The bottom 50% need not apply. They just get to eat the soaring costs of housing. How the Fed totally blew out the already gigantic wealth disparity during the pandemic.

By Wolf Richter for WOLF STREET.

On Friday, the Fed released the detailed data about the wealth of households by wealth category for the 1%, the 2% to 9%, the “next 40%” (the top 10% to 50%) and the “bottom 50%” for the second quarter, after having released less detailed figures on September 23. You read the stories at the time about how the Fed’s money-printing and interest-rate-repression has enriched American households.

But the detailed data, just now released, show whose wealth jumped the most, and who got left endlessly further behind. It wasn’t households in general that benefited, but only the richest households with the most assets. The more assets they had, the more they benefited.

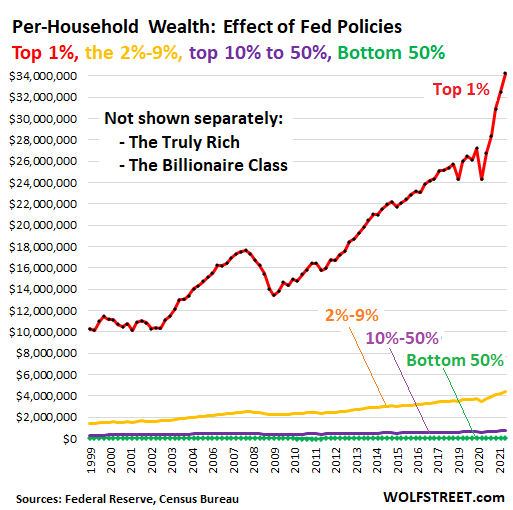

My Wealth Effect Monitor divides the wealth (assets minus liabilities) for each wealth category by the number of households in that category, which produces average per-household wealth within each category. The wealth of the bottom 50% is reflected by the jagged green line on the bottom, essentially on top of the horizontal axis:

Not shown separately are the truly rich – the 0.01% – and the Billionaire Class. The Fed wisely doesn’t provide any information on them separately, but includes them in the Top 1%.

But according to the Bloomberg Billionaires Index, the top 30 US billionaires are worth on average $69 billion per household currently, having gained on average $2.2 billion in wealth each over the quarter.

The bottom 50% of US households (green line above) – 63.2 million households – are worth on average $47,900 per household. But this includes $25,970 in “durable goods” (cars, phones, furniture, etc.), which for consumers are normally considered consumables, not assets, because their values are declining, and they don’t produce incomes.

The bottom 50% gained $7,900 per household over the quarter, and those gains included $2,085 from purchases of durable goods!

You can kill someone with reckless usage of percentages.

If I give a homeless person $5, and he already has $5 in his pocket, I increased his wealth by 100%. But he still is homeless and still doesn’t have any wealth. Percentage increases are touted as a way to show that the wealth at the bottom increased sharply, when in fact, it increased by only peanuts because the bottom 50% have so little.

But even a tiny percentage increase on $65 billion in wealth is a huge amount of money, and the wealth disparity continues to balloon.

The wealth disparity between the top 30 billionaires on average and the bottom 50% grew by yet another $2.2 billion per household, to $69.2 billion.

There were 126.34 million households in the US, according to the Census Bureau. The 1% by definition make up 1.26 million households. That’s a lot of households, from Musk on down to the regular multi-millionaire.

And the wealth disparity within the 1%, from the average top 30 billionaires to the least wealthy among the 1% also grew by around $2.2 billion to $69.2 billion. Because the bottom end of the 1% still own only peanuts compared to the Billionaire Class.

Since Q1 2020, when the Fed started its crazed money-printing and interest-rate repression scheme, according to the Fed’s data:

- The wealth of the 1% jumped on average by $9.95 million per household to $34.3 million.

- The wealth of the bottom 50% rose by less than a rounding error in terms of the 1%, by $18,600 per household since Q1 2020, to $47,900. Over half of their wealth is in durable goods (cars, phones, furniture, etc.).

- The wealth disparity per household between the 1% and the 50% ballooned by $9.93 million, to a record wealth disparity of $34.2 million.

The reason is that the 1% hold most of the assets, and the 50% own practically no stocks, no bonds, and very little real estate.

For the Bottom 50%, real estate is their largest asset at $68,504 per household. This means that relatively few households own real estate. And they have on average $40,122 in mortgage debt, which leaves them with $23,382 in home equity.

They own practically no stocks and mutual funds ($4,122 on average). And inflating the stock market, as the Fed tries to do, just leaves them purposefully further behind.

But they own $25,970 in “durable goods,” which the Fed counts as assets, rather than consumables. If you don’t count these consumer goods as assets, the wealth of the bottom 50% shrinks to $21,948.

So when asset prices rise, they leave the bottom 50% behind.

This is all part of the Fed’s official doctrine of the “Wealth Effect,” which has been described in numerous Fed papers, including by then San Francisco Fed president Janet Yellen in 2005. “As part of its analysis of demand in the economy, central bank models have long incorporated the wealth effect of house prices and other assets on spending,” she wrote. In November 2010, Fed Chair Ben Bernanke explained the concept of the Wealth Effect to the American people via a Washington Post editorial.

The Fed, which has now embarked on creating a kinder-gentler facade, no longer calls it the “wealth effect.” But the policies haven’t changed: asset price inflation. And the costs are borne by the bottom 50% for whom life just gets more expensive – including housing costs.

The bottom 50% range from getting by OK to the down-trodden.

Among the bottom 50%, there are also large differences. At the top end are households perhaps with a modest house weighed down by a big mortgage, a small 401k, plus cars and other durable goods, minus auto loans, student loans, and credit card debt. But that category also includes the poorest of the poor.

The bottom 50% face the soaring housing costs and other costs that are a result of the wealth effect. Many live from paycheck-to-paycheck and use their credit cards to tide them over. They have on average very little money left over to put aside and buy stocks with.

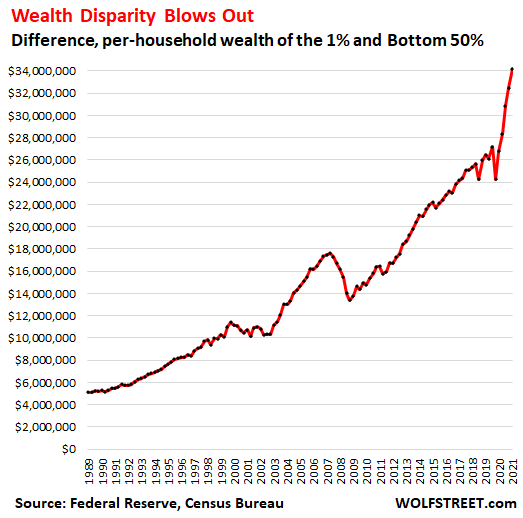

Fed blows out the Wealth Disparity during the Pandemic.

The Fed’s doctrine of the “Wealth Effect” is designed to enrich the top 10%, particularly the top 1%, particularly the top 0.01%, and particularly the Billionaire Class. The more they have, the more they benefit. This is official Federal Reserve policy.

But during the pandemic, the Fed went all-out: It printed $4.5 trillion in 18 months and repressed short-term interest rates to near-zero, in order to inflate asset prices to the extreme. And it succeeded.

This was the greatest economic injustice committed in recent US history. Congress could shut it down but doesn’t want to even debate it. Members of Congress mostly belong to the top 10%, or hope to soon belong to it (on their Congressional salaries, of course, hahahaha), and that’s why this continues.

The bottom 50% don’t understand what the Fed is doing to them, don’t even know what the Fed is and does, and they are too busy trying to survive in this economy that the Fed has so powerfully rigged against them.

My Wealth Effect Monitor tracks that economic injustice. Below, it shows the difference in wealth between the 1% and the bottom 50%. Asset price inflation is the cause. The more they have, the more they get. The bottom 50% don’t have anything and need not apply. But during the pandemic, the Fed went hog-wild and completely blew out this wealth disparity:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The 1%er chart would be more steep if they accounted for the Fed governors’ insider trading.

Nice analysis. But as you point out nothing will change cause who in our largely wealthy congress, including those who say they are trying to help the less well off, will do anything that affects their wallets ?

Oh something will change: I am sure that measures will be enacted to keep the “small fry” out of trading options.

Can’t let the wrong sort into The Club!

Exactly what I was thinking.

Does anyone really expect faux-socialist Sen. Sanders to raise his OWN taxes? Of course not.

Nothing to be ashamed of or worry about at all. Capitalism’s foundation/outcome is wealth disparity. Just make sure you try your best to take the advantage of capitalism, climb the social-economical ladder and become the lucky club of the top 1% or 5%. It is all that matters.

Make sure you were not born disabled or get sick before you get rich, and also be sure to go back in time and buy a POS crap shack in Phoenix in 1997.

It’s your own damn fault and that of public education if you haven’t figured out time travel by now. Apply yourself, watch some youtubes.

Sheesh!

exactly how I feel – NOT MY PROBLEM you are — fill in blank

most of us with some assets have worked diligently for years

I will continue to push up rents(ie due to devaluation of fiat $dollar)

and if you can’t afford then bye bye

You really have a simplistic view. What we have is crony capitalism, not free market capitalism. We also have a fully bought and paid for government owned by multinational corporations with no allegiance to any country or people, so the decisions made by that bought government will not reflect what is in the best interests of those who elected them.

The top 0.1% also have many times the political influence of everyone else by virtue of their having what a bought government wants: money. Need science-based proof? (besides infamous recent snapshots like Pelosi holding a large outdoor dinner party for wealthy donors in CA where the only people wearing the required masks were the servants) Here:

Testing Theories of American Politics: Elites, Interest Groups, and Average Citizens [Princeton University, 2014]

Excerpts:

A great deal of empirical research speaks to the policy influence of one or another set of actors, but until recently it has not been possible to test these contrasting theoretical predictions against each other within a single statistical model. We report on an effort to do so, using a unique data set that includes measures of the key variables for 1,779 policy issues.

Multivariate analysis indicates that economic elites and organized groups representing business interests have substantial independent impacts on U.S. government policy, while average citizens and mass-based interest groups have little or no independent influence. The results provide substantial support for theories of Economic-Elite Domination and for theories of Biased Pluralism, but not for theories of Majoritarian Electoral Democracy or Majoritarian Pluralism.

In the United States, our findings indicate, the majority does not rule—at least not in the causal sense of actually determining policy outcomes.

When a majority of citizens disagrees with economic elites or with organized interests, they generally lose. Moreover, because of the strong status quo bias built into the U.S. political system, even when fairly large majorities of Americans favor policy change, they generally do not get it.

To be sure, this does not mean that ordinary citizens always lose out; they fairly often get the policies they favor, but only because those policies happen also to be preferred by the economically-elite citizens who wield the actual influence.

The academics and policy makers (typical of the hundreds of PhDs in the Fed, for example), believe that in a recession/crisis, the wealth effect is helpful in keeping the economy going. Which is true in a healthy real economy.

The “asset holders” (rich), are supposed to do many things with the wealth they obtain: save, invest, spend. Any of those can be productive if they go to the real economy.

“Investments” in today’s economy have nowhere to go. The real economy in the developed world has been off-shored.

The bottom 50% doesn’t have enough to spend so there is a dysfunctional vicious cycle.

Much of the wealth is used to purchase stocks, most of them being bought as buybacks by large corporations.

Until the wealth has a place to go in the real economy, this will continue.

From the below paper:

“Since the 1980s, however, the apparently robust growth in manufacturing

real output and productivity have been driven by a relatively small industry—computer and

electronic products, whose extraordinary performance reflects the way statistical agencies

account for rapid product improvements in the industry. Without the computer industry, there is

no prima facie evidence that productivity caused manufacturing’s relative and absolute

employment decline.”

https://research.upjohn.org/cgi/viewcontent.cgi?article=1305&context=up_workingpapers

“The academics and policy makers (typical of the hundreds of PhDs in the Fed, for example), believe that in a recession/crisis, the wealth effect is helpful in keeping the economy going.”

Then they’re delusional, dogmatic, ivory tower idiots, a common disorder.

Go to YouTube and search for “Minsky Introduction Video” to see the simplistic garbage they use to run the world via the artificial manipulation of the price of money – interest rates.

Then we’re back to my point about why such a fundamentally bankrupt and proved to be wrong in multiple bubble/bust cycles NON-science persists – the only factions in a position of power to change it benefit from NOT changing it.

“It’s difficult to get a man to understand something when his salary depends on his not understanding it.” – Upton Sinclair

“It doesn’t matter how beautiful your theory is. It doesn’t matter how smart you are. If it doesn’t agree with experiment, it’s wrong.” – Richard Feynman, Nobel Prize winning physicist

“In his book, ‘Thinking Fast and Slow’, Princeton University Nobel Laureate, Daniel Kahneman, introduces us to the principle of ‘Theory Induced Blindness’ – the adherence to a vulnerable belief, even though a counterexample may exist, about how something works that prevents you from seeing how it REALLY works. So once you have accepted a theory, it is extraordinarily difficult to notice its flaws, trusting instead the community of experts who have already accepted it.”

Nice analysis…. it’s why to make any real changes we need term limits, an end to corporate lobbying/influence, and reforming our voting system to something that is just common sense fair so the percentage votes get the percentage seats/representation.

Free market capitalism as described by Adam Smith, was predicated on a universal basic income, free college, and

Free healthcare to keep poverty from being a cycle. And he advocatef for heavy taxes on the rich.

Actually”free markets” don’t work. We can’t just get money out of politics because there’s always a way to bribe someone if you’re clever. The only way to fix this is to make it so nobody can be ultra wealthy. If nobody could get more than $20 million of wealth they wouldn’t be able to bribe politicians

Tony,

You totally missed everything I said in the article. This isn’t about someone starting a business and making it (that’s capitalism).

This is about the Fed inflating asset prices to make the asset holders immensely rich, at the expense of the bottom 50%. That’s purposeful and planned economic injustice.

So please DO READ the article.

Thank you Wolf and Winston (from 1984?) for these comments.

Thanks Wolf for your comments. I did read your article and well understood your concern over our unfair monetary policy and injsutice toward the bottom 50% of our fellow Americans. However, we have always been fooled to believe we can democratically elected our government/officials to represent our best interests but in actuality those elected ones have always been representing the bloody rich or super-powerful corporations. Has it unfortuantely been like this for generations? You presented a really painful reality to the readers but I from solution perspective simply suggested we try to ride the wave if we can’t change it. Social Darwinism!

Tony,

Recently saw a commentary that claimed the Gov of Florida just raised $55M from private equity guys for his next election bid. Any suspicious person would wonder what they get in return.

can you distinguish between the 0.1 and 0.1-1%? Or even better, 0-0.001, 0.001-0.01, 0.01%-0.1%

The line for the 1% is likely way too much pushed up by the inclusion of the 0.1%.

If you do that it will become more clear what the problem is that you describe.

The higher the amount in assets, the less percentage wise is spend things.

Bezos most likely spend less than 1% of his wealth on consumables so 99% stays in assets of which most will never be taxed because no capital gains on stock that is never sold.

At the other end, it is 99% on consumables and 1% in assets

Above that, it is the savers who are totally f*ked by interest rates way below inflation so they will keep saving but never able to do that downpayment for that house.

And above that are the tax payers. They have probably some investments but not enough to leave them and never sell. And when they sell, 25-60% depending on location and how long held is taxed.

We are heading back to the feudal system. Only if the goverment starts giving assets = land, away can things go back to helping the masses.

Businesses existed before capitalism, communists countries have businesses. Business and markets existed before the concept of . You don’t even know what capitalism is.

It’s an ownership of capital being private that makes Capitalism what it is. In feudal times it was the king and nobility that could own capital with some owned by landed gentry if they were lucky. Communism has collective ownership by the people. Sometimes the people can be represented by government since it’s supposed to be democratic but that’s not always the case.

@Mara,

Nice attempt at gaslighting.

Capital owned by private individuals and entities and free exchange of capital for goods and services is capitalism.

A king or nobility owning capital and directing where and how it should be allocated is not.

True capitalism involves an ever-present risk of loss from taking equity risk. This risk no longer exists – as it has been permanently papered over by the kleptocrats in Congress and the Fed. Nice gig if you can get it.

Tony, I hope that was sarcasm because climate change issues added to the poverty/disparity in the country can easily lead to anger and then violence. Capitalism may make some rich, it may be a great generator of innovation and progress of a kind but it has no ability to solve climate change or social inequality. It can’t even fix its own infrastructure problems. In fact it has created the problems we all now face. A new paradigm is upon us and how we move into the future is probably how mankind survives its own illnesses, if it does.

I personally maintain all the riots, political deathmatch discourse, protests, and the general populations anger with the current system are driven by the horrible economic policies that benefit the rich (not even mentioning dismantling the social safety net).

In a society that is functioning well, all boats rise with the tide and the general population buys in because their lives improve.

In our current reality that is NOT the case. This leads to insecurity and struggle. Hatred, bigotry, envy and anger are much easier to cultivate in this scenario.

The books I have read about the Great Depression all enumerate this. FDR was faced with rioting, extreme protests and a real risk of systemic failure. He enacted socialists policies to save capitalism from itself………

I fear the future, as the very wealthy have completely captured our .gov

Not that it was needed, this comment and the article show the cruelty and archaic, to say nothing of the anachronistic nature of capitalism. It is a system that thrives on exploitation and war. Cooperation, not competition is the natural order of society. Compassion is instinctual, greed is a learned behavior. Socialism thrives. Would you get rid of the Veterans Administration, public roads, publicly owned utilities, Social Security benefits, police and fire departments, the Post Office, public libraries, State and Federal aid to areas struck by natural disasters, the National Weather Service, etc. ad infinitum. Spare me the “ argument “ the profit motivation will provide better services. Just compare utility bills between public and private utilities.

Now Clarida. What could be more cynical? These jerks are convinced they deserve their advantages. I once considered Fed folk typical ivory tower space cadets but they are playing this game for their own enrichment.

Dont forget all the people they “advise”….all the fund managers…and all the “speaking fees” to come

Bernanke claimed that inflating asset prices would cause a “wealth effect” that would boost GDP for all.

He was lying. Oh, there is a wealth effect alright, but it’s not what he said.

Bernanke’s “Wealth Effect” is that the wealthy have their financial assets priced beyond rational bounds – but this come at the (relative) expense of everyone else! The already-wealthy are given unearned and undeserved economic power when their asset prices are inflated. When they can sell a single share at 2-3x its intrinsic value, that buys a lot of extra stuff in the tangible economy. Meanwhile, the workers struggle to make ends meet because their labor (wages) are depressed and undervalued.

A more cynical person would say the Wealth Effect is the Fed board members lining their own pockets at our expense, by deliberately inflating the values of their own assets while devaluing our labor, pricing us out of our own homes, and making it far more challenging for the lower 80% to get ahead. There’s no helping-hand in the Wealth Effect.

Did you notice Benny said this while middle class families were losing everything they owned. I noticed because their gains came from my losses. Plus, I just assume everything they say is a lie.

Yeah they act like this wealth effect is the only way they can do things so we must accept this side effect of also enriching the wealthy the most …. while there are 100 different things they could do if employment and stable prices were their goals. They make all this out to be some phd magic only they can understand and most people buy it. If they understood it they would be out with pitchforks.

My plan to combat this? Once I retire and am closer to dead I plan on going on a huge debt spending spree on all my credit cards and take out loans. I will then give all the assets I purchase to my daughters and stick the losses on the banks and creditors when I die. And yes, this is a serious plan.

The wealthy, lobbyists, Wall S, elected reps and corporations created this slippery moral slope and I am going to go sledding on it when I die. F–K them.

You could probably buy a ton of gold bars and then have them say they never saw them. Just tell anyone that asks that you probably used it to pay gambling debts or something, who knows.

Amen. Also, this is traceable wealth. If you assume that the billionaires and trillion a I r e families allow the governments or public to truly learn of the bulk of their wealth, you are being naive. (Tablet does not allow even typing this reference to our neo-feudal owners.) Hundreds of trillions of dollars in wealth are being hidden. For example, read the Pandora papers and prior Panama papers. Watch “Britains Second Empire: The Spider’s Web.”

Those in the front of the government cheap and easy money line (wall street bankers, politicians and friends of politicians) get insanely wealthy for doing nothing.

Those at the back of the line (middle class and working class) get $750,000 crack shacks, $70,000 per year communications degrees and hamburger helper.

“Those in the front of the government cheap and easy money line (wall street bankers, politicians and friends of politicians) get insanely wealthy for doing nothing.”

– Yes, the Cantillion Effect. See history does rhyme!

I call it the pantalones effect.

Because the cheap and easy money spigot kicks you in your middle class cohones and leaves you on floor trying to breath.

It doesn’t rhyme. History is the same old rehashed false historical narrative repeated repeatedly with more fashionable characters transposed on the perpetually revived story line, kind of like netflix and marvel do with redux movies.

Study Classics, it’s all superheroes, chimeras, transgenders, profligate rich demigod kids. Same thing in Wiemar.

Religion and regimentation of education, utilize fanciful history books and mythological superhero archetypes, controlled by some old dudes who are your landlord and people gradually accept their toxic fish tank.

Ask a fish in a tank; “what is the most obvious thing in your environment?” The fish will say (speaking for all fish here), the fish will say, it’s the pirate that pops out of that treasure chest on no particular schedule and blows smoke bubbles, driving me crazy, or that other jerk fish over there that is camping on my rock… that was my rock, I had it before they came here (singular they, not gonna misgender fish in Portland.)

Ask another observer, looking at the fish tank from outside, and Them may say that frickin’ fish tank is filthy and rancid, the water is brown, and it smells like a pulled tooth from a dead pers-them.

Don’t study history, it will make you crazy, depressed, unrelatable, and ultimately cancellable.

Oops

Yup

Yup

Love your comments in general oh, but dis agree re read/study his or herstory!

What reading enough of that will tell you,,, certainly with the caveat of understanding who wrote what and when:

Nothing has changed much in the last couple thousand years, overall, except for some ”blips” now and then when the oligarchy has rewarded the yeomen for their very clear results, e.g., USA for a while after WW2; cuz used to tell me he could and did buy a 3 and 2 house in the county of the angels in SoCal for $2500 in the 50s…and then bought in the hills above for $50K that was worth over $5MM just a few decades later.

IMHO, the oligarchs who have owned the world, formerly including ALL of WE the Peons,,, still do.

And will not let go until WE make them do so IMO.

As a now ”elderly” person hoping my spouse who will clearly, (OK, statistically for sure ) outlive me by at least a couple of decades will be OK with the nest egg, NO DEBT at all, but continuing to face increases from guv mint taxes and monopoly on utilities, and similarly for off spring who seem, at least, to understand their challenges after hearing about that for decades now.

Clearly, ”Clean House, Senate too.” as some of us used to spout and have on our bumper stickers as far back as the late ’80s, will continue!

And I am very hopeful all the young boomers and subsequent ”generations” will keep on increasing the vast improvements in communications that will eventually inform each and every one of WE THE PEONS to be able to vote in our self and collective interests instead of the interests of the oligarchy, as is currently due to their ability to bring major, major brainwashing, AKA advertising to every election…

And, yes, I will take that hope to my rapidly approaching demise,,, and would take it to the streets as I did in Berzerkeley after ron e ray gun tear gassed my home without cause in the spring of 69 if able,, and might even do so in my wheeled chair if this very badly out of balance nonsense continues — and I do…

Is Wolf trying to pull a Santelli here? I have no idea how big his audience is, but would be kinda cool if he did.

It’s hard to believe a house can be a $750,000 crack shack. Boy, did I miss the boat, or maybe I didn’t choose my parents better.

Taxes are regressive. Inflation is regressive. 1% are the financial “honey badger.” Honey badger don’t care.

Before the 2008-2009 GFC there was a growing wealth inequality problem. Wages were/are stagnant, while inflation has been eating the 99%s lunch.

The Fed is the arsonist in the fire brigade. Congress allows this since a) the Fed funds deficit spending via debt monetization, and b) they’re lining their pockets trading stonks and RE. The Fed’s real dual mandate is to blow asset bubbles, esp. in stonks and housing. However, bubbles always burst. End the Fed and our self-enriching “representatives.” It’s taxation without representation all over again. History may not repeat, but it does rhyme.

Honey Badger = Vampire Squid

“… a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money.” – Matt Taibbi

Taxes are not regressive. What is Jeff Bezos tax rate?

Like, one percent of his wealth.

https://www.businessinsider.com/jeff-bezos-did-not-pay-income-taxes-2-years-report-2021-6?op=1

“For the years he did pay federal income taxes between 2006 and 2018, Bezos paid a total of about $1.4 billion on a reported income of $6.5 billion, or a rate of about 21.5%. That reported income does not include the vast increase to his net worth during the same period — about $127 billion, according to Forbes — due to his stake in Amazon.”

1.4 billion on 124 billion in investment wealth. That’s a nice gig to have.

Congress, particularly the Democrats, love to conflate “earned income” with “wealth” in the tax context, so they when they “tax the rich” they have progressive tax rates only on people with earned (usually labor) income … but not truly rich people like Bezos.

The elites skate by with minimal taxable income but lots of passive dividend income, muni bond interest, and then stock appreciation and other unrealized capital gains. Not to mention the ginormous untaxed 401K and IRA plans that they’ve goosed with special insider-trading tricks.

Meanwhile, the hedge-fund managers also manage not to pay proper income taxes on their 1-2% annual fees (not to mention their 10-20% share of any growth in their funds).

Amen. The way to end the “Fed” while preserving the financial system given its roles now is to require that banksters, etc., who benefit from its bailouts or get below the rate of inflation interest , have to turn over in exchange bonds convertible to 9999% of the outstanding or authorized voting shares. Eventually, the Federal Reserve will own the banks and similarly parasitic entities. We can then tax it heavily and treat it as a sovereign wealth fund.

Nice analysis. But as you point out nothing will change cause who in our largely wealthy congress, including those who say they are trying to help the less well off, will do anything that affects their wallets ?

All justified as long as Dr. Evil can send his penis-shaped rocket ‘into space’.

I am ok with that. Space travel is inherently risky: There is a 1% chance on every launch of the rocket blowing up on the launch pad and scratching Bezos or a few of his friends.

IOW: We should be encouraging billionaires in rockets!

Wolf,

Let me use my best virtue signaling/TED talk lecturing voice here.

You must stop telling people they are uneducated… words like the “bottom 50% don’t understand” and “reckless use of percentages” are designed to demean and degrade. Everyone must be made to feel like they have an equal voice and empowered.

And it is wrong to mock our congressional leaders (unless they are on the other side) because they are looking out for their constituents best interests, that’s the way things work in a free liberal society guided by fair and equitable elections.

Your leaders are there for you, they fight for you everyday to make sure you have your share of the American Dream.

As…

Ok… enough, even my sarcastic and hypocritical voice can only go so far.

The WOLF STREET Extra Bold Stencil font: “Mind the Sarc”

Is now flashing red.

The masses vote for whoever promises the most freebies. The fed is the reason we have a national credit card with low interest.

Inflation is the result.

It will get worse.

Enjoy the ride.

It isn’t just the elites who are to blame. The government is also reflective of the public who elects it.

They want what they think they are voting for, they still just end up as losers in an unequal horse race.

No reason to expect anything different, as if the elites are ever going to voluntarily allow themselves to be stripped of their political defenses so that they can be plundered by the masses. That’s never happened anywhere ever and it never will either.

The anti- vaxers aren’t getting enough criticism. They SHOULD be familiar with the infectious agent reality of a bacteria or virus, but they are more like a stone- age tribe.

I still don’t understand why progressives like AOC want more Fed intervention. Do they not understand these issues or are they knowingly complicit?

MMT enthusiasts always blame the supply chain as if the later can quickly adjust to a sudden spurt of money. Printing money is never a problem. That can only be true if all resources are infinite.

The MMTers havent thought the entire thing out…

and “for every action there is an equal and opposite reaction”…

and the MMTers are so sure they are right…..but they arent.

The experiment is too large, and when it proves faulty, it will be fatal.

I doubt AOC has the mental capacity to understand these issues

But I can tell you for sure she is making lots of money

After 5 years or so look at her net worth before entering politics and that time

Jon,

She has the mental capacity to understand this just fine. That’s why she wants the Fed to print money — because she understands that it would make her wealthier. That’s the problem. She’s probably worried about taper, balance sheet runoff, and higher rates, even as we speak, because they might make her less wealthy. These people are not dumb.

CNBC just had a article Sept 30th titled “Lobbyists shielded carried interest from Biden’s tax hikes, top White House economist says”. Yes it turn out team blue has raked in 60% of the $600 million that hedge funds have used to bribe congress over the last 10 years (per CNBC stats). Turns out there are 4,108 lobbyists registered for “Taxes”…thus carried interest will not be taxed at this point, yet Roth IRA conversions go away for every income group to “save money”….seriously! Perhaps AOC should have wrote “Tax the Rich except for carried interest” on that $12,000 dress…or better yet “Hugs and Kisses for Hedge Funds”…HA

You can’t make this stuff up, both sides are corrupt to the core due to human greed disease…and the people who float to the top of politics are a very “special breed” in order to win and maintain power (hint – they are not the best of humanity). Voters are not dumb, but when they herd up into “tribal voting” and trust their side unconditionally in order to belong, they are easily manipulated.

Wolf,

You just have to look at her questioning some of the people that comes before her in committee from her first term. You get the idea of how smart she is. Unless others are writing those questions up for her and anticipating the potential answers, you don’t get that kind of questioning.

The problem isn’t that she isn’t capable or smart… you know where I would take this next, so I won’t go there. But I’m disagree with your assessment that she is in it for the money, with AOC, the wealth would be a side benefit.

OK to disagree with AOC. But the insults implying she’s in it for the money are: just that : cheap insults. so easy to throw those around when lots of other commenters are doing the same thing.

Thought you would be above that.

Ralph Hiesey,

OK.

The ENTIRE Congress is run by money. They have institutionalized corruption. They have given themselves immunity, for example for insider trading, for which other people have gone to jail. Money runs that show. AOC is no exception. If she were an exception, she would jump all over the Fed — she laments wealth inequality in various forms, as she should, but then she supports the Fed in creating it.

I think of AOC as a bit of an airhead MMTer, but also think of her as sincerely thinking a raft of expensive social programs are a good thing. And it is possible to think what is good for others is also good for you.

Whatever. However, she is not wealthy. A congressperson has to disclose their assets.

‘After that report, the Center for Responsive Politics’ OpenSecrets.org ranked Ocasio-Cortez as one of the poorest members of Congress, where more than half of members have a net worth of at least $1 million.

‘The congresswoman filed her next financial disclosure in September 2020. By then, she reported that the same three accounts held between $2,003 and $31,000 and that her student loan debt remained the same at between $15,001 and $50,000.’

Moving on to SERIOUS, hidden, offshore wealth, check out the Guardian for the latest huge ‘Pandora’ hack. No doubt some Americans are named, but guess who is number one.

She can both suck on the FED’s teet and believe that printing will make everybody rich(er), just like her. It’s not a rational thing.

I totally agree with you!

Wolf

Yes, I do agree with you about national politics –really depressing to see in such a chokehold from big money.

But I would say despite that there are at least some who are at least really trying to be of service. If all were at least making effort as honestly as AOC and some others, I think it would be a much better place–and with decent and respectful deliberation I suspect her opinions would likely be more mature.

Hard to maintain an atmosphere of sanity when everyone is yelling insults.

If AOC is worried about the taper, then she should become the next Fed chairman or should I say chairwoman.

The woke crowd will get bats*** insane and then she’ll trash them with even more widen the gap policies.

I do believe many members of Congress are dumb enough to believe they can to tax the mostly fake paper wealth to spend it in the real economy on their progressive dreams. This is evident in the proposal for the wealth tax and taxing unrealized capital gains.

The thing with congress is you do not have to be smart or intelligent.

You just have to be popular.

In China, you pretty much have to have an advanced engineering or finance degree to be a top dog.

Most of the U.S. top positions are lawyers. They are good at arguing but things light green energy, climate change, finance, balanced budgets is beyond their core compentancy. These things are like a foreign language to them.

I wonder if AOC knows what an ROI or IRR means. Could she explain what GDP is or the CPI. What does it mean when you normalize a data series.

Anybody remember when they put Kathleen Sebelius who was in charge of Obamacare. She has a political science degree. She pretty much bankrupted the Kansas Pension fund too.

It might be sort of a mirror-policy, polar opposite to oligarch military-industrial complex.

The right strategy has been to tolerate gross federal debt caused by gratuitous wars and war profiteering, unregulated capitalism, and tax-windfalls for filthy rich. That strategy accepts a freefall toward federal bankruptcy, which they would expect to reduce government, cut social safety net programs, etc.

In the other corner, an analogous strategy. Accept freefall toward bankruptcy caused by poorly regulated entitlement programs, unproven green and other ideologies, wasteful nanny government, etc. With the hope and expectation that bankruptcy would push away the other side’s priorities.

The top three Federal expenditures in 2020 were Social Security, Medicare and the military.

Payroll taxes support Social Security and Medicare.

My paying Medicare premiums also support Medicare?

Ya know, AOC isn’t that dumb… she may act like a dope sometimes, but she isn’t one. You’ve seen acts like that once, you’ve seen it all. The virtue being signaled may be different , but it’s all the same basic variation, grab attention, get power or wealth or both.

None of the people in Congress are that stupid. Behind all that mindless yapping, they are in it for themselves, not the benefit of others. Certainly not for the benefits of their constituency.

The data Wolf pulled isn’t exactly hidden, it’s public domain, but it gets selectively used to push whatever agenda. And really, no one in charge gives a crap. These politicians are a bad as your corporate CEOs, short term focused on getting themselves re-elected.

You are giving them too much credit. Sure there are some smart people in congress there should be some type of aptitude test?

You have to take the ACT or SAT to get into college. I think people running for congress should take a standardized test and publish the scores during the election.

AOC came out of BU with an economics and an International Relations degree. BU is not necessarily an easy school to get into, and collegiate standard in the early 2010s hadn’t gotten as ridiculous as it is today. Her background suggests someone highly intelligent. Again, you have to watch her in action grilling people in Congressional committee meetings to appreciate what she can do. I think people don’t give her enough credit as far as her intellect is concerned.

It’s easy to demean your opponents and cast them as *pick your pejoratives here*, but when that happens, those people get underestimated. History is replete with those types, some go on to do great things, others… well, you get the idea.

It does not matter if aoc is intelligent or not

She is in it for the money and fame aka ego

Check her net worth after 5 years

AOC isn’t out to get rich…. Any real attempt to do so herself is not only stupid but would derail her from her true objectives.

Any increase in her net worth will only be happenstance. And seriously, she won’t need to daytrade her way to billions, she just have to follow Nancy’s example.

These guys talking about AOC after Trump is something else. It began with the freaking Inaugural, a 100 million or so and never stopped. Every single time any excuse to book (and overbill) anyone into a property: the VEEP is flying back from Europe: why not drop in with all the gang and security at a Scottish golf course?

But the most serious grift may be with a kid and I’m not talking about a dozen trademarks for crap in China.

Enter 666 5th Avenue and the Saudi blockade of Qatar.

Those are related? You wouldn’t think so, normally, would you? But in what normal admin does a son- in- law conduct foreign policy behind the back of the Sec of State? ( ‘I was angry’: R. Tillerson)

Checking OAC’s bank account in 5 years?? How about we check out what HAS happened.

I think they want helicopter money. That is the feds next move.

Next move? If you hadn’t noticed, they’ve been at it since April of 2020…one “stimmie” package after another. The latest is cash child tax credits to just about every household with kids. The choppers have been flying for a while already.

You fo not think Trump’s tax cut was helicopter money? PLEASE….

Nope…by definition, helicopter money can only be public spending. Cutting taxes is simply letting people keep more of their OWN money.

AOC comes from a generation of NYC minorities that grew up being told the govt had a “program” for any problems they had. I am in her parent’s generation, a NYer, a minority like her, and saw this take fruition with Johnson’s War on Poverty programs. AOC just drank all the kool aid.

This was a reply for Jon.

One thing that stuck in my mind watching a Netflix documentary about the federal reserve:

A federal reserve guy trickle-splaining how Fed policies resulting in a windfall for the filthy rich were an unintended side effect of policies designed to increase employment. Shameless rationalization.

Leaders in American culture seem to be, for the most part, professional liars and connivers.

“Leaders in American culture seem to be, for the most part, professional liars and connivers.”

Don’t forget inside traders, too.

Wolf-

Can u post a link to the fed article please?

Avg household net worth of top 1% at 34Million is how i am reading this, which seems high- maybe bc that is avg and has bezos, gates etc i it.

What is median household top 1% net worth?

Thankas

You can download the data from there (spreadsheet format):

https://www.federalreserve.gov/releases/z1/dataviz/dfa/distribute/chart/

The Fed gives only totals per wealth category. For example, total wealth of the 1% = $43 trillion. I get the average per household by dividing the $43 trillion by 1% of households: $43 trillion / 1.26 million households = $34 billion per household average, as total US households = 126 million, per Census Bureau. These are averages, not medians. The Fed does not provide medians or group limits. Without a complete list of all these households individually and their wealth individually, it’s impossible to figure the median wealth per household.

There are “wealth calculators” on the internet that break down median wealth by age. Not surprising, it takes much less to be in the top 1% at age 26 than at age 66.

Per NerdWallet:

The average net worth for U.S. families is $748,800. The median — a more representative measure — is $121,700.

Age Range/Median/Average at NerdWallet:

Less than 35

$13,900

$76,300

35-44

$91,300

$436,200

45-54

$168,600

$833,200

55-64

$212,500

$1,175,900

65-74

$266,400

$1,217,700

75+

$254,800

$977,600

Yort,

This doesn’t tell me anything in terms of the wealth disparity between the big asset holders (the top 1% or the top 10%) and the bottom 50%, which is the only thing I’m interested in because that is what the Fed is responsible for.

The NerdWallet stuff is total wealth for the total population split into age groups. There is a logical curve for wealth by age — same with income. But that’s beside the point here.

Curious, how did you manage to find this data in the first place… Let me rephrase the question, how did you even know to look?

To find this kind of stuff is my job :-]

I started covering this nearly a year ago. But it took me a while to fine-tune it. The data comes in a shitty hard-to-deal-with format, like they did that on purpose, and you have to know your way around the sorting functions of Excel to get it into a format that you can use. This is not something the average journalism major knows how to do, and so it doesn’t get any kind of coverage. The Fed doesn’t promote it either. It promotes the earlier release (this time Sept 23) and comes up with handy stuff and charts that journalism majors can just use as is.

THANK you Wolf, once again, for your clear dedication to helping WE (the PEONS) at least try to understand what is the ”reality” on the ground these days…

Came on here to at least try to figure out if We, the family WE could begin to ”invest” in SM and possibly commodities mkt we had done well in before early 1980s, when WE realized how corrupt both of those mkts had become due to SO much ”financial assets” exceeding ”real assets”…

Thanks again, and, ”checks in the mail.” LOL

To support your wonderful efforts with CASH…

Wolf – I found some more information on the median new worth breakdowns, perhaps more relevant to your article.

Per the most recent Federal Reserve 2019 Survey of Consumer Finances (SCF):

Median Net Worth

Top 1% $10,700,000

Top 80th to 99th = $746,950

Note the median net worth numbers are obviously higher in 2021 than 2019, but unfortunately the Fed only conducts the SCF every few years…

Also note that the top 1% median net worth in 1995 $3,734,607, so using a compound calculator, growing at 4.5% per year for 24 years results in the 2019 median net worth of $10,700,000. The stock market compounds close to this amount (around 5.5% annually until recently), which would make sense as most top 1% have gotten wealthy almost entirely by owning stocks. The middle class not only own very little stocks, but they also got scared out of stocks, looking at the ownership charts, after the 2008/2009 stock market crash. Personally I think the data proves beyond a reasonable doubt that the stock market “IS” the wealth inequality mechanism, and the Fed has admitted at this point the third mandate is to keep the stock market inflated, and thus their role inequality is indisputable.

Also it is probably not just “coincidence” that the Estate Tax Exemption was raised to $11.58 million for 2020, as that would allow the median top 1%ers to give every penny to the next generation and still avoid the estate tax. For reference, the estate tax exemption was only $1,000,000 back in 2003…it has been increased 11 fold in 18 years by both team blue and team red, in order to keep up with the Federal Reserve “wealth effect” that the bottom 50% have had absolutely no chance to participate…

Wolf,

You aren’t kidding about shitty formatting. I downloaded the csv and it took me a while to make heads or tails of it to chart it in any meaningful way.

You can get a lot more from this set than just income disparity, especially given the historical going back so many years. But you can come up with some interesting broad interpretations on a macro level.

Having a few paragraph doesn’t do justice to what the data provide, don’t mean your paragraphs since you had a well defined topic using the data.

Yeah, journalism majors aren’t going to be able to make great use of this unless they had some training and regular usage of excel.

Yes, there is a lot of stuff in it. I got all kinds of charts on the bottom 50%, for example, and my earlier articles on this covered some of it. But I now want to focus on this one element of it.

Really hard to negotiate the Fred wealth data. Here’s where I’ve found most useful information:

https://fred.stlouisfed.org/release?rid=453

Then click on “Levels of Wealth by Wealth Percentile Groups”

or “Shares of Wealth by Wealth Percentile Groups”

Ralph Hiesey,

Good lordy. This is exactly the same data from the Fed that I used. Look at the source. And it came out on the same day. Except it FAILS to divide the totals by the number of households in that group to get the per-household data that I showed you. Looking at the totals alone is DECEPTIVE in terms of the Wealth Disparity. You have to look at it on a per-household basis; and the only place you get that is on WOLF STREET.

Cause Wolf knows how to do division. :)

The per household metric is kind of tricky to get… and Wolf has to put that into an excel spreadsheet and make changes to a few cells. heh heh.

“This was the greatest economic injustice committed in recent US history.”

Brilliant, except for the word recent.

I think “recent” is correct here, because the 2007-2010 financial rape of the middle class was a greater injustice and it’s still within memory of most of us.

I’m starting to think (based on a more careful look at history) that it’s actually pretty normal for a huge financial upheaval to destroy a lot people’s lives about every 10-20 years. Consider:

2007-2010 Great Recession / Housing Bubble / Financial Fraud crash.

1999 dot-com crash

mid-late 1980s Oil Bust and Savings-and-Loan crisis; 1987 market crash.

1970s…

The 1950s and 1960s were a calm period, financially, but there was a lot of other social turmoil, plus drafts for wars in Korea and Vietnam.

1940s: WW2

1930s: Great Depression

1914-1920: WW1, Influenza Pandemic, major postwar recession.

And so on.

Bottom line is that you have to keep your wits about you, don’t trust too much in keeping your job when borrowing money, and be prepared with exit plans for any major investments (unless you’re in the 1% and can afford to lose a few times).

Agree mostly WsSK, except for your comment that 1950-60s were calm:

Our family lost our family farm and once other residential property when dad, on strictly ”commission” income had NO work at all for six months in ’56-57, my first awareness of the swings and round a bouts of every USA ”economy” since, and continuing.

While there is no doubt in what’s left of my mind that the era after WW2 was a great, very great ”boon” to WE the Peons to compensate us for the sacrifices made to ensure the continuing wealth and, more importantly, the ”control” of the world by the presiding oligarchy of that era,,,

there is also little or no doubt that they, the oligarchs, did not actually have as much control of the world as they thought while they were bashing FDR, etc.,

This was very clearly shown by the rise of the various totalitarian regimes of that era between WWs 1 and 2, and continuing thereafter for many years in Soviet and later RU and many other fascists states,, even, apparently, today.

“The bottom 50% need not apply. They just get to eat the soaring costs of housing.”

Golly I was wondering where all those middle class people got the money to outbid Blackrock. Turns out they didn’t.

Can someone please give me an example of how QE transfers wealth to the have-nots? I don’t understand the plumbing of the Fed like Wolf does but I can clearly see that after over a decade there is no transmission mechanism from QE to the debt serfs.

Mike,

Was QE ever designed to transfer wealth?

I always thought it was to bailout the financial class who bet wrong in 08/09… can’t let these losers, lose…

Then it morphed into “ gotta keep it going “ for employment numbers so our wealthy will invest in jobs…

Then it was keep the stock market high…

And on and on…

The only wealth transfer I’ve seen have been the stimulus…

@MG

QE was designed for benign reasons as a means (as usual) to get demand into a flagging economy (Japan).

The theory was that by buying underperforming old assets from banks and giving them fresh money they would be able to invest in, and support new growing SME’s. With many small competing local banks like say Germany, it could have worked and maybe Germany’s strong industrial position is evidence of that.

But, But But. In USA and UK in particular the huge banks dominate the landscape and there is no way they will risk their money on small businesses they cannot get to know. In short , they used the QE money to lend into purchases of existing assets and thereby created a one way price track which enriched everybody who already had safe collateral to be lent to. The rest is 12 year history. Whether the Fed is responsible, or the Banks are responsible for the failure is a moot point. Getting the money back is unlikely to be on the cards any time soon so dumping QE once and for all is the best that can be hoped for, but I won’t hold my breath.

Thanks Wolf an interesting article, so what are the solutions to improving this inequality in wealth. I think a consumption tax may help and improved social security systems and laws to ensure people are paid a living wage.

Its a western society phenomenon, and we have a similar problem in Australia to.

Cheers be interested to hear other peoples perspectives on this, thanks again for sharing your views Pete

So what are the solutions…

We need more taxes!

And more laws!

And maybe more free money…

Cause bigger and bigger government can solve the problems caused by bigger and bigger government.

Wealth is power- power to control national economic policy. The quickest, easiest, and surest way to reduce the power of the .01% is to tax the living krap out of them. High marginal axes help level the playing field, exactly as the high marginal taxes of the post-WW2 period did, a period which “coincidentally” saw the fastest and largest increase in middle class wealth in US history.

People who express antipathy to taxes on our masters and elite ubermenschen are often fallen under the spell of the spurious “Austrian school” of economics promoted in the US by European carpetbaggers (Hayek, Rand) who were literally on the payroll of the .01%ers in need of a line of propaganda to help convince immiserated working classes that the source of their misery was other poor people (who happened to have brown skin), and deflect their attention away from the wealthy industrialists and financiers who were waging merciless class war against them.

High marginal taxes aren’t the whole story, but until you can chip away at the power/wealth of the .01%, you’ll never be able to enact genuinely equitable and fair policies. The .01% thank you for your support in maintaining and augmenting their wealth!

@two beers

I may have been reading the wrong books by Ayn Rand and Austrian economists, but I never got the impression that they advocated things like central banks, money printing, interest rate suppression, bailouts, unlimited debts, Wall Street frontrunning and what not.

Blaming them for all today’s wrongs seems a bit farfetched to me.

1. No one paid those high marginal tax rates as there were massive deductions (even for the uber rich) that have all been eliminated.

2. Government, as a percentage of GDP, was ONE THIRD as it is today.

3. The Federal Government Budget, right after WWII and through the 50s was nearly 50% for defense (vs about 17% for today).

4. There were almost zero entitlements in the Federal Budget and Social Security was off Budget in an entirely separate budget. Entitlement spending today is nearly 70% of the Federal Budget.

5. Insane, out of control massive government gives us more and wealth equity.

Raising taxes, even to 100%, won’t change that.

“So what are the solutions…”

There aren’t any since those who greatly benefit from the status quo control what can and cannot happen. PERIOD.

If you still have the delusion that voting with fix anything, read the 2014 Princeton study excerpts I posted above and also realize that even if those findings weren’t true that we’d need an engaged, attentive, intelligent majority voter base capable of critical thought and analysis instead of the willfully ignorant idiocracy we do have.

Public assets were historically about 25-30% of GDP. And then the libertarian point of view came to the fore, primarily thanks to Milton Friedman and the Chicago School. It was adopted by most western economies. Today Public Assets are net zero or negative. They’ve all been sold for pennies on the dollar to private capitalists, who run the entire country. The game has been over for almost 4 decades.

@2bn

Theoretically the economic solution would be for the Fed to run down it’s balance sheet by re-absorbing all the cash it printed during QE.

This would mean that all the mega-rich beneficiaries would have to repay their cheap loans, which would mean they would have to liquidate all their inflated assets.

There’s the rub, they can’t liquidate their assets at these prices unless there is more easy money for somebody to buy them. No QE the rich are suddenly stuffed.

Will it happen? Ha Ha Ha.

U.S. has been in political gridlock and culture war for decades. Pragmatism and non-partisan rational compromise was it’s great strength. But that is gone, zilch. Nothing is done without the other side screaming “over my dead body.”

Is that also a big problem for Australia?

Peter,

The issues discussed here were caused by the Fed. So in terms of the Fed, the solution would be for the Fed to start shedding assets at a pace of $120 billion a month, and raise interest rates above the rate of annual core CPI inflation. That would reduce the wealth inequality from the top down.

And yes, as you pointed out, the government too could do a lot of things too in terms of the tax code, plus breaking up monopolies and oligopolies, plus, plus, plus… But the wealth effect is a Fed deal.

Thanks for connecting the dots. I had no idea the Wealth Effect was a stated policy. I read the linked past stories and their linked stories as well. It’s very depressing that this is all stated policy out in the open that is not widely talked about or understood. The cost of trickle down economics is the divergence of the top percenters from the rest. As the hourly minimum wage goes up in California I’m wondering if it’s purchasing power is dropping at a faster rate.

If they attack U.S. big business, Chinese big business might take over. Huawei stole Nortel technology and competes with Apple. Alibaba competes with Amazon. Baidu and TikTok takes market share from Google and Facebook. Are these Chinese monopolies or competitors?

The Fed bought too much MBS. Home values soared during a housing affordability crisis. Washington is approving sky high deficit spending and taking on debts. My car is worth more than before, but already six years old. The M2 money chart shows what is happening.

The government can stop Chinese companies from buying ANY US companies, including startups. Who is against that? The billionaire class because they make huge amounts of money on these deals (this is when they cash out).

The gov could also try a little harder to prevent IP theft, which is a crime in the US.

So these are additional shortcomings of the government. But the solution is NOT to allow monopolies in the US to fight off Chinese companies.

The Chinese bought Smithfield (hams) in 2013. They have minority interests in a number of US listed companies.

Consumption taxes hurt the poor who spend all their income. Consumption taxes don’t affect the rich because they spend a tiny amount of their money and can easily afford the tax too.

Peter Schiff had interesting story on cost to go to Harvard since the data goes way back. Before the Civil War the cost to go to Harvard was $33 if I remember correctly. There was no inflation and price stayed the same for 41 years.

All the advances in technology should have reduced cost. It costs 18 times more in real terms to go to Harvard today. Isn’t fiat wonderful.

The US the only G7 without a VAT aka GST

The future of tech probably hinges on some kid currently sitting in a basement trying to figure out how to send a 100K volt feedback loop to 1.26 million smart phones. And we’ll never see it coming as usual. Wonder how the Fed will try to explain that away.

Wolf, that was an awesome grab attention article. Thank you.

It is exactly like Trickle Down economics; same crap, same results, different era with the same gullible electorate.

I get it that people here hate politicians, but AOC is far from dumb and it is just wrong to imply she is on the ‘take’ because she is an activist.

Biography:

Born to a working-class Puerto Rican family in the Bronx, New York, Ocasio-Cortez graduated from Boston University, majoring in economics and international relations, and worked for Senator Ted Kennedy’s office where she focused on immigration issues while in college.

After graduation, she returned home and became a community organizer. However, with the recession taking hold, along with the financial issues her family faced after her father’s death in 2008 from cancer, Ocasio-Cortez took multiple low-wage restaurant jobs to help keep them afloat.

Paulo, fleshing out the AOC bio a little more. Her dad was an architect. Yes born in the Bronx ( Trump was born in Queens for what it’s worth). When she was 5 or so the dad bought a house and moved the family to Yorktown Heights — Westchester County. Not sure how familiar you are with the NY metro area. Westchester County is pretty exclusive. Working class not so much. Good on them for being able to make that move but it this info sheds a little different ligbt on the AOC hagiography.

That’s firmly middle class (edging on upper middle class).

I think the bigger issue, which you’re alluding too….as the middle class shrinks inextricably, it becomes more difficult to recognize.

She’s worked for a living in a taco joint.

Trump: ‘born in Queens for what it’s worth’

Not much. Inherited 500 million. In the form of the Strarret Apt complex which would be worth more today if he’d never done anything. Almost went TU in 90’s, saved by Apprentice, whose producer owes a BIG debt to society.

Working class ‘not so much’ ??

How about at all?

Seriously. I am no fan of OAC but you need to pull your head of our your ass.

Democrats well understand that if they stray too far from the party line the party will replace them at the next primary. See: Dennis Kucinich.

I assume it is similar for the Republicans.

I graduated from high school in 1979, just before the US switched from being an honest industrial economy Flo a financialized racket economy like we have now. Back the. The the range of incomes of the kids families in my class was fairly narrow, with the bottom being the kid who’s dad was the school janitor and the top being the kid who’s dad owned a successful pancake house. The poorest kids family came to the Friday night football game in a VW bug or a pinto and the richest in a Mercury. Once we started down the path of becoming a nation of financial advisors, stock speculators and real estate agents it was inevitable that the fed would keep the party going by printing money until we arrive at where we are today.

A lot like my school but baby we weren’t in THOSE schools. Who do you think had the richest dad in Dan Quale’s school? Not to speak ill of Quale!

You know what happened around that time? The WWII bonus finally got used up. The glorious 50s when the US had no competitors were gone.

The losers were back. The VW Bug began it for Germany, maybe the Datsun 510 for Japan. Detroit spawned the Pinto and Vega to compete.

The Bug and 510 are collectables.

Hey! Not true. Datsun was well made. I had a very old Datsun 510 station wagon that ran for 3 years on basically 3 cylinders and then finally the transmission died.

We called it the safari wagon. Had no carpeting, no ceiling, no seat padding left, no paint on the roof, all the inside parts of the doors were gone. Looked like hell but was made to last. I would take it 30 miles down 4WD rutted dirt tracks! The thing just would not die.

Nissan is when it became crap.

Agree with you on separate private schools though.

Careful, Wolfe, you’ll be accused of “class warfare,” and class war is only acceptable when it’s waged from the top down, in which case it isn’t called “class war,” but instead known as “the just result of free markets,” “the fault of the losers for not getting Harvard MBAs,” or simply, “the American Way.”

The problem with the Fed is that 90% of population have no clue what the Fed does or how it manipulates the economy and enrich their cronies.

Just check comments on mainstream media articles regarding inflation, they all blame the greedy corporations and landlords for price increases, Fed policies are never mentioned.

Also, all people I know have no clue what the Fed is or does or some very vague idea.

And those are educated people.

And if they bring down the economy and trash the dollar, nothing will happen to them.

What happened to central bankers in Weimar Germany? Nothing.

Powell will get away with a “nobody could have foreseen it” and retire to enjoy his inflation indexed pension.

The elite is so disconnected from the plebs that one has to go back to before the French Revolution to find a comparable situation.

its a crime what the fed is doing now..

In 2008. 300 folks at most, protested the fed, wall street rescue and walked from SF fed to Union Sq.

Some gold bugs and dollar helicopter folks but mostly smart older folks who saw what was coming…..

Potter won, he got the houses in bulk and built investments out of them…..

I’m astounded they carried this far……

The Fed pulled a fast one on people. They assured the public they were going to normalize rates, so prudent people waited to buy homes.until the time was right. Then, after 10 years of 10% increases, housing got out of reach.

Thanks Fed. You still plan to normalize rates? Yeah right. Your lying does tremendous damage.

Bobber…

Yep.

People can read markets, but who can read, who can detect that the Fed will ignore their duties?

5%+ inflation……and near zero Fed Funds…never happened before.

IF you were told the Fed would flood the economy with money and not address the coming inflation, one might have heavily bought equities and real estate.

But who could imagine a 27% jump in M2 in less than a year decided by an unelected unaccountable cabal? Who could have imagined the Fed would intentionally PUNISH SAVINGS to fluff markets? Who could have imagined the Fed would lend money (buy MBSs) 3% below inflation?

This is a tragic era…..

The Fed has made water run uphill, for a while….

What value is a government sponsored agency that does the opposite of what it says? I hate to call it lying, but it is. At some point the Fed determined they couldnt pull the economy off life support. They told Goldman. They told Wall Street. The farmer in Illinois didn’t get the message, nor did the nurse in Nevada.

Totally agree. This is the elephant in the room that mainstream media ignores. They lied. And this will have long lasting repurcussions.

The chosen wealth effect stimulus policies from global CBs have made a few rich, and the global masses poor. This will accelerate demographic decline in the developed world. By preventing young people / wage earners from achieving economic security, they are literally reducing future demand via lower family formation and child birth.

We are now well beyond the demographic deflationary event horizon. And they just push us faster toward the black hole. Mind boggling.

Part of me thinks it is all by design… Maybe to prevent climate change?? All I know is, I’m checked out. Not worth trying to get ahead if you know the game is unfair.

At this point, I’m just waiting for social unrest to really get going. Global energy and food prices this winter could heat things up.

Given the state of affairs, and this headline I just read, I have absolutely zero hope for mankind:

“The value of cryptocurrencies is erupting after El Salvador announced it is now using volcanic energy to mine Bitcoin.

El Salvador’s President Nayib Bukele tweeted on Friday at about 1 a.m. local time that his country had minted the first volcano-powered Bitcoin. He referred to the mining operation as the “volcanode” after posting a video earlier this week of what appeared to be rigs at a geothermal Bitcoin mining operation.”

Volcano powered electronic tulips. How cute.

Depth Charge,

The amount of fake BS that crypto promoters are getting into the media is astonishing. This has been the same thing for years. That country needs every bit of power it can generate to keep the lights on in households and companies. But it’s one of the most corrupt countries on earth, and nothing the top guys say surprises me.

Geothermal energy production has been around for a long time. Iceland relies heavily on it. There are some geothermal plants in the US too.

But there is no “harvesting” of volcanic power. You have to build a power plant that uses the heat from the earth to create high-pressure steam that then powers a steam turbine that then drives a generator. And there are all kinds of technical issues to overcome in this setup.

If that country builds one of these powerplants to mine bitcoin instead of supplying that power to industry and households so that the country can develop its economy, that president needs to be thrown into the hoosegow and rot there for the rest of his life.

i bet the plant already existed, and previously did things like supplying power to industry and households. it’s just been, ah, repurposed.

somebody has to waste the electricity to back the bitcoins, otherwise they’re backed by nothing.

The wealthy are arguing over the last few morsels – all that’s left from the once middle class. Sickening. They can steal every last penny while impoverishing the masses, but if I so much as utter anything about French Revolution type stuff, it’s deleted and I’m the bad guy. Tell me how anything short of that will change ANYTHING.

Things will change of their own accord. Especially with the rate of cultural change in modern times.

Referring to head-chopping strategies (e.g., French Revolution) for change as the only way in the current context is dangerous, because a lot of stupid people start believing it. And although not always, revolutions consistently produce something worse than before.

If parts of what you assert are censored, it doesn’t imply you are a bad guy. Your other insights and experience can be valuable input to a discussion of macroeconomics.

With history as our guide, only revolutions effect change. The problem is they need to reach critical mass. If a few people try to “take things into their own hands,” so to speak, they are labeled deranged, murderous thugs by the PTB and will meet a swift trial resulting in a guilty verdict and a death sentence.

However, when the majority of people rise up and start butchering the real thugs who have stolen everything, suddenly said thugs have a change of heart and start bleating “you’re right, you’re right!” and begging for their lives and promising change. Only fearing for their lives will mitigate their rapacious greed.

Depth-i respect your sentiments, but your blood on the barricades, first. And, (to repeat) most of the instigators of la revolution met their end on the scaffold courtesy of their fellow revolutionaries occupying the Committees of Public Safety. Napoleon dealt harshly with most of the remainder. (But, perhaps you envision a Napoleonic ‘Republic’ as a preferable alternative…).

I have no knowledge of your actual combat experience, but i would counsel moderation in your calls for it if it’s minimal. Having your fellow combatants (and ‘collateral-damage’ innocents) die in your arms (presumably without even the chance of a dustoff arriving in the interim) may play well on the big screen-in the reality, not so much.

may we all find a better day.

Hitler, Pol Pot, Stalin, Mao’s Cultural Revolution …

just sayin’

French revolution:

“While about 17,000 people got guillotined in the ten months of the Terror, all this bloodshed was just a drop in the ocean compared to the other crazy stuff that was going on at the same time.”

My or your personal experiences are irrelevant, 91B20. Like I said, “with history as our guide.” NOTHING is going to change without a revolution. Repeat after me: “N O T H I N G.”

Depth-i agree with history as our guide, but your own blood, first, especially if it’s your first rodeo…

may we all find a better day.

Have to agree with ”91B20 1stCav (AUS) ” on this sub category DC, though usually with you totally:

NO ONE,,, repeat, NO ONE really and truly ”wins” in the eventual end of any irrational violence,,,

And in the opinion of most serious students of his and her story, ALL violence has become irrational and counter productive these last few dozen decades.

OTOH, Certainly and certifiably, peaceful ”mass” demonstrations, following the very clear personal leaderships of Gandhi and MLK, have produced wonderful and continuing beneficial results.

You can make the case that there have been very few successful revolutions. I won’t make the case against the US one, but serious American historians have argued it. But it was revolt against another power not an internal one, which are the ones I will mention.

France never recovered from its revolution. The Great Terror, by the way, is not a commenter’s ‘personal experience’. But that was just the beginning. When a mob was chasing the new govt thru Paris, the govt sent an SOS to the army. A Captain of artillery called Bonaparte responded and administered ‘the whiff of grapeshot’ The grateful revolutionaries promoted him to general. Then came what has been called the actual first world war, ending 20 yrs later in the defeat of France. Then the Restoration, more turmoil, defeat by Prussia in 1870 then back to Republic.

At the end of all this it was a country with less social

mobility than the UK, where the influence of the monarch and the nobility (Lords) was reduced by evolution. The first Labor govt in the UK was elected in the 1920s.

But nothing compares to the Bolshevik disaster in Russia and the Maoist in China. Both produced famines, the famines in Russia its first true Asiatic types. Both produced tyrants worse than the monarchs. (Russia was slowly evolving, creating a prototype parliament the Duma, until the catastrophe of WWI.)

Not a very good record.

Nick Kelly-very well-stated.

may we all find a better day.

Part of the problem is the middle class has been robbed of earning interest on their savings since 2008. Prior you got 5% average and on one million $ that was $50,000 a year income. Now at .25% it is only $2,500 a year income. The Fed has forced many to go into the stock and RE casinos to try to earn money on their savings. I can not remember in over 50 years where you could borrow 30 year fixed money for mortgage at 3% with inflation running min of 5%. This is total insanity. When interest rates go up many companies who are loaded with debt will file bankruptcy and real estate will take a min 25% hit from today’s insane prices. When the next bust happens and these 2 asset classes take a severe hit, it will be the very wealthy most effected since the lower 50% have min exposure to these two asset classes.

So which will the Fed fight when they finally get the memo that the entire planet is moving toward StagFlation, via stupidity by the American Fed in which the global Feds have been forced to follow? Will the Fed fight the “Stag” or the “Flation”…place your bets in the market casino accordingly…

I’d guess they continue to actually fight the “Stag” via actions, and they will fight the “Flation” via jawboning.