But now the Fed is planning to end QE.

By Wolf Richter for WOLF STREET.

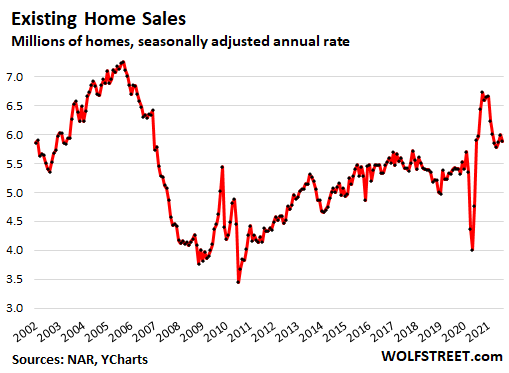

Sales of single-family houses, condos, and co-ops fell by 2.0% in August from July, and by 1.5% from August last year, to a seasonally adjusted annual rate of 5.88 million homes, according to the National Association of Realtors today (historic data via YCharts):

Sales of single-family houses fell 1.9% in August from July and by 2.8% from a year ago, the second month in a row of year-over-year declines, to a seasonally adjusted annual rate of 5.19 million houses (SAAR removes the effects of seasonality). House sales are now down by 14% from October last year.

Condo sales fell 2.8% in August from July to 690,000 seasonally adjusted annual rate, but were still up 9.5% year-over-year.

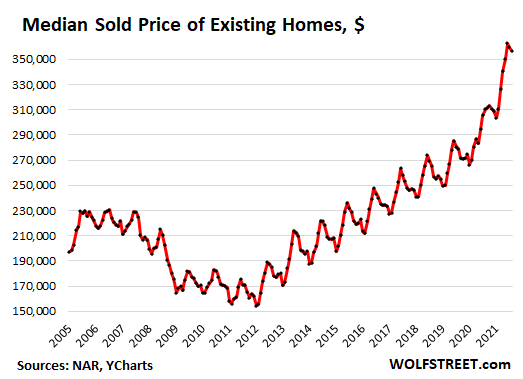

The median price of existing homes fell for the second month in a row in August, not seasonally adjusted, to $356,700 for single-family houses, condos, and co-ops combined. This whittled down year-over-year price gains to 14.9%, down from a year-over-year gain of 23.6% during peak frenzy in May.

These median prices, which are not seasonally adjusted, show that they’re reverting to seasonality, after having blown through any kind of seasonality during the frenzy in 2020. Reverting to seasonality is the first step back from craziness toward what is now called “normalization” or “deceleration” (historic data via YCharts):

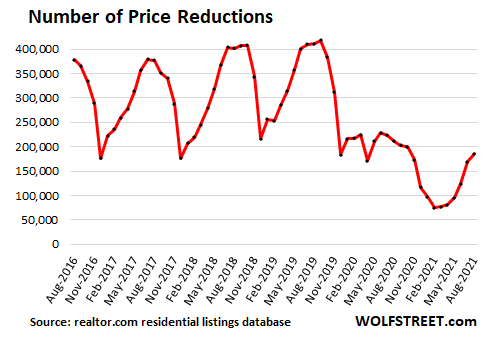

Price reductions increased for the sixth month in a row, jumping in August by 9.5% from July, after having plunged in 2020 and early 2021.

Seasonally, the first five months of the year are when price reductions are surging, and then taper off. This year, they barely ticked up in March and April but began surging in May. The 37% jump in July from June was the largest month-to-month increase in the data provided by realtor.com’s residential listings database. While price reductions are rising from still relatively low levels, they confirm the trend that sellers are facing more reluctant buyers and that “normalization” and “deceleration” are starting to set in.

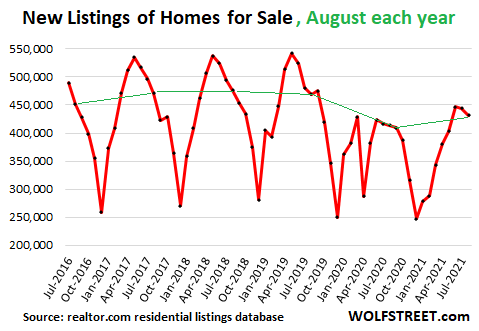

New listings, which normally peak in May and then drop sharply over the following seven months, have broken this seasonality during the pandemic. And now they’re breaking seasonality again: They rose through June, flattened in July, and barely dipped in August (data via realtor.com residential listings database; the Augusts are connected by a green line):

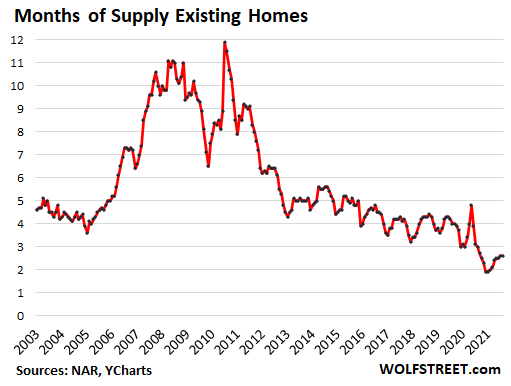

Supply of unsold homes on the market remained at 2.6 months, up from the low of 1.9 months in December and January. With 1.29 million homes (seasonally adjusted) listed for sale at the end of the month, inventory remains low (historic data via YCharts):

The share of all-cash sales dipped to 22% of total sales, from a 23% share in July, June, and May, according to the NAR. Cash buyers include institutional investors that can borrow at the institutional level, plus individual investors and second home buyers that have the cash, or can temporarily borrow against their portfolio and get a mortgage later.

The share of sales to individual investors and second-home buyers remained flat at 15% in August, compared to July, and was roughly flat with August last year.

But now the Fed is talking about ending QE and raising its short-term rates. The Fed will likely start reducing its asset purchases “soon,” as it said today, which likely means later this year, and end those asset purchases entirely by sometime next year.

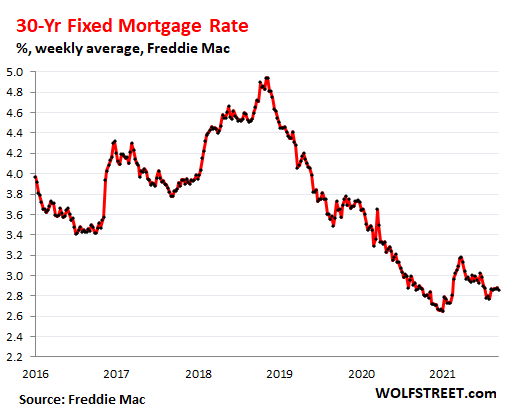

The $120 billion a month in net asset purchases, including the $40 billion a month in net mortgage-backed securities purchases, have been pushing down long-term interest rates, including mortgage rates, and they have remained near record lows, with the average 30-year fixed rate mortgage rate at 2.86%, according to Freddie Mac.

But CPI inflation is over 5%, which turns these mortgage rates into massively negative real mortgage rates, which should be immensely stimulative for the housing market. But despite them these massively negative real mortgages rates, the housing market has already started to decelerate.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The market doesn’t believe that the Fed is ever going to taper or raise rates.

I heared the same story from multiple RE agents telling that back in 2007-08 multiple factors caused the recession. A big one was that no one was expecting a rate to be raised.

Saying that I also have doubt that the FED will ever raise the rate. In case of an emergency he can even go lower. Deep into negative rate. So we got to pay the bank to keep our dollars.

Right, I mean, would anyone really be buying treasuries at 1.35% or whatever it is if they thought tapering was actually going to happen?

Many buyers are doing it with someone else’s money.

(that’s just tooo funny your name being “educated” and then you follow up with you “heared” the same story. that’s a metaphor for EVERYTHING.)

Hello internet troll 😂

What is toooooooo funny? maybe you are toooooooo idiot not understanding my point. I was just transferring RE agents opinions to other people here.

Educated but Poor Millennial,

Good lordy. This is way over the line. Kitten Lopez made fun of your typo (“heared”) in connection with your screen name. And then she generalized from there.

The fact that you still don’t seem to know you made a typo and asked what’s so funny, makes me a little nervous too.

So go look up how to spell the past tense of “hear” and then crosscheck that with your screen name. And then try to see the humor in that.

Look, we all make typos. I make epic typos. And that’s OK. What’s not OK is losing your sense of humor when someone points them out.

EbPM:

if you expect us to take you seriously, spell your words correctly.

I believe that many times when people see a “typo” it might not be intentional. In this sometimes hectic world, people use speech recognition program’s which aren’t so much a typo (folks aren’t actually typing) than a translation problem. I try to use the rule that if I can still discern the intent, life is good.

Sorry to be too serious here, My impression was that KL was trying to say something hurtful.

I am not native here and sometimes don’t get jokes hidden behind words.

English is my 4th language and I see odd typos that sometimes I make, specially when I am tired.

“I heared the same story”

Sometimes I write like that because it can be jarring and thus emphasize a point I am trying to make. Besides, I personally have no college degrees and talkin’ funny is kinda expected from apparently uneducated persons like myself.

Why not bury it or stuff it in your mattress?

DC looks at money printing/interest rate manipulation as a tool.

It should view them as symptoms of an underlying disease that must be addressed.

But DC doesn’t address things, because that implies accountability.

DC is the disease. If you think about it, from the early 90s to now, our leaders have managed to muck things up seriously. It doesn’t matter which side.

As far as I can tell none of them are in it to help the people… just themselves.

Things manage to go from pretty decent to shit in the last 30 years.

DC has been garbage far longer than that. My current operating theory is that, until around the 80s, technological advances outpaced DC mucking things up. Eventually DC began to muck things up at a pace faster than technological progress could cover up. This could probably be illustrated easily in a line graph. Outsourcing, was probably the thing that put America over the edge, many things take years before full effects kick in.

Some technological advances takes years to decades to be fully used to their advantage, in this decade (the 2020s), I would expect to see alot of such better utilization of existing technologies. AI and automation may hold the key, to finding and stopping corruption and fixing DC to a viable status.

Even though, automation and AI will progress for decades, in terms of what things could come up that forces law changes, I expect to decline rapidly, by end of decade (this in terms of technology and social factors). As the need for such law changes declines, lawmakers will be less able to distract the public with nonsense.

Right now, the status quo has been in decline, because the primary purpose of the US government has been the protection of the everything bubble, after it pops, anything can happen.

Right now, it’s all a waiting game.

Well, the corruption has certainly accelerated in my view, or perhaps it’s just much more visible now thanks to the internet, one would assume the people in Congress was trading on inside info too before the 90s

The corruption has accelerated, the everything bubble is a central part of US public to US government relations. Until that pops, too many people are comfortable with the status quo, and will actively try to prevent real change. The stock market is the most critical aspect of this. Things are very unlikely to change for the better, until the pop. Things may get increasingly crazy, until then.

After the pop, anything can happen.

Ending the war on drugs, which is making progress, will be a big step towards stopping corruption.

The end of transistors shrinks, which will mark the decline of consumer electronics spending will also help (it involves alot of money and power, creating ideal conditions for corruption). This is much more certain to happen. The last transistor shrink might be only 5ish years away.

Waiting for bubbles to pop and trying to actively end war on drugs, are the only real political things most people can do, right now.

Although, I’m sure some impatient people out there, are working behind the scenes to pop the everything bubble, sooner rather than later ;)

@Educated: The Fed had begun raising rates in 2004. It was not until late 2005 that sales started to drop in the peak-bubble regions. In 2007 the housing bubble had clearly popped and the savvy blogs like Wolfs were all over the imminent crisis… but the market went on to new highs anyway.

To say that “no one expected” rates to go up is total nonsense because rates had gone up for years prior to 2007. It was specifically that steady rise in the Fed-managed short-term rates which made adjustable-rate mortgages unaffordable and popped the bubble. But in the perverse psychology of bubbles, while anyone could see it coming (and some did), too many chose to blind themselves. Some of us, on sites like this one, were raising a hue and cry – but we were ignored.

Always keep in mind that Realtors are in a fundamentally conflicted, dishonest business and few will tell you the truth. They may not even be telling themselves the truth, or even care what the truth is other than sell-sell-sell to get commissions. But they will always have stories to tell you.

Was going to post this. Market topped in San Diego late 2003 in the richest areas. My hood was spring of 04, right as rates were first raised. Ghetto areas were still in a frenzy into early 2005, but it was a dead man walking. Vegas went from 5k for sale to 45k in that time. San Diego inventory tripled.

San Diego was the first after 9/11 and the rate cuts to rocket up, 20,,% gains for the next 3 years.

Also should mention, I moved to another state in 06, and the bubble was just peaking then. I warned a few, most scoffed but a few got into safe investments and are very thankful. Point is, it takes some time to move through all 50 states, both in the rise and the fall.

Vise inputs, Wisdom Seeker.

“But in the perverse psychology of bubbles, while anyone could see it coming (and some did), too many chose to blind themselves. “

whoever could see it , was smart enough to understand that bubble , now, it is not a new thing for people anymore and it can cause a different market reaction, I am in waiting game too, lets see what going to happen.

IMHO the housing bubble of the mid 2000s was a lot more about overleveraged/unqualified borrowers and MBS than interest rates.

I remember listening to the radio in 2004-2005 with all the mtg company ads touting “no down payment mortgages” and other financial chicanery related to mortgages and thinking “this is not going to end well”. And it didn’t.

I continue to believe that all of this “give anyone a mortgage” stuff was all about the financialization (MBS), just another grift perpetrated by the wealthy against the middle class.

Wisdom Seeker, well said! I work in the appraisal industry and we were having discussions about not if, but when, the crash would occur in late 2006. Many of my peers are having that discussion now. The when is starting now …

As for realtors, I was just having a discussion with a friend who was trying to convince me that I was wrong and her realtor is correct that market prices are going to go up and rates most likely will increase come spring. I said much of what you stated in your last paragraph. Look at what 19 countries in Europe & Japan have been doing for the last 2+ years – zero to negative interest rates. Rates in the US have a lot of room to go even lower than they currently are.

Wisdom Seeker:

I couldn’t agree more. People are just willfully blind at some points. About a year before the Great Recession kicked off I was on my two weeks of Reserve Duty in Korea and riding the train back to Seoul with a bunch of Navy Supply Corps officers. One was from Orange County, CA and was telling us how he was making a fortune flipping houses there.

My brother was on the other side of the equation selling mortgages so I was aware that there were problems brewing. I mentioned that the market was probably getting overheated to the Supply Officer and his response was that the market was “just going to keep going up and up and up.” When I pointed out those were the exact words my sister used with me before getting burned in the 2000 Internet bubble meltdown he said…

“You just don’t understand the Orange County real estate market.”

Some people just don’t want to see. I hope he got out in time.

When rates rise, the market can or will do it whether the FRB goes along with it or not. No one ever makes a similar claim for hardly any other central bank.

The difference is the currency. Well, at some point, the currency crashes and rates soar with it, no matter what anyone wants. The USD isn’t immune to this, no matter what anyone here thinks.

“In case of an emergency he can even go lower. Deep into negative rate. So we got to pay the bank to keep our dollars.”

This is crackpipe talk.

Why a crackpupe talk? didn’t they tested negative rates in Japan and Europe ? But that is just one guess,

Another is to raise it for a little , or just keep it as is for a long time. But for sure they need more debt to run the country’s deficit . Have a better idea dear sober?

Why don’t you tell us WHY it’s crackpipe talk, instead of just being glib?

In France a mortgage can be had for 1%. Negative interest rates are real and the fed IS capable of going there.

It’s called sell the rumor…. Buy the news…. I know, I know, I have it the other way around. Stocks are looking at this as a sign to party for a few more months.

Signal to everyone, if you haven’t locked in your low rates for loans, do it now. As to the question who would buy bonds now?

DUH. The Fed.

After QE1…QE3 ended, rates actually went down, as if they Fed was using QE to raise rather than suppress interest rates. The difference this time is the massive Gov. spending in addition to massive Fed QE.

I am not sure how it can. However, while I would be happy if there would be a managed decrease in the prices of inflated real estate and the inflated stock market (reportedly by massive use of leverage-margin), I doubt that this can be so easily managed. I am a fan of the panicked cattle stampede economic theory, which means that due to bots or other reasons, too many markets react like cattle react when you fire a magnum gun near their ears.

And the market is right.not untill at least 2024 QE has never stopped if anything they will have to pump even more than ever.but at some point this sick twisted game will end when the FED is ready. The fed a criminal cartel gets away with it because the corrupt congress just looks the other while lining there pockets

“The fed a criminal cartel gets away with it because the corrupt congress just looks the other while lining there pockets”

I often wonder if any one person can truly comprehend the depth and extent of corruption in US society. Even better, much of the corruption is perfectly “legal”, if the word still has any real meaning.

Noriel Rubini has good article out today that explains there are four possible outcomes from where we are at. Find it on Real Clear Politics or Project Syndicate.

Public and private debt levels are too high for the fed to risk normalizing rates. Inflation and price spikes are here for the foreseeable future. Retirees will have to suck it up!

Oh no… the party is coming to an end. What’s going to happen when interest rate rises, and no more purchase of MBS. Who will buy all of the CDOs if the Chinese buyers aren’t allowed to send their money oversea. OMG, this is a disaster, we need a new Fed chairman, pronto. This cannot stand. This will not stand, free money forever.

Amen. The Federal debts, not even considering the reportedly hundreds of TRILLIONS of undisclosed, US government’s liabilities and the liabilities of pensions and state and local governments that it will have to eventually bail out, as so great that even a 3% rise in interest rates will make the government insolvent, unless it cancels something big, like Medicare or the US air force. Thus, interest rates will not be voluntarily increased. Such interest increases on rolled over treasuries will only occur when the “Fed” and our government lose control catastrophically. The saying catching a tiger by the tail seems applicable here.

Central banks set rates as a policy instrument and the US Federal government cannot be “insolvent” in US dollar terms, a currency over which it jealously guards a monopoly of issue.

Wherever do these notions about mysterious interest rate rises and US Federal government insolvency come from?

Dear eg,

Legally, insolvency includes inability to pay current debts with current assets or else, total debts with total assets. If taxes are not raised, so government revenues increase, to pay liabilities, the US government creates more treasuries and pays its bills with the proceeds.

As you print dollars to buy treasuries or create more and more treasuries, demand WILL NOT keep up at some point. Thus, you get High inflation, either way, which will make interest costs rise to get third parties to take our rolled over treasuries. The question is when buyers of treasuries will demand higher returns through higher interest rates.

“Federal” Reserve banksters believe they can always control treasuries’ interest rates. I say, you cannot fool all of the people all of the time. Economics is not repealable.

This tablet must have been programmed by a German speaker, because it adds unnecessary capitalization.

To clarify, capitalization is used within sentences in German.

Amusingly, the Chinese real estate developers’ implosion and loss of value of 30% to 40% of ALL Chinese persons’ savings might have contagion effects that tame US inflation.

I think what you’re saying here is that CA and IL is just ahead of the curve in terms of liabilities. Everyone else will eventually fall into the same boat, so why not have a party now.

I think they should start by putting in a moratorium on all government employees / contractors (especially members of congress and their staff) from being able to invest in anything but boring treasuries. The only exception here would be people working in the Federal reserves, they should only be allowed CDs. That alone would solve some of the current problems we have.

And by the way, did anyone catch JP’s comments regarding his muni ownership… isn’t it coincidental that he presided over the Fed purchase of munis in the first time ever.

Thank you JP, you are definitely not corrupt. Utterly stupid, yes, but not corrupt. Yes, I’m being sarcastic.

Pathetic Powell could never fill the shoes that are only fit for AI.

#ReplacePowellwithAI

“Decelerate”?!! Good political decorum dictates that we leave room for rebuttal arguments. SoCal Jim, are you ready with your statement? I yield the floor for five minutes to the honorable representative from dreamboat alley (i.e. Newport California).

Lawrence Yun of NAR is warming up the bullpin.

LoL

House sells for 500k.

SoCalJim: “price will go up.”

You: “It can’t, you are crazy”

House sells for 550k.

SoCalJim: “price will go up.”

You: “It can’t, you are crazy”

House sells for 650k.

…

House sells for 800k.

…

House sells for 1m.

…

House lists for 1.2m, price reduced to 1.15m.

You: “Haha SoCalJim see I was right. Respond right now”.

Pathetic.

I will step in for SoCal Jim.

In highly desirable areas (most of FL and the SW), prices will continue to climb, but less sharply. In rural areas and less desirable rust belt, Midwest etc, things might “decelerate” to a normal 2-5% annual appreciation rate.

Unlikely that tapering will affect this as long as interest rates stay sub-4%.

Interest rates won’t stay sub 4% without QE.

Thank you Wolf for another excellent article.

My question is where price reductions are occurring and where new listings are growing.

Are they in big cities when rental eviction moratoriums and mortgage forbearance are now being lifted? Are companies based in cities calling everyone home?

Or, are people who overpaid for a nice suburban house after fleeing the city now trying sell and move back for work (or just because they miss the city life).

Anecdotally, I still see more remote workers moving into my rural neighborhood and prices seem to still be rising

I think there is still the dynamic between rural/suburban and city prices.

Is there a way to find this data?

QE and ZIRP and Real rates being below zero will exist as long as there are crises. Crises being climate, terrorism, pandemic, whatever it may be next, perhaps war, all that will happen is more of this.

Seeing as we will never run out of crises and we rely on a largely completely unqualified governing body of multi-millionaire “public servants” and “globalism” there is no logical line to draw. If there is even a minor taper actually done by the fed, rates will rocket upwards because nobody wants to buy this shit debt with no yield.

Lael Brainard will be fed chief and we will have negative rates. Either risk on or no yield. The global battle against whatever crises you want to insert here DEMANDS us give up on logical economics and accept increasing collectivism!

Unfortunately, this means rounding down for most. And most don’t realize it yet. Big plans indeed, but don’t take for granted the reliability of your electricity now!

Roger Pedactor,

When CPI inflation = 12%, and Americans are getting frustrated over it, the government will lean on the Fed to do something about inflation. It’s just self-preservation. Politicians remember how Carter fared.

Inflation is a political bitch.

@Wolf,

It is a political bitch, but the advantage is only if you happen to be in charge at the time of said clean up. So, the goal is to make sure the mess is left to the next guy to clean up.

Looking at you, George and Bill.

Eventually, he (not SoCal Jim) will be right…. Prices will fall eventually. Let’s imagine this was 2015, prices are higher, and one decided to wait until things come down a bit… eventually it will, but if it’s 10 years on, did the guy who wait have his situation remain static? And how much does the housing price have to drop before time to buy? And what’s more did the cash you hold down to lose value? So many variables….

After a while it starts feeling like analysis paralysis.

I know a few people who refused, and refused, and refused to buy an affordable but overpriced house. Some for 30 years. And they are still living in apartments paying more, and more, and more rent. Those who bought paid dearly, and some lost everything in the crash due to job losses, but those who survived have equity and lower expenses now than those who shied away. Bubbles and crashes are unjust generators off inequality IMHO.

Bubbles and busts are a fact of life. And one simply cannot time life. We rented for one year in between and watched prices go up in our target location by $150K to $200k. That was 2015.

This is coming from someone who bought in 2007 and had to suffer through 4 years of down market.

Now tell us about 2007 through 2009 and the subsequent 6 year crawl out of the CA housing impact crater (barely managed, with near maximum ZIRP)

This is ridiculously hyperbolic. Look at the historical charts, price reductions are still way below yearly seasonal numbers from the past five years. The drop in prices over the past two months is very consistent with ordinary seasonal trends and very minor. (In fact, percentage wise, it is lower than typical seasonal decreases). I see no indication with this data set that shows the market is poised for any type of measurable decline beyond just seasonality.

Unless there’s some major change to policy or the economy, I expect we see another (more modest) leg up starting again in January.

SocalJim has a record of pretty much 100 to 0 here over the past five years. You’re all cherry picking a very minor seasonal adjustment to make something that isn’t there… yet anyway.

Possibly due to hive mind effect.

This forum was also convinced UBER and NFLX and crash and burn. 3 years later both are doing fine.

Sometimes it’s good to step out of the echo chamber and get some fresh air.

Indeed. There’s a lot of valid points made on here, and Wolf frequently has good analysis. However, the endless doomers keep shifting the goalposts where “The Big Crash” has been 6 months away for the last ten years.

Sadly, there doesn’t seem to be a desire to engage in meaningful debate and conversation amongst many of the posters here. Last time I posted a hypothesis for why I think housing will remain resilient, I was personally attacked and lectured about how I can lose my home. I sense it is coming from a lot of well justified anger about how the fed and congress have allowed the wealthy to loot the economy at the expense of the middle class.

I’d just rather debate on the actual economics. Right or wrong, fortunate or unfortunate, I am not seeing anything that points to any type of non-seasonal decline in housing at this time. We may (finally) be bouncing off of a ceiling, but it doesn’t mean a significant decline is on the way. Demographics and the supply (im)balance suggest there are many years ahead before we can actually see a shift .

Toward the end of this decade, the first-time buyer population will begin to shift to those born post-2008, when the birth rate dropped 10% and has never fully recovered. This is when I expect pressure to let up somewhat, along with an acceleration of boomer downsizing/passing on. It will hit colleges in 2026-2028. Posters on here will call it the “death to the higher-ed brainwashing scam”, but smart and well-ranked schools have been planning for years and will have no trouble filling seats. It will likely mean a culling of a good percentage the smaller schools.

sc7,

With all due respect, the “doomers” as you call them didn’t think the world’s central banks would go to the extent they have to empty out the future to satisfy the elite.

The “doomers” are still right. Our economy is not nearly productive enough to pay for everything people are convinced is their “right.” Everything over the past 10 years or so has been fueled by debt and financial shenanigans. That’s not to say that you are right that the games can’t go on for longer, but don’t pretend that this means the economy is actually healthy. It’s not.

There is always this moment when buyers say screw it.

They just stand and wait for the dominos to fall.

The problem is when to get back in.If they time

it right there’s your retirement.

10 year Treasuries are at 1.36%.

So…everyone in the market is playing the cheap and easy money game.

“But CPI inflation is over 5%, which turns these mortgage rates into massively negative real mortgage rates, which should be immensely stimulative for the housing market.:

dreamboat alley = a town located in the dystopian states formally know as…

If they end QE then what happens to the Fed chairs wealth?

Interest Rates will rise once the Central banks loose control.

The Fed Chair is investigating his own insider trader scandal…along with two other Fed Presidents.

I am sure the investigation will be objective, thorough and impartial.

And…no one is above the law.

Bet you all my money in the bank, my stock and everything that I own that nothing will come out of this.

It’s not even good theatric as most MSM simply ignore this story as a whole.

That’s an interesting point about CPI inflation vs mortgage rates, and it’s an even bigger effect with the tax benefits for most borrowers. It’s pretty easy to borrow at a 3-5% rate if you have good credit, so that’s making me think that in this environment, it’s much better to borrow than save, if your cash flow is good.

Cash flow = expected sweet appreciation

Everyone thinks they are an Evergrande on ever rising real estate speculation.

Not necessarily talking RE here. Just that the environment favors borrowing over saving.

With a standard fed tax deduction of $12k and more for some, your mtg int deduction has to considerably exceed that amount to benefit you at your marginal rate, esp. with SALT caps. For certain you will be paying ~3% for borrowed money…can you be equally certain that your income will increase by that 3% or more?

Deceleration is simply a reduction in speed and Wolf is correct to use this description of the market. Home prices are still increasing, just at a slower rate. With inventory at only 2.6 months supply, housing stock is still tight.

The new construction picture isn’t much better. Outrageous increases in material and transportation costs from price gouging suppliers are squeezing builders’ margins so most are cutting back new construction and slowing deliveries. This will only exacerbate housing shortages and put continued upward pressure on prices until interest rates rise substantially – maybe late 2022

Home prices FELL for two months in a row. It’s just that they were up 24% in May year-over-year, and the year-over-year increase is getting reduced. But prices are actually LOWER than they were.

The question for homebuyers (not speculators) in this environment is always a tough one, especially if they keep watching house prices. Imagine if one was on the side lines for the last five years…. How much would prices have to drop to keep it even, and then how much would interest rate have risen in between.

To be fair, Median prices are vulnerable to changes in mix, and seasonality as you noted.

The Median price of “homes that sold” can drop even if actual prices of all homes for sale are rising. Just need the buyers to preferentially choose to buy more of the cheaper ones (or be out buying more in cheaper areas) while buying fewer of the pricier ones.

Anyway it’s always too soon to make predictions about the future. ;)

…which your own charts show happens every time at this year due to seasonality.

An interesting indicator on what is going on is when you look to the number of mortgage applications and rejections.

I do not have the stats so may be worth looking into.

They advertise with all these rates but it is like the cheap chairs on an airline flight, there are only 2 of them and those have already reserved for a friend of a friend.

Especially in the area of jumbo loans it is nearly impossible, they try really hard to find any reason not to loan, anything not picture perfect will be used as an excuse .

All not very surprising since which bank wants to underwrite a fixed mortgage (and even the ARMs can go up only so much) that has a rate way lower than inflation.

Conforming loans are freddy/fanny so uncle sam who likely does not want to do this either but officially cannot say so

I’m one of those suckers that got screwed in last housing crash. Finally I got some equity on my home. However the common narrative seems to be the same as in 2007. The house prices are even higher then back then. As an amateur I wonder how long an average Joe can afford a house with such high prices even at low interest rates? Payment on a house that is priced for 1 million is much higher then for a house 5 or six hundred thousands. Can salaries adjusted for growing inflation keep up with the current optimism of the market? The current policies of the Biden administration are at odds with higher economic growth. I’m looking forward to for wisdom from the the honorable audience.

Isn’t it only the ∆ that matters?

Interest rates can continue to be low relative to inflation, but if they don’t get lower than there isn’t really pressure on prices.

That is, we’re already priced for low interest rates and higher inflation so now asset prices have to deal with the real world of ups and downs again.

China kaboom America next

This is reaffirming what we been noticing around here in Swampland. I see signs “PRICE REDUCED” . We may have seen the top of the market. All the buyers have already bought. Its turning over from a sellers market to a buyers market. Of course it depends on where you live. Next thing you will see is “days on market” will increase substantially. When interest rates on the 10 year Treasury start to increase it will be game over.

The Fed will NEVER end QE.

They may make reductions for headlines……but they will never end it.

Raise the debt ceiling and subsidize debt…….and the pile will grow and grow. Do the 20 and 30 year olds know what going on with their future?

You can be sure that we will report on it, charts and all. They did last time, and they shed assets last time, and they raised rates last time. And there wasn’t even much inflation. Now there’s a LOT of inflation.

Wolf, how can QE ever end when there is essentially a mandate by almost every international group from the UN to the G6 to the IMF and World Bank that massive sovereign debt is needed to prevent climate catastrophe?

I mean at an extreme macro view, there is no reality where people will be able to afford reliable electricity at a certain point without constant subsidization and cost defragment basically centralizing the economy even further.

There is no reality, if climate change is real, where current currency systems even function at all with any intrinsic value to the currencies via debt value. Nobody seems to consolidate and answer this. Wanna take a shot?

Defragment not defragment…..

Defrayment

Roger Pedactor,

Too many things mixed together to sort through it this late. So I’ll just take a crack at your first 6 words: “Wolf, how can QE ever end…”

A number of countries already ended QE this time around.

https://wolfstreet.com/2021/09/09/the-process-of-ending-massive-money-printing-has-started/

The Fed ended it just fine last time (Dec 2014), and then began shedding assets on its balance sheet (Nov 2017 to Aug 2019). People kept saying all along the process that the Fed could never end QE, and after it ended QE, they kept saying that the Fed could never shed assets, but it sure did.

They ‘temporarily’ ended QE and they ‘began’ shredding their assets. And how far did they get? I suppose they can blame their failure on Trump wanting negative interest rates, but that is just bull. Fed was raising rates despite what Trump said until the market crashed in a giant taper tantrum. No, they cannot raise rates for long and tapering will be limited. Only a matter of time until the next crisis hits and off they go again..

Good….hopefully this will continue for many months to come. Once again you can always count on Lawrence Yun to tell you this is a good time to buy now.

Of course, you still get plenty of people that are in denial that SoCal will ever drop in price..fly over countries sure? Not in our precious paradise will price ever fall.

They aren’t making anymore 3,000 sq foot lots in which to squeeze 2,700 sq foot homes in SoCal.

Jim is right, a million is too cheap for Cudahy!

Cudahy is a little too nice for me…I am thinking South Central as the next up and coming neighborhood for the hipsters

Straight outta Compton

Crazy motherf*cker called J-Pow!!!

I’m jackin’ assets b*tch

Yeah doin’ that now

Ya better jump in

Oh while the jumpin’s hot

1.2 for a crack house or

Ge you some Tesla stock!

Word!

The whole key to LA is to somehow get closer to the sea as you’re playing the housing bubble, Cudahy is right off the 710 and before you know it, 20 minutes later the Pacific awaits. Compton is marginally closer though.

Joke interlude:

A guy and a gal are going at it hot & heavy in the back seat of a jalopy when she whispers to him ‘kiss me where it’s dirty!’ so he drove to Long Beach.

Newsom signed SB8, SB9, SB10

Abolishes single family zoning. Overrides local zoning. Get ready for cram down high density neighborhoods near you.

They have to start putting in high density neighborhoods to limit sprawl and all the expenses it takes to maintain sprawl.

I cannot tell you how many mega apartment complexes in the past 10 years that have been built in my historical zoned SFH residential area. Everyone of these apartments was met with a NIMBY revolt but the city wants to grow so the apartments were built.

The GINI factor (the gap between the wealthy and poor) keeps getting bigger. More and more people will just have to live in apartments or buy condos in mutlifamly buildings. In the future, people will need to be mid to upper middle class to afford a Single family home.

This is the new normal and if you look at the numbers…it is here. Out of all home ownership, only 17% of families earning less than the median income own a single family home.

Also SB 8 and SB 9 in cal changing zoning of almost all R zones to allow 1 to 4 units. Going to be biggest give away to developers, esp those connected to Dems.

Probably a topic for an article by Wolf, esp as to what long term affects.

Robert Hughes,

If a homeowner sells their tear-down to a developer, why should the developer be prevented by law to build a duplex or two duplexes on this property? This freedom to build a duplex has been the norm in many/most states.

A friend of mine’s rickety big house on a large property in Tulsa was bought by a developer who tore it down and built 8 townhouses on the property. What’s the problem? If it’s good enough for Oklahoma, it’s good enough for California, except the max in California is four units. Oklahoma is not run by “Dems,” as far as I can tell.

There’s this assumption that any slow down we see now will just bring in the new normal and this is healthy after a big run up. The conventional wisdom is that it can be insane on the ride up and that’s normal but when it comes to price reduction/decrease people will always behave rationally and market will only move side way. Maybe I am dumb as a rock but I just find that assumption completely illogical and counter to human behavior.

What I fear is that this market especially the coastal cities will never crash again since FED have now unchecked and unlimited power to jump right back in if there’s so much a whiff of a market crash. Unlike China, they are not going to make companies feel the pain or let people loss their perceived wealth effect even at the expense of younger generation not being to afford anything.

Until the younger generation gets into power and has had enough. I’m looking forward to my generation cutting off the older people’s medicare and social security.

That sounds mean. The politically correct way to accomplish the same thing is to print money quickly so the old folks SS check will only cover a few sacks of beans, a bag of rice and a some shoe goo to fill in the holes in the bottom of their shoes. That is JaPow’s plan don;t you know.

DR Havenstein got rid of all pension liabilities in the 1923 Weimer Republic via the printing press. J Powell is following the same playbook. Get used to it. 100 year cycles repeat. Enjoy.

Easy now, I am an “older people”…..And there are others here just like me!

I, too, look forward to people reaping the fruits of the debts they heaped on their children.

They also inherit the assets — or hadn’t you noticed that there are two sides to a ledger?

I’m pretty sure end of life care gets most of that.

RNY

Then YOUR generation will be moving Mom & Dad into YOUR spare bedroom and supporting them.

You think that is inexpensive ?

See, you young guys forget that Social Security & Medicare benefits YOU as well.

It takes a lot of the cost of aging parents off your back.

But them maybe you want to force your parents into a three generation household.

Or maybe you have no parents or wife or kids.

That would explain your callous disregard.

I’m guessing RNY is planning on changing his parents diapers and spoon feeding them while they live in his home. It’s cheaper than $8 – 10 K per month, not including medical expenses, in a nursing home.

As one gen Xer said for all the Jones and gen Xs; “The boomer generation screwed me over and I have no doubt that the generations following me will do it all over again when they come into power.”

I felt the same way 30 years ago. You have realize peons like us didn’t create the system. We just had to live with whatever public policy was running during our life time.

More and more I am seeing housing prices reported in the news as more of a political issue rather than a statement from NAR. I am even seeing them report about the same issue in other countries, here on our news. Politicians are talking about it more than healthcare these days. Things are changing and the pandemic has a lot of people reconsidering what 30 years of debt really is. You can keep your high priced houses.

All I’m saying is that I’m tired of the Boomer generations’ callous disregard for the well being of the nation. They’ve been in control for decades now, and have flooded America with illiterate peasants for a combination of votes and cheap labor.

The country is being destroyed before our eyes, and they don’t seem to care, because they figure they’ll be dead when the chickens come home to roost.

Actually many of those at most senior and powerful levels of govt power ( Polizi, Schummer, Biden, McConnel, Finstein, etc. ) are not boomers, but “the greatest generation”.

Let’s actually go back to 1964 where many consider the societal change, decline started. LBJ’s ego trip “the great society” program. Bread crumbs for the masses, happy name social programs ( yes also some valuable good changes ), but above and below the table big spending for the MIC vua Vietnam. Recall the oldest of us boomers were just turning 18 or 19. Perfect dumb fodder for sending to get killed, wounded for what?

Oh that’s right the Dulles brothers “stop the dominos” of freedom from being swallowed up by communism in some little 3rd world country worth “saving”. Oh I forgot what we were never told. USA got into indo China in 1954 after French defeat. They needed help to maintain their holdings, plantations, profits, ect. Read history for how many “advisors”, we had in country by 1959 or 60. What industries, political connections benefitted. Oh let’s see defense ( offense ) industries location in Texas.

Boomers gen perfect, no. But Just read history for what we were led into kicking and protesting by “the silent and the greatest generations” and have been and still are by those too old, too rich, too ego controlled, too powerful to let go.

“The earth is not dying, it is being killed, and those who are killing it have names and addresses.” Utah Phillips

“I’m looking forward to my generation cutting off the older people’s medicare and social security.”

I don’t believe there is any generation that wants to impoverish their parents, who will then need support by their children and grandchildren, even in the United States of Corruption and Greed.

RightNYer,

“I’m looking forward to my generation cutting off the older people’s medicare and social security.”

Hahahaha, this is funny and nuts. When the younger generation gets into power, they’re no longer “younger,” and now they’re looking at being able to get health insurance after 65 and getting some retirement benefits.

These two programs are the two best managed government programs. SS has accumulated a surplus of nearly $3 trillion that the Department of Defense then ate up. It’s the Dept. of Defense, that mastodon of corruption, that the “younger” generation needs to shut down when it gets into power.

Yes. It’s just like the stock market. When stocks go up 5% for no reason, there’s nothing there worth mentioning. When they drop 5%, however, all the media alarms go off at once.

The Federal Reserve cannot prevent declining living standards, regardless of what the nominal sticker price shows. “Eventually”, home prices in the aggregate can and will fall because money won’t be cheap forever, credit standards will return to some form of sanity, and no one can buy what they cannot afford. The nominal price may be (a lot) higher if the currency depreciates enough but not the “real” one.

Homes are more like money than money these days, in that you can be assured of a decent interest rate in yearly ‘savings’ on an abode (for now, when the bubble pops everything will turn on a dime and suddenly nobody will care, the vacation rentals will be the worst, as suddenly there’s a mad dash rush to the exits in attempts to sell) as opposed to the niggardly amount a banking institution will give you for lending them your money.

Asset appreciation has been so profitable the last 12 years, that it has made many complacent. But wealth affect is a dangerous and desperate monetary policy that had many unintended consequences that are yet to be played out.

Wow

I live in rural Maine and handle closings for a living (and have for over thirty four years) – there are no price drops in our region – if anything the prices of both raw land and existing houses are still rising as quickly as ever.

David,

Every market has its own dynamics. In San Francisco, condo prices have gone nowhere in three years and are back where they first had been in March 2018. House prices — which had been super-hot — dropped for two months in a row and are back where they’d been in April.

Let me guess – everybody’s wealthy in rural Maine? Weird, because every rural “Mainah” I’ve ever met did not come from money.

It’s all the New Yorkers buying summer vacation homes up there. Cape Cod is sold out.

This is a very real problem for our young people who we desperately need to stay and make a life. The worst is when some dope buys a 20 acre field and plants a giant cottage smack in the middle and destroys a valuable resource.

One black fly season is enough to drive most of ’em back to the city, but the cottage is still in the middle of formerly productive farm land.

Fortunately there are also working stiff refugees moving into our area over the past year or so. They are very much welcome, even from New York.

(I live in The County – about as rural as one can get in Maine)

The US is now running $3T annual deficits. What do we think will happen when people start defaulting on their mortgages, bailouts are required, and businesses beg for more support? Are $5T annual deficits next on the agenda. $7T deficits?

Then what happens when Medicare and social security need funding, along with private pension plans?

Bobber

Getting a little hysterical there eh?

Calm down

Is that what you would have said when the deficits were less than half pre-COVID?

The actual fundamentals of the US economy are mediocre to terrible and have been since 2008. At some point, politicians and voters will need to choose what they can and “can’t” live without. This “some point” will arrive when market psychology turns against US debt and the USD, whenever it happens.

The idea that this country can pay for every program with endlessly increasing borrowed money forever is a complete fantasy.

Not at all. It’s just math. It took massive govt spending to spur this growth during the pandemic. The tradeoff is inflation and wealth hoarding by the 1%. If it takes x trillion in govt deficit to spur 5% GDP growth, it takes x+y to create that same level of growth next year, due to paying off debts or paying for inflation or both. A recession will occur unless the government spends more than last year. Government spending is included in the GDP calculation, as I understand it.

I’m not being hysterical. When people say there is no housing crisis, then it happens a few months later, that is hysterical. Were you making the same type comments back in 2007, to calm down?

IMHO…what is different this time is in 2005,2006,or 2007, if a person wanted to buy one house, 2 houses, or 3 houses….it was easy. There were housing subdivision popping up all over. You could buy with no money down.

Now it is hard for someone who can even provide 30%, 40% …. to 100% down to find only one house to buy.

ru82, once this thing unfolds, like it did in the GFC, there will be houses for sale everywhere for a lot less than they sold for in 2021. Just like in 2010 – 2011 when everything went on sale.

Tom S & Bobber

Here’s some math for you….

The United States government is immortal.

Unlike business and personal debt, the government has a MUCH longer timline.

All government debt can be paid back over centuries.

Spread out everything and repay over three hundred years.

Math says that is pretty easy to do.

Bobber

Don’t calm down. Keep up the good work

The answer is easy, we go from T to Q;

Just as we have gone from M –> B –> T –> Q… what’s the difference? The only potential point of confusion is that there are two successive Qs, actually QUs, and that makes it hard, I suppose we can just name the second Q, U instead.

The median price of a new home rose with the most recent report.

The median price of an existing home has dropped about $4,000. from its high. The median price of a new home rose with the most recent data reported in August.

New housing starts have been increasing. More multifamily units are under construction.

Evictions increased with the end of the eviction moratorium.

emptying out the system…taking the ball to the wall….going all in for immediate gratification…

They found the flaw, and they are exploiting it.

Ignore the Fed mandates…plug in your own puppets ……print like crazy, and own everything you can get your hands on.

Realize NO ONE IS WATCHING WHAT THE FED DOES

Punish those who save…force them to buy the things you already own.

Disregard historical norms of inflation vs interest rates…(7 decades of short rates equaling inflation)

What’s the old saying.

“Pushing on a string with a bulldozer”

Idiots….and trapped ones at that.

Where is Paul Volcker when you need him?

China’s DEBT /GDP is 50 TRILIONS/15 Trillions = 3.6x

USA is around 1.7x

Nothing to see here. Mov on!

Every nation has a different debt profile of 1) consumer debt 2) corporate debt and government debt. Last I looked most countries debt was around the 3X – 3.5X range.

50/15=3.333

China Government debt to GDP 2020: 66.x%

US Government debt to GDP 2020: 106.x%

China Total debt to GDP 2020: 280%

US Total debt to GDP 2020: 895%

Sources: IMF, traidingeconomics, ceicdata, US Bureau of Public Debt

King Co. WA (Seattle) has over 60,000 rental units behind on rent, 37,000 over 5 months behind, per the PI (local paper). Seattle Mayor just extended the in city eviction moratorium because they expect the Statewide one (which ends 30 SEP) not to be extended. The thing is that it’s not based on a possible threat of the spread of disease that’s being used as the basis of keeping squatters in place, but “financial hardship”.

Pierce Co. (Tacoma) is expected to exceed the numbers of evictions in King Co.

That’s a huge number of newly available properties appearing within the next 6 months (or sooner), not counting new builds.

“For rent” signs, which have been quite scarce for the past two years, are starting to appear. I expect single family residences, previously rentals, to start showing on the market as soon as possible as small landlords take what they can to avoid the Gov’t cutting off their income stream.

“…Seattle Mayor just extended the in city eviction moratorium…it’s not based on a possible threat of the spread of disease that’s being used as the basis of keeping squatters in place, but “financial hardship”…”

Of course not, because liberals moved the goal posts after the kick was in the air.

For the last 1.5 years many houses now for sale have not been maintaind properly… if at all.

To fix damage requires materials (high prices currently), workers if any, and time. That is, the house cannot be used or rented immediately… lost income.

So…?

The median price in my area is $1.1 MILLION. This bubble is so far out of control that it’s sickening.

Just read this article and here are some quotes:

The sale of a multi-million dollar listing in North Saanich is shattering any previous record for highest house price on Vancouver Island.

For $22.75 million, the Lawrence Road property includes a 13,000-square-foot home with eight bathrooms, six bedrooms, a two-storey study, a detached yoga studio, an infinity pool, tennis court, gym — even an underground wine cellar.

and:

With demand up for properties worth $4 million and more, so are prices.

“Last year’s assessment, we had seen a 10 per cent increase,” Ireland said. “This year I think we’ll see at least that in our assessed values.”

There have been 245 sales of homes in the $2 million category so far in 2021, compared with just 94 in the same period in 2020.

Prices aren’t dropping here, but greedy sellers are getting hung up when listing at 30-40% above realistic values. The rainy season will soon arrive and if stuff doesn’t sell before the leaves drop it’ll be on the market in the spring.

I think we’ve reached peak greed, Paulo. The classifieds are loaded with used trucks, boats and RVs asking tens of thousands more than the people paid brand new, and well beyond any realistically attainable price. Everybody’s looking for a sucker.

1997 Toyota Tacoma. 15,000.

350k miles, some rust and needs a windshield and some other tlc. Cash only.

Don’t low ball me, I know what I got. These things run forever and I’m not letting it go for cheap!

I love this new normal of free money raining from the sky for everyone but me. Wish I had a time machine to become a crypto millionaire and just be able to not work and RV all over the place with my 3 homes. Anyone who partied and lived it up the past year deserve all of the heat that’s to come from the rocketship coming back from the moon.

There are several of those for new Ford Broncos, $25K or more over the sticker that they paid a few weeks ago.

A house sold for $800,000 near me in a sister neighborhood. The buyer was a builder. Leveled the house and put up a picture of the new home to occupy the property. Price $2,000,000. Before a brick was laid the house was sold sight unseen. If this ain’t a bubble nothing is.

Not just recently, either…

A few years back, friend of friend bragged about her 1.5 mil home on a river here in old white people land…

Went to visit , but wasn’t impressed… friend asked why…

Told her it was a $500k house on a million dollar lot… big difference…

Kind of like the Cali thing now I guess.. And your example as well…

Sold it for 2 mil… I still wasn’t impressed…

DC metro real estate is so expensive Biden used to commute daily from Wilmington, Delaware by rail. He was able to build a 7,000 sq ft house and also has a house near the beach. Does not trust the stock market as much as real estate.

One has to question what house prices would like like without FED MBS purchases. Or artificially low interest rates.

Ground report from socal/san diego: No slowdown seen yet. craziness still continuing.

I doubt FED would do meaningful tapering or rate hike. It’s all jaw boning

Hi. Seeing way less offers on listings and price reductions. Yes, there is still some madness in the SD market… for example Encinitas and Carlsbad, but it is definitely slowing down.

Lots of houses not selling as quickly in Crook Cty, IL. House sold for 472k in2/20 now listed a 535k. Wtf? Seeing price drops on already high prices

jon,

Funny. People kept saying the same stuff last time all the way along the process: the Fed can never taper QE, and when it finished tapering QE in 2014, they said that the Fed can never raise interest rates, and then when it started raising interest rates, they said the Fed can never shed assets, and then it shed assets on its balance sheet (Nov 2017 to Aug 2019). And there wasn’t even much inflation. Now there’s a crapload of inflation.

I have huge respect for all the articles you post and I salute you for this.

The biggest problem I see is: People are using logic and reason and in contrast this show is run by the greed and corruption of few bankers.

FED is shameless and I am sure at the end they’d be proven right about inflation. The home prices in SoCal has increased 30% in last 1 year or so. Even if it stays at same level, one can say confidently that inflation has reached zero.

I still think: FED won’t do any meaningful tapering and/or meaningful rate hike.

jon,

Maybe you’re right. Who knows. Meanwhile, the markets are starting to react to tapering. Hot off the press:

https://wolfstreet.com/2021/09/23/10-year-yield-jumps-to-1-43-as-bond-market-reacts-to-what-the-fed-said-yesterday-about-tapering-rate-hikes-and-inflation/

Lack of inventory is why there’s any slowdownin San Diego. Nice south of the 8 neighborhoods are routinely selling near or just above a mil (for a nice flip). Go further west of the 805 and it’s all above a mil, and there’s also no inventory. Not saying it’s going to continue forever, but there’s no slowdown here.

We still have rentals in SD. Typical 2 – 4’s in core areas. Rehabbed and we keep long term tenants. Guess what get 1 of 2 calls a week if we want to sell. We have 1 or 2 standing offers per week on 1 complex. We keep raising price, they keep coming back. Presently about 6.5 NOI for a new buyer, maybe 7 to 7.5 if they pushed the rents which they could. Insanity! I was born and grew up there and left in 2010. Quality of life has declined so badly. Conversely QOL is 10 to 100 times better than in LA.

One thing to look out for is the real estate market starting to crash even before the Fed starts the tapering, or raising interest rates. With inflation running at 20% right now how long will it be before the bonds vigilantees start flexing their muscles, and start leveraging the bond market on the down side. When credit dries up, there will not be a sucker left to make bids on bonds that are falling through the roof. The Fed won’t be able to do anything either with inflation running red hot. Any excessive Fed bond buying will be seen by the investing community that the Fed has completely lost control. When credit dries up housing financing dries up with it and prices crash. It will be worse that 2007/2008.

You mean you don’t think somebody with a 450 credit score will be buying a house with zero down anymore? Hmmph…

Well crap, guess my contract is going to fall through…

They drove a really nice car, though…

Inventory is too low for a housing crash like 2007/2008. In 2007 there was an excess of over 5 million homes built with no one to live in. When things started to rollover the flippers could not flip anymore and then tried to rent out their homes. But so was every other flipper. Thus excess rentals also started to appear and vacancies were above 10% while historically vacancies should be in the 7% range. Home vacancies which usually sits at 2% rose 50% to above 3%.

Flash forward to today. Now we do not have enough homes. Historically low inventory. Home vacancies have dropped 50% to 1% and rental vacancies is historically low at 6%. I know several people who been looking for 6 months or more and have been outbid everytime.

I can see housing prices going flat with maybe a little drop.

IMHO for housing to go down in price the following have to happen.

1) Liquidity – This will shut down anything sector if there is no liquidity. This could be because banks quite lending or interest rates rise a lot. In reality, it means the GSEs would need to tighten as they back 97% of all mortgages. I doubt they will tighten any. Rising interest rates may cause some people to not borrow….but…..

2) Interest rates rising. Well Japan has kept interest rates at ZIPR for 25 years. The U.S. has only kept interest rates a ZIRP for 6 or 7. Not sure how the FED can raise interest rates if much at all.

Inventory will go up drastically once the rent forbearance ends and evictions start.

Rent forbearance at one time was over 5 million when unemployment hit 14%. The number in forbearance keeps dropping with the unemployment and now is down to 1.6 million with unemployment at 5.2%. They expect forbearance to drop to 1.3 million or less in a few months.

Who know how many are in forbearance and are back to work?

I think forbearance ending will be a meh event. IMHO

I don’t think it will. Where are all those people going to go? What will all the landlords do? Most renters will “miraculously” find the money and/or the government will issue housing vouchers/subsidies.

Swampy,

I agree and i think it’s going to happen but the actual crash will be hidden by all these parasites trying to get the last possible Shekel out of the suckers…

Then when the crash is no longer hide-able, it will seem like it happened “oh so suddenly”…

Then it will be “who would even have seen this coming”…

There is no BOND market, all things manipulated by FED.

Am also reading a good in depth article on housing unaffordability world wide;

September 19, 2021

” increasingly out of reach. Democratic and authoritarian governments alike are struggling with the consequences. […] Soaring property prices are forcing people all over the world to abandon all hope of owning a home. The fallout is shaking governments of all political persuasions. […] rents are also soaring in many cities. The upshot is the perennial issue of housing costs has become one of acute housing inequality ”

” The leader of Germany’s Ver.di union called rent the 21st century equivalent of the bread price, the historic trigger for social unrest.”

“In Canada, Prime Minister Justin Trudeau has promised a two-year ban on foreign buyers if re-elected.”

Gives some info into what attempts countries are trying. None are working. I don’t think we’ll see a real resolution until caps are put on large corporate RE investments on housing units, government subsidized building and very large taxes on units that stay empty.

I’m seeing a slow down in one county near me and none in another county. But prices are ridiculous. People have been moving out for some time as rents are unaffordable and unobtainable. Too many empty units and Air BnB conversions. I don’t know what percentage of Air BnB conversions are actually profitable. They’re priced higher than hotels.

Nurses are holding up signs saying “we move = you die”. Certainly happening in my county- they keep hiring nurses for the local hospitals who quit after a week or so, not being able to find affordable rentals. Can’t keep many new doctors either.

Oh, and the county that has slowing sales? Just in the last 30 days. Before that it wasn’t. But last 30 days was half that of either of the 2 months before.

Lynn,

Urban or rural…

Makes a difference if the workplace is near the hood…

Nurses and doctors ain’t hurting… just talking their book for the tv… better PR equals better money…

Although, I dont even think Swamp Creature would take a triple pay nursing job in Baltimore…

Good lord.. Rural California. The nurses can’t afford to live within an hour of their job. The doctors don’t want to. California is losing both.

Don’t worry, Deranged Weimar Boy Powell is still buying $40 billion per month in MBS. That should solve the crisis insofar as soaring housing costs are concerned. Oh…wait……

Get rid of this artificially low interest rate nonsense, ban Airbnb, and heavily tax 2nd homes and the bottom would drop out of the residential real estate market. Alas, politicians don’t want that.

Yep. But all of the above.

There are condo buildings in NYC, LA, SF, Singapore, Vancouver, Toronto, London, etc etc that all units have sold and there is only 25% occupancy. Domino effect.. One whole town south of me has low occupancy and a severe problem keeping it’s volunteer fire dept going- most of the younger people have had to move. Chock full of rotting empty $2m+ homes with no one being able to afford to live there if getting paid to mow the damn lawn. & at least half of the abandoned lower priced homes I looked up at the county offices were owned by what looked like offshore LLCs. Just rotting away. Not lived in, not rented- not even Air BnB. Half of that area’s county tax sales buyers were LLCs.

Kind of doubt it will matter much, but I hope Evergrande etc has substantial loans, bonds and investments in offshore companies.

I think something like 70% of households own a home. That’s a political majority that doesn’t really care about home price increases. If they have an opinion, they talk their book and support the price increases. Politicians can be expected to support the majority, and pay lip service to everybody else.

When the home ownership percentage drops below 50% because younger generations can’t buy houses any more, maybe there will be some political shifts and a home price crash. Or, if there is recession and people can’t afford to pay their mortgages, there could be a price crash much sooner.

I don’t see how banks can make money on 3% interest rate mortgages now. The direct origination costs are at least 1.5%, and only 1.5% is left over to cover all the overhead costs and pay shareholders. On an inflation adjusted basis, the banks are losing lots of money, unless they can offload them quickly to a mortgage servicer like Fannie/Freddie, or to hapless taxpayers via the Fed’s MBS purchases.

I think that is why the Fed continues to buy MBS. The MBS are money losers, and the free market wants nothing to do with them.

Home ownership varies widely by state. California is 54.4%, NY is 54%, DC is 40.4%, West Virginia is 78.8%. Average is 65.6% and falling.

I’m not sure how households are counted. It used to be that grown children living with parents were not counted as a separate household. AFAIK that still holds true. That might skew the data in places where less adult children move out.

Also, an increase in the value of a home is not always seen as a benefit if it is only a home and not an investment. It can cause higher taxes or higher taxes when selling the home and buying one of equal value.

I don’t see many people out here that welcome an increase in home valuations. I’m in a very high priced state. I see more people worried about where their children are going to live.

I am a home owner as well as have rental but I absolutely hate high home prices. Why: Because it’s destroying neighborhoods in Southern California. A 4 BR home for $1.5 million usd hosting 3 families, 6 cars .. No, I don’t want this.

^^^^^ This. Jon gets it.

I explain this to people ALL the time….rising prices are not a good thing for almost anyone other than those who make their living banking on property appreciation (read: developers, flippers). The rest of us are much better off with flat prices. That way taxes don’t go up, and when you sell it the commission doesn’t rise and you don’t have taxable gains that sap your purchasing power.

Banks do not want to own loans at 3%. That is why the FED buys 97% of all loans. The banks write the loan and make money on the loan service fees and sells the loan almost immediately to the GSEs. The GSEs put them into MBS and sells them to investors.

The GSEs are the biggest homeowners in the U.S. If people default, they will own the house.

Mortgage backed securities for SFH is probably a safe bet. Even if the debtor quits paying and the MBS is worth pennies on the dollar, the MBS owner will still be guaranteed the full value of the bond.

Amazing how Wolf is the antidote to the Wall Street Journal….

If I was still in graduate school I would do a compare and contrast project on what the WSJ says (and why?) and the Wolf’s response to the same.

Strategic Communication is a concept that came from the Department of Defenses and one of SC goal is to PERSUADE AND CONTROL rather than to expose and inform which was the old model of journalism.

It is amazing to compare the analysis found here and the case of characters (especially JPow who I think is the CCCP influencer assigned to Wolf LOL, No really…..)

Those who have grown up in other cultures often have an advantage in seeing things differently that a cultural native (which I saw among the sales crews in a big way in the auto sales industry) because they were very rational about the “animal spirits” of Capitalism without cultural affinity that once existed with a significant number of now older American customers. And many made BIG MONEY doing it……

When I saw the WSU article on the funds who purchased life insurance retirement insurance funds and then “invested” which cause many of the life insurance policies paying out say 20k on a 100k policy AFTER churning it to their benefit (of course they would never do that as a fiduciary….Right?)

My plan is to disengage from outrage media but I think this will be one of the last media outlets to go as it is the most relevant of all I look at and will be as long as the “WOLF” keeps HOWLING……..

Note, that almost every night at my ranch I hear the coyotes getting a rabbit, a neighbor’s bird, or a domesticated dog who did not know the coyotes were “not friendlies.” This is use as the metaphor of how Wolf talks about the “coyotes” and listening to the coyotes tear apart there prey is tantamount to investors on a daily basis…. I never forget this brutal analogy that shows up in so many “investment” vehicles whether new or old ideas. Nothing like the sound of blood and muscle being torn usunder……. Happy Investing =)

WOLF. Here in Oakland and San Francisco, we see massive numbers of apartments and luxury condos being completed in the last couple of years (in downtown Oakland they are full city blocks). Are they selling and renting these? or is there a growing inventory of empty places?

Matthew,

The median condo price in San Francisco in August was where it first had been in early 2018 and is down some from the peak. Condo prices have gone nowhere. There is plenty of condo inventory. But houses were red hot into June.

I think Oakland condos would benefit a little from the exodus from San Francisco.

I think you should walk into their offices, ask a lot of questions, get concrete numbers and report back to us as to what you find.. How many have sold and how many are occupied?

What’s important is New Privately-Owned Housing Units Started: Single-Family Units (HOUST1FNSA)

https://fred.stlouisfed.org/series/HOUST1FNSA

Today’s numbers don’t even exceed the average number of starts between June 1994 and May 2007.

This is just single-family houses. Now look up “multi-family” units such as apartments and condos. Each tower contains hundreds of apartments or condos. There has been a HUGE construction boom in multifamily for well over a decade. So if you just look at single-family houses, you’re missing the biggest part.

What was going on in the early 1970s with housing construction? HOUST5F shows a massive spike that peaks in 1973 and is never been matched