This is now moving fast.

By Wolf Richter for WOLF STREET.

The two-year Treasury yield started rising in late September, from about 0.23%, and ended the year at 0.73%. In the five trading days since then, it jumped to 0.87%, the highest since February 28, 2020. Most of the jump occurred on Wednesday and Thursday, triggered by the hawkish Fed minutes on Wednesday.

Markets are finally and in baby steps starting to take the Fed seriously. And the most reckless Fed ever – it’s still printing money hand-over-fist and repressing short-term interest rates to near 0%, despite the worst inflation in 40 years – is finally and in baby steps, after some kind of come-to-Jesus moment late last year, starting to take inflation seriously. Treasury yields are now responding:

Jawboning about Quantitative Tightening.

Even though the Fed hasn’t actually done any hawkish thing, and is still printing money and repressing interest rates to near 0%, it is laying the groundwork with innumerable warnings all over the place, from the FOMC post-meeting presser on December 15, when Powell said everything would move faster, to hawkish speeches by Fed governors, to the very hawkish minutes of the FOMC meeting, which put Quantitative Tightening in black-and-white.

The Fed is now spelling out that it will make Quantitative Tightening – QT is the opposite of QE – its primary policy tool in battling inflation. It even spelled out in the minutes why QT won’t blow up the repo market, as it had done last time in September 2019, because last July, the Fed established the Standing Repo Facilities (SRFs) to calm the repo market while the balance sheet gets unwound sooner, faster, and by more than last time.

It is now clear to everyone that the Fed will hike interest rates sooner and by more than expected just a few months ago, and that it will reduce its balance sheet sooner, faster, and by a lot more.

This is a huge thing. And the Fed is communicating this shift to the markets so that markets can adjust to it gradually, more or less orderly, and not all at once. And the Treasury market is doing that.

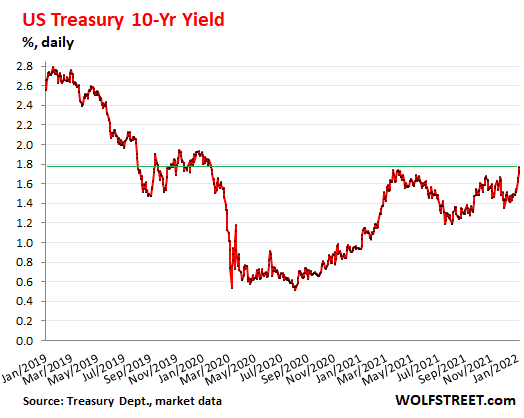

10-year Treasury yield highest in nearly two years.

The 10-year Treasury yield has risen by 25 basis points since the end of the year, to 1.78% on Friday. It’s now at the highest point since January 21, 2020, before the pandemic was even a factor for the markets:

The jawboning will continue until morale improves.

Browbeaten by the worst and very un-temporary inflation in 40 years, even ultimate Fed doves, such as San Francisco Fed President Mary Daly on Friday, are now talking up rate hikes this year, and more importantly the arrival of Quantitative Tightening soon after liftoff.

“I would prefer to see us adjust the policy rate gradually and move into balance sheet reduction earlier than we did in the last cycle,” she said, echoing in harmony what the minutes of the December 15 FOMC meeting had revealed in detail on Wednesday.

Powell and the minutes called the balance sheet reduction the “runoff.” This Quantitative Tightening, or QT, is the opposite of QE.

QE was designed to push down long-term interest rates, and it did a marvelous job at that, and it triggered the biggest asset bubbles the US had ever seen, including the massive real estate bubble, with house prices spiking by 20% over a 12-month period, from already very lofty levels.

QT does the opposite: It allows long-term interest rates to drift higher, and markets will adjust to it, just like they adjusted to QE.

Markets are responding to the Fed’s jawboning, and long-term rates are already rising even though the Fed has just started to talk about QT, while it’s still doing QE, and while it’s still repressing short-term interest rates. Jawboning is an essential and official tool in the Fed’s toolbox.

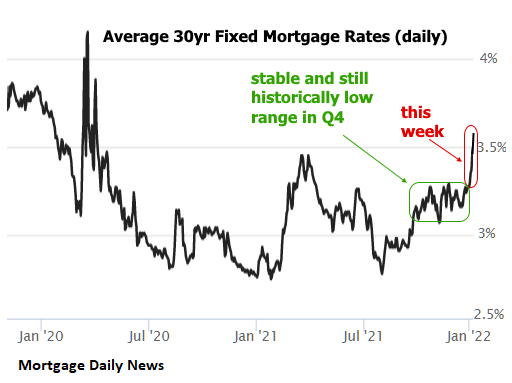

Mortgage rates highest in two years and moving fast.

The surge in the 10-year Treasury yield has already translated into the highest mortgage rates in nearly two years. And those rates are moving higher fast.

According to Freddie Mac, the average 30-year fixed rate mortgage rate rose to 3.22%, the highest since May 2020. But that was based on surveys that most mortgage bankers filled out at the beginning of the week. And since then, mortgage rates have spiked.

Daily measures of average mortgage rates have jumped every day. The Average 30-Year Fixed-Rate Mortgage Rates index by Mortgage News Daily has jumped to around 3.50% on Thursday and Friday – rates not seen since the end of January 2020 (chart via Mortgage News Daily)

This rate of 3.50% is still very low, but it’s a lot higher than it was in 2020, when the average 30-year fixed rate dropped to 2.65%. And the Fed is still repressing long-term interest rates via QE. QT won’t even start for a few months. So the show hasn’t even stared yet. We’re watching the preview.

And these coming higher mortgage rates will have to be used to finance the home prices that have exploded by ridiculous amounts over the past 18 months from already ridiculously inflated prices, given the massive QE and interest rate repression for a big part of the past 13 years.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Hi Wolf, you seem to be going against the Commentator consensus that the FED are truly serious in tackling Inflation. Jessie Felder recently quoted Louis Gave, I paraphrase but …“Inflation is not a bug it’s a feature”. Most Commentators believe the FED will jawbone but really drag their feet on actions as long as they can.

My question to you would be how strong is the pressure on the FED to tackle Inflation and how long can they continue to be behind the curve without upsetting the Market ? Thank you !

Marco,

The Fed’s long-term credibility is at stake. Volcker built it up after the Fed had lost it. And then the Fed benefited from it for 40 years. Now it’s in the process of blowing it again, as your comment shows. Bullard already said this out loud. So the pressure is huge.

In addition, there’s political pressure from the White House. High inflation is a political bitch for the party in power, as it should be.

The markets certainly want to believe that the Fed won’t crack down. Markets will be in denial for as long as possible. Markets can live with inflation; but they cannot live with a crackdown on inflation — especially not at the super-inflated prices right now.

Thank you for your thoughts on this Wolf

Wolf – if you are right and the Fed has to let rates rise, will it overshoot? Even if rates only go up to 3-5%, Treasury will be financing the deficit and rolling over matured debt at over twice the old rates. You have easier access to the data. Is it possible to say what the interest on the debt will be at the end of 2022 depending on what interest rate actually happens. I think the Treasury went to shorter term debt to save on interest rates but I might be wrong.

I’m just wondering when the government needs to borrow just to pay interest.

Markets didn’t start freaking out last time until the Fed had already boosted 25 basis points 8 times over 2016-2018. If the Fed measures it rate increases we could be in an ‘up’ equity market until 2024. The Treasury is going to have to make adjustments in the time that it has, but seriously if inflation doesn’t abate on it’s own by November (highly unlikely) with the Fed dragging it’s feet, the Democrats are going to get brutalized in the midterms.

Go search: Interest Expense on the Debt Outstanding Treasury Direct

You will see that the US has averaged $545B in annual interest expense over the last four years, all of which exceeded $500B.

I’m sure Wolf can tackle your question as the expert, but it’s fair to say that interest rates would probably have to double and stay that way for several years in order for it to really start to get out of hand as the treasury rolls over debt that matures to higher rates.

The more likely scenario is that interest rates will rise over the next 12-18 months and then some sort of economic downturn will force the FED to lower rates again and the startup QE again, thereby suppressing rates.

We’ll push past $30T in total debt within the next 30 days. We’ll be at $35T in total debt by the time Biden’s first term ends. I personally believe our economic moment of crisis will occur somewhere between $35-40T in total debt. This will happen around 2028 and by that time I expect Medicare to move from $495B in the red last year to at least $750B. I would expect our interest on the debt will be at least $700B annually by then.

The last two big issues are the Trump tax cut expiring after 2025 and then the SSTF going red by 2030. This is a very big deal and one that it seems like Congress is willing to completely drag their feet on. Obviously, there are several things they can do, but all of them require some form of tax increases on different income levels along with changing the “bend points”. My big question is how much more in taxes will the rich be required to pay between now and when Congress comes back to the well to save Social Security. And, of course, how late in the game will this be?

Higher yields also produce higher taxable incomes in the private sector and by individuals (interest income from Treasuries, savings, corp bonds, MBS, etc.), and thereby higher tax revenues for the government. Only the replaced portion of the federal debt will actually cost more for the government, as you said, but that total pile of gov and corp debt will gradually start to generate more income for holders, and more tax revenues for the government. This is a pretty big chunk of money that the government is now not collecting. These tax revenues from higher yields are often overlooked in these discussions.

Allowing rates to rise to 3% or 5% won’t stop inflation. You have to entice people to buy US Treasuries by offering an interest rate that clearly exceeds the rate of inflation. That way, you take dollars out of the economy. No one on Main Street is tempted to buy US Treasuries and that won’t change if interest rates are 5% but inflation is raging at 7%.

Roughly $10T worth of US Treasuries will come due in the next 12 months. It ‘s impossible to roll that debt over at rates that clearly exceed the rate of inflation.

Inflation is not really a problem – have you not noticed the Democrats talking about another stimulus bill?

If the Democrats were seriously worried about inflation they would not be looking to inject more stimulus into the economy to stoke inflation!!

Wolf,

As of 1/1/2022, the FED’s balance sheet was $8,815,239,000,000.

Maybe this is a stupid question, but is all of this crazy amount of money the fake stuff? Now, I know that the FED monetizes debt, so they do turn a profit and, in general, remit tens of billions of dollars back to the FED, over the recent term at least.

In other words, JP gives the order for some dude sitting at a terminal to press some buttons and create digital money out of thin air. I know that’s a very simplified version of what really happens.

Thanks!

Jay,

“but is all of this crazy amount of money the fake stuff?”

This $8.8 trillion are mostly Treasury securities and MBS, but there is also some gold and some other stuff on it. This is not “fake.” I would love to have some or all of it on my balance sheet :-]

Wolf

“Volcker built it up after the Fed had lost it. And then the Fed benefited from it for 40 years.”

That is so true….and those who werent there disregard the importance of what he did. The Fed has been busy spending that “capital” that Volcker created ever since.

Powell has a real problem, the American people are on the verge of either giving up or getting real pissed.

I laugh at hand wring over 1/4 pt raises……meaningless.

Part of the problem is that all sort of positions that used to be considered bullet-proof, are now not and are seen to be vulnerable to political pressures — Scotus justices, FBI head and Fed Chair to name a few.

Powell has behaved as a political animal for the last 4 years and it shows. Not sure how that mindset is going to change.

I agree. The real rate of inflation is at least 8% and the Fed is looking to raise interest rates two or three times this year so that rates are still less than 1%? This will do nothing. And if the Fed does get rates up above 5%, where they belong, what will they do when the stock market drops 80%. Will they really have the fortitude to do what needs to be done and hold rates there while the market drops 80% and unemployment reaches 10%? No way.

LOL I don’t get why it is a Fed’s problem that the Fed may not have credibility, long-term or otherwise… they keep screwing things up for decades… So what?

We’re back to work today after two months off. I wonder what’s going on with Real Estate in Swampland. My gut feeling is that things are starting to unravel. Noticed a new condo project that has a sign 75% sold. That means 25% are unsold. If they are having trouble unloading them at these ridiculous low interest rates, 7% below the inflation rate, then what will happen when the Fed normalizes rates, if they ever do that. And what about all the shadow inventory out there that will appear out of nowhere when the market starts tanking?

These people know nothing about Finances but buzz words and print money. That’s why crypto became popular, and now they’re scrambling because they f’ed up prices for everything. Whoever thought it a good idea to set inter bank lending rates with a private company is also contributing to our problems. Now they want to follow crypto because of the promise of fixed amounts, unlike the Fed, which prints money out of thin air

“Now they want to follow crypto because of the promise of fixed amounts, unlike the Fed, which prints money out of thin air”

Good lordy, nearly 9,000 cryptos have been created out of thin air, and each is creating new units out of thin air all the time. This is like the biggest joke in the history of mankind.

The Fed has no long term credibility and to be honest they don’t seem to be worried about their credibility.

The Fed enabled massive government deficit spending. The Fed is the reason government debt grew to almost $30 trillion and the $30 trillion debt is the reason the Fed can never raise rates or stop purchasing bonds with conjured money.

Anyone who thinks this so called tightening cycle is going anywhere has not been paying attention for the last couple decades. The Fed has 3 choices:

1) They can continue to create currency to fund the government. 2) They can stop creating currency and let the government default 3) They can print less currency and force the government to spend less.

Spoiler alert! The Fed will continue to create endless sums of money to fund the government and inflate assets. That is their purpose, if they don’t do those two things they have no reason to exist.

Fool me once, shame on you. Fool me 5 times and I deserve to lose my life savings to inflation.

I’m astounded that, after everything that has happened, people still believe the Fed will stop being the government’s primary funding source. The government is looking for new ways to waste money, they sure aren’t behaving as though they think Fed funding is about to end.

Do the arithmetic. QE is permanent, it may take a few month for them to invent an excuse, but you can be sure they will find one.

QE money is not permanent. QT means that the Fed sells the assets and the money goes where it came from – to Nirvana. M2 shrinks, because that money is not in circulation anymore.

That is the difference to the money created when producing credit. Credit money disappears if the credit is payed back, I.e. in 30 years or so, if it gets paid back at all.

And off course you are right that the Fed will be hesitant to start QT because that is like kicking everybody out of a roaring party and yelling: Come on guys now it’s the time for the hang over!

Honestly, there is no painless way out of a credit financed boom. Mortgages and leverage boosted the real estate and the stock markets. And those bubbles are even bigger than the QE bubble.

I also get the feeling they’re still kicking & dragging their feet. They’re still printing $90 BILLION A MONTH and will continue to do so until later this month, when the pace drops to $60. QE will still continue through March, and this pace is unlikely to be sped up any faster. If they were serious about tightening, they’d just do it now.

The only reason the Federal Reserve has to sound “hawkish” is inflation has become severe enough to be a hot-button political issue. Central bankers would much rather be in the shadows working for their personal portfolios, Wall Street & the billionaire class, instead of being at the forefront of political debate.

I realize Wolf uses the language “they’re still printing”, but that’s not really how it works.

The financial system prices-in the existence of future money whenever the Fed says they’re creating any. The timing is only secondary. If bankers know there will be $60 billion printed next month, the bankers can act right now on that information, and it’s as though the money was already here.

This is why the Fed’s meeting minutes were such a downer for the markets. The Fed basically un-printed future money and the bankers then had to pull back on plans based on that future money.

Down one day and then basically flat for two days – that is what passes for “a downer for the markets”? Seriously? 2% off all time highs, a downer?

Oh the humanity!

Time for Cramer to make another dramatic call for the Fed to do something to stem the tide before it’s too late.

Cramer was correct about one thing: ” they know nothing!” – “they know nothing!” Even a blind squirrel finds nuts.

Nasdaq is down 7.9% from its high in mid-November. True, that’s no biggie, but it’s not 2% either.

Fed has created inflation y/y of 7% and short term rates are 0%. That’s as loose as a girl at the bar at 3 am.

The bars close here at 2 am. So I think you’re onto something with this statement… ;o

Will what’s offered be honoured is the question?

Marco

I once knew a fellow who was on CNBC all the time. He was talking up JDS Uniphase stock on tv. I saw him later in the day and said….’the PE is 80, what are you doing?” He first started to defend himself….then surrendered and said..

“You don’t understand, I am PAID TO BE BULLISH.”

So when watching the talking heads on tv, keep that in mind.

It will be very apparent once you are aware of it.

Hi Historicus, you are right… after many years of observation and surreptitious FED deceit that has costed many honest people a large part of their savings, I think actions are the only things to matter these days. I will be interested to see the jawboning move to backbone or jello.

Cramer’s “Just don’t sell us” (!)

Oh what it seemed to be! Quick ride down.

FOMC members don’t live in an alternative bubble world. They aren’t and never were immune to external pressure. Only someone who believes people are robots would believe otherwise.

Sentiment has moved against them.

Great interview. “The Fed would be happy with 4% inflation for the next decade..”

How does a FED reduce a balance faster than those “assets” maturing when those “assets” do not pay interest even equal to today’s paltry higher rates on new “assets?”

In other words…why by used when new pays much better?

“It is now clear to everyone that the Fed will hike interest rates sooner and by more than expected just a few months ago, and that it will reduce its balance sheet sooner, faster, and by a lot more.”

2banana,

MBS alone are generating about $50-70 billion a month in passthrough principal payments for the Fed as the underlying mortgages are paid off and are paid down, which reduce the MBS balance by those amounts every month. If the Fed stops replacing those passthrough principal payments, the MBS balance would drop by $50-70 billion a month.

Treasury security maturities might come in the $30-60 billion range a month.

You can check this out by looking at the current purchases to replace the runoff and to add to the pile.

For example, before the November tapering, the Fed was buying $100-$110 billion a month in MBS to increase its balance sheet by $40 billion a month. The rest was used to replace the pass-through principal payments.

So if the Fed chooses to let everything run off that matures, and if it chooses not to replace any of the MBS passthrough principal payments, the balance sheet might decline at a rate of over $100 billion a month.

But the Fed is going to put caps on it. Last time, the caps were phased in to reach $50 billion a month. This time around, the caps will likely be higher, but I don’t think they will be over $100 billion a month — maybe somewhere between $50 billion and $100 billion a month.

I’ve got my popcorn ready to watch what could be the greatest show of our lifetimes…stay tuned as it’s going to get very ugly very fast!

Or worse a quiet fizzle reduced to no sound. Everyone continues without comment. They quickly forget. Move on. Accept a gold backed system and look forward.

The question now is how to benefit from the event. Schedenfreude is enjoyable but not a source of profits.

Having liquidated the majority of equity investments during December and put the proceeds into Treasury Bills, I’m now wondering where to deploy the capital. Short selling is not to my liking.

Does anyone on copy have any suggestions?

Wolf I recall in the distant past you shorted the broad market. I assume that position was covered long ago. Have you taken any positions recently?

Mr Ponzi

Waves of investors are now moving from growth stocks to value stocks since value stocks don’t rely as much on debt and will pay more consistent dividends.

The US stock market is so overpriced that “value” stocks will provide no “safe haven” in a major bear market.

Most corporate balance sheets also “suck” versus the past. Not that I would ever rely on credit ratings for safety in a major bear market, but even with lax agency criteria, still worse now than the past.

However, just like 2008, given current financial health, most interest coverage ratios will crumble in any major bear market.

Start a business. Perhaps a soup kitchen.

Can’t get workers…

:)

I have a small side bet in an OTC security that loses money gradually in normal times and spikes crazily when the VIX does. It is based on one-month futures linked to the VIX, and is easily bought through any brokerage. I don’t think it a good practice to tout names here. I’m not betting the farm on it, but if there is a panic that is steep, I expect a consolation prize. It spikes so quickly, it needs to be monitored on a daily basis. It is a little goofy tax-wise, may require you to file an additional K-1 schedule. Probably more of a novelty than you are seeking. But fun for me.

As long as you exit your position with a profit every time, you are a winner.

There has been underinvestment in infrastructure in the oil industry for decades, and we will have major shortfalls over the next several years. Wait for a dip in oil— probably starts soon (to early March), and then buy some oil stocks— such as Marathon Oil, Apache, or Devon Energy, and get a double.

A guy named Ponzi asking for investment advice, that’s like a Nascar driver asking for directions.

It took almost 2 years last time 2016-2018, so I wouldn’t count on it happening as fast as you think.

That’s good fun but schadenfreude doesn’t pay for the popcorn. It’s kinda like the old Charlie Brown cartoon about wearing a dark suit whist urinating.

I must have missed that one.

Here’s a plot: Bankster’s got a rich Uncle Jay, who said he’d be giving $120K/month for a while. So Bankster got himself a nice car and some bling, hitched up with a high-maintenance trophy spouse, and took out a mortgage on a big house. Bankster’s a player, living the high life, Crazy Rich Asians style.

But then Uncle Jay calls up Bankster one day a couple years later, and says “sorry nephew, but I’m going to be cutting your payments off gradually over the course of the next 6 months, it’s time for you to go out and earn a living”. Bankster still has the income for now, but that mortgage is now a big problem to deal with, the trophy spouse dumps him for her personal trainer, and all the made-in-China bling starts falling apart all over the house…

To Be Continued!

The Dystopia the Fed has created now…

Inflation kills cash…

Fighting inflation kills stocks…

But watch those who were on the stock market gravy train whine and moan about losing their “magic” money. Up 25% in 2021 and they deserved every bit, just ask them. They will beg the Fed to defend the spiked evaluations.

The Fed has been recklessly tardy and shirking of duty. Maybe on purpose.

historicus, maybe because the fed governors are all highly invested too? They made huge sums on bonds as the interest rates fell, then they made huge sums on stocks as the mania grew.. Does anyone actually think they are going to willingly give any of it back?

There is nowhere to go now.. Bonds will be losers as will stocks and real estate.. The best times are over.. Maybe they will all go into Bitcoin or Precious Metals?

They are most likely already moving their wealth somewhere .. To where is the best question to be asking.

Shorting futures in stock market ,as Cramer says always a bull market somewhere then gives advice after his investment club already purchased

The thing about real estate is that everyone has to live somewhere and there is a limited supply. So compared to gold, for example, real estate has intrinsic value. You can live on it, you can grow food on it, you can rent it.

@Enlightened –

Speculative booms cause all markets to become overpriced, and housing isn’t immune.

For starters, there’s a huge overhead supply – plenty of speculators with “second homes” that are ready to cash out when the market finally rolls over.

Next, in a recession, household size isn’t fixed – people will bring in housemates to make rent. That creates more surplus housing.

Next, that emerging housing surplus brings down rents.

Finally, in recessions, cash-strapped governments are prone to raising property tax rates. They always want 10% for the big guys.

P.S. As bonus – governments are also prone to imposing eviction moratoria, rent controls, and other profit-reducing but entirely legal shenanigans to make life difficult for landlords. Except of course the politically omnipotent monster corporations…

Wolf said: “QE was designed to push down long-term interest rates, and it did a marvelous job at that, and it triggered the biggest asset bubbles”

———————–

Well give the bastards a cookie —- for being scumbags and manipulating markets, suppressing savers and rewarding speculators

The tech bubble is already starting to deflate – look at clepto-currencies. The transition to value, and dividend paying vehicles is clearly in process at this very moment. I’m making a considerable amount of money with my income earners while those married to tech stocks are losing money.

Klepto-Currencies – what a term – I love it!

Actually it could be applied to all the ways that financiers abuse money & credit to rob the workers!

Cryptos – are mostly pump-n-dump vehicles

Gold – price manipulation via futures markets

US$ and other fiat currencies – asset-stripping via waves of inflation and deflation, that most people aren’t sharp enough to adapt to in time…

Bottom line – if it doesn’t have an intrinsic use-value that pays dividends, it’s not wealth.

….and the current kasakollapse may well accelerate the deterioration of bitcoin. Where bitcoin leads, other digital insecurities may also follow. Right or wrong.

My reasoning- isn’t Kasakhstan a major part of the bitcoin ecoverse due to cheap energy availability?

I’m considering copying the bitcoin algo and launching a second bitcoin system.

Why would my bitcoin system catch on? Because it is exactly the same in every way, there can never be more then 21,000,000 and my bitcoin would start trading at under $1 compared to the existing and identical $40,000 version, pretty good deal!

I have not decided what to call the new bitcoin system, but I’m thinking of calling it bitcoin (why waste time inventing a new name when one already exists)

Watch harry dent interview on web

Harry Dent is a bright guy but not of the caliber of Jeremy Grantham or John Hussman, in our humble opinion.

Our job is to profit from the market decline by selling into euphoria and buying into despair.

Please remember that the largest rallies in stock market history occurred in bear markets.

Of course, we have disclosed on this web site that we are utilizing both SRTY and SQQQ which are triple short the Russell 2000 and Nasdaq 100 respectively, by purchasing during the tops of market euphoria and selling with a profit.

To be successful, you must sell at a profit. It is far more difficult to profit in bear markets because of the increased volatility; you cannot buy and hold on the way down. Do not allow tax considerations to bias your decision to take the chips off the table and book a profit. Many studies have shown that investors who allow tax considerations to affect their trading decisions do worse.

Of course we realize the future is present in nascent enterprises in which we are actively investigating (hydrogen and green energy, in our humble opinion), but for the current U. S. stock market in general, look out below.

cb

If only the younger people realized the wealth of their future has been pulled forward by reckless debt creation….to fluff the present…..and that money used to run housing prices up and stocks away from any reasonable entry point that they might have enjoyed.

They pulled the ladder up on you guys, wake up.

Well said

Don’t worry amigo, many of us young people do realize what’s going on!

And once we take over, we’ll clean up the big mess we’re inheriting.

Sure, money/prices are broken currently.

But we should still be optimistic! There will be plenty of resources to go around in the future, especially as the population declines and tech gets more automated.

Future governments run by today’s young people will ensure everyone gets what they need, and nobody is allowed to hoard. Call that socialism if you want, but it really is that simple.

Oh, and we gotta figure out renewable energy…. probably a mix of hydro and solar.

“ Future governments run by today’s young people will ensure everyone gets what they need, and nobody is allowed to hoard. Call that socialism if you want, but it really is that simple”

So is moving to Ethiopia to pursue your dreams….

LOL…Seriously…Funniest post in a long time on this site.

All you have to do is figure out renewable energy, something nobody’s put any effort into over the last 100 years.

And use socialism to make sure everyone’s got stuff despite the fact that no society has managed to make that work for any length of time. George Orwell pointed this out 100 years ago, but he’s on the banned list in schools now days so you might want to Google him.

But while you’re going to take over and run things, you keep voting into office people who are 70+ years old.

You might want to factor in that the worlds population is not declining, it’s just not growing in the more advanced societies; which means your programs to share will drag down your standard of living. And those multitude aren’t going to wait for

equitable distribution; they are going to come after what you have.

The number of idealistic younger individuals who want to change things are massively outnumbered by the masses who just want what they have without having to work for it. Inertia’s a bitch.

Your utopia has arrived already in Portland, OR.

Socialism is the only answer to the cancer known as capitalism.

“Oh, and we gotta figure out renewable energy…. probably a mix of hydro and solar.”

Just snap your fingers and close your eyes and it’s all better now! LOL

Oh the idealism of youth!

Add in some good old human nature and a few sociopaths and a couple of psychopaths and your dreams will become much more realistic. Sorry!

Don’t forget, you are going to inherit a lot of debt but also an incredible amount of assets. No one lives forever, and Gates and Bezos and Musk know that. Try to change the inheritance tax laws for a more equitable spread.

To all the replies to my previous comment:

“It hasn’t worked yet, so it will never work” is an intellectually lazy argument. The Wright bros and Nikola Tesla would like a word with you.

I propose this time actually is different, thanks to the most important invention in recent history: the internet.

The public can now organize quickly and hold individuals and organizations accountable for their actions (Arab Spring, BLM, etc). And we can share knowledge instantly and efficiently around the globe.

But hey, maybe I’m wrong and y’all are right, and we’ll all continue to suffer and struggle against each other… that would be swell :D

Also, for the record, Portland still is great, as is Seattle where I live. But keep telling yourself you know better because you read some articles on ZH

Occupy Wall Street much?

You’re basically on the right track, PNWGUY. Boomers gonna boomer, though.

Just make sure you don’t make the mistake that previous generations of progressives made, where they tried to address wealth inequality by making, e.g., housing more “accessible” via easy credit (debt), thus juicing demand and raising prices.

Totally with PNWguy on this. In the US there is immense resistance to renewable energy, systemically and politically. It’s a failure of will more than a failure of technology. But not for the younger generations. They are politically motivated to go after renewable energy as policy, where older generations have not.

Also, it’s not socialism to share (and preserve and protect) common resources. You know, air, oceans, stuff no one owns or should own. That concept does not go over well here though with the uber capitalists, because for them wealth is the ultimate achievement and the only goal.

On the other topic though… I must say that Portland is not so great anymore, at least for me, and I’m moving out very shortly.

Ignorance is bliss.

I assume you will accomplish this after you are done building separate bathrooms for everyone who identifies by different pronouns?

And you can do all of that as soon as you stop voting for the same useless old fossils.

The silent generation and the boomers made a lot of mistakes but at least they did something.

Have fun building imaginary hydro dams in the metaverse (I assume you will also be blowing up existing dams to save the salmon)

PNWGUY

Your sentiment and optimistic predictions are refreshing. It’s not a war between the young (Millennials / Z’s) vs the Boomers etc. – truly, as a Boomer, I “believe” I can speak for all of us in saying we truly want something better for your generation. We made a LOT of mistakes through those we elected (mostly fossils) going back many decades. The constant wars from Korea to present are probably the most obvious of our failures.

Financially, none of us (voters) have learned from the 70’s / 80’s and the 2000’s to present – that’s mostly on the Boomers since it is mostly Boomers in office who went through all that S*** and choose to continue the S*** show.

Every generation has made mistakes. The mistakes are more magnified now when the mistake perpetrators are unapologetic and untouchable (Fed mostly and those who have the authority to control the Fed).

I am ashamed of what we are creating for our future. As you state, it might manifest in socialistic takeover ideology. Communism works well when there is anarchy, not so much when a country of people are confident / productive. The USA is not what it “aspired to be” in the years after WW2. It has been a slow but steady decline. There will probably be mistakes made turning it into whatever it will become in the future, but I am not worried.

PNWGUY. Go research Peak Oil. Some may say that, as a theory, it has been discredited. But from what I see (the ongoing decay of western civilzation, global financial collapse and now the depopulation agenda and rise of socialism) Peak Oil has never been more valid an explanation for the world’s condition.

History will demonstrate that the Fed’s (and all CBs) reckless and myopic monetary policy and interest rate tampering were but symptoms of and response to an inexorable geologic phenomenon which was poorly understood.

Oh, and btw, the whole renewables thing. Yeah, that’s all just Baby Boomer brown acid still talking. You should read more legitimate history and less hysteria being promulgated by your groomers because, as mentioned, they’ve already pulled up the ladders and you (and me) ain’t gettin’ on the boat!

Let us not jump into conclusions about Fed determination to do anything other than easing before the stock market falls by more than 10%.

Market only corrected 4%, high valuations and high price to sales down 40%+ same show different day,

I’ve been curious about the impact of the following on 2022 retail sales/inflation and haven’t noticed it covered/discussed:

The impact of the expanded CTC expiring, I’ve read that it averaged about $16B/month from July – Dec.

Also, these advance payments should also be shrinking refunds normally hitting people in Feb/Mar, so will it ‘feel’ like a double whammy from a retail sales perspective?

Student loan forbearance ending (maybe) in May, I’ve read that the payments are worth $8B/month

Other expiring rent/mortgage forbearance.

Wouldn’t these factors be significant headwinds for retail sales activity in 2022?

Morbaine,

Maybe supply chains could finally catch up a little, which would be a good thing.

But there is a lot of pent-up demand from things that are now in shortage, particularly new vehicles. That is a big part of retail sales. Once automakers can actually build enough vehicles to meet demand, I would expect those sales to jump back to more normal-ish or higher levels, making up for any slack in other parts of retail sales. So I don’t expect retail sales to take a big hit.

However, if markets crash, retail sales WILL take a big hit.

I can’t see how 15% auto loan rates are going to stimulate demand for $100,000 trucks, but perhaps my imagination just isn’t wild enough.

“ perhaps my imagination just isn’t wild enough.”

DC,

Your imagination is just fine…

It’s your prudence and common sense that’s out of whack….

15 year loan terms…balloon note on the end.

Inflation not only in vehicle construction costs but price of oil has risen dramatically.. So wondering about the baked in higher prices of vehicles and what happens if oil stays high or goes even higher?

What is the point where higher prices break the back of consumption?

Ironically, despite all the hand-wringing about energy costs, the price of oil, at $75 a barrel is still LOW. 12 years ago it was $150. In 2014, it was still over $100 before it collapsed.

I wonder what the gas price will be at the pump when oil gets to $100/barrel or $150/barrel. It’s $80/barrel now heading in that direction. $10/gallon anyone? Why is the pump price so high now? It’s almost as high as it was in 2007 when the oil price was $150. Someone is making a killing.

Wolf,

How much does the stock market really matter to the real economy? From 2000 to 2003, markets entered the last prolonged bear market, yet retail sales continued moving up (though not as fast as in the 1990s) & GDP growth was positive. And the 1990s were a time of unprecedented retail participation in stock market speculation during the first internet bubble.

I don’t really buy the idea that the stock market matters that much to the economy? Only about half of Americans own any stock, and only the top 10% or so have any significant holdings outside of retirement accounts (which are typically held till retirement, making short term fluctuations irrelevant.)

The stock market probably doesn’t matter as much as the bond and real estate markets. Although some stocks are leveraged as assets. Interest rates going up means losses in value in already issued bonds.. in their value as an asset.. Same with real estate, both residential and commercial.

So a change in the direction of interest rates should have a dramatic effect in that the entire system of fiat money is based upon a loans against assets.. This probably wouldn’t do much short term but if it is perceived as a longer term condition……..

Years of gains could just vanish! Causing calls on debt and margin and … spiraling downward

This is why most people think it won’t happen.

You heard it here first. Do not forget to give Wolf credit.

Student loan forbearance will probably never end. The DOE was sending out emails saying the forbearance through January would be the FINAL extension and then at the last minute it got pushed back. We will now be at almost two years of nobody making payments, there won’t be much appetite to tell people they need to start paying hundreds of dollars a month again.

Perfect

This is really an odd ball in the punch bowl. The VP wants some out of the box solution to handle student loans. While the government is on the hook for the loans they are all private. What if the FED pivots and starts to change from MBS purchases to student loans. What a hoot

lol,

well I guess sitting on a porch holding your 45-70 to your right foot and pulling the trigger to see what happens may be the political outcome nearest to that.

How many pension funds hold the liabilities that will go poof…

Morbaine,

At least one big servicer of student loans stopped doing it last month and all those loans have to be moved to other servicers. This was supposed to have been finalized by the last start date for paying student loans, Feb 1, I believe. Now the payment start date has been moved to May and I believe it is because the new servicers are not ready to start accepting payments. The first announcement for this went out last summer and it may not be finalized until next summer.

I think I will have a lot of free entertainment provide watching investors leave bloated PE stocks and rotate into bloated “value” stocks. The biggest inflated asset whomping stick is when the Fed starts QT. Liquidity starvation will rub up against margin debt rising mortgage rates and a looming recession. Suddenly you will hear the reason the Bear is back in town is due to valuations and fundamentals. WTF is that? Fed got no interest rate differential to cut when recession hits. They waited way to late. The Fed is absolutely sober in its knowledge it has put a stake in the heart of DC spending. The Dollar lies in the balance and the Fed better make the right moves. At the end of the day Fed will protect King Dollar no other asset matters more than,King Dollar. The Party doesn’t matter. Reds and Blues love spending and agree on most of it. Only a fool thinks their is a difference between a red pill or blue pill. When they dissolve they both spew money as DEBT. If King Dollar sinks then Debt manufacturing will dry up. Fiat Debt is the Fed’s sole purpose. This is going to be a good old fashioned cluster f&$k.

Agree value of the USD ultimately trumps everything else. I don’t know what the downside pain point is on the DXY (or similar index) but there is one.

The public and the financial markets will ultimately be thrown under the bus to defend it.

Pretty sure I recently read about Americans getting back to their old bad habits i.e. drawing on their credit lines and draining their savings. With rates rising all over, lots of people will be hurt from all sorts of directions.

The Fed has taught people not to save…

they have taught people to behave as the government….borrow and spend.

Terrible for society.

True and it’s because this country seems to collectively believe there is something for nothing and can live above its means forever, even at someone else’s expense.

The county has a belief in Cognitive Dissonance as a religion! The Power of Positive Magical Group Thinking! If you confront people with it they get angry..

You have to realize that most people do not have the mental capacity you do. Most of the people posting here I’m sure exceed IQs of over 120 and are neither sociopaths or psychopaths.

Why be surprised about how dumb other people seem? This is why democracies are so rare and usually don’t last all that long.

@economicminor. The US is not a democracy, it’s a constitutional republic. What’s the difference? In the later, minorities can not be bullied because they disagree with the majority.

I bet most US people don’t know that.

The problem is that it has worked for 40 years, and there is no one left working in the financial sector that knows what reality is. The people that could have properly handled the coming crisis are all dead. The current crop of “economists” are perpetually confused.

More jawboning BS from the FED, which is directly responsible for most of the economic issues we face and will face for years to come. As soon as the markets tank, money printing will be back, because they have no other real political option. SOS from the eternally corrupt establishment.

The market IS BIGGER than the Fed.

Oh yeah? What comes next after trillion?

How can the market be bigger than the Fed?

The Market is the Fed.

Take the Fed out of the game and you will also bench TINA. If TINA gets benched investors will have an alternative.

Of course investors had an alternative all along, they could just quit participating. Stop working for the U.S. stop investing their earnings in the U.S. Quitting was always an alternative.

Putting my life savings into 1/3 partnership in an avocado farm in Spain, and getting citizenship in the bargain, was an option all along. Galicia is a nice place to live (but far from the avocados).

You all made the country the way you like it. Those of us who disagreed left.

Don’t forget how happy your SUV makes you – and keep eating avocado toast!

There is an article in the Washington Post by Mark Zandi from 1/6 titled “No, the housing market isn’t in a bubble. But there still are many things to worry about in 2022.”

I read that and then Wolf and I figure the truth is either somewhere between or further off the scale to the negative. Zandi has some good points but I think he’s high on something, like money sloshing around is the new opium of the people, or of the mainstream press.

I smell danger in the idea QT can be an orderly endeavor, much like controlled drinking for alcoholics.

No surer sign of a housing bubble than seeing new articles every day that read “Are We in A Housing Bubble? Experts Say No.”

Pea Sea

The recession ( after 13 yrs of expansion with easy-peasy money going mostly to unproductive Economy besides the insane assets bubble) will precede it, first. Wait n see!

Just talked to mortgage broker. He has never had as many people as he does now lined up to buy a house. He said used to be 5% investors now it’s 20%.

That’s why we call them bubbles.

Consider the source. Mark Zandi works for Moody’s. Moody’s was rating garbage MBSs, CDOs and SIVs as AAA, knowingly ripping investors off during the last housing bubble before it all blew up. They have been successfully sued and have paid more than a billion dollars in fines. Mark Zandi appears to be a complete crackpot economist and fraudster on the surface. He works for a company which should have been shut down, but instead was allowed to keep the ill-gotten loot and remain open to this day.

Moody’s and the other credit rating agencies became corrupt when they ‘sold’ their opinions. Before, their income was subscription only.

Zandi is a Wall Street schill. He’s ideologically related to the three monkeys who didn’t see, hear, or speak any evil.

Bernanke supposedly didn’t see the housing bubble in 2006 either. It doesn’t mean one didn’t exist.

The only bubble Bernanke could see was the one inside his bubble tea.

SRFs may alleviate LIQUIDITY squeeze but it cannot resolve the INSOLVENCY (besides inefficiency and incompetency) baked into our financial system. Cannot solve supply chain problems, increasing inflation or the raging Omicron!

Wonder, Why any one wants stay invested in the Equity and or the Bond mkts, let alone putting new money into them? Any other rational explanation to stay invested? There will be (most of the time) slow grinding BEAR with periodic sudden drops (depending on the good news being bad or the bad, very bad!)

Greed will reset the market , look up buffets first two investing rules ,simple SHTF

Pardon my ignorance but I don’t understand something (many things actually but I’ll start with this one):

1. the government “prints” treasuries out of thin air.

2. investors then buy these treasuries with money they have lying around.

3. the Fed then “prints” money and buys the treasuries back.

How is this actually adding money into the system when it is essentially using “printed” money to buy back “printed” treasuries? Presumably investors who bough the treasuries with their cash in step 2 could have done something else with that cash or sold the treasuries to someone else so why is the fact that the Fed is purchasing them instead making a difference? Is it just that the Fed is overpaying for them to drive the price up and therefore the yield down?

The government isn’t “printing treasuries.” A treasury is a note – a debt security. Think of it as an interest bearing loan. You loan the government “X” dollars, they give you the IOU with interest.

And yes, the FED is artificially holding rates down by gobbling up all those treasuries at lower rates than any sane person would ever buy at. Once they’re out of the picture, rates will quickly spike because nobody with a modicum of common sense would want them without a serious return, especially given the inflation outlook.

Thanks Depth Charge. I was using “prints” for treasuries in the sense that the government makes them up out of thin air just like the Fed will later make money out of thin air. Investors had to have cash to buy them initially and could have bought stocks, housing, etc. Instead but choose to buy treasuries. So why would they sell them back to the Fed? And I hear you on the low interest rates but if you believe nothing will beat inflation and everything else is in a bubble couldn’t they be the least worse option? I just don’t understand the liquidity argument when there was liquidity to buy the treasuries to begin with.

okay, think of it like this. the government issues treasuries, which is a debt obligation. a person buys it with $1,000. the government then takes that money and spends it in the economy. there has been no change in dollars. if the person who bought the tbill subsequently sells it to the fed, now he gets his $1,000 back, and there is $1,000 more cash in circulation. that’s how the fed “prints” money.

How does Wall Street prints a Trillion dollars of Tesla shares?

The legal entity Tesla issues shares. Other entities or people offer federal reserve notes in exchange for a share, which represent ownership in the entity Tesla.

Wall Street is just a street in NYC where there is a physical entity that provides the service of exchanging these shares after they’ve been issued.

Wall Street doesn’t issue (print shares).

Tesla issues the shares and people like you and me (not me, actually) buy the shares. Multiply the number of shares issued by the current price per share and you get the “value” of Tesla (or any other company, for that matter).

Excess liquidity pumped into the system, lots of credit, puffing up the paper securities, plenty bought on borrowed money to speculate, just like houses last time. My townhouse went wildly up in market price then the price was cut in half in months.

Yup, that’s it. If the Fed stops buying? Investors see the ‘Fed Put’ is dropping down, which will drop both bond and equity prices. Interest rates rise, which encourages savings–if you had any–ergo the ‘paradox of debt.’ Under Volcker, interest went to almost 20%. Cratered economy and made a mess of financial product pricing. Bonds were a bonanza! Sold at depression prices. If you had cash (rich?) you made out like a bandito. How do you reconcile the ‘paradox of debt’ with the narrative that claims Volcker’s crushing rates somehow generated a growth in capital?

perpetual perp,

This comment is twisting what happened under Volcker and afterwards into a very bizarre narrative.

I made all my money thanks to Paul Volcker.

For a rerun, I think we have to have a lot of liquidity squeezed out of the system first. But my cash is on the sidelines waiting! I would love me a 30 year treasury at 20 percent.

Perpetual perp –

I view that similarly to how you describe. In my opinion Volcker was a tool for the rich (himself included), just as the Fed has always been.

In some sense his policies did generate a growth in capital — for the banks in the U.S. that greedily created lucrative but not-so-safely-secured dollar-based loans to other countries (especially third world countries).

When the dollar spiked, the countries suddenly owed much more than they could pay. Many of those countries went into default, and the IMF was brought in to enforce draconian policies which saved the greedy banks loans, and bled the countries of needed capital for decades. This was a coup for the oligarchs of the American empire era.

People may cheer Volcker for some effects of his actions on some domestic macroeconomics. But I suspect it was really like much of American policy (geopolitical wars, CIA coups, etc.) — helped United States domestic economy and consumption, but screwed over other countries as empires tend to do.

This narrative I subscribe to may be wrong because I am nowhere near being an expert. But, I don’t give the benefit of the doubt to anything a Fed chair or committee does.

The Fed “monetizes U.S. debt when it buys U.S. Treasury bills, bonds, and notes from member banks. The Fed doesn’t have to print money to do so. Instead, it issues a credit to the bank’s reserve deposits. The credit is treated just like money.”

Well, correct me if I’m wrong, but it IS money. Any debt instrument (car loan, credit line, etc.) is creating money “out of thin air” that didn’t exist before. It was not part of the existing money supply. This new money is spent by the borrower, and is expected to be repaid by the debt asset holder (with interest).

As Dalio describes it, there are decades-long debt cycles in which the accumulating debt (money created out of thin air through credit / loans), when added to the existing money supply, eventually becomes too much more than there is real wealth (real estate, etc.) to purchase with it. So if there is a trend to buy real wealth, there is a too much money competing for real wealth, and it get’s more expensive (inflation).

Note that the Fed buys Treasuries, etc. from its member banks. But the Fed is the member banks. In that case there is no third person or independent entity that decided to use their liquidity to buy the Treasuries in “step 2” as you describe. Although, that is maybe how the process was originally intended?

6% inflation last year, and 4% inflation in 2022 is going to be a 10% devaluation and this is the most -harcore- Fed tightening scenario possible….

Volcker devalued the dollar by 40%, you can look at the compounding inflation figures over his term.

Yet whenever the idea that the US is devaluing is raised because of unpayable debts (which it has done many times before as have many other countries) everybody seems to think oh no the Fed will be forced to tighten.

No it won’t. None of the countries holding US treasuries are going to sell because they have those treasuries to enable mercantilist trade policies. Its not about the numbers its about the real factories, chip fabrication etc. Mercantilist policies are to shift the location of production because the location of production is real.

You may think well the stock market is in a bubble, and you may also point at Japan and say look the Nikkei still down now. The US is not Japan. The US is not heading into a deflationary crash and the Japanese yen wasn’t the reserve currency.

I think this is going to be a 4-6 year devaluation of the dollar. Its the only way out apart from anything else. All countries are in the same boat which is why you can’t see the dollar shifting so much.

There is no maybe about the US stock market being in a bubble. This is the greatest global bubble of all-time in stocks, bonds and real estate collectively. It’s not even close.

A supposedly moderate US P/E ratio due to a fake economy and insane monetary policy doesn’t change that the actual fundamentals totally “suck” either. Look at “growth” since 2008 and median household income and net worth since late 90’s. The latter two have flatlined even with the smoke and mirrors.

Inflationary or deflationary, one way or the other the majority of Americans are destined to become poorer or a lot poorer in the future.

No, it isn’t different this time and the US isn’t exempt from the reality which applies to everyone else.

I stopped reading after you said Volker devalued the dollar 40% (and immediately regretted having read that far)

Well, with the increasing energy issues, amongst many others in European countries that may hamper productivity, isn’t the Euro looking more shaky than the Dollar?

To expand on your comments, the Dollar milkshake theory could prove more compelling, to the degree that fear of local inflation turns to relief when looking over the fence, so to speak.

LordSunBeamTheThird’s comments, I mean.

I thought this information of use

From mises.org

Jan 8,2022

“The Federal Reserve now owns on its balance sheet $2.6 trillion in mortgages. That means about 24% of all outstanding residential mortgages in this whole big country reside in the central bank, which has thereby earned the remarkable status of becoming by far the largest savings and loan institution in the world……

This $2.6 trillion in mortgages is 48% more than the Federal Reserve’s $1.76 trillion of five years ago, and of course, infinitely greater than the zero of 2006. Remember that from the founding of the Federal Reserve until then, the number of mortgages it owned had always been zero.”

The Fed had no business in mortgages for almost 100 years…..then suddenly they account for 24% of all outstanding mortgages….

This is just more proof of a morphing Fed that ever expands their “mission”. In a system of checks and balances, which allegedly is our government, where is the “check” on the Fed?

The Fed is too confident they can control inflation through monetary policy. For example, China just shut down a city of 13 million for two weeks to contain the virus (with only 1800 sick), and they still stick to their zero tolerance policy. Having not allowed their population get any significant level of herd immunity, and having a inferior vaccine (and too much pride to buy the better versions), China could create supply disruptions for the next 1-3 years with a more aggressive future variant… simply because of their zero tolerance policy, and being too aggressive on allow herd immunity. How does the Fed stop China from clamping down on cities, and shutting down ports and manufacturing that the world relies on currently? It can’t…

The Fed has a God simplex, and at some point the world is going stop believing in Fed omnipotence, and that is the “Black Swan” panic moment that will ultimately force the Fed to buy both bond AND stock ETFs (around 25-30% market collapse), and perhaps start QE back up. I am guessing they will not drop rates back to ZIRP as that has shown to hurt the mega banks, they will buy bonds because that helps mega corporations and the mega fed govt, and they will buy stocks at that keeps the mega wealthy elites happy. I think this will be the last time the Fed remains in power almost solely for the benefit of the “megas”, as the “other 99%” will be forced to stop bickering about nonsense, and vote in unison for major changes in both govt and Fed powers. It will take one more mega bailout of the elite monetary economic structure in the next 1-3 years to bring about real, lasting changes…

Or any of another trillion ways this could play out…HA

The only entities with the power to confront the federal politicians are the states.

In 1913, the 17th Amendment substantively eliminated that power. Moreover, it effectively combined the power of the states with the power of the people. Where once the power of the states acted as a balance between the power of the people and the King (based on experience and wisdom of governance of past 2 thousand + years), the power of the states is now compounded with those of the people. As the electoral college is effectively meaningless, the emotions and passions of the mass of humanity are on full display at the federal level. There are no meaningful balancing principles.

Moreover, in that same year of 1913, we had the Federal Reserve Act and the 16th Amendment.

The only change a reasonable person should expect is the manifestation of everything the Founders, AntiFederalists, etc. feared.

Funny how the 60 years following 1913 were the so-called American Century, the greatest flowering and spread of national wealth and power the planet has ever seen. A broken clock is right twice a day, diagnosing the time.

Where do you think congressional support for allowing the Federal Reserve to buy equities would come from? They don’t currently have authorization & thus it’d require an act of Congress.

The Bernie wing would see it as a Wall Street bailout with negative distributional effects on income inequality. (They see QE on treasuries differently because their big spending plans depend on central bank monetization.) Republicans traditionally dislike interventions on free markets, and have been even more vocally opposed to QE in general.

“Republicans traditionally dislike interventions on free markets, and have been even more vocally opposed to QE in general.”

I missed it…..I have never seen one politician complain about QE.

When money is too cheap to borrow, per the Fed policy, politicians view it as a money pot for programs and bills that are vote buying schemes.

Trump said he wanted NEGATIVE rates……I took that as a want to interfere in free markets.

Republicans traditionally are fine with interventions in the free market as long as those interventions are good for them personally. The last twenty or thirty years of serial bubble-blowing by the Federal Reserve have been implemented under Republican and Democratic presidents and legislators with their enthusiastic assent.

You’ll do well if you leave the upper and lower 10pc on the table. most will leave the upper and lower 20pc. It’s a rigged game. Push away from the table.

I have a small sliver left on the table now. But I am afraid the table will grow and I will, despite my craftiest efforts, find myself “all in.” In certain macro events, we are like tidal creatures, with no real self-steering, swept up in it.

the fed will raise rates to try and help the democrats in the midterms. 4 rate hikes of 1/4 % only would raise mortgage rates to around 41/2%. 5% seems to be the line in the sand which they won’t cross. 10 to 20% down for stocks and other assets. Just blowing the foam off the beer!

With current polls showing almost 70% are not happy about the economy due to high inflation, and they blame the President…it is likely at team blue wipeout at midterms no matter what the President begs the Fed to do, as inflation will still be 4-5% by mid-terms even if it magically peaked in December (which is highly unlikely)…

If only team blue had been reading Wolf forums 18 months ago, they would have read me along with dozens of others ,including Wolf, stating “inflation is going to be a political bitch” come midterms. Amazing that the high paid consultants did not warm them…although maybe they did, and they just kept snorting elitist political hope-ium and now it is wearing off and reality is finally sinking in…

Agreed that the Dems are going to get hammered.

Is it fair? Of course not–the hyperdrive money printing and stimmies happened during Trump’s term, with the GOP majority Congress’s enthusiastic assent, and they massively lucked out that the resulting consumer inflation didn’t print until after January 2021.

But do I feel bad for them? Nope. They had a perfect chance to stop the madness a year ago and they didn’t, for fear of upsetting their owners on Wall Street.

Consider fiscal policy as a source of inflation. One politician promises tax cuts without cutting funding to special interests. Another politician keeps taxes and promises spending programs to help families. Neither has enough money to pay for it, thus they borrow money, or increase the money supply.

In 1803 the U.S. bought the Louisiana Purchase from France for 4 cents an acre or $15 million.

The Sunseeker Resort, a 680 room hotel and conference center with 200 boat slips is under construction in Charlotte Harbor for $400 million.

France had 2 choices take the money or u.s. would just take it

I was burned in 2012 when we had to move and sell our house at a loss. We need a house now as we have been renting ever since. Now we don’t know what to do! Buy or not buy? I’m in stinkin Illinois.

@ Lisa “I’m in stinkin Illinois.”—-> I think you answered your own question…=)

Amen! Lisa….if there is any way possible, you would do well getting out of Illinois. Maybe head south to Texas or the Carolinas.

Rich are moving to Costa Rica

Flea, that is insane as CR has worse infrastructure than Puerto Rico.. Stores there have armed guards.. Even at the surf shops. It is definitely a 3rd world country. Yes, better than most but unless you really love a low level of service and accessibility of goods probably not a good place to relocate to. Very low key existence. Awfully quiet for an American.

Also, you can’t just move there. Maybe if you were rich enough you can bypass all the government bs but until you somehow obtain residency you have to leave for 2 weeks every 6 months. And like all 3rd world countries, they don’t have to let you back in.

Meant costa rico

Don’t buy in Illinois. Now, re-read the last sentence.

Lisa, depending on your income situation, you may want to see if RE asset prices will go down some as these mortgage rates continue to climb.

As Wolf mentioned in his article, mortgage rates are very quickly rising. Some here in the comments (gametv) are speculating that the 30YR FRM will be up to 5% by April. That will have a significant impact on housing prices.

If you have the income to support slightly higher interest payments on a monthly basis, I would wait for a few more months and then test the waters to see if you can find a distressed seller in the areas you want to live in.

Remember that the CS HPI numbers and the average prices you see in publications are simply averages. If you negotiate hard and play your cards right, you can of course perform better than the averages shown in the data. The market is slowly turning more favorable for buyers; this slow turn could turn faster!

In other words, keep your eye out and test the market – see how desperate sellers get.

I wonder if there was any correlation to Fed buying half a trillion in MBS (Mortgage Backed Securities) per year and the insane increase in housing prices?

So what happens to housing values if they stop buying, and start selling a few trillion???

Good Comments. Time for a re-read, watch of The Big Short just to remind everyone how the game is played. So many today are 100% clueless of what’s transpired in the past.

Go Chargers 🏈🏈

I’m in the same situation, we’re going to buy. I know I’m over paying by 15%, or maybe not, who knows. I talked to my mortgage guy and he has more people than he has ever had lined up to buy. He also said a larger and larger portion are investors, up to 20% now. At some point I truly do believe everyone will be priced out and will be renting.

I’ve been coming to this site for years, and every time it’s the same thing, markets going to crash, housing is going to crash, blah blah. No one can time the market. I bet SPX will be up 2% tomorrow and everyone once again will be dumb founded on why. Face it, the fed will continue to be the fed. Currency will continue to be devalued.

If you buy a house and the housing market crashes walk away from it. My mortgage guy said they same thing. Play the game. Put down the lowest down payment, invest the rest, walk away if you have too. Stop thinking there are any morales left in the world. And if there is a housing crises again, what is the chance of help from the government, probably pretty high.

Play the game and stop being played. It’s a sad world and unfortunately having morales hurts. Doing the right thing never gets you ahead.

I disagree with the comment that it will keep going up. Not with internet rising and inflation

*interest*

All the smart money knows Powell will let inflation turn to hyperinflation.

Bankruptcy or jingle mail is not a path to wealth. Doing the right thing doesnt make for a “quick win” and it may mean “missing out” on some ill-gotten gains but you also wont be paying for your “fancy footwork” later on. Doing the right thing allows the possibility for actual long term success.

Horse s***. A bank or investor is on the other end of the transaction. You’re not making wedding vows to the lender, it’s a profit-motivated endeavor on both sides. The financiers try to guilt you into continuing payments on an upside-down product, while banks and investors opportunistically use every legal avenue they can, including bankruptcy, when it suits them.

In short, the contract includes contingencies for non-payment. Non-payment is PART OF THE DEAL.

Jon, your point fully relies on the fed to keep things going. If they decide not to step in or to not step in immediately, virtually all recent home owners would be underwater on their mortgage which means that you cannot simply just walk away unless you want to shell out the 100k’s in cash that you are undewater by.

I agree that there is a immoral game to be played here, but it seems that you are only looking at the last 13 years of the game and not the full history.

I also agree that no one can time the market. I think timing is more prevelant in pricing specualtion and not true value. I don’t think anyone would disagree that virtually everything is overpriced right now. That will be the case until debt becomes more difficult to take out which seems like will be the case starting in 2022 with interest rates rising. The real question, which you acknowledged, is “What will the fed do when this thing starts to turn?”

I have been asking that question for the last 10 years… the only difference now is that the decision to keep printing and devalueing isn’t so popular anymore.

Jon,

“If you buy a house and the housing market crashes walk away from it. My mortgage guy said the same thing.”

Wait a minute…. You made a generic comment. But that works only in the 12 “non-recourse” states. In the other 38 states — the full recourse states — the lender can obtain a deficiency judgment after selling your home and hound you for the deficiency, fees, interest, and other costs.

The state you posted this from is one of the 12 non-recourse states. So yes, if you buy a house in that state, you can walk away from the mortgage.

But if you buy a house in one of the 38 recourse states, you’re on the hook if you try to walk away from your mortgage.

This article explains all this and has the list of the 12 non-recourse states.

https://wolfstreet.com/2018/06/20/us-style-housing-bust-mortgage-crisis-in-canada-australia-recourse-non-recourse/

//If you buy a house and the housing market crashes walk away from it. //

Wolf, which city (cities) do you think the housing market bubble will burst first? I have been reading your writings under the tag “housing bubble 2”. You mentioned cities like San Francisco, Seattle, Phoenix, Atlanta etc.

Are these cities on your list? Or do you have other thoughts?

Probably the places that have exploded recently but are big nothing burgers as far as real industry and growth outside of speculation.

I’d say Boise will take the biggest hit. Then places like Denver, SLC, Vegas, Phoenix, Austin/San Antonio, etc.

Place like SoCal, NYC, Chicago, Atlanta will have a dip and then a rebound.

Rural trendy hotspot towns like Sandpoint, ID, all of Western Colorado, Logan, UT, and Missoula, MT will get obliterated initially and have a harsh recovery if WFH falls from favor.

Western and mountain states will be hit the hardest as usual. Eastern states will have a smaller dip. If the housing market goes up in flames. Same as last time. East coast zip codes haven’t exploded like Western ones. They’re high but don’t have as far to fall. Imo.

This to continue TG’s:

There can be huge crash and recovery differentials within very small physical location differences.

Been watching this playout in the FL and CA RE mkts for many decades, starting in FL in the mid 1950s, when dad had no work at all for six months and we had to sell two of three properties with much lower gains than had been anticipated.

Last time, really high end gulf front SFR and condos went down hugely in the SRQ area, but came right back up to above previously after only a year or so, while properties farther back were down for several years.

Other locations, including some in other US states, still had not reached previous high prices 10 years later, though they have the last couple of years, that’s for damn sure.

Interesting! Thought it was the same for every state. Thanks for the insight.

True Wisdom dispensed daily:

There are only 12 “non-recourse” states.

These are the only states where homeowners can walk away from a residential purchase mortgage without fears of being hounded by a bank (in some of these states, lenders may have recourse with other types of mortgages, such as a refis).

Alaska

Arizona

California

Iowa

Minnesota

Montana

North Carolina

North Dakota

Oregon

Washington

Wisconsin

Nevada,

Be sure to contribute enough to get in line for a beer mug.

You can also be sent a 1099C for canceled debt from your lender. This could be for tens or even hundreds of thousands of dollars and the IRS regards it as ordinary income for tax purposes so may get a huge tax bill.

And of course, your credit score will take a big hit which will result in having to pay more for a bunch of things like insurance premiums, rent, utilities, car payments etc. and can even limit your career prospects because many employers include credit scores in their background checks on job applicants.

Jon

This whole posting is the worst advice I have ever seen posted on Wolf Street since I began reading this site in 2018.

Your Mortgage guy is a complete moron and a stupid and dishonest one to boot. I have learned over the years to stay away from people like that.

“Doing the right thing never gets you ahead.” Wrong, wrong, wrong

Nick-illustrating again the hubristic ignorance/underestimation of our nation’s potential adversaries’ intelligence capabilities and associated intense studies of the American populace which has been a fairly constant chink in our armor since WWI…

may we all find a better day.

As for the market most of tech is really media companies. They don’t like that designation, or the rules. The value growth distinction is a nonissue, there’s enough money to own both. Rising bond yields will reverse when stocks pullback. There is so much money out there imagine it all in a classic flight to safety. Snider makes a good point about yields (rising) versus yield curve (flattening) and about the nature of inflation, one part energy, one part autos, and one part stimulus. Ignore energy inflation and deflation at your own risk, so inflation is also one part anti fossil fuel policy. They want to take away my NG? Electricity is priced several multiples higher. What does that do for business? If gov hates inflation, somebody better take a cold shower. (I don’t believe it – they could segway to self driving EVs if the global economy was shrinking – the challenge is for the Fed to show us the upside to inflation – growth and jobs – and that requires energy…) Human beings also emit Co2 by the way.

Inflation was “transitory” while a cottage in the middle of Canada sold for C$500,000 over asking price in 2020. Tiff Macklem denied that there was inflation in Canada last year, until Powell changed his words a few months ago.

Powell had to change his words because, unlike Canada, America has a large per capita population of a certain utility which were traditionally used to start revolutions.

If real estate does implode in China all those quite margin calls are going to come in meaning Canadian, Australian and New Zealand real estate will tank big time to meet those margin calls. All three markets are all based on Chinese buyers and nothing else.

Is anyone here paying attention to the US Treasury published auction dates, and what they are auctioning? They recently auctioned some 30 YR UST.