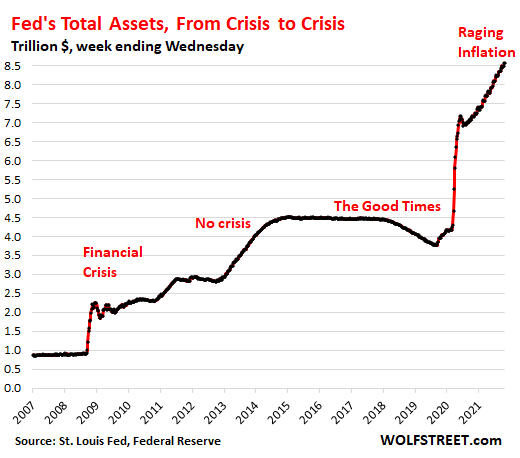

Assets at $8.6 trillion. QE faces Tapering. Already gone: Swaps, repos, corporate bonds, bond ETFs, corporate paper, money market bailouts.

By Wolf Richter for WOLF STREET.

The Fed continues to add Treasury securities and Mortgage-Backed Securities to its holdings for the time being, despite raging inflation, but said it will reduce these purchases in increments, likely starting in November and end adding to its holdings by mid-2022. It has already largely unwound its crisis specials, ranging from repos and liquidity swaps to that alphabet soup of programs, such as its holdings of corporate bonds, bond ETFs, and commercial paper, which it sold in recent months into one of the hottest bond markets ever.

In total, the assets on the Fed’s weekly balance sheet through Wednesday October 27, released today, ticked down from the record last week, to $8.56 trillion, having ballooned by $4.2 trillion since March 11, 2020, when this whole money-printing insanity started.

It has been a mind-boggling amount of QE designed to repress long-term Treasury yields, mortgage rates, and long-term interest rates of any kind, and to inflate asset prices, and to thereby create the biggest wealth disparity ever via the Fed’s Wealth Effect doctrine. As a result, nearly all corporate bond and loan yields, except for the highest-risk junk-rated instruments, are below the rate of inflation, which has taken off early this year at a blistering pace and by various measures has hit multi-decade highs.

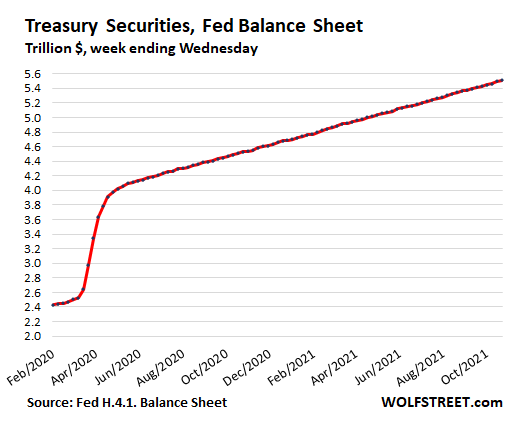

Treasury securities hit $5.5 trillion.

Since the beginning of March 2020, the Fed’s holdings of Treasury securities have ballooned by $3.0 trillion, to $5.5 trillion.

This includes $436 billion of TIPS (Treasury Inflation-Protected Securities, face value and inflation protection). By dominating the TIPS market, and thereby manipulating TIPS prices and yields, the Fed has assured that market-based inflation indicators, such as the 10-year Breakeven Inflation Rate, reflect only the Fed’s purchases and expected future purchases, and not any expectations about inflation.

Inflation expectation indicators that are based on the bond market have become so manipulated by the Fed’s bond and TIPS purchases that they’re useless.

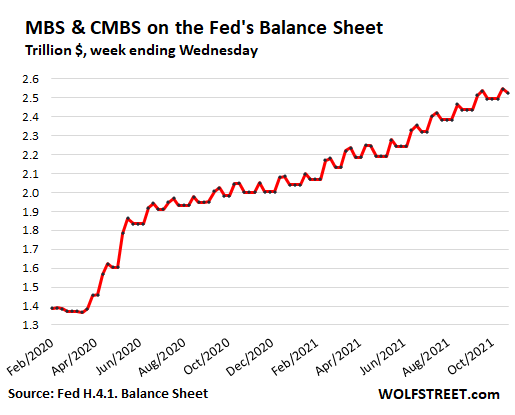

MBS zigzag to $2.53 trillion.

The Fed’s holdings of mortgage-backed securities reached $2.53 trillion, up by $1.16 trillion since March 2020.

Holders of MBS receive pass-through principal payments when the underlying mortgages are paid off (after the home is sold or the mortgage is refinanced) or are paid down with regular mortgage principal payments. The Fed buys large amounts of MBS in the “To Be Announced” (TBA) market – around $100 billion a month – to replace the pass-through principal payments and then to increase its balance by about $40 billion a month.

But these pass-through principal payments are unpredictable, depending largely on refis and mortgage payoffs from home sales. Trades in the TBA market take months to settle, and don’t match the timing of the pass-through principal payments. This creates the zig-zags in the chart:

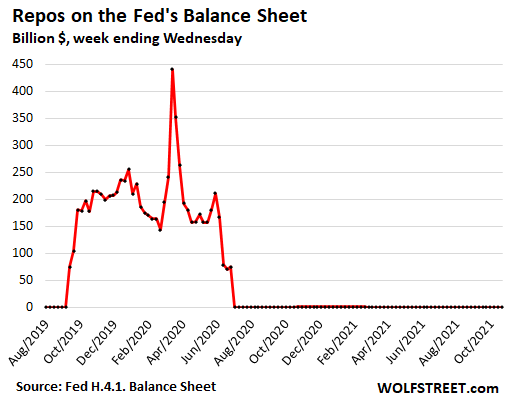

Repurchase Agreements (Repos) at zero:

The Fed is still offering repos but has raised the rates to where there are better deals out there, and no one has been taking up the Fed’s offers since July last year, when the balance fell to zero.

With these repos, an asset for the Fed, it hands out cash in return for securities, a quick way to send lots of liquidity to the markets.

Repos are the opposite of the currently hot overnight Reverse Repos (RRP), a liability on the balance sheet, with which the Fed drains cash from the market, currently amounting to $1.38 trillion. Under pressure from excess liquidity that QE has created, the Fed is using RRPs to keep short-term yields above 0%.

Repos are in-and-out transactions. On their maturity date – the next business day for overnight repos – the agreement unwinds, the Fed gets its cash back, and the counterparty gets its security back.

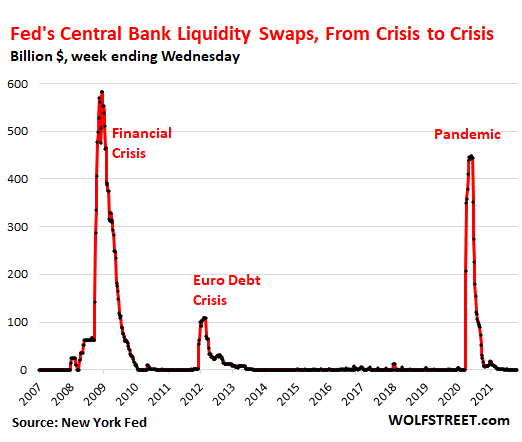

Central-bank liquidity-swaps at near zero.

The Fed has been offering dollars to 14 other central banks via “central bank liquidity swaps,” in exchange for their currency, to provide cheap dollars to those economies for their dollar-funding requirements. The Fed did this during the Financial Crisis in 2008-2010, during the Euro Debt Crisis in 2011-2013, and during the pandemic.

Almost all of those swaps have matured and were unwound, with the Fed getting its dollars back, and the other central banks getting the local currency back. Only minuscule amounts of swaps ($323 million) remain outstanding:

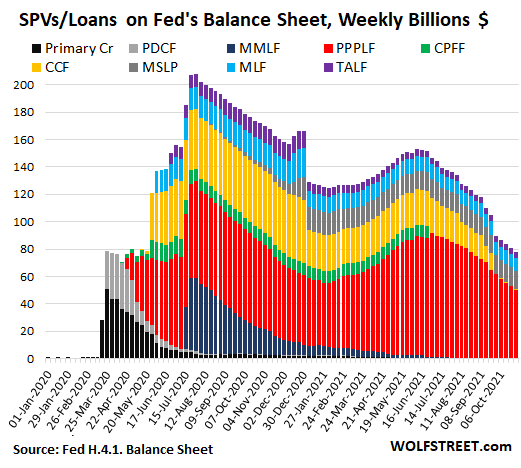

SPVs continue to decline. Only biggie left: PPP loans.

Special Purpose Vehicles (SPVs) are legal entities (LLCs) that the Fed set up during the crisis to buy assets that it was not allowed to buy otherwise. Equity funding was provided by the Treasury Department, which would take the first loss on those assets. The Fed lends to the SPVs, and shows these loans and the equity funding from the Treasury Dept. in these SPV accounts.

On December 31, 2020, five of the SPVs expired, including the SPV with which the Fed bought corporate bonds and bond ETFs, a creature called CCF. Over the past few months, the Fed sold all of its corporate bonds and bond ETFs into the hottest corporate bond market ever, and they’re gone.

Total amounts of the SPVs combined dropped to $79 billion, from a peak of $208 billion in July 2020. Of that $79 billion, PPP loans that the Fed bought from the banks account for $50 billion. The remainder are the Main Street Lending Program ($13 billion), Municipal Liquidity Facility ($10 billion), and TALF ($4 billion):

So, all those crisis specials have either already been unwound completely or are being unwound. What’s left are Treasury securities and MBS, the two biggies. And the Fed will likely reduce purchases starting in November.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

And there’ll be collywobbles all round as the alcoholic markets perceive a drop in in available liquoridity.

Symptoms of mighty withdrawal.

Looking at the Fed balance sheet since 2008 makes you think system is busted and rates might stay near zero. I don’t think it’s going to take my h to bust inflation. Fed could go full stop on purchases tomorrow and it would stop excessive spending in a month. USA is consuming too much.

Rates can stay near zero as long as the currency doesn’t take a big dive and jeopardize reserve status. Then if high inflation is acceptable, the FRB and government will have to choose.

No guarantee coordinated QE won’t fail spectacularly either where the USD or another will bust and trigger a major crisis.

Ultimately, it’s psychological, not central bank omnipotence or wizardry. There isn’t anything actually new about QE. It’s only “printing”, not magic.

exactly. printing $4 trillion to increase “wealth” by $50 trillion would be a pretty good deal if it wasn’t all so fake.

Well, the Fed has to come to the conclusion at some point that what they’re doing simply is not working.

it’s working for them. it’s just not working for america.

Yes, central banks thought 2019 was the best the economy ever, with 2% GDP growth, rising asset prices, and stable consumer spending. They didn’t care if wealth concentration was getting out of control. That’s not a problem they create, they say.

It worked well for the top 10% of people that run the country, so it was a smart thing for the Fed to do politically. The Fed wants to get back on that path.

“Not Working” is an assumption made based on one’s particular vantage point within a system. I would argue that FED officials, after realizing significant personal financial gains from unprecedented FED-determined monetary intervention, are feeling pretty good about the system right now.

TT,

Couldn’t you have just said upset stomach?

Noooo… you have to go all Brit slang on me…

You made me look that one up :)

As good as bits and bobs…

Cheers !

The only thing keeping America from falling into a dystopian hell is it’s Reserve Currency status. But it will end badly. As wage and input prices ripple through a structurally broke American system the trade deficit will continue to climb and the US$ continue to decline!

Expect the trillions in $$$printing to continue until the country dissolves into a complete police state!

Why would police go to work if the thing they are paid with has no spending power?

Police states always ensure the police and military are well compensated even though the majority are living in a dystopian society! When the police state can’t compensate their armed tools adequately the state then spins out of gvt. control!

Very very true in the long and longer her and historical perspective G:

Good point for the oligarchs and their political puppets to keep firmly in mind, or whatever minds they have left after/over such an incredible expansion of that group the last few decades,,,,

Including far shore their now clearly known as corrupt puppets at now every level of guv mint in USA and throughout the global financial world…

SO called ”derivatives” at $$$600 TRILLIONS,,, while SO many of WE the PEONS who are actually producing ”real” goods, etc., are suffering in E#VERY NATION..

Cannot last, and clearly WILL NOT last,,, and also very clearly, time and enough for our owners to clean up their act and share appropriately…

Ranking military in Thailand are relatively wealthy. You can find one owning a nice compound in many of the better neighborhoods.

There are two military families, with nice big houses, on the street where I live. I think they keep an eye on things, so rabble-rousers will be identified and reported.

And use what? That’s a legit question.

Every global currency is even WORSE than the dollar.

Sure the policy behind it is terrible but the Yuan can be repossessed at a whim. The Yen and euro are stagnant and the GBP has a worse Outlook than any other major currency.

Gonna load up on rubles?

Bartertown here we go.

We’re already there.

Where exactly?

The only true metric I see of currency failure is cryptos. And who even knows if they indicate anything anyway.

The price of Gold and Silver haven’t done anything. What exactly is going on here? Where are we going?

While I agree that government spending is out of control and the cost of debt is nil (which is all fiat really has for any logical valuation) if the roosters are going to come home to roost they haven’t yet. Nor will they unless there is a fresh coop to run to. And there isn’t.

Wolf simply reports facts and he avoids alot of speculation on here. Because at the very least they are facts. When taper starts let’s see what happens.

As it stands PE ratios in equities are ridiculous for the most part and earnings are largely a meme when viewed through the prism of dirt cheap corporate debt.

So why has the 30 year rallied recently

For one, the 30-year isn’t really “rallying.” Since July, the yield has been between roughly between 1.9% and 2.0%.

And two, the Fed is STILL buying full blast. Taper hasn’t even started yet.

When the Fed starts the taper, would the TIPS get into the normal territory again? That makes sense as a sure buy.

It should be shooting through the roof..

The Fed would have to unload part of its portfolio before bonds could more or less react freely. When it finally gets through with the taper, it just stops adding to its portfolio. The next step is let maturing bonds run off the balance sheet without replacement, which would shrink its balance sheet; with enough of that, bonds should start moving on their own will.

Ja Vohl!

Bretton Woods was just another of the many international agreements America broke. It is well known that America is not “Agreement Capable” and many countries refuse to sign any agreements with America. The breaking of the Bretton Woods agreement is driving hundreds of millions deeper into poverty. Strange the Democratic progressives aren’t upset by this fact but want to further the poor’s pain by printing trillions more of fake fiat US$$.

Interesting and valid points you are making.

It’s because of this Yankee attitude of the big ones that the smaller honest entrepreneurs miss out on business with foreigners.

For a long time a large part of the world relied on the US for inventions, state of the art goods and protection and accepted that Yankee attitude as part of the deal. But as the US fails to deliver on those more and more over time, the former trade partners are seeking their needs in other countries and no longer have to deal with the ‘being superior’ attitude.

Don’t take me wrong. I have had conversations with and have bought nice car and musical equipment from honest hard working Americans and never regretted it. But sadly you people got stuck with a majority of the wrong representatives. Maybe there is no real choice. I live in The Netherlands and it’s no different over here. There is lot to choose from the pool of carrier politicians, but in the end it’s all the same incompetence.

Great post…

Put your money where your mouth is and leave NATO ( oh yeah, how much does your country spend?)

Defend yourself with your 30k army… wouldn’t last 30 mins…

First bullet you would be “ please America can you print some money to defend us so we don’t have to learn Russian”…

Be careful what you ask for…

Jeez…

You might want to go back and have another conversation with your car…

Cowg, you actually still believe in the USA freedom and democracy fantasy. Wake up and look around, you’ve been played you entire life.

I don’t get this Bretton Woods nostalgia. most of gold is mined in Africa, Russia, south America these days. so why would anyone want to give up created value in the form of electronics, planes, automobiles for something that nobody really needs? gold (and most preciuos stones for that matter) don’t have any intrinsic value (except limited usage in electronics, abrasive materials, etc). it’s silly, plain and simple

I bit you’re wholly “invested “ in $SHIB and Doge Coin!!! 🤪

Gold is acceptable alternative when Uncle Sam starts screwing you over with the dollar. China, Russia and Turkey went big on gold and gave Uncle Sam the finger.

Oh, so THAT’s why the Turkish lira dropped 50% vs the dollar the past 2 years- because of all the gold backing (LOL)

Nobody needs paper tickets or entries in electronic accounts either. If you give the state authority to declare anything ‘legal tender’, you have given up your freedom. 5000 years of market history says gold and silver are the most marketable commodities and thus should serve as money.

Not to mention the appellate committee at WTO

The 100s of millions of poor who are being driven deeper into poverty are non-Americans. With the US$ fueling rampant inflation in commodities around the globe the poor nations are suffering the most. American politicians and the “exceptional nation” of Americans don’t give a chit that their monetary policies are starving people around the globe but I just made the comment to expose the social-fraud of the Demo-progressives!

“ The 100s of millions of poor who are being driven deeper into poverty are non-Americans”

Being driven by non-Americans…

And, yeah, I don’t care…

Most were starving before and will be starving again… they are always starving…

If you feel that strongly, do something about it and let me know… I’ll send some nasty fiat your way…

BTW, the only thing you have exposed is your lack of capability of well thought out and pertinent thought…

“the only thing you have exposed is your lack of capability of well thought out and pertinent thought”

Did you even bother to read your own comment.

Sure did, Don…

Several times as I wrote it…

To correlate the world is starving is America’s fault because of the current Fed is ridiculous, patronizing and does not give one a license to bash America using a thin thread trying to relate to this article…

The poor in the world has been starving for a long, long time…

Usually by corruption by their own leaders, usually by stealing the aid that America has GIVEN to them , using my tax money…

Read thrice…

COWG

I wouldn’t crow too loud about foreign aid and US generosity.

Per Gross National Income: (most recent stats 2016)

Donation levels

US .18% GNI

Canada .31% GNI

Netherlands .59% GNI

Luxembourg 1.05% GNI

And this was before Idiothead who cut it way back in 2016

I don’t think foreign military bases and civilian contractors working the population counts.

Holland considerably more generous, your tax dollars, notwithstanding.

Paulo:

So the 1.05% of GNI that Lux gives in foreign aid is MORE in dollar terms than the US’s .18%……………..

I think not.

Paulo,

Thank you, my brother from another country…

Wasn’t crowing… if it came out that way, my apologies…

My only point was that stretching Fed actions to causing world poverty and bashing Americans because of the Fed was overreach I felt… and not germane nor pertinent to the article…

Thanks again…

DC lives in their own ivory tower like the Queen in Alice in Wonderland.

+1000

Central bank swop slow down is telling. What time is it Mr Wolf? Shame you cant get a cheap plumber anymore to fix that broken tap of money flow. Creative accounting options will dry up soon. Emperor has no clothes. Time for a new horse?

Astrologers unsurprisingly predicting stock market noise 5 to 12 Nov. Lets see who has a game appetite and who makes the world a better place with their purse?

The only thing astrologers do is expose people like you to the rest of us…

Where can I find details of these astrologers? There was one a while ago called Rebecca Nolan who made some good calls

Funny, I saw a different article than most responders here. I saw the Fed (as in ’08) faced a genuine big sudden crisis, and did big things that avoided the system otherwise spinning out of control at a bigger level. And then it unwound many of them. It bought a bunch of corporate bonds which was weird, but sold them back. Yes, there is plenty reason to be concerned, some of the big trend lines are scary, but I do see a coherent strategy, aims and time frame. We have situations in this democracy, deep problems that are messy. Other countries are not immune, and I think we are doing pretty well, in a messy situation, and being the world’s bellwether still, shouldering more than other countries. We are a wealthy economy, still. Lots of problems have origins in the social conditions, the governance structure of the USA, and the trends in wealth distribution. Many causes are external to the Fed. The too-easy call is to lump it all on the Fed. The incessant doom p*rn on some site comments can be amazing. It is hard to demonstrate the alternatives we would have without this, but try mass riots all across USA cities that didn’t happen in 2021.

i see comments like this all the time, and what you fail to realize is that the fed didn’t fix anything. it just transferred pain to other people and prolonged the inevitable. i don’t see why avoiding mass riots in 2021 is such a good thing if even worse riots occur in 2026.

Yes, the interest rate repression undertaken by the Fed during the Obama years caused the US Social Security fund to lose hundreds of billions in dollars of interest income that would have made it solvent for many more years.

It got a break for a about two years under Mr Trump and is now even worse.

Interest rate repression kicked into gear bigly in early 2019 when the Fed started cutting rates. In mid-2019, it ended the balance sheet run off, started cutting is policy rates, and started printing 100s of billion via repos and Treasury bills, all in 2019 before there was any kind of crisis, just a repo market hissy-fit. And it continued printing money by buying Treasury bills through February 2019. Then in March 2020, it cut rates to near 0% and created the biggest and fastest money-printing operation ever… all under a Republican chair of the Fed and under Trump. No other president ever got this much this fast.

Sure, if you say so.

8 years of interest rate repression under Mr Obama disappears because of one year under Mr Trump.

Some real facts for you taken from US Social Trust Fund documents:

1. The trust fund had cash flow deficits in 11 of the past 37 years which were from 2010 to 2020.

2. Net interest peaked in 2009 at US$118 billion and declined every year since then.

3. In 2020 the net interest income was only US$76 billion

4. The total decrease in interest income from the peak amount since 2009 is about US$270 billion dollars.

5. The amount of interest income fell slowly and then tanked as the interest rate repression was phased in as lower rates worked through the Trust Funds holdings.

6. From 2009 to 2010 it only fell by about $US1 billion from the peak. In 2018 it had fallen by over US$35 billion. In 2020 the amount was US$42 billion.

7. During the period from 2008 to 2020 the Trust Fund balance increased by some $US500 billion or about 20%.

So the huge fall in interest income is even worse than than it appears.

Had the same rates been in effect at the peak rate in 2009 and based on the current balance the interest income would have been some US$140 billion instead of only US$76 a huge difference of US$65 billion.

the interest rate repression under Mr Obama has caused a huge loss in income for the US Social Security Trust Fund.

Going forward the amount will increase for a while and then decline as the Trust Fund balance gets depleted which will happen many years earlier because of this interesr rate repression.

The Trump years will work its way through into the figures, but the impact will be less for a number of reasons:

1. Fewer Years in the Trump administration.

2. A small uptick in rates for the first year or so of his administration.

3. A lower Trust Fund balance over the upcoming years until it is depleted at which time there will be zero interest income. Less balance to earn income on which means less of an impact.

https://www.ssa.gov/OACT/STATS/table4a3.html

There are only two reasons for supporting FRB or any similar central bank policy:

One: Believing there really is something for nothing, contrary to physics and logic.

Two: Knowing society is increasingly falling apart and are trying to keep it glued together as long as possible. It’s called “kicking the can”.

If there is a door #3, what exactly is it?

The US as a society isn’t wealthy. Remove the artificial support from government deficit spending and artificially cheap credit from the loosest credit conditions in history and it collapses into widespread unprecedented poverty.

Most “wealth” in this country is fake. The greatest asset, credit and debt mania in the history of civilization centered on the USD which has inflated the debt, stock and real estate markets to ridiculous heights.

The riots? That’s part of door #2 I provided above and coming later, one way or another and big time. It’s coming because fiscal and monetary policy can’t paper paper over the underlying long term social decay in American society forever, going back my entire life to the 1960’s.

Politics is substantially about dividing the “economic pie”. It’s one thing when it’s growing. It’s another entirely when it’s both shrinking yet expectations still remain that it is or will continue to grow in the future.

This is presumably one reason why politics is increasingly bitter this century. More and more people realize the “pie” is shrinking and are fighting to keep enough of a share to maintain or increase their economic position at someone else’s expense.

best comment i’ve seen all month on any blog. during the post ww2 boom, there was more than enough to go around, so society was fairly cohesive and peaceable. starting in 1970 or so, it’s all been downhill, but it’s been gradual enough that we haven’t completely fallen apart. i think we’re reaching the bottom of the hill faster than anyone can imagine.

I suggest re-learning your history of the 1960s and 1970s… not much cohesive or peaceable going on back then, with all the political assassinations, civil rights movement protests, massive rioting, antiwar movement including college shutdowns and students massacred, and major labor upheaval… In short, there were far MORE riots and protests then than now.

The reality is that history is always doing random unfair sh** to some fraction of the population, and those on the short end NEED to get up and do something about it, because otherwise nothing gets fixed or gets better. If you just sit around and whine you’ll get shafted over and over again.

Augustus,

Can I have some of your pie…

I don’t think I have enough…

Leave a little bit for yourself, though… I’m not greedy…

More seriously, the problem is the one at the bottom of the ladder wants to be at the top without the time and effort to climb…

give me a friggin break. that may have been true at one time, but when the fed is intentionally printing money that goes to current asset holders, pricing even people with good jobs out of reasonably priced assets, like houses, how exactly are those at the bottom supposed to “climb?” more accurately, the people at the top are pulling the ladder up behind them.

Jake,

I don’t disagree with you…

My point, even if poorly expressed, is that maybe NOW is not the time to try to climb that ladder…

Today’s situation may or just as importantly, MAY NOT continue in the future…

When you are 30 yrs old and beating yourself up if you don’t buy an overpriced new house or new car, you tell yourself and are told you are a failure in this warped situation we’re in…

Some commenters in here have expressed that same sentiment…

My main point is be patient, be smart, improve your current situation and proceed slowly…

Everybody can’t win…

If you try to play this game now, you’ll probably lose… rather than try to win, right now is a time to try not to lose…

There is a Door #3, which is called Face the Damn Issue,

a principle that the nation’s leadership used to understand.

But that was back in the days when appropriations bills were passed prior to the start of the fiscal year, when pride was taken in a balanced budget, when policymakers were capable of compromising to increase the pie for all….

phleep,

The Fed created in just 18 months the biggest wealth disparity ever, on purpose, and unapologetically. Regular people get to eat inflation. Revolts are nurtured by this principle.

Find the green line — the bottom half of the population, from the Fed’s own data:

https://wolfstreet.com/2021/10/02/my-wealth-effect-monitor-for-our-money-printer-economy-is-out-in-the-pandemic-the-fed-totally-blew-out-the-already-gigantic-wealth-disparity/

I am trying to find the Purple line :-)

Thank you. I totally agree. Blaming the Fed for America’s financial problems seems just bizarre to me. They seem to have been the ONLY rational actor in Washington for the past dozen years. And they have not gotten any help from the political side of the city.

As I type this the Reconciliation Bill has stalled in the Congress after having been lowered from Six Trillion in spending… to $3.5 trillion… to today’s $1.75 trillion. That $1.75 TRILLION is being depicted as some sort of consolation prize… and yet it is TWICE the amount that Congress appropriated in 2009 to get us out of the Great Recession (the Obama Stimulus Package). And it comes ON TOP of a bipartisan Infrastructure Bill that is spending another $1.2 trillion.

THREE TRILLION DOLLARS in future deficit spending being appropriated in a single year… and people on this site want to blame THE FED for the inflation that we all see coming???

No! As you say, the Fed had a plan and executed it. They saved the system when it needed saving. But they can’t save us from ourselves. We keep electing these Goobers and we are going to pay the price for that.

SpencerG,

“the Fed had a plan and executed it. They saved the system when it needed saving.”

The Fed saved the wealthy and made them immensely wealthier, at the expense of everyone else (inflation). That’s what the Fed did. And that’s the system, and so yes, the Fed saved that system.

The government paid some people some unemployment compensation and a few other things. That saved those people. And that would have worked just fine without $4.2 trillion in QE for the wealthy.

Wolf…

Let’s hope that the rich will be hurt by the coming QT as much as they have been helped by QE. But neither the Middle Class nor the Poor would have come back from a financial system collapse.

THAT is who the Fed really saved.

SpencerG: “But neither the Middle Class nor the Poor would have come back from a financial system collapse.”

The assumption in that statement is that there was no other way for the Fed to prevent a financial collapse, other than skyrocket windfall assets for the wealthy.

As I stated before current QE equates to about a minus 2% Fed funds rate resulting in a lot of bad stuff. Who knows exactly how much of taper they can get done before economy locks up?

One thing has proven to be true, it’s very easy for Congress to vote yes on spending and know on tax increases leaving Fed to fill the gap with Zirp.

Good article! Bringing us up to date on the current positions of the Fed.

Where is the outrage on the Fed not lifting a finger to raise rates to halt this crippling inflation?

The Fed does have alleged oversight, and the best I can tell it is Sherrod Brown on the Senate Banking and Finance Committee. Right? Crickets.

And Legarde not lifting a finger with inflation over 4% there.

Who decided back in 2009, it seems, that the Fed would no longer fight inflation, but in fact promote inflation and let it run? What a policy change…..what a deviation from the mandates/agreements/instructions under which they are allowed to exist and operate!!!

We are about to see the damage and the self generation and geometric progression of inflation, IMO. Every union in the country is poised to go on strike, which will lead to more price increases passed along, then more inflation, them more strikes.

“Stable prices” is the only SANE posture of the Fed, and it has departed that posture…….gone rogue and off the rails. Who allows, who benefits, and who pays? I’ve got an idea….

Bank robbery leaps to mind.

“ Who decided back in 2009, it seems, that the Fed would no longer fight inflation, but in fact promote inflation and let it run? What a policy change…..what a deviation from the mandates/agreements/instructions under which they are allowed to exist and operate!!!”

h,

They did that to protect the baby boomers and their voting block…

If you look at most charts, the expansion took off from the mid 90s on… right when the boomers came of age screaming “ gimme, gimme, gimme “…. US population increased appx 1/3 since the 80s without an industrial base to support it… add in a dash of social wokeness and the politicians to support it… and here we are… nobody has the guts to say “ you’re screwed,..we did it… sorry” and then try to reset this crap society the boomers gave us…

They are hoping it will fix itself through appeasement without having to take the blame for it in history…

Huh? Until this year, inflation has averaged less than 2% for the period since 2009 (when it was actually negative). The Fed has a DUAL mandate and fighting unemployment was far more important than fighting historically low inflation rates.

first, it wasn’t 2% when you account for things that actually matter, like housing, food, health care, education and so on. the fact that you can buy cheap samsung tvs does not low inflation make.

second, you can’t exclude assets from inflation calculators if you’re being honest.

The “Core Inflation Rate” of food, energy, and the like has done better than the overall inflation rate. It hasn’t hit 3 percent since 1995. Like the overall rate… from 2009 to 2020 it was less than 2 percent in eight out of twelve years. UNLIKE the overall inflation rate it never hit 2.3 percent in that timeframe… much less 3.0 percent.

Spencer, wake up.

The cost of housing has doubled in 10 years.

The cost of retirement has tripled. An annuity generating a fixed income stream costs 3x what it did just 10 years ago.

These are the two biggest necessities, and they have been in a state of hyperinflation for at least a decade.

Bobber…

I don’t think we should compare temporary highs to temporary lows. Housing prices in 2011 were still at a low because of the housing bust of 2007-2008. House prices now are at a temporary high due to the pandemic stimulus money.

If instead we compare Q1 2005 to Q1 2020 we see that house prices are up on average from $288,500 to $383,000 according to FRED. Up by a third in fifteen years… an average of 2.18% per year (without compounding).

It depends on the location. On the coasts, it’s housing hyperinflation no matter how you slice it. Houses in my neighborhood were $800k in 2015. Now they are $1.5M.

“the current positions of the Fed”

The Fed heads are all getting caught insider trading and front running their policies. Didn’t Chairman Pow just get exposed as well. I’d like to know more about their personal current positions as well.

What if the Fed and Treasury are doing all the things they can to keep the economy from collapsing? That is how I see it. I don’t like it, but the alternative is really, really bad.

Fear of falling as you climb farther up the tree and out on the branch?

Too high is …..”too high’

The Fed has FORCED misallocation of resources….

The drug user analogy is perfect…

We cant raise rates because we have too much debt….they say.

So, I guess we keep in place the fake low rates that subsidize more of the debt creation and more of the problem?

Its like the crack user saying…’all my teeth are gone, so why stop now?”

see my above comment. also, historicus is right. you don’t fix a problem by bailing everyone out. then the moral hazard just continues.

Here we are with the results:

1. 19% of income is transfer payments.

2. 20% of companies are zombies

3. record trade deficit

4. negative real return on savings.

5. junk bonds yielding less than inflation

6. young people gambling on crypto instead of paying off student loans

20% of companies being zombies understates the problem. many of the ostensibly healthy companies are reliant on zombies for their customer base.

Add in that 20% of the US economy is the pathetic immoral extortionist medical services industry that can’t even be honest about prices.

GOOD, actually very GOOD summary OS:

While some or maybe many of us ”older than ‘boomers”’/…

keep trying to ALERT,,,

WE the Peons continue to be either ”left behind” or ”right behind” because WE only want to work and be paid appropriately to our production…

Doesn’t matter now, and has not mattered for at least since the various and sundry very clear ”advances” of the various and sundry groups advocating for this, including, clearly, ”communists” in every country, as well as the ”trade unionists” in many countries, as well as the ”wobblies” and similar workers of the world in many countries,,,

most of them ”put down” by machine guns,,,

Mike R.

Exactly. My other comment like this is in moderation at the moment. But I agree with you that the Fed has been doing what needs to be done (since 2009) to keep the economy from crashing. They have made their mistakes with the “taper tantrum” and “taper tantrum light” (if you will)… but their overall performance has been heroic. They are doing things never before imagined by a Central Bank (at least in the U.S.) and deserve praise for doing so.

As you say… the alternative is really, really bad.

SpencerG,

“but their [the Fed’s] overall performance has been heroic.”

I hope you’re being sarcastic. If not, have a look at the chart I posted above.

To call creating the biggest wealth inequality “heroic” is quite something.

Wolf… what do you think that chart would have looked like if the Great Recession (or the COVID Pandemic) had become the Second Great Depression?

Would “wealth inequality” be MORE… or less? Answer: The billionaires never get hurt in those things.

If we want to reduce wealth inequality then there is a SIMPLE solution… Congress can raise taxes on the rich. Personally I would start with restoring the Estate Tax system that has been totally gutted over the past two decades. I can think of no better time than one’s death for there to be an accounting of one’s life… financial and otherwise.

” if the Great Recession (or the COVID Pandemic) had become the Second Great Depression?”

Inflating asset prices has very little to do with the real economy. But inflating asset prices is all the Fed has done. This “what-if-Great-Depression” BS is constantly trotted out. But it’s the worst red herring EVER. It’s a cover-up and a rationalization for what the Fed has done.

The government pays unemployment compensation, not the Fed. The government provides the safety net for the people who get laid off. That works and is well established.

But those safety nets were NOT in place during the Great Depression. Laid off people starved and had no money to pay for stuff. And so the economy kept spiraling down.

But when people receive unemployment compensation and other benefits – which were not available back then – the downward spiral is interrupted because people keep spending money even after they lost their jobs. That’s why these government safety nets are beneficial to the overall economy.

The situation during the Financial Crisis was totally different from the situation during the Great Depression – because back then, there were no safety nets.

And during the pandemic, the government created additional safety nets. And I’m OK with that if applied to people who need it.

But the Fed has simply made the already wealthy immensely more wealthy. It has led to more concentration of power in the corporate sector and has produced all kinds of other evil things, and it is now fueling this inflation.

@ Spencer G and Wolf

It is amazing that how many think Fed is doing a great job!? Either they belong to top 10% who have 90%+ wall st wealth or living in a Cacoon of their own!

Wolf – I agree with 100% with your answer to Spencer G.

I have been in the mkt since ’82. Never I have witnessed a rigged mkt, on massive scale supervised by regulators, Fed and vested interests against the common interest of the oublic.

At the same time JP denying his (FED) criminal role in creating the most inequality in Income & wealth in American history. WE are now no way, different from a South American ‘banana Republic” reined by Oligarchy!

You don’t get to say the team played a good game at half time. Fed’s done the fun part by keeping people drunk for 20 years. At some point you have to unwind what you did and land the plane safely.

“the alternative is really, really bad…”

for asset holders.

The bottom 1/3 of society will hardly notice if houses and stonks tank. Society has already collapsed for them. Another bad alternative for asset holders is the bottom 1/3 running out of food and shelter.

I think the strategy is to ignore poverty and hopelessness until they can no longer, then make it illegal to be poor, unsheltered, or a dissenter.

People are getting angry out there. I see it every day. So much division has been sown in the last five years. It keeps people from addressing the real problems like the massive theft by supra-national corporate oligarchs and the kleptocrats that service them.

Tell us why a drop in asset prices will lead to something really, really bad. If you can’t, perhaps your hunch is wrong.

Depends on the “asset” that you are talking about. For most people that is their house. It should be obvious why the loss of value of THAT asset would devastate most Americans.

It only hurts if people owe huge amounts for a declining asset in their house, then hope to sell it as an investment. As long as a person’s home is at the cost of rent, or below, they will be fine. As they say, buyer beware.

I’ve owned a home now for 42 years, buying the first place at age 24. It was a shack, to be honest. We have weathered numerous recessions, layoffs, and housing downturns along the way, and quite frankly we could care less what housing does. It is all relative. If we sell and receive a lower amount at closing, a new place will correspond to that lower price. The secret is to get into the housing market with realistic monthly payments, use the 1/3 NET income rule, set the terms to mimic area rent prices, and save and pay the place off ASAP. If you can’t follow the 1/3 rule then you are buying too much house, living in the wrong area, don’t earn enough money, or all of the above.

This system worked 40 years ago and it still works as I watch my children following the same strategy.

Pretty good scam. Export good paying jobs to beef up company profit margins. (Yes, all equity holders are silently complicit.), thereby increasing the speed of the educational hamster wheel, whilst siphoning more and more potential future earnings from the now disenfranchised Labor seeking an alternative path to gaining the American dream. Prop up asseet values through manipultation. Bring in unskilled, easily abused, illegal labor. Co-opt reporting via corporate buyouts of the once occassionally credible media. Placate the sheeple with opioids, weed, streaming dreck, and distract with purposefully inflammatory and divide-and-conquer sociopolitical crack. Crush the peasants, good sport, wot!

CtP,

Two points….

1. You would make an assumption that all are relatively intellectually equal…

2. The situation you describe above, while not necessarily false, requires a seller and a buyer to produce… which would therefore make statement no.1 false…

It can’t go both ways…

I vote for the Krueger-Dunning effect myself…

“1. You would make an assumption that all are relatively intellectually equal.”

… Way to go with the straw man argument. Are you the tin man?

2. The situation you describe above, while not necessarily false, requires a seller and a buyer to produce… which would therefore make statement no.1 false…”

… what are you saying? Are you saying it takes a buyer and seller to make intellects equal, or the opposite. Forgive me, I’m not as smart as you.

Otis,

You, my friend, are definitely smarter than me…

If everyone is of the same relative intellect, then the decisions that many make that keep them poor or less wealthy would not occur… there would be no marketplace for overpriced houses, autos, etc to sell because smarter people would not buy them…

Same for drugs ( illegal) and many other ills that keep poor people poor…

One would have to assume that poor people, being of the same intellect as me or you, would not do these things…

So what is the difference…

The answer is intellect and its application in everyday life that successful people do and others don’t…

I actually identify with the cowardly lion….

As an anecdote, I used to frequent a blog a while back of a cartoonist ( think Dilbert) who was hawking his book for sale on “ how to be successful “… I asked him how many copies he gave to people living under the overpass… never got the answer… he called me an a$$hole and blocked me… I thought it was a fair question…

I’m pretty sensitive and that really hurt my feelings :)

The dollar (DXY) has broken out. Will go much higher as the Fed tapers. A lot of debt will find it’s way to money heaven. This will strengthen the dollar more. DXY will top over 110. Should be a great buying opportunity for those who have dry powder.

Simultaneously gaining value and losing buying power domestically.

This entire situation is too weird.

The QE over the past decade has essentially created a wormhole into a place where no logical economic theory makes sense.

That losing buying power domestcally on buying imported goods is for sure weird with the curency gaining strenght at the same time.

All this printed balance sheet and nothing to show for it. I just dropped the grandkids off at school, the number of newly financed SUVs and pickups (with the latest fancy tailgate) is mindblowing. All in the 50k to 90k range, bright shiny gas guzzlers sporting along on the unrepaired roads of the poor south. More (much more) stimulus payments will be needed soon just to make the payments on all this fluff. Most people here like to look better off than they are.

Off the subject, but on the subject: Left out of the latest 4 tril+’infrastructure’ bills (again) is I-49 in Arkansas, the last link needed to complete the interstate from Kansas City to southern Louisiana. Why blow a couple of printed billions on something actually needed employing hundreds to build? Is there just no way to import a highway from China?

interstate highways are the least of it. many of our bridges are structurally deficient, our rail system sucks, our power grid sucks, and so on.

a sagging tree in ohio should not have caused a cascading failure that left 50 million people without power.

“ a sagging tree in ohio should not have caused a cascading failure that left 50 million people without power”

Everything was fine until that Russian butterfly landed on it…

Why di I sense that you drink Gin and read Nabokov?

Good update. During the QT period, the Balance Sheet posts at Wolfstreet are what brought me to this site in the first place.

How surprising that MBS purchases spiked in early 2020 and shortly thereafter the real estate market went insane.

I’m sure it’s just a coincidence.

They needed to rescue the soaring housing market /s.

The Fed has signaled the markets to keep inflating . We ain’t really serious about inflation. That’s the un-washed masses problem. Everything is fine in the rarified air in Georgetown. The Fed will nibble with tapering in November to give Congress a talking point that the masses will accept as good enough but nothing much will change except they will have higher inflation. The markets know the Fed ain’t serious about inflation. Only external events out of control of the Gov’t and the Fed will bring change. The un-washed masses could get it done quickly but they are spending their time worrying about the behavior and the thinking of their un-washed power-less neighbors. Only massive pain yet to come,will focus their thoughts. And god knows what the object of that focus might be. It’s a good bet it won’t be the Fed .

Only industry we have left. You can’t spell FIRE without Real Estate.

Houses in Seattle that you could get for 250k not more than ten yrs ago are going for 2.5 mil.

The market here on QA keeps getting reset every six months. A new house with no lot and some fancy SF style finished went for 3 million.

New target- 3 MILLION. Tell me that the yearly jumps of 100k then went to 500k and are 1mil a year aren’t a sign of Fed-induced Hyperinflation….

To stave off the coming deflationary crash

It’s only a deflationary crash for the person who bought a $500k house for $2.5 million and sees the value drop to $1 million. The old feller who bought the house for $250k ten years ago is just fine looking out the window as the neighbors come and go, eating microwave popcorn with netflix, and a big gulp thirst blaster soda and chicken tendies.

The FED has painted itself into a corner, crash or inflate those are the only choices left, and BTW the stock market is not the economy.

MF

Fed takes on a partner, first time ever. (March 25 2020) Blackrock which runs $10 Trillion dollars and has major investments in residential real estate.

In the first quarter of 2021, 15% of U.S. homes sold were purchased by corporate investors — not families looking to achieve their American dream. …BlackRock is one of a number of companies mentioned by The Wall Street Journal in a recent exposé. (source strangesounds.org)

Another giant private equity firm, Blackstone, is also deeply entrenched in U.S. real estate. Blackstone is the largest landlord in the U.S. as well as the largest real estate company worldwide, with a portfolio worth $325 billion. In June 2021, Blackstone agreed to buy Home Partners of America, a company that rents single-family houses, and its 17,000 houses, for $6 billion. (source strangesounds.org)

The Fed started buying MBSs at a $40 Billion a month (40,000 Million a month, in other words) in March of 2020, almost concurrent with the partnership with Blackrock.

A detailed contract appears on the New York Fed’s website for BlackRock’s management of the agency commercial mortgage-backed securities facility. That contract reveals this:

“…the Manager is hereby appointed as the FRBNY’s [Federal Reserve Bank of New York] agent in fact, and it shall have full power and authority to act on behalf of the Account with respect to the purchase, sale, exchange, conversion, or other transactions in any and all stocks, bonds, other securities, or cash held for investment subject to the Agreement…

“This Agreement shall be effective as of the Effective Date and shall continue until terminated.”

From the agreement itself. As of now, the agreement has not been announced as terminated.

My thesis, from watching this all replay like it did in Post -2008 crash, is that the ‘Blacks’ are being positioned to come in protect real estate prices, at ANY cost.

Here in Seattle, in the near future, all houses will be worth 10 mil and everyone will be homeless…. ‘Blacks’ will be the only owners.

you refer to “stone and rock” correct?

Sure looks that way.

historicus,

Quit repeating this lie that the Fed’s purchases of MBS are linked in any way to Blackrock. The Fed’s purchases of MBS have ZERO to with Blackrock. The Fed has been buying the MBS in the TBA market for over a decade.

Blackrock, along with other bond fund managers such as State Street, was involved in setting up the minuscule corporate bond purchase program which purchased $13 billion in bonds and bond ETFs, but ended in Dec, and is now dissolved, and the bonds have been sold.

Last warming. Future lies about MBS-and-Blackrock will be deleted.

Quote the lie you say I commited

from the actual contract between Blackrock and NYFRB

section 2.1

“ That contract reveals this:

“…the Manager is hereby appointed as the FRBNY’s [Federal Reserve Bank of New York] agent in fact, and it shall have full power and authority to act on behalf of the Account with respect to the purchase, sale, exchange, conversion, or other transactions in any and all stocks, bonds, other securities, or cash held for investment subject to the Agreement…

“This Agreement shall be effective as of the Effective Date and shall continue until terminated.”

historicus,

I’m going to explain this one last time to you, including the lie you committed:

The type of security that this agreement that you cited relates to is specified at the top of the contract (I added the bold):

“… is made between the Federal Reserve Bank of New York (“FRBNY”) and BlackRock Financial Management, Inc. (“Manager”) with reference to the following facts:

“A. The Federal Open Market Committee (“FOMC”) has authorized and directed the FRBNY and its Open Market Desk to purchase for the System Open Market Account (“SOMA”) agency commercial mortgage backed securities (“Agency CMBS”) as part of its domestic policy directive.

This was part of March 2020 arrangements, as I said a million times. This is NOT related to the Fed’s regular MBS, but to CMBS that it bought in March through May. The Fed bought a total minuscule $9 billion (with a B) in CMBS. The program ended last year. It’s over.

These CMBS is the ONLY this this contract relates to. The paragraph you cited was boilerplate, but you conveniently left out the key sentence in the paragraph:

“… subject to the specific limitations made part of this Agreement, including the investment objectives and guidelines attached to the Agreement as Exhibit A (as further described in Section 5.1) and instructions as described in Section 15.2.”

What are these limitations? The CMBS, and only CMBS. And with all kinds of further limitations.

So make sure you read the top of the contract that defines what the contract is about.

The Fed made a similar deal about its corporate bond and bond ETF purchases in March 2020 (the infamous CCF SPV), which totaled a whopping $13 billion (with a B), were terminated last year. The Fed has now sold the bonds and ETFs, and they’re gone. I cannot remember how many times I have told you this. But you keep refusing to understand because your fantasy is just so much more fun to cling to.

Clearly, you cannot distinguish between $9 billion (with a B) in CMBS, authorized in March 2020 and now terminated, and the Fed’s regular purchases in the TBA market of residential MBS now amounting to $2.5 trillion (with a T). And clearly you don’t know how to read contracts. OK, fine. But don’t be spreading lies about stuff you don’t understand or don’t want to understand. You can ask a question if you don’t know, no problem. I’ll be happy to answer. But don’t spread lies.

In 1999 and 2006 inflation was just below what we are experiencing now.

The 30yr mortgages were 6%, above the then inflation rate, and double what they are now.

Why would anyone or anything lend money, buy MBSs 30 yr paper, 2.5% the current inflation rate? Who would advise the Fed to do such a thing.

Answer in previous post.

should read “2.5% BELOW” the current inflation rate.

Wolf

The arrangement between the Fed and Blackrock is not limited to CMBS. Per the NY Fed

SMCCF_Terms_BlackRock.pdf (newyorkfed.org)

BlackRock FMA (financial advisory unit) will buy and sell corporate bonds, corporate loans, and corporate bond ETFs as a fiduciary on a best execution basis, in order to best advance the Facility’s objectives.

As part of BlackRock’s overall fiduciary duty to the SMCCF and the New York Fed, BlackRock FMA will act as a fiduciary in the selection of ETFs on a best execution basis.

The SMCCF (Secondary Market Corporate Credit Facility) may purchase a diversified set of U.S.-listed ETFs whose investment objective is to provide broad exposure to the market for U.S. investment grade bonds, when and where ETF execution offers efficiency, speed, and liquidity benefits to achieve the purposes of the Facility, including rapid transmission of Facility policy to the secondary market.

https://www.newyorkfed.org/medialibrary/media/markets/special_facilities/SMCCF_Terms_BlackRock.pdf?mod=article_inline

historicus,

Give it up. You’re not even reading what I wrote. You’re hung up in your stubborn BS about BlackRock. Why do I even waste my time? READ THE COMMENT I WROTE, including this 2nd paragraph from the bottom:

“The Fed made a similar deal about its corporate bond and bond ETF purchases in March 2020 (the infamous CCF SPV), which totaled a whopping $13 billion (with a B), were terminated last year. The Fed has now sold the bonds and ETFs, and they’re gone. I cannot remember how many times I have told you this. But you keep refusing to understand because your fantasy is just so much more fun to cling to.”

What was initially called “SMCCF” was later abbreviated to CCF, which is the SPV I’ve been reporting on for 20 months that is now gone, and that I mentioned in my comment above and in my article above (last chart).

The SAME agreements about these SPVs exist with State Street and a whole bunch of other bond fund managers, and you can google them. BlackRock was just one of them. You refused to read my reporting on it for the past 20 months. You refuse to know anything because you’re hung up in your stubborn BS about BlackRock.

This SMCCF, renamed CCF, is the yellow area in this chart, which is in the article above, and since you didn’t read the article, but waste my time with your stubborn BS, I’m going to re-post it here. The CCF is the yellow part that maxed out at $13 billion and is now gone.

Any future stubborn BS on this topic will be trashed. I don’t have time to mess with it. Either you get it, or you don’t. Up to you. I don’t care. But you’re not posting this BlackRock BS here anymore.

historicus,

And I know what site you get get his BS from. I call them “purveyors of fiction” because they’re either totally ignorant about finance or they’re doing it on purpose to get clicks.

For example, they didn’t even understand how repos worked, that they’re in-and-out transactions. They just added up all the “ins” without subtracting the “outs,” and came up with this ridiculous figure of $15 trillion in repos hidden at the Fed somewhere. It was just pure braindead ignorant BS, or termed differently, fiction about finance. Fun to read but made up BS. I called them out on it because I got tired of seeing this BS in the comments and in my inbox. And that stopped it.

When you go to their site, just understand that you’re reading fiction. And don’t drag their fiction BS into here.

The FED can do whatever it wants, whenever it wants. Their dual mandate of “maximum employment” and “moderate long-term interest rates” allows them to use one, the other, or both as an excuse to do whatever. Inflation is measurable (albeit we argue about the rate as noted in this article) [or you just label it as transitory], but max employment can never be satisfied. Just before the pandemic we has both low inflation and arguably full employment. But then the argument was that the unemployment numbers is not capture those who as stopped looking and/or that some specific underclass was not fully employed. Even in the best of times, there is always some sub-group of the population that is un/under employed. Hence, the FED can come up with an excuse to do whatever it wants. So we can whine about inflation all we want, they see the numbers but have other priorities.

I believe that they must print dollars to keep this ponzi skeme going. Once they stop printing, this house of cards will fall…

“Dual Mandate” usually refers to Max employment and stable prices.

Indeed, there is never a reason to raise rates with this new breed of Fed (starting with QE Ben Bernanke)

5% unemployment used to be considered full employment..we got to 3.5% and they said…”we cant tighten now, things are going great”

Then we had the “emergency” and then again we heard…”we cant tighten now, things are bad.”

You are correct…the Fed is autonomous, unmonitored, and undisciplined to their three mandates…max employment, stable prices and moderate not extreme long rates.

There has never been such a wide gap between the rates the Fed sets (Fed Funds) and the inflation rate.

For 7 decades until 2009, the Fed kept rates up there with inflation, much of the time in excess of inflation…..then this new breed of Fed came in…rogue, off the rails, hijacked IMO.

Where are our elected representatives that monitor the Fed and hold them to the agreements/directives/mandates under which they are allowed to exist and operate?

The set up is just like in 79-80, with Paul Volcker replacing William Miller. Today Powell is likely to be replaced with Brainard. So just like in 1980, when gold and silver were skyrocketing, today commodities are skyrocketing. And the distributed lag effect of money flows (which the Fed’s Ph.Ds. know nothing about), is about to peak, just like it did in Feb. 1980, in this Jan. 2022. Volcker panicked. We hope Brainard learned from that.

Oh come on how many times has the FED said there gonna back off. Lets see i can count at least 4. They cant period, how many times do i have to say it Fiat currency is a ponzi scheme. In order for a ponzi scheme to work it needs a constant inflow of more funds. If they back off buying securities the whole system crashes. Our whole financial system is one gigantic ponzi scheme. Fiat is dead, its hanging on the edge of the cliff. All fiat dies, history proves this. Every day it dies a little more. All the FED has done is kept it on life support for 2 decades. Its like administrating medicine to the dead the end result is still dead.

“Common sense without education, is better than education without common sense.” ~ Benjamin Franklin

“Paper money is liable to be abused, has been, is, and forever will be abused, in every country in which it is permitted.” ~ Thomas Jefferson