If these sentiments become reality over time, it’s going to be a sea change for demand and supply at these crazy prices.

By Wolf Richter for WOLF STREET.

So just briefly: This explains some of the dynamics we have seen in the housing market recently, with mortgage applications, sales of existing homes, and sales of new single-family houses dropping for months even as investors have piled into the market and as inventories have started to rise.

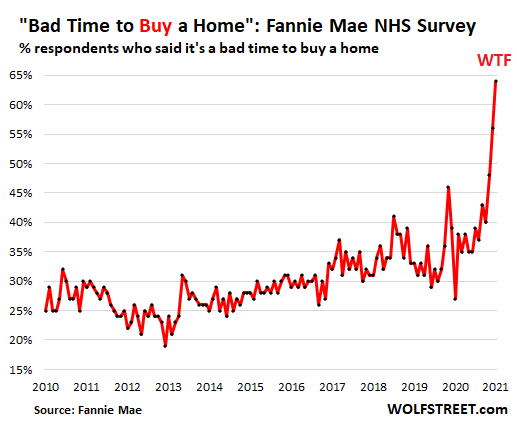

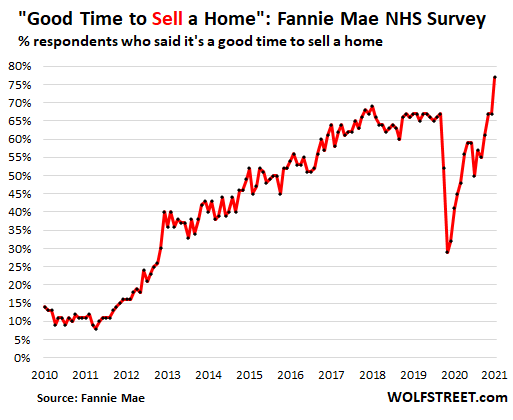

Fannie Mae has been conducting its National Housing Survey monthly since 2010, one of the data collection efforts to come out of the Housing Bust. The survey covers a range of housing-related topics. And in its survey for June – conducted between June 1 and June 24 and released on Wednesday – there are record trend changes in consumers attitudes about whether it’s “a good time to buy a home,” or “a bad time to buy a home,” or “good time to sell a home,” or “a bad time to sell a home.” And you know what’s coming.

The percentage who said that it was a “bad time to buy a home” spiked over the past three months from record to record and in June hit 64%. Consumers cited home prices as the predominant reason.

A record low 32% of the respondents said that it was still a good time to buy a home, while the percentage of fence-sitters who didn’t know dropped to 4%.

“While all surveyed segments have expressed greater negativity toward homebuying over the last few months, renters who say they are planning to buy a home in the next few years have demonstrated an even steeper decline in homebuying sentiment than homeowners,” according to Fannie Mae’s press release.

“It’s likely that affordability concerns are more greatly affecting those who aspire to be first-time homeowners than other consumer segments who have already established homeownership,” the report said.

But it’s a great time to sell a home.

The percentage of respondents who said that it was a “good time to sell a home” spiked to a record of 77%:

Conversely, only 15% of the respondents said it was a “bad time to sell,” and 7% didn’t know.

During the Housing Bust in 2010 and 2011, when prices were low, fewer than 15% of the respondents said that it was a good time to sell. Folks know when homes are priced right to buy and when pricing is ridiculously out of whack for buyers but ideal for sellers, and when it’s time to sell.

But each of these insightful and motivated sellers eager to cash out at these ridiculous prices must find a buyer of the opposite persuasion who thinks they’re getting a deal, which is what makes a market. As the market moves forward, with nearly two-thirds of the people thinking that now is a bad time to buy a home, all these sellers have some explaining to do.

If these sentiments play out in reality, future demand by potential buyers at these crazy prices will be weak; and future supply of homes that sellers want to cash out of at these crazy prices will come out of the woodwork.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

According to comments here supply is so high this should have no affect.

…and yet every kpi disagrees with that sentiment.

Housing is pro cyclical. Stock market valuations are exceeding 4 sigma on some valuation measures which implies a more than 1 in 100 year event.

House prices increase have a averaged 3.8% last 25 years. We are at a out 4X that number.

Real economic growth is expected to be 1% next 10 years.

SP500 yield and 10 year yield both at 1.3%, both highly negative in real terms.

All money market funds going to be backed by the Fed as banks can’t hold them without losing money.

We are getting close to something blowing.

As long as it isn’t my aorta, I will be fine.

Amen. I think that most Americans are starting to recognize the numerous bubbles, which means that they cannot keep growing. Moreover, the requirements for Jumbo loans and other limits, e.g., the massive, overuse of margin to purchase stock which cannot continue to be increased when brokers are beginning to anticipate a market “correction,” mean that the bubbles will start to blow up.

The overuse of margin creates a potential for the market to collapse, like the potential energy locked in the ice on a mountain before an avalanche. The end of the eviction moratorium, upcoming bankruptcies of more firms, requirements that mortgage/credit payments be resumed, end of extended unemployment benefits, federal debt limit battle which may result in less government stimulus, the billionaires’ “Federal” Reserve banking cartel’s reduction of liquidity, etc., mean that there is not enough steam for the stock market to keep increasing or even to hold.

I predict a stock market crash sooner or later this year due to the overuse of margin and leverage not just by stock investors but by many companies that could just barely issue investment-grade bonds when times were good, whose bonds will become junk bonds now. My panicked cattle stampede theory of the stock market, as opposed to the erroneous, efficient markets theory, predicts that panic will grip investors are more companies are unable to pay their current liabilities and become insolvent or at best, issue junk bonds at huge interest rates.

The resulting market “corrections” will force brokers to make more and more margin calls, which cannot be satisfied by indebted investors, because the historic low margins (which are like down payments paid for securities) currently being paid for stocks are at historically low levels for too many stocks, versus the huge amount of debt borrowed from brokers used to buy the stocks. That will cause more “corrections” as brokers have to sell the stock that foolish overindebted investors had bought on margin.

E.g., many who own $1 million in stocks, after paying a margin of $200,000 to their broker for the purchase, may not be able to come over and pay their broker lender $200,000, more to keep the stocks with the same margin, if the stock went down 20%. Therefore, those stocks that were held by using margin will have to be sold by their brokers to mitigate damages, which will trigger another correction and thus, other margin calls by other brokers.

Have you seen the trend that was probably started way before Tesla. Companies just keep minting and printing stocks no matter what and the voracious apatite of Wall Street to mop them up. AMC, GameStop, Royal Caribbean, Carnival…

Nathan: that may not continue as stock prices collapse and people are afraid of losing their shirts. I cannot speak as to Tesla and its ludicrous, irrational, PE ratio.

Its “investors” may be more accurately called cultists, despite Mr. Musk having many great ideas and follow through but odd judgement. Transferring its technology to the CCP by setting up there was the height of naivete.

Next, he should have MS 13 assemble his cars. They are less likely to steal from Tesla than the CCP.

more homes coming on the market in the coming 2 months will finally start to move the housing market toward a point of more balance. i think that next year is when things get real ugly, as prices start to fall, the desire to invest in real estate is going to be shattered.

As long as the government and federal reserve support low interest rates and addition of money into the system, home prices will remain high.

Hahahahahahahahaha!!!!!! It’s a great time to buy a home!!!! Clearly, I have created the greatest economy EVER!!!!!! Why wouldn’t you pay hundreds of thousands to get a mortgage at over 150% of the rental value!!! What fool would reject this!!!!!!!!!!!!!!!!!

St Louis Fed has a research paper out saying nationwide house prices are 30% above their long term price to rent value. It looks like a good methodology. Rents going up or house prices coming down or some combo of the two.

i question rents going up here, as so many more people are out of the work force. once the stimmie money and unemployment run out, there will be many people who just cant pay the rent, many other people who get dumped off forebearance.

So why inventory is still very low? Why sellers not opening up their houses for Open House? Is it still Covid?

Inventory has been climbing little by little. This is already underway.

Didn’t you report recently, many potential sellers were holding their second homes (in lieu of selling) ,to basically used the inflated home price valuations as cash ATM’s via HELOC’s, etc?

With recent trends, are we expecting to see a glut of these homes entering the market?

Because sellers still need to live somewhere.

Thanks J-Pow I sold my house for $100k more then market value. I will rent for a year or so. This time is not different, prices will adjust to real prices soon.

If sellers think prices are inflated, the smartest of them will be eager to put price reductions in place, which will drive prices down. Once prices start dropping, the chance to cash out at these levels will be gone for decades. Prices tend drop quickly and silently. Stubborn sellers will follow the market down – perhaps. all the way down.

This time is not different, prices will adjust to real prices soon. And harm the banks? No way. They will convert underwater mortgages to a lease and then the owner/ leaser will give up all future equity. Remember, you will own nothing and be happy!

As 30+ year Realtor, I can tell you there is no such thing as selling your house more than the market value. Where did that idea come from?

My friend is in process of selling her modest second home. She improved it with sweat equity and upgrades. If deal closes it’s going to net out 50% before cap gains on 15 month flip. She loves the place, but market is so hot she stuck a big price on it to see if it would sell. Took about a week. No realtor used on purchase or sell.

Seen on FT boards;

“Long term, the 40,000,000 homes owned by Boomers will start flooding the market as that generation begins to pass away. Their children and grandchild, now saddled with heavy debt, will need to sell those houses but the glut of homes will push long term housing into a long term crisis. ”

Demographics is destiny; the Boomers are dying.

Nah, when the Boomers die the kids can move out of the basement and into the master bedroom.

Until the kids find out the parents had a reverse mortgage and somebody else owns the house now.

Or, the heirs find out their parents had the house highly leveraged (HELOCs and other equity extraction) and its market value is under water in a (coming) housing decline. The elderly owners needed cash to pay bills and health expenses.

Using a house as an ATM for cash today means a poorer tomorrow as the winds of change blow harsh.

if they can afford the real estate taxes….which are being ramped up by this loose Fed polilcy.

Exactly!

This is the cost no one, media, politicians, RE agents, etc wants to talk about.

My RE taxes have more than doubled in the past 10 years, to the point where they are almost $1000/month, and more than my mortgage payments.

This is the kind of thing CA’s Prop 13 was supposed to stop. I do not live in CA, but I can see this type of tax reform becoming a need nationwide as owners of single family residences are forced out of their homes. Paying tax on a valuation that does not exist until the property is actually sold (and on which you also (hopefully) have to pay a Capitol Gains Tax, should be limited to the actual valuation (that of the last purchase price).

Yep…the “Wealth Effect” from rising home values is of little consolation if the actual cash flow from owning and maintaining that home (all at inflated costs) is robbing you blind.

Wolf, is SALT/real estate tax increases a national phenomenon, or is it limited to coastal cities with high real estate tax?

It would be interesting to see how much it’s affecting real estate markets.

So Ben Bernanke, can we all solemnly proclaim R.I.P. to your Wealth Effect, aka Smoke & Mirrors?

+1000

If interest rates are negative enough it will make sense for investors to buy these homes and keep them off the market. This will ensure prices and rents do not collapse. This price stability will make storing money in these empty homes a safe bet. This is already happening in places like central London where property taxes are virtually non existent.

The fed will say this is acceptable because of all the loans secured against notional equity values – that if there was sustained downward pressure on prices the stability of the financial system would be under threat. That and wealth effect.

The system is screwed. Once govt and fed allowed stupid non productive endeavours such as crypto to suck up real resources it was clear they don’t care about the quality of economic output. We’ll all be repeatedly smashing windows then repairing them soon so the govt can claim record GDP numbers.

“stupid non productive endeavors such as crypto…” I believe this is what they said about the Internet way back when. Crypto is comparatively still in its infancy as far as integration and utility. Give it another 10 years and then get back to me. Sure, there will be 10s of 1000s of crapcoins that disappear, but so did Pets.com and many other useless websites during the dot.com bust, while Amazon and Priceline survived to take over the market.

But even if some crypto ends up being a good store of value or “investment,” that doesn’t change the fact that it’s non-productive.

Crypto is all about getting into the ponzi early. I bought into Million coin last week at $3 and sold at $17.

There aren’t any other use cases. Everything in crypto is ponzinomics.

There’s nothing wrong with that either since Millennials are getting the short end of the stick with the fiat ponzi, so they made their own game.

Pets.com, unlike Bitcoin, had a real life use case.

The “Wealth Effect” (textbook/oversimplified version) is supposed to work like this:

1. Fed keeps interest rates low

2. loans become attractive= money borrowed

3. borrowed money put to work in the real economy (workers share in the wealth)

Step 2-3 is the transmission mechanism. This does NOT work when the labor market is destroyed/damaged by globalizing labor rates. The (wealthy) people and corporations put the money into financial assets instead.

Money velocity tanks, real wages tank, etc.

The purpose didn’t start out to be that the wealthier people get more wealth, but after about 30 years of this (at least 10 years), you would think the Fed eggheads would 1. figure it out and 2. recognize the unethical system they had constructed.

Remember- Bernanke said there wasn’t any problem right before the 2008 crash. These guys aren’t as smart as we or they think.

Typically, older folks sell the big house after the kids move out and move to a smaller house or condo. This is for a generation of 20+ years over a 30+ selling window in their older years.

I have seen no data showing some huge tidal wave. It will be a slow and low ripple.

“Demographics is destiny; the Boomers are dying.”

For empty nest boomers ‘aging in place’ is the byword for now– stay as long in house as they can before moving to condos, assisted living facilities or nursing home.

Aging in place might be manageable unless their house is too big and expensive to heat/cool, maintain and clean (and property taxes are still affordable).

If gray-haired mom and dad are stuck in such a money pit house (and there are many such places that oldsters live in) then they are likely to downsize and move sooner than later– adding to inventory (hurrah).

As Wolf says, this demographic shift won’t happen overnight. But it is happening now and will accelerate quickly as seniors get older and more frail every year.

Yup H, ya nailed it:

Got to be too much to mow the pastures/meadows and weed eat a mile of fence,,, and the very elderly parents needed a ton of help to ”age in place” …

Now coming to a home much nearer for us,,, and the wise woman said to buy a small home,, and we were lucky to get into such in a really good hood near her parents,, about half of the last place we had built with our own hands.

IMHO, after watching RE mkts since 1950s, the coming shake out will be worse than any since the 1930s,, so feeling blessed to be in a state with absolute cap on property taxes, lots of help for elderly and vets,,, although they keep on adding ”fees” so continuing to wonder if anywhere is safe..

As others on here have commented more than once,,, ya really do not “OWN” real property anywhere that the local and state and national GUV MINT can add taxes and fees and then take your property if you are unable to pay the piper when they say you must…

Definitely need a constitutional amendment forbidding any GUV MINT from taking property from, at least elderly on fixed SS or other,,, not to mention all folks at least trying to keep up on the merry go round, but not able to grab the brass ring.

Real estate is much more location dependent than demographic dependent. Places that attract people will still be good investments. But places that are losing people will sink like a stone. See IL.

In Texas you can defer property taxes until both you and your spouse die if you are overly 65!

The boomers are just starting their endgame. Give it time.

Yes, but there is a huge lack of supply and willing millennials now with real jobs ready to buy or live in them. The idea that they are all baristas living in the basement is outdated, many have careers, especially the children of the wealthier parents with those houses. It might put the brakes on things but between real inflation and solid demand I doubt there will be any material crash. Also, rates are never going up (I hate to say “never” and might eat that but it seems they have been successful at doing all the wrong things to keep this charade continuing )

Nicko2,

“Demographics is destiny; the Boomers are dying.”

Yes, like everyone else before and after, boomers will eventually die. But they’re now between 55-75. The life expectancy for a 75-year old is another 11 years for men and another 13 years for women, and those are the very oldest boomers. Mid-boomers, now 65 have another 18 years for men and 20 years for women.

People who think that boomers will impact the housing market this year and next year, one way or the other, are delusional.

People who think that demographics in general will impact anything this year or next year are delusional.

Demographics play out over decades, not months, or a year or two.

These guys are hilarious. Right out of 2017.

https://marketmadhouse.com/baby-boomers-blow-real-estate-market/

4 years ago. Stay out of real estate. Prices are going to crater.

55+ now dominates SFH. That trend has been in place for years. It’s been the only group to expand. I think it’s gone from 44% to 54% of home owners.

You’re only seeing the leading edge of the Boomer retirement wave.

Retire-in-place is going big time. If you want a derivative investment try companies that make walk-in tubs and stair escalators.

Five years ago we sold our two story house and bought a smaller single level one nearby in a 55+ community. All the similar 55+ communities near us are full and if a house comes on the market, it is sold in a day. This is what’s happening with boomers around here (North of Houston).

Retire in place, baby!

Mr Wolf

I think this RE series is taking too much energy and bringing too much excitement/anxiety ( depends on where you stand) to a lot of people here.

I think it’s about time to round these articles up with what historicus alluded to in his comment earlier on;

“ the subject of creeping up of taxes imposed on long times owners of property in particular is of great importance”.

The current proletariat faux representatives have planned their MMT along the lines of taxing the ordinary citizens to the hilt “ directly or indirectly “ that shouldn’t become an issue.

But to dig themselves from under the mountain of debt that is increasing in size, the American people have No other choice but to declare the country bankrupt. Something that has happened a few times in the history of the US.

Such a move will allow the country to stabilize its economy, adhere to the norms and force a real change to materialize in the lives of its citizenry.

Many here are familiar with the corporate and individual bankruptcy and the protection that these measures afford them.

This is nothing to be sneezed at, or overlooked. The alternative is a long, painful and lonely road to recovery.

The world at large deserves a better leadership than the bunch of hypocrites that are strangling the daylight out of their populations .

The lip service of the earlier G7 meeting to change the rules around taxing the large corporations will achieve “ NADA”.

If on the very weak chance of implementation of these rules, the NASDAQ will be performing an astonishing dive to match ,if not surpass the Olympic champions, those same champions that’l soon be performing ( without crowds)!

A more salient issue is how many of the 10,000 Boomers that turn 65 every day through 2029 are financially prepared for the next 18+ years…in retirement or otherwise.

Yes, some of those boomers are already sleeping on the sidewalk.

Yes Wolf, the knock-on effects could be significant over time. Have to assume a number of the 65+ year olds who are not financially prepared will come to rely on their kids and/or other family members. That, in turn, will exacerbate the challenges of the “sandwich generation(s).” So it’s not just the seniors who are impacted…it’s a ripple effect. As you well know, some other countries have a lot more experience with this phenomenon than we do in the U.S.

You sound like Harry Dent.

Yep, in the end we are all dying. As Einstein said about his friend Besso dying: “Now he has departed from this strange world a little ahead of me. That signifies nothing. For those of us who believe in physics, the distinction between past, present and future is only a stubbornly persistent illusion.”

But right, Harry Dent has been saying for years how demographics will eventually kill the housing market.

I thought Boomers were just entering retirement, not dying yet? Are my demographics off?

Lead boomers were born in 1945 making them 76. Many aren’t aging well from lifestyle choices.

Many of boomer cohorts, according to the actuarial tables, are into life stages of increased morbidity and mortality– same as for every generational cycle.

We have a very expensive and overdone medical system just to keep these people alive (so many are obese and/or have chronic ‘doctor-managed’ degenerative diseases like diabetes, heart and lung disease, and cancer) for longer than expected.

So, boomers will not die off in droves yet but they are as group pretty fragile and will continue to consume tremendous medical resources until they depart from our contemporary scene. They are not going to be a major factor in housing or other consumer activities going forward.

And yes, I know everyone knows exceptions to this aging norm– Uncle Willie who smoked, drank, and ate mostly Oreos and partied hardy until his 90s (those are outliers).

That will be my que to buy my retirement home. Not quite old enough to be a boomer. Missed it by a few years. Hopefully I can find something modest and on the smaller side.

The millennial are an even larger generation who are in their prime home buying years. They will buy what the boomers are selling.

SoCalJim must be in a state of catatonic shock after reading this.

Quick! .. someone get the defibrillator!, STAT istic!

But, but, but, if house prices fall, and lumber falls, and chip supply improves so more cars can be made and the other stuff falls too as the economy re-establishes a modicum of stability, then horrors! Powell might be right about the transient (“transitory” sounds like Jed Clampett or Bush 2 talking) nature of price inflation.

We can’t let that happen. It destroys the narrative, and the narrative is more important than reality.

I’m still reluctant to pronounce the current inflation in prices as established for the long term, although the introduction of direct fiscal stimulus bothers me a great deal as a new source of inflation.

We just recently came out of a devastating global disruption and in quite a few countries (eg, the UK, which still has mask requirements and social distancing policies) the fat lady is just clearing her throat.

You don’t recover from that smoothly. It takes seconds to fall down the stairs but it can take months or years to recover. I don’t want us to pull a “1937” with a premature victory lap.

“chip supply improves”

Intel says that could take several years. 40% of the price of a new car is in electronics. Things are so bad that the Chicom counterfeit chip scam which has long been a problem has become much worse, particularly in China, but it manages as always to leak outside their borders.

But TSMC disagrees

Michael,

China have other opinions, and can put very tough options on the US,

They only need 2 stray rockets to land close to your favorite chip manufacturer, to send a clear message of who own what.

Do you have the cajones to reply to them forcefully ?!!

( obviously Not you personally)!

There are things that keep me awake at night but that isn’t one of them. They’re still having trouble digesting Hong Kong and they have outright owned it for years.

Japan is saber-rattling about Taiwan. The Chinese aren’t going to risk WW3 over a chip factory.

Workers who are vaxxed can name their price. Where have all the flouters gone? Workers on the sidelines to replace the dead and dying. Am Taliban spreads the Delta Variant. We opened up too quickly again. That is your “1937” premature deescalation.

I agree. We spent a lot of resources on a broken window and did it in an inefficient way. I heard 13 Trillion was the US cost, but whatever it was a lot of resources. The resource cost will have to be paid for slowly with additional Fed easing most likely. It’s a little bit of a mirage, more taxing by financial repression.

Michael Gorback

Inflation can come from many sources but there is one interesting route for the USA that I don’t think many see yet. That, of course, is the large areas of “farmland” in the USA that is not what I would call, farmland. I’m talking about what is really reclaimed desert. If you look in the history books, California and the South-West had a drought that lasted 100 years in the 1600s and another of 50 years in the 1700s. Drought doesn’t have anything to do with man made global warming but just the simple change in direction of winds.

It would be good if the lack of water only lasted two years but huge amounts of food producing areas in the USA depend on man-made water supplies. If something doesn’t change soon, then food prices in the USA will go to the moon and back. It would be wise to keep an eye on it. Oh, and just so you know, England is as green as ever. Now where is my umbrella…

Anthony-would advise you to not get too-certain about steady annual precip in the UK.

Left my native SoCal for good in ’77 in no small part because i foresaw an imported-water crisis (only in terms of the virtually unrestricted growth in a semiarid region, admittedly) having an impact by the time i planned to retire. Ultimately settled in a then-‘forgotten’ redwood rural area of CA north of SF that research revealed had longterm average rainfall of 70″-100″, and still in the high 40’s during the then-‘big drought’ of the ’70’s. Have had lows of 40″ twice in the last 20 years, while the longterm average has now dropped into the low 50’s. As a kicker, the normal summer coastal fogs (vital to redwood forest survival) have all but disappeared in this period, as well.

Flash-forward to this last rainy season. We received 27″, total. Over a foot less than our previous lows, and in an area that historically has been the second-wettest in the state. The issues linked to this situation, as you can surely imagine, are legion.

I can only hope that the UK’s luck and historic climate patterns continue. I won’t be placing any bets on them doing so, however.

may we all find a better day.

There is nothing like feeling a mug to stop you buying anything, especially a house.

For a young married couple, buying a home can become a decision based on emotion and a dream so that doing a real cost analysis doesn’t even happen. I know from experience.

I bought three homes in my lifetime, probably one too many but sometimes you just get talked into it by a spouse.

Wolf has talked about the fact that there is a lot of pent up supply from people holding two homes. Apparently, a lot of people bought new without selling. I wonder if that has been enabled by the ease of renting out houses in suburbia during the pandemic. I’ve seen a lot of renters from here in the city move out of town while they were working from home. But we just went back to full work from office mode. Those suburbanites are now commuting in traffic or busy trains instead of walking, biking, or taking a 10 min subway ride. Will it last? I think that a year of leases will churn through the system and next summer will be the big move back into cities as people tire of commuting.

A lot of the people who haven’t sold their last house are not renting it. I don’t understand why given the carry cost.

The only thing I’ve been able to think of are the new fintechs like Orchard with their Move First program. They are lending 90% of appraised value to buy a new house now and handling the sale of the current home for a profit.

I don’t know how much impact they have, but I don’t think there’s enough data right now to know who’s hanging on to their old house without renting it and why. It could be a nothing burger.

“Wolf has talked about the fact that there is a lot of pent up supply from people holding two homes. Apparently, a lot of people bought new without selling.”

Wolf has talked about it but Wolf has not shown any data to suggest that this is happening in great enough numbers to affect the market in any meaningful way.

Nearly every home we appraise in the Swamp is empty. That’s all the data I need. I’d say 80% is closer to the true figure of the number of homes on the market that are a second investment home or some leftover from a trade up transaction.

This was great during the pandemic since we weren’t allowed to go into occupied properties. Didn’t matter. Most of the properties were empty, so we went in. All this inventory is out there starting to be dumped on the market. Once interest rates start going up this will turn into a panic and a tidal wave.

Let me see….. if you had sold your house and took the cash, or part of it.

Your former house rose 17% or more last year.

The cash you put in the bank dropped 5%.

How’d you do?

As long as the Fed is “advised” by the likes of Blackrock regarding mortgage rates, look for those rates to stay below the inflation rate…and people and companies scrambling for the “cheap” money.

historicus,

If you adjust one for inflation, you have to adjust both for inflation. If the purchasing power of your cash dropped 5%, then the purchasing power of the value of your home dropped 5% too. So if your home went up 17% nominal, adjusted for 5% inflation, it went up something like 12% in “real” terms. And cash went down 5% in “real” terms.

Most people do not have a spare home that is not rented out. The Florida population has grown 4X since 1960. There are also many vacation homes for winter residents who are not included in the state resident population counts. I may not sell my home unless I move. There are square miles of woods, cattle pasture and orange groves killed by the citrus greening disease. Some of these estates were subdivided with planned communities under construction. I remember traveling through Arkansas in the 1980’s. Trees and hills as far as the eye could see. There is cheap land in the Arkansas boon docks. Muskogee, OK is cheap too.

My parents owned a motel in Ormond Beach in the 60’s right on the Beach. Back then my nearest neighbor was 1 mile down the road and was another motel. Now that same stretch of beach is multistory condos blocking the sun. Disney screwed Florida up bad. It use to be miles and miles of Orange groves. Now its miles and miles of a asphalt jungle. And it never stops its just constant land clearing for more damn housing. They just keep coming a constant invasion of Yankees and immigrants lol.

Just/not-so-weirdly resonant of SoCal in the ’50’s/’60’s/’70’s-orange groves, Disney, asphalt and all. Good luck to y’all going forward, as long as opportunity is perceived in an area, there will be immigrants…

may we all find a better day.

Their children and grandchild, now saddled with heavy debt, will need to sell those houses but the glut of homes will push long term housing into a long term crisis. ”

I know I dropped out of the housing market and opted to rent another year. My rational self says what goes up so absurdly surely must come down. But it’s hard to ignore the trending news stories that say I’ll be locked out forever because prices will only rise. Every so often I take a look at r/realestate and r/firsttimehomebuyer to see what the millennials are thinking and it seems they too have bought into the idea that prices only go up. And so many of them are still gobbling up homes at stupid prices.

But history says otherwise and so I’m standing firm and renting even though rent has gone up to absurd levels — at least it’s not a debt I might never be able to discharge. (But it makes me wonder: With so many young people being squeezed by high mortgages and rents, how will they be able to consume at a level that sustains a consumer economy? I mean, when your rent goes up, or you’ve gotten into a note for $500,000 for a place only worth $300,000, how do you continue to eat out, get nails done, travel, and do all the stuff that keeps this post-industrial economy humming along? Seems like many will be living a Victorian-like existence, concerned solely with securing shelter and food.)

Whether it’s stocks or housing if incomes or revenue growth is 3 or 4% the stock market or house can’t keep going up at 15%. The difference is temporary fluff created by loose policy. All but the bag holders know policy makers have created the biggest bubble of all times.

Looks like my house is up 32% YOY. That’s more than inflation! I cannot wait for interest rates to go up. Powell!!!

No! I won’t raise rates until 2024!!! Housing is undergoing pent up demand and some temporary restructuring of normative monetary behavioral practices. I have this all under control. Hahahahahahahahaha!!!!!!!!

Old

“The difference is temporary fluff created by loose policy. ”

Why does the Fed continue to buy MBSs well under the inflation rate…for up to 30 years. No one else would.

And doing this with record and scorching new highs in the housing market….why? Who is telling J Powell this is good policy? Who is the advisor to the Fed?

And $40 billion per month of MBS buying is 2,000 mortgages – each and every day – on homes worth two-thirds of a million dollars.

Yes, the Fed is buying the paper on two thousand high-end (relatively speaking) homes day after day after day.

Free-market supply and demand is not what the powers that be will allow anymore (if they ever really did?).

Only thing two things I can think of:

1. Fed knows when the financial asset bubble bursts it’s game over as negative wealth affect plays out in economy.

2. They are using nobody can see a bubble in advance and we will print to clean up the mess when bubble bursts.

“Why does the Fed continue to buy MBSs well under the inflation rate…for up to 30 years.”

IMO, the Fed is ‘taking out the garbage’ for the member banks so that those banks balance sheets are artificially cleansed. It would also not surprise me in the least to find that there are CMBS being bought under the guise of MBS. After all, it is only taxpayer money…

Gut tells me that the government and the US economy went tits up during the 2008 housing crisis. Banks were struggling and the government had to consolidate the ones it deemed the weakest. That caused a great financial crisis. So if the government is the paper owner then a housing crisis of drop of 25% can only be absorbed by somebody as BIG as the .gov

This is the basic logic people used to predict the last bubble popping. Very few people grasped it, and today very few grasp it. It’s the compounding rate of stupidity, the 8th wonder of the world.

Any economist who believes in the equilibrium of supply and demand, especially when it comes to money and budget constraints should immediately (like within microseconds) realize why these rapid price increases are either evidence of an imploding economy or astoundingly maniacal bubble blowing behavior.

I agree. In London and the south-east it will only take a small interest rate rise for people to get very nervous, and 2+% for it to all fall down.

Homeowners with fixed rate mortgages may be able to ride it out for 5 years, but rental occupants will be hit on all sides. Utility prices in the UK will be attacked soon with Net Zero policies.

American friends are already seeing the what happens when intermittent power is increased into the energy mix. See California blackouts in the summer where solar is promoted) and Texas where wind turbines are enforced (by Obama policies). China and India are building coal powered stations at a faster rate than ever before.

Not just London but huge parts of England. Prices have gone bonkers everywhere……..

Look at the exponential (rocket straight up) line of government and Central Bank debt. No civilization can survive by cannibalizing their young and their unborn.

“Debt doesn’t matter” was true for the personal life of the guy that sent his debt to future generations.

But the entire system depends on faith, belief that money and debt are honest brokers.

From my standpoint, the debt will never be repaid. It’s not so much that my generation (and after) will be tasked with the bill, but we’ll be tasked with having to rebuild from the ground up.

Keynes around 1921, when asked how the children would pay the debt, he said. “F–k the children, we will all be dead”

Everything happens in a cycle and the COVID stopped they cycle for about two years. We will be back into a recession soon and house prices will adjust accordingly. There is also a shift starting with buying American. Gen X and Millennials are looking for what quality their $ buys them. Great customer service, quality of product, etc. We also want the self reliance of the 70’s that got us through the Carter years. Auto makers are shocked at the sell out of “older” style vehicles that do not have the chip issues. If COVID taught us anything is that jobs need to come back into America for supply and demand issues. It will be a slow prices, but it will happen. That is where my investment friends are looking into – Made in USA ventures.

It’s not wrong to just live with your parents like in asian countries. My buddy made like a million and a half in crypto and he still lives with his parents. The idea you have to move out and pay extra money out of your family to the feds and to some landlord or boomer is ridiculous.

The idea that you hang around and share in your parents life after they’ve raised you and shown you the door is ridiculous. I have friends right now having to explain to their 20+ year old “children” that it’s time they learned to stand on their own. It’s not going down easy in most cases, but you can’t blame mom & dad for finally wanting some “alone” time.

And when mom and dad are old and decrepit, they’ll expect those children to handle end of life care. Hopefully those kids don’t want their alone time….

The Fed has blown the mother of all bubbles (MOAB), and yet they continue to purchase MBS + Treasuries at $120B a month. Why? Because they know, and they’re scared of what happens when it stops. If they stop, then asset prices and the economy crashes. If they continue, then the same thing happens, but only from a higher level a little farther out in time. They’re damned if they do, and damned if they don’t. Damn the Fed. Pushers of monetary heroin.

“Trees don’t grow to the sky.” – German Proverb

Stein’s Law: “If something cannot go on forever, it will stop.” – Herbert Stein (1916-1999), Economist

“Anyone who believes exponential growth can go on forever in a finite world is either a madman or an economist.” – Kenneth Boulding, economist

Marketwatch: “Here are four reasons the West is headed for a ‘very drastic crisis,’ according to a veteran economist”

First Published: July 7, 2021 at 7:03 a.m. ET

By Steve Goldstein

“Rising relative asset prices cannot be extrapolated: If they become too high, the savings of asset buyers will no longer suffice to buy then, leading inevitably to a downward correction in prices,”

What Bubble?!

It took the dow from May 1896 to July 2007 to reach around $14,000.

It then took from July 2007 to July 2021 to reach $34,000.

So over one hundred years to reach the last bubble peak.

14 years and more than doubled in price……. nope no bubble…..now move along people nothing to see here

I live in Boston, there every square inch of available land is being used to build a rental.

Every other house has a construction crew in the driveway.

This mania started almost a year before the pandemic when it made no sense.

I wonder if this frenzy of building will result in lower prices. I live in a nearby city and many Bostonians are fleeing to it because, even though it is an hour away, housing was cheaper. I say was, because now condos and the like are being bid up to absurd prices.

For example: The condo unit below me sold in 2019 for $300,000. The person who bought it did quite a bit of work on it: new bathrooms, lead remediation, etc. But it was still a lackluster condo in a 3-unit building from 1900 — a building that needs a new roof, etc. She sold it this past May for $550,000. I expected the new owners to pull up in a Mercedes or at least an Audi. But they own an older Honda Civic and seem, to outward appearances, to be of modest, middle-class means. Not the kind of people to spend over half a million on a condo in a second-tier city. Of course, maybe they got an inheritance or Bitcoin money — but still not a sound financial decision, especially in a city where salaries are low and many people subsist on welfare. The last bubble really destroyed housing prices here because the local economy is inherently weak.

It blows my mind the kind of money the younger salariate are spending on houses these days…

When the little guys have a consensus……Go the other way.

That’s the nature of markets.

The unique problem for having a raging mania in the home-to-live-in market is that a correction becomes an economic existential crisis.

Everyone is forced to play. But power is insanely lopsided favoring early entrants, who think they are geniuses by dint of being in the right place at the right time as part of a herd.

This has no good end.

The moment we decided houses are one-armed bandits instead of places to live, we sealed our fate.

One-armed bandits?

Slot machines.

Old people remember when you had to pull a lever, instead of push a button, to gamble and hand your money to the Mensch Mafia.

One armed bandit = slot machine (Vegas)

Financialization of homes was a mistake. and now we’ll pay for it the young don’t have a means to have kids. They were wringed dry by debt and rent expenses.

IF you own a home, ONE home….and you believe there is inflation, an inflation that will go on for a while and will not be addressed by the Fed (ie rates to combat the inflation), then how can you let go (sell) your largest hard asset?

I think this, combined with the realization that the replacement cost of the house in question just went up by about 30% in 6 months….is keeping the supply of homes off the market.

Its been a good time to sell stocks for about 20,000 Dow Points.

You can sell your “largest asset” without worry because after taxes, insurance, maintenance, inflation,etc, its not a great investment.

I know docs here in Houston who have been big believers in protecting their wealth from malpractice suits by owning expensive houses. Malpractice suits pierce the corporate veil so any judgment not fully covered by a malpractice suit goes to the doctor personally.

In Texas a creditor can’t touch your house so docs put a lot of money into their primary residence. I can’t recall a doctor’s personal assets being attacked in a med-mal suit in almost 25 years of living in Texas.

Texas is debtor paradise. Creditors can’t touch your house, one car per driver, $30,000 of personal property, garnish wages or hit your retirement accounts.

Buy a house because you want to own your own home, not as an investment.

MG-illustrating again that ‘moral hazard’ is a highly a fungible term…

may we all find a better day.

If that one asset (your home) is also your only source of retirement funding, and the price is threatening to fall significantly, why wouldn’t you sell?

This brings us back to the inflation or deflation argument. In the last crisis, the Fed could not stop the plunge. Will they be able to stop it this time?

Probably another moratorium and forbearance is my prediction.

I wouldn’t consider a house to be a store of wealth. If that’s someone’s plan then yes they need to re-think their strategy and maybe dump the house and put some of the equity away for a rainy day.

Are these prices really crazy if everything else is going up, too? I wouldn’t be eager to sell excess homes unless I was putting that money into other hard assets. The places we own are hedges against the inflation everyone is seeing and experiencing now, and will be dealing with for several years to come. How many people sold places in the 70’s with the purpose of cashing out and ended up regretting it?

What’s crazy here isn’t the symptom, it’s the nuts in office, the Fed, and every other entity and policy actively destroying our economy. Hold your real estate or not, your call, but you better figure out how to make your little pile of worthless paper grow into a large pile of worthless paper somehow.

I predict that we’re all going to start hearing anecdotal stories about old timers eating dog food again. Inflation is gonna destroy fixed income folks and anyone else who isn’t paying attention, or was paying attention but didn’t have the means to make more paper. This won’t end well…and that’s my optimistic take.

>>> Are these prices really crazy if everything else is going up, too?

Are wages finally going up? I understand building material is increasing in cost but in many areas homes are selling for 30% more than one year ago.

That’s what’s gonna destroy folks, the wages aren’t going up as fast and fixed income is limited to the fairytale town CPI so will never even be close.

My sister just abandoned high-tax IL to move to NC… just in time for her first tropical storm. People were clamoring to buy her beautiful home built in an extremely low-crime central IL location where high quality home construction still exists. She is now renting in NC until they decide what to eventually buy there or in SC.

On an automobile YouTube channel I just heard that the average USED car price is now $26,400 and that certain 2019 vehicle trade-in values are higher than their new price in 2019!

Indeed, bought a new Kia in late 2019 that has a trade-in value today that is $3,000 more than I paid. That’s with 11,000 miles and a repairable cosmetic issue. Korean cars have been known to depreciate quickly.

I would think most cars 1 – 2 years old will sell for more than paid for new.

I am soaking in, for later recollection, the stories of people jumping ship from states like IL and CA for states like AZ and SC.

As the populations of those destinations states grow, they will have to raise taxes and create regulations to deal with it all, and the cycle will repeat.

Anyone who lives in IL and is not leaving is economically illiterate.

Happy1, I live in Illinois, and I assure you I am not economically illiterate. Many people have excellent reasons for staying in Illinois. I have fantastic reasons for staying here (I am a Gigolo and all my clients are here, and I am not ready to do remote work, unless I want to go into online sex & porn). Some women just need to feel a real live man as opposed to a virtual screen lover. The sex trade in Chicago has never been better. The pandemic has been Gold for me. Women short on cash pay me with jewels, stocks, and sometimes they just steal things from their husbands and pass it over to me. I inherited my house paid-in-full from my parents, so all I need to pay is property taxes.

By the way, Illinois, Mississippi, and West Virginia are the only states that lost population between the 2010 census and the 2020 census. It is very interesting to live in a state which has seen real population loss, as opposed to the hot spots like TX, AZ, WA, CO, FL, NC and GA.

All this talk about California losing population? They went from 37,253,956 in the 2010 census to 39,538,223 in the 2020 census, an increase of 2,284,267, equals 6.13%. Yeah OK, maybe the recent losses the past 2 years is the start of the new trend, so we’ll see.

The population density where she moved is much greater than where she came from and if taxes increase to CA or IL levels in red states due to migration it will be because blue state fools who soiled their nest have brought their voting habits to their new nest.

Red states are more dependant on the federal government than blue states on average. Lots of whining about debt but God forbid somebody has to get taxed. We’ve had several generations brainwashed into protecting the wealthy at their own expense and this is what we get

1) The 10Y plunged to 1.28%.

2) Most recent home owners cannot benefit from lower interest rates, because they still have a lot of interest to pay.

3) JP tapering is bs. SPX have reached it’s main target, 3 out of 4 targets. QQQ : 4 out of 4.

4) SPY : day # 9 was on July 2. If Fri close will be below July 2 close, SPY

will have a bearish flip.

5) US30 daily don’t look good. It took out 5TD SL already. US500 Futures big red

6) If Warren Buffett don’t care, it’s will be a normal correction, an opportunity to buy. But if he does, WB will push the markets down.

FOMO rages and is prevalent everywhere.

Housing, Autos, Phones, Consumer crap, etc..

Hey, cars “appreciate” like mad now. Let’s wait and see if the same happens to iPhones. They usually go from $700 – $50 in five years. I just replaced mine. Expecting to sell it next year for $1,000. :-P

I fear of missing out in my garden’s bounty .. therefore, I will NOT mutany under any psychotic fed-induced circumstances! Of course, it helps to own outright this ramshackle hovel of ours … At least we won’t starve .. too much.

1) Pre fab houses will render old wooden floors and paper walls

obsolete.

2) Ilan $50K pre fab mini was equipped with Nancy fridge, for ice creams

and red beef.

3) When the boomers will die, the lower 50% of income, with no assets in their name, will move in, with 10% jubilee and low interest rates on 120% mortgage of value, with low interest rates, to save the RE market from becoming rural Japan..

Add in immigration, legal and illegal. They flew to America on tourist visas and did not use the return portion of their round trip ticket. The population is growing.

It is a great time to sell but if one is selling their only home and needs to buy another then they win on the selling side but lose on the buying side. I believe this has held a lot of properties off the market. The only way to “win” is to move to a lower cost area, but those choices are dwindling and this assumes one wants to move.

“3. Euphoria

During this phase, caution is thrown to the wind, as asset prices skyrocket. Valuations reach extreme levels during this phase as new valuation measures and metrics are touted to justify the relentless rise, and the “greater fool” theory—the idea that no matter how prices go, there will always be a market of buyers willing to pay more—plays out everywhere.”

Obviously buyers are not in “euphoria” as much as they are in desperation (although less of it)

Someone in another forum argued that this “euphoria” only applies to buyers (I think they were thinking of buyers speculating on home prices per the Great Recession) but I don’t think it really matters whether it’s the buyer or seller. “Caution is thrown to the wind” is the key phrase that stands out to me…. and that seems to translate to sellers thinking prices will go up forever and many buyers waiving all contingencies and inspection.

BUT… it’s different this time guys! ;)

BTW: we actually went into escrow on a home last month then backed out because the seller failed to disclose a $17k water damage claim. We actually called them out on related issues as the general inspector called out PEX piping in the attic. The seller disclosed that there were a couple slab leaks in the kitchen but somehow conveniently forgot about the $17k of water damage that occurred after. There was also a notable crack in the foundation in the garage and sloping in the bedroom directly above. Aside from all this, we knew going into it that the house was going to be a “light fixer” at a minimum…new HVAC, roof repairs, termite remediation…. of course this was all we were hoping for. Glad we backed out of it – we waived repair costs and appraisal contingency but had the loan contingency (with a large down payment) and still had inspections done, and I’m glad we did, because we would have been screwed into buying a lemon otherwise. Right now, there sure are a lot of sellers unloading lemons. Right now is a great time to sell… your lemon!

Oh, and we still overbid by a margin of over $50k… while it was a “good deal” relative to other homes on the market currently, I’m still relieved we got out. I think we would have been quite unhappy.

We’re looking for a home right now not to flip or invest in but to live in – we’re a family of four, two kids ages 5 and 4. We sold our condo in a neighboring city and moved to the area last year, decided to rent to “feel things out” then got trapped in this horrible situation. We were planning this move pre-COVID and I was already WFH well before WFH was a thing. So all these remote work noobs and newly minted retirees really screwed demand over around here >:T

I am selling my rentals, all of which have either closed in the past month or are in escrow. While inflation will eat up some of my cash, I will regain my purchasing power when prices crash and I jump back into the market. Holding on to RE in this market and expecting prices to keep rising is unrealistic, but there are a significant number of investors and buyers who believe holding and buying, respectively, is prudent and fiscally sound. “A wise man learns from the mistakes of others, a fool only from his own”.

True that, in your last sentence/quote G,,,

But the other side of that is the old old saying,,,

“A Fool who persists in his folly becomes wise.” EH???

Fool that I am, and I know it,,, and in spite of being out of the SM since the 1980s,,, I started to read Wolf’s wonderful information to see if, by chance and hope, I could get back into the SM…

So far, answer is NO,,, but I will keep trying, if for no other reason than I have been in the RE mkt ,,, before and since, and see them going to be hell on wheels for decades,,,

Once again, SO similar to 1930s

“A foolish consistency is a hobgoblin that haunts little minds.” I think it was Emerson. Too lazy to look it up.

I used to hear that it is a regular man who learns from his own mistakes – but a fool never learns :)

Clearly its a great and terrible time to buy or sell (or rent, or lease) a home.

Brokers win, again.

Some of the new paradigms cut out the broker.

They probably all go by the surname of $hroedinger .. donning shimmery cat pins on their lapels.

A bit unrelated, but Wells Fargo just shut down all existing personal lines of credit.

Something bad this way comes?

Yes. Looks like they’re not gonna let people run and hide in their lines of credit.

WFC shut down all personal loans credit on July 23, ex credit cards.

Why would anyone today still even use a personal line of credit? Credit cards have long ago obviated that old system. It’s just a tiny left-over business for Wells Fargo. Makes sense to shut it down.

WFC kept their personal loans, though, which are a bigger part of the business.

Last year, they shut down their home equity lines of credit. In the US, use of HELOCs has plunged since 2009 and continues to drop every year. People do a refi if they need cash from their house.

Things change.

The reason why WFC is pulling back from these marginal loan businesses is that the Fed put a cap on Wells Fargo’s assets (such as loans) to punish it for compliance problems. The bank keeps bouncing into that cap. So it’s focusing on the big profitable types of lending and is shedding the others.

This was also a problem with the PPP loans. WFC couldn’t do PPP loans until the Fed agreed to buy its PPP loans. This was a big problem in California because WFC is such a huge bank here with lots of small business customers, who got shafted by not being able to get PPP loans quickly.

I believe HELOC’s are not tax deductable under the 2017 Tax law. That may explain the drop off in demand.

After reading this I went online and couldn’t find anyone attributing this to evil intent. I guess I have a pavlovian response to anything WFC does.

1) 12:45 PM : the DOW breached the cloud and bounced backup, leaving behind a large buying tail (at the top) > dma50 and dma20.

2) As long as today close < Jul 1 close, the DOW is bearish.

3) The DOW might glide higher on Fri, above the cloud hump and still be bearish if Fri close is the red flat bed, moving higher.

3) AI job

I checked the entrails of a chicken this morning and came to the same conclusion.

Regarding the Millenial buyers, most of these are kids did not suffer the dot.com crash, did not buy homes during the last bubble and suffer the crash, and had little if any skin the stock market during the ’08 crash. Too young, most of them.

Investing geniuses tend to eventually be humbled.

Remove the rabid bidders in my zip code and see a quick 10-15% plunge in closing prices. If buyers get nervous that could pick up steam to the downside. Consumer sentiment is a fickle thing.

As with the last 2 RE bubbles in SoCal, i suspect an eventual devaluation period to kick off (when I don’t know) resulting in approx. 5 year slide. Better buying opportunities lay ahead.

FWIW it’s not just Millennial home buyers. Anyone on Wall Street under age 32 has probably never worked in a non-QE market.

Michael,

That’s a good point.

As a friend of mine says, “In thirty years, students in business school will ask their professors, in astonishment, “No way. People really paid money to lend it out?””

1) The raging AAPL : day 13 today, beware.

2) The raging MSFT : day 13 on July 13, beware.

3) Raging AMZN : a hanging man at the top.

4) $NYFANG tried to move higher, but failed, producing a large buying tail (1:30 PM).

5) We don’t know what will happen next, until we see either big red supply bars, or price move higher above Feb 16 to a new all time high.

6) FDN made a new all time high > Feb 16 high. Day #13, perhaps tomorrow.

I wish those charts went all the way back to 2000.

That will give a better picture as to where this might be headed but its certainly asking too much from Wolf. Great charts anyway.

The Housing Bust gave birth to these charts :-]

I saw a chart the other day that went back about 50 years. This is either the 4th or 5th housing bubble in that time. The first 2 or 3 were small bubbles compared to the one in 2006 era and this one. The one in 2006 can mostly be laid at government’s door step by encouraging lending to people that were not credit worthy. Greed did the rest.

Maybe this bubble is mainly due to government response to covid. Greed will do the rest.

The market is just in a itsy-bitsy little gully right now.

It’s like everybody said “okay, that was crazy, let’s just calm down”

The Big Short (2015) – FrontPoint Partners’ investigation in Florida & first trade

As a corollary I suspect that if indeed the RE bubble should burst, the localized destruction of personal wealth via evaporation of equity will exceed that of the last bubble. The prevalence of NINJA and NINJA-esque loans in the past meant very little buyer skin in the game. So they suffer credit destruction but little or no equity destruction. Foreclosures. Short sales. No defaulting party brings cash to the table at time of purchase or at time of final disposition.

With more conventional financing in this cycle, and in many cases in SoCal the need to go beyond 20% down to win a bidding war that results in a price that exceeds the appraised value/loan amount, recent buyers have far more at risk in terms of property devaluation.

“As a corollary I suspect that if indeed the RE bubble should burst, the localized destruction of personal wealth via evaporation of equity will exceed that of the last bubble.”

Exactly. All that evaporated equity will sing its way to money heaven.

1) The average house sold in US + $400K.

2) New home sales : 0.7M.

3) Existing home sales : 5.8M.

4) The total : 7M.

5) JP buying MBS : 40B x 12 =$500B/Y

6) $500,000M/ 7M homes = $715K.

7) What does JP do with the $315K x7M homes.

8) Most 7M transactions have already existing mortgages and ownership

value, so it’s getting worse !

Just because people say “Its a bad time to buy a home” does not mean they won’t buy. As indicators go, perhaps there is something to this, but lets wait and see what happens.

True.

Anecdotal evidence: Most of my friends have decided to wait before this madness according to them ends.

I am in SoCal and now I am seeing multiple price reductions as well as many homes coming back to market, not sure why.

LongtimeListener,

I would say it normally means nearly nothing, so I usually don’t even cover it. But these are extremes, and they might mean something.

I take consumer polls with a healthy grain of salt.

What they say and what they often actually will do now or later are, shall we say, at odds with each other.

Wolf – As an aside related to the everything bubble, did you see Wells Fargo is shuttering personal lines of credit? I wonder how much money they removed from the economy by ending that line of business. Additionally, I wonder if they are more concerned about inflation making that side of the business less profitable, or more concerned about people overextending themselves.

LongtimeListener,

Here is what I said earlier today somewhere:

Why would anyone today still even use a personal line of credit? Credit cards have long ago obviated that old system. It’s just a small left-over business for Wells Fargo. Makes sense to shut it down.

WFC kept their personal loans, though, which are a bigger part of the business.

Last year, they shut down their home equity lines of credit. In the US, use of HELOCs has plunged since 2009 and continues to drop every year. People do a refi if they need cash from their house.

Things change.

The reason Wells Fargo is pulling back from these marginal loan businesses is that the Fed put a cap on Wells Fargo’s assets (such as loans) to punish it for compliance problems. The bank keeps bouncing into that cap. So it’s focusing on the big profitable types of lending and is shedding the others.

This was also a problem with the PPP loans. WFC couldn’t do PPP loans until the Fed agreed to buy its PPP loans. This was a big problem in California because WFC is such a huge bank here with lots of small business customers, who got shafted by not being able to get PPP loans quickly.

“People do a refi if they need cash from their house.”

Works fine as long as house prices go up.

But as we all know, house prices always go up, becuase “they don’t build new land”.

Recent market crashes are just little exceptions to this rule. The next one will end it.

The setup for the housing market is getting exciting.

A nice size earthquake in the US equity market will send a wall of re-allocated money to real estate.

Get ready.

This is actually a good sign that the housing mania has a lot more room up to go. When the entire public thinks you should buy a house, then you worry.

Bottom line is that the government is the problem! (and that includes the Federal Reserve, Treasury dept., etc and of course our completely corrupt Congress, etc etc etc… ) Complete overreaction to the pandemic in terms of endless increase in money supply, stimulus, etc. We need strict term limits and need to hold these criminals feet to the fire. They have overinflated everything, but that’s because they have no intention of ever paying anything back and don’t mind screwing those who are fiscally responsible savers. Inflation is a TAX on savings so all of this easy money has destroyed any notion of price stability or price discovery. It’s a Monopoly game on steroids. Sadly, I was taught to save and not to take on debt so I have missed the boat and do NOT own a home and now feel hopeless as to my prospects of EVER being able to buy a home. I live in a high tax state and properties have doubled in the past 2 years. My salary has barely budged in the last decade. The math doesn’t add up and most homes are selling in a day or 2 for 50-100k over asking on the “low end” of the market, meaning anything listed for less than 400k. Is it any wonder the suicide rates, drug use, alcoholism, domestic violence, etc. have skyrocketed? We do NOT live in a democracy folks and we never have. It is a one party system of oligarchs. And people like me are screwed. If you already own a home, or two, or three… then you are in the catbird’s seat. Just remember, this all looks good on paper, but currency debasement is ultimately what brought down the Roam Empire, so this will not end well.

Wolf I wonder if anyone has correlated the brief, but sharp drop in sentiment at the start of the pandemic (or any drop at other times) with actual house prices? That might be a model for what might happen to house prices if there is a sudden change in seller sentiment again, absent any intervention radical intervention from the FED or government. Would love to see your analysis on such a correlation if possible!

I was referring to the drop in the seller sentiment-second graph in the article.