The big shift from durable goods to services is underway.

By Wolf Richter for WOLF STREET.

Some stimulus checks are still straggling into bank accounts, and the extra unemployment moneys from the federal government are still flowing to claimants in about half the states, and that money is getting spent, but all this extra money is a lot less than it used to be, and some stock market gains are also getting spent as part of the Wealth Effect, and employers are having to raise wages to attract people back into the workforce, and wages have ticked up, and that money too is getting spent. People are making a heroic effort to spend. But red-hot inflation is eating it up.

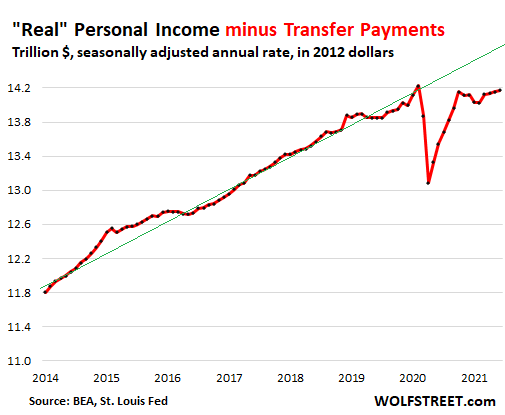

“Real” (inflation adjusted) personal income without transfer payments: Personal income – including income from interest, dividends, rental property, etc. – but without stimulus payments, unemployment payments, and other transfer payments from the government, and all of it adjusted for inflation, was still below where it had been in February 2020, according to the Bureau of Economic Analysis today.

This is a function of how many people are earning money, and of higher wages and higher income from rental properties, etc. But inflation is the insidious counter-force. Adjusted for inflation, real personal income without transfer payments hasn’t improved much in recent months despite many more people getting back to work and despite higher wages, because inflation ate up the increase in aggregate income. Note the pre-pandemic trend line (green):

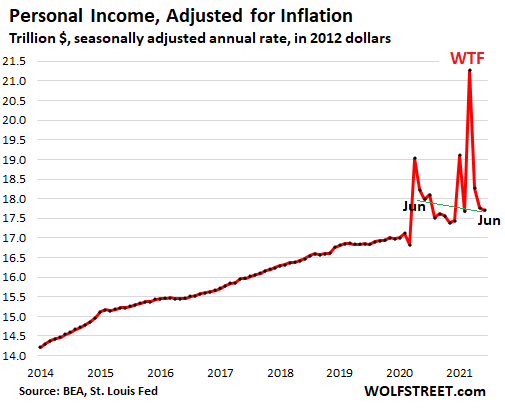

Personal income from all sources, including transfer payments, not adjusted for inflation, ticked up a smidgen for the month and was up 2.3% year-over-year.

But adjusted for inflation, personal income from all sources fell 0.4% in June from May, and was down 1.6% from June last year. The three spikes in the chart reflect the three waves of stimulus payments that created some of the weirdest distortions in the US economy ever. But the stimulus effects are now fading

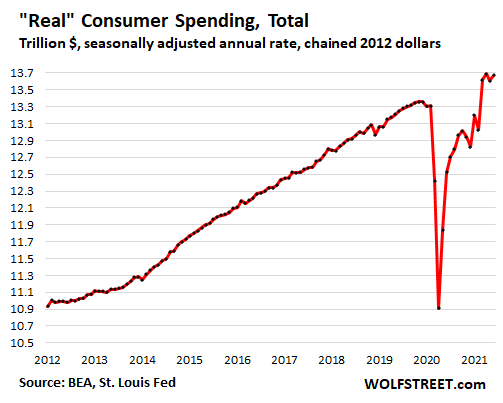

“Real” consumer spending: Inflation ate their lunch. People are trying, that’s for sure. They’re out there spending money hand over fist, but adjusted for inflation, spending hasn’t gone anywhere in four months.

Not adjusted for inflation, spending on goods and services rose 1% in June from July, to a new record.

But adjusted for inflation, “real” spending on goods and services ticked up less than half that, after having dropped in May, and is still below where it was in April:

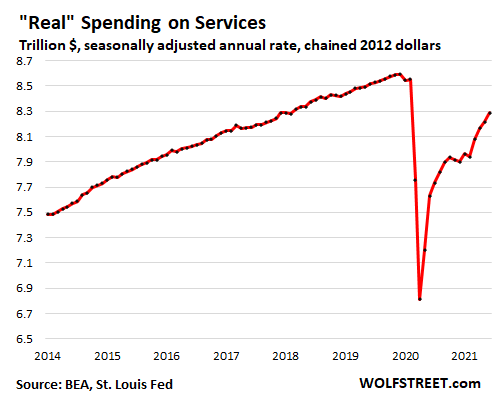

Real spending on services rose 0.8% in June from May, but was still way below pre-pandemic levels. Services include the biggies such as rents, healthcare, hotel and other travel bookings, entertainment and sports events, etc.

During the pandemic, spending shifted from services to goods, particularly durable goods, and this shift is now reversing, with spending on services coming back, but still being way down, and with spending durable goods declining, but still being heroically high. Compared to June 2019, real spending on services was still down 2.7%:

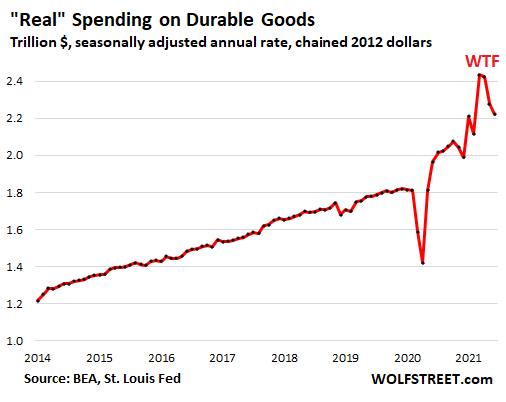

Real spending on durable goods fell 2.5% in June, the third month in a row of declines, after the stimulus-high in March and April. But amid shortages ranging from semiconductors to raw materials, tight inventories, transportation backlogs, and massive price spikes, triggered by sudden stimulus-powered demand, the durable goods business remains at nosebleed levels:

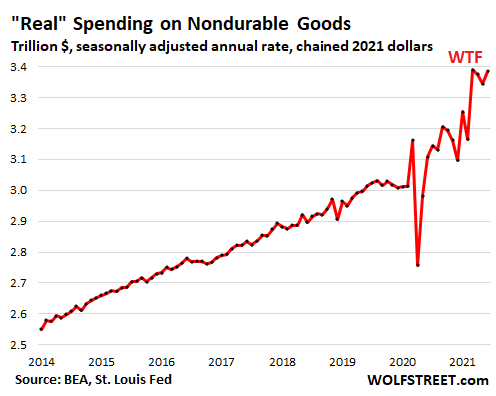

Real spending on nondurable goods rose 1.2%, after two months of declines, but remained below the record in March. These purchases are centered on supermarket items, personal care items, gasoline, etc. Supermarkets in particular benefited during the pandemic as consumption shifted from workplaces and surrounding businesses to the home. And as the phenomenon of working from home continues with energetic persistence, consumption patterns follow:

This consumer spending data for June was largely incorporated into the GDP data for the second quarter, released yesterday: All this stimulus, so little to show for. Read… Socked by 6.4% Inflation, Record Trade Deficit, Inventory Shortages, and Drop in Government Spending, “Real” GDP Jumps Disappointingly

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

You cannot print prosperity, wealth or a middle class.

And the soon to be real hangover consequences are going to be brutal.

“All this stimulus, so little to show for it.:

Why not?

Joe hit on a perfect formula, run up the deficits, use stimulus to force wage increase. Then he gets credit at improving wages. Who is going to argue otherwise, as for inflation, that’s Powell’s fault, he is Trump’s holdover.

Powell is Trump’s holdover.

And the kettle from which these candidates are drawn is full of the same ilk. You want Kashkari and MMTers?

The Fed must first be held to its mandates….and we cant even get to that point.

Congress loves the free money…and until inflation is a bigger problem, nothing will happen for no politician dare upset the stock market and debt market and the stream of free money to the federal govt.

so in our new born ‘ROOSEVELT’ / biden economy

which DEMANDS davis bacon(sorry but you need to learn so figure out) wages

only ‘workers’ ie WORKING will be govt workers

rest will have to SETTLE FOR $10 an hour or NOT WORK

oops – forgot big guy got 10% for being stupid

America’s credit card will be overextended then what’s next. But we produce most of worlds food

Ron-only as long as the water, soils and necessary temperatures hold out…

may we all find a better day.

100 degrees and counting

guess we didn’t make cut

“You cannot print prosperity, wealth or a middle class.”

You’re right, but a lot of people think short-term. My wife’s ne’er-do-well nephew keeps bragging that he and his wife make more on stimmies than working, so why work?

They’ll milk that cow for as long as they can.

“My wife’s ne’er-do-well nephew keeps bragging that he and his wife make more on stimmies than working, so why work?”

Not a fan of these people. At all.

And think of all the money being made in the Stock Market Stimmies…!! (based on a Fed pegged interest rate “stimmi” 5% below inflation.)

Both are different forms of gifting to the masses.

“Honey, is the stock market up again today?”

How about the crowd that is temporarily “rich” from day trading on Robinhood?

Can you blame your nephew when the government has so distorted incentives?

The fundamental loss of work ethic is going to mean more government support. I am going to be callous for a minute, just look at what we spend on the homeless problem, the incentives are so perverse that it encourages people to seek hand out and accept their conditions.

Do they deserve help? Yes, up to a point. But as the saying goes, God help those who help themselves.

Some 150Mil people in US receive some handouts from US gov.

It’s not worth it to get upset ?

Ditto…..Their good times will be over sooner vice later, then what will they do?

MCH finds punching down both easy and totally ethical…..as do all good Calvinists.

Whether they even realize they are programmed that way or not.

@NBay

Well, my inner Calvin is often outmatched by my inner Hobbes. :”P What can I say.

Hobbes believes in responsibility while Calvin… not so much, but he does like to collide planets together in order to see what’s left. i.e. when you crash the planet 6 into 5 to solve 6+5; and the survivor is planet 6; well, then the answer is 6.

“MCH finds punching down both easy and totally ethical…..as do all good Calvinists.

Whether they even realize they are programmed that way or not.”

Let me guess, you’ve given until it hurts to help these people right? I didn’t think so.

Yet another always willing to volunteer sacrifice at someone else’s expense. Or worse yet, believes it’s possible to get something for nothing.

I don’t get much out of that gibberish, MCH, and not gonna try, either. And to Frost, I never TOOK much from this planet (for an American) and still don’t, so don’t try that old saw on me.

To me, you two just represent the thinking that has likely doomed us all…sooner or later…enjoy, we’ll all be dead when the real suffering begins….and it won’t be financial, in fact they will WISH it were only bookkeeping.

Us hippies tried to stop growth for growth’s sake, and it killed Carter’s political career….but both of us had same goal and now have clear consciences…..mine’s biological and his is religious. You two should be a little more guilt ridden.

Middle class?

how can you have people elevate themselves to a middle class with inflation, and an intentional arrangement where Savers are PUNISHED at 5% a year?

The American mechanism for elevating oneself financially is to work and earn, save, and then invest.

Now it is a two step attempt….work, invest.

I am 60. I could not worry about the nuances of inflation, deflation etc. During the first 20 years of my work career which started in the 70’s with 18% inflation I did the simple math. I worked about 75-90 hours a week. I made twice what my neighbor would, started my own business’s, did not borrow even for a home, built small and moved up, hedged inflation with a massive garden my wife and children would tend in our backyard, learned to can our food so nect year a can can of beans cost me 5cents, my neighbor 35 cents and so on. I retired this year, sold one of my houses, my business’s . I now have an oceanfront home in USA I rent as a vacation home doing very well, no mortgage and another oceanfront home in aforeign country that the COL is 50-60% less than the USA. Building a much smaller home next door to the one in the foreign country for VRBO. Not bragging here but setting up everytime I hear all these complaints about not being able to “make it” to a man none work more than one job. Yes, I worked hard and long, dont know if borrowing and leveraging is “smart” but I kept it simple and have no complaints, just gratitude that the USA would allow me to work as much as I wanted to. I hate the taxes though and this is the reason for the out of the country home.

Is “have wife & children tend a garden” the new “stop eating avocado toast”?

Because I don’t even need multiple houses across the world. One would do just fine. (& we are the entitled ones?)

Nephew is just making decision based on public policy incentives. He is not much different to CEOs off shoring jobs based on public policy incentive or someone retiring at 62 because of public policy.

@Old School,

Yes and those who say “the rich won’t leave America” are dead wrong.

There is certainly “reluctance” to leave America on their part. It’s been a great grift, certainly – and not on that will be available in the Sino-Russian axis that will shortly control the world

But…

That grift comes to an end one of the following ways…

a) Future grifting is forbidden (we can all stifle our laughter for a moment at *that* prospect)

b) The proceeds of former grifting will be seized (somewhat likey)

c) The proceeds of the former grifting – i.e inflation debasement (playing out right before our eyes)

Our finance capitalists may be yelling and screaming about “China crackdowns” on the ultra-wealthy over there – but once it becomes evident that transfer of their monies to the PRC is the only wealth-preservation game in town – they’ll cut and run so fast you’ll get whiplash. Bet on it.

If you were paying attention, you’ll note that they’ve already given Elon Musk one heck of a chin check…and the lesson wasn’t lost on him.

The biggest problem is dragging all of the non-productive along with. If nothing fails that inevitable dead wood clogs the whole system. An unintended consequence of a participation trophy economy where no one loses and no pain is felt to learn by – whereby resources become allocated inefficiently to the detriment of everyone.

DJ

You made an interesting observation to go along with MiTurn’s nephew example.

I always think back to a small village, like it used to be everywhere. Would any non worker be tolerated if locals and neighbours had to pick up the slack and carry them? No, they would be banished. Sure, if someone can’t work then we look after them, but if they are able bodied they need a kick in the ass to pull their weight.

When the freebies come from a faceless “program”, then people put up with it. But if it is in your face, people don’t. I’ll stop before my neck turns crimson. It’s the same everywhere these days. I guess.

I agree with you.

There is a lack of accountability which needs to be ended. I conclude it’s too late due to the widespread culture of entitlement. That all with the parasitic elites who have plundered the country.

“All this stimulus, so little to show for it.”

There’s plenty to show for it… for some. Look at a graph of US income disparity.

Kinda ironic, isn’t it?

The bigger government gets and the more it spends…

The bigger the wealth disparity becomes.

“Too Big to Exist.”

We have been doing it for last 20 years

We can do it for few more decades

First chart to me shows state of real economy. Real income lower than before covid and real income growth rate lower than before covid. If labor force was 165 million before covid and real growth in economy was 2%, it’s only going to take 3 or 4 million dropping out to flat line GDP growth.

I believe the elite would argue that point. Most printing prosperity and wealth found its way to the top 0.1%. Take Gates his wealth increased by 20% last year. He made more money in one year than he made in 10 years. What middle class? Its been destroyed. I said last year these stimulus checks would be ate up by inflation. This is a big plan to kill the last of small businesses that are left so the conglomerates are all thats left standing. Its been a 5 decade long consolidation. And go to shadow stats if you want to know the real inflation. As the saying goes “Figures dont lie but liars figure”. Math is a wonderful thing, give me the answer you want and I’ll give you the equation you need for your answer. You think inflation is high now just wait, this is nothing compared to whats coming.

After 25 years of using the internet, just want to say that Wolf Richter, as far as economics and the effects on real people, you and your commenters are the best, clearest and most useful educational website out there.

Remember the pre-internet pull off tabs with a phone number along the bottom of a flyer posted on bulletin boards? I print hundreds of those with a brief description and wolfstreet.com url. After engaging them in conversation, I ask most working men and women I encounter.

“You are being screwed by the economy aren’t you?”

They always agree.

“Take this and go online to learn about what’s happening to you and the country.” Every one handed out is a little insurrectionist act.

Thanks

Amen bro!

The truly scary part about monetary debasement and its effects on price inflation is just how truly understated dollar debasement really is. We see from the articles in this excellent blog that prices are indeed rising year over year and nowadays month over month. But what our current price inflation measurement tools really miss out on is a measure of the hidden currency debasement that is not accounted for in the price reductions we do NOT get to enjoy because of manufacturing, transportation, and service providing increases in efficiency.

Instead, the (retarded) Fed makes every effort to sell the gullible public on the validity of precisely the opposite effect: hedonic adjustments.

I think most people have never heard of the Fed and these people also can’t spell “hedonic adjustments” to save their lives.

Buy, buy, buy. Lending Club says thanks.

Call it hedonistic adjustments and we get more of a reaction.

See latest comments by BoC re: inflation: they assure us inflation is unlikely to persist… (Article in financial post in Canada)

Notice no questions on when “transitory” becomes the wrong term.

Someone ask the question……how long , 3 months 6 months , a year…before the Fed admits…”we were a little off in our projections”

There’s no jobs in Canada and wage gains are non-existent. Coupled with the fact the immigrants now coming to Canada are all penniless means deflation will likely prevail as the Canadian dollar pushes above par with the U.S. dollar. Our dollar will prevent inflation as it soars to all time highs vis-a-vis the U.S. dollar in the coming years.

Didn’t you write something like this a few days ago? With the US beating up on the oil industry and the completion of a major oil pipeline from Alberta to the US Midwest being blocked by President Biden, I would not expect the C$ to perform all that well.

Historically, most immigrants to Canada were poor. They came for a better life than what they experienced in Ireland or Germany or Hungary or Russia and, in many cases, they or their children succeeded beyond their wildest expectations. Immigrants to Canada in the past few decades have generally been much better educated than when my older relatives immigrated there over a century ago.

They seem quite confident about it, actually. They don’t dare not be….they have to keep people lined up and not worried about the future. Spending.

Are we the ones wrong? Like many here I worry about debt, think the economy is built on hopium, and believe this won’t end well. But it just keeps ticking over….so far.

What confuses me is that in the last few months the dollar has done pretty good on forex against several major currencies.

Where I live (Thailand), it has gained about 10% against the Thai baht since the beginning of the year. (This is good for me, since my main living expenditures are in Thai baht).

So the other currencies are debased even more than the dollar, or is it some function of the dollar being the world reserve currency?

Did the dollar get stronger because a couple of months ago Powell mentioned that, somewhere around 2023, the U.S. would start thinking about talking about tapering? And this excited the wealthy international interests to swing toward the dollar?

For the answer to your question, look at the demand for US Treasuries, almost at any price

Andrew:

“A strong dollar is making Treasuries more attractive to foreign buyers — a key source of demand as the U.S. government pumps up supply to fund the response to COVID-19 — and buoying already robust international demand for the asset class even as yields fall, according to experts.”

According to (some) experts, the foreign demand for Treasuries is strengthened by the strong dollar, not vice-versa. So it seems like the strong dollar is not adequately explained by demand for Treasuries.

Why does the Fed have to buy and monetize Treasuries if there is such a strong demand for the Treasuries?

Maybe the Fed is wrong to absorb 120 Billion a month in federal debt…

Maybe they should stop….maybe they should let some roll off the balance sheet without reinvesting

Maybe the Fed has everything “skewed up”

Yardeni just posted good historical data on dividend yields vs t-bills and treasuries. The 75 year history of sp500 vs 10 year Treasury yields is one to ponder for a long time. I would hate to have to pick between the two with both yielding about 1.2%.

Money is tight, demand for US$ is strong. The FED is leading the rest of the world down the toilet.

Profit taking for the first half of the year and as we know the traders will pump things up before they sell them short amass (to suck in the imbeciles/bagholders on the pump phase) . The U.S. dollar will turn to confetti next year.

The dollar may be the tallest midget in the room

Shifting jobs overseas and blowing money on failed wars is also helping to debase the dollar.

“They’re out there spending money hand over fist, but adjusted for inflation, spending hasn’t gone anywhere in four months.”

On paper, in my case, it looks like this. If you look closely though, what I’ve done is kill housing, taxes, and healthcare and pass that burden to NIMBYs living in HCOL areas thanks to Remote Work.

Sure, so far it seems I’m spending more because I’m fixing the REO I bought for basically the cost of the lot the house sits in. I’m not paying rent ever again, I locked property taxes under $1k, and live in an LCOL selling services to NIMBYs living in HCOL.

The biggest arbitrage isn’t financial, it’s geographical. Americans don’t need to wait until retirement to move to LCOL areas. Thanks God! Sure, moving costs look like an increase of spending, but it’s an investment towards NEVER AGAIN wasting $ on bloated housing, taxes and healthcare.

Despite taxes, COL and congestion, people younger ones always move to cities like NY or LA. Think about this way, I never met anyone from Wyoming in my 10+ years of living here. In young age, its very essential to gain knowledge (schools), money (high paying jobs), experience (doctors, lawyers) and general interaction with people. I would say, people are the major resources to know. Once after gaining experience with these and potential to earn money, it would be good to move to WV or AR or MO for retirement or semi-retirement. Its a carrier-drawback to move away to move to small towns.

You are thinking like a Boomer, the young now connect online in the US and abroad.

Almost 30 yrs in the business. Typical client age is youngest since the early-mid 90’s. I thought it would slow down, but the calls keep coming.

Our private school that always struggled to get by the past 20 yrs now has a waiting list over a 100. WFH, or the ability to live on only one salary = large increase in home schooling as well.

It is enjoyable to watch these youngsters as they open small businesses in our rural towns.

I have no doubt that NY & LA will continue to attract. Out here in flyover that freedom for the adults & kids to play & interact with others is a driving force for why they are moving here.

Or, like my son you can work away and commute.

I always did the regular shift stuff at home, but did work away for a few jobs for several years. Son does this now and has done so for almost 15 years. He is away working for 2 weeks, then at home on days off for two weeks. He is one plane ride away from living anywhere in North America he chooses. I knew many geologists and drillers who did the same thing. They made a years income in 4-6 months, then did what wanted the rest of the time.

I also know a guy who works for a big company in Texas, and does so from Vancouver Island. Makes huge bucks helping run a construction project, from his home. His background is construction, not computers….and he has never been out of work.

Having spent most of your life in BC logging country, that type of life must seem almost normal. All my coastal CA logger HS friends (who moved north following the timber) worked a usual 21 days at camp, 7 days at home. You likely flew a lot of them. Can’t “log from home”. But my friends also told me it was the higher level PM or even on call repair guys who made the big bucks. And then like your son, they could pick up work at home if they wanted.

And since I spent most all my life fixing/fabricating electro/electronic/mechanical systems, they always tried to get me to move up.

But I was in love with the climate, and said, “I wanna live where the grapes grow”. They’d laugh, and say, “Fine, whatever…just make sure they keep coming up in little bottles”.

With climate change effects seeming to accelerate recently (heat domes, fires, dying trees, power outages, water shortage, etc), I am now starting to wonder a bit about that decision.

Yep….people are spending more money but that does not translate into more stuff. It is the same amount….it just costs more.

I think we are seeing shinkflation. A lot of food products are shinking. The old 1/2 gallon of ice cream containers are now about the size of Ben and Jerry.

Gatorade which was 32ozs for it seems like forever is now 28oz. That right there is 12% inflation.

> I think we are seeing shinkflation.

I haven’t seen this nor price increases at my local Trader Joe’s.

Again, not being in a NIMBY area helps.

All my friends complaining about food inflation are in NIMBY areas, so likely the issue of housing costs for employees and the store’s rent have a final cost impact for those areas. Not my case.

Ed Hyman is considered best economy on wall street. He sees inflation overshooting and then running at 3% in 2023, 2024. Fed has kind of hinted that is their plan. Slow taper. Short term rates at 0% probably out to 2023 or 2024. Add it all up and they will have worked transferred 15 – 20% of savers money to keep the debt expansion going.

Old School,

No one has ever been through that kind of massive fiscal and monetary stimulus even as inflation is surging. No one has any idea what this combo will do. It has never happened before. But now we’re in the middle of it. At this point, zero QE and 5% short-term rates would still be “accommodative” — negative real interest rates.

@Wolf

So, the J team is boldly taking this country to where no capitalist society has taken us before.

Well, I’m glad we’re along for this crazy ride.

But human psychology is eventually going to inform things. Sooner or later, something will break. And that break will likely be because the rest of the world will no longer want to go with this crazy situation

You should move to Bangalore, that’s where your job will go.

Politically we are trending toward the tide changing to benefit labor at expense of capital. Probably not good for retirees as their laboring is done. Supposedly profit margins have been very high for a long time.

Margin swing can mean a big reset in stock market if net margins go from 10% to 5%. Stock market is more insanely priced on a P/S than P/E because margins are high.

This is spot on. Remote geographical labor arbitrage. I can undercut coastal competitors, save money for my clients, and still personally make more than I was previously as an employee of a locally based firm. The losers are the local firms in LCOL areas who are now competing for labor not with other local firms, but with every firm in the country. The biggest losers are the local firms in LCOL areas who refuse to allow continued WFH arrangements. There will be a massive exodus of trained professionals from those firms.

Live in Ohio, work for a company in LA or Boston or Seattle.

When Mr powell admitted that his prediction of ‘transient’ is not only happening but tacitly forecasted that it will keep go on, up, more than he thought. He offered no shor term solution.

Any business owner of any kind after hearing this, got an open licence to increase prices or reduce the size of products. Why the SURPRISE? How many call their representatives to protest this?

I mentioned it to my Representative in an email.

What you will get is the Fed speak spit back at you..

“Authorities assure us it is only transitory. Thanks for calling.”

I still think the future is Japanese

Stagflation?

Andrew, can you explain why you think this? Their government, social norms and population makeup are nothing like this country.

High debts, property bubbles, the USA off shored a lot of its industry, I don’t think you will have inflation, Im thinking peak debt, falling incomes, defaults. The growth is just not happening.

Im thinking this as Im in a highly geared industry and I don’t see light at the end of the tunnel.

Look at milk production, no sign of inflation here.

“Milk powder values could come under further pressure in the months to come if global demand falters. Dairy Market News notes that some Southeast Asian countries likely ordered extra skim milk powder (SMP) in the first half of the year, hoping to avoid shortages caused by shipping delays. But now, “inventories may be building to the point where buyers are willing to wait before making more purchases.” If that’s the case, a slowdown in demand could collide with growing supplies. Global milk output is high and rising. In May, milk production among the four largest dairy exporters other than the United States outpaced the prior year by 2.5%. Throw the U.S. in the mix, and output among the big five was 3.1% greater than in May 2020. That’s the largest year-over-year increase since late 2017, which does not bode well for prices in the coming year.”

Thanks, some good thoughts here. I still think our social norms would have to change dramatically if we were to morph into an Asian economy and lifestyle.

I think it depends on our politics where we end up. Because of high debt load we are going to have no real income growth for a long time.

It would be deflationary, but that is going to crush assets. Government can spend us to inflation but people will start complaining because with food and gas it’s in your face every week.

Also see on you tube Peter Ziehan’s address to Dairy Council about world competition in dairy industry and how New Zealand is and got to be top exporter. Confirms what you are saying, plus much more info. Well worth the view.

No, the future is China. Not Japan. It will now take a little longer than in 2012 because of the big guy in charge, but the that’s only temporary, he is only president for life.

MCH, concur.

Google Japans property bubble and their lost decade. You won’t be like China, China has artificially low wages, lots of highly educated people coming on stream, very low birth rates, a very export orientated command economy that does as it’s told.

I suspect you will face a ‘lost decade’ the worst of outcomes. Falling assets, falling real wages and lots of unemployment.

The only difference is that China knew how to get into the driver seat. They were well on their way until 2012, then momentum carried them through a little further. But all of the goodwill has been used up because of the big guy…. All of the things that China is being accused of now, none of them are new, or even that different from before.

The only difference in reality is that somebody wanted a legacy and put himself ahead of the country. So things are coming off the rails a bit. If he just acted like his predecessors a little more, China would have been firmly ensconced in the driver seat in the next ten years. And the bozos here would be left wondering how it all happened. Now he has to struggle for control of that driver seat and it’s far too visible a struggle.

I recall reading, in the New York Times Book Review, a fascinating article on how the battle of the coming decades will be between totalitarian capitalism (China, Russia) and democratic capitalism (United States, Europe, etc.). And it isn’t clear who will win in the end…

“And it isn’t clear who will win in the end…”

The Chinese have proved the great truth of the old Soviet adage, “A capitalist will sell you the rope you hang him with” when bought governments don’t at to prevent that.

Read the outstanding 2019 book, “Stealth War: How China Took Over While America’s Elite Slept” [they weren’t “sleeping” and how I hate the term “elite”]. We are compromised six ways from Sunday and the economic incentives are very much against fixing that. Virtually nothing he describes as fixes in the last chapter, fixes that he claims must be done within three years (which would be 2022) are being done.

@Prue Grubstreet

There is another important aspect beyond totalitarian/democratic tendencies which the New York Times Book Review may have omitted:

Neither China nor US are capitalist. China’s government is nationalist socialist. The goal is to centrally manage the economy to increase the power standing of the country regardless if it has to walk over the individual’s life. The US (and to a lesser extend Europe as its instable political appendage) is corporate socialist. The goal is to serve big money’s lobbyists, regardless if if means impoverishing the common man. China is doing wealth redistribution from the people into infrastructure, the US is doing wealth redistribution from the people to the 1%ers. Now which will win in the long run?

It’s very clear that the USian corporate kleptocracy will converge with the CCP autocracy. In the end it’s about total control by the dominant class. The end of that will be the beginning of the new Ages of serfdom.

@Prue Grubstreet,

Totalitarian capitalism will win…in a walkover.

@GD,

The “winning capitalists” will sell you the rope to hang unneeded serfs and ALL lesser capitalists with.

Teddy R. was accused of being “out to get anyone who was richer than he was”.

Not sure how to word it, but it ought to be a part of the oath of office.

Capitalism is increasingly undemocratic in both the West and China.

Without social cohesion, all is lost. Japan had a huge bubble, etc, etc, that’s all true, but I bet most of the commentators here never set foot in Japan even once. It’s by no means a perfect country, but compared to the US it might as well be. Crime is super low, the people are mostly super honest (you can leave laptops etc in Starbucks for hours, and no one will steal them), and of course it’s a homogeneous nation (no chance of an internal war).

In 2020 alone we had George Floyd, etc, and early this year we had the Jan 6th event. But hei, no problem, we’ll scream USA, USA all the way to kingdom come. And lest we forget, 2021 is on track to be the most violent year in the US in 2 decades. I don’t even want to imagine what will happen once the next depression starts.

Well said, we are the exact opposite as Japan as far as culture, people and social norms. We are going to crash and burn in a different way and who knows what will emerge from the internal fighting and broken economy.

There are too many normal, right-thinking middle class people in the United States for there to be “internal fighting and a broken economy.”

The U.S. is blessed with the strongest middle class in the world; this, despite the stagnating wages of the past generation. You can still make good money in America by working hard. Inflation has been reasonable for a long time. I know it’s spiking now, but there’s a good chance that’s temporary. As long as the inflation stays reasonable, savings can be built from all that hard work I was talking about.

Now, there are armed right-wing militia groups operating in the shadows of society, but they illustrate how VAST the safe middle class is, and how PUNY the dissidents are. The economy continues to be stable-to-strong and it is an ocean rising all boats with it. Couple with with a civil legal framework and you won’t see disturbances in the United States any time soon.

Savings? LOL. Without free money from the government last year, a lot of people would have had trouble meeting their obligations. Today at midnight, rent moratorium will run out. Expect some fireworks.

Middle class? Not sure what planet Catxman is living in, but the reason why there’s still a “middle class” is because both mom and dad are working. And on top of that, they’ve been splurging on credit. Back in 2019, the WSJ ran an article on seniors over 60 still owing student debt to the tune of 86 billion dollars. Completely reasonable!!!

If January 6th wasn’t a disturbance, then what is?

@Anthony A.

What will emerge?

I’d wager on “very few survivors”.

@MonkeyBusiness,

Ignore the effects of asset financialization and you’ll discover that this depression has been raging for some time.

The U.S. dollar will be dropped as the world’s reserve currency and like you said then deflation will prevail.

Deflation would strengthen the USD’s purchasing power. Inflation weakens it. So if there is a long stretch of deflation, everyone is going to stock up on the USD and hold it because its purchasing power will increase.

Cash shortages would push end users toward crypto. Inflation is good for debt sellers, fixed yield bonds, and deflation is bad for debt owners, the other side. For USG the debt was monetized and the money is already printed. My guess is that money would become worth-less. Brainerd wants a dollar backed digital currency. SDR rides on top of the sovereign, and crypto on top of dollar, the underlying are still being used. Its a hoax, another money printing scheme. The gold backed yuan is more credible, but gold can be rehypothecated a million ways. Tin foil hat answer, own the physical.

Just some good practical info on precious metals…..to me, gold isn’t much use unless one really likes rubbing their lump of it or wearing it. Like bronze, it’s time of great value is over.

@The Real Tony”

I think you meant “inflation” will prevail.

Japan has the great advantage of having a declining population, though, Andrew. That makes it much easier for them to bear up under economic contraction.

Countries with increasing populations need to at least maintain the net energy (energy output less the energy cost of it) available per capita in order to stop things from sliding downhill, and that has shown itself elusive since peak conventional oil.

Their biggest advantage is that they are savers

I really think so!

Worked with a guy this week who complained about the price of beef and how he was not buying it much these days. He felt it was the grocery store gouging him.

I explained to him a number of factors why things are going up to the best of my ability (I’m no Wolf!) and he said “Oh.” Mind you, this guy is a sports enthusiast and can tell you about what teams are doing, but knows absolutely nothing about financial markets or much of our politics. He speaks for a lot of people I work with. They just know things are going up in price and they’re not happy.

It will be interesting to see what happens when we really get a financial crisis and how people respond. There is a popular American forecaster that has a saying and I believe it’s true…”When people have nothing left to lose, and they’ve lost everything, they lose it.”

Stay prepped, my friends.

Wait, you mean the price of gas going up isnt a direct result of Trump not winning the election? It seems most dont care about the fundamentals, they just want a team to root for….or against.

we are a “sports nation” in the mind of the peons.

Har-Har!!!!!!

Only the peons?

The “losers”?

Getting as rich as you can any way you can is our national “sport”, in case you haven’t noticed…..pretty sad bunch, eh?

I also only buy on sale 14$ ribeyes no way

There is NO “prepped” in a dystopian scenario. If one happens, take a lesson from Somalia. Join up with a good warlord, try to advance through the ranks before you are killed…and hope you picked a good one, too.

Being high up in our existing Military, might be a better choice, but that decision would have had to be made years ago. And when I was in they didn’t want anyone over 34, so most all people here can forget it.

Best to fight for spreading the wealth and saving the planet while you can.

“But red-hot inflation is eating it up.”

I’m retired. I am learning quickly how inflation negatively impacts a fixed income. Especially food prices. Ouch!

Milton Friedman said , “low interest rates signal tight money high interest rates easy money”.

If the USA gets inflation and they lift interest rates, assets will crash. There is some form of self levelling mechanism. What has happened, we have been financialised by banks and finance. What happens when borrowing gets tough when lenders don’t want devalued dollars back some time in the future?

I think you will start to see demand fall and the knock on effect of that on business.

The fact is if they don’t raise interest rates and let inflation turn to hyperinflation the U.S. dollar will be supplanted as the world’s reserve currency. This is the most likely scenario.

@Tony: Exchange rates would have to give before dollar gets supplanted by any other currency.

Currently all the world’s currencies are heading down the same slippery slope to worthlessness at about the same speed, though some will get there well before US$.

Savers like myself will finally be rewarded. I will have pricing power if I want to buy a new vehicle, since I will have massive skin in the game. The zero down crowd won’t be buying jack sheet.

Andrew,

It’s worse than you expect.

Much of the demand for US dollars is driven not only by its status as a reserve currency – but also demand for assets (e.g. US equities, but other stuff, too) – that can only be purchased in dollars.

Raising interest rates could actually exacerbate inflation this time around because:

a) Many, many businesses are heavily leveraged. To the point where debt service can be practically treated as an essential input of production. Increasing it’s cost will actually trigger price raises.

b) Per my earlier point – decline in the value of US dollar-denominated assets could result in an overall decline of the demand for US dollars.

Right now the US dollar looks pretty good against most currencies. That could change quickly. That said, I should mention that inflation worries have cropped in lots of places – e.g. Australia, Korea, India, etc…even to a lesser extent in China. The same is true of worker shortages.

you can only rise prices if people have the money to pay.

I think how, why, and by who that “Chicago School of Economics” was PUT together, is far more interesting than what “phoney Nobel” alumni Uncle Milty had to say.

FAR FAR more interesting.

But he is on my list of dead people I’d like to resurrect and have on hand to torture a while…..when I have nothing better to do.

If you only rented in SF over the last 20 years. Now you can get tenant buyouts.

Saw a new one on KTVU about tenant buyout. The goal is to kick out the current tenant who has their rent controlled by giving a lump sum, and then jacking up the rent.

Only in SF can you get paid the equivalent of a few months rent by the landlord to move out. So they can charge the appropriate rent. The market is just hilarious.

Yet at the same time, rents in other part of SF is going down. What a strange world.

@MCH,

We’ve been seeing the same tenant buyout phenomenon in the Boston area, too. But with very, very few takers.

I can also add:

a) Tenant-at-will (essentially a month-to-month lease) is becoming the norm for small landlords

b) We’re seeing a pivot to shorter-term leases (6 or even *3* months) in large, managed apartment buildings. 12 month leases remain available for now. Unsurprisingly, tenants are taking them. Surprisingly, they are taking them despite the fact that they are being offered at a higher price than the shorter-term releases. That’s new. And disturbing.

Please note….we do not have rent control in Boston.

Why did you leave out the half million part of the story? The ritzy guy buyout?

(Fox 2 is my go-to station if I want to view several replays of a crime or especially the kids and their “side shows…wild car action, eh?”)

@Nbay

Because I am too lazy to cut and paste the detail, and that if you wanted to look and figure it out for yourself, there are plenty of clue there to figure out what to look for. And you did. :)

And the half a million buy out is a one off, and was actually click bait if you think about it for a second. That one point was just that, and covers up the rest of the data, which is most people do not end up getting that kind of ridiculous payout.

You should mention the rest of the story if you’re so eager to get the correct and full info out.

@BigAI

At will leases has some advantages, and some disadvantages. But let’s face it, if you had a tenant on a year long lease, and four months in, they buy a house, what do you do? The lease is a piece of paper, practicality matters.

Interesting, but not entirely surprised to hear other places have the same scenarios going on.

It isn’t surprising though, given the fact that rent control places a limit on what landlords can do. But there are ways out of such situations, and the rich in SF have been leveraging those methods for the last decade or more especially as the town boomed.

Your Aducanumab post is much better, so I’ll ignore the above mix of “look over here” stuff.

I got yet another good example from my absolute favorite bunch of “MY hard earned money” villains to follow….you aren’t even close to being their league, human damage-wise.

On a lighter note, when they finally burn through fusion protein profits, maybe they will “create” nano jack hammers to break up those tough beta sheets? :).

Generationally speaking we here who are old will be made to suffer inflation to eliminate the gigantic obligations of government. The young will support this imposition as they too will be held, “face down,” never, for most, to achieve what those 55 and above have historically enjoyed.

High speed inflation is nearly impossible to manage by anyone with preservation of capital paramount even to the point of only being able to slow the devaluation of cash. What good does it do for me to have a 700K ranch when after selling expense/repairs/negotiations leave me with say 300K in best case scenario.

With 80K retirement having just lost about, in my guestimate, about 20% value means I have 66K buying power….WOW and all in about a year’s time.

I am a builder. I can move to say Tennessee which is amazingly affordable but it is the South…. Still, no mortgage seems the best way to protect with nothing else as valuable or certain. Land and a say 1200 foot compact home with barn, shop, and land management equipment will ensure a productive life with an element of freedom most here cannot fathom.

People talking about this are like cats on a red hot tin roof. Even a better metaphor is how horses behave as a herd. If one horse gets spooked the entire herd will move en masse until it perceives no threat.

Really, the issue is what can be done…RIGHT? Not much really….RIGHT?

The “solution” here is different for all but I thing most would agree that it is nearly impossible to avoid what inflation will do as it is like COVID on steroids’ in effect.

Like the funds getting the data (from RobinHood) on the platform small investor investor behavior on RobinHood (amazing double meaning!) is the metaphor describing best what seems to be happening over all.

Conclusion? Only a few will survive this especially since after the run up inflation is done MONEY WILL NEVER RETURN TO THE VALUE IT HAD A YEAR AGO.

If you think inflation is coming borrow like crazy, let inflation destroy the value of money, repayments get easier and easier, saving is for fools. Easy peasy

Not when income is fixed or even worse when working and hoping to stay employed.

Cash for land, build my home at wholesale price and watch my retirement become less and less year after year…

Debt is not a good thing….

debt is okay with inflation. Without inflation in wages it comes crashing down. I am 60, I started a business in 1984, i borrowed at %19, I had to prove to the bank I could return over %30 in my business. Fear of losing your job does not make one spend, all the Central Bank attempts to create inflation have been in vain, all you got was asset bubbles as people capitalised low and lower interest rates into property and equites.

Debt is good with inflation. Specifically at a fixed low rate when inflation is higher than the rate of your debt.

> Not when income is fixed or even worse when working and hoping to stay employed.

Of course. You are the first American I come across who gets this very basic fact.

Buying hard assets on debt prior to hyperinflation is trickier than you think.

Eventually, the state must attempt to recapitalize and this almost always requires some form of asset seizure. This is done when the currency re-denominates – i.e. the state basically saying “we can no longer accept the prior regime’s fiat for tax payments”. Or something quite similar.

You’re best off buying a hard currency with fiat-denominated loans and then using the hard currency to purchase assets from the state post seizure. At least that’s what the history of failed states in the past half-century would suggest.

Don’t think it’s that easy. You have to borrow for something. Any asset is already inflated because of Zirp. You might find yourself borrowing for an asset that plummets even when there is inflation in goods or services.

About debt, etc.

For those who think debt is okay, let me know how you sleep if you ever lose your job or income stream on borrowed money? It doesn’t matter one whit whether we are inflating or deflating if you owe money and lose your income.

Sometimes debt is necessary. Sometimes debt is good. But it is always better to have no debts.

@Old School,

Another angle to consider…

Banks are actually doing somewhat less lending than in prior months right now. Why? If a financial institution anticipates currency debasement – it purchases hard assets, itself.

Under such conditions, why would a party lend to persons who would then bid up the prices of the assets that they, themselves, would like to purchase?

The really funny part about is that this bank behavior is being interpreted in the financial press incorrectly as “tighter lending standards that indicate the housing market isn’t in a bubble”. They’re right about it not being a bubble, obviously (we’re in the “top of the 1st inning” of the inflation story that will propel the prices upward) – but their interpretation of diminished lending as “lending discipline” is wildly, wildly wrong.

You’re going to see lots of types of lending slow dramatically soon. This will probably be mis-interpreted as resulting from uncertainty over the Delta variant (I *do* think the impact from Delta will be significant) – but the actual cause will be different.

This is the worst advise I have ever read on this site.

This is the worst advise I have ever read on this site.

Reply Andrew Wilson

Jul 30, 2021 at 10:07 pm

“If you think inflation is coming borrow like crazy, let inflation destroy the value of money, repayments get easier and easier, saving is for fools. Easy peasy”

I disagree. Inflation is good for borrowers who secured fixed rates at historical lows and used the funds to purchase cash flowing assets. The dollars you pay back in the future are worth less than the dollars you borrowed. Your income, or the internal rate of return of the cash flowing asset, should rise in nominal terms along with the devaluation of the currency. Likewise, the market value of the asset is higher due to this higher cash flow.

Your cost is fixed, but your income is variable and the trend is upwards.

High inflation is the best possible situation for debtors who were lucky enough to secure financing prior to the current devaluation. You borrow one dollar and pay back 50 cents on a discounted basis.

I lived and ran a business in the 80’s, borrowed a million dollars to buy assets that 20 years later were worth nearly 10 million, I wrote a check to pay off the debt from cash flow.

“borrow like crazy” only works if you make every single loan payment AND your assets don’t depreciate. Run into any kind of cash-flow trouble and you’re BK.

Your success wasn’t universal – there were plenty of people who owned “great assets” in the 1980s and lost it all along the way.

There was the oil bust and savings-n-loan fiasco in the south and west.

There was the huge wave of defaults on those juicy-high-yielding Latin American government bonds.

There were those who lost their jobs in the 1990 recession.

Those whose jobs went away after NAFTA.

Those who were part of the SoCal aerospace defense sector economy.

Those whose debts were going to be paid by cash flow from their corporate pension – that turned out to be a hollow promise backed by little more than thin air.

Those who worked in Midwestern manufacturing plants whose jobs were exported to the 3rd world.

To win the “borrow big and invest” game wasn’t so “easy-peasy”.

If 20% of your retirement money was in real estate, you would not be sliding backwards. A modest 2 or 3 family can be the best thing you own.

Maybe if I paid cash but not if I could not pay for indebted real estate from current income.

Add to that if I had been renting out this property I would have quickly been toast after inflation and no rental income.

Much is assumed and not stated in the advice given by some here which in this case negates the point

make.

Feed for cattle is an issue now from the drought.

Meant for JK

The new normal

—————————–

Owning a home is no longer feasible for Americans coming of age in the 21st century, according to Bloomberg columnist Karl Smith, who smugly suggested in an op-ed that they stop worrying about whether they can afford a house, ignore the asset-stripping investment vultures, and just embrace the depressing reality of lifelong debt peonage under the rule of those same private equity giants.

Lest there be any misunderstanding, the feudalist character of this glorious new “sharing economy” is reflected in one increasingly popular “solution” for the generation currently facing the steep uphill climb to pay off their student loans. Under this scheme, known as Student Loan Asset Backed Securities (SLABs), students are invited to essentially indenture themselves to some corporation, paying off their debts by selling off a percentage of every paycheck they subsequently receive until the balance is zero. Any questions?

Feudalism for thee, but not for me

With multi-trillion-dollar asset managers such as BlackRock, Blackstone Group, State Street, and Vanguard flaunting their bottomless pockets, ordinary mom-and-pop landlords looking to buy an extra property or two to open up a guaranteed income stream don’t have a chance in such a rigged market – and neither do their tenants.

Just as they did after the 2008 mortgage implosion, giant corporations are sprouting up everywhere, snatching for-sale homes off the market sight unseen, paying a hefty premium to do so, then turning around and charging fee-laden premiums to the new tenant for what, in pre-“new-normal” times, would have been considered the landlord’s responsibility.

Having nabbed the coveted post of running the US Federal Reserve’s special investment vehicles under the CARES Act last year – not once, but thrice – BlackRock is rapidly outpacing its progenitor, Blackstone, in terms of sheer rapacious asset-stripping. Massive asset managers such as Vanguard and State Street have so much money one might think they’re literally running out of things to spend it on – but the firms’ return to manipulating the market suggests more sinister machinations are at work. Far from running out of things to purchase, the private equity coteries are reducing entire industries into vertically integrated, dehumanizing life cycles

Buying a home even means your competing with an online investment platform. LOL

——————–

A bidding war broke out this winter at a new subdivision north of Houston. But the prize this time was the entire subdivision, not just a single suburban house, illustrating the rise of big investors as a potent new force in the U.S. housing market.

D.R. Horton Inc. built 124 houses in Conroe, Texas, rented them out and then put the whole community, Amber Pines at Fosters Ridge, on the block. A Who’s Who of investors and home-rental firms flocked to the December sale. The winning $32 million bid came from an online property-investing platform, Fundrise LLC, which manages more than $1 billion on behalf of about 150,000 individuals.

The country’s most prolific home builder booked roughly twice what it typically makes selling houses to the middle class—an encouraging debut in the business of selling entire neighborhoods to investors.

“We certainly wouldn’t expect every single-family community we sell to sell at a 50% gross margin,” the builder’s finance chief, Bill Wheat, said at a recent investor conference.

$32M/124 homes = $258K each.

Yes siree!…….. 9.9 miles from my house. Wait until the renters see their water bills! Oh, an all cash purchase by Fundrise.

Buying a home in a housing bubble is not a good idea no matter your age. Homes were a great buy during the last bust and they probably will be again.

Old School,

Agreed. And there is also a fundamental difference in buying a house (an investment) and buying a home (a place to put one’s roots down).

At least in my mind.

Mi-a situation that makes me think of the ‘only gamble within your means’ fine print, while finding few options other than the one to enter the casino…

may we all find a better day.

@Old School,

How are you defining “housing bubble”?

If you are defining “housing bubble” as “my house is worth so-and-so many fiat units” – we are not in a housing bubble.

If you are defining “housing bubble” as “my house is worth so-and-so many bags of groceries” – then we probably are.

I probably am using mental math which can get you in trouble:

1. High price to income

2. Case Shiller charts Wolf shows

3. Very high house price to rent

4. Twenty year house price growth at about 6% or 50% faster than nom GDP growth

5. Pay any price behavior by buyers

Of course all of this is made possible by Fed policy.

Ask idiots how they invested in Spain lost there donkey per wolf

1) The Real disposable personal income is down $3.64T, in the last 3 months, from it’s peak @ $19.210T in Mar 2021 to just $15.569T.

2) The LT uptrend served as a support, tested twice, but it wouldn’t last. The Real income might dive to the other side, forming a painful anti bubble, doubling our social and economic troubles.

3) US Treasury General Account in the Fed bubble didn’t last either. TGA decayed $1.2T within a year from the peak @ $1.8T in July 2020 to just $578B. TGA might be overdraft for a while, paying penalties, fees and c/c interest to JP,

US gov might lose it’s highest Fico rating, but TY investors (in US 10Y Futures price) don’t care. They will invest in the impaired US gov, not in gold, commodities & WTI, sending rates to zero, or below and USD up.

4) Real consumer spending reached a new all time high in Apr 2021

@ $13.7T, but the last 4 dots stalled at high altitude.

5) AMZN weekly latest bar is a big red supply bar on high volume, above the cloud. Jeff spaced out, demoted himself, in a blues escape capsule, after building a one year cause. Jeff markdown might start.

@Michael Engel,

Regarding Bezos…

Remember there were similar concerns when Gates left Microsoft and Jobs left Apple. Neither really mattered (though Microsoft had an “unproductive dalliance” with Steve Ballmer) for those companies the long run.

Bezos has become a focal point of political criticism in the USA – he is a drag to the stock price now, if anything.

The Delta COVID surge could be a short-lived problem or not. If it’s not – there could be more stimmies. Perhaps this time, Americans will save a greater portion of them – fearing even further COVID surges. But I am betting they will not.

Inflation is a terrible problem. I’m wondering how many people are now in real distress because of it, especially elderly on fixed incomes whose savings are all they have got for the rest of their lives and no options left to improve their situation.

This distress will be massively amplified by the fact that central banks take a completely disinterested view of their plight and just keep throwing more gasoline on the fire, to achieve exactly what?

I see a massive suicide wave coming.

The Federal Reserve is INTENTIONALLY PUNISHING SAVERS.

There is no question of this. They intentionally promote inflation…they intentionally have rates at zero. Theft, pure and simple.

Allowed.

And the Fed is allowed to ignore the agreements/instructions/mandates that allow their existence…..and not a word from the Congress that loves the free money for the Trillion dollar socialistic programs and vote buying schemes. And that, sir, is the great flaw in the system.

One of their mega-trillion dollar socialistic programs is QE and ZIRP that pumps up the stock market and other assets, making the wealthiest even filthier rich.

Socialism for the rich, and capitalism for the poor, is not gonna end well.

The FED is engaged in a game of psychological warfare. They have forced people out on the risk curve through the artificial suppression of interest rates, and they admitted to it. You can go back to the days of Bernanke. They openly admitted to wanting to blow a stock bubble, and a housing bubble, etc. We’ve finally reached the “now what?” stage of that recklessness.

Depth Charge…

Did you happen to watch the PBS special on “The Power of the Federal Reserve”…? You can watch it from their web site.

Ex Fed Gov Fisher said the Fed dropped rates down the curve to “FORCE” investors to take more risk. He let it slip out….

The Fed is not there to alter the behavior, force people to act in a certain way. They are there for the 3 stated reasons in their mission statement. (One of which is not to drop long rates to all time lows…”promote moderate long term interest rates”)

Now who knew first the Fed was going to FORCE people to take more risk as they dropped rates out the curve? Intentionally FORCING people to act a certain way….what power. (Did I mention the word FORCE?)

I saw it, historicus. My biggest takeaway is that Kashkari appears mentally ill.

Depth Charge,

? Yes, that would apply to lots of talking heads at the Fed.

This is why I’m changing to independent voter there out of control both parties we the people need an awakening not a great reset

@Ron,

If voting ever did any real good..it would be illegal.

My parents are in their 90’s. They are doing pretty well because their home is paid for and they can still care for themselves.

The biggest problem they have is they are well insured for health care and the insurance premiums gobble more income every year. It’s probably up to 40% of their income which is social security and a tiny pension. Loss of interest income wasn’t that big of a deal for them as it occurred so late in life they can start depleting their capital if they have an emergency.

I think the groups most vulnerable to this are not the real elderly but more the people in their 50’s and 60’s who were careful and prudent with their money, i.e. much of it invested in savings and bonds, because of crazy high stock markets valuations and other bubbles and counting on responsible monetary policy. They are going to have a massive shortfall, despite being prudent savers. Several percent NEGATIVE real rates on what you saved your entire life, it is impossible to keep up with that.

Of course the young are being shafted too and they are facing a bleak future, but at least they can hope that this whole house of cards will collapse within a few short years and then they can rebuild from there. They still have time to do that. People in their 50’s and 60’s are doomed, even if they own some assets now, because these assets are likely to implode. If not in nominal terms, then at least in real terms. A portfolio that looks OK-ish at today’s crazy valuations simply won’t see you through. You need to be rich now to have enough left once this is all over.

YuShan, your comments hit the nail on the head. The one thing I’d add is that the plight you describe of the 50-60+ year-olds will negatively impact the younger generations as well as the children of these retirees become the Sandwich Generation(s). Mom & Pop will increasingly be forced to depend on their kids and other family members for support. It will result in a huge ripple effect over time. Not good.

True,only 5 % will survive the coming fin crises,which may last to 2025.The bottom 20% will be relatively o.k also. Med ins ins premiums will skyrocket also. They want to cash bleed the boomers .

The Federal Reserve MUST BE CALLED OUT for intentionally punishing savers.

Promote inflation at the same time they peg rates at zero.

Theft….pure and simple.

Then inflation runs hotter than their illegal goal of 2% and they don’t lift a finger.

Powell points to the employment numbers not being where he wants them. He lists

1. Childcare considerations

2. Looking for better jobs

3. Generous unemployment compensations

4. Covid fears.

So the question SHOULD BE, but is never asked by any of the “pre screened” economic experts..

“WHAT DO ZERO INTEREST RATES DO TO ADDRESS ANY OF THOSE FOUR POINTS?” answer is nothing….so employment numbers is NOT a reason to keep rates low.

YuShan

Inflation affects everyone differently . With respect to routine expenditures, I’m not adversely affected. Just went to fill up my gas. Price went up from $3.39/Gallon to $3,49/Gallon. So what. Food inflation for the stuff I buy has been neglegeable. Housing costs are not changing since my mortgage is paid off. Utilities are not much different. Medical costs have gone up but I have good insurance. So I’m OK. But a lot of people aren’t. I get it. We are becoming a society of the halfs and halve nots. That’s the reality.

Are you raising a family apparently not

@Swamp Creature,

“Housing costs are not changing since my mortgage is paid off.”

I doubt that.

As your home’s assessed value increases – so will your property taxes (unless the rate is decreased).

For the most part cities and towns have been getting generous state and federal aid – but that may not last. When that runs out a lot of cities and towns are going to find their tax bases diminished by the closure of lots of small businesses (and it looks like Delta will be a second “killing frost” for these). With those losses incurred, cities and towns will be increasingly forced to tax residential property to fund themselves.

I really think headlines like:

“Millions of homeowners tap HELOCs to pay property taxes”

are not all that far in the future…

BigAl

Property taxes hardly went up at all. Maybe 1 1/2%.

And the consolidation of multi-generational families into shared quarters. And in most cases, it will be the younger family members moving in with the older family members.

Lots of efficiencies/synergies, from what I hear

@MiTurn,

Yes and keep in mind that the long-term care industry is in dreadful shape for a couple of reasons…

a) There’s an acute labor shortage forcing them to raise wages for hires

b) The long-term care insurance is in atrocious shape due to years and years of negative real interest rates and spiraling claims from aging baby boomers. Don’t believe me? Plot Genworth’s stock price. It makes for grim viewing.

Millenials are going to need to inherit their parent’s properties (and be able to service their tax burdens) in order to survive. No exaggeration.

Well, we are not going to commit suicide but are starting to feel the effects of inflation as 75+ year old seniors with a fixed income . We are lucky to have enough savings to weather another 10 years before things get tight as costs will really start to get past our ability to keep up.

Our modest 2,000 square foot 20 year old house is paid for and in good condition as we put a new roof on 5 years ago along with replacing the worn out A/C. This is Texas and A/C’s last 15 years and a 30 year roof only lasts 15 years also (shingles go to hell in the constant sun).

My health is real good but my wife has some real issues (COPD, osteoporosis, heart stuff) and is on a dozen Meds. Medicare costs are starting to get expensive (supplemental plan premium increases) and Med costs are getting crazy for her. This is a constant battle……and every year I am losing a little more of the fight.

Our cars will last forever as they are low mile cheapo’s and I do all the maintenance. Plus, they are paid for. I can dump one car as my wife has pretty much given up driving anymore. My next car insurance bill may be the thing that makes that happen.

It’s really sickening to watch this once great county devour it’s working class and older folks who have helped build this nation. I fought a war for this country back in the 60’s and the way that we military veterans are treated by the populous and government these days is down right embarrassing.

Keep up the good work Wolf!

Plenty of retired people I know have decided it’s not worth it to drive themselves, or have jettisoned the extra car and just rely on Lyft/Uber or a taxi when needed. No insurance or Maintenence expenses.

Lyft/Uber is fine and dandy if you live in a city. For those of us who choose to live in unincorporated areas (where we don’t have to weather the municipality tax grab pointed out in previous posts), it is not a practical option.

I would say the best thing to happen in my life in the last ten years was medicare. Now they are going to expand dental vision and hearing.

Anthony A:

We have similar issues with pharma costs. I spent a few days fiddling with the Part D choices last November in an attempt to lower our overall drug costs. I ended up putting my wife on a plan that costs over $90 a month, but the actual net cost works out thousands cheaper than the $35 plan she was on. For the first 6 months of the year, it’s translated into a $2,000 savings out of pocket for her meds. When you have one prescription that costs $500 a month, it doesn’t take much to hit the “donut hole”.

This plan pays for just about everything at an affordable price, encourages 90 day supplies, and their mail order fulfillment is second to none.

Good Morning Wolf. Thank you for your commentaries and your educational bent. Just one unserious question: “WTF” is found on many of your charts. Trying to figure it out. Does it mean “Way Too Far”? Thanks again.

“Fantastic” is the favorite word of Arnie the former Gov of Cali (where Mr.Richter resides)

Therefore it may be inferred

WTF=Well,That is Fantastic !

Way Too Fantastic…. I like that. The Fed should adapt these WTF charts and call it Way Too Fantastic. You just have to ignore certain charts and focus on the others.

Take the income growth chart and eliminate the inflation chart, or the GDP charts. Data can be selected to present great stories, and they are fantastic for telling lies. It just depends on how you torture the charts and spin the data.

Want a prime example, just look carefully at FDA clinical trials and see how the data point are literally cherry picked for results. Latest fun, look up Aducanumab. This was an example of poor data cherry picking.

Actually those are steps in STH (Stairway To Hell)

Wasn’t That Funny ?

Way To Fail…

Where’s The Food ???

Who’s The Fool ???

@Brent,

You know, on that’s last one. Usually if you’re asking the question, it’s time to look in the mirror.

Heh heh, but seriously, as I look around the room, my automatic first assumption is that I’m the sucker because there is something everyone else knows that I don’t, and every other A**hole is the room is trying to take advantage of me.

@MCH

Last WTF has an expanded version in the form of a deep American proverb:

“There’s a Patsy at every Poker Table,if you dont see him it is YOU”

Lee Harvey Oswald realized it in the movie theater and started screaming “I am not resisting arrest ! I am just a patsy !” and thereby extended his lifespan by 2 days.

=it’s time to look in the mirror.=

And fold ???

“What the F**K” = expression or exclamation of utter puzzlement, astonishment, and bewilderment.

I like mine or Brent’s ideas (the first one) better. Come, Mr. Richter, where is your optimism for humanity. Way Too Fantastic or Well, That is Fantastic.

Don’t worry, things are looking up….

HAHAHAHA

I think you need Alf on your website. He would make everything better.

Once upon a time the U.S. bought Alaska for $7 million dollars. That included fishing rights, Fort Knox gold deposit, Red Dog zinc deposit (7% of global zinc production), Prudhoe Bay oil field and timberland.

The 10 yr treasury dropped to a 30 day low yesterday.

The Federal eviction moratorium is supposed to end at midnight. State laws may vary.

The 10 yr treasury interest rate reached a 30 day low.

@David Hall,

Yes, I am surprised about the moratorium given that: a) the moratorium is driven by CDC guidance…and the Delta surge is very much upon us b) Biden’s standing with progressives seems to be in difficulty

It’s possible there will be last-minute reprieve. And it’s also possible that processing of evictions will be dead-slow to an overwhelmed judiciary and the diminished capacity due to the COVID surge.

It seems, from reading the comments, that many believe inflation will be followed by deflation. Is this correct? I mean, if wages don’t follow, then the consumer, at some point, must cry, “Uncle!” And if rent, mortgages, and health care continue to increase, how can one spend money on restaurants, clothing, and other goods and services? Won’t the octopus strangle the smaller fish? But I suppose by the time a recession sets in, a lot of people will be impoverished by the inflation that preceded it — and then be impoverished by the deflation that follows!

And an aside question: will rents go down eventually now that the eviction moratorium ends today?

There’s a lot of political anger against landlords across America. The mega landlords make the problem worse because they have a bigger footprint in specific communities. I expect rent control to become a big political issue in the next election. We have too many people living on the streets of America and they are not all drug addicts and lunatics, many are working families with children and retired people with low incomes. If you are not aware of the anger out there due to this issue, you are seriously out of touch politically.

Agreed. I wonder how this anger will eventually manifest. Protests in the street? That general strike which is planned for October?

Underground or black economy where everyone trades services instead of using money to pay for things. This way nothing goes to the government. This way the people stay solvent longest without declaring personal bankruptcy.

Yep.

Most of the time during my life, a big bout of inflation was followed by more inflation, but just at a somewhat slower pace. There were only a few deflationary quarters in my lifetime.

The last time we had deflation was because the biggest housing bubble in history popped. Now we have an even bigger housing and “everything” bubble. It seems they should pop, too, as maintaining bubbles into perpetuity seems like an impossible feat.

The same gang which brought the TWO boom-bust cycles in this century, is the creator current(3), epic proportion ‘every thing’ bubble.

Normalization is virtualy impossible without implosion. No wonder Mr. Powell still buying 120B /month and at the same time doing 1Trillion+ Repo-Repurhase!

How long this will go on is any body’s guess. In a morbid selfish sense, I think Covid Delta is equalizer against the insanity of Fed & CBers. Delta is spreading and the immunity is slowly wanning, all over. Big Pharma advising booster doses, soon!

As I have repeatedly said, Delta variant is a big change and challenger for Fed and for the jubiliant crowd-Wall St expecting strong recovery. Just last week the financial press including Goldman Sachs declaring that delta variant will have minimal impact!!?

I remember how the talking heads a couple of years ago was worried about how deflation would destroy the economy.

Meh…. We will get back to that sooner or later.

Glad I got a raise recently then!

… until they fire you in a restructuring.

Pure

Who has ever seen deflation?

File it with the Loch Ness monster and Bigfoot.

Even in the “deflation fear era” from 2009 to 2020..(ha ha)….the CPI was up 17%…..

To be clear, flat inflation or even a down quarter (negative) doesnt make for deflation any more than a down quarter in stocks makes for a bear market.

Given Powell’s policies mathematically inflation will turn into hyperinflation. In theory hyperinflation is the only outcome not deflation.

We’re now in stagflation already. Inflation is running at double digits and wags and employment are going nowhere. It will get worse.

Look how fast these clowns’ money printing came back to haunt us all. What a joke. History is replete with failed currencies, yet the hubris of these bureaucrats caused them to ignore the lessons we learned in the past.

All smoke and mirrors as world bank will go to world digital currency dollar yuan euro obsolete wake up

That’s one helluva run-on sentence.

I still think Ron is a defective bot (punctuation circuit gone bad).

P GRRUBSTREET…WHAT MAKES YOU THINK that the eviction moratorium

won’t go on forever? or at least renewed & extended? ….in the greatest wealth transfer in history? Count on Congress to just “do it!”

They tried yesterday but failed. Now Congress is off for six weeks of vacation… Perhaps they will try again after some fun in the sun.

And this is only a side menu. We need to totally replace our equipment. Everywhere. Electricity will replace all fossil fuel energy. Have to. Not an option. Suburbs will disappear. Single family homes are relics. Not sustainable. Mass transit will be transformed. Building out highways is stupid. Etc. Etc. As financial economist Michael Hudson admits ‘there may be some fighting involved.’

Chris Herbert,

“Suburbs will disappear. Single family homes are relics. Not sustainable. Mass transit will be transformed. Building out highways is stupid. Etc. Etc.”