Margin pressures from surging labor costs for the first time in at least two decades.

By Wolf Richter for WOLF STREET.

Companies are now announcing this on a daily basis: They’re raising wages, and by a lot. Some companies are raising wages in reaction to the threat of unionization. And unions have been emboldened by the labor shortages.

Labor costs – which for many companies are over 50% of their total costs – are rising, and will rise further going forward because the wage increases are just now starting, and labor costs will pressure their margins for the first time in maybe decades.

The whole power balance has changed: There is blistering demand – thanks to all the monetary and fiscal stimulus – but not enough labor because workers have gotten choosier, and a few million have left the labor force to go retire on their gains in the stock market, housing, cryptos, or whatever, thank you hallelujah Fed. And others cannot work or don’t yet feel like working, etc. Myriad reasons. But it changed the dynamics and pricing of labor.

Starbucks was one of the big names with relatively low-wage service workers that came out with an announcement of “unprecedented investments in wages” – because calling it an “investment” sounds a lot better to investors and algos than calling it an “expense,” which is what wages are from an accounting point of view.

In January, Starbucks will give a raise of 5% to folks with two or more years of service and a raise of up to 10% for folks with five or more years of service. Next summer, it will raise its minimum wage to at least $15 per hour, and the “average pay” for all its US hourly employees “will be nearly $17/hr.” Baristas will earn, depending on market and tenure, from $15 to $23 per hour, it said. We’ll find out if this will attract enough workers. In lots of places, the local minimum wage is already over $15.

This will raise its costs of wages and benefits in just the US by $1 billion, Starbucks said. And some of these wage movements have started to show up in the data.

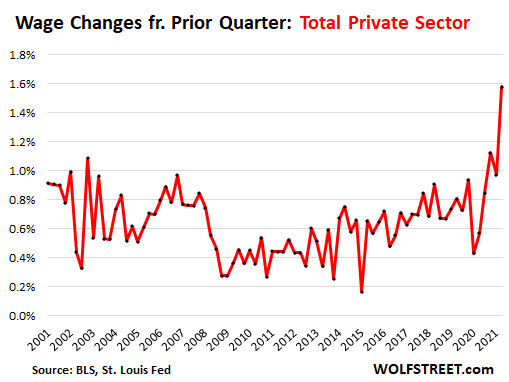

Wages across all private industries (government entities excluded) jumped by 1.6% in the third quarter from the second quarter, the largest jump in the data going back to 2002, according to the Employment Cost Index, released today by the Bureau of Labor Statistics. This amounts to wage gain of 6.4% annualized.

This data is based on surveys of about 23,000 business locations from 5,900 private sector employers, tracking changes of wages paid by industry. Unlike other wage data, such as average hourly wages, the Employment Cost Index is not impacted by people switching from lower-paying industries or occupations to higher paying ones since each data set reflects the wage movements within each industry, and not the income of the workers, who might be making more money by switching industries.

Wages made big gains across all industries.

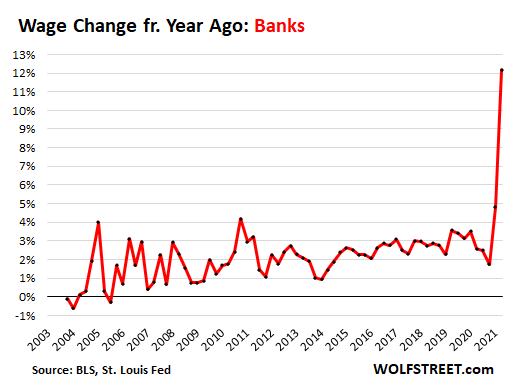

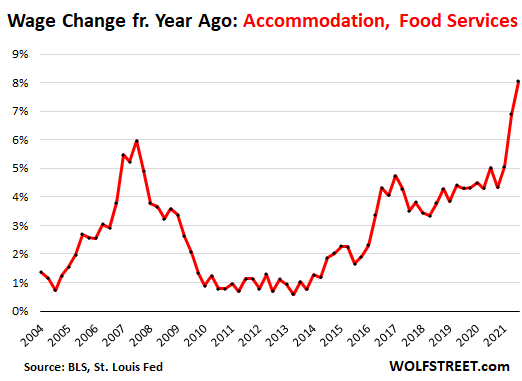

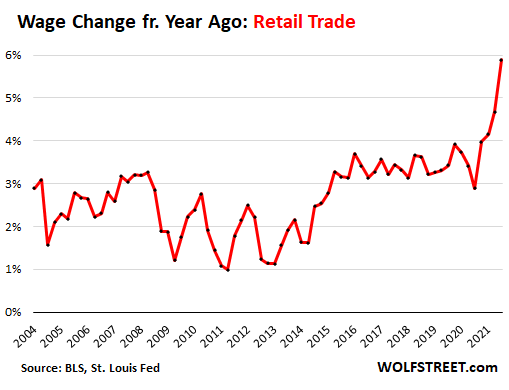

Below are some sample industries that span the spectrum on the wage scale: At the upper end, banking; and at the lower end, accommodation and food services, and retail trade.

Upper end: at banks, salary gains were stunning. At these fine institutions of “credit intermediation and related activities,” some of which are desperately trying to get their people to go back to the office, wages exploded by 7.7% in Q3 from Q2, after having already jumped by 3.6% in Q2 from Q1. Compared to Q3 2020, wages spiked by 12.2%, by far the fastest increase in the data going back to 2004.

Goldman Sachs is in this category. In August, sources told the Wall Street Journal that the base pay for its entry-level first-year analysts in its investment banking division would jump by 29% to $110,000. For its second-year analysts, salaries would jump by 31% to $125,000. For first-year associates, salaries would jump by 20%, to $150,000.

A few weeks later, it emerged that Goldman also is boosting salaries on the same scale for its junior staff in its sales, trading, research, and asset management divisions.

JPMorgan Chase, Bank of America, and other banks have already increased pay for their junior staff not only in their investment banking division, but also in sales, trading, and research.

At the lower end: Accommodation and food services saw big quarter-to-quarter increases in Q1 (+1.7%), Q2 (+2.9%) and Q3, with another gain of 2.6%. Year-over-year, wages shot up 8%, the fastest increase in the data going back to 2004. And compared to Q3 2019, wages shot up by 13.5%. Starbucks is into this category:

At the lower end: in the Retail trade, wages increased by over 1% quarter-to-quarter in each of the past four quarters, including in Q3 with an increase of 1.6% from Q2. Year-over-year, wages jumped by 5.9%, by far the highest in the data.

Note: These are employees working at retail stores, and do not include warehouse workers at Amazon or tech workers at Amazon or truck drivers at Walmart. Those are in their own categories:

While all industries booked wage gains, not all gains were this hefty.

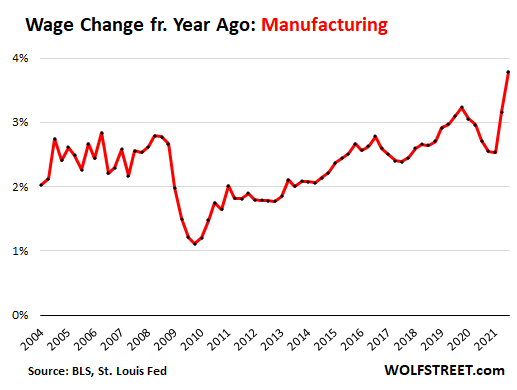

Manufacturing saw modest wage gains until Q2, when wages suddenly rose by 1.3% from the prior quarter, and then in Q3, they rose another 1.2%, for a year-over-year gain of 3.8%. While that sounds like a more modest gain, it was nevertheless the highest in the data going back to 2002.

This industry is struggling mightily with shortages of parts and materials, particularly semiconductors that now go into so many products, and production in the huge auto industry has plunged. This may be keeping hiring pressures lower for now than in other industries.

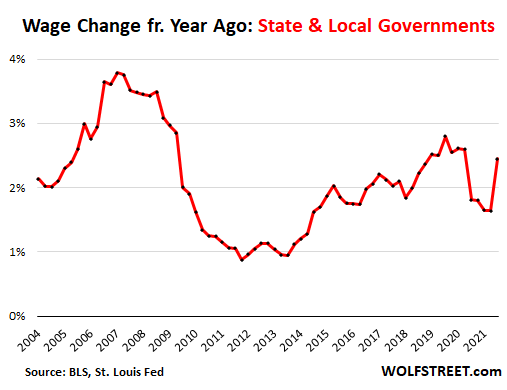

Governments are slower-moving.

State and local government entities did not increase wages overall in the same manner as the private sector. Governments are slower moving. Things take a while. Overall, state and local governments raised wages by 2.4% year-over-year:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Hi Wolf,

I respect your work very much, but what if the stagflation thesis ends up being wrong?

The BEA’s (admittedly lowball metric, but it’s what the FOMC uses) numbers do indeed show monthly inflation coming down. The last 5 month-over-month core PCE readings were 0.6, 0.5, 0.3, 0.3, 0.2. The year-over-year number increased due to base effects.

The S&P 500 just broke through 4,600, and 10-year treasury yields just dipped back to 1.55% after failing to break through its March high of around 1.75%. Markets are pricing in a Goldilocks scenario in which core PCE inflation, if it continues at a 0.2-0.3% monthly rate, will be back down to 2-3% by the middle of next year. Under this scenario, the FOMC won’t need to increase rates by very much to keep inflation anchored.

What do you see as the catalyst for another burst of inflation coming ahead? Stimulus checks are over. QE will be tapered. Supply chain issues will improve after the holidays. If Republicans take control of Congress next year, they’ll block any further government spending. A few months ago I was concerned about the prospect of another 1970s, but to me the recent data don’t suggest it’s happening?

Jackson Y,

“… but what if the stagflation thesis ends up being wrong?”

Yeah, I don’t think it’s a great thesis. I said before that I don’t really see stagflation.

Stagflation requires “inflation,” which we’ve got in ample supply, and persistent “stagnation” (for longer than just a couple of quarters) which we don’t have for now.

So the stagflation theory is not on top of my list of scenarios. I’ve been through stagflation in the 70s, and it was a whole lot different.

I’m curious to see if the tremendous debt overhang will be the catalyst for further slowing leading to a decline in real GDP. With the potential for rising rates, this could be disastrous.

The downward trend in GDP would suggest that stagflation is a distinct possibility in the next 12 months.

I remember well doing my homework in the UK in the 1970s under a light powered by car battery whilst worrying if my father would have a job at the end of the month.

The republicans have never tapered spending on companies and are as complicit as the Dems are. The party stops when the floor collapses.

Agree. Unfortunately some parts of the floor are much stronger than others. It will be early hell for those that fall through into the basement, but only a matter of time before the problems below start trashing the piers and floor joists of the those on the “stronger floors”.

Sometimes I wish the Military would take charge and force a “Green New Industry COMPREHENSIVE Program” on the present system, and let people’s “chips” (wealth) fall where they may, just like in WW2, only much more mission dedicated and serious, and then we just have to hope they give up power and give this “democracy” thing another shot.

Jackson Y,

“What do you see as the catalyst for another burst of inflation coming ahead?”

You’re looking at one of them right here (article above).

Plus, the stimulus money — trillions of dollars of it from the government and from the Fed — are still everywhere slowly getting spent. Liquidity is everywhere too. There is so much unspent fuel for inflation that it’ll go on for a long time, if nothing is done about it.

You forgot to include trucking wages up at least 20% got 4$ an hour wage increase transitory to higher prices on everything pay more taxes to cover spending simple formula if you have any common sense

Hey Ron,

Can you throw a few spaces in there…

Makes it a lot easier to read…

Thanks…

Higher energy costs is a catalyst for inflation, and also reduces growth…a definition of stagflation. With free investment money starting to sort out and no one willing to finance money losing shale, higher energy costs is a given with today’s increased demand.

Increasing production volume and still selling at a loss is no remedy, wasn’t 5 years ago and won’t be one going forward.

regards and great article as always.

Oil companies are making money at these production levels. There are over 2,000 wells drilled and not completed here in the states. Even Suncor in Canada is reporting great earnings and a restored dividend. Look it up.

What you are seeing here in the oil patch is that a lot of companies are being real careful and smart on bringing in new production. At $83 WTI, there’s good margin if you are a smart operator.

like the $170 billion given to schools to “reopen.” most of them are just using the windfall to buy new laptops, do renovations, and things like that.

Add big bonuses for school administrators (not the teachers)!

Interesting video up on Kitco of Economic Professor Hanke. He runs through the monetary calculations of why he thinks inflation is probably going to be 6% for three years based on what Fed has done already.

It’s already 30% for things that matter like food, gas, utilities, rent, and medical expenses. And wages are “exploding” by 7%. What a pathetic joke.

A ceo of a grocery chain said 10% food inflation in 60 days

Inflation is 20% when you average the items that most people need to survive from day to day. I’m sick and tired of hearing this government propaganda bull s$it about 5% inflation year over year parroted over and over. I’m going to have to publish a Swamp Creature inflation index which will be backed by real data and blow this crap out of the water.

Don’t bet on the Republicans controlling spending. Look what happened with T. Massive deficits and near zero interest rates, after he ran on deflating the debt bubble. Reagan was supposidly a deficit hawk and look what we got. Massive defense spending and large deficits. We’re in stagflation right now. 20% inflation if you calculate it using actual real life data vs lies from the government and the bureau of labor statistics. GDP growth at 2% when it really negative. That’s stagflation in my book.

the problem is that anyone who runs on a platform of sincerely reducing spending changes course when they get into office and realize that there’s always someone waiting to outbid them for office, whether it’s with deficit spending or higher taxes.

as long as people are allowed to vote themselves public money, there really isn’t any hope.

Jackson, that’s an interesting question that I have as well. If we are going back to the pre-Covid environment, why are stocks 30% higher now? It seems like that 30% would burn off quickly in a low growth 2019 environment.

because people are absolutely convinced that the fed will never let the market go down. at the next major drop, whenever that is, that will be the real key. if they come back in with more trillions of qe, we’ll have our answer.

Market Cap = GDP X Fed Balance sheet coefficient.

Hallelujah Fed? FU Fed.

HarrisX recent Pres approval poll:

1. Inflation – 31% Approval

2. Supply Chain – 32% Approval

Thus what we see now will be a total pendulum swing in a few short years after mid-term elections, which creates a uncertainty of what a company should short term at all the laws could flip 180 degrees again shortly.

We not only have an inflation and supply chain issues for products at the moment, we have inflation and supply chain issues for “labor/people” that could last at least a few years…

External events out of control or lack of wanting to control by Gov’t and the Fed has brought this wage reality. Inflated assets and wealth disparity due to the Fed and its master Congress will also be dealt with the same way. Events that they could or won’t control will dictate the reality. They will be an observer as they are an observer of the wage change described in this post. The question will be what use are they other than their own self interest? This is the epiphany I pray that happens because the only agent of real change that matters in a Republic comes from,” We the people”.

If stock market outperforms t-bills and inflation the next 10 years it will be the first time ever from this valuation on price to sales ratio. Never happened before whether followed by inflation or deflation.

A 10% raise on a $15.00 Hr job is $1.50 per hour.

$12 dollars a day.

$60 dollars a week.

$240 a month.

$2,880 a year.

Everyone, I deliver too, regardless of age, lives in a million dollar home and has at least two $600 per months cars, parked on display in their open garages.

None of this makes any sense to me…

If your customers are like many of the people in my PNW town of 25K then most of the good times are financed by cash out refinance, or crypto / stonk gains 💵💵😅😅

Some Californians moved to my ‘hood. $350k house I imagine purchased with CA real estate gains. Shiny new Hondas (eye roll) parked outside, grass a foot tall.

I hope they don’t bring any of their friends.

I’m not sure which is more grating, CA or Yankee accent?

californians don’t have an accent. they do have a cultural jargon

Californians don’t have an accent? LOL. If you’re from outside of CA, yes they do. And I’m not referring to their jargon—I don’t listen to what they have to say.

Bainbridge?

In the manufacturing company I work for there has been a wage spike to recruit new production workers. They first had to raise existing workers wages so the new guys weren’t making more. We still struggle to fill positions. Maybe 2 out of every 10 end up sticking.

The veteran workers are sick of training newbies then have them start no call/no showing in a few weeks. The new strategy has shifted to this. Embrace the misery now and hopefully things smooth out in the near future. Hopefully this results in everyone keeping their job when demand softens.

That’s pronounced “Braindead”

Go Spartans

Wolf,

It might be worthwhile to use FRED/etc to take a look at the size of various working age cohort populations over time (25 to 54, 18 to 64, etc).

Decades of economic stagnation and the slow rolling Baby Boom retirement wave have finally resulted in a stagnant-to-slightly-shrinking cohort population of working age people (economic stagnation=fewer babies year after year).

Couple this with DC’s print tsunami and the stagnant/declining working age population finally has the leverage for a raise.

Transitory for a while. TA, skip :

1) WTI futures weekly backbone : 99.29 from 11/19/2007 and 85.82

in 12/03/2007. Guess where we are.

2) There is a tilting fractal zone : 130.00 in 9/22/2008 fractal high to

112.24 in 8/26/2013 high, to 107.73 in 6/16/2014 high and Oct 2021, now !!

3) Gold futures monthly : Jan 1980 fractal zone : 875.00/ 681.50.

4) From Mar 2008 high @1014.60 to Oct 2008 low @681.00 gold

was backing up to the 1980 fractal zone . It was not about the plunging stock markets, because SPX bottom was Mar 2009.

5) Gold futures backbone : Dec 2009 high @1226.40 and Feb 2010 low. The backbone enabled gold to rise higher to Sept 2011 @1911.40.

6) Gold might test the backbone for the second, or the third time, in order to rise insanely higher.

xxx xxx xxx

7) It’s not about being bullish/ bearish, it’s about accumulation, TA.

Welcome back. I like your comments, always have.

I’m glad you’re back, too.

But I always wonder why chart technique should work. WTI? Okay, but we have fracking now. Doesn’t that (cost of production) affect the price for WTI in some ways? And gold: with 40 yrs of inflation, CPI or real, what’s the point in using numbers of the Carter administration? S&P 500? In 2009, ExxonMobile was the biggest of them, followed by Walmart and something like IBM and AT&T down the road. That’s comparing apple(s) (#5, not even within the medal ranks in 2009) and oranges.

I suppose you’re a technical analyst, but please bear in mind some of us (yours truly in particular) aren’t. But, speaking only for myself, I would love to understand not only your posts, but the thinking behind them. Premise, argument, conclusion.

Again, it’s good to see you.

Zubi Meta conduct FB second symphony.

So are the increases in wages outpacing inflation? That is, is real income increasing?

And can we thank the Fed for improving workers’ wages?

For the US overall, per this ECI, year-over-year inflation is still outpacing the overall year-over-year wage increases. But Q3 wage increases outpaced Q3 inflation. In many industries in the ECI, current wage increases are outpacing current inflation by a big margin.

But these wage increases go into what will be feeding inflation next year, along with a bunch of other stuff. So this is going to be complex dynamic with lots of variables.

For labor, today is one of the greatest moments in decades. Not sure about next year.

yes but most of those gains are at the lower end. so while the people who were making $11/hour are now getting $16/hour, the people who were making $70k are not now making $105k. So they are screwed, as houses are not out of reach.

Thanks, Wolf! Looking forward to following this.

Where’s the wage increases for us poor RE appraisers? Nowhere to be found. We’ve been paid starvation wages for the past 4 years, while the owners of the houses we appraise walk away with millions in cash out refinances. Not fair in my book. But as JFK once said “Life is not always fair”

“unprecedented investments in wages”

This reminds me of how the BBC talks about “House price growth” in the UK instead of inflation.

Whenever the BBC mentions house prices are up I always imagine the newsreaders jumping up and high fiving reach other because they always say it is such a happy voice. 30 grand on the price of a house over 12 months is great news but if chickens are up 50p at the supermarket it’s the end of the world.

Sadly the vast majority of the population have no understanding that a percentage increase means your next larger house is going to cost you more than before.

Property sellers advertise.

Property buyers do not.

So you know how the media will spin the story, even though housing is an expense and not an investment.

Self employed. 20+% increase for health insurance.+20K/yr just to pay the premium for the Mrs & I.

Zero medical issues, no meds, not obese…

employee recruiting & retention: provide great coverage v.s. high $$/hour.

tom,

re: Zero medical issues, no meds, not obese…

Many of us are the same, but shite happens. Aging is just one factor, and so is luck. My buddy owned his own small 9 hole golf course. Fit as a fiddle, trim and spry, he slipped off a roof and hit his head. Another friend and I cut the greens for him the whole next season. Someone else cut the fairways. They finally moved away and he had universal medical coverage and no bills. Anyone can get sick/hurt at any time for no fault of their own.

You may be the only exception. :-)

paulo, i don’t think he’s complaining about the fact that his insurance is being used to pay for others, because obviously, that’s what insurance is. he’s complaining about the fact that health care, as a whole, has gone up in price so much that his premiums have gone up correspondingly.

Correct.

“Shite happens”.. sounds like what I hear out DC.

Regarding the question if we are really entering stagflation: I think we might.

Right now there is solid GDP “growth”, but this is generated by unsustainable deficits (which directly adds to GDP, so of course it “grows”, duh…). This has been the case for a long time and people think it can go on forever but it can’t.

The big change this time is that inflation is now starting to get ingrained in peoples mindset. It is finally all over the MSM too. This won’t be transitory. Even if the “growth” slows down, that inflationary mindset will not easily disappear. History has shown that this can become very persistent, at which stage you can only kill it with interest rate rises. And I’m not talking about a couple of 1/4 points here, because that will do nothing to slow inflation.

So I wouldn’t be surprised to see a slowing economy, because inflationary pressure will force the government/ central banks (same thing nowadays, unfortunately) to reign in money printing and raise rates more than anybody now thinks likely. And this monetary expansion has been the main source of “growth” as we have known it in the past decade.

Remember: if your CPI inflation numbers are a lie (which they are), then your real GDP numbers are also a lie. Imo, most of the “growth” that we have seen in the past years is actually understated inflation. If you use real inflation numbers in the equation, your real growth disappears.

And then I am not even taking into account that much of the real growth is driven by bubble activities which also only exists because of the money printing.

Despite all this “growth”, most people are not better off than they were 20 years ago or even 50 years ago, when you could raise a family and pay for all essentials (food, shelter, healthcare) on ONE income.

People are now starting to wake up to this and demand the wage rises that Wolf writes about. Companies respond by raising prices. The inflationary spiral is here.

Another thing that many people don’t get is that even when you can hollow out debts with negative REAL rates, NOMINAL rates also matter. Hollowing out debt takes a long time, but higher nominal interest rate payments is funds that you have to cough up immediately, so it affects free cashflows.

And then I’m not even talking about the effect of deflating asset bubbles and negative wealth effect of that. People with an inflationary mindset are not going to tone down their wage demands because of popping bubbles. In fact, it may even reinforce them when people realise they have just lost their savings.

We could easily get a situation of falling asset prices, slowing growth (or recession/ depression) and still persistent inflation. People will lose jobs, but bankruptcies will also take supply offline. And people now start to appreciate the the tsunami of fiat creation that has taken place, while natural resources, goods and services are limited.

It’s not just an inflationary mind set though that is much of it.

It’s also when the government gives “free” money to the masses who are more inclined to spend it.

Interesting how a partial but significant temporary shutdown of the economy which led to a short term depression (that’s what actually happened) somehow magically results in a “booming” economy.

The economy was mediocre prior to COVID and it miraculously is supposedly so much better now.

Excellent summary…you’ve captured what I experience in my town of about 50,000 people.

Great piece but this is why I think they will try and turn a blind-eye and let it run ‘hot’ for as long as possible or until they are forced by the Bond Market which they can slow

I have been experiencing stagflation for the last 13 years. My employeer is one of the bluest of blue chips and hasn’t given me a raise that has come close to even the lowest inflation estimates for time. I made the mistake of comparing my salary from 1998 to today. Its the same. My salary has made a round trip to 1998.

When I was hired in 2000 I got what my company passed off as a pension fund. They contributed 5% of base pay to account that earned 1% over prime set on first of year. This after building a reputation on life employment. Recently looked at what those rates were. In 2000 that account was 6.8%. Over the last 21 years never broke 3% and has averaged < 2%.

Isn’t the majority experiencing what many have already been living.

Same here

Stagflation has already hit our business. Rising costs across the board, higher expenses. Frozen appraisal fees. More money for the fat cats making the deals and commissions. We”re fighting back by not taking properties deals from lenders that don’t pay on time. A lot of them are slow to pay. They sit on the escrow cash which is paid up front for as long as they can. We have a couple of lenders that we have blacklisted.

A great portion of the 70’s stagnation was driven by EPA & related pollution abatement mandates from the Swamp. If we soon get similarity in the Green energy mandates then yes some stagflation will be inevitable. All will depend on how much green energy pork winds up in the current Swamp legislation .

“A great portion of the 70’s stagnation was driven by EPA & related pollution abatement mandates…”

Hahahaha, is that now starting to circulate? That’s a joke, right?

It caused a boom in engineering, it shook up the auto industry and caused it to invest heavily in engine technologies for the first time in decades, yes right here in the US, as imports were blowing by it. Whole new manufacturing sectors sprang up to deal with it (remember “hush kits” for old jets?), yes here in the US back then. I know the guy who started making these hush kits for jets and got very rich doing it.

The stagnating part was because consumers had less money to spend due to the oil-embargo induced oil shock that triggered massive spikes in gasoline costs and then triggered general consumer price inflation.

I just love folks that, looking upon the burning Love Canal environmental disaster, blame environmental protection rules for everything, including the damage the Arab oil embargo caused.

The baby boomer workers that retired or died during (from) the Covid lockdown are lost forever. This is the main factor in the severe labor shortage. A falling population rate is a world wide phenom, though just now becoming a reality here too. (We didn’t lose millions of lives in WW2 like the rest of the industrialized world.) But this trend has certainly been foreseen. Maybe, the low interest and insane asset inflation scam is a preplanned means available to the powers that be to confiscate wealth before the plebs gain the upper hand.

Its the Goodfellas economy. ‘F U pay me.’ -im trademarking this.

“F U, pay me.”

I believe this is inscribed, in Latin, above the main entrance to the IRS in DC.

As part of the BBB, a new motto, in Latin, will go above the Fed.

“So long as I can print, who needs your F’ing money”

But it is all in Latin so everybody knows it is “classy” and “elite”, just like all the expert gentlefolk of our nation’s capital

“I believe it is inscribed…”

Your belief is incorrect.Granddad of my High School Wop buddy,a stone mason,carved on top of the IRS main entrance in Italian:

“Lasciate ogni speranza, voi che entrate”

Because Latin was not good enough to express how he REALLY fellt.

There is nothing “classy” or “elite” about Latin.Mae West used to say:

“Estne volumen in toga, an solum tibi libet me videre?”

Which was usually met with blank stares.She gave up and switched to English:

“Is it a gun in you pocket or are you happy to see me ?”

Anyway,before the IRS audit it is nice to say:

“Te futueo et caballum tuum”

F.. you and the horse you rode in on !

In the ongoing salary increases dept: School bus drivers had a sickout Friday in Raleigh. 200 of the 600 did not show up. They announced (somehow as they don’t seem to have a leader or spokesperson) it the day before. It was quite the traffic snarl, but every pissed off parent interviewed by the tv news said the drivers needed more pay and they did not blame them for the situation.

I think pay raises are just getting going.

Yep. Every group of worker, unionized or not, will be going on strike. It’s way overdue anyway. Unfortunately the cost of living will rise way faster than wages will. This is barely the first inning of wage pressures, and is no doubt part of the many warning signs of a coming hyper inflationary environment. Buckle up buttercup. This ride will be anything but smooth.

In most places, wages could double and houses would still not even be remotely affordable. If you ask most long term owners if they could afford their house if they had to buy it at today’s price, the answer is an emphatic “no.” That right there tells you how massive this housing bubble is. It needs to crash.

I predicted this in my earlier posts. Massive strikes are a result of workers not getting paid a decent wage for essential services they perform. This was widespread in the Weimer Republic in 1922/1923. This is being repeated here in the USA today. Workers who are not unionized like ourselves cannot strike and we have to suck up the loss in purchasing power.

You do NOT need to “suck up the loss”.

There are many other ways workers can “negotiate” raises or other concessions, besides unionizing or going formally on strike.

The Southwest Airlines and Raleigh bus-driver sick-outs are just one example.

The folks lying flat (choosing not to work, or not to work as much as they could) are another example.

The most common of course is quitting one job and going to another which offers a better deal. Plenty of that going on too.

If you know you’re worth it, you just have to do what it takes to persuade someone to make you a better offer, then carry that back to your current employer and see if they want to make a retention offer. (This only works if it’s a credible threat and you’re willing to follow through and leave.)

Might have to leave regardless of retention response, depending on the job I guess.

That company may pay you more temporarily (until they can replace you) but they probably aren’t willing to raise everyone’s wages.

A company can’t have one employee making way more than the comparable others.

I just showed my current employer their competitors (currently hiring) much higher pay scale. I am willing to quit & might have to do so, but I’m hoping they increase all of our pay.

We are currently losing people much faster than we can train them.

So inflation is FIRMLY embedded once it hits wages. Definitely not transitory. The fed got what it wanted. In spades. The 70’s inflation will have been a Sunday stroll in the park by comparison, as the Fed is backed itself between a 1000 ton chunk of granite and that hard place. QE has wrought so much damage, the resulting financial devastation will be mind boggling. They cannot raise rates to arrest this, let alone stop tapering, for if they did stawks would tank by 90%. It’s all but game over for our US currency now.

The FED is evil and should be disbanded or severely, SEVERELY, neutered. But Congress is responsible for a lot of this. You never hear a peep from them about a real estate bubble, the homelessness crisis, etc. These people are vile filth, working hand in hand with the FED to loot the Treasury and rip off the people.

So…. just issue a new currency.

Problem solved.

Mike, disagree about the currency and stock market.

Control of the currency is the source of the Fed’s power, and vital to the Establishment as well. Changing currencies is too risky. Most of the Establishment is wealthy enough to tolerate stock market price dips, provided the Fed signals early (which it is doing now) so the Establishment can position themselves.

They will raise rates, tank the stonk market, and use control of the government to do “stimulus” bailouts again.

The Fed CAN QE to keep FedGov from going BK, while ALSO tightening non-FedGov credit to fight inflation. Although they haven’t done those simultaneously before, they can. For instance, the Fed could rapidly unload MBS to raise rates, and slowly buy Treasuries to prop up FedGov. To help raise rates they can also raise short term IOER rates and tighten up bank regulation.

Timing is the big question. Establishment needs to engineer a dip and then recovery before the 2024 election. They learned in 2016 that they need to keep the populists in BOTH parties at bay, and blatant vote-theft won’t work again after 2020.

I think Powell’s plan is to give the Progressives everything they want (so he can stay in power)… which coincidentally also gives them “rope to hang themselves” and get flushed out in the 2022 election. Late 2022 market crash, 2023 recovery, 2024 smooth sailing for Establishment pols.

So I see high inflation ahead, but not hyperinflation.

The next question I have will be whether China wants to ruin this party, and whether it can?

JP will start tapering next month & raising rates late next year.

But I agree, the debt will be unsustainable at high rates, so the Fed will intentionally be way behind inflation & will not do nearly enough to stop it.

It will cost Dems big time.

the fed is going to make the colossal policy error in tapering into a slowing economy. You’ve got Larry Fink from blackjack and other Wall Streeters hammering on the fed to begin raising rates because of inflation. Meanwhile they are salivating on all of the distressed assets they’ll buy for 10 to 40 cents on the dollar. rinse and repeat! Ask yourself one question. When has the fed ever been right about anything? The downturn is coming folks. You better own your stuff or the bankers will take it from you!

bream,

When Greece defaulted their prime infrastructure assets were snapped up by other wealthy Europeans including dubious money sources. At the same time a convenient meme exploded about lazy Greek workers, excess holidays, and corruption. Can see the same thing happening with this situation. Maybe there will be a Govt change and suddenly, “We just have to sell this road, bridge, water service, etc because we can no longer afford to run them”. While people dodged paying taxes in Greece, other folks just move to no tax states and laugh at the chumps who didn’t.

Zoning? What’s that?

The Flint water system privatised:

From the Guardian

The internal Veolia emails, obtained from the court by the watchdog group Corporate Accountability, show company executives discussing the possibility of lead seven months before the city confirmed the problem publicly.

On 9 February 2015, a Veolia vice-president wrote an email to company executives saying the firm had previously identified the risk of lead contamination.

“Do not pass this on,” wrote Rob Nicholas, then the vice-president of development, in an email to Veolia executives. “The city however needs to be aware of this problem with lead and operate the system to minimize this as much as possible and consider the impact in future plans. We had already identified that as something to be reviewed.”

Nicholas forwarded the information to Veolia engineer Marvin Gnagy, adding: “Yep. Lead seems to be a problem.”

no, they’re hammering on the fed to raise rates because they want to avoid a crack up boom, not because they want to buy cheap assets.

A lot of these wage increases are temporary, until the job is automated, outsourced or eliminated.

Our very lives are temporary as well.

Now what was it that John Maynard said…..

Yes, but the ones that can’t be, like nurses, truckers and bus drivers, could collapse the whole economy very quickly if the problem isn’t dealt with.

I think that governments no longer have either the competence or the will to fix the situation. The fines at the San Pedro Bay ports would be an example.

Housing is a massive problem. There is no way workers will move without huge wage increases to afford property (rental or purchase), even assuming such is available, so if the existing local workers down tools then everything stops.

blackrock!

Well, the Fat Lady has finally sung. The crucial missing ingredient that has been necessary to chase the Deflationists out of town, and welcome in the Inflationists, is the trend and price changes in the key element to the Cost of Everything, LABOR. And what is almost hilarious, except of course for all the human suffering to get there, is that it sure as heck has not been a booming U.S. economy that has lit the Labor Cost Fire, but an almost dysfunctional one that has been grossly distorted by a Chinese originated virus (partly funded by NIH stupidity), runaway train Monetary Actions, and a Government falling all over itself to give free moola to any living creature with a pulse. Ain’t no boom that has caused this Labor Price Spike, since 3rd Quarter just came in a year-to-year trendline of miserly 2%. There has not been an economic boom since March, 2020, period.

All of the stock and bond market cheerleaders out there, still mostly blind to the profit margin and default risk that accompanies a new inflationary cycle, are sitting down to a repast of mainly good ‘ole Crow. China’s cheap labor market is turning less and less cheap while the disruptions to the international supply chains are not allowing many of their not-made-in-America goods to reach U.S. wholesale and retail shelves. Investors on Wall Street have been living in Hog Heaven for so long now, I count 13 years, that the real possibility, if not reality, of Margin Shrink coming to a venue near them has not totally been reflected in financial asset prices.

I almost get giggly over the raises being given Goldman Sachs employees, because how typical is it of an investment bank to start piling on the lard just before a very severe downturn in the financial markets. They must employ the same forecasters and economists that the Fed eventually does. Oh, I forgot, the banks that own the Fed, technically at least, are a training/breeding ground for Federal Reserve employees. Can anyone say conflict of interests here!!

Some observations:

The pig fest on Wall St. started in the 1980’s, the GFC was a small decline in the overall market. If you want to get really technical, the pig fest really started in the late 1970’s, but was confined to only a few investment firms.

As far as raises go on Wall St., it is not unusual for a firm to raise wages and give promotions, just before a big purge. They do it to give the laid off employees a higher wage base and title when they go looking for a new job. It is a very perverse incentive to bestow. Most professionals on Wall St. with any longevity have seen this happen more than once.

and the 70s was roughly when our best and brightest transitioned from becoming doctors and engineers to selling financial “products,” whatever the hell that means.

What is coming is going to be interesting.

1970s stagflation was largely, if not entirely, due to the international turmoil after the closing of the Fed window.

Today – the turmoil is more likely going to be the “Let’s Go Brandon” folks and the low wage workers getting screwed, combining into a lashout against whoever they think is the cause.

The sitting administration and Congress is in the crosshairs.

I wouldn’t discount secondary effects either a la French Connection (where did the drugs go).

I’ve said this before and will say it again. We did not pay the bill for the ’08-’09 mess and we have what we have today. A false economic platform that is weakening day by day.

Given what the “American Dream” is supposed to be all about we have exaggerated it’s boundaries with enormous consumer debt.

Somewhere, sometime economic reality will set in. Those who have overspent and gotten themselves too far into debt will pay.

Those who have not overspent and have tried to modify their “lifestyles” to fit reality will make it thru the next downturn without too much difficulty.

I am one that truly believes that the “economic leadership” in this country led by the FED and it’s intolerable lax interest rate policies has painted (itself) themselves into a corner. How long they can keep this up is the question.

No one in the investor class really wants to pay the price for realistic interest rate hikes; no politician wants to be heard for the same. No private citizen wants to be the scapegoat.

I’m always reminded of the line in the good movie, “Wall Street” (original)…..”Somebody’s gonna pay and it ain’t gonna be me!”

That’s what all individuals are saying to themselves.

“Survival of the Fittest” will be very apt for the coming economic catastrophe.

Either we change our vision of what “life” is all about…..the differences between “quality of life” and, “lifestyles” and we understand those differences we will perish as a viable society.

One of the conditions of “refurbishing” a downward economic/societal spiral in the past was to somehow start a war that distracts from the problem. Today we cannot. The military weapons ultimately available are too unbelievably destructive. That option (world war) is not on the table. Not like WW2 which contributed so much to the eventual economic recovery post Great Depression.

“Capitalism” is not a bad game; it just needs rules like all games and vigorous enforcement.

The game is being played with the destruction of those “rules” and all the referees have left the stadium.

Prepare yourselves!

Sierra-sagacious, as usual. The universal phenomenon noted in Diamond’s ‘Collapse’-‘ISEP’: ‘…it’s somebody else’s problem…’.

may we all find a better day.

@Sierra7 Maybe this is not a false economy but is the new economy of the future. People do not work because they make more money buying cryptos that just keep going up in price.

After all the U.S. GDP is over 70% services. So the government just needs to keep pumping in money so the coffee barista can hire a landscaper to mow the yard. then the landscaper gets his hair cut, the barber then goes and buys a coffee.

On a side note….I know a just above minimum wage landscaper employer said he made 90k in cryptos this year. Probably almost 3x his normal salary.

When you look at these wage gains, look at total compensation. I know some of these wage gains come at the expense of benefits. Expect deductibles and premiums on healthcare to go up, expect matches on 401Ks to be lowered or disappear, etc.

Petunia,

Yes, there probably is some of that. But in terms of this data, benefit costs (what it costs companies to pay for those benefits, such as health insurance) also went up, but less than wages.

Many companies have improved their non-wage packages, including better benefits, or they’ve added benefits when they didn’t offer benefits before. They’ve added vacation time. Starbucks is improving its system of working hours so people have a better chance of getting the shifts and hours they want, etc. Lots of things happening in the non-wage area to attract workers.

Stock prices, dividends and profit per employee…

When these start taking a hit, it will get real for most companies…

Until then, it’s a PR cost…

I just received a letter from my pension fund stating that death benefits and disability pensions are ending, the pension vesting rate is being cut in half, and new employees are not going to get any pension benefits at all, as of December 1, 2021. The pension fund is only 70% funded, and it appears that the ‘game plan’ is to end all meaningful pension benefits except those for the long-term employees, and gradually wind down the fund as they die off and no new employees are added.

This doesn’t affect me too much as I’m only vested enough to get the princely sum of $35 a month if I retire. The employees who have 30 or 40 years will get something substantial from the fund, the people who have worked there for 20 years will probably get back about as much as they paid in, but anybody with less than 20 years (that’s me) gets screwed out of anything meaningful. ‘Bupkus’ for the new hires, to use some slang from NFL football .

It’s one less incentive for anybody to work at my employer, and we are staffed at about 65% of the level that management wants to have. My department manager says that the staff that he manages are operating at less than 50% of the number of hours per week for union employees that we had twelve years ago (1175 hours in 2009, about 545 hours in 2021). The people who are still here are working more than twice as hard as they were in 2009, by that metric.

The current union contract has the unionized employees scheduled for a $0.30 raise in July 2022, a $0.30 raise in July 2023, and $0.40 raise in July 2024, with the contract expiring in July 2025. Yes, that’s $1 an hour total by July 2025. Methinks they are going to have even more staffing issues.

Did I mention that the union is considered to be absolutely worthless by its own members? Their leaders have run things into the ground.

There is rampant speculation that the company is about to break and shatter like glass if the current situation is not rectified.

Ensign_Nemo:

Just a little FYI. Bupkus is a Yiddish term for sheepshit. 😘

Hi Wolf, the FED wanted this Inflation and so why do you think they are going to want to stop it unless the Bond Market makes them ? They are going to leave this ‘hot’ and I believe barely reduce stimulus

For me, it all still comes down to the bond market. That high in the 10Y and 30Y treasuries was unpierced in this latest runup in yields. If inflation was getting ingrained, those highs should have been taken out by now, but they weren’t.

The LT bond market could be seriously wrong on this one. The bond market is assuming the Fed will remain in control and suppress interest rates forever, and asset prices will never revert to historical trends.

I’d say there’s a better chance the Fed is cornered, can’t prevent an asset price crash, and can’t prevent LT interest rates from rising to factor in default risk, as well has higher demand for cash that always comes from lowered asset prices. When assets tank in price, economic growth rates and interest rates rise because people see prospects for higher real return. They want cash to invest.

Given the rapidly changing dynamics and huge rises in inflation, I’d say an asset price crash is a serious risk during the next few years, if not the next quarter.

Well, sure, the bond market could be wrong- that is always a possibility, but when was the last time it was actually wrong? By my reckoning, they haven’t been wrong in my lifetime, and I am 55 years old. Every time since WWII, the bond market has sniffed out inflation before it actually appeared, and has sniffed out real growth rates, too.

Basically, they have to be wrong at least once before I start to doubt it with my money.

Why do you say bond investors have never been wrong in your lifetime? Just since 2011, the TLT has ranged between $90 and $170. That’s a ton of variance, which is attributable to continual revisions of long-term interest rate expectations, which are in turn attributable to the Fed’s whims and flip-flops.

I’d say bond investors have been more wrong than right, largely because they believe the Fed’s projections have credibility.

You have never seen a market this manipulated. Try to find a similar period when bond yields offered a negative return like this taking into account inflation. This is a great opportunity to participate on the downside.

Here is how you know you are right: ask every human you have contact with it they think the stock market will continue to go up.

When more than half say no, it is time to buy.

Do your survey.

It is time to sell.

That’s not what my charts of 1970s data show.

Interest Rates lagged inflation surges every time.

Just as they did this year.

It’s worse now because the Fed IS the bond market today.

people don’t care about the long term value of the bonds, only whatever they can flip them to because of central bank interference. no one would buy these bonds if they had to hold them for 30 years

From a G20 report:

“National income is the sum of all income available to the residents of a given country in a given year. The division of national income between labour and capital is called the functional distribution of income. The labour income share (or labour share) is the part of national income allocated to labour compensation, while the capital share is the part of national income going to capital. A falling labour share often reflects more rapid growth in labour productivity than in average labour compensation, and an increase in returns to capital relative to labour. “

https://www.oecd.org/g20/topics/employment-and-social-policy/The-Labour-Share-in-G20-Economies.pdf

So, if labour income share has risen, we should celebrate, not moan about inflation.

Nobody seems to be discussing —> Labour Income Share <—-

There was no “moaning” about wages in the article or in the comments.

Ha, point taken.

For labor share of income to grow, the wage increases have to exceed both inflation plus a half of productivity gains. And, this would have to happen for many years.

So far, wage increases don’t even offset inflation. It’s way too early to celebrate. Workers are still like a fish flopping around in the boat. You need the boat to rock enough so that the fisherman falls out.

Let’s consider the impact a true pandemic has – the black death. It’s estimated that 40%-50% population died in Europe and 70%-80% in southern Europe.

The price of food initially fell as people died. But then they started rising as the labor shortage hit home. Prices reflected scarcity not higher demand. Tenants and laborers benefited rather than the landlords.

Agricultural workers who were free to move (many were not) headed for the cities and higher wages because dense populations was where the plague hit the hardest. Skilled workers who died were unable to teach a new generation their craft – quality suffered.

Many workers were unwilling to work or work only for “excessive” wages. Government stepped in and forced labor to accept what was offered. Things became so oppressive to labor, in England, it ended in peasant revolt. At the same time population failed to regenerate itself and negotiation rather than coercion would become the norm. It does not end well for government/employers.

Covid seems to be having a similar effect. Government/employers are being just as coercive towards labor just as during the Black Death. Wait until Biden administration drafts wage and price controls in support of employers. His recently whispered “pay them more” is coming back to haunt him. The birth dearth is eerily similar also.

Fertility rate is down to 1.6.

Just a slow motion version of a catastrophe.

We lose about a quarter of each generation.

Issue seems to be neither recognised nor have solutions offered.

Some people have such a creepy self hatred that they rejoice at declining populations.

I read the Denver Airport concession operator had a job fair and was hoping for up to 5000 people to attend. 100 attended for the 38 positions they wanted to fill. Only 2 if the positions were filled.

ru82

No one wanted the jobs because they were looking at $7/gallon for gas to drive 50 miles out there in the middle of nowhere to take minimum wage jobs. They would lose money taking one of those dead end jobs. Do you blame them?

Wages have to soar, or assets crash. Nice spot for the Fed.

In short, no good choices, only less bad.

A big tax increase could delay by soaking up liquidity….but that is also contractionary.

True!

I guess the next step if for companies to build company towns.

Provide room and board and you have to buy groceries at the company store.

Who is dumb enough to work at an airport these days, when they close down travel anytime somebody sneezes? I’m surprised anybody showed up and the two they hired must have desperately needed a job.

Airports now have everything you don’t want in your life. Traffic jams, parking fees, crowds of sick people, lines, bad food, rude clerks, security goons.

I don’t even enjoy picking up people at the airports anymore. I’d rather send them the money for a UBER or cab ride.

Who is going to buy I phone or Microsoft computer when there are no jobs

Bank of America has already announced in countrywide high profile advertising that their minimum wage is $25 an hour. For a job during regular business hours with no heavy lifting in air conditioning with benefits and maternity leave.

No inflation? Really?

If you lose your shirt in the coming market crash, do not blame Wolf.

Why would there be a crash? Especially since the Fed is still printing?

Inflation begets inflation so the Fed will continue to print, print, print.

You want the stock market to crash, you better hope the Chinese or somebody/anybody has something in mind. Ironically, in order to fix this country we might need some foreign intervention because the people in DC are only concerned about their own wallet and nothing else.

I think the folks in DC are deeply concerned about the people and how much they must give them for “free” to remain elected.

There is no “Labor shortage” it is an excuse…

Notice how the executive management teams at all these large corporations are using the same excuse.

Notice how the media lets them get away with their nonsense.

A bad employee will always have an excuse as to why they were late, screwed up or didn’t show up at all.

It all starts at the top. Most of the executive management employees at these same large corporations have not shown up for work in decades.

A labor shortage is when you can’t find anyone to hire. An executive managerial problem is when 75% of the labor you hire quits within the first month.

There is plenty of labor available. The problems we are seeing is that the executive management branch of these corporations are not currently being viewed as employees.

Excuses are tolerated, until they are not.

There is not a labor shortage.. there is a wage shortage and a rejection of working conditions.

My local McD closes now from time to time. They can’t keep people… Hmm maybe pay them more, give better benefits, and stop your just in time labor practices.

I have zero sympathy.

Amen. Wages have 30 years of catching up to do on top of last year’s inflation.

Capital always competes with labor. Subsidizing capital with Fiat credit always impoverishes labor. Regardless of any short-term effects to the contrary. This is why Mises claimed the welfare state is necessitated by the wage slavery which Fiat credit inevitably imposes.

I talked with the managers of a casino buffet this weekend. We were talking about how much it costs to hire people right now. I said it was probably temporary and that as people started drifting back into the workforce the wage rates and incentives would go down.

Interestingly they did not agree. They said that once you offer one employee a certain wage you are pretty much bound to give it to to all of the others as well because they all talk to one another. They thought that maybe the hiring bonuses could go away… but that they were stuck with the new hourly rates.

The casino manager was correct. Wages are very sticky and it’s nearly impossible to cut them without losing all your best people. Maybe in the future, you can hire people at lower starting wages, but you cannot easily cut wages of people you already have on the payroll.

There is little I have understood in the economy the last twenty years. As those years passed, I thought the only “inflation” that the rich cared about was wage inflation. I figured they eventually would let or cause a recession if wage inflation started. We are about to see if my speculation will be correct.

This is so true, In Ontario, Canada here my job as a dishwasher for 5 years now, I was making $15.50 an hour and now $19.50 an hour just last week. I have not had a raise in 4 years. The 55 hours a week means an extra $300 gross, $225 an hour net pay. It is a good thing I have been used to living on less every month. I will just save as much as I can as I don’t want to help their economy.