Fed’s coming tightening cycle sinks in, amid still brutally negative “real” yields, as bonds’ purchasing power gets eaten up by inflation.

By Wolf Richter for WOLF STREET.

Bond fireworks lit up the sky on Friday, following the release of the jobs report that dashed fervent hopes in the bond market that crummy employment numbers would cause the Fed to back off its rate-hike tango before it even gets started. Over the past few days, reports were bandied about that explained why the jobs number would be anything from dismally low to hugely negative. But the numbers were far better than expected – they were actually pretty good for all kinds of reasons – and instantly yields spiked and mortgage rates shot higher.

The two-year Treasury yield spiked 13 basis points to 1.32%, the biggest one-day jump since the turmoil on March 10, 2020, and the highest since February 21, 2020:

The one-year yield spiked 11 basis points to 0.89%. This is up from near-0% in September last year. Over those five months, the world has changed.

The one-year yield and the two-year yield are particularly sensitive to the market’s outlook for monetary policy changes by the Fed – namely the dreaded rate hikes this year and next year, as CPI inflation has hit 7.0%.

Despite these jumps in yields, they remain ridiculously low and deeply negative in “real” terms: Minus CPI inflation, the one-year yield is still -6.1%; and the two-year yield is -5.7%.

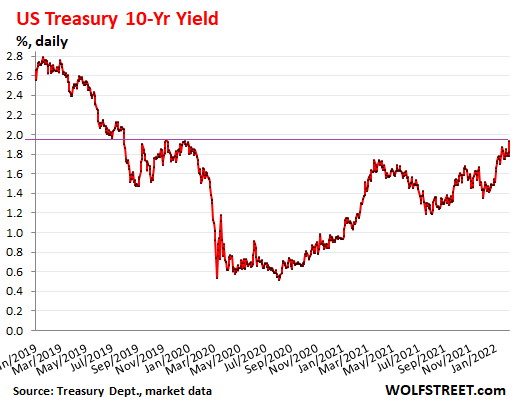

The 10-year Treasury yield jumped by 11 basis points to 1.93%, the highest since December 23, 2019.

Rough day in the bond market: When bond yields rise, it means bond prices fall. And it was rough on Friday in the bond market. Below is how two Treasury bond ETFs did. They’re considered conservative investments focused on Treasury securities, and they pay only tiny yields.

The price of the iShares 7-10 Year Treasury Bond ETF [IEF], which tracks Treasury bonds with remaining maturities between 7 and 10 years, fell 0.8% on Friday and is down about 9% from the range in April-September 2020. The ETF yields 0.9% annual, and Friday wiped out nearly a year’s worth of yield.

The price of the iShares 20+ Year Treasury Bond ETF [TLT], which tracks Treasury bonds with remaining maturities of 20 years or more, fell 2.1% on Friday and is down about 18% from the peak in July 2020. The yield is currently 1.6% annual. A few hours on Friday incinerated well over a year’s worth of yield.

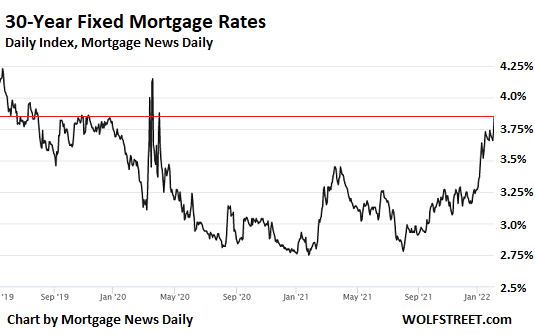

Mortgage rates spiked on Friday, nearing 4%, with the 30-year fixed mortgage rate reaching an average of 3.85%, according to the daily index by Mortgage News Daily. This is the highest rate since late 2019 – except for the rate chaos in March 2020, when rates spiked and plunged from one day to the next:

The 30-year mortgage rate moves roughly with the 10-year Treasury yield, but with a spread, given that the average 30-year mortgage is paid off in less than 10 years, either because the homeowner sells the home or refinances the mortgage.

And these increases in Treasury yields and mortgage rates are a reaction to what the Fed is about to embark on: The next rate-hike cycle and the next quantitative tightening (QT) cycle, which will do the opposite of what the Fed’s interest rate repression and massive QE had done. The Fed has been communicating its plans, and Powell locked in the date for the first rate hike: March 16.

As mortgage rates increase, with today’s super-inflated home prices, two things are happening:

One, people rush to buy a home to lock in the still low mortgage rates; so initially, rising mortgage rates create a flurry of activity.

And two, with each uptick in mortgage rates, more homebuyers hit the ceiling of what they can afford, and they drop out. This is not visible in the data at first since those people are outnumbered by the flurry of people desperate to lock in the low mortgage rates.

As mortgage rates rise further, more and more people are throwing in the towel, and fewer and fewer people are desperate to lock in those now higher mortgage rates, which then translates into the decline in demand. This becomes visible after mortgage rates rise to a magic number. That magic number will become clear only with hindsight. This magic number is likely above 4%. By the time mortgage rates reach 5%, as they did in 2018, demand will likely be waning in very visible ways.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

We’re still in the euphoria stages of this massive everything bubble. BTFD is still alive and well. We haven’t even begun to see and feel the pain that’s coming.

Will dog coin reach 80 cent levels? Lots of Americans took payday loans and maxxed their credit cards at the 70-80 cent target.

Who knows? It’s hard to put a dollar figure to something when it has zero intrinsic value and is just the speculative fervor of greedheads.

Is it greed or just a desperate attempt to maintain some purchasing power in a thoroughly corrupt politico-economic environment?

Is canine coin any more ridiculous than negative interest rates?

I already alerted everyone here on the bear blog that dog coin is extremely undervalued and that people should all be leveraging themselves to the hilt to get rich once it explodes in value. A nothing can be worth something if we all will it hard enough. Kibbles and bits, kibbles and bits, I’m gonna get me some kibbles and bits!

Even your sarcasm is beyond perversion.

Yessss,

Do you believe? Clap real hard, or Tinkerbell will die!

There are already quite a few well known formerly high flying tech stocks down 50-80% from peak.

Sure, but look at the DOW and all the indices. The bubble is alive and well. There is so much money still sloshing around that it can prop things up throughout this entire year. We have a housing bubble still raging. The amount of trillions the FED and .gov printed are so outlandishly massive as compared to normal GDP that it turned the economy into a speculative joke.

As was pointed out on ZeroHedge, with inflation at 6+% if the market goes up the Fed will take the opportunity to raise rates further and faster. So effectively the Fed is capping the market price. The top is in and there’s only sideways or down from here.

Unless the Fed hits the gas again, the bond-market bubble (40 years in the making!) is just past the peak.

Treasuries and investment-grade bond funds are already in a classic bear market after peaking last August. The charts show the classic sign: downtrending lower-highs/lower-lows (over years, not days or months) – substantively different behavior than the earlier taper tantrums.

Bond fund holders haven’t done this badly since at least 1994 (I can chart back that far) and I suspect since about 1982.

Toss in inflation, and it’s even worse.

Who knows when it will stop, but this could turn into a generational bear market – an ongoing multi-year decline that destroys all investor enthusiasm.

The bond market is huge and could take the stock market down with it.

The ones caught up last in the euphoria last are the sheep who get shorn.

WS – Thanks for this information on the bond market, of which I don’t have a good intuitive understanding.

So, when the bond funds go down, the owners can hold, and take a hit (increasingly negative yield due to inflation). Or they can sell low, giving someone else a higher yield. Is that correct?

I got out of my 401K bond funds about 9 months ago, motivated partly by reading Wolfstreet articles and comment threads. Perhaps in the current environment, bonds are more trash than cash.

I’m OK with holding bonds outright. I hate bond funds. With a bond, you can hold to maturity and get face value (unless the company defaults). With bond funds, there is no such thing. If you get a run on the fund, the fund becomes a forced seller of fairly illiquid bonds, the most liquid bonds first and the less liquid ones for cents on the dollar later, and if you’re not among the first out the door, you can loose 60% or 70% on what would otherwise be a portfolio of decent bonds.

Wolf

The bond funds you mention, and ETFs as well….

are priced on the close of the day, correct?

So if you put a sell order in on the opening, you get the closing price? Correct? Same with the buy order?

historicus,

The funds I mentioned are ETFs.

ETFs are priced by market action second-by-second, like stocks. You sell your ETF shares to other investors at whatever the highest bid is that you can get.

Bond mutual funds have a NAV that is adjusted once per day. When you sell a mutual fund, you sell the units at NAV back to the fund, not to other investors. This means the fund has to come up with cash to pay you.

With corporate-bond mutual funds, this can be a huge issue (not with Treasury bond funds). Many corporate bond issues don’t trade for weeks or months, and the NAV is just an estimate. So when market prices change quickly, bonds that don’t trade might not be adjusted to what the market price would be, and NAV could be overstated.

If investors start thinking on those terms, they want to get their money out of the mutual fund, and suddenly there is a run on the fund, which can cause the fund to collapse because they cannot sell the underlying illiquid bonds fast enough, and if they become forced sellers, they will have to sell them for cents on the dollar to whoever is buying at all. The first movers (first out the door) are still OK, but investors that don’t pick up on this and wait too long can lose 60% or 70% that way. Many bond mutual funds collapsed in that manner during the Financial Crisis.

I currently own a short term muni bond fund. I keep a close eye on the total assets owned. If I see a lot of turnover or redemptions , I’ll be getting out of dodge. So far so good.

“Unless”?. Fed learned from 2019 not to push normalization too far, or too fast. They won’t make the same mistake. We are probably in a recession right now if you count all the economic activity that isn’t happening. A slowdown isn’t necessarily bad then, its a question of getting economic activity channeled in the right direction. There are some huge structural problems like semi conductor plants, that government needs to get involved, and not just making tit for tat deals with CEOs in states with the party flag. The challenge like Covid, is national, and the difficulty is dispersing aid over parochial differences, and this applies to spending and CENTRAL bank policy.

Ambrose Bierce,

in 2019, inflation was at or below the Fed’s target. That is a HUGE difference. Backing off when inflation is at or below target is one thing. Backing off when inflation is 2-3 times the target and heading higher is quite another. And Powell pointed that out.

In addition, now the Fed has the standing repo facilities with which it can calm the Treasury and repo markets if they lock up. It won’t have to cut rates or end QT to do that.

” We are probably in a recession right now if you count all the economic activity that isn’t happening.”

I would say this statement is correct if you believe what you see with your own eyes rather than the government bull s$it that is put out every month. Businesses, are going bankrupt here like there is no tomorrow. 75% of the restaurants are closed. The ones that are open are hangin on by their fingernails.

I call this Stagflation. The Fed is in box. If they raise interest rates they will be accused of following Hebert Hoover economics and making the recession worse. If they stay pat, inflation will continue unabated. They have NO WAY OUT! End of Story.

Wolf said: “In addition, now the Fed has the standing repo facilities with which it can calm the Treasury and repo markets if they lock up.”

_____________________________________

calm the Treasury and repo markets?

I think you mean manipulate and distort the Treasury and repo markets

and continue to reward imprudent behavior

“Unless the Fed hits the gas again, …”

…What is the current Octane rating? Bad gas will not make the engine run.

It’s a…you know, metaphor….

And hit the gas they will. The rate hikes are already priced in there will be no action by the Fed. What will be the next catalyst for more QE. To big to fail, nope we had that already. Fake pandemic, nope we used that one to. How about a supply shortage due to trucking? That will surely hurt the markets and wallstreet can’t have none of that. This bubble wont pop QE5 will surely be coming. They will find a excuse. And less than a 1% move is hardly fireworks when real inflation is raging at 15% not that phoney crap the corrupt Fed dishes out. I go by shadow stats using the same methods used decades ago, before manipulation of the math. More inflation pain to feel.

“By the pricking of my thumbs,

Something wicked this way comes.”

William Shakespeare

“We haven’t even begun to see and feel the pain that’s coming.”

The rich are laughing – as they brush the crumbs off the table and onto the floor – for us to fight over.

Thanks Fed You’ve destroyed a nation

The Fed simply immunized (temporarily) DC from the consequences of its pathologies (by making the future much worse for everyone not in the political class).

The modern Fed has long been less a cabal of top hatted capitalists than a cynical, desperately employed tool to obscure the failures/delay the consequences of America’s political “elite”.

Bankers don’t particularly profit from ZIRP…they will loan at a spread at any interest rate level.

But the political “stewards” who courted and created a 100%+ debt to GDP bloated corpse of a government/economy/country (pre-entitlements catastrophe) will cease to exist once interest rates remotely approach an honest, market clearing level.

If interest rates could hit 15% in the early 80’s, when debt to GDP was maybe 40%, what is an honest rate for deadbeat debtor nations now in hock in excess of 100%?

Well said

Cas 127 said: “Bankers don’t particularly profit from ZIRP”

————————————-

But they do profit the heavy leverage and push to a debt society that the FED and the government foments. And they certainly profit from the bailouts given to bail them out of their greed reaching imprudence.

there’s two schools of thought on this. One, the fed won’t be able to raise rates due to the increased borrowing coasts to the government and two, the fed will raise rates until they break something( mainly over indebted borrowers). I go with number two! What thinks everyone?

Maybe there is a hybrid of numbers one and two: couldn’t the government calmly incur “increased borrowing costs” and just wave its magic print machine somewhere down the line to monetize it? Could this be another variant of “extend and pretend?” Another shell game?

I am concerned for folks locking in a (currently) negative real rate with super-high house prices, and then what if inflation IS tamed? Doesn’t that negative real rate transform into a positive real rate, maybe in a down market for housing (compared to buy-in price)? Sounds like a dicey prospect. Illiquid houses seem a weird thing to trade in steeply changing markets, unless there is an obvious gain. Then again, I bought in ’94, a time of rising rates, and it went well (just lucky for me).

Elegant explanation Wolf, thanks! Keep ’em coming!

When youre an LLC out of China, nothing is illiquid.

Depends upon the time horizon you have in mind.

Nothing moves in a straight line, so rates will initially peak in the relatively near future (later this year or next) and then partly retrace. When this happen, rates might not be that different several years from now. Compare now to early 2020, two years of essentially no movement.

It’s only if the bond bull market from 1981 is actually over (my belief) that the next phase of rising rates is going to bite hard. I expect this second of many rising phases to lead to noticeably higher rates.

As for the government “doing something about it”, if the 39 YR bull market is over, any forced attempt at yield suppression (regardless of the mechanism) will show up in a sinking currency. The USD isn’t the Turkish Lira but the principle is the same.

There is a day of reckoning in store with an extended period of lower living standards for the majority of Americans, and neither the government nor anyone else can do anything to prevent it.

Massive defaults will no longer take down the banking. They will just be a burden to the US government ledger. They will just have to adjust and accommodate. The banks initially loan the money out but the movement purchases them via the MBS market. This was all part of the plan. Pump the market and be able to sustain the large failures on the backs on the government paper where this is entry that can be buried. The movement isn’t in the mortgage market to make money. It is there merely to handle the crushing failure it setup

When the government ledger has reached saturation and any further print-and-spend MMT-style fiscal antics are met with further inflation… which is political suicide … banking-sector defaults may suddenly become an option again.

Nathan, I’m inclined to think as you do on MMT and the government’s interventions. But the real effect has been that more Americans are living in houses, driving their cars, eating their cheeseburgers and… the currency has not tanked. Yes, the doom n gloom is abundant, especially among the commenters here. But even though wealth has trickled up and the lower half of Americans have accumulated almost no additional assets during this MMT run-up, the bubbles haven’t burst and may not burst. Currency value is relative to other currencies and the USD has held its position. The inevitable “day of reckoning” may be an illusion. Just sayin’…

HowNow,

So you believe in something for nothing? That’s how your post reads.

Augustus Frost said: “So you believe in something for nothing? That’s how your post reads.”

—————————————————-

Why shouldn’t one believe in something for nothing? The FED/Government/Bankers and Wall Street/Private Equity have firmly established that business model as a fast path to riches.

In that case, what is to be done by the government, with the bottom 50% who will be in truly dire circumstances?

I can’t think of anything pleasant that rulers do to the ruled in such a scenario.

As a bond market investor over the years I have come to the conclusion that the stock market cannot do well if the bond market goes into the tank. Not over the medium to long term. They are connected in many ways, too numerous to mention here. Since the consensus is that the bond market is headed for trouble, then the stock market is not far behind. I would not own any stocks right now.

And then right behind it will be another real estate implosion.

After the dot com crash in 2000 RE took off here until 2007/2008. Not exactly correlated. Of course we had easy money thanks to Greenspan and Bernanke.

First off, we all thrive on this forrum and critical insights amazingly insightful and comprehensive. Kudos and cheers to Wolf!

@Augustus Frost, re “if the 39 YR bull market is over, any forced attempt at yield suppression (regardless of the mechanism) will show up in a sinking currency. The USD isn’t the Turkish Lira but the principle is the same.”

No. That cannot happen any time in the short/mid-term to the USD b/c of its reserve currency status. To understand why better you have to wrap your head around the Euro$ (BTW. that is not EU Euro), global derivatives & contracts, and how all that creates synthetic shorts against the USD which in effect induces a global USD short squeeze any time there is any global finance concern, and also enables the Fed to sustain a $10+T balance sheet w/ no effect on the USD. I wrote the below comment about this ~1-2 years ago on another forrum, but applies even more today.

****I have a tricky financial conundrum that I’m eager to hear plausible way(s) it may play out, from Wolf, or anyone. ****

That is, it seems to be the Fed’s only way forward is into an MMT abyss, which if my below is correct might not be the insanity that most believe, but an MMT version of relatively ‘sound money’, which (I figure) will keep a steady strong bid for risk assets post GFC2, yet with very specific implications to consider to best position one’s portfolio.

It seems to be the Fed’s way forward now is amass a $10-15T balance sheet and enable the Treas to go into an MMT abyss, which if my below is correct might not be the insanity that most believe, but an MMT version of relatively ‘sound money’, which (I figure) will keep a steady strong bid for risk assets post GFC2, yet with very specific implications to consider to best position one’s portfolio, b/c we can be assured it will happen so long as bond vigilantes are structurally neutered.

BTW, one implication is that the US no longer needs foreigners to buy UST or even keep the ones they own b/c the Fed could monetize all foreign held debt and the USD would stay strong.

Recently, I read a great zerohedge (see below cite) which calculated at least $2T in foreign contracts/obligations/derivatives denominated in USD need funding by end of this year, and argued that gave the Fed room for at least a $10T “balance sheet” without causing any downward pressure on the USD. Combine the points of my below 2 cites then (according to me) we basically got a broken Euro$ system paradox: monetizing the debt cannot drive up cost of our debt or devaluate our currency b/c doing so would BK the reserve currency and make the far greater Euro$ short (and all their sovereign currencies) go BK even harder. Hence, IMHO, near 100% guarantee the Treas./Fed are going to go full MMT to at least $10-13T w/in the next 1-3 years. But, how long can the US stay the cleaner dirty shirt? The US gov are like drunken sailors with the only nuclear weapon in the world. Unfortunately, I cannot see were MMT is wrong thanks to the broken/BK Euro$ system. There seems to be absolutely no way for any sovereign to “fight the Fed”, so they’ll be drinking its Euro$ Koolaid until hell freezes over…

So, if true, $10T (or even $15T) balance sheet is just fine for our USD to still be ‘sound money” under MMT monetizing all of our annual debt and all GFCx bailouts/QEs, at the same time NZIRP is forces financialism risk taking/profits so money velocity/inflation/productivity should continue to drop post GFC2 at least as bad, if not worse than post GFC1.

Do you have any insightful take on the mechanics of how the MMT path might end otherwise? If JS would pen an article towards supporting/refuting this line of argument how the massive Euro$ short actually validates MMT and debt monetization as relatively ‘sound money’, so our financial system, economy, and status as reserve currency will stay strong and dominant for decade(s) to come, so long as the world is relatively short of USDs vs the Fed’s balance sheet.

BTW, I think JS is right, the only (long term) solution is for the Fed to become the global CB and properly run global repos, etc.

Cite 1:

https://www.peakprosperity.com/the-federal-reserve-is-directly-monetizing-us-debt/

The Federal Reserve is now directly monetizing US federal debt.

…

The Federal Reserve, under no conditions, buys Treasury paper directly. The Federal Reserve’s own website still maintains that this is the case:

…

So according to the Fed: it’s independent, it follows the rules set forth in the Federal Reserve Act of 1913, and it mostly buys “old” Treasury paper that the market has already properly priced in a free and fair system.

MMT is Already Here!

The debate over whether or not MMT (“Modern Monetary Theory” see here for background and discussion) should or should not happen is now moot.

It’s already here.

Over the past year, the US government has spent ~ $1.3 trillion more than it took in. To cover the shortfall, it had to raid the Social Security piggy bank for (another) $170 billion and tap the “markets” for another $1.1 trillion.

If not MMT, what other name should we give a program where the US government spends $1.3 trillion more than it takes in and the Federal Reserve covers the shortfall by by purchasing US government debt on the day of issuance?

…

The Fed bought more than $4 billion of this CUSIP. If these T-bills were out in the “open market” they weren’t there for long. At most, less than a day before the Fed scooped them up.

…

Cite 2:

https://www.zerohedge.com/markets/despite-qeternity-bailout-bill-us-dollar-shortage-intensifies

The Federal Reserve has identified the Achilles heel of the world economy: the enormous global shortage of dollars. The global dollar shortage is estimated to be $ 13 trillion now, if we deduct dollar-based liabilities from money supply including reserves.

How did we reach such a dollar shortage? In the past 20 years, dollar-denominated debt in emerging and developed economies, led by China, has exploded. The reason is simple, domestic and international investors do not accept local currency risk in large quantities knowing that, in an event like what we are currently experiencing, many countries will decide to make huge devaluations and destroy their bondholders.

According to the Bank of International Settlements, the outstanding amount of dollar-denominated bonds issued by emerging and European countries in addition to China has doubled from $30 to $60 trillion between 2008 and 2019. Those countries now face more than $2 trillion of dollar-denominated maturities in the next two years and, in addition, the fall in exports, GDP and the price of commodities has generated a massive hole in dollar revenues for most economies.

If we take the US dollar reserves of the most indebted countries and deduct the outstanding liabilities with the estimated foreign exchange revenues in this crisis … The global dollar shortage may rise from 13 trillions of dollars in March 2020 to $ 20 trillion in December … And that is if we do not estimate a lasting global recession.

…

The Federal Reserve knows that it has the largest bazooka at its disposal because the rest of the world needs at least $ 20 trillion by the end of the year, so it can increase the balance sheet and support a large deficit increase of $10 trillion and the US dollar shortage would remain.

…

A country cannot expect to have a global reserve currency and maintain capital controls and investment security gaps at the same time.

The ECB will likely understand this shortly when the huge trade surplus that supports the euro collapses in the face of a crisis. Japan learned that lesson by turning the yen into a currency backed by huge dollar savings and increased its legal and investment security to the standards of the US or UK, despite its own monetary madness.

I think they will just print as money as they need/want.

Path of least resistance.

That’s certainly what they have been doing, and if their masters require that, they will do it again.

Been hearing it’s more of a political issue. Fed will not break inflation until population is so fed up with inflation, they are willing to take the pain it’s going to take to crush it. In reality, who knows.

I keep living frugal and tweaking investments to try to live in a financial repressed age. Trying not to make a fatal mistake.

“Fed will not break inflation until population is so fed up with inflation, they are willing to take the pain it’s going to take to crush it.”

There is something to that theory. The Fed has to have popular and political support to really crack down on inflation. Volcker had it. Powell is starting to get political and popular support for a crackdown.

But there is a chance that this will get a lot worse, given the deeply negative real yields, and the slow process for the Fed.

Volcker did not crack down on inflation. The before and after of Volcker was a ~40% devaluation of the dollar.

LordSunbeamTheThird,

BS. Inflation was getting close to 15% a year when Volcker got serious about cracking down. In the three years between 1979 and 1982, when the crackdown started, there was 40% devaluation as per CPI. Over the following years inflation slowed a lot. By 1990, it took 12 years for the next 40% decline. From 2000 on, it took 15 years to get the next 40% decline.

There is a HUGE difference between 40% in 3 years and 40% in 15 years. Good lordy. Where does your BS come from?

LordSunbeam, I’ve never heard that – that the US dollar devalued that much and that Volcker didn’t crack down on the i-word. Where did you get those facts? I’m just curious, not disputing it. And, I agree with you, Wolf, on the widespread fear of inflation during that time, which translates into some political support for stopping its run-up, but Volcker was reviled for jacking-up those rates to the point where the housing industry, at the least, was in complete smack down.

Larry Summers said it best when he said 100% of the population is upset when inflation is outpacing wage growth by a 2:1 ratio, while only a small portion of the population suffers deeply during a recession, with most of the population having nothing worse than flat or slightly increasing wages as inflation recedes.

That’s the politician’s way of looking at the problem, and thus what determines the outcome.

Conversations on this site seem to center around wage-earners, but don’t forget to consider the large voting block of retirees and pensioners.

If stocks and bonds are in simultaneous decline, as happened in the 1970’s, even for a year or so, this cohort gets double-crushed with wealth declining while costs rise.

If its stagflation, add the unemployed the list of who votes the current rascals out.

Not saying that the wage-earner cohort is insignificant, but the disenchanted mob is bigger than that, IMHO..

Here’s how I see the magic mortgage number playing out:

1) By March 1st, 30-year mortgage rates will be at 4%.

2) For each .25% rise from 4% to 5%, refi demand will drop about 25%.

3) Over that same period, new mortgage demand will drop at least 15%.

4) So whenever we get to 5%, refi demand will have completely evaporated while mortgage demand will be down at least 60% but most likely as high as 75%.

5) How long will this take? Unless there’s a recession in the next 14 months, that’s about how long it will take for mortgage rates to rise to 5%.

6) Inflation as we all know is the kicker here in terms of affecting people’s willingness to buy into a highly inflated housing market.

7) Don’t be surprised to see lumber prices tank back below $450 as well as other supply bottlenecks such as windows, appliances, etc to “mysteriously” evaporate by late this fall.

8) The last part of the magic number is the slow burn on the stock market & other assets like bitcoin. If all of these continue to decline in value over the next 12-18 months as we should all fully expect them to, then this becomes the final nail in the coffin for housing prices.

9) Housing will peak in August of this year and then will have a healthy & needed drop of 5%-10 over the next 12 months or so.

10) What happens after that is anyone’s guess. Oh, the biggest question out there is what happens as the FED starts to let its balance sheet run off. That’s the mother of all when, how, & to what effects.

By early fall, we’ll know if the FEDs glacially slow turning of the Titanic was too little & late or just about the right amount of QT.

John H, Vote the rascals out? This time it is extremely different than the last time with who the other rascals are, how much overall debt there is and a plethora of other issues we didn’t have back then. The extent of the homeless is more reminiscent of the pictures and stories I’ve seen about the 1930’s.

This time may rhyme but that’s as close as it gets.

Vote the socialists out to get in an authoritarian group whose monetary policies are different but just in who the money goes to? Not in their attitude towards money and debt though. I’ve always said for years the public was given a choice between the worst of two evils but the two parties are more extreme than I have ever seen in my 74+ years.

I hope this all ends up OK for my grand children’s sake. Right now I just don’t see a path out without lots of tragedy and pain.

@ Wolf –

Volker may have slowed inflation, but inflation was never broken, especially after scumbag Greenspan, Bernanke, Yellen and Powell followed. There has been continuous inflation for decades. aside from a blip here and there not even worth the mention ….

Someone is going to have to get thrown under the bus, but who?

No one is going to volunteer.

From Mises.org, an interesting article regarding your question:

Title:

“The Fed Is Trapped: It Has No Room to Taper or Raise Rates”

Author:

Andre Marques

Quote:

“Note (in chart 8) that when the Fed raised the federal funds rate (green line, right axis), the banks started to register unrealized losses (purple line, left axis, below zero). To prevent this, the Fed started to lower the federal funds rate. Also note that recessions (represented by the grey bars) have occurred most times after unrealized losses have been registered. That does not mean that there will be a recession right now, as there are other factors to consider. But it shows how fragile the system is, considering that the Fed is barely tapering (let alone raising rates or shrinking its balance sheet) and the banks are already facing unrealized losses.”

Article’s Conclusion:

“The Fed is trapped in its own web. It does not have much room to raise rates without major complications in the financial market and in the economy. Even if it finally delivers on tapering and starts raising rates, it won’t get any further than it did back in the last rate hike (2015–18) and balance sheet shrinking (2017–19) cycles.”

Every time I read this stuff about the Fed being “trapped,” and “cannot taper,” and “cannot raise rates,” I burst out in a huge raucous insane laugh and innocent bystanders think another one has gone over the cliff.

Everytime I look at the wolf on your mug, I picture you with a huge raucous insane laugh while you read our comments!

Is it just me that perceives some Dafoe vibes in WR?

Hi Wolf brand new here, Preferred stocks with a call of 25$ have been hit hard, even the investment grade ones, Do you think they will recover? Payout remains the same. Thanks

Mathematically, there’s a level of interest rates / treasury yields that if maintained for a certain period time that will cause great harm to the interest on the debt. For example, if interest on the debt within 6-8 years doubles to $1T and the amount Medicare Part B is in the red doubles to $1T, then America will be in the world of hurt. That’s $2T a year in mandatory spending, most likely in the form of borrowing.

I’m sure someone at the FED knows what these two parameters are, and I’m sure JPowell will do everything he can from moving us past that tipping point but to what harm to the economy? So, yes, I would agree; they’re trapped bigtime at least on the tail end of things, and I’m certainly not laughing.

IMO, they’re not trapped in terms of tapering MBS or the remaining QE or raising interest rates. But what happens if we get to 2% nominal interest rates and inflation is still chugging along at 6%?

Now, as I’ve said all along, the tapering of the FED balance sheet is the 800 lb gorilla in the room. Anytime someone in the know starts talking about when and how the FED can taper $3-5T off its balance sheet without causing a sonic boom, it gets really wonky and hard and understand as a layman. And the FED isn’t the only central bank that has to do this. Most likely, there’s $8-10T that needs to be tapered out of the global money supply in the next 3 years.

” I burst out in a huge raucous insane laugh and innocent bystanders think another one has gone over the cliff.”

“The lunatic is on the grass

The lunatic is on the grass

Remembering games and daisy chains and laughs

Got to keep the loonies on the path”

-Brain Damage, Pink Floyd

Senecas Cliff?

Here’s an article I framed and put on my wall

from the Mises Institute, misis.org

“The Fed’s latest lie: It can make everything back to normal”

August 31,2020 by Brendan Brown

This article was written before this massive inflation heated up.

Read it and weep.

Will do and thanks. Typo edit:

misis.org => mises.org

I read the article, and it doesn’t seem to offer a pragmatic solution. Just intellectually dense theorizing, which may have validity, but is too deep for me to connect to a data-driven understanding. For example:

“As regards liberty, this Jackson Hole policy review blasts another wide gap in the constitutional guardrails which are meant to guarantee the right of US citizens to enjoy sound money. Of course, those guardrails were damaged severely almost a century ago when the Supreme Court ultimately approved the Roosevelt administration’s monetary radicalism.”

I would have to understand how he defines “constitutional guardrails” and how they were damaged in the Roosevelt era. Maybe my opinion would be that there were other more important guardrails that were already broken. The author’s other treatises may clearly define this. But in the particular article, that kind of statement is moot without defining terms in an argument.

drifterprof

Read the article again. It was written during Trump administration in August 2020, when the current massive money printing started. The article was so well written that is actually could be written today and be 100% applicable to the current environment. I’m on the Mises mailing list and is the only other site other than Wolfstreet.com that I read. I think the point that we have a right to sound money is something I never hear anybody talk about. Without sound money, society collapses. Ask the Germans in 1922/1923 how they liked the German Mark becoming worthless and their savings and pensions wiped out.

I listened to a couple of articles by Dr. Doom Robin. He had a list of 9 reasons why he thinks inflation is going to be persistent. He said Fed is trying to inflate away the debt, but his prediction was that strategy would eventually fail. Debt is too big to manage it away if I understood him correctly. Probably going to be some defaults going on somewhere down the road.

Prophet,

I tend to agree with you. Fed is central planning politburo. Sure they can taper and increase rates, but they are going to be limited once defaults get to a certain level. They used to say they have to let one large financial institution go under before they come to the rescue to try to impose at least some discipline on Wall Street.

Last time it was Lehman Brothers, although some look at that as a mistake as it was messier than they thought.

They will keep raising rates to whatever level it takes to sell the damn debt and finance the MIC/SS . The Stock market is a piss ant and the bond market is an Elephant . The total cap of the Dow if liquidated would not finance the MIC/SS more than 7 or 8 years. They will throw you and me the Stock Market, Housing and keep throwing anything and everything under the bus to keep the Empire and the MIC/SS in wealth at the top. If the bond market thinks real negative yields are more permanent than transitory they could take control of interest rates away from the Fed. The Fed has competition. The credibility of the Fed will not survive that. We are now a fully mature Empire where wealth goes up not down. The Electorate could change this quickly but it has been intentionally divided over bull shit issues instead of Following the Money,Money,Money.

“The Stock market is a piss ant and the bond market is an Elephant”

I don’t believe that’s actually true anymore. I made a list (Wolf added and corrected a few items) of bond types (Federal, Muni, ABS, MBS, corporate, junk etc) versus equities and from what I (vaguely) recall, bonds valuations added up to something like 60 trillion and equities were like 50. The numbers I’m giving are certainly wrong, but the relative sizes were the same order of magnitude.

Now, which market the Fed answers to is another matter, but above my pay grade.

To be clear I was referencing the Dow 30 not the whole stock market in comparison to the bond market. Dow 30 was +10T in August 2021. It’s lost some more ground to date.

both SM and bonds miniscule with re: gazillions of ”derivatives” and other similar and mostly hidded ”financial esoterica” now approaching SO many hundreds of trillions, maybe even quadrillions…

last report seen, several years ago, was $$600 trillions in the hidden back ground that was actually driving ALL ”global markets”’

gonna be some very interesting outcomes this time, eh?

And similar going forward until all,,, repeat, ALL such esoterica is made clear

GOTTA AGREE with this DD:

After 30 years IN the SM, and about 40 OUT of it because, as very well said by others here on wolf’s wonderful world, IMHO, it, the SM, became a wholly manipulated casino in the ’80s, where I clearly was NOT part of the party; my opinion is that we are due for the mother of all depressions sooner and later…

SOME folks already in that depression because they chose NOT to participate in the GUV MINT give aways.

Others who took all they could get away with, SO FAR,,, are not, SO FAR, ”on the hook” to repay, but time will tell about that, as always.

Meanwhile, ”smart” young folks are making hay while the sun shines, and could not care less about all the various and sundry peregrinations of the talking heads or us ”old folks” who cannot, for various reasons, ”work” to make our taxes and fees and utilities and etc.

Good luck and God Bless us all!!!

Breamrod…

“The CAUSE can not be the SOLUTION.”

There are people out there that say rates can not rise, thus they must believe the CAUSE of our predicament is somehow the SOLUTION..ie to continue with rates forced well below inflation and the subsidizing of debt creation. The mind boggles. It can not be.

The Fed is SO LATE, they have exacerbated the problem. Wake me when Fed Funds equals inflation…the way it was for 70 years prior to 2009.

We will pay for the irresponsible monetary “attitude” of the past 3 Fed Chairman…Bernanke, Yellen, and Powell.

The wild cards….Russia and China.

When the Olympics finish, watch out.

The unchosen already have paid and have been paying for a long time now. Inflation, asset pumping, house price pumping, and the creation of the debt society and “easy” money has been continuous for decades. It is nothing new; it has just been accelerated under the guise of Covid.

The Fed will always be behind the curve and inflation will turn to hyperinflation after all the lies about inflation receding are over leading into the midterm elections. Hyperinflation in America in 2023 and beyond.

Powell and Macklem see no inflation. It’s transitory until the end of time.

Easy come, easy go. Powell’s claim of “transitory” was, uh, transitory.

The intentionally blind.

Tiff Macklem sees 2 percent inflation in Canada in the future. I don’t know how inflation will abate when you don’t raise rates at the meetings?

1. If the rates are raising, stocks and inflated housing market will fall. But lot of the prices that were raised will never go down. Salary never went up.

2. If you cant rent, why dont you just buy a home? A head scratcher for sure.

3. Facebook meta stocks may be hammered. But the concept of meta is the best way to track a person, their friends and family interactions. Meta will harvest all the data. A sound business model.

4. Swamp area gas prices lowest is $3.2.

5. Truckers will get their money stolen

6. There will be no shutdown. May be a continuing resolution. Debt ceiling will rise.

7. No war in the near future.

8. Now, the incidences are reduced, get ready for a hot fun summer of takeouts and sleeping inside.

Thanks for putting up with me folks…

The main difference between this housing bubble and the last one ending in 2006 is that rents weren’t also in a bubble.

This time, the choice is a lot more difficult. I consider the current bubble unsustainable but since history never repeats exactly, don’t think there will be as steep of a decline when it ends.

It’s probably going to take longer because the government will attempt to “do something”. My prediction is another mortgage moratorium, of some sort.

Given the median home price and how broke most Americans actually are, it won’t take that big of a back-up in rates to be noticeable. On a $300,000 loan which about equal to the median price less a 20% down payment, it’s $1265 @3% versus $1610 @5%, a $345 difference.

That’s a big difference to a substantial percentage of prospective buyers. It will be an even bigger difference when their portfolio has a taken a hit when this manic stock market even partially deflates, since it has a long way to go before it resembles anything close to “reasonable” valuation.

20% down…..

BAHAHAHAHAHA.

The nineties called, they want their lending standards back.

Yes, I know.

Money supply overdone…

Asset prices over done.

There are those who can’t believe that the spiking of assets and stocks can not retreat, and should be defended. And, to allow them to come down off the ceiling will ruin the economy.

(we had 2% Fed Funds in 2018 …no recession)

This is merely underscores the stupid environment the Fed has created. They let their game get too big and run too long.

The quick and effortless money made in real estate and stocks can be “transitory” also, right?

$1265 vs $1610, now add the exploding PGE bills in California, increasing insurance rates, $4+ increasing gas prices, more people end up in tents and junk RV’s. That’s just the beginning.

“The main difference between this housing bubble and the last one ending in 2006 is that rents weren’t also in a bubble.”

Rents aren’t assets and therefore they can’t be in a bubble.

@Dazed – Rent is absolutely an asset… to the landlord.

And to those invested in the landlord.

In fact, rents are an asset for most 401K investors, since real-estate investment trusts are part of the total stock market funds, and securitized lease-revenue bonds are in the total bond market funds.

The Ontario Teachers Pension fund invested in buying up large swathes of American homes for the purpose of renting to tenants.

Correction: the Ontario Teachers Pension Fund bought and is buying professionally managed rental communities from other companies. Those houses were already rental houses. Many of them were build-to-rent.

Rent is the earnings accruing to holders of real estate assets.

It should not be confused with the asset itself.

Real estate asset prices like other asset prices are prone to bubbles but their earnings (rent) are not.

Rents are also inflated by the fake economy.

Whatever you want to call it, it certainly isn’t sustainable. If you think it’s normal, let’s have the government “normalize” the budget back to pre-COVID and the FRB’s balance sheet likewise.

Rents will decline back to pre-COVID, at minimum.

I agree. I think JPowell & company are okay with a 15% decline in the housing market. Everyone knows this would be a good thing, especially if it happens over a course of 12-18 months in an orderly fashion. The problem is that once the housing market starts to turn, and it will turn, it could start a recession. If we tip into a recession, the risk of an eventual 30% downside to the housing market three years from now becomes a lot more likely. This is where I agree the government will step in with additional mortgage moratoriums and rent forbearance. The out-of-control rent prices could be a game changer once the housing market starts to turn. In 2008-2013, we saw rising rent prices because people were temporarily pushed out of owning homes for 3-5 years. Nowadays, rent is so high that you’d expect it would have to come down versus got up, if we find ourselves in a recession. That would hit the entire residential housing market as opposed to somewhat of a rebalancing back in 2008 – 2013.

I don’t know why rents would go down if the population that wants/needs to rent keeps going up.

@Enlightened. Exactly.

What I am seeing is extended family pooling income together to rent.

One of my renters who is late twenties, has his mother, and a friend renting a 4 bedroom house. Now 8 months after renting his 30 year old sister into the house too.

I made the lease out that he could only have 3 occumpents living in the house at the base rent. Every extra tenant has to pay $300 a month.

Thus he is now paying me $300 extra a month for his sister. I am starting to thing his girlfriend will move in too because I can technically call one room in the basement a bedroom and have a 5 bedroom house.

#5 Truckers and everyone else will get their gas siphoned in addition to the other misc car thefts. Hope you got a garage and can keep it locked. Alarms won’t hurt.

Current population too lazy to siphon fuel.

Meta will never be the company that launch’s the metaverse.

They have not launched a successful product since thefacebook in 2006. And they just reached saturation. There is no one left to sign up.

Some scrappy startup will create the metaverse.

The metaverse is the ultimate surveillance platform, far beyond anything Orwell or Stalin or Xi ever dreamt of. See WSJ yesterday on how tic toc measures every pause the “user” makes at anything in front of the them, as a psych metric. It is the ultimate transformation of human self into product.

When they start censoring your Facebook page which they now do that’s the end of them. I still have an open pinball challenge to the entire world and they pulled some of my pictures. I guess they don’t want their Facebook entities used for someone’s personal gain.

I think they spent $10 billion so far investing in Meta too?

Maybe they just should have bought Bitcoin like Saylor. LOL

Your money sayloring away=hilarious

Thank you again, Wolf.

Clear, concise analysis and commentary on what is happening financially and indispensable information for investing.

Wolf is helping us make some serious money.

If you are not on the waiting list for a beer mug, this review of condensed wisdom should move you to contribute to Wolf’s site.

The astounding thing to me is that Wolf is focused only on the truth with humility, intelligence and humor. No other motive.

That is rare indeed.

“The astounding thing to me is that Wolf is focused only on the truth with humility, intelligence and humor. No other motive.

That is rare indeed.”

He’s the “Fonzie” of the investing world!

eyyyyyyyyy

…. Now can’t get the intro song out of my head…. 😒

I’m looking to sell my home and will attempt to time the market just before it goes over the cliff, assuming it does. I survived the last housing bubble but I’m not going to sit this one out. Not looking to sell at the top but want to see the top in my rearview mirror. House is in selling-condition and will price it to sell. Here’s what I’m watching for:

1. Sales, pending sales, prices reductions, days on the market, etc., on Zillow. As of today, this market is still red hot (Suburbs, west of Portland, Oregon.)

2. SoCalJim’s observation of the narrowing of the spread between the CPI and the 30 Year Fixed, to about 200 basis points, I believe it was.

3. Case-Shiller for Portland, Oregon, mainly, but all local charts.

4. Case-Shiller national chart. Currently, this chart is still trending up.

I understand the Case-Shiller charts are lagging, so I’ll keep that in mind.

And then I’m gett’n the freak out of dodge and heading to fly-over-country. That’s my plan.

Here is your answer:

“That magic number will become clear only with hindsight. This magic number is likely above 4%. By the time mortgage rates reach 5%, as they did in 2018, demand will likely be waning in very visible ways.”

The number of new housing starts went above 1.7 million in December. They are building more multifamily housing as people want apartments and condos.

What is a 4% mortgage rate? The CPI is 7% as of the latest report.

David Hall,

Look at a 4% mortgage payment v. a 3%. On a $400K home (in many cities, that won’t even buy a dog house), that rate increase means an extra $4,000 a year in interest expense ($333 extra a month), which is going to knock out some potential buyers. Each time the rate goes up, another layer of potential buyers gets knocked out. That’s always how it is.

So assume you get a 5% raise on your $60k salary, and that’s an extra $3,000 a year before income taxes and maybe $2,400 after income taxes, for an extra $200 a month to pay an extra $333 in mortgage payments with.

But wait… your other expenses are way up: you pay 40% more for gasoline, and food is up 6%, and your rent jumped 12% which makes saving for that down-payment even harder, and your insurance jumped 15%, and all your other costs are up, and your raise will be more than eaten up by your regular cost of living, and you can kiss that house dream goodbye. Inflation is a shitty thing.

Don’t worry, Wolf, the scvmbag bankers and .gov will just increase the maximum allowable DTI on loan applications. Pretty soon, 100% of your pre-tax income will be just fine. Maff skills not required.

I agree with you analysis, but in MOST cities, $400K will buy you a decent house.

I work for a manufacturing company that is highly dependent on new home construction. Business has been BOOMING for the last year and a half. So much so that we ran out of parking spaces. Only hourly production workers are allowed to park at our facility. If you are a salaried worker you must park at an offsite location and take a shuttle into the facility.

Last week while waiting for the shuttle to pick me up, I was standing with two managers (I’m a senior Engineer). They were talking about the state of the business and what the long term solution would be for the parking situation. I told them that in 1-2 years their would be plenty of parking spaces available for everyone. I said that if mortgage rates rise our business will slow down. They both looked at me like I was joking and went on with their discussion.

So, I guess we’ll see?

there are still a lot of 4 bedroom,2000 plus sq ft homes in my area under $400k. Theses used to be $250k 4 years ago.

the houses that are hard to find now are the Under 250k price range

Yup.

The simple mathematics will tell you where the pain points are.

Rental increases in one area I looked at was Cornwall, England.

2 bedroom, poky little townhouse, jungle garden, built 10 years ago, £900 a month.

12 viewings in a day. Only open on viewing days, no individual visits.

Realtor expected high interest from families up to 3 kids. Minimum accepted annual salary £27000.

How do you run a car, heating, local tax, food, with that rent on that salary?

A lot of people in that part of the UK are going to be in real hardship.

@Harvey, thanks for the anecdote. It’s always the same story.

Retirees are paying cash for Florida winter vacation homes. Part of Florida remains jungle, dead orange groves and cattle ranches. I met family at a crab house yesterday. They advertised help wanted with a poster in the entrance area. Women waited tables. On the way home I saw an area recently bulldozed with grey block single family homes and grey block garden apartment style homes under construction. A stretch of road across the county line used to be two lane. Now it is four lane. Someone has money.

I don’t necessarily think they want aptments and condos, most are families are getting priced out of the SFH.

David…

IMO, as long as the 30yr mortgage is well under inflation, housing will be supported by speculators and corporate real estate entities.

To figure a working person’s buying considerations vs a real estate investing company sitting on a bunch of cash wasting under inflation is folly….they don’t line up. The later will always reach and buy quicker than the former. (However, not all residential real estate is candidate for investment.)

@historicus – I totally agree. As someone else pointed out. Why sell an asset in an inflationary environment that has to be replaced.

Plus rate are still very low.

Prophet – I think it would be super cool if Wolf could compile some WS RE insider sentiment indicator – there are a lot of people posting here who are in the Re business or closely releated – like Melissa Terzis, or Harvey Mushman, just to name a few.

Alku,

Yes, that would be cool! But in the meantime, I’ll stay tuned to the articles and comments section. I pay attention to SoCalJim’s comments too.

Not that far away with 30 year mortgage rates already at about 3.65% for the lowest risk borrowers.

“That magic number will become clear only with hindsight. This magic number is likely above 4%. By the time mortgage rates reach 5%, as they did in 2018, demand will likely be waning in very visible ways.”

My house is ready to sell, as stated previously. Since this is the month of February, I figure we’re heading into the RE season, so that’ll give me some time and a great time to sell. But perhaps not. I’ve been planning for this for a long time. And I read every word of Wolf’s articles and the comments too. Best website and quite educational and entertaining as well, IMO. But thanks for the heads-up!

Why Wait? Add on an extra $100,000 K to your best Guess and List it with 30 days to leave

To price it to sell do you mean under the market ?

Great question. What I’m trying to avoid is being without a house while the markets are still rising. I plan to rent after I sell. I don’t want to be renting while the C-S national index is still rising. I want to rent on the downhill side of the bust, if there is one. And then I will attempt to buy after the market has bottomed, however long that may be. But I hear you and appreciate the advice.

By “priced to sell,” I mean at the prevailing market price, whatever that may be at that time. But if the buyers don’t show up, then I’ll reduce the price. I’m ok with that. Again, as of today, the local market is hot, and has been throughout the winter months.

I’ve also studied the Case-Shiller charts from the last bust and have noted which local markets peaked out ahead of the national index and stuff like that. It won’t be exactly the same this time, if it happens, but studying the last bust helps.

The real estate market is broken.

The great danger is you sell your largest hard asset in a roaring inflation, and you can not reload.

The Fed has everything skewed. If you sell and the Fed CONTINUES to drag their feet (1/4 pt raises) , you could be renting, and likely storing, for a long time.

I am in the same boat. I had my house sold, and the one I was signing papers on went into a bidding war two days before attorney review process. I had to break my sale. (last year)

Now I add 17% to the old price and see what happens.

historicus,

Thanks for sharing your experience and I hear you loud and clear. I’m in the camp that the Fed will drag its feet with rate hikes and QT simply because that’s what they’ve done thus far. In that case, I do not want to sell.

It’s Always RE Season these days: (Once sold you can always find a Temporary Rental) while you find what suites you best.

Beware of RE Agents suggestions about Price! Your best interest is NOT Their agenda its strictly about the fastest road to their commission. Very often they will suggest a Low Price Bla Bla. “Talking about offers over the asking price ”

during this suggestion > don’t be sucked in.

Buyers: look at Homes beyond Their Hopes for price however an overpriced Home may bring a Lessor offer but, in this market, it’s Very common to get far more than expected.

Always Remember when you don’t sell a House you still have it you have not lost anything.

Yes, the market is is set to turn but rather then to “Gamble on Timing” just Mark it up $100 K and a 90 Day Listing or less. Price research on all Homes sold in your immediate area neighborhood should tell you a lot

in the last 2 Months. You can get you can always “consider offers “after 30Days as well in writing in your contract with the option to turn down all offers. BTW $100K is not a lot of Money these days inflation remember.

I have been studying the local market very closely. Here in Oregon, Zillow shows listing price and sales price, number of days on the market before pending, etc. Houses are not on the market long before going pending and in many cases, being sold for several percentage points above the list price. It’s actually crazier now than I think I’ve ever seen it, and I’ve been here a long time.

“Always Remember when you don’t sell a House you still have it you have not lost anything.”

Amen. Again, appreciate your input.

I’m holding onto my house as plenty of scenarios I can imagine make it super hard to replace. I’m not trusting cash or other assets all that much. Volatility makes all of the sort of question marks. I can’t live in a TSLA to-the-moon revenues dream. I CAN hunker down in my home and cut costs to the bone.

Rising rents are the cause for even the dimmest bulb to try for a house. Sadly, those marginal buyers will be the first to suffer with a high payment that they can’t afford. I can see the big corporate buyers feasting on these foreclosures. A 2.75 ten year and a economic downturn should get the ball rolling. The stock market will be curiously unaffected to fund some of this.

“I’m holding onto my house as plenty of scenarios I can imagine make it super hard to replace.”

Reading all of your comments, you sound like a housing speculator, not one who bought a house as shelter for which they were designed. Until we get rid of this riverboat gambler mentality when it comes to houses, the whole sector will continue to be sick. What it’s going to take is millions upon millions of real estate speculators getting burned to a crisp.

Phleep,

I am in the exact same situation as you. I rode out the first bust and I can certainly ride out the second bust, if there is one. And I have cut costs to the bone as I’ve been a saver all my life. But I cannot control increasing property taxes and increasing utility bills and the like. I’ve exhausted all of my discretionary “cut-to-the-bone” options, just about.

I’ve seen many housing cycles and 18% mortgage rates.

I believe the magic number is when mortgage rates reach 9% you will see the slow down on housing. Credit debt has a long way to go.

History says the consumer is the king and the consumer will spend until they can’t.

Carl M. Fernstrom

In 2018, the magic number was around 4.5%.

What happened in 2018? Sure, overall home sale numbers stalled and dipped but prices didn’t.

chim,

Oh they sure started dropping, including along the hottest West Coast areas, from San Diego to Seattle. The Case-Shiller lags about four months, so here is my report published in April 2019, which covers price movements roughly at the end of the year 2018. What happened afterwards is that Powell caved under Trump and started to back off QT and rate hikes, which then caused mortgage rates to drop from the peak of 5% in Nov 2018, which caused housing prices to rise again. This is the oldest relationship in the book. Funny how people tune out house price declines:

https://wolfstreet.com/2019/04/30/the-most-splendid-housing-bubbles-in-america-april-update/

OK, folks, just back from my fav tourist-trap gas station in our neighborhood: regular on the verge of going over $5, premium already above $5.

We don’t get gas there ever. But other gas stations are not that far behind. Thought you might get a kick out of it, in terms of our inflation discussions

Wolf,

Did you miss that when you fill up that you can “play” to win free fuel!

Instantly!!!!!!!

This is so not inflationary!

Hahahaha, yes I missed that!!

There are not enough “I Did This” stickers with Joe Biden’s picture to go around.

People are angry about this stuff. They don’t like expensive fuel and being forced into EVs. You won’t, of course, see that on the news, or in the rigged polls.

$3.20 gallon regular at many midwest Sam’s Clubs.

$2.89 for RUG this morning when I filled up here in Texas.

Those West Texas oil rigs are no doubt stating back up now that oil is approaching $100.

I pay $2.20 per gallon… Because I drive a CNG Civic. But it was a $1.80 per gallon equivalent only a few months ago.

Steve Sovring,

It’s a shame that CNG or dual fuel systems never took off with consumers. Hardly anyone bought Ford’s CNG F-150. Ford also made I think a CNG Crown Vic that hardly anyone bought. Other automakers too made some CNG vehicles, as you pointed out with Honda.

Wolf tried congress in Midwest utility company ,I worked for they won’t start @ 19 degrees ,total failure but only wasted 500,000 $ idiot management ,

just filled up for $2.95 in fly over country. But that won’t last long.

Not far behind in AZ. Regular was $4.34 when I filled up yesterday. What a sham…. Noticed someone put a sticker of a grinning Biden pointing at the price on the pump with the caption of “I did this”.

Gas here at my favorite station here in fly-over Wisconsin was $3.06 for regular this morning.

Two weeks back was under $3.00. Something like $2.94 if I remember correctly.

I suspect a lot of those sky high gasoline prices reflect a regressive tax on the locals.

CNG

Interesting Wolf,

if you convert our UK prices to USA gallons (which are about 17% smaller than UK gallons) it works out at roughly £5.40 a gallon or about $7 a gallon in US funny money. There was a time when US Gas prices were a fraction of European, not so much now.

The other point is that people in the US do tend to drive much, much further than we do, just to do anything, so it probably works out more or less the same. So, in real terms you know inflation is bad over there in USA land, if you are spending the same or more than we do, in highly taxed Europe, just to drive to work. (and that doesn’t count the fashion , over there, to drive around in truly massive, gas guzzling trucks) Meethinks I spy trouble a brewing.

Anthony

I’d like to see gas get to $7/gallon here as well and get some of these cars off the road. It’s gets horrible driving around here with the traffic. Since the pandemic started winding down, a lot of people are still shunning public transit leading to excessive cars on the road. A $7/gallon gas price will do wonders to cure this problem. Bring it on!!!

…and probably put half the country living under bridges and overpasses (and on public transit).

A lot of people live in DC don’t even have a car. There is great public transit and bike lanes all over. Most of the trips are very short in terms of mileage. There are also very few big cars in DC. No way to find a place to park with them. Small cars, small trips = low gas consumption. $7/gallon would not affect the average resident here one bit.

The country runs on gas/diesel, and a domino effect would follow the hike. Consumers are at the end of the line.

Most people in the US HAVE to drive. The infrastructure doesn’t even exist for public transportation. There are 11 states in the US which are each bigger than the entire UK. When you consider the size of the entire US, and the population, there’s a whole lot of driving going on.

That is standard around here (San Diego area). I bought some hedges. A nice thing is, regular brokerage accounts have so many products these days.

Oil popped to $150 bbl. in 2008. That was the final straw that broke the market.

That’s bupkus….try £1.50 a litre x 5 (imperial gallon) = £7.50/gallon x 1.35 = $10.25 (minus 25% for the imperial gallon adjustment) but you get the point…suck it up, buttercup!

That’s the ‘planter’ you live in, buttercup!

Time for the CPI guys and gas bars to switch to price by the quart.

Here in Can it’s in liters, 1.62 C$ per right now.

So 1.25 for a WHOLE quart sounds better eh?

I remember when certain gas stations in the US sold gasoline by the liter. Talk about gouging a confused customer!

Come on 3.5% 10yr !

3.5% ten year….with 7% inflation is a deal?

Who’d a thunk it.

oh, that’s only the ‘transient’ rate. 🤣

Mill Valley CA Arco is $4.13 Cheapest most likely

https://www.gasbuddy.com/station/11594

Fort Bragg CA is $4.44

I was thinking condo purchase in the next couple years. Already have a substantial down payment raised. Just waiting for RE prices to come down. Saving what I can in the meantime.

LK

They won’t come down. The only thing you are going to get by waiting is a higher interest rate and a higher monthly payment.

If the price of gas rises rapidly enough the stations will make more money if they stop selling the stuff and just sit there.

Typical storage capacity of a gas station 40,000 gallons.

US gas price November 2021 was 2.20 dollars. Today 3.40 dollars. So if you’d just locked the place up in November of last year you’d have made 48,000 profit.

I only mention that because countryside dwellers in the UK have reported that their deliveries have stopped, not that the price of LNG has gone up, but that the deliveries themselves have stopped and suppliers aren’t returning their calls/mails. I wonder if these LNG suppliers are in fact delaying because nobody wants to be in the business of selling anything that is rapidly increasing in value.

Not a good dynamic as far as the inflation story goes. That could be whiskey sales, its not just consumers who hoard.

Gas doesn’t have a long shelf life

Great in theory !

However, gasoline, unlike whiskey, does have a shelf life….

Unopened whiskey in glass bottles unopened 20 years ,gas about 1 year

…and I suppose the expenses just stop?

I am so happy since I went to 50cc scoot. Still haven’t been able to put $3.00 fuel in the tank even though fuel is $3.00/ gal. Look forward to every trip, but I live in a great location to go 30 mph.

Old School, you just brought back some awesome memories for me.

When I was 16 (in 1973), my father allowed me to get my driver’s license with a motorcycle add on. But he refused to get me a car because he didn’t want to pay for the car insurance for a 16 year old (it was substantially higher than insurance for an 18 year old). So what did he get me? A Yamaha 50! Its top speed was 35mph. Living in Massachusetts, I drove that thing all the way up to Christmas, wearing multiple layers of clothes and topping all that off with a parka, a neck scarf and gloves along with my motorcycle helmet. BURRRR.

A high school buddy who I still stay in contact with told me a few weeks ago he remembers his grandmother laughing her butt off when I used to visit his house in December because of what I wore to say warm riding that scooter.

Thanks for bringing back a fond memory for me!

Mine was a Miny bike in Nebraska ,twice as fun in snow

Minibikes were way cool too, as were go-carts!

If 4.5% was the magic number in 2018, wouldn’t 4% or less be the magic number today, given home prices are 15-25% higher than they were in 2018?

I think this Spring is going to be a no-win scenario for RE owners. If the Fed keeps raising rates, RE drops. If the Fed stops raising rates because of stock market and bond trouble, RE drops along side those competing assets. In short, RE drops.

I think this Spring is going to be a no-win scenario for RE owners

But actually, it gains because $ Money is worth More

and that’s the most important thing. Makes your house worth more simply not being inflated. Creates a “Normal Market” rather than a Nightmare. Got something in the bank becomes ok again having a stable Value rather than partial deprecating value.

Having Less becomes having more.

Now about all the fools that are responsible for this

and get off scat Free that’s a good question

Bobber

Not gonna happen. With rents going up by double digits, no one is going to sell their investment properties. This creates a shortage in available housing for owner occupied housing and first time home buyers.

Even if most do not sell, some will, and prices will fall. One transaction reduces the price for everybody in the neighborhood.

Those who want to sell at the top will sell. Inflation will evaporate when asset prices crash.

What about all those homeowners who locked in 30yr loans at 3% [like me]?

If they keep the job they qualified the loan for, they can just ride out the dip. If rising interest rates slow down construction and the population keeps going up, you are going to even more of a housing shortage problem. That will drives housing prices back up again. As the population goes up there will always be a percentage of renters who will do anything to buy a house. They will drive the market.

If you have a house with a low interest fixed rate, you have nothing to worry about in the long run. I am not worried about a dip.

On the other hand, if you borrowed against your home equity for toys and blow, you probably have a problem.

The average stay in a home is about 8 years, not 30.

Just because in the past home loans turned over in 8 years does not mean that in the future people won’t keep their houses longer, especially to ride out a dip.

Plus, that’s a safe road to stability, but not wealth. You don’t want money tied up in a slow moving asset with little upside for 30 years after the stock market tanks by 70%. By owning your home, you lose a ton of option value. Better to stay liquid until the stock market tanks, and buy stocks and RE at a reduced price. Committing your capital at these levels makes no sense to me. Think long term. Think opportunity cost. Have patience.

It depends on your portfolio.

I have nice house I bought in Dec 2019 which has doubled in two years [from 1.6 mil to 3.2 mil].

The 400k that I put down was a small percentage of my net wealth.

1.2 mil that I borrowed is on a 30yr fixed rate,and I can easily afford the payments from my NOI. In real terms that payment will only go down with inflation, making my house even more affordable.

My wife and I have to live somewhere-we chose to live15 minutes from our grandkids, even though it is an expensive neighborhood.

Anyone who buys a house now at 3.25% is going to be laughing evey day when rates hit 6-7%.

As long as they can make the payments, which a prudent buyer should be able to do.

RE here is still selling in days for 5-20% above listing.

When does it become prudent to buy bonds ? Inflation is not going to run 7-10% forever. Buying and holding a 10 year bond at 4% ? 5% ?

Beardawg

Correct, 7-10% can’t run forever, based on past history.

BUT, never has the money supply been so “goosed” and never have rates been so suppressed. Historical norms have been tossed out the window by these central bankers. This could get very crazy before any normalcy returns.

Beardawg,

If the 10-year goes to 4% or 5%, I’m going to be a buyer. Except if CPI goes to 12%, then I’m going to be a wait-and-seer :-]

That’s an interesting thought. Do you suppose the retail investor has any influence in this market? At 5% yield the stock market would probably lose some altitude. Would you cover your short and buy bonds? To me the 30 year at 5% is a lot more interesting.

Yes, buying bonds is bearish for stocks. If lots of people sell stocks to buy Treasuries, the stock market is going to take a hit. This is normally the issue when Treasury prices have fallen and yields become attractive.

So from that perspective, my short would be supported by investors selling their stocks (someone is going to buy them but at lower prices) to buy Treasuries.

If someone has no experience shorting stocks / funds or dabbling with VIX or inverse funds, how would they short the market? (asking for a friend)

… and we are to assume the Fed keeps their filthy hands off of rate depression?

I’m with you Wolf. You have to make a bet that some tightening will cool the RE and financial markets. It’s just that it always seems to take forever to get to the point of pulling the trigger on the bet.

If the weekly SPY close Jan 10/17 gap, before plunging to the bottom

of the cloud, near the cliff, between Feb high and Mar low, JP will bs the Wimmers.

in the early ’80’s my finances were a wrEck. Having indebted myself to 30k in a silver fox farm gone bad, I began selling life insurance while living in a 250 a month apartment with a urine smelling elevator. I was earning 12 to 30k gross but paying 22 percent on my debts didn’t leave me with much. people noticed I was losing weight, basically starving to pay off that loan, which I eventually did.

Watching what is happening today with govts and individuals levering their debts to the max I have difficulty understanding how this thing won’t collapse into a steaming pile of excrement within a month or two. Default seems to be the way forward and will be inevitable on a massive scale but in the end,property will still be there, just the name on the title will change.

KLAUS’ prophecy: you will own nothing, and I will be happy, (paraphrased) does not seem impossible, anymore. Debt is a like a nagging wife that just won’t shut up.

I built my own house, am debt free and recently got an assessment of 200k. I guess I won’t be selling. With 200k I could rent a shack for 5 years and look forward to being homeless after that. An obvious nogo. I could not afford to buy what I built with my own hands.