This change in the inflation mindset is likely not “temporary.”

By Wolf Richter for WOLF STREET.

Record new-vehicle retail sales despite slashed incentives by automakers, record new-vehicle transaction prices, spiking used-vehicle prices and trade-in values, very tight inventories on popular models, and record dealer profits – that’s what stimulus and stock-market gains along with supply disruptions produced in May. It has inflation written all over it, as the whole mindset has changed.

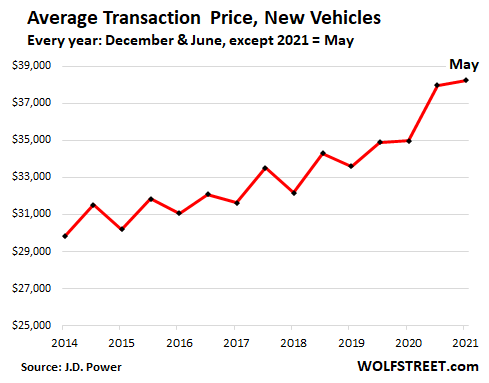

The average transaction price (ATP) of new vehicle sold to retail customers in May reached a record $38,255, according to J.D. Power estimates. The ATP is a function of the price of new vehicles sold to retail customers and of the mix of new vehicles sold: the shift to higher-end trucks and SUVs that we have been seeing in recent months helped push up the ATP. The chart, based on data provided by J.D. Power, shows the months of June and December in every year except in 2021, when it shows the ATP for May:

The MSRP (manufacturer’s suggested retail price) doesn’t normally change during the model year. What changes are the automakers’ incentives paid to dealers and/or to customers, and the prices negotiated between dealers and customers.

Retail sales, despite much lower incentive spending, jumped by 10.6% from May 2019 to 1.35 million units, according to J.D. Power estimates.

This surge occurred despite automakers slashing their incentives, with the average incentive spending per new vehicle dropping by 24% compared to May 2019, to $2,957.

But fleet sales plunged by 49% from May 2019, to just 167,000 units, amid complaints from rental car companies that they have trouble ordering new units for their fleets as automakers are juggling supply chain issues and component shortages due to the semiconductor shortage, and are prioritizing high-profit margin retail sales with high-end retail models, such as pickups and SUVs.

And overall new-vehicle sales – strong retail sales and dismal fleet sales – at 1.53 million units are still expected to be down about 2% from May 2019.

The mix of new vehicles sold to retail customers continues to shift from cars – generally lower-priced and lower-profit-margin vehicles – to trucks and SUVs that are generally higher-priced and high-profit-margin vehicles. In May, trucks and SUVs accounted for 76.2% of new-vehicle retail sales.

This trend toward high-priced vehicles and strong retail unit sales, created another record in terms of dollars: Consumers are on track to spend a record $53.1 billion on new vehicles in May, up by 27% from May 2019, according to J.D. Power.

And new-vehicle dealer profits soared. Gross profit and profit from Finance & Insurance (F&I) combined are expected to reach an all-time record of $3,245 per new vehicle sold.

Soaring used vehicle wholesale prices, which pump up used vehicle trade-in values, helped create new vehicle profits through trade-ins.

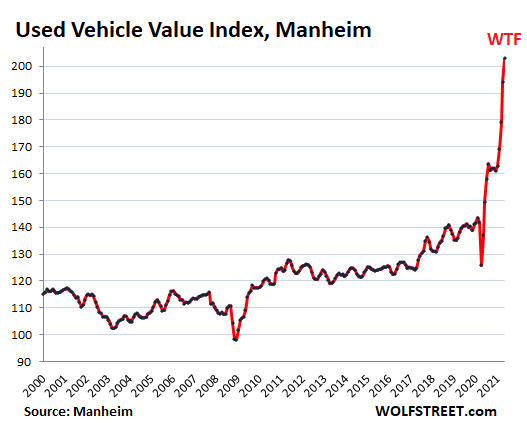

Prices of used vehicles that were sold at auctions around the US through the first half of May spiked by 45% from May 2019, according to the Used Vehicle Value Index by Manheim, the largest auto auction operator in the US. All vehicle segments experienced large price increases at auction, and prices of pickup trucks exploded — though I suspect that some but not all of that spike will eventually unwind:

These spiking wholesale prices of used vehicles have the effect to raising trade-in values, and people that might have been upside down in their vehicles – owing more than trade-in value – might now find themselves less upside down, or even having positive equity in their trade-ins, which makes it a lot easier for the dealer to put a highly profitable deal together.

New vehicle inventories are tight, and very tight in some popular segments. The pace of sales has been exceeding the supply of new vehicles, where production is constrained by the semiconductor shortage, and the situation has not yet improved.

On average, the number of days that a new vehicle was in dealer inventory before it was sold dropped to 47 days, when 60 days is considered healthy. And 33% of the vehicles were sold within 10 days of arriving at the dealer, up from 18% in May 2019. This is an indication that the hottest units, such as trucks, are often sold when they’re unloaded. This includes vehicles that were ordered by retail customers.

Used vehicle inventories are tight as well. Retail supply was down to 38 days in mid-May, according to Manheim; and wholesale supply was down to 18 days (23 days is normal).

That companies can increase not only their prices – based on strong demand and mangled supply – but also their profits to the extent shown by record new-vehicle gross and F&I profits, shows that the entire inflation mindset has changed, that this time, consumers are willing to pay more. This is a theme we’re now seeing across the economy. And that change in mindset is likely not “temporary.”

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Wealth effect. The Fed has been proven right.

Definitely not. The Fed has simply proven it can print money to create inflation. It has not proven any ability to create sustainable jobs, stable prices, and economic growth, via pursuit of its current policies. Thus, the Fed is failing to accomplish its mandate, and this has been going on for many years.

Great report on your special area of expertise. Seems dealer franchises are REALLY rolling in $$$s.

Question on SUVs;

Are the (crossovers, I think they now call them….e.g., “SUVs” with a unibody like cars?) SUVs not built on a truck chassis still counted as SUVs and therefore considered “trucks” as far as fleet mpg laws (if they even still exist?)?….and 76.2%….WOW…..and do you know the rough breakdown between them and the PU trucks?

Thanks.

Yes, crossovers are essentially hatchback cars, sharing power trains, suspension components, and chassis with cars, but have 3 inches extra roof line, and are a little higher off the ground. They have similar performance and mileage as their corresponding cars.

Calling them “trucks” and “SUVs,” instead of “cars,” is strictly for marketing purposes… because Americans don’t like to buy “cars” anymore.

So the old “station wagon” has become more “truckish” than “carish” (plus mostly unibody vs ladder frame) and auto marketing and America hedonically continue to roll on.

Playing around with the Kalecki equation gives nice insights. What it usually boils down to is that when government runs big deficits and wages don’t go up much, that money ends up as corporate profits.

So, there is no magic here. The big question really is how long the government can run such large deficits before something breaks.

Forever – the govt. can run deficits as large as it likes forever without anything breaking.

So what happens when the fiat petrodollar collapses and the price tag of all those imported goods we have become so dependent on sky rockets?

can’t happen – the USA is the consumer of last resort for the world, that is why the dollar is the reserve currency. Anyone wanting to sell to the US must accept dollars for their stuff and as there is no replacement for the US as world-consumer everyone has to accept dollars.

lol. Like no one ever thought that about the British pound

Right-

What if a US Navy fleet anchors itself around the City of London? ;)

Tell Argentina. They will love to hear this good news!

The US dollar will “reign supreme” as long as the US has the military/economic blackmail ability to smash interlopers.

The FED has shown it’s true colors by backstopping any whiff of a falling financial “market”.

It’s a chaotic system run amuck with hardly no restraints.

The US financial/political oligarchy has literally crushed organized labor, shipped the good paying jobs overseas, created bogus financial “derivative” instruments to “extend and pretend” horrendous potential losses, created the greatest political/social propaganda devices to confound the commons and, here we are!

There will come a time when the FED will be forced by global pressures to “taper” it’s confounding support for the financial markets and then the whole system will face total collapse.

Most of us have been engorging ourselves with the “good times”; those of us who are aged enough to have decent memories know that whatever “….goes up must come down”. We have been annealed with the fires of the Great Depression and the inevitable financial ups and downs over the subsequent decades. And, we have accepted the hard financial historical facts of “…..nothing goes up forever and must inevitably find their ‘mean'”.

I believe we have a ways to go yet. But the inevitable will not be escapable.

Sierra 7

I tend to agree. The US benefits from capital inflows into stocks, especially big tech trillion dollar giants. Fed doesn’t want a panic and foreigners selling US assets.

Sierra-on target, again.

The wheel of history: “…This time it’s different (extend/pretend/ignore environment/economies)…”, until it isn’t.

Some of us have aged/experienced enough to caught this emotionally, as well as intellectually, but still can be difficult to accept if these long-term, wave-type truths (often longer-term than one will actually live) haven’t actually punched one in the nose…(‘…you don’t know what you don’t know…’/’…who knew?…’. The liquor of willful ignorance is very seductive).

may we all find a better day.

91B20-

Somewhere along the line it was decided it was better to be a military powerhouse than a manufacturing one. And greedy US corporations were only too happy to oblige. I saw both ends of it and we both know the rotten end of it.

Pity we didn’t go for a middle ground, at least….

Argentina has foreign currency debt and it’s the fundamental difference.

Just look at new $6T budget. 50% increase from last year.

And yeah, Sierra7, that’s one great verbal picture you painted, having just re-read it.

There goes any hope of a buyer strike anytime soon, guess we’re so conditioned as consumer culture that, even with a price hike, we are just used to taking it up the rear and just buy more..

People have become conditioned to buy GME at $241

Some of us have changed. COVID broke my consumer habits. Last June I decided to trade my van in for an older model. Cut my payments by 2/3s. We haven’t eaten takeout food since the second week of March 2020. In comparison, we averaged at least $100/week on takeout. Our teen now cuts my husband’s hair for $5 a cut compared to $15. We were able to triple our retirement savings starting in Feb. We are trying to stay afloat and in order to do that, we are going against the grain. Wish I had figured this out 15 yrs ago.

I also downsized. $800/month to $250/month. Groceries still kill my budget at $2k/month. I cut my hair and my 2 sons hair! Peas in a pod. We’re saving for a home though, which feels completely pointless as we can’t even come close to saving at the rate that prices are going up.

Groceries keep getting more expensive. We do save money by buying groceries for 4-6 weeks at one time. We might add 1 trip in between for fresh produce. Our farmer’s markets are starting back up and we eat a lot of salad so that saves money too.

What are you eating that costs $2,000 a month and how many armies are you feeding?

I’d have a hard time spending $750 a month for a family of 4.

James,

Seems like without penny pinching I am at about $7 per day per person. Pretty easily do it on $5 if I wanted to.

I believe $2k in food costs. We spend about $1k, but we shop at a discount grocer. We eat every meal from home. How can you eat three meals a day on a total of $5? Our kids are thin, but eat like adults.

I’ve been giving myself (sometimes have sister do it) a 1/4-3/8 inch buzz cut for over 30 years. Gone through a couple sets of Wahl clippers. Ran a more expensive comb-over until I decided it looked stupid. When I was a kid, the old man cut all our hair, except his and mom’s. Down sizing is only option at my life long level of “lifestyle”….doesn’t hurt at all, and I don’t feel “cheated”.

At some point the two groups that are spending the stimulus have to stop. Those that are getting the extra unemployment, and those not paying their rent/mortgage because they can’t be evicted. When those pools dry up, then spending slows dramatically and we go through the correction. Prices will drop, people will be laid off and the real fun begins.

While the free money flows and debt defaults protected, it’s easy to spend it.

When the debt finance taps are turned back on, and the free money off, let’s see what happens to buyers loose wallets.

Too many dollars chasing too few goods. Production has effectively stopped of many popular vehicles due to the chip shortage. When production resumes I doubt it will keep up for long because the suppliers haven’t exactly been building inventory this whole time. The industry is not being transparent about depth of the chip problems, the timelines, or who is to blame, likely because these are are self inflicted wounds due in no small part to outsourcing and cost cutting.

The automakers made a rash decision to cut their chip orders in the early days of the lockdowns, almost in a panic move. Then, when things went the opposite of the way they envisioned, they were caught with their pants down. They called the suppliers and said “um, about those chips – we actually need them after all.” The suppliers said “get in line.” That’s what really happened, and there are many articles about it.

Could have been a rational decision. Who knew how this would turn out? Who knew Fed and Congress were going to go all in?

Exactly, who knew communism was the answer to all our problems?

The USA is no longer a corporation. All those entities organized in the USA between the end of the civil war and last January are now null, with profits and assets destined for reassignment.

and DJT is the 19th president??

Correct, He was the last president. And USG was the first.

So what is happening?

Low auto loan interest rates?

Longer loan terms nearing 6 years on average?

2/3 of loan originations are for super-prime/prime borrowers = wealthy?

Average sales price spike driven by luxury sales?

RE and stock wealth effect?

Covid shuts down public transportation use?

Flight to the suburbs = need a car/another car?

Stimmies are easier to part with, its not my money?

Chip shortage = inventory shortage?

Used cars – I was shopping for a used SUV for kids sports and camping transports in January 2021, took a break and a month or so later Autotrader prices were up 25%.

Just guessing but….

1. FOMO – get a new one before “they run out”

2. Feelin’ flush because of stimmies and reduced entertainment expenses (restaurants closed, theaters closed, sports venues closed, fear of airline travel, resorts closed, international borders closed, etc.,)

3. Old clunker falling apart

4. Used in the realm of new in terms of pricing (my used MY17 SUV is *worth* as much as I paid for it wholesale in 2017, now with 38K on it) and manufacturers still have incentives bringing the gap between new and used closer – so why not stretch?

5. Old sled needs repairs and parts are unavailable (certain electronics unavailable for new as well as used) as manufacturers feeding assembly lines, not repair parts supply chain.

6. Supply chain disruptions

Saw nice 2018 Toyota Tacoma sitting at Chevrolet dealer lot. Just stopped to take a look. Low mileage(26K), clean, stripped down model. Dealer wanted 32K for it, no negotiation. Went home and looked it up…..Sold for 23K when new. I can wait.

So now when you drive a new car off the lot it increases in value. Down the rabbit hole where you may get to meet the mad hatter.

The Tacos have always had good resale value due to the reputation of the first pickup truck Toyota sold in USA. Watched a video of a red truck on some horrible roads ? n an island in Tonga. Guy had put a large wooden bed on it and huge wheels and tires. Still going after 30 plus years. Sure enough had Toyota badge.

Old school-

They sell an entirely different version of the Tacoma overseas. All beefed up (an Australian guy here was describing it, couple years ago, as they also get them). It’s also the one you see with 20+ migrants in it with an African version of a “Coyote” driving across desert wastelands to the Mediterranean…..or with a 50 cal, 105 recoilless rifle, or even anti-aircraft gun on the back used by “informal” military outfits.

Used vehicles are commanding the same or more clamshells as sold when new, but the size of the clamshell is smaller.

A lot of people with a little extra money now anticipating heavy inflation. A lot are blowing it all and expecting heavy inflation a la the internet’s crypto philosophy of infinite gains, and probably assuming their paychecks will grow accordingly to wipe the slate clean. Who wants to take bets that corporate America will continue to try their hardest to not let wages inflate and all these people will be sorely disappointed they bought the shit out of everything.

We’ll get inflation when the people who hold the majority of base money actually start to use it.

So let me wrap my mind around this: new and used car prices continue their non-linear jumps; housing market (single family and even rents) is on a roll with ever increasing prices.

With both vehicles and housing the demand side remains very robust in face of steep price increases.

Both markets’ inflationary spurts have been largely explained away as a supply/demand issue– supply constraints causing higher prices, and also from artificial liquidity sloshing in system from stimulus and asset profits.

It’s an old economic adage that the fix for high prices is high prices– that is, higher prices reduce demand and resulting excess supply means lower prices.

We will have to wait and see if that still holds true or we are temporarily in never-never land where supply and demand laws have winked out.

No, the Fed will print more money to prevent prices from falling. That way the gov gets money inflation multiplied by price inflation multiplied by financial repression to greatly speed up the demise of it’s debt burden.

Money inflation x price inflation x financial repression = No debt!

There have to be some economics professor somewhere capable of stripping from internet goods and services prices to get more realistic inflation numbers than the BS Fed is feeding us.

It’s too easy to rob us if i

I am curious to see how do al these do when all kinds of stimulus ends: mortgage moratorium, rental eviction ban, extended UE benefits etc etc.

Same here. Unless this stimulus in never ending, there is no way this is sustainable.

Just to be clear, it sounds like this is a price phenomenon and not increased units sold, correct?

Why would a price increase surprise anyone during a supply disruption?

Add to that the increased value of a trade-in. Guesstimating from the charts the ATP for new vehicles has risen about 15-20% since 2019 while Used Vehicle Value Index is up about 40%. If the new vehicle price goes from $40,000 to $48,000 while the trade-in goes from $20,000 to $28,000, it’s a wash.

Probably a little FOMO mixed in as well. You can see the depleted inventory driving by a dealership and then add in the news about chip shortages and wonder if you should catch the boat before it sails.

What is pushing the market for trucks?

Michael

A good question:- is it temporary supply constraint or new eagerness to be willing to pay more no matter how much? -to try to answer the question whether this “inflation” is temporary or not.

Another similar question I have:

Are more than average of these sales being sold in cash with no financing? Or is there the usual mix between cash sales and financed sales? If more are cash only sales, this may be those with lots of cash, rather than “normal” people buying a necessary vehicle now–who might be willing to pay extra now, because they have to have it now.

Are these more high ticket sales rather than low price vehicles, or are sales distributed in price similarly as they historically have been?

In other words, inflation panic among high rollers, or everyone equally?

Michael Gorback,

I think you got this wrong.

Retail new vehicle sales hit a record.

New vehicle sales are mostly discretionary spending. We saw that during the financial crisis when people stopped buying new vehicles and vehicles sales plunged. It took till 2016 to get back to the 2007 level.

People do NOT have to buy a vehicle today. Most people can wait a year or two (OK, some people totaled their car and they have to buy now, but most others don’t). You can keep (buy) the car at the end of your lease too. No need to lease a new one.

But people WANT to buy a vehicle, and they’re brushing off the steeper prices.

This is discretionary spending. And when there is a supply disruption, you’d expect for people to WAIT until prices settle down, and prices would instantly settle down due to lack of demand.

But that’s not happening. What is going on now is something I have never seen before. Prices are spiking, and people are eager to pay them – rather than wait. That’s an inflationary mindset.

Or they feel emboldened to overpay by their paper gains in stocks, crypto, real estate, and other assets.

“What’s another $3k for my new Toyota? After all, I “made” $50k in the stock market today!”

RightNYer – I’ve also been wondering how much of that mind set is playing into what is happening. Given the rampant financial illiteracy are they making sound financial decisions. How long can they balance the household budget given the increasing debt servicing costs, and paying for inflation with stagnate wages? If they are counting on those “gains” they better be willing to routinely cash in and be prepared if the “gains” drop out but I seriously doubt it.

I wouldn’t otherwise care but the knock on effects will be really nasty for almost everyone.

The “wealth effect” is the notion that when households become richer as a result of a rise in asset values, such as corporate stock prices or home values, they spend more and stimulate the broader economy.

As I said in my post earlier. Wealth effect.

MoneyBusiness, The wealth effect would have to derive from rising RE values, as, according to Wolf, just about no one in the USA owns any appreciable amount of equities. The home ownership rate is around 65%, I believe. But if you put 20% down, and borrow the rest, who owns the home exactly?

But the real reason: In 2019, AOC said the world will end in 12 years. It’s now 2021, and so when the world is running down,….

MonkeyBusiness – My point was that the Wealth Effect is an illusion and folks don’t understand that. They are wealthy until they aren’t. They are not prepared for that moment nor are their decisions based on that reality. If that wealth was real then it couldn’t just dissipate into thin air when the bubbles pop.

I remember the 1980’s with the 50%+ drop in RE prices within 6 months, 18%+ interest on mortgages (up from 5-6% 6 months earlier) and $1 sales of homes (no that wasn’t a typo). I remember the tech bubble popping and watching folks go from “wealthy” to broke on Nortel. People need to learn from this history and based on the current activity they clearly haven’t.

Additionally, as Crush the Peasants! points out, unless you own the assets out right you don’t really have that wealth. The lender has at least partial ownership which by definition is not your wealth. Forgetting all of this makes lots of folks appear or think that they are significantly wealthier than they are, however, often due to debt load they have at least 1 foot on the insolvency banana peel.

LifeRunningForward and MonkeyBusiness,

The issue is that people very rarely are actually selling their appreciated assets to buy the other stuff with. Of course, if enough people did this, it would cause a decrease in the values of the assets.

What they’re doing is spending OTHER money they have, figuring that they have the stocks in case they need it.

The problem with this “wealth effect” is that it can go away as quickly as it came. If the values of assets drop drastically, people have still spent that cash that they likely need for other things. At that point, spending is reduced. So the wealth effect is really just bringing spending forward.

I think spending based on unrealized gains is very foolish. There have been times in my life when I’ve made a decent amount of money in speculative investments. One time I bought my wife a nice watch, but I actually SOLD some of the assets to get the cash for that watch.

Fed policy is so short sited. How did they think they would unwind the wealth affect. They going to call it the poverty affect?

It might also be a ‘life is short’ mindset’, especially after the past 15 months of disruption and worry. Mind you, we’re still driving old cars in our house and doing diligent maintenance, but we’ve always done that.

The life is short mantra is why I just finished a big reno. I spent $10K in materials, but it added $50K worth of value to our home. Plus it was a fun project. Rather buy tools or materials than wheels, any day.

“I spent $10K in materials, but it added $50K worth of value”

Just like they do on HGTV!!

“It might also be a ‘life is short’ mindset’, ….”

It may be short, but if you go broke with all that ill-advised, irrational spending frenzy I assure you it can get even shorter— with an empty belly homeless on the streets.

My question is did sales spike because prices spiked or because more units were sold? Big difference.

I see what you meant. The “average transaction price” (ATP) in the article is per vehicle, so it’s independent of the number of unit sales. It’s a function of prices (including reduced incentives = higher prices) and a shift in the mix to more higher-end units.

The latter is a function of many factors, including the fact that the top 10% on the wealth scale made a huge amount of money during the pandemic, thanks to the Fed, while the bottom 50% had to make to with unemployment benefits and stimulus checks which are not super-conducive to buying a new vehicle.

Wolf – I AM waiting for prices to settle, and I think there are many of us. I’ve seen them on this thread and I’ve talked to people in my circles. I think a lot of this demand is coming from a bunch of young people hopped up on stimmies being completely irresponsible.

Further, as I mentioned before, if I didn’t have to pay rent anymore and stiffed my landlord, I could afford 3 new car payments per month. People have grossly underestimated the financial effects of the stiff the landlord/don’t pay the mortgage laws. All that money that used to go to the highest monthly item on the budget is now being spent on toys.

I’m a young person who is waiting for prices to settle and I know quite a few of my friends have the same mindset. I also know a lot of older coworkers who are being “completely irresponsible”. Funny how anecdotal data works huh? I appreciate the convo on this site but the commenters do skew older and it would be nice to avoid the generational warfare bs

“…and it would be nice to avoid the generational warfare bs.”

Most def agree :-]

LifeRunningForward

That is why they have to keep the system propped up

Sad but true. They have an illusion they painted and it will be awful to wakeup to reality

But if a new vehicle comes w/free vaccine, that could be a hedonic adjustment so no inflations.

My none car economic world:

Went to Lowes last week and overheard manager asking someone to hurry up clock in because they are short staffed. Went to different Lowes today and the 1 checkout clerk was backed up with a long and moving slooow.

When inside to purchase, but again only 1 checkout clerk with a long line and 2 self checks outs that were not working. The clerk left his customer to “fix” 1 self check but he didn’t fix it because the next person couldn’t get it to work. When my turn finally arrived I presented 5 bags mulch, 1 rose bush, but the clerk charge me for 1 mulch and 1 rose bush.

I don’t know if he did that deliberately, but I do know the super rich greed-hole who own the establishment is probably losing more money than what he saves paying sh*t wages.

Proceeded to BJ’s to dodge the Memorial Day rush. Ditto experience, watched as half the customers waited with “need assistance” signs flashing because staff was scarce.

K shaped recovery.

If you’re fortunate enough to be on the rising part of the K, a 5-20% increase in car prices is insignificant. Just like $100 plywood.

If you’re on the bottom half, sorry.

It’s not a k-shaped recovery, it’s a k economy.

There is an older college professor in Florida on YouTube that reviews engineered products especially motorcycles. He personally has 11. Buys them all used. He bought an electric one for $300 that was 10 years old.. The battery was dead and a new battery was $6K. He said the technology just isn’t there. Not much he can do with it. Plus the fit and finish was grossly inferior to a Honda.

Makes you wonder when new Ford truck is sold for $50K and government kicks in $7500 how that is not capital destruction.. Maybe in 15 years truck will be worth $1500 instead of $15,000 like a standard truck. It will be $7500 more tax dollars not put to best use.

Given the continual rise is average selling price of new vehicles, it could be that wealthy individuals see no better use for the money. Stocks, bonds, and RE are too high priced, so they may think it is time to spend the money on consumer goods, now that they see inflation as a real risk. Better to use the cash than lose it.

This mindset taking hold within wealthy circles could lead to a massive inflationary acceleration, given the massive wealth concentration built up as a result of the Fed’s policies. If the Fed keeps stock, bond, and RE prices elevated, the inflation could run fast and hard for a long time.

The massive housing bubble has a lot to do with it. People were out buying brand new cars because they felt wealthy last housing bubble. Just watch what happens when it all goes bust. There will be used vehicles for days.

If consumers continue to pay the escalating prices of houses, vehicles, education and healthcare (The Four Biggies) without so much as a peep of protest, then they deserve what they get. Can’t expect someone else to save us from ourselves.

True but I really don’t like being forced to pay for their stupidity either. Suspect most here, yourself included, feel the same way.

Right, and as long as the reckless and stupid get to vote themselves our money, it’ll continue.

Sad but very true.

I understand where you’re coming from, but my comment above was aimed more at the need for consumers en masse to vote with their wallets, at least for the discretionary portion of their spending budgets. The whole government handout thing is a different, albeit important, issue. Switching en masse to the products and services of companies who hold the line on price inflation would send an effective message to companies who eagerly jump on the inflation bandwagon.

“….as long as the reckless and stupid get to vote themselves our money….” I assume you’re aren’t talking about a $1400 check to some poor schlub that works at a meat packing plant?

I’m sure you’ve noticed the 1%, the corporations, the MIC, etc….have been “voting themselves our $$$” for a century? It’s been especially bad over the last 50 yrs.

You might recall some cherry picked “intelligence” (from a guy nick-named ‘curveball’) and the lie that Saddam Hussein had WMDs (“don’t let the smoking gun be a mushroom cloud”) that got us sucked into Iraq….billion dollars a week down the toilet for 2 decades!

We got LIED into a bloody and expensive war we didn’t need. Bill Clinton’s big crime? A Blowjob.

Trillion$$$$ and thousands of US soldiers’ lives wasted. Never mind all the civilian deaths.

It’s not the guy w/the $1400 check that’s ruining this country.

Other countries around the world are helping out Joe and Jane Sixpack too due to Covid.

It’s the massive corporations, bankers, billionaires, MIC, etc. that are driving the bus into the ditch again.

I hope that’s who you’re talking about. Because blaming all of “this” on the average American who got a couple of grand during a global pandemic would be ridiculous.

I would expect to see this type of ‘buy everything now’ consumer behavior Wolf is reporting on during a hyperinflationary event, simply because people know their money is becoming more worthless every day.

Hence, get your goodies while your money still has the purchasing power.

But we are not in hyperinflation mode yet. Maybe this is dress rehearsal for the real thing …

If people can afford the higher and higher prices, then they must not be too high. I’m calling bullsh!t, but that’s just me. I know a couple who recently bought a brand new Chevy diesel 4×4. I happen to know their combined income, and it’s less than $50k. They bought a truck that is more than their combined annual income. People are smart, mmmmmmkaayyyyyy?

Let’s see…would your anecdotal evidence be further proof of this “reckless and stupid” subgroup, that is the focus of your and your ilk’s current and obviously extremely enjoyable “blaming exercises”….which at one point earlier was the “irresponsible younger people”?

Sometimes it’s hard for me to follow exactly who the “enemy” of the “proper order is”….sorry.

1) Inflation bs : the Fed RRP @486B, sucking liquidity from the market, parking in the Fed for safety, the highest ever. The 2Y was down today.

2) If there is inflation why the O/N Repo @ (-)0.01.

Reverse repos have nothing to with inflation but with excess liquidity.

Why too much liquidity, what for.

Yes, good questions. Ask the Fed. But they don’t know either “Why” they’re doing it. They’re just doing it :-]

It’s money burning a hole in someones pocket.

1) New car sales hit 19M, the average transaction hit 38K,

financed by $550/m debt, thanks to the madness of the crowd, as the DOW theory described the final crazy vertical rise.

2) US treasury pump liquidity in QE to the primary banks, for

their treasuries. RRP send treasury back to the banks.

3) States and municipalities flush with liquidity are buying treasuries. Foreign banks too.

4) US Treasury “saving account” in the Fed down $1T from it’s peak, sending cash to MMF.

5) RRP send treasuries back to MMF for their cash.

6) The Fed know exactly what they are doing. Your friend in

Barcelona told them why. : COLLATERAL !!

7) CRM rusty Johnstown steel skeleton in the heart of SF is another reason.

8) The primary banks, not the stupid banks, MMF, states and municipality are piling ammunition for the next debt crisis, perhaps after gov debt ceiling in late July/ Aug.

9) Option #1 : NDX PnF in re-accumulation since Jan or Feb lows will send NDX to a new all time high.

10) Option #2 : Apr dbl tops are UT after distribution.

11) JP : tell us #1 or #2 ?

The Fed prints money because that is the only thing they know how to do!

The Fed keeps QE running which forces money into reserves. The banks are now stuffed with reserves.

Not all liquidity is equal. Reserves are liquidity but you can’t do much with it. They can’t be lent out in the conventional sense. A bank can’t draw on reserves and lend them – except short term to other banks.

Otherwise there isn’t much a bank can do with reserves. Until recently the Fed didn’t pay interest on reserves. At present interest on reserves is negligible. The banks don’t want reserves. They’d prefer assets that paid something, like bonds. But the Fed, through QE, is force-feeding money into the bank reserves. Then they drain it out with reverse repos. I really don’t get it.

Supposedly once upon a time this injection of reserves was supposed to cause inflation. It didn’t. Those with intact long-term memory will recall that as far back as the initiation of QE there were complaints about excess reserves. And we were not experiencing the predicted inflation. The price inflation is very recent. The inflation of the money supply is not. Trillions have been printed, but when given out as reserves, it’s like putting all the money in the closet.

Reserves enable a bank to make loans. Without going into double-entry accounting, eventually the loan becomes some kind of cash or equivalent and ends up in another bank as deposits, which requires increased reserves (deposits are liabilities). The lending bank has reduced reserves. It evens out.

Double-entry accounting also explains why you can’t directly lend out reserves. Let’s avoid it if we can.

So while individual banks can have variation in their reserves the entire system has constant reserves.

But what if banks don’t see enough of a spread between the return on reserves and the interest they can make on a loan, of if they can’t find suitable borrowers? They just sit on money that’s not producing anything.

What I’d like to know is if the Fed wanted banks to spew money into the economy why did they pay interest on reserves? I think at one point it was 2%. How was that an incentive to lend? Might as well have run reverse QE and sold them bonds.

Anyway, it’s either too much money or not enough collateral, but it’s the end game for QE and possibly Fed loss of control of short term rates.

So there we are – still confused but on a much higher level.

If you read some of the other blogs there’s a recurring meme of the Mr. Creosote skit by Monty Python describing the reserve glut. I’m sure it’s on YouTube.

Michael Gorback,

Your description of “reserves” is incorrect. Reserves = a bank’s cash on deposit at the Fed.

Repeat after me: Reserves = a bank’s cash on deposit at the Fed.

Banks on their books do NOT call them “reserves” but “cash” or “Interest-earning deposits with banks.”

So to spend this cash on deposit at the Fed, all a bank needs to do is withdraw those funds from its account at the Fed and transfer those funds to its own account from where it can do whatever it wants to. This is a near-instantaneous transaction.

Below are the asset accounts of Wells Fargo Bank, and the link to the bank’s 10-Q where the balance sheet begins on page 61. In the entire 10-Q, the word “reserves” shows up only once and in a different meaning:

Assets:

Cash and due from banks

Interest-earning deposits with banks

— Total cash, cash equivalents, and restricted cash

Federal funds sold and securities purchased under resale agreements

Debt securities

Loans held for sale

Loans

Allowance for loan losses

— Net loans

Mortgage servicing rights

Premises and equipment, net

Goodwill

Derivative assets

Equity securities

Other assets

— Total assets

https://www.sec.gov/Archives/edgar/data/72971/000007297121000221/wfc-20210331.htm#i379a784381c54b31ad371d993c457ae8_157

See? ME. I warned you your complex writing style was really getting close to making sense to people.

3) The Repo trucks will do great.

Everything is truly broken.

I expected the unemployment bonus to result in far greater unwillingness to go to work. The fact that you can still go to a store and buy things shows how deeply ingrained the work ethic is in Americans.

Most likely the employee shortage will be used as an argument against UBI. See what happens when you pay people not to work? But with UBI, you can work to earn additional money as unemployment is not a prerequisite for getting paid. That totally changes the incentive structure.

The point is that it’s clear that we’re going back to normal now. People will work hard for low wages and inflation will be contained.

My girlfriend had been looking for a job for a year when the lockdowns started. Now that she got a taste of regular income, she doesn’t want the income to disappear, so now she’s trying hard to find a job. She thinks this is her chance to land a job while there are many openings and employers can’t afford to be so picky.

The reality is that most people had to work very hard to get to where they are now and they have little interest in spoiling the younger generation with an easy life. The overwhelming consensus is that the young should develop a strong healthy work ethic like their parents because that’s what makes a society prosper. Just have a look at the comment section of post #242369 of Karl Denninger’s blog. You can’t get the commenters to shut up about how hard they used to work as kids.

The implication is that markets are not going to crash (valuations will not return to normal levels) because assets derive their value from the willingness of the population to perform work in the future. Valuations rise as long as people are willing to perform more and more work for the same piece of the wealth pie. The financial system will thrive and collapse right along with the work ethic.

Nonsense. Have you been to the same stores I have? They’re ridiculously understaffed compared to February 2020 levels.

People are willing to work hard when there is a reward for their labors. When their money buys less and less, they won’t, and they’ll just want to burn the system down.

My sister in law runs a big grocery store front end…all the tills, IT and service people, etc. One employee listened to some customer/jerk giving everyone shit about …whatever, (for the umpteenth time), took off her smock and walked out. Quit, just like that, mid shift. This past year many many customers have been total a-holes, especially older wealthier types. There has been lots of staff turnover due to Covid, AND stagnant wages. Workers have been asked to do more and more, for the same wage. The store chain has never made so much money and I know this because my SIL is privvy to the numbers. She’d quit as well but too close to retirement to make it work.

Must be a Canadian thing. ;)

In Canada there does not seem to be the same pressure to raise wages as there has been in the US.

As Paulo pointed out, when a small fraction of employees slack off or quit outright, everybody else is pressured to work even harder. The system should be burning down right now, but we are witnessing people hanging in there and putting up with it.

In theory, employers should be able to call up workers and say “hey, I got a job for you”. If they don’t accept, they should be able to claim unemployment fraud, since PUA recipients are required to accept a job when offered one.

Most states have a requirement that workers apply for a minimum of X jobs each week. They must list the contacts every week when they file their weekly claim. It is easy for a state to check if the worker applied or if the company made an offer.

I know a couple of people who do this every week. Companies post the same jobs week after week, but don’t ever fill them. Some postings show the number of people who have applied, and it’s always a good number 80, 100+, etc. Somebody is lying about the availability of jobs.

Employed population in the US is at a record low, as are fertility rates, and immigration rates. No…there is a crisis coming.

Immigration rates are low? Man, come down to the Texas border and have a look at who’s new in town!

They’re not new, they’re family! ?

The immigrants would really fare better in their own countries than here in the land of gloom and doom. They just haven’t realized it yet. I wonder when they leave, who will do all their work? Certainly, not the locals! They’re would rather suckle on the teats of Uncle Sam!

I really dont see any equation between work ethic and stock market valuations.

These purchasing bubbles have been created by PPP, unemployment insurance, stimulus, Fed money printing, a shift from service to product purchases and low interest rates. It has created a fully unsustainable economic picture, which will unwind shortly.

Higher interest rates will be the real big problem, as that hits housing prices and car sales. We have maybe one or three more months where the stimulus money gets burned off and then we fall into the economic hole on the other side of all this.

Inflation prevents the Fed from containing interest rates which is the catalyst that breaks the housing bubble. Americans are spending freely because they are feeling rich based on stock and housing equity, but that will fall very quickly as leveraged is unwound. Watch for Treasury auctions to start to pose a real problem, as the government must begin to sell off vast amounts of Treasuries, yet the foreigners are NOT buying. This will mean higher yields are required.

What if the Fed just buys those treasuries?

The slaves are rebelling. Oh no!! What will happen to the plantations???!!

“Most likely the employee shortage will be used as an argument against UBI.”

That certainly rings true. I think Denninger is spot on with this analysis.

You see, those in power in DC and state capitols will realize that UBI is the extra unemployment benefits of today on steroids.

People in power are just like regular folks in that they rely on workers in these lower-tier income jobs to keep our society functioning. Many, if not most, of those workers under a UBI scheme will sit at home all day rather than going to a job they may not care for.

Even the most liberal, extreme, and spendthrift politician needs a hairdresser or barber, relies on garbage workers to haul off their trash, knows the grocery store shelves will be bare if no one want to do the work, the gas pumps will run dry when fuel truck drivers no longer drive, and so on and so on.

Karl Denniger! I didn’t know who the hell that was….for good reasons I guess. Some tea party doofus that spreads his ignorance on Glenn Beck’s show can’t possibly be a good place to get your info.

Yes, a lot of us worked really hard and are proud of it.

Of course people will work for low wages. It beats starvation. Thanks for making me laugh w/the tea party guy reference. Those folks were silent during the administration before and after Obama.

I went to a tea party event out of curiosity. It was only a mile from my home. It was just a bunch of racist fools who were using their newly found “concern” over govt spending to walk around with posters of Obama dressed up a witch doctor.

My future daughter-in-law just got her first job out of college working from home doing customers service for some sort of start-up women’s clothing company. Paid in the mid 40’s. Within a month of getting the job she went down to the Mercedes dealer and got a new SUV for $48,000 with $500 down. I think they are turning on the credit spigots and that is what is causing this run up in prices.

“I think they are turning on the credit spigots and that is what is causing this run up in prices.”

Exactly my thoughts. But this is what defines all bubbles – this time credit expansion seems almost infinite but so will the fall back to earth.

well daddy will probably be making the car (and insurance ) payments (not to mention maintenance & repairs)..

She gets paid in the mid 40’s??? hopefully she plans to marry her way up the income ladder because in the NYC area (and other parts of the USA) there is NO WAY you can make a HOUSE PAYMENT AND A MERCEDES PAYMENT….Even if she got a 0.50% rate for 6 years daddy is going to be making those payments

I know a sales manager at a new car dealership. He said he’s never seen a person turned down for a loan, and he’s worked there over 5 years. Think about that.

As a counterpoint, I don’t work at a dealership, but when my wife and I bought a new(to us) minivan last January, the guy trying to buy in the cube adjacent to us got turned down on for a loan in the low 20’s. His sales rep was very loud.

Thanks. Saved me from having to “think about” DC’s comment. And possibly even running out for a bottle of Prevagen.

1) In 2008 the Fed saved the banks.

2) In 2020/ 2021 the Fed preempt.

3) The Fed built defensive lines with ammunition dumps, for the banks.

4) There is so much liquidity in the market, – ammunition dumps, – the banks vaults overflow, exploding. The banks need the Fed vaults to park their excess money. But first, the banks provide collateral to the Fed to get the cash.

5) Will the banks be out of ammunition in the next crisis, if phase I will induce phase II, phase III will start after phase II… and phase VII will follow phase VI, like in 1932.

6) US Treasury General Account in the Fed is down from $1.8 to $866B.

The way the consumer price index is consolidated in the USA it looks to me like it most of all track purchasing power. Any increase in CPI a reflection of rising purchasing power, not necessarily in absolute terms but denominated terms. In short more dollars to spend, higher CPI. Now, without rising wages the “inflation” will probably be temporary. What can distort this is the methodology to consolidate the CPI. There may be details in how that distort even the link between CPI and purchasing power.

where have you gotten the notion that wages aren’t rising?? Even in places where the minimum wage isn’t $15 an hour yet, that is how much retail stores are paying 17 year olds with no work experience…

$100,000 a year now is the new $50,000 and most out of college are making at least $80,000 with no work experience to speak of

“$100,000 a year now is the new $50,000 …”

Sez who?

Smaller to medium sized businesses are likely unable to spend $15+ /hour (plus any benefits) on entry-level, low skill jobs without a drain on their long term profitability and viability as a going concern.

Those thinking low-skill wages are going to go gang busters in current inflationary environment are wishing it so, but reality may be different.

No it’s pretty real. I can go to the local Wendy’s and make 17 an hour and work when I feel like it. I can’t even go to Walmart and check out at a proper register. I have to wait behind 40 people to check out at the self check outs.

I don’t know if it will last or not but the reality is there. Caterpillar is hiring technicians right now for 30-40 dollars an hour. 3 years ago they brought in low level parts swapper “technicians” for 25/hr.

The median income and workforce participating rate. Ok, the median and average income data lag quite a bit, but no large pay rise have been reported. On the other hand, the CPI may only track the purchasing poser of those that have.

It could be that the incomes of those that have a decent purchasing power are on the rise. The purchasing power of those that can not afford a car is not counted in the car price index. Same with other goods and services. Someone that can barely afford food is pretty much invisible to the CPI.

I started saying “the Bachelor’s Degree is the new high school diploma” about 20 yrs ago. I guess now, it’s the new GED! :)

I was all excited when I first got a $100K job. A few months later I realized I was actually doing two (2) $50K/yr jobs.

7) If the fools persist with their folly, the repo trucks will teach

them a lesson o/n.

“A fool who persists in his folly becomes wise” -W. Blake

(actually kinda meaningless in this context, but he once had a big following)

Repo Man is one of the finest American films ever made, imho.

– Yes, prices are rising but when wages/income of workers remain flat then this is very deflationary. This kind of inflation it therefore VERY “Transitory”.

– It reminds me of what happened here in the US in 2008. In the 1st half of 2008 everyone thought inflation would continue to go through the roof.

– I remember that families in my neighbourhood saw the price of gasoline (in mid 2008) and decided not to on holiday to say Florida, the Gulf coast, etc. etc. It would cost too much to drive to e.g. Florida and the these families decided to stay home. That’s how people responded to the rising costs.

Willy2,

“That’s how people responded to the rising costs.”

That’s how they responded in 2008, and sales of new vehicles collapsed because people went on buyers’ strike.

But now the opposite is taking place. Now retail sales of vehicles are surging, and prices are spiking. Most people could easily wait buying a vehicle, but they don’t. They want it NOW, and they don’t mind paying extra for it. This is highly inflationary. I have never before seen this industry or car buyers in this inflationary mindset.

1.35 Million retail units in May, so how many wealthy families are there in the USA, top 20% maybe, so maybe 15 million families? This group have made out like bandits during the corona pandemic, so I don’t see any real difficulty in understanding where those SUV’s are going. This group can probably keep a lot of businesses in the US running, the poor people have to eat and pay rent and are living in poverty. If the 20% shrinks to 10% then maybe everything falls apart.

True. But like Seneca pointed out above, even workers making middle rung salaries are splurging on high end vehicles. I could add that my daughter is a bit over extended and driving high end BMW SUV (I drive an 2004 CRV). Her husband buys and sells BMWS at car auction and doing pretty damn well right now. None of his clients are high end by any means.

Tomcat – At least in Canada, the top 20% are also drowning in debt. Even a lot of the top 1% are and are seeing their lifestyle/status/level slip along with everyone else. Most of the top 99% of the top 1% live very similarly to the middle class. Yes, a bit more discretionary income and some nicer things including homes. The lifestyle still isn’t that different. Most of the top 1%, while they technically fall into that category, don’t have the income to be able to take advantage of the tax scheme’s that the top 0.01% do but they still pay 55%+ income tax and significantly more property tax. At the end of the day, it means a lifestyle that isn’t that different.

Either way, never judge a man’s wealth status or debt level on his spending habits, his lifestyle or what he claims his wealth is. Even towards the top many are drowning in debt and the lifestyle is an illusion. Just ask most Consumer Trustee’s of Insolvency.

At some point, surely we will run out of the cluelss FOMO buyers whether it’s RE or car sales. Not everyone is that stupid or believes they have an endless pocket book or that mountains of debt are a good thing. At some point, reality has to bite. Are you saying that reality wouldn’t set in for sometime? To much group think is happening?

The top 20% are doing very well and can afford the stuff and have the money, they are not drowning in debt. As long as the bottom 80% are prepared to keep working for poverty wages to keep the 20% wealthy, then the game will continue.

I agree on inflation, but this is very different from the inflation I saw in the 70’s & 80’s. Today, wages may not be going up so much, but independents are setting and receiving their price. Truckers turning down loads for x dollars, getting offered x++, and taking it. Fencing contractors, landscapers, fabricated steel, etc.. All are naming and receiving the price they ask. It is not just cars.

“All are naming and receiving the price they ask. It is not just cars.”

Well, that may be true now after disruptions and dislocations caused by pandemic, but it won’t last in a dynamic and increasingly chaotic and unpredictable economic situation.

Are they trying to beat inflation, without realizing they are contributing to it?

That’s exactly how a crack-up boom occurs. People start buying at ridiculous prices because they have no confidence in the currency. This creates a positive feedback loop until the financial system collapses.

Another thing to factor in. If are supplying an existing 2 x 4 to a customer, you need to be aware that the next 2 x 4 is likely to cost you x plus 20%.

If you don’t bill the first customer x plus 20%, then you will sometime in the future need to come up with the extra cash to pay the 20% price increase out of your own pocket.

This is also part of the inflation mind set needed to survive in inflationary times.

Reposession and reverse repossession meme is Worth a reconsider, but not much else in tonight’s viewing program. More news at 11. Mayorkas interviews an astrologer.

The kids on the wall-street-bets feed all say that when the inevitable MOASS ( mother of all short squeezes) happens with GME and AMC they will all buy Lambos. That will drive up the average vehicle price big time. Har Har.

Same thing happening in the UK. Been looking to replace my Mazda which is 15 yrs old. During during lockdown in March I was looking around and a car that matched what I was after on at £19500 but really wanted a test drive without too much COVID hassle so decided to wait a bit. Right now there is a car at the same dealer, exactly the same model, same age, same mileage but different colour at £22500. I read an article saying Minis are really in short supply and someone commented underneath that they were phoned by their local dealership asking if they wanted to sell. So desperate are they for cars

Consumers cashing in their bitcoin winnings? Can you buy a new car with bitcoin? Is the Reddit crowd, trashing the dollar shorts?? Simple, bitcoin doubles, I buy a new car 1/2 off. And if you don’t have bitcoin, you lose.

A new 2021 Kia Soul in Tampa for under $16,000. Inventory is low in places, but some are showing cars of various makes and models are available.

” I have never before seen this industry or car buyers in this inflationary mindset.”

I had been in the deflationary camp but now I’m not so sure.

Does such a development mean that in 6 to 8 months we will still have only modest inflation or is it conceivable that our Central Bank through its current romance with digital currency, and its own credit creation along with more credit creation in banks primarily for consumption are beginning to flirt with hyperinflation.

Is our financial plumbing this broken?

I red this and thought about the lines at the food banks.

They are Long…very long.

It’s estimated that more than half of my County’s residents will be getting food at the Santa Rosa Food Bank.

If you are in the bottom 50-60% it’s rough and about to get rougher.

So…this is the other half who still have money and credit.

I don’t know if Wolf has mentioned it, but Vehicles are lot easier to repossess these days because they have GPS and are connected to the internet, a lien holder can tell where it is at any given time.

The chip shortage might fix that. Manufacturers are starting to cut corners on chip use. I wouldn’t be surprised to see GPS sacrificed. Years ago I bought a used loaner car from a dealership. Since it was a loaner it was no-frills, which meant no GPS. I got along fine for 7 years with my cell phone. My current car has GPS but I still use my phone.

Silverados will no longer have a chip that enables economy mode, which will reduce mpg by about 1.

Peugeot is replacing the digital speedometer on the 308 model with an analog speedometer.

There might have to be some cutbacks – probably at the low end models – on electronics like Bluetooth, Android auto, sound equipment, etc.

They could also use equivalent chips of lower quality. The problem would be failure to function properly at extreme temperatures.

They can still be “Stolen” when you can’t make they payments anymore.

There’s a famous cliff in rural TN where I used to live, where people’s “stolen” cars got dumped when they couldn’t make the payment anymore.

Leave it running with doors/windows open in a bad neighborhood. No longer your problem!

I’m a multi-millionaire that started with nothing. We raised rabbits in our barn because it was an affordable way to eat meat. One significant way that I beat the system was low cost transportation. I haven’t bought a new car since 2000 and I regret buying that car. I’m a firm believer in buying quality used cars, maintaining them, and taking them as far as they’ll go. Screw status symbols. Cars are the worst investment known to man.

“Cars are the worst investment known to man.”

No, that would be RVs and boats.

Correct, Depth Charge. Remember the two best days in a boat owner’s life?

After owning at least a dozen boats over the last 50 or 60 years, CitM, I cannot help to respond:

THE very best day in a boat owners life is the day they buy the boat;;; the next best is the day they sell the boat!

Definition of a boat,,, ”a hole in the water into which you drop/THROW money” ;;;

Definition of living on a boat in the water: ” Like standing in a cold shower, shredding $100 bills into the drain!!”

What I cannot really understand after owning boats and sailing both Atlantic, GOM, and Pacific both before and after US Navy, ( which I loved dearly if for no other reason than getting to see the sea purple in the very very deep parts of the Pacific, )

is why any reasonable person not previously a ”rag top” fan would ever buy any boat except those clearly designated for ”near shore” etc., and then try to go across any ocean???

Please folks, do NOT try to go ”out” into any ocean, including GOM, with less than two completely independent modes of propulsion, no matter who says what about the reliability of any source of propulsion, especially any ICE…

I thank you,,, and I am damn sure the US Coast Guard will thank you.

Onionpatchkid,

I too have always bought used cars, and it seemed better to me to have an older high quality car than a newer one that did not perform as well.

But at some point, if one is financially set up, it is OK to have a vehicle that you enjoy driving versus one that is just a utility for transit.

DR

At around 25yrs ‘most’ vehicles tip into the ‘collector’ category and the price usually tends one way thereafter if you keep it clean.

In UK at 40yrs it’s tax and annual road check free, and gets a heritage insurance category which makes it the cheapest way to own a car bar none.

Still one of the cheapest ways to raise a meat supply.

That or surf craigs list for all the new hobby farmers

looking for a “good” home for their spare roosters.

Yeah well somethings up. In my work I drive past two of the largest repo car lots in the midwest, and to be sure they are packed. acres upon acres.OK I also drive past a Ford Motor facility. And their lot is packed with pickups. (chip shortage?) How did they drive onto the storage lot? There may be a chip shortage, but I think the truth is “they really are not selling many vehicles”and the the cover story is the chip shortage so the companys stock dont crash. So tell me , Who has got 46 grand for a pick up truck? We now have a tremendous part of the population unemployed. BLOW MORE SMOKE UP MY ASS IT TICKLES!!!!

DUGTRUX,

Nonsense. Or should I say, clumsy fiction? In reality, they only build vehicles where the missing component isn’t essential, such as the fancy mirrors that contain oodles of chips. If a component for the engine management system is hung up, or if the transmission is hung up because of the chip shortage, the assembly plant shuts down until the component arrives. Happens a lot now. No one drives anything to a lot. The plant just shuts down for a few weeks. Period.

WOULD YOU LIKE PICTURES? LIVE FROM METRO DETROIT?

Read what I wrote!!! The whole entire paragraph!!!

The point of the article seems to be that the auto purchaser has altered the traditional view of a vehicle to resemble a financial instrument more than a capital investment in operating efficiency. If I’ve not misunderstood, that’s probably right. You can look up it’s value, history, buy or sell one on your phone. Local car dealerships want my mother’s Accord bad, and were bothering her eighteen months ago to sell, before wuflu, that’s significant. They know exactly what a’17 Accord with 17k miles is worth without having to see the specific car, the information system is pervasive. Communications technology and the advancement of mechanical/electronic systems reliability has taken the car business into the realm of commodity trading. There’s less wrench and more part-swapping per trouble code, allowing for more precise depreciation. And people are seeing the ongoing demand for most vehicle classes, see no reason why it shouldn’t go on the same way indefinitely, and don’t hold the need of a vehicle personally as an impediment to it’s negotiable value in the market, any more than owning the house they live in subtracts from it’s value. So the two asset types become one in the opinion of those who have both. But say you live in central Munich, or London, and rent a flat, don’t need to own a car. Purchasing a place to live is a de facto investment in such prime locations. It would have to be a real special car to qualify as any kind of investment , but lots of city dwellers have such cars anyway, or lesser cars, against the odds and at additional expense and inconvenience, it’s not just the usefulness , they are viewed as a store of value. Or bling. Here, your home is your refuge, but your truck or SUV is your refuge from your home. It’s your rolling castle, an investment in personal sanity. And bling. “Sanctuary” was the word used in a car commercial last year. Obviously it’s a negotiable asset displaying far less volatility than crypto’s or even many equities. A prudent man might hedge against future misbehavior on his part with a shiny F-150 for the wife (timing is important). If only the new cars were designed to be attractive and didn’t shut off and start back up at every traffic light. I miss filling a Coupe de Ville with hi-test at bledsoe’s Texaco for 46 cents a gallon and blasting down Forest Lane in Dallas.

A neighbor would loan you a car without a second thought, and you could lose children in the big Buick station wagon. And new cars smelled special. But nobody in their right mind would have considered the present day financing arrangements and durations, as rates were far higher then. The splitting off of financing (à la GMAC)has resulted in a mature market that is only peripherally involved with it’s underlying asset, which has also matured on a happily parallel course. So it’s rational to pay more, if the asset depreciation can be held separate and quantified as a credit against retained value, no problem. The Dutch proved you can make a financial instrument out of anything four hundred years ago.

@ Rick m

Once again the comment section here at Wolfstreet provides both insight and humor. Sadly, I believe you are correct about rolling castles. American’s, so rich yet so fragile. So many feel the need to have two tons of metal and plastic surrounding their bodies and egos before they will risk going outside. And yes, if anything can be financialized, it will be financialized

Thanks. I drove a friend’s Hummer back from the New Orleans airport to Biloxi, got glare-stared by old ladies in old cars, like the looks smoking in public used to get you in Los Angeles. He sold it, too inconvenient and a gas hog.didnt drive all that great either. Some vehicles telegraph their owners priorities pretty clearly. An anonymous 2007 e-250 work van with ladder rack says everything and nothing about me, same as the house I live in. Some express their fears in their choice of vehicle, others their fascination with their own specialness, me, I’m an electrician and a slob, and after crawling out of an attic I like a big box of a truck I can throw my tools and materials in, to be sorted out when I feel like it. If your truck is organized, you’re not busy enough. That’s my excuse, anyway.

SC

A trip in a 5ltr ‘Chevy’ V8 was a great American experience gift to the world, sadly no more, other than in some of your classic movies.

We get to dream sitting in a silent ‘autodrive’ electric lounge.

You’re now driving the same little P*** A** tin boxes as the rest of the world. How the mighty have fallen.

I’m becoming paranoid that somebody is going to hit my truck and total it, or it will get stolen and I find myself NEEDING to be in the market for a new truck. The mere thought promotes anxiety. The current prices are not something I am on board with nor will every be. I need a 1 ton dually 4×4 for my work, trailers, etc.

My buddy’s car was destroyed while parked on the street in front of his house. Some one driving some kind of construction vehicle dropped several thousand pounds of metal beams on it (they’re lucky they didn’t drop it on someone’s head).

He got them (or their insurance company) to give him an extra $4k over blue book to compensate for the fact that he’d have to pay more to replace it.

YMMV of course.

@Wolf. My question is simple. When do you feel this insanity will peak and begin to subside? It feel to me the peak is happening as we speak.

I don’t know when. I don’t think there is an example in modern US automobile history of what is happening right now. We have nothing to go by. I really don’t know how this will play out. My feeling is that it will subside partially, but that prices won’t go back to where they were, and that after dropping for a while and giving up part of their recent gains, they will start rising again.

Wolf, that’s silliness. Automobile prices can’t just keep going up in perpetuity. This is all because of the mass stimulus, and you know that. It’s coming to an end.

The dollar is worth less. That’s all that is going on. So even if unit sales remain the same, total sales in dollar terms rises, as it takes more dollars that are worth less and less to by a unit. And when the price of your asset rises, but there has been no real change in the asset, while that will give you a thrill that the asset is worth more dollars, it’s not because the asset has changed, but because the dollar is worth less and less.

As to the wealth effect – the belief that an asset is worth more (nominally) acts as a transmission mechanism triggering the perception that the asset holder can spend more as he has more dollars in his treasure chest.

So how does the hypnotist make a volunteer from the audience reach into his wallet and give all of his cash to the audience? He hypnotizes him to believe he is a billionaire, and that he can easily afford to give away (spend) the realtively little dollars in his wallet.

Not everyone who buys new vehicles needs to mortgage them and lives paycheck to paycheck. We buy new F150s, 250s, and/or Expeditions every two to three years through our corporation and write checks when we do it. Our manufacturing company has been debt-free since 2010 and nice new vehicles are a fruit of labor all while being tax-deductible.

I ordered my Expedition the second week of January and it came in the first week of March. We ordered another Expedition the second week of March and it *might* be in by the end of the year. We need to replace a 2019 KR F250 with 130K on it and are waiting for the 2022 order bank to open up.

The Expedition we are waiting on is replacing a 2019 Platinum Max that is adding 900 miles per week and has the better part of 80K on it now. The salesman said with the prices of used cars on the lot and at the auction, the miles aren’t hurting our strong trade, which was prenegotiated.

Not bad on the wait time.

I checked several places on a new backhoe.

Only had one dealer that believed they could get it for me

by next spring. The rest could not give me a time frame.

Showered with government money, consumers in the lower middle-income bracket reduced their credit card balances. Consumers in the middle- and higher-income brackets decided to spend the money. Some bought a car. New vehicle inventories are tight due to this buying binge and a concomitant semiconductor shortage. Used vehicle inventories which are also tight, are due to new vehicle shortages – some consumers buying a used car for lack of a new one. This does not signal a new inflation mindset in the consumer.

Inflation will start eating away at people’s savings they built up over the pandemic. Soon they will not be able to afford the monthly payments on their overpriced houses and cars as inflation on food, clothes, and other necessities eat into their budget on top of the overpriced purchases.

That’s the thing – it’s one thing to sign on the dotted line, but another thing entirely to actually pay for the thing.

As concerning as it is to read about inflation in the news every day, I suspect it is going to be temporary. Between the one-time exodus of cash rich city dwellers with their inflated pricing expectations and an immediate need for a vehicle and housing, the one-time stimulus payments to a lot of people who didn’t need them (myself included), and supply chain bottlenecks preventing companies from meeting demand, it seems like all of the obvious pressures are short term in nature.

Regarding the stimulus payments, my 401K contributions lowered my taxable income below the bar for eligibility. Very needy indeed.

“As concerning as it is to read about inflation in the news every day, I suspect it is going to be temporary.”

Me too. As another commenter mentioned, today’s economic scene does resemble more and more a speculative crack-up boom a la Austrian school of economics.

If you factor in $trillions infrastructure bill passing, that will supercharge commodity and labor inflation because demand will far outstrip supply of raw materials, goods, and services the economy can currently provide. The lumber pricing brouhaha gives a clue about those consequences.

Of course, a boom is always followed by some sort of bust, as night follows day.

So we may have a later bout of deflation, though short-lived.

Long term inflation is however likely with J & J (Jay and Janet) propensity to continue to monetize incredible amounts of credit (i.e. debt).

I dont really understand how the economics that used cars and new cars have both suddenly increased in demand. Should this not be an inverse relationship? New car bought, old car traded in. Less new cars, more used cars. What am I missing?

Think about how many people vacated big cities that didn’t previously own a vehicle. When new car prices spiked, some got priced out and migrated to used car lot. No trades.

That’s not how it works. Many people buy only used vehicles. Others buy only new vehicles. Some buy either. Many people cannot even afford what they consider an appropriate new vehicle, such as a new truck or a new SUV. They’re locked out of the new market.

Is there anything that has been happening that is not likely to continue in perpetuity? I don’t know, maybe things like

Ever-rising stock market value and P/E

Bidding wars and vertical spike in RE prices

10/1 ARM rates in low 2’s

Mortgage pmt moratorium

Rent pmt moratorium

Utility pmt moratorium

Student loan pmt moratorium

Stimulus checks

Extended unemployment bennies

Trillion upon trillion of injection dollars

Moratorium on personal spending on travel/eating out/etc.

Are these forever and ever and ever? What happens if not?

Still not sure who’s gonna fix these cars, much of the later innovations concern fuel efficiency which will be somewhat orphaned technology as EV’s come in, will there be enough people who want to learn how to work on the old stuff? knowing that it is increasingly a niche area and traditionally dirty work, as opposed to some lab coat swapping boards. If you needed your TWX terminal worked on today there’s simply nobody. A freezer with a million pounds of shrimp locally operates the ammonia refrigeration system with software running on Windows 95, pure luck finding somebody that can keep that running. So these vehicles will require a hedging instrument, such as a mechanic default swap, to accompany the primary deed, the value of which fluctuates contingent on market demand for your truck. Cash-out refi your F-150 a couple of times and then scrap it for the aluminum. Stupider things have come to pass. And it’s still better than the veneration certain europeans hold for their cars, but they’ve never been a necessity for almost anyone in Europe, the United States is largely inaccessible without a vehicle. So the tokenization of the people’s wheels is even more interesting here. I can see “junk” bonds aquiring a new meaning.

It’s an entirely effective parlor trick. Just look at people gleefully stating that their used vehicle is worth as much as when they purchased it. They cannot realize that it is valued in dollars that are worth less. Can’t even see it. Amazing.

Nothing at all wrong with record gross profits. They’ll be able to invest in increased production and jobs and new plant and R&D and new showrooms and sales staff.

As if!

They’ll increase bonuses, buy-backs and pay Washington lobbyists to persuade the Govt to pay for an electric car or chip factory.

Capitalism USA.