No housing market can handle the perversity of vacant homes being used as leveraged investment vehicles to generate capital gains by just sitting there.

By Wolf Richter for WOLF STREET.

While 17.4 million people are still claiming some kind of state or federal unemployment compensation, as the delinquency rate on FHA insured mortgages hit a record 17.5% and 2.3 million mortgages are still in forbearance, the beneficiaries of the Fed’s monetary policies are treating homes as leveraged investment vehicles with huge returns on equity. And people are buying homes and moving into the new home without putting their old home on the market to ride up those prices, documented by an explosive surge in second-home mortgages, leading to starved inventories and more surging prices… and yet, sales plunged again.

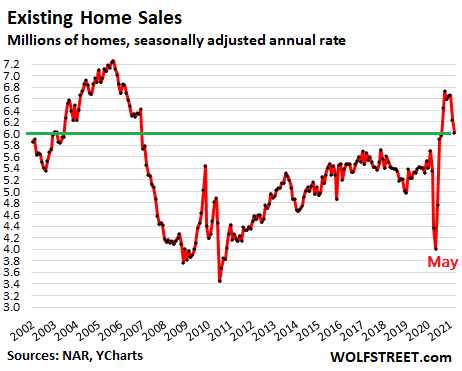

In March, sales of existing homes – single-family houses, condos, and co-ops – dropped by 3.7% from February after the 6.3% plunge in February from January, to a seasonally adjusted annual rate of 6.01 million homes, the lowest since August, the National Association of Realtors reported today. Compared to March 2020, sales were up 12.3%. The past two months have now unwound the entire sales spike since last summer (data via YCharts):

But condo sales disconnected from house sales. Sales of single-family houses fell 4.3% in March from February to a seasonally adjusted annual rate of 5.54 million houses. But sales of condos rose 1.4% in March from February to a seasonally adjusted annual rate of 710,000 units as inventories have remained within the normal range over the past few years – there are plenty of condos for sale.

Why are sales dropping in this crazy market?

Mortgage rates. In January, February, and March – the time frame of the sales that closed in March – mortgage rates were rising, with the average 30-year fixed rate mortgage hitting 3.36% in early April, up from 2.9% in mid-December, according to the Mortgage Bankers Association. This made homes, whose prices had shot up, suddenly a lot more expensive, pushing them out of the affordability range for some buyers.

Buyers’ strike? There are some indications, anecdotally mostly, that some buyers are saying, forget it, I’m not participating in this zoo of insane bidding wars on homes seen only on video with all inspections and contingencies waved, with the winner (or the loser) agreeing to pay ludicrous amounts over asking. Terrible deals are made in great times, and there hasn’t been a better time to make terrible deals.

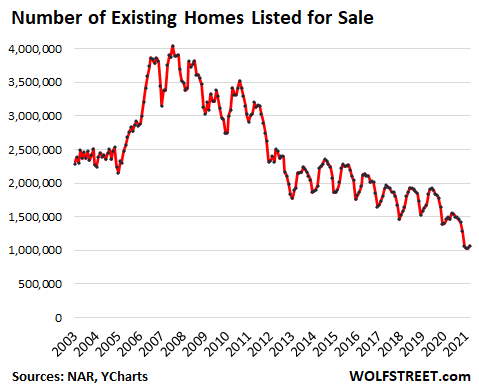

Inventory of homes for sale late last year and in January this year had plunged to a record low in the data going back to the 1980s. In February, it remained at the low of 1.03 million homes. And in March it ticked up 3.9% to 1.07 million homes, and supply ticked up to 2.1 months at the March rate of sales (data via YCharts):

But forget the rule for a balanced market = four to six months’ supply. That used to be the rule of thumb, now obviated by technology that is speeding up the process of selling a home. The time a home sits on the market waiting for processes to take place has shrunk, and thereby the inventory of homes for sale on any day has shrunk, which is depicted in the 12-year decline of inventory for sale in the chart above – but two months’ supply is still very tight.

Prices spike, blow past historic seasonality.

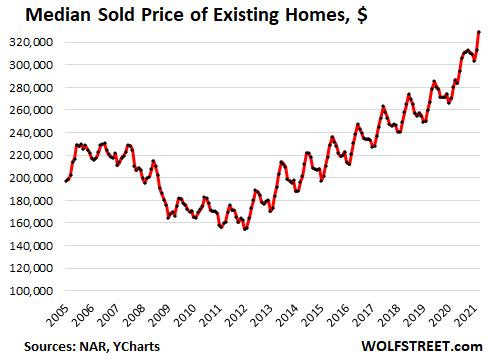

The median price for all existing homes spiked by 17.2% year-over-year to $329,100, after having blown through the normal seasonal decline in the second half of the year, and is up nearly 50% from March five years ago. For single-family houses, the median price spiked by 18.4% year-over-year to $334,500. For condos, the median price jumped by 9.6% year-over-year in March to $289,000 (data via YCharts):

Waiting for shadow inventory to come on the market.

Those vacant second homes that people have left behind when they moved to their new digs, are now being used as a highly leveraged investment vehicle to ride up the surge in home prices for huge returns on equity.

No housing market is equipped to handle the perversity of vacant homes being used as leveraged investment vehicles to generate capital gains just by sitting there.

But these vacant homes are part of the shadow inventory. When owners decide that it’s time to take profits, they’ll put the homes on the market whereby they move out of the shadow inventory and into the inventory for sale. But since these homes are vacant and the owner lives somewhere else and doesn’t need to buy another home, it adds inventory without adding demand from the seller (who already lives in a home and doesn’t need to buy another). This would be the opposite of what has been taking place, and the effects of this would be the opposite too.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks you for continuous coverage of the housing market insanity Wolf. If people don’t know any better and listen to someone like Jason Walter ( a real estate agent) on Youtube then the market has never been better, everything is record breaking this year and this momentum won’t slow down anytime soon, your typical NAR narrative.

I sure do hope this is the start to something of a bigger crash. People need to vote with their money and boycott buying at current insane price level, especially considering all the headwinds ahead in the broader economy. With that said though, why do I get the sense that, as soon as price dip a little bit, FOMO crowd will pile back in again? Maybe housing just have this religious hold over people that unless there’s a fundamental shift in how people perceive housing as an investment in their mind, any downturn will be limited to the short term. Hopefully I am wrong on this, maybe the FOMO mentality will eventually turn into FOOP all at once.

In the meantime, read this on another housing site….welcome to this new insanity normal, I had a good laugh from below.

“The Democrat and Chronicle in New York. “If you want to hear horror stories, you can find them all over social media. One example from Rochester. ‘My parents are in a money pit situation because they waived the inspection. A few months after moving in my dad went right through the kitchen floor due to rot. Owners had put down new laminate over the rotted floor to hide it. They got lucky no one fell through during the viewing. That was just the beginning. Porch is falling apart, HVAC is ancient, roof is leaky. It’s their own fault, but I would never waive an inspection.’”

“And this: ‘An agent (not ours) recommended that we empty out our 401k’s and wave (sic) all contingencies in order to make a cash offer on a house. We refuse to over-leverage ourselves, get deep under an overpriced home and risk our retirement for a pile of wood. We will not yield on inspection requirement no matter what, and you shouldn’t either if that’s important to you!’”

I have been a broker in California for 30+ years. Any agent who would suggest or allow their clients to buy a house without seeing inspections

should find another job.

Another job? They should be in jail.

Home inspectors are largely incompetents who couldn’t find work elsewhere. Hiring them is a complete waste of money. Need to get your own roofer, plumber, electrician to do the inspection. Been there, done that.

My Sentiments exactly. People are all FOMO, and go crazy, super emotional about housing. Plus the media, social media, housing shows and remodel shows don’t help.

It’s nuts, waving inspections and all contingencies, and even crazier paying 10-30% over asking.

Rents are inflated everywhere, and people gotta live somewhere. The masters of the Universe know this so they keep the housing game going… some winner and some losers… musical chairs…

I need house to live in it with my wife and 2 kids, for me is NOT an investment (my investments are in the stock market, 401K, IRA, growth stocks…) stocks are also inflated, but I’ll take the risk over a savings account paying a quarter percent.25%.

Housing though, is criminal the way they have turn the homes to trade like stocks but Very NOT LIQUID, and crazy costs for buying/selling or fixing anything. Let’s not forget the taxes. In some states like Texas, the counties assess value every year as they see fit to tax people on inflated property value.

Only REITs or investors really benefit of every increasing values. You gotta live somewhere, If you live in the house, high value = high taxes, if you sell you have to buy somewhere high and high we go. Unless you move to your car or leave the country, your screwed.

There won’t be another crash like 2008. The FED, already said that we won’t have another crisis like before because they can manage the crisis figure something out. So far, I have no reason NOT to believe the FED. Thus far, we’re in a world pandemic and everybody body is buying 50K cars, and 500K+ houses and with stacks of money, even if not working…!!!

All I have to say is I think the Fed has much less power than you think it does.

All I have to say is that the FED has all the power it needs. Seems like you’re watching what’s going on.

The FED can and It WILL print, print, print. till a gallon of milk is $25. A Burrito in California is already $16-17.

They are the masters!

The Fed doesn’t have the power to sustainably make things more valuable, but it does have the power to make the securities it issues less valuable. People are going crazy trying to rid themselves of depreciating dollars, and even shorting (borrowing) them against other assets, whether they are stocks, houses, cryptos, NFTs …

Fed is destroying the currency and raising the value of assets.

Ok wolf, I questioned a local realtor here in the woodlands/greater Houston area of Texas a few weeks back.

I get it why people are wanting to leave certain states to come here because of the impression of lower taxes and lower cost of living, although I can tell you with absolute certainty that this is not going to be the case much longer. The level of home price appreciation and consequently, property taxes are what can only be described as insane. I just received another yearly appraisal for a piece of commercial property where we have business operations. It has been creeping up over the last five years from the 300k range to last years which was valued at 420k. I almost had a heart attack when I opened it, AND I was prepared because several of my other properties have doubled and tripled this year. This years appraisal is valued at 2.2 million!!

This is land only, no improvements .

The Realtor told me that people are moving here without selling their old home , they figure they can just sell it later ( because , you know, home prices only go up) She was of the opinion that there will be a ton of foreclosures, once forbearance ends ( if it ever does) .

BUT , what I can’t understand is the fact that many of these sales are cash only, and in many cases for considerably more than listed price.

That’s a phenomenon that was was unheard of for this area, ever.

These are not cheap homes either, from the 600k

To over 2 million range.

My question is, where is the money coming from?

PPP “Loans”. Sounds like you are an honest hard-working business owner. That’s so old school. I hate to break it to you but that makes you a loser in today’s Brave New World.

I guess you haven’t heard about startups like Ribbon. It got launched in 2018 and was backed by NFX, Bain Capital Ventures, Greylock, and NYCA.

“If the buyers can’t afford to make a cash offer themselves, the company will make the cash offer for them and give the buyer time to get a mortgage.”

“If the buyer doesn’t have a mortgage secured by the closing date, Ribbon will buy the house itself and rent it back to the client for as long as 180 days, when the buyer can then buy the house for the original contract price. The startup takes a 1% fee if the buyer closes with financing, or as much as 2.4% if the company closes with cash.”

I just sold a duplex in SoCal for $700K which had no monthly net profit, just broke even. Took the $700K cash to Springdale, Arkansas and closed escrow on 3 newer duplexes which will net me over $3000 per month cash flow. About $90 psf and the property taxes run .50% of 1%. Beautiful country. Near by is home to Walmart, Tyson foods and JB Hunt Trucking. I still live in LA due to family but prices are insane and this will end badly.

Good job on being part of the problem

Brilliant!

If you want to buy a house it may be time to bite the feces sandwich and force a smile. House-buyer-strikers will probably meet the same fate as bond vigilantes: mowed down by Fed money printer salvos.

I imagine it sounds and smells just like an M61 too.

“Brrrrrrrrrrrrrrr!”

What is interesting is that the Fed is still buying more bonds every month, yet the interest rates have started to rise a bit. But the Fed has been able to finance a good portion of the massive federal deficit by drawing down the cash balances it put in the Treasury from last year. Starting in around June, it will have to start to sell bonds on the market to finance the deficit and that is going to further cause interest rates to spike. All of that is going to happen at the same time that the mortgage agencies implement a new rule that limits the number of second home mortgages to 7%, the historical average, instead of 14%, the current average.

So we will have the following:

– Pressure on long term interest rates to move higher, due to the need to finance the deficit

– Higher interest rates. Now the government is currently able to reduce interest payments when it refinances its debt, but as interest rates rise, that could start to drive interest expense for the government much higher

– Forebearance programs will be starting to end and no new forebearances starting in June

– Foreclosures will start to be allowed again after June

– As COVID lockdowns end, alot more houses get dumped on the markets

– The shift that allows people to work from home actually will have a long term deflationary effect on housing prices, because there is less need to be located in the most desireable areas, hence less competition for limited demand. A more spread-out population will result in lower average prices and at some point, more home building in those areas where it is cheaper/better to buy a lot and build than to purchase an existing home.

You reminded of my own painful experience. I’ve had both an incredibly good and an incredibly bad home inspector.

Do yourself a huge favor: Find a thorough, bad-ass home inspector. Those people are worth their weight in gold. You MUST do your diligence on what is probably the biggest investment of your life.

And in places like FL, where 30% of the state is wetlands, check those topographic maps. Talk to the neighbors….does the property you’re looking at (or the neighborhood in general) have flooding issues?

I’ve made them before….”unforced errors”….FOMO is real!!!

Wolf – I would love to hear your take on cryptocurrency. My opinion is that the biggest problem for cryptocurrency is the proliferation of cryptocurrency. In other words, if there is only one cryptocurrency, Bitcoin, that has value, then the value of that crypto could soar infinitely as a value of store, even if it has no value as a medium of transaction simply based on the limited supply with increasing demand. But if many cryptocurrencies begin to increase in ownership and price and many new cryptos come onto the marketplace, then the value of any single crypto will plunge, because instead of being an asset that has limited supply, the whole universe fo crypto delivers infinite supply. In that scenario, gold might gain favor as the asset that soars, because the supply is more limited than crypto.

gametv,

“I would love to hear your take on cryptocurrency.”

Yes, you can actually “hear” me take on cryptos — that’s my podcast on it from a couple of months ago:

https://wolfstreet.com/2021/02/21/the-wolf-street-report-dude-offers-to-buy-my-book-for-1-5-bitcoin-in-2012/

“Never been a better time to make a terrible deal!”

Nice.

Any chance of getting those sales volume and median price charts extended back to 1995 or 2000?

You can’t appreciate the ZIRP induced stupidity unless you can see the run up.

“Never been a better time to make a terrible deal!” It’s a great line right, I think he had a better one, something like the winning bidder being the loser, oh how true.

“If you win a bidding war, you’re the loser.”

win the battle, lose the war.

In other news, Wolf, houses just got 20% more expensive in Bitcoin in just the past week. 50% more expensive in Dogecoin.

Depth Charge,

This type of rampant crpyto inflation really knocks the socks off me ?

aka a “Pyrrhic victory”!!

Never, Never sell an asset for cash. You must have assets, if you are in the unfortunate position of having money and no assets, god bless you. You don’t enter a bidding war to put cash to work, in order to turn a profit on your portfolio, you buy to get rid of cash and own tangible assets. Same priniciple as the crypto bubble. You will pay a premium to move cash, tax free in any direction, because crypto is barter. Money is an artificial store of value. It is only worth something when you buy something, and then it is worth nothing. This is what turned Buffett around, off the sidelines in the market. Problem with stocks. The only reason to hold cash is on the outcome that money may be worth more someday soon (buy more assets). This is the trade 1 share of Apple for 4 shares of Wells Fargo, but that is an asset swap. Money is never going to be worth more that it is today without the Fed putting a gun to their own head. Sellers boycott the market, prices reset lower, the currency has no utility. The endgame is worthless fiat. Markets swoon on a rumor of a capital gains tax. They want to tax my worthless paper profits? Hahaha. Sanity returns today.

Very poor advice, Ambrose. Sitting on cash is the smartest thing a person could do at this point. I will get a massive return on my cash as all assets fall in price. I am busy amassing more of it.

I’m with Depth Charge on this. Cash will be king when this everything bubble explodes into a million tiny little discounted pieces. It’s worth having enough dry powder on hand to pick up the bargains when reality rears its “ugly” head.

Cas127,

I’ve got the data going back to 1999:

Charts like these always make me think of a patient dying of a heart attack.

Which isn’t too far wrong…

Cas, it looks a lot more like a bad acid trip than a heart attack to me.

Unfortunately, this patient appear to still have life. Just waiting for it to flat line….

Wolf, I really appreciate your approach to data and to markets.

Thank you.

House prices up 2X and Stocks up 5X from the bottom. Grandma renting an apartment with savings in the bank didn’t do so well with all the printed money.

DC r***d grandma so it could live the lie a little longer.

If Jerome Powell, Lloyd Blankfein or Jamie Dimon could get away with knocking grandma’s teeth out with a crowbar to get the gold fillings, they would. These bankers are devil spawn.

i think they would feel better paying someone else to do the dirty work. even if it cost (a little) more than the filings were worth.

once the middleman costs too much? then we may see them wielding crowbars.

Yes, how dare Grandma rely on the faith and credit of the federal government to keep her currency stable.

Shame on her!

Any observer observing this confusing housing market (a highly manipulated Ponzi if there ever was one) could develop whip lash from the conflicting opinions about things pan out from here.

It seems you can get about equal opinions in regular media and social media that 1) it is not a bubble– there will be no crash, or 2) it is a historic bubble and it is ready for a correction (I am in this camp).

When I read that there are more realtors now than homes for sale as well as insane bidding wars breaking out– I knew we had jumped the shark on housing mania.

Heinz

I will take your friendly wager. By 2023’ish, avg prices will be flat or higher than today, regardless of interest rates.

You may be right about prices, but the buyers will all be corporations. I’ve heard some RE agents talking about homes being bought en masse, by companies like Amazon and Tesla, to insure their employees have rentals in the areas they are expanding into. One story was about Amazon buying up houses in Slidell, Louisiana, where they are building a distribution center. And the other story was about Tesla in Austin, Texas buying up homes for the same reason.

All of this activity pushes out normal buyers and turns these towns into company towns. Company towns are illiquid markets, like Detroit and most of the rust belt. Prices may go up in the short run when business is good, but when the downturn comes, the jobs and the homes will be dumped.

Think you are pretty on the money here.

A fairly decent probability that tax and accounting treatments for corporations holding real estate assets (like a couple million SFH), *might* make them less sensitive to overvaluation, particularly if they can borrow at lower rates/better terms than individuals.

@Petunia

“… You load sixteen tons, and what do you get

Another day older and deeper in debt

Saint Peter don’t you call me ’cause I can’t go

I owe my soul to the company store…

These developments give me a creepy-crawly feeling…

the pump n dump built into the company store business model.

this is the plan our soi-disant betters have come up with. we need better “betters.”

I thought the same in 2006-2007 that home prices would never go down, worst it may plateau. I have been wrong many times

I thought, around 2003 when interest rates were down to 1%, that interest rates would go back up. I’ve been wrong too.

That’s a bold prediction, but you could be right.

But I am hoping for poetic justice that deals the Fed, real estate industry, and greedy speculators a rout in housing that will teach them a lesson about avarice without boundaries (actually, they never learn).

I want the little guy/gal looking for affordable shelter to win for a change.

Poetic justice for the Fed means we all will feel the lash.

The Fed should just stick to clearing checks and leave the monetary manipulation alone. The short term interest rates, if kept, becomes the long term interest rate. Simple, really. Congress needs to wise up and do its job. Fiscal tools of taxation and direct spending (no debt) are far more powerful and deliver predictable results.

@grassranger

if you feel the lash, you have been failing to take the prescribed dosage of your medication. please report to room 22B first thing in the morning for a behavior correction.

thank you,

the management

The vacant houses are the real problem.

A problem that a 10% per annum vacancy tax would readily solve. Since we’re in a tax-raising mood these days.

You’ve never seen a real housing ponzi as the Chinese never showed up to drive your average home prices up into the millions of dollars. Just look upwards to the 4 Chinese cities in southern Ontario Canada that is Richmond Hill, Markham, Unionville and Stouffville. They’re up about 75 percent in price year over year. The Chinese also drove the average home price in Vancouver up to 3.3 million dollar a city where the average wage earner makes less than $40,000 a year.

Are you kidding me? What do you think is driving up RE all over the world? Here they are now doing it through REITs and hedges.

Clearly the red line for the GOP or Dem and the entire West is no recession will be allowed. So 10’s of trillions will be printed to support zombie companies, overly generous unemployment benefits to everyone including gig workers and subsidies to companies to keep workers on the payroll. Hard for housing to crash and burn in an inflationary environment that the world has never seen before on this scale. The politicos and their fed bankers will keep printing until it breaks and it will but it will take many years!

I doubt it will last a month or so before it bursts, they might thing they can avoid a recession but that’s just the height of hubris, if that was the case did all generations before suffer cuz they are stupid, go through pain & loss for fun, the fact is these bubbles only exist cuz people believe as you do, they can stop recession, can stop a crash, can keep it going, soon they will find out to their horror it was always to good to be true, for the few benefiting anyway.

Without this belief that the Fed are Gods the bubble would never have happened, no one would be taking out gargantuan debt to gamble, just like a novice gambler at the casino, they go all in until they are all out.

Exactly. The Fed doesn’t have that much power beyond people thinking it has that power.

Seems like something akin to a tautology although I know not the right term.

I imagine a rebel arrested and brought before an evil dictator. The rebel says, “You only have power because everyone thinks you have power!”

And the dictator replies, “Yeah that’s exactly right. Now off with your head!”

*chop*

I don’t think that’s quite a fair comparison. The issue is that people think the Fed can fix all economic problems, so they are willing to buy grossly overpriced crap on the basis that the Fed can fix it. Enough people buy, and the value stays high, and it APPEARS that the problems are fixed. But they’ve just been masked, not fixed.

Last time I looked, the Fed can produce trillions in a snap. You are obliquely referring to their talking up certain markets (junk etfs for instance), without actually making much in the way of purchases.

Look, the Fed is Godzilla and when he (she?) roars you don’t have to speculate as to whether it can stomp you if it so chooses.

Flooding markets with liquidity is what the Fed does.

Robert, I didn’t say they couldn’t print and create bubbles. I said that they can’t actually fix any problems in the economy, as many of its worshippers think. All it can do is make one party a winner and another a loser.

Central bankers still have yield control and negative rates and ETF buying and whatever it wants to keep the bubbles inflating and that can continue for many years! Of course, more folks will be thrown under the central bank bus but the bus will keep on rolling and printing!

The U.S. can’t go to negative rates if it wants to keep reserve status.

I agree there is some time left, but I don’t think it’s as long as people think.

The current, “recession,” we’re experiencing started in ’08, when (what I still call…), large, “Obama Towns,” full of homeless tents started popping up all over big-city America in the wake of the mortgage melt-down. Since then we’ve watched as squalor in America steadily expanded in lockstep with value of steadily skyrocketing assets, both driven to new heights by all the, “printing,” and other financial/monetary shenanigans since.

Call this gradual degradation into squalor the, “Stealth Recession,” as it has already consumed the bottom ranks of our society, which appears to be sliding from, “recession,” to, “depression,” conditions despite the recent massive expansions of debt.

This long, gradual transition in the character of America, (fifty years) from middle-class into squalor, has been generally ignored by the mainstream politicians and media, except when the, “source,” of this generalized degradation is, “found,” to as the product of racism…

More accurately, when, “racism,” is perfectly employed/used by irresponsible politicians and the corporations who pay them as a massive social DISTRACTION away from the real causes driving the long economic degradations all wage-working Americans have experienced. That would be massive migration backed by offshoring our skilled labor.

This squalor and poverty is the social-political-economic, “cherry,” on the, “cake,” of fifty years of the economic, “policy,” of (historically!) massive cheap-labor immigration backed up by the deindustrialiation of the US.

Our country was asset-stripped over this period by our, “leaders,” and their corporate sponsors.

At this point we already have, (what I call), “The Greatest Depression,” firmly ensconsing the lowest classes, with depression-level hard times (and attitudes!) spreading steadily upwards in the income distribution. This movement upward in poverty/impoverishment will not stop. It will hit the top, and ring the bell, when these Ponzi (Madoff?) markets finally pop.

These already serious self-inflicted wounds, of removing the earning power, the demand generated by our once-prosperous middle class manufacturing country, and concentrating this stolen wealth into the ever-finanicalizing hands of the decendents of the Robber Barons, (who have expanded it to infinity and beyond!), has made the people, the average citizens of our country weak, (stupid) and especially vunerable to any of the typical disaster/emergency situations any/every responsible government can easily anticipate, and was supposedly designed to mitigate. Supposedly…

Our Party Leaders have assumed different roles from those authorized by our Constitution. They and their corrupt policies have created these econ/fiscal/social disorders & disasters, rather than avoided and mitigated them, in their pursuit of ever more concentrated wealth and power.

Mission accomplished! Now its time to pay the bills…

The ex-middle-class manufacturing base of America, long on its knees, is now rapidly being pushed down onto its belly, into an open state of post-industrial peasantry, an interesting parallel from our own time-frame back to the industrial peasantry our Robber Barons originally imported and built their empire upon…and their descendents have NEVER been more powerful or wealthy… Hummmm…. They have a Solution! Enter the racism scam…

Well, getting rid of, “racism,” will certainly fix the fifty years of social-political-economic damages done to our country by the diverse forces of universal unrestrained international greed, and turn us from the Consumers of The Corporate Empire that we’ve become, back into citizens of The Republic… s/

If that does not work, then maybe the breaking of the biggest market bubble(s) in history, sitting upon an already impoverished and pissed-off (dare I say depressed?) population, might just do the trick.

The pin to this grenade is the market(s). The monoplizers of these crazy markets better keep the pin in, or we are going to have a great depression that turns to 1929, and says, “hold my beer.”

We are going to have social unrest that will make everything since the last Civil War look tame.

And, the breakdowns in supply chains and resource access for billions of people will trigger the next Great War, unless that kicks off first, before markets finally implode…

We are now moving from the, “asset-stripping,” stage of American elite policy to the, “blame it on something else,” stage, soon to transform into the, “real consequences.” stage.

Well said Alex. I agree with everything except that most are stupid. Most are smart enough to not argue with insanity and hysteria. You can blame the media for that insanity..

Their problem is that they have oppressed leaders in grassroots movements to the point of there being no real leaders. They have co-opted the grassroots movements and substituted stupid unthinking flailing anger directed by shallow pop-culture narratives instead of any real analysis. Which means that if and when the SHTF, when people are afraid of not having food and shelter, it will be mob mentality. No intelligent person wants to join a mob. It’s a vicious cycle and may end up be more dangerous than the alternative. They’ve destroyed constructive cross communication and created a monster.

They know it too. They still haven’t taken down the razor wire have they?

I expect some large crash, then the fed will give out money and bailout whoever and crush savers even more, forever more.

It will never end. I couldn’t believe they actually did the last stimulus. That made me understand that the system is changing in radical ways.

These guys are absolute idiots. They are going against all conventional wisdom and have bought into this MMT garbage. They will destroy the currency and the country with their reckless endeavors.

Maybe they are doing MMT right now. Pump out trillions in free money and raise taxes on the rich to try to contain stock bubble. Doubt if it will work.

If inflation gets out of hand Bezos’ and Musk’s wealth will go up in smoke. Zero interest rates tells you someone let the debt get out of hand and they are trying to keep all the plates spinning.

Name one time MMT didn’t work in USA. You can’t.

Timbers, name one time full blown communism didn’t work in the U.S.? Name one time that the laws of gravity didn’t apply in the U.S.

I sometimes think they are idiots and then sometimes think this is some diabolical plan. Either way, if you think a tree can grow to a thousand feet tall, you’re not being sensible. The ONLY asset the Fed is suppressing is Gold and Silver and they have secretly stacked enormous quantities of it. What does that tell you?

Old school, yes it is unofficially MMT right now.

Print unlimited money without any concern over devaluation.

Borrow unlimited money with an assumption no one needs pay that back.

Pump up the asset prices and then tax that artificial wealth.

RightNYer,

Burden of proof should lie with the MMT proponents.

But in the current clown world of ‘guilty unless proven innocent’, ‘sick until proven healthy’, these clowns will destroy this country and then blame it on bogeyman of their choice.

Don’t get too surprised. More stimulus coming and more extensions.

You’re so right. The aid will go on til the bitter end.

Escape the over priced big city housing for really overpriced suburban housing today! There’s a sucker being manipulated every day!

There are some facts missing from the article and the comments above. It is difficulet to draw an accurate conclusion therefore. First, there is no evidence of the empty 2nd homes that the Author claims here and in past articles exists. None. I’ve been in the industry 22 years and I’m not seeing it. The vacated homes are being sold immediately . I would love to see the hard data on this as it would be a great tool to leverage in understanding this market better.

Also missing is any commentary whatsoever on what is driving demand. How can one assess a market without studying this crucial component? Hint: look at the birthrate boom in the early 90’s.

Population surge of homebuying-age young adults, low rates, high commodity (lumber) prices. That is the working theory.

Paul Basil,

“First, there is no evidence of the empty 2nd homes that the Author claims here and in past articles exists”

Nonsense. There is a ton of evidence. In addition to a running ton of anecdotal evidence, there is data. Make sure you look at the charts:

https://wolfstreet.com/2021/04/01/the-explosive-surge-of-mortgages-for-second-homes-housing-bubble-math/

“Also missing is any commentary whatsoever on what is driving demand.”

Leading question with false premise: sales are down, mortgage applications have receded.

Anytime someone drags out demographics to explain what is happening “this year,” I stop reading. Demographics play out over decades not “last year,” or “this year.”

Wolf, looks like you’re landing more on more on RE’s or NAR’s radar. Wonder if they are putting you on the top list of people to watch out for to counter their predictable narrative, especially since I am seeing more and more of them in the comments lately. You and Randy Patrick gotta be pretty high on that list of NAR naysayers…

Paul Basil: Are you a real estate agent ? Just Curious.

Must be. They all parrot the same talking points. All BS.

Vacation homes that are not counted as primary residences are considered vacant by the Census Bureau. They may be near beaches, ski resorts, lakes, etc.

Houses being renovated without occupants are vacant. Houses held for speculation, but not for rent may be vacant.

There are one heck of a lot of vacation rental in Sonoma County and when AirBnB took off the effect on home prices in places like Sebastopol, Glen Ellen, Sonoma and Healdsburg were significantly affected.

I spoke with a number of other Agents and Brokers at the time and the increase in price was about 25% for homes suitable for short term rentals.

Rental prices were also driven up, and by more than 25% over a 3 year period.

Although I haven’t been active in RE for a couple of years I still belong to the MLS and still keep an eye on the market.

It’s not my first rodeo so when I see the clowns riding bulls I know the show is about over.

Like Wolf, I called a top several weeks ago.

Hey Tom

I remember a blog back during the last collapse “bayarearealestatetrends” that I think you wrote for awhile back. I forgot who was running it before but he was someone heavily into the shadow inventory. After he left some guy named Tom Stone kept it going. Is that you? PS: I went to Thomas Stone elementary long ago so the name always has a ring to it.

…”clowns riding bulls”… funny as Hell!

Paul

As I said before 75% of the home we appraise in Swampland are EMPTY. They are mostly cash out refinances. This may change as interest rates go up and refinances dry up. The ones that are for sale are way overpriced and don’t often appraise for the contract value, so the deals don’t always go through. So what I am seeing is exactly what the analytical data shows.

My family and I are moving to SoCal and we are one of those who can buy but refuse to jump into this crazy market.

In the process of finding a rental, we’ve come across 3 homes that are being rented by the owners who used to live there but just bought another house down the street. Anecdotal, but there you go.

Should I buy now before I’m priced out forever? ;)

This article above reaffirms everything I’ve been seeing with my own eyes. Since the pandemic hit appraisers have been forbidden to go into occupied homes because of the risk of contracting Covid-19. Exterior only is the requirement. But with all the empty homes unoccupied homes out there being refinanced on to extract cash the word “occupied” doesn’t apply so we’ve been actually GOING IN about 75% of the homes. That is closer to the true figure of the shadow inventory. When housing prices start collapsing because of rising interest rates and unaffordability issues, these empty homes will be dumped on the market, as the owners will find that owning two mortgages isn’t the greatest investment or even possible, especially when housing prices are plunging, rents are plunging, inventory rising, and job losses continuing. All the lemmings, that thought they were big time real estate investors, that got sucked into this Fed enabled malinvestment scheme are going to be in the same shape as those who were caught on the wrong side of the subprime fiasco in 2007. Enjoy

I look at buying a house as an investment- an inverse annuity. Just as an annuity pays you a fixed amount, owning a house fixes the amount you pay for a place to live.

Bad idea to use one’s house as a source of cash. It’s like selling an annuity at a discount for cash up front.

The new wrinkle is as prices increase to ridiculous levels, so do the real estate taxes. Those RE taxes make the paid off home unaffordable over time, because of the craziness. And that well planned retirement can derail, when you can least afford to do anything about it.

My parents house is kind of an interesting study in inflation. I believe it was built in 1956 and they paid $8,000 and had $44 payment on 20 year mortgage through the local savings and loan. That’s $540 per year.

They have made improvements but their taxes are about two times what their annual mortgage was. So is their cable bill. Overall it was a good decision to buy and stay put as they are in their 90’s and it still meets their needs. It will soon be a good 70 year home for them.

They all bought on fixed rate in the 50’s and 60’s, and then inflation took hold and wages went higher, but those fixed rate mortgages were money in the bank. In Ca Prop 13 went through, and if you limited your improvements to the foundation you never had to reset. I have some younger friends who bought after the golden age, and still got in on the low prices, but they kept layering on the permits and their taxes rise along with them. Then they REFIed out to infinity, they have a much nicer home, debt overhang, and a mountainous tax bill. I bought CEA because one good shake could crack the back of this 70 year old home. If it falls in I plan to collect the insurance, sell the lot and move on.

Refi house, buy bitcoin, buy stocks, get rich, buy mansion. We’re going to need a lot more mansions and electric lamborghinis for all these future rich people.

Nah bro, I’m gonna blow it all on surgery and my kid’s education, after the $2k iphone that is.

Yeah it’s a joke, and the Fed can’t help but make it even funnier bc otherwise their stupid economy would implode.

Thanks WR.

In San Diego County, I can tell you, sales are down if they are then only for 1 reason: Low Inventory. Every home listed is going thru bidding war and people are literally going crazy over real estate here.

The increasing rate or affordability or home prices are not the reason for low sales at least in my county.

And this is why it makes no sense, there is some other force we can’t see or know.

We are in a financial trap that has yet to be fully understood.

Prices this high should attract sellers, but that’s not happening.

I don’t think anyone really knows what is going to happen, but a lot of smart money people are worried. Ten million less people are working, businesses are having trouble hiring people, savings pays zero, sticks are crazy high, Fed is monetizing the debt and average Joe is on a buying binge.

Welcome to the Biden, it’s time!, Depression.

@Karl – remember Bid’n Harris!

“Prices this high should attract sellers, but that’s not happening.”

Indeed this is true in a healthy economy. But despite people’s generally idiotic outward appearance – politics, social wokeness, etc. – the instinct to preserve wealth has not been stifled.

Folks know that owning something NOW that has immediate utility, such as a place to live, is going to be a better bet than hanging on to currency (or worse yet, debt/bonds) or even business equity. In a way, this is the early stages of the mad scramble that is hyperinflation.

yes, Crunchy. that could be the mindset, and not a foolish one. but real estate is waay too hard to hold onto during a hyperinflation. unless you’re living in it yourself.

after the currency resets, those people will spend their lives in court trying to get the squatters out. in other words, real estate can’t be hidden. or moved. so a risky play.

Prices this high should attract sellers, but that’s not happening.

A combination of Covid, forebearance, and renters who are not going anywhere because of government policies has taken all of the lubricant out of the market. Wait for these policies to end.

The real inflation is also causing the price increases. The food inflation is so in your face now, it’s hard not to notice.

When the median income for an area isn’t enough to qualify for the median-priced home, the end isn’t far off.

I’m not sure that this is relevant anymore in certain parts of the country. When prices reach the point that the middle class and upper middle class can no longer afford to buy, investors seem happy to step in to take up the slack. Lots of SFH on my area are getting purchased and turned into rentals.

Wolf, do you have any idea what percentage of purchases this past month were from investors/landlords?

People buying second homes are investors too. People getting mortgages for second homes has doubled yoy. In addition, all-cash sales rose to 23% of transactions in March, up from 19% in March 2020. This includes larger investors that can borrow at the institutional level, or individual buyers that might fund the purchase with a portfolio loan and later get a mortgage and pay off the portfolio loan. Not all of the individual cash buyers are investors unless it’s a second or third home or whatever, in which case they’re investors.

The median home price in San Diego is un-affordable to median income earner for decades. I don’t see the end honestly.

A lot of the demand may be from parents refinancing on their own homes to raise cash to help their kids buy their first home.

Naw, a little dose of stimmy soma will get the plebs quietly back into their shipping container rentals. Who’d want to wake up from the American dream?

Agreed, but only in normal markets. Places with outside money coming will always be unaffordable, think Hawaii.

Median income can’t afford a garage there, all the workers live in their grama’s house w/ the rest of the family or in some kind of gov subsidized housing.

One more anecdotal evidence from San Diego: Most of the homes out in the market are put out by sellers bailing out on CA and moving to other low tax states

Is everyone still fleeing to San Ysidro or is that all full up now? Once upon a time that was one of the places where you lived when you wanted to cut costs.

There is no place in the US that better demonstrates the damage the Fed has inflicted on society than San Diego. Once it was a nice, affordable place to live. You could live the American dream. Now it’s a hell-scape of high costs.

I live in a neighborhood with a minimum home price of 1 million used.

Most of the homes are multi generation and ofcourse the quality of life has gone down quite a lot

Same thing happening in Seattle.

We looked at a home listed for $460k, eventually it sold for $580k. The house was livable, but needed substantial updates for our taste and we didn’t like the neighborhood either.

Even if the amount of folks buying second homes is cut in half, I’m not sure it will even dent this market. I’m also not inclined to think it will impact the market much (in Seattle at least) when people owning more than one home, decide to sell one of their homes.

Perhaps when those in forbearance and delinquent sell, it will make a impact.

I live about an hour south of Seattle and a 5 minute walk from the water. I’ve been here nine years, which is the longest I had a single address since I was 10 years old. My house has more than doubled in “value” in those nine years. That’s insane.

The house I sold back in the 90’s in CA is now listed at 900% more than what I sold it for.

My pay, as a top professional in my field, has about doubled in that time.

The FED is diligently destroying the buying power of my retirement and at the same time making sure the next generation can never afford to actually own an asset that should (theoretically) gain value over a lifetime of ownership.

Yep.. you are going to see a lot of two generational living situations for now on. The under 40 set should be livid.

I lived in San Diego in the 70s and people were crazy over real estate back then. And almost every year since then. Every party or gathering I ever attended seemed to always include a conversation about real estate. When I think of future problems for “America’s finest city” water availability if the 1st that comes to mind. The primary source being the Colorado which is headed for extreme problems. When I lived there the population was about 750,000. Now look at it.

SD Co. local governments put a freeze on development. Homeowners in semi-rural areas are nimbyism. The only development in my city is downtown high rise, something which never existed, and destroys the cities self image (and demographics). The Biden admin has a plan to open up these repressive zoning laws using incentives. SD Co. is the new SF, a geographically isolated quasi pennisula, ocean on one side, border on another, fire and intemperate zone on the other. This is also a med-tech zone, with government committed to preserving “quality of life”. There are many ways to play this build “in” including the spillover of wealth into Mexico. There are miles of trash housing, built in the 60s and 70s. Cash for shacks might be one program, then gentrify, gentrify.

Well the property market in the US & other countries is now a total scam perpetrated by the banks, it is the banks who decide property prices as they are the ones who say yes or no to a loan, look at the link below for this home in LA, Pacific Palisades, it is listed for $8,750,000, in Dec 2019 it was valued at $3,500,000, so the seller is asking nearly 3 times the value from Dec 2019 after the virus & a Massive collapse(Even though people pretend otherwise).

The fact is this is all a mirage, all asset values will collapse, it’s all a psychological game being played on greedy & stupid people who, the property should have gone from $3.5 million to $1.75 million on a good day, that is it’s true value, that is where it will be soon, even lower probably, maybe $1 million, the reason for all this crazy borrowing is to inflate the debt bubble to stop it from collapsing, it’s not gonna work, it is on the edge of a cliff about to go off.

I have looked at other properties in this area & the crazy prices seem to more a symptom of certain sellers greed rather than the market itself, I have seen properties which have reduced pricing from Dec 2019, so the fact is the prices they say have gone up to is false, some silly people buy at insane prices which will end up in default & the low inventory then keeps the median price up, these price increases are not real or sustainable, hope ya don’t mind the link Wolf, and I will add a star after my name cause I see there is another Jack commenting here also, check out this how below.

” … is now a total scam perpetrated by the banks, it is the banks who decide property prices as they are the ones who say yes or no to a loan”.

Very good point.

If you look at a site like Zillow and peruse the tax and sale history of a property for sale today, you will usually see on the historical property values chart for that property (and its neighborhood) a huge spike up that is current asking price compared to previous house values.

So I want to know how the lender is able to work out a viable loan for a clearly overpriced property. Are the property appraisers in cahoots with sellers and give the wink and nod to these bloated values?

Easy, they portend the property value has increased due to renovations. The latest sucker play in RE!

I don’t know, the fed broke the system. They keep giving money away in every way. Nothing makes sense anymore.

If the markets are up they lower interest rates, print money, and extend all benefits. If a couple has 5 million in assets but on paper makes less than 150,000 they get free money and their assets increase.

If a person doesn’t want to pay their mortgage or rent, they don’t have to and get enhanced unemployment with stimulus; and get to invest all that saved money on whatever they want- while bass fishing in some lake somewhere on some new boat pulled by some new truck…..

Meanwhile, a poor shmuck like me goes to work, pays the rent, pays off student loans, and has no debt…. keeps cash in savings, pays for childcare, well I’m not corrupt enough to make it in America apparently.

Hey now, not all bass fisherman are goobers with new boats and shiny new trucks. I happen to ba a saver that pulls a 96′ model Gambler with 2008 model Jeep Cherokee. I feel your pain though, it’s gotten out of hand. Somewhere along the way I saw the real estate market go screaming past me, and now if it doesn’t inplode, I’ll never own a home here. Let alone get to fish much. (South Bay Area CA)

I have just enough to buy a decent house, but most of the houses aren’t decent, and most are outright crude. Many of the painted ladies have bugs under their caps and sinking foundations.

We’re both in the same(bass) boat. In 2018-2019 I could just barely have squeaked into some dump around here, but you know the type, bad area, bad home. Or I move 1-2 hours commute time from my job. The value is gone and until it returns or we all get tired of being punished for saving money and having zero debt, revolt, all we can do is watch. My question is this: what could cause a card in this current house of cards to tumble? It seems like just one thing will bring it all down, a big stock market pullback, some more civil unrest, supply chain break down of needed goods/services? It seems so so so fragile at the moment.

I rented for two years when first married. I bought because of dear wife. I bought second home because of dear wife. I bought third home because of dear wife #2. Single for 15 years and back to a rented man cave. It’s better this way. Never felt really at home in over priced and over taxed sticks and bricks.

There is certainly a great amount of buyer FOMO now. The lower the inventory, the bigger the demand due to FOMO. The faster the rate rises, the bigger the FOMO until a point that the buyers can no longer afford it. The agents’ narrative today is buy now or never, you are guaranteed to see both higher prices and higher rates tomorrow. But that’s the same script they used in 2005. We all know what happened afterwards. Remember, agents don’t care about the buyer getting sucker punched. They also don’t care if the seller gets sucker punched. They only care the number of punches, aka the transaction volume.

Don’t care if buyers and sellers getting sucker punched? I would say not only do they not care, they prey upon it. The idea that real estate agent is your friend and looking out for your own interest other than profiting from their customers is about as comical and logical as counting on corporation to self regulate or a 3 yr old to self limit on how much candy they eat..

Soon we will get the 40 and 50 year mortgage. Just like the old 5 year car loans are now 7+ year or lease. Just wait and they will come out with the 100 year for ultra low rates

The difference between a 40 year and 30 year mortgage payment on the median priced home is only a couple hundred per month. That certainly doesn’t move the needle much when you’re talking $2,300 vs $2,500. The desperation is palpable.

And with that a whole new batch of players enter the field. Think about the ARM loans that caused all the chaos during the lead up to 08-09′. This could be the new manipulation ‘so thin it almost isn’t a real mortgage’ scheme. It isn’t the monthly cost it is what you could afford if the rates were stretched out

“It isn’t the monthly cost it is what you could afford if the rates were stretched out.”

I don’t know what you’re talking about. It’s ALL about the monthly cost.

What about 100 year mortgages? They have them in Argentina. J Powell would be salivating over the prospect.

FOMO is definitely causing a lot of people to make bad choices in my opinion. It’s safer to buy assuming you are not going to get price appreciation in a stock or house unless the supporting income stream is there because price appreciation isn’t guaranteed.

Speaking of FOMO, I got on the email list of a group that doles out foreclosures in the greater Tampa market. As with most foreclosure mills, they appear a little shady/creepy.

I look at the inventory every week out of curosity and they’re some of the most run down crack shacks you’ve ever seen. All overpriced by a min of $100K and they try to put lipstick on the pig by listing their “wholesale price” and the suggested “after repair value”.

You can tell if the FOMO is powerful and they get a lot of responses…a “price correction” email will follow 2 days later w/price going up $100K. This feels like the top (total mass hysteria) to me.

I followed up on a waterfront foreclosure through a different realtor out of curiosity. She said they had “11 back-up offers”! I believe those pending foreclosures are popping loose in about 2 months.

“And people are buying homes and moving into the new home without putting their old home on the market to ride up those prices”

Sounds like a lot of ‘oops’ potential in the future.

Shoulda/woulda/coulda sold…but didn’t. And now juggling two houses…

The difficulty with a mortgage or especially two is that you have committed to keeping the income flowing every month for 30 years. That’s a tough thing to do.

I’m going to complain to Redfin & Zillow because the didn’t make my house go up $10k last week.

Slackers.

It’s human nature that the smaller the supply, the bigger the demand. We saw that with toilet paper and hand sanitizer last year. Now we are seeing the same thing with housing. But everything will eventually normalize. Buying a home today is like hoarding toilet paper at 5 dollars a roll in 2020.

Does this mean all my kids might come back home cool

No, it means you might have to move into your kids basement. Bubble 2.0

Zero debt house paid off they all have massive debt house 2 cars kids in school Not the way I grew up

Back when rates were, what, 8 percent or more?

If people are financing home purchases, isn’t it usually a requirement of any lender that the property is inspected and meets standards? If it is a cash purchase, one would think the prospective buyer had a few brain cells to have the money to risk in the first place. Who buys a pig in a poke? Who lends money for a pig in a poke?

What is floated around here is a prospective slowdown of new construction. Some contractors are losing their shirts trying to complete fixed and firm bids with rising material costs. I’m presently building a 500 sq foot covered outdoor living area at my house and expect to have about 10-12K into it for just materials and that is with a contractor discount. If I had to bid it I would just double the costs, or work cost-plus with an hourly rate. My son bills out his electrician at $65 per hour plus materials and no one blinks an eye.

Electricians around here bill out at over $100/hr. Your son needs to raise his rates. Plumbers get over $100/hr too. And this is Texas, not California where things are out of whack.

My next door neighbor is a self employed master electrician. He’s so busy I never see him home anymore.

There is a training college here with an electrical program so the area is saturated with electricians because it is a great place to live.

If you charged $100 per hour here you would never get a call. It is different in every area depending on where you live.

It’s just a side business as he has a salary job for big bucks.

Weird. The land of milk and honey has double the real estate prices but half the wages.

DC, that is kind of off center. Around here, we can’t even hire a lawn service to do some landscaping for $65/hr. And 99% of those folks can’t speak English.

“If people are financing home purchases, isn’t it usually a requirement of any lender that the property is inspected and meets standards?”

We (from N. Cali) were looking to buy a sweet house in Tucson that we saw over the internet. (We had lived in Tucson before.) The realtor in Tucson pushed us to pay cash, saying that getting a loan from a bank would just be way too slow, and if so, we should waive the right for the bank to make an assessment as to the value of the house.

That right there convinced us that this was not something we wanted to get involved in. How, exactly, would I tell the bank I needed a loan but they could not be allowed to look into whether I was overpaying? And if the bank doesn’t care, isn’t that in itself kind a crazy?

The Fed has found a way to leverage forward home buying, by increasing the number of buyers while decreasing the number of sellers.

But at the same time the Fed is also leveraging forward home selling, by increasing the number of sellers while decreasing the number of buyers!

This option’s expiry date is not known.

This is exactly what is going on.. My wife and I have sold our home at a 95k profit, but a year ago we tried to sell and couldnt get but maybe a 30k profit due to a market of low ballers.. Fast forward to our apartment and the property manager stated she has never seen this… The last 10 new rental tenants just sold there home and the renter that moved out just bought a home. She also stated the renter that moved out shouldnt be buying a home because they were never current on rent… my wife and I are sitting out of the housing debacle until a deal comes along or I guess no home for us anymore. We have owned 3 homes over our 11 years of marriage.

There is nothing in inventory in my immediate area. Have been seeing an increase in people posting on social media asking about possible pocket listings they could try to buy. We saw a lot of houses move once prices regained levels that brought people back above water, that appears played out. Just anecdotal and from a non-RE guy.

Did a Turkish cryptocurrency disappear from the web? The financial director took the ship for I do not know where?

The entire space is one giant fraud. I will laugh heartily when the whole thing blows up.

1) The Existing Home Sales chart : take a horizontal line from 5.3M.

2) Split the chart. Triangle down/ triangle up and back to the dividing line. 2009 high was an UT. UT job was to send sales down to 2010 low, in a zigzag.

3) May 2020 was a test of 2010 low, thereafter sales popup, in a symmetrical way to Oct high.

4) When sales breached a downturn resistance line from 2005 high to Mar 2020 high, there was a “Premature” jump ==> to ignore.

5) Option #1 : the economy is strong. The economy is strong, but home sale will plunge and make a bearish horn.

6) Option #2 : home sales will make a new all time high, because there is much liquidity in the market. It will cause some kind of a German hyperinflation in the fomo brains.

7) In 2008 the chart made a reverse.

There have been many out of state buyers buying rental properties. I’m surprised it isn’t more but 14% of all Milwaukee rental homes are now owned by out-of-state landlords. (But I don’t think this house will be for rent, the Schlitz Brewing family mansion is for sale, $7m price tag).

I suspect much of the ‘shadow’ home inventory is generating rental revenue on Airbnb or similar to ours. Demand for inflation hedge driving this.

“Those vacant second homes that people have left behind when they moved to their new digs […]”

Do we really know that a significant numbers of these houses are vacant?

If you own two homes, and live in one, and don’t rent out the other, then one of them is vacant.

I’m aware of what vacancy is. I’m wondering whether there is any hard data about how many of these “second” houses are actually vacant. It would be useful as a gauge of sentiment.

Anecdotally, I’m currently a renter and have recently encountered a few people who are dabbling as landloards, and are really not cut out for it.

Another reason I think we’ve peaked, just anecdotal, but the listings are chock FULL of “flipped” homes.

I see a ton of listings where the homes were last purchased in 2020 or even 2021. You look at it on Google Earth street-view and see it before the fresh paint job. The bathroom and kitchen photos all have that same “pebble mosaic” crap from Home Despot. Please flippers, stop using that stuff.

I don’t blame them. In this economy, flipping homes has probably been a great way to make money.

But just like last time, when the music stops, some of these flippers are going to become reluctant landlords. The current Pinellas Co. Property Appraiser told me once “Every developer goes broke at some point.” I imagine every flipper gets stuck w/something at some point too.

This cycle has to end sometime and somewhere…..

The Census Bureau says home vacancy rates fell in 2020?

http://www.census DOT gov/housing/hvs/files/currenthvspress.pdf

The Census Bureau has been way off on this data point. During the Financial Crisis, this data became a joke.

I’d say 75% is a good guess based on my own personal observation

8) 2004 was a backbone. That’s why sales collapsed in Oct 2020.

Inversely .. as you know doubt know Wolf, that wonerful (to use the Ed Sullivan locution..) deals happen during times of econ woe. The best decision for us .. was to by a fixer from an SnL just before the commencement of that most ceremoniou of events ..

the DotCom Crash of 2000. The loan rate, as I recall, was somewhere in the 7.5 – 8 range. This was the 2nd res. we owned, selling our 1st for @breakeven (after a decade of dealing with neighborly funky goings on. Sold the second one for 2.5 times what we initially bought it for, moved outta HellCal (sorry)… purchased a dreamscape res. that didn’t, for various reasons pan-out , and sold it 8 mos. later .. again@breakeven, cap gains penalty goal achieved however, as we simultaneously bought .. uhh, a ‘downgrade’ at the top-o-the-mark … only to witness the Awesome House Crash of the 00’s.

It’s a circle of life thing, kiddies!

Have handled real estate closings for 35 years and been through two to three previous real estate bubbles and the resultant fallout – this one fells different, as I agree with a previous commenter that the FED will certainly keep printing in a attempt to prop things up as long as possible – to my thinking hyper inflation is coming – it may already be here, as there is an urgency to purchase assets (and shed the dollar) I have never seen.

One of the reasons I want to buy is so my savings doesn’t disappear in a puff of smoke. But that’s me and I don’t believe the average person is thinking they need to get out of cash–do you? I know people who have bought recently, but getting out of cash wasn’t one of their reasons for doing so.

Investors may be thinking this way however.

Good point.

Speculators maybe. Long term investors probably were using cash to buy in 2009. Anyone spending cash to buy into the housing or stock market now certainly isn’t buying low and selling high. At best buying high, hoping to sell higher.

Is it that the houses (or most anything tangible) worth more, or is it that the Dollar is worth less?

That was not an issue in the real estate run up to 2007.

I sometimes think this won’t stop until Nancy and Joe get their faux televised gravitas State burial ceremonies in the Rotunda. They can’t let this Ponzi tumble until the old guard is shown as having fought the good fight for 5 decades, and the fault for the crash lies with whatever regime comes next.

@Wolf – Could it be that a lot of the second homes that are being purchased are from people who were living in states where they can now sell 1 home and buy 2 homes elsewhere? I live in Houston Texas and many people from California are flush with Cash driving up prices here and buying a second home to rent out with the money they sold their one home in California.

It’s not a second home if they sold the first one. WR’s proposed scenario is that an owner-occupant buys a new house but does not sell, or even rent out, the house she moved out of, instead choosing to sit on it as its (potential, unrealized) value increases.

I mean to say that 1 home in california can be sold and then a person can proceed to buy 2 homes in Texas easily with that money. With the pandemic, people are moving out of these expensive states and buying 2 homes with their money in another state. Would it not count as a second home if after purchasing the first in Texas they buy another?

Freddie Mac just released a new report that the US housing market is 3.8 million short to meet the present demand. The demand is likely to increase, given the improving financial picture of Generation Z in employment and house buying. According to Freddie Mac, the shortage has increased 52% since 2018.

On top of this, we have a govt who has triggered a massive hard asset run with ludacris financial policies.

Participating in a buyers strike is futile and stupid.

Uh-huh, sure. Yet we have millions in forbearance not paying mortgages. So much for all that “demand.”

SocalJim,

What gets me with this “3.8 million shortage” nonsense is that in 2019, there wasn’t a shortage, and in 2020/21, suddenly when household formation stalled and population grew at possibly the slowest rate in history, suddenly there is a shortage of 3.8 million homes???

Someone isn’t adding 2+2. What there is – which is what I have been pointing at for months – people are buying a home without selling their old home, and they’re riding up the price increases on both homes. And one of those two homes is vacant. That’s not a “shortage.” That’s housing speculation.

Once investors buy homes and keep them vacant for speculation purposes, no construction can ever keep up with global financial demand for an asset class.

The “financial policies” you’re worried about, they’re coming from the Fed and are monetary policies, in form of $3.5 trillion in newly printed money, most of it under the prior government. That’s when all this started. You’re getting your calendar mixed up.

Considering that the number of excess deaths in the U.S. in the Covid pandemic is in the hundreds of thousands, that about two-thirds were among whites likely to have been older and likely to own their own homes, one would think that the number of homes coming on the market due to owner death would have been significantly greater than usual, perhaps on the order of a hundred thousand.

I love you SocalJim. When I finally give in to my FOMO and buy a crapshack and overpay by a lot and waive inspection or contingency just to owe that American Dream, I’ll give you a call so I can have someone to reassure me I am making a smart decision.

Having SocalJim as advisor is the new American Dream.

And yet, having Socaljim as your advisor is probably an improvement over all the other advisors.

Socaljim was trained by Lawrence Yum in the art of peddleing Bull s$it.

Nothing stupid about not spending $1,000,000 on an ancient 2 bed, 1 bath “cottage” draped in utility lines.

Secondly, the long term cap tax gain proposal will freeze supply in the high end of the market. If you have a CA home worth 3.5M and have zero W2 income, you will lose more than half of that to taxes.

Best off taking a second on that for a down payment on your next home, then make your old house a rental. Any other move is just stupid.

Also the local real estate taxes, mortgage interest and repairs are deductible on IRS Schedule D.

Sorry make that Schedule E,

Sell now before the new tax kicks in, no?

That’s the correct answer.

“Secondly, the long term cap tax gain proposal will freeze supply in the high end of the market.” I get a kick out of articles predicting doom and gloom If we tax the rich and they leave. Let them and good riddance! As I’ve long stated, driving the rich out of London-NY-Boston-Europe-America-Earth is the best thing ever that could happen to working folk because our communities will become affordable and the rich will no longer control our government. Tax the rich out of existence and return to the good days of 91% tax on the rich and watch our economy soar like it did when we taxed the rich heavily.

Thank you! Finally somebody making some sense re: boogie-boogie-boogie, mean old handsome joe is gonna raise taxes on the 1%.

I saw a graph years ago that showed how the % of total federal taxes paid by corporations and people had flip-flopped. Instead of corps paying the bulk and people the minority, share, it was reversed.

Which makes perfect sense as none of us have K-Street lobbyists who are writing the tax code for our benefit. The wealthy have had their way w/the USA for decades. Enough is enough.

Pay your fair share. We can’t afford to continue the madness that got us “here”. It’s not a donkey or an elephant thing. It’s a survival thing. Go check out the bring a trailer website….somebody is buying a $200-$300K car on there constantly.

The wealthy will be OK even if they have to pay more….

“The problem with socialism is that eventually you run out of other people’s money.”

– Margaret Thatcher

Another piece of bad advice from one of Lawrence Yum’s interns. Making decisions based on tax laws that have not even passed Congress.

I finally own twelve houses and I’m considering buying a hotel. Buying the hotel would help the housing inventory shortage by returning houses to the bank for subsequent sale. But just like 2009 I’ll lose half of what I paid for the houses.

It all looks like the prices are going nuts but is it?

The increase in nominal value, is it because these things get more expensive or the buying power of euro’s and dollars just halfs about each 11 year?

Go back for longer e.g 22 years and many houses quadruppled in price. Or compare with 33 years ago and an 8-fold increase may exist, just use zillow to see it is not a far fetch.

A relative of mine grew up in a house in Europe that his parents bought in 1966, 55 years ago for $10000 value in local currency. Current value is 520k euro = 642k$. That would have been 66 years if we follow the price doubling every 11 years so reality for this property is even higher price inflation but it may be an exception.

So bottom line is, we are all navel gazing about increased prices whereas in reality, it’s just devaluation of the currency.

And with current monetary impasse, it does not look like the devaluation of currency, usd, can, euro may actually go faster.

I keep thinking about the guy in Germany in 1920 who borrowed to buy real assets. In 1930 he was one of the richest.

Can it be that more people think along those lines when buying a home with fixed rate mortgage?

I for one don’t have that objective but I do like to keep the value of my assets…

Long end of bond market is pretty smart and it isn’t seeing a booming economy. Can’t say for sure but I say it’s going to be like most debt bubbles and will result in an asset bust. Probably because the Fed is going to be in a tough spot and will get ran over by market on the way down.

It’s frequently said that the long end market is smart but is it really? A big part of it are pension funds & SSA, insurance, central banks. Most of these are invested for regulatory reasons and not for optimizing real returns. While investors like Druckenmiller (who could at least from the rearview mirror be called smart money) are short long maturity.

There’s an argument to be made that using a liability (fixed interest rate mortgage debt) to hedge against inflation actually makes it a rewarding asset.

What is dodgy about this assumption is that it leaves out all the nasty surprises that can spoil this magical thinking– like when in a currency reset (it is coming) debt values get adjusted up accordingly (you didn’t think the bank/lender would be left holding the inflation depreciation bag, now did you?)

Not to mention skyrocketing real estate taxes, insurance costs, and maintenance.

For background, I live in Austin in a relatively new 500ish home neighborhood with about 20 homes on my street, all of which are – should be – about the same price give or take $100-200k.

Under two years ago my home appraised for $650k. Two weeks ago a home on my street sold for $1mm. Another sold for $1.2m, but that fell through when the buyer visited after having bought it sight unseen. Last week another neighbor sold to the founder of a well-known tech company for $1.5m.

Just stupid money.

The only valid reason for the decline in sales is severe lack of inventory. The rest is irrelevant.

Market is red hot but there isn’t any inventory left.

There are two major headwinds I see:

1) the end of the moratoriums should increase the inventory

2) investors who bought a lot of houses pre pandemic to do Airbnb must be severely underwater by now.

Will see how this plays out.

Inventory rose, sales went down.

Yes, inventory of houses is very tight. But there is plenty of condo inventory out there. There is no shortage of condos on the market. And still, condo prices jumped 9% yoy. This market is full of distortions.

Tight inventory doesn’t matter. Housing has become unaffordable. That’s the show stopper. Everything else is noise. Nothing the Fed, the administration or anyone can do about that. We’re putting that comment in all of our reports.

The whole “houses are for sitting vacant and appreciating” strategy is apparently working in China. I read that 90% of Chinese households own one home and over 20% own multiple. They keep building empty units and selling them and the prices keep going up.

I’ve seen an argument that this trend will become entrenched in the US too, except that it would mostly be a wealthy minority owning everything. In China the argument is that there aren’t many good investment choices so real estate booms by default. In the US the central bank and government policies are eroding opportunities in various markets so housing here will become primarily an investment vehicle as well.

I hope that doesn’t come to pass but it wouldn’t surprise me. When’s the last time the US government ever said housing prices were too high? Never. They only talk about affordability being a problem, which is different because that can be solved by heaping on more debt, which of course drives housing prices even higher.

In China there are no property taxes so to hold a second home costs little to carry.

Chinese prefer new homes, so those holding second homes leave the cement walls, floors, and ceilings, unfinished.

One would almost get the impression that the government is run by bankers, what with debt being the solution to any problem.

Hit the nail on the head.