Defying economists’ expectations for sixth month in a row, inflation heats up instead of easing off. And it’s a lot worse than it seems.

By Wolf Richter for WOLF STREET.

The Consumer Price Index jumped 0.9% in June from May, after having jumped 0.6% in May, and 0.8% in April – all of them the steepest month-to-month jumps since 2009, according to the Bureau of Labor Statistics today. The CPI without the volatile food and energy components (“core CPI”) jumped by 0.8% for the month and by 9.5% for the past three months annualized, the red-hottest “core CPI” since June 1982.

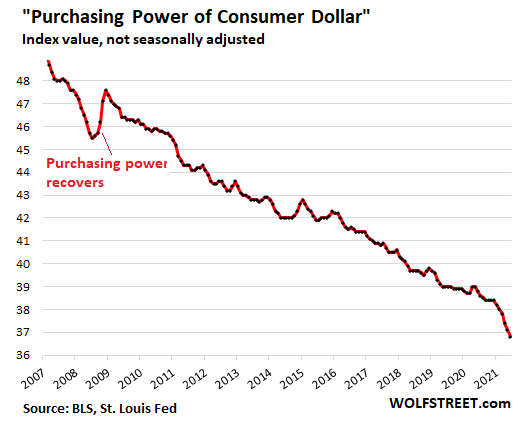

On an annual basis, including the periods of low inflation last fall, CPI jumped 5.4%. The CPI tracks the loss of the purchasing power of the consumer dollar – everything denominated in dollars for consumers, including what they can buy with their labor – and this dollar has dropped at a rate of 10.7% over the past three months annualized, the fastest drop since June 1982

Loss of purchasing power is “permanent,” as the chart shows.

There is nothing “transitory” or “temporary” about the loss of purchasing power as the chart above shows. Only a period of deflation can reverse some of the drop in purchasing power, which is a rare event in the US and happened only a few quarters over my life time, including for several months in 2008 – that little notch in the chart above.

The only aspect of inflation or the loss of purchasing power of the dollar that is temporary is the speed with which it progresses, faster or slower, from month to month.

Actual home price spikes v. charade of CPI for housing.

Housing costs – rent and homeownership costs – are included in the CPI as services and account for about one-third of overall CPI. It’s the biggie, but it barely moves despite surging housing costs.

The rent component of CPI (“rent of primary residence”), weighing 7.7% in the overall CPI has been ticking up every month this year at a constant 0.2%, including in June, and is up only 1.9% year-over-year.

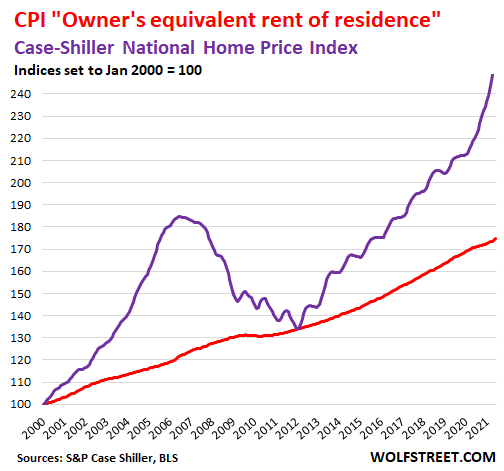

The homeownership component (“Owners’ equivalent rent of residences”), weighing 23.7% in the overall CPI, rose 0.5% in June and only a stunningly low 2.3% year-over-year, even as home prices have exploded, no matter how they’re measured.

The median price of all types of existing homes in the US, as tracked by the National Association of Realtors, spiked by a record 24% compared to a year ago.

The Case-Shiller Home Price Index, which measures the price changes over time for the same house and is therefore an appropriate measure of house price inflation, spiked by 14.6% year-over year, the red-hottest increase in the data going back to 1987 (purple line). This contrasts with the languid CPI for homeownership (red line):

The reason the CPI’s homeownership component doesn’t track this rampant home-price inflation, and thereby the loss of the dollar’s purchasing power with regards to homes, is because it doesn’t track it. It is survey based, and tracks what homeowners think their home might rent for – hence its name, “owners’ equivalent rent of residences.” It is a measure of rent, as imagined by the homeowner.

Hotels & motels. The measures of rent and homeownership are the dominant components of “shelter.” Small components are “lodging away from home” which is mostly hotels and motels, weighing 0.9% of overall CPI. So they’re not the biggie. But prices soared 7.9% in June, and by 16.9% year-over-year.

So maybe prices for hotel rooms are just catching up to where they’re used to be. And with city hotels that are just now coming back and are still suffering from lack of business tourism, that’s one factor. But hotels that cater to leisure travelers, especially in recreational areas, such as around national parks, have been booked solid, and prices have jumped.

The CPI for services, which is dominated and kept in check statistically by the above charade of housing inflation, ticked up 0.4% in June and by 3.1% year-over-year.

Durable Goods inflation spiked 14.6%, biggest since at least the 1950s.

Durable goods, which include cars and trucks, appliances, consumer electronics, furniture, and the like, spiked by 3.5% in June from May and by 14.6% year-over-year, the biggest jump in the data going back to 1957. This jump was fueled by used and new vehicle prices.

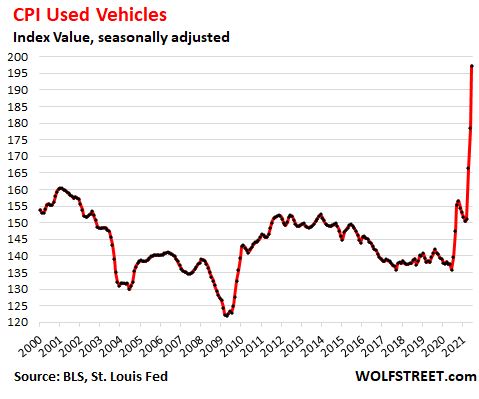

Used Vehicle CPI exploded by 45% year-over-year, and by 10.5% in June. For months, I have been documenting this craziness, that cannot last and will not last, and that will partially unwind at some point. And there are now the first signs on the wholesale side that this was finally “Peak Insanity” in used cars and especially used trucks. Clearly, a portion of this ridiculous spike in the CPI for used cars and trucks is “transitory.”

Long-term price increases are squashed by “hedonic quality adjustments.” As you can see in the chart of the used vehicle CPI, used vehicle prices appear to have fallen over the 20 years between 2000 and early 2020, which is of course a ridiculous assertion. Prices of used cars and trucks have obviously jumped over those 20 years.

But the Bureau of Labor Statistics uses “hedonic quality adjustments” to account for improvements in vehicles over the years (for example, from a four-speed automatic transmission to a 10-speed electronically controlled transmission). The price increases estimated to be associated with “quality improvements” are removed from the CPI for new and used vehicles (hedonic quality adjustments explained here with my real-world two-decade F-150 and Camry price index v. the CPI for new vehicles).

The idea is that CPI measures price changes of the same item over time; and when the item is improved then it’s no longer the same item, and the price increase is not inflation because it reflects a better product. In reality, this has caused a consistent, purposeful, and very bipartisan understatement of inflation as measured by CPI. Same as with the housing data. The idea is to keep people in the dark.

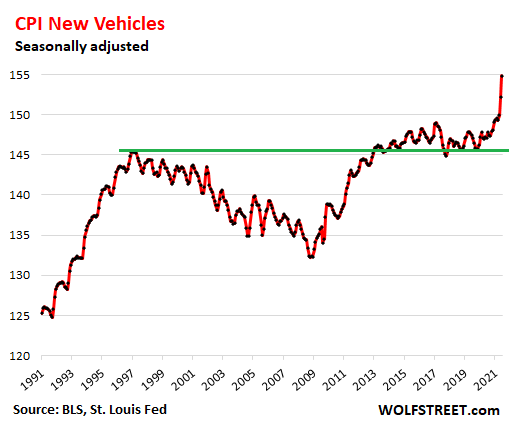

New Vehicle CPI takes off. In June, the CPI for new cars and trucks jumped by 1.8%, after having jumped by 1.5% in May, the biggest month-to-month jumps since the cash-for-clunkers program kicked in during the Great Recession. The index is now up 5.3% year-over-year. Even the aggressive application of hedonic quality adjustments, that pushed down the new vehicle CPI even as vehicle prices rose in reality, cannot keep up with those price increases:

What to make of it.

In the inflation data today, there are completely understated components, such as housing inflation, which in reality is red hot. And there are temporary factors, such as the spike in used vehicles, that cannot last. And price increases are spreading to other categories.

What we will get in the future is ups and downs of the monthly inflation rate that will give false hopes of declining inflation, followed by increases that wipe out those hopes. And we still don’t see the actual inflation rates because of housing costs not being properly included and because of other strategies, such as the overly aggressive application of hedonic quality adjustments. So inflation is here, and its big, and its understated, but it will change up and down on a month to month basis.

Meanwhile, the Fed is still buying $40 billion a month in mortgage-backed securities, thereby repressing mortgage rates, thereby doing everything it can to further heat up inflation in the housing market, and it’s still buying $80 billion in Treasury securities a month, and it is keeping its policy rates near 0%, to repress short-term and long-term interest rates in general, and to inflate asset prices and consumer prices, thereby further burning the purchasing power of the dollar.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Indeed. If you simply went back and included housing like cpi did pre 1980, you would be in double digits overall. Kind of astounding.

So that’s how Reagan did it. His plutocrat friends had it all figured out. Where I lived, the cost of housing went up 5 times between 1980 and 1987. Meanwhile, Reagan was boasting about how he “beat inflation”.

he forgot to mention that fiat $dollar was declining in value

remember ‘inflation’ is made up word by govt to hide

FACT IT IS REALLY DECLINING value OF FIAT $CURRENCY

the federal reserve is unconstitutional since 1913 and should be done away with…this is 95% of our inflation problems/debt in the world ….trash the federal reserve today…that’s what we americans should be doing is getting rid of the fed reserve…

Where is our modern day Volcker?

Modern day Volcker? Probably not born yet based on wolfs charts and the history of dollar debasement as a choice

If the US dollar ceases as world reserve currency:

1) general trade,

2) petro dollar,

3) currency of choice to put cash into in order to hedge against own national currency,

then the devaluation index is going to spike. Not like Central/South American hyperinflations, but absolutely far more than anything seen to date.

Our biggest export today is the literal US dollars that non-Americans are using.

The barriers preventing such a change have been falling steadily.

a) Foreigners stopped increasing their net Treasury holdings in 2012:

i) December 2012: total foreign official holdings of US treasuries was $4032B vs.

ii) April 2020: total foreign official holdings of US Treasuries: $4047B (0.37% increase) vs.

iii) April 2021: total foreign official holdings of US Treasuries: $4201B (4.2% increase)

b) Overall Treasury holdings did go up from $5573B to $7070B (27%) over the same period – but how much are offshored hedge fund/insurance company investments (which are really US)?

c) Compare the above changes vs. changes in the size of the US national debt: in 2012 it was $16B – today it is $28B (75% increase).

Dr. Michael Hudson noted in his latest talk that bubbles pop from unexpected reasons. Like an avalanche – everyone knows it will happen but the precise timing and trigger are unknown as yet.

The question is: what will the impact be?

Will the crash reinforce the dollar’s present status – as it had in the past? Or will it be different this time?

I would also note that the US’ debt is so large now that – between Japan and the US – 50% of *the entire world’s debt* is in these 2 countries. But Japan’s debt is almost entirely internal while the US’ debt is not.

Last of the hardnoses; I don’t believe there will be another. Maybe when it’s Schacht time.

Volcker was better but only a little bit — for a banksters’ crony. He still kept unchanged the privately owned but deceptively named banksters’ “Federal” Reserve which most, repeatedly-financially abused Americans are correctly realizing FINALLY has as its primary, patent goal the funneling of funds to banksters and their cronies which goal its latest actions make harder and harder to ignore.

If banksters’ gambles fail them, their “Fed” will create more dollars as it is creating $40 billion a month now after just creating $2 TRILLION in 2019-2020, all to buy uncollectible mortgage backed securities of the banksters and their cronies. Americans then all suffer the resulting inflation to bear the banksters’ losses.

If the banksters’ gambles make a profit, only the avaricious banksters keep the entire profit, of course. Americans get what the juice media hilariously calls “f___a__:” $0. (I.e., in the US, we would say that we get what remains after the banksters took the elevator.)

Volcker was a true public servant who did exactly what he needed to do and brought an end to the ridiculous hyperinflation that was ravaging the US.

He did not change the banksters’ falsely named “Federal” Reserve at all, so he bears part of the blame for the disasters that his “Federal” Reserve has caused since he left it. His tactic of raising of interest rates to high levels now would result in the US having to cancel social security payments or medicare, or something of the same size.

The “Fed” has covertly funneled so much money to its banksters for DECADES that the US now cannot afford to meet its obligations if interest rates rise to what were normal levels historically. Federal interest payments will grow so much with even a 4% increase in interest rates (way below what Volcker used to stop inflation) that huge portions of the federal government would have to be just cut now: e.g., either Medicare or the US air force.

I used to like him, but I realized eventually that he was just a banksters’ crony, because he enabled the continuation of the misconduct of his “Fed.” His “Federal” Reserve is the world’s biggest and most destructive parasite and has sucked out the wealth of Americans like a leech sucks out the blood from its victims.

There are likely modern day Volckers out there. They’re just not likely to get anywhere they can put their vision into practice.

I believe Powell also began his tenure making more hawkish sounds, but it didn’t take long to bring him in line.

If someone came in and started ramping up rates to any significant degree now, the financial system would quickly begin sending warning signs, and if pushed enough it would implode into a black hole under the weight of the gigantic load of aggregate debt emanating from it as debt expansion fails and gets drawn back in. Steeply negative real rates are today required to maintain the faltering financial and economic mirage.

I’m pretty sure Volcker would be doing exactly like the rest of them if he were in Powell’s position today.

The damage is being done now. If we get our Volker it’s going to hurt to take our medicine. I remember when Volker had to administer medicine before. A lot of pain to go around.

There are those who argue that Volcker was able to do what he did because:

1) Workers were started to successfully make wage increases stick

2) The US, while at unprecedented debt levels, wasn’t really that indebted.

2) is clearly no longer true.

Does 1) matter either, given offshoring? And its domestic half-step – WFH?

My wife does all the grocery shopping and increasingly complains about both higher prices and empty shelves (plus, less staff so longer waits in line). All I know about higher grocery prices is that my favorite craft beer has jumped from $8.99 a six pack to $11.99 in less than four months.

I might have to find a “hedonic quality adjustmented” beer to save money.

Brew your own. It’s actually fun.

Been homebrewing for a while now, and it’s a wonderful hobby. A good way to save money? Not even close.

i second this. on both the hobby and saving money aspects. however, i think the investment in the brewing equipment might pay off in the long run, but it will be years and years.

forgot to add: the homebrew tastes way better in one of Wolf’s mugs. we keep our set in the freezer when not in use.

I’m ‘a go “Carrie Nation” on ya’ll right now, Engel-style:

1. Nobody ever regretted being a teetotaler.

2. You save 100% on alcohol.

3. You help avoid ruining your own life.

4. You help avoid ruining other peoples’ lives.

5. Why risk become yet another miserable alcoholic?

6. Interesting fact: Donald Trump and Joe Biden are both total abstainers. #NonPartisan

7. A temperance rant would be incomplete without a Scripture reference (I’ll make it entertaining): “These people are not drunk, as you suppose. It’s only nine in the morning!” -Peter (read Acts 2 for context)

My grandpa’s brother-in-law asked him why he and my grandma always seemed to have more than enough. His reply: “Because I don’t drink and run around with women [like you].” One couple died young and poor, the other lived long and happy.

I’ll spare you from all the stories of wife-beaters and innocent lives lost from drunk driving. I’m sure we can all find it in our own families and circles of friends.

But that’s just my opinion. Your choice.

“There’s nothing left to do but get drunk.” – Franklin Pierce, 14th POTUS of the USA. He made his choice. Died of liver cirrhosis before reaching a ripe old age. So maybe you have a point.

…Engel-styled continuation of enumerated list:

9. Our local recreation areas by the lake are hosed with trash. Half of it is freaking beer cans and alcohol bottles. I don’t see a whole lot of Snapple or juice boxes, so my conclusion is that drinkers don’t have the sense to put their trash in the proper place. I resent drunks ruining my nature experience.

[/Carrie Nation]

I noticed some low-lifes the other day eating fast food in their cars while driving and then throwing all the waste out of the drivers side window onto the street. This has become the norm here. The DC Swamp has become a filthy mess. Getting worse every day.

”Moderation in all things” T, including consumption of alcohol or anything/everything else;”

Those that cannot drink alcohol responsibly, ”should really and truly totally abstain;

For the rest of us, it is definitely one of the great pleasures of a life of moderation in all things, including moderation:

daddy always warned me about the ”holier than thou” crowd, who were usually/frequently doing things a whole lot worse, secretly, than drinking alcohol, but totally willing and aggressive about trying to convince others of their holiness;

Much more easy to see this these days, eh?

That’s some third-world stuff there. People not minding trash everywhere. You’d have to wonder if parts of the US will sink into a sort of pseudo third-world state. Like China, where there are places crawling with Land Rovers and others that are just squalor.

Turtle and Swamp Creature:Yep,fought that litter battle in Chicagoland.Knew who dumped trash,it magically migrated to their yard.Moved further north,even worse with the broken bottles everywhere+trash+booze bottles+cig.butts+occassional drug paraphenalia.They do not care and I am also sick of seeing it at parks/natural areas.Some Choose to live as literal animals and think only of themselves.Neighbors in apt building and on street Were same until I started doing the same protocol of dumping/kicking their trash back to their monster truck or filthy yards.Ive thrown out a few bottles because I dont want the drunkies to break more of them,there are lots of outdoor cats.It is Better,now!! :-)

They must really be some “low-lifes” on the islands around those huge trash gyres in the Pacific. The trash in the water there is so thick one can walk on it!

No civic pride at ALL. Disgusting people. No matter the mess where you live, at least you aren’t around these sub-humans.

Skirt steak at Costco has gone from $20-30 per package to 40-50 per package plus some shrink-flation, from what I can tell. It is (was) a favorite grilling cut.

As for stocking, it really depends on the store. I have notice Kroger brands is able to maintain their stocks, but they are a bit higher price and will cap hot selling items. Contrast that with Walmart or Target who do seem to run out of items often.

Let’s be honest. There is a reason Kroger brands stay on the shelves….

One thing is pretty clear that savers are paying the freight for current policy.

About 3 years ago my interest income was roughly equal to my social security check. Now social security check is about 10X bigger and sounds like will be going up by 5%. My savings not so much.

My wife says she hasn’t noticed price increases but I find myself having to supplement our income with savings the last few months to meet our budget. I’d say it’s to the tune of about 8%. Interesting.

I stay away from those craft beers. They are too strong for me. I prefer a Bud Light or Corona light.

You know what they say about Corona Light? It’s like making love in a canoe- f***ing near water.

You can pretty much say that about any “light” beer. :) If I want a “light” beer I will add a couple ounces of water to it. No thanks!

The name “Corona” might have had some bad connotations. Same as Corona virus. I wonder if that has hurt sales. I still like the taste of that beer. I’ve loaded up my fridge with a couple of six-packs.

It’s courageous of you to share this.

Just kidding of course. I am trying to cut back on alcohol too. I like a Corona but in terms of taste find it already lite. But also find some craft beers too bitter.

Gonna go ahead and disregard anything you ever say now.

I love Swamp Creature and Mrs Swamp Creature, but he sure made a colossal booboo here :-]

I need to correct something I reported earlier.

Mrs Swamp now tells me there has been no appreciation of properties in the marginal neighborhoods of the Swamp, even two units. What I reported earlier was incorrect. The 13 to 14% appreciation was on renovated pristine properties only. And there you have to figure a large expenditure in Capital improvements added to the cost basis of the house. Most of the existing properties are not going up like these real estate shills want you to believe. In fact the truth is that even with these abnormally low interest rates they haven’t gone up at all. That might explain the lack of increase in rents.

I’m just hired help. I have no skin in this game. Don’t own any investment property, and don’t intend to. I just report the facts on the ground as I see them.

LOL.

Swamp, I love you but I hope that was sarcasm….we don’t want to lose respect for you…?

Yuck. Bud and Corona are high-alcohol, carbonated water that is also overprices for what it is. If you want light beers that taste like beer, you’ve got to go all the way to central Europe.

Craft beers are expensive for a reason, and they’re high inflation item.

or .. brew your own

my father did & stored the bottles under the stairs

in the middle of the night we would hear a pop & mum grumbling

but it was great stuff

Internet archive.org,look up sale ad prices for groceries from last year and look at prices this spring.

All of this ultimately stems from the fact that the Western world hasn’t yet accepted the unfortunate reality that our economy is not productive enough to provide everyone with the standard of living that we think we “deserve.”

So we have to make up the difference with debt. I obviously don’t have a crystal ball, but I think the end game is sooner than anyone imagines.

You are correct. Plus we are slowly losing the benefits of the Imperial Wealth pump that directed low cost resources and goods with low cost labor to improve our standard of living. One has to marvel out how up until just recently Americans ( which make up about 5% of the worlds population) could consume 25% of the worlds resources. At one point we might have had the corner on technology and productivity such that we might deserve it. But now that we mostly just export printed money, cartoons, defective planes and 2nd rate military goods our claim to that share of the world’s resources is shaky at best. I think we are in for a good deal of belt tightening in the years ahead.

Yes. One should dive down to earth, and become the yeoman peasants we were really meant to be .. I mean we, well most of us anyway, are heading for Empire collapse one way or another. Might as started on the ground floor. Takes a spell to grok the tricks and nuaunces of n e o liberal feudal country living.

ps. Get to know your local ferrier and blacksmith .. never know when that field mare ofyour’s will need a decent shoein.

our greatest lack is that of an achievable frontier.

branson and his tiny amount of minutes in “space” are, FED jawboning aside, like tears in rain.

That certainly doesn’t help, but it’s not the only reason. Medical advances that make it possible, but very expensive, to maintain life at the very end is a large part of the problem, as is our mass immigration from the third world.

How many people get their jobs because they applied to a “random” job advert and were the best candidate, as opposed to because they already knew the hiring manager? Although I don’t have statistics, I would guess that skews productivity downwards much more than any “woke affirmative action”, which if done well is supposed to identify talent with potential to do great, as opposed to just identify those who simply already had the opportunity to prove them selves. If done badly, however, yes it probably does hurt productivity.

You know who doesn’t give a shit about equity and all that crap?

China.

There are other issues there, but looking at the situation, it’s not difficult for one to understand why China is getting ahead. What we have in this country writ large is kind of like Bush’s no Child left behind program, I remember an old colleague told me back then, that program’s other name among anyone who gave a crap about the education of their children was receiving was NO CHILD GETS AHEAD.

On the subject of immigration, I think this country need immigration, the legal kind. I know, that word LEGAL is rotten these days. But that’s what rules are for. But at this juncture, I bet the best and brightest are looking at this place, and thinking, may be not. Capitol riots, shootings in cities, defunding law enforcements, seriously, how is that any different from any third world country we can think about.

The answer is not that simple I think, when we weren’t so focused on being woke, the economy also experienced stagflation among other things. Heck, woke or not, New York city almost went bankrupt!!!

SocalJim is almost certainly trolling here. The explanations remain the same. Our corporate masters sent jobs overseas, and that’s why we are in this state. On top of that, the powers that be just love war very much. What SocalJim is saying is akin to “hei wokeness led to the mortgage crisis!!”

ROFL.

The legal versus illegal immigration distinction is a smokescreen. We don’t need more low skill, low income peasants (and the numerous family they can bring over through family reunification), whether they come legally or illegally.

i think its equality, are there any black readers on this website

Do you mean minorities?

It doesn’t matter if you are black or white. The only color that matters on this website is green.

The wokeness is temporary. Once the potted plants have been arranged it will be back to business (as usual).

“our economy is not productive enough to provide everyone with the standard of living that we think we “deserve.””

You are 100% correct. And this is true across the western world, including Japan. Even in countries with socialized healthcare and pensions. These things are unaffordable longer term.

Yes. If I had to pinpoint one main cause, it’s medical advances and our much longer life expectancy because of it.

Given that 65+ people are largely taken care of by the rest of society (very few have enough money saved to retire and support themselves), working age people have to be productive enough to provide living expenses and health care to retirees for an average of 20 years (based on today’s life expectancy). That wasn’t the case in the past when life expectancy was 68.

Of course what could be inferred in your statement, is that the coalescing of traditional extended family members will evenually become the historical norm again, for a whole host of reasons.

The mechanisms that allowed so-called modern families to atomize .. and thus scatter across the four winds, will no longer make sense as thing continue to unwind.

Polecat, I think that’s probably right. And for families that can’t do that, the idea of a “golden years” retirement will likely become a luxury, like it once was.

Polecat,

It’s interesting what you mentioned about families, as my wife and I have de-atomized by intentionally sharing a rural property with my son and his family. We share costs, plus we get to be involved in our grandkids’ lives on a daily basis.

I’ll add another. There are large segments of society producing less than they consume which reproduce at higher rates than the mean. No, it’s not just the parasitic elites. In a sane world, this would never happen because no one would be permitted to produce unlimited offspring they cannot support.

RightNYer, The medical care expenses are unnecessary if those seniors had actually taken care of themselves. Proper nutrition, good relationships, good movement that maintains health and mobility. Basically the Blue Zones research and the data related to those pop’s. That would significantly reduce the required funds along with increasing quality of life. It doesn’t need to be one or the other. The question is whether it can be turned around in time.

Polecat, the sociologists have long considered the nuclear family a short term experiment and expected society to move back to the multi-generational unit again. Arguably, the transition in western society started awhile and it will only increase as financial pressures climb. Anecdotally, I have long assumed that my son’s will probably never move out, instead they will bring their partners and children. Any home has to be able to comfortably deal with that reality. I doubt that we are alone in assume this is our future.

Thomas Roberts, you are mistaken if you think resources aren’t limited. They are and that means Capitalism (a modern religion of industrialization like Marxism and Fascism) is done.

Btw found the coded slur on equality for women is very unpleasant.

Public policy has been terrible the last 50 years. A lot of corruption involved with lobbying to sell out real economy for wall street financialization. Wars from Viet Nam era until today. Debasing money. Elite schools pumping social garbage into the country so that up is down.

Find me a chart to support this.

I have not once seen a chart that indicates a decline in productivity as a whole across the nation. Wealth gap has certainly taken off like a rocket ship over the last 30 years though, in conjunction with falling taxes on only the most wealthy.

Productivity doesn’t have to have declined, if the expenses have gone up by more than productivity.

How much productivity is there in performing tasks which don’t generate real economic production?

There is a lot of economic activity counted as “growth” which has either zero actual value add or it is actually negative by making society actually poorer.

Your definition of productivity seems to differ from the standard models.

Let’s use the typical monetary one and we see each individual produces more GP per hour worked than 40 years ago (inflation adjusted) but has received almost none of those increases.

The “how” of all of this is an easily researchable and interesting topic you can explore on your own.

Bottom line: people are WAY more productive than ever in generating revenue and have received zero ‘real’ (ie increases not even keeping up with inflation) increases in pay.

Not so fast C:

From ’85 to 2017, first my productivity at least doubled and so did my pay,,, then, ’03, pay doubled again,,, then again in ’06 to 09 when, in fact, I was doing the work, with my computer knowledge up to par, 4 folks of similar qualifications did in ’85;

then, to top it off, when I was hired back into the office as an employee in ’16, my pay was close to doubled again, and continued even better up to ’19, when I decided to retire fully based on my belief, at that time, that We, the family We, had enough to take both of us elders through to the end…

Times are changing now, far shore,,, and even though in my late 70s, I might just answer positively to one or more of the recruiters who are keeping after me.

Anthony A says no one will hire him now at our age, but IMHO, he is wrong:

IF you keep up with the technology,,, AND/OR you have a fount of knowledge that can only be gathered through long experience,,, AND you are willing to work,,, you will always be of value, perhaps great value to some company; and, with the great communication of the internet, it is a TON easier to find that company, or for them to find YOU:::

IF you WANT to work, eh?

( I personally don’t,,, so perhaps a bit easy for me to say! )

The USA and some minions has been constantly exporting low productivity jobs, so they don’t show by the formulas of the economic quacks.

Heck, they even export high productivity jobs when the technology transfer is copied and naturalized, which built up China where it is.

Wall Street demands it.

Augustus and Cem you’re both right.

People are “getting more done” (Cem’s productivity) but much of that labor is wasted effort that isn’t making people better off (Augustus’ productivity).

One must also look at the employment to total population ratio. A nation of 330 million people with only 145 million employed workers is going to be less well off than one with 180 million workers. We just don’t produce enough for everyone.

There would be more workers if there were more demand, but wealth inequality is starving the 90% of their historical income level (as share of GDP), and ultra-low interest rates are starving savers of their historical income levels too.

Back in the 1960s-1980s most high school and college kids, and a healthy fraction of senior citizens, could easily get decent part-time jobs.

Cem, most of the productive capacity of our societies now is derived from our energy sources, and they’re getting steadily less productive on average in terms of energy returned on energy invested, as those incredibly productive easily accessed conventional oil reservoirs slowly deplete.

We should have adapted our systems to cater for contracting economies many decades ago (and thereby maybe have saved ourselves from the worst effects of climate change, environmental degradation and resource depletion).

Instead we exponentially inflate the number of outstanding debt units, which are the units we use to measure so-called ‘productivity’, in order to create an illusion of prosperity that is belied by the actual rise in social unrest, anger and unhappiness taking place around us.

Salt-what a world where the term ‘conservative’, when related to natural resources, seems to mean behavior suited to an alcoholic at an open bar…

may we all find a better day.

RightNYer:

You said: “our economy is not productive enough to provide everyone with the standard of living that we think we “deserve.” ”

What??? Our economy, and the global economy is extremely efficient. There is slack capacity almost (not quite – chips as contra-example) everywhere.

What’s lacking is buying power among the 99%. If they were making more, they could buy what they want/need.

The global economy is astonishingly, amazing, wonderfully productive. To produce the food, energy, housing, water, knowledge we need takes a small fraction of the available labor.

The thing we’re “making up the difference with debt” is the buying power the middle class (in the U.S. and western economies) no longer has.

The “debt” and (my addnl component, not yours) new money we’re creating is used to plug the gap between what we want to buy/afford, and what we actually can buy via the wealth our households are creating.

I’m saying this to try to direct attention to where the problem actually is.

Look, I don’t dispute that wealth inequality is a huge problem, but even if you taxed the top 1% at 100%, we still would have massive deficits. Our entitlement spending alone is unsustainable. Every other problem is just gravy.

I agree that taxing the 1% isn’t the answer.

I’m saying that the middle class doesn’t make enough, doesn’t capture enough of the benefits of productivity to make ends meet, and that problem is getting worse every year.

It’s _why_ we need borrow and create new money the way we do.

Entitlement spending is the _symptom_. The “effect” and not the “cause”. Lack of wealth-creating capacity in the middle class is the _problem_.

Your serve.

“Lack of wealth-creating capacity in the middle class is the _problem_.”

It would help if the middle and lower classes would use the resources they have more wisely. I get that many people don’t make and have enough. They still waste a lot of what they have.

@TP

Yet, oddly, the middle class is what is getting taxed out of existence. What taxes you say?

Increases in property tax, gas tax, sales tax, the indirect tax in terms of inflation, in addition to the squeeze put on by the income tax. Thank goodness the communist in the Senate had enough sense to say he wouldn’t support a federal gas tax on the infrastructure deal, because that actually hurts the poor people the most. And he figured he better buy cover for himself first.

The problem here is that basically, our so called leaders have been put band aids on the problems for the last 20 years, while the paper cut grew to a point that it’s almost like a limb has been hacked off. The same geniuses continue to apply the same band aid. And here we are, waging war on the “rich”

RightNYer,

The more major issue than wealth inequality itself is that when proper market competition doesn’t exist, companies can rip you off, costing you alot, but they themselves only make slightly more (most of the time). This is the major reason for skyrocketing inflation in America and elsewhere.

Easy credit bidding up the price of housing is a major factor as well. There is also the fact that commodities markets can be rigged. Healthcare in America needs to be rebuilt from the base up.

and here comes a 3.5 TRILLION package from the Democrats

courtesy of the fake free rate money from the Fed.

The world is productive enough

The worlds assets are being mismanaged by the ass aspect of the world.

“All the real talent is siphoned off into the Arts and Sciences. That leaves the dregs to put it all together.” -Bucky Fuller

It’s not like we weren’t forewarned. And the is only one way for this type to get richer…MORE business (busy-ness) and more GROWTH….more sales, more consumption.

You didn’t listen to us hippies…..or our heroes.

I think that our production is fine, it’s just who gets the benefit. To much of the benefit goes increasingly to the few at the of the food chain.

Exactly correct and by design.Break the unions,yep.Let lots of immigrants and invaders in to depress wages,yep.Tax law to benefit alreadywealthy,yep.Cut I.r.s. Enforcement so they are tight on resources and cant prosecute an intricate,lengthy case afainst a tax evading/shelter-abusing millionaire/billionaire,yep.Allow criminal ceos to not only stay free but collect millions in bonuses/salary though the bank or co. Is gutted,yep.Bailins,yep.Stock buybacks possible because banker fiends loan co.$ at 0%,yep.Wealth inequality and reasons behind it arekey.

I do fear that our debt as a nation will be the end of us. There is zero reason the United States or any other developed country that has not suffered some kind of terrible disaster or the effects of war should have debt. Neither should most middle-class households not having had some kind of unfortunate medical/financial emergency.

It’s a cultural and societal problem. In short, we’ve been fools that got comfortable. I don’t imagine anything will change unless something very, very, very difficult causes us to process our mistakes.

Turtle: Sanders and AOC will not be thought of fondly, if their strong left partisan agenda now on the table passes without too much adjustment. Although in that case, Sanders may well be dead before the consequences actually strike – if so, he won’t know how he is being thought of or remembered.

Yeah, as a great people, we probably still do miss the good old days when all we had to do to increase our standard of living was kill more Indians….was much easier than learning investing or starting a business I bet.

It was hard to finally run out of that resource……and the especially the feeling of exceptionalism that went with it. At least they all got to live forever in heaven, and as tough as it seems nowadays, we will too.

Cheer up.

NBay-i’m grinning, kemosabe…

may we all find a better day.

And yet UST yields and gold barely moves…

It jumped from 1.25% Tuesday morning to 1.42% today.

at the moment bonds are still low, maybe they are still more scare of deflation than inflation

I guess people still trust in government honesty.

Lying SOS Daly got no love today with his polyanna-isms. I think folks are finally waking up to the reality that this inflation will not be transitory, and the Fed is either stupid, or lying.

Do you think the unspoken policy here is to devalue the National Debt, like we did in 70s and 80s? Of course, current and recent spending policy out of Washington seems intent on counteracting such a strategy, if it exists, but of course the Fed has no control over that. Perhaps the strategy to devalue all existing debt generally, which would of course benefit not only governments at various levels, but corporations, and the ultra rich? What is the strategy?

Yes, I think there is some of that.

With an average maturity of 65 months I don’t see how they can get ahead of the curve even if they weren’t adding new trillions on a yearly basis.

Could this be the start of hyperinflation?

No. Just normal big inflation. That’s bad enough.

Hyperinflation is a relative term. The five countries with the highest inflation range from 51% for Iran to 200,000% for Venezuela (an anomaly). Zimbawe is second with 162%. That’s clearly hyperinflation. But Wolf is correct…what we’re experiencing is bad enough. Just take your current annual expenditure (representing your current lifestyle) and extrapolate it out 20 years at a 9% compound annual inflation rate. It will quickly become apparent how devastating even single-digit inflation can be.

You don’t even need hyperinflation. The way the math works most of the damage is done in the high inflation years up to hyperinflation anyway. How much wealth is left after the following five year inflation run 7%, 9%, 12%, 15%, 20% ? By this time half your wealth is gone.

Tony,

Wack a mole inflation is what is in the cards. Some items going up 30 to 40%. Other items not going up at all or going down slightly. Depends a lot on your own personnal situation. If you own your own home like we do and don;t have a mortgage and work from home 85%, and cook mostly at home, and have one personnal vehicle then your inflation impact is not as seriuos as some working class person who has to commute 75 miles a day to their job in the city, has a big mortgage, high family food bills etc.

Living with margin is helpful in every way.

Too bad excess is the norm. Few families need the 3,000 square foot homes they’re buying. I wonder how many two-car families are going to go one-car now that one or both work from home.

BTW, people think you’re struggling when you have one car. It’s hilarious. It’s like, no, I’m a millionaire because I have one car and you’re struggling because you have a car loan.

Tony, Swamp Creature didn’t mention your age, retirement status and health condition as additional relevant factors. If you’re retired on a fixed income and have some persistent health issues, health care inflation alone could dramatically alter your lifestyle…let alone all the other sources of purchasing power erosion. So yeah, it does depend on your individual situation.

Which reminds me, what’s the situation with reverse mortgages these days?

Lots of disappointed heirs…

The debasement of paper currency by people in either elected or unelected positions is a phenomenon as old as humanity.

The US is effectively on our 5th currency (the continental, greenbacks, grey backs, redeemable fed res notes, and now irredeemable fed res notes). I’d suggest figuring out how to have a voice in what type of monetary system comes next, and which is compatible with liberty.

How this ends shouldn’t be a mystery for anyone with access to the internet.

Historical note on currency debasement: most here are familiar with runaway inflation embodied by Zimbabwe and Weimar. I read a disturbing account about the officials orchestrating that. After the fact they were proud of what they did. It was the right thing to do and they congratulated themselves at how well they performed.

A human trait is that self can always be self justified.

Now consider our financial officials with their elite pedigrees, high IQ, intellectual status, dominating personalities and being cheered on by vested interests. Do you suppose they are any different than the blind ignoramuses of Zimbabwe and Weimar? Something for future historians to mull over.

Hi Eferg

great analogy ?X?=?

“history is the history of nations debasing their currency” F A Hayek

Whilst here in the uk. Just this week the cost to repair the fence in my garden is up 10% from last month. Engine oil is up 45% from last year. Home energy costs are up 15% from last year and groceries are up an average of 10% over the last 6 months and that’s with a good dose of shrinkflation thrown in.

As a saver the only thing I can do is spend less money. Oh and by lots of essentials as and when they go on offer.

“buy lots of essentials as and when they go on offer”

Agreed, especially house brands.

I’ve noticed Sherwin Williams keeps texting me but not to with their monthly 30% off coupons. Some products haven’t increased in price technically but practically speaking they have because the regular discounts are hone.

Also, is it just me or does my box of microwave pizza bites have one less?

Grow some food,even vertically indoors.Agitate for community gardens.Superinsulate and hang heavy drapes/tapestries.Bigbuddy portable propane heater or a rocketstove may be helpful.Learn to repair things,wikihow.Barter goods/services with neighbors while setting up a mutualaid network.Eat different,less popular foods.Namaste :-) :-)

We are in the CRACK UP phase of collapse. Isn’t clear as a bell now?

…The problem comes when the government continuously pours more and more money, injecting it into the economy to give it a short-term boost, which eventually triggers a fundamental breakdown in the economy. In their efforts to prevent any downturn in the economy, monetary authorities continue to expand the supply of money and credit at an accelerating pace and avoid turning off the taps of money supply until it is too late…

Sounds about right. I sure hope that isn’t what is going on. But Based on what I see from my view of banking I believe lax lending practices are here for everything you may want. RV, Boat, 4-wheel etc..

Don’t anyone worry….the Bureau of Labor is working nights and weekends to ensure the inflation does not affect us. The substitutes they have arrived at thus far are:

1. Used car prices to Mule pricing. For those that want luxury…..horses. Some of the boys were opposed due to hay costing more that gasoline.

2. Home pricing……to tents. One of my sons reports the Afghans live in hovels made of buffalo chips…..but the boys at labor have not picked up on that one quality improvement yet.

3. Food…….MRE’s made for the army in 1975. Your choice of delicious menu items such as green eggs and yellow bacon, deep fried green jello salsa or brown orange jam.

4. For those that enjoy electric air conditioning…….you’ll be issued a dog tread mill attached to a generator. What does your dog have to do anyway.

….the lights are still burning so more great ideas on the way.

Regarding MREs, you forgot the bean component ..

Funny you should mention lighting, as the book I’m reading is about the early modern period western societies (15th to late 18th centuries, generally) where illumination was produced by candle, torch, oil lamp, bonfire or even moonlight – pre electrification. Facinating history, that! Things could go there again, you know ..

Maybe inflation is already being hedonically adjusted for the light output of our light emitting sources… Does that actually happen..?

Would be particularly amusing if that were so, given that some hospitality venue employing the older versions of light sources will likely charge you a premium for enjoying them…

Just to be militarily correct, the MRE did not circulate across the spectrum of widely dispersed units until the transition in 1982-83. C-rations were still being consumed with those nasty cans of de-viled eggs packed back in the Nam-era. John Wayne bars continued to rule as the cat’s meow out in the mud. And the P-38 was essential survival gear. Freeze dried meat in a box was a wonder to behold when it arrived…could have even put those blocks under the tires to get out of a hard place. Maybe the Fed heads should pay heed to their value.

Buy-you got to those corrections first, and better. Salut! (Bon appetit?).

may we all find a better day.

But people are paying these prices for items that are completely discretionary like lodging, restaurants, recreation, airfares, apparel etc…. If you look at these surveys everyone agrees that there is inflation but they think that both the economy and especially the job market are the best they have ever been (especially the job market), that wages will catch up if they haven’t already or they can just find another job with a 10% + pay increase.. Both the conference board and umichigan consumer confidence surveys are near their all time record highs respectively

From my perspective, all the essentials of life have become much more expensive , not only in last 6 months but in last 10 years.

Rents have doubled, home prices have doubled, food prices have increased, utility prices have increased quite a lot, gas prices up, cost of education has gone up, medical/insurance etc have gone up yoy.

the inflation is not 5% but much more higher but govt would manipulate the data as much as they can

Wolf, can you dp CPI comparison apples to apples to current CPI to 1970s CPI at the 1970s calculated and included items?

“But people are paying these prices for items that are completely discretionary like …”

Wolf and many of us on this board have gaped in wonder about these buying frenzies we have seen in recent months– where people are so willing to overpay for everything from used cars to houses to building supplies to vacations, etc.

When you sit down and think about it– this is not normal, it is an aberration, given the pandemic, lockdowns, and recession.

Analyst John Rubino has an interesting perspective on this phenomenon that resonates with me: this weird consumer behavior is evidence of a form of mass psychosis permeating through society. Whether through sheer frustration or fear of uncertainty it seems people are opening up their wallets and spending with abandon.

Of course, this trend will revert eventually and that hangover is going to be a doozy.

I don’t understand it either. I can understand, for example, once you realized you’d be working from home a lot, buying a comfortable chair and a larger computer monitor.

But the amount of spending on pure “toys” is really bizarre to me. I’m starting to think that something is wrong with me.

No no RightNYer, you’re plenty sane. Stay as nimble as possiblle and maintain.

RightNYer,

I’m the poster child for buying new toys. Motorbike, turntable, car, bike and sub woofers all in the last year and a half. I spent a fair bit, tried to get the best value, and other than the bike, came nowhere near the top-end in terms of price that could be spent.

Why does this matter? For me, these are things I enjoy using and use often. They increase my quality of life. Did I need any of them? Hell no. Did I already have all of the above toys? Yes.

But as the purchasing power of the dollar gets shredded, in large part due to the actions of the Fed and Uncle Sam’s debt which influences the Fed’s actions, my spending spree looks better and smarter to me. Better because I could sell my car for more than I paid for it 14 months ago (which I will not do). And better because none of the other toys are less expensive now, nor will they be in the future. In the mean time, I get to use and enjoy them.

In the end, it comes down to affordability. As I’ve commented, my dad taught me, “Son, if you can’t pay for it, you can’t afford it.” I could afford my toys, no problem, thankfully.

“Just normal big inflation. That’s bad enough.” is what people see on the horizon, and it is influencing people’s decisions to buy sooner rather than later.

The psychology behind this is quite interesting. Maybe people spend more during uncertain times as a way to have some control in an otherwise uncontrollable situation? Or maybe they have just given up?

“nor will they be in the future” – my bet is that craigslist and ebay will fill up with stuff bought during this frenzy by this time next year. One way or another we are going to have a crash and all this ‘stuff’ will be on a huge discount.

Those in the stock market have made a ton…

and they are spending before they sell anything…

usually a mistake…

Just wait until most of these people empty their bank account or can’t pay their rent, mortgage or student loan. It won’t be their fault and there will be calls for more stimulus and UBI.

Delusional and ignorant in spades!! :-)

Jerome Powell “Inflation is not a problem for this time as near as I can figure. Right now, M2 [money supply] does not really have important implications. It is something we have to unlearn.” Jerome Powell, Chairman of the Federal Reserve.”

M2 doesn’t represent means-of-payment money. The correlation between transaction deposits and inflation is perfect. It hit a new high in June. Inflation is not transitory.

M2 has not or ever tracked CPI inflation for any recent period of time.

The reason for this inflation is because people are willing to pay these higher prices for items that are entirely discretionary like restaurants and new /used cars along with the weekend warriors shelling out whatever for those UTVs abd and jetskis along with the God awful Thule cylindrical things that people put on top of SUVs – – – how much stuff does someone need whentthey travel by car

Powell explains it away…

we have to ‘unlearn’. He “unlearned” the Fed mission statement and the agreements/instructions/mandates that ALLOW their existence.

new Fed mission statement

“It is the Federal Reserve’s actions, as a central bank, to achieve these goals specified by Congress: promote unemployment by providing cheap money to the federal government to dole out and encourage idleness, promote inflation, punish savers and holders of dollars, and promote record low long term interest rates so as to facilitate the pulling of wealth forward from the future generations of the United States””

I’d like to hear the pros of modest deflation over modest inflation. What would that do to our economy? Where would that put us compared to competitor countries?

No takers? No one wants to explain the benefits of day 2 to 5% deflation vs 2 to 5% inflation, either as to the country as a system or as to the country vs it’s competitor countries?

I’m not economist, but from what I have read, deflation is the bigger boogieman for the economy. This is because spending dries up and since economies operate on the trickle up principle, well you know what happens next.

During deflation people are waiting for prices to drop before spending their money. If enough people wait and don’t spend money (waiting for better prices), it’s a massive downward spiral and the economy severely contracts.

In contrast, 10% annual inflation while rather unpleasant for the consumer class is far more palatable the John Galt’s of the world because in an inflationary environment, life goes on. With deflation, life might not go on since few people are spending money and the economy seriously contracts as a result.

You don’t want inflation or deflation. You want stable prices.

makruger,

A little bit of inflation followed by a little bit of deflation works just fine. That is true price stability. No problem. No one wants an extreme of either one. Try to keep it to zero, go over a little, go under a little.

The BIS published an interesting report in 2012 (?) about the influence of deflation on the economy. They researched 150 years (or so) data from many countries worldwide. The conclusion was very clear: There is no historical evidence that CPI deflation hurts the economy.

The reason many people think that deflation is bad is because of the experience in The Great Depression, where deflation was a symptom (not cause) of the collapse of a massive asset bubble and the collapse of the banking system. A similar thing happened during the GFC.

So the danger to the economy is not mild CPI deflation but collapsing asset bubbles. And since asset bubbles always collapse eventually, central bank policies should therefore be aimed at preventing the formation of asset bubbles.

This was a report by the BIS, the central bank of central banks!

This conventional economic deflation claim is mostly a strawman argument. The idea that people defer most expenditures due to falling prices is ridiculous. Many or most people will do this for big ticket expenditures (a home or car) and some things they don’t have to have but mostly, there is no reason to believe it. Can’t be proved though since the government continually debases the currency.

Consistent deflation with falling wages would make it more difficult for most people to service their debts.

Wasn’t the time in the U.S. after CW and before WWI steadily deflationary? A lot of growth and innovation then.

The growth and innovation were in technology and related areas but there were long periods of massive economic depression, high unemployment and really low farm prices that badly hurt ordinary people.

Ever watch those picker/ antique shows? It is common for vending machines up to the 1950’s to have the price cast into the metal. There was zero expectation of inflation.

All the wealth in America is held by the boomers and retirees. Deflation would be a godsend for them. If the people live long enough their annuities will put them out on the street will all the rest of the homeless as inflation ravages their fixed income annuities.

Hi The Real Tony

Are u talking about the Hordes of The Aged that we were warned would devour our world ??

Deflation….

a myth. Where, when …..ever?

Reductions in inflation pointed to as deflation…..nope.

Even down ticks in prices are not “deflation” anymore than a down month in stocks makes a bear market.

I thought the Fed’s Plan for this increase in Inflation was to start bringing down the massive US debt – when ?! The only thing this is doing is killing off the Working Man and Woman’s chances of affording their quality of Life

M

I don’t think they planned for this inflation. I think they wanted to cruise along at the same old 2% but they screwed up massively and now they’re in a ba** vice.

You can’t play with inflation and deflation is even worse.

Many have compared today’s inflation to the 1970’s. Future historians can debate this. But point of view makes a big difference. In 1969 I was a brand new college grad starting a job as a chemical engineer. Breezed through the 1970’s as salary kept up or exceeded inflation. Watched prices go up, but so what.

Fast forward 50 years and I am retired and modestly comfortable – but on a very fixed income. This time inflation is going to be cutting into my standard of living. Guess what – I am a lot more concerned this time.

Eferg,

We’re in the same boat. The wife and I are saving furiously, but not money — things. Stocking up on nonperishable foods, silver, etc.

It’s pretty cold in SF now, so I am burning my dollar bills to keep myself warm.

Everyone will end up just like Micheal Jackson who used to burn thousand dollar bills for fun.

The things they do to stay on the front pages.

“Hey, woow, I’m Michael Jackson & look what I can do.”

It takes all day to thing it up you know.

Oh, C’mon man! Couldn’t you utilize human chips instead? You know, improve the local ambiance by doing your civic duty and staying warm at the same time (Yeah, I get that SF ain’t the Prairie, but still..) Perhaps you could market that uh, ‘concept’ .. maybe even venture pitch it to ‘ol Lizzy Holmes, giving her a new outlook on life, once she’s paroled of course.

By SF you mean Frisco? And you are cold? Wow. We’re not cold here on Van Isle I guess about a thousand miles (?) north. Who knew?

Nick Kelly,

Burning worthless dollar bills sounds appealing. I’m sitting here wearing four layers: undershirt, long-sleeved t-shirt, sweat shirt, fleece. I heard on the radio that the past two weeks were among the coldest for this time of the year, and it’s always cold in July in San Francisco. My hands have been cold all day! But I refuse to turn on the heater in July. So maybe I should scrounge up some twenties and light them up. I’ll save the 100s bills for later :-]

Couldn’t you just drive over the bridge to Marin to warn up? p:)

The contrast these past days between San Francisco weather and the Central Valley/Sierra Foothills has been extraordinary!

Daughter in SF where it has been in the high 50’s low 60’s wearing sweater, and here in the Sierra Foothills (as has been in the Central Valley) where the thermometer has reached almost record levels of 100+ degrees; reached 110 several days in a row!

At this rate, that may be the best use!

Hm, truthfully when the time comes, I can use them to wipe my behind as well.

Let’s not get too far of ourselves though ;)

Global warming sucks doesn’t it!

1) In the last 10 years the dollar fell 20%, yet deposits

in commercial banks are up from $7T to $17T, peaking @ $17.12

last month.

2) Real M1 up in 10 years from $850B to $7.16T, taking off within a

months, almost $5T, from $2.27T in Jan 2021 to to $7T in Feb 2021.

3) When TLT breached June 2020 low, TLT gap lower between Jan 5 2021

and Jan 6. The selling didn’t stop until mid Mar. TLT rise was stopped by Mar 18 2020 low. TLT in re- distribution, or re-accumulation.

4) TY, US10 Futures price : after a sell off that lasted until early Apr 2021, TY moved up until it reached big red Mar 18 2020 low.

The inflation guff is not going to hold and this article is exhibit A. When purchasing power declines you are technically in deflation, and at first glance, prices rise. Inflation in assets has been going on for years, now it hits main street the end of monetary inflation is at hand. Also the backwash when supply chains and labor equalize. We are going to negative rates, soon, and the Fed isn’t worried because they know the dollar will be last man standing. Even while the purchasing power declines, the forex dollar will rise. (thats the story in yields). The US has to do nothing really,, keep the peace, and they will come out smelling like a rose. Shortage of dollars probably means that EMs will have to adopt crypto. Let them work out the bugs. US consumers are end users. Maybe SDR will provide a bridge.

With zero interest rates and inflation running at 10 percent the dollar will turn to confetti. All Americans will end up poor like what happened in Argentina. The average person won’t even be able to afford a loaf of bread.

‘ When purchasing power declines you are technically in deflation…’

You are inventing a private language. Technically, as in the dictionary definition, deflation is an increase in the purchasing power of the dollar.

The Great Depression is universally known as a period of deflation. The purchasing power of the dollar increased dramatically, to the point where once valuable real estate went for back taxes.

Here is a Canadian example:

In spite of two 5 % wage cuts for a Dominion Civil Servant (Fed Gov) their standard of living rose dramatically due to the increased purchasing power of their dollars.

This was true of the English- speaking world, which did not experience a currency collapse or change. Germany rapidly went through 3 currencies, the hyper- inflated Imperial mark was replaced by the temporary Renten mark at one billion to one in 1923, and it was replaced by the Reichsmark.

Nick Kelly:

“The Great Depression is universally known as a period of deflation.”

“….deflation is an increase in the purchasing power of the dollar.”

Problem during the Great Depression there were no dollars to be found!

I do agree that during mild deflation cycles the purchasing power of the consumer will be done with an “increasing” value of the dollar…..as long as they have the dollars.

What we desperately need now is a period of “austerity” that blankets our whole monetary system. A resort to the “mean”. Mildly.

We had a chance to right the ship in ’08-’09 but financial/political cowardice reigned.

“When purchasing power declines you are technically in deflation, ”

Disagree. Explain how higher prices is deflation.

The result of dilution of a paper asset is lower value. You notice when a company issues more stock, that the value often rises, when institutional investors feel they can own a stock without worrying about being caught with no exit. The rules on the way up are different than the rules on the way down. On the way up you dilute the asset and the price rises, on the way down you shrink the asset and the price falls. All technologies when overheated reverse in this fashion. The catalyst in this instance is crypto currency, which destroys the stored value of money. Investors aren’t buying stocks, they are dumping dollars. Two long term trends, loss of purchasing power in the underlying, and exogenous threat to the concept of money as wealth. The reversal isn’t an instant in time, but the gradual if sudden awareness that things have changed. The Fed isn’t worried about inflation. There are two things there, the exit from monetary policy (liquidity only serves to place a bid under the market, and is inflationary) and the adoption of fiscal policy, which is what they did in the 30s.

Will being Woke be satisfying enough for the electorate or will they demand more stemmie fiat. This is the main thing on the table in DC at the moment. I think that “the people” will opt for more free fiat . There is a quote from an old dead white guy named Ben Franklin that warns of mob rule “democracy” displacing our constitutional republic . The warning is simple. The republic will fall when the mob and their mouth piece , the politician, figures out how to help themselves to the treasury of the republic . Old Ben also knew the protection sound money offers against the bankers debt notes such as the federal reserve note . Hey, the guy tried to warn us and he even took the time of operating a quill pen to put it on paper .Get ready for less and less with anethesising Fed hedonic ointment liberally applied. The old Bard gave us the mantra. Neither a lender nor a borrower you be.

“Vote for Warnock and Ossoff and we’ll give you $2,000 right away!”

What a despicable human being.

And they only got $1400 out of it!

(Hey, at least I got to use to cash to buy a couple dozen more oz of PMs.)

So PBS has an episode of “Frontline” on tonight entitled “The Power of the Fed”. It proposes that the Fed has been captured by Wall Street and is creating dangerous asset bubbles. Jeremy Grantham characterizes what the Fed has created on Wall Street as a “giant bloodsucker,” that is “sucking more than twice the blood out of the rest of the economy.” Might be worth checking out tonight.

Captured???

There are dozens of youtube videos of Fed presidents and chairperson testifying in front of congress in 2021.

Go watch a few.

A softball Kumbayah love fest.

Oooh interesting! Might take a peek at that. Surprised they’re letting that air ?

Well Wolf, not to worry, because the Second Coming of COVID is upon us.

Saw a bunch of new cases of COVID type pneumonia come in thru the ER in the last few days. Younger people, in their 20s to 50s.

I figured this was coming, a week after the big 4th of July holiday, all the masking mandates removed, people gathering and traveling like the pandemic was over.

It’s not over. It’s back

Just curious, but were these cases of un-vaccinated people? And what part of the globe are we talking?

Anthony A.,

If I remember right, Gandalf said that he practices in a big metro area in Texas.

Yes they were unvaccinated. If they were vaccinated and got Covid, it would be proof the vaccine doesn’t work. It does work.

The part of the globe is the US, mostly the South. There are lots of places on the globe that want the vaccines but can’t afford them. There aren’t many where they are available and not wanted. One state, Tennessee, just fired the doctor in charge of ALL vaccinations. Are they going back to a pre- science era?

Dr. Jenner is the inventor of vaccines. He noted that milkmaids almost always got cowpox, a much milder, nonscarring disease, but didn’t get smallpox. So he induced cowpox into an eight year old boy, who became immune to smallpox. When was this? In May 1796. It took a while but today smallpox no longer exists.

If folks want to believe the earth is 5000 years old, so what?

(After all. it could have been created to look ancient! ) But this science denial is out of hand, and endangers everyone because the unvaccinated are a breeding ground for variants. Guess where the majority of the new Delta cases are? The virus adapts but the victims don’t.

If someone believes science is just a belief system, why would they get on an airliner and be whisked along at 500 mph at 30,00 ft. where it’s 40 below and you can’t breath the air?

If an anti-vaxxer buys a puppy does he ask if it’s had its shots?

Anthony A. (and others)

According to this morning’s NYT, 7-14-21 Covid stats cases are up 105% as of today.

Arkansas and Louisiana charts look pretty concerning right now. The US overall is starting to trend up. I don’t see how we can avoid spiking bad like the UK considering how vaccinated they are. Delta + Unvaccinated People = Uh oh.

But, but, what about all the vaccinations and herd immunity?

If the ‘second coming of COVID’ as you put it means enforcing more draconian lockdowns and restrictions on people as per 2020 then the economy will enter a final tailspin that even unlimited trillions of dollars won’t stop.

But, but, what if people AREN’T getting vaccinated. That is the whole point and premise.

There is a very recent book out that describes a lot of this: ‘The Death of Expertise’

When you are in an airliner approaching descent, do you want the captain to poll the passengers on flaps, throttle, rate of descent etc.? Or do you rely on his expertise?

Now compare the training of an airline pilot to the training of the scientists studying Covid-19 and X variants and creating vaccines. Nearing 30 yo. usually with a doctorate in something like micro-biology, they have been in school most of their lives. They’re not GPs, many aren’t MDs, they couldn’t deliver a baby. It’s not their expertise. But folks want a half- hour splainer, a condensation.

As for the economy, if people had listened to the experts instead of rabble rousers trying to get elected, it wouldn’t be necessary to chose between lockdowns and business. But if a choice must be made, ask a guy being in-tubed in the ICU if he’s worried about his portfolio. Being really, really sick gives one a sense of priorities.

Masks indoors are mandated in Los Angeles again.

Suppose the economy is affected by a Delta-caused COVID surge.

How will that affect Mr. Powell’s thinking about thinking?

Sounds something like the Spanish Flu of 1918/1919. Took out a lot of young people in their 30s including my Grandpa in 1919. He was 30.

Let’s just say I live in a very large Republican controlled state whose governor lifted all mask mandates four months ago, and where EVERYTHING has opened up – bars, movie theaters, restaurants, etc.

The vaccination rate statewide is about 42%, which is about the same rate as the metropolitan area of my practice.

Yes, vaccines DO PROTECT PEOPLE. Not 100%, but if you are vaccinated and continue to take precautions with masks and do not go to closed gatherings with large numbers of people vocalizing (that lethal combination has been shown to be absolutely the best way to spread lots of the virus into the air to other people), you will be pretty close to being protected 100%.

Lots of stats and data have been coming in about this, and something like over 90% of the NEW TESTED POSITIVE cases of COVID are in the un-vaccinated. Over 99% of the severe cases of COVID, the ones who are not only +COVID, but are severely ill enough to require hospitalization, are UN-VACCINATED.

I got vaccinated with the Pfizer vaccine back in February and early March of 2021, in the early group of doses given out to healthcare workers. The vaccine was available through our hospital system as early as mid-December 2020. I waited about two months to get some more info to see if anybody got any bad reactions from this and then got vaccinated. Yep, I did get a reaction to this vaccine, but it went away and I’m glad I got it.

So, at 42% vaccination rates, my state is no where near herd immunity, which would probably occur at 60-70% vaccination rates. Some states, generally the smaller Democrat controlled ones, do have such high rates of vaccination rates. They are and will do fine.

The numbers of new COVID cases I’m seeing now are about what it was like in April and May of 2020, when COVID was starting to spike and spread across the nations.

Welcome to COVID Hell, Part Deux.

P.S., in case any of you are wondering why I threw in the bits about Republican and Democrat affiliation and the COVID pandemic, there have been lots of surveys/polls which have shown a vast chasm in beliefs and willingness to get vaccinated between people who identify as Democrats vs people who identify as Republicans, with the great majority of Democrats believing in the vaccines and willing to get them, and the great majority of Republicans NOT trusting the vaccines and unwilling to get them.

Gandalf,

I think it was a colossal screw-up by the Trump administration to not call the vaccines the “Trump vaccines.” They completely dropped the ball on it. This was a huge thing that administration got right. And they blew it and didn’t take credit for it. Vaccinations rates would be 80% by now.

You meant, 20 and 21 presumably.

By the way, just how severe are the cases from variant D, and L? (I think it’s L for Lamda right, or are we at E for Epsilon) Totally lost track on this one.

I have heard over and over again how easily it spreads, but for all that, not a single word on effects. I would be curious to know from someone who is actually practicing medicine (like yourself) and presumably has first hand experience on how dangerous the current variant is in terms of health. I mean are we talking common cold level of symptoms, or are we talking MERS/SARS level of threat?

MCH,

Read what Gandalf said. He describes the symptoms that the patients have that show up in the hospital. People that show up in the hospital are really sick. From the data coming out of Los Angeles County (I’m on their email list), 99.4% of the hospitalized cases are un-vaccinated, with 80% being under 50. If vaccinated people get infected at all, the symptoms are mild.

Wolf,

I have read what he said; the one phrase that was of note:

” COVID type pneumonia” And that they came through the ER.

Was there something else?

Trying to understand the severity here, are a majority of these put on the ventilator, given some anti-virals (Remdesivir), sent home with a pat on the head? Context would be actually useful. Cause how many people go into the ER everyday, and they come right back out? This is an honest question, cause I have no idea. Do you, when you read those lines?

In terms of LA county, I’d be curious about the stats behind the numbers. Because if I look up the local news, it says about 376 people hospitalized, then it says about 1000 new cases per day for the fifth day in a roll. So, that’s 5000 cases, 376 hospitalized, means about 7.5%. So, let’s assume 100% hospitalized are unvaccinated, and let’s assume all the rest, 92.5% are sent home. I’m now really curious what percentage of those sent home are vaccinated, and which are unvaccinated.

There is all sorts of useful statistics and information. But you don’t get that from a generality like “bunch of new cases.” Specifics like, we’ve seen about 100+ patients over the course of the last three days in ER. That’s useful right?

MCH,

In terms of LA county, for example:

This from the July 12 email:

Over 99% of the COVID-19 cases, hospitalizations and deaths we are seeing are among unvaccinated individuals. Of the cases reported today, nearly 87% were under 50 years old. The COVID-19 vaccines are the most effective and important tool to reduce COVID-19 transmission and the spread of variants like the highly transmissible Delta variant. Getting fully vaccinated is the way we protect you, your family and our community from COVID-19 and the Delta variant.

……….

This came into my inbox on July 10:

COVID-19 Transmission Increase Among Unvaccinated Younger People

8 New Deaths and 1,094 New Confirmed Cases of COVID-19 in Los Angeles County

Transmission of COVID-19 in L.A. County is increasing among younger unvaccinated L.A. County residents. Of the 1,094 new cases of COVID-19 reported by the Los Angeles County Department of Public Health (Public Health) today, 83% are among people under the age of 50 years old with the highest number of new cases among residents between the ages of 18 and 49 years old with 70% of new cases.