While the Fed is still printing $120 billion a month and repressing short-term rates to near 0% in the most monstrously overstimulated economy.

By Wolf Richter for WOLF STREET.

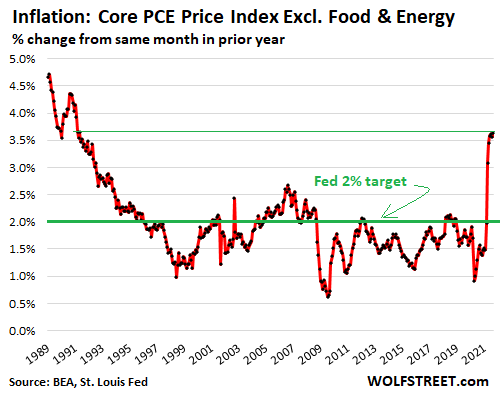

The lowest lowball inflation measure that the US government releases, the PCE price index without food and energy rose by 3.64% in September, compared to a year ago, the hottest inflation reading since May 1991.

This “core PCE” is the inflation measure that the Fed uses for its official inflation target of a “symmetrical” 2%. The reason it uses this measure is because it is the lowest lowball inflation measure the government publishes, and it understates actual inflation even more than other indices the government publishes. For example, CPI-U inflation in September was 5.4% and CPI-W was 5.9%, which themselves understate actual inflation.

Food and energy, precisely what regular people spend a lot of their money on, are excluded from the Fed’s inflation measure because prices of food and energy jump up and down a lot and create even more volatility in the inflation index.

But the regular headline PCE price index – we’ll get to it in a moment – has been running higher over the years than core PCE. Since 2012, when both index values were set to 100, the headline PCE index increased 1.5% faster than core PCE index.

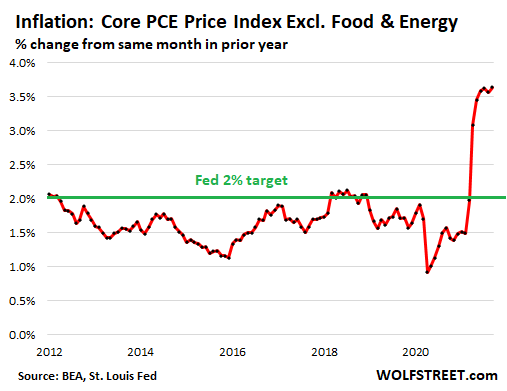

The close-up of core PCE, covering the past 10 years, shows a little more closely what is happening on a year-over-year basis.

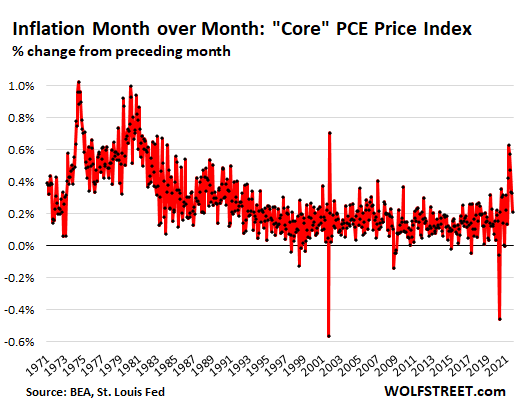

On a month-to-month basis, the core PCE index rose 0.21%, according to the Bureau of Economic Analysis today. Month-to-month readings are volatile. But when they’re bunched together in a long-term view, the dynamics emerge. Note the volatility in the 1970s, as inflation was rising, leading to year-over-year core PCE to exceed 10% in early 1975 and 9% in 1980. In between there were years paved with false hopes that this thing would go away on its own, but it didn’t, and interest rates were far higher already, and the Fed wasn’t doing QE:

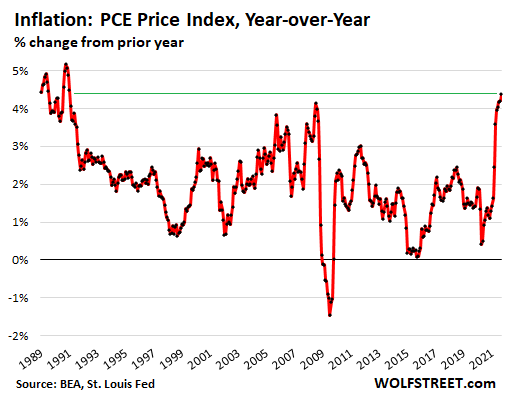

The headline PCE price index, including food and energy, jumped by 0.32% for the month, and by 4.38% from a year ago, the hottest PCE inflation since January 1991:

This inflation surge is happening while the Fed is still recklessly printing $120 billion a month, having amassed $8.6 trillion in assets, nearly half of it – $4.2 trillion – in the past 20 months to repress long-term interest rates and inflate asset prices. And it’s still repressing short-term interest rates to near-zero. With these policies, the Fed is energetically throwing enormous amounts of fuel into the world for further inflation. Read… Fed’s Assets from Crisis to Crisis to Raging Inflation: Balance Sheet Update

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Can anybody think of a reason why hyperinflation will not benefit the rich?

Easy Peasy MB,,, as many on here have said repeatedly and recently:

#1. The availability of light poles, still, in almost every metropolitan area.

#2. The continuing, though less than formerly availability of ”precious metals”,,, certainly including, as always for the last several centuries, Lead…

And BTW, having dealt with a few of the old old money folks, and way to many of the new new money folks, I can and will testify that most, if not all of those types think THEY are ”bullet proof” similar to some of the folks in various and many parts of the world who somehow became convinced they were bullet proof because of some mythology propagated by their ”head honchos”,,, fortunately, WE the PEONS, know otherwise, eh

The uber wealthy and their corrupt political allies will just leave to less corrupt and less destroyed countries.

Their wealth will also leave.

Yeah, they will lose some houses and land…a pittance to their net worth.

It is shocking how many elected politicians have dual passports.

what form do you think their wealth takes? stocks in u.s. companies? what will they be worth if the u.s. collapses? is apple going to relocate all of its operations to one of the less destroyed countries?

The power base of the actually super rich is based upon US geopolitical power. To leave means giving it up. No elite (the real elite) has ever done that in mass.

Most billionaires aren’t uber wealthy. Look at what they actually own, not it’s inflated market value.

And guess which country has the most dual passports/dual citizens ( “dual agents”) in Congress?

MB,

Depends on the cost of bigger walls, gates, security guards, and armored vehicles…

Or that people wake up and quit playing the game these people depend on for their wealth…

What is coming.

Back in the day when I traveled throughout Central America, we would rate restuarants on how many security guards they had and how well armed they were.

A top rating.

Two guards at the front door with semi automatics and a guard on the balcony with a shotgun.

Low rating.

Single guard with a machete.

Keep track of who are the biggest failures in the local political scene, the ones that cost you money, create and vote for policies that disenfranchise your family, and who fail to deliver on their promises.

Don’t forget the heads of local nonprofits that scalp public money paid for by you, and then use it against your interests. Make your lists and check them twice for accuracy.

Well I see a problem the guards below should have shotguns for close range and balcony guy needs the semi auto with a scope.

Depends on the cost of bigger walls, gates, security guards, and armored vehicles…

Rich people already live and travel differently from the rest of us.

Also, people waking up? Just like the depression you mean? Didn’t happen then, will not happen now. Muppets wouldn’t be muppets otherwise.

With hyperinflation all middle class will be millionaires.

Hyperinflation also accelerates wealth gap.

If you think you are immune to the wrath of revolutions, think again. For someone living in a micro apartment who has zero savings, every homeowner looks rich.

Apple is not a American company if you count sales and the countries where the money is siting tax free.

Doesn’t everything benefit the rich?

In retrospect they worked longer hours and sacrificed most earned the money now government doles it out as trump said Elon owes us

We are all “Peso” millionaires already !

The biggest market in the US is housing, which consumes the greatest share of income, constitutes the largest asset and is the one most dependent upon the money supply. However, there is little price elasticity in that market (just look at its little cousin hotels, no guests and the room rates drop precipitously). If the demand slacks off, because of fewer people, low birthrates, little immigration, no maintenance personnel for larger estates, etc., the prices implode. Just look at areas where folks don’t want to live anymore. What happens then, is what the real estate investors and the finance industry fear: Folks walking away from their houses, stiffing the banks, and moving into better, but now cheaper digs. The investors and most of all the finance overlords (who incidentally also control all the big corporations) will be broke overnight. That’s why they are desperately selling the idea of more people (immigration) and supporting demand with public money. It’s keeping the carousel going. We got a first taste in 2008, the next crash will be a lot bigger.

I want to alleviate the shortage of comments and unload my thoughts.

1. Nothing is written in the stone. Even if the prices surges, money printing will be justified because, people need more money to buy stuff

2. The first two graphs are like a snake raising its head before the bite. Anyway only poor and middle class will be bitten.

3. There are two kinds of people in USA. One believes the institutions are doing a perfect job. Others don’t even know what is going on.

4. Bipartisan usually means that a larger-than-usual deception is being carried out.

5. The scariest costume of this Halloween will be FED chair.

Bi-partisan:

Republican: socialism on the installment method.

Democrat: socialism on the fast track

For anyone who doesn’t believe me. “Compromise” is always toward more and more government. Never sufficient votes to get rid of anything of substance.

More and ore government is a symptom of a society falling apart, regardless of the (supposed) underlying reason.

Keep on doing what’s failed spectacularly.

Supposedly, it will work one day.

Amen

If they are landlords or other creditors they will be paid back in increasingly worthless currency.

Maybe JPs next gig will be a drug counsellor: ‘now you don’t want to quit too fast. Cold turkey is no fun. Why don’t we set up a plan where you can think about maybe tapering your use to what a more moderate party person might consume on a fun weekend? That way you don’t suffer and I get to keep you as a client.’

To be serious, if I could ask JP one question it would be this: “Every economist agrees that real interest rates are far below inflation, one UK banker says the lowest in centuries. You have announced your intension to normalize them. Are you prepared for a large number of people who have made investments thinking these rates are normal, to be very unhappy with you as you take away the punch bowl?

Meaning: if you are seeking popularity, the job of Fed Chair is not for you, anymore than it would be for a bank manager anywhere. This is why it’s a seven year appointment. It’s not an elected position to prevent a populist from holding it. At least that was the idea.

Who gave these jokers this kind of power????

They are destroying the middle class, working poor, retired and savers.

“This inflation surge is happening while the Fed is still recklessly printing $120 billion a month, having amassed $8.6 trillion in assets, nearly half of it – $4.2 trillion – in the past 20 months to repress long-term interest rates and inflate asset prices.”

I agree with you 2 banana. Who indeed? The answer is me and you in a perjorative way. The Electorate if you prefer. We the people have not been paying attention and we got rolled. Well worn Pogo-isum but still efficent in explaining our dilemma.”We have met the enemy and it is us”.

Who? Among some few others, Nelson Rockefeller’s grandfather.

Depressing but voting doesn’t actually matter.

Which pre-selected clown do you prefer? Tweedle Dee or Tweedle Dum?

If you want to clue someone in, who is clueless, on what’s happened to the economy and our civic life over the last couple of decades,

“While The Rest of Us Die” is a great series on Vice.

Love the segment on “The Game Is Rigged.”

Made me finally understand how the wealthiest get away with paying zero taxes after transferring the national wealth upward.

“The Game Is Rigged”

“George Carlin – The big club” on Gábor Hényel YouTube channel.

Looks like inflation ran swimmingly until the late 80s/ early 90s…

The drop I assume after that was the off shoring to China…

Started again rising but got whacked by the GFC…

Then started rising again ( even with all the Fed intervention until appx 2015…

Then rising again until the Rona…

What happened in 2015 ish?

I don’t recall…

10 year Treasuries were 9% in 1990.

Mortgage rates were around 14%

In 2015 the rich Chinese started leaving China.

I buy the same bottle of shampoo every two years (big bottle, little hair). Just for kicks I looked back at the last three purchases including this week.

2017: $21.50

2019: $24.50

2021: $41.25

We buy shampoo and conditioner by the gallon. A gallon lasts three of us for just about a year. Works out to about a dollar a week, or a nickle a day per person.

You’re not paying for the packaging for one thing. And, often you can special order the gallons through your local market if they sell the small bottles.

According to those in power in the WH.

This is a great sign.

It means folks are buying and spending and building back better!!!!!

Will you still buy if the price is $10,000 each?

but…but…those are hairdonistic adjustments!

😂

Hi Wolf,

I respect your work very much, but what if the stagflation thesis ends up being wrong?

The BEA’s (admittedly lowball metric, but it’s what the FOMC uses) numbers do indeed show monthly inflation coming down. The last 5 month-over-month core PCE readings were 0.6, 0.5, 0.3, 0.3, 0.2. The year-over-year number increased due to base effects.

The S&P 500 just broke through 4,600, and 10-year treasury yields just dipped back to 1.55% after failing to break through its March high of around 1.75%. Markets are pricing in a Goldilocks scenario in which core PCE inflation, if it continues at a 0.2-0.3% monthly rate, will be back down to 2-3% by the middle of next year. Under this scenario, the FOMC won’t need to increase rates by very much to keep inflation anchored.

What do you see as the catalyst for another burst of inflation coming ahead? Stimulus checks are over. QE will be tapered. Supply chain issues will improve after the holidays. If Republicans take control of Congress next year, they’ll block any further government spending. A few months ago I was concerned about the prospect of another 1970s, but to me the data don’t suggest it’s happening.

Republicans are endlessly bragging about being more fiscally responsible then the Democrats, yet whenever they are in control deficits go up, and when the Democrats take control deficits go down.

That doesn’t seem to be the trend since the GFC and, BTW, stop falling for the phony left/right paradigm. They’re all to varying degrees bought and paid for by interests who do not give one damn about YOUR best interests and if you think your vote controls anything where there’s significant coin involved at anything other than a small town level, read the study:

Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens [Princeton University, 2014]

Excerpts:

A great deal of empirical research speaks to the policy influence of one or another set of actors, but until recently it has not been possible to test these contrasting theoretical predictions against each other within a single statistical model. We report on an effort to do so, using a unique data set that includes measures of the key variables for 1,779 policy issues.

Multivariate analysis indicates that economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy, while average citizens and mass-based interest groups have little or no independent influence. The results provide substantial support for theories of Economic-Elite Domination and for theories of Biased Pluralism, but not for theories of Majoritarian Electoral Democracy or Majoritarian Pluralism.

In the United States, our findings indicate, the majority does not rule—at least not in the causal sense of actually determining policy outcomes.

When a majority of citizens disagrees with economic elites or with organized interests, they generally lose. Moreover, because of the strong status quo bias built into the U.S. political system [that describes the overwhelming influence of the administrative state and lobbyists – W], even when fairly large majorities of Americans favor policy change, they generally do not get it.

To be sure, this does not mean that ordinary citizens always lose out; they fairly often get the policies they favor, but only because those policies happen also to be preferred by the economically-elite citizens who wield the actual influence.

What you wrote is undeniably true but only believed by the majority when it isn’t contrary to their personal preference.

The other ironic part is that if you ask individual voters if they support the most expensive far reaching social programs, they mostly or overwhelmingly do.

They believe in “democracy” but predominantly or exclusively as a mechanism to have someone else pay for what they want benefitting them or to plunder the undefined rich.

Problem is, when political influence is for sale, the masses will always get the short end of the stick.

Always been that way and so it shall ever be.

Relying on any of the ‘data’ provided by the government/survey groups results in manipulation of the masses.

Our regular supermarket is selling 3 rib eye steaks for over $37. We took a ride to the Latino mercado where all the working class Latinos shop. Bought 4 rib eye steaks for $18. They are not as thick as the more expensive ones, but good enough for the money, and we get to eat steak.

Instead of substituting items, we substituted merchants.

You’re catching on. Shop where the Asians and Latinos shop, they know where the bargains are. However, you may end up eating pesticide residues in your cheap food which in the end, will cost you far more than you save.

Do you really think there are no pesticides in organic food? Everything grown in America has pesticides in it, it’s in the ground and water.

Also, during the first week I moved to Florida, I paid a visit to my bank. It happen to be when they were spraying for bugs. It was a tanker type truck and the exterminator was holding a fire hose spray the plants and grounds. I couldn’t believe it, but there he was with the hose, and the name of the company was on the truck. This is totally normal in Florida. BTW, it’s very bug free in south FL.

The real comparison is how do the steaks compare by the price per pound and grade?

“Choice” grade rib eyes in Costco last week were $19.97 per pound. Needless to say, they weren’t jumping off the shelves. I did not price the “prime” grade ones. The run of the mill grade rib eyes were $14.97 per pound. If memory serves me right, these prices are about 50% higher than last year at this time. I bought chicken breasts instead.

Crazy prices…

‘I bought chicken breasts instead.’

Those were an outrageous $6/lb at Costco last I checked.

I noted a substantial 40 to 70% jump in meat prices at Kroger following the Social Security Cost of Living Adjustment announcement (6%, Oct 14).

My suspicion is they were merely playing the news that ‘money is worthless, so give us yours!’ Prices have since settled back to their earlier 2021 normal prices.

Does anyone recall last year the ‘stimulus checks are coming’ headlines that would not die? Every day, from March through November, headlines were screaming ‘we promise free money – hurry and spend today. We promise free money soon!’

Cynically, I suspect there was a push to shake out the ‘normal’ Americans to part with their money. Perhaps even go into debt, awaiting their ‘guaranteed’ free money.

Is this not the same narrative, different story?

‘You’re getting free money! GO SPEND!!’

‘Money is becoming worthless. GO SPEND!’

From Ford’s recent dynamite quarterly sales call:

“Sales volume is expected to increase by about 30% from the first to the second half of the year, driven by an improvement in market factors, according to the company.”

A 30% boost in sales volume? I’d suggest it’s people fleeing the dollar and throwing it at anything, but it begs to ask.

Hyperinflation, or marketing manipulation? Probably somewhere in between.

They are doing the same thing with Xmas spending. Buy now or you will forever regret it. I’ll wait for the Xmas in July sale.

110% agree. The local Latin supermarket chain selling meat, produce,… has far reduced rates for similar staples. They even have a meat counter with a ticket system where they call your name and produce what you desire.

They advertise right along side the big brands with their reduced rates. Some people would rather not be seen there I assume

Saving money isn’t crazy if it works

Find a farmer. It’s cheaper that way, and better, if you find a good enough farmer.

True Wisdom-

See “Food Fix” by Mark Hyman, M.D.

No more red meat in the Swamp household. Getting too pricey. We’re on a buyer’s strike. Switched to Tofo and vegetables at our favorite Thai Restaurant. I may add that I noticed most of the chinese places have gone out of business.

>No more red meat in the Swamp household.

+1 Ditto!

Way to go! The only thing to do with inflation is to fight it by shopping around.

ALDI, “the stock up store”. Cheapest prices around. They have the best select brand ice cream with no fillers. 4.99. Was 3.99 last year, but the prices there are great still. They have the best ice cream, and the most affordable produce.

Eating steak has become a luxury – like eating ice cream.

Does anyone actually think that US government will stop spending money that they don’t have on dumb initiatives that they don’t need?

They will just spend themselves into oblivion and then blame it on something else like China, Russia, or an any political party that opposes them.

No one could have saw that coming…

The current bill under consideration is a giant slush fund for the ruling party and they can’t even pass it. Their ability to govern is impaired to the point they can’t even bribe themselves.

i used to think manchin was just a pawn, but watching his interviews, he actually seems legitimately tortured by this decision. it reminds me of the way lbj was tortured by vietnam during and after.

Nah, Papa Pork just wants to make sure his special interest lobby gets what they want. It’s all theater.

LBJ was tortured? In what parallel universe? Just curious.

NDX, SPX & IWM : Sharks bites !

Crabs in SF

I found an old pay stub from July 1951, that person was making .82c per hour. He worked 31.5 hours for a whopping $25.99 a week. That’s all you have to know about inflation.

It look like price and price index have started to play catch up with (monetary) inflation;)

As I see it, monopolistic megacaps are sucking the wealth out of the middle class while technology reduces the demand for labor. That is a prescription for deflation. The supply chain induced inflation won’t last.

The markets do not believe this. The USD was up huge today crushing the precious metals.

I would recommend ignoring single day results, especially around month end.

Expecting tapering, end of QE, and rate hikes, no?

They can ‘taper’ all they want (ha), but the rates (tenths/hundreths of one percent don’t count) will not budge! Who’s kidding who?

Still can’t get my head around price of the two big gold miners and the price of gold. It doesn’t really fit with the story of real negative rates being persistent and high inflation. Usually you think that gold would be popping if Fed really is making a policy mistake, but maybe it depends on the type of mistake they will make.

Maybe crypto is part of the answer, but cryptos trade like a risk asset most of the time.

Crypto is the new gold maybe? Bonds don’t seem excited.

There’s some momentum in the inflation trade but it might not be the right trade.

Crypto is another Ponzi scheme. It’s the ultimate nothing supposedly worth something. It and NFTs.

Agreed someone is going to lose but it wont be me said by everyone that holds crypto.

The gold mining companies are making money hand over fist even with gold around $1800. Which explains why their stocks are getting crushed! These days the high flyers are companies that lose billions! In fact the more you lose the more your stock goes up.

We have been buying gorgeous Italian designed extravagant 18 K gold jewelry sets at the bullion price of the gold (getting the artistic component for free and at a huge discount to the original sticker price). We didn’t need a second opinion.

When cash is trash, they throw out the baby with the bath water.

We are buying gold. My wife enjoys the dividends of being able to wear the investment.

Screwing Russia they sell oil for dollars than buy gold losing proposition either way we win

What is really the difference between a communist country and our democracy?

Yeah, you get to vote, but do you really rule?

You get to say anything you want but does it matter? does anyone cares?

How isn’t forced expropriation of your labor and savings when the Fed can dilute your money at will and allocate credit as they see fit with zero accountability?

Ok, they don’t put you in jail for saying FJB but that is only because it costs money and you are more useful to work and pay taxes.

“What is really the difference between a communist country and our democracy?”

About 2 years.

I know this is not going with the main flow of thoughts around here, but my first reaction to this kind of stats and facts and graphs is that their ultimate goal is to ease the lack of balance in trade surplus – deficit. Meaning that by devaluing the USD the ultimate goal is stop hemorrhaging… This easy I can buy anything attitude won’t last. Credit won’t last. Cars, as I see it, will surely become a luxury item with petrol up the charts, etc. Someone mind giving me a rational reply to this idea? Essentially I’m saying that is the end of the corporate US companies out sourcing. That the 90s are done with. It feels like the clock is going backwards and that we’re going to see social realities soon looking like they’re out from the 1900s and prior… downtown slum kind of idea, etc. (I know that you guys down south get to see that a lot more than us up north, but I’m finding that social decay is staying to normalize in Canada… We’re always catching whatever you guys in the US have coughed up years prior…

>Cars, as I see it, will surely become a luxury item with

>petrol up the charts, etc.

I’ve noticed an increase in listings for newer Used Toyota 4Runners as they get less than 18-mpg, and they’re costly to insure. I’m looking for an older v8 version with low mileage.

The Canadian govt is causing the same homelessness and drug addiction we have in our major cities. Couple that with the deliberate destruction of your productive industries and civil liberties, and you are in the same downward spiral as us. Our leaders are crooks, yours seem dumb.

“Our leaders are crooks, yours seem dumb.”

Well, you’re half right.

Our leaders are dumb and crooks.

Got Bitcoin?

Bitcoin vs the dollar in 2021 +100%

Bitcoin vs gold 2021 +100%.

Bitcoin vs the dollar for 11 years. You don’t want to know.

In the fiat universe inflation matters.

In the Bitcoin universe deflation happens.

We should sell the U.S. gold reserves. In 10 years or less, we owe no taxes. There is no inflation and the deficit is zero.

We have a choice stay in the Dollar universe or the Bitcoin universe. There no one robs you by the 1000 paper cuts of inflation.

We better hurry though cause we have enemies who see what Bitcoin is doing vs the dollar.

“Bitcoin universe deflation happens”

Bitcoin isn’t a currency. It’s an online gambling token.

Bitcoin is defined by the IRS as a asset. So, yes not a currency.

The market decides the value of bitcoin. The market is saying it has value not you, me or Warren Buffet.

You can avoid Bitcoin like the Amish did with electricity. As the retail sector did with Amazon. That won’t stop Bitcoin.

Equating Bitcoin to the advent of electricity is the most pathetic thing I’ve ever heard of.

Remember oil paintings by the masters? They are just like bitcoin from my observation. People went nuts over the value of old master’s paintings and often bid them up to very high prices at auctions.

One day, someone found a really good counterfeit painting by a master. Then they found many of them. Seems like someone figured out how to make really good copies. Seems like some of the ones that were passed as originals for high prices….were copies. Now I know this can’t happen with bitcoin, could it? But I do recall someone a while back hacking an account and running off with lots of bitcoins….millions of dollars worth!

Now what would happen if a government decides that bitcoins can’t be used as a replacement for good old fiat? Would that cause any problems? Didn’t China just do this? I’m not up on bitcoin so please refresh my memory.

If you can’t use bitcoins for currency purposes, then all they really represent are collectibles, like old masters paintings, Olympic pins, beanie babies, etc.

When I see people say this kind of stuff it’s a dead giveaway that they have no idea about what they are even gambling on. It’s like playing blackjack without knowing the rules but someone told you the odds were pretty good and you went with that. You’ll be crying outside the casino when all is said and done.

Malibu,

By comparing bitcoin (nothing but a digital gambling token) to Amazon (one of the largest companies in the world with over 1 million employees), you’ve turned yourself into Exhibit A of how nuts Bitcoin promoters are.

The “market” are a bunch of speculators hoping and praying a fool bigger than themselves comes along to purchase their digital asset for more than they paid for it.

That’s the entire game. Crypto isn’t the future, it is the next big grift only sustained by how awful other investment opportunities are and the ceaseless gaming of “the market” in a deregulated, volatile, highly-influencable space.

My millennial friend who invests in crypto is now pushing something called “SHIBA INU”… I tried to explain Tulip Mania to him last year when he was pushing Dogecoin.

Unfortunately he made a mint on Dogecoin and I was proved to be a Know-Nothing. So for now I keep my mouth shut.

you can always make mints on bubbles if you get in and out at the right times. most people don’t though. You only hear about those who do.

Jake, I know of some smart people that have a unused bedroom room chock full of beanie babies. They didn’t have good timing!

So has shares and countries currency turned into too;)

Hint, Tesla shares.

A bitcoin millionaire walks into a bar.

Him: I have $1 million in bitcoins.

Girls: Wow, wanna’ buy us some drinks then?

Him: Oh, no, I don’t have any real money.

Good luck convincing cryptobugs about that. It’s like they invented a reality with words having their own meaning that all reinforces one idea: you should buy crypto, like I did!

If the federal government outlaws it, how will you spend it? No major company will be able to accept it, because their sales process is observable. The internet can be anonymous, but not the physical world. In the physical world, any exchange of goods where either party is a large organization is subject to intermediation by the government. There are many possible variations on the general theme of confiscation of outright banning.

I didn’t buy Bitcoin at $5000 I’m definitely not going to buy it now!

These crypto shills proliferate like flies on feces when the price is pumping, then disappear like a fart in the wind when it collapses.

I didn’t buy Bitcoin at $5000 I’m definitely not going to buy it now!

I made a similar statement about Amazon when it was $5.

Amazon has a 40% share of eCommerce today. Few saw that 20 years ago. How much more valuable is a monetary network like Bitcoin?

Bitcoins share of the worlds 400 trillion of wealth is tiny. Will Bitcoin take a 40% share in 10 years when global wealth will perhaps double to 700-800 trillion? A 200x for Bitcoin would be conservative.

Change is scary ,but Bitcoin is amazing.

Malibu,

So I’ll repeat it because you’re repeating your nonsense.

By comparing bitcoin (nothing but a digital gambling token) to Amazon (one of the largest companies in the world with over 1 million employees), you’ve turned yourself into Exhibit A of how nuts Bitcoin promoters are.

“Change is scary ,but Bitcoin is amazing.”

Bitcoin isn’t a “change”; gambling has been around for as long as mankind. But yes, Bitcoin is an “amazing” gambling token.

From now on, each one of your Bitcoin promos will cost you $1,000 to be paid in fiat. You can contact me via this site for details. No more free promos :-]

John Hussman on bitcoin – bitcoin isn’t actually creating “wealth.” It’s only creating the opportunity for wealth transfer, primarily from those who will end up holding the bag.

———

Non-governmental cryptocurrencies are doomed. PERIOD. If private cryptocurrencies ever present a real threat to the existing financial systems to the extent that their negative effects outweigh the “elites” ability to bilk the ignorant via them (note the large organizations now playing with them which does NOT legitimize them, it merely indicates that their extent has reached a level where they are worth exploiting by those large concerns) their use will simply be banned and that ban will be thoroughly enforced since legitimate businesses are under the governments’ thumbs in numerous ways in every country.

And don’t EVEN dream that blockchain transactions can’t be tracked if they actually want to.

Also, cashless systems will be a potential dystopian nightmare because everything you buy and everywhere you go can then be centrally monitored and your ability to survive in a modern society can be turned off with a few keystrokes by governments. See “China.”

Forgot to mention that a cashless system also allows central banks to implement negative rates, but you will not have the ability to withdraw funds from your bank as cash.

Negative rates push Japan’s savings from banks to mattresses

10 Mar 2016

TOKYO — Japan’s cash in circulation is growing at the fastest rate in 13 years as ripples from the Bank of Japan’s negative interest rates push consumers’ money out of savings accounts and into safes and other at-home repositories.

Japan had 6.7% more currency in circulation in February than a year earlier, the BOJ reported. That increase is the largest since February 2003, when consumers withdrew cash following changes to Japan’s deposit insurance system. Particularly popular now are 10,000-yen ($88.25) bills, with circulating stock surging nearly 7%, the central bank said. The 5,000-yen and 1,000-yen bills have seen upticks of less than 2%.

“Safes have really taken off since the negative-rate policy was announced,” a worker at a major Tokyo home electronics retailer said. Fireproof models selling for around 50,000 yen are especially popular. Shimachu, a home goods chain based in Saitama Prefecture, reported twice as many safe sales now as a year ago.

I have cryptos including some btcs.

I absolutely have no faith in it

I have multiple my initial investments many times and can afford to lose all my cryptos

Btc is a big ponzi scheme but make money while you can

I (sort of) respect guys like Jon. He’s gambling in Bitcoin but admits it’s a scam. The people like Malibu who try to legitimize an obvious speculative mania with no fundamentals are the ones who are extremely annoying and delusional.

“….but Bitcoin is amazing.”

GAG.

We let government take over our lives time to take there power away

Let me guess – you’re a crypto gambler. YAWN.

Do the many hours of Bitcoin education available and you will see how laughable the “crypto gambler” definition is.

^^^Bahahahahahahaha!!!! There’s no such thing as Ponzi school. Get a grip.

Another fun exercise: Look up the business plan and strategy of every crypto coin and token. If you can make any sense out of the crypto-babble, you get a gold star. Or maybe a free token.

Fun exercise: Try to find the actual physical address of any crypto exchange. If they even provide one, it’s a mail drop, usually far far away.

Billions of dollars are funneled through these exchanges every day.

Right. Do a search for “Coinbase stole my money” or “Coinbase Reviews.” These places are legalized fraud rackets. The problem with the US is that the rule of law has been ignored by those charged with enforcing it.

Malibu-

It is difficult for me to understand how someone who owns cryptocurrencies does not own gold.

I cannot coat the terminals of my electrical connections with bitcoin.

Harry Houndstooth

I’m starting to read stories of people getting socked with property taxes they can’t pay because the value of their house went up so much. Skyrocketing property taxes another hidden inflation that the FED keeps covered up?

good. i hope those who bought houses as “investments” with no intent on living in them get creamed.

Austin, TX is one of those places where taxes are insane from overbidding and real estate agents flipping houses to each other. I hope they all get to enjoy the high taxes they engineered out of greed.

Saw recent video of $680K houses there, unfinished with grass grown taller than the materials stacked outside the homes. Prices seemed ridiculous to me and apparently to buyers too.

Many tech jobs there, but you don’t have to live there to work there.

I am wondering if the status of having a 4000 sq ft home gets turned upside down by zero green house gas politics. Homes do go out of style. Might be a depreciating asset in 10 years.

Coming to a rental unit near you. Remember people who rent property out pay these taxes too. They’ll be reflected in the rent.

So no, renting instead of owning will be no use.

you’re assuming that they can just raise rents and people’s ability to pay won’t come into play.

If you don;t pay your property taxes on time they charge 24% interest rate penalty.

No worries citizens, Grandma Yellen has a solution to reduce inflation, per CNBC:

Treasury Secretary Janet Yellen told CNBC during an interview on Friday that the spending bill that Democrats are proposing would lower inflation by reducing household costs including health care.

“I don’t think that these investments will drive up inflation at all. First of all, they’re fully paid for and not by imposing higher taxes…

Grandma Yellen even proposed a way to conjure more free money from all those “super rich folks” to fight our Fed induced “Everything Inflation”, per CNBC:

A separate proposal that would require gross annual inflows and outflows of financial accounts in the U.S. over $10,000 to be reported to the IRS…

I saw that headline.

Yellen is a complete moron, doesn’t matter that she has a PhD. One of. if not the stupidest economic statements I have ever read in my life.

For starters, she has no clue about investment. The bill is pork and welfare.

All the rage about Powell when Yellen is worse than he is, and causing more damage,

I am trying to understand this “fully paid for” argument – just doesn’t make sense to me.

Is it a Jedi mind trick phrase everyone is saying loudly and repeatedly to confuse the public?

“This inflation surge is happening while the Fed is still recklessly printing $120 billion a month, having amassed $8.6 trillion in assets, nearly half of it – $4.2 trillion – in the past 20 months”

Is it inflation if the Fed keeps it all, or is it sensational price gouging by big business?

Inflation = price increases across many products.

The USA is one giant ponzi scheme, (along with many other countries), in which the FED has to print, it cannot stop, it is print or crash, and it will crash eventually in any case,though when is anyone’s guess, when the gold standard, imperfect as it was, was dropped, everyone on the planet became part of the ponzi scheme, that means you!, there was no longer any restraint to the creation of money, at least as long as we accept little squares of fiat paper or electronic digits as money, (maybe sea shells would have been better),the effects you see as regards the bottom 33% are simply the Cantillion effect, the FED and other CB are like children exploring, they are getting bolder and bolder the further they move away from any restraint, (gold standard), and the further in time from 1971, the FED is comprised of people, just like you and I, and they have all the failings of people, just like you and I, ask yourself this, if you had the power to create money out of thin air at what point would you stop?, would you care about the consequences to to others?, people you didn’t know and never will, be honest, think about it, and now you know why we are all where we are.

Where does the demand for dollars come from? Foreigners buy the dollar because it inflates *less* than other currencies. But other countries cannot afford to print more than the USA, or hyperinflation. Hence the Fed will be forced to taper once those other currencies become more valuable. In the mean time, US assets are liquidated in a leveraged buyout by beneficiaries of the Cantillon effect, the master class.

Something that has come to mind recently has been the results of social media on the awareness of the great unwashed knowing who the 1%ers are and what they look like. In the Depression, you might have passed a Vanderbilt or any other uber-rich person on the street without recognizing them, but not anymore. Jamie Diamond would be recognized by most people. For sure, some of the old money families have kept a low profile (does anyone know what a Rothschild looks like?), but a lot of the 1%ers have sought out and revelled in a higher public profile. If the shit really hits the fan, I think they may come to regret the public awareness of who they are. Just saying.

Governments have always demonized the wealthy to agitate the mob. It may be social media today; before it was the newspapers, before that it was the peasants pointing at the very visible ‘big house’, owned by someone who provided employment to those who would otherwise starve to death while blaming someone else, the most visible target being the government.

It’s just a defense mechanism.

What the trading desk giveth, it also taketh away. The FED is not loose, the FED is too tight. The axiom is that the money stock can never be properly managed by any attempt to control the cost of credit.

John Williams of shadowstats.com has an alternate calculation of CPI-U, based on the method that was officially used in 1980. I think it’s difficult to do, so I am not sure his calculation is right, but I am sure the calculation method of the CPI-U today is politically deformed a lot to the downside.

So his alternate CPI-U as of September is 13.38%, almost 8% higher than the official 5,4%. Even if the difference was only half of that it would be brutal.

His measure is a joke. Inflation is higher for average people across the US than CPI, but for those average people, inflation isn’t nearly has high as that site proclaims. It was proclaiming 10%+ inflation during the low inflation years.

Do the math: 10% inflation means that prices across the board for all Americans DOUBLE in 7 years, and nearly quadruple in 14 years. That is just braindead BS. People who take his numbers seriously are falling for bad joke.

Actual inflation for all Americans, averaged out, is higher than CPI (but not by much, though the error compounds over the years) but is far lower than that ridiculous outfit proclaims. What he is producing is just a bad joke.

You are right, thanks, 10% is not possible. Hopefully we will not get there in future.

In August 2019 the 4 week T-Bill was 2.07%. Trump was publicly tweeting that JPow was “stupid” and continued to threaten his job unless he cut rates to what Japan is paying.

For those of you who read the 20Y and 30Y treasury inverted this week – keep in mind that the 2019 August 4 week T-Bill mentioned was inverted – higher than the 10, 20 and 30 year bond. Danger signal, red flag?

He did cut rates.

On 2/27/20 the 4 week T-Bill was 1.56%.

The market began its correction and by 3/25/20 the 4 week T-Bill was 0%. Was it gonna happen and covid was the perfect trigger and explanation? I think so. No elected person is gonna take the blame.

The zero rates are doing nothing but kick a burning trash can down the road imo. It was upright and not on fire in 2019.

I am glad the government finally abolished slavery and allowed womens rights. The current cadre would never admit a mistake.

Extinguish the fire, let the can cool down, paint it and set it upright again. It can be useful.

The long end of the curve will never go where it needs to go if the Fed keeps buying $120 a months in bonds. It needs to stop now. And it needs to start unloading its balance sheet now so long-term yields can range more freely. Right now, long-term yields don’t say anything about anything other than the Fed’s balance sheet.

Exactly, there is zero price discovery in the bond market.

For people sitting in cash, when they earn interest, they get to pay taxes on it.

Now that real interest rates are negative and their cash is being devalued, can they claim a loss on their tax declaration?

This is an interesting concept. My current savings yield less the official CPI as a loss carry forward. Will I ever make a profit on interest in this lifetime?

This, ladies and gentlemen, is the reason we need to have a cadre of Wolfstreet beer mugs on site. His laser sharp focus on the truth is unique and worthy of our adulation.

re: “And it needs to start unloading its balance sheet now so long-term yields can range more freely”

Impossible. You’d have to nationalize the banks, to monetize and sterilize assets, i.e., impose uniform legal reserve requirements, for all deposits, in all banks, irrespective of size, both as to types of assets eligible for reserves, as well as the level of reserve ratios.

Nah, the Fed unloaded a bunch from its balance sheet just fine from late 2017 through mid-2019.

As M Friedman once said, “If you put the federal government in charge of the Sahara Desert, in 5 years there would be a shortage of sand.”

Wouldn’t a more appropriate saying be that in five years the Congo and Amazon basins would also be deserts..?

Putting J Powell in charge of the Federal Reserve is the same as putting Count Dracula in charge of your local blood bank. Congrats T. for making the worst appointment in the history of the USA. We may be stuck with this clown for another 5 years.

It doesn’t matter who is in charge. Greed will make sure that there will be a shortage of everything.

You have that slightly wrong. Greed AND free competition are what create ABUNDANCE of everything. Yes, greed combined with the ability to limit or prevent competitive market entry can create shortages. Greed ALONE can’t do it.

Was out trying to buy Halloween Candy today and they were sold out everywhere. I guess most of it is sitting on some of those container ships off the coast of California. No loss. Who needs candy anyway. Luckily, I’ve got lots left over from last year when there were not very many trick or treaters in the middle of the worst of the pandemic.