Who’s going to be the sucker? Even the SEC, which has been asleep through all this, warns retail investors. But in the current mega-bubble craze, no one gives a hoot about anything anymore.

By Wolf Richter for WOLF STREET.

SPACs – Special Purpose Acquisition Companies, or more descriptively, “blank check companies” that have no operations – have accomplished a huge feat that fits seamlessly into the current mega-bubble craze.

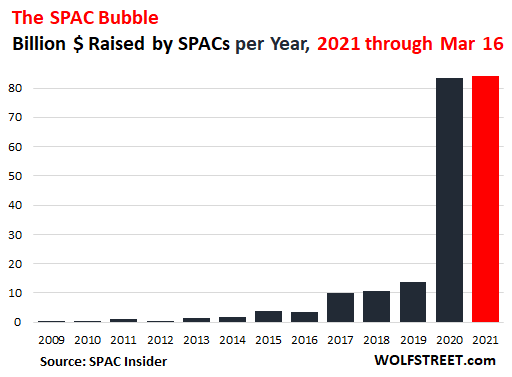

So far this year, as of today, 260 SPACs went public and raised $84 billion with their IPOs, according to data provided by SPACInsider. This is a big moment because it exceeded the total amount raised during the entire year 2020 of $83 billion, which itself had been six times as large as the prior full-year record in 2019. At this pace, SPACs are forming the next WTF chart of the year:

In the IPO, a SPAC sells shares and warrants that then trade separately. SPACs have no operations at that point. They’re an entity stuffed with the funds they raised in the IPO, looking to acquire a company, such as a startup, within two years normally. After the acquisition, if approved by investors, the SPAC changes its name to the startup’s name and changes its ticker. In this manner, the startup can go public while avoiding the arduous disclosures and scrutiny a traditional IPO filing entails.

This arduous scrutiny was put in place to protect IPO investors. However, investors don’t give a hoot about protections anymore in the current mega-bubble craze. No one gives a hoot about anything anymore as long as this stuff goes up. See cryptos and NFTs, and well SPACs.

Dozens of SPACs that went public this year and late last year have either been created by, or used as figure heads star athletes, Hollywood celebrities, celebrities of all kinds, the former Speaker of the House Paul Ryan, former Commerce Secretary Wilbur Ross and, of course, Larry Kudlow, rapper Jay-Z, Gary Cohen, who was also President Trump’s chief economic advisor for a while, and Chamath Palihapitiya, former Facebook executive and current god of the traders hanging out on Reddit and Twitter, who has listed six SPACs so far.

In order to be someone, you have to create a SPAC and sell the shares and warrants, and get it listed, and ride the SPAC bubble and draw in retail investors.

The SEC warned retail investors about SPACs last week, yes, the SEC that has been asleep through all this and that is still asleep.

“SPAC transactions differ from traditional IPOs and have distinct risks associated with them,” it said. “For example, sponsors” – celebrities, ex-politicians, or other backers – “may have conflicts of interest so their economic interests in the SPAC may differ from shareholders.”

“SPAC sponsors generally acquire equity in the SPAC at more favorable terms than investors in the IPO or subsequent investors on the open market,” it said. “As a result, the sponsors will benefit more than investors from the SPAC’s completion of a business combination and may have an incentive to complete a transaction on terms that may be less favorable to you.”

“Even if a celebrity is involved in a SPAC, investing in one may not be a good idea for you,” it said.

The SEC also sent a series of Tweets into the wild yonder at the Investor Advisory Committee Meeting on March 11 that included further morsels:

“As the volume of SPACs transactions reaches unprecedented levels, staff is taking a close look at the structural and disclosure issues surrounding these business combinations.”

“We’re seeing more evidence on the risk side of the SPACs equation as we see studies showing that their performance for most investors doesn’t match the hype.”

“Many investors and commentators significantly misunderstand SPACs and their costs, particularly the role of warrants and redemptions in increasing SPAC costs, and how merger agreements can leave investors bearing SPAC costs.”

“The SPAC panel is considering implications of the current market trends in valuation, acquisition targets, alignment in versus conflicts of interest, quality of disclosure, and litigation.”

One of the issues is the special treatment that investors get: If a SPAC that has gone public at $10 a share six months ago announces an acquisition, and its shares tank upon the announcement, investors have the option to withdraw their initial investment at $10 a share. This insulates them from losses. But retail investors that bought their shares in the stock market at over $10 a share lose the amount they paid over $10 a share.

So a hedge fund got shares and warrants in the IPO. Months later when an acquisition is announced and the shares jump, the hedge fund can sell the shares and pocket the profit. But when the shares tank upon the announcement, the hedge fund has the right to withdraw the cash of their initial investment before the redemption date. In other words, they sit on a risk-free investment with the potential of a high return. Retail investors that bought the shares in the market for over $10 can redeem them at $10 before the redemption date, but will lose the amount they paid over $10.

And SPACs haven’t done all that well. Despite the mega-bubble, the Defiance Next Gen SPAC Derived ETF [SPAK] has dropped 14.5% over the past four weeks.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It will be great fun watching SPACs and crypto frauds circle the bowl in the end.

SPACs look more like a shorter term scam to me.

Agreed.

SPACs and crypto are the outgrowth of entirely different trends.

SPACs are benefitting from a foolish overload of money into an already overstuffed equity mkt (see idiot PE ratios). SPACs become just another bucket for equity money to slosh into as other goofy high PE sectors predictably crater…with thousands fewer stocks available relative to 2000…SPACs have simply become tulip blind pools (with warrant gaming built in).

Crypto has risen because DC has aggressively degraded the dollar for two decades to save itself. Any given crypto may be a bad idea, but the underlying impulse driving them all is real.

Then why isn’t gold going up? No crypto’s are speculation and chasing greed.

gold isnt going up because it has been trading as a commodity (for the last 40 years) . don’t look to gold price as any type of indicator. just wait for the market to fail.

Cas127s point holds. there’s an aspect of the ‘hard money’ belief in cryptos. (but they’re still gonna fall off a cliff [smile])

Cas127,

I agree! I have been saying for about 6 months now that this is a new world. Crypto is at the center of this belief. We have left reality! We also need to look beyond our borders and think Globally….Crypto is a global happening!

C

Bitcoins’ value at the moment is up to China and the CCP. 65%+ of bitcoin mining is in China and it’s used to funnel money out of China. The CCP tries to prevent as much money as possible from leaving the country. Even if bitcoin mining yields a negative return on paper (in near future), most of the Chinese miners will continue unless the value falls drastically or if a better way to get money out arises. At any time the CCP can also actually ban bitcoin.

There does have to be a buyer on the other end of this money funneling as well.

While China isn’t responsible for bitcoin, the Chinese pulling out would be a very major price shock that could collapse the market value and confidence.

Alot of crypto advocates don’t seem to get the main reason why bitcoin can’t last is that it’s not unique and has no backing, there’s alot of alt coins out there and many more will be there in the future. The alt coins are the main reason why bitcoin can’t hold value long term. Analogies to computer standards don’t hold because it’s difficult and expensive to support multiple standards for computers such as http, on the other hand many places that accept cryptos, can easily support 100+ cryptos. Gold and silver are unique elements. Even fiat has the interests of major economies behind it (which may not always be enough, but it’s something).

Bitcoin could have a resurgence in the future (after a crash), but will lose steam then again too. It’s also possible that for various reasons such as money funneling Bitcoin and other alt coins could emerge in the future that skyrocket and eventually crash.

These SPACs should be outlawed. Can anyone explain any useful purpose that they serve?

Make rich people richer, is about it. The same as short selling. However, if banning them ever gets proposed to congress, I’m sure they will bring up that a small amount of money produced from it, made it to some average jo’s pension fund.

they serve the purpose of VC finding muppets to take the risk.

VC gets out, its free money without the oversight of an IPO

its sole purpose now is to fleece more sheep

You could say the same about moderm art.

https://www.bbc.com/news/world-us-canada-50704136

By the way it was a real banana, taped to the wall. It was not even food art, aka food shaped like art that can be eaten; just a banana taped to the wall.

Will the Fed come in to support these “vehicles”?

And if not, why not?

Should they?

Should they support any equity or bond? Who decides?

Loose money promotes so many bad actions. And the bad actions OFFSET any stimulative effects. For every action there is an equal and opposite reaction.

Waiting for the Cardi B WAP SPAC.

Plans on acquiring a nationwide chain of cat washing facilities.

Wouldn’t cat drying facilities be more appropriate?

Actually cat disinfection facilities would be the most appropriate/socially responsible.

Cas127,

Especially, if work from home actually lasted, I wouldn’t assume anyone in that household washes or gets washed. Cat food companies, however, will be become the new unicorns.

Fed’s easy money bubble is going to face one ugly truth about human beings that it hurts more to lose money, than it feels good to make money. Once the pain gets going, it’s going to be ugly.

That is true, but I think FOMO is the highest level of discomfort that novice investors face. A market crash is OK, because everybody loses. The fear of getting left behind, by yourself, is what drives the stock market and the housing market. I think this fear is particularly strong for the millennial generation, which supports teaming and pack-like behavior.

Money/Wealth is CREATED. SPAC’s, Crypto may be more volatile, still it can be a generator.

Heck no, it will not be fun at all “atching SPACs and crypto frauds circle the bowl”, because we will all get to suffer from the losses.

These frauds should have been stopped years ago, but Wall St has never seen a fraud it did not like.

Crypto should have been snuffed out immediately, or at the very least once Silk Road was shut down. Bitcoin was funding that entire operation.

I saw on a Lance Robert article the 16 characteristic steps of the speculative cycle. The last step before a crash is “complacency leads to fraud and manipulation”. We are definitely there.

As you get older you realize you hopefully learn to do due diligence on anyone you hand money over to for a major purchase, especially financial assets. Everyone is there to make a profit on the transaction and you should be sure you are getting value for your cash.

In the momo trading with animal spirits encouraged Fed’s loose money policies no one care for VALUE. as witnessed since March of ’09!

Imagine where the mkts would be without Trillions of QEs and buy-back shares!?

May be the fear of expectation higher inflation, will get the attention of the Fed. Until then party on!

Powell says he is going to give us plenty of warning, so go all in and sleep well.

The FED has engineered the biggest speculative orgy in history. The fraud is off the charts. They should be ashamed for what they’ve done, all in an effort to prop up asset price bubbles so their buddies don’t have to lose on their bad bets.

Fed is the cartel for Banks and their friends at the Wall ST! Nothing secret here.

The current, 3rd largest ‘everything’ bubble was created as a ‘cure’ for the previous boom-bust cycles in the century!

Like all bubbles this will meet the same fate. If DEBT could provide prosperity & wealth, there would be no poor in the world!

It’s a close call with John Law and him trying to paper over the war debts of France. There seems to be a clear lesson in all these fiat money schemes as they buy you a few years of fake prosperity, but make the bust truly one for the history books.

If you are an addict admit you have a problem early on and don’t deceive yourself that everything is ok.

Hey Wolf, love the work that you do and data that you are able to dig into.

I wanted to push back on this comment here “retail investors that bought the shares in the market get to eat the losses”. This is not an entirely true statement in my personal experience with SPACs, but is definitely true in post-SPAC. While there are few ways to win and many to loose, an investor buying in the market will have the same redemption rights as those who bought in during the IPO (assuming that redemption date hasn’t passed). The big difference is buying through the IPO you are getting units (combo of shares, warrants and sometimes rights) where a lot of the retailers are buying juiced up shares and warrants after the deal announcement. The shares are redeemable at issue price (normally $10.00) plus interest earned. If/when retail buys juiced up shares or warrants, they are risking way more and will likely get burned. And these ETFs that are holding post SPAC companies will be on the front line for this. There is one SPAC ETF out there that looks like it is only holding pre merger SPACs which I think is the better way to play these.

With interest rates moving back up it is becoming easier to find units that are trading for less than cash. Far less risk IMO, split out the units, sell out or redeem the shares for a small gain and take the free ride with the warrants.

Anyhow thanks again for all of the great stuff!

Cheers!

“Even if a celebrity is involved in a SPAC, investing in one may not be a good idea for you,” it said.

wait a second here. i thought i could trust celebrity investment advice, it’s not like these celebrities are shoeshine boys. they are legitimate influencers!

I dont know about you, but I need to know what Whoopi Goldberg thinks…

/s

For god sakes, don’t encourage them…CNBC will give her a show.

It would just be the latest in a long line of CNBC’s crimes against finance.

Sounds just like another ponzi to me

We are currently arranging for the IPO of our newest SPAC, BitKoined, plc, which will exploit opportunities in the blockheadchain for profit and fun. Get in while you can before it’s too late.

“We are currently arranging for the IPO of our newest SPAC, BitKoined, plc,”

I do not like that name. Please change it to BitCon Plc, and I’m in if Whoopi’s in.

Count me in to! My stim check has already been spent.

Lisa

You meant, BitConned, surely.?

Forget the SEC “warning” about SPACs… how are these things even legal???

Casinos don’t just have slots. They also have poker, blackjack, roulette, craps, etc. The stock market needs more games too. Variety is the spice of life!

Mate, it’s modern business culture that makes this possible. There is a whole infrastructure dedicated to bringing rubes into the zoo. There are few contrarian views (such as Wolf St) and 24/7 talking heads telling us all that this is a completely normal investment environment.

There are few contrarian views because that would be unpatriotic or talking down the economy. There are no judgements about whether a particular investment is historically worthy or has a clear path to future profitability due to ever shortening news cycles and short memory syndrome. The everything bubble seems to have the consent of the establishment. In such a permissive environment anything is possible.

That chart tells it all. We are really in the blow-off phase of a bubble.

It also shows once again how rigged the whole system is. These SPACs are really designed to circumvent protections to the general investing public. But when policymakers themselves are personally benefiting, of course nothing is done to stop this madness.

Like the Roman senators that sold out the republic, these “policy makers” think they will survive when the empire gets sacked. The barbarians are already at the gates.

All of these guys are already set up with “plan B” and “plan C.” They have compounds in New Zealand, Argentina, the Caribbean, etc. They can fly away at a moment’s notice. Unfortunately for them, the world is a much, much smaller place due to technology. There’s nowhere to hide, and once the whole thing implodes, the countries they flee to will not be interested in sheltering them. They will be finished.

People know about those compounds. They’ve already failed in their purpose. The point of a secret bunker is to be secret. They can run to space, but unless they take all the missiles, rocket fue and what have you with them, they will be a big floaty target.

1) 2007/ 2009 collapse was 1932 Schabacker Horn. // Feb / Mar 2020 plunge was Schabacker Horn.

2) Sport medicine experts hang a chart of the “anatomy of the

spinal cord”.

SPX have a spinal cord :

3) There is an open space between the fused area of Schabacker Horn, between early Mar 2020 and Apr 2020.

4) There is also an open space between Feb 2021 and Mar 2021, SPX crazy head. There is a line between them. This line is SPX spinal cord.

5) SPX spinal cord go through the tail bone to S1 – S5, to : L1 – L5, through :

T1 – T12 and then to the head, to : C1 – C7.

6) The pain is coming from the space between each vertebrae. Not from the bones. The fractals are less important than the nerves system. Measure the distance between those spaces.

7) For next move measure the distance between SPX crazy head and

the tiny spaces between T1 to T12.

8) Options for a swing trade : measure the space between Feb/Mar 2021 and Oct/ Nov 2020. or Sept/ Oct 2020…

9) For a longer duration options : kick from your ass, go all the way down to Schabacker Horn tail bone.

10) Shift those distances to the right, for a trading range.

11) Swing slightly down, for correction options.

12) Sharply down for Schabacker plunge.

Suggestion: Have someone read this to you in the calm dusky dawn allowing you to close your eyes and simply savor. Ah… Pure poetry from what will someday be considered Engelish’s internalized 3rd period, not to be confused with his early external dying of the light linear collisions. Kick from your ass and feel the correction options wash over your face!

Ah….

I love reading Michael Engel’s post. I can’t tell is they are a sort of mocking ironic metacommentary, or an earnest attempt at sharing some proprietary technical analysis insights he developed, or the rantings of a crazy person, or a joke, or serious, or what. But always interesting. I can’t make heads or tails of it.

“I enjoy talking to you. Your mind appeals to me. It resembles my own mind except that you happen to be insane.”

– George Orwell

ME is a bot.

Petunia,

He is not because he got pissed off at me once or twice for deleting a comment that ran afoul of one of the guidelines (political I think). Bots don’t get pissed off. Humans (who care) do.

Kick from your ass is Roberto Carlos soccer

CC, you are not the target of my comments.

1) Snevelgasker might agree, if volatility permits.

2) Run the numbers through a Wyler chart, if M1 > 29.

4) Leveraged trades like those of the late 90s, may repeat.

7 ….

It’s a small club…and you aint in it.

“So a hedge fund buys the shares in the IPO, and months later when an acquisition is announced and the shares jump, the hedge fund can sell the shares in the market and pocket the profit. But when the shares tank upon the announcement of the deal, the hedge fund has the right to withdraw their cash of their initial investment before the deal closes. In other words, they sit on a risk-free investment with the potential of a high return.”

Anybody else dreaming for major jail time for people like Bernanke, Yellen, and Powell ( the couterfeiters), and all the regulators “in the pocket” of their rich corporate friends (SEC).

I sure am. But don’t count on it. That’s why George Carlin in his famous “It’s A Big Club” routine said:

“That’s why they call it the American Dream- Because you have to be asleep to believe it”.

After doing my tax returns, noticed my interest income is going to be near zero in 2021 compared to last year’s. I love Powel stealing my money so he can give it to deserving casinos like GameStop.

And what’s going to happen when rent eventually is no longer free?

Paul Craig Roberts and Michael Hudson at NC have a brief article regarding how we need to zero debt that can’t be paid, to get us out of this mess the Fed & Co have gotten us into. They don’t say it, but that must be accompanied by normalized interest rates, no more bailouts, ending stock buy back….thing like that, so we don’t get re-addicted to debt.

Bankruptcy works fine in eliminating debt that cannot be paid — at the expense of investors who got paid to take those risks, rather than taxpayers.

But bankruptcy has costs which inhibit the return to growth that Roberts and Hudson say their ideas promote. And not all will seek bankruptcy, and it’s really not possible for student loans except at extraordinary effort.

They are talking only private debt, because public debt has never been a problem on the same scale because MMT.

“No one gives a hoot anymore”….very, very true and very, very sad. This poignant comment, from my view, supports what I have said before before and, quoting Carl Jung to some extent….”Houston, we have a problem of the spirit”. People that believe in nothing will do and believe anything. I fear for the tragic events that this attitude will soon unleash. Many innocent people will be hurt. Theoden, King of Rohan: “how did it come to this”…

Wolf

For every debt, there is a lender expecting a income stream + return of the pricipal. that lender, could be, banks, pension plans, MFunds, Institutional & retail investors++

Who is going to declare bankruptcy, when 20% of S&P are zombies supported by Fed/Cbers?

A DEBT has to be paid, written off either bancriptcy of lender or the borrower. Then who is holding the bag in the end?

Taxpayers just like last time. It is NOT by accident but by design!

We are too deep in the rabbit hole!

The investors were part of the problem. If they truly believed in a free market they’d take it on the chin. Or does this mean we all need to admit that the game was rigged from the start?

They made Steve Mnuchin serve four years at Treasury.

Buying into a SPAC is no different than sitting in on a friendly game of poker.

If you can’t spot the sucker in a poker game in 3 minutes, the sucker is you.

Desperation investing and yield chasing….

because there is no Fair return on fixed income…

What is “fair”? What was “normal” was Fed Funds equal to or in excess of the inflation rate.

What was normal was a Fed that fought inflation rather than promoted inflation.

What was normal was a Fed that only added liquidity in illiquid times …and temporarily. Now they “digital mint”….. and not a word.

No its not desperation investing! “New Age” investing. Thank God the USA has the wealth creation mentality. Yes, some people will get burned. Not all will.

Ponzi?

Yep. No audit, no oversight and Tulip Mania symptoms.

And, the Fed is pumping at full speed.

“Round and round it goes; where it stops nobody knows.”

Cheers,

b

“No audit, no oversight ”

Not even a requirement to meet their THREE mandates….

Not even a restriction of their self authored powers…

Not even a complaint about PROMOTING inflation…which is a taxation, by a body of which we have no representation. Taxation without Representation…..sound familiar?

And what of the Fed going from providing liquidity in times of necessity, to “digital minting” (m2 up 27% in under a year)..

I thought Article I, Sect 8 gave Congress the minting and taxation powers…how did it move to a body out of the control of the People of this nation?

Yep.

SPACs, “Speculative Purpose Acquisition Cons” are just that Ponzi schemes.

They have no inherent value, payoff only for the initial scammers, and depend on suckering other greedy bastards into the scam.

They are doomed to succeed in this “market.”

Like bitcoins, the true advantage of SPAC is they do not have any current or future operations. Therefore they cannot be valued. In other words, they can go up as much retail investors think.

Why would anyone care? Just ride the wave. Show is fun. Isn’t it?

“Therefore they cannot be valued”

Don’t slander BitCoin/HonestDollars…what operations/income streams attach to USD cash?

1) The “store of value” function doesn’t require operations or cash flows…simply an honest, stable supply

2) There is no reason why loans cannot be arranged and interest (ie, cash flows) paid in BitCoin/HonestDollars.

You’re obviously a Bitcoin investor – don’t try to rationalize the crypto craze – it’s for suckers who think they’re smart – perfect for this generation of fools

Have to disagree on this count. Crypto is a global happening and has a future.

The reasons are vast and political so I’ll refrain as per Wolf’s rems of service but this is not going away.

C

I am a BTC invester and have no faith in BTC. It’s all a bubble and have no value. Same can be said about Gold though. Gold persisted as store of value for long time so can BTC. Problem with BTC is: Any Govt can shut this down very easily for common joe as it needs IT infrastructure to access BTC generally.

Actually I am not a BitCoin owner…just a hardbitten US dollar cynic

re: “Like bitcoins, the true advantage of SPAC is they do not have any current or future operations.”

Not true in every case. I sunk my ‘fun money’ in Virgin Galactic (SPCE) a little over a year ago. I’ve been a ‘space nut’ since I was a kid growing up with Mercury, Gemini and Apollo–early dreams of fighter pilot and astronaut-hood were dashed by inadequate eyesight–and VG is actually building operations (their spaceport is complete, as are a couple aircraft and the launch platform, and they’re working with the FAA to pioneer the logistics of high-altitude missions). Rode it up, down, then unloaded it during the last rise.

Sounds like Celebrities touting a Bain Capital, and honest you can mingle with the big boys…..just send me your money and sign on.

I believe the term is “promotion”. There will be lots of people signing on. Crazy. I guess this is one step away from stars selling cars or skin cream.

The eighties are back. This time on steroids.

20% interest rates?

Snake oil salesmen chamata comes to mind of course he makes 20% on 500 million then sells out before it craps who are the fools only buy established companies paying dividend Hershey comes to mind

Saw an interesting interview on this yesterday. It seems if the spac acquires an existing public company outright, the new valuation has to be reflected in the indices containing the public company. An all market or sector fund must increase their holdings to reflect the new valuation. These fund purchases increase the value of the spac even more, allowing investors in the spac to get out at increased valuations at the expense of fund holders, who don’t have a clue the wealth transfer is occurring.

The interviewer called our markets the Golden Age of Fraud. Sounded right to me. I have called it, a giant crime scene.

This was intended to be a reply to Ron.

I was puzzled by the open illegality of these things. SPACs are money-laundering, NFTs are art forgery.

But then I remembered that old-fashioned scams often advertised a flavor of illegality. “We can offer this great deal because we’re off the books. But you and I are sharp enough to get around the law, aren’t we?” The sucker, believing that his own participation is illegal, won’t call the cops when he loses everything.

I am eagerly awaiting Wolf’s take on NFT’s. I can’t wrap my head around it.

Wolf talked about them in the most recent audio podcast.

“Even the SEC, which has been asleep through all this”

WHEN have they ever been awake?

The SEC just wants their cut. That’s all they do is take a cut of the loot then let it all continue. It would be difficult to find a more corrupt institution.

^This. With the Madoff scheme, it wasn’t just that they didn’t find the fraud. They were EXPLICITLY told what Madoff was doing and where to look, and STILL did nothing. Whether it was incompetence or malfeasance, we’ll never know.

How does one go about forming a SPAC? You can’t present projections about future revenue, first-to-market advantage, killer IP, or anything really, as there is nothing in the SPAC. Is it the reputation of the SPAC founders? Is it only an insiders’ game?

That’s why it is called ‘BLIND CHECK”!?

It’s like no doc loans combined with a ponzi scheme on a Kardashian cell phone. One giant scam.

You’ll know we’re at the peak of the SPAC bubble when Gwyneth Paltrow gets her own SPAC.

Not when Muilenburg can raise $240 million to buy up aerospace companies? Speaking of jail….

“Never give a sucker an even break.” – The Flim Flam Man.

“There’s a sucker born every minute.” – PT Barnum.

With the 30-percent tithing that GOOGLE etal have been fighting over, it’s a wonder there is anything left to uh XXXX! Looks like the Texans are ready to charge for what all is NOT LEFT!

“The only winning move is not to play the game.”

— Switzerland or some 80s movie

Jimmy Carter economy Current economy

1. Rising Inflation Rising Inflation

2. Rising Interest rates Rising Interest rates

3. Energy prices rising Energy prices rising

4. Illegal immigration out of control Illegal immigration out of control

5. Fed run by incompetent morons Fed run by incompetent morons

6. Interest rate controls ___________ (Not Yet)

7. Credit crunch ___________ (Not Yet)

8. Gas lines ___________ (Not Yet)

See a pattern here?

You forgot to mention the 12% CD’s.

Soon to be 20%

Forgot the solar panels on the White House.

I’d rather have the Jimmy Carter economy than this pile garbage from Jerome P. I made money back then with my Swiss bank account.

Any billion dollar canals to give away?

Everyone keeps calling this a bubble. It’s not a bubble if it doesn’t pop.

………it’s a hyperinflation.

It’s a bubble UNTIL it pops. Then it’s a bust.

I just saw this headline: “The FED signals no rate hikes until after 2023.”

Wow, so this clown is a clairvoyant and he’s going to keep the nonsense up for another 3 years. Get ready for some serious pain coming to the middle and lower classes. As if the current homelessness epidemic isn’t enough, Powell is personally going to laugh and spit in their faces while he ratchets up the misery index.

This is no surprise. Fed works for the rich people and is hell bent to prop up the asset prices and thus make rich people richer.

It was so obvious he was going to say that. The Fed will never act preemptively; it’ll always be a reaction to bad things that have happened. They’ll change their tune when their hands are forced, but by that point, I doubt it’ll be fixable.

Depth

My BNY Mellon fund sent me an annual report a month or two ago and they reported this same “no rate hike till 2023” bull s$it. How did they know this if the Fed just released this information yesterday. Sounds like some people are more connected than others. Especially those close to the NY Fed. I would say this leaked inside information should be investigated by the SEC.

Depth Charge,

The sequence is:

1. taper asset purchases to zero.

2. wait and see.

3. raise rates.

In other words, they won’t raise rates until after they brought QE to an end. That’s how they did it last time. And Powell said many times that that’s how they’ll do it this time. So the first thing that will happen is a discussion at the Fed meetings about how and when to taper QE. This may happen later this year.

Wolf, the FED has never ended their QE since they began after the last crisis, they’ve only increased it. What makes you think it’s ever going to end? In my opinion, it’s not.

This entire economy is QE dependent. Once QE ends – CRASH. Then they fire up QE again. It’s QE infinity at this point, because the FED will not allow market clearing prices. Their asset rich buddies would take massive wealth haircuts.

Note the end of QE in 2014-2017 and then the $800 billion decline during the “Good Times”:

Wolf – the “end of QE” is not maintaining all of those assets on the balance sheet, it’s selling them back into the market. The FED was supposed to reduce their balance sheet, and never did.

PS – the $800 billion resulted in the “taper tantrum” or whatever they called it, so they went right back to QE.

No and no.

Look at the chart.

The Taper Tantrum was a surge in long-term interest rates in 2013, when the Fed started discussing “tapering” the asset purchases.

The tapering of asset purchases then started, and by the end of 2014, the Fed had stopped increasing its balance sheet, and QE (“quantitative easing”) had ended. The flat line in the chart says that QE was over.

At the end of 2017, the Fed started reducing its balance sheet, and eventually cut it by $800 billion. That was the period of “quantitative tightening.”

All of the Fed’s assets are securities that mature and are paid off when they mature. In addition, the Fed receives large amounts of pass-through principal payments from its MBS when homeowners pay off their mortgages (refis and sales). So simply not buying any new securities will reduce the balance sheet fairly rapidly. The speed limit the Fed put in place was a reduction of the balance sheet of $50 billion a month, which drove Trump nuts, and that’s why he lashed out against Powell, if you remember those days.

Haha, I feel like a scolded school child, but deservedly so. I am an idiot compared to you when it comes to these things. But I guess in my own mind I consider a massive FED balance sheet “QE” in and of itself, because in order for the market to not be fake, they should have to sell those back into the marketplace in a timely fashion. Carrying trillions for decades seems like QE infinity regardless if they expand. What would you call their terminally bloated balance sheet?

Also, wasn’t there a Wall St. tantrum of some sort when the FED tried to reduce the balance sheet?

Petunia, I love u.

So, ME and Pet, does that mean ME is or is NOT a bot?

Just wondering, as I find his contributions inspirational in the sense of enjoying the challenge of figuring out the implications,,, and IMO they do have at least suggestions of implications and predictions.

Wolf, care to chime in on the answer to this question?

Is it possible they are both bots? I mean, anything is possible with AI.

It’s probably a bot with a supervisor observing its interactions, with the ability to take control if they want – kind of like Tesla autopilot.

Creepy.

Micheal Engel,

Repost this comment in reply to “Stephen.” I think this will make it show up under Petunia’s comment.

Are you testing his “botness,” Wolf?

Is there a single known SPAC that turned into a company or name we know and use? Just wondering where all this money is coming from and where it is going. Before C19 I can’t recall hearing about this vehicle

I think they’re all still “in utero.”

OK, I’ll play the devil’s advocate.

Some examples:

BurgerFi (burgers…)

EOS Energy (zinc based batteries)

Ouster (lidar sensors)

PureCycle Technologies (plastic recycling)

Bespoke (not yet deSPACed – wine)

Ecomedics (weed, man)

Great article Wolf.

One of the most disturbing things about this article is that the SEC has totally dropped the ball on this like they have on so many other important issues in the last couple of decades. The efficient markets theory has been revealed to be the greater fool theory.

LMAO is now trading at 9.80 a share.

Wonder what the 1928 investor attitude was like? Cavalier, sky’s the limit, fear of missing out….were those mindsets present then to mitigate the warning signs?

I’m old, but not that old.