Americans are having to pay more to get less.

By Wolf Richter for WOLF STREET.

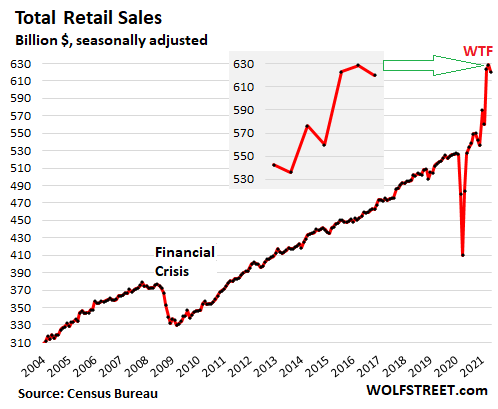

“Gonna Be Tough in May,” I said a month ago, when discussing the stimmie-powered retail sales in April. And that’s what it was. Retail sales in May, at $620 billion seasonally adjusted, were down 1.3% from April, and down a smidge from March too, according to the Commerce Department today. But retail sales remained very high historically, powered by left-over stimmies, and by market-mania gains, and above all, by inflation.

There have been massive price increases in the biggest segments of retail sales, including sales at auto and parts dealers (these retailers account for 22% of total retail sales), where prices have jumped into the stratosphere, including in used vehicles with an 18% price spike in the two months since March. These price increases are pushing up total retail sales in dollar terms as Americans are having to pay more to get less:

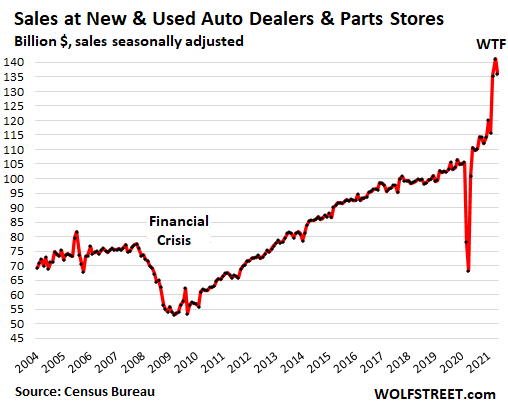

New & used auto dealers and parts stores: Sales fell 3.7% in May, to $136 billion seasonally adjusted, from the historic WTF spike in April and March. And sales fell despite the enormous price increases.

People are figuring it out, and some potential buyers are going on buyers’ strike. That is why a 30% year-over-year spike in used vehicle retail prices – and a 45% spike in used vehicle wholesale prices – cannot last and will unwind, but won’t unwind all the way, and prices will remain relatively high, as pricing pressures shift to other products or services:

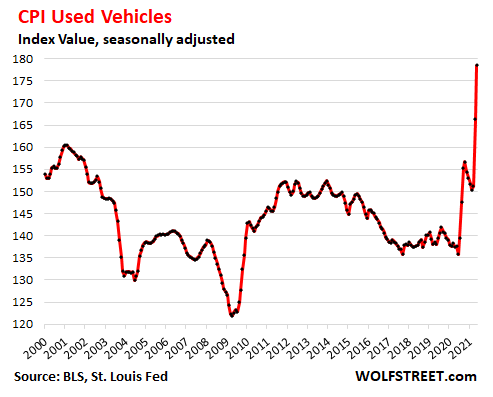

For your amusement, below is the CPI for used vehicles with that phenomenal 30% spike year-over-year, triggered by an 18% price spike over the past two months. Auto purchases are mostly discretionary. Most people can delay by a year or two or more the moment when they buy a vehicle. That was proven during the Financial Crisis, when auto buyers went on strike and vehicle sales plunged and stayed down for years. In the retail data today, there is already a first glimpse of a buyers’ strike in the making (the chart shows the CPI value for used vehicles and not the year-over-year percent change).

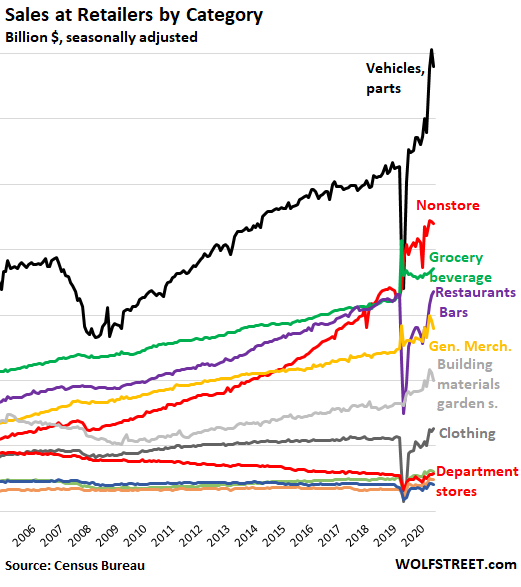

The who is who of retailer segments.

Undisputed #1 in America are auto sales, accounting usually for over one-fifth of total retail sales (black line). Sales at nonstore retailers, mostly ecommerce, have become #2 over the years (top red line). Sales at grocery and beverage stores are #3 (green line). Sales at bars, restaurants, and other “food services and drinking places” are #4 (purple line), having been surpassed by nonstore retailers in 2019. Sales at general merchandise stores but not including department stores are #5 (yellow line). Department stores are near the bottom:

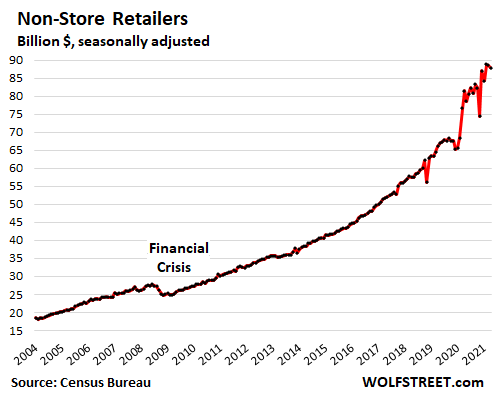

Ecommerce and other “non-store retailers”: Sales edged down 0.8% in May from April, to $88 billion, seasonally adjusted. Compared to May 2019, sales spiked by 33%. This category includes ecommerce, including ecommerce by traditional brick-and-mortar retailers such as Macy’s, mail-order operations, street stalls, vending machines, etc.

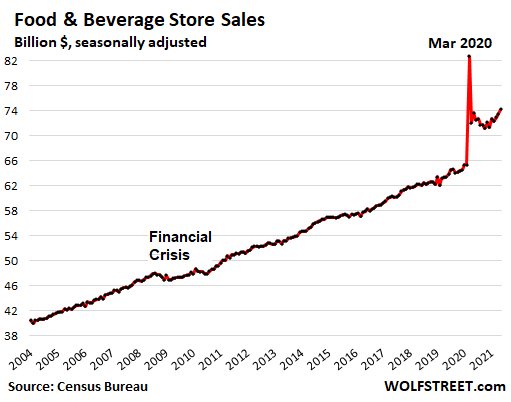

Food and Beverage Stores: Sales ticked up 1.0% in May from April to $74 billion, about the same as in May 2020, but up 17.1% from May 2019. Working from home, reduced restaurant visits, etc. have shifted some consumption from business venues to households, and thereby to retail stores. But as we’ll see in a moment, the restaurant business has come back.

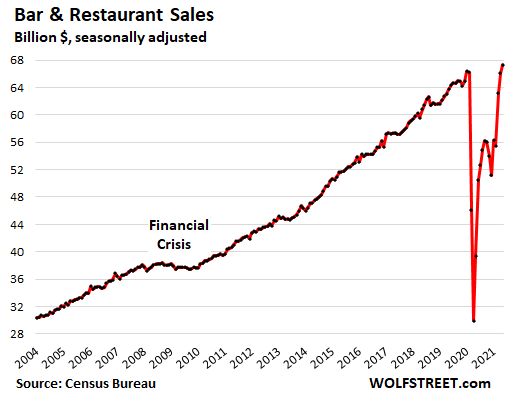

Restaurants & Bars: Sales rose 1.8% in May from April, and are up 5.6% from May 2019, having fully recovered. There have been widespread price increases in restaurants, from fast-food restaurants to higher-end restaurants, and these price increases contribute to sales growth. In foodie cities like San Francisco, the restaurant scene is now booming.

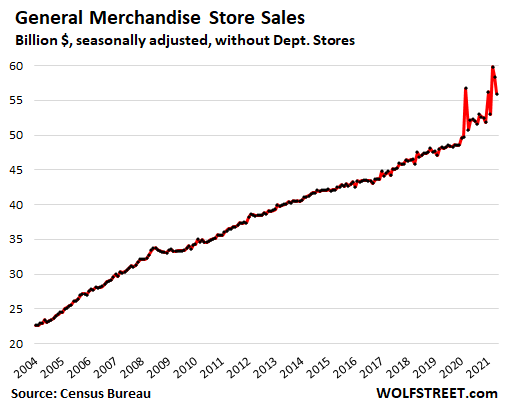

General merchandise stores (minus department stores): Sales fell 4.2% for the month, to $56 billion, the second month in a row of declines, but were still up 16.3% from May 2019. The brick-and-mortar stores of Walmart, Costco, and Target are in this category; but their ecommerce sales are in nonstore retailers:

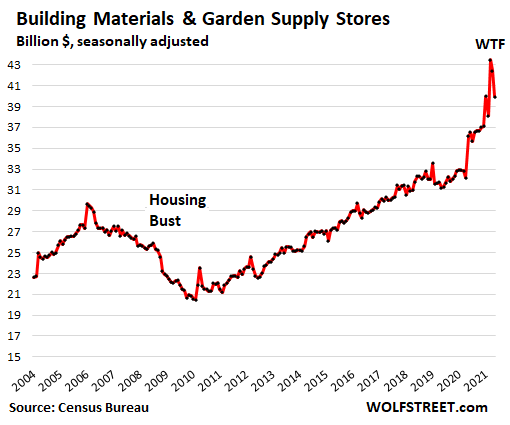

Building materials, garden supply and equipment stores: Sales fell 5.9% in May from April, the second month in a row of declines, to $40 billion, but were still up 28% from May 2019.

Price spikes, particularly of lumber products, have contributed to the spike. But potential lumber buyers have gotten the memo, and some have put projects on hold and have gone on buyers’ strike. In early May, lumber prices started plunging and have now unwound a portion of the price spike, but remain above the former WTF record price spike of September 2020. That buyers strike is starting to be visible:

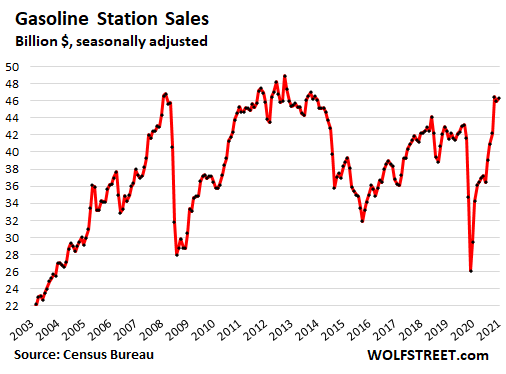

Gas stations: Sales ticked up 0.7% for the month, to $46.3 billion. The price of regular gasoline, according to EIA data, increased by 5.7% at the end of May compared to the end of April. Sales in the past three months are the highest since 2014, with gasoline prices also being the highest since 2014:

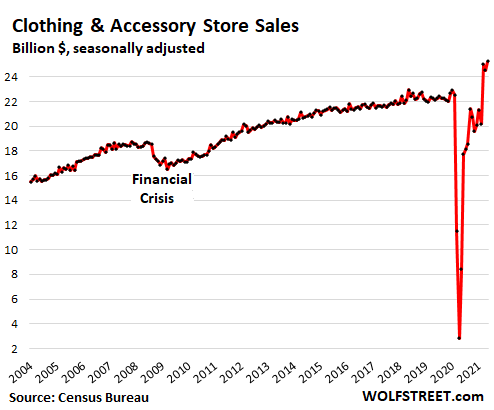

Clothing and accessory stores: Sales rose 3.0% in May from April, to $25 billion, roughly flat with March, and up 14% from April 2019:

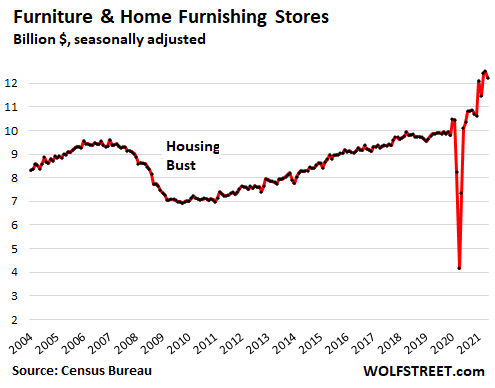

Furniture and home furnishing stores: Sales fell 2.1% for the month, to $12 billion, but were still up 24% from May 2019:

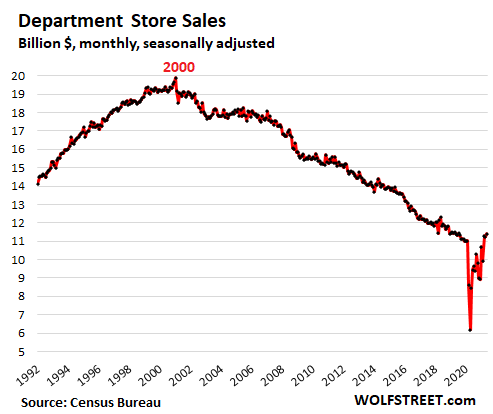

Department stores: sales rose 1.6% for the month and were about flat for the three-month period, at $11 billion, and were about flat with May 2019. This includes sales at the brick-and-mortar stores of Macy’s, Kohl’s, J.C. Penney, etc., but not sales in their ecommerce operations, which are included in nonstore retailers:

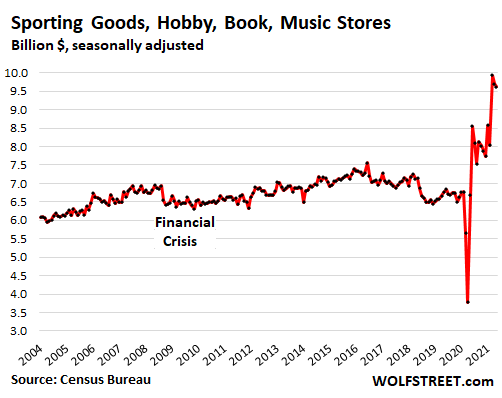

Sporting goods, hobby, book and music stores: Sales ticked down 0.8% in May from April, to $9.6 billion, second month in a row of declines, after the WTF stimmie spike in March. This left sales up 42% from May 2019:

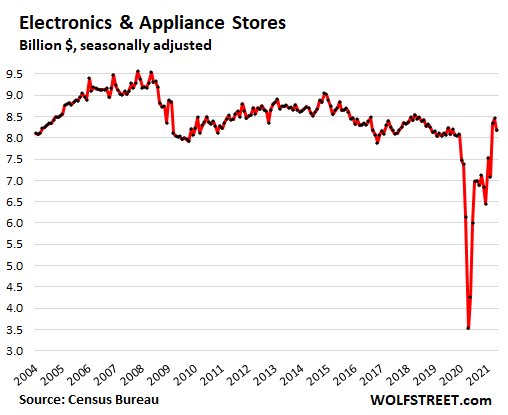

Electronics and appliance stores: Sales fell 3.4% in May from April, after the WTF spike in March, and were up just 0.9% from May 2019. Most consumer electronics and many appliances are sold via ecommerce channels, and have been booming for years, leaving brick-and-mortar sales where they’d been in 2005:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Just buy the Jerome`s “transitory” inflation scam, and dont ask……LOL

Don’t know how much is Feds doing but the bigee, oil is coming up fast. WTI is around 72 or about double average of 2020. Oil price can cause a recession all by itself…a big factor in 74.

But potential lumber buyers have gotten the memo, and some have put projects on hold and have gone on buyers’ strike.

yeppir – 2 years will wait to see

NO HURRY

got lots of other things to look at

and btw – we have money to do if we so choose

In spite of the WTF moments the various markets have provided for the last decade, reality comes to bear eventually.

Wealth divide is greater than before, wages are still fairly flat (for those that are working) and the higher costs across the board just drive the nail.

We aren’t crazy. Just perplexed.

We aren’t crazy! Just hammered!

Great!

And there are plenty of pills and other distractions/reliefs being sold to those who can’t take the heat in the kitchen.

One of the reasons I value this website…..face it with a clear head and compare your thoughts and experiences to others.

I think there is no such thing as “reality” past Big Bang when everything was one by quantum entanglement, information being everywhere at once.

Entanglement is weakening, the universe is getting loose in the joints, new things are pushing through into existence, old reality is smoothly being replaced by new, local, realities but absolute reality never happens again until everyone and everything agrees on what it is :).

UFO’s and UAP’s entering, another reality is created, not like the last one. One should relax and enjoy the show, it is going to be better.

Ever wonder if that’s what black holes do? Recycle old universes?

Hussman had an outstanding article this month explaining the whole economic and financial system in the US. In the past there is zero correlation between interest rates and 12 year stock returns. This time may be different, but if not we all have been sold a lie that low interest rates justify high stock prices.

Low rates only justify high stock prices if you believe that low rates will remain forever.

I guess that is true. Low interest on long term treasuries predict low long term growth in economy. Low long term growth means future cash flows are going to be much lower than if growth rate was normal. PE will adjust down when earnings disappoint. At least in theory.

Those billionaires that don’t pay taxes need to start spending some of their money quick!

Tut tut serf…

Excess profits go into the family foundation, to immortalize our family line, so none of our decedents have to work until the end of time… As board members they will paid enough to never have to work a day in their lives.

You serf’s will be satisfied with what we choose to spend on the interest on our endowment and thank us for our tax deductible donation.

Within 40 years of the Roman Army leaving Britain, there were zero elite villas occupied, and no money in circulation. And similarly through history. So, “till the end of time” should be “till the end of the current system of government”. After which, they are quite literally toast.

Serfs Up!

“You have need of me, because I am rich and you are poor. We will therefore come to an agreement. I will permit you the honor of serving me, on condition that you bestow on me the little you have left, in return for the pains I shall take to command you”

*holds pinkie to corner of mouth*

Hahahahahahahaha!!!!! My evil stimmies are working just as planned!!!!!

*slips out of character*

Why did my car have to die during all of this??????

Don’t slip out character, this account cracks me up everytime.

Lol! Also, unrelatedly, its a big day today in Geneva-

There’s a break-even point below which the revenue loss from a sales volume drop more than offsets the revenue gain from a price increase. It will be very interesting to see how many businesses that rushed to raise their prices end up learning that lesson the hard way. It’s easy to raise prices…not so easy for it to be a wise business decision.

Meanwhile, Jeff Bezos, a man who knows a bit about retail, has dumped $16.6 billion dollars worth of his Amazon stock, just in the last year and a half. That’s more than he sold in the prior ten years.

Amazon is priced based on AWS more than the retail business. Much more competition in cloud marketplace. Google Cloud using price to increase business.

Makes sense that he is selling it, the stock price will soon follow his lead in a general stock sell-off.

He needed to pay for the 400′ yacht he is having built.

He has 15 more bundles just like that one.

They’re taking up space, so that’s how he’ll use the money.

Space.

His shares are probably worth more than they were in the last 10 years, plus he isn’t running the business any more

PR

Good point.

Inflation screws everything for everybody.

In the inflation hit 70’s I did weekend gas station work, and every time a tanker came in the driver had a new invoice which showed a new price. We then had to quickly re-calculate what margin we needed to add to stay in business. Somebody then had to climb the pole and change the road signs. If we priced too high we lost customers, if we priced too low, we got cleaned out and pi**ed off all our regulars. The next delivery was a nightmare to plan for. This happened 2 or 3 times a week. It was better in the OPEC embargo when we cleared our whole ‘allocation’ in an hour at top price then shut the place up and went home to spend all the money.

My sis and her husband bought some land to build a home. Because they live in an area that has received an influx of rich folks escaping the cities, the local builders are overwhelmed with demand. The bro-in-law said that to have a ‘site-built house’ on their bare property was four years out! A bit of hyperbole I think, but probably two years out. They are living in an RV. So they went with the manufactured house option. He said that prices for them were going up 5% a week! Again, maybe a bit of exaggeration (?), but they’ll have the new house set up within a month.

New house going in a quarter mile down the road from me, also a manufactured home, and for the same reason.

I remember waiting in long lines at 4:30 AM based only on a hot tip*. And then siphoning gas from my filled old beat-up Chevy wagon to put in a Honda 350 SL chained to the apt staircase that I rode to work even in the rain.

Locking gas caps were a MUST.

*A buddy like Auldyin was pure gold.

NB

Happy Days!

Learn from in-n-out

I’ve decided to cut my discretionary spending this summer. Too many needs have gone up. No choice

Well, discretion [is] the better part of valor.

Or something like that

“Valor morghulis” to all you ‘faceless persons’, who are out there scattered amongst the Realm in silent .. or not so silent .. desperation over our shared fates – brought about mostly by those on high.

So yeah, Minutes .. I feel for ya! Choices are to be made, and, with that mind, perhaps new allegiancies.

I’ve cut everything to the bone. I’m not playing the game.

Have you seen the new bone scalpel?

Time to grab your ankles and bend over. The J team is here to make sure it goes up smoothly and quickly. It won’t be a problem, for them that is… not for you and I, we can scream and complain about the pains associated with inflation for all they care. Hint, they don’t. For them, the price increase is irrelevant.

Does anything think any of the J team gives a crap that the price of milk is going up. Or lumber costs however much more than it used to? Just go get someone to cut down more trees. DUH.

The issue with lumber isn’t the supply of trees, but the supply of processors of that lumber. There is a supply glut of wood.

There’s also a glut of retail ready lumber at the local yard. And it’s dead there.

There are two construction projects near my home that have slowed to a crawl. I guess the average home price spike to over $500K really has had consequences…

A sheet of OSB is so expense in the US because here in The Netherlands we burn your woodchips in our environmentally ‘green’ electricity plants. Those are not ‘green’ because it is by science, but because the European Counsel says it is.

A world gone nuts. We need more central planning to fix this i guess. /sarc

We have a wood chip plant here in NW Florida. The local trees are processed and the chips are shipped all the way to Scandinavia. You are right. It makes no sense environmentally and certainly not economically. But the politicians can virtue signal about how green they are.

Wolfbay,

Growing trees on a tree farm and then harvesting them to generate power is “carbon neutral” because when trees grow, they take carbon out of the air, and when they get burned, the carbon goes back into the air.

The problem with wood as a fuel is that burning it in a clean way is not that easy. Wood fires in the open air, such as wild fires, generates lots of toxic pollutants.

A lot of times, wood chips are a byproduct of timber that cannot be turned into lumber. This includes branches of trees and the like. Using a waste product for power generation is generally a pretty good idea and is very common in the paper pulp industry and elsewhere.

Heh, you mean like petroleum is technically a renewable because if you stretch the time horizon out long enough, we are the petroleum, quite literally.

Appliance stores have been short of inventory. Dryers have been harder to find than that rare mineral, unobtainium. Shipping problems seem to be a long way from being solved.

Lowe’s has them

FWIW – Many kinds of printers are on “not in stock, awaiting delivery” at “my” online computer pusher.

Ditto printer toner cartridges, now out of stock or 4+ days delivery, but wait the super double pack is available which forces low volume user into buying way more than needed.

Once a shortage occurs, and supply lines get backed up it takes quite a while to get it back to normal. Add to that the fear of not being able to get something, and even consumers who may not need something right away, but are concerned because of the possibility of it breaking down, put in there orders… just in case.

At some point, all this forward buying works its way through the system and then sales fall dramatically. About the time when factories have ramped up production, and lots of new container ships are completed…

Durable goods shortages aren’t like toilet paper. People are going to hoard cars and things. I foresee a massive inventory build shortly.

*AREN’T going to hoard cars and things

Line dry. Haven’t used a dryer in 10 years. Clothes last longer.

I always say that if people were really concerned about global warming they would be hanging out their laundry. It’s the easiest thing to do, but it has the stigma of poverty.

Now, that IS “old school”

Well, most of us are gonna get there eventually, so why not be ahead of the curve, right? Us monkeys wearing hubris have squandered fossil sunlight, all for a hand-held e-device and a plastic bag of junk food – all of which being derived from said accumulated goo ..

I see animal, human, and limited energy technologies in our collective future. So dive out of that 1st floor window and hit the ground deftly .. while you still have the means and wits to adapt!

I sure like the smell of clothes dried outside, too. It may not be so great in other places, I don’t know. In fact, when I’m cooking outside with Ozark perfume (Hickory), the clothes smell good enough to eat.

We ordered a new stove and it was delivered in 2 weeks. No problems at all.

“For your amusement…” Wolf

These charts look like a roller coaster that goes up *clink by *clink to the top it lumbers. Then comes the arms up and SCREAMS of joy or perhaps terror this time. Gravity is coming to the markets. All of them

Its obvious the Buyagra is wearing off, need more stimmies, Stat!

what we are seeing is where people would spend money if they had no job but were given a check every week. so how long does this last? not much longer. sales going to plummet in the coming 5 months. and the real estate meltdown will be a leading factor. higher interest rates that are forced by the market on the Fed will cut the number of buyers at price points and then falling demand and increased supply will create a rebalance – at much lower prices.

As I replied to you in another thread, considering interest and price go in opposite direction, RE price still goes up in previous high inflation years. I’m not sure if price will stay at his level this time”temperature”.

RE went up in the 70’s with high inflation because unions had power and all wages followed them. Unions are dead. Inflation and rates will outpace wages. RE will suffer.

In 1980, as house prices were still going up, interest rates crested at over 16%. Do you think that union members were paying 16%? In 1983 there were less than 18 million union worker in the U.S. and that included public sector unions.

Today, 36% of single family home buyers pay cash. They will still be in the house buying market, if, for nothing else, as a hedge against inflation. Corporate ownership of SFH is growing in leaps and bounds, and they will continue to buy. Yesterday’s union members would be today’s SFH renters.

Corporate buyers continuing to buy doesn’t mean their tenants can pay current rents, much less higher ones. Corporate buyers pay “cash” (actually wholesale financing) because cost of credit is cheap and lending standards are a joke.

A reversal of the 40 year bond bull market into a full fledged bear market and tighter credit conditions will change the economics dramatically.

Much higher inflation isn’t a guarantee either. In the 70’s, houses sold at a noticeably lower multiple to median income. Housing is “affordable” today due to artificially cheap credit and lax lending standards which many have somehow convinced themselves are “strict”. Even if buyer’s had to always make 20% down payments (which they do not), an 80/20 loan on a frequently ridiculously overpriced home hardly constitutes strict lending.

Funny how all the bad things that will happen to the bad rich people, that will somehow benefit all of the poor people, are always going to happen tomorrow.

But they really never do happen yesterday.

I hear ya, getting tired of the daily chorus. Sing, Fat Lady America, Sing!

More than the stimulus checks is the fact that people have been stiffing the landlord for over a year and a half. That’s a lot of discretionary income they didn’t before have. Rent/mortgage is the largest monthly bill in most households. Take that away and people can lever up on a couple new vehicles. We have the worst crop of loser politicians in history. These clowns destroyed the economy.

Al Capone (once removed) would do a better job running this country than these incompetent gangsters that are in place right now. I really fear the future of this country. Every major institution is corrupt and beyond salvation.

That explains MANY things about the choice of #45. You simply wanted a COMPETENT lying, cheating, ignorant, self serving gangster as your savior.

If I’d only watched the Apprentice, I probably would “get it”.

18 months. No rent need be paid.

Soooo, which clowns decided it was a good idea in the first place?

JP Morgan already floating idea that people of color need help buying a home as home ownership rate is 30 percentage points lower than whites. There can always be a program for government and banks to try to reflate house prices when they crash.

If they are foolish enough to go down that road, I see a lot of lawsuits coming for racial discrimination against non-colored people.

Biden admin tried giving race-based aid preferences to black farmers and has been challenged in court, so far successfully.

The meme during the crisis was that pent up demand in services would not materialize. You can only eat dinner out once each day. These charts then prove one of two things. Despite Covid restrictions, consumers are spending more on nonessential services, or the pace of the recovery is smaller than supposed. Durables, appliance sales are tepid, which may explain supply issues. The stimmies have bridged that gap somewhat or it would be far worse. What happened in the 30s people were homeless, vagrant, and they ate in diners. By Lacey hunt when this surge in domestic production meets the surge in imports, the competition for market share is fierce, driving down prices. Bernanke contends the the depression could have been solved with helicopter money, we may get to see how that works out. When assets hold their value and money loses value you sell your higher priced assets. The last decade we see the lowest quality stocks rise, most shorted index. That should continue for a while.

The issue is, the shortages that were caused by the virus shutdowns were not just here in America, they were world wide. When the entire world is unwilling or unable to purchase things that wear out, for 3-6 months, it creates one hell of a lot of demand. Now add to that labor shortages and you have a situation that will take a while to normalize. The price gouging and inflation are a natural result, and drive people to buy used items pushing up those prices.

I think the shortages are more due to the trade war with China than anything to do with Corona: “Piss the factory off, expect that they ‘work to rule’ ” – either for a while or until reparations are made!

That’s how it worked when I designed power electronics in industry and China is the worlds factory, a fully unionised one too.

Corona Everything is just a little too convenient. My TBTF project is also talking a lot about Corona, but, they would have been equally late and equally over budget without Corona.

Corona was a golden opportunity to get out from under a lot of failure and dysfunction, but it still going on, and they will be in the same shit again in only 1-3 years time. With Nothing being changed, because nobody are ever wrong here, the eventual results will also not change.

An example of brilliance from the once red state (colors for right/left states are exactly backwards simply by chance – read about that elsewhere) of Colorado.

The unemployment supplements remain in effect until mid-September, but rather than ending that to get people back to work, Colorado is offering a one-time payment of $1,600 to accomplish that. You see, the state government claims the supplemental payments “help businesses” because of the amount of money handed out being spent.

Of course, they aren’t helping the many small businesses who can’t find anyone to employ, thereby ensuring that perhaps even more than the 35% of small businesses projected by the SBA to go out of business this summer (thus the reason for the supplements ending in September?) will go out of business, shifting their business to the large corporations who own “our” government and via an indirect method raising the minimum wage so that even more small businesses can’t afford to exist.

“simply by chance” – that was sarcasm…

Most politicians couldn’t run a lemonade stand. They’re corrupt idiots.

And they’d make you wear a mask, too, without providing a straw.

Your meme doesn’t go very far in Colorado.

Senator John Hickenlooper, former governor, former mayor, owned several restaurants in Denver.

Even that crazy Rep Lauren Boebert is a restaurant owner.

Bought a dining set and a sofa at the Macy’s Presidents Day sale. Awesome discount. This is in mid-February. Dining set just arrived last week. Sofa? Ha. They keep kicking it out. Looking at September, now. If a major, high volume retailer can’t source this stuff…

Back at the beach and my friend wanted to go thrift store shopping. There is so much good stuff for sale here. A lot of really nice shirts $1 each. Sheet sets $3. Soft insulated Thermos brand cooler $4. These places help the lower class have a decent standard of living although most people shopping there are middle class.

I often find ‘treasures-in-the-rough .. furniture items with ‘good bones’ and potential, only needing some TLC and vision. Bought cheaply, putting in labor and materials resulting in a new family heirloom. The hunt for said items is the hardest part of the process.

It used to be the case that many volume retailers did not even order sofas from the manufacturer (especially leather) until the customer had paid. They didn’t tell the customer this of course, and routinely used to push the made-up delivery date back every month until the sofa arrived.

I made a point of only ordering my lounge set when I had checked they actually had them in stock in that store, and arranged delivery for 3 days later.

3 months later, the major retailer went bust. Needless to say, the customers with “delayed” deliveries got neither sofas nor their money back.

You may wish to consider canceling your order.

My neighbor ordered a new bedroom set for her daughter, delivered in a week. No problem at all.

What will happen to these numbers when the mortgage / rent forbearance ends in a few more weeks. No one in the MSM is mentioning this?

Don’t be surprised if it isn’t extended at the last minute. It should not be but I expect it.

I guess forever? There is the highest number of job openings in history. There is ZERO justification for extending it.

The majority are low-paid shit jobs that no one wants.

Maybe this time the gov will have to add $600 per wk on the paycheck if they want people going back to work.

Whether they are s%it jobs or not these people should either take them or take nothing and not get any handouts.

Just back from my morning dog walk with a recently retired commercial real estate lawyer who keeps close track of what is going on. He mentioned that the relevant federal entity has just told the mortgage servicers that they need to focus on “working things out” with mortgages in trouble when the forbearance period runs out and noted that this time, vs. 2008, most mortgages are not “underwater”. He thought that was a pretty clear signal that there won’t be extensions.

with price at this high, does it matter?

Was reading about the rent moratorium and I don’t think it ending is going to affect much. It’s expired in a lot of states and only ~8 million homes are in forebearance iirc.

Besides, renting outside of major cities is like being bent over and taken for a spin right now. In my area and the area I used to live in, you’re getting punished for renting if you can even find something. Hence the run up in real estate, or it’s a part of the equation. The more I look at everything the less likely it seems that there will be a major collapse. I see a lull eventually but I’m rather skeptical. But fear controls the markets so who knows.

Inflation must be working since nominal spending in every category is at or above pre-covid levels.

When I first read spending at $620 million, I first thought Wolf was talking about spending in Canada! Clearly the work of auto incorrect!

“Inflation must be working since nominal spending in every category is at or above pre-covid levels.”

I’m hoping this is sarcasm

WES,

Thanks. Yes, the magic of fiat currency :-]

“Inflation must be working since nominal spending in every category is at or above pre-covid levels.”

Its like the poker game…and everybody breaks their chips in half…

now the game is twice as big. Viola!

1) AMZN space ship is flying above the weekly cloud.

2) After reaching a buying climax in July 13, Jeff produced an inside bar,

a black Harami, in July 20 2020. The Harami close is an important support.

3) Mar 1 2021 buying tail was followed by four weeks of accumulation that sent Jeff to a new all time high. It might be an UT after distribution.

4) If AMZN drop to the bottom of the weekly cloud, Jeff will space ship will takeoff, for diversion.

5) The sparrow basks in the deep moonlight, execute plan G.

LOL!

Let me try one.

The dog’s feet have no ears.

He cannot hear what the ground tells him.

Meanwhile the e-minis laugh and gold sings to the universe.

6) Lesser eels, from calls we hear.

The Inflation report oppose Chuck D’Israeli $6T in our throat.

June is going to see many kicked off unemployment. People think they are only losing the extra $300, but they will also be losing benefits extended under federal programs, PEUC and PUA. These people will surely be cutting back in anticipation of the coming financial cliff. If May was bad, just wait for June.

I don’t think those unfilled jobs really exist.

Yes and to help ease the conscience of the rest of the working class (who up until now have shown little sympathy for these handout seeking miscreants), those losing these benefits will no longer be counted as unemployed, but rather discouraged workers who have voluntarily decided to remain out of the workforce.

No better time than this summer to sell your extra stuff on Craigslist, either as single items or via garage sales. Or just give it away,to get extras space you can rent out in your home.

People overstocked for the pandemic and they need to get rid of the foodstuffs that are expiring. There is so many sofas, beds, refrigerators, washing machines etc being given away, or sold for next to nothing, as well as large furniture items, you’d be nuts to buy new.

“I don’t think those unfilled jobs really exist.”

I see quite a few “help wanted” and “hiring all positions” signs outside of many businesses in my area.

There are unfilled jobs, YES, but just a 60% will be available compared to the beginning of 2020 levels, companies have made adjustments, working with less employees, increasing wages to those who remain employed, and other businesses will not even be able to open again, there will be a vacancy of 40% unemployment, minimum

I predict that our WFHA (Work from Home Anywhere) experiment will eventually lead to fewer such jobs net going forward.

Once employers discern that these WFHA type jobs give them a great deal of flexibility in deploying workers I am confident company CEOs and their bean counters will leverage it to transform traditional corporate employment into a new relationship with rank-and-file workers— morphing more into gig and contract work, and even more outsourcing where possible to lower-labor-cost countries.

Never let a good crisis go to waste, as they say …

The new balance of power : side by side, Putin pendulum swing to our side, in a move from the opposite side. WTI @72 on the way to $100 please Putin, worrisome to China. Xi was born before Nixon 1972.

Yup WTI still will most likely double from here over next 2 years.

Plus most WTI majors pay you to get paid!

My favorite is the Real estate pros trying to promote commercial rents will rise along with goods. The justification is that tenants can afford to pay higher rents with higher sales prices. Ok but higher insurance premiums higher real estate taxes higher costs, and a choice of vacant spaces…. the smart LL lower the rents along with offering concessions. Prices getting out of control can lead to dangerous consequences in the streets.

I intend to personally push up overall spending in the bars and restaurants sector whenever this plague is done with.

This almost certainly has to have a negative effect on consumer sentiment.

Getting less and paying more in itself insures people buy less, as their budgets are strained by increased prices.

Putting consumers in a bad mood is not good for the economy, and may convince many to go into belt tightening mode.

Everyone I know are saying that it’s time to juice this thing up with more stemmie fiat. It is our birthright to claim our children’s ,children’s , children’s future wealth and spend it….NOW..,..Powell will say just that very thing and lay it at the feet of Congress using cryptic bullshit fed speak with incantations and illusory fog. The Stock Market will rally to all time highs waiting for the transitory messiah to appear and walk on water. The MSM money show jabber jaws will have wet dreams over Powell’s command of the situation. Simultaneously OWJ will be beating up on Vlad with a really firm wheat noodle.

Just read an article claiming that container ship costs are up over 200% and will be going higher for the foreseeable future. That pretty much ensures that prices will continue going up along with them…

Sorry kids Christmas is cancelled again because of COVID*. Santa got stuck in the Suez Canal

*actually FED gone wild policy. But seriously what is going to be affordable or available or desirable after a year of mail order bliss

In my area we now have Sunday deliveries at home. Outside of the Xmas season, I have never had this before. Shipping costs may be up, but so is the level of service.

Same here with Sunday deliveries, however the delivery drivers are now gig workers in their own vehicles who often just dump stuff at the end of the drive, so the level of service has dropped significantly.

Service here is as good as ever, Sundays included. Some things show up early. The delivery people are still busy.

Oh yeah, let’s just print this currency into oblivion. Sounds like such a great idea for the future of this country. I’ve got a better idea – let’s fire these aszholes running things, starting with Weimar Boy Powell.

Please keep in mind, the CPI will fall, it will decline. The CPI will soon return to 2-3%.

Inflation probably is now about 10%, but CPI will soon fall from what it is now. Why?

Because what I wrote years ago here.

Government inflation reports are:

100% FRAUD.

100% FAKE NEWS

100% PROPOGANDA.

I expect the cpi to collapse in the third quarter, the one used to calculate the social security increases.

Will the advance and increase in the child care credit have much of an effect on these numbers? We will get $500 extra a month, but we know a family who will be getting $1,850/mo!

Free moolah will continue.

Pay people to have kids, when overpopulation is the root of our problems..

Brilliant, our government always seems to be able to come up with the wrong solution at the wrong time….

Serf production! Malthus would understand. It’s difficult to live like Romans without the help.

Malthusianism, it works!

Two views?

‘~ TLDR: “there are fewer and fewer items that are rising in price by more than 2% y/y.”?

https://twitter.com/PriapusIQ/status/1403266417965899777?s=20

‘Someone’ is not optimistic re inflation?

“Last week the Bureau of Labor Statistics announced that in the year to May the US consumer price index rose by 5.0%. This unexpectedly high figure means that the consensus of a year ago has been quite wrong. Nevertheless, a new consensus – similarly relaxed and complacent – has emerged, that the current inflation upturn is transitory, due to “base effects and bottlenecks”. According to this new consensus US consumer inflation will be back to 2% or so by late next year and in 2023.

In a note accompanying this e-mail, we challenge the complacency, particularly in the American context. The heart of our argument is that the velocity of circulation of money has been artificially depressed by the Covid-19 pandemic, but a vast amount of evidence shows that in the long run money-holding preferences are stable. We assume – in our main projection – that M3 velocity will return in the USA by end-2022 to a level about 5% lower than that which prevailed in 2018 and 2019; we also assume that money growth from here will run at an annualised rate of 5% (i.e., about 0.4% a month).

The result is that nominal GDP in the final quarter of next year is about 30% above its value in the first quarter of 2021. If nominal GDP has to rise by 30% in a little more than 18 months, what does that mean for real output and inflation? As we say in the note, “the annual rate of US consumer inflation between now and end-2022 will typically run in the 5% – 10% band”. We could not in logic reach any other answer.

Time will tell. The test of competing theories is reaching a very interesting phase.”

https://mailchi.mp/928db1c48509/which-economic-thoughtcomes-out-best-from-the-last-decade-1336363?e=260ed9002a

Seeing what the “stimulus” is spent on, one can only conclude that WAY too much of it has been handed out.

I just read that in a country in Europe, retail savings account balances have increased at 2.5x the normal Rate. And these are savings accounts that earn 0%. In a crisis you would expect people (on aggregate) to have to dive into their savings to help them through the lean times. But of course with people keeping their normal incomes but with less opportunity to spend, the money ends up in savings accounts (and stocks, crypto and inflating house prices of course).

People might be increasing savings because they want to survive if it all blows up. It isn’t about investment and return in that case. Plus, savers most likely reduced purchases for same reason.

1) Patterns fail, especially vertical patterns that lead to infinity.

2) WTI approach Oct 2018 high @76.90.

3) It will form a neckline.

4) Corrections will form : RS1, RS2, RS3… of an inverse H&S,

in a symmetry with June 2017 (L) @42.05, Dec 2018 @42.36

and Mar 2015 selling climax @42.03.

5) We don’t know how many times WTI will visit the 42 support line, or beach it in direction to Feb 2016 low @26.05, before the jump > the neckline.

6) All we know is that after Oct 2018 fractal zone, WTI formed a Horn.

It led to Apr 2020 (L) @6.50, which is the inverse suggested H&S head.

7) WTI osc will brew HQ inflation later in the decade, or the next one.

8) WTI multi RS might send USD > 104 on the way to 2000/2001 triple peaks.

9) The suggested inverse H&S pattern might not materialize, or fail.

If Putin don’t care :

XL pipeline with TM will send WTI down.

75% of Americans live within 5 miles of a Dollar General store. 1 in 3 new store openings is a Dollar General store. With the price of gasoline and auto parts rising, that is a plus.

They have built one about 2 miles from me. It improved my life as it reduced full shopping trips to grocery store. Reasonable prices and clean store. Missed out on the stock.

I lived near a Big Lots in Florida, we benefited from their low prices on food they sold. I think it’s great Dollar General is moving into food deserts and giving poorer people a cheaper way to get non perishable foods. Some people say DG is putting small grocers out of business, but I think small grocers in these areas have been exploiting the poor for a long time.

DG can be a bit pricey if you don’t watch out, but they are handy. Dollar Tree and Aldi’s are the best bargains. The ones I go to are across the st from the Walmart, and thriving.

I thought rising prices reduced demand. You know, supply demand stuff. I’d like to see whether or not incomes have increased over all. The big box retailers pay significantly more compared to last year. Is that significant enough to support higher prices? And the private debt levels too. Where are they? Has saving increased? That takes demand out of the market.

Pickup trucks 41 gallons tank : 41 x $3.5/g = $143 (max), twice a month

==> $200/m – $250/m.

I take a very different impression from Wolf’s charts. Looks to me as though:

a. The emergency stims, accommodation, etc. seems to have worked. Sales figures in all categories are back – at or above pre-Covid levels. Yes, I understand that inflation is inflating the sale numbers, but not that much

b. The inflation effects are mostly about supply constrictions, which are rapidly being sorted out. Lumber is one example. Cars and computer chips will follow along shortly

The inflation numbers are a direct effect of too much new money chasing an (momentarily) reduced supply of new goods to buy with that money. That inflation rate will come down.

What won’t return to previous levels, as Wolf has repeatedly pointed out, is the buying power of a dollar.

What also won’t return to previous levels is the earning power of families whose income is derived from labor.

I’m seeing all this hubbub and consternation about “inflation” as a bit over-blown. Inflation has been with us forever, and we just spent a lot of money to repair the economic roof which as torn off by a hurricane (covid). That sort of calamity brings disruptions and distortions.

The main (durable, inexorable and as-yet unsolved) economic problem is the systematic reduction of wealth-generating capacity at the household (99%) level, and the resulting, continuing, and intensifying concentration of wealth-generating capacity in the hands of the relative few.

That’s what MMT, stims, entitlements, and all the other econ gimmicks (transfer programs) are designed to address.

Those gimmicks don’t seem to work. We need some new gimmicks.

Inflation has been with us, not forever, but since 1972. It has always worked to our determent, and not in our best interests. If everyone realized that, and pressured the government, it would be forced to do something about it. In the end we get the government and the economy we deserve.

Not sure what that first sentence was supposed to convey, but perhaps you should rethink it…unless you just enjoy throwing sht at the wall and hope something sticks, as they say.

Good thing monthly stimulus is kicking in next month!

Stonks will thrill! Grab your piece of golden calf!

From a personal viewpoint:

1. I’m spending more because there’s no interest on my savings, so I might as well buy everything non-perishable I know I’ll need. This includes stuff to renovate my bathroom in 2 years time, so the sales increase is just bringing forward sales from future years. This applies to most people I know around here. We are rural and all have the storage space (and no crime).

2. Not everything is inflating. Bathroom fixtures, e.g. faucets, are cheaper now than 10 years ago (I have records). The reason no one’s buying (my supplier says he has a warehousefull) is because you can’t get the pipe to plumb them, or find a decent plumber. I bought my piping 4 months ago (last available) and do my own plumbing. Breaker panel prices have not gone up simply because the vast majority have not been in stock for months. I have no idea what will happen to prices when they eventually do get some in. Wire went up 30% in one jump last month, but that’s the price of copper.

3. Some sales rushes do not trigger good thoughts. Midway just got 20,000 WW2 M1 carbines from Italy, original condition (not great). They sold out in one day.

I don’t understand the gas chart. yes, prices are up a lot, as mentioned. But I don’t see the usage side of the equation. In the Seattle-metro area, we still don’t have morning and evening rush hours. A lot of people are working from home still. Usage of cars is still very low. My wife and I took two road trips recently – traffic was very light. Much lighter than before last March.

The one thing I can think of that may be a factor is the efficiency has gone down. Perhaps there are more trucks and lower mpg vehicles than before? And the combination of higher prices and lower efficiency is countering the lower miles driven?

Mike, the Seattle is not the rest of the US. Here in Houston, the freeways have been jammed for months on end. We opened up months ago.

I’am sure glad not to be a member of the fmoc right now.

For the first time in history the weakness of this mess we call our economy is becoming apparent.

Raise rates in the light of an economy that has a dollar with a huge payment deficit, retail spending declining, parts shortages from overseas issues, potential variants developing, sizable unemployment.etc etc.

Stay put and let inflation roar, housing prices beyond ability to pay, cars sky high, cultural collapse, low savings rate, banks stuffed with bad paper, bad allocations of funds and leveraging everywhere. etc etc.

Yep….they have a choice……what a choice…..and given the weak ass generation we’ve raised they will take a snakes way out……at rat speed……my prediction.

Raise the defense budget and get some kids killed…….oh…..they already tried that.

Joe Dimaggio….where are you?

Currently Ocean Container Shipping Rates are over $15k to the US West Coast from China. $20k and climbing to the US East Coast. The price increases for goods are going to be breath taking. Like a wise man once said…”I’ll soon be growing my own food, weaving my own fabric, and riding a bike”. Weimar Republic here we come!

Fred, the stuff in those Chinese containers is primarily low quality junk that you did without in the past. Just don’t buy it. It’s certainly not food or other perishables.

Not sure you are right. For examples, 30% of our apple juice comes from China and some of our Pacific salmon catch is processed in China and sent back to us. I noticed that on packaging a while back where I had been buying frozen salmon and shifted to another store that had US processed salmon.

Great charts Wolf! My fav was Sales at Retailors by Category. I love high level views like this. It puts things into perspective. Keeps us out of the weeds so to speak.

I was hoping someone could explain something to me that’s been irritating me for years. Why are charts like this (everyone does it) put in terms of dollars instead of unit sales? Using dollars seems to me as using a yardstick that is constantly changing its length. Using unit sales would resolve this problem. I realize calculations would be more complicated but surely in the computer age this could be overcome.

If we had a chart that showed things in terms of both dollars and unit sales wouldn’t we able to even derive an implied inflation rate?

RedRaider,

Unit sales are done with motor vehicles, and I report on those regularly.

I also report occasionally on consumption of gasoline, jet fuel, and distillate in terms of barrels per day.

Houses and condos are tracked by unit sales, and I report on those. Etc.

But when it comes to sales at “clothing stores,” or “grocery stores,” or “home improvement stores,” or “general merchandise stores,” or “eating and drinking places,” or similar, unit sales are nonsense.

“Home improvement stores sold 23 billion units last month.” Ovens, screws, hammers, sheets of plywood, light bulbs, power drills? This would be a total nonsense number to describe an industry.

Each store tracks how many ovens and screws they sold, and they might put a special on screws next month to bring up their sales.

But how many total “units” the segment of home improvement stores sold last month is just useless. If anyone reported that, I would never waste my time clogging up my mind with it or reporting on it.

That’s why we have “currency” which serves as a unit of account and allows us to denominate those kinds of disparate things with a common measure.

I dont pretend to understand this madness, but it appears to me that the USA and the USD are under pressure. We went from having China be a net deflation mechanism via cheap outsourcing to now bing a net importer of inflation to the US as Chinas costs of labor are rising. At the same time we are pumping cash into the economy which is inflating all asset prices and now we have true inflation in the good section of the economy and that is before the personal services part of the economy really opens up. What is the FED doing with all of this? If we keep quantitative easing in place, I would imagine that this would only exacerbate the real inflation we are seeing in the economy. How acceptable is that to all the bon owners and newly retired baby boomers? Are they expected to just keep plowing all their cash into stocks and pray that the things does not crash and wipe out half their lifetime of savings?

The last vestige of an honest Agency the VA, has now been corrupted due to the greed and selfishness. We did an appraisal of a 2 unit property which was illegally turned into a 3 unit without a permit. The owner and lender will make a big stink about the requirements that we put in to tear down the garage which was turned into a third unit. No way the loan should go through. But I expect to be harassed day and night to make the deal go through by modifying the repair requirements. This ain’t gonna happen. The dude just paid $700 for an appraisal that is completely useless for his refinance.

Big wheel keeps on turnin’, Proud Mary keeps on Burnin’ Just keep rollin’ down dat river…..

Saw Fogarty do that at Telluride 2012….bet GF it would be his finale….it was….age 70 and was on stage maybe 2hrs….voice hasn’t lost a thing…..crowd loved him….totally magical music and venue.