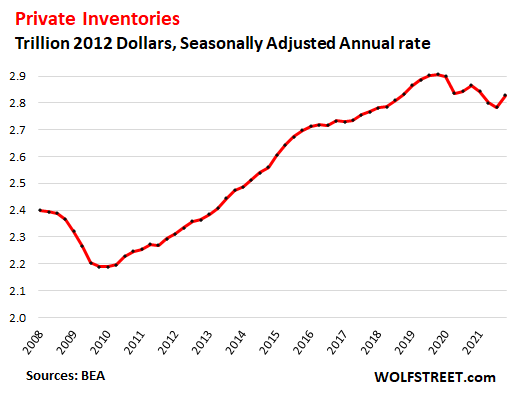

But companies were finally able to rebuild some woefully low inventories in Q4.

By Wolf Richter for WOLF STREET.

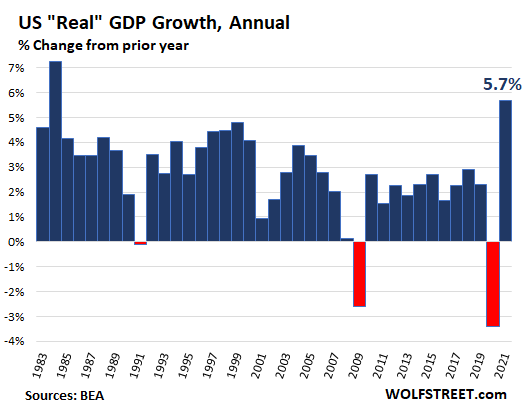

GDP is adjusted for inflation to get “real” GDP by expressing everything in “chained 2012 dollars.” In this manner, real GDP in all of 2021 jumped to $19.43 trillion, up by 5.7% from a year earlier, the fastest annual growth since 1984, according the Bureau of Economic Analysis today.

This was a historic year, in terms of inflation, hyper-stimulated economic growth, trade deficits, and distortions, such as the labor and materials shortages. In the decade from 2010 through 2019, annual real GDP growth averaged 1.9% and never quite reached 3% in any single year. A range between 2% and 3% growth is now considered good and sustainable for the US economy – without running into the distortions now bedeviling the economy, where business are hobbled by not being able to get what they need, and consumers are confronted with some empty shelves, nearly empty lots at new vehicle dealers, and soaring prices.

In actual or “current” dollars, not “chained 2012 dollars,” GDP — “nominal GDP” — in all of 2021 jumped by 10.0% year-over-year to $24.0 trillion.

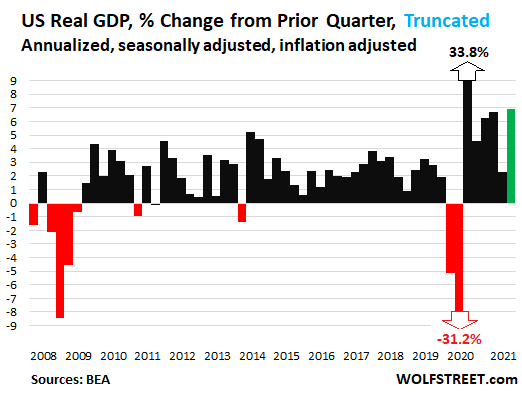

In the 4th quarter, “real” GDP, expressed in 2012 dollars, jumped by a seasonally adjusted annual rate of 6.9%. For a better view of the details, I truncated the two historic outliers, the 31.2% plunge in Q2 2020 and the 33.8% spike in Q3 2020:

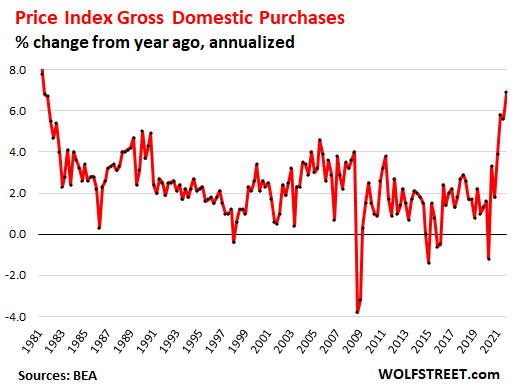

Rampant Inflation on the loose: The Price Index for Gross Domestic Purchases, the BEA’s inflation measure that roughly parallels its inflation adjustments to GDP, spiked in Q4 by an annualized rate of 6.9%, the worst inflation since Q2 1981. This is why the Fed is getting serious about inflation:

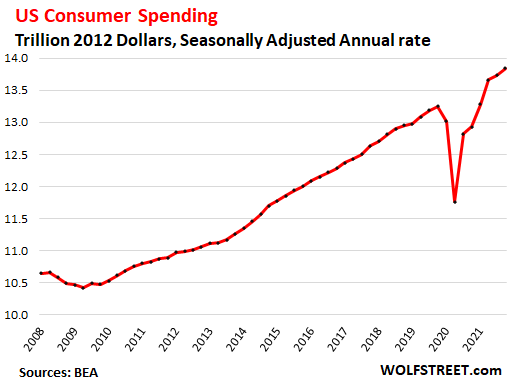

Consumer spending rose by an annual rate of 3.3% in Q4, adjusted for inflation. This was at the higher end of the normal range before the pandemic, after much of the stimulus money sent directly to consumers was spent and new flows largely ended.

Consumer spending as a percent of total GDP, at 69.9% in Q4, has now returned to below 70%, after two historic quarters above 70%.

Consumer spending was still hampered in part by shortages of goods to buy, particularly a biggie: new vehicles. And spending on goods edged up by only 0.5% (annualized). But consumers made up for it by buying more services, where spending jumped by 4.7%.

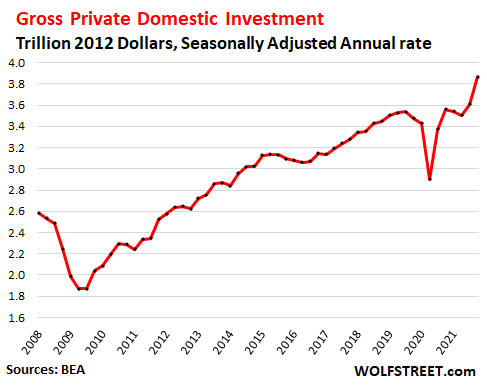

Gross private domestic investment soared by 32% (annualized), to a seasonally adjusted annual rate of $3.87 trillion. This category includes fixed investments, such as nonresidential structures, equipment, intellectual property, and residential structures. And it includes “change in private inventories,” and more on that in a moment.

Private inventories finally rose, after having dropped for the first three quarters of 2021, leading to the shortages that businesses and consumers have encountered. As we have seen with new and used vehicles, industries were able to rebuild little by little their inventories, though in many industries, including the new vehicle industry, they remain woefully low.

In Q4, private inventories jumped by $240 billion annualized rate to $2.83 trillion. A rise in private inventories is considered an investment and thereby increases GDP, while a drop in inventories reduces GDP. After having dogged GDP for the prior three quarters, inventories finally added some oomph – and there is likely more to come in 2022, as companies are trying to rebuild their inventories:

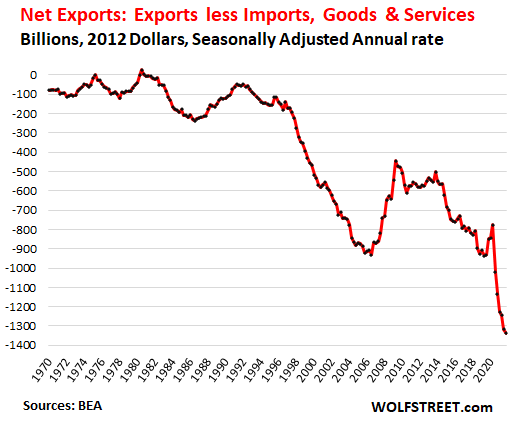

The Trade Deficit in goods and services worsened by 6.7% (annualized) to a new worst record of $1.34 trillion annual rate.

Exports add to GDP, imports reduce GDP. “Net exports” (exports minus imports) deteriorated due to soaring imports, which were fueled by consumer spending on durable goods.

Since Q1 2020, the huge amounts of stimulus sent directly to consumers and provided by the Fed via asset price inflation has stimulated the big exporters outside the US. The relatively small dip in Q4 shows that either stimulus has worn off or that consumers had trouble buying imported goods due to the supply-chain chaos, or both.

The chart is an indictment of globalization over the past three decades, committed by Corporate America:

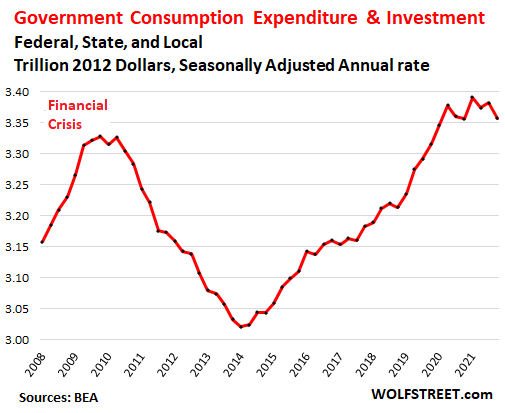

Government consumption and investment declined 2.9% (annualized), split up by a 4.0% decline by the federal government and a 2.2% decline by state and local governments.

Government consumption and investment does not include transfer payments to consumers and companies, such as stimulus payments, unemployment payments, Social Security payments; nor does it include government salaries, and other direct payments to consumers. Those payments enter GDP when consumers and businesses spend or invest this money.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The government pretends the economy is doing great and we pretend to believe them!

a Russian colleague (naturalized) of mine used to say of the government “they pretend to pay us and we pretend to work.”

No one in their right mind believes anything that comes out of Washington DC or Sacramento these days

It is true! I saw this first hand while working in Siberia in 1983! In addition, they all waited for the other guy to do the hard work! The problem was, the other guy was waiting on them!

If this economy can’t produce a reasonable path to rewards and opportunities in a reasonable time, across a broad segment of society, the incentives and the work ethic will evaporate. Yes, it is partly the responsibility of business, and partly of the individual. But there is no sense to work oneself silly just to enrich some superstar oligarch. Oligarchs have an unbeatable pile of chips in the casino, bargaining power for steep and ironclad contract terms, and access to power. I think we’ve been losing traction on this. The loose money aggregated at the top means prices of vital things in capital formation (such as home ownership, and stocks and bonds with reasonable returns) are bid way up. Hence, high buy-ins and lower return rates.

Making money and credit more dear, now, does not un-ring this bell.

The alternative, sadly for those who can’t find a respectable trade going forward, is to beg or steal, in some form.

The government is supposed to have the power to protect the oligarch’s game just as it is, but it also has the power to tax them, so that it can make money and credit more dear for them, and less so for all the rest of us.

But like you said, has our government lost traction on it’s ability to do this?

Wes, Michael, we get all the “hate the government” bumper sticker speeches and anecdotes.

So do the oligarchs who programmed you.

Real GDP fell -3.4% in 2020

Then Real GDP rose +5.7% in 2021.

The net gain in two years was +2%

Ho hum.

It also took trillions in additional public debt and QE to achieve that pathetic result.

I’m hoping my wife doesn’t get the idea of increasing our family GDP by greatly increasing her credit card expenditures.

Very good point, Mr. Frost !

@Richard … and the 2% is well within the error margin of the inflation measurement. Wolf has shown how the CPI gets it wrong on housing and cars.

We also know food is wrong because it assumes people will substitute hamburger when steak prices go up, and that they’ll substitute dog food when burger prices go up, and they’ll substitute lawn clippings when the dog food bill is too high… , and food wrong.

We also know that medical care is not priced using a system that any sane person could comprehend, although somehow it generates huge profits for the CEOs and their well-reimbursed pet government officials.

Housing, cars, food, and healthcare together comprise about half the economy.

Doubt they can measure the other half any better!

WIsdom

You make a point that is often overlooked.

The PCE allows substitutions OUT of items that rise “too much” in price. Chain weighted.

Talk about a low reading of inflation biased metric. File that game with the renters equivalent survey for housing costs.

Do the math. Government deficit was 12.4% of GDP in 2021. 5.7 minus 12.4 = minus 6.4.

2020 government deficit was minus 15% of GDP.

Real negative rate of interest of minus 7% is a feature, not a bug. We are in a humongous debt bubble that has to be paid for one way or another.

1981 – FED funds rate almost 20% with annualized 8% price index.

2022 – FED funds rate .25% with annualized 6.9 price index.

Just absolutely stunning how far behind the curve the FED is.

The only real explanation, IMO, is the Treasury’s enormous fear of what rising bond interest payments will do to our interest expense, especially if they stay high for years to come.

Not addressed to Jay in particular, just general comment.

I’m sick and tired of ANY comparison between Volker and Powell.

Totally apples and oranges.

Can you say, “There was NO DEFICIT SPENDING of any significance, and the budget for all practical purposes was BALANCED prior to the Great Reagan? (except maybe for a lot of “hidden” Vietnam stuff. WW2 was essentially paid off, anyway.

Not to mention all the other oligarch favorable things that this senile oligarch puppet began. And a Corporation and/or a pile made during prohibition, the GD, or WW2/Vietnam was the primary ticket to oligarch status.

Repeat till it sinks in…then think (look at) about tax rate schedules, including the “death tax” until that also sinks in.

EVERY time he saw Reagan on TV, my very conservative businessman step-father (built his own large insurance agency and also was involved in a very large extended family booze business…Italians)

Would yell, “Balance the budget, you dummy!”

“If you lived with a roommate as unstable as this economic system, you would’ve moved out or demanded that your roommate get professional help.” ~ Richard D. Wolff

Judging by the “only” 10 percent reduction in the SP500, I get the sense that the markets don’t entirely believe what the Fed is giving forward guidance on.

Why isn’t the bond market front running / pricing in all of the rate hikes for the entire year?

There is still some level of disbelief by market participants that the Fed may or may not do what it says.

But there will be a surprise waiting for folks if the Fed does indeed do what they say they do. God forbid if the Fed hikes by 50 bps or more…

Fund managers rotated heavily from growth to value, which is distorting indices. The blue chip names are holding up the Dow.

Many high-growth, money-losing names, especially in the technology sector, are down 50%, 60%, 70% from highs. All because of a minuscule 0.25% funds rate increase in 6 weeks.

Well depending on how you want to look at it, they should have never been up 50,60,70 percent to begin with?

I think the keyword was “miniscule”

down 50% means they were up 100% (1/0.5), down 60% means they were up 150% (1/0.4)

“Fund managers rotated heavily from growth to value, which is distorting indices.”

Which means someone else owns the growth stocks they sold. So what?

Jackson Y

‘because of a minuscule 0.25%’

When the the mkts being played with borrowed money + leverage, even a minicule increase in rates has a profound effect across the credit mkt. Wait it goes above 1.5 % or close to 2.5% (in 4th qtr 2018) when the mkts made a tantrum. we are NOT there yet but going there down the roads unless Mr. Powell chickens out!

As per Fund managers rorated heavily from growth to Value is a Wall St’s siren song to assure investors ‘everything is ok, b/c we are buying only stocks with value. Bunkum! When the indexes are going down, all stocks including value stock go down with the exception of staples, some health care products, meat packers, food – wheat, corn and soyabean. An of course now the gossil fuel are the darlings and will remain in the clamor for ESG. There is a chance we may be heading into recession with stagflation or worse disinflation due to Fed’s pl[olicy erors (s) . It has happened in the past. Been in the mkt since ’82, NOT to believe what financial media broadcasts.

Your MFund managers won’t protect your portfolio (unless they are bear funds) restrained (cannot go against the mkt(by the rules in the their prospectus. They may go to some cash but most will remain invested in the mkts. See what happened to those MFunds during GFC, when S&P lost nearly 60%!

Don’t forget precious metal ,usually go down too

Rotation huh? How about value being next rotating into the breach for multiple slashing. There is no such thing as value stocks at these ridiculous multiples. The market didn’t partially inflate. If the Fed does what it says it will do, all will have their multiples slashed along with their dividends.

Very true.

Even the so called value stocks are not really value as high tide lifted all!!

Intel and AT&T both sell at less than 10 times trailing earnings and pay good, well-covered dividends. There is some value out there if you look for it.

Peanut Gallery

The reason the bond market hasn’t completely collapsed is a lot of people including myself and Larry Lindsey don’t believe the Fed will follow through with their rate increases in March. There will be some Black Swan event which will be used as an excuse for holding off on the action which will affect the markets in any negative way. And even if they follow through with a 1/4 point increase in the federal funds rate, that is so minuscule compared to the magnitude of the problem with inflation that is almost like doing nothing. The bond market is smarter than you think.

Swamp

There are those who maintain Russia makes its move (and maybe China) after the Olympics…and before the ground thaws.

That makes it before the alleged March hike.

Thus the Black Swan.

historicus

Yep, good bet

If it happens it will happen after the Olympics. Russia and China talk to each other. China wouldn’t be very happy if Russia spoiled their big show for the world.

The Fed will do what they say but grudgingly while dragging their feet. The PMC depend on asset inflation for compensation for their support and could care less about the working classes. This has been going on at least since the 80’s (remember yuppies).

Powell said today he thinks that inflation affects all Americans, and that the Fed controls inflation to the benefit of all Americans.

Except some Americans have “tough choices” to make. This is double speak. The “tough choices” for one sector is “do I fill up my gas tank or buy groceries?”

Powell slipped up badly. He revealed his duplicity.

4 hikes still leaves inflation 6% above Fed Funds….UNHEARD OF….and one can only think it is by design.

I will think that until further notice.

It’s funny, for as much as they talk about the Phillips curve they hardly understood it. Labor at maximum employment is causing the high inflation. Soon it will reverse and cause a massive panic. That’s how stopping money printing has worked in the past.

Last week Federal Reserve Credit

was a record $8.826 trillion.

This week Fed Credit

averaged $8.839 trillion,,

an increase of $0.013 trillion

setting a new weekly record.

Richard Greene,

This week (Wednesday level, released this afternoon), Fed credit FELL. Jerry-picking “Wednesday level” for your first paragraph and “weekly average” for your second paragraph to make some kinda point??? Sheesh.

A lot of times the market actions seem strange especially the treasury market. Each time QE was implemented to lower rates, rates rise. Look at the 10 year vs. QE.

Economic growth since GFC has been very poor but stocks and housing up in the stratosphere.

“Indictment” of globalization to be sure, but with no punishment of the responsible parties. Instead we give them and those they helped elect more tax breaks.

High inflation really derails the whole charade. Inventories are still down while consumer spending chugs right along, doesn’t make me think inflation is going away any time soon. Policy makers can’t pump in support for the lower/middle class without bringing on more inflation, all they can do is talk about raising rates and hope that cools things off.

all pretty good ex the trade deficit. China is signalling a slowdown, and more domestic consumer investment. The US has no excess capacity to take up the slack. Supply chains may be with us for a while.

The beauty of economics is that it is a science….much like physics.

For every action, there is an equal and opposite reaction. We see it now with PUNISHING inflation……the reaction to M2 expansion and fake low rates.

There is no escape from its realities.

I would put it this way for every well intention government action there are 330 million unintended consequences as people try react to get the carrot and avoid the stick.

“The beauty of economics is that it is a science…”

US economists, as a group, have never predicted a recession. Not very good scientists !

I agree with your sentiment but must strenuously object (as a physical scientist) to your analogy sir!

Econ is not only NOT “a science like physics”, it isn’t even a science.

If economics were a science, it would have jettisoned all the models that failed in 2008 and started over.

For that matter, if Econ were a science, it would’ve recognized that abandoning the gold standard in 1971 was a fundamental change in the nature of the fundamental unit of economics (the dollar). Data series priced in pre-1971 gold-standard dollars are not comparable against post-1971 series. Mean-reversion as a principle depended on credit being fundamentally limited by the supply of gold – that no longer applies. Nearly every data series that goes back far enough shows some kind of inflection in 1971 or thereabouts. And yet nearly no one noticed that something huge had changed in Econ!

Not noticing that huge fundamental change… is comparable to physicists not spotting a change in the speed of light, or chemists not realizing that H2O became HOHOHO.

I would add that inflation as a consequence is neither equal nor opposite to the money printing.

The money printing benefited asset prices and the wealthy.

The inflation is punishing all right, but it’s punishing the poor, the hard-working non-savers who can no longer make ends meet, and also the savers who hold all the assets that didn’t get inflated by the money printing.

Money printing –> inflation isn’t an equal-opposite thing. It’s just another turning of the screw that inflates wealth inequality and deflates justice worldwide.

I hope everyone understands your point about limited gold-backed dollars. In those days banks competed for our savings, paid competitive interest because ‘Money’ was worth something.

Now with unlimited dollars coming from the government low-no interest, our savings are worthless to banks. Money is a tool for the rich and a predatory burden for the rest of us.

“If economics were a science, it would have jettisoned all the models that failed in 2008 and started over.”

The central bankers are sure they did the right thing.

How have the scientific responses to COVID played out?

What theories to follow is decision making, and that process applies to both economics and science. The choosing of the theories, in economics and science, becomes more a matter of “art” than either, at some point.

For every monetary policy decision to “action”, there is a “reaction”. And I do maintain that the bump in the money supply has created an inflationary “reaction”. That fake low rates “action” creates irresponsible debt creation “reaction”.

I agree with the remainder of your comment.

Thanks WS,,, I get SO tired of trying to get folks to understand that economics, and all so called ”social sciences” are NOT any kind of science AT ALL.

As one with a solid science background, including some of the math used to communicate the ”theories” of the ”hard” sciences, physics and chemistry,, and, OK, maybe biology, it seems a Sisyphean task, that’s far damn shore!!!

Just one more example of the dumbing down of the public in the last 50 years or so,,, sure seems deliberate at this point, making it much easier for the ”divide and conquer” techniques that the commies announced they would be using against USA back in the 1960s,,,

@Historicus –

Thanks, but understand that I’m not talking about policy responses in real time. COVID is a great example of how science and politics mix poorly; it doesn’t help that the pandemic policy playbook is authoritarian and suppresses the very dissenting voices that are what drive progress in science.

What I was talking about is much deeper. The fundamental theoretical flaw in Econ that I’m talking about is the inability of any of the standard models to predict, or even to comprehend, things like price bubbles, market crashes, or basically anything other than a first order if-x-then-y effect. There’s no understanding of second-order or more complex behavior, which is why “unintended consequences” is such a thing.

So basically whenever things are going okay, econ is roughly right but nearly useless. But when Econ would actually be useful – to predict and avoid, or even to mitigate (in a just way) crises – it totally breaks down.

Econ currently is like a weather forecasting system that barely gets the usual daily temperature right, but cannot predict storms, heat waves, cold snaps, high winds, tornadoes…

Meteorology is a complex science and doesn’t have long-range predictive power, but I suspect it’s far more valuable economically than today’s macroeconomics, because even a few minutes notice of a tornado or a few days’ notice of a hurricane or hard freeze saves lives and money for millions of people…

“All Science Is Either Physics or Stamp Collecting”.

(Ernest Rutherford)

The seasonally adjusted annual rate of 6.9% is double the number of comfortable GDP growth and indicates an overheated economic steam engine.

One more worrisome reason for Mr. Powell & team to take the shock and awe route for their first rate hike, if they understand.

And doing so will be their only credible action towards trying to bring the runaway inflation train -which they’ve created- under control.

Anything less than a 50-bps raise would only confirm their cluelessness and will have dire consequences for Mr. Biden and the Democrats.

Peter Doocey of Fox is a nuisance troll other wise, except his question about inflation was IMO valid and come November Mr. Biden will be regretting not understanding the question..

Fed knows they can’t kill inflation without killing a debt ladened economy. As Bernanke said inflation can be killed in 15 minutes by a central banker. They can’t do it without putting US in a recession.

Minor correction, “ Without putting the world in a Depression”

Fed Funds were 2% in 2018.

No recession.

But………..the markets didnt like it. So the curtain is really pulled back as to what the mission of the Fed really is…..

Is it the economy or the market? For they are not the same. Looks like it is the market.

His question was stupid because he is a stupid sonuvab***h. No coded language needed.

Out-of-control inflation is always a political liability. That’s why his question was stupid. It was something everybody already knew. And Doocey milked the moment for all its worth on Fox News.

He understood it just fine.

QQQ shakeout day. AAPL will lift the market tomorrow. There is hope for QQQ, even if they will turn down in Feb for while.

Why would aapl lift the market?

I thought they were a just another China company?

It is time to DECLARE…

Apple and Microsoft are MONOPOLIES (biopolies)

They control how much of the operating systems of person computers?

And they FORCE YOU to make upgrades….and one wonders the impact of all these “updates” that are forced upon your computer.

I switched to Linux / Mint on my desktop. So far, so good. Takes some studying to understand the nuts and bolts (understand dealing with some things by command line interface). But very nice liberated feeling to not have Microsoft implanted on my nervous system (including using LibreOffice instead of Microsoft Office).

Wow. Bluest chip tech firms = built-in treadmill of malinvestment. THAT cheers me up. All a peasant like me can do to hedge that is — buy their stock?

Apple owns intellectual property. Without intellectual property rights, innovation would collapse. There is Windows, Android and IOS. Huawei is developed their own operating system to try to get back in the game after being cut off from using Android. Plenty of competition. They won’t give you a free lunch, they want you to get a job.

@Drifterprof and @AnyoneElse, I too switched to Linux/mint for a perfectly fine 12 year old macbook pro that would otherwise be a brick apple quit supporting with software updates. Not even their own Safari browser works on it anymore. It was a very expensive purchase for I had to make for work back then.

Linuxmint is similar to WolfStreet in that it is free and supported through open source and donations. It’s worth investigating if you’re so inclined. Search for ‘linuxmint’.

APPL has 150 billion in cash reserves…

Going backward 7% a year….

oops?

No, it’s actually $150B of someone else’s debt. That’s what practically all “cash” actually is.

@ Augustus Frost –

Cash is not debt

MSFT and TSLA just recently posted solid results – did it help?

Now good news is bad news :)

Sentiment changed

The +6.9% annual growth rate of real GDP in 4Q 2021 was mainly from +4.9% inventory growth. Meaning that real final sales grew at a +2.0% rate. Real final sales (6.9 minus 4.9) is a better view of the US economy because it eliminates volatile inventory changes from quarter to quarter. A large increase of inventories might be good news if economic growth was going to accelerate for the next few quarters, but that is not happening.

This is global China will default on dollar bond payment ,us gave away manufacturing base ,Russia trying to start a war ,with there interest rates at 8% it could get ugly

Ukraine became an independent state after the 1991 collapse of the Soviet Union, and had the world’s third-largest stockpile of nuclear weapons.

Budapest Memorandum:

Russia, the U.S. and the U.K. pledged to “respect the independence and sovereignty and the existing borders of Ukraine.”

Ukraine gave up its nuclear weapons after that promise, sending them to Russia for dismantling.

Russia violated the Budapest Memorandum in 2014 when seizing Crimea.

And appears to be ready violate the Memorandum again.

China, with an interest in seizing Taiwan, is watching Ukraine carefully.

One problem with your fable Dick , Russia didnt “ seize” Crimea. There was a referendum and the population voted to become part of Russia Please stop spreading “ fake news”

Flea,

the manufacturing loss causes may surprise you.

20% loss of manufacturing can be chalked up to offshoring. The other 80% is due to advances in tech and automation.

Automation and tech are the true culprits, but don’t believe me I am just a dude commenting. Research it for yourself.

The problem with tech/automation is it does employ vast scores of people with decent wages(like manufacturing used to)…… it employs a very small percent of the population with tremendous wages/wealth.

My brother told me 30 years ago when he was programming and working in tech how they were eliminating jobs en masse.

Good reply

Industrial Production was rising at a healthy rate until Fall 2007. Getting more industrial production with fewer people would be considered good news by most economists — that’s called productivity. The rise has been much slower since Fall 2007, but there is still growth.

An automotive body shop (sheet metal stamping factory) used to require thousands of workers. Now they are all heavily automated. How is that bad news for the auto companies, their shareholders and customers?

Good point, but what’s the alternative? Maintaining or increasing the number of jobs in a manufacturing process, letting other companies – foreign and domestic – innovate, automate, and produce more efficiently? The jobs saved are only saved temporarily, until the product is no longer competitive, sales wither, the company fails, and the workers fired. Or the government can support a labor-intensive model for (incentivized) domestic or third-world consumption.

Dave: this point needs to be emphasized repeatedly. The role of automation is primarily to factor labor out of the production equation.

The other point about “so what do you do about it? Load up production with lots of labor, and thereby become un-competitive?” is a great objection, but it’s not a great solution.

This is why the Fed, the Gov’t, and industry – all three – are totally boxed-in. The answer, so far, is to print money, inject it into the economy somehow(s), and try to keep the kite aloft for a while longer. Hence all the distortions from easy money.

This goes on until, for some reason, money can’t be printed without really severe distortions, like the asset-price inflation and basic-household-inputs inflation (housing, education, food, energy) we’re seeing now.

We are finally hitting the limits of money-printing, as everyone here knows. It’s not the Fed that’s in a box; it’s the entire economy that’s in the box.

The value of labor, which almost all of us sell, is falling rapidly relative to the costs of common household inputs.

No middle class, no economy. More automation, more concentration of wealth, less middle class.

This is a really, really tough nut to crack, because we’re going to have to redistribute the capacity to generate wealth. Lest that phrase trigger the “Communist!!” objection, remember:

You can simply increase the middle class’ ability to capture the fruits of their productivity. You don’t have to take that capacity away from the ones that already have it.

Yes, indeed, the effect of building the middle class reduces what the 1 percent gets, but it’s a competitive re-balance, not a taking. We’d be equipping the middle class to compete more effectively.

Is that not exactly what should be happening, not just for the middle class, but for the benefit of all classes?

So, how does a nation re-equip the middle class to capture the benefits of their productivity?

GREAT post IMO TP;;;

My answers: first and foremost, make damn sure ALL of the ”working folks” who actually MAKE things and DO things supporting making things are paid fairly, as I have commented on Wolfs Wonder several times before…

After that, in spite of, or perhaps because of the massive propaganda machine saying other wise,,, PAY FAIRLY,,, for each and every and any manual laborer,,, not only the ”skilled labor” now getting well over $100 per hour in SF bay area, Lake Tahoe area, likely other areas I don’t look at as I do above….

While there was, clearly, unjust evaluations or/and for manual labor for the greatest part of the last thousand years or so,,, IMO, that miss allocation was due to the lords and ladies still having hegemony over their serfs at all levels…

WE THE PEONS can at least HOPE that has changed, or at the very least IS CHANGING…

VintageVNVet:

Yep, wages are the right place to start, maybe the major place to concentrate for a while.

Once the big companies are able to pass the higher labor costs on to … the laborers, that dilutes the benefits of jacking up labor costs.

There’s another (maybe 100s of others) way to do this, and that’s to equip the middle class to buy, or design and make, automated production machinery.

That’s the track I’m on, but I can’t say it’s been easy, and it sure ain’t for everybody.

Couldn’t of said it better myself

One thing you don’t hear anymore from the Ivory Tower Academics…

“Trade Deficits Don’t Matter”…the dollars must return.

What the academics miss is that with the return of the dollars, ownership and control also change hands.

Example: The Chinese use the dollars to buy (via lobbyists) a Congressman. He gets the use of the dollars for his pleasures, the Chinese gain sway with the Congressman, and the constituents lose sway.

OR, let’s use the Chicago Skyway. Chicago sold the Skyway to a foreign entity for a Billion dollars years ago. The city then used the money for flower pots on Michigan Ave, and who knows for what else…and the control of the Skyway (tollway) goes to a foreign entity. Good deal?

We trade dollars for items such as cheap clothing and electronics that are in dumpster in a few years. The Chinese use it to buy lasting hard asset items. Our largest pork processor, farm land, etc. The net effect long term is obvious.

Trade surplus nations ASCEND.

Trade deficit nations DECEND…and must print TRILLIONS to keep the game going.

Since 1997 the EU and China ran a combined $9 trillion trade surplus with the US.

As the Fed tapers, stagflation will accelerate. The Fed has been waiting for this Catch-22 moment.

The BIS central bank heist will now accelerate the global transition away from the dollar.

The Fed doesn’t give a shit; it’s only waiting for the right time to pull the plug on the US economy.

In the novel War Day published in the 1980s, there was a one-day limited nuclear war and the novel explores, in fictional format, the economic and personal results of that.

One thing I thought of when reading this article from Wolf and cross-referencing it with that novel was that the U.S. factories get repatriated from overseas and brought home. The war had the beneficial effect of increasing America’s industrial muscle. Also there were two kinds of money: fiat currency and gold-backed currency. You could buy a new Ford Tornado (or whatever the brand in the book was) for $6,000 fiat … or $2,000 gold-backed dollars. It was much cheaper to buy everything in gold.

Oh, and England and Japan and California were the three economic superpowers of the world in the story.

Interesting..

Scratch California

How’s this for inflation: just got dog lic renewal from city ( Nanaimo) last year either 30 or 25 for quick pay. This year 60 or 50 for fast pay.

You have to license your dog?

We save $$$ on our dog. He identifies as a human & is only 10.

So we can claim him as a dependent.

WONDERFULL!!!!

Thanks tom!!

Last night, before going to bed I noticed that the indexes were in deep red. Morning they were all green and keep climbing until Bear started growling. DJIA kept on fighting but the rest of the gang especially Nasdaq kept going down!

There is old adage ” Mr. Mkt always wants MORE DIP buyers on his band wagon before he heads south!” Gets repeated through out the secular Bear mkt with a bounces back ( dead cat bounce?) between peak to trough. This may take a couple of years like 2000 approximately 30 months, GFC was about 18 months until rescued by Fed in the March of ’09!

Now the KARMA of Fed’s lose, lose monetary policies are biting back, hard!

This is a purely TRADERS” mkt NOT investors. Most of the retail investors (especially newbies under 45y) will end up, holding the bag just like all the previous bear mkts. Unless one has hedges ( going against the mkt) being invested predominantly in the equities is a suicide. Being in cash won’t cause 50% or loss! But again there is greed lurking in the back! Just read the mkt history and study mkts!

DIP buyers are suffering from acute ‘PAVLOVIAN” syndrome infected by Fed’s persistent PUT(s) for the last 13 yrs. They keep coming back every day, thinking indexes will stay green from AM to PM but it is NOT yet happening. Yes, it could for a couple of days or even weeks but the trend is/will remain down, fulfulling ‘reversion to the mean’ well recorded in the 200 yrs of mkt history!

A one day reversal is considered a very bullish short term market timing signal by technical stock market analysts.

I vented recently my frustrations on the lack of credibility of Mr. Powell + FOMC members on these threads, some perceived me as cynical.

But today, surprisingly, a well know brokerage ( Goldman Sachs No. 2 John Waldron, the investment bank’s president and a Wall Street insider) came out swinging unreservedly against the Fed, at a at a meeting of the New Jersey State Investment Council! (Bloomi)

This is quite unusual b/c Wall St is well known ‘carries the water’ for the Fed, During what the reporter later characterized as a rant encompassing many of the Fed’s failures in responding to the COVID pandemic, the senior Goldman banker complained that the Fed’s political “independence” has been hurt, which in turn has weakened its credibility with markets.

He also said “He pointed to Paul Volcker, who led the Fed’s brute-force campaign against inflation in the late 1970s and early 1980s. Back then, the Fed raised interest rates by several percentage points in one go, leading to some of the fiercest public protests and political critiques of the central bank in its history. But, ultimately, the policies were widely credited with stabilizing the U.S. economy.”

My sentiments exactly. I was there during that time! Mr Powell is NO Paul Volcker, not even close!

Paul Volcker raised Fed rates > 20% during the neutral zone period,

the lame duck period, after Carter defeat, before RR became the new president.

I’ve been waiting 20 years for the Fed to get serious about inflation. It’s too late now.

The BEA numbers are skewed.

The Port of Los Angeles (biggest port) intentionally delayed their December report by 12 days so the value of imported goods wouldn’t be deducted from the 4th quarter GDP.

Missing data gives an artificial outlook for the GDP.

Would the Port of Los Angeles intentionally hold back data in order to help the White House give a false and more optimistic impression of the U.S. economy?

A few hours after the BEA made the public GDP release, suddenly POLA releases their data.

When POLA would normally generate their data on the 10-15th, Pete Buttigieg showed up at POLA for a supply chain initiative briefing

In politics timing is never coincidental.

Given the political issues and importance at stake, the White House influenced a December port reporting delay for two reasons. First, to help the illusion of better economic picture; and second, because the White House port supply chain initiative was a fraud.

They hid the ships 150 miles from the coast. Anyone who follows marine data knows what I’m talking about.

“Starting Nov. 16, ships waiting to anchor at the ports of Los Angeles and Long Beach will have to wait for a green light about 150 miles from the coast, the Pacific Merchant Shipping Assn., the Pacific Maritime Assn. and the Marine Exchange of Southern California said in a statement Thursday. That compares with 20 nautical miles (23 miles) now. North- and southbound vessels must remain more than 50 miles from the state’s coastline.”

The number of cargo ships waiting off CA set a new record of 105 in the first week of January 2022. Many were further offshore, out of sight, but had appointments for unloading. I have not seen an update since then.

Today I read (at the freightwaves website):

Los Angeles disclosed on Thursday that it handled just 385,251 twenty-foot equivalent units of import cargo in December. That’s down 16% year-on-year and down 18% from December 2018.

Maybe the California ports can enlist the train robbers to help unload cargo, letting them set aside a grocery cart for themselves per 4-hour shift?

15 bps before 5s and 10s invert. Tick tock.

20-30 yr treasury bonds have been upside down for a minute. This curve is about to get so flat it’ll look like it got ran over by a convoy of truckers in Canada.

Hate to point out another ‘NOT so well, feeling’ news

‘Fed’s Fisher(former Dallas Fed chief): Market Must Take Off “Beer Goggles” Because Powell’s Not Coming To The Rescue’ (online if any one is interested!)

1) Who is afraid of Virginia Wolf : the Bond market.

2) In Oct 1979 weekend Carter & Volcker “Sat night massacre” raised the Federal Fund rates by 2%. Inflation started to fall. The economy recovered.

3) President Carter was almost elected, but Tehran…

4) Interest rates started to fall, the The Bond market rally, causing

inflation resurgence. Round II :

5) RR was elected. Paul Volcker lifted the Fed Rate > 20%, thereafter, for forty years the Bond market don’t care.

6) Jabbing QQQ in repetition and a 2M flood of illegal immigrants into the

black market will tame inflation. JP on the bench.

7) Pareto top chopped, the gap between the 0.1% and the rest will shrink. Today negative rates will find equilibrium, before rising into positive rates, scaring the Bond market.

8) Who is afraid of crazy Virginia Wolf : the warmongers.

9) in 1930 the economy recovered. The Fed raised interest

rates to attract gold.

The US economy hit bottom from the 1929 Recession in 1932 and grew about 40% in the next four years. Then there was another recession. When World War Ii began unemployment was near 15%. Unemployment had reached 25 percent during the Great Depression, hovered at 14.6 percent in 1939, and then dropped to 1.2 percent by 1944—still a record low in the nation’s history.

The 14.6% unemployment in 1939 was not a recovery to the pre-1929 recession peak.

Your claim: “In 1920 the economy recovered”, does not match actual history. The US economy turned around from the 1929 recession in early 1932, BEFORE Roosevelt took office in March 1932, and many months before Roosevelt’s socialist programs were approved by Congress.

As usual, MSM is absolutely clueless as to the state of the real economy. As a reference point, the US GDP was estimated at $19.2 trillion for 2019. Based on Wolf’s figure about, the real economy reached $19.43 trillion for 2021, a whopping $230 billion increase over two years (a 1.2% increase over two years).

During this same period, the FED balance sheet increased from $4.2 trillion to $8.9 trillion ($4.7 trillion increase) and the Federal Government debt increased from $22.7 trillion to $28.5 trillion ($5.8 trillion increase). Combined, these two sources of “stimulus” increased by $10.5 trillion over a two year period. Now accounting for some inter-entity activity (i.e., FED buying US debt let’s say of $2.5 trillion) and normal annual Federal Gov’t deficits of let’s say $1 trillion a year for two years, this leaves $6 trillion of so called stimulus injected into the economy. And what did it produce, a whopping $230 billion of real economic growth (for a 3.8% GDP growth on invested capital).

Needless to say, no business let alone an economy would ever be able to survive producing these results over the long-run. I haven’t completed an historical analysis but I doubt there has ever been such a horrible return on capital invested (a term I use lightly given that most of the capital simply ended up in the hands of the super-wealthy) compared to economic growth generated. Clearly, this is not sustainable as I can’t even imagine what the next economic correction would produce in terms of required capital infusions just to get back to even.

Thanks for this perspective and data!

and the GDP calculation is roughly one third government spending….

so the Fed has essentially pumped TRILLIONS to the federal govt via securities purchases to come up with this paltry result.

Federal govt. spending $7 trillion

State govt. spending $2 trillion

Local govt spending $2 trillion

less ($1) trillion transfers from feds to others

= $10 trillion total government spending

GDP = $23 trillion

$10 trillion / $23 trillion = 43% of GDP

43% of GDP is socialism, as I define it !

It’s easy to be clueless when incentivized or the person doesn’t want to admit the truth since it’s likely contrary to their personal preference.

I’ve said it here (and elsewhere) that most Americans are destined to become poorer or a lot poorer later, at least the next several decades after this mania ends. Even with the mania, since 2000 median net worth and household income has flatlined for an entire generation according to FRED.

Most reading my comments probably don’t believe it, believing somehow, someway that because this is America, the country is exempt from the reality applicable everywhere else, now and previously.

They believe in the economic priesthood (central banks and governments) to “manage” the economy to prosperity using some “deus ex machina” they apparently have hidden in a closet, somewhere.

It’s a belief in magical thinking, that debt and an asset mania = wealth, deficits don’t matter, and spending you can’t afford creating “growth” makes a society richer.

Why Mr Powell is CLUELESS about inflation affecting lower income groups during his press Conf

Q from WP reporter on impact of inflation affecting more on bottom 50% of the society

Mr. Powell : “I’m not aware of um, you know, inflation literally falling more on different socioeconomic groups. That’s not the point. The point is some people are just really prone to suffer more.”

O M G!

sunny…

Powell’s comments were disingenuous at best.

Then he said something about some people having to make difficult decisions. How can that be if he is unaware of certain groups being hit harder than others? It is an oxymoronic response, and a stumbling one at that.

He’ right. Some have to decide “gas tank or groceries”, others must decide if 3 country clubs is just too much.

The US is going to run straight into Gibson’s paradox, which is that raising interest rates correlates with a rise in inflation, as an increase in real rates is a cost for business and damps down on investment for supply (because investment is also a purchase). This correlation has been observed over 150 years of UK history.

When the Fed increases the real cost of buying a new car, the Fed also increases the investment cost of purchasing a new truck. That is to say, investment is -also- a demand purchase. Rising interest rates dampen investment, and hence reduce supply. Lowering interest rates make investment cheap, and hence increase supply.

Now it may be, that crashing the stock market reduces demand from boomers etc etc but I wouldn’t bet on it. Historically the way things play out is that high inflation continues with rising interest rates until the country tips over, or is induced, into recession, and demand moderates from high unemployment as the private sector sheds jobs and the government is forced into cuts. Or put it another way, a system reset with a dollar devaluation like post-Volcker (who presided over a dollar devaluation of 40%).

“Rising unemployment and the recession have been the price that we have had to pay to get inflation down. That price is well worth paying.”

— Norman Lamont (In office 1986-1989 Head of both fiscal and monetary policy for the UK. (<= I know i posted this before)

Of course I hope I'm wrong all seems a bit bleak, this is why the UK is so desperately trying to get ahead with tax increases and rate rises because we don't have reserve currency benefits and could see import inflation from a weaker currency.

Nah, the “Gibson’s paradox” has been debunked a gazillion times.

One of the fatal errors of that theory is that rising interest rates don’t dampen “investment” because productive investments make sense even at higher interest rates. Also, higher interest rates may discourage zombie investments, and economically destructive investments such as leveraged buyouts, and that would be a good thing because the allocation of capital would then be focused more carefully on productive investments.

But higher interest rates in the US dampen US consumption, and thereby demand, which would lower inflationary pressures.

Stagflation may have reached a condition now, where demand destruction will no longer lower inflationary pressures, because the concentration of wealth and its occupation of governments are implementing authoritarian capital controls and digital social credit systems to tighten their grip on the debt trap and what’s left of the free market. It remains to be seen how many debt slaves can be forced into digital currency that is programmable through AI and controlled by a centralized authority. Were in uncharted waters, debunking theories with technology of the past is problematic.

It seems like whoever controls the capital, that person or entity will become authoritarian. IMO there is no modern “free market” system where capital is magically not controlled.

stoneweapon,

“Stagflation” with 6.9% economic growth? Are you high?

Stagflation means stagnation and inflation. We have the hottest economy right now that I have seen in decades.

In the future, we might get stagflation, but not anytime soon.

Wolf

The GDP is pathetic when you consider the increase of federal debt in the last two years.

As I said before, I believe the Fed has now reached a Catch-22

It’s Inflation/Stagflation from her on out.

Who got the Lion’s share of the money Wolf?

Wolf, forgive my agitation here. I know the definition but we need a new words that define our current economic condition.

2% inflation with a negative 2% GDP is better than 15% inflation with 6% GDP.

We’ve been institutionalized in a narrow lane.

“Hottest economy in decades”

– 75% of restaurants here closed for good.

– Businesses having going out of business sales.

– Mom & Pop businesses closing at record rates.

– Entire commercial strips vacant in affluent neighborhoods.

– Commercial vacancies at record levels

If this is the hottest economy ever I’d hate to see what a slow one would look like.

You make it sound like you haven’t ready anything I posted here.

Just to respond to a couple of things:

“75% of restaurants here closed for good.” That figure is clearly nonsense. Here are the restaurant sales:

“Businesses having going out of business sales.” and “Mom & Pop businesses closing at record rates.” I don’t know where you go this but there is a historic boom in new businesses:

“…raising interest rates correlates with a rise in inflation,..”.

Mr. Erdogan in Turkey seems to have studied the same text.

Look how that is working out for the Turks…

> In this manner, real GDP in all of 2021 jumped to $19.43 trillion, up by 5.7% from a year earlier, the fastest annual growth since 1984

Housing was up nearly 20%, wages were up by 4.3%.

The term “real GDP” overloads the word “real”. “Real GDP” means GDP adjusted for inflation. The deflator used for this does not reflect the total cost of housing, only the monthly cost.

The amount of time you have to work for financial independence fell in 2021. Therefore life got harder, not better.

Wolf you are using a statistic that, although it’s got the word “real” in it, doesn’t reflect reality.

The only comparison to 1984 is the novel and in particular the term “newspeak”.

When are people who already own a home going to stop ignoring this glaring detail?

georgist,

Yes, we would all like to have our own personal measure of the economy.

But GDP is defined very specifically, and the purchase of a house does NOT enter into GDP, just like the purchase of stocks doesn’t enter into GDP. They’re considered investments. But other costs associated with housing are included in GDP, such as rents, utilities, etc.

GDP is a measure of money flow in the economy. It’s not a measure of how good you feel about your life. There have been some proposals to come up with a measure that tracks how well consumers are doing or feeling, but that’s not GDP.

> Yes, we would all like to have our own personal measure of the economy.

Everyone has to have a home to live in. It’s universal.

> just like the purchase of stocks doesn’t enter into GDP

Nobody needs to own stocks, it’s 100% discretionary.

> It’s not a measure of how good you feel about your life

I specifically stated that the time people had to work for the same essential thing, the biggest expense in their entire lives, had increased by over 15%.

This has nothing to do with “feeling”. It’s about hours worked for the essentials of life.

You’re building your own measure of the economy. GDP doesn’t measure the purchase price of a home or the purchase itself of a home. GDP doesn’t measure wages either. It doesn’t measure investment income either. And those help pay for that house. But those are other measures. We’re using GDP as the official measure of the economy. You and I might not like it, but that doesn’t matter, it is the official measure of the economy.

Wolf,

So the 22K that I spent over the last two years for two Implants and a Bridge didn’t boost the GDP? It all went to Oral Surgeons and Dentists. Why doesn’t that count?

Swamp Creature,

What makes you think it doesn’t count in GDP? Of course, it counts. Thank you for doing your part in propping up GDP.

It goes into various healthcare accounts, such as medical devices (the titanium implant), healthcare services, etc., which are all part of consumer spending.

Ms Swamps hairdresser just got back from Turkey. She got all of her dental work done for 1/3 of the price of the similar work here. At least I contributed to the US GDP instead of contributing to the GDP of Turkey. I did my patriotic duty.

When a new home is constructed and sold, the full sales price is not counted in GDP. Instead, only the value of the construction put in place is counted in GDP— when the construction is completed.

This why governments allow housing bubbles. House completion goes in GDP now, but debt is 30 year liability. Works well as long as prices go up.

“GDP is adjusted for inflation to get “real” GDP by expressing everything in “chained 2012 dollars.” In this manner, real GDP in all of 2021 jumped to $19.43 trillion, up by 5.7% from a year earlier, the fastest annual growth since 1984, according the Bureau of Economic Analysis today.”

But since “real” GDP is calculated by backing out “inflation” from nominal GDP, any understatement of inflation results in an overstatement of real GDP.

Is your use of quotes an indication of skepticism?

If so, about what do you think think real growth actually was?

Finster,

Quotes are used here to denote the official terminology and to separate “real” (meaning inflation-adjusted) from “real” (meaning actual.)

Since real GDP is expressed in chained 2012 dollars, it is not “actual.” Actual GDP would be “Nominal” GDP. I addressed this in the third paragraph:

And yes, if the deflator is understated, then “real” GDP is overstated.

I never liked the term “real” for inflation-adjusted. But that’s what we’ve got. The official terms are: “Real GDP” v. “Nominal GDP” or just “GDP.” So I gotta live with it.

1) in 1998 the LTCM virus attacked the Bond market. Few global corp

collapsed.

2) The BOJ asked top Fed expert for advice. Ben flew to Tokyo. Ben told his Japanese counterpart to cut interest to zero, to save the economy.

3) Japan 10Y plunge to 0.88%. The zombies survived. The economy

recovered and the 10Y rose to 2.18% in Feb 1999.

4) 2.18% is Japan highest interest rate in the last 22 decades.

5) In 2016 iapan 10Y ewnt negative. The zombies are still alive.

6) The smart money parked in US 10Y sending rates down.

7) The global speculators started in US and moved to the Euro zone.

8) JP might raise rate, but gravity with Tokyo and Berlin will drag it

down.

9) It will cont until equilibrium will be found.

Regarding Powell, watching that press conference, he couldn’t have been more clear on his resolve to raise rates.

What else can we do other than to take the man at his word?

Georgists

Powell thought the impact of inflation fell equally across socio economics.

And he said the Fed controls inflation for every American….Control? Its at a 40 year high….where is the control? Or is THAT the control…the desired condition so as to deflate the debt?

Way back in “olden times” there was a concept of Net National Product aka NNP after depreciation.

I t has been lost. Ok, so what would REAL Net National Product be?

My guess is at least a 20% haircut from the GDP numbers we are getting.

We’ll never get those numbers.

Cheers,

B

Google search:

A027RC1Q027SBEA

Fed Fund Effective Rate during “Lame duck periods” :

1) RR victory Nov 4 1980 election : Nov 12 1980 : 13.01%

Jan 1 1981 : 22%.

2) Clinton victory Nov 8 1994 :

Nov 8 1994 : 4.51%

Jan 5 1995 : 6.59%

3) Bush victory Nov 1999 :

Nov 20 1999 : 5.72%

Dec 31 1999 : 3.99%

4) Obama victory Nov 20 2008 :

Nov 30 2008 : 4.66%

Dec 31 2008 : 3.06%

Detroit and Ford @1.01 were saved.

1) USD is rising along with WTI. Gold in real terms suck.

2) Jan QQQ monthly bar is as large as both Feb 2020 high to Mar 2020 low.

3) Jan candle is the failed Jan 26 high will keep the bull run alive.

6) That doesn’t mean that QQQ will not close May 19/20 open gap.

Longer term Gunlach expects dollar to fall to about 75 on dxy due to USA large twin deficits. Might be good to own gold then.

The DXY only includes six currencies, trade weighted.

Longer term, I expect the USD to lose a lot of value versus those from countries that actually produce physical goods, especially those needed most. These currencies are mostly not in the DXY.

Currencies of countries whose GDP and exports consist of “services” which are discretionary, very overpriced, or economic waste should decline as they become a lot poorer.

The DXY was around 70 in 2008. So longer term, I expect 75 is not that low. It’s probably going to go lower, maybe a lot lower.

What is the DXY good for, then? What exactly does it tell you if it goes up or down?

AI, thanks

Unfortunately, I can’t post links here, so go the St. Louis Fed FRED and chart the “federal funds effective rate” MINUS “consumer price index for all urban consumers: all items in U.S. city average” from 1955 to present. History doesn’t repeat itself, but it surely rhymes.

The Bloom Is off The Ruse, White House Port Manipulation Hiding Economic and Supply Chain Issues – January 27, 2022

Excerpts:

When we finally grew frustrated and asked the Port of Los Angeles (POLA) about this ridiculous delay (in port data), they responded January 25th, saying: “Good morning. Data from one vessel has delayed final numbers. We plan on releasing numbers today or tomorrow.”

The POLA justification and timing seemed odd, and their explanation seemed fishy. One container ship manages to delay the entire POLA result? However, this morning after checking and seeing still no result we realized what was going on.

The Bureau of Economic Analysis released the U.S. 4th Quarter GDP result. The value of imported goods is a deduction to the U.S. GDP. If the biggest port in the U.S. holds back their import cargo data, the resulting information cannot be deducted from the GDP. Missing data gives an artificial outlook for the GDP. Put another way, the 4th quarter GDP is inflated by the missing deduction.

White House: “The Ports of Los Angeles and Long Beach—which handle 40 percent of the country’s containerized imports—continue to show improvement in moving containers out of the docks and into warehouses.”

The outcomes speak for themselves. Both the Port of Los Angeles and Port of Long Beach handled less cargo and fewer containers in the two months after the “new expanded operations” were announced, than in October when the expanded supply chain operations were announced. There is no improvement at all. Less cargo is being handled.

Despite what the White House Supply Chain Disruption Taskforce is claiming, the actual records from the ports do not concur. Someone is clearly lying and not expecting anyone to check.

More.

There’s an excellent graph which I can’t link to since links aren’t allowed here, not found within the excerpted article, but from another one on the same subject, which shows a steady rise to a HUGE number of ships, the most thus far, orbiting 50 miles or more offshore and a corresponding huge drop in ships near the port:

“Following its success in Southern California, the new system is being expanded to the Bay Area. Ships will wait 50 miles off the coast in a safety and air quality zone until their scheduled arrival time at the Port.”

We call this “Operation Hide the Ships.”

What the White House supply chain taskforce did was move the line of awaiting cargo ships further offshore to make them less visible. Then the White House just started making up talking points about productivity at the ports increasing and capacities expanding; neither claim is based on facts that surface in the actual operations of the ports.

The purpose of telling the ships to await their port time in a queue farther offshore is transparent. The Biden administration wants to give the illusion they eliminated the bottleneck of container ships. Out of sight is out of mind.

“What the White House supply chain taskforce did was move the line of awaiting cargo ships further offshore to make them less visible. Then the White House just started making up talking points about productivity at the ports increasing and capacities expanding; neither claim is based on facts that surface in the actual operations of the ports.”

BS. This was done by local and state authorities and the Ports of LA and LB to get the pollution that these ships produce further away from the populated areas and to get them out of the risky coastal waters and shipping lanes — after an anchor from one of those ships ruptured an undersea oil pipeline, causing a big oil spill in the Huntington Beach area.

I don’t know why they don’t bring those cargo ships through the Panama canal and unload them on the East coast at Savanah or Baltimore. I once shipped a couple of cars the other way with no problem.

They’re doing some of that if the ship fits through the Canal (must be “New Panamax” or smaller), and there are now reports that other ports in the US are also backed up.

Great post!’

Friday sell of started to be continued

I don’t think I really understand how any of this works, but shouldn’t the inflation target be 0%? Or would that be a bad thing?

Nevermind, I Google’d it. Feel free to delete both comments.

Thats exactly what the Fed is supposed to do 0% inflation. But the game is rigged the table is tilted. 1st definition of money is “Store of Value” thats a oxymoron with inflation. How can money be a store of value when it looses purchasing power? Answer is: it isn’t a store of value. Can anybody prove me wrong?

So, what does it take in debt issuance to produce a rise in “GDP”. Several people have shown that for every increase there is from $3.50 to $7.00 of debt for every $1.00 of increase. This has been increasing for the last generation. How long can that last?

It has also been shown that as the price of oil has increased, there has been, more often than not, a recession to follow. Since almost everything we do, buy, and consume needs energy, inflation can been seen to echo the rise in price of that energy.

“Between the optimist and the pessimist, the difference is droll. The optimist sees the doughnut; the pessimist the hole!” ~ Oscar Wilde

Randy: “…the optimist sees the glass as half-full, the pessimist sees it as half-empty. The engineer sees it as the wrong size…”.

may we all find a better day.