Oil Bust Houston hardest-hit. San Francisco, once hottest US market, coddles up to it, followed by Los Angeles, Chicago, Washington D.C., Seattle, and Manhattan.

By Wolf Richter for WOLF STREET.

A nightmare has been unfolding. There were issues before working-from-home and “hybrid work models” slashed current and future real-estate needs of office tenants in the major office markets in the US. And now office footprints got slashed, and companies put their leased but vacant office space on the sublease market, undercutting landlords that want to direct-lease vacant offices.

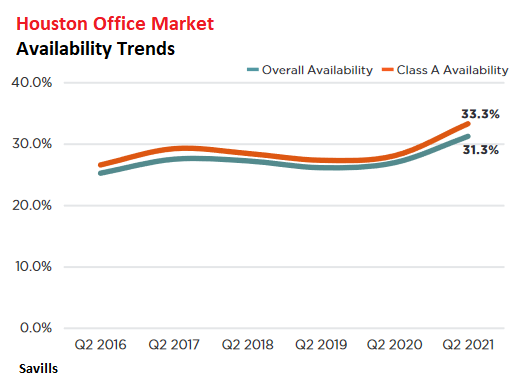

Houston has been the hardest-hit major office market in the US since the oil bust collided with a phenomenal office construction boom in 2015. Availability rates soon were over 20%. But in Q2 2021, they’re over 31% — meaning that nearly one third of the office space is sitting on the market! And San Francisco, three years ago the hottest and tightest office market in the US, is now coddling up to Houston, with a historic office glut.

And “asking rents,” in this environment, are not indicative of actual lease terms and concessions agreed to. For example, real estate services provider Savills points out that in Washington D.C., “Concession packages for new, long-term, Class A leases now average $147.00 psf (per square foot) in tenant improvement allowances and 23 months of free rent, totaling $270.00 psf in total value – a 30.9% increase since the start of the pandemic.” This compares to stated asking rent of $58.46 psf.

Houston, first the oil bust then working from home.

The Houston office market is huge, with 192 million square feet (msf) of office space. Of this space, 31.3% are currently on the market available to lease, according to Savills. In terms of Class A office space, 33.3% is available for lease.

By submarket the availability rates range from 10% in Medical Center/South Houston to 52% in North Belt/Greenspoint. In the Central Business District, availability is 34.7%. These are the effects of years of oil-and-gas bankruptcies, downsizing, layoffs, and since 2020, the effects of working-from-home (chart via Savills).

Leasing activity, at 2.0 msf, was down 41% from Q2 2019.

Landlords have their asking-rent philosophy down pat. Asking rents – $33.42 per square foot (psf) per year for Class A space and $28.96 psf overall – haven’t budged in years. Whatever deals landlords make with potential tenants – including lease terms, such as rent, plus periods of free rent, improvement allowances, and other concessions – are not included in this data.

San Francisco, office shortage turns into historic office glut.

The epicenter of working-from-home, San Francisco saw a number of large employers pack up and leave to cheaper pastures. This started well before the pandemic, and by Q2 2019, office availability started rising. But it became a torrent during the Pandemic. Some of these moves were across the Bay to Oakland; other companies moved to other states, including Charles Schwab, which moved its headquarters to Texas, though it continues to lease now mostly empty office space in the City.

Sublease inventory rose to a new historic high in Q1 of over 9 msf, according to Savills. The overall availability rate leaped to 26.3%, and Class A availability to 24.0%, compared to 7.7% and 7.3% in Q2 2019. By submarket, availability ranged from 21.9% in Mission Bay/Showplace Square to 35.5% in South of Market and to 39.2% in Jackson Square (chart via Savills):

Asking rents fell further to $75.45 psf per year for Class A space, and to $72.55 psf overall, down 11.9% and 9.1% respectively from Q2 2019. This is not reflective of actual leasing terms being agreed on, topped off by free rent and other concessions.

Leasing activity recovered some from the near-nothing levels in the prior quarters, but at 1.1 msf remains down 62% from Q2 2018 and 56% from Q2 2019. About 40% of the leasing activity were renewals.

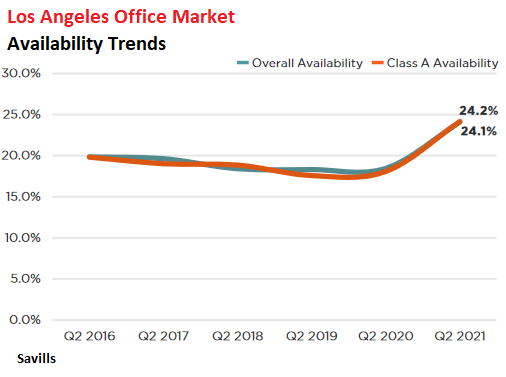

Los Angeles

Sublease space rose to an all-time high of 9.2 msf, and total availability rose to 24.1%. By submarket, availability ranged from 8.8% in Burbank to 38.0% in Fox Hills/Marina:

Leasing volume in Q2, at 3.1 msf, was down 42% from Q2 2019. Of the total leased, 38.5% were renewals.

While asking rents keep rising, landlords are competing aggressively to make deals by offering better lease terms and all kinds of concessions. So overall asking rents rose to $3.84 psf per month ($46.08 per year), and Class A rose to $4.04 psf per month ($48.48 per year), both up about 6% from a year ago.

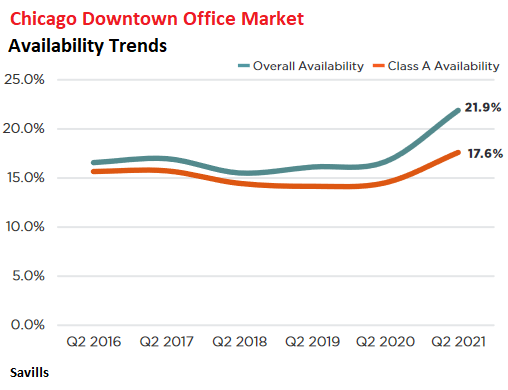

Downtown Chicago.

Amid ballooning sublease availability, overall availability rose to 21.9% in Q2. By submarket, availability ranged from 15.9% in North Michigan Avenue – the only submarket below 20% – to 28.0% in Far West Loop/Fulton Market. Class A availability rose to 17.6%:

Leasing activity at 1.4 msf in Q2 was down by 52% from Q2 2019 and by 62% from Q2 2018. Of those leases that were signed, over half were renewals.

Asking rents have been ticking down very slowly, and in Q2 reached $40.40 psf per year overall, and $45.90 psf for Class A, roughly were they’d been in 2017.

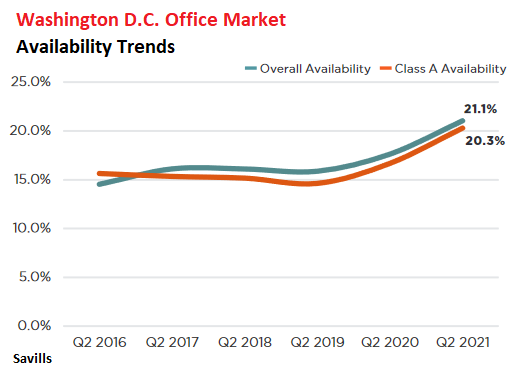

In Washington D.C., “already record-high concessions have soared.”

Overall availability rose to a record 21.1% in Q2. This includes 2.5 msf in new developments, of which less than half are preleased, with some projects having seen no preleasing. By submarket, availability ranges from 10.3% in NoMa and 13.1% in Southwest – the only two submarkets with availability rates below 20% – to 26.9% in Capitol Riverfront:

Leasing activity, at 2.0 msf, was down 37% from 2019. Over half of the leasing volume by square footage was with the government. Renewals accounted for 57% of the leasing volume.

Asking rents have barely edged down to $58.45 psf for Class A and to $55.31 psf overall, but “already record-high concessions have soared,” according to Savills:

“Concession packages for new, long-term, Class A leases now average $147.00 psf in tenant improvement allowances and 23 months of free rent, totaling $270.00 psf in total value – a 30.9% increase since the start of the pandemic. Free rent has risen the most aggressively since March 2020, increasing by seven months on average for a transaction term of ten years or greater.”

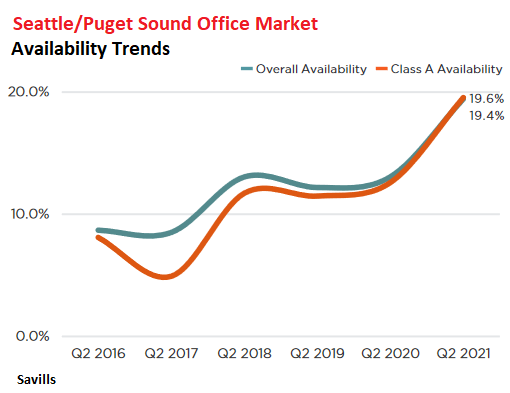

Seattle/Puget Sound.

Availability rose to 19.4% overall, ranging from 9.0% in Everett Central Business District to 29.8% in Southend.

Leasing volume, at 1.1 msf in Q2, was down 60% from Q2 2019. Asking rents have been about flat since 2019. But Savills says, “tenants should generally expect owners that are facing significant pockets of availability in their portfolios to be generous with concessions and flexible with lease terms.”

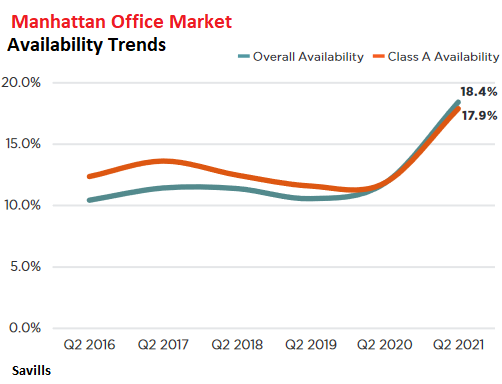

Manhattan, largest office market in the US.

Availability jumped to 18.4% overall and to 17.9% for Class A buildings. By submarket, availability ranged from 12.3% in Hudson Yards to 25.8% in Soho.

Leasing activity, at 4.9 msf, was down 50.5% from Q2 2019 and by 54.6% from Q2 2018. Asking rents have been inching down. Overall asking rent at $75.60 psf was down 3.5% from Q2 2019, and Class A asking rent, at $86.05 psf, was down 5.3%, and according to Savills, “concessions continue to rise with the current value of free rent and tenant improvement allowances for long-term Class A leases up 17% from the beginning of 2020.”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“Landlords can ask for $33 psf, and not budge, but then throw in concessions such as free rent.” To me, this is a classic example of maintaining a charade of rental price stability for the banks, pensions, and non-traded REITs that fund the office construction industry. Since there can be no recognition of reality, markets are forced to extend and pretend, until the entire market collapses, at which point the players will be shocked into reality. This is the financial equivalent of the Miami Condo collapse. Nobody saw the cracks, or if they did, they were silenced.

Possibly another 2008 triggered by a different sector.

A 2008-style crisis isn’t really possible today. It would mean the FED itself is going under, taking the dollar and the full faith and credit of the United States down with it.

That is entirely possible.

Do u remember back then when people were not predicting housing crash and once it happened then they tried to find the cause of it. They said it was caused by adjustable rates, or bad lending standards etc.

Now if crash happen again, then they start to think what kind of excuse they can tell to the average Joe , that it was his fault buying pricy cars and homes. Lets see in 3 years then will talk agian.

There is no housing bubble. And even if there was, and I’m not saying there is; it won’t pop because we have higher lending standards now. This time is different and we don’t have a housing bubble anyways. And in fact, even if there was a housing bubble, and again, there isn’t; it would be a good thing because it makes consumers richer and that’s good for the economy. Actually we need housing to become more expensive, you know, for the little guy, Joe Blue Collar. The price inflation we’ve seen is all transitory, but it’s also not a bubble and the real estate only goes up and you should buy before you’re priced out. We’re not in a bubble but the prices will go back down because it’s transitory but it isn’t in real estate, but we’re not in a bubble…

Trucker Guy nailed it!

I don’t know if we are in a housing bubble or not. However, inflated prices are not good for buyers. If you buy at an inflated price and there is a downturn, all is well until you must sell. Many years ago, I was one of those unfortunate suckers who bought high, then had to sell due to a job move. Unless you can ride out the downturn by renting or have enough in savings to bail yourself out, being underwater is no joy ride. It took us many years to bounce back from that setback.

Fred Flintstone,

In 2008 people couldn’t afford their houses, and faced homelessness; and the banks ran out of liquid cash. People needed a place to live, but couldn’t afford their mortgages.

Now, the issue is that a large and potentially about to explode amount of commercial real estate is just not needed. The total value of loans that could default is higher than the 2008 crisis, but will unfold slower and the response is already likely to be…

Bailouts.

Despite, a larger amount of money being involved (more dollar value worth of loans will likely default than in 2008), the fact that these loans defaulting, won’t directly result in homelessness, will mean this situation will be treated with less concern; it will cause less of a shock to the economy.

There are of course many other things that could also happen though.

Eventually, a bunch of commercial land will have to be turned into residential land, fields, parks, and more.

Looks like Miami will once again be the epicenter of the real estate collapse. Between all the costly repairs and lawsuits, it’s looking ugly.

Curious to see how the ocean-side condo market holds up. Especially in the older buildings. I suspect there will be an uptick in inspections, if only to reassure current and future tenants.

The inspections will conclude that $$$ is needed to repair the damage. The bill will be sent to the HOA teams and letters will be sent to the owners stating they will need to pay a one-time special assessment of . These can be $2,000 to $100,000. From my history we dreaded these even when they were $500 since people live paycheck to paycheck so often. Another disaster that will be spun into a crisis requiring the federal government to intervene is already upon us

The condo market is NOT going to hold up. People in these high rise condos on the beach are going to be running like scalded dogs.

Would those inspections be carried out by a new graduate in his/her first job, who is being pressured into passing the structure without even doing a proper inspection and getting paid a fortune to do so? When the SHTF, it is this poor sap who gets the blame for passing an unsound structure. The senior members of the firm are “shocked” that one of their employees could be so irresponsibly negligent and of course everyone believes them because it’s in everyone’s self interest to do so.

An inquiry into how this could have happened? Don’t make me laugh. Everyone knows this is how it happened, so unless a group of lawyers get together to game the system with a class action to get some of those corrupt dollars in an undisclosed out of court settlement, an inquiry is completely unnecessary.

I still have no idea why someone would choose to live in Florida.

Florida is terrible until you consider the alternative.

I live in the Tampa Bay area of Florida, I’m a transplant from the Northeast who also previously lived for a decade in Texas. For me, it’s the natural beauty, the abundance of options for outdoor recreation in nature, the never having to get through 280+ cloudy days every year again, the never having to endure the vagaries of Winter, the plentiful birdsong, oh…and the diversity, because with it comes an amazing bevy of dining options. People are terrible everywhere, but I’m an extrovert and it takes a lot to get under my skin. I also lost half of my home in hurricane Rita while in TX…I still prefer to risk hurricanes over whatever the Northeast offers in terms of quality of life. Oh! Also forgot to mention that I have an incredible and well funded library system and free dual college enrollment for my homeschooled kid. Free as in completely free, including books and bus transportation if necessary, which here means beach stops. Many students can earn free associates degrees by the time they reach high school graduation. Students can take advantage of a scholarship program called Bright Futures too, which covers a significant portion of the tuition continuing on to the first year of graduate study within the state of Florida. The legislature is tinkering with this program, putting some majors and dollars at risk, but right now we’re secure. I have easy and cheap-ish still air service back to my peeps up North, so I can catch them and the Fall foliage when I need to. Now that I’ve written this, I can’t remember what the tradeoffs are. Maybe cheaper car and home insurance.

Jess, FREE meaning someone else will have to pay for it? Correct?

And parts of California are highly susceptible to landslides and their devastation, but life goes on there.

More stupid, childish comments from people who want to denigrate a city or state.

For many people, living next to the white sand beaches and crystal blue waters of the Gulf of Mexico, is why they choose to live where I do.

With 22,000,000 residents and the 3rd most populated state in the USA, your question make you an ignoramus. If you want to keep humiliating yourself in public, go right ahead you childish buffoon.

If they condemn Miami buildings, more people will be homeless looking for homes. After Hurricane Katrina flooded New Orleans there were many looking for homes. Some of them moved to Houston. I met a couple at a community pool from California. They told me Californians are moving to Florida. The drought stricken west is at risk of wildfires. A town in Canada burned down yesterday after record high temperatures earlier in the week. They are homeless.

Davis, it’s starting to look like a huge game of musical chairs. It’ll be interesting to see who has a chair and who doesn’t when the music finally stops.

*David

Newsflash:

People who live in ocean-front condominiums are not poor people who will be homeless if they can’t live in their condo anymore.

I heard the Cable TV company that served the collapsed building is filing a lawsuit against the homeowners association because of the lost cable TV customers.

SC,

When you do appraisals on condo units, how much is the building vs. the unit? Do you account for special assessments outstanding at the time of appraisal?

SC,,, please be so kind to share with us the/your answers to Pet’s questions, especially relevant these days in FL, and, in fact, many places where condo type arrangements continue to be major sources of ”homes” ,,, especially homes for the middle of the middle classes, at least by income.

With reference to repair costs of condos, I will repeat a comment made at an earlier article from Wolf:

Worked as estimator on many many condo structural and finishes repairs, including one where the original purchase price was about $65K average circa 1980s,,,, and the structural and cosmetic/painting&caulking repair was $300K circa ”early oughts”…

This problem, certainly exacerbated by the very shoddy construction and the certifiable corruption at all levels, is NOT going away easily or possibly ever..

And, as commented on here earlier articles, at least some of the problem results from building on sand bars,,, as SO well documented by John D. McDonald in his books, especially, ”Condominium” many decades ago.

VVN,

Spoke to a guy who did real estate management in FL. He was a condo manager with a condo association managers license(certification in FL). He keeps up the license for his resume, but says after this, he would never do that job again. He expects the manager or maintenance guys to get blamed for this disaster, even though the boards control the spending.

I’ll check with Mrs Swamp for an answer. I’m just hired help//

In a case involving Cable TV contracts for Condos I have 1st hand experience with this matter. My parents had a town home community in Fla and the cable TV contract was sold to another vendor in violation of the easements clause in the contract. The new cable contractor essentially stole the underground cable infrastructure on the advise of an incompetent junkyard dog attorney. The original contractor filed criminal charges against the homeowners association for theft, and put a lien on every homeowner’s property and won the case hands down. The homeowners association leaders also faced jail time for theft of the underground cable infrastructure. So much for their volunteer work. The case was settled with a $20,000 special assessment which had to paid by every homeowner. This knocked the appraised value of every unit by that amount overnight.

This happened in a community called Country Manor in Delray Beach Fla. Look it up if you don;t believe me.

In response to P’s question, according to Mrs Swamp, special assessments have to be paid at the time of settlement. No if and’s or buts. If they are not paid and the property is not on the sale block then the appraised value is diminished by the amount of the special assessment. Its sort of like a lien on the property. The example I cited with respect to the Cable TV company is an example of the worst case scenerio. We’re doing one right now where the seller has to fork over $10,000 at settlement to the homeowners below him that had their place flooded due to a defective water heater in his unit.

I always think it is interesting to see local Govt and state Govt bash the Feds and any Federal admin until they need cash for some catastrophe or another. How silent they sit at the table while the cameras roll. Like junkyard dogs, when the crisis is over and the Feds are walking away, they quickly turn and bite them from behind. Pants torn, wallet falls out, Fed limps away, Governor reaches down for the wallet, “Look what I found, guess it’s ours, now. Always was, didn’t you know”?

This time will be no different. No one could foresee loans going bad, interest rates increasing, hurricanes descending, winter ice storms surging south, buildings collapsing, power interruptions, ____________. pandemic consequences. But when the shoe is on the other foot it’s always we want want and demand demand, our rights, and leave us alone without interference; any interference. No taxes paid here! No one tells us to wear a mask. And yes, I am referring to Texas and Florida, maybe Hurricane Sandy in NJ, and fires in whatever western state that currently wants to be left alone to live in Freedom.

Until.

No surprise Miami will lead the charge this time around. We could write the script with our eyes closed. And hurricane season is just starting. Suddenly this month, it is the United States…..that is until the next election cycle. Then it ain’t so united.

A disaster? Crisis? Suddenly blank cheques on an overdrawn account is exactly what we need, yesterday. Everyone else can help pay.

But a gas tax increase to fix decaying bridges and roads caused by time and use? Not on your life. A tax increase on the 1%? Not likely. Just let the working stiff’s kids pay for it.

Empty buildings decay. This is a brewing mess that will produce financial reckoning in many many sectors. So get your pencils out and let’s have a contest for the best demand phrase for a bailout. We all deserve a bailout, don’t we? Not our fault the buildings are empty.

So what’s your solution to all you ranted? Move to Canada where life is perfect? Turn Socialist like Canada? (although the U.S. is headed in that direction).

Somehow, I believe you either posted in the wrong article or are just off topic.

Miami will be underwater on their mortgages literally. Climate change is accelerating. WFH is a good idea if managers can make their subordinates actually work at home. It would save fuel, tires and reduce time commuting. Commercial real estate is in trouble. Why fly to a conference at Sun Valley, ID, if it can be done on a screen?

Paulo:

Ain’t free market capitalism (with “regulations” business friendly) fun????

AA-Paulo’s neither misposting or offtopic. He has merely presented a later point in history of any successful/prosperous civilization. When a civilization forgets that majority cooperation brought them to the dance, and the idea of general civic duty/necessity of shared sacrifice is no longer in vogue, can-kicking, unrest and possible decline have been the result.

There are not, and have never been universal or facile answers to the governance of our species’ internal/external conflicts and desires, especially now when our numbers are huge and relying on a technoindustrial operating system hitting its limits in comfortably sustaining those numbers.

We can only resolve to do the best we can with each other and work our hardest to avoid crossing yet another of those PNR’s that seem to litter the path of human history.

may we all find a better day.

US Accounting Standards are smarter than that. They include “free months” when calculating an average monthly cost for rent.

I assume that banks, pension and REITs follow US GAAP, or at least perform simular calculations.

Seattle in better shape than most cities it appears.

Seattle may be in a denial bubble. Let me explain. My company, as well as many others, is still planning how to re-open our offices and bring employees back. We have not reduced our office footprint, it’s all sitting unused as it has been since March 2020. Talking to other leaders in the Seattle/Bellevue area, their companies are doing the same. They all have “open the office” committees that are focused on getting back to “normal”.

This is in spite of large numbers of employees choosing a “remote” or “field” status where they will work from home permanently. It’s in spite of hiring upwards of half of new employees from outside Washington state. It’s in spite of employee surveys saying people want to work from home either full time, or come into the office 1 day a week. It’s the same at many companies according to leaders I network with.

This denial has kept real estate occupancy rates higher than they would otherwise be. And, when Executives finally come to the conclusion that they really can run their businesses successfully with WFH employees, they will see real estate as a high cost item they can optimize (i.e. lower). Then you will see Seattle/Bellevue commercial real estate start to look like San Francisco.

Work from home and Save The Planet. If the company has an office in Chicago, then work from home and save your life.

Most people don’t see the office space glut, especially WFH. They do see the empty storefronts everywhere. Not even the upscale areas have been spared. So now it’s obvious, the commercial center of our country has been hollowed out and it won’t be bouncing back anytime soon. Doesn’t look inflationary to me.

BTW, how will the residential side stay up in these areas? I don’t think it will.

Shh… don’t let the Feds hear you or they will keep ZIRP and buying MBSes for another 5 years.

Those in senior mgmt are loath to give up thier corner offices.

I just did a long trip up the eastern seaboard and did not see that at all.

WOLF stated:

“….San Francisco saw a number of large employers pack up and leave to cheaper pastures….”

I doubt any San Fran companies came to Prescott AZ and no pastures, but beautiful mountains, trails and lakes here. There is ZERO commercial property available here. I am guessing it is the same across much of the small / mid-size SW USA.

ZERO? Not all the boarded up shops & medical offices? Small/mid-sized USA will empty out

Seems to me that the office space carnage has just started. Those leases are long term and there will be pressure on the market for a long time to come. The real fallout happens if interest rates move higher while rents move down further, squeezing some of those investors and REITs into bankruptcy. At some point the cost of debt exceeds the cash flow and properties start to flood the market with supply.

Can you imagine how property markets would be performing if we had an economic downturn, instead of a boom of free money?

Money is flowing. Right now it’s flowing out of commercial leases to residential work from anywhere USA residential properties. It probably will be overdone as money then flows to work from anywhere becomes work from any English speaking country such as Philippines or India.

1) The est cost of repairing the cracks in the Surf City balcony building was

: $200,000 to $400,000 for each apartment owner.

2) The cost of repairing the covid WFH cracks will be higher.

3) In the last 5 years, Houston office buildings lowest vacancy rate was

25% in Q2 2016. Today : 33%.

4) SF lowest vacancy rate was 7% in Q2 2019. Today : 26%.

5) Seattle best vacancy rate was 5% in Q2 2017. Today : 20%.

6) The commodity index bubble peaked in 2008. The anti bubble nadir

was in Apr 2020. Today : a lower high.

7) The Nikk had a bubble in 1989, 30 years ago and never recovered.

8) Gold bubble peaked in 2011, but had no anti bubble.

Gold made a new all time high in Aug 2020. Currently it’s backing up to 2012 the LPSY.

9) It’s hard to predict how the housing bubble will end.

10) It’s impossible to predict if an office building anti bubble will happen, because the future is deeply unknown.

Do you mean the CTS condo in Surfside, Florida?

The actual cost includes $$$ to demolish the place, cart it away, and rebuild. The 2018 estimate was way low. If it is about to collapse, patching concrete will not help.

Spot on.

“10) It’s impossible to predict if an office building anti bubble will happen, because the future is deeply unknown.”

Mr Engel you are right as rain on that statement.

Once the dust settles on current office building market fracas, things might eventually get back to relative normal– with WFHA experiment not living up to hype and companies slowly and quietly bringing their tribes back on the reservation.

We have had need for offices for centuries and I don’t see consequences of a pandemic destroying that legacy overnight.

Boomers can go back to the plantation, they can enjoy their 2 hour commutes and crappy lunch spots. Rest of the us that have choices will work from home.

I have two sons and two nephews all now permanently (at least, so it seems) working from home. All previously worked in offices, at a desk, etc.

And from what they tell me, each of their employers is happy with the arrangement.

I wonder what it’s like to get fired over zoom. I bet I could dodge that for a while while my internet connection malfunctions.

Fedex, followed by an email with a link to a prepackaged video from your HR professional to your personal email, where a CGI based charming young lass will tell you about your non-existent exit package. And a note at the end that said by pressing on the link from your company, you agreed to the termination policies. Thank you and get out.

Wasn’t there are George Clooney movie about that?

I heard that when one of the big shoe companies here in PDX started a program of layoffs last summer the IT department first loaded some special software on every employees company owned computer. Then if your number came up and you got the call from HR that your time was up , they could input a few keystrokes and your computer would be wiped clean and ready for pickup by the retrieval team.

Plus, your access to company networks is denied from here on out.

Amazon Bots are firing contract delivery drivers if, for some instance, they don’t meet the required delivery standards over a specified time period. No human involved.

No excuses like traffic delays, can’t find the drop location, your truck broke down, etc.

It’s a shame what this world is becoming.

And you don’t even have to clean out your desk and get escorted by security out of the building!

O, the wonders of modern technology.

@heniz,

Saves on security guard costs. In fact they will be replaced with robots too.

Security that is.

“Getting fired by a Bot”

Not as bad as Rex Tilisen the Sec of State and former CEO of EXXON/Mobile. He was fired by the orange man while on the toilet.

The FBI Director was fired on live TV while he was giving a press conference. T doesn’t take no prisoners.

Everything they could do face to face is now possible over the phone or video call. Emotions are muted. Boxes are not needed. Security to escort the individual has been removed. It really is just like a Dear John breakup.

Your internet connection may buy you a few minutes/hours or a day but the reaper is coming.

It was the same giving notice. I called my boss directly after sending in my resignation directly to them. We just spoke after three months and they had given notice and are on to greener pastures.

It probably beats being fired on Twitter, by the greatest capitalist the World has ever known. Yuuuugely better than that. :-)

Cute, but that was not being fired, but being censored, first amendment rights revoked.

Having “let go” two employees during the WFH period, it’s really no different over Video than it is in person. Since everything else has been done over Video since March 2020, people have become accustomed to using Video to communicate. There are some benefits to it as well – the person doesn’t need to be “walked out” publicly, in front of fellow employees. Or, in better situations, doesn’t have the awkward situation of packing up their desk while others look on. For the company there are benefits too – no outbursts or other behavior to worry about after the message is delivered. Just remove network/account access.

If the leader and HR are humans about it, the experience can be very similar to how it was in person.

Here’s the side you don’t see. When that person is let go online, the rest of the staff has no idea what happened to them. They become a “disappeared” person to the ones still working. And as they slowly disappear one by one, it depresses the rest of the so called “team.” Cause they all know they too will be “disappeared” some day.

We had a contractor in my IT shop who was on vacation in a rowboat when he go the news on his cell phone.

It went like this

Jack’s boss: ” Hey Jack, how are you enjoying your vacation”

Jack: “Its great wish I could stay here forever, great fishing”

Jack’s Boss: ” I got some good news for you. You can stay as long as you wish. No need to hurry back. You’re position was eliminated due to budget cuts. We thank for your loyal and faithful service.

I’m not making this story up.

They’ll turn off your email and you’ll get a phone call from HR about 5 mins later.

One NYC smart cat (rock musician,no less) recently generated a map of vacant NYC commercial space using open-source government databases – many of which I was not even aware of (see website section “How it’s made”)

http://www.vacantnewyork.com/

We all saw that B&W eerie map in the beginning of “Escape from New York” movie ?

Also he explains why commercial landlords will prefer to have their properties to stay vacant for >10 years to lowering rent.

So what you’re telling me is that the Fed’s going to ‘monetize’ commercial leasing?

Lionel Hutz will finally be able to move out of the Krusty Burger toilets now.

1) Gold is old, older than any bank vault in NYC.

2) Gold is cup & holder.

3) 24K gold grains are shiny, but ZG (Gold Futures) monthly have

wrinkles and cracks.

4) The cost of repairing Mar 2020(C) and Apr 2020(O) largest gap (crack) will be in the billions.

5) ZG board might go for it and reach/ breach a support line coming from :

Jan 2015(H) to Apr 2018(H), a half line from June 2013 (C) and a parallel line from Dec 2015(L).

6) Gold precursor inflation/ deflation.

NKE, Xi shoe shine boy, jumped a hoop and pooped.

Remember The Count from Sesame Street? I read all your comments in his voice and cracks me up every time.

Empty office space at record levels does not, to me, signal inflation. At the end of the ‘stimmie’ pipeline lays unemployment. Doesn’t look like inflation to me. Mosler, who knows a thing or three about economies, suspects debt deflation is ahead. Michael Hudson, financial economist extraordinaire, is predicting debt deflation. Record high private debt levels doesn’t look like inflation to me. The pandemic messed up pipelines, for sure. But no buyers at the end of the line, doesn’t look like inflation.

Central banksters has for a long time preferred to confuse price index rise with monetary inflation. The method of concatenation of price indexes make it difficult to se what they do measure. How these price indexes link to monetary policies is less than clear too.

Inflation or deflation? There is a god chance there will be prise rises on many products and services. What happen to the monetary supply no one knows?

Remember the pipeline of commercial properties was already shutting down before this last crisis started.

I can’t find any sympathy for Houston. In previous oil boom/bust cycles, the oil companies moved their offices from smaller towns like Enid and Ponca into Houston, taking away most of the good jobs. Now it’s their turn.

polistra,

Tulsa is the prime example of a large single-industry oil town – “oil capital of the world,” it was once called – whose single industry abandoned it. During the oil bust in the 1980s, all the oil companies there moved their headquarters to Houston, which threw the city into a 20-year depression.

But unlike Tulsa then, Houston now is a very diversified large economy, with oil being only a relatively small part.

The old cracks will spread from Bal Harbour and Panama City to

Myrtle Beach, Rehoboth Beach and Ocean City, before moving to San Diego and the rest of the cracked west.

Buildings on the West Coast need to withstand earthquakes, so they won’t be collapsing from lack of repair any time soon.

The West Coast lacks water. The buildings won’t fall down, they’ll simply be abandoned.

Tough earthquake standards are true of California but not Oregon and Washington. In PDX we have hundreds of URM buildings ( un reinforced Masonary). The authorities are too weak to even come up with a plan to get owners to fix them. Every day I see condos for sale in old “brickers “, which are multi-story brick building with no reinforcement. Even a small earthquake will cause the walls to bulge and the joists pop off their ledges causing the floors to pancake down to ground floor. The costs to reinforce these things are massive. But idiots buy condos in them unaware that one day something will happen and they will have to pay a fee equal to the value of their condo to fix it or get condemned.

Many of the homes in PDX are built with 4×4 posts holding up the first floor framing – set on small concrete pads and simply toe-nailed to the beams vs. a “Strong Tie” or like plate at the beam and footing. The crawl space that I had on my home in West Linn was two stories deep in some areas as it was built on a hill…. with a live spring during the “rainy season” running through it and exiting the foundation through a perimeter drain. I always wondered how long that house would stand in a significant seismic event.

I get what you are saying Seneca, but can we really blame people for trusting a system that is there to ensure the integrity of structures? Not everyone has a degree in structural engineering and that is why the system is necessary. People trusting a system that is inherently untrustworthy seems to be the real issue here.

SC

Blues Brothers showed the classic ‘brickers’ collapse to great humour but not funny in real life.

@El Katz

Have you see the stilt houses in Los Angeles?

https://www.gettyimages.com/detail/photo/houses-built-on-stilts-in-the-hollywood-hills-of-royalty-free-image/520204730

1) The cause of Surf City condo collapse : a third world aerodynamics

engineering.

2) The basement cracks are the symptoms. Spending $8M on pharma

to cure the symptoms, without shaving and erasing every balcony, will extend the life of the building, until the next event.

1) – Ah ah ah

2) Vat is ze vnumber of ze day. Sewen!

3) Elevwen ah-ah-ah

4) Twelve! The number of the day! Now let’s stomp, it’s time to get up of your feet to this great foot stomping transylvania beat. Start nice and and slow then speed up more because we are about to find out the number of the day!

5) Now Let’s stomp 13 times. Ah- Ah Ah.

6) So that’s the number? Stomp Stomp

7) What is the number? The number of the day?

Thank you Otis for the chuckles.

You (“as Count”) and M.E. make quite the duo.

US added 850K jobs, but the 10Y don’t care.

The unemployment rate is up to 5.9%, waiting for Claudia Sahn.

US still down 7.5 million jobs since one year ago.

A lot of those jobs will not come back. Dollar General has been opening close to 1000 stores per year. They are ran with very small crew. The one near me doesn’t even keep a person at the register anymore. You use self checkout or ring a bell for person to stop stocking and come to cash register. Security camera doing the rest.

Remote workers and airbnb rentals have to be 2 of the main reasons there is a housing shortage on the demand side. Pair that with low interest rates and a lack of construction and here we are.

95% of workers are considering new work. The Great Resignation. Something like 40% would consider work in a new industry.

Low-end entry level jobs aren’t being filled

Wages are rising?

There are major frightening things going on.

The never ending USA story of a weak economy produced by excesive printing with excesive unemployment, trying to fix the unemployment with printing for the rich, LOL.

A fake movie produced by The Joker, a cynical liar Fed chief.

Job market is smoking hot

orders up

and interest rates promptly head down

Yep…..thanks to the fed for teaching our youth that you can pick tomatoes without planting……..just steal someone else’s.

The ghetto kids breaking into store ought to be released immediately. Under this generation’s rules they have done nothing wrong.

I think Fed and its .gov accomplice somehow adopted the make-believe fantasy that they can figuratively if not literally print goods and services into existence by increasing leverage and liquidity into system.

The jobs crisis and shortages are evidence that their nonsense is just that.

We are seeing in US a growing negative output gap between amounts of goods and services actually being produced and demand for them.

When people are paid to sit at home (unemployment benefits, .gov transfer payments, etc.) vs. engaging in productive labor activities, and yet still desire to consume as usual— gee whiz, guess what will happen?

SPY day #9.

I think in the end there has to be a debt jubilee. Debts that can’t be paid won’t be paid. The fed though will try it’s hardest to keep everything afloat but will fail in the end. I don’t think they they really want hyper inflation but that’s usually the end resort when confidence collapses. The August Jackson Hole meeting will be interesting to see if the fed can walk the line once again.

1) IWM is red.

2) The DOW daily reached May 10 fractal zone.

3) The weekly DOW, efforts/ results : June 14 red bar is x3 times the previous bar, on 33% larger volume. Something is wrong.

4) June 21 : same size bar on smaller volume.

5) June 28, the current weekly bar : half the size, on slightly lower volume @ noon time.

6) Block the bull trap, stick the right elbow to the left, jump to the neutral zone, kick from your ass and stomp, stomp, stomp…

IWM below 200 this month

(i love your lists but can’t read them anymore without thinking of Otishertz doing like the Count from sesame street now. you’ve gotta admit that was hella funny.)

x

The uglier things get, the higher the stock market goes.

I mean, how are people supposed to make money nowadays?

distribution.

What’s basically happened is that the markets have called the Fed’s bluff. They don’t believe they’ll ever raise rates or reduce the $120 billion a month in printing.

So the two choices are, 1) the markets are right, and continue going up, because the Fed continues to destroy the dollar and let inflation out of control, or 2) the Fed DOES raise rates, and we see an absolute bloodbath. I’m talking a 25% drop in one day.

I believe the stock market will make a major correction…at least eventually. It is on steroids. Our 1st qtr report had one of our retirement accounts at an almost 67% annualized rate of return compared to -12% one year prior. Even our kid’s 529 had a 1-year return of 51%. This won’t last forever. Wish it would, know it won’t. Let’s see what the 2nd qtr report will look like.

Fed has messed up big time in my opinion. Stock markets tend to go from boom to bust even without Fed’s help. They have blown the biggest stock bubble ever which feels good on the way up. SP500 only going to pay out $60 no matter how high they blow it this year.

The impression I get is that the Fed wanted to prevent the markets from continuing to crater in March 2020. I don’t actually think they wanted to blow this huge a bubble, they wanted it to stabilize at something reasonable.

But once they got in, they got in too deep, and now have no way out.

You can’t. Just do what I’m doing. Accept 3% to 4% loss in purchasing power every year. Better than getting wiped put completely when the s$it hits the fan.

1) Spain lost the navigation map of “where to look” while heading, but won the pk and moving on to the semi.

2) The English ref red card is a correct call. Italian’s slide tackles are done to intercept, not to break opponents ankles from a long distance.

3) Italy is next !

BLM should learn from the Italians how to sing the US national anthem.

“Availability” rates” ??? Please. Its called vacancy.

Yes, but hey, you gotta stick with the times :-]

One gist of the late, great, David Graeber’s book ‘BULLSH** JOBS’ was that a large proportion of office jobs had no economic value whatsoever and existed only to bolster the Egos of ‘Superiors’ by allowing them to humiliate ‘inferiors’ in public. WFH may well have eliminated this forum for play acting and it is indeed a tragedy that DG is not here to chronicle the WFH phenomenon and it’s potential effects on employment.

Where are the geniuses when you need them?