Stock market leverage, the big accelerator on the way up, and on the way down.

By Wolf Richter for WOLF STREET.

Increasing leverage – borrowing money to buy stocks – puts buying pressure on the stock market up. Declining leverage – selling stocks to reduce leverage – puts selling pressure on the market. Stock market leverage has ballooned over the past 20 months by historic proportions, which has contributed to the historic surge in stock prices. So we’ll keep an eye on leverage.

The tip of the iceberg of stock-market leverage that we can actually see is margin debt, which is reported on a monthly basis by FINRA, based on data reported by its member brokers.

Other forms of stock-market leverage occur in the shadows, such as Securities Based Lending (SBA) that isn’t tracked and reported in a centralized manner, though some banks choose to disclose it quarterly or annually.

There is leverage associated with options and other equities-based derivatives. Then there is leverage at the institutional level such as with hedge funds, which doesn’t show up until a fund implodes, such as Archegos, and everyone gets to pick through the debris.

The only form of leverage we can see monthly, margin debt, gives us an indication of the direction of the much larger overall stock market leverage.

So, recall that in November, a major fiasco happened: Despite all kinds of bullishness out there, stocks as measured by the S&P 500 index didn’t rise. I mean, what affront! They actually ticked down a smidge for the month, -0.8%. But beneath the surface of the indices, all kinds of mayhem broke out, with lots of the most hyped stocks plunging.

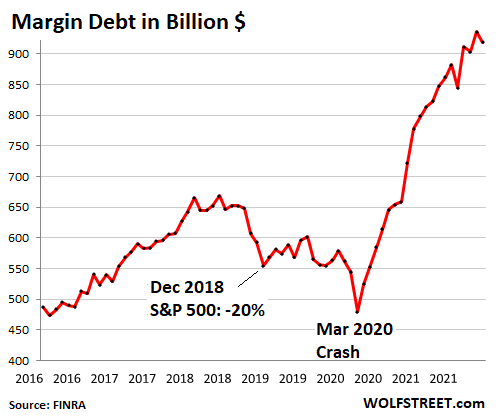

And margin debt, after its historic spike? Stock market margin debt in November fell by $17 billion, from the tip of the spike, to a still monstrous $918.6 billion, still up year-over-year by $197 billion, or by 27%, and up from January 2020 by $357 billion, or by 64%, for one doozie of a spike:

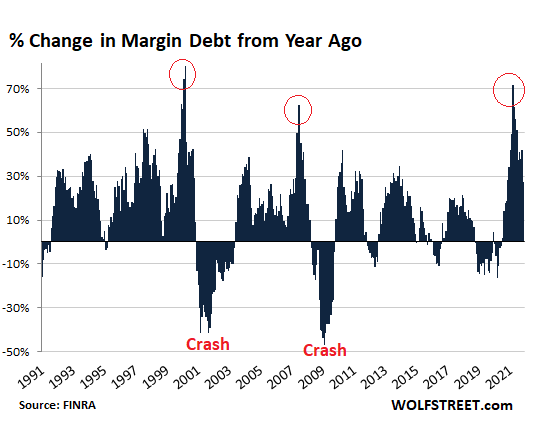

The boom in margin debt was a powerful fuel poured on the stock market over the past 20 months – and it was a huge outlier by historical standards, as the chart below of year-over-year changes in margin debt shows. In terms of dollars, nothing in the data going back to 1991 comes close to the year-over-year increases in margin debt over the past 20 months.

In percentage terms, there were only two months when the year-over-year percentage increases were even higher: February and March 2000, on the eve of the dotcom crash:

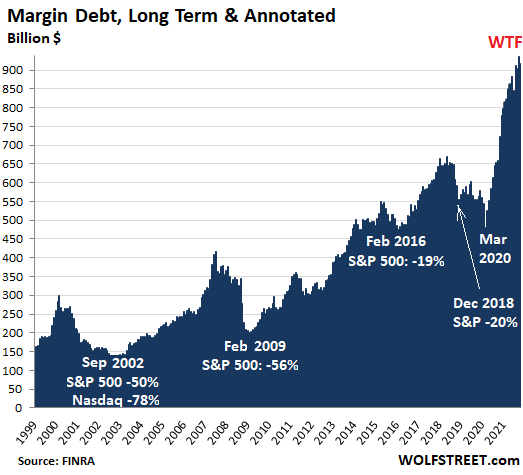

This explosion of margin debt and broader stock market leverage cannot predict when the market will crater. It shows that as long as margin debt continues to balloon, newly borrowed fuel is thrown on stocks.

What this explosion in margin debt does predict is that when the market falls enough to scare investors, or worse, falls enough to force investors, into selling stocks to reduce their leverage, the selling will be made worse by this effort to unwind margin debt, which pushes down prices further, and triggers further margin calls and forced selling into a falling market in order to pay down margin debt.

It’s every time the same thing. Ballooning margin debt is the big accelerator on the way up as borrowed money enters the market and creates buying pressure. And when prices begin to unwind, that massive pile of margin debt becomes the big accelerator on the way down.

Over the long-term, given the declining purchasing power of the dollar, it’s not the absolute dollar amounts of the total balance that matter, but the steep increases in margin debt before the selloffs, and the exponentially steep increase over the past 20 months. This market doesn’t need more alarm bells – they’re already clanging and jangling all over the place – but here we are:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Really great presentation!

How come all charts move low left to upper right?

For about 12 years now?

These central bankers and eCONomists are dangerous crackpots. Their whole “wealth effect” bullshit has destroyed the quality of life of the masses.

Monday’s Opening (Sunday Night) could be real interesting

The US has a Congress that represents the top 10 percent of wealth in the country. The Republicans the top 1 pct and the Democrats the top 10 – 6 pct.

Joe Schmoe ain’t invited to the party.

Because Joe Schmoe is a patsy that lets them get away with it.

Joe Schmoe would shop at Walmart while they destroyed the mid west manufacturing belt

Joe Schmoe didn’t actually fight in American combat

He just ignored it because of the voluntary draft

After the blowback from Nam the brass wern’t about to take any chance of running out of cannon fodder

Dang,

Sounds about right, and in very few words, too.

Your question is appropriate. The absolute amount of margin debt tells only half of the story. The other half is what is it relative to the underlying valuation of the market? It may not be so extreme when viewed against its related metric.

Comparing margin debt to stock market valuation is circular logic because rising margin debt (and rising leverage in general) drives up stock market valuations (buying stocks with borrowed money) and falling margin debt does the opposite.

Today is full moon and red lunar cycle ends Monday,green lunar cycle starts monday night.So we can have a small Christmas rally for 2 weeks.Come mid jan,look out below .Better sell crypto first.

If I read Michael Engel’s hieroglyphics right, we will HAVE that Xmas stock market rally! Then watch out below!

I was able to decrypt his missives, and the message reads:

‘Drink more Ovaltine’

Lunar cycles are big buy signals :)

Thanks wolf fixed problem your fantastic in reporting,replying best wishes for happy holidays RON

Looks super heathy and normal. /s

Much like the housing market, which, we are assured daily by experts, is also quite healthy and normal.

Fantastic when this ballon blows up citizens go to zero – check history wolf why did my profile change no includes full name not secure

A big stock market crash at this point would be the healthiest outcome long term. I’m honestly looking forward to it.

A crash of like 90%, and then a flatline for 30 years a la Japan. Separate the pigmen from their ill-gotten gains. The world has way too many billionaires and hundred millionaires.

It can not crash if you can print money to infinity. since 08 this has been proved over and over.

chris, but from 2008, they were able to get away with their printing without the effects being so obvious for everyone to see. now that it’s clear the printing is causing inflation, and the media is reporting on it, with 70% of the country unhappy with the job the president is doing controlling it, printing to keep markets up is not going to come without a political cost.

Jake, if the public is unhappy with the Pres because of this high inflation, I wonder what Joe Sixpack is going to think of him when the market, housing, and crypto all crash once interest rates are raised? They will be looking for his head on a stick.

Anthony A.,

Joe Sixpack might not own much or any of the items you mentioned, and if he bought a house recently, he may decide to let the bank take the loss. It’s the top 10% who’ll be furious, and they’re split three ways. But bringing the asset bubble nightmare to an end might actually rouse the support of tens of millions of voters – those that are now being taken to the cleaners by inflation, after not having benefited from the asset bubble since they don’t have any wealth to begin with.

People forget that only a small percentage of households has nearly all the wealth in the US.

“I wonder what Joe Sixpack is going to think of him when the market, housing, and crypto all crash once interest rates are raised? They will be looking for his head on a stick.”

Nope, most people will be just fine. You’re making the classic mistake of thinking about the rich people and speculators again thanks to mainstream media talking point brainwashing. Most people have zero exposure to the stock market, are not gambling in crypto, and can’t afford housing. Once all of that falls in price, they’re actually better off.

Thanks for reminding me that the Big Losers when the crash comes will be the top tier folks. But I am surprised at how many people at lower income levels have their meager savings in Crypto and are proud to talk about it.

anthony, what wolf and depth charge said. a common justification for the “wealth effect” policies is that so many americans have 401ks. but what people who say that leave out is that very few of these 401ks have any real money in them. let’s say the wealth effect inflates your $45k $401k to $70k. big deal. that won’t even pay for one year in assisted living. the average person would be much better off with a smaller 401k but without ruinous inflation.

I too, am trying to take a holistic approach about the future about the bubble economy I sense all around me. If the Fed takes away the ever overflowing challis of reliable monetary stimulus

what happens to the gamblers seems to be the foremost concern of the so called independent central bankers

John Taylor’s mechanistic model suggests that the correct interest rate is about 8 pct. In the new economy, run by a lawyer from a right wing think tank, supplemented zero percent interest rates seems reasonable.

Guess who’s paying for the orgy. Go look into the mirror.

There is no question that the Margin Debt levels are monstrously out of whack. But as I have said before, a lot of that is due to Millennials investing in the markets… and they don’t seem to be investing more than play money.

But so what? Play stupid games… win stupid prizes. When margin calls get executed the effect on the stock markets will be enormous… if the effects on the Millennials is limited.

Since 2000 people are not investing, they are gambling. Nothing in the markets are real, you are totally reliant on the Fed and Political whim.

True. Also, gambling is a tax on ignorance.

“a lot of that is due to Millennials investing in the markets…”

Is it unfair to say that speculating or gambling might be a better term than ‘investing’?

Not unfair at fall, since that’s what is…

They think it’s a game…

If they end up on the wrong side of the equation, they’ll find out just how serious the people who live and actually invest in the financial sector are about money…

Depends on the amount.. for a few thousands nobody would do anything but call a collection agency, and that would be forgotten after a few years.

No… I think that would be EXACTLY how they think of it. Reddit short squeezes and the like… not exactly how most people think of “investing.”

in their defense, they didn’t see an economy of fake bs, houses that cost 10x more than the average income, and -7% savings rates as something good for them. they feel like there’s no other way.

“A lot of this is due to Millennials” is not correct:

(1) Millennials do NOT own a lot of cash and are not experienced enough to make a difference; they may create short-lived bubbles in specific areas e.g,. about 95% of millennials do not have large positions and all of them are effervescent. They sell out, lose, buy, sell; they are chaotic most of them. Again, unskilled and not ready to make an appreciable effect on the markets. There are certain pools of individual millennials who do matter in the market, but they are in the 5%, or fewer I would bet.

(2) As usual, the picture is much broader, but some analogies to the current situation are more suited than others at explaining more precisely who the real culprits are.

The Fed and the easy money policy is the real influence here. It is easy to lend credit and let everyone, as much as possible, participate. Since the global population is a huge dry reservoir (parched investor/gambler theory) for cash and credit, it is easy to play money games enabling these groups world wide, coupled with technological ATMs, and a whole host of other fast credit technologies and policies. WE WILL ALL KNOW WHEN THIS PARTY ENDS; so far, the party is a raging monster in a sea of cash and credit. All FED (central bank) has to do is cut credit and cash. Of course, the will not do this, or they might. They will play word games and starve the already parched investor/gambler. And still some of you will say, “it is not that bad”. But it is that bad. Would you all like a world where several of you are rich and the rest poor? Are we okay looking at a squalid and rotten city while our house is on a hill safely away from the squalor? Is this the kind of a World we would like? Opportunity and a means to act on the opportunity to create is the best savior or nations. Restrictions will kill the Bull, SLOWLY. Watch a Toreador enervate his Bull to death. We are being slowly devitalized and squeezed.

Regards,

Stevik

When I look at the charts, it looks to me like the margin debt levels have remained fairly constant relative to market cap. If margin debt was near $200 billion at the 2009 lows when the S&P 500 was around 800, you’d expect them to be 6 times higher now, or $1.2 trillion, but we’re only at $900 billion, so that shows that investors are prudent and understand that even though the value of the collateral has increased, they are borrowing a smaller percentage of the value of their trading accounts.

I think there is a distinct possibility that the era of major bear markets in stock indices has ended. If major indices drop 15-20%, the Fed reverses course, and everything goes up again, until a substantial fraction of people truly give up on working for a living and decide to earn a living trading the markets instead, since that’s so much easier. That’s when we’ll see stocks double in value, but margin debt go up 3-5 times. When that happens, the Fed will have no choice but to take away the punch bowl for real.

Orthodax Investor

‘If major indices drop 15-20%, the Fed reverses course, and everything goes up again’

That’s the hope and wishfull thinking of main stream media, all over now. Does it really work this time? I think NOT!

Inflation acentuated by supply chain squeeze + increase in wages

Omicron spread in the next 2-4 weeks ( doubling every 2-3 days)

Stocks STILL remain over valued!

Fed cannot change the course of above events. Come January, the reading of inflation in Dec won’t be soothing to Fed or the public!

B/w By law ALL pension plans (401K++) have to Re-balance 60-40 by the end of year! Since Stocks have appreciated over 20% this year, they HAVE to sell and buy bonds!

For having been in the Mkt since ’82, this SURREAL mkt ( everything bubble!)without any iota of fundamentals but blown by insane credit creation is just crazy. I am gland SANITY is being restored forcibly by forcing trapped FED! I welcome refreshing REALITY! Many young investors (45 and below) will have an experience of their life time!

Lookout the volatility there in indexes between green & Red. This is a (nimble and experienced ) Option traders’ heaven. One make $ both ways with proper and adequate hedging against ‘whipflash’ NOT unexpected in secular Bear mkt!

Most of retail investors are NOT, ready, trained, or ready psychologically to go against the mkt, especially after almost 13 yrs of ‘Pavlovian’ training by Fed- Stocks always go up, right?

Again as Wolf has said in the past, NOTHING goes down straight. There will be a lot hopeful bounces ( Bear traps) along the way. Secular Bear is characterized by ‘ Lower of the Highs and Lower of the Lows’! Just study previous bear mkts! Trade accordingly

I’ll worry about that when I actually see lower lows. So far the lows have held.

Secular Bear needs some kind of a driver. Credit isn’t collapsing like it did in 2008 (except maybe in China in the shadows?). Dot Coms aren’t collapsing like they did in 2000. It’ll happen again sometime but… doesn’t feel like it’s time yet.

Be good to know what’s going on with the Fed’s huge RRP balance though.

We will let markets collapse, and the economy with it, to contain inflation – said no central bank in the history of the world.

I think the economy is like a car and the Fed controls it with the gas pedal and the brake pedal. Back in a day when debt levels were low, it was like driving a car with no load, so every time the Fed steps on the gas it ends up being too much, so they have to brake again. But that ends up slowing down the car too much so they press the accelerator again. Since the GFC, the car’s gotten so heavy that the Fed stepped on the gas with QE1, but as soon as they release the pedal, the car slows down too much, so now the Fed is controlling the car with only one pedal, which is the gas pedal. The inflation was caused by government spending and that’s slowing down, so the Fed thinks inflation will slow down, too. When the market drops 20%, it’s a deflationary scare, so the Fed steps on the gas pedal again. It goes on forever until the behavior of the American worker changes. If they don’t refuse to work, the S&P 500 continues going up in an almost straight line. The best hope for a market crash is if the government starts imprisoning the unvaccinated. That ought to destroy worker morale enough to cause some serious market panic.

Already is starting same story ats 2018 small caps down high flyers down up next good companies down good luck

“If margin debt was near $200 billion at the 2009 lows when the S&P 500 was around 800, you’d expect them to be 6 times higher now, or $1.2 trillion, but we’re only at $900 billion, so that shows that investors are prudent…”

I’m wondering if that ratio of margin debt to market cap is somewhat misleading. What about looking at the relation of margin debt to PE? Wouldn’t that be a more realistic indication of how much the average investor is risking for a given amount of expected return?

(I defer to the experts and those with long experience)

i agree with that. taking on margin debt increases share price (on the way up) so saying that margin debt isn’t that high compared to market cap is kind of circular.

I think we need someone with a view of what customers at Fidelity, Schwab, and Robinhood are using their margin to buy and what else they have in their portfolio that could be sold to meet a margin call.

I think the idea that valuations must mean-revert may be wishful thinking. Due to excessive money printing, stocks have become a currency alternative, and in relation to money supply, stocks are not as overvalued as during the dot com peak. Chris Ciovacco has a healthy, open-minded view of the markets, as he is open to the idea that the stock market may be near the beginning of an epic bull run, regardless of what valuation metrics say.

The “Federal” bankster Reserve has created inflation by printing dollars to pay the US budget to benefit its ultra-rich owners of its district banks, who have thereby transferred the burden of supporting the government to average Americans by avoiding paying most taxes that other Americans pay. Read “The Great Inheritors: How Three Families Shielded Their Fortunes From Taxes for Generations” in Propublica.

FDR quote:

Roosevelt, himself an heir, earlier had warned that “economic royalists” had “carved dynasties” off the backs of America’s working men and women. Now he saw a chance to address the unfairness in the nation’s tax system.

“The time has come when we have to fight back, and the only way to fight back is to begin to name names of these very wealthy individuals,” …

Roosevelt summed up the stakes of this historic probe in a letter to Congress. “Taxes are what we pay for civilized society,” he wrote, invoking former Supreme Court Justice Oliver Wendell Holmes. He then added his own knife twist: “Too many individuals, however, want the civilization at a discount.”

END OF QUOTES.

Of course, the trillionaires and billionaires of today did not just avoid taxes by putting their factories in China to avoid paying US taxes and so depriving Americans of jobs; they also unknowingly, recklessly, indirectly armed and funded the PLA in its coming attempts to invade and intimidate its neighbors.

I don’t believe financial history will change that much. Asset prices have to eventually reflect the underlying future earnings of the assets.

If we live long enough we most likely will see extremely poor market conditions with PE ratio of less than 10. I believe 5.9 is record low for stock market.

How do you assess “underlying future earnings” when inflation is an unknown large parameter in any such estimate?

Looking at chart 3 seems market is about 30-35% overpriced patience

It’s one heck of a lot more overpriced than that. By this measure, it was cheap at the March 2020 lows.

Not even close. Try 75%.

Using the P/E ratio (one of the worst measures of value), the “E” is vastly inflated due to the fake economy. It’s “reasonable” if assumed the country can live beyond its means forever with negative real interest rates.

augustus frost, correct. at the march 2020 “lows,” the total market cap to gdp was around 125%, which is the buffet scale. not “cheap” by any means.

Then rates go up. Employment pool doesn’t grow because people have amounts of money that even rates slightly below true inflation can passively make enough monthly to cover cost of living.

I have come to the conclusion that the only way things change is if the renmibi becomes the reserve currency and for that to happen China would essentially have to overthrow the CCP.

This is bizarro world. Strong dollar internationally but crap dollar domestically.

The dollar is not strong internationally, except against currencies no one would ever own as a store of value.

The DXY is at about 96 now. It was at 120 in both 2000 and 2002. It was at 185 in 1985.

It’s somewhat higher versus the Euro versus when it was launched in 1999, $1.12 now vs. $1.19 then.

It’s much weaker versus the Yen and CHF.

You’re basing this on what, exactly?

The millennials “investing” their spare change or stimulus/unemployment?

I doubt that’s enough to even be noticeable in that graph. Of those who weren’t “investing” prior to COVID, most of them are broke or near it.

Besides, I have read that they buy options in higher proportion, the traders that show up in the data buying 10 contracts or fewer. This trading is at record levels.

“…if the effects on the Millennials is limited…”

The oldest millennials are now 42…for most of the cohort, that’s too old to literally be betting the family farm on leveraged stock market crap shoots.

Known risks include Evergrande defaults, inflation, Fed raising interest rates, and we no longer even pretend to believe in “black swans”.

But as someone once said, Millennial is as millennial does.

OK boomer

The Boomers are the parents of the Millennials. Cracks me up when they go at it.

“Me” generation vs “Selfie” generational SLAP FIGHT, brought to you by Twitter.

Pea Sea

Responding with the ad hominem “OK Boomer” to an opinion is at least an attempt at being avant-garde;

Responding with the ad hominem “OK Boomer” to a set of facts is cognitive dissonance.

(For the record, I’m expecting a response of “ok Boomer”).

OK Boomer.

I’ll take the cognitive dissonance rap, but not the avant-garde one….I do have some integrity.

No need to make things unnecessarily complicated when it comes to SPAC market participants. Think not in terms of Millennials or Boomers or what-have-you.

There are only two types of market participants: Insiders and everyone else.

It is not irrational when you consider the ramifications of zero interest money. Especially when it is supplied at the behest of the mob that is directing the investment and is properly or conveniently invested before hand.

Zero interest money is another scam, in a series of scams, by the United States Federal Reserve, whose performance in my lifetime I would judge as abismal. They have never been right, unless you were one of the owners who had inside information.

Since America is a democracy with an elected body, sworn to protect the Constitution, and we stand ready to protect ourselves all the way to the Supreme Court of the United States, which currently resembles more a right wing focus group than an impartial interpreter of our Gog given rights. We could sue the owners for making us pay for their excesses like we used to do.

But that was yesterday, when my Dad was a war hero and a shop steward, and yesterdays gone. At least that is what the business community, the United States Chamber of Commies and their Communist Dictator buddy, is telling us. They say they have a right to import all goods into the US, produced by the captive labor force of our philosophical enemy.

And we do not resist. We bitch and reelect the party that gave us GW Bush. Because the other party is a mirror reflection of the corruption. In some ways worse, if that can even be defined.

How can we, as a people, support the same ones, who are still making the horrible decision that got us where we are. The ones that destroyed it are now going to reserect the corpus that they consumed. Hope springs eternal.

The sun brings inspiration and amnesia

I agree with most of the lament expressed in the comments of other commentators, because I have experienced similar experiences with similar revulsion.

A fair game is a ways off of from what we have today. The Aristocracy (Asses) is ascendant, as it always has been. We pay for the Asses excesses. We are a nation of fools that think that paying the bill is a patriotic gesture, including giving our lives for the texas country club bars quorum of a good idea.

Like love, bravery is never free

Increasing interest rates certainly won’t help this.

@Dj

More than that,

It’s another huge risk for the Fed putting rates up. Apply it to all other debt positions.

Which many in todays world have absolutely no experience with….

8% mortgage… the horror, I tell you…

I paid 8.5% in 96 but the house was 113k then. Same house with an added dock 8x more now.

My first mortgage was 12 3/4%. Private and held by the seller with a balloon in 5 years. I bought another house in a few months with a mortgage held by the seller, also balloon in 5 years. Sold both before 5 years and doubled my money. High interest rates are not the end of the world. I got my real estate license and went to work as a Realtor in 1986. Interest rates were 12%. Houses were selling like crazy. The economy was great. It was the Eighties, the last economic Good Times that I participated in. Tune out the Doom & Gloom crowd. Chicken Little was wrong.

I moved via a job to California in 1981. With a young family in tow, we bought a small house in Thousand Oaks and signed for an 18 1/2% mortgage. I really won’t feel sorry for anyone that has to sign for an 8% mortgage going forward.

As long as there is a country to exploit cheap labor, or cause by army force it will be done…the world population is HUGE, and this means nearly no end to how many times they can play us. Unfortunately, we again will have to go through the eye of the needle I feel.

The investor class (real people spending hours investing and researching) will probably be all okay in some sense. Newbies will lose, some of them will sing the blues, some will win. Once newbies get a better grip they will supersede the older investor class, and the game goes on.

I don’t agree it is a risk that you and I should not worry about. In fact I think we should insist they pop the bubbles. Think about it: if there are billionaires risking their fortunes betting that their dystopian plans for your family collapse, that is a good thing.

You and I rely on our neighbor doing well.

Well said again.

Right, it will correct it.

Decreasing the size and weight of a Tesla car battery would help the car. Tesla’s battery is 1200 pounds! And the weight never changes! LOL. While in my diesel I fill 100 pounds of gas and can go for miles all the while my car weight is decreasing as fuel diminishes. Who thought of manufacturing a car with a permanent 1200 lbs. of battery metals???? This is so moronic, so, so stupid.

This is a random comment here :)

Stevik,

You could see it the glass-is-half-full way too: Your truck’s weight increases as you fill it up, but Tesla’s weight doesn’t increase when you charge the battery :-]

Yes, the battery is heavy. But so is the entire complicated and huge power train and everything around it on your truck (the engine, the 10-speed transmission, cooling system, fuel system, emissions system, exhaust system, starter, battery, etc.) A Tesla Model 3 weighs about the same as a BMW 3-series, equivalent models.

Standing still doesn’t count.

The “Wolf” is one of the very few voices of reason out there today!

Retail (mostly dumb money) investors will be the ones losing their collective asses while the smart money makes it on the way down, and then on the way back up again. Keep your powder dry, you will need it very soon!

Cowboy Logic

Insiders, Hedge funds and Private Equity company owners have been selling stocks, over the past several weeks (ZH has the data!) The retailinvestors are the one, just like in all Bear mkts will end up. holding the bag. This time a different class of newbie ones!

This will be an experience of a life for most young newbies(45y or under) who have NEVER experienced a true secular BEAR mkt in their life time.

As I repeated that BULL and BEAR the TWO faces of the same coin. One follows the other, eventually. You cannot have one without the other. Past 200 yrs of Mkt history prives that!

All market history “proves” is the RIDICULOUSLY OBVIOUS.

ANY MARKET will be dominated by the largest most powerful players.

NO EXCEPTIONS.

Need a Constitutional Maximum Net Wealth, and an (militarized, if need be) IRS that can always enforce it. $10M ought to do fine.

Only kind of Capitalism that will work.

Things are now so bad that all of Wolf’s charts end with ‘WTF’

Those are just Wolf’s initials.

Wait…

…!

Fed will not hike, neither will they taper to zero. Its all talk. FED is taking advantage of USD being the reserve currency. Anyone rational will. This is the way to mitigate some of debt burden. As long as USD remains the reserve currency FED can get away with anything they want. Yeah there will be inflation but wage will catch up. Both will grow in lock step. There will be some noise there will be some outliers but overall the bus will keep rolling.

One USD is no longer reserve currency, we will be done. We will not be able produce nothing and consume everything anymore. But thats far in the future.

Kunal,

This is really funny.

People kept saying this the last time all along the way, and were wrong all along the way:

The Fed would never taper “QE Infinity”, and when the Fed tapered, they said that it would never finish tapering and keep QE alive, and when it ended QE entirely, they said it would never raise interest rates, and when it raised interest rates, they said it would never reduce its balance sheet, and when it reduced its balance sheet…

This, back then, with very little inflation, was a 5-year process, and people were wrong about it for five years. Now there is huge and ballooning inflation and even the biggest Fed doves, such as Daly, are clamoring for rate hikes next year.

KUNA & Wolf

Hope is eteranal for many retail investors who have NEVER undergone a true,finger nail biting, secular Bear mkt! I have!

Today (Marketwatch) Fed’s Waller says’ March is’live meeting’ and it’s very likely a rate HIKE could happen that meeting!

Never seen so dovish FOMC members becoming this hwkish suddeny!

A lot newbie investors still think (&hope) it is different this time, by reading several comments, here! It is said ‘Experience is a good tutor but tuition is very high!

sunny129,

“Never seen so dovish FOMC members becoming this hawkish suddenly!”

Yes, amazing, in like two months, the entire line-up changed from three hawks, two of which are now gone, to all-hawks. They’re talking in unison now. There isn’t even any disagreement.

As you can see from some of the comments here, lots of people are still in denial about this shift.

“Never seen so dovish FOMC members becoming this hwkish suddeny!”

Sweetly timed – soon after JPo’s confirmation of 2nd term.

“Yes, amazing, in like two months, the entire line-up changed from three hawks, two of which are now gone, to all-hawks.”

With all due respect, calling any of these profligate money printers “hawks” is embarrassing. They have lost all credibility and can NEVER be classified as hawks. These are the most dovish of doves ever to inhabit their positions. It simply does not matter what they do from here on out, the damage is done. Just look at the tent cities. They destroyed tens of millions of lives.

I wonder if these “new hawks” have unloaded their portfolios of stocks and bonds yet in advance of the crash and higher interest rates which will murder both equity and bond holders.

I don’t think FED has become hawkish.

They have no honest intention to tame the inflation.

They are simply jawboming to how off that they care.

Just think.. real inflation on ground is 20 percent plus

A 3 rate hikes would bring rates to 1 percent. This is just not enough to tame the inflation.

FED is not stupid but they are dishonest to the core.

Shift happens.

NBay… 🤣

And now the FED promises to end QE, but has so far done nothing, and they say they will rise rates three times next year, but so far have done nothing, all the while inflation is surging. Fool me once, shame on you: fool me twice, shame on me! My guess is that they will allow inflation to rage on ahead of rate increases and keep the real rate of interest at below zero allowing for the stimulus to continue unabated. There may be a few in the market who will respond, but those who benefit from the past stimulation will not be fooled and will continue as they have. There may be a few blips, but most likely the bubble will continue to be inflated.

Robert Russell,

“And now the FED promises to end QE, but has so far done nothing,”

This stuff gets kind of tiring. Cutting of QE started on November 15, and the speed of cutting doubled as of Dec 15, so this is well underway.

“…they say they will rise rates three times next year, but so far have done nothing,”

Yes, rate hikes, scheduled to start early next year, haven’t started yet because they’ll start early next year. In your expectations, you’re confusing future and past.

So I’ll just repeat what I said elsewhere here — because it looks like you may be one of them:

People kept saying this the last time all along the way, and were wrong all along the way:

The Fed would never taper “QE Infinity”, and when the Fed tapered, they said that it would never finish tapering and keep QE alive, and when it ended QE entirely, they said it would never raise interest rates, and when it raised interest rates, they said it would never reduce its balance sheet, and when it reduced its balance sheet…

This, back then, with very little inflation, was a 5-year process, and people were wrong about it for five years. Now there is huge and ballooning inflation and even the biggest Fed doves, such as Daly, are clamoring for rate hikes next year.

With all due respect, Wolf, look at the FED’s balance sheet and then get back to me. It’s like 9 TRILLION DOLLARS. You act like they reduced their balance sheet or something. The amount they actually did is a rounding error, then they did a complete 180. It’s only logical people would be skeptical of these fraudsters. You, on the other hand, oddly seem to defend them.

Everyone here is complaining about the speed with which the Fed is responding to inflation.

But guys, remember that derivative instruments and other types of financial contracts in the markets are often not very liquid and take time to unwind.

The Fed has to slowly give forward guidance on the direction they take and move in baby steps because Wall Street cannot just pivot on a dime with some of their positions. Some mammoth positions take a very long time to unwind. So this is just simply the Fed accommodating that reality.

Sorry Wolf, I have to agree with Depth Charge.

From NOV 1972 to JUL 1973 (9 mo) the Fed funds rate went from 3.5% to 13%.

From AUG 1980 to DEC 1980 (5 mo) the Fed funds rate went from 8% to 22%.

A far higher acceleration than the maybe 3 each possible .25% increases during the whole year of 2022.

Shows what they can do if motivated.

And it will take a long time to attrite $9,000,000,000,000.

If I’m reading the Fed charts wrong, let me know.

“The Fed has to slowly give forward guidance on the direction they take and move in baby steps because Wall Street cannot just pivot on a dime with some of their positions. Some mammoth positions take a very long time to unwind. So this is just simply the Fed accommodating that reality.”

Hello Goldman Sucks, is that you? Who the f**k cares what “Wall St.” can and cannot do? Where in the FED’s mandate does it say ANYTHING about Wall St.?

“A far higher acceleration than the maybe 3 each possible .25% increases during the whole year of 2022. Shows what they can do if motivated.”

This is so embarrassingly low that it’s like an ant pissing on a raging forest fire. The idea that it would have ANY appreciable effect on inflation which, by many measures, is running close to 20%, is laughable. And then, all of a sudden, people are calling the FED “hawks” while they continue to print for the next 3 months before some chintzy 25 basis point rate hike? It’s like something you’d read on The Onion.

I agree that the corruption of the Fed is apparent. Unlike our host, I agree they are not going to harm their clients only their customers. Zero pct interest rates to the banks and 20 % credit card rates, come on, the Fed wouldn’t lie again, unless they have to.

The passing of the generations was marked by the acceptance of the lies warned about by the father, considered groundless by the son.

As far as I understand (and I am not saying it is much) so far as interest rates are less then real inflation on the ground money is free and thus will be poured into markets and markets should go up. Also due to money being free inflation will persist (it might decelerate but it wil stay high). So how I see it, as long as money is priced below inflation show goes on, and plebs is doomed.

They will use the Omicron variant as an excuse to halt all tapering and will begin adding even more every month to the balance sheet. These people are liars to the core. I wouldn’t buy a used car from any of them.

I used to fly with this old crazy (like a fox) German who had experienced the lies of the monied elite in his native country. His favorite saying when talking about the insiders was “F… the lying liars and the lies they love to lie about” . We miss your wisdom Dick F., rest in the knowledge that you are now free from the influence and control of these liars.

It’s been ten years of held low 10yr rates. Most people expect realistic governing, not sudden clamoring of Fed doves, that will result in, what, historic actions by the Fed? LOL

He’s assuming the FRB is run by a bunch of robots instead of human beings.

The FOMC is not immune to blowback and is subject to the same psychology as everyone else.

They aren’t going to “print to infinity” because they have no motive to do it and wouldn’t do it anyway without a consensus from outside parties.

Hi Wolf,

We all know the problem and it is consumerism. Humans, for now, do not know how to stop and enjoy what they made and keep it clean and in shape. Constant demand for ever more and ever greater is the factor that causes a lot of this non-sense. Some view this as a fun ride, however. Fed is the problem I agree, I wonder how fast they would raise rates. Volker?

Pure wisdom dispensed consistently.

The Fed will taper. Rates are already beginning to rise … in the Treasury market, where it counts … the one to two year part of the yield curve is already hiking. The Fed may be dragged along kicking and screaming, but it will go along … because it has no choice.

Hear, hear, Finster. In the end, the price discovery that occurs in normally functioning markets, with less and less Fed interference as the Sorcerer’s Hour Glass starts to run out, will trump (no pun) the manipulations of the bevy of manipulators. Markets are much, much larger by multitudes and are infinitely more fluid. KICKING AND SCREAMING, I LOVE IT. Merry Christmas to All. And to all a good fright.

“…but overall the bus will keep rolling.”

Is this the same bus that featured in the 1994 movie “Speed”?

If so, then gotta keep it rolling quickly.

And watch out that you as investor don’t get thrown under it.

Nah, bus at the end of ‘The Italian Job’

‘Hang on lads, I have a great idea…’

If I weren’t a law abiding citizen, I might just think that liberating a bit a gold could be helpful in the years to come….

(…and no, before I’m tagged as a villain, I’m not actually encouraging robbery…)

Summers said recently, that he fears that markets will deflate surreptiously, without cause or event. Everyone has the same information. Real market crashes are driven by long term investors who enter through the futures market. Margin debt is not a problem directly. Valuation is not a problem, (you have to own stocks, TINA) until the system resets lower. That could be a process by which investors trade overpriced stocks for cheaper stocks, and the spiral feeds on itself.

I think the wild-card will be how investment sanctions with China and vice versa unwinds stock positions.

R,

The wild card can come from anywhere…

Doesn’t even have to be wild…

The Fed is making policy on past data and trying to extrapolate that to future policy…

And failing miserably…

Even the “transitory” inflation caught these fools flat footed…

My prediction for the wild card is pension funds… stock crash will flush that bunch from their hidey holes and make them face a whole bunch of pissed off people…

Yeah, I shifted my small stash in TIAA-CREF out of stock and bond mutual funds. It has hurt a little to be left behind on the rising values. But just have to suck it up, pay a premium for the sake of safety.

Another small stash in Colorado State employee retirement fund makes about 3% a year. No options for mutual funds there, as far as I know. I haven’t researched how they invest it. Colorado is one of those states that has a retirement system that preceded and excludes federal.

No trigger event is required. It’s psychological, as market participants aren’t robots.

Go look at a price chart at the bigger price movements and try to identify the supposed cause. Try doing it without a timeline or the scale.

To give you one example, the DJIA fell about 3% on Pearl Harbor day. There have been hundreds of similar declines prior and since.

The distinction between the market on December 7, 1941 and recently is that sentiment was already negative. The DJIA peaked on March 5, 1937 at 190 and bottomed on April 28, 1942 at 92.

The US stock market is on an island in deep outer space versus prior history and the rest of the world, has been for years.

“To give you one example, the DJIA fell about 3% on Pearl Harbor day.”

Probably related to the huge issue with Amazon Web Services on that day which I’d guess, considering the date and their “explanation” of it, was probably a hack attack.

To be fair, Amazon Web Services on Pearl Harbor day consisted of thirty guys with vacuum tube shortwave transmitters and straight Morse Code keys. Pretty easy for hackers to disrupt.

@AF

I’ve been wondering how much of market movement is influenced by AI driven nano-second market trading. I got used to following the ups and downs when working in remote locations where night/day hours are reversed, while not being able to get to sleep.

It may be subjective, but it seems a bit weirder now. The ups and downs for both individual stocks and the market seem to jump more randomly.

This reminds me of Elliott Wave analysis folks = The market has its own sentiment and rhythm which can be charted and thus, significantly, predicted.

What do you think of EW, Wolf?

It works for some people apparently. Not my cup of tea.

AI behaves the same way the people who programmed it would. It has no actual intelligence. It’s not alive.

No worries; we’ll all get out at the same time. Just need some helpful fools (perhaps the Fed?)

Thanks, Bead. Makes perfect sense. Will you be ringing the bell?

I don’t know enough to ring any bells but when you smell smoke head to the door. We’ll exit single file in fine order.

I like your style, Bead. An adage that I once heard that captures the sentiment:

“When the paddy wagon shows up, even the good girls go to the slammer .”

Sure, get all the pension funds, IRAs, 401s,etc… to switch out of the index stock funds. All together now!

“Long term investors” in the futures market with no margin debt? OK.

Maybe this time is different?

Maybe the Fed won’t allow any margins to be called?

It will definately be different this time!

Wile E. Coyote knows his next purchase from Acme Inc. will finally work!

Charlie Brown knows Lucy will finally let him kick the ball this time too!

What about Calvin ball?

Charlie Brown couldn’t handle Calvin ball.

That’s why he played with girls and birds. He’d rather sit by Spoopy’s doghouse with a chia tea watching his security feed via smart phone and reporting ongoing nearby Malthusianism for internet points live and play by play, becoming ever more corpulent on HCFS shilling for body positivity and inclusion.

“What this explosion in margin debt does predict is that when the market falls enough to scare *gamblers*, or worse, falls enough to force *gamblers*…”

FIFY

“But it’s different this time.”

Most retail SPAC market participants don’t realize that when they go long, they’re buying from their broker’s “inventory.” Hence, and by definition, their broker is the counter-party to their trade. And the objective of the financial entity backing the brokerage house (bank, hedge fund) is to wipe out the retailer’s account.

Think about it. Why have brokerage houses been consolidating over the last few years? It’s because they’re running out of retail accounts. Why are commissions “free” at many of these brokerages? Because brokerages are desperate to attract new sheep for the slaughter.

Nothing new under the sun…

I predict further consolidation in the future, i.e., Schwab, E-Trade, Robinhood, etc.

Correction: E-Trade => Morgan Stanley

Well at least the rise is consistent when compared with other debt categories. And I take the perceived market downside risk with a grain of salt. Look at where markets were 20+ years ago, i.e., much, much lower. Anything that brings markets down now seems temporary and is not be tolerated anymore, 9 out of 10 politicians agree. Why should financial markets be sad when you can just give them some Prozac?

Duane: I guess you either weren’t around or slept thru 2007-9 (15 years ago…).

All the Prozac in the world couldn’t put Humpty Dumpty together again.

The difference between GFC and today is the relative size of the monetary base to the bubbles in RE and Crypto. Large bubbles leverage smaller bubbles. The monetary base in 2008 was only a couple T. With a monetary base this large the potential for a liquidity event is acute. There is adisconnect between the number of physical dollars and the leveraged dollars parked offshore. Powell said the dollar is not his concern, and Yellen said “The US does not support a weak dollar policy”. While deglobalization builds the leadership has no clue. Trade deficits tell the story, the US economy would starve on its own. China seems to have its own RE bubble, which could spread on default of their dollar denominated debt. Rumor is that offshore (US) holders of that debt are not going to be paid, and China may divest its bond reserves.

AB

You and I are in pretty close agreement on this one.

I interpreted Duane’s comment as wildly underestimating the current global financial risk. If he really believes current risk is less than the 2007-2009 crisis, he doesn’t understand risk.

There is never something for nothing. It doesn’t get any simpler than that. That’s all anyone needs to know to realize the world financial system is a house of cards.

The longer it lasts, the worse the ultimate day of reckoning.

Of course they won’t pay as saying goes fools and there money soonparted simple

Markets are on Viagra. Prozac comes after the Viagra.

I don’t do US stocks much, but is it true that all of the S&P gain since Oct has been in half a dozen tech stocks and everything else is down around 10-15%? Seems lopsided and dangerous to me if true.

Yes, 5 top stocks combined are $10 Trillion.

My guess is that the FED is scared S*#%LESS!

But they will go down swinging with their big bat.

B

Well if all goes wrong for them, atleast it will keep them warm at night..

“My guess is that the FED is scared S*#%LESS!”

That would be a losing bet. These people are happy as clams. They are clinking their cocktail glasses at their high society parties every weekend, gushing with delight over their handiwork.

SPX RS. Void if SPX < Dec 3 low.

I sleep good at night with cash. I will own stock again. I have owned Duke and Its components CP&L ( Progress Energy) for 40 years. I optioned ( got called) them out 2 years ago for $115 ( including call money) and have not owned Duke since. I will own them again when their PE looks like a utility and not a momentum stock. Might have to wait another year. Don’t give a shit if I do. I am increasing my positions and have successfully made some trades ( no big gains) on SQQQ . Made money at $9 and $7. It’s gambling and I enjoy it and I do not hold them for more than two days. My wife agrees that I can use 2% of our cash assets to gamble with. She does the audit and she is a nut buster. No bullshit,no excuses accepted . Scorched f&$ing earth under you’re feet if she catches wind of a film flam.That’s just one of the reasons why I love her.

It’s not gambling. That’s for Las Vegas. You want to manage risk, not totally avoid it. Markets, over the long term, reward risk.

There is a distinction between “going to all cash” and “raising cash” to manage risk. Going all to cash is just plain stupid. You should always have some money working for you. Set a minimum equity position- 25%, 50%, whatever.

Right now your bonds are paying huge negative rates and your taskmaster wife is costing you 6% or so.

You should have a set minimum in equities and leave yourself a cash cushion. You never want to be a forced seller of risk assets at reduced prices that locks in permanent capital reduction.

There has to be liquidity in your portfolio when equity markets go down. The best way to protect capital is to follow your investment playbook and rebalance back into equities while they’re cheap.

Next time you want a nut buster get a pet squirrel.

Michael – This may have been good advice, 15 years ago. The stock market is no longer defined by fundamentals. People are buying on the dip because they think the Fed has their backs. The shoe shine boys are giving stock tips. The short sellers are at the lowest level in years and they would have provide buyers when the market goes down. No more. Insiders are selling their stock and the decline is being masked by company stock buybacks. The top few companies are holding the stock indices afloat. And the margin debt is at historic highs as described in this article. It’s gambling.

TxRancher

+100%

M Gorback

‘Markets, over the long term, reward risk’

Been in the mkt since ’82. There is a concept called ‘RISK adjusted Return’

Well worth the risk taken when stocks are under valued like before ’82 (PE was 7!) but like now where the trailing PE is 40x and wishful thinking forward earnings is 26x and the Buffett’s famous indicator is over 200%!

Those who wants to stay invested and buy dips this time will learn an entirely different lesson – Without Fed there is no market of any kind’

The first discussion of covid was at the end of 2019. The first death reported was in early 2020.

There is investing and there is speculation/gambling.

Try not to confuse the two.

Some principles don’t change, like not putting all you money in cash.

Las Vegas, taskmaster wife, nut buster pet squirrel. You Sir win the internet.

Thanks. Considering the meager competition from people who don’t understand risk management here, it’s not such a great honor.

I’m with you MG. I set a minimum stock holding of 30%. It’s the only way to reduce risk of multi-year hyperinflation, which has already started. With real inflation at 10%, including housing inflation of 15% annually, a 100% cash position can wipe you out quickly. The Fed is out of control and has already started us down a hyperinflation path with no convincing sign of reversal. We learned a lot about the Fed’s conviction when it caved to market pressure in 2018.

Fantastic when this ballon blows up citizens go to zero – check history wolf why did my profile change no includes full name not secure put in stops protect yourself

As far as I can tell, there are no profiles on this site, you just type in a screen name and an email.

Ron,

“wolf why did my profile change no includes full name not secure”

Your full name is included because you put it there. If you use an auto-complete or auto-fill function in your browser or smartphone, that function put it there.

I can delete your last name if you want me to. But you need to confirm first, because I want to know that you have read this message, and I want you to understand that you need to turn off the auto-complete or auto-fill function, or else it happens every time.

I will NOT delete your last name every time. I’ll do it once, if you confirm that you want me to. The rest is up to you.

AI will get you!

Michael Gorback said: “Going all to cash is just plain stupid. You should always have some money working for you. Set a minimum equity position- 25%, 50%, whatever.”

—————————————-

when does “working for you” become gambling?

cb,

It’s OK to “gamble” with some of your money. You just need to understand the risks and not be mislead about the risks (Wall Street is great at misleading investors about the risks). And never gamble with money you cannot afford to lose. I think the older you get, the less of your total wealth should be used to gamble. But risk-taking has some real benefits. If nothing else, it holds your feet to the fire.

or become “working against you”

Thanks Wolf,

But if you take Gorback’s lead, stated as:

“Markets, over the long term, reward risk.”

“Going all to cash is just plain stupid. You should always have some money working for you. Set a minimum equity position- 25%, 50%, whatever.”

“You should have a set minimum in equities and leave yourself a cash cushion.”

———————————————

I would like to know why:

Extrapolating past stock market rewards into the future, in the face of current valuations, is “putting money to work” and not gambling?

Extrapolating past FED interventions into the future, in the face of rising prices(inflation2), rising political pressure and as a result, the FED’s stated intention to end QE and raise interest rates is “putting money to work” and not gambling?

Yes, I know the FED is not to be trusted. Perhaps they will continue QE and interest rate suppression. I would bet that they remain as manipulative as possible to bail out their constituency — the monied interests.

That aside, the market has become a casino and a momentum machine based on FED speak and Wall Street speak with a good dose of FOMO (fear of missing out), YOLO (you only live once) and TINA (There isn’t any alternative). Money might still be made. Irrational valuations might become more irrational. But not much forward money is being made on good old practical fundamental analysis. The fundamentals are horrible, are they not?

Where is the line between putting money to work and gambling?

“Where is the line between putting money to work and gambling?”

That’s a good and complicated question. I’ll give it a shot here.

I think one of many answers is that there is no line in between, and they’re in fact the same thing. The risk profiles of investments are on a spectrum, from low risk to high risk. A “gamble” is just another term for “high risk.”

When you invest $100k to start a restaurant, you’re “putting money to work.” But it’s also a very risky investment. So it’s a “gamble.”

The problem we now have is that so many assets are so richly valued, and nearly everything went up together, so that:

1. risks due to high asset valuations are very high nearly everywhere, and

2. diversification is not possible when assets went up together. Diversification means one goes up and the other goes down. When both go up, you’re not diversified. Stocks, bonds, and real estate went up together. So that classic split isn’t diversification anymore.

Cash (short-term Treasuries, cash in bank, money market funds, etc.) is a form of diversification that actually works as diversification.

But “cash” is also “putting money to work,” because in effect you’re lending this money to the government or some company or a bank, but at very low risks. So you’re not making much if anything these days of interest rate repression.

But even if you buy junk bonds, you’re still making less than inflation, and now you’re taking fairly good risks. For BB-rated junk bonds, you get an extra 3.5% over cash but at what risk!

I think the whole lexicon of classic investment terminology and strategies has been obviated by this ridiculous amount of global money printing.

@ Wolf-

Great answer. Your genius continues to shine, and your closing sentence was the cherry on top.

“classic investment terminology and strategies has been obviated by this ridiculous amount of global money printing.”

The scumbags at the FED continuously lie and try to gaslight us, and unfortunately they suck in some very bright people and a lot of self interested people who have benefitted, many accidentally, some purposely, from the FED’s actions.

They are a shameful benefit to one class and a corrupt oppressor to a much larger class.

Just ran across this quote from John P. Hussman, Ph.d

“Yep – what Wall Street flatters itself as “putting money to work” is nothing more than chasing the most extreme speculative valuations in history, in return for negative long-term prospective returns. The whole house of cards now relies on permanently accepting return-free risk.”

Michael , I really do sleep good at night. Squirell’s do not “bust” nuts they “cut” nuts. The 6% loss is not realized if I don’t spend it. Just like stock cash can be an opportunity. Wolfs article points out when the margin calls start people and institutions will be mad for liquidity in the form of cash. Powell is terrified of this and if he does not engineer a soft landing America will be on sale. My wife loves a sale.

And your stock losses aren’t realized until you sell. No difference.

I have no quarrel with people who want to change their risk profile given what’s been going on. But going completely to cash or any other asset is an amateur move.

Mr. Gorback,

I understand your stance, and the apt follow-up Peter Lynch reference :). However, going all in on cash is not equivalent to going all in on any other asset. This is because assets are denominated in cash, and it is virtually the only thing that remains uncorrelated in sharp asset price downturns. Sidestepping asset bubbles is a perfectly legitimate risk management strategy, esecially because you can not time the reversion. If the fair value seems 100 and the current price seems 190 with no forecasts regarding when prices will revert to fair value, it is perfectly reasonable based on historical evidence of reversions to go entirely in cash. Value of cash lies in its optionality, the question you have to answer is this. If paying a -6% per annum premium gives you put options on all underlying market assets for the entire year, would you be willing to buy these put options if the assets prices are known to be massively overvalued at present?

Then how do they make baby squirrels?

Michael Gorback

‘But going completely to cash or any other asset is an amateur move.’

Staying invested without uncorrelated assets to indexes will be slow suicide. If one cannot fel like going against the mkt, alternate is CASH which does not go down 20-50%

Been in the mkt since ’82. Gone thru more than one bear mkts. I trade with options both long and short but PUTS are dominent with some to hedge. I also inverse ETFs! Didn’t a lose a bit in GFC!

Most newbies (45y or below) have NEVER gone thru a secular BEAR mkt (with periodic, furious bounces aka bear traps) in their life time! They are in for a surprise of their life time!

fyi

Consider just how insanely overvalued the stock market is here in December of 2021. The total market capitalization of U.S. stocks is nearly $69 trillion. That is 3x the level of our gross domestic product ($23 trillion). At the height of the 2000 stock bubble, total market capitalization only reached 1.9x gross domestic product (GDP).

“But going completely to cash or any other asset is an amateur move.”

Says the guy who bought real estate at the top. Talk about “amateur….”

TweedleDum,

Love it. Thank you.

Exactly what I am doing. I also sprinkle few puts in tesla-like stocks here and there. And slowly accumulate outside-US stocks to balance it out (e.g. Chinese tesla-like stocks already crashed 60-70%; and European stocks aren’t that crazy it seems).

“And your stock losses aren’t realized until you sell.”

—————————————–

or until select stocks go to zero. Some stocks go to zero. Not to mention opportunity costs. There have been “no return” decades.

I’m starting to feel guilty about piling on, but complacency can wipe a position out. Don’t be lulled by past comfort.

Michael Gorback

“…And your stock losses aren’t realized until you sell…”

At the risk of being a Karen on this thread, stock losses are also “realized” if chapter 7 corporate bankruptcy has $0.00 left over for common shareholders (a reasonably frequent outcome for chap 7 bankruptcy). At that point, the stock is simply cancelled. No selling required.

Calling Peter Lynch! Your asset allocation is ready at the counter. Beep.

Michael, what are squirrels going for nowadays? Last one I bought was $2.50 back in the 60s. Couldn’t housebreak it though… do you think that’s why it was only two-fifty?

We take off our stocking caps to the squirrels this time of year because they provide a very good example of Prudence before A Time of Scarcity, i.e., Winter, that the funny looking two-legged creatures below their nests seem wonton to forget about decade after decade. An acorn is not only edible, it is also fungible which means that Gaggles of Squirrels can exchange them for Goods and Services, like nest cleaning.

But those funny looking Homo Sapiens below the trees seem to prefer to Spend Nuts that they don’t Even Own. Borrowed Nuts. My, my. A fool and his money (nuts) are soon parted.

Aside from the Heathen Unvaxxed turning the world into a virulent Hades this winter, there is going to be no shortage of pestilence foaming from the financial markets to boot.

Patience, an air rifle, and a few cents for the rifle pellet should do it, no?

Michael Gorback,

“Next time you want a nut buster get a pet squirrel.”

Sent to me for you from Dan Romig:

A good wife is a gift from God. SQQQ is a trading vehicle. A very good one. But we are forced to guess the bottoms and tops on the way down. When you are way ahead, take some chips off the table. You can always get back in. In my humble opinion, there is no way for this massive bubble to correct without the Nasdaq 100 at a much lower level.

Wolf has done all of the heavy lifting in revealing the truth.

Yra Harris had a good blog this week titled “Notes from Underground: Coal for Some Stockings?” Interesting read & the comments are good, too (as they are here). One regular commenter had these startling facts:

1. At March 2020, US households directly owning stocks (not in their 401Ks) stood at 18%.Today, it is 50%

2. Equity stock inflows in 2021 will reach $1T

This equals the cumulative inflows of the past 20 years!!

3. Crypto fun fact….50% of all Bitcoin wallets came into existence in 2021.

Block chain expert and crypto enthusiast figures BC may not be around much longer. Inefficient and slow use of blockchain compared to new arrivals.

Makes sense that a piece of software would be overtaken by evolution.

The only thing that makes BC valuable is the belief that it is, based on the belief that a) it has a limited number and b) it will be used as a means of exchange. The first is true, but so what, and we now know the second is not true.

Prediction: when the run on BC really gets going, the cult will attribute this to the machinations of the Fed, the BOC, the BOE, the Illuminati, Soros, or an alliance of all of them.

Yep, after every calamity, the search for scapegoats beings again in earnest.

They will blame China too.

yes, but those extra 32% will bail the moment they see massive drops that aren’t recovering in a few days. that’s the precarious situation we’re in.

Everyone is now pyramiding into crypto. It’s the common man’s fear indicator. Fear of missing out as well losing to the FRB inflation thieves. Gold and stocks are so 20th century. Both have zero expected real returns, anyway. Longish term the world (economy) is contracting, wealth preservation in real terms is a win.

I more or less maxed out on what I permit myself in terms of US stock positions today (buying retailers, some tech companies, some industrial companies, and some house builders and decorators, and selling some commodity stocks, in which I’m currently losing faith) after having net sold down my equity positions in general over the past couple of weeks. Options expiry possibly conspiring with the overall macro uncertainty to make things a bit shaky in the markets.

I may well end up looking like an idiot, and I would not contest the accuracy of such a claim, but I believe the probability is for a rise in US stocks in coming weeks, at least within the sectors I bought (as I must believe…). If it comes with a concomitant relative rise in the USD, then there’ll be a fine champagne for New Year’s Eve! If not it’ll be fizzy water and a resolution to stop making risky bets.

Please note that my current dispositions do not reflect any longer term view of mine as to the overall and long term terrible predicament we find ourselves in!

“ I may well end up looking like an idiot…”

Been there, brother….

I’m a poster child for the old saw about how to make good decisions… make a lot of bad ones first…

Hey there, COWG, I’ve made a shedload of bad decisions all life long.

I guess the determination as to whether I’m an idiot or not depends on whether I learn from my bad decisions or not. I imagine the verdict would depend upon who you ask…

Argh, case in point: ‘..upon whom’, not ‘…upon ‘who’. One – nil to the idiot verdict just during my own posting.

“I more or less maxed out on what I permit myself in terms of US stock positions today . . . after having net sold down my equity positions in general over the past couple of weeks.

I may well end up looking like an idiot”

You’ll look like someone rationally managing risk, whether the outcome is good or bad. Risk is a statistical game dealing in probabilities of GROUP behavior.

If you ask your doctor what the chances are that your operation will be a success they correct answer is “I don’t know”. A 75% success rate doesn’t mean all the operations work 75%. It means if you do 100 operations you an expect about 75% of the operations to work.

What CAN’T tell you is what group you’ll be in.

Sometimes you’ll be a winner and sometimes a loser. I don’t recall anyone predicting covid in 2019. Was everyone an idiot? No it was a huge statistical outlier.

Hey Michael, I do sort of know I’m managing risk. That is also my own intention.

The question is whether I’m doing so based on a sensible data reliant projection or upon a heap of nonsense that somehow has scrambled itself into a projection that only make sense to my own out-of-tune mind…

But looking at e.g. how interpretations of y.o.y. accelerating retail sales got interpreted as below expectations and how rates mid to long term are backing off in spite of the current Fedspeak, I sort of reckon there is a chance for at least some short term rewards to be reaped from going against the markets just at this moment in time…

I was reading stories in Barrons back in the late nineties, of historically great investors who were losing their shirts shorting absurd stocks. As overly cautious as I was back then, staying mostly in cash, I felt, not only stupid, but cowardly. In 2001, I felt very smart but injured my shoulder patting myself on the back. Pretty fickle, eh?

Hey, and by the way, I did see lots of people predicting Covid in 2019! I personally actually sold all my equity positions in the first week of February 2020, after already having followed medical professionals on YouTube, who even in late 2019 were warning about the potential in what became known as Covid-19. Once hugely important cities in China started closing down I did not want to hold theequity risk any longer.

Um, February 2020 was not in 2019.

Covid wasn’t on the radar until late 2019.

The first covid death was reported in 2020.

I don’t know why I bother arguing with people who can’t use a calendar.

Where were the covid predictions in July 2019 or January 2019?

You’re just cherry picking your dates.

Hey Michael. My reaction to it was in Feb 2020, but I was aware of people warning about it in late 2019 (And in a more general sense pandemics are sort of a threat on an ongoing basis, anyway…).

Of course I must add to the story that I also took far too long getting on the right side of markets after central banks and governments had gone crazy, so even then I went from feeling clever to feeling foolish in short order…

As you probably well know, research indicates that when people hear that there is a 25% of an operation failing, they are more scared and conservative than if they hear it has a 75% chance of success.

😁️

Hey, drifterprof, hat sounds about right. I’m also generally a ‘glass-half-empty type, so it resonates well enough with me.

Yes. Kahneman and Tversky’s research showed that people are inordinately fearful of risk vs. reward on a bet that is weighted toward success. But if you want a real ballbuster (or nutcracker, if you have squirrels), check Prof. Sheldon Soloman et al’s research on how “fear of death”, even when nearly unconscious, drives us toward authoritarian figures.

For ”how now”:::

Exactly why the Buddha told his followers to go sit and meditate in the grave yard until ”they” accepted death…

Until that acceptance of the inevitable death,,, all other attempts or work toward ”yoga” or ”enlightenment” are just more of the ongoing attempts to avoid the inevitable…

IF JP will be able to reduce the cost of food, rent, used cars and WTI, the current gov will be more popular. If pharma develop an effective booster,

or pill, Joe will be a superstar

ShiShi PiPi will be a friend, if Joe and Vlada get along.

Inflationary default starting to come through.

US household debt 80.4% of GDP to 79% of GDP for the second quarter.

US non-financial sector went 165.8% of GDP to 161.3% same period.

I think those graphs are not deflated? Would be better to make them figures in real terms.

Look at chart #2, the year-over-year-percentage-change chart with the little red circles that makes dollars and inflation irrelevant. So you can forget inflation. That’s why I put it there. It’s the most important chart here. Print it up and post it on your fridge.

Fair point. I’ve printed it out, it’s on the fridge. Hope you don’t mind Wolf but I added a title: “proof America is a total failure as an extreme capitalistic experiment”.

That chart really shows what a total oscillating mess the USA has become, captured by bankers.

Do you think the capitalistic experiment might have faired better without the corporatism?

Two very good points.

And I don’t think I have enough wealth (or quality lifespan left) to be anything but 100% in cash, but the debate by those that do has been interesting as “anecdotal sociology”….for lack of a better term.

cb-corporatism ensured that it would never be ‘fair’. Fared better without it? Think that’s what Mr.Smith meant when he referred to ‘WELL-regulated’ (i.e: ‘fair’) markets…

may we all find a better day.

I only post WTF charts on my fridge. Going to need more magnets!

Do little red circles now represent reoccurring WTFs?

I shoulda put three WTFs there, with hindsight.

What eventually stops it, is the log nature of those growths. Arithmetic growth cannot be sustained. In anything. It can deflate or explode.

Same result.

That said, it can be a long time before it happens.

For financial instruments it’s even more complicated when markets rise exponentially while the underlying currency melts down exponentially as well. Lots of people became market billionaires in Venezuela, but could no longer buy a decent meal.

In the meantime everyone is so rich, it’s quite amazing.

There was a long period like that before the french revolution: everyday new millionaires were minted (the term millionaire was invented then) rue de Quincampoix ( then Wall street). The only ones who kept their wealth…..had hidden physical gold.

The rest lost it all in hyperinflation and a market collapse, sometimes even lost their heads with it. Literally.

Oh well…life is short.

The French after a huge crash: huge political reform, massive unrest

Americans after 2008: well been I guess I’ll work even more hours boss man!

The slave mentality makes your elite *very* comfortable.

I trust you aren’t suggesting the French economy is in better shape than the US? The dream job in France is the govt job, to become a bureaucrat.

As for elites, France is run by a thousand people. The class system is more rigid than the UK. There has never been a person of humble birth reach the top job and all of those near it went to the same two schools.

bought off politicians and military also makes things quite comfortable for the elite

Lot of you requested my comments on this topic. I give you some of my thoughts…

1. Fed has so many tools TARF, QE, MMT and other alphabet soups just in case the crash even if it ever happens.

2. I am not saying there will be no crash. May be but lower losses and quicker recovery.

3. older people are already out of the stocks, younger ones have lesser money on stocks. So, only gamblers will be affected.

4. Margin money comes from investment bankers not the retail banks. So people money is safe.

5. If everyone of us predicted a crash, who are willing to buy VIX? Not me.

Cobalt Programmer

I agree. No sudden crash like in ’87 but so slow bleed ( death by 1000 cuts) is possible and palatable both for Fed and the Public. Frog in slow bloing water but in REVERSE!

‘Fed has so many tools TARF, QE, MMT and other alphabet soups just in case the crash even if it ever happens’

Same tools when repeatedly used, have lost their intended effect!

IF inflation next year 8-10 %,and stocks have no gains,it mezns stocks corrected 10%.Fed will never stop printing.No other way out,but print .Recession may start next december,but will be short with Fed going to hiperdrive again.

Reversion to the MEAN is SET!

Consider just how insanely overvalued the stock market is here in December of 2021. The total market capitalization of U.S. stocks is nearly $69 trillion. That is 3x the level of our gross domestic product ($23 trillion). At the height of the 2000 stock bubble, total market capitalization only reached 1.9x gross domestic product (GDP).

“older people are already out of the stocks, younger ones have lesser money on stocks. So, only gamblers will be affected.”

How is this possible when in the gerontocracy that is the US wealth is concentrated on the elderly? Are the old sitting on a pile of bonds? That will hurt too.

Nonsense. Neither Zuckerberg nor Musk nor many of the other multi-billionaires are “elderly,” though some, like Bufffett are. Some of them are young. If you want to know where wealth is concentrated, I can tell you where it’s concentrated: at the top 1%, and that’s not an age group:

It would be insightful to know what % of that 1% is older and legacy money.

That is a great chart and to me just PROVES that class warfare is the major human game on our ball in space…. always has been since the Neolithic Revolution. Can democracy reduce the severity of it, as Rousseau had hoped? Guess we’ll see….

Biological evolution meanwhile just cruises right on along, despite all the homo sapien antics during our little “blip” in time.