting that in the supply-demand equation, we have added 250 billion per month of issuance (relative to last year). Let that happen for 3-4 months in a row and you sop up alot of demand and then the market demands much higher rates to finance the deficit.

Big crisis coming. And that is without QT. When the crisis happens in markets, it will be much more difficult for the Fed to step in and execute QE, they will need to just step aside and let it play out, due to inflation.

How much more ‘communication’ does the Fed need – maybe they should send the braille version.

If they had one of those sign language translators at the fed meeting I would imagine it would be head scratching and shoulder shrugging, followed by double birds and head thrown back in deep laughter.

Iona-sprayed cafe on the keyboard and all, you’ve made my week!

may we all find a better day.

They are going to be pretty surprised when the Fed fail to step in, as markets tank.

This Fed LOATHES surprizes PERIOD! .. as in pitchforks and tar+feathers ..

Here is a good look at some different Fed members recent comments [NY Times link removed by Wolf]

Headline of the NY Times article you linked says:

“Federal Reserve officials call for a measured response to inflation.”

Subtitle:

“Central bankers panned the idea that they will raise interest rates between meetings. Nor have they settled on a big rate increase.”

A week ago, there were some people that thought the Fed would raise rates in between meetings, and I said a week ago that that would be “a bridge too far for the Fed.” So finally, the NY Times caught up with me, it seems.

And correct, no decision has been made on how big of a rate hike. That decision will be announced after the FOMC meeting on March 16. That has been known for months. No news there.

I have no idea why anyone reads the NY Times for their economic coverage.

Then there is Bullard who wonders ( approx) ‘why we can’t do something now’ and also suggests a .5 bump.

Of course many will say this is pre-arranged kabuki.

I disagree. I think JP may be unhappy with Bullard and also the head of the other FED bank talking about .5.

I don’t know enough about Fed governance to know if a revolt against the Chair is possible but I’m pretty sure it’s unusual to have so much public divergence.

If anyone knows of past examples, fire away.

I, too, was recently thinking through the possibility of a divided Fed.

^Bumping Nick’s question on whether anyone can share previous examples.

Did Volcker face resistance from within the FOMC when he went on his massive rate hike campaign or was there solidarity in the need for drastic increases to the FFR?

I think it is interesting to think about the Vocker situation versus our current situation.

Inflation during the Volcker years wasnt driven by monetary policy out of whack, it was driven by commodity price increases, mainly fuel. Today, we have the internet, which is very deflationary in effect, and we have been using outsourcing for decades to keep prices low, shifting production out of the country.

So when interest rates went higher, we didnt have the same massive deficit problem where higher interest rates would cause a blow-out of the budget. Now we have a situation where higher interest rates is going to absolutely blow out the Federal budget.

This is a much bigger crisis potential.

I really hope they reduce MBS holdings and that materially lifts rates. If you stop the home price inflation I think that will have major ripple effects and stop a lot of other types of inflation.

The FHFA just raised conforming loan limits by 20%. Selling MBS is not going to counteract the effects from that.

JeffD I plead ignorance, if conforming loan size limits increase what does it matter? It looks like jumbo rates aren’t terribly different from conforming and my banker was pitching their 10% down jumbo to me so there are low down payment jumbo options out there apparently so I don’t see the magic in a higher limit. Is there some reason the higher conforming limit would fuel buyers/is it the 3.5% down payment type conforming options? Thanks.

With inflation above 7.5% and being a hot-button political issue, central bankers have no choice but to act – for the time being.

However, I could well imagine a scenario in which inflation drops to a still-elevated but more politically tolerable 3 to 4% (whether through some combination of “careful” rate hikes, supply chain disruptions abating, base effects, etc.), the stock market throws a tantrum, and that becomes their new defacto target. The previous 2% PCE target is now effectively a floor instead of a ceiling, as Powell just said in the January press conference there’s no circumstance under which the committee would target inflation below 2%.

The entire institution is full of shit. Their only loyalties are to Wall Street and their own investment portfolios.

” inflation drops to a still-elevated but more politically tolerable 3 to 4%”

and the 4% will be tagged “deflation”….just watch.

But the 4% will be add on to the 7%….the 7% doesnt go away,

The Inflation rate does not register in the average joes mind. I know the average joe real well. Average joe will tell you the stuff he buys has went up at least 15%. He can’t tell you the percentage but he will tell you that an extra 15 cents on the dollars he spends wouldn’t cover the increase. Average joe does not give a shit who Powell is or what the Fed does or what the rate of inflation is. He does know pain. The average joe votes and that is where the shit hits the fan. The rest is just beak flapping. If Joe’s world is not improved by the mid-terms you won’t find a Fed Head to jawbone with . They will be in hiding.

Shoe repair last year, heels and slip guard $22, this year $42. Watch battery last year $11, this year $16. Average Jane knows this isn’t 15%. And the list of increases is long. Wage increase $0.

@ Wolf –

Jackson Y said: “as Powell just said in the January press conference there’s no circumstance under which the committee would target inflation below 2%.”

===========================

1. Is this true?

———————————-

If it is ,,,,,,,,,,,,,,,,,,,,,,

1. How do you fight inflation without deflation?

2. How much credence do you really want to give to the FED’s claim to implement QT and raise interest rates, on a level of substance.

This is the result of what happens when you convert your country into a corporation.

Exactly right. The people doing most of the complaining are the SAME ones who allowed it to happen.

Corporation?

Insider game….

For, “Who knew the Fed would not answer their mandates/instructions/agreements to their existence this time?”

People knew the inflation was coming, every thing the Fed did was aligned to promote a BIG inflation….and people were cautious….but some werent and made a killing, somehow knowing the Fed would do this then be very very late to deal with it.

James:

+1000!

Exactly right James. I was talking with a friend the other day about my fresh out of school I-Banking days how I wanted to buy a nice ski condo for my family to grow up enjoying. Fast forward seven years it was out of reach to someone making a top 3% income because the government has transferred the wealth to people who had assets before Millenials even started working. Now instead of reaching for the prize I’m trying to figure out how downshift my career, skate by on what I have and work as little as possible because it feels so rigged. I can’t be the only one and this has to be very long term damaging to the economy.

Haha, same Fed BS. They will keep QE alive and interest will go negative over time.

They said two decades ago that QE is temporary.

Kunal,

You’re dead wrong about QE.

If you still think that interest rates will go negative in the US, you do not understand who the Fed represents: the banks. Negative interest rates wipe out bank profits. Look at a two-decade chart of European bank stocks to see how that works. Look at a four-decade chart of Japanese banks. The Fed isn’t going to use negative rates for that reason. It didn’t during the financial crisis, and it didn’t in March 2020, and it’s not going to in the future, for that reason. And it started the overnight reverse repos with the express purpose of preventing market rates going negative.

I agree.

Unlike ECB, FED pays the banks for reserves deposited. I read recently that they might even increase that rate by another 15 or 25 basis points after the next rate increase!

Without the stable Banking syatem( primary dealers) , US GOVT cannot finance their deficit spending.

The primary mission of the ECB since 2011 has been to keep the Eurozone and EU from falling apart, totally different than here.

The goal of the EU elites seems to be to create a European superstate at all costs. To my recollection, Jean Claude Junker was the Luxembourg Prime Minister prior to his EU roles. That’s about equivalent to being mayor of a large sized US city at most. Not much different for most of them and they aren’t interested in being demoted.

If true, anything and everything will be sacrificed to preserve it.

The FED paying banks for reserves deposited is a fairly recent phenomenon. It’s shouldn’t be done.

Why does US GOVT need stable Banking system (primary dealers) to finance their deficit spending. They can sell through treasury direct. It is the US GOVT, by guaranteeing Treasuries, and their ability to back that guarantee with the printing press and the US military that provides the security and stability ………………. a thousand fold over the banks. It is the Banking system that needs the US GOVT, not the other way around.

Fed used to pay 0.25 percent on reserves. Now they pay only 0.15 percent. However, they must pay something, as it is required by law. After 13 years of QE, banks are stuffed with more reserves than they can use, so leaving them at the Fed to draw a reliable but far below inflation return is the best they can do. After all, they can’t lend them out, they can’t invest them, they can’t pay their bills with them. They are bank money with very restricted usages that are confined to the internal operations of the banking system. Japan has done QE for 20 years, and the US and Europe for 13 years, and there is no evidence that its effect is much more than psychological. If there is a small effect beyond that of investor psychology, it is so slight that it is not even clear that increasing QE is inflationary or deflationary, and it may be null.

@ Mike Smith –

I think you are wrong on several counts.

The FED has been paying interest on reserves only since 2008.

(I do not believe it is a legal requirement, but something the FED is now able to do if they choose to.) Paying interest on reserves prior to 2008 was illegal.

The FED can lend out reserves, spend them, pay bills with them or invest them. They are not confined to the internal operations of the banking system. Reserve requirements are zero. They are not required at all.

(contrary to the opinion of Jeff Snider, this is the case.)

@ Wolf –

1. The FED paying interest on reserve accounts is bad practice.

2. Bank reserves are cash, and banks can use them to make loans or for other uses.

True of False?

1. I think the Fed did this to give this bank cash a place to go, instead of ending up in Treasury securities and distorting that market (leading to negative yielding short-term bills, as we saw happening in early 2021, which is a problem the Fed wants to avoid).

The interest on reserves also helps keep the effective federal funds rate in the middle of its range. Without this interest, the EFFR might go to 0% or even below 0%.

You will see the Fed adjust this interest upward as part of its monetary policy changes each time it raises interest rates. This helps keep the EFFR above the bottom of the Fed’s target range.

I’m OK with the Fed paying interest on this cash.

2. T

My guess is that the Fed cannot “tolerate” real interest rates returning to their historical level: 3% ABOVE the rate of inflation.

10% nominal long term rates would devastate the economy.

b

A typical savings account in 1930 paid 3.5 % interest. Given that deflation was underway, this would be perhaps a 5 to 6% real return. You just had to make sure your bank was not one of the 10K or so that would close by 1934.

But cash under the mattress would produce a healthy real return all by itself. However it would not seem worth a depression to achieve that.

One of the arguments in the blogosphere for gov’t run cryptocurrency (see section removed from House bill now in place for a Senate bill positioned for a vote this March) is precisely because this empowers gov’t to enforce negative interest rates……accent on enforce.

phillip jeffreys,

That argument only exists in the blogosphere. The blogosphere has been red-hot foaming at the mouth predicting negative interest rates rates any day now for over a decade.

You still didn’t get what I said: you can kiss your bank stocks goodbye if negative interest rates are here, see European and Japanese bank stocks over the past 2-3 decades. And the 12 regional Federal Reserve Banks are owned by the banks in their districts, and that’s why the Fed won’t do negative interest rates, because it will kill the stocks of the banks that own the 12 FRBs.

The Fed has this very unique bank-centered setup. None of the NIRP central banks have that. That’s the #1 thing you’ve got to understand about the Fed and NIRP.

Re “this balance sheet is significant, and we will have to think about its implications for the unwinding of accommodation”

Uh-Oh: Esther George basically says the Fed has no workable exit strategy.

This is the world’s biggest Trade Gone Bad. The market has moved well past their ZIRP+QE stop-out point. They no longer have time to thoughtfully formulate a well-conceived exit strategy. And it’s a Committee Decision.

Will they manage to do something even dumber than being trapped in ZIRP+QE with the economy already at full employment + 7% inflation?

Flashback to 1977:

Princess Leia: “This is some rescue. You came in here, didn’t you have a plan for getting out?”

Me to Fed/DC in 2002 – “Aren’t you a little short to be an economic God-Emperor?”

“, didn’t you have a plan for getting out?””

Central bankers ONLY enter, with no real concept of exiting.

We had record stock prices and record low unemployment and they KEPT THE PEDAL TO THE METAL….

Never a retreat or retrieval….

All traders know….getting in always looks good…it is the getting out.

Simpler than dat! The gravy train paying old debt off with new debt is in jeopardy – and they know it. High and persistent inflation is the difference maker.

Wolf,

It’s common for regional bank presidents to be more hawkish (relatively speaking – there are no real hawks on the FOMC today), and Esther George has been known to be more on that side of the policy spectrum.

Biden just nominated 3 “labor economists” and promoted Brainard to the vice chairmanship. Since governors are always eligible to vote on rates (as opposed to regional presidents who rotate from year to year), this will tilt the balance towards even more dovish.

Jackson Y,

Even the biggest dove, Bullard, is now hawkish.

“Labor economists” dread inflation because they know how the purchasing power of labor gets sapped by inflation, and how inflation adds to income inequality. They can be the biggest inflation hawks. They don’t care about stock prices.

Brainard has already put fighting inflation at the top of her list.

Biden’s agenda is getting crushed by this inflation. This changed everything.

You can have high stock prices or a crackdown on inflation. You cannot have both.

Policy makers that don’t prioritize stock prices but focus on the purchasing power of labor will focus on fighting inflation.

And if a market downturn lowers the wealth inequality depicted in my chart, labor economists won’t be too upset.

There is a reason there are only 5 FOMC Regional voters and 7 appointed Fed Governor voters… and they say the Fed is independent.

Then why the imbalance between the appointed vs the elected (Regional Presidents are elected)?

I truly wish you are right but data supports otherwise.

Stocks are near all time high in spite of all Fed BS about fighting inflation and in spite of record inflation on ground. If anyone thought Fed is serious, stocks would have crashed by now. Smart and powerful folks with insider info know that all Fed talk about inflation is lip service BS.

Kunal,

Stocks and bonds are down quite a bit, with entire sectors having been totally crushed, the Nasdaq down 15% from its high, the S&P 500 down 8.7%, the Russell 2000 down 18%, and yet the Fed has ONLY been jawboning. It hasn’t even started the actual tightening. It’s STILL printing and rates are still 0%!!!

Jawboning works!!

All very good points, but I would ask: why do higher rates restrain inflation? By making credit more expensive, which reduces demands for loans, and especially demand for bank loans, i.e., less money creation. At the same time, the money that the US gov was redistributing to low and middle income people who would spend it (thus straining supply chains and igniting inflation) is stopping, as are moratoriums on rental evictions. So I see demand getting strangled at the same time that oil prices (the traditional forerunner of recessions) are spiking. Meanwhile, the wealthiest 20% will not drive the economy because crashing stock markets will reverse the wealth effect. Whoever runs the White House will be trading inflation for recession during an election year, in all probability. I think the only question is how deep and painful will the recession be.

Labor economists won’t be upset – that’s true. But the middle class/bluecollar workers screwed by all of this fake retribution (not to mention the impoverished who cannot afford basic commodities)? Social unrest sure to follow.

“ They don’t care about stock prices”

Sometimes I wonder about you Wolf.

Fed doing what it does best.

Jawboning.

Let’s see what they actually do, not what they say they’ll do.

Jawboning is already working pretty well :-]

Wolf’s got a point here …

Treasury Interest Rate changes in 2022

3 Month Bill: +0.37%

6 Month Bill: +0.55%

1 Year: +0.75%

2 Year: +0.8%

5 Year: +0.64%

10 Year: +0.46%

20 Year: +0.41%

30 Year: +0.39%

There’s been about half a Powell Movement across the whole yield curve.

But there is a bit of a chicken-and-egg question with this Fed-Dances-With-Markets business: is the market moving because of the Fed jawboning, or is the Fed reacting to what the market is saying?

Bullard wasn’t calling for half-point immediate rate hikes until the curve was already up more than a quarter-point – with no sign of slowing down and a full month to go before the March Meeting. Was he leading the market, or being led by it?

Or are both the market and the Fed reacting separately to the music being played, dancing madly while watching each other for cues, and trying to avoid knocking over the band?

If inflation is a lagging indicator, and the fed is fighting it by reducing liquidity and possibly even increasing interest rates then it would appear that fed action is simply following (er…lagging) market conditions.

As a follow up to another comment about expats. For 40 years this country exported its manufacturing base and now it exports its retirees.

But I’d argue it’s why the markets are being schizophrenic.

No one dares be on the wrong side of the reality, if/when it arrives.

But many probably assume it’ll be called off if jawboning is sufficient, in which case tech will fly off the charts… for a time… again… more jawboning.

Until markets stop reacting to words, and start reacting to reality, jawboning will be sufficient to keep kicking this can for a good time yet.

“is the market moving because of the Fed jawboning, or is the Fed reacting to what the market is saying?” — I am not an expert on this, but some people who are experts say that the Fed follows the markets, not vice versa.

How’s real GDP been doing over the last 6 mos? We’re headed for nasty deflation – and the Fed has cornered itself into position where it has few to no tools to stop it.

btw…claiming jawboning and establishing a causal relationship are two different things. It’s just as easy to argue that the people in the know see the stagflation storm gathering around the bend and are adjusting discount values accordingly. The “transitory” Fed is a group of insider dealers always behind the power curve – which makes sense given their allegiance to higher political objectives (Yellen/reset) or their own wealth priorities (Wall Sreet).

meant nasty stagflation. autocorrect is a pain in the patout!

The Fed is the market. There is no separate market.

Wolf

How?

Indexes are going down in spite of INACTION on the part of Fed.

Fed continues to buy – MBSs and Tresuries!?

Rates are reacting in response to markets, inflation news, Ukraine, oil price going up etc

One more inflation reading coming up in March before Fed actually does some thing, beside jaw boning!? It should be fun!

6) Esther is smarter than Larry the vacuum tube.

Tell you kid you’re taking away his allowance and he’ll throw a tantrum. Threaten to take away his Xbox, bicycle, smartphone, TV and internet, and he’ll know your full of it. Past a certain point, the more the Fed postures, the more markets smell BS.

Here are your two choices. There is no third choice. Pick one. Then resign. We won’t need you anymore.

That’s pretty good. I like: We DON’T need you anymore. Let AI run the whole schmeer!

If I had a vote I would sell the assets first,

see what happens. and then gradually raise rates from there.

Makes sense to me. Fed only did QE because they hit the lower bound. If they really intended to run most of it off they would do what you say. It would be more logical.

Wolf,

Other than “wishin’ and-a hopin'” that people will buy the liquidity-draining securities that the Fed now wants to sell from its engorged portfolio, how exactly can the Fed *be sure* that such tightening will actually occur?

l mean, it isn’t like the Fed can *make* people buy its MBS/Treasuries/whatever.

And if the Muppets won’t chow down, how can the Fed drain liquidity/slow inflation?

(This always seemed like one of the big “underpants gnome” aspects of having the Fed play act as economic God-Emperor. Historically, the Fed’s answer has more or less been, “Trust us, we’re experts.” Well, that, and something approximating Fredo’s “I’m schmart” speech at the end of Godfather 2, just before he ends up in the boat.)

The Fed might be counting on pension

funds that are forced to allocated certain % of monies

to treasuries etc.

Gorby,

Yep…pretty sure forced “savings” in (and only in) gvt. securities have been tried in a few places (Argentina? Chile? Hungary?).

(DC: “And why not! After all, we are all in this together, right?!…of course, by we, I mean *you* citizen”)

cas127,

There will be plenty of demand, including from me, for these securities if the yield rises high enough. And that’s what QT will do, it will push up yields until there is demand for this stuff from people like me. A 10-year yield of 4% will bring out droves of investors; a 10-year yield of 5% will bring out more droves, including the little people like me.

At those yields, people will dump their stocks to buy Treasuries. Well, someone is going to have to buy those stocks they’re dumping, but that will likely take place at much lower prices if the 10-year yield is 5%. And a 5% yield means that bondholders that bought those securities at a 1.5% yield will get totally crushed.

You see, as this stuff is getting repriced, there will be plenty of buyers looking for deals, but all this will be accompanied by a lot of wailing, weeping, and gnashing of teeth.

That process of rising yields to where demand is, and falling prices, translates into higher costs of funding for companies, home buyers, consumers, etc., and this is precisely what “tightening” means.

Yep, everyone including corporations and the consumer will have more of their budget get allocated to higher interest payments when they have to roll over debt or take on new debt. Everyone has less money to spend. That as you said is the wailing, weeping, and gnashing. LOL

I have a question in regards to the MBS the FED will sell. The MBS the FED holds probably carrys a pretty low interest rate? Will those bonds have a buyer. I guess with ZIRP in Japan and Europe they probably will.

A friend of my was able to get a 15 year mortgage loan for 2% in the past 2 years. Right now the U.S. Treasury 10 year is pretty much at 2% now. Who is going to want a risky 15 year home mortgage lona when they can get a risk free 10 year treasury for the same price? I was able to get a 15 year 2.25 loan too.

Just trying to figure this out but will the FED will take a loss when they sell these assets….not that it matters as they never had to borrowing any money to buy them? Is that correct?

If I’m remembering correctly, Wolf has mentioned that the MBS owned by the FED are government backed. Thus risk is comparable to a Treasury for the investor (taxpayer is the bag-holder).

Also, correct me if I’m wrong, an MBS provides monthly payout which might be a little more liquidity than 10 year Treasury?

Also, it seems like the FED can let some of the MBSs mature (people paying off loan or refinancing their houses to new loan), and continue collecting the monthly payments, if faced with taking too big a loss.

I believe the Fed owns MBS that are backed by government (GNMA) or agencies (Fannie and Freddie). The latter used to be termed “moral obligations,” but with the current state of government, that might be an oxymoron. So, on balance, MBS on the books have a very similar “risk of repayment” to US Treasury securities.

There is a separate risk to consider, though, that can have a big impact on pricing for MBS’s, and it’s called extension risk.

If and as rates decline in the marketplace, the repayments on a specific MBS pool increase due to refinancing motivation on part of mortgagees. If and as rates rise, though, refinancing slows to a trickle, cuz mortgagee has big incentive to pay of loan as slowly as possible due to it’s THEN attractive rate. What was expected to be a medium-term holding (from bond-holders view) is now a much longer hold.

Bottom line: when buying MBS paper, the bond buyer doesn’t know what the maturity date will be. Fine if just collecting payment, but can be a bitch if you want to liquidate early, as lots of institutional buyers do. If the Fed sells MBS paper off, it’ll be to institutions…

For perspective, read up on Long Term Capital and Orange County California fiascos in mid 1990’s. (I could name a dozen others, off the top…)

“but that will likely take place at much lower prices”

Does the Fed have the stomach for lower prices is the moot question? In the last 4 decades and more so since Mar 2009, it has shown no stomach and has jumped in with all the money it can print.

Without inflation biting the Fed’s hands to the bone this might be a pipe dream.

It would be still better if the inflation chews off the Fed’s hands. Then maybe it will get the stomach for lower prices.

I’m betting it has a much lower tolerance for a washout in most asset prices versus a DXY crashing below 70.

DXY is at 95 now but getting below 70 can happen quick.

DXY 70 is the 2008 low and just below the re-test in 2011.

DXY 70 is also the all-time low, except during the US Civil War (before the index existed) when the US printed “Greenbacks” to pay for it.

No empire to pay for back then.

Is Powell protecting his venture capital buddies who have floated massive amounts of CLOs (Collateralized Loan Obligations)?

Wolf,

Good answer…I had a bit of a hunch that higher Treasury yields would serve as the Muppet bait.

But you indirectly highlight the “Heads We Win, Tails You Lose” bottled macroeconomy that the Fed/DC runs using USD fiat, more or less transforming US citizens/dollar holders into lab rats/cattle.

1) On the one hand, hard earned USD savings can be diluted away at will by the Fed/DC simply turning on the USD unbacked printing machine.

2) On the other hand, when the Fed/DC’s appropriation of economic power through printing starts becoming too politically obvious (headline explicit inflation versus, say, silent confiscation of US consumers’ lost “China price” savings), then pissed off USD holders can be lured back into the Fed/DC van by promises of “higher rates” (doubling! from 2% to 4%…huzzah) and a puppy to pet.

And DC runs this circular scam on its citizens over and over.

I know that my view comes across as a bit like being shocked that a whorehouse is run like a whorehouse, but the whorehouse *does* seem to be growing and yet becoming even more blatant.

How does the gov’t sustain the old debt covered by new debt gravy train?

Phil,

Because it can always print unbacked money with one hand (da Fed) and use it to buy debt-sodden new debt with the other (US Treasury).

Of course, that particular DC circle jerk doesn’t create a single real world asset…so inflation (ratio of printed money to real assets) goes up…by definition.

Historically, DC has been able to use its incestuous relations with the MSM to be able to blame the inflation it creates on some black-hatted, mustache-twirling business/industry.

But alternative sources of info (mainly the internet) are undercutting that old, old frame story this time around (although see Old Joe’s few abortive attempts late last yr).

Joe is so old…he remembers when DC’s lies used to work.

Now he has a better informed, much more pissed off country on his hands.

It isn’t an accident when political “leaders” start surrounding themselves with multiple divisions of infantry.

CAS…..the printing press breaks down when new debt has to offer ever growing interest rates to pay off old debt….relative to slowing or retracting GDP. I am making the assumption that we are headed for a period of stagflation

Since you mention ‘Joe’: over on Fox etc. they are talking about Bidenflation and how bad this is for midterms.

Question: how childish is the US electorate?

Do they realize that there is time lag between a Fed rate cut and inflation? In 2019 Trump lashed out at Powell for his baby steps towards normalizing rates, at one point calling him ‘worse than China’.

Which by the way was a violation of his oath to respect the independence of the Fed.

But even that wasn’t enough for Trump: he wanted negative rates.

Maybe it’s time to look at a calendar: ‘Joe’ has been in office for just over a year. He INHERITED the Trump ‘blow- off top’ as the Fed unfortunately responded to Trump.

Now President Biden has made getting control of inflation a priority.

This is a ‘sea change’ and is a main source of encouragement to Fed hawks.

Chanting ‘are we there yet, are we there yet’ like a kid in the back seat is not an intelligent response to the lag between Fed action and economy reaction. We are now living through the consequences of Fed mistakes made between one and two years ago. If the Fed takes gradual steps to normalizing, i.e., raising .25 at a time for 5 to 7 times, it will take a year plus to impact inflation. If the Fed takes more drastic action, raising .5 or more at a time, the reaction will be faster.

But it will be more painful, because of mistakes made in 2019- 20.

Which Pres do we blame for those?

“We are now living through the consequences of Fed mistakes made between one and two years ago.”

DC has been addicted to ZIRP for decades…both parties (although the Dems, cheerleaders for State driven solutions to everything, bear more long term responsibility).

To pretend that DC’s fiscal and monetary dysfunction (dragging the rest of the economy down with it) started with that bad orange man, is palpably absurd.

American economic decline (“led” by DC incompetence and corruption) has been going on for 50 years – that is more than enough time for both parties to be responsible.

But, again, it is Democrats who portray government as god emperor in economic matters (*especially* when it comes to spending, and the taxation historically needed to enable it – except now the crack addicts have “discovered” the printing press).

The Fed is like the offensive line of the Bengals last night; poor QB Burrow is the American Consumer who is getting sacked a record 7 times or 7% plus by the ravages of dual push inflation, played by the Rams defensive players, Donald (demand push) and Miller (cost push). Amazing how real life mimics art, or is it the other way around?

The Fed is spooked, the markets are spooked, investors are beginning to get real spooked, and the very scary people in Washington are also getting spooked. I guess Halloween is coming early this year. Boo.

Fasten your seatbelts, Sports Fans. It is going to be a very bumpy ride.

How bumpy for stock market? Any predictions on the S&P over the next year?

We are entering the opening scenes of Ursa Major. Every cheerleader out there points to the record funds flowing into stock funds, but at Record Valuations and Prices, this savior for overextended equities is a mere fraction of the existing holdings of wobbly kneed investors who will gladly sell to this new money. When the crowd heads to the exits, there is really no way to keep them in the burning theater.

Stock investors probably have a 70% to 80%chance of losing money in 2022. Don’t fight the Fed, he, he.

The Fed is just going to keep trying to prevent a total collapse with its shucking and jiving public utterances, but would not rule out a 15% to 25% haircut for stock prices in 2022, IF STOCK INVESTORS ARE LUCKY. As Dirty Harry posed: “You feeling lucky, Punk.”. Not you, S.C., but the maniacal public at large. Trees never did grow to the sky.

“The goal is to get to a primarily Treasurys portfolio [and shed the MBS]…”

The Fed never had any business buying MBS in the first place. Playing favorites with sectors is not a monetary function.

” Playing favorites ”

And who might the favorites be? Who benefited? Who had the Fed’s ear and partnered up with them ( March 20, 2020) in alleged limited capacity, but likely unlimited influence?

The Fed owned NO MBSs in 2006….now own 24% of all residential MBSs.

Why?

Who were the big buyers of residential real estate ….corporately?

Not sure – lemme ask Larry Fink!

The GSEs and the FED can stop any future housing crash.

Just like they did during COVID. Easy to give out forebearances.

IMHO….they will never let housing crash like in 2009. If they would have given all those people who were getting foreclosed on sometime in a forbearance program before determining that they indeed could not pay the mortgage, it would have prevented a lot of 50% fire sales.

That will be the plan going foreword. IMHO

Also, if the GSE forecloses on a home, they could just sell it to low income people who cannot afford a current priced home but if homes drop 30%, just sell it to low income.?

If I can think if these idea, I am sure they can too. Is it the right thing to do ….. probably not.

I think the Student Loans forbearance is going on.

Yes, exactly, and the Fed has conceded as much. But it keeps wanting to bail out the housing market as a way of bailing out the lenders.

Castor oil!

It was worse than playing sectors, they literally broke the existing law in 2008-2009 by buying MBS that were explicitly labeled as NOT having a federal guarantee (you could read the prospectus, it was right there), despite having a legal mandate to only buy federally-backed securities.

Then Congress rewrote the law to make it legal, but supposedly discouraged the Fed from doing it again.

Then the Fed did it again.

It needs to stop, now. When kids with good jobs can’t afford a tolerable (much less decent) place to live, you know the country is off the rails.

Wisdom…

well said.

Having mortgage rates so far below inflation is a gift to the speculator.

In 2006 and 1999, we had much less inflation and the 30yr mortgage was 6%. Recently, how long was it at 3% or below…? Supported by the Fed who was lending money well below inflation to the housing buyers.

Did Powell really think he was helping people …. of did he know he was helping corporations and other speculators…

When the Fed violated their THIRD unmentioned mandate, promote MODERATE (not extreme) LONG RATES, they entered into a game of stealing wealth from the future (and thus future generations) by allowing cheap creation of long term debt. The Fed pounded down the long end (to 4000 yr lows, extreme by any metric) and Trillions of new long term debt was subsidized.

This basically took money from future generations, pulled it forward, and was used to bid up stocks and housing away from reasonable entry points for the generations X,Y,Z.

Those generations were thus having their own money (future) used against them. IMO.

The “promote moderate long term interest rates” mandate per the 1977 Federal Reserve Act was the key to PREVENTING just what the Fed did in the past few years. An adherence to the mandate would have kept a positive yield curve, kept a balance between borrower and lender, and prevented the irresponsible actions we saw in the mortgage markets.

Try and find any mention of the “promote moderate long term interest rates” on the Fed website or in any Fed publications. One can only reference it by reading the Act itself. (hence the “dual mandate” misdirection)

It’s usually better to ask for forgiveness than permission, especially in an “emergency”.

Don’t you just love Fed Regional Presidents from KANSAS CITY??!!

Hoenig was from the same district…

and they seem to have a completely different approach to things than those from the Wall St, Northeastern Prep Schools and country clubs that rocket their way through venture capital schemes and inot departments like the Treasury, then the Fed.

They miss all the elbow rubbing with actual workers/earners/savers that turn the lights on each morning in this country, fill the shelves.

Remember when…

* People said the Fed ONLY controls the front end of the curve

(Then the Fed intentionally pounded the long end and said “see? people arent worried about inflation.”)

*Powell said the yield curve demonstrates the government doesnt have a problem borrowing at these rates. (as the Fed did a lions share of the lending!)

Inflation is a RACE TO THE BOTTOM and the Fed has no place, authority, or right to promote inflation (a tax) when they are charged with stable prices. I am surprised the “Dual Mandate” (there are really three as outlined in the 1977 Fed papers) hasnt been trimmed down to ONE mandate….

“Maximum Inclusive Employment with gender and demographic Fairness for all, enjoyed in a Green Powered economy”

In the KC district, the people who live there actually produce useful goods and services in much higher proportion. If the district president’s thinking reflects the local economy, that might have something to do with it.

Only a recession or two due directly to QT and an honest attempt at rate normalization will work. Removing liquidity will be a bitch. It will be painful and messy. Either save the last 40 % of the last nickel that the dollar has in buying power or lose the Empire and the majority of its wealth that goes up to the connected and to fuel the obscene MIC/SS . They have already screwed the majority of Americans and now the fools on the gravy train at the top are going to screw themselves. My cynical gut feeling is we are going to slowly circle the drain and drop in the shitter.

“Removing liquidity will be a bitch.”

Central bankers never seem to understand that going in is easy, exiting is the key.

But the unprecedented growth in money supply must be met with an unprecedented reduction in the money supply, or else the bad effects of the money supply growth will not be reversed or halted. This is logic.

For those who say we can not raise rates…and rates must stay abnormally low….

“The Cause can NEVER be the solution. If fact, nearly always, the SOLUTION is 180 degrees from the Cause.”

Ultimately, the only solution to return to a “normal” economy is an unprecedented economic depression.