That’s the big question. Looking for signs of widespread push-back but not finding much. Consumers pay whatever.

By Wolf Richter for WOLF STREET.

One of the bizarre factors that has driven the current surge in inflation – the worst in 30 years per CPI-U, the worst in 40 years per CPI-W – has been the sudden and radical change in the inflationary mindset among consumers and businesses.

We saw that in late 2020 and all year in 2021, when prices of new and used vehicles spiked in practically ridiculous ways. People are paying more for a one-year-old used vehicle than what a new vehicle would cost, if they could get it, and they’re paying many thousands of dollars over sticker for new vehicles.

Out the window is the ancient American custom of hunting for a deal. And yet, new and used vehicles are the ultimate discretionary purchase for the vast majority of buyers that can easily drive what they already have for a few more years. But they’re jostling for position to pay these ridiculous astounding prices. And there has been enough demand to keep inventories bare and prices soaring.

During the Great Recession, potential new-vehicle buyers went on a buyer’s strike, and sales collapsed, and two of the Big Three US automakers filed for bankruptcy, along with many component makers, and sales didn’t recover for years. Consumers have this power because vehicle purchases are discretionary. But this time, consumers aren’t exercising their power to put a stop to those price spikes. Instead, they’re paying whatever.

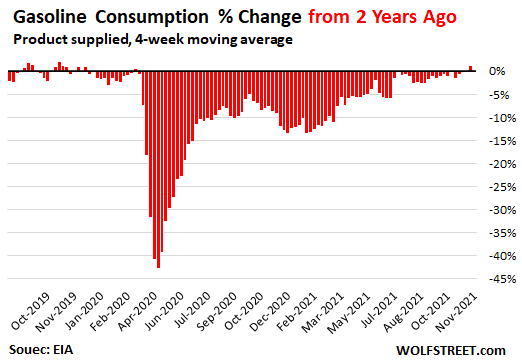

We’ve also seen this with the price of gasoline, which at the end of November had spiked by 59% year-over-year and by 31% compared to November 2019, to an average of $3.38 per gallon, according to the EIA.

And yet, consumption of gasoline has completely recovered from the collapse and is back where it had been in November 2019, and the surge in price had zero impact on demand. Will gasoline have to go to $5 or $6 on average across the US before demand takes a hit? $7? At what point are consumers going to push back? Consumption in November ran at 9.16 million barrels per day, same as two years ago:

The same has been the case in other categories, unrelated to consumer goods. For example, rents have been spiking in many markets. And house prices have spiked at a ridiculous pace to ridiculous levels.

Despite widespread and large wage increases, amid this peculiar phenomenon of the labor “shortages,” inflation is now outrunning those wage increases.

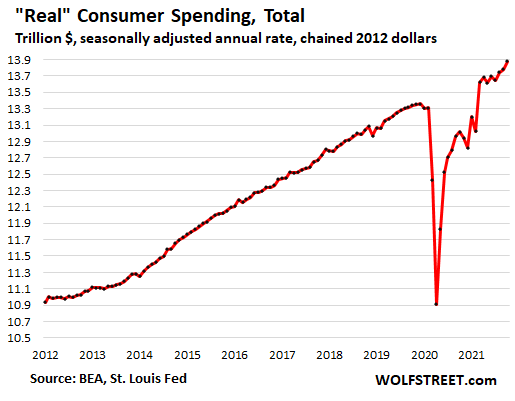

And yet, consumers are outrunning inflation with their spending. Total consumer spending, including for services, and adjusted for inflation – so “real” consumer spending – in October rose by 0.7% from September, and by 6.6% from a year ago:

How far will prices be able to rise before consumers balk?

For the first time in four decades, consumers have allowed prices to spike. In prior episodes, when prices rose beyond a certain point, consumers started to balk, buy other products, delay purchases, or take those items off the list altogether, and enough demand disappeared that companies were reluctant to raise prices and were careful in doing so, and if they did, competitors were eating their lunch, and price increases had trouble sticking.

Now price increases stick, competitors aren’t competing on price anymore, and new price increases get slapped on top of the prior price increases, and consumers are paying whatever, for the first time in decades. And by still paying those prices, consumers are encouraging further price increases.

At the same time, consumers have been agitating for higher wages – they’re agitating by not returning to the labor force for some crappy job, they’re agitating by being choosy, they’re agitating by switching jobs to get more pay, leading to enormous amounts of churn as companies poach each other’s employees by offering higher wages and bonuses.

Companies are now willing to pay higher prices for labor, materials, and components in order to do business. And they will pass on those higher prices, including to the consumer. And consumers are paying those prices, and are demanding higher wages to pay those prices. And the cycle is established.

In this scenario that most people below retirement age have no working experience with, we’re looking for signs that consumers are pushing back on a larger scale – not just on an individual basis – against those price hikes. But there haven’t been a lot of signs of pushback against higher prices.

The Fed’s Beige Book, released today, specifically pointed out the lack of pushback. It summarized that “Strong demand generally allowed firms to raise prices with little pushback, though contractual obligations held back some firms from increasing prices.”

Those inconvenient contracts are keeping companies from raising prices even further. Outside of those contracts, there’s “little pushback” against price increases.

But also today, we heard from the IHS Markit US Manufacturing PMI, which surveys executives of manufacturing firms in the US, and for the first time, in terms of pushback from their own customers, we see this:

“Although firms still sought to pass on greater costs to clients, the pace of increase in prices charged slowed to the softest in three months amid signs of push-back to higher prices from customers.”

The PMI report went on to say that with signs of resistance among their customers cropping up, but input cost inflation raging, margins are getting squeezed.

If there is no widespread pushback against price increases – if consumers and businesses just pay whatever – then inflation could get a whole lot worse than it already is. But even if there is pushback, inflation will continue to rage, but at least there would be some resistance.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Why no pushback? Because people know that their money will buy even less next week.

100% this.

It’s what people did the last time we had insane inflation. We spent every dime on payday because by next payday everything cost more.

like 70’s this piggy ain’t playing fair

expect minimum 10% inflation ANNUALLY

ie devaluation of fiat $dollar

ONLY way would be to DECLARE 100% govt debt null and void since FEDERAL RESERVE issued it under FRAUDULENT CIRCUMSTANCES

That doesn’t pull the created dollars out of the system. The increased dollars in the system (Inflation 1) stays.

Mr. Richter, I’m not a chartist, but it looks like the trend line on your “Real” Consumer Spending, Total chart would have brought us to this point anyway without the covid dip. Is that correct?

Not sure what might have happened if Covid hadn’t happened. What you’re looking at is adjusted for inflation.

Here is per-capita disposable income, adjusted for inflation:

Wolf, people lost their mind all at the same time. There is no other explanation to what is going on.

Before folks try to draw too many conclusions from this data I just wanted to stress the fact that as indicated, this chart reflects income from “all sources”

Take out government transfer payments and the graph changes dramatically.

Max Power,

Yes. Exactly.

With the issues in the supply chain people are buying while it’s available They r hedging against inflation It’s better to go ahead and buy at a higher price now than edit a week a month whatever and be even higher later Only thing I’ve seen reasonable lately is ammo For some reason ammo is plentiful

Also, consider that (if I have the info correct) 40% of people work for the Government (Local, State, Federal). They never lost their jobs. They got the stimulus checks. Their home values have gone up. Why should they stop buying?

And yes, they may be buying before the price hikes. Can you blame them?

As for cars and such. Why wait? Some people may be facing repair bills larger than they want for a car older than they trust. Just make the mental shift to go to 7-8 year loans and be done with it. If you have guaranteed employment (see above) you don’t have unemployment looming over you to scare you.

I notice numerous people who value a nice car over their own homes. On the way to work, I take the back-roads and I enjoy seeing 3-4 really nice cars in front of the dump of a home.

You can’t impress strangers driving your home around.

Then, there may be an overriding pessimism permeating existence . Don’t most of you feel “The End Is Nigh?”. “Eat, Drink and be Merry for tomorrow you may die” is in the air. If society IS going to fall apart, any day now, with an Iran-Israel War, Taiwan-China War, Global Cooling with doubling of heating bills, Food shortages due to Climate Change Global Cooling….well, enjoy it while you can.

CPS data has about 25 million people working for any level of government, which is about 15% of workers (~150 million total workers in the US).

Also, the sum of personal savings increased by $2.8T above trend. Lot of cash out there to be spent.

You have to be getting a current 8% per annum Pay rise to even keep up with Living Standards. This is all going to negatively circle loop, what have the FED been thinking ! I had expected and hoped for some backbone and sanity from them ever since 2000 but they have always taken the easy, cowards way out…pathetic…now they are being forced downhill fast on skis towards a wood-chipper with no turns possible.

Been asking at work how Inflation factors into COLA. COLA Adjustments are usually 2%. Morale will plummet and people will jump if they aren’t keeping up with inflation.

The COLA this year is ‘suppose’ to be around 5.6%, but, the percentage of increase in product(all encompassing) has gone up at a far higher percentage, not to mention the inevitable raise in MediCare cost/premium that will happen shortly after COLA, as it always does. So, bottom line, we are getting screwed again.

When a bunch of psychopaths in control of the nation’s currency are allowed to meet in secret and conspire to tweak numbers to perpetrate a fraud, this is what you get.

If everybody gets a COLA then won’t there be more inflation?

The only thing I can think of is that the financial system is close to failure for the Fed to be running such outlandish policy since GFC. Fed has horrible record of identifying next crisis that is just around the corner. The warning is going to come from an outsider like Michael Burry of Peter Schiff.

and you have to be working to get that pay raise so the labor market will tighten further.

The taper accelerating, with rate increases to follow……forced by inflation pressure

Consumer bound to have less after inflation, after tax, cash

High inflation embedded

Bubbles with leverage and margin everywhere

Congressional spendaholics

The markets are smelling a serious problem.

Well folks……you’ve been wondering when…….hold on tight…….this might be it.

Markets only go higher. It is all priced in they say. /s

I expect some funky things to take place but nothing we have seen before. While COVID takes the heat the market was already on precarious grounds in 2019.

…the big banks knocked at the Fed’s door, asking it to substitute as a lender at rates they would consider normal, that is, about 2%. The Fed hesitated for a moment before massively intervening, in a highly uncertain climate bordering on panic, by injecting over 50 billion dollars of liquidity on 17 September 2019. Thus the Fed acted as a substitute for the markets….

The next act is about to start

There will never be any type of pushback. If gas goes up to 9.00 a gallon, we will gladly pay it, the government will just give us more money for human infrastructure, after that we will all get into the boxcars.

BP

Really ?

It’s difficult to imagine a more reactionary response.

I wouldn’t use the word gladly. We’ll pay it out of necessity. They’ve got us by the soft tissues.

The working man will say “Whata ya gonna do?”.

Been on buyer,s strike the whole time old enough and with common sense know most possessions aren’t nessecary but as they say can’t fix stupid

Easy enough to stop buying what you want, but still have to buy what you need.

As what you need continues to go up, everyone buys less of what they want.

Certain “needs” can change too…….

Hookers and Blow?

“As what you need continues to go up, everyone buys less of what they want.”

and this is how inflation destroys an economy

I’ve wondered about this, the microeconomic change that has suddenly made so many buyers willing to pay higher prices. Was everyone previously paying less than their max price, or did everyone’s willingness to pay increase?

Marco, you’re forgetting taxes. You need more like a 12% increase, which is 6-8% net of taxes, to cover inflation.

A lot of people have lots more money, are you surprised by that? The Fed and the government unleashed trillions, created by tapping a few numbers on a keyboard.

The Fed lowered people’s monthly mortgage payment or allowed them to pull out equity but maintain the same payment, that is money available to spend.

The Fed flooded markets with liquidity that made wildly speculative bets pay off handsomely. People bought calls in TSLA and GME and made lots of easy money. One fifth of house down payments came from crypto profits last year. That was a gift from the Fed.

All of this bullshit ends when people who do real work for a living get real angry. When the shop worker or guy doing roofing in August heat realize a lot of bureaucrats have been “working from home” and trading BTC for fun and profit and have gotten rich without working an honest day in their life, they will shrug and walk off the job.

Never mind the buyer’s strike, this shit collapses into rubble when the people who do the work are tired of being laughed at, get fed up, turn their back and walk away. It’s been happening for over a year and the Fed can’t figure why.

I’m an engineer who retired into welding in my late 40’s. Now in my late 50’s I quit altogether. I’m not going to work hard to earn something that bureaucrats at the monetary politburo thoughtlessly create without a care for how hard others work to earn their conjured tokens.

Everyone’s a hero these days: postal workers, teachers, librarians, bus drivers… Everyone’s a hero, except for the people who do real work. Screw the Fed, I quit.

Amen brother Amen.

They’ve just totally destroyed the value of work, and demonstrated that they won’t hesitate to continue to do so to ensure that the 1% never see any losses.

This is hugely demotivating for actual workers, and our leaders have no idea because they’ve never had to do any real work. Sums equal to the median annual earnings just materialise in their bank accounts for doing a speech or a couple day’s ‘consulting’.

If you are running a marathon and the organisers keep moving the finish line out, the first time you might get angry and push even harder, but eventually you realise they are psychopathic idiots and just give up and go home.

“our leaders have no idea because they’ve never had to do any real work. ”

I saw J Powell in a lumber yard just the other day…….or at least I thought I did. /s

Where is the Senate Finance Committee on holding the Fed to its mandates? or do the Senators (and House members) like the free money? ha.

That is the great flaw in the system. IMO.

well said. people only want money as a store of value. if that will constantly be eroded, they’ll spend it to get any asset they can the moment it hits their accounts. that’s how you get hyperinflation.

I quit public work when I was 50 I had gotten my kids grown Just bought a little homestead Raised my own food Did odd jobs Worked out good and I was fortunate not to have health issues I’m 69 now I have a great life which I’m very thankful for

Same. I’m 64 doing light home construction (painting, drywall, fences, etc) for people who still have money. Call me old fashioned, but that folding cash in my pocket still feels good and I don’t mind working for it.

You were able to buy a little homestead before prices went parabolic. Talk to the young people today – hell the 50 year olds – about that plan. Unobtainium. NON-EXISTENT.

Van_Down_By_River

Welcome back! We thought you went into the river.

That!!!

You are totally correct.

I personally know people (actually married couples), where one has stopped working. They have cut costs and calculated that both working was stupid and really didn’t make any money.

I can imagine people selling out and moving out of California, etc. with a large house profit, some savings, and relocating in Free America. With a sufficient reduction in spending, you can do it.

The issues in rural America (Pacific NW) are different than in the urban centers.

Out here we have to go a long way for anything. Health care, even banking, Costco. Local groceries are Dollar General and Grocery Outlet. When I moved here 50 years ago there were 6 grocery stores. All major services are now 30 to 80 miles away.

There is little in the way of law enforcement either. Our county defunded it decades ago. In the last 5 years the number of illegal pot growers just exploded. They steal the water, pollute the environment and use non english speaking ? for their labor.. Not many locals. They are also very irresponsible drivers. My wife and I quit walking on the county road because of them.

Some of our neighbors have become hoarders of ? junk as far as it looks. Lots of trash.

We have poor internet, poor electrical infrastructure.. Over the years the maintenance of the power grid has dwindled down to visible dead trees over power lines.. I report them and no one comes. I have solar w/ battery back up to run the refrigeration and water pumps.

Then with the climate change we have dwindling water in the rivers and the ground water. We are also at high risk for wild fires.

I would move but I can’t tell you where things seem better. Everywhere there is gun violence, fentenal and meth. Everywhere there are growing homeless camps.

Where the prices are reasonably cheap, so is the quality of life. Last year, even seeds to plant were not readily available, neither are canning jar lids. I couldn’t buy chicken manure as the pot grower bought it all up at 2-3x the price I had paid for many years.

I’d do my homework before moving to a rural area.. Besides that the skills needed are much different than those of urban life. Do you know how to build and operate, maintain a drip irrigation system? Change out a broken electrical breaker? Fix a frozen pipe or pull and replace your well pump? Have you ever replaced a capacitor on one? Built/fixed or replace a fence? Dealt with wildlife? Squirrels, moles, gophers and gardens just don’t mix. Neither do deer and fruit trees. If not, you just might not like life in rural America as it could be more than a challenge.

This to econminor:

You forgot to add the fencing needed to keep out deer has to be 8 feet high if electric,,, at least 12 high if not; left the farmstead for a couple of days when the garden fence was only 10 feet, came back to find the okra eaten clean to the dirt — 4 inch diameter main stem included…

Pretty much have to have very good neighbors or someone home with a shotgun always,,, various vermin will kill the chickens, or eat every bit of green in the garden, etc., if you not there with the

( big ) dogs ,, other vermin, two legged, will take everything else, even including every tool on the premises these days.

The stimulii resulted in personal savings increasing from March 2020 to October 2021 a total of $2.8T above the 2010-2020 trend.

Government largesse is directly causing this inflation. The supply chain was already known to be fragile, this demand spike was just too much.

“Government largesse is directly causing this inflation.”

If true, that should mean it’s temporary and will settle down soon.

“I’m mad as Hell and I’m not going to take it anymore.”

LOL the original definition of COLA was “Cost of Living Adjustment”, i.e. a way to adjust salaries according to the HR-approved inflation numbers.

Gatto, no, you don’t need a 12% pre-tax COLA to maintain after-tax income in-line with 6-8% inflation, because the inflation is only hitting your after-tax expenses (assuming income=expenses which is true for most non-savers).

Suppose you made $100 last year and were taxed at 20% (for $20), so you had $80 which you spent on living expenses.

Suppose your living costs rise 10% to $88.

How much of an income increase do you need to cover the new expenses? Unless your tax bracket changes (which it’s not supposed to if CPI inflation is correct), you should only need the same 10% boost on your income:

Old Income: $100

Old Taxes (20%): $20

Old Income available for Expenses: $80

Old Expenses: $80

Inflation: 10% (expenses increase $8)

New Expenses: $88

Income needed for new Expenses: $88

New Income = Old Income +10% = $110

New Taxes 20% = $22

New Income available for Expenses: $88

Voila… don’t panic. But don’t sacrifice income during an inflation-storm either. Not everyone’s going to be keeping up with the Jones’ here.

Simplistic and wrong math.

Among the many, many implicit and wrong assumptions:

1) That taxes are flat. No, actually they’re progressive. If you are taking the standard deduction, each additional dollar of income is not going to be covered at all by the standard deduction – and making over $40K or so means 25% taxes for each additional dollar. It would be more for higher brackets.

2) The assumption that income matches inflation. Even assuming any individual has the pricing power to demand this – there’s still the problem of what to demand. Do you know right now what the actual pace of inflation is going to be for the next year? Did you know last year what the pace of inflation would be?

Can any individual or even group of consumers accurately predict what their rent, food, transport and other costs are going to be in such an unstable environment?

Very good point – it’s the average tax rate that determines income-left-for-expenses, but it’s the marginal rate (whatever you pay on any extra/new income) that determines whether a pay increase will help you keep up with inflation.

On the other hand, not all expenses automatically go up with inflation, particularly fixed-rate mortgage and car payments, stabilized rent, etc.

One size does not fit all and you have to work it out for each individual case.

COLA is marketed as a paycheck “sweetener” (so to speak), but can in fact be quite “sour” for your budget, if it can’t wash away the inflationary “aftertaste”.

I’ve always been very diligent about prices, but even more so since I retired — fixed income and all.

I’ve always bought my cars and trucks second-hand, except for one time (a 1979 Honda Civic — which I regretted). It boggles my mind what people are willing to spend on a new vehicle. FOMO? But automobiles are not an investment. I would guess that many of these folks (used-car buyers too) have nice new cars but no savings.

Big hat, no cattle

😉👏

I remember very early on in the pandemic a story about a guy who was getting ready to retire from the lumber mill. He was the manager of the mill and said he was still driving his 30 year old truck while all the young guys under him had brand new trucks, some with $1,000 per month payments. He said he didn’t even understand how they were affording them because he knew what they earned and their salaries were nowhere near enough, but then he exclaimed “none of them are even making their payments anymore!”

We used to say in Oklahoma about a guy who was all talk, “He’s all hat and no cow.”

Regarding buying a new vehicle, i have been the opposite as you. I prefer the new vehicle because i know i wss the only owner and i know how i have taken care of it. I have seen others buy new and greatly regretted it as they “bought someone esles problems,” as my mother would say. That being said, if you buy new, you can keep that vehicle for a very long time, well after that last payment has been made. I think that is the difference, keeping a vehicle for ten plus years vs new every two, which czn be a waste of money.

Should be otgers buy used, my bad.

I see push back in the luxury markets. Women are complaining about the constant price increases, in the last couple of years, of designer items. They are turning to the resale market for many of these items. The prices have gotten stratospheric and many are admitting these items no longer make sense at current prices.

I always buy clothing off the sale rack and have gotten most things on sale. But even on sale items are more expensive than last year. I also put very few items on my Xmas list and told my husband I really only want 2 of the items.

You would love the little shops in Thailand, China, Korea, Vietnam, Turkey that have a hidden door in the back that goes into the room where they keep the really good fakes. And the new models you haven’t even seen yet.

But even those are getting more expensive.

Best buys are on the street in major cities sold by entrepreneurs of questionable immigration status.

Consignment, Secondhand and Thrifts have been doing very well last several years. You can find quality there for much, much less than retail.

And it’s better than things going to a landfill when “fast fashion” goes stale.

And no concern of stolen goods as at Amazon.

Do all my shopping a second hand retail stores. There’s one here that is sponsered by the Vet Veterans of America that has some like new clothing that is better than you get in the malls. I also donate stuff to them.

If you were to peek into my closet, you would think I spend a small fortune on “designer labels.” But, everything I have comes from one of two local thrift stores. Seems that some of the wealthy folks in my little city ask their maids (or whomever) to clean out their closets on a pretty regular basis, and I made friends with the thrift store folks who give me a heads up when these shipments arrive. Most are very lightly used and some even still have labels on them. Also, these very nice clothes fit great and last for years.

Thrift stores have become a habit ever since university and my meager money days making ends meet.

With rising income, my thrift shopping morphed over the years into a search for pre 90’s quality hardware, tools or household items and lately tending towards the small, decorative, often old world objects that make their way onto the shelf neglected (usually as part of an estate reduction). Used but lovely and robust, these items are now, gratefully, lasting a second lifetime. This reduces the need for new and costlier replacements of lesser quality.

I see that demand side pressures have changed things though, with thrift necessities greatly increasing in price and shelf space, such that the once forlorn Salvation Army location has moved to a bigger showier spot at the empty mall. This, right next to the only other booming retailer, the dollar store (which has very few items for a dollar anymore).

What hasn’t changed is the interesting kaleidoscope of humanity, the bargain hunters, pensioner patrons, street urchins, plenty of Mums, their little ones, those that have fallen through and increasingly, those that have yet to.

To all CCP groupies/”investors” in China, who may not have been reading the news for weeks and still have investments there,

Please, please, in a year write to us as to what happened to your “investments” in mainland China or its companies. I love the people who are now buying up the shares in or bonds of Evergrande, or other mainland disasters. LOL

Laughter is good for the soul. Reading about your experiences as you lose all of your money would cause schadenfreude for all of the rest of us.

What about the ADR for companies like DiDi or BaBa. These look to suck up a lot of money. Friend said these were going to make him rich just like the crypto coins. Time will tell. We shall see if they do de-list these Chinese ADRs

Wolff!

I am over of those consumers who told the auto dealers who tried to add on $4,000 to $5,000 beyond MSRP ($45k SUV) with lame add-ons I didn’t want to go F$#! themselves.

Continuing to drive my very old, but faithful 1999 Jeep Grand Cherokee.

Keep pounding the drum please.

Driving that old car is a smart move. The surge in crime is crazy. A new car just makes you a target. Just make sure the old car is reliable and has working air bags.

Until the money runs out. 6 months … 1 year.., who knows

This sounds like a fad to me.

People are often like fish in a school, which dart together here or there, colorful but brainless. The masses see others acting a certain way, so THEY follow. The fad leaders are dictating what goes on. If used cars are selling so well, it is because the fad leaders chose it months ago, and the fad followers are finally getting on board. We saw this when VCR killed Beta video machines, or any time fashion trickles from the urban centers to the distant subdivisions.

It’s influencers straight down the line.

It was inevitable, though credit card balances have decreased. I know many people from both political sides that bought new toys, something they easily could do without. The reason? Most say “I always wanted one”. It must be coronavirus relief syndrome.

When/if stock market keeps falling and feel-rich factor starts dissipating, resistance will emerge.

Come on, do you really think Weimar Jay is going to let the stock market go down? The stock market is ALL that matters to them. They are going to inflate this thing to infinity and beyond!

It’s the wealth effect. People see home prices skyrocket, stocks skyrocket, and they want to spend. Everybody selling a home or stocks is pocketing $500k in gains, while the buyers haven’t suffered any losses.

Exactly. The wealth effect aka socialism for the rich. Savvy people have turned 10-20k in savings to 50-100k if invested. That all has to be spent, and credit card debt racked up on top, with rampant inflation, before spending goes down. I’m more curious about non-inflation adjusted spending because we mightve spent more dollars than we would have in a normal 2020-2021 at this point. Inflation is gonna remain for a little while longer, probably even after some dramatic market drops, because people are going to race to the exit to cash out those gains and then be flush with even more cash. The lower 50% living paycheck to paycheck, they got their rent and unemployment and its back to working in a more expensive word.

Seeing my house’s value increase depresses me, as i know the county will be increasing the taxes on it to keep up.

Keith, I agree. In reality, a money grab.

Not necessarily. If your home value rises at the same rate as everyones, your taxes shouldn’t increase unless they increase spending.

Property taxes are usually based on a mill rate and assessed value. Has nothing to do with your neighbor’s house.

Increased spending is a given. Price a gallon of paint… municipalities use the same products you do and suffer the same inflationary pressures. Then there’s the demands for increased salaries and pension contributions.

Bobber, I feel like you and I are the only two people on this entire site who understand how property taxes work. It’s like spitting into the wind.

As part of the management team of a large multi regional coffee shop chain, I can tell you that the pullback in spending has already begun. Our late summer and fall numbers were fantastic. But the past several weeks have seen a gradual decline. When you as a consumer expect more inflation, you spend more carefully – so it’s not just today’s expenditures, it’s what you expect to have to pay 2-3 months from today. A $5 latte is definitely a discretionary expenditure.

I hate to use the word stagflation, but I’m not sure what else it will be.

Could seasonal factors be in play? With it getting colder outside, folks may be less out and about. I guess one would need to compare this trend to how folks were behaving in late fall in years prior to the pandemic.

I work in retail, and our sales have plummeted, even for online orders that we ship for free. Black Friday was mostly dead.

With the crime wave in retail, who wants to go out shopping, especially alone. I don’t shop alone anymore, so I have to wait for husband or son to be willing to tag along. I have been doing this for years now. It was bad before in the malls, now they are no go zones.

The retailers have been “extending” Black Friday and Cyber Monday pricing all week. My email box attests to that.

Signals to me that things aren’t so snappy right now in certain segments.

Geezer talk (my wife’s stitching group) indicates that most of our friends / acquaintances won’t be buying discretionary presents for each other this year. In fact, most (us included) don’t exchange gifts among ourselves and our adult children during the holidays – haven’t for several years. We buy what we need at the time we need it.

We figured out awhile ago that exchanging gifts with our adult children amounted to nothing more than exchanging checks. So we quit.

That’s a really sad indictment of the USA, Petunia. I am sorry you are scared to go by yourself. It’s no way to live.

It’s a lot easier to be price insensitive when the government has been raining money until recently for over a year.

And giving you an illusion that you deserve it just for being alive…

When that illusion turns turns back into a cold, harsh, political reality at some time, it will not be pretty…

Unless the Dems can choke through another stimulus… that will delay the screaming for a while…

Sure, pay whatever … for stuff that lasts and can be bartered or resold if needs be. It’s all funny money that will blow up later. Save it? Even Penguin Powell finally figured it out.

What’s the difference between $1000 X 0 and $100,000 X 0?

Might as well enjoy yourself now since we will all be in Venezuela later anyway.

Why go to Venezuela when Venezuela can come to you…………….

I listen to Steven Van Metre quite a bit and this narrative of consumers balking at the price and the gradual easing of supply chain woes will turn inflationary pressure into deflationary. He does make some pretty good points through charts and data.

Personally I am still on the fence about his narrative but keeping an open mind. I wouldn’t mind if he is right on the money though, anything that would cause way overvalue assets like housing or stock to come down to reality is positive in book. Not sure if we will see it, cause so far as Wolf as presented, consumers taking it up to A and still spending so there’s that…

They will never balk again!!!!! I control all of you!!!!!

Muhahahahahahahahahaha!!!!!

Honestly think that you are now playing the bad guy on purpose. Your true goal is to be remembered and talked about for 50-100 years. You started with seeking wealth but now only seek fame and a legacy

Go ahead and muck up the financial systems and perhaps you will fix the world economy with your unlimited QE. What are we going to do about it?

I mean, he did enact strict rules on fed officials trading their stonk accounts last month. We should’ve seen his 180 degree change of sentiment on inflation coming, shame on us really.

Oil is down some 20% in the last few weeks. Wall Street trash funds are throwing a hissy fit about Federal Reserve normalization and trying to tank all commodities to bring inflation down. It worked for them in December 2018.

In terms of consumer trends, something often absent from the discussion (this article included) is something which should be obvious: the pandemic.

One would expect that after a year of being cooped up indoors or restricted in their movements, coupled with a boom in their assets’ on-paper valuations, that people might go out and…roam around a little more? And these very same consumers understand that companies are going to gouge consumers a little to recover the “losses” they incurred during the close-down. Restaurants, airfares, same: and it’s still Early Days. We’re not even close to being “over” the COVID “crisis”, yet everyone is really starting to act like we are.

Besides, it’s not like people need 70K cash to buy a new, now more expensive car. They often don’t even need much of a down payment. All they have to do is take on yet one more monthly payment and viola! Road Trip! Life is short, many now realize. And if one dies in debt? Isn’t that what 90% of our beloved Founding Fathers once did, too, in all their glory?

Now…if prices fail to return to normalcy, say, in six or nine months (unless media whips up this new Moronic, sorry, Omicron strain into another shutdown)? You might expect fewer buyers then…but right after they’ve just “survived” the faux horror show that the media has made this whole pandemic thing out to be? Nah…for most Americans to be penny pinching when Media says “wages surging” and “stonks reach a new high”? Nah…

OMFG your name. I feel like a must pay a tax and add something. This too will pass.. everyone will die someday. Go hug your family.

Story time… I usually take dollar options from taco bell. Full belly and lot of fats for 4 dollars and tax. Due to inflation, TB reduced the fillings inside the $1 tacos. Anyway this week for the first time they raised my favorite $1 item to $1.29. I was appalled even as a famous economics commenter in wolf street. A 29% increase in prices because now team Fed admitted that inflation is “not transitional”, TB realized that the prices must be raised or their tacos must be just the size of french fries. Ok, Am I going to stop going to TB? Nope. I will still go because I can afford the 29 cents raise and even $2. I see cars around me so, people are not stopping either. I will however stop if the prices are $10 per taco. Same story with gas prices. $10 gas is not pumping enough miles in my economy Korean car. My driving habits are same commuting for work, groceries, gym and park where most of them are in the same highway. There are no alternatives as metro trains are stopped or running on reduced times. Buses are also reduced in number. Actually, it will be costly to ride the public transportation than commuting by car (Factor in convenience and time and preference). People who complain initially will adopt in longer run by reducing the expenses like no vacations, no luxury purchases like sofa or bed, no girlfriends, no clubbing and no future house purchases. No savings either.

Even if there was annual 10+ percent inflation on the Taco Bell meals, you’ll be saving a lot of money by dying a decade or so earlier than you would have.

LMAO!!! So so true.

The TB where I’m currently at is closed because all the workers have covid. (Utah)

As a vegetarian, I find TB a great place to eat while on the road in the USofA. One can eat healthy and decent tasting foods there, if you know how to order.

i’m a big fan of the cheesy bean burrito. it used to be $1.29, have no idea what it costs now.

Yeah. I read a few stories where TB hired a menu designer who actually made the food healthier and tastier. Basically got rid of the junk fillers and additives and made it more natural. If you fill a taco with real plant based food (tomato, beans, onions, lettuce) and some sauce, its about as healthy as fast food can get.

Regarding food shrinkflation and beef prices, how many people here remember the classic Wendy’s “Where’s the Beef” ads?

What goes around comes around…

I remember, it was around 1984 when those commercials were so popular.

I think they’ve already baulked.

Biden hasn’t suddenly started talking about inflation and generating price investigations for no reason. Powell hasn’t “retired” “transitory” for no reason. They were both in full-blooded denial last month, with every indication that they wanted to keep on ignoring it. I’ll bet their focus groups are screaming about it, although of course the MSM will ignore it.

Nothing they seem to be doing is going to change anything, but they are publicly admitting inflation’s real, and we all know how they hate doing that.

It would be wrong to expect the baulked effect to show up in less buying. If inflation is running away, we should expect purchases to be brought forward. What we could look for, however, is exactly what’s being bought.

The sales of guns, inverters, woodstoves, and hand-operated grain mills are through the roof. In many cases there’s a 9 month wait at least, and these are being bought by ‘normal’ people as well now. Sales of PS5 consoles are also crazy – if you have teenagers they ARE essential ;) What’s going to be dropping is all the stuff that represents middle consumerism – home decor, a new lawn tractor, air purifiers. None of that stuff appears to be selling round me, but that’s what keeps the consumer economy healthy.

Instead of calling for investigations into high prices, shouldn’t they just purchase an economics textbook and read it?

Knowledge is just sooo 20th Century. It’s all about how they feel these days ;)

And in any case, more bureaucracy and scapegoating is the only thing they know how to do. When all you have is a hammer, everything looks like a nail.

Nacho,

When New York City went bust in the 1970’s, instead of making the next mayor the most popular guy, they voted for a boring accountant.

Competence matters. Vote accordingly.

Incompetent candidates aren’t the only problem. An equally big one (and it’s a whopper) is the apathetic and ignorant electorate. An even bigger one is the range of policy subject to the political sphere.

“Competence matters. Vote accordingly.”

“Those who vote decide nothing. Those who count the vote decide everything” – Joeseph Stalin

Yesterday I saw customers balking at the rising prices.

At our local supermarket the slot where 1lb cans of (Holy) Mackerel used to be is completely empty.

Next slot with $14 per 1lb can of Alaskan wild caught salmon is completely full.

Meanwhile our beloved Top 1% are not balking at all and busily order from Amazon $500 per kg Kobe beef and leave raving 5 star reviews.

There is no farm raised mackerel. This is the savior of many seeking a healthy diet on limited budget. Excellent quality protein and omega three fatty acids.

The size of the can has shrunk at Dollar Tree.

Consumer spending peaking? Who is stocking up at Dollar Tree before it becomes a Dollar Fifty Tree?

Canned sardines, herring, and mackerel; the path to health.

HH-as long as world fishstocks hold out…

may we all find a better day.

Didn’t credit card balances decrease during the COVID mess? If so, I would speculate that everything gets bought until credit card balances start to hurt.

Tons of people have already balked, Wolf. I’m one of them. It’s just that there are enough people hopped up on PPP loans and cashout refis to skew the truth. Almost everybody I talk to tells me they are cutting back on everything. I just saw a bag of dog food for $90. And it was only 28 lbs.

You reminded me of the PPP

My small business was-is considered “essential” during last year’s panic attack.

I got the PPP (first one) and didn’t need any of it. It went into my company account and I got to keep it. Free. It is still there, but I did give myself a pay raise (legal) and have, thus, more free money to spend.

I also got the first EIDL Grant for the full $10,000. Free.

And, and these amounts are not taxable income items !!!! So, it could be all the business owners buying brand new trucks with the free money.

This has to do with lack of education for consumers throughout the decade.

It’s not just consumers who are financially illiterate. I have a second major in economics and I didn’t learn much in school about managing money. I still see that deficit in most economist’s training. I learned the hard way, by paying attention, and accumulating a library full of financial books.

I once exchanged emails with the Chief Economist at MarketWatch.com, a well known economist. It was obvious he did not understand the social security trust fund or accounting.

I’m sure he was well-versed in cry closets and gender studies, though.

Because I am aging into retirement, I have made a study of social security for the last couple of years. Congress has turned it into a labyrinth of financial repression for the average beneficiary.

Gotta love their “Moneyist” Quentin Fottrell who dispenses financial and legal advice with a degree in journalism/psychology. It’s comedic that this goof is the personal finance editor at Marketwatch.

Petunia,

I have got a math brain, but with the complicated tax code the only way to not give Uncle Sam unnecessary money is to utilize a good computer program.

I like Optimal Retirement Planner which is free on-line. If you load all the inputs in it can solve for the most tax efficient way to withdraw money and also solve for optimal social security retirement age if you want it to.

It’s a neat tool, not the most user friendly. There might be better ones out there, but this one is ok for me.

I also like Curry Cracker who has an ability to explain the tax code in graphic form.

Widespread shortages indicate that market clearing price levels are still higher than current prices. Shortages won’t abate until pushback develops.

Hubby and I were young adults, mid-20s and out on our own, the last time inflation got out of hand. We know the drill and have already changed behaviors to fit the times we are living in now.

Not a lot of difference between young and broke and retired on a smallish income.

Great comment Josap! Would add maybe that the old (or wise) are capable of seeing the invisible hand coming their way, whereas the young (or naive) tend to get Smith-Slapped.

Smith slapped by the invisible hand even!

I was 11 years old, but my parents had me helping out with all the economies, like baking our own bread and gathering wild berries. At 13, when I started delivering newspapers, I was obliged to pay for everything I wanted (except shoes, because they didn’t want me buying rubbish ones) myself.

I’m baking my own bread again, and I’ve planted berries to have some to pick next year.

I had to start buying my own clothes (except socks and underwear, which were Xmas presents) starting around 11 or 12 years of age from my earnings picking fruit in the summer. Always made enough from working summers on local farms to afford shoes, coats, jeans, whatever. Only after I was completely outfitted to my mother’s satisfaction for the upcoming schoolvyear that I could then buy other things, like fishing equipment. It was this way through high scbool.

Balk at Surging Prices? :

How ? its Illegal to steal Food , Gas , Rent Money . Rob Banks , Carjack Uber on and on ?

The Pan is greased : They give out huge amounts of Food Stamps why over what’s normally needed ( like 2 X ) say for a Family of 2 Evan and as such you get used to spending way more than normal because it’s Free money ( Pump and Dump when it ends ) and what Happens ? you gain weight that’s what .

Only scenario that works I know of is : Go to the Food Banks and get free food > BTW if you don’t know how Food Banks work its outdated Food mostly donated from stores along with Old trucks Etc as a tax write off. ( In other words its to make money ! )

Use as little Gas as possible , go electric ( for now until they jack the Electric rate ) and Buy Used stuff .

I don’t personally know anyone who goes on food strikes but read and heard about people in prison for what sounds strictly political reasons : But wait it is political .

Apparently, the upper end luxury watch market consumers hasn’t quite balk at the price yet. Rolex, FP Journe, AP, PP are still on a massive bubble run up. Gives even home prices and unicorn stock a run for its money, the lunacy even extend to one PP Natilus owner creating a NFT of his watch and trying to sell it for some crazy amount.

I’ve worn a Rolex GMT master for many years. A few months ago, it was (again) time for an overhaul. My trusted watchmaker quoted me a price but also informed me of the current market value of my trusty old watch. It almost gave me a heart attack.

Long story short, I traded in the Rolex for a G-shock (which better suits my current lifestyle anyway) and pocketed the HUGE difference.

Recently, in the Netherlands a young guy was killed for his Rolex. Which, to make matters worse, turned out to be fake. In Paris, there’s an explosion in holdups to relieve people of their expensive watches.

Who needs that sh1t?

Visibly wearing expensive jewelry is like screaming “ROB ME!!!!”

Today, the thieves by-pass the middle-man….you

They just raid the store.

Expensive cars too.

In some parts of the world, even wearing Tevas is notification that I’m an American. Come beg, hustle or rob me.

I’ve been tracking this mania for a few years now. Luxury goods of all types have become a currency you can hold. They are good for bypassing capital controls or holding cash outside the system. Now you can carry a down payment for a house or the purchase price of a car on your wrist.

Not even luxury only…this everything else but cash is an asset mentality has even turned GShock, or some of their higher end offering to over $3K and these aren’t just one of limited edition either..

Yup, $1K+ Gshock is not an uncommon sight now….

The Powell fiasco (creating over a third of all US dollars ever created starting from 2018 to 2020, and then continuing that creation to the present) has to have been planned. They planned to create continuing, massive inflation. Such would reduce the value of the depositors’ funds held in banks, so for each $200 billion in depositors’ funds held by banks for example, while true inflation was 5%, who paid for those deposits 2.5% per year (including administrative costs), banksters would be getting $5 billion in assured, guaranteed profits.

What will happen with the two countries with the largest nuclear arsenals, aside from the US, in the coming months? Tensions are rising. Inflation may follow.

If there is a plane crash or a ship sinking or other incident that leads to fighting given the 1914-like tensions and agreements among them and Ankus and NATO, will all “investors” in mainland China lose their entire investments to confiscation by the CCP earlier than planned? That may be slightly deflationary. Conflict may accelerate inflation as the supply of many items suddenly becomes rare.

I bought all electronics that I expect to need for two years in the last months. I worry that the CCP’s worsening economic position and decreasing popularity may cause them to take crazy actions with a bribed Russia following their lead. Either way, inflation and/or a 1929-like market crash appear to be on the horizon.

I concur with your analysis, except for the last part. As far as I can see from Europe, the USA is aggressively beating the war drums all over the place, and the rest of the world is merely reacting to this.

Not that it will make any difference in the final outcome. With the emphasis on “final”.

This is astounding!

Helicopter cash !

The American consumer will balk when gasoline and booze starts crowding out fast food or take out and the deluxe cable package. They will cut out anything and everything to protect being on their ass and packing their snouts while they watch the real housewives of Mars. This is the line in the sand. They will then demand Congress fix the problem caused by Vlad and Xi or they will be re-directed to the next big bad thing coming their way. A huge meteorite a year away from being any where close to Earth could easily keep them distracted from inflation for a long time. If the politician could get control of the meteorite narrative it would be a bonanza. Unfortunately for the politician a lot of sober Physicists stand in their way.

A meteorite is a solid piece of debris from an object, such as a comet, asteroid, or meteoroid, that originates in outer space and survives its passage through the atmosphere to reach the surface of a planet or moon.

Ah, DR DOOM, you make doom scrolling fun!

“when will consumers balk at surging prices”? When they are so broke they don’t have a pot to Dinkel in.

Fed and government tried to protect consumers from pain during shutdown. All it did was train people that government has their back, that you should buy the dip and having a 6 month emergency savings account is for losers. So spend it if you got it is the mantra.

What’s strange to me and I haven’t seen a good explanation for it anywhere is that with rent moratorium expiring, consumers should have pulled back quite a bit, but no, they appear to be unaffected. I mean we all know that Americans will quit buying IFF they can’t get someone to advance the money. Right now BNPL (Buy Now Pay Later) and Credit Cards are still keeping customers afloat, so my guess is once BNPL goes to hell, then we might see some boycott from consumers, but who knows when that will be.

The explanation is that the people buying shit ain’t on rent assistance, theyre middle upper class or higher. My evidence is the huge decline in number of vehicles sold while every car company posts record profits. It’s going to be the price cut of the century when that middle upper class runs out of flex cash.

“…flex cash.”

Hadn’t heard that one before, but I like it. Flex as in “flexing,” I surmise. In essence, a bunch of cashed up people posing.

It takes up to a year in some states to evict someone Before c19 hit. In N.C. in my county an individual can go to a tax payer supported free legal service and get a motion to stop an eviction. The civil courts ain’t going to hear the motion for 6 months using c19 as the excuse. Another motion 6 months later for another six months is guaranteed for just about any bullshit reason that’s close. The end of the moratorium was just phase 1 of not paying. If you really want to go big and got some big kohunas hanging you can threaten a jury trial for discrimination. Declare yourself a Tranny and scream, it will work. The landlord will pay you to leave. Go to Wall Mart and grab a bunch of shit and throw in a plastic bag and hit the door. They ain’t no one going to stop you. Employees could get fired for trying to stop you because if the employee and the theif got into a tussle and got hurt Wall Mart will get sued by the theif and the employee. If it ain’t over $1000 bucks theft there will be no investigation. One thing you better not do is park your ass in the Speakers Chair. You will find out that we are a nation where no one is above the law. If you wore horns and sat in the Chair you might be summarily executed on the spot. We are a nation of laws.

Lolmao 😂

Very true!

The rent moratorium hasn’t expired everywhere either.

Don’t forget about the child tax credit. If you have three children, you can get upwards of an extra grand each month. And the income cap for this is quite high… Also, the temporary student loan forbearance has freed up a lot of funds.

just remember that the $300/month is up for $180 a month, so it’s only an extra $360, not $900.

I know of at least on person (millennial) who bought a home in upstate New York because without paying student loans he could now “afford” the mortgage payment.

A couple months later he quit his job, sold the house, and moved to Seattle. Hope it works out for him.

Hope he likes tent life!

Not all leases expire at the same time. As an example, my daughter’s lease on her apartment in DFW is coming up for renewal in February. She moved into the apartment in October 2019 and the rent was $1,275. She got her renewal notice and it’s now $1,700 two years later. Obviously, the increased rent hasn’t affected her spending up to this point, but it will.

When the leases roll over, it’s going to hit…. not at some defined date. Some have two year leases… others one….. some month to month, so the reality will hit at various times.

The brand of bread we buy is up 50%, but it is still cheaper than other brands so we still buy it. It is difficult to replace the basic necessities.

Go to dat old store less than half price or make your own self sufficient is the new normal

But … bread isn’t a necessity. ;)

Watch prices for rice, beans and subsistence produce.

I think that consuming is so deeply ingrained in Americans that it may now be at the epigenetic level.

The fin tech Buy now pay later,and transactional financials are being hit in the stock markets UPST, AFRM, MA ,V the banks are topping. Something not pretty lurking out there. I have seen the pullbacks starting in groceries. The high dollar Yogurt usually selling out, now there is plenty. In the last three months its gone from 9 dollars a quart to 11 plus. Gas here at Costco is now 4 dollars a gallon. I am ever grateful I do not commute. Cost 60 .00 to fill my highlander.

The honey I buy went up 25%. I sent an “online message” to the company asking if it was they or the big W who increased the price. Didn’t get a response, “You must sign up for newsletter”. Bought another brand. Don’t be stupid, folks! Fight it.

We buy an odd vegetable… kohlrabi. It has sold by the pound and individual piece for the past several years with the tops cut off, so you only paid for the vegetable itself.

Yesterday, the kohlrabi was being sold in bunches with the tops attached. The tops added about 15% to the weight. So, the price per pound didn’t go up, but now you are expected to pay for the inedible part.

I did also notice that there were a lot of BOGO’s on expensive branded items – like $5 cans of diced tomatoes… which brought them down to competitive with their house brand. Ditto soup broth and “designer” yogurt.

This morning at Walmart, the Propel water I buy (with electrolytes) which was $6.68 for a 12 pack is now $7.68, a $1.00 increase. That’s about a 15% increase.

Yesterday at the dentist to get impressions made and pay for the new tooth for “Part II” of my dental implant (the new tooth and titanium abutment), I was billed $2,173.50.

For the previous implanted tooth done in late 2019, the bill was $1,805.00. Same dentist for many years. He said prices for the tooth and titanium abutment, which he has made outside, have gone up substantially.

BTW, no dental insurance for old timers like me on SS/Medicare is available to cover this kind of dental work.

Anthony A.

I had the same thing done. Cost $2,325. GEHA ins pd $859. My out of pocket $1466. Get dental insurance. GEHA has a high option plan where the premiums are about $100/mo for me and the Ms. Swamp.

I buy a bottle of wine once a quarter.

It dropped $1 in price at the big W.

Wouldn’t be surprised if big G is subsidizing it.

I may have to buy more.

Because it feels so good.

Bread and circuses.

One bottle a quarter? I am impressed. Couldn’t invite me over for dinner I swill wine . My wife keeps her jaded eye on me and cuts me off before I start babbling. I do obey because she is wise. I personally buy the supposedly aresenic laden (10ppb) $3.5 buck Chuck at Trader Joes. It was 2 buck Chuck 18 months ago when when inflation was transitory. God knows what a non-transitory inflation bottle will cost. Man, that was some good times back in the day when we had transitory inflation.

I don’t buy cheap, cheap wines. I encourage you to research the ingredients; I couldn’t find anything, maybe you can. There’s a big national brand at the big W that uses high fructose corn syrup. I strongly advise against drinking that on the regular! For just a bit more, you can buy a more quality product.

If people read the ingredients of the food they buy, they would see tons of high fructose corn syrup in damn near everything.

A good place to look is at the name brand BBQ sauces.

I have a feeling the fomo is driving it. Seeing emptying dealership lots confirming the feeling scarcity for auto sales, “shipping shortages” being repeated on the news constantly. It’s a fear driven economy ever since people had their jobs threatened in 2020. Now if they have the money they spend it incase the items aren’t on the shelf next week.

Fast changing of vehicles isn’t just a 2020 thing. I’ve been noticing it for at least 5 years in my neighborhood. These are lower-middle income households, not McMansions. Most of them buy a new car every year.

“In the third quarter of 2021, Americans racked up $17 billion in credit card debt, the same increase as in the second quarter, according to data published Tuesday in the New York Federal Reserve’s Quarterly Report on Household Debt and Credit.” -Marketplace

They aren’t really paying for their purchases are they? Consumers have become accustomed to being in debt and they readily assume more since there are seemingly no consequences. It seems that those whose only product is debt don’t care that the debts will never be repaid.

Consumers are spending something like $1.2 trillion with a T a month on average, and credit card balances rose by $17 billion with a B?

True, I was just using that stat as an indicator of their behavior. Many people aren’t “paying” for their purchases. They are adding to their debt. Decades of easy credit have led to very irresponsible consumers. The fact that some are now price insensitive doesn’t surprise me in the least.

U.S. household debt climbed to a record high of $15.0 trillion in the second quarter of 2021, and mortgage debt increased by a whopping $282 billion between April and June.

Auto makers have prioritized high end vehicles due to production limits. Folks who are not sensitive to pricing are buying these vehicles.

To prove the point that the average buyer is not sensitive to prices, production would have to be unlimited/normal and all buyers would ignore the inflated prices. Which I doubt would happen.

Vehicles are in effect a limited commodity and those with $$$ are willing to pay. I think there are many more potential buyers on the sidelines.

When vehicle sales reach 2019 levels and dealers are still selling vehicles at a premium – then we’ve all gone bonkers….

I don’t think consumers care. Here in Calif, they reelected Newsom. Despite paying $5.00 for gas. My buddy has a Ram diesel pickup, 12 mpg. 50 gallon tank. Every 600 miles, $250. That almost pays the lease payment on my Chevy Bolt. And no waiting in line for gas at Costco.

People aren’t paying up for some things, like AT&T stock. It’s dropping like a rock. They’ll pay an arm and a leg for growth, but nothing for profit. They’ll pay $80k for a fancy car, but nothing for anything with cloth seats.

It was a head-scratcher when AT&T bought DirectTV (2015) for $67 billion (including DirectTV’s accumulated debt). Weren’t AT&T execs aware that DirectTV was probably the most hated cable TV company, known for bait and switch hustles, bleeding customers in various ways, and that’s-too-bad-sucka customer support?

News says AT&T recently completed “spinning DirectTV off.” But it seems a bit of an overstatement to say AT&T spun it off, since AT&T owns 70% of the newly spun company (co-managed with private equity firm TPG Capital that owns 30%). I’ll have to remember to run for the hills when I hear the name “TPG Capital” associated with any potential asset.

I’ve been buying some AT&T stock at the $22 level. They still have some moat. If you change your cell carrier, I think you need a new cell number, and that’s a hassle.

that hasn’t been the case in nearly 20 years.

Before the ATT breakup I work for a firm whose biggest client was ATT. It was then and still remains the worst managed firm I have seen. The only thing that made them profitable was the monopoly they held in telecommunications.

My 2 cents:

The majority of the reported inflation is shelter, food, gas/energy, and cars.

Until prices on these items go absolutely bonkers, Americans won’t change their habits on these expenses.

Changing homes is a PITA. Eating is the world’s most popular entertainment. And most Americans need to drive to the supermarket/restaurant.

I would add healthcare and insurance.

People are not getting richer in broad base and have less disposable income. So something have to give. Instead of having multiple cars, a significant portion of families will choose to have less cars. In the end, it’s still car manufacturers lost, less cars, less service, less petrol used, less insurance and less TAX. It’s a lose lose situation for everyone.

The pie is shrinking fast.

As for me, hell yes, I won’t buy a second hand. I think 2022 will be very unsettling year and lets see what the price will be.

Babylon Bee, kiddingly, said Amazon is to allow on line looting….

This might be more accurate than suspected.

What would on line looting look like? Lots of purchases on new credit cards, then NO PAYMENT. Just don’t pay. The equivalent of looting from home. Maybe there will be a $900 limit like looting brick and mortar stores.

Hey Wolf,

Let me expose my current delusion:

What’s your take on the the stock sales by the tech and Walmart elites ?

Are the billionaires small enough that it won’t cause a market selloff or collapse?

Wouldn’t it be ironic if this ultra wealthy crowd triggered a collapse and increased the wealth disparity by their withdrawals?

But is it highly improbable that even due to their great wealth, still too small to affect the entire markets capacity?

We shipped a lot of manufacturing jobs overseas in order to make larger profits. Shipping production there means the future product will be invented there too. So we are no longer the leader in many areas of production. We stopped investing in ourselves so we became a high priced producer. We never figured out that a lot of public spending, in the right way (for example medical care for all), would reduce the cost of production and lower our prices. We would be more competitive. Not happening because we adopted an ideology that elevates the individual to sovereign status. Pure hubris. We keep it up, it just gets worse.

I just got the 2022 audio gear & music catalog from Chicago’s MusicDirect. At just over 300 glossy pages with photos that are absolutely beautiful audiophile porn, I get a bit excited perusing through it.

But to keep myself from getting too much lust for the gear, I say to myself, “Made in China.”

$6,000 for a “Great British Sound” (yeah that’s what’s the rear panel proudly displays) Cambridge Audio Edge A Integrated Amplifier? Sure, it is a nice unit from a greatly respected company. But next to the “Great British Sound” slogan, there’s this: “Designed & Engineered in Britain — Assembled in China.”

Me? My preamp is a piece of Schiit which was engineered and made in Califorina. My amp is an Adcom which was engineered and made in New Jersey. Speakers are Magnepan which were engineered and made in Minnesota. Subs are JL Audio which were engineered and made in Florida.

Michael Engel will like this: my new neighbors across the alley both play the clarinet. One is in a band in St. Paul & one is in a band in Minneapolis. When they recently listened to Mahler’s 5th on my system in SACD, they were blown away by the accuracy.

“Doing the recording was not as enjoyable as performing live to an audience. A lot of re-takes and technical stuff … but when you hear it like this, man, it all comes together!” -Tim Z.

Amen

My speakers are still the 30+ year old Wharfedale E30s. Proudly designed and manufactured in Yorkshire, England.

Will never let them go.

1) For entertainment purposes only.

Option #1 :

2) SPY will rise to a lower high, before dropping above Oct 4 low

to between 430 and 450.

3) There will be a reaction to T1, or T2.

4) That distribution will send SPY to targets between 385 – 400.

5) Option #2 : SPY will rise to a higher high, before dropping to

430 area, or to a lower low, under Oct 4 low, to 420 area.

6) There will be a penalty for higher prices if options #1 and #2 materialized, sending SPY in a bear market rally to another lower high before plunging deep down.

7) Option #3 : SPY will move higher,to higher highs, in rolling hills, consumers will preempt the high inflation by buying low, before highs, before prices take off .Most economist p,redict option #3,

Is the answer to Wolf’s query in this article in the WSJ 12/2

“Americans are applying for credit cards at a rate not

seen since before the pandemic, according to recent

data from the Federal Reserve Bank of New York.”

Guessing this is a precursor to record consumer debt, a logical result of inflation.

Hard to cut back on gas purchases. Gotta get to work each and every day.

Lemmings. Then if we ever do hit a wall on artificial liquidity, watch out. These greedy median-IQ consumers will turn on a dime to be armed, angry, populist lemmings, new meme, same stupid impatience. About that time there may be some stress tests in Ukraine and Taiwan, with their own crowds of lemmings on the other side. Lovely. I tremble when I think there may, occasionally, be some kind of exogenous rebalancing or justice in the universe.

There was a video game back in 1983 called “Lemmings”. I used to play it. along with “Pacman”. This is what the American people have turned into. Most are Lemmings , easily manipulated by the mass media. Now we have social media which has made things even worse. The video game Lemmings was way ahead of it’s time.

That old Lemmings game is now called Twitter.

I suspect the “wealth effect” plays a big role in this too. Many trillions have been added in stockmarket and crypto “value”, and people actually think this is real money, so they feel richer and don’t care spending more/ going deeper into debt.

Also, they expect that every 10% or so dip (should it even occur) will immediately get backstopped. After all, we have been educated for over a decade that this is the case and an entire generation has never known another world than this. So they feel rich and secure.

Even most people who should know better seem to be onboard with this “the Fed can (and will) backstop everything”. “It can never happen”. If I point out that 50% market drops have happened TWICE in the past 20 years, when the world economy was a lot less unhealthy than it is now, and when central banks still had plenty of tools in their box to soften the blow, they still believe it can’t happen this time.

Therefore, it is going to be a truly epic collapse when eventually the wheels come off.

Most seem to think of “collapse” in the abstract, meaning it will always or only really impact someone else but never them.

The end of this mania will almost certainly be a process and not an event, with numerous bear markets and recessions between rallies and (weak) economic recoveries.

There is the bull market from last week, last month, March 2020, post GFC, August 1982, July 1932…The scale and duration of this bear market and economic contraction will dwarf anything anyone alive has ever seen because the distortions and excesses are bigger.

There won’t only be abstract financial collapse either. It will hit the social and political order with a gut punch too and there is absolutely nothing any government can do to prevent it, only “kick the can” further down the road which is what is happening now.

AF-very well said, particularly your opening sentence.

Sic transit gloria mundi and national purpose…

may we all find a better day.

I’ve been wondering lately how much of the US stock market is Americans. It looks very global to me. I’m wondering if people in other countries just think the US market is safer.

Lynn-makes me think of the ongoing ‘cleanest dirty shirt’ analogy (or, as in the case of a late neighbor of mine, refused to launder his jeans, insisting that the embedded soil slowed wear and actually held them together in the long run…).

may we all find a better day.

“..50% market drops happened twice in the past 20 years…”

And in 2020 the Fed successfully stopped what would/should have been the third one.

You stated ‘Consumption in November ran at 9.16 billion barrels per day, same as two years ago’, it should be 9.16 million barrels per day.

Interesting all the comments this hot topic developed.

Wolf,

I’m curious if all the money I spent this year and the last on dental work, a bridge and two implants (20k+) goes into government statistics for services or does is count as retail spending? The Lab had to make these items.

It’s services. The easy way to check is if you pay sales tax, it’s retail, otherwise it’s services.

It counts as healthcare spending within the overall consumer spending category, but does not count as retail spending (which is just a smallish part of consumer spending). It may get subdivided within healthcare spending because it involves healthcare services plus materials and devices, namely the implant itself and the crown.

I sold my tesla 3k$ more than what I paid for it 2.5 years ago. Everyone I know is swimming in cash, remortgaging their properties now having a lot of equity… buying more properties, stocks, and goods. Which in turn, creates more wealth effect.

It’s a vicious cycle. They will need to break it eventually

It’s a complex situation, but I think we’ll see more than a little pushback when the bottom falls out of the whole economy. A crash that I’ve been predicting was imminent for over 5 years, and it still hasn’t happened yet. So, what do I know..

Don’t be hard on yourself. Everybody expected the Fed to apply common sense and respect longstanding social norms and incentives.

Poor – only 5 years?! I’ve been expecting a crash since 2008 … !

Yesterday, a guy I work for asked a parts store for an air pressure gage.

It rang up $61 dollars.

He said that is unacceptable.

No air pressure gage is worth that.

Walked out with that same gage for $48.

Hey Universe, look at the guy with the Rolex/Lexus/”…a guy I work for asked a parts store for an air pressure gage.”

Just a different way of measuring inflation…

Ray Dalio just released WHY NATIONS SUCCEED AND FAIL.

Finally an explanation that lays out enough analysis to see a range of likely scenarios due to things like the negative interest rate phenomenon….

Meanwhile the hordes howl and scream about what they can really do nothing much about….

I have mixed feelings about Ray Dalio. One thing I remember is he testified in Congress a couple of decades ago and made some kind of economic prediction and was totally wrong.

For my credo, I paraphrase George Patton: no dumb cluck ever won a fortune by going out and overspending for his ego or “pent-up demand.” He won it by making some other dumb cluck do that.

Cuck = “cluck”.

Just like spraying “RoundUp”, inflation kills the crop from the roots upward. Many on the lower parts of the US society plant are already in deep trouble as their resources are bled away. Those living day to day are already victims of the new left’s Utopian policies.

Get your head out of the closed loop of the financial world and see what has become of main street. What businesses that remain open are limiting hours for lack of help, despite now giving signing bonuses. Others are departing for greener pastures or simply “getting out while they can”. As printed money continues to flow into what is left of this economy, the killing effects of inflation will be creeping higher and higher up the plant’s roots and stems. The more spending “help” they enact the worse it gets.

We manufacture components that go into commercial delivery trucks. I am preparing out annual price change analysis this month. Just starting to pull the data now.

In 2021, we saw costs of raw materials hyperinflate (by definition of 50%+ in one year). Everything else was up a lot, but to a lesser degree.

This has translated to a net price increase for our product line of around 30% in one year – some products more, some less. Our value line product will have nearly 50% increase over the year.

I was able to get some competitive quotes through a contact in the industry to help gauge the competitiveness of our coming increase. My conclusion is that they are in the same boat as we are.

Going forward, the only thing that would cause this level of price increase to continue is more price hikes on raw materials (steel, aluminum, copper). So far, there is no indication of that happening, but there is also no strong indication of downward price movement either. Prices went 2x-3x during 2021, and will probably hang there a while.

At a national level, inflation will still have legs as these kinds of costs continue to trickle through the rest of the economy. A more expensive truck will eventually translate to the price of the goods it is moving.

As wages have risen quite a bit to keep people here, even if we see commodity prices drop, there will still be a good chunk of increase that remains permanent, or at least sticky.

Demand is still through the roof, though it’s seems to be entering a lull right now as bottlenecks at the chassis manufacturers are slowing all of us down.

I just started resisting. My lawn/snow guy

wants 20% more. I’m going to put him on an

on-call basis to keep costs down.

I’m cutting my pwn grass now…..like I did 20 years ago. Screw them all.

I bought a used lawnmower this summer for $50 and rebuilt it (new blade, belt, two wheels, air filter, spark plug, oil change, etc). Runs like a top.

No snow here.