The #1 weird phenomenon: The labor force.

By Wolf Richter for WOLF STREET.

Amid reports of hiring bonuses even for jobs at the lower end of the wage scale, and amid reports of companies raising wages to attract workers, and amid widespread complaints about “labor shortages” and difficulties in hiring people, and amid reports of supply chain issues because essential jobs cannot be filled, and amid a historic spike in job openings, there’s the Department of Labor’s tidbit that 14.7 million people are still claiming state or federal unemployment benefits, including 11 million people on federal PUA or PEUC benefits – however marred by an epidemic of fraudulent claims and bad accounting this figure may be.

These benefits were topped off by the extra $300 a week in federal unemployment benefits, which are now being phased out in 26 states, but they were still mostly in effect when the data for today’s jobs report were collected in mid-June.

That’s the weird convoluted backdrop for today’s jobs report from the Bureau of Labor Statistics.

The #1 weird phenomenon as result of all this: The labor force

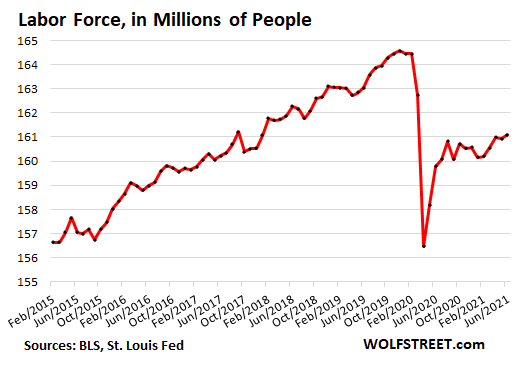

The labor force consists of people who were working during the survey period or who were actively looking for a job in the prior four weeks. Someone who eventually might want to work but wasn’t actively looking for a job during those four weeks isn’t considered to be in the labor force.

So in June, the labor force grew by 151,000 people, after having fallen in May, and was still down by 3.5 million people from December 2019, with little improvement since last August.

In June, 6.4 million people wanted a job in general terms but didn’t actively look for a job over the past four weeks, or who were unavailable to take a job, according to the BLS. They were therefore not included in the labor force. This was up by 1.4 million from February 2020. They’re on the sidelines of the labor market.

There are numerous reasons why people aren’t going back to work, and are not looking for work, and are therefore not in the labor force. This includes having to take care of kids in areas where schools and daycare centers are not fully open; and it includes what is now called the “retirement boom,” where people have decided it wasn’t worth it anymore, and went for quality of life.

#2 weird phenomenon: Upward pressure on wages during an unemployment crisis.

It’s is rare that there’s upward pressures on wages during an unemployment crisis. But that’s what we’ve got.

The wage pressures employers have been jabbering about, and the wage increases they have been implementing, are starting to show up in the numbers despite the fact that a lot of hiring took place at the low end of the wage scale in the hospitality industry, which pulls down the overall average.

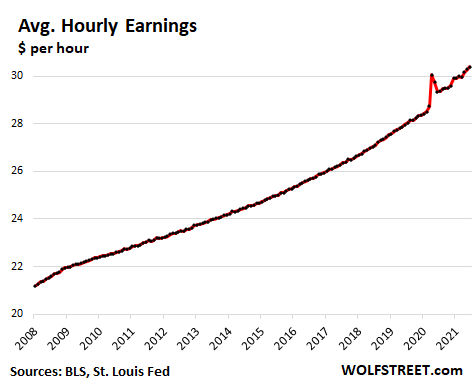

The average hourly earnings for employees on private nonfarm payrolls rose by 10 cents per hour in June, from May, to $30.40, after having risen 13 cents in May and 20 cents in April, for a 43 cent per hour increase in three months, or 5.7% annualized.

In the chart below, note the spike in May 2020. There was no spike in pay. It was a result of many lower-paid workers getting laid off, especially in the hospitality business, while many higher-paid workers kept their jobs and switched to working from home. This caused the average to spike.

Now the opposite is taking place, with lower-paid employees being pulled back into jobs in large numbers, and this should push down average hourly wages. The fact that the average is rising despite the influx of lower-paid workers shows just how much pressure there is on wages.

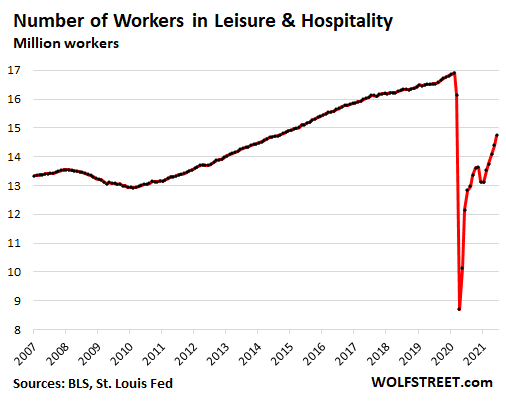

Employment in the leisure and hospitality industry – food services and drinking places, hotels, casinos, etc. – jumped by 343,000 jobs in June, after having jumped by 306,000 jobs in May, as restaurants, hotels, and casinos are desperately trying to hire workers. Total employment in the sector was sill down by about 2.18 million people, compared to the peak in February 2020, but it’s still a huge improvement of where it was a year ago.

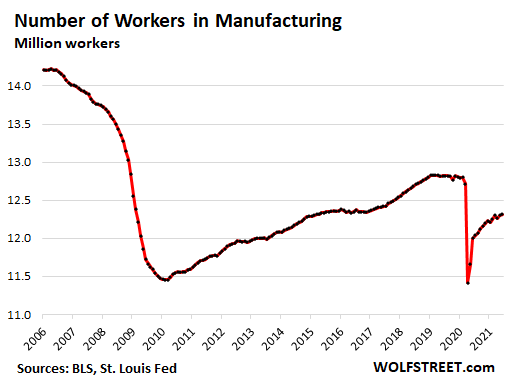

Employment in manufacturing rose by only 15,000 jobs following the increase of 39,000 jobs in May, amid widespread complaints by manufactures that they’re having trouble filling orders because they’re having trouble “finding suitable candidates for current vacancies,” according to the IHS Markit Manufacturing PMI, and that growth was weighed down not only by tangled-up supply chains but also by “labor shortages.”

In June, the number of workers in manufacturing was still down 481,000 or down 3.9% from February 2020:

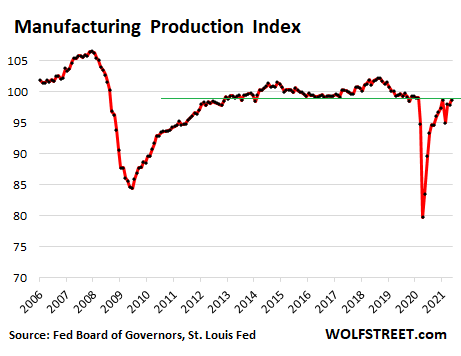

But manufacturing production in May fully recovered compared to February 2020. During every downturn, manufacturers cut costs by investing in automation and by offshoring production. While employment in the sector peaked in the 1970s and has since fallen by about one third, production, boosted by automation, continued to rise until the end of 2007. During the Great Recession, manufacturers massively offshored production. Adjusted for inflation, production never recovered to the 2007 peak. Then in March 2020, it fell off a cliff.

But by May 2021, manufacturing production was back to February 2020 levels – despite 3.9% fewer jobs in the sector:

Gig workers giving up gigs to become employees?

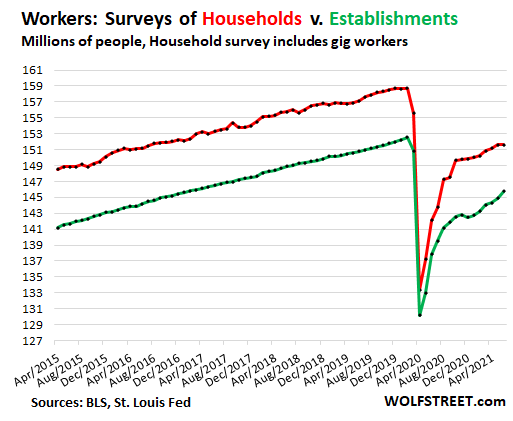

Employers – companies, governments, and nonprofits – reported that they added 850,000 workers to their payrolls in June, according to the BLS today. This is a big gain in employment. The total number of jobs at these establishments rose to 145.8 million, but that was still down by 6.76 million from February 2020 (green line in the chart below).

Households, however, reported that the total number of people working, including gig work, fell by 18,000 in June to 151.6 million, still down by 7.1 million from February 2020 (red line). And this includes self-employed workers.

Even as employment has increased sharply, according to surveys of establishments, households have been reporting slower improvements since the end of 2020. And the gap between the two has fallen by 2 million workers in six months. This suggests that over the past six months, employers have hired many people that were self-employed.

#3 weird phenomenon: “labor shortages” with so many people not working.

There are plenty of potential workers in the US to fill all those jobs, and there is no shortage of people. There may be a shortage of certain skill sets – and that is always the case, and that’s where training, education, and on-the-job learning come in.

But more significantly, there appears to be a shortage of people willing to work under current wage levels, benefits, and working conditions. This is like a quiet strike.

And this time, over 14.7 million people are still claiming unemployment compensation, including the extra $300 a week from the federal government. In many cases, recipients make more by not working. OK, this 14.7-million figure is marred by an epidemic of fraudulent claims and dubious data. But even with those removed, there would still be a very large number of people receiving unemployment benefits. And in mid-June, employers still had to compete with those unemployment benefits, including that extra $300 a week.

But employers understand that the $300 a week is already being phased out in about half the states and will expire in the rest of the states on September 6, that this will make competition with unemployment benefits easier, and that hiring at the lower levels of the pay scales might become easier as well.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I understand the data but just cannot sync it with price increases, a soaring stock market, an off-the-rails housing market, and the supposed massive turnover of employed people. Nothing makes sense. Where is the money coming from? And where is the actual value in any of it?

I ask the same questions almost every time I read an article here. Homes routinely being bid over asking, new cars selling at jaw-dropping prices, credit card debt being paid down…where is all of this money coming from? It can’t be all stimulus checks and unemployment benefits. I can only hazard a guess that people working from home the past year saved a lot on expenses and socked it away then for a big purchase now.

Me, I’m having a “low buy” year. There’s pricking in my thumbs…

“where is all of this money coming from?”

That is a head-scratcher question that vexes a lot of people who dare to ask it.

I don’t there is one single cause or answer that will satisfy that question, however, I do think a lot of it stems form the pandemic-induced stimulus (all forms, including stimmie checks to individuals) which now totals around $6 trillion and counting, or roughly 27.1% of the nation’s GDP,

Stimulus together with debt forbearance schemes (notably rent, mortgage, and student debt payments) are a rocket fuel monetary mixture and sent many people into consumption overdrive. And of course the shortages, panic buying, hoarding, and bidding wars.

I watched a local TV news story recently about how students were being so oppressed by their student debt obligations. One student bragged about how he had finally managed to amass personal savings since pandemic because he didn’t have to make the usual student debt payments.

I had forgotten about the forbearance schemes, Heinz.

If any significant portion of the buying frenzy is from people who were spending money they should have been saving to pay their mortgage, rent or student loans, your local TV news station will be able to spotlight more sob stories once the forbearance ends.

Heinz – best summary I’ve read so for. You nailed it.

Add to your list a large number of folks who are not having to pay for childcare (quite an expensive item) due to them watching their kids themselves.

Most people just look at the immediate situation with no thought as to how they’ll deal with the end of forebearance. No foresight at all.

“where is all of this money coming from?”

Really? This is obvious.

The Fed buys $120 billion A MONTH! of federal paper.

That’s 120,000 MILLION!

That’s 120,000,000 thousand dollars a month. Theoretically, that would pay 120 Million people a thousand dollars a month.

I tell you its strange for sure. And whats stranger is im 59 and lived in the same town my whole life. And i dont know a single person collecting this unemployment or getting this forbearance nor does anybody i know, know anybody getting this free ride. So just who are all these people getting paid more money not to work than those who do work? And where are these people? “This is the strangest life i have ever lived”

Jim Morrison

It sure is strange. It’s like a episode of the Twilight Zone

Why not assume the credit card debt is being vaporized by these two possible sources a) rolled high debt credit card into refinanced mortgage b) absorbed by one of the large debt consolidation that isn’t considered a CC per se but allows reduced rate lump sum to pay off credit card debt

What is in your mailbox???

cash back for being deadbeat == interest paid since 1995

$000,000.00

you’re just to easy to comment to

This is a combination of people who spend every dollar in their bank account with no care about saving for the future and soaring asset prices that make people feel rich.

The people who dont save will blow through their stimulus checks or PPP money or unemployment just months after it stops. The asset bubbles are built on ultra-low interest rates, which will rise once the Treasury starts to sell bonds to finance the deficit. So there should be at least some adjustment down in the asset bubbles too.

My guess is that this all ends very badly.

Those in the top 10%, or the global wealthy investing in safe-haven markets….have the cash to burn. This is globalization in action; there is no shortage of wealth in the world, it will gravitate to safe-havens.

“Those in the top 10%, or the global wealthy investing in safe-haven markets….have the cash to burn.”

So why would the ultra rich be spending more a lot more money into economy right now?

Admittedly their Fed-sponsored Wealth Effect largesse has roared upwards during these unusual times. That would be bubble assets like real estate, stonks, bonds, and crypto.

However here in the ‘in your face’ economy a filthy rich individual can only eat so much expensive food per day, can only sleep in one house at a time, consume only so many recreational drugs at a time, only find berths for a finite number of yachts, and have only so much space for fine art collections.

Many of the rich got that way by putting a ceiling on their material desires. That’s the only lesson I would care to learn from people.

Reply to Heinz (reply depth limited):

“So why would the ultra rich be spending more a lot more money into economy right now? ”

Fear of inflation. Anything you’re going to need or want, there’s no use waiting. The interest you can make on the money you don’t spend is miniscule and way less than the price increases you’ll see by waiting. If you are very lucky in the stock market you can invest at a rate of return higher than current inflation, but on average most cannot. Inflation, properly measured, is actually 6% annual or more, and you have to pay tax on gains, so you need more than that to stay even.

The stock market has made the top 10% wealthier, and it feels smart to cash out and buy those big ticket items before the market crashes.

If hyperinflation (not just 6-10% but much higher) is in store, you want to spend now on durable good and assets.

For the top 10% the stimulus payments are noise. If you simply held your s&p 500 index fund through the covid dip you are up 28% from the pre-covid high in a year and a half. If you had cash before covid and bought in at the bottom you’re up 89% in under 16 months.

And Biden is talking increased capital gains taxes – so there’s plenty of incentive to cash gains now and buy that yacht, high-end car, or flip your house for a bigger one in a less-dense area.

Between PE and those “Ultra High Net Wealth Funds”, I don’t think anyone has any idea in hell what ultra-rich are doing…..besides buying whatever laws/favors/governments that exist…..that seem worth buying to them.

FWIW, last Credit Suisse High Net Wealth report I could get puts about half of them ($50B and on up) in the US, (about 75-80K of them as of a couple years ago), and the other half scattered in the rest of the world, mostly “developed” countries.

But that’s only “known assets” that Credit Suisse knew about, or chose to publish.

Which does, at a minimum, say the US has the safest places to park a rich ass.

HQ

The money comes from deficit spending by the Govt. Look at W’s charts for US Govt debt. Vertical.

When the Govt spends more than it taxes it means individuals somewhere in the economy are getting more money either by working directly for the Govt or by the Govt buying products of their employer (eg F35’s) or by direct Govt payments to individuals, etc, etc.

Technically, it need not be problem, if interest rates were allowed to respond to demand for loans but the Govt ‘cheats’ by printing new money via QE and keeps interest rates artificially low, which in turn makes mortgages, etc cheaper and inflates demand for assets of any kind. It’s a racket you would get put in jail for, but US govt is ‘Master of the Universe’ and no-one can control what they do.

guess you tuned out CONSEQUENCES OF ELECTION

few trillion BORROWED here(ie made out of PITA) and FEW OVER THERE

and now lets put 3D chess players(chinese) into equation

limiting exports – ie due to covid and supply chain

AND BOOM BOOM 30-50-200% increases in things we need

shortages abound due to CORPORATE STUPIDHOOD called JIT

and your question was???

Election consequences? Hogwash.

Trump is a FED loving money printer who cares not for justice & law

Biden is a FED loving money printer who cares not for justice & law

Obama is a FED loving money printer who cares not for justice & law

Ditto for all former presidents (…) since at least 1980. Probably all since 1913 too.

Trump = Biden = Obama = ….

The recent election changed NOTHING substantive, only the style of the actors

Wake up presidents don’t run this country corporations do remember meetings at White House with apple Microsoft and others presidents get told what to do

i’m a republican/libertarian/indendent, but in my book the last decent president we had was Carter. That’s right, carter. he actually cut the amount of oil we consumed over his term (because we were reliant on the middle east) and he hired Paul Volcker, the last independent Fed president who wasnt just a pansy for bankers.

The reason Carter was so loathed is that he did things based on principle, not based on special interest group power.

Oh, and for those Republicans that love Reagan, he is the guy who said deficits dont matter. He fired Volcker because Volcker was against allowing banks to become investment banks.

Raging Texan

“Trump is a FED loving money printer who cares not for justice & law”

You got the first part right….but strangely you miss the second part. It is Trump who is against the rioting in the cities…it is Trump who is against the porous borders now in your home state of TX.

Both stances are pro law enforcement.

Same with the big Defense and Intel Agencies. I once asked myself who’s running this joint. I said to myself, its these big contractors and system integrators. I was 100% correct. The government managers were just props and facilitators.

He encouraged rioting in Washington DC.

Have people really forgotten about that?

Historicus-it has always appeared to me, long before he realized any political aspirations, that that particular gentleman took a “…those limits are for thee, but not for me…” approach (i.e.: there’s no such thing as ‘white-collar crime’…) in terms of the law.

may we all find a better day.

RT

There’s always another plonker comes over the hill!

Historicus wake up bro

Trump SAYS he wants to control the border. To get your vote so he can be closer to the FED and steal your wealth. Proof: What did Trump actually ACCOMPLISH at the border? Zilch!

Its just choreographed propoganda like pro-wrestling.

Oh but Trump had people fighting him, right? Not his fault they say? Incorrect he had the power to fire anyone in the exec branch if he’d really wanted to.

What was Trumps real focus? 1) The Fed 2) himself

END THE FED AND REQUIRE THE FEDGOV TO ABIDE BY ITS CONSTITUTIONAL LIMITS

gametv

Carter was a sniveling fed worshiping constitution shredding loser.

Carter did nothing to end the fed, or end the unconstitutional programs of fedgov including social security, medicare etc

The world will not end if consumers can’t buy cheap plastic Chinese junk.

“The world will not end if consumers can’t buy cheap plastic Chinese junk.”

how about

light bulbs, spark plugs, semi conductors, car parts, F22 parts…??

I went around my house looking for things to donate to the charity pickup. I found a lot of Chinese junk that needed to go. Then I realized it was broken and not fit to donate so it made its way into the dumpster. I’m done buying this crap.

“Where is the money coming from?”

It is coming from not having to pay for financial obligations anymore. No rent, no loans, lots of spare cash burning a hole.

End of the year is going to be popcorn time…………..

Good point although these benefits are not for classes of individuals who can truly move markets. Perhaps it is more the disassociation of money from anything tangible, as it the volume of trades creating wealth rather than actual underlying value, which seems like a quaint notion. Even so, I agree that this house built of cards will come down, painfully. A lot of strange behavior is driving this while thing, on every level, showing a lack of foundational emotional resilience in a population spun around by a pandemic.

Very little coming from the stimmies as far as buying a house.

Good chance some big money coming from the stock market if you owned AMZN, APPL. GOOG etc.

Don’t forget a third of the Fed’s asset purchases are going into MBS (or Agency Securities as they now call them).

To avoid negative rates on Treasuries they are distorting the housing market.

“To avoid negative rates on Treasuries they are distorting the housing market.”

They certainly are distorting the housing market..

in 1999 and 2006, when inflation was near, but actually lower, than today, 30yr mortgages were 6%. Now 3%. Why?

But the threat to rates moving negative is really from the massive “digital minting” by the Fed (by what authority?). M2 up 27% in less than a year….and with the country reopened (restaurants packed, airlines packed, motels packed) there is curiously NO EFFORT to retrieve that 27% injection.

When did the Fed obtain the authority to be the controlling force in the money supply? That is a Congressional power as noted by the Constitution and thus can NOT be delegated.

Not so sure. I have seen couples with $2k+ monthly student loan debt payments who were able to buy a house solely based off forbearance.

Interestingly, student loans are not counted dollar-for-dollar in your Debt to Income ratio. So these buyers are able to qualify for conventional mortgages with already a veritable mortgage of student loans. When the payments resume, their effective DTIs will be 60%+ of gross income.

Where is the money coming from?

Aside from what others have mentioned (stimulus, forbearance, etc) probably debt. I don’t see any other explanation. It would be nice if mr Wolf also included charts regarding this (besides credit card debt; debt regarding housing and vehicles is what is needed).

One more thing I just thought off is inheritance: a lot of people have died because of the pandemic and their children are spending what they inherited or gambling with it in the stock market.

I read somewhere that before the tulip mania there was a plague outbreak in the Netherlands. A lot of rich merchants died and their sons started gambling their inheritance on tulips because they were bored (there were lockdowns and a lot of the usual entertainment was gone).

“One more thing I just thought off is inheritance: …”

As the boomer generation passes from the scene some of the them will leave substantial wealth to their heirs, but most oldsters will die broke or otherwise wealth-less.

There are many reasons for that sad state of affairs but big ones are inflation wiping out accumulated savings, market crashes (still to come, just wait), and huge medical expenditures for aging bodies and end of life terminal treatment.

For those lucky well-off elderly that can and want to pass on their dynastic wealth to their scions, I think many of the smarter ones will turn to trusts to keep those hard-earned assets in the family.

I don’t think inheritance played a huge role…yet. Estates can take a while to work out especially if they go through probate. Estate bills must be paid or written off first. Also, during covid last year, many of the courts had limited operational capacity. I admit, I do not know how long trusts take. It is my understanding that it depends on the details of the trust. For example, my husband belongs to a trust where no property can be sold for 5 years. Generally, funerals do cost the family unless people have prepared properly. Although, I believe families can seek reimbursement for covid related funerals from the gov. I suppose people could “double dip” for funeral expenses by also being reimbursed from the estate. It is hard to anticipate what people will do especially when money is involved. Perhaps, some people did leave the workforce in anticipation of their expected inheritance, however, I don’t personally feel that number would be significant.

My understanding. The government is going to run a $3 Trillion deficit this year. That $3T deficit is pushed into the consumer and corporate sector.

The money was borrowed from our future in hopes of mitigating the damage from covid. In theory the extra debt will cause our future prosperity to be a little lower than it would have been without covid.

OldSchool

“was borrowed from our future”

This is why the third mandate of the Fed is perhaps the most important…and always carved out with the “dual mandate” game.

The third mandate …”promote moderate long term interest rates”

And this is brilliant and important.

This third mandate keeps a reasonable balance between lender and borrower

it prevents, when honored, the emptying out of future generations to “fluff” the present by always keeping a “moderate cost” to borrowing, putting are REAL cost on pulling forward future wealth.

This Fed has promoted IMMODERTE long term interest rates….

30yr mortgages 2% under inflation?

Ten years notes 3.5% below inflation?

All time lows in long rates are NOT MODERATE by any definition. They are extremely low.

Moderate means “not extreme”.

Just as “stable prices” means fixed, unlikely to move.

J Powell needs a vocabulary lesson….maybe an inquisitive journalist will help him on the journey.

The reduction in future prosperity is going to be more than just a “little”. The country has been living beyond it’s means for decades.

Easy answer is stock market craziest I’ve seen pump and dump making a killing but in end most people just get killed financially

Easy answer is stock market craziest I’ve seen pump and dump making a killing but in end most people just get killed financially

For long term investors with our retirement tied to stocks, this makes me nervous as heck. It screams instability.

Maybe another way to look at it was that if you add consumer, business and government there was nearly no savings last year. We as a whole spent all we made.

No savings is ok for a year or two but if it goes on too long we are going to have bigger economic problems.

“Where is the money coming from?”

Did you miss the trillions the FED just printed?

The would be the Fed who is charged with “promoting maximum employment” but provide the free money to be doled out to discourage employment.

Only in government…..but perhaps entirely INTENTIONAL.

New stock valuation data is out for the month of June. ‘Investment Advisers’ site has an interesting chart called Crestmont PE10 plotted against inflation for the last 150 years. It’s a scatter plot of monthly valuations.

Covid hit to GDP took market from very high to highest valuation in history. Now inflation is shoving stock market over to a more extreme level as past market data drops of as inflation gets above 4%.

There is no time in 150 years we have been this over valued. Not even close.

Exactly! And reversion to the mean is always a bitch.

I remember the last bubble pretty clearly. The hot stock then was First Solar. Green, Global warming and growth. Rocket ship up to close $300. When bubble popped it lost 96% of it’s value and 12 years later is still down 70% from peak. We have a lot of that pumped up junk in the market.

“where is the money coming from?” You have quite the sense of humor. I will assume you are being sarcastic.

Your economy is not complicated (or productive):

1) your government gets huge sums of currency from the Fed to monetize reckless spending

2) the government hands out the money to buy votes and receive kick backs from wealthy donors

3) your citizens spend the currency on products made by productive foreigners

4) productive foreigners receive no goods in exchange and buy up USA hard assets to get something for their effort

5) Americans complain that assets are too expensive

6) the process repeats endlessly until foreigners own your companies, your farm land, your utilities (including water), your infrastructure, your parks and your house.

7) you are a wage slave

Enjoy your plastic baubles – aren’t they fun.

re: point 6’s hyperbole. You really expect all of that to happen without any reaction? There’s a reason that this country spends so much on the defense budget and it needs to be justified at some point. so they create opportunities for conflict. Point 6 happens and we end up kicking the shit out of whatever poor country thinks they were given the green light to do that. Maybe China, maybe Russia, maybe someone in the Middle East. The US may not be “productive” in your terms but we are the world leader in producing weaponry to inflict pain and misery and keep the military industrial complex chugging along.

Maybe most of the unemployed are attending skool, learning how to build solar cells.

They are on the golf courses around here.

You need a better speed dialer to get your tee time. Also rotate the duty to others. Get up at 3AM if you have to.

The best tee times we (retirees) could get is after 11:30 AM here and that’s when the temperature is 95 F with 85% humidity. The courses (5 of them around here) are FULL of the WFH crowd. I know this because I have asked several young guys why they aren’t at work….they say they ARE working. LOL

And don’t forget the Public Sector people who also have enjoyed the fruits of the WFH process. How many cities and municipalities are still operating under “Emergency Guidelines”. The sheep are getting sheard. ???

Yep, woodlands is awesome eh?

Same thing on the lake Conroe area courses, Bentwater and Walden.

Used to be, there was no one boating on lake Conroe, Monday through Friday, now it’s hard to distinguish it from the weekend.

All the lake campgrounds packed with 250k

Motor homes, complete with a 125 k ski boat next to it .

I dont know exactly what is coming, or when, but I can tell you with 100% certainty that it will be one for the record books.

your funny – a MIL building something

And I am sure there are armies of unemployed learning to code as we speak…

95% of Americans are not smart enough to make good programmers. Maybe 20-25% could be mediocre programmers.

About right (humans in general, not just Americans). A lot of the new business coding tech is crazy hard and mind-boggling. Like the Angular stuff for Web UI. 25 years back doing VB6 line of business projects over and over was much more sustainable as a career, for keeping mental sanity. Java as well – a very sleepy vanilla language that worked pretty well for boring large enterprise projects. C# came along, and it was better and more fun than Java – but it’s now a very large and complex language.

Some of our tenants are a bit funny. “I’m going to ride this assistance out until it’s gone, I’ll worry about a job after that.”

Or, I have a guy working and making enough money to pay, but he doesn’t pay. He just asks for assistance.

3 people who live in one unit. Each earns enough to pay the rent, but none of them do. They get assistance — I mean, none of them alone can afford the rent and afford to eat, but they are elegible.

And, yes, it’s hard to hire people.

Everyone needs a break now and then — especially me!

During the 2006/7 meltdown, it was the financially “sophisticated” people I knew who simply stopped making mortgage payments when their homes went underwater. They figured the banks wouldn’t be able to foreclose them all at once, so why throw good money after bad.

Kaleberg

So “financially sophisticated” equated to breaking their word to pay their obligations….

Are they also waiting for their college debt to be wiped away?

Where is honesty?

Honesty is for the proles.

Those who live in non recourse states did not break their word – they were under no legal or moral obligation to pay back the money.

Their mortgage contracts stated that the lender had the right to claim title to the house in the event of non payment – nothing more. The lenders signed on to this agreement – it is not the borrower’s fault if the lender never foreclosed.

lmaooo good one. Honesty. Wall Street operates on that principle surely

All these debt forebearances/moratoria are setting a dangerous moral hazard precedence for our muppets.

It will be all too easy for politicos to enact more such popular debt forgiveness schemes next time economy hits a bump in the road.

It’s the old idiom of camel’s nose in the tent– that is, something that was okay in a limited way inevitably turns out to take over in a big way (camel forces itself into tent and brings it down).

These measures will be widely approved as a tool to help people and that simply must be provided.

Your comment reminds me that there are 2 ways to keep a bank from foreclosing on your house if you have a financial crisis. First, is to own it outright. No loan, No chance of foreclosure. Second is to be mortgaged over the house’s current value. Your mortgage is now toxic to the bank since they will take a loss if they foreclose and sell the house.

The absolute worst position to be in is to have your house 1/2 or more paid off. If you start missing payments, they will add incredible late fees and penalties to the amount owed, then foreclose as fast as possible, keeping the owed principal, penalties, and all the excessive legal fees they can dream up before giving you a few crumbs left over.

Kenn,

“The absolute worst position to be in is to have your house 1/2 or more paid off.”

No, because you have equity in the house, and you can sell the house, pay off the mortgage, and walk away with the remaining cash.

And if the mortgage is 50% paid off but the house price drops 60%, and you can’t sell, then you’re back at your point #2: mortgaged over the house’s current value, at which point, according to your theory, your bank will leave you alone.

K

“Your mortgage is now toxic to the bank since they will take a loss if they foreclose and sell the house.”

It is more than likely the issuing bank will roll-up your mortgage Into a risk graded MBS which it will sell on to eg a pension fund, etc. If your mortgage goes bad it is only one of maybe a thousand or more in an MBS. The MBS is rated and insured to reflect the quality of the individual mortgages in it. It’s all very sophisticated, they can chuck in a few triple d’s alongside triple a’s etc to get any risk profile they want to sell on to the buyer. If enough mortgages go bad in an MBS it’s market value could drop but then the Fed could step in and QE it at full face value, hence the failure is ‘nationalised’ to the tax-payer. Later on the Fed could sell the MBS back into the market at true market price which could allow the original owner to get it back without taking a loss. Neat eh?

Your mortgage is a tradable financial security (a bond) issued by you and secured by your house. If you default the MBS holder can reclaim the security which then becomes another MBS asset which can be sold on to another business that specialises in dealing with foreclosures. On and on it goes, it’s called financialisation of the economy.

Financial life is kind of weird. Here are two examples from what I have read.

1. IRS can’t seize your home if you have no equity in it.

2. People usually will not try to put a lien on your home if you have no equity in it.

Old School, I was once told by a tax professional that the IRS has no interest in houses. If you owe back taxes, they will go after your bank account. They will freeze whatever is in there at that time. The state, however, will show up and want your house. Not sure how true all of this is, but that is what I was told.

September and October may be very busy months for hiring. I also have a friend who does not even intend to look for a job until her kids return to school in Sep and she is a single parent.

Victory of the Proletariat?

Boomers are fleeing the workforce.

It goes overlooked how many in their sixties simply retired when COVID hit.

Those early retirees could number in the millions.

iirc, the number I saw was 2.6M people retired during covid.

Until the financial markets finally crash for real. How many people have planned their futures around permanently insane bubble valuations?

I wonder that too. All these retired 401k millionaires might quickly become 401k thousandaires when the government can’t contain a market crash. Do they have a plan for that?

One can only hope

The only “ shortages “ in the labor market are the availability of jobs that pay a living wage and provide health insurance. Exploitation is not a sustainable model and will be met with resistance whenever feasible. Biden lied about supporting a $ 15 minimum wage and the U$A joining the rest of the wealthy nations in providing Socialized Medicine to it’s citizens isn’t happening either. The answer ? My name.

Biden lied? Oh NO!

Who would have thought it of a 50 year political veteran of DC? A liar?

General

I find it curious that those who wish a higher wage structure are not INCENSED by a Federal Reserve that promotes inflation.

This 5% bump in inflation just delivered a 5% pay cut to the American worker….and was retro active if they had any money “saved”.

And there is more to come…as this Fed is rogue….and will not lift a finger to fight inflation…though they are supposed to. No one seems to care.

h

It’s ok.

Your caring alone lifts that burden from a multitude of us.

Keep shaking your fist at that cloud.

“Exploitation is not a sustainable model and will be met with resistance whenever feasible”

Say, what about the robust cheap labor market for illegal immigrants?

That has proven to be a sustainable model for many, many decades. And kept wages low for many Americans. But it has handsomely padded the pockets of businesses large and small at the same time.

Medicare is socialized medicine, with a minimum age of 65.

Medicare is NOT socialized medicine.

The VA IS socialized medicine.

At the VA the docs and all the rest are employed by the government.

Docs who accept Medicare are independent business people.

Apparently, you are not on Medicare?

OTB hit the nail on the head for you. Now go study up rather than spouting off inaccuracies.

Yes, the country is broke but should now add more open ended entitlements, like medical and child care. That makes a lot of sense. Of course, the estimated cost will prove to be wildly understated again.

If you want women to work – there must be child care. There also must be in-home elder care.

The Reserve Army of Labor may be substantially smaller than we realize:

1. Two and a half million people in prison, most of them working age.

2. Millions more on probation/parole. No one will touch them with a ten foot pole.

3. Millions more have “paid their debt to society” but are still effectively being punished because no one will hire them. Ever.

4. Millions more who are credit criminals (bankruptcy), or have bad credit scores, or wrote the wrong thing on Twitter, are excluded from some jobs.

5. Even though cannabis is legal in many places, many employers insist on clean pee. That excludes thousands? Millions?

6. Society is structured around the policy of Work or Starve but does not allow immigrants to work without the proper papers. Sometimes they are required to wait a year before they are allowed to work. Many immigrants are qualified professionals in their country of origin, but US institutions will not recognize their credentials.

7. There may be one or two million unable to work due to Long Covid. Some will likely become permanently disabled and greatly expand the ongoing crisis of huge numbers of disabled workers.

It may be gratifying for some people to growl about lazy unpatriotic bums who won’t work, but putting the screws to people who don’t have a job won’t fix the problem. Although it will make the lives of poor people even worse, which some people would consider a feature, not a bug.

Thank you for that post. Add that there is $35 Trillion in retirement accounts. Part of that is certainly getting to children and less fortunate sibs.

1) Wages are rising because gov jobs are up 188,000. Gov jobs

are well above the min wage.

2) The teacher’s union threaten to strike unless every kids will be vaccinated, using a face masks in the classrooms.

3) The police forces have shrinking in every major city.

4) The employment rate of 16-19 yrs is up from 9.6% to 9.9%. About 1/4 millions more kids are out of the labor force, with less police, during a summer break in the streets, because Miami beach is out of reach.

At 19 I was working in a packing house decent wage now pays 20$ a hour but our enabled kids were never taught to work but can beat my ass in a video game

One high school friend had a job catching grown chickens in chicken house and stuffing them in crates and stacking on a truck. He said it was tough once you got down to a few chickens. I think he made $2.00 per hour.

I had a better job cleaning a corporate office and manufacturing facility, but pay was $1.60.

My grandfather’s first and only job for 53 years was in a cotton mill making 10 cent per hour. Girls got paid 5 cents per hour.

Ahhhhh yes!

All that nostalgia from the late 19th century.

Next we will hear about walking ten miles to school ( uphill both ways ).

It’s ok…..I’m a geezer too.

OTB, not only did I have to walk to school 10 miles each way (uphill, both ways), but I didn’t speak English when I got there. I was sent home and told, at 5 years old, to learn English before I came back! It took a while, but I made it.

Wolf I think the other factor is the number of workers taking early retirement. I’m seeing it where I work. First the market has bounced back bringing retirement balances back up and two they don’t want to return to work onsite after working from home the last year.

I did a little more than 2 years ago, retired 3-4 years before I wanted to. Couldn’t handle the new hires work ethics and the sensitivity trainings. The 3 years before I retired I lived on the road on per diem and saved like a fool. Put 66% down on a new house and started collecting SS shortly thereafter. Moved my 401K to a self directed IRA. When I turn 66 I’ll pay off the house from the Roth and some retirement funds. Recently did a refi @ 2.75%, my monthly SS income easily pays all the bills. Out of the 26 homes on this street probably 20 are new retirees.

Nice to hear some good news once in a while! Good for you, escaped the matrix with an intact soul.

Got a buddy in his early 30s, waiter who doesnt want to get the jab and is still living off of stimmies. Wont work anywhere they force the jab, said he would work under the table doing yard care or construction. Wonder how many are in that same boat?

Also, I paid $225K for a 3 bedroom 3 car garage a little more than 2 years ago. Recently someone sold the same style house for $355K. I tell the neighbors if/when it gets to $450K I’ll sell. (doubt I will but it would be tempting)

Yes, agreed. I mentioned that with the “retirement boom.”

right above the section heading “#2 weird phenomenon…”

“and it includes what is now called the “retirement boom,” where people have decided it wasn’t worth it anymore, and went for quality of life.”

I know a couple of people like that.

The retirement boom does bear watching (although talked about *forever*, it was a lot slower coming in reality).

Post, 90’s tax reform and various asset mkt disasters, a large number of seniors started working well past 65.

But working past 85 is much less feasible, regardless of financial circumstances.

So, with a 20 delay, openings for younger workers may be accelerating.

Wonder how the 25 to 54 employee to Population ratio is looking relative to the wasteland of the last 20 years…

It’s funny, kinda. We had a retirement boom in 1999. Young-ish folks that made $2-million-plus (quite a bit of money back then) in the stock market were thinking about retiring or actually quit their jobs. They were planning to do day-trading when they felt like it or just doing fun stuff. I did that. I quit in 1995. And from late 1995 to early 1999, I traveled around the world without going home, over 100 countries.

But then the thing came apart, the Nasdaq plunged 78%, and those retired folks whose dream had gone up in smoke were back out there looking for a job. At least, I’d traveled around the world before that happened :-]

I had some friends do the same thing in 1997. Sold their house and retired young. They both were in tech. They bought a 46 foot Cat and picked her up in South Africa. Sailed the South Atlantic the Caribbean and eventually the east coast to Maine. Woke up one morning in 99 broke. They had lost everything!

I retired 2 years early just shy of 68. Just wasn’t fun anymore and I didn’t need the money.

My main household appliance purchases this year were along the lines of weedeaters, leaf blowers, trimmers, and mulch.

Fighting weeds can keep you busy. Plus, you can cut, burn, poison, uproot and otherwise destroy weeds. Much more empowerment than dealing with insurance companies, hospital administrators, regulators, and unpleasant patients.

Plus, once you’re done wreaking devastation people will compliment you. It’s like being in Antifa.

Good one MG,,, and have to report at least somewhat similar:

Had the 56 acre ”farmstead” going strong by the time we were able to move there full time at the last crash, late 09, and then due to increased age became less able and willing to mow 10 acres, weed whack about a mile of fences, etc., etc.

Then elderly parents needed tons of support, so back to near childhood home, with subsequent gardening in late 15…

Now concentrating on learning to ”graft” mango and other tree foods, learning to grow others from ”cuttings” and, very similarly, very very glad not to have to worry about non performing sub contractors, et alia, as you mention…

Life is Good for us who are savers and worker bees,,, as long as ya don’t be enticed by the advertising/propaganda,,, so we watch the BB game/other live sports and a movie concurrently while switching away from ads, etc., and enjoying especially the ”’murrican”’ movies from the 60s-80s that are SO obviously aimed at those with elementary grade cognizant ”abilities” that those movies are easy to ”get” with very intermittent viewing,,, LOL

:-)

It’s nice to read a happy comment here. It seems too many people are obsessed with what’s going, or could go wrong, and forget all the things that are going right in their lives.

“But employers understand that the $300 a week is already being phased out in about half the states and will expire in the rest of the states on September 6”

I’ll take a bet on the stickiness of extant wages. I suspect most employers will not do a u-turn as more employees enter the market, and tell everyone that the wages will be reduced now, even as the effects of higher prices of housing and energy (and salaries…) take over in maintaining inflation measures from the currently (temporarily?) faltering price effects of some other commodities and inputs.

Agreed. No one is thinking about cutting wages. But it is expected to make hiring easier and candidates more plentiful (or less scarce).

When there is a corresponding rise in prices , why worry about cutting wages.

It’s like saying you made $50k a year, and an SFH of say 2000 sq ft was $500K. In 20 years, you make $500k a year, that same SFH now costs $5M. So, basically congratulations, nothing changed.

MCH

So increased pay is the same as current pay?

And your next argument will be a pay cut is the same as current pay ?

If corresponding prices of goods and services decrease by the same percentage, yes.

Remember, it’s the relative value that counts, your average joe gets a 20% bump in pay, and let’s say the costs raise by the same percentage, what difference is there?

Ah there is the flaw in your argument!

Corresponding !!!

A percent rise in wages DOES NOT equally correspond to a rise in prices and services.

Since labor costs are only a portion of all business expenses, cost per good or service rises at a lower rate.

Well, you got me there, the word corresponding shouldn’t have been used. Or should have clarified with pricing in general decrease by the same amount.

The point is the value of your earning power stays relatively constant over time with respect to pricing.

If anything this is going to cause management to have an excuse not to give raises in 2022. Inflation is eating at the bottom line. Take one for the team Timmy. We are really struggling will be the got to line from HR

Get a better job while you can negotiate. Because in about six months there will be a reckoning

That’s why many are doing ‘hiring bonuses’ rather than substantial wage increases.

“I’ll take a bet on the stickiness of extant wages.”

You betcha. But the result is that wage push inflation now has a higher base to spring from.

Everything has labor inputs so most consumer goods and services will be much pricier and standard of living will take a beating (sorry, this time GDP growth is not going to come roaring back to outgrow inflation and debt).

Cutting pay at a large scale is difficult, unless the competition is also doing it if the economy crashes.

I expect more jobs to be automated out of existence. Already read an article about how it’s being done now in eating establishments due to the labor shortage. I also expect it later because not everyone’s labor productivity will be enough where employers will continue to pay it if they do not have to.

I say they will work to keep payroll cost managed, fewer people, leaner health care plans and finding teenagers to work at lower rate.

It’s almost like there’s a hidden 30% of parents that were otherwise forced into the working part time jobs through desperation, but following a grueling year of zoom school, a hot vaxx summer where they still have to be a parent, a nice child allowance rightfully compensating them for their efforts, and a possible re-orienting on what matters in life, we can’t get the poor saps to show back up to get yelled at by power-tripping middle managers for 7.50 an hour.

Weird how that works.

The jobs numbers aren’t as high, when people find better things to do that aren’t jobs.

The jobs numbers would look just as bad if everyone became autonomous or independently wealthy too, but lets keep wringing our hands, because god forbid that happen.

The economy needs wage slaves.

Noticing a lot of high school and even younger age youth soliciting babysitting, dog walking, gardening, “I will do anything” jobs on the Nextdoor data mining platform. They are undercutting immigrants with what they want as well.

And, this in one of the wealthiest zip codes in the state, Mill Valley.

I think it’s either a sign of parents tightening allowances, or needing financial help, or less likely, the beginning of a great awakening and generational shift from Grandpa the Stoner, to Mom the “Business Person”, ex-shoulder pads, but now is a caterer, to something completely new.

It might just be an excuse to get out of the house, especially with COVID. When you’re a teenager, it gets tiresome living with the people who pay the rent/mortgage 24/7.

One ounce of Ag / hour, under the table, works wonders.

get real, nobody but zerohedge reading weirdos has physical silver laying around for bartering purposes. people want cash

When every stimulus program ends in July, I expect to see a $h**show of humongous proportions.

There is no labor shortage, the jobs don’t exist. Why take a job when the wage doesn’t cover the expense of coming to work. They are retiring because if you are going to be broke anyway, why work.

Not in California at least, we are flush with money and we’ll be doling out even more free money.

Best state in the country!!!

So why are the homeless everywhere and all the shops are closed?

Because the government is flush with money.

In Chicago the homeless are used as theater props by the politicians and media.

In their own cities, in flyover America, the homeless are paid to leave. In Ca there were too many shops in the first place, too many restaurants, (because things were too good?) and now we see the self employed are getting jobs. The economy is transitioning. The state is going to add low income housing to accommodate the poor from somewhere else. Fifth largest economy in the world. In the 1930s they had to turn em back at the border, and they will probably do it again. Immigration used be Americas problem, too many people wanted to come here, and Trump fixed that. Some lower income people leave, until they get a leg up, and they’re back, or they go bust and get a free ticket home.

It’s your money duuuuummy

No it’s our money.

It’s not my money. It says “United States of America” on it. It’s their money, and one of the better government services.

US Government…

What’s mine is mine and what’s yours is mine. (hmmm… that’s what the ex-wife used to say)

Been watching on-line videos of all the major stock crashes on-line. The one where Prime Minister of Great Britain pegged the pound was an example of stupid policy. Cost Britain a great deal.

Crash in 1987 and flash crash ten years ago shows you market can break down and you can’t execute order when you want in a crash. Not sure we ever got the truth on the flash crash.

Old…

“The one where Prime Minister of Great Britain pegged the pound was an example of stupid policy. ”

I believe that’s where Soros made his $$

Yep. G.B. wasted $16 billion trying to support the pound. I think Soros got $1 billion of it.

I am pretty sure Paul Tudor Jones made out like a bandit during 1987 crash.

The words you want to hear as a value investor is “sell at any price”, just get me out.”

The dysfunction and willingness not to work is a sign of a very sick mindset.

A large fraction of Americans are being treated like wage slaves: work and you just get survival without “getting ahead”. Getting ahead means more freedom for yourself- owning something, maybe able to even start a business based on savings and other economic assets (including your own skills, persistence, etc.)

If you are just a wage slave, you stay home if the price is reasonable. You don’t do that if you have hope for the future.

People in the ’30’s wanted jobs. They got some: WWII. The contrast is pretty large, no?

Have no fear, we’ll be in the 30s again soon enough, less than a decade away.

Heck, at the rate things are going, we’ll probably pulls the 30s into the 20s. Except this time, the oceans aren’t going to be any impediment at all.

Quiet strike….good one.

Just my opinion, but labour has been getting screwed since the orchestrated attack on union representation/organising started with Reagan. It has continued on through every admin since as all Govt has bent their knees to the wealth class due to election campaign funding. Toss in globalization and here we are.

This is the result. If they want the wealth machine to run, they have to fuel up the tank.

I have been lucky in my work life because my skills are portable and I was always willing to move on if the games started up. Or, I worked away until something better came along. But if you take an average employment situation, add in debt, workers are stuck in chains. People lost their jobs this year and had some breathing room to evaluate their situation. The numbers are speaking loud and clear.

My sister in law works in retail grocery as a front end manager. Her job is shitty beyond belief. She is paid about 1/2 of what she is worth and what she accomplishes, but she soldiers on hoping it will improve. Grocery is also almost all non union, with the exception of Costco and a few others. She would quit tomorrow, but guess what….she built a new house a few years ago and is stuck stuck stuck at 55. Hopefully, her home will be paid for by the time she wants to retire or she’ll just have to keep working.

My hope is that Branson and Bezos will run into each other during their upcoming space flights. Maybe their crafts will tumble to the ground and crush Musk. Maybe they’ll hit Davos and help out the World.

“My hope is that Branson and Bezos will run into each other during their upcoming space flights. Maybe their crafts will tumble to the ground and crush Musk”

What is it about the rich that makes them so space horny?

Personally, I would put my billions into life extension med/consciousness transfer research (closer to their tech wheelhouse than space too…)

One small comfort regarding most ostensible billionaires…there wealth is usually overwhelmingly stock based and semi frozen in their own companies.

Once reality intrudes upon the hyper PE ratio hype, those billions can evaporate fast. And they can’t fully extract those billions because share dumps of epic size would crater share prices.

They are still absurdly rich…but not really as rich as the headline numbers proclaim.

re: “What is it about the rich that makes them so space horny?

Personally, I would put my billions into life extension med/consciousness transfer research (closer to their tech wheelhouse than space too…)”

They already have. The billions for rocket joyrides is just fun money to them (though Branson may be feeling the squeeze, just a bit).

“My hope is that Branson and Bezos will run into each other during their upcoming space flights. Maybe their crafts will tumble to the ground and crush Musk. Maybe they’ll hit Davos and help out the World.”

Lol. They look around at the fkwits everywhere on this planet and figure out how they can blow this pop stand and just happen to have money to try it unlike the rest of us misanthropes.

“Maybe their crafts will tumble to the ground and crush Musk.”

Remember the Tesla Roadster car Musk sent into space a few years back?

Let’s do it again with Elon at the wheel– I wish him many millions of happy driving miles out there.

P

“My hope–”

You should make a movie of that, guaranteed box office smash.

This little hissy fit that some workers are throwing right now will ultimately come back to bite them in the a$$. Businesses that can take advantage of automation and AI are likely exploring ways to make themselves less vulnerable to these “labor shortages” in the future, as well as less susceptible to mandatory shutdowns in future pandemics.

And yet Amazon is struggling to hire more despite having some of the best AI scientists.

Why is that?

Could it be AI is …. overhyped ???? Say it ain’t so.

Like any other major transformation, it takes time. History is replete with examples.

You spoke of it as if it was going to be soon though. This future of AI has been talked about for 60 years plus. By the way, as an IT guy, I’ve worked with a lot of these tech, from Rules Engine to AI models, and IMHO opinion they are all overhyped. Neural Networks went through a long cycle of “if only we have enough data and computing power” (which happened) to “well perhaps if only we have good data” and still things like self driving cars are either ways off (see Google’s 15 years effort) or they kill their passengers (Tesla).

Time does not guarantee anything. Remember, we still don’t have a vaccine for flu.

Wednesday 6/2/21…CEO of McDonald’s claims they’re testing automated drive-thru’s at ten Chicago locations. That same week, a McDonald’s franchise was lamenting they’re needing to offer iPhones in order to attract workers. I’m sure that’s purely coincidental.

No they are not, but you seem like a guy who just reads the headlines. CNBC has the following:

“CEO Chris Kempczinski said Wednesday. Kempczinski said the technology is about 85% accurate and can take 80% of orders.”

That’s not good enough, because the other 15% to 20% who got their orders wrong would swarm Twitter with complaints, and then we’ll see what happens with McDonald’s stock price.

Self Driving cars already run on the road, so what McDonald’s is doing is nothing ground breaking. Google also demoed a voice assistant 2 years ago(?) that was capable of making restaurant reservations for you. It was capable of saying things like “hmmm, ” etc, etc. After that demo though, zip, nothing.

These tech demos are nothing more than the management class trolling the lower class.

Why not have an AI that can invent and manage companies? Managers are expensive after all. Or failing that, how about a visa to bring in successful enterpreneurs/managers from 3rd world countries. They’ll do the same job for cheap.

So what, Monkey Biz…the variability amongst the humans behind the counter at my local Chipotle makes 85% accuracy seem like the gold standard. The Google reviews are abysmal for the online orders. The only way to get what you really want is to stand in line and verbally guide the process along.

Oh……you mean like the jetpacks we were promised?

Also the flying cars ?

Major transformation……puh-leeze

Automation speculation is just the ownership class trolling the worker class.

Hahahaha…what planet are you Luddites living on, OTB & MB??? You crack me up!

3D

No not Luddites.

Nice try at deflection though.

Just pointing out the many many failures of technology and their….shall we say….exaggerating technology fan boys. Could I be describing you?

By the way…..why can you NOT buy a REAL self driving car? After all, they were promised to be operational YEARS AGO.

Not just a Tesla that runs into things like a techie Mr McGoo.

Yes, they are. I followed a flatbed with eight manufacturing floor robots (no idea what model) strapped to the bed on I-95 a couple weeks ago. My wife and I looked at each other and said, almost simultaneously: “Slightly less of a labor shortage for someone…

Were they orange, yellow, blue or white?

So true. Businesses are using the “labor shortage” as a driver for investing in automation. IA is great but robots that never take a break, sleep, get paid, complain or cause HR debacles. And if you look these are not just work by hand. They are also ‘bots’ in the computer world too. IT in every industry is heavily invested in automating tasks and having them be run via scripts and computer code rather than humans

Yes. Check the manufacturing employment chart against the manufacturing production chart above. Production has fully recovered to Feb 2020 levels, employment is still way down. That’s where the robots went.

Is anyone doing market research on the buying power/habits of robots, yet???

may we all find a better day.

All stores going to self checkout it sucks

You do self checkout when you buy online so why not in a brick and mortar store?

Easy answer is stock market craziest I’ve seen pump and dump making a killing but in end most people just get killed financially

At least someone has a job picking your groceries

I don’t use them. On the very 3 occasions I have because the other lines were way backed up I made sure to make a real live human being spend way more time with me than if I had gone through their line. Sabot.

Do you pump your own gas?

I don’t know about now, but used to Oregon wouldn’t let you pump your own gas.

3D, yes. I have only ever seen one gas station in California that pumps it for you. The equipment at that station is very very old.

3DM

We have a totally unstaffed gas station in our small town. You stick your credit card in a slot on the pump and it all switches on automatically. If anything goes wrong there is a dedicated onsite phone-line to somewhere. Works great, but scary absence of life apart from yourself especially late at night.

My dad was born in ’42. He used to set pins in a bowling alley. He also said you could go into almost any business right off the street and find work. Boy how times have changed.

These self checkout machines are just another way to offload work to the customer, like these mobile APS and other Bull S$it. I never use the self checkout unless I have one or two items.

No automation.

Years long chip shortage.

Remember ?

Right, almost forgot. Chip Shortage, Labor Shortage, Everything Shortage…Brain Shortage.

It’s ok

Memory fades with age.

Its just your time now.

When the government pays people to relax its bound to disrupt the workforce. One other thing, this is not an unemployment benefit. It’s a thinly disguised vote-buying scheme by the party in power.

A lot of us with COVID discovered that we rather have more free time than $. Consuming our time instead of stuff is the right thing to do for the environment as well, a ton of positive externalities.

Maybe the lowlymokestanis have had enough bs, as pronounced from on high, and have decided to sit this one out …rumple stiltskin-like! Think about it, if enough of the workings class, those that actually, physically DO work .. as opposed to office cubies, said uh uh, NO!, even increasing some in numbers .. imagine the utter panic in the 1%ers (That includes those grifting H$S “leaders” of ours’) and their karen-like toadies – the Professional Managerial Class ..

It would be a sight to behold.

Halal Guys in Oakland on Broadway has a sign out…hiring at $18/hr.

I got my 2nd shot this week and walked around Old Town and up Broadway. I think every single restaurant had a hiring sign.

Yet rents are moving up and housing is unaffordable.

> Yet rents are moving up and housing is unaffordable.

Instead of healthcare, employers should start offering housing as the benefit.

It works and it’s needed. One of the hotel/bars around here offered a $1K bonus to anyone working more than x length of time, plus free housing as part of the compensation. A friend of mine may be doing a news story on it to inspire others.

Free housing is taxed at value.

Oh, also, I forgot. One of the pot companies here bought up a fairly nice motel as worker housing. I would guess starting wages are minimum of $20 pr hour, basic labor or clerk. They train.

Company provided housing used to be a benefit in Japan. Heck they might still have it.

I was raised from birth to about 3 years old in a “coal company” house in eastern Pennsylvania in the early 1940’s when my Dad was at war. The coal company owned the house. He was a coal miner and went to fight the Japs because it was safer than the mines. When he got back, we moved to Connecticut for him to find work as the mines were shut down.

That very small house had a well for sink water, an outhouse, and no heat (coal stove in the kitchen kept the place above freezing during winter). Such fun, no internet, video games, Fakebook, etc.

It still out there…the town of Scotia in Humboldt is entirely a company town for the mill workers and forestry staff.

Same with the town of Moccasin, its owned by the SFPUC and folks that maintain the Hetch Hetchy water lines and dams live there.

The leading character in Nomad was a women whose husband worked the Gypsum mines in Empire, Nevada. They lived in a company house. He got cancer, HB1 killed the town. He died they lost everything and she moved into her van. I think even more people are living in vans and trailers then imaginable. A lot of these single early retirees seem to be headed in the same direction. Inflation is killing them from all sides.

AlamedaRenter, Scotia’s housing, or much of it, has been sold to private buyers. The mill hasn’t been fully operational for years. Those houses are very nice and roomy for the most part.

Thank you, Wolf.

In recent years the post WWII baby boom “boomers” have been retiring. The baby boom produced a demographic bulge as the fertility rate was higher after WWII depleted the population. Fearing COVID many retired early in 2020. The 65+ segment of the population has grown from about 8% of total population in 1950 to nearly 16% today. These retirees are less likely to get hired, yet they may be able to purchase goods and services.

“Fearing COVID many retired early in 2020.”

The youngest Boomers were 74 in 2020…that isn’t retiring early.

Your broader point is well taken, but the “retirement train” long foretold, has be a long, slow time actually getting here.

No, the oldest boomers were 74 in 2020. The youngest were 56.

Arghh.

Right you are.

The oldest Boomers are 74.

But my point still holds…the Boomers have delayed rather than accelerated retirement, delaying (by a considerable amount) the long anticipated “retirement wave” that is expected to hit the job and housing mkts.

But the Boomers can’t delay it forever.

Cas, I think we have to separate Boomers into two groups, those who have substantial stocks (or paid off houses in places like San Jose or Mountainview) and those who don’t. Those in the former category feel “rich” and that they can retire a few years before.

Those who don’t have a lot of assets have to delay retirement, as they see inflation eating away at their savings.

Your math is wrong. The oldest Boomers turned 74 last year. The youngest ones were only 56 years old in 2020, so assuming anyone born in 1960 thru 1964 retired last year, it was an early retirement.

You are correct, I reversed youngest/oldest.

But a look at FRED data indicates that starting in the 90’s (after tax reform lowered the Social Security tax penalties for working), a rapidly increasing number of 65+’ers continued to work.

This delayed the long foretold “retirement tsunami”…but it is 20 yrs later and in the nature of such things, retirement cannot be delayed forever (despite various stock mkt disasters…)

Someone born in 1959 would be 62 and able to retire early before the 66 yrs 10 months full retirement age. People born 1946-1964 are boomers. To get the largest Social Security check, one needs to wait until the age of 70 to start drawing benefits.

One in four retirees get 90% of their income from Social Security (Center on Budget and Policy Priorities).

cas/right-dammit you two, first i’m pleased to find i’m no longer a Boomer (which confirms my personal run at life’s trajectory), then crestfallen to find i’m still firmly embedded in that demographic…

Back to weedwhacking the firebreaks…

may we all find a better day.

The Jones generation aren’t quite Boomers socially or financially. quote;

“Generation Jones is the social cohort of the latter half of the Baby Boomer Generation to the first years of Generation X. The term Generation Jones was first coined by the cultural commentator Jonathan Pontell, who identified the cohort as those born from 1954 to 1965 in the U.S. who came of age during the oil crisis, stagflation, and the Carter presidency, rather than during the 1960s, but slightly before Gen X. (…) The name “Generation Jones” has several connotations, including a large anonymous generation, a “keeping up with the Joneses” competitiveness and the slang word “jones” or “jonesing”, meaning a yearning or craving.[14][15][16] It is believed that Jonesers inherited an optimistic outlook as children in the 1960s, but were then confronted with a different reality as they came of age during the shift from a manufacturing to a service economy, which ushered in a long period of mass unemployment, and de-industrialization arrived full force in the mid-late 1970s and 1980s, leaving them with a certain unrequited “jonesing” quality for the more prosperous days of the past.

Generation Jones is noted for coming of age after a huge swath of their older brothers and sisters in the earlier portion of the Baby Boomer population had come immediately preceding them; thus, many complain that there was a paucity of resources and privileges available to them that were seemingly abundant to older Boomers. Therefore, there is a certain level of bitterness and “jonesing” for the level of freedom and affluence granted to older Boomers but denied to them.”

Was a teen in the 70s and twenties in the 80s. If I could buy a DeLorean with a flux capacitor I wouldn’t hesitate to go back if given the chance.

Sholoh1 I agree. Each generation since has had less and less opportunities. Rent was cheap as a percentage of wages then. It started to go up quite a bit in the early eighties.

I knew a guy who bought one of the first DeLoreans in NYC and anywhere. It broke down the first week and for the first year was in the shop. I don’t know if it ever ran after that. Nice looking car but a total brick.

Petunia,

During the development phase of the DeLorean, I was excited about it. A new competitor, I thought. Then he couldn’t figure out how to design and build his own engine and instead went with a Peugeot V-6. That was the death knell. Back then, engine tech was key, and Peugeot didn’t have it and was building under-powered duds. An exotic high-$ car needs to have an exotic high-powered engine. If I’d want a Peugeot, I’d buy a Peugeot.

Forget it McFly, you Irish bug! All you get is the Toyota 4×4 with a 22R, hefty payments, and a less-hot replacement girlfriend. No hoverboards either. Read my fax McFly, “You’re fired!”.

@Wolf,

That engine used in the DeLorean was known as the PRV-Douvrin engine, jointly developed by Peugeot, Renault and Volvo, hence the PRV.

Originally they wanted to do a V8, with the usual 90deg cylinder bank angle. At the last moment it was decided to cut off 2 cylinders but keeping the rest, thus ending up with a 90deg V6 instead of the technically ideal 60deg V6.

This kludge never ran as smoothly as a real 60deg V6. Although versions of this engine have been used in an enormous variety of EU cars at the time, it has never been loved by true petrolheads.

Interesting description of Jones generation, Lynn. By age, I’m a boomer born 1951. But I was set back a few years (drugs and associated mental problems), so my experience is actually that of a Joneser. As an idealistic boomer teen, I couldn’t hold down a job because the world was too freaky, and my antiwar activism / counterculture radicalism arrested my maturity development.

Becoming a competent human involved realizing that “straight” society was more supportive and useful than the culture of my old “friends.”

I don’t have any great stories about navigating the career world, vaulting up to stratospheric income levels, like many of my generation. Right up until retirement, I’ve always had anxiety about being employed, partly because my smart-ass question authority attitude tended to me fired. Through it all, my attitude was that if I lost everything, I would just start off at the lowest rung again and I was efficient, thrifty and organized enough to do well.

My philosophy has always been that it seems like real needs are very minimal. I view most “needs” (especially American needs) from a Buddhism perspective: illusion — desire is basically a trap. It seemed like a rich country could provide basic income to every individual that would cover their basic, real needs. But health needs throw a monkey wrench into that principle. Because health is pretty strongly associated with personal behavior.

With quite a bit of luck I got through it all in one piece.

Drifterprof, That wasn’t mine. I didn’t think I could link to it and wasn’t sure I could mention it. Easy to google part of a quote though.

Yeah, I don’t know how people without support or a support system survive now.

That’s one of the biggest lessons I ever learned. Before making any kind of significant purchase I always ask myself “What problem am I solving?”

Drifter/Lynn-thank you both, Lynn for the ‘Jones’-generation background and Drifter for recounting your experiences-found each highly resonant…

may we all find a better day.

The government pays for old people to sit on their asses. It’s called Social Security. I don’t recommend retiring at 62, but if you have a job that is physically killing you and you were born in 1959 or earlier, you should consider it.

Don’t forget that was part of the deal of being in the labor market. You had your check docked so you could retire in your 60’s. It was a forced deal, but don’t take the carrot away now that you are ready to eat it.

What was SS tax back in the day? 1%, 2%??

Apple,

SS withholding taxes have been 6.2%,plus 6.2% employee match for 31 years. You have me confused with my grandfather.

I saw the numbers for someone my age and it’s was an average real return of around 1%. But like any ponzi first ones in got treated the best of

Millennials and Zoomers were not invited to the bargaining table when that Social Security deal was made and they never agreed to pay old people to be idle for 30 years.

No one wants to to hear it, but those are the facts. Younger workers can change the agreement whenever they outnumber older people who are not working. I don’t know if that will happen but I don’t doubt it.

You made an agreement with people who are dead, I would say that was not a wise agreement.

Kaleberg

“The government pays for old people to sit on their asses.”

Only in a situation where that “old” person didnt pay into the Soc Sec scheme. You should make that distinction.

I would gladly take a lump sum of what I paid in over the decades, with the compounding…and call it even.

I paid into Social Security since 1962. I don’t feel guilty about taking that check. If I had put it into virtually anything else, it would be a lot bigger.

“I paid into Social Security since 1962. I don’t feel guilty about taking that check. If I had put it into virtually anything else, it would be a lot bigger.”

Same here….started working in 1961. Ended a couple of years ago and paid in all the way along.

What was SS tax back in the day?

1%, 2%??