“An upside surprise to inflation is among the greatest risks”; we’d need “to tighten policy even more rapidly or on a more significant scale, or possibly both, in a way that would take the legs out of the recovery.”

By Nick Corbishley for WOLF STREET:

“The situation we need to avoid like the plague is one where inflation expectations adjust before we do, or where we wait for proof positive that effects on inflation are not transitory before acting,” said Bank of England chief economist Andy Haldane during the Treasury Select Committee this week. “Because in both of those cases that would be doing too little too late.”

It’s not everyday you hear a central banker of an advanced economy voicing concerns about runaway consumer price inflation. Most of the time, central bankers are doing everything they can to play down such fears. The current price increases, they say, are “transitory” or “temporary,” and as such nothing to worry about. Haldane disagrees:

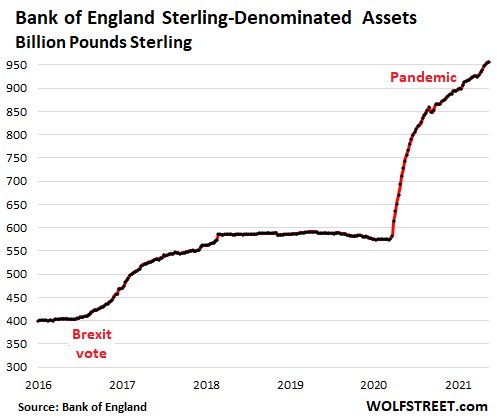

With interest rates at zero, “give or take”, and with the government and Bank of England injecting “unprecedented-in-peacetime fiscal and monetary stimulus” into the economy, Haldane believes that tapering the BoE’s bond purchases is not enough; it’s time to “turn off the tap,” he says. “This is serious money, edging up toward £1 trillion of QE.”

“It’s clear if you speak to businesses across the UK right now that among the top three issues is this pipeline of very significant cost rises. It’s hard to find very much, whether it’s goods or assets, that aren’t going up right now, with the honorable exception of Bitcoin.”

Haldane’s comments are also noteworthy given that consumer price inflation in the UK is not yet nearly as high as it is in the US and other economies. It more than doubled in April, mainly on the back of higher energy prices and clothing costs, but it still clocked in at just 1.5% in April, up from 0.7% in March — a lost less than the 4.2 % increase in the Consumer Price Index in the US.

Haldane won’t be chief economist and executive director of monetary analysis and statistics at the Bank of England for much longer. He is scheduled to leave the Bank in June, having taken up an offer to become chief executive of the Royal Society for Arts in September.

But before he leaves, Haldane is making a few waves. In the last meeting of the Monetary Policy Committee (MPC) Haldane was the only member to vote to lower the UK’s quantitative easing program by £50 billion, to £845 billion, citing inflation concerns. And that, it seems, has touched a few nerves. David Blanchflower, a former member of the MPC, said that while dissenting voices on the panel were important, Haldane was dissenting on the wrong side:

“He should not have been saying there’s going to be lots of inflation. There isn’t. Most of what he said was based on wild guesses and wishful thinking. It’s not what you’d expect from the chief economist, but what you might expect from a commentator on a news program.”

Unlike the Fed, the BoE doesn’t have an open-ended QE program, but has set a target of bringing its holdings of UK government bonds to £875 billion and its holdings of corporate bonds to £20 billion, for a combined target of £895 billion. And like the Bank of Canada, it has already begun to gradually taper its bond purchases, from £4.4 billion a week to £3.4 billion a week.

This stimulus, together with a host of other factors — including low inventories, supply chain shocks, rising shipping costs, surging demand for certain commodities and consumer goods in developed economies — is fueling inflation. Unlike most of his colleagues at the BoE, Haldane believes that inflation, now that it’s arrived, is unlikely to be transitory:

“[Inflation] is starting to show its face in the output price — the wholesale prices businesses charge each other,” he said. “We do expect some pass through of those cost pressures later in the year; that’s why we foresee inflation picking up, first to around the target (2%) in the late summer and then a little above target by the end of the year. The question is: will those higher prices stick around?”

“It’s on that particular point that I have a somewhat different view than some others on the committee,” he said. “I think there’s a better than even chance that companies will take advantage of what will then be a pretty strong economy, running at above its pre-covid levels of activity, to use the opportunity to recover their margins, to put prices up. That may then flow through to the wages that workers demand as headline pressures pick up.”

Haldane admits he could be wrong: “It’s just a judgement,” he says, “based on how big the pipeline of cost pressures are — and how much it will flow through to consumer prices.”

But given that the balance of risks has now shifted, as the economy recovers at real pace, the focus should now be on the Bank of England’s primary objective as an inflation-targeting central bank, which is to say inflation, he said, adding:

“Of all the things we want to avoid right now, an upside surprise to inflation is among the greatest because that would come at the cost of us needing to tighten policy even more rapidly or on a more significant scale, or possibly both, in a way that would take the legs out of the recovery.” By Nick Corbishley, for WOLF STREET.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Inflation has gone up quickly recently in tandem with

declining birth rates in all modern countries.We

cannot have long term inflation with fewer people

chasing those same goods.Soooo get your

paperwork in order for even lower interest rates.

Population growth is not required for inflation as many countries in history have already shown. However, it’s never happened to a reserve currency before.

Reserve currencies aren’t forever.

“Unlike most of his colleagues at the BoE, Haldane believes that inflation, now that it’s arrived, is unlikely to be transitory:”

And if he’s right, what then? What will the response be to address this inflation and will it have come too late? Seems like the window is closing.

I hate when people make candid statements when leaving their posts!!!!! I, Jay Powell, promise never to do that!!!!! Hahahahahaahahshs!!!!!!

Yes, but then we’ll get another recession followed by a long period oof stagnation. Isn’t it time to pre-empt that as well? The window is already closing.

There are so many open ended statements contained in this one snip “I think there’s a better than even chance that companies will take advantage of what will then be a pretty strong economy, running at above its pre-covid levels of activity, to use the opportunity to recover their margins, to put prices up. That may then flow through to the wages that workers demand as headline pressures pick up”

The amount of hopium is palpable

Inflation has only been able to be kept under control to the extent it has because of offshoring and the lower costs of importing goods at slave wages vs. the cost of producing them here.

That advantage has now run its course and we are seeing inflation coming from all markets as costs for materials and labor increase worldwide.

Chinese are not stupid, and now that we are dependent on them for the majority of what we need, they see the opportunity to increase profits.

There is nothing now to keep inflation from growing exponentially the same way it did in the 70’s especially now that we are putting ourselves in a more vulnerable energy position.

Expect inflation to continue and increase, and interest rates to follow as they are the only cure for the inflation disease.

Sterling….

Lol

Inflation is real but even if it weren’t, how is it not a complete scam for governments to print money and purchase their own debt? Some will say that the end justifies the means but it seems like the end result of all these bond purchases is more riches for a select few and a higher cost-of-living for those without assets.

Was all the wealth disparity created by QE merely unintended consequences or was this the greatest orchestrated heist in the history of mankind?

Volcker 2.0 is the answer you’re looking for.

Volcker made me more money than Microsoft did for people who bought it when it IPO-ed. I still have strip bonds from 1980.

Heist,with a few Dorito crumbs for hungry pleebes!wake up,people.Knew gubment would Never Ever allow Bitcoin and friends to seriously challenge either the dollat or new tracking digidollar.Blockchain has been developed for parasitic elite to hijack and use against humanity.Whats our move!??????

“ Was all the wealth disparity created by QE merely unintended consequences”

They almost literally state that as their goal. Inflation, unemployment, etc. Do they not?

The government can finance the roll over of principal, but it must pay the interest on the debt with tax revenues.

What that means is Biden’s spending spree is going to mean the government is going to need more revenue in the future to service the ever growing debt. They will start by raising taxes on high income, but soon it will mean higher taxes for us all. Much higher taxes… Enjoy your free check, you will pay several times what ever they gave you in future taxes…

There is no “must”. Government is sovereign. It can decide not to pay any interests with tax revenues, it can decide to take those interests payments out of the military spending, it can even decide to reintroduce the 90% millionaire tax. Nobody knows!

Well, no.

Firstly, government is only sovereign without a revolt. Government can’t suppress revolts without the military, so historically military spending has always been the last to go. Secondly, the government can’t afford to go against its sponsors, so failure to pay interest on government debt is out too. Lastly, a massive increase in any tax bracket produces reduced total income (Laffer Curve).

Essentially, governments worldwide have painted themselves into a corner. Current debt levels are unrepayable. Massive increases in wealth disparity, coupled with real inflation (not the rubbish the CPI purports to measure) mean that tax revenues from the poor have very little room for increase, and the wealthy can hide their revenue from further tax increases. Furthermore, the massive government spending necessary to buy votes to retain power means spending cannot be reduced much. Add in the ever-decreasing efficiency of both government and regulated private industry, and the result will be not long in coming. I reckon there’s 4 years maximum before a worldwide crash, maybe much less with a big trigger event.

I said back in January 2020 that governments would crash the world’s economy whilst still failing to deal with Covid, and that’s exactly where we are now.

If you disagree, what’s your scenario for paying down the debt?

Jd

I thought exactly that in the 1970’s, and here I am in the 2020’s having the same discussion all over again.

I am firmly converted to the view that this can, and will, go on forever. Anything to do with Govt spending, tax and paper money is utterly and completely a ‘game’ with random winners and losers.

Nobody can know how it will all play out long term, like I didn’t know the desperate 70’s would ever correct long before 2008 came along.

An even simpler way of looking at it:

The biggest global borrower is the same people who control interest rates. What do you think they’re going to do? Most likely the same thing you or I would do in the catbird seat – keep rates low!

The fly in the ointment is inflation. Inflation will take them out of the catbird seat and put them in the dog house – game over!

I feel that the UK might possibly be in the weakest position among developed countries, with massive budget deficit, massive trade deficit, but without reserve currency. So they should be very careful.

USA obviously has THE reserve currency (still, but for how long?). Eurozone is economically weak but at least has a more or less balanced trade balance.

All European countries are vassal states of the US. When the time comes later on, we’ll have them switch to the US Dollar. There’s plenty of US Dollars in the Eurodollar system anyway. Problem fixed.

Brilliant and yes. Just look at the long list of governments that get whacked when they start getting serious about getting off the USD.

There’s plenty of US Dollars in the Eurodollar system anyway

that’s not how I understand it. ive heard it works as european banks keeping a set of dollar-denominated books. the dollar to them is a foreign currency, they can’t print them. well, they fractionally reserve these deposits, re-loaning them out (without american regulations and limits btw). but since they can’t print them, there is no real backstop when something breaks. so there’s not plenty of dollars in that system. and it is theoretically fragile.

also, europe hasn’t spent the last 60 years unifying their currency just to give up because of inflation. the euro is there to replace the dollar. at least that’s what i think.

“the euro is there to replace the dollar. at least that’s what i think.”

Except the US controls SWIFT which means the US can terminate/ban/destroy the EU from all foreign exchange based in USD.

That’s probably why the Euro poodles broke their promise to Iran to continue to trade with Iran when the US broke it’s treaty with Iran and imposed and economic blockade on Iran.

Because of the American threat, the ECB has also launched it’s own systems for electronic payments: https://www.ecb.europa.eu/paym/target/tips/html/index.en.html

B

Nobody prints faster than the ECB.

Something need to happen over there .. but definitely .. the place is being run by geriatrics hell bent of returning to the good ol’ medieval days of yore.

Yesterday when I could have been king, king I tell you king.

I think the US dollar would be just fine.

After WW2 everyone had expectations of glorious times ahead .. the place was a shambles .. it cost a lot of money & it was a new day .. a new mindset .. all the oldies were dead & a new era began .. as it to be expected .. non so blind that they will not see .. they saw what they wanted & tried as hard as the could to regurgitate yesterday where they could be great .. alas !!

They have tried everything they can .. every possible which way in traditional fashion & milked the 28 member nations for everything they were worth .. & it was a waste of time.

You cannot bring back yesterday.

Varoufakis said that Germany is loaded — I like Varoufakis &/but he has no idea what he is talking about.

He is Greek & may also be gullible.

YuShan,

The biggest reason of all that the USD remains on top, is the lack of a better alternative. The only realistic alternative is to develop ways to bypass a reserve currency, find a way to benchmark prices, among other things. There is a lack of will as well, among the better performing countries to upset the status quo.

The US would have to do something really stupid to lose the reserve currency in the short or even medium term.

There is no question who is the worst performer among countries designated ‘developed’: Russia.

It is either in 50 or 51 place in GDP per capita depending on using dollars or PPE. Do you know how far you have to go down the roster to hit 50? Much further and you are into Africa. Russia is way behind Argentina.

BTW: the UK pound is an SDR reserve currency, just not THE reserve currency. That’s why at the top of the CNBC Fx line they quote it along with yen and euro. If you want to compare pounds vs rubles, drop into a forex booth. They won’t want to talk about rubles, nor will a Russian exporter. The ruble isn’t money outside Russia and is only money inside Russia because it’s illegal to accept anything else.

Russia does lead the developed world in one respect: Credit Suisse says inequality in Russia is so extreme it belongs in a category all by itself.

On paper, Russia is one of the worst performers, this is because sanctions have hit their exchange rate. The actual economy is slowly growing and becoming much more self sufficient.

The UK is in a very different situation, where they voluntary left the best deal their country was going to have and now face the prospect of their country not having very much to sell or to provide to other countries. The EU could rip away alot of those financial services away from them, in the process, scaring away alot more.

The pandemic has caused all kinds of weirdness, so we’ll have to see what happens with the UK and the EU next.

NK

What about ‘national debt’ and gold reserves and the fact that gas bubbles up out of the ground?

Maybe some other countries bought their Gdp per capita by borrowing from China and others.

Just sayin’

At the end of June 2020, Russia held $128.5 billion in gold, representing 22.9% of Moscow’s total international reserves — and almost $4 billion more than the value of U.S. dollars in its reserves. Jan. 12, 2021

German citizens own a staggering 8918 tonnes worth $330 billion. This does not include the 3370 tons held by the Bundesbank. So total German is more than 4 times Russian, but no one assessing the strength of the German economy would bother saying much about it.

Indeed Russia has oil and gas, and in many ways is a typical petro- economy with energy over 50% of income and controlled by a ruling clique.

Did Germany ever manage to actually get it’s gold back from Fort Knox or did they agree to leave it there, so that the USA would continue to pick up the tab for their defence against big bad Russia who everybody seems to be very scared of for a country that is so third world.

Their central banker is a woman and if you take debt to Gdp as a marker, she must be around the world’s best.

Just askin’

YS

I hope you are wrong.

UK got whacked by a socialist government for 15yrs ending in the disastrous 70’s

Our then leadership was so inept and defeatist they sold out the country to the EU which was also socialist. The Brits are not socialist by nature and, for the first time in 45yrs, we’ve got the chance to be a free capitalist country again. Lots of restrictive laws to reform.

We also got hammered by Covid like everybody else but see what the OECD says about UK recovery today. I am seeing sparks of confidence in shares that have languished for 10yrs.

Btw: why is it always that people that leave their position of power or are already outside that position, suddenly start talking sense?

So the public won’t stone them once they are “out”.

Trying to protect their legacy…

Look at all the rats that jumped ship from the last administration, after they lost the US election.

They are hoping history focuses on them resigning rather than them being good Eichmann’s….

The current UK government is just as corrupt and incompetent; they will not want to be aligned with Brexit when history passes judgement.

WyleeEconomist,

I agree, but to specify, all American administrations for decades have been terrible. Most governments in the world are pretty terrible, at the moment. But, there’s no way to rid yourself of governments or authorities, so people have to find a way to fix them.

Don’t forget it was the USA that created the oligarchy in Russia today. Larry Summers and the Harvard Business School was welcomed with open arms to transform Russia, and that they did. They sucked her economy dry and trashed the place so bad they were eventually kicked out and saner folks took over. But yes it does appear many of the US disaster meddling remain in place.

Opps this was meant to be reply to nick kelly/Thomas Roberts

YS

Andy Haldane was a pretty sensible guy who always spoke his mind but he was always in a minority, he knew there was no chance of change when the top job went to Baillie.

OK guys. Time to relax just a little at least.

All this inflation panic came up AFTER Biden was elected. Did anybody notice that connection, despite a ton of money being put into play during the previous administration with barely a bleep? This recent talk, not surprisingly, has thrown panic among a lot those with serious money they’ve been holding.

I’m not minimising the problem of very high inflation, but for just maybe little little perspective at least, everyone should at least look at this FRED graph of inflation data since 1960 in US.

Also, a lot of this extra money didn’t go to the people who buy a lot of stuff to cause big inflation– it went to those will high wealth who favor assets with their money.

Wrong article. This article is discussing the UK.

RH: “All this inflation panic came up AFTER Biden was elected.

On the few sites I read that accept comments (Hill, Yahoo, etc), most comments regarding inflation, Fed, US economy issues are soon thoroughly wraped in comments accusing economic issues on the political class, Trump, Biden, brexit (UK), imbecility of the electorate and so on.

They say you can measure inflation by the price of gold against your currency… Since 1970 gold has gone up (approx)

9182% against the pound and 5386% against the dollar…..

with pounds 580% since 2000 and 601% for the dollar

The previous administration won the election then pursued policies that grew the economy. This administration fights the audits while pushing massive spending.

Taking that a little further, international investor confidence in the USD is much lower now than it was before 2021. Much of the massive spending is more about virtue signaling than economic growth. That is behind the inflation.

The previous admiration was one of only two administrations that never achieved a 3% year growth rate, so it failed utterly to grow the economy, as you say.

That is because he took over when the business cycle was late in the expansion cycle but was still able to grow it further. Every other president failed to grow the economy at that point in the business cycle.

“That is because he took over when the business cycle…Every other president failed to grow the economy at that point in the business cycle.”

Not true.

Every single President in all US history (except one other) did in fact succeed in breaking past 3% even late in the business cycle, except the previous and one other.

“That is because he took over when the business cycle was late in the expansion cycle…Every other president failed to grow the economy at that point in the business cycle.”

Reagan took office, Volker crashed the economy into a deep recession, and still the economy smashed far far above 3% before he stood for re-election.

So your are incorrect. And there are other examples this one just happens to leap to mind.

Dude. Seriously?

“Dude. Seriously?”

Yes. The two and only US Presidents who never achieved a full year 3% economic growth or more where Trump and Obama.

Timbers,

In the interest of getting history correct, chronologically that is, Volker was nominated to head the federal reserve under Carter. He then, before Reagan was elected, started raising the fed funds rate, induced a recession a year before Reagan took office, and didn’t start lowering it until 5 months into Reagan’s first term.

The perception that Reagan and Volker were working in tandem to create the recession is entirely incorrect.

SocalJim,

You already forgot: the economy collapsed under the previous administration, starting in March 2020, and still hasn’t fully recovered. Memory is a weird thing… this shit happens to me too all the time :-]

Here we go again. Well, if someone is going to sneak in politics, here is a reply. For a partial audit of the ‘audit’: enter ‘Experts or Grifters..’ from AP. This is a summary.

Maricopa county had already had two recounts with no discrepancy found. But Senate leader Fann wanted another. An outfit called Clear Ballot with 13 years experience entered a bid, but Fann didn’t like the 500K tag ( would verifying 2 million ballots be cheap?) and for 150K down, hired an outfit with no experience ‘Cyber Ninjas’

Fann says she can’t remember how she heard of them but they were known for being pro-Trump, and their ‘staff’ wear MAGA hats while counting.

Incredibly, this tiny fringe outfit actually obtained physical possession of the ballots, with no govt supervision of the chain of custody.

The only young cub reporter who gained access noted right away the ‘staff’ were carrying blue markers, the same color used to mark ballots and a strict violation of a recount. The supervisor agreed and those at least are gone.

Two of the companies cited by the ninjas as former clients, JP Morgan and Citi, have denied ever working with them.

Coincidentally or not, another venture of a head ninja is publishing a series of booklets on how to find treasure.

The entire farce has the rest of the world amused but also worried. If a twice recounted election can’t decide who governs, does the bigger mob win?

The PPI blows your argument out of the water. Inflation is here, and what the current administration is doing is making it worse, much worse.

I think he actually said everything rising except the “dishonourable” exception of Bitcoin, although strictly speaking many would consider a 600% increase decent especially given the most savings accounts no longer pay any interest.

Whether inflation is transitory or not I guess it boils down to those who don’t know and those who don’t know they don’t know.

Bills are going up no doubt about that but it seems as long as the housing market keeps rising then at least everyone feels wealthier and that’s all the matters to the government these days.

England just needs to figure out how to make sure all the extra currency it’s creating goes only to their rich folk and corporations like the Fed has. That will solve everything including inflation.

England has yet to form a Government. Looking forward to more of an equal and organised approach in the United HA! Kingdom.

North Sea Oil was going to save the Great Island! And maybe it did just that. I don’t read much about the state of the UK oil business today.

Black and viscous, bound to cure blue lethargy

Sugar-plum petroleum for energy

Tightrope-balanced payments need a small reprieve

Oh, please believe we want to be

In North Sea Oil

New-found wealth sits on the shelf of yesterday

Hot-air balloon, inflation soon will make you pay

Riggers rig and diggers dig their shallow grave

But we’ll be saved and what we crave

In North Sea Oil

Prices boom in Aberdeen and London Town

Ten more years to lay the fears, erase the frown

Before we are all nuclear, the better way!

Oh, let us pray: we want to stay

In North Sea Oil

Ian Anderson

So what it boils down to is one set of bankers thinks we should wait and see if this is an established trend before acting and another group thinks that we have to act immediately.

Powell wants to wait and see while some others on the FOMC want to act now. In the UK Haldane wants to act now and the rest want to wait and see.

I think Brainerd commented that we need to see if this temporary (I’m tired of “transitory”) due to bottlenecks and other anomalies or an established trend.

Personally I agree. If you don’t know what’s going on you can’t possibly know how to address it.

My favorite part of the article:

“David Blanchflower, a former member of the MPC, said that while dissenting voices on the panel were important, Haldane was dissenting on the wrong side:

“He should not have been saying there’s going to be lots of inflation. There isn’t. Most of what he said was based on wild guesses and wishful thinking. It’s not what you’d expect from the chief economist, but what you might expect from a commentator on a news program.”

Ad hominem much Mr. Blanchflower? Dissenting on the wrong side? I’ll have file that one away for future use. “I’m sorry but you seem to be dissenting on the wrong side”. In the US all we have is “Jane, you ignorant slut”.

Right or wrong, Haldane is moving on to other pastures and is able to provide a refreshingly unfettered opinion.

OTOH this what makes the occasional viewing of Parliament so much fun. 10% of what is said is the Speaker yelling “Order!” which appears to mean “Everyone please continue to yell at each other”. Then someone eventually gets thrown out for the rest of the day.

Do you think Congress would ever have a member begin his speech with “First of all Mr Speaker may I wish you a Happy Kiss a Ginger Day. [Everyone starts laughing]. I’m sure you could look it up.”

Former Speaker John Bercow should have his own late night talk show. Bone dry wit and funny as hell.

Michael Gorback,

I love it when central bankers head out and either right before, during, or after passing through the exit door, open their mouth and blow off the whole facade. Alex Weber, Bundesbank Prez and ECB Governing Council Member, did that wonderfully in protest a few years ago and then took the top job at UBS. USians are little more careful. There is like a post-Fed omerta.?

Not just bankers. Look at the stuff Newt Gingrich says these days, as if he wasn’t neck deep in it.

And CEO’s. “Mine” kinda shat on the table and slammed the doors on his departure.

It will be an interesting year, that I am sure of.

“Dissenting on the wrong side” is like “being on the wrong side of history.” It’s a way of attacking your opponent’s positions as illegitimate and in bad faith.

I love to watch that Treasury Committee on Parliament channel but they always repeat it late and at odd hours, wonder why? Haldane was always on the ‘hawk’ side of Govt profligacy unlike Blanchflower and most of the other big spenders at the Bank.

I think he’ll be glad to be out of it, after years as an underling to ‘Bubbles’ Carnie’s endless PR speak, which has gone to Global Warming now. Haldane talked sense for an economist at the BoE, so I suppose the Establishment wouldn’t like him. He said we would do great after ‘Brexit’, very bad mark.

Man to watch, MP Steve Baker, knows his stuff, next PM, is ‘red hot’ on holding them to account on QE. It would be great if Haldane became a ‘behind the scenes’ advisor to Steve Baker. Between them they could maybe bring down this whole QE scam which is causing so much misery and division around the world.

Where the UK goes the world follows. Who’ll be next to dump the basket case EU?

Hi there I have watched with some interest the price increases that have occurred to date, interesting and illuminating particularly for oil and other commodities. I have often wondered how this has arisen, and the pandemic if you look back has caused a number of unusual circumstances to the supply side of every economy, in particular people unable to work due to risks associated with the virus, oil demand falling precipitously due to low demand from all sorts of industries, and production of goods to have fallen as a result of the pandemic.

I believe these supply side constraints and capacities are the root and stem to this inflation problem, once this has alleviated, that is oil output rises, production and labour capacity is increased, this will resolve the present increase in prices that are now being seen. Lets just hope that businesses and government can work together to make the necessary adjustment in particular take an example the semi conductor manufacturing in the US so that the supply side can return to the production volumes that were available prior to this pandemic.

For now I believe this to be temporary, I believe within 6 months or so production and supply will pick up, and lets hope inflation is contained to more normal limits. Now is not the time to lift interest rates, current economies are presently too fragile to bear this load.

Nothing to do with oil. Oil is still down 40% of where it was in 2014 and down by over 50% from where it was in 2008. Thank god oil is still so cheap. Imagine what this would look like with WTI at $200. That would be up only 40% from where it had been in 2008. So no biggie. But you’d get to re-figure inflation all over again.

Wolf,

Some form of war would probably do it…..

where…no idea, when…no idea but war would do it…..

“Now is not the time” would send more sincere if its proponents were ever able to articulate a threshold as to when the “time” had come

But really nuanced,excellent cuisine! :-) :-) :-) hah,ha,ha!

Everything in Life is temporary,the auestion is,how temporary;a week,a month,two years,or twenty years?In 6 months,the world will witness some more of the intended effects of the various jabs in the forms of increased Actual covd illness,hospitalizations,death.More labor shortages= more severe supplychain delays/disruptions as portworkers,truckers,pilots,store staff,meatpackers do not show up as they fall ill or care for their ill families.Weatherwars=Texageddon and western u.s. Drought=less agriculture.Klamathfalls area farmers/ranchers just Cut off from irrigation.People Not ill or caregiving will be rightfully afraid to come to work at warehouses,stores,meatpackers,gas stations.

Funny how central bankers always start to talk sense as they leave. I don’t recall such utterances while he was inside the bank.

Mervyn king did exactly the same. I was overjoyed to see my electricity and gas bills will be increasing a tad above inflation ( 15% !!!!) from next month.

I

I quoted Andy Haldane on this site last month. He warned against inflation as the number one danger then. That was before I even found out he was leaving.

He should have been a ‘shoe-in’ for Carnie’s job but he didn’t get it. Probably because of the UK number one problem of not going to the ‘right’ school and being too unconventional. Sad.

David Blanchflower said while dissenting voices were important .. Haldane was dissenting on the wrong side .. Most of what he said was based on wild assumptions & wishful thinking .. It’s not what you’d expect from a chief economist but a news commentator.

I don’t know weather to laugh or not ..

M

Blanchflower always was good for a laugh.