The used vehicle price spike will subside, partially, but the psychological aspects of inflation have set in.

By Wolf Richter for WOLF STREET.

Ford announced on Wednesday that it would cut production at eight US assembly plants in July and into August due to the semiconductor shortage. These production cuts will hit numerous vehicle lines, including the crucial F-150. Due to an “unrelated part shortage,” production of the Ranger mid-size pickup and the Bronco SUV will also be down for three weeks in July. This comes after the company said in April that it would cut its global production by about 50% in Q2, which just ended.

Other automakers have been struggling too with supply chain entanglements and the semiconductor shortage. And the supply crunch continues. Over the next few days, we’re going to see auto sales for June. Auto sales to retail customers had been strong earlier in the year, but June sales were handicapped by widespread inventory shortages of hot models.

Today we’re going to look at prices and profits in June. And there have been huge moves.

Vehicle purchases are discretionary for most people. Most people can wait a year or two or three before buying a new or used vehicle and just keep driving what they have. People did this during the Financial Crisis, and auto sales collapsed and stayed down for years. Today, the opposite is the case: Prices are soaring and consumers – those that are buying, and there are enough of them – are eager to pay mind-boggling amounts.

There have been numerous reports that consumers are now willing to pay over sticker price for a new vehicle to grab the new vehicle that they want, instead of waiting a year or two – the very consumers who’ve been trained to haggle hard.

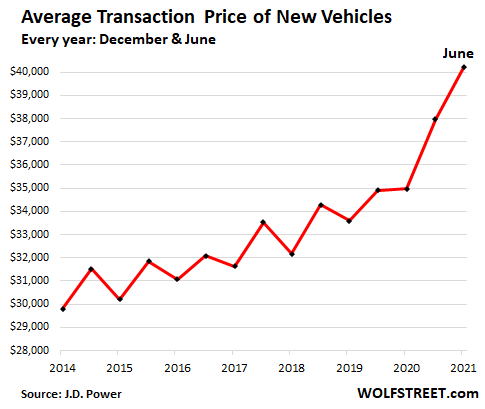

So the average transaction price (ATP) of new vehicles in June jumped 14.9% from a year ago, to $40,206, according to J.D. Power estimates. The surging ATP is a measure of price increases, reduced incentives by automakers, and customers getting shifted into more expensive models:

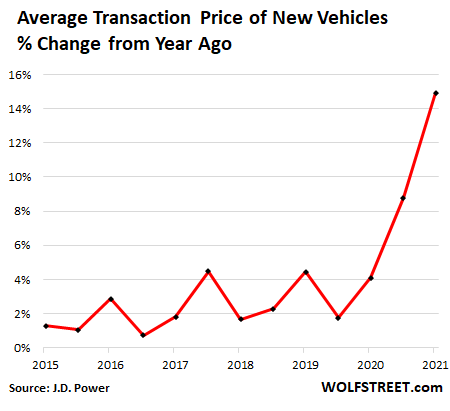

That 14.9% year-over-year surge in the ATP was a record in J.D. Power’s data. Previously, through June 2020, the ATP increased between 1% and 4% year-over-year:

For Q2, consumers spent $150 billion on new vehicles, up 28% from Q2 in 2019, according to J.D. Power estimates. This spending lust, as we’re now going to call it, is producing huge gross profits for dealers and manufacturers.

Dealer profits per new vehicle sold – which includes gross profit from the vehicle plus the profit from finance and insurance – have more than doubled year-over-year in June, to a mind-boggling all-time high of $3,908 per unit.

Total profits from new vehicle retail sales in June for all dealers combined have jumped by a mind-boggling 175% from June 2019, to $4.4 billion. If “mind-boggling” is cropping up a lot here, it’s because that’s what it is.

That consumers allow dealers to make that kind of mind-boggling profit per unit shows that the normally tough, astute, and haggle-eager American car and truck buyers have become laydowns. Most of them could have waited a year or two before having to buy a vehicle. But no. Suddenly price doesn’t matter – and that’s a scary thought from an inflation point of view.

Automakers’ profits from retail sales in June are also expected to hit a record, a result of the shift to high-priced vehicles and reduced incentives. Incentives plunged by over 40% from June 2019, to $2,492 per vehicle, the second-lowest on record for any June, according to J.D. Power estimates.

In addition, automakers have put fleet sales, which are typically low-profit-margin sales, on the back burner, which rental car companies have been complaining about for months. They’re focused on building expensive high-profit-margin vehicles for retail sales in order to maximize their profits, given the constraints on their supply chains and sales volume.

New vehicle inventory is tight. In June, about 41% of new vehicles were sold within 10 days of arriving at a dealership, up from 25% in June 2019. Supply of new vehicles is down to 39 days at the current rate of sales, when 60 days would be considered healthy. Last June, supply was 93 days.

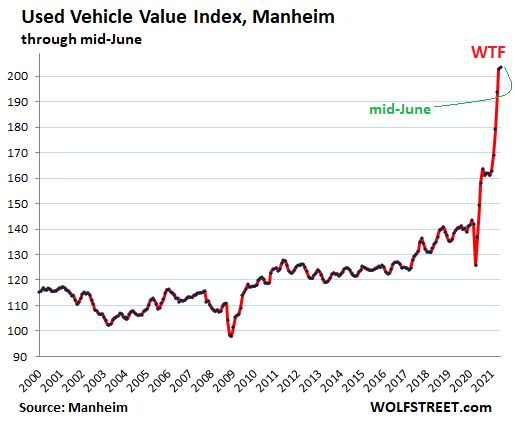

A big reason for these massive profits is the spike in trade-in values. Wholesale prices of used vehicles have skyrocketed. The Used Vehicle Value Index by Manheim, the largest auto auction house in the US, spiked by 36.4% year-over-year through mid-June:

It now appears that the spike has stalled. By mid-June, the Manheim index was barely up from the end of May. And in the second half of June, the first reports of minor price declines have appeared. So the spike has finally hit resistance.

Nevertheless, with wholesale prices up 36% year-over-year, trade-in values have skyrocketed similarly, which gives dealers a lot more room to make profitable deals.

The shortage of new vehicles, particularly of hot truck and SUV models, has led to the bizarre reports of low-mileage used vehicles costing more than the new model would cost, if it were available.

When a customer comes in to buy a new truck or SUV, and the dealer is out of stock, but has a low-mileage used model available, the salesperson will switch the customer to the used vehicle. And these days, customers are willing to pay out of their nose for the privilege.

A study by iSeeCars, which combed through over 470,000 new vehicles and “lightly used” 2019 and 2020 model-year vehicles, found that the gap between new and slightly used had “drastically narrowed” across the board, and it found that 16 hot models were selling for more money as used vehicles than their equivalent new versions, that were not in stock.

On top of this list is the Kia Telluride. The model that would sell for $44,166 as new vehicle sold for $47,730 as slightly used vehicle. The first six on the list were either pickups (GMC Sierra 1500, Toyota Tacoma, Toyota Tundra) or SUVs (Telluride, Mercedes-Benz G-Class, Toyota RAV4 Hybrid).

In normal times, this is nuts. Why not wait a little while and buy a new vehicle for less? A buyers’ strike would very quickly bring down prices. And that could happen, but it’s not happening.

Then there are reports of dealers charging over sticker for new vehicles, and of customers eagerly paying over sticker – rather than go on buyers strike and wait it out.

This is a mindset that is now prevalent – and it’s not just car dealers. Companies are encouraged to raise prices, and they dare to raise prices, and their customers, and they don’t lose sales because their customers are willing to pay those prices.

Consumers and to some extent businesses have lost their pricing inhibitions – a hallmark of persistent inflation. It’s the psychological aspect of inflation. Rather than waiting till prices come down on discretionary products, consumers are buying because they want the vehicle now, and they’re paying whatever it takes.

While part of that used-vehicle price spike is temporary – and we’ll see it come down by some – that change in the mindset may be very persistent and hard to dislodge.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

I was going n the dealership to return the leased car, they offered $2000 to return the Elantra, instead of going for buy option. wow they dealership was EMPTYYYY!!!

He said if I am not rushing to grt a carI ac wait 7-8month so things will be normalized.

Core Issue:

Lower to Middle income workers cannot afford to work, for the amounts that employers can afford to pay anymore..

Run a budget these days for any mid to large city…

Take NET that is NET income.. and then budget all the expenses that have to be carried for the average worker…

Add in Student loans and other debt…

You will see.. what is left over.. after all deductions of pay.. is not enough to live on…

Never mind get ahead…

Run what kind of budget? A budget for someone who can do basic math and has self-control, or a budget for the average American consumerist like Wolf just described who NEEDS a shiny new car right now?

Anyone who can’t figure out how to get by on $2k/month nearly anywhere in America (let’s exclude Manhattan and the Bay), is the type of person that wouldn’t be able to figure out how to save even if they made $100k.

OK, boomer.

$2K a month in OR is ~$1440 net (state, federal, and FICA). The average market rate rent of a 1 BR apartment in Portland is ~$1500.

$2k a month? My house rent is over half of that and is considered “market rent.” I haven’t had a rent increase since 2017. Sure, I could live somewhere cheaper if I wanted to pick bullets out of my roof. We don’t splurge, but our family of 4 does spend more than $2k a month. We don’t even eat out. We make our meals. Do other families on here intentionally live off from $2k a month (including your housing)??? If so how are you doing it?

My budget is for one person. Kids are a “luxury” budget item.

Regarding budgeting, you can tell a lot about a person’s

philosophy by the type of car they drive and vacations they take, if any.

just think some 30% of retirees have SSI income(sole) of under $1k per month

I’m raising rents 10% annually going forward(minimum)

and will soon PRICE OUT MANY RETIREES who don’t get additional govt grift

btw IT Is nOT my problEM

Not a real american,

Not quite, I missed being in the boomer cohort by about 40 years. The $2k/mo number I gave was net spending, so would require a higher gross income.

Zero chance somebody making $2k/month is paying a 28% effective tax rate.

Also I live outside Boston, your $1500/month 1 bedroom apartment is a bargain to me.

$2k/mo for one person makes more sense. All of our monthly expenses total $3815 (for 4 ppl). This includes discretionary. This is still too much in my opinion and we are working to cut out some expenses. Once we shave an extra $300-$400 off this total, it will be more reasonable (in my opinion) and sometimes we do have a surplus at month end. Also, kids are well work the money.

*worth, not work

We all have a lot of choices. There is a young guy on-line that tours North America on a small 50cc Honda. He built his small paid for home in rural Alabama, has no debt, is off grid and says his budget varies between $300 and $500 per month. (He is living like a typical rural person in most of the world). We all have to carve out a lifestyle that we can be satisfied with.

Old School, It is amazing that people can be that self sufficient to live that low cost. We aspire to live cheaper than we are now. It is definitely a journey.

> Lower to Middle income workers cannot afford to work, for the amounts that employers can afford to pay anymore..

Haven’t corporate earnings peaked? All they have to do is to reduce executive compensation to the multiple over the lower-paid employee as it used to be.

Oh is that all? I guess we’ll just nicely ask the executive boards to do that. Or maybe ask our elected officials who are all paid off by corporations….

big companies are making mint(they get it directly from fed)

small/medium – quickly going broke as planned

A stock corporation has it’s biggest duty to it’s stockholders. CEO’s job is to do all the tough stuff to make a return for them. If you don’t like that you have to find employment with a different type of organization nonprofit, coop, county or state who have different charter.

I don’t follow this reasoning at all and how this has to do with people willing to pay ‘whatever it takes’ to drive out of the dealership with either a new or slightly used $45,000 SUV.

People making $40,000 a year shouldn’t be driving $45,000 SUVs either not to mention the cost to Insure and maintain such a vehicle.

Your comment makes no sense.

The Mindset of people now is FOMO and YOLO with any type of purchase home, car, vacation whatever….

Also having kids is 100% ones choice, same thing with being a single mother (in all but very few circumstances). . Others shouldn’t have to subsidize (not to mention have to listen to one complain) due to one’s life choices

Corporations and wealth are subsidized and protected. No fake libertarianism about that though.

Wolf – You should have linked this in with a couple other statistics. In another post you showed that public transportation ridership is way down. Those people were probably buying used cars. I might also look at how much money went out in PPP, and if there was a way to determine what percentage went to business owners that had no decrease in business, you could find lots of people who had the government pay for their labor costs with a nice big fat check. No wonder trucks are selling so well.

My guess is that in some dual income households, they have decided to buy a car while their income is still high, even if one of them lost a job and might not be going back to work.

The whole world will change dramatically in the coming six months. The money spigot runs out and then reverses, as the need to start financing government spending hits the financial markets in another month or two.

Very true, many farmers and ag companies in our recieved huge ppp loans which covid had no affect on. They want to talk about socialism and they are recieptants of alot of social money.

I think that a lot of Americans would wait, if it were not for a fear that prices will be much higher next year, not lower. Remember that inflation is determined by “expectations,” which even the billionaire-owned but deceptively named, “Federal” Reserve financial cartel says that it tries to manage.

Thus, when most Americans expect higher prices and increased inflation, prices next year and inflation next year will go higher: dealers or stores will charge more and more to cover the anticipated replacement costs of their inventory, thus, restaurants will react to higher prices by charging more, and so will supermarkets, and so on, etc. I already raised what I charge for my work as an attorney, except to existing, loyal clients.

Nothing like limited supply to raise pirces, margins and profit.

Its transitory….havent you heard?

The price index rise yes, but not the price increase;)

Unfortunately as we have seen before, this will end on over supply eventually. Probably in two to three years when suppy chains become way better that they are at the moment.

Not necessarily. First, that implies that natural resources are not the bottleneck. Second, that the bankers and others that have lent all the money do not take steps to protect their investments. Why invest in over supply?

The Fed inflation circus is only transitory as long as one drowns their inflationary sorrow by filling their Wolf mugs with beer and chugging repeatedly until one passes out…

Ohh wait, beer got J-Pow-ed too per the Wall Street Journal???

Per WSJ:

‘The cost of moving a truckload of beer 600 miles has approximately doubled to about $2,000 because of high demand and a lack of drivers. Also affecting beer costs are aluminum prices, which have increased around 70% since May 2020.’

Lack of drivers…..due to federal payouts to stay idle….which money comes from the no cost borrowing of the federal govt ….courtesy of a Fed that is keeping rates at zero to promote employment. See?

Lack of drivers is about low pay crappy companies and shitty hours try this job then comment

Yes. The frogs finally jumped out of the boiling water thanks to the politicking around covid.

Happening in retail and other low level jobs whether the worker has unemployment / stimmy or not. Let the $20,000,000 / year CEOs work the cash register and deliver the pizzas.

Ron…

the point was the Fed is providing free money to promote inflation…

the federal govt takes that money and doles it out in a fashion that promotes people to not work. Do you see the irony?

That is the point.

Ive done plenty of lousy jobs….and it made me want to do better jobs…that’s the idea.

Yep work 70-80 hours a week for a take home pay of 700-900 a week if you’re lucky and work 7 days a week for months on end trapped in a rolling closet.

There isn’t a driver shortage, it’s a slave shortage.

@Truckerguy. Your right. If they would increase the pay for truckers….the lack of drivers disappears.

Unemployment is still high yet there are help wanted signs and labor shortages everywhere. I drove by a JC Penny warehouse and they have a great big temporaty sign on the building saying are offering a $1000 signing bonus. I have never seen this before in 15 years. This is from a company that is struggling financially.

The labor shortage goes away if pay would be increased. There are plenty o people sitting on the sidelines not working.

There are plenty of people on the sidelines not working because they are getting free money, most recently from the government. Any labor supply constraints aren’t caused mostly by low pay. It’s not like most of these people liked these crappy jobs before COVID hit. The difference is they had to do the work anyway or starve.

Shiloh1, I always thought the appropriate punishment for white collar criminals like Jeffrey Skilling was to have them work a cash register rather than letting them use their time in prison to network and plan, so they can steal millions more when they get out.

People have been told for YEARS that automated trucking is coming and the career is a dead end. Now you are blaming them for listening.

Complete BS. How many 100% self driving cars are on the road now?

It enabled a strike.

My Aluminum supplier said that the mills just finished selling out all of next years production. This means that any wholesaler ( metal service center) or direct customer ( auto companies) that does not have supply ordered and reserved will be out of luck for the next year. Good luck with that Giant Aluminum Casting Elon.

And to think the aluminum tariffs are still on Canadian product, + steel and lumber.

Can’t make this stuff up.

When I say “the mills” it includes the mills in Canada as they are in the marketplace as the remaining US mills with Tariffs not having much effect on supply. The bigger issue is that China and Russia have become the dominant players in the Aluminum market with the US and Canada reduced to small fry. There is not enough capacity in North America left to offset even a minor change in Chinese exports.

Amazing how the hardest core of crusty gator fiscal conservative capitalists conveniently forget the best way to lower prices is competition.

In economies with decent and active competition policies, they’re not wringing their hands over this.

Even China can reel Jack Ma in and chain him down when he gets too big for his britches.

There is no competition when there are only 4-5 car companies. The only way we get back to normal is if: 1.) We enforce laws that ban monopolies. 2.) We strengthen our own supply and demand by reducing needs on external shipment. 3.) Our politicians work for us and not the hand greasers. The sad thing is that greedy politicians broke the laws that made America the power house that survived the 1970’s recession. Politicians start their jobs worth less than 50K and leave worth 250 Million. They are paid to look the other way and not enforce laws. Sad day in history!

And stop bailing out failing corporations. That’s a great way to boost competition in a market, naturally.

When people start paying over the odds for ordinary goods you realise that they are acting like inflation is here to stay. Their fear is not about missing out but that next year they may need to pay much more. Is that the 1970s I see before me.

Paying whatever it takes….

for TP and Paper Towel…..cars…..housing….

Next CPI and PCE will be another lie…..

We’re experiencing this in our house hunt. Sellers are pricing below what they think it will sell for to induce bidding wars, so they can ultimately make more. Insanity.

I don’t think most people are aware of, or really understand inflation.

They spend money when they have it.

If a low income, unemployed couple found themselves making $70k/year by staying home, and then did not pay their rent or mortgage, they suddenly had more cash then they ever did before.

An old car and fresh cash allowed them to buy a more expensive car than they ever thought they would own.

Unless gov’t subsidies keep coming the inflation will end.

Trudat. It’s just another cost of doing business.

Exactly. People have plenty of cash right now. The banks of plenty of cash.

I know a waitress who bought a car, a computer, and a house during this recession.

Who does that during a recession. People are normally scared, reduce spending, and save money.

“At no fault of their own”, anyone with a pulse is bailed out by govt in order to buy votes and legalized lobby bribes, and that includes people and corporations. The one single factor that makes every human unpredictable and thus dangerous is it is human nature to attempt to “control” every thing that can imaginably controlled. And the Fed is exercising experimental monetary and fiscal control on a level not seen in the last 50 years…

Very similar to putting out every forest fire like the USA attempted to do for the last 70 years. What happens is the excess brush builds up, and ultimately there is so much “fuel” in the form of dense brush and too many smaller trees…an unexpected fire ultimately gets ignited and nobody can put it out no matter how much money is thrown at water plane drops and thousands of firefighters. In the process large trees that would have lived via smaller, less hot fires die, and of course the smaller trees have no chance at all. Animals get wiped out as the fire moves quicker than they can flee…

So here we are today, with the Fed being the fire marshal over all monetary matters for basically the entire planet. The fed has stopped every monetary fire over the last 30 years by letting the underbrush grow more and more dense in the form of bad debt and unproductive money printing. What we have now is enough monetary and fiscal fuel to burn the entire monetary global forest to the ground, and both people, small corps, and large corps will attempt to flee the chaos.

The global Fed(s) are attempting to remove the human experience out of humanity. At some point, nature will win…and as life is transitory, so too will be the era of the Fed(s)…

Anecdotes do not equal data. Millions of people are hurting very badly economically speaking.

That there Yort is probably the best description and/or analogy I have ever heard about this fiscal charade

I’ve been pounding the table on this for months. Costs increases that are willingly accepted are not transitory. It’s stupid tax.

“Stupid tax!”

You should trade mark that term and lease it to writers of Econ books!

“When people start paying over the odds for ordinary goods you realise that they are acting like inflation is here to stay.”

If that is true, then consumers overpaying for stuff (FOMO or panic buying) right now rather than waiting to buy later sounds a lot like pulling future economic growth/demand forward to the present, inflation or not.

That would lead to lackluster economic results in future because that future demand was stripped out for present consumption.

This is the Tulip craze all done again. Tulip mania (Dutch: tulpenmanie) was a period during the Dutch Golden Age when contract prices for some bulbs of the recently introduced and fashionable tulip reached extraordinarily high levels, and then dramatically collapsed in February 1637

Lots of FOMO going around. Fear Of Missing Out. And also just plain Fear. I heard an A/C company on the radio trying to scare people into buying, saying things about shortages and increased costs. They of course suggest buying a new system ASAP to avoid the possibility of spending the entire Texas summer without A/C. *shudder*

“the entire Texas summer without A/C. ”

That of course depends on whether the Texas electrical grid holds out this summer.

The 1970s inflation was in essential items. Today’s inflation is in ‘must have’ discretionary items like $45,000-$60,000 SUVs, $1500 IPHONES, and $1100 coats that even low – middle income people are willing to pay whatever it takes to aquire such items

But it’s a mindset, and ability, fuelled by free money.

It’s easy to sit with money burning a hole in your wallet and worrying that aspirational non-essential item X might be 5% more next year.

Try doing that with zero money in your wallet.

Its a mindset all right..

The Fed punishes anyone holding cash……5% now….

(are they supposed to do this?)

The ability to SAVE has been removed from personal finances. In fact, the FED punishes people for doing nothing with their money…

Think about that. Punished by a contrived inflation on your nation’s currency by the EXACT BODY that is charged with FIGHTING inflation. And you will not only be deprived of a fair return on your money that existed up until 2009, you will PUNISHED for doing nothing.

It is remarkable what the Fed is doing to the people of this nation.

You can’t SAVE and if you try, you will be PUNISHED.

Fed Funds should be north of 3% right now and perhaps higher with the current inflation. Criminal. Cui bono? (let’s start with the RRP counter parties…JP Morgan, Goldman, Blackrock)

You are a man obsessed

But he is right !!!!

If you’re not obsessed with the fact that the “elites” are ruining this country, you’re not paying attention.

Or you don’t have children.

A small cabal of people in unelected positions, and unaccountable positions, have inverted the financial norms of this country.

Fair to notice.

The People will wake up soon to the fact that the Fed, which is partially in existence to FIGHT inflation, promotes inflation.

And the 5% wont be transitory, but will be a pay cut for all working now, and a cut in the value of past labors if saved.

Who gives them the right to punish so many?

historicus is 100% correct.

Capital should have value. Tomorrow’s money should be worth more in today’s time – not counting for inflation. If I lend you money today, I should be paid back more over time. If not, there’s no point to lending money.

By the way, the answer to the question asked at the end of the reply by historicus is Congress with the 1927 passage of the McFadden Act.

Wolf’s reply yesterday in his $1T Reverse Repo article on Representative Pelosi, “She’ll leave office when she is ready to. Not a second before.” sums up the situation with Congress & the supposed congressional oversight of the Fed quite accurately.

Ted Nugent’s ‘Stranglehold’ is spinning on my turntable as I type.

“…let’s start with the RRP counter parties…”

That line doesn’t fit into you complaint about interest rate repression.

The purpose of RRPs is to keep money market interest rates above 0%. The counterparties, namely money market funds, including those by BlackRock and JPM, are giving their excess cash to the Fed. This has the opposite effect repressing interest rates.

I was referring to the mechanism when $1 Trillion changes hands over night. Am I wrong to assume that nobody made money on this arrangement? There was no fees, etc.?

Yes I understand the RRP was to keep rates from going negative due to the massive supply of money in the system.

I think banks expect to make money on everything they do….

and G Sax, J P Morgan, Blackrock et al , (and I am just guessing and wait to be proven wrong)…made money when the Trillion dollars moved.

The money market funds made 0.05% annual rate on their cash. That’s more than 0% they might have gotten otherwise; or they might had to deal with negative rates.

Re: the huge RRP spike, I buy this complex analysis on YouTube. Don’t reject it out of hand due to his admitted hyperbolic title.

Reverse Repos EXPLODE! Is This Signaling Next Economic Collapse? – George Gammon

“NOTE: Today (day after vid was shot 6-30-21) Reverse Repos hit 991 billion! Almost 1 TRILLION a day in RRP. Something in the system is breaking down. As I state in the video, I think probabilities are high this is more than a shortage of collateral problem it’s a counter party risk problem as well.”

Nah. If the rate were 10% instead of 0.05%, I’d say there might be an issue. This was the case when the repo market blew out in late 2019, and repo rates spiked to 10%+. But I’m sure with that kind of title, the video will get lots of clicks. Just keep it out of here.

Historicus, if Jerome Powell were an avid Wolf Street fan and read your comment, I suspect he would argue…”But the Fed has provided you as a saver an opportunity to invest in assets like housing and the stock market that are at all-time highs right now…despite having endured a wrenching pandemic.” Of course, that’s notwithstanding the risk inherent in the bubbles the Fed has created in those asset classes. And depending on your age, that risk level may very well be intolerable. Nonetheless, the Fed doesn’t care much about that…they feel satisfied that you have alternatives to a negative real interest rate FDIC-insured bank savings account. I’m not judging whether that’s right or wrong…it’s simply the way it is.

Given the big market plunges in the past couple decades retirees have every reason to worry

“the FED punishes people for doing nothing with their money…”

Yes, and savers will be beaten savagely by Fed masters until their morale improves.

Savings, according to old school economics, doesn’t ‘do nothing’. It is capital to be used for investing in future economic growth and productivity (rather than just printing money as is the primitive custom today).

One way to determine what those cash savings are really worth is to ponder what would happen if every cash saver withdrew their savings and stuffed the cash under their mattress. What interest rate would the Fed be willing to pay to get some or all of that cash re-deposited into the nation’s banks? Who knows…they may even need to throw in a toaster oven!

3D modeler, you’re aging yourself with that. I remember my grandmother telling me about how she and my grandfather would run around in the early 80s moving money from account to account and get free toasters and the like.

Haha, I know…and my Mom was getting 12% on her CDs, plus the grandfather clock!

I’m glad you keep bringing it up. People don’t seem to care. But maybe it’s because most people don’t have cash. They have debt and are experiencing a temporary reward.

That is true about Fed policy making cash painful to hold, but if they are blowing up stocks and housing 15 – 20% per year those assets are much riskier and more over valued than cash.

Even people holding stocks know they are over valued, but feel like they can hit sell button before everyone else.

JP Morgan alone sitting on over $500 billion in cash.

“JP Morgan alone sitting on over $500 billion in cash”

I wonder what this tells us…

We didn’t have much choice about it, but the economy has been debt driven, especially when it got completely severed from gold in early seventies.

So now here we are with the system so levered up with debt that savings pays -4% real, and you can buy a starter home for $300,000 with 0% real rate.

What are we to do? I will just eat the increased inflation for a few years and consume less. I will stick my tongue out at the Fed and say you are not going to push me out further out on risk curve.

Lemmings.

I’m looking for that old family recipe for lemming meringue pie.

If supply eventually catches up to demand the issue of negative equity could really bite the impulse buyer in the butt. Overpay for your F150 well beyond MSRP, add taxes, fees, extended warranties, maintenance enhancements, low down loans, good luck if you want or need to get out of that vehicle.

Overpay for your F150 well beyond MSRP, add taxes, fees, extended warranties, maintenance enhancements, low down loans, good luck if you want or need to get out of that vehicle.

Or it’s totaled in an accident and the insurance co will only pay you fair value that doesn’t cover the note.

The repo man comes and gets it if you don’t pay. Easy!

In a way Fed and congress tricked average citizen by over stimulating economy. How much spending would be going on without government largess.

Economy will eventually have to run without government overspending or we will stop having a functioning economy.

With supply down the last year?

There will be less second hand 2020 models on the market in the future. Supply of new cars may eventually catch up, but the numbers produced in 2020 is set. Now what is the chances the asking prise for a new 2022 Ford F150 will be lower than the 2021 as sold new?

The inflation index may go down, but probably not the price. Remember inflation as the central bankers like to define it is an index on the development of some prices.

The price of gasoline is the highest it has been since 2014. The new administration has banned oil and gas drilling on Federal lands including in the Gulf of Mexico offshore and the New Mexico side of the Permian Basin. The large SUV’s bought during the pandemic shutdowns when gasoline was $2.00 a gallon are more expensive to operate as gasoline prices have risen to well above $3.00 a gallon.

Yet oil is still undervalued according to a lot of industry insiders (and not just green activists). Oil moving in the 100-200 $/barrel range is more realistic if they really want to fuel the recovery with it.

Amazing….A gallon of oil is still less than a starbucks coffee. Take away the taxes and a gallon of gas is 1/2 the price of a cup of coffee.

I can live without my coffee but I need gas to get to my job

The rules of frugality don’t work for savers anymore. Young people can’t afford housing. Many here are delaying life plans due to rising house prices. The pandemic upset the apple cart and Govt has gone nuts with debt. Old folks are worried about retirement and in some countries worry about health care costs. Many are just saying, “Screw it, life is short”. Then they sign the papers and drive way.

Resignation and acceptance.

The 7 stages of grief (tongue in cheek)

Shock and denial. This is a state of disbelief and numbed feelings.

Pain and guilt. …

Anger and bargaining. …

Depression. …

The upward turn. …

Reconstruction and working through. …

Acceptance and hope.

(Hope it wasn’t a stupid purchase and that the car lasts 10 years) and…..

Hint. Oil is fungible.

Part of the mindset happening for these car buyers may be in feeling that it’s hard to bother too much about saving 5 or 10k on a bill for a nice new toy from where it was a year or two ago, when a moderate family medical crisis easily can land a clinic bill for 100k in your mailbox, just like that.

I would say a 100k medical bill is not typical for an average family?

And more often than not, such a thing is preventable with a good diet and healthy lifestyle

PG

You are very very wrong.

Health is actually a gift, randomly distributed.

If you are healthy, you have been blessed. Your own efforts gave little to do with it.

Yes and no. A lot of health issues, like cancers, are often bad luck.

But a large percentage of our health issues are due to obesity, which is very much preventable.

Wrong, watch the documentary “ Forks Over Knives” and educate yourself on the benefits of healthy eating. I am living proof that diet plays a major role in a persons health. “Bad luck” does not cause obesity, inflammation or chronic illness, diet choices do however.

Box,

You sound a lot like the Medical Industrial Complex bosses who are lobbying right NOW to get obesity classified as a “disease”, so Medicare, etc, will have to pay for “treatments”.

Right now it’s considered “cosmetic” and only the wealthy can afford it.

It’s bad enough they have to pay for all the RESULTS of “metabolic syndrome” due to obesity/diet/lifestyle, i.e., diabetes 2, high cholesterol, heart problems, etc, etc,etc.

Little doubt that, statistically, people reduce risk of serious illness with better lifestyle and health habits, when those are poor. But you still could, or someone in the family, could fall ill with cancer nonetheless, even when following excellent health habits. Cancer treatments are very expensive.

There are also accidents. Getting a body part fixed up by a surgery following an accident is probably going to cost quite a bit.

I guess I stand sort of in between you and OutsideTheBox, on this issue.

Read recently from Suze Orman that she believes a person needs a few million in their accounts to be, truly, secure – as far as paying for potential medical catastrophe. Getting that kind of scratch into my own accounts is not likely a game I’m going to be capable of playing.

Or you know, universal healthcare that every first-class nation offers. It’s not some novel idea and with the amount going to subsidize means-tested folk, the government might as well provide coverage for those who want it also.

Every other first world nation doesn’t have a huge third world population living in their borders.

If America was solely composed of the descendants of the British colonists and the very early German immigrants, we could have easily affordable universal health care as well.

They can move to another country. Plenty of countries with adequate medical care which costs a fraction of the price in the US, even paying out of your own pocket. No one is entitled to minimal living standards at someone else’s expense just because they do not want to move.

August, have you tried moving to Canada and getting on the system lately? It’s not easily done. Or try Switzerland? They really don’t want people showing up for the bennies.

Right,

I always figured you were one sick MF, but you just proved it.

BTW, European peasants (where your genetics came from and diet is fine TUNED to) ate mostly whole grains, (flour was for richer folks) and what few vegetables, dairy, and bits of meat they could find.

It’s what I model my diet on and I’m doing fine.

They also got LOTS of exercise.

Right,

I always liked the Australian “bumper sicker condensation” of the formation of their country as compared to ours….it’s much better than yours.

“Better Criminals than Puritans and Euro-trash”

Uh huh, right up until genetics or the rest of the world get a vote. If all your parents and grandparents died before age 60, guess what? I have a friend in that situation. He’s had 5 stents and has outlived all of his predecessors. Not even 65.

And healthy living does not protect against drunk drivers, muggers, or contaminated food.

Famous Jackie Onassis comment when she learned she had cancer: “What did I do all those push-ups for?”

I believe I am rather well-preserved because I eat a lot of preservatives.

Michael G

What’s your recommendation for a family member who just got over a bad Covid-19 experience which required 4 days in the hospital. He’s OK now.

Should he take one dose of the vaccine ?

When should he get it?

Or should he just rely on natural immunity and skip the vaccines altogether. His spouse also got infected without symptoms.

They are part of the anti vaccine crowd. I’m trying to give him some good advice.

Come on MG, dispense some more “wisdom”.

The curse of a bankrupt nation is that it needs to print money just to survive.

The more the Fed talks about tapering, the more we know they’re trapped.

The can talk it, but never can do it.

They know it

We know it.

The $ is going to sh.t.

My wife’s 2014 Honda accord recently got an issue with multiple lights (7) come on for abs, traction control, etc. Honda dealership had it for 2 months and couldn’t figure out exactly what was wrong and wouldn’t guarantee the fix would work. We are having an independent guy look at it in a couple weeks, dealerships use him when they can’t figure it out. The wife almost had her vehicle paid off and now we might have to trade in with these ridiculous prices.

You should be able to get a ton of money for it :-]

I have an older model PU which I paid a few grand, now I can sell it at a profit and buy a new hybrid Ford Maverick for 20K? Why wouldn’t I do that?

Indeed, I was thinking the same. 40 mpg

They call these vehicles electronically totaled vehicles. Nothing left but salvage value.

Not any more! Won’t take long for people like the “independent guy” Chis mention to show up and fill the niche….it was my plan before I trashed back. Dealers probably already train such folks.

And the car companies keep adding electronic gadgets because it is the almost the ONLY “innovation” they can do, other than financial engineering.

@Chris Rogers,

Take a photo of the dash with warning lights and post your problem on some Honda Accord Owners Club forum or the like, just Google that for some pointers.

These forums oftentimes have in their membership a knowledge base that dwarfs anything the average dealership has on offer.

Asking in a forum has saved my assets multiple times when encountering problems on all kinds of equipment.

System problems like that are often faulty ground. Try hard wiring all your grounds.

Bad ground, corroded connectors or a damaged wiring loom, these are the things I would look for first. But people with lots of Honda Accord experience might give you valuable pointers on where to start looking…

WOW! That is EXACTLY the semi-retired super fun job I trained for, but I totally trashed my back building a container home (doing concrete when too tired to tense muscles up, back took full load and stuff broke).

Would you believe that just like in the case of my primary instructor who got a new $50K loaded Saab convertible for $20K for the same reason, your problem could be in the radio?

Likely it’s CAN BUS stuff. Few mechanics know electronics, or how to approach an electrical problem.

His problem was intermittent….100x harder…..but if lights are on ALL the time, child’s play.

You tube idea is ok for those who have had a lot of auto electric fixing experience already, and are NOT parts changers or board jockeys.

Unless you hit a blind luck common problem, which is kinda unlikely as the dealer would have a TSB on it if it WAS common.

(1). Always look for who/or what fucked with car last (before it started) and where as your first step. Could be the careless jerk kid at the Jiffy oil change, easily.

Just a broad comment without any empirical support (yet)…

It is always in a distressed sellers’ interest to try and ignite buyers’ panic (“OMG!!…the dealer/realtor/etc has said they’ve shown this car/house to a bazillion other interested buyers and that by next year god knows how many trazillions they may cost!!! Apparently another car/house/etc. will never be made/built!!!” Insert hyper-ventilation).

Even if seller supplied data isn’t being outright lied about, it can be gamed (supply can be selectively throttled (Cabbage Patch, Beanie Babies, etc) and product mix can be adjusted (“Push the fish”).

There are transient supply issues (chips, lumber…although the latter is already evaporating) but the demand side dislocations are real and vast as well (8 million fewer employed out of 152 million…whose own salaries have stagnated for decades…hundreds of thousands dead, which tends to reduce spending activity…)

I’m not entirely discounting the reported data, but the more it seems to disagree with basic common sense forces/trends, the more closely I want to examine/step through it.

Be careful shopping at discounters now. Many premium products they carry are being sold at full retail. Saw this with some of the toiletries and other usually high end brands. I only buy when I know it’s a good discount.

I don’t like it, but I have to say I told you so. I’ve been urging readers here for years to get out of cash and buy quality real estate, S&P 500 index, and Gold. The Fed doesn’t care about you, your family and your savings, nor does the US government. You are on your own wen it comes to protecting your savings and wealth. There will be a big dip or major crash again someday, but you can’t sit idly by and wait because the next low may actually be higher than where we are today. The easiest thing to do is to start putting cash to work in an S&P 500 index each week, each month, or whatever time frame you choose. Dribble it in. The people running the Federal Reserve and the US government are terrible, awful people. Don’t let them eat your lunch every day. This ain’t the good ‘ol USA anymore, things have changed.

“This time is different” would have been a more concise way of making your point without all the words. Good luck to you sir.

When that big crash finally does arrive, the same fear that is keeping you out of the market today will keep you from buying through the bottom then. I will be here when that big crash comes, and it will, and I will be begging you all to buy through the bottom and up the other side. Few will have the courage and discipline to do so.

Depends on how you are wired. I like to consider myself a patient investor as far as stocks.

I am a whole lot more comfortable buying when things are selling below long term valuation measures instead of at record valuations.

You can leave a lot of the money on the table with a blow off top and this time could be completely different, but most likely scenario is an asset pop when Fed gets forced to tighten or even slow pace of QE.

Putting “cash to work” in an S&P index today means paying $100 for $2 worth of earnings.

No thanks.

I’d rather buy physical precious metals.

Your advise only works for somebody with time, money, and good credit. Those people are already doing ok.

Or people who have entered at a reasonable point. What do you say to the 24 year old who saves a good chunk of money from his first job? That he should buy stocks that are historically priced at double what they’re worth?

It’s more than that. Earnings are absurdly inflated from the credit bubble too.

For a 20 something year-old absolutely YES! Start buying index funds now. Each month save 5-10% of your take home pay and put it in a low cost index fund. Do it with your 401k if you have one. If you are 30 or 40 something then YES. BTW – I did not start doing this until I was 30, so I am a couple million lower than I would be had I started at 24.

If you are older, near retirement, and you are sitting on a large amount of cash, it is more complicated and more risky. It is best to avoid being in that situation.

Keepcalm, with all due respect, this is very much a “It worked in the past, so it’ll work in the future” argument.

In the past, slowly investing index funds was a winning strategy because you were investing into companies that existed in a growing economy.

Now you’re not. The economy is not growing. All we’re doing is borrowing and printing money. So now you’re not investing in a growing economy, but in a ponzi scheme, where all stock gains are based on P/E expansion, not economic growth.

So in the past, you could invest in stocks at reasonable prices while saving enough cash for living expenses, which case earned a fair rate of interest.

Now, your choices are to invest in obscenely overvalued assets (knowing the bubble could pop at any time) or hold cash that the government insists on inflating away. Meanwhile, that young person trying to save for a house will see assets climb faster than he can ever save.

THAT is why people say it’s a “hated” bull market. THAT is why people say it’s grossly unfair to the younger generations and the middle class who don’t have a lot of assets.

Your strategy assumes that the financial system won’t collapse before the person is ready to retire. I think, for a 24 year old, that’s a very optimistic assumption.

One theory is stocks have duration similar to bonds so with sp dividend yield at 1.4% it’s suitable for a 70 year time horizon. Not sure about that but most people used to say stocks were at least a ten year investment, I think that is maybe 20 – 30 years now.

Indeed. I had to hop back in after CDs expired. AAPL with a PE in the 30s along with MSFT pushing 40 screams too hot.

What if it never goes back to what some of us considered normal?

“The Fed doesn’t care about you,”

Correct…but a 1% or 2% interest rate increase (via Fed) will slash 20% off the RE and stock invts you list.

ZIRP has long poisoned/inflated asset valuations…the Fed has put every dollar holder on the planet into a box with no exit…unless an exit from the dollar is made.

Tragic, sickening, and true.

I don’t buy your strategy. The time to buy the SP500 was close to the bottom at 666. You probably going to be a bag holder buying at 4200.

Still surprised the preacher bunch ignored that “666” “omen”, but finally decided they all owned lots of stocks, too, and were too worried about their own wealth to bother with what that musty old desert god had to “say” about it.

“Show me a man who claims to be a man of God. If he has two suits, as long as there is one person left in the world with no suit, that man is a HUSTLER” -Lenny Bruce

Once oil goes to $100/barrel and gas at the pump hits $5/gallon you are going to see a lot of people ditching their gas guzzeling monster and taking public transit. Some will even move back into the cities an ditch their cars completely. I saw this happen once before in the late 70s.

Yup. Yesterday I insured my ’81 Honda Trail 110. It will probably cost me $10 to run the rest of the summer and I use it to scoot around and for fun. It’ll do 50 mph on the flat, has a cargo rack for a case of beer or for fishing/hunting gear. I even made an aluminum trailer for it and a hitch. It’s pretty funny, actually. I told my cute wife she had to ride in the back to town with me, like Ma Kettle. It’s a blast actually. Throw on the helmet with a few hockey stickers, (don’t even do it up), sandals, shorts, one kick and away we go.

25 years ago I paid $900 for the bike. I could sell it for $2k today. I’ve got a ’79 Trail 90 in the shed with 2500km on the clock. Same thing, I paid $14 for a new carb a few years ago, that’s how cheap these things are to run and own.

People pay more for bicycles and lawnmowers these days.

People in the ” Philippines ” and countless other country’s have been doing that for a Very long time !

Compared to the USA well ? You can’t . Perhaps the Fed is spoiled Like humm I will let you Guess …

Last week I bought a 1995 Ford 4.9 F150 6 Cylinder XLT Extended Cab PRICE $ 500 CASH > with the “Clutch out” not driving 5 Speed trans on Non Operative status DMV 127,000 Miles on it . Started right up and sounds great and with new 6 Ply Tires on it . Picked up a Free 1 day only moving permit @ DMV

and had it transported Via My AAA 200 miles Towing Card 51 Miles . They where not happy but had to do it and did . I gave the driver an extra $50 . just sayin you can adjust to the times .

Sounds like what we called a “ranch rocket”; good for firewood, rocks, water, boneyard trading, or just hauling drunks on an afternoon/evening visit everyone who likely has or needs beer trip. I used to swap stuff for doing mostly electrical work on those. Some were even highway legal.

Too old now, but sure was great lifestyle while it lasted.

Nice!

I had a Honda trail 90 back in the mid 80s. Those bikes are legendary for riding from campsite to fishing spot. I have been scanning craigslist for the last few years just to see what used bikes are for sale. I am amazed at how much used motorcycles have gone up. I bought a clean used 2006 Kawasaki KLR 650 in 2017 for $2600. Today I could probably sell it for $3600.

Have fun on your Honda Trail 110… just watch out for cars!!!

Paulo/ghost of SteveMcQueen-amazing how a demand for Trail90/110s never really fell off even after American Honda decided to quit importing them. Understand they are considering reintroducing a modern model, but the value/price won’t be at the original’s level-dovetailing nicely with Wolf’s market observations in this article (am currently completing a restoration/street legal equipment upgrade of an offroad ’70 CT90 for a friend, even though i told him he might be able to buy a nice licensed one for less than i’ll be charging him to revive his…).

may we all find a better day.

On the original 50cc 110, it cost $1.49 for a set of rings in 62-63 or so. Could do it quick anywhere. Also had to have an impact driver for those extreme butter heads (what WAS that metal they used ????) until Allen head aftermarket sets came out.

Original manual specs said they had 30 degrees “clinking” ability, and 10 mm torque settings were STRICTLY enforced.

NBay-case fastener situation exacerbated by the fact that they were JIS rather than SAE #2/#3 Phillips config-use an SAE Phillips driver in ’em and they cammed out with attendant fastener head carnage. (Strangely, much easier to obtain JIS Phillips drivers now than then, Kowa and Snap-On make nice ones).

may we all find a better day.

You might enjoy C90 Adventures about a guy riding a little Honda similar to yours all over the world.

I bought a Honda Elite 110 scooter and am hooked on the small Hondas now. So durable and fun.

So when I began my descent into homelessness in 81 I was renting a room from a Jr Hi friend, and a HS friend owned the house across the street. He had restored a Hodaka 100 and had his young kid out there teaching him how such garage things are done. The kid got the idea alright, found a small bolt, and put in in a hole…the spark plug hole. He did such a good job restoring it, it unfortunately fired on the first crank. Then we all drank beer, and ragged him about all his model A parts he had disassembled, but had yet to do anything at all on after months.

OPEC+ has plenty of volume shut in. With the prices recovered look for them to start to release more to keep prices in check, in order to not allow the frackers to restart drilling.

I think most people now believe nothing have real value, and that life can on any day so just live for today and don’t worry about tomorrow. When hundreds of thousands die from a virus, crypto’s are manipulated by a tweet, a man is worth $140BN, an NFT can be sold for $69MM, reality is transformed. Life, death, saving, spending, nothing means what it used to. Nothing is really defined anymore.

“Life, death, saving, spending, nothing means what it used to. Nothing is really defined anymore.”

Life isn’t supposed to be defined by love of money and propensity to consume material goods. It is ultimately about love and striving for self-realization.

We have lost sight of life’s purpose in a very dark age of greed, avarice, and corruption.

Mounting anxiety about our financial futures should compel us to look inside ourselves for security and peace of mind, and work hard to become more self-reliant and independent.

The only way for an average good person to win this game is to opt out of rat race and choose the gentler path that is seldom taken these days.

“It is ultimately about love and striving for self-realization.” I agree -and even sing and write songs about these oddball notions. I would not really call myself a hippie though! Nor a punk. I’m just me. I believe in roads less travelled.

I am a relative minimalist, but no one can live without trade. We all have to figure out how much we desire to consume and structure our life around earning that.

You also have to figure out how you are going to provide for yourself when you no longer can work. You have to have some pension, savings or investments or rely on family and friends.

This is the other ‘facts of life’ we all have to figure out.

On Haight St 66-67.

Us hippies tried to tell you stupid bastards, and even Carter made one last plea…..few listened. Now ya got your well furnished big home on the golf course in a gated community and ya pissed away your entire youth getting it and likely trashed your body, too.

SO FUCKING WHAT?

I hope the kids wise up and trash your stupid system completely and I don’t much care HOW they do it.

Heinz, well written. Did you know that the original meaning of wealth had nothing to do with money? Wealth meant “well being”. I know people with a lot of money who are not “wealthy”. William Blake wrote “The greatest danger a man faces is the seduction of the material world.” We’ve all been really seduced. Socrates said, “A man is rich when his wants are few.” The one thing that works without fail is the marketing that keeps us wanting.

“the artifices of needs inducement”

—-David Harvey

That reminds me of the tale of a frustrated early German trader among the Blackfeet Tribe in America.

In his chronicles he complained about the Indians’ Verdammte Bedürfnislosigkeit, or damned wantless, modest lifestyle.

Yes, I also believe and agree that this is a lot of the psychology going around now, relating to money/credit, and how people are spending/using it.

Years back, certainly back in the 60s or 70s, any smart, astute person, born into a relatively better modern circumstance on the planet, could make a 10 year work/study plan, and be justifiably confident that their plan would end them up, more or less, in the place they hoped for, after those 10 years. Not anymore.

I have trouble thinking about 2031 and what our systems will look like. Will Toffler’s “Future Shock” (we are in that right now) have led to something better?

People used to have to save for troubled times. Now the govt will give you money anytime something bad happens so spend like no tomorrow. Throw in decreasing appetite for labor, maybe less immigration, and here we are, supply goes short, prices go up up and away. An inflationary event might be better near term for jobs than a prolonged recession, but payrolls tomorrow will give better insight into how well that long ago debunked causal Phillips Curve is “working”.

Agreed, NoPrep. Toffler wrote the Third Wave in 1980. He predicted all of this. He really did.

Unless you are born into money, the main thing to try to do is learn a skill and try to stay employed throughout your life. When I came along the Japanese were eating our lunch. I had to move from textiles to consumer products to automotive in my life time.

Sometimes things in the USA don’t seem logical I guess because of reserve status. USA has 3000 counties to choose from to try to find a shoe that feels good to you. Some are almost lost in time if that is what you desire.

The data is going to be skewed since the lower-income workers didn’t have the option to work from home. They’re the service workers who are awaiting the return of the office workers. They would buy less expensive vehicles.

The more telling information is what level of inventory exists.

1) Fill-A-pickup truck 40 gallons tank @ $4/ gallon twice a month.

2) WTI have reached the weekly Oct 2018 fractal zone, forming

a neckline.

3) USD is down, because the Chinese tourist tsunami to US, Europe, ASEAN, – using USD, – was stopped in 2020.

4) US Total Vehicle Sales was down 9% from 19.243M/Y in Apr to 17.474M/Y in May.

5) Manheim stall.

6) The chronic unemployment stall.

7) Rent payments stall.

8) When Junk rates will show sign of strength , car payments will plunge O/N.

With virtually no real growth in Personal Incomes for decades now, I do not think that American consumers have totally abandoned their Silas Marner ways. Even with below inflation financing rates, the monthly payment is still a big chunk of their Disposable Incomes, certainly with an Average Transaction Price at the $40,000 level. Divide that ridiculous bite by 72 for the not-atypical financing period of 6 years and viola: You have a nut per month of $556 even with a zero-interest rate loan. Add in property taxes in Virginia and another say $50 per month for average maintenance costs and the cat is eating cat food along with its owners. Crowded scene at the cat bowl at dinner time.

I think we can thank the unrealized gains in stocks such as Tesla and other rocket rides (rockets run out of fuel and descend to the earth, EVERY SINGLE LAUNCH, hello crytocurrencies!!), and a Government that has basically created a Guaranteed Basic Income system via Stimmie Checks to the moon and uber-generous supplemental Unemployment Benefits. In my humble opinion, I think these factors of Mana from Heaven have more to do with this bizarre and uncharacteristic behavior than any permanent change in Inflation/Ballooned Price ACCEPTANCE by the Joes and Josephines on the street. Financial reality is a very tough taskmaster, and Americans have seen the effects on their well-beings of retracement events such as in 2000, 2008, and possibly this year in 2021.

Then we turn to the FED, with a disgusted eye, and see that the cost to enter these uneconomical arrangements is virtually zero, and certainly is less that the current and going-higher 5% inflation rate. A lot of Government players can take a bow here, but the curtain will eventually fall on their heads in the final act as many consumers having gond on the hook for such overpriced motoring outlays cough these rides up as the economy does what it always does when a bubble pops: CRATERS.

AND THIS WILL BE THE TIME TO BUY A USED VEHICLE, WOULD NEVER BUY NEW MYSELF AGEAN, AS THE LOTS ARE ONCE-AGAIN FLOODED WITH REPOS AND EXCESS INVENTORY AND SANITY RETURNS TO THE USED CAR MARKETPLACE. END OF STORY.

Good analysis. I wonder if the “cash flow” to purchase these vehicles is coming from second mortgages, again.

Why pay it off in 7 years when you can do it in 30. :D

How about property taxes of over $10,000 a year, another $3,000 a year for auto insurance plus don’t forget utility costs – – where are maintenance fees $50 a month???

I went looking for a new 4Runner. What a joke. Who falls for this crap? Yes they want more than original price for a used model but the prices are falling from the totally laughable.

A very nice hardworking sales person was put on my case and I sent him this email:

” I am impressed by your dedication and initiative and creativity. But, right now it seems that 4Runners are at a ridiculous premium. I could have bought a white SR5 a year ago for $32K. But my wife shot down the white. Hey we are all just travelers in life.

I spent the money to fix up my old 4Runner which should give me a couple more years. That takes the pressure off for a while. And saves me a pile of money in taxes and insurance. I still want a hybrid 4Runner because 17 MPG is a problem looking at what is going to happen to gas prices. But I wonder if they can work the batteries into the truck body. So I will just wait until the tide turns or the horse sings or my 4Runner turns to dust. I’m a value buyer kind of guy.

If you do have an amazing deal, call me. But I think it will be 6 months to a year before things change. “

No one is forcing anyone to pay those prices. they are charging over the original price for a used model (which totally defies logic and any type of common sense) because people likely with IQs of under 100 will pay those prices…

I mean seriously, what is so special about a depreciated vehicle that it is worth more than the original price

If your old 4-runner is pre 95 or more, the rock crawling guys will pay TOP dollar for the frame. Not sure why, guess it must be stronger or have some dimensional advantages for what they intend to do to them.

On some vehicles (like 85-95 Toyota PU/Suv) you can often make a lot more by parting them out, if you know how to play Craigslist games, which I find a drag. But I have a lot of stuff for them, mostly in my containers off grid.

I paid 17k for a used truck 4 years ago and I can sell it for more now. It’s not worth more, it just costs more. This is what happens when you print money, put rates near zero, and give free money everyone. We all seem to get this concept here. This won’t end well.

Very true.

Next time the FED have to bring more money as gift!!! to save the economy and the inflation.

This will not end well, definitely.

The employed workers, specially essential workers got screwed. They didn’t get free money and sat down and watched the unemployed buying cars and houses with given free money. By doing frauds on small business loans and other things, they paid cash for houses. Have anyone wonder, where all this cash buyers came from?

In the boutique market of which the car market has become the solution for higher prices are even higher prices . Cache seekers will keep paying way beyond the pain point to insure that one captures the cache of the SUV or the gleaming lord of them all the Luxury Gentleman Farmer 4×4 Truck. They don’t need the vehicle for work.The Plumber that I have used for 20 years recently installed a gas line in my basement for converting from electric to gas cooking. He showed up in one of the 3 vans he bought 15 years ago. He still has all three. His brother in law keeps them running . Off the subject the gas line install cost 2.7 times more than the cost would have been when I started building my wife’s custom hickory cabinets 3 Years Ago. Also since I paid in cash The Plumber sold me the last 40 feet of gas flex that should have went to a high end contractor of custom homes. The Plumber has been to several rodeos and knows that when it takes 60 to 90 days to get paid by a high end contractor the bottom is getting close to falling out and The Plumber ain’t going to be the one holding the bag.Cash is still king!!!! I hung the first cabinet last week . My wife is happy and I get sausage and eggs . Life is good.

DD, I used to do engineering projects in Trinidad during the late 1990’s for their national gas company. I used to hire private drivers to haul me around. The drivers had 30 – 40 year old U.S.made cars that they just kept on repairing. Most had over 500,000 miles on them.

My friend’s older Honda Odyssey van has 400,000+ miles on it with the original engine and one rebuilt transmission. He follows the maintenance schedule religiously.

Period maintenance can keep them running. Most people here in the U.S. are not too smart when it comes to money and think a car/truck is “toast” at 100,000 miles. So they replace it rather than keeping it running at 1/20th the cost.

AA-basic maintenance, like thoughtful thrift, is inimical to a system chained to never-ending growth and easy disposability (the need to have and exercise basic survival chops, and a societal memory of that necessity, appear to have been slowly boiled away in a roiling, tasty stew of ‘convenience’).

may we all find a better day.

Well said!

Yeah, and you say it much nicer than me….but when my back hurts I get grouchy…..er.

When my 1968 VW bug repair costs were higher than new car payments, I thought about selling it. When the axle broke I sold it to someone who wanted the rebuilt engine.

I purchased my current car new five years ago. I get synthetic oil changes. It has a backup camera. I need one that has blind spot beeps. Autonomous would be better. Then I might save more on my car insurance.

Saw a guy on-line. He had ridden all over on a Honda 50cc scooter. The motor had 80,000 miles and it was all original. That motor probably runs at 10,000 rpm. It’s amazing how long an engine can run if designed, built and maintained correctly.

Honda once built a 50cc FOUR for GP racing!

Had a VERY narrow power band and 15+ gears, custom spark plugs.

The racing authorities saw how this volumetric efficiency thing could get out of hand (just like in F-1) and, IIRC, said only one cylinder in 50cc. Don’t know if that class even exists anymore, but while it did I think “Germany area” 2 strokes ruled…Koenig, maybe Rotax of ultralight fame.

NBay-Suzuki had developed a 50cc two-stroke three for the ’77 season with a specific horsepower of 400 (yes, 400)/liter. Doubledigit (17, i think, but memory fails me here) speed-gearbox and knife-thin powerband, natch. Also never raced due to the single-cylinder-only rule change by the FIM. Later, the 50 class was increased to an 80cc limit, but ultimately phased out in the ’80’s with a worldwide decline of interest in performance tiddlers. Same for the old 350/125/250 classes now replaced by the all four-stroke MotoGP/Moto2/Moto3 classes.

Glorious times if you were into it, though…

may we all find a better day.

NBay-ps:in those later 50/80 1cyl/6-speed years the players were the Dutch (Jamathi & VanVeen) and the Spaniards (Derbi &Bultaco). All long gone…

best.

Don’t buy the VHS, the Betamax player, or the mini disc of the car business,

until have a winner.

Next up: Price controls! Then the shortages will really kick-in. Nixon and Carter instituted a lot of price controls…

Might be a good idea to get a new car now, borrow with increasingly worthless dollars, and then comfortably ride out the next decade of inflation-price control-policy error…

Making me feel nostalgic for the generally kind and decent, if not so brilliant, Gerry Ford, and his WIN (Whip Inflation Now) campaign and buttons.

“Next up: Price controls!”

I was thinking they would send out INFLATION COMPENSATION CHECKS

why not?

That’d be like trying to lose weight by going for a run, but instead going for a run to the ice cream shop and getting a triple scoop sundae.

unfortunately they wouldnt see it that way.

This sounds clever enough that it will be tried. Maybe just temporary. But nothing is harder to kill then a temporary government program it has been said

Its all a car wreck of distorted subsidies and other interventions in the market by the Fed/Gov. Won’t end well. Don’t be a sheep like all the others, because you will be rounded up eventually and sent to the slaughter house.

1) SF millennials WFH on zoom are jogging in the parks, swimming in Bay,

feasting in the last surviving restaurants still standing, for $200K/y – $400K/y, doing little for the owners.

2) The young zoomers want to work in the office, out there in the field, with and around people, tired of zooming.

3) Labor Force Participation rate is stalling, because the boomers are retiring in large numbers.

4) In the next recession, the young zoomers, graduating

from the best colleges, will replace the lazy millennials, at 1/3 of the

cost.

I don’t know any zoomers who would rather work in the office than work from home. And I know quite a few

Michael,

All I have seen is that Millennials have worked harder, smarter and got paid less than Boomers.

In 2008 to 2013, Millennials worked their ass off going to universities for master and PHD degrees to have better chance for getting a job as a new graduate. And still there where no jobs for new graduates. They have said that they need at least 10 years of experience for entry level job!

Interestingly, now Millennials are working hard to buy overpriced crappy houses owned by Boomers and ballooned 401K to pay off the Boomers retirement.

Millennials hear this stories from people like you a lot, go and get matured.

Yes, the opportunities became less and less for each generation starting for those born after around 1954 or 1955. This is the tail end of the boomers which are called the jones generation. They drastically slid for those born 1958 or later. Then they slid yet again for gen X, and even more for millennials.

Granted, I’ve lived in expensive states my entire life, but I honestly do not personally know one person born after 1958 who succeeded by their bootstraps. Or who was even able to buy a house with electricity and working plumbing. Every single successful person born after that that I know had help from their parents or some kind of windfall. Most of them initially said they did it themselves, and some publically decry others, but if you pry deep enough or know them for long enough you may find differently.

This doesn’t detract from the fact that millenials as a group have fewer opportunities in this country than the generations before. I’ve seen many millenials who work full time and live in the bushes. That is just wrong. We need far less of a wealth gap and have needed less of one for quite some time.

“Or who was even able to buy a house with electricity and working plumbing. ”

without help.

BTW, I am far older than you and agree. All I see are expensive tear downs full of rats or rot who’s sale price usually supports a lifestyle far beyond mine.

Don’t make the same stupid mistakes, change the damned rules to the insane game. Get into the streets, not the offices….occupy was a good start, but nobody acted like their lives depended on it…

WHICH THEY STILL DO!

If the average consumer has the means – credit or cash – and the desire for something, he will buy it.

Emotion drives most purchasing decisions thus ensuring future woes.

No one ever went broke underestimating the intelligence of the average man. (H. L. Mencken)

Auto makers aren’t dumb, if they are pitching higher priced models that’s what the public wants and the public can afford. Roll out the new line of a new higher priced models, call it the McMansion. Fed is blowing bubbles in everything.

Higher priced cars probably also have a higher profit margin. A shortage of lower priced cars will force some to higher priced. Thus- more profit.

You can’t rely on Americans on pretty much anything, but when it comes to spending, Made in America is the best brand on the market!!!

Pretty sure that houses and cars are on the COVID Toilet Paper trajectory.

My neighbor went out looking for a Camry and came home with a Yaris.

? Only car left on the lot?

They told me they were going to get a beater Camry for their 16 year old son for $3,000. I was thinking that sounds a bit low because my 14 year old totaled Corolla yielded a surprising $5K a year ago. Add inflation and BAM! you’ve got your kid a Yaris with manual windows. ;)

I just looked at Toyota sales for my next article. Turns out, Toyota sold only 9 (nine) Yaris in the US in June (down from 479 in June 2020), and your neighbor bought 1 of those 9 ?

In Canada used car prices didn’t rise but there are less used vehicles for sale. No one can afford a car because of the cost of car insurance. The government has yet to step in and privatize the industry. New car prices are slightly higher maybe 2 or 3 percent higher than last year.

“The government has yet to step in and privatize the industry.”

Canadians buy car insurance through the government?

Yes!

Only one company administered thru provincial govts. you are at their mercy!

My daughter lives in Vancover B.C.

BS.

Two Provincial Govts in Canada have public auto insurance for basic coverage. That is for mandatory coverage. Optional packages can be private….. (collision, comprehensive, etc). This is to ensure all drivers have minimum insurance and if anyone is hit by an uninsured driver they are covered/protected.

All Provincial Govts mandate certain basic practices, like not discriminating based on age, minimum coverages, etc.

In 1973 my yearly private insurance costs were $649 through private. I was 18. When the public option came in my rate drropped to around $150 for the year. Costs were rising these past 20 years from litigation and customers looking at massive settlements in the courts. Plus, unibody construction and expensive cars produced more expensive write offs.This year the Govt instituted ‘no fault’ accident insurance and my rates dropped around 20%. In fact, I received 3 rebate checks this past month.

My son works in Alberta and has his main residence in BC. He recently switched his coverage to BC Govt insurance as the new rates were cheaper than private in Alberta.

I would hope no one on this forum is actually defending the private insurance industry, (medical, auto, property). Come on. My private house insurance is my biggest yearly bill….just over 2K. My property taxes are $950.

two years ago I had a fire in my Westfalia (81). It is worth about 35K in today’s market, but I had it insured for 18K. Anyway, my defrost fan motor seized and the fuse didn’t blow. (bearing went, I knew it was failing so the fire was my own fault to be honest). This produced an electrical fire in the wiring which caused a whole bunch of damage behind the dash. Luckily, I carry a fire extinguisher and had water in the tank…and put the fire out. The damage was around 10K. The insurance company offered to tow it to my preferred rebuild shop, but it was still driveable so I didn’t bother. They repaired and replaced everything, although they would only pay $100 towards a new stereo. This included painting the front end as the paint bubbled, plus a new windshield seal. My cost was $300 deductible. This is the only claim I have ever had in 50 years of driving. The agent was awesome, and offered to pay for transportation for medical appt ( I had some nasty cuts from putting the fire out), but I just sucked it up and didn’t bother. No stitches required. Of course there would have been no medical bill either due to public medical insurance, but who wants to go to a doctor regardless of cost. Not me.

The average American moron, having been thoroughly trounced trying to FOMO into a house (or a second one), now resorts to overbidding on large, unnecessary vehicles in order to feel like a “winner.” Can’t get a dump last updated in 1980 and 300 feet from the freeway without bidding $80k over? Here ya go kid, take that down payment and get this awesome 2.5 ton vehicle that you ONLY have to bid $5k over on! What a deal! Everyone you pass on the freeway will surely know you’re a [wannabe] member of the elite upper middle class!