Home prices spike in a few cities, “pause” in some, drop in others. Vancouver prices are below August levels.

By Wolf Richter for WOLF STREET.

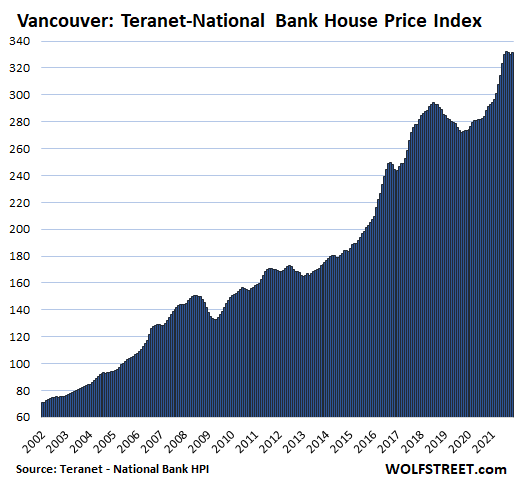

In an amazing development for the Canadian housing market where prices have relentlessly exploded higher – fueled by money printing and interest rate repression that started in March 2020 – prices in November didn’t explode higher in all cities, but only in a few, and “paused” in some, and declined in others. In the most hyped red-hottest housing market of them all, in Vancouver, prices were below the peak in August.

So maybe this is just a seasonal breather in those markets. But last year and for most of this year, there were no seasonal breathers in Vancouver or any of the other major markets, the whole thing just went exponential, fueled by the Bank of Canada that was printing money and repressing interest rates like there’s no tomorrow.

But this is tomorrow.

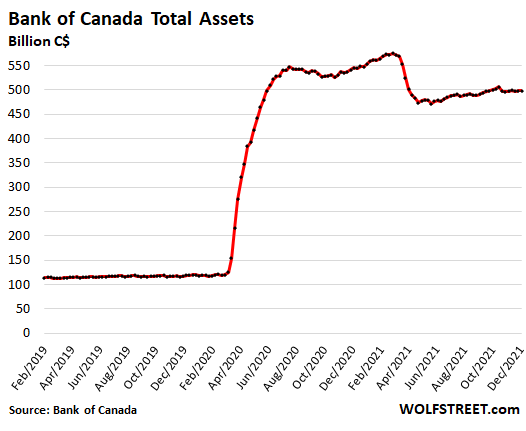

The Bank of Canada announced its first taper decision in October 2020, over a year ahead of the Fed. It let repos and short-term Canadian Treasury bills mature and run off the balance sheet without replacement. It ended other smaller purchase programs. In October 2021, it ended QE altogether, and is no longer adding to its holdings of Government of Canada bonds. And it has put rate hikes on the table.

Throughout this 14-month period since the taper announcement, the BoC has pointed at the excesses in the Canadian housing market that resulted from the BoC’s reckless asset purchases and interest rate repression.

And inflation in Canada has reached the worst levels since 1992, as measured by CPI in November (+4.7% year-over-year).

Total assets on the BoC’s balance sheet, as of Friday at C$498 billion, have been roughly flat since the end of October and are down 13% from the peak in March.

And here is how the housing market in Canada responded.

Greater Vancouver, one of the world’s biggest housing bubbles, “pauses.” House prices, after falling 0.4% in October from September, ticked up 0.4% in November and are down by 0.3% from August, according to the Teranet-National Bank House Price Index, released on Friday. This whittled down the year-over-year gain to 13.9%, the slowest such gain since March.

The BoC’s reckless monetary policies, starting in March 2020, performed a miracle on Vancouver’s housing downturn that had started in August 2018 and converted it into another exponential spike that is now broken:

The Teranet-National Bank House Price Index uses the “sales pairs” method, similar to the Case-Shiller Home Price Index in the US, by comparing the price of a house that sold in the current month to the price of the same house when it sold previously. It thereby tracks the change in how many Canadian dollars it takes to buy the same house over time, and is thereby a measure of house price inflation.

The charts here are all on the same scale. As we go down the lineup, the markets with smaller two-decade house price increases have larger white spaces above the curve.

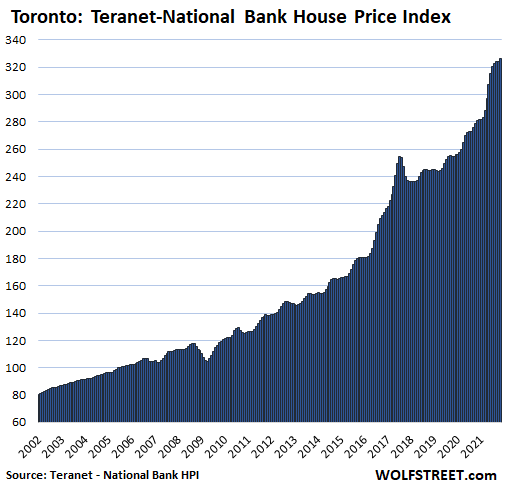

In the Greater Toronto Area, home prices rose 0.8% in November from October. The year-over-year increase remained at 16.3%, down from 18% in August:

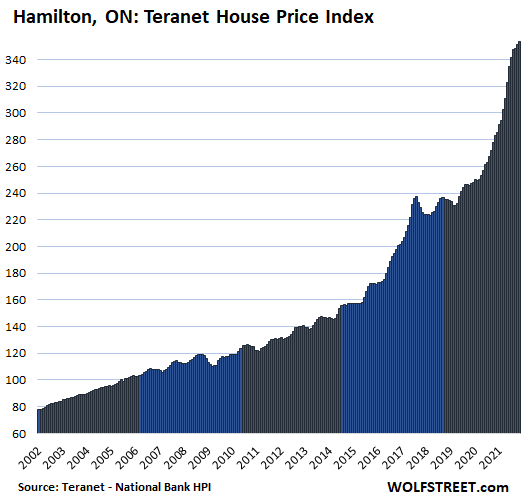

In Hamilton, Ontario, house prices rose 0.6% for the month. This is still a lot, but those month-to-month gains have come way down from the nuttiness earlier this year that topped out with a 3.8% gain in June. The year-over-year increase was whittled down from 30% in July and August to 25% in November. “Crazy” is the understatement of the century to describe this market.

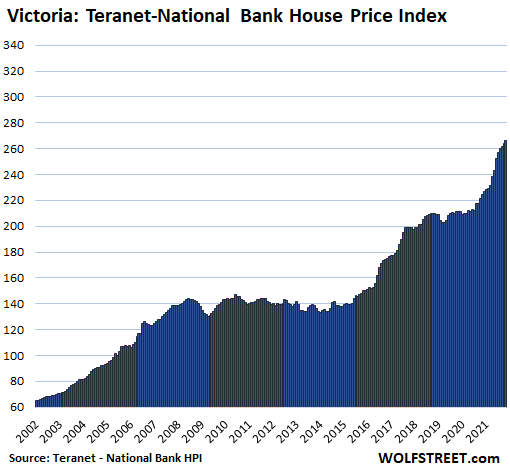

In Victoria, house prices rose 1.0% for the month, still steep, but down from the ridiculous 3.6% increase in June. This whittled down the year-over-year increase to 18.8%, from 21% in July. Prices had flattened from 2018 through June 2020, at which point the miracles of money printing did their job, producing an exponential spike:

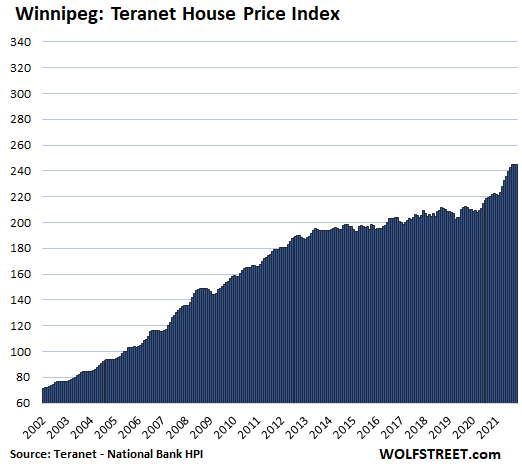

In Winnipeg, house prices remained flat in November for the second month in a row, which whittled down the year-over-year increase to 10.6%. The jump since the summer of 2020 occurred after prices had been roughly flat for seven years, following the prior housing boom that ended in 2013:

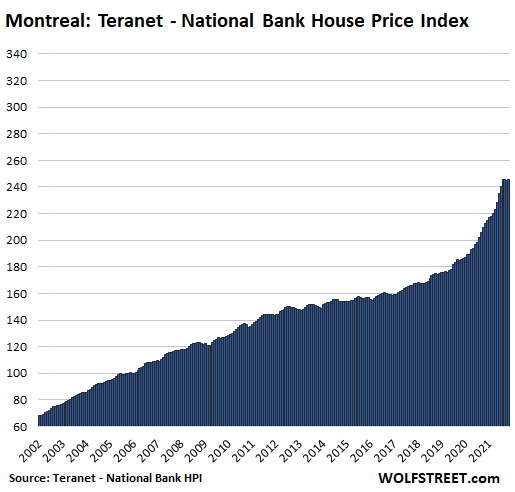

In Montreal, house prices were flat in November for the fourth month in a row, which whittled down the year-over-year gain to 15.5%, from the peak of 21.6% in August:

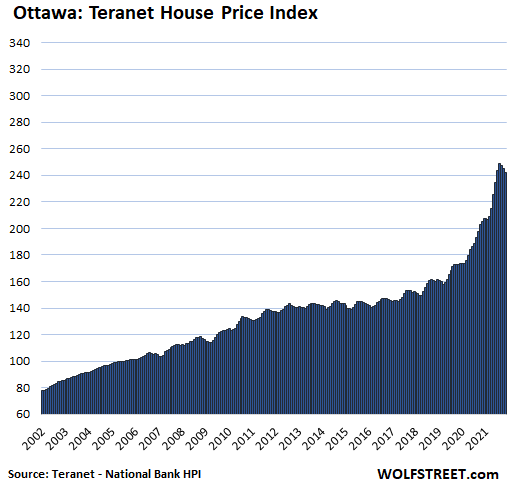

In Ottawa, house prices fell 1.1% for the month, the third month in a row of declines. This chopped the year-over-year gain to 18.0% from the peak of 28.9%:

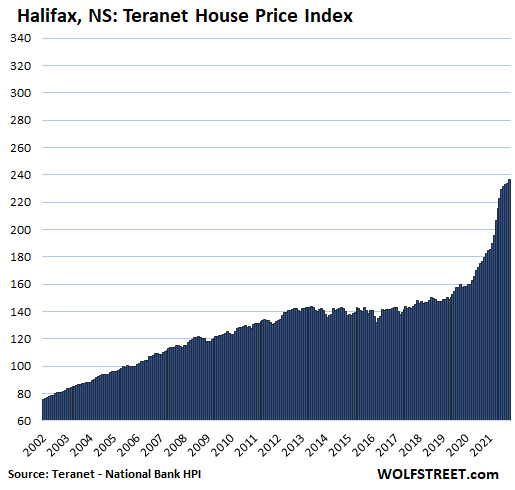

In Halifax, house prices rose 1.2% for the month, and while that is still a crazy increase, it’s down from an idiotic 5.4% spike in April. This whittled down the year-over-year gain to 29.8% from 33.4% in July, which is just nuts:

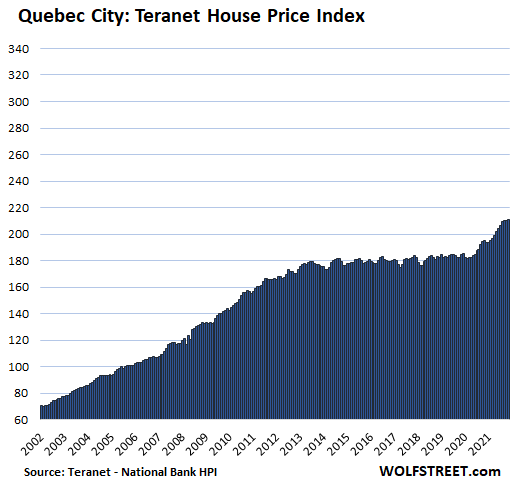

In Quebec City, house prices ticked up 0.3% for the month, which whittled down the year-over-year gain to 8.0%, the slowest gain since February:

Calgary and Edmonton, Canada’s oil towns, had spectacular housing bubbles during Canada’s oil boom until the whole thing stalled in 2007. 14 years later, Calgary’s home prices are just a tad above 2007 levels while Edmonton’s remain below 2007 levels, despite the gains of the past 12 months, following the BoC’s money-printing.

In Calgary the index is up 8.3% year-over-year, and in Edmonton 4.8%. Edmonton was one of the cities where home prices fell in November (-0.3%).

But with house prices near where they’d been 14 years ago, the last two in the Teranet-National Bank House Price Index don’t qualify for the most splendid housing bubbles in Canada.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wolf, thanks for the article. I just emailed it to my friend who is a native Canadian and now a U.S. citizen after 10 years here. His son is still living in Canada and trying to save for a house in Vancouver (I think).

Young Canadians have no future because the system is designed for the home owners.

It’s designed for corporations to import millions of low wage slave labourers. The housing bubble is just a side effect of this unsustainable growth in immigrants.

Exactly! Not much else needs to be said.

The contribution of natural increase to population growth has waned as the Canadian population aged and fertility rates declined … natural increase accounts for less than one-third of Canada’s population growth and has ceased to be the major player in the equation …. migratory increase plays an increasing role in Canada’s population growth (and) currently accounts for about two-thirds of Canada’s population growth. Statistics Canada projects that immigration will continue to be a key driver of population growth in the coming years but without it, Canada’s population growth could be close to zero in 20 years.

Ten years ago, there were laws enforced for the maximum amount of persons in an apartment or dwelling by square foot and rooms.

Today, TEN OR MORE “international students” studying at Seneca, Centennial or Lambton College are packed inside a ROOM within a BASEMENT in Scarborough.

They work at factories for minimum wage at plants, bakeries, etc

If Canada (the whole country) ever had a year where they had as many immigrants (legal or not) as Arizona or California take in every year the country would flat out freak out.

Maybe not. Bubble may burst. Less than 50 years ago stock market to GDP was only 35%, now it is 205%.

People have gotten very complacent with current asset values. The most likely situation is when asset prices get to record highs there is a panic and they go to record lows.

I was wondering how Fed would try to keep asset prices elevated. I didn’t really consider they would run negative real rates so low. As I said with QE adjusting factor negative real rates are somewhere around minus 8%. If people panic over inflation it will feed on itself. If they panic over bubble bursting market will run all over the Fed as there want be buyers as people try to avoid losses.

Save for a house, or any major purchase….how does that work?

You put money in the bank, it goes backwards in value due to inflation…as the real estate market runs away on the upside.

Same as in the US. The central bankers are pulling the ladder up ….. disconnecting those “without” from ever “getting”

Punishing people for prudence and saving….cattle driving people to borrow and buy….

The system can and does only benefit ownership.

A bit off topic but the SUV we got 4 years ago used is almost selling for the same price… Used and 4 years later! That’s rather strange.

I hear a LOT of rumbling in the 30 years old and younger crowd….

this is how you cause societies to collapse. when the younger see nothing worth living for, they either vote for change or they seize control by force. either is bad.

“Save for a house, or any major purchase”

Did car prices — both new and used — explode in Canada as in the US? Just curious.

Yes they did. When we turn in a late model vehicle to the dealership they put it out for bids from brokers who ship it to the U.S. where the demand and prices are higher. Trucks are the most popular

exported vehicles.

Central banks abandoned disciplined Taylor rule policy more than 20 years ago mainly replaced by unproven wealth affect. Taylor rule would have Fed funds rate above inflation to bring it back to its long term Fed stated goal of 2%. A rules based central bank allows investors to make rational decisions about investments. If Fed has made a policy mistake, everyone long and leveraged on stocks and housing are going to get crushed.

Yes, the days of committing “only” to steal 2% from all holders of the currency.

Those were the days.

Wolf, did you mean to tell us that it’s actually possible for housing prices to go DOWN?

Priced in USD, they already have.

Hussman had an interesting chart showing that if you set in t-bills from 1995 to stock market lows in 2008 you would have had just as much money and been able to sleep better at night. Even with t-bills at nearly zero, same is probably going to be true from here. Long term assets are priced irrationally except if Zirp is here to stay.

But you can’t borrow 500k from a bank to stick into tbills, mortgage lending is the unique conduit for credit creation.

When the Go-Go Eighties ended in 1988, home prices dropped 50% in many states, and did not return to that level for a decade. In 1987, nobody would have believed it was possible. I remember it well. It forced me into a financial trifecta of bankruptcy, foreclosure, and divorce.

No worries now, so the mania participants think.

It’s really (supposedly) different this time.

There actually is something for nothing, not just temporarily but forever.

And yes somehow today, lumber prices are back up close to $1,100 bf. How on each does anyone think these prices aren’t going to weaken the new home market. 30-year mortgage rates could be in the low 4% this time next year, and that extra cost of lumber translates to at least $25K in additional costs for builders and homeowners.

If wood stays high for long enough, people will switch to alternate construction and give up some of the tradition of wood. Structural foam panels or something else to keep price down. In the end the product has to be affordable

The new homebuyers don’t care if the house is $450k or 475k…

$100 per month ain’t gonna stop em…

The only thing that will stop them is a lack of buyers for the assets used to prop up this market…

I’m not that smart but it looks to me that the dam holding back Lake Stupid has some cracks in it…

Over time the banks will not let housing fall

Notice that Sparkle Socks printed money for every province except Alberta!

That is why Calgary and Edmonton housing prices didn’t go up. No money for you!

Prices didn’t go up in Calgary and Edmonton because there’s no renters. Meaning there’s no out of province buyers and all the property managers in Alberta are crooks. The only honest one was Libertas property management but they’re gone. No one is going to buy in Edmonton and Calgary because of huge negative cash flows due to no renters. The locals in Alberta can’t buy a bigger house because all of them lost their shirt on real estate since 2007 and they have no money.

Think I’ll go out to Alberta, weather’s good there in the fall.

Charts may be going sideways now

BOE raised rates like Denmark & Norway

Its only Normal for Home prices to Drop they are not sitting on thin Air only a lot of inflation

this may be the time to think of the big short

@T

Russia raised another 100bp they’re up in the 8’s.

This is the difference between reality and delusion.

I would buy in, but exchange rates are so manipulated I could be got at by your state department. There’s nowhere to go we are all suckers now.

It’s still a play on the price of oil.

I’ve noticed locally the less desirable markets have skyrocketed to being level with the vaunted ones. Everything has equalized around absurdly expensive. Even in the utter dung hole counties.

The really desirable areas have had a slight slowdown in pricing. East coast zip codes I watch have slowly started ticking down a bit. Bidding wars seem to be on the decline most everywhere. But again, might be seasonality as well. Mortgage rates are and have been slightly up as well.

Again, still sitting on the sidelines hoping. Of course real estate, much like stonks, only go up.

Adam Vaughan will never allow real estate prices to drop under his watch. That is, until hungry and angry people are at his front lawn.

I’ve seen similar price behavior in my limited searches in the metro ATL area, when the price history is available in listings. Properties which were crushed in the GFC increasing from admittedly depressed levels by a factor of five or more to levels which future buyers can’t service except with artificially low interest rates.

It’s like hardly anyone really wants to live there and those who do are financially stable.

Call my grand ma got first 80 acre farm in depression for money in savings in bank believe she said 800$ nothing is guaranteed

Why it’s beneficial for the ruling Pharaoh elite to keep printing trees:

Most of the people 99% are not money people; that is, they are the proletariat ( a very relevant term still) who loses money just as fast as they make it- a lot of this loss is due to ignorance as well as tight capital control, and of course unlawful taxation.

So the elite print and entice the Proletariat to participate wherefore the said laity gets throughly cleaned. The elite know the Proletariat does not know how to manage his money and will likely part with it; therefore they rightly suppose they may be confident in this endeavor, Oceans 11?

On Taxation: See why and how here: sedm.org. If you can ignore the Bible talk on that site, you will learn a great deal of good laws and history of taxation in the USA.

sedm.org is one of the weirdest websites i have seen in a long time. It is like traveling back in time to 1994. And wow, they don’t make it easy to sign up. After like ten minutes of trying, i still can’t figure out how to sign up for an account…

Stevik, what resources do you find useful there on that website?

As Trucker guy said, there’s great equalization in the less desirable areas. This is the case in Canada too. The house pair index also masks some disturbing gains. For example, a single family home in Ajax sold for $750k in spring 2020 and resold with no noticeable changes for $1.3M within the past month, a 73% gain in 18 months. Markets such as Brampton, Durham, and some smaller markets have gone haywire. Apart from residential, industrial has gone crazy too. In the past year, prices in the GTA quickly climbed from low 300s per sq ft to well over 400 now. You can’t even get a garage shop in urban southern Ontario for less than $500,000. Meanwhile, a 3,000 sq ft place just across the border in Buffalo goes for mid 200s.

Many young Canadians like myself wish for the real estate bubble to collapse, for laws to tax capital gains on real estate, and to end money laundering via “students” from corrupt countries.

I’m surprised Wolf didnt mention the Chinese money laundering impact on real estate in Canada, especially in Vancouver.

From those I have spoken to in Canada, the purchases are often conducted by a lawyer and the property often sits vacant for an extended period.

That was the case 5 or 6 years ago when Vancouver was going crazy..

I dont know the details, but there was a quirk in the Canadian laws that allowed this, but it somehow did not work in the US.

“A citizen of the People’s Republic of China reported average annual earnings of $40,615 to Canadian border agents yet went on to buy $32 million worth of Vancouver real estate after moving $114 million from Hong Kong-based depositors with connections to organized crime and the Chinese Communist Party, a case study by counsel for the Commission of Inquiry into Money Laundering in B.C. shows.”

from Business Intelligence for British Columbia BIV

We’ve addressed money laundering in RE in Canada and specifically in Vancouver. It doesn’t change. This article wasn’t about money laundering though. Different topic. Plenty of money laundering going on US real estate too.

https://wolfstreet.com/2019/05/10/money-laundering-provided-1-in-20-dollars-for-real-estate-in-b-c-canada/

https://wolfstreet.com/2019/04/24/how-a-little-money-laundering-can-have-a-big-impact-on-real-estate-prices/

Yes, it did ”work” in USA h:

Bidding for a couple billion, total on/of many construction projects in SoCal in ’17,,, turned out most of them were owned by Chinese folks who soon were unable to continue, in spite of their 100% ownership of the RE.

Suppose it’s possible all were some how part of CCP, but don’t know that with any certainty…

Be very interesting to see how it all ”shakes out” in SoCal and other wheres, eh?

Of course it works here too. About a quarter of the condo units in my complex in San Antonio are owned by Mexicans. Some of them never come up here but a few come up to shop a couple of weeks a year. I had to help one guy who forgot where his parking place was – he hadn’t been here in so long.

Same thing in the US. The treasury dept through FinCen is quietly asking for comment on composing their regulations for exposing real owners of offshore LLCs.

But- they currently have a limit to over $300K. In other words, anything under $300K has not yet been required to reveal real (beneficial) ownership. If this isn’t changed it will funnel offshore money into lower end properties that ordinary US citizens might possibly be able to buy.

I’d suggest anyone concerned about that to comment on FINCEN-2021-0005-0217 and RIN 1506-AB49. Do an internet search. As of now most people commenting seem to be banks and real estate associations complaining about how much extra work they’ll have to do.

The laundering in what pushed up the prices in Canadian Real Estate……

Germane?

The real damage is done by the Chinese foreign students that Trudeau brings into Canada. Virtually all the Chinese students get at least one house put into their name from their relatives back home in China when they arrive in Canada.

Canada’s Political Elite allow foreigners and foreign corporations to own Canadian Residential Real Estate, so hot, dirty money flows in. This crowds out Canadian working people. Ergo, Foreigners get rich while impoverishing Canadians.

The only real hope, and it is only hope, is that Central Banks run out of printing options (borrowing on historical assets to inflate using the hoped-for credit of the unborn).

Look to China. Real Estate and Real Estate construction financed by Political expediency.

I wonder how the oncoming Chinese real estate market crash will affect Canadian and US money laundering. Their record $3.8 billion RE developer defaults this month are a sign about a third of their economy may tank.

The CCP cadres must be terrified of a revolution/coup as their economic growth is flushed away. Will they move all capital outside of China or pull it in to save Chinese companies? I suspect the former will happen.

The CCP own the Canadian government, so it will be er happen.

Buffalo’s population peaked in 1950 at 580,000 residents.

70 years later it’s less than 1/2 that.

A lot of that was flight to the suburbs. Greater Buffalo is down less than 15% from it’s 1970 peak. As I was referring to industrial, the metro population would be more appropriate. But fair point, I don’t think there’s a single area of southern Ontario with noticeable population decline.

Now that I’m out of the GTA (greater Toronto area) I’m coming to deeply realize that it’s an immigrant city: don’t get me wrong, I’m all for immigration, but not if you’re going to lose your soul in the process …

I can see Hamilton prices going the way they do (it’s a lovely city with Prime university etc) but Durham? Ajax? Those are no name places…. Ajax doesn’t even have a downtown…. Just homes. With the new highways feeding Durham this whole area is poised to look like Brampton and Mississauga in a few years.

Thanks A LOT Wolf for those charts. Always a pleasure to read you.

I discovered a parking spot in a parking garage in downtown Toronto, listed for $C 30k. It was in close proximity to the elevators.

There are bids of over C$50,000 for a strip of land 8 inches wide and 100 feet in length. It was bought for C$5000 at an auction. The gains will be UNTAXED.

@Z

Is it a ransom strip?

Does somebody need to get across it to get to somewhere valuable?

It’s at 1060 Danforth Avenue, beside a church.

That’s awesome!

You could park your Mini-Winnebago there. Affordable housing, Toronto style.

I work for a developer…..we are selling parking spots on condos for 150k now in Toronto. Condos in that bldg start around 900k cad. 95% Chinese money.

Nothing fancy in this condo

Unsustainable. Can’t wait till it blows up

Adam Vaughan laughed at Canadians on TVO and told the host Mr. Paikin that he will never allow Canadian home prices to fall in the bubble,

Adam Vaughan also admitted Canadian real estate is attractive for global investment, but bad for Canadians wanting to own a home.

Vaughan, Macklem, Freeland and Trudeau own one or more homes.

It’s estimated nearly 9% of homes in Canada are vacant. This is a problem in ALL major cities in the world, and Canada isn’t even the worst example, they’re 11th on the list of most vacant homes. In NYC half the units on Billionaire’s row are vacant. Entire sections of central London are practically a ghost-town after dark due to empty units. As on analyst noted; hot money (dark money, laundered money, whatever you want to call it) investors WANT homes to remain vacant, for they are not ‘homes’, they are ‘assets’.

Said it here a thousand times but hardly anyone can be bothered to read up and just see the word tax: land value tax.

I don’t understand why the concept hasn’t gained more traction among the non-ownership class. On the other hand, it’s equally obvious why it hasn’t among owners, and they vote (in elections at all levels — municipal, regional, provincial and federal) out of all proportion to their numbers.

We are governed by and for rentiers.

Yep. The Golden Rule. The one with the gold rules.

Not a new concept….. been that way since…. forever.

> the one with the gold rules

Ideas can create change, the information is on the internet. The main obstacle is the total defeatist attitude of Canadians, Brits and Americans. No wonder these countries have been so successful as capitalistic centers, capitalism needs a ready supply of subservient labour, and it appears to be etched into the culture.

g,

You should watch some of the reruns of the Beverly Hillbillies…

Just to further your education, you know :)

Not very good examples. Neither of those two are areas where the middle class should reasonably expect to be able to afford to buy or rent. I’ve never heard that they could in the past even in a pre-bubble economy.

I agree it’s a problem generally though.

Canadian and American retirees have been buying winter homes in Florida for 50 years or more. Since they are not primary residences, they are counted as vacant homes. Some of these are passed from generation to generation by inheritance. They are not offered for sale.

Look at the demographics, there will be more dying that there are people to bequeath to, there will be many sales.

Actually g,

David is somewhat correct… I live in SW Florida…

Many of the homes will be offered for sale…

The heir/ heirs don’t want them…

1) Many heirs have established lives in other places… so for them, it’s a nice place to visit but I wouldn’t want to live there…

2) if multiple heirs involved, the only equitable split will be a forced sale…

3) A single heir may want it but may have to refinance to pay other heirs their share… and be subjected to a tax reset and loss of exemptions…

4) Carrying costs to keep it vs a money windfall now…

5) some people don’t like Florida…

And so on… it just depends on the heirs and their circumstances…

Florida is a great place to live or come for the winter months and when the next big hurricane hits it, there will be a lot of house sales (people leaving) and once all that is forgotten, new buyers will come back in droves, like now. When I was a young boy in the 1960’s lots of people we knew had winter homes in Florida.

It’s the same thing over and over again. Most of my 1961 Connecticut high school classmates now live in Florida. I went to Texas instead.

COWG – there’s no numbers reasoning in your statement. Is that anecdotal?

g,

Anecdotal…from personal observation…

A lot people down here put their properties in legal trusts to avoid probate or heir fights…

Example 1… an elderly lady passed away , house in trust, house transferred to heir… no formal sale that would show up in numbers…

Example 2… homeowner passed away, left granddaughter as executor, drawn out probate with will… GD lived in Colorado, had option to buy house but had to reimburse other heirs… No heir including GD wanted house… house sold… house would show up in the numbers as a listing and sale, but no reason why unless you knew the parties…

A like exchange (IRS) would be the same as example 1….

g,

Also meant to add another form of property transfer down here is via quit claim deed, tax sale, and others…

Not to get deep in the weeds, just trying to show the various ways property can be transferred, without a formal RE sale, that wouldn’t show up in transactional data…

There’s a very good documentary on you tube on that called “Who can still afford to live in the city? “by DW Documentary. Easy to follow for people like myself who don’t know the ins and outs of how financials work.

8.9 percent to be exact and nearly 100 percent of those are owned by the Chinese.

This stock market is beyond insanity after what happened Wed with the Fed announcing the tapering of QE and three interest rate hikes, and DJIA went up about 300 points that day, – are you kidding me!

However it sobered up by Fri, – but the BTFD/Algos folks could surprise us Mon, that’s why I refrained from buying puts, because the market is a emotionally unstable entity.

The fact of big insiders selling, and rumors of hedge funds dumping, margin selling, crypto coins made out of “thin air” should tell rational folks that the party on the back of the Titanic flowing with booze and band playing, has to come to a end.

I say this from a witness of crashes from ’87 forward.

I still receive lots of mail of dealers wanting to buy our house for about 3x what we paid, sight “on seen” in 10 days.

Somehow, and this is pure speculation that the Crypto markets “funny money” will be the catalyst for the next crash, – just a gut feeling without facts.

There are so many who post with such good informative posts about their opinions, situations, and how the future looks to them.

I’m naming just a few, but there are a lot more, – keep telling it the “way it is”.

Wolf

Trucker Guy

Just a Guy

Depth Charge

Old School

Truth

Antwan

Stevik

Well, prices could, in most of the areas illustrated above, descend by nosebleed amounts and still be way above 2019 pre-pandemic levels.

General panic will still happen, though, even if the proportion of actual severe financial distress doesn’t warrant it.

I wouldn’t call it a bubble from a valuation perspective. Construction prices have been spiking at a similar rate – if one values real estate by the alternative cost of building a new turnkey house on the same property this makes sense. Of course that may apply to a certain given real estate, not to the whole market, but what’s worth examining is the same hedonic price effect Wolf examined for cars. Did the building codes get stricter? Do construction companies offer the same quality as they did 30 years ago? Prefab prices are the best indicators in my opinion as that’s fairly standardized in terms of production. The FED actually has a prefab price index and it seems to show a similar pattern (it excludes residentials, but I there’s no reason to believe it would be independent of the market): https://fred.stlouisfed.org/series/PCU33231133231112

Market prices are not set by cost but by what people can afford. It’s only a fake economy inflating incomes for a segment of the population, insane monetary policy making borrowing artificially cheap, and an asset mania that makes these prices “affordable”.

In markets which aren’t distorted, no industry can perpetually price it’s products above their customers capacity to pay. They will ultimately go broke.

Sorry to keep everyone waiting.

1. Canadians must save enough money to buy a home in Florida directly. Why buy in Canada? Just rent until you retire.

2. Canada was not affected or less impacted by the 2009 housing crises. Even if there is a crises, it will recover like Vancouver. Add in recent WFH craze.

3. Garth (greaterfool ca) is calling the housing bubble for almost 10 years but the bubble seems to be solidified as a foundation.

4. Canadian immigration policies are very easy compared to US. There is no border crises in Canada. In the absence of free flow of migrants (with or without documents), their policies must be open. Just fill in the paper work and get in. Once upon a time, they had open visa for Indians. Yes. For some strange reason it was cancelled. What that could be? Will be a mystery forever. Cannot be solved.

5. Thus, legal immigration will keep the house, rent prices raising forever. Even if the BOC increases rates, the diligent immigrants with protestant work ethics will pay.

It’s a fallacy to say Canada’s immigration system is easier than the US. Canada has a well funded Federal government, perhaps what the US lacks given a decade of austerity policies… however, immigrating to Canada is no simple thing. Canada generally takes he best and brightest, application processing is measured in years…. but there is a process, and entire families make it over. Most importantly, the subject of immigration in Canada is a non-partisan issue; all major political parties see the benefit of high immigration levels.

—

Anyway, Canada housing is cheap again for the moment, thanks to strengthening USD$ and falling oil prices. No bubble!

I wouldn’t say immigration is a non issue across the board in Canada…

Toronto city Council just gave Ontario based Muslim and Sikh legal teams $100k to fight Quebec’s bill against religious signs in government jobs…

That’s how the immigrants are dealing with challenges to their hard worked for liberties (wtf): they sue the”native”Canadians… More happening on this soon

Does Quebec ban priests or nuns from teaching in schools ?

Nick:

Quebecer’s banned the church from their lives a generation ago! Nobody in Quebec bothers to get married anymore. Back in the 1960s women lost ownership of any assets they owned by getting married!

Ex Quebecer.

Housing is cheaper for immigrants because Canadians pay very high tax.

You can earn 300k here and your net is not far over 150 in Quebec.

Right No Bubble? Did you even bother reading the article? Ok if you couldn’t be bothered, did you look at the graphs.

Are you being sarcastic?

Quebec provincial taxes are very high.

Quebec is a very socialist province.

Hey WES,

I was replying to Nicko who believes that Canadian real estate is “cheap”. Cheap for the Chinese drug trafficker or narco cartel boss maybe.

John Tory benefits from high immigration because his Bay St. cronies get more “international students” to replace the unionized workers.

I have become fascinated with the guy in eastern Tennessee trying to mass produce small homes at affordable prices. He has got a design that is liveable that is just over $100 / sq. ft and specializes in the 100 to 400 sq ft range.

If you want it custom and high end, he will do that too, but even then he is in the $250 / sq ft which still keeps price low as size is so small.

Society is going to need entrepreneurs to solve central bank induced housing bubble.

His homes are built on trailer so in Tenn they are taxed only one time at the sale which is around $1400. No tax after that. Only land is taxed and that is low. A lot of people are saying I am done with the rat race and cashing out with a small home in rural area.

Only thing that bothers me with rural area is good medical care. I don’t know how long I can drive, I may not be able to. My only hope is Elon musk will introduce a flying taxi for medical purposes kind of medevac and medical care is absolutely free. Otherwise my tastes in life are cheap and affordable.

What you say is true as you need to get to a city to get high tech health care.

The driving part is not too much to worry about as in small places you become part of the community and people look out after their friends.

It’s not always a sure thing incomers will be viewed as welcome or worth caring for, in the small communities they move to.

Perhaps rent somewhere for 6-12 months first. Might not prove wasted funds.

I believe you’re talking about tiny homes, a phenomenon that has been growing for years.

At first there was a lot of enthusiasm. Then reality set in. Since a tiny home can be transported it is considered more along the lines of a trailer or camper in many states. That means being zoned out of many areas even if you own the land. Tiny homes are so new that there aren’t zoning and building codes for them. Usually you have to declare your tiny home as a trailer, camper, mobile home, etc – none of which can be placed in urban areas in most locales. So you’d better plan on escaping to rural areas. Nobody gets to build a tiny home in downtown Memphis, Nashville, or Knoxville.

Tennessee may be an exception or it just might be that your tiny home guy is playing the zoning and tax laws by cherry picking certain (undesirable? ) areas. My ranch qualifies for wild life and agricultural exemptions.

Transporting a tiny home is very expensive and they are rather fragile. Imagine taking your house on a long distance haul on a flatbed truck. Houses aren’t built for that kind of punishment. Tiny houses are not trailers.

Your appliances will be smaller, especially the refrigerator.

Forget overnight guests and get used to laundromats although small laundry appliances are possible.

Where does your water come from and where does it go? Sewer hookup? Septic field? Will you have a municipal water hookup or drill a well? Out in the boonies it’s likely that a septic system and a well will be needed. Add $20,000 to $30,000 to the purchase.

Theres very little storage space. Eventually you end up buying storage sheds and other buildings to hold your extra stuff.

The bedroom is usually a loft with limited head room and unpleasant accumulation of heat.

You know what tornadoes do to trailer parks? Imagine little tiny homes in trailer parks.

I’ve been looking for something in a rural area for several years. I’ve spent countless hours researching mobile homes, RVs, campers, campervans, barndominiums, shed conversions, container conversions, concrete domes, and tiny homes.

I finally bought a nice piece of land with a conventional stick built house. Very isolated and quiet but cell reception is crap. However, using a cell signal booster and an unlimited data plan I can stream from my phone to the TV without resorting to $70/satellite fees.

I know what you say is true, but this guy is zealot for his cause. He has three developments with a total of around 200 lots. It’s good seeing someone trying to come up with relatively high quality construction for $30K – 80K.

What you say about the lofts are true due to 13′-6″ height restriction, but he can build full two story if it’s going local. Definitely not for everyone, but at least he is trying to give people another option than an RV.

Ah the American dream. Living in a kitschy little shack with 40sqft of living space.

Why not just cut out the middle man and just let people live in storage units and shit in buckets?

Trucker,

I think because average single retiree with modest income of $1500 per month income needs options to living in a 1500 sq ft 3 bed 2 bath house.

You can build a pretty decent floorplan for one person in 400 sq. ft with functioning kitchen, bathroom, bedroom and living area for around $60,000.

You can’t run stimulus policy forever. As someone smarter than me said we now have the greatest mismatch between supply and demand in their lifetimes in the economy. How this gets resolved is to be determined. Fed definitely is dragging their feet on their inflation mandate.

‘4. Canadian immigration policies are very easy compared to US. There is no border crises in Canada.’

Legal immigration should not be conflated with the US border crisis. The reason there is no border crisis in Canada, allegedly because anyone can get in, is actually a result of geography. The US shares a long border with Mexico, Canada doesn’t. Canada’s border ‘wall’ is the US.

I am personally acquainted with several persons denied immigration to Canada. One was a young Scot with mechanics papers. He was told it would help if he spoke French. That was years ago but very recently I know a young female American who was turned down for permanent resident status. She was the prime live- in care giver and friend to an old lady who will now have to rely on whatever the system can provide.

I have personal knowledge of several young persons denied tourist visas.

If persons from India could easily get into Canada, the population would quickly triple. It hasn’t.

One area where I do have reservations: student visas. A relative is the retired Administrator of Foreign Students of a University and thinks a lot of applications are merely to get into the country. One concern is that anyone born in Canada is an automatic Canadian citizen. There is no pregnancy test to enter.

One small correction. The U.S. shares a long border with the cartel….not with Mexico anymore. Otherwise, informative post.

Canada legally accepts approximately 250,000 immigrants a year (usually less). They have illegal immigrants; averaging 1,000/year, most of whom are denied and returned to their country of residence.

California receives approximately 150,000 illegal immigrants annually. The total number of illegal immigrants (2020 numbers) in California is 10,700,000. the other boarder States have the same problem.

Mind you, the USA does have, and fills every year, quotas for legal immigration. Plus the addition of “refugees” allowed legal entry.

Canada couldn’t begin to handle the numbers the USA has, and they are one of the reasons for declining standards of living which no one wants to address.

also, it bears mentioning that the u.s. fills most of its quota with people through “family reunification, which means that most of the immigrants who come legally through the quota are not coming here because they have needed skills or education, but because they’re related to someone who already has a green card.

$300/sq.ft. to build new where I am looking, $720,000 for a 2,400 sq.ft. new home, built to spec. Add to that the cost of the lot. Kaching!

It’s amazing how central bankers let RE prices shoot higher year after year, then act as though nothing has happened. They even hide housing inflation in the inflation statistics. It’s indicative of runaway unresponsive bought government. Aren’t we supposed to receive representation in return for the taxes we pay?

It is a wonder that the FED, to this very day, is STILL BUYING MBSs almost 4% below inflation. Why would they do that after the WHITE HOT and in my opinion BROKEN real estate market? Why lend money so far below inflation to the mortgage industry? Why are Fannie and Freddie now moving up to 1 Million?

And it is fair to ask, who benefits? And the answer is those with HEAVY investments in residential real estate.

And then ponder if there is a connection, an influence on the Fed by these power brokers who have placed Billions into residential real estate in the last 5 years.

The 30yr is HALF what it normally would be with this type of inflation.

Central banks have used extreme emergency policy to solve the 2000 bust, the GFC bust and the covid bust.

It doesn’t take a genius to figure out if corporate profits are normally around 7% – 8% then fair long term stock market valuation should be roughly same size as GDP not 3 times as big, as it currently is.

That’s about $45 Trillion of hot air plus whatever is in the bond and housing market. That’s why they are resisting running a Taylor rule type normalized policy.

It’s really difficult to find which politicians or FED employees own massive amounts in RE. Either the information is protected offshore or they invest in conglomerates.

The Panama and Pandora papers conveniently don’t mention any US politicians or powerful people. They do mention a few Canadian ones.

Pelosi husband duh

And Trump, duh, and who else? Or are they just heavily invested in Invitation homes etc? Easy to find info on who owns mansions, but hard to find who owns hundreds of rentals etc.

Asset Inflation, brought to you by political Central Banks, was the easy substitute from building a real, value-creating, productive economy.

Imagine a real economy where money is used to build the future, not inflate real estate, and jack up paper.

1) US gov might ban flights to Canada, Mexico, Europe, S. Africa…and other

countries to protect us from Omi.

2) Dr Faust will strengthen the dollar.

3) If the DOW plunge, the dollar will strengthen further.

4) US retirees in Canada, Mexico, Turkey, Thailand… will have plenty

in local currencies.

5) Like Hemingway in Paris, or Berlin nightclubs in 1920’s for the elderly, but in Mexico they will have target on their back and US gov will not let them in to visit their family or seeing their grandchildren.

Is Turkey ETF a good investment at this level? Thanks

Are people living in tents yet

I have seen a few you tubers living in tents full time. Looks like a tough life, even for me.

If you like seeing back roads South America a you tuber called “Itchy Boots” is riding a Honda 300cc adventure bike from Ecuador up through S. America and plans to finish up in Northern Alaska.

She is good distraction at end of the day.

“Itchy Boots” is quite an adventurous young lady. I have followed some of her “travels”!

This goes to show that we never know what will happen in the financial world. Central banks, responsible for maintaining price stability and overall economic stability, can fail miserably, and they have. One class of citizens can be favored over another, quite arbitrarily. Businesses can get support, then be penalized, based the political winds. There is no basis for long term planning for retirement, for investments, or small businesses. Hiring other people above slave wages becomes a ridiculous proposition.

You can dream of home ownership and save accordingly, then watch that dream evaporate, as well as your wealth, as you become a casualty of foolish central banking endeavors. All the while, salt is rubbed into the wound as speculators and unethical misfits have their heyday.

How about the nascent metaverse real estate bubble?

SuperWorld, Somnium Space, Cryptovoxels, Upland, the Sandbox, Decentraland.

Anybody who puts money into that sh*t deserves to lose it.

Wile E. Coyote just bought another Acme Inc product on Amazon!

In the olden days people would buy web sites like coke.com, firestone.com, etc, and camp on them until Coke or Firestone bought the site, often just the name.

Eventually this was regulated out of existence. If You own madonna.com then you better be the real Madonna.

These are the virtual real estate assets – websites. Maybe just a name, maybe a developed business like Twitter. In 2010 sex.com sold for $13,000,000, despite the underlying business going broke. All of the value is in the name. Right now sex.com is “parked”. Go there and it’s just a page of generic ads.

To me, the difference is that in physical real estate nobody is going to sneak up and dig an iron mine next door.

Web sites, having no physical limits, can’t build moats. Yet they talk shopping malls and arcades. And Zuckerberg is all over this.

I’m still trying to wrap my head around this. It seems to me that there will be a few incredible winners but a vast majority of losers.

This might play well with young investors who think robinhood is an internet game, spend half their lives living in pixel world where when you die you respawn, and currency is just a game token.

Have you seen where someone finds the Magic Sword of Flaming Eyeballs in a game and sells it to another player?

It reminds me of the sci-fi genre where people get special life support tanks or fancy helmets and go off to live a fantasy life online.

Maybe they believe we are all in the Matrix so it doesn’t matter and you might get a leg up if you invest in Matrix 2.0.

Or most major religions believe there is a better life after you die in this one. Just like a video game.

My guess is a lot of those people have student loans the taxpayer is going to eat.

If the only real estate you are going to see over the next 10 years is your parent’s basement, why not?

Had an argument with a realtor over this last week. People in the business are still frothy, claiming there is a shortage of housing. They are using some weird math but the basic logic behind it is flawed. There are more homes/condos/apartments available than there are Canadian families to buy them(but according to realtor math, they add “new Canadians and foreign investors” to the pool of buyers so we need more. The price for new builds will also skyrocket with the inflation in materials so this whole mess will either collapse or go to the moon, there is no middle ground for it anymore.

If you are really bad at math and get very bad results at school, you become a realtor. They have zero idea how money works. Ignore them.

The real money is in sales not being good at math I am sad to say, but it can be a tough life.

To a large extent, a buyer has to cozy up to a realtor to get access to “pocket listings” that often will never hit the MLS until after they’re under contract – if at all. It’s quite common where I live. One only needs to look at the listing date / time and then the “pending” time to get a view into who the players are. This is a hidden inventory that can contain some relative bargains as the sellers want to filter out the looky-loos and just get off a somewhat distressed property (ugly, poor repair, don’t want to fix it, no contingencies, etc., ad nauseum) without a lot of drama.

Those realtors are not the ones sitting open houses…. they’re the ones who show up in the real estate rags as having the most listings and the most sold. And they’re pretty dang good at doing math.

This is why many of the young ‘uns are shut out. The realtors know they’re mostly “get me dones” with 5 or 10% down and needing a FHA or VA loan to complete the purchase – unless Daddy is bankrolling the transaction which moves them up the food chain. If the house doesn’t appraise, those in short pants can’t keep the deal together. With a pocket listing, a realtor can’t waste their time on those marginal buyers because, if the deal bounces, the realtor runs the risk of losing “both sides” of the commission.

There’s a hidden inventory and those buyers with a “heavy hitter” agent and access to capital are the ones that will prevail.

Is it fair? Nope. Is it reality? Yup.

I once tried buying a home using a friend’s wife as an agent. She was a newby and, after wasting a few weeks, realized she couldn’t close a door. Found a shark and had a house in a week. Same offers. Same inventory. Same location – just someone with more talent and connections. Of course, I did lose a friend over it…..

El Katz

> This is why many of the young ‘uns are shut out.

No it’s due to absurdly high prices which the boomers have voted for in exchange for easier retirements with the faustian pact that their own kids’ future is destroyed.

It is not down to a lack of savoir faire from the young, and this is yet another attempt to smear an entire generation instead of taking responsibility for the total mess made by the least successful generation in the history of time, who have cratered living standards and yet fail to take any responsibility as they live it up.

@El Katz,

Spot on. We are looking for a new home, and came across a new recently finished nice home in a small development. Several of the other homes were just beginning to be built, a few just foundations in. We called a realtor in a nearby town that we were working with, to see if she could put us in touch with the selling agent for the development who was in the same RE agency. All the homes were sold. Only the newly completed home was listed and was sold.

@ Georgist

“boomers have voted for in exchange for easier retirements with the Faustian pact that their own kids’ future is destroyed”

And I thought it was the millenials who voted en masse for Obama. This is where this latest run up comes from. You got conned just like everyone else. Or at least your “generation”

“Faustian bargain”. Please.

These foolish statements undermine everything else you post here.

There are three types of people

those who are good at math

and those who are not

Sometimes distance gives a clearer view. I have followed the Canadian real estate markets for years now. Here are a few of my current observations:

What’s going on in China will spook Chinese investors more than is anticipated. The Chinese are now learning that real estate can go down by a lot and very fast too. This will curtail future investment more than capital controls.

Past Chinese investors have abused both the educational system in Canada and the medical system as well. With the medical crisis, the medical system itself is in crisis and Canadians are now paying attention to the real cost of immigration. This hasn’t reached the educational system yet, but it will soon.

The closed borders in Canada are not about keeping people out, they are about keeping people in. If the borders had been open for the last two years, net immigration would have been deeply negative. When people are reined in, they have to overpay to survive.

I was going through some old junk that was in storage. I found two briefcases I used as a Realtor in the Eighties. Inside I found a bumper sticker from 1986. “It’s always a great time to buy a home”. It’s the Realtor mantra.

Double digit RE price appreciation WILL happen in 2022.

It’s not a housing shortage – pure speculation/laundering. “…the average home contains 2.6 rooms per person, more than the OECD average of 1.8 rooms per person and the highest rate in the OECD. Returns on housing have being far better than returns on the stock market for Canadians and were I live, farm land is purchased, divided and sold as “estate lots” which are often just left. Until returns drop, this bubble will grow.

Even though there are boneheads in business, the only real returns on borrowed money is in the private sector.

The more easy money policies are allowed to blow bubbles and then have government mop them up, the less productive total debt is going to be in the future. Debt needs to pay for itself, with some left over. You need a real hurdle rate for projects, so the debt is productive.

It is difficult to unpack the relationships between interest rates, tax effects, immigration effects, housing imbalances, supply chain disruptions and whatever else has been magnified by the various ‘roids.’ One thing is certain. Projecting these issues out in a linear way will be inaccurate. Not to mention out and out corruption, which in my view the impact of which is grossly underestimated. The government, like it or not, will be forced to put the hammer down, sooner rather than later. I would start with corruption and tax reform.

I’d start with government corruption first….. perp walk a few of those “citizens” and watch what happens elsewhere.

I live in Port Alberni on Vancouver Island which has been a Forest Industry town with an industry in decline. My 1977, 2400 Square foot house is worth 650-700k now. Most families here do not qualify for a 600K mortgage. It’s pretty much WFH and Vancouver cash outs driving our market

Peter Stoll : if u sell your house for $700,000, a house u bought in 1977, it will give Case/ Shiller “False Positive Bias” a $650,000 booster and save the stalling Vancouver bubble from plunging.

Michael Engel,

That is NOT how any of the sales-pairs indices work. If this Peter Stoll — whoever he may be — actually said this, he’s an ignorant moron and should keep his trap shut. At least, people should not drag this ignorant BS into here.

I don’t see anything wrong with ME’s logic. Every model has flaws which can be exploited. RE agents can trade houses back and forth to increase their commissions and net worth, not that they would ever actually do that, but we can speculate.

It’s pretty much how Zillow algo’s worked. They were the only buyers pumping market values up. Once they pushed out competitors their inventory value collapsed.

Prairies I hope your right. I know some people who just bought a house that had changed owners 3 times in 2 years and had been empty that whole time. Obviously passed to other investors. I suspect that’s a good portion of residential RE now.

And Petunia I suspect there’s a /s at the end..

Lynn,

No I wasn’t kidding. ME was correct that his exploit would work as a manipulation of the index. If somebody wanted to manipulate the index, they could overpay for older properties held over time, and create an increase in valuation. On Wall St. they call it unlocking shareholder value. ME’s exploit unlocks RE value.

Petunia,

You have to separate how people might try to manipulate prices paid (which is what you’re hung up on) from the methodology of the indices that track those prices, which is what ME discussed. The indices track actual prices that were paid and recorded in the public records, and you’re not going to manipulate the index into reflecting anything other than prices paid.

What you can maybe manipulate are the actual prices. But that is not what ME was talking about. He said that the long time span between sales (decades) wasn’t considered in the index, but that’s BS. It’s one of the ground rules of the sales-pair indices to take those time spans into consideration.

Petunia Ugh… that’s really nauseating. I’d assume they would have to have at least a large percentage of the total market- local or otherwise in order to do that?

Of course Zillow also had a firm grip on making numbers public, even if their “zillow estimates” were off.

Petunia,

Read ME’s sentence again (what he quoted someone else saying). It is bullshit. It misrepresents how the index is structured. If a house sold 30 years ago, and now it sells again, the time span between the two sales is made part of the price change. That is one of the basic ground rules of any sales-pair index, such as the Teranet here or the Case-Shiller in the US.

The sentence pretends that the time span is not taken into consideration, and that is a lie.

It’s OK for people not to know this. It’s not OK to spread lies. If ME doesn’t know and wants to know, he can ask a question, and he can say that he heard that etc. etc…. and I can answer and even post the link of the methodology.

In addition, it’s the Teranet index for Vancouver, not the Case-Shiller, which only covers 20 US cities. Everything in ME’s comment was BS.

Wolf,

Whether or not time is taken into account in ME’s example is irrelevant, because Vancouver Island has been a rising market for decades. The increases would be accounted for regardless of the period chosen. The trend during the period is what is important.

If someone wanted to exploit any index using pairs, it could do so by overpaying for property. Since RE is priced at the margin, it is easier to do in thinly traded markets, but can be done in hot markets as well. Overpaying for the last three sales in any steadily rising market can create a new hot market.

Look at Lynn’s comment about her friend buying a property that has been flipped 3 times in 2 years. Maybe the flippers weren’t intentionally manipulating an index, but they were sure manipulating prices up, and that surely is reflected in an index.

A rank fixer I bid on in a depressed area quite a while ago sold for $60K over any other bid. $60K was 33% of the asking price. That’s when I gave up for now. I’m just hoping things will crash. Damn, I really wanted that house too, was imagining living there and fixing it. Small, but really nice space.

I have a feeling I know who bought it. While I was looking a woman came in, spent less than 5 minutes total looking at it and ran out yelling over her shoulder to her agent “put a bid on it”. No way was that woman ever going to live in it and it would need a lot of repair to rent out. I should swing by there and see if any lights on.

#1. You completely changed the topic. So sticking to the topic – This is what ME wrote:

“Peter Stoll : if u sell your house for $700,000, a house u bought in 1977, it will give Case/ Shiller “False Positive Bias” a $650,000 booster and save the stalling Vancouver bubble from plunging.”

Every part in this sentence is BS, including this BS about the $650,000 booster. It ignores the 43 years of time that passed and that will be calculated into the price movement.

#2. On your topic, which is a different topic — you did a switcheroo here: You cannot “exploit” the index. You might be able to manipulate individual home prices up or down, and those are actual prices that were paid. The index just tracks those prices that were paid. It’s the same with the S&P 500. Share buybacks manipulate individual share prices higher, like some short-and-distort short sellers manipulate individual share prices down. But those are actual prices that were paid, and the index just tracks all the transaction prices. You cannot manipulate the index with share buybacks to reflect something other than actual transaction prices. That is just nonsense.

Wolf,

If Peter’s house had been sold every year since 1978 for it’s increased value, it would have been reflected in the index exactly in the same overall way as if the increase had occurred from one sale last month. The index increasing the value of the property over time or all at once reflects the same overall increase in value over the period.

So ME is correct that he can go to a stable neighborhood of older homes, buy them up at their increased value, and increase the pair values of that general area, especially if he overpays to further manipulate the market.

The whole point of a pairs index is to show the growth of a particular house over time. Forty years of growth can be shown yearly or all at once.

I give up.

Petunia, I think it’s semantics. It can raise the market by fake worth or manipulated worth but that wouldn’t make the case-shiller *data* fake. And the real worth rather than the dollar value as the dollars paid aren’t fake.

The reasoning why the prices are rising so much is BS and completely manipulated but I don’t know if there is a word for that. Other than greedy evil bastards.

It’s not even the Case-Shiller. It’s the Teranet, for crying out loud.

I have learned a new meaning to the word ‘Splendid”.

Prices of Real Estate discussions are always amazing. There is so much confusion re value, worth and sold price just like most things, commodities, entrepreneurs, vehicles and real estate.

The true Value of anything is what the Buyer is willing to Pay for it. After it is Sold then you can discuss what it is Worth. 💵💵

Price discovery in a market is everything unless the price of money itself is in question.

Just saw an updated chart I like that two researchers at the Atlanta Fed produce. They show that the effective real short term interest rate is more than a minus 8% and is at a record. How do you determine the value of anything when effective rate is so negative?

All you know is its an unsustainable policy

Exactly. If there is no yardstick you can’t measure relative risk/return. Ultimately it distills down to the risk-free rate. Unfortunately we only have rate-free risks.

Disinflation might repair this

The amount people will pay is the amount they can borrow, as they bid against others also subject to the same constraints.

The “worth” doesn’t really come into it on a non discretionary good.

georgist:

Baloney. The one’s that don’t get skinned know when to stop, despite their ability to borrow.

Housing costs are clearly set by interest rates, that is as clear as day and really it’s simply absurd to state otherwise.

The mechanics of pricing mean that you are always bidding against others who will max it out, so you are forced to overpay.

To deny this is just absurd. I won’t be wasting a single second more on this.

As with car loans, most mortgagors are really buying a house for a monthly payment not a purchase price.

“The amount people will pay is the amount they can borrow”

Interesting concept. How about those of us who paid cash for their last two houses? What were our borrowing constraints?

I corrected it: “The amount people are willing to pay is the total amount they are WILLING to spend & borrow.”

You were limited by your unwillingness to use leverage. Whatever you paid in cash, you could have bought 5X more; assuming that cash was used as a 20% down payment.

The thing that makes the housing bubble extra frothy in Canada, is there aren’t areas with cheaper homes as in the USA in the midwest and rust belts, everything is fairly pricey.

Canada like China is fairly priced, until it’s not.

If you’re willing to buy it for whatever price for whatever reasons, then it is priced fairly…

In a pure market sense, that is, comparing apples to apples…

There were cheaper homes, until the bureaucrats who work from home decided to move to Newfoundland and overbid with the Chinese drug trafficker.

The big problem in Canada is cultural. Because prices never dropped in 2008 they see house prices as being reasonable. Because of course this house is 1,000,000, after all the house next door just sold for 950,000. Never mind the median wage is sub 100k CAD!

Thankfully their perception won’t be a factor when the Fed raise rates, which will tank prices. BoC will probably drag their feet, killing CAD in the process, ultimately screwing boomers who then have to sell up, compounding the sell off.

To prevent “urban sprawl” and reducing carbon footprints, the Liberals are importing MILLIONS of “international students” to work for below minimum wage, replacing unionized Canadian jobs.

I don’t think most people in Canada think it’s reasonable. It’s corruption, just like the US.

It’s pretty amazing to me that Xi is the first leader to say it- “homes should be lived in, not seen as investments.” or something like that. I suppose it’s only because it’s so extreme there.

I saw an economist one time that said you could compare how well an economy is functioning by the cost to construct a mile of paved road as it is pretty similar product in all countries.

I suspect starter 3br 2 bath housing is similar. Areas that are 5 – 10 times local income tells you there are constraints whether land, labor, regulation, corruption, fees.

i like that. japan’s economy has a lot of problems, but it doesn’t cost them $5 billion to build a bridge like the new tappan zee.

Housing bears always use the median income of the population relative to the median home price to declare a housing price bubble. This is a flawed statistic and this calculation always shows the housing market to be in a bubble even when it is underpriced.

What matters is the median income of the pool of home buyers combined with their pool of down payment money to the median home price. That is the calculation that matters.

Why are they so terrified of raising rates SocialJim, if that’s not part of the equation as per your last paragraph?

Why do all central banks constantly mention “asset prices” (housing) when discussing raising rates, when it’s only the income / down payment that matters?

You are not a stupid guy, so I have to assume you are being deliberately deceptive. In a pool where the 1% own 90% of everything, that pool of available down payment cash is going to be huge, with the smallest percentage belonging to the median and under income group.

It’s the same thing that happens when Elon Musk walks into a room, the median income and net worth goes up for everybody. But you know who can afford to buy everything and the rest not so much.

Which leads to a discussion of a future where mega landlords own all the rentals. They can raise the rents beyond their own 3X income requirements until nobody qualifies. That’s where this is going with the over bidding for properties. Z……..oh.

No, unfortunately he’s right. A lot of the RE money is offshore LLCs etc. See my comment above- the US treasury is actually considering doing something about it, but their plan has a major flaw.

Lynn do tell

Lynn,

I was agreeing that the pool of available money was going to win.

Where I thought he was deceptive was in using a metric that includes average buyers, who have been totally priced out by big money. Median income and median available down payments are two barely intersecting sets.

The median and average income of a home buyer is much higher than the median and average income of the population.

Furthermore, the median and average savings of a home buyer is also much higher than the median and average savings of the population.

Therefore, the average american can not afford the median house. It always works that way.

Petunia, I read that as him saying that was flawed- both of you saying the same thing. Maybe the use of “home buyer” in the second paragraph is confusing. Different connotations. The home buyers now aren’t using them as homes.

Flea, I can’t give a link here, but if you search for regulations gov docket FINCEN-2021-0005-0217 you should find it. There are a lot of articles out there on FINCEN-2021-0005. -0217 is just the newest comment request.

Basically, FinCen started a global anti-money laundering pilot test program in 2016 which asked for beneficial ownership (or real ownership) information on offshore and opaque shell companies buying real estate before a sale was OKed. This program at first was only in NTC and Miami and only for a certain amount of time. It then expanded to portions of many other cites. Now it is being considered for all of the US. However, as of now only properties selling for more than $300K have that requirement. That is the fatal flaw that if kept as is will funnel more offshore $ into working class homes and put them further out of reach of ordinary people.

The pilot program was very successful. In Miami, according to a study by the University of Miami; “After anonymity is no longer freely available to domestic and foreign investors, all-cash purchases by corporations fall by approximately 70%, indicating the share of anonymity-seeking investors using LLCs as “shell corporations.” Granted, both Miami and NYC have reputations as having 2 of the most corrupted real estate markets in the US, but the entire US housing stock is prone to rapidly rising prices in good part from these opaque interests.

Oops, NTC should be NYC

OK, yeah, I misinterpreted that, I can see that now by his second post..

I think I get it….

If only 50% of a population ( the pool) can afford a house, the median would be at the 75th percentile…

Thus skewing to higher numbers….

And a wealthier all around buyer group …

And giving Jim his statistic…

While furloughed Canadians were collecting CERB at home, MILLIONS of “international students” enrolled in generic “business”, “IT” and “office admin” diploma mills were replacing the Canadian jobs at the factories for MINIMUM WAGE or LOWER.

They cross the road like sheep when traffic is incoming, and they hold on to the TTC buses while it’s departing. It’s a chaotic scene from the overpopulated cities in Asia.

Welcome to CANADA

House for rent per people $600 + utility,minimum 6 people.

Canada is the paradise of real estate. I wish I will be around long enough to see how that obsession with real estate will resolve.

Chinese investors have a huge influence in Canada. Actually, Chinese investors is a misnomer maybe as most of those people are corrupt party officials who came into easy money and contribute zero to the communities where they park their money.

First, Canada is the ideal ground for RE speculation. There is no capital gains if you live for some time in the house and CRA has turned a blind eye to Chinese investors for fears of racist bias as documented by Ian Young , Canadian journalist. Most investors in Canada own $5million dollar homes while declaring no income and even claiming government benefits.

Second, there is zero reporting required by Canadian banks, you can transfer millions, no questions asked. Canada is a paradise for money laundering.

Third, Canada gives easy 10 year tourist visas which is akin to getting permanent residence. I also don’t think it’s going too far in claiming that part of Canadian government structures , especially in BC are captured by Chinese money.

In the US rules are a bit different.

Big cash transaction are reported by banks to the financial crime unit and they do investigate.

It’s harder to transfer money. Plus, you would have to pay taxes on your worldwide income, it’s harder to own a 5 million dollar home here and declare no income like in Canada, IRS has a long arm and is no joke. Imagine Chinese millionaires declaring their worldwide income to Uncle Sam? They are the kind of people who don’t like paying taxes.

Then, getting residency in the US is much harder.

If you have money, you would have to invest I think about $1 million and create a certain amount of jobs for some years, quite complicated.

Then the most important, while Chinese investors pay cash, the money is usually borrowed in China.

My opinion is that with real estate about to go south in China, things will get dicey.

They might need to sell rather than buy more.

Plus, unless our government and the Fed have decided to let inflation rip and destroy the dollar and social fabric, interest rates might rise and that could spell the end of the RE mania.

I sold my house last month and I am renting now.

I have seen this movie before. But I could be wrong.

Since the US is 1-2 years behind Canada with fiscal policy, real estate prices will not be leveling anytime soon, perhaps not until 2024 or later.

It is a wonder that the FED, to this very day, is STILL BUYING MBSs almost 4% below inflation. Why would they do that after the WHITE HOT and in my opinion BROKEN real estate market? Why lend money so far below inflation to the mortgage industry? Why are Fannie and Freddie now moving up to 1 Million?

I saw that one of the biggest and most successful hedge funds is running 7:1 leverage. The Fed can’t surprise the market or somebody big will blow up.

You just can’t be too confident on timing anything in the financial markets. Fed is trying to ever so gently change policy, but market might be like a heard of cattle where one unexpected sound can cause a stampede. At least that’s how it works in the movies.

1) If inflation accumulation reach 15% in the next three years

and the RE bubble decay by 10%, in real terms, prices will fall by 25%, with some gov help.

2) Sales might rise, because RE will be more affordable.

3) Since capital gains taxes are 25% the most positive tax flow will come from houses bought by millennial in the 1980’d and the 1990’s, sold today.

4) A house bought for $900K a year ago, sold for $1M contribute $25K to the gov.

5) A house bought in 1980’s for $100K sold for $1M will pay $225K.

6) If RE fall by 10%, millennial who bought a house in 1980’s don’t care. The IRS still love them because they pay : $200K.

7) The gov will sell land, gov buildings and confiscated properties, for profit, to private developers, to build, to convert – and to finance themselves, – in order to reduce the high cost of housing and make it more affordable to young couples.

8) Minis and micros for the meta rule the waves.

9) The rich will buy condos in space with view of the blue earth.

I doubt that very many Millennials bought real estate in the 80s and 90s

Newsweek pegged the Millennial generation between 1977 and 1994.

New York Times on two separate occasions placed the Millennials at 1976-1990 and 1978-1998.

Time magazine bracketed the Millennials at 1980-2000.

Your remarks probably apply to Gen X or perhaps the younger boomers

Wolf,

There is a lot of misinformation (abbreviated “B.S.”) in other comments.

Regarding Michael Engel’s items:

3)

4)

5)

6)

There would be NO personal, capital-gains-tax revenue in Canada for any of these scenarios. One’s “principal residence” is exempt from capital-gains tax, with no dollar limit. (It used to be one per person, allowing a married couple to exempt both their actual main residence and a cottage. It is now limited to one principal residence PER COUPLE.) The tax authorities exempt up to one such principal residence per personal-tax year (calendar year).

Yes, “house” market pricing reveals inflation/deflation/bubbles. But I still like Yardeni’s comparisons of rail traffic long-term to reveal the real bottomline US economic flows that affect the majority in closer to more revealing “facts” when all the charts ARE mostly fiction and myth.

“Real” real estate prices aren’t really going up.

It is the real value of the dollar going down.

The same game as it has always been.

I read an interesting article in the Kansas City newspaper. It said there was a land grab going on for the low income housing area.

I am guess this is the last low hanging fruit that Wall Street can suck up?

They are buying homes for $50k to $70k that would rent for $500/mont and fixing them up and renting them for $1000. The local paper did a checked on who was buying all these homes and the Cerebrus Equity Fund was one of the biggest buyers. People who lived there for over 20 years said they used to know all neighboors on their block but now 17 of the 22 homes are owned by LLCs and most are out of state or outside of the country.

People who lived in this area for years said the rise in property tax and insurance is forcing them out at they cannot afford the area.

Basically this tells me to say goodby to home ownership for the bottom 50% of income demographics in the U.S.

Because these big hedge funds and companies that buy homes to rent can get the loans backed by the GSEs and bundle them into MBS then investors have no fear of buying these MBS. So these big companies can just keep buying up single family homes at pretty much any costs.

Who cares if they renters bail and stops paying rent and the servicing company cannot collect rent to make loan payments. The loans are guaranteed.

This is a completely different scenario to HB1 where the loans or MBS dropped to pennies on the dollars when sub prime borrows stopped making payments. Investors actually took big losses.

As black stone is buying a 930 million building in nyc

ru82,

There’s lower hanging fruit…

Check out Havenpark or NPRs report “ Mobile Home Parked”….

Short version is these scum borrow millions at low cost from the govt, buy mobile parks where people pay for the lot rent… they own the trailers… they then jack the rent up substantially to cover the loan and make a profit… evil bastards…

i can’t wait until the people priced out of housing start burning these houses down.

That won’t happen as long as they have access to donuts.

ru82

I had about 10 of those SFH in Kansas City in 2018 / 2019. I actually bought them for $20K to $30K, put about the same amount into rehabbing them, and rented them for $900-$1100/Mo, depending on 2BR vs 3BR etc.

I then sold them as turn key rentals to Mom n Pop investors who earn about 15-20% annually on them while I carry the paper at 10% interest only.