For now, the story is that it’s just temporary.

By Wolf Richter for WOLF STREET.

For now, the story is that the sudden and massive shifts in the economy in 2020 have caused shortages and distortions in the goods-producing sectors and in shipping and trucking, as consumer spending has shifted from services – such as flying somewhere for vacation and spending oodles of money on lodging and restaurants and theme parks – to goods, particularly durable goods.

The story is that prices are rising because components and commodities are in short supply, and supply chains are dogged by production issues, and are facing transportation constraints, as demand for those goods has suddenly surged. And that all this is temporary.

And the Fed has said it will ignore inflation for a while, that it will allow it to overshoot, and only when it overshoots persistently for some unknown amount of time and becomes “unwelcome” inflation – “unwelcome” for the Fed – that it will try to tamp down on it.

Meanwhile, inflation pressures are building up. Two reports out today show a large-scale surge in price pressures for manufacturers – and they’re able to pass them on to their customers.

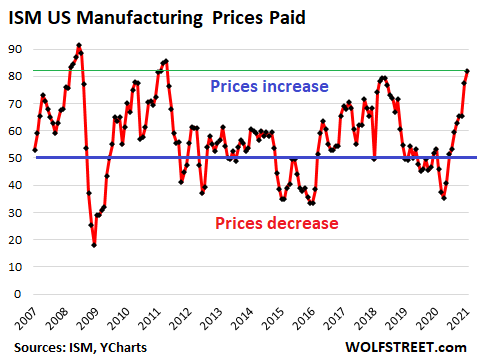

The Prices Index “surged dramatically in January” to a level of 82.1%, after an eight-month upward trajectory, the highest since April 2011, “indicating continued supplier pricing power,” said the Manufacturing ISM Report On Business.

In the ISM data, a value above 50 means expansion, and a value below 50 means contraction. The higher the value is above 50, the faster the expansion. January saw the fastest expansion of the Prices Index since April 2011 (data via YCharts):

Of the roughly four dozen commodities in the index – from corrugated boxes via cold rolled steel and plastic resins to memory chips – only one showed a price decline (caustic soda); all others increased. Some of the prices started increasing more recently, but others have been increasing for eight months, including copper.

A number of commodities were considered in “short supply,” including:

- Copper

- Corrugated Boxes (for 3 months)

- Electrical Components (for 4 months)

- Electronic Components (for 2 months)

- Freight, trucking

- Semiconductors (for 2 months);

- Steel (for 2 months), cold rolled; fabricated; and hot rolled.

The ISM data is based on how executives see business conditions at their own companies. The names of the companies are not disclosed in the report. Executives are asked if various business conditions – orders, prices, employment, etc. – are up or down in the current compared to the prior month.

Concerning prices, 64.3% of the executives said that prices rose in January compared to December, while 35.7% said that prices remained the same, and 0% said that prices declined.

For manufacturers and their supply chains, the shifts in the economy, and also other issues are contributing to a slew of problems: “Survey committee members reported that their companies and suppliers continue to operate in reconfigured factories, but absenteeism, short-term shutdowns to sanitize facilities, and difficulties in returning and hiring workers are continuing to cause strains that limit manufacturing growth potential.”

Similar price pressures were reported today in the IHS Markit U.S. Manufacturing PMI, which added that manufacturers, given the strong demand, were able to pass a portion of these cost onto their customers via increases in selling prices.

In January and also December, supplier performance “deteriorated to the greatest extent since data collection began in May 2007,” the report said. “Supply chain disruption reportedly stemmed from raw material and transportation shortages, notably trucking,” and also from overseas “due to a lack of shipping capacity.”

“Lead times are lengthening to an extent not previously seen in the survey’s history, meaning costs are rising as firms struggle to source sufficient quantities of inputs to meet production needs,” the report said.

And “amid favorable demand conditions,” manufacturers were able to pass these higher costs on to their customers via higher prices, “with selling prices rising at the fastest pace since July 2008.”

The report cited strong demand for goods from consumers and from businesses that “are investing in more equipment and restocking warehouses.”

The report too assumes that the supply conditions will start to improve, and “these price pressures should ease,” but they “could result in some near-term uplift to consumer goods price inflation.”

So for now, everyone is on the bandwagon that these price pressures are just temporary, a result of the sudden shifts in the economy, and that they will reverse when those shifts reverse.

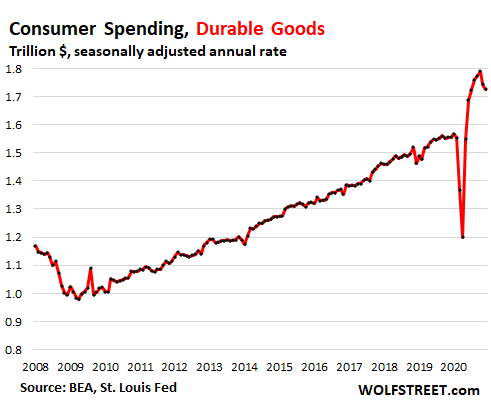

Consumer spending on goods has surged in 2020, particularly on durable goods, as demand for services, which account for nearly 70% of the economy, has dropped sharply. There is now massive inflation in shipping costs, including ocean freight, driven by the surge in demand for goods and capacity constraints. In December, spending on durable goods, though down for the second month in a row, was still up 11% from a year earlier after a historic spike in demand (from Americans Cut Back as Income from Wages & Salaries Hit Record as 10 Million People Still out of Work: Weirdest Economy Ever):

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Fed is operating under the premises that inflation is good and easy controllable.

They will be proven wrong on both counts.

But they will grasp more power in the process to deal with this new problem they have been largely instrumental in creating.

Amen. I think also that the latest stock scandals may be their Affair of the Necklace as in 1784-5 France, which may ultimately result in a complete loss of faith among Americans in this corrupt financial system as the “Federal” Reserve scrambles to bail out its Wall Streeters from their gambling again followed by hyperinflation as the economy “recovers.” I do find the, shall we say, awkward positions in which the Wall Streeters are now endlessly amusing. If it were not for the darn CCP “gift,” life would be sweet.

“As the Treasury paid interest on its bonds in assignats at their face value, the rentiers who had invested in government “securities” as a protection in old age found themselves joining the rebellious poor. Thousands of Frenchmen bought stocks in a wild race to cheat inflation; when values had been swollen to their peak, speculators unloaded their holdings; a wild race to sell collapsed stock prices; the innocent found that their savings had been harvested”

The Age of Napoleon (Durant, Will;Durant, Ariel)

The German stock market was posting impressive gains in 1921-22 as the mark started crumbling, seemed safe.

When do we learn from history?Suggest buying metals and ca water futures which just started selling on the CME.Buy u.s. Farmland before bezos,gates,and china but it up.Remember the little people who can not do these things and help.

You bring up an excellent point. There are HUGE numbers of companies out there that have quasi-junk bonds, which in a just world would be recognized as junk. If inflation surges, eventually, and Uncle “Fed” decides that it must temporarily pause its main mission of helping the banksters and Wall Streeter accumulate wealth to raise interest rates and fight it, where will those companies be?

Will they be able to re-finance their huge debts? Or will they be toast? I predict that most will be toast. It will be a 1929 crash v. V2 Weimar Germany hyperinflation. Who will win and for how long, stagflation?

Good post. As I keep trying to tell the more well off, they are on the menu…..not invited to the party.

As Bush2 put it at a fundraiser, “We have the have-nots, the haves, and the really haves.” Got a big laugh, too.

Watch money velocity…it will behave like bankruptcy. Slowly at first, then all at once.

The prospect of Weimar inflation is terrifying. Don’t you think they’ll just get bailed out on tax payer dollars again like ‘08? Ugh

Keyphrase today is Fed “Dissent”. We heard some from Kashkari today. They know they are stoking a speculative bubble, the Reddit mania is more than a few small fish with stimulus checks. Sharks devouring sharks, hedge fund on hedge fund. and the Fed is faced with the task of taking all the plankton out of the ocean. Only one solution, let the market price your bonds. That will give them absolution they desperately need, the symbolic hand washing. When pressed they will say, we had no choice, the market dictates the change. With a straight face too.

1974. Caterpillar had an order file on their key equipment that extended out 14 months. Later in the year that order file, after cancellations (b.s. speculative orders that vanished), turned in 14 seconds.

JIT is wonderful until it ain’t

sourcing out of mexico/closer/friendlier places(not 2,000 miles away) is were NEW OPPORTUNITIES are going

to bad CONGRESS can’t get act together and RESTRICT EPA/other regulatory bottlenecks in MERICA

MERICA is now 3rd world country run by OUR MASTERS/OLIGARCHS

As long as the masses are kept fat and happy, fed with a main stream media diet of pablum, nothing will change.

If Wolf was mainstream along with a few other like minded and people had hungry bodies, then we may have a chance at change.

Until then, same as it ever was until it ain’t.

“And the Fed has said it will ignore inflation for a while…”

and the Fed then has said..”we will ignore our second mandate (stable prices) under which we agree to operate and wield great powers.”

And not a word from anyone. So they promote immoderately low long rates in direct conflict with their 3rd mandate of “moderate long term rates”…and they ignore their 2nd mandate of stable prices. Thus they are batting .333. Good in baseball, bad in all other categories.

Wolf leaves out shortages in Corn and Soybeans which have shot up in price in just two months…and will hit the food chain pricing soon…

First the Fed will explain away the inflation.

Then they will paint it as welcome and a sign of recovery.

Then they will limp in with meaningless 1/4pt raises.

Finally they will realize they cant control it….the “Bridge Over the River Kwai” moment…..Alec Guiness

The coming inflation, the one designed to lift markets for some, will grind down and pound the working families of this nation. The divide already created by this wealth creation for some and wealth destruction for others (COVID response) will widen.

Not a good thing for society.

Anyone with money in the bank, who has not yet provisioned their home with ALL their daily necessities,

except milk, fruits and vegetables,

for the next couple of years, is an optimistic fool.

If it brings about change such as mobs requiring that the “Fed” get convertible bonds, which it converts to controlling interest in the bailed out companies, it might be good. Right now, the “Fed” only cares about the welfare of its cronies: if its low interest and higher inflation (miscounted) policies result in savers and pensions losing money, that is great for its banksters.

For example, if companies like Citadel, which “coincidentally” paid huge “speaking” fees to Ms. Fellon and hired her leader, Buttbeard, continue getting gigantic “Fed” bailouts, it might start to look bad to the peons. Let us hope that the righteous rage boils and boils, until action is demanded.

Like heroin and gambling addicts, the banksters cannot resist for long. They will be gambling again and when they get their feet caught in bear traps, yelling and demanding that their dear uncle “Fed” bail them out, YET AGAIN. When hyperinflation starts, their “Fed” will ultimately have to raise interest rates, which will shrink the available US federal government’s maneuvering room: the interest payments on the budget will swell to an even larger part of the national budget. See “As Debt Rises, Interest Costs Could Top $1 Trillion” in crfb.org.

It is a vicious circle, if you think about it, in a declining economy in recession: as the economy goes down, while hyperinflation takes off, the government wants to spend more to boost the economy. However, its required interest payments (rolled over at higher rates when the “Fed” must ultimately act) are too large, so it cannot spend much to boost the economy.

Hence, an economic Chernobyl, the vicious cycle from money printing drives the economy down: to spend more, more money is just printed, which causes more panic and thereby, more hyperinflation. Hyperinflation is a form of panic: as people raise prices because they expect prices charged to them to rise, and so on.

EVENTUALLY: Welcome to Weimar Germany V2.0.

Charts of food inflation…

China buying up our grains…with their trade surplus dollars…

and trade deficits dont matter? It will matter at the check out counter…

Agricultural commodity inflation, not mentioned in this article, is also going to be a concerning factor in 2021 and beyond.

Price increases in boxes (Amazon shipping boxes galore!) and consumer electronics pales in comparison to inflation in everyday food staples. Meat consumers in particular are likely to be reamed but good.

The well-off upper 20% income group cruising on Easy Street will not be deterred from their consumer goods spending spree by food inflation but our average Joe and Jane Doe will have to pull back.

Energy expert Art Berman also expects petroleum prices to continue to increase this year due to a number of factors, pandemic not withstanding.

So there will consternation and swearing at the filling stations as big a** pickup and SUV owners feel gaseous pain.

Thank you!Someone who comprehends.Not only what you said,but theyve been longterm leasing/buyingup prime farmland not just here,but everywhere,Ukraine,Africa,Australia.They are suckingup all the major foodstuffs in commodities and building national food reserves while America has none.Huge wheat order this week probably going to China.Iceagefarmer sums it up very well.Re:shipping costs,yes more demand as those with $ ordered akot of thingslaw from China mostly,but also there is a military element in that theyve been building shippingcontainer missile launchers.This is No secret,research it.It has been on the internet since 2015.Every $ sent to China strengthens their military hacking,subs,bribing of our gov. Officials,and their capacity to build strategic foodstocks while ours dwindle before our eyes.

Hey y’all, here’s an update from Korn Kounty: last week, China made their second-largest purchase ever of corn. “Their hog herd is recovering from African Swine Flu. They’re buying like 15-20 million metric tons of it.

The U.S. 10 year treasury yield has risen 8% in 30 days.

The bond market fall will be in geometric magnitudes.

Who is holding all this mortgage paper written at all time interest rate lows?

Laws, regulations, charters, pfft. It’s Aleister Crowley’s law now:

‘Do what thou wilt is the whole of the law.”

The Fed will do and rationalize whatever it needs to do to preserve it’s power and privilege. And where are the founders checks and balances now?

But this is nothing new, how much does a dollar buy now compared to 1913?

Some of us folks really and truly prefer Kant’s ”Categorical Imperative” to Crowley’s later attempts:

”Do what you will/can,,, at the same time praying/hoping that your action becomes universal.”

Probably NOT exactly correct quote, but I hope the meaning is clear enough to Wolf Streeters.

Sooner or later,,, and I would pray for sooner,,, all the BS that Wolf does such a good job to dig up, decipher, and describe to us lesser mortals will ”come home to roost” ,,,IMO just exactly as has been the case for eva…

Hope all y’all can stay out of the way of the impending crash…

Fed’s batting 0.00!

Don’t have full employment.

Don’t have stable prices.

Don’t have moderate rates.

Don’t have credit supply commensurate with long-term growth yada yada.

Do you have low blood pressure and want high blood pressure quickly? Search for the news reports about the “Fed” bailout of Citadel and Bernake’s role with it and now, the details of Citadel, Melvin, and Robinhood. Read about “Well, Janet Yellen Got $810,000 to Give Speeches at One of the Firms in the GameStop Mess” in MSN.

“They must have been almost Shakespearean speeches”, as Bernie said to Hill-dog during a debate, before he was shoved out of the way as an old nutcase by both parties.

Neither party should comment re: anybody being a nut case, Pot calling kettle black et al

One-off price increases are not inflationary.

All price increases are one-offs.

There is no inflation!

Sarcasm, I hope? Hyperinflation when economy restarts and more, much worse virus variants preclude normal shopping = RIP Main Street businesses.

Pay your bribes people! It will be pure, crony socialism for the wealthy and the shaft for every one else, henceforth!

Yes, 100% sarcasm!

Powell has said that “perception” is the key.

So they will explain away the price increase….temporary, welcomed sign of recovery, etc etc…

Remember…

All central bankers, and most govt employees, have inflation protected pensions. What care they of inflation? But what of us?

It is so charmingly naive that you actually think that central bankers and their government cronies look to their government pensions as their main, future source of compensation. See “Ben Bernanke joins hedge fund Citadel” money.cnn.com. See “Tim Geithner and the Revolving Door” in the New Yorker. See “Eric Holder, Wall Street Double Agent, Comes in From the Cold” in Rolling Stone.

You clearly underestimate them if you think that a stinky, little government pension is even a 2% factor in their motivation.

Lobbying is where the real money is, if you are good at it, trust me.

Have gun, will Travel.

Pensions wont matter except to use asopponents t.p. When the $ is killed.Hope pensioners have other assets.

slowly, then suddenly…

WES…do you ignore reality all the time?

Commodities, services, housing all up and up….

Inflation is dead, long live inflation!

I am not willing to believe the “Inflation” & “Pent Up” demand story (yet). Yes, production is up by 6% but inventories are up 6% as well.

There was something similar going in the early 1970s as well. Companies feared (price) inflation and started to order more than they needed for their current production. And at some point it turned out that end demand was weaker than anticipated. As a result the “deepest recession since the 1930s” happened in late 1973, early 1974.

Yeah, I’ve said for a while now that the “pent up demand” argument for durable goods is complete nonsense.

Restaurants, travel, theaters, and such, yes, people do want to do that again. But the idea that the end of COVID makes you want to go out and buy a new couch is just ridiculous pumping unsupported by any facts.

Pent up demand is an over used misunderstood term. You do not get EXTRA haircuts, eat EXTRA meals, buy EXTRA shoes. It is as rediculos as saying as saying “when we return to normal”.

Those days are gone and will probably never return.

Well, I do think some people who love going to restaurants will go overboard at the very beginning of no COVID, but the novelty wears off quickly. So, say a retired couple who went out to eat twice a week pre-COVID. They might go out 4 times a week for a few weeks as it’s a welcome change from the lockdown. But after a month of this, it’ll be back to their normal schedule. The idea that people are getting extra haircuts or going on extra vacations to make up for the ones they had to cancel is not really in line with human nature.

RightNYer. retired people going out to eat after Covid will be facing higher priced meals. That will slow them (us too) down and the result will be less participation in dining out thn before…quickly.

My story: I used to go to hair salon for my haircuts. But in the last 9 months or so, I have accumulated enough expertise to cut my own hair. I did screw up many times but I don’t see me going to hair salon for long time.

BUY couches? One can go to the Craigslist “Free” listings and find hundreds of couches, really nice ones, that cost thousands when new a couple years ago, being given away.

Same with furniture, shelving, clothing, all manner of things, as people move to smaller homes and don’t want to pay shipping, or double up and need the space. Those who want to rent to a couch surfer can get one free.

Used couches.

We had a bed bug inspection in my 200 unit apt complex a year or two ago. Wasn’t here, but was told they used a trained dog. Was glad for that.

Now back to trying to figure out if silverfish have much good protein in them, just in case. Grow slow, though, it seems.

Bedbugs?

Put the pre-owned couch in full summer sun,for a day or two, wrapped in a large black plastic sack made of duct taped together garden sized heavy black garbage bags. Temperature inside will get to hundreds of degrees and kill anything.

There was also the 300% oil price hike of 1973

Precisely. It were simply the last straws on the back of the camel (a.k.a. the consumer). But already in late 1973 BEFORE the oil crisis US production started to shrink. But the big hit came in 1974.

(I wasn’t alive in those days but A. Gary Shiling wrote about it in his book “The age of Deleveraging” 2010)

I think a new age of deleveraging is creeping upon the world

I was. A couple significant things happened.

By 1973, (for 10 years by then), the money that should have been invested in our own commercial industries, was instead invested in companies who spent their Capex on making stuff that blew itself (and people) all to hell in Vietnam, plus a lot of other Capex that also supported the massive war effort….lots of oil was consumed in doing both, and add “dealing with” pissed off people, too.

The Vietnam “project” cost 2/3 of WW2 in today’s dollars, although the cost was well hidden….and “deferred”.

People had stopped saying “Jap Junk” and instead continued to buy shitloads of it, as our R&D and factory updates Capex had also suffered….badly.

Schilling thinks we actually deleveraged from ALL this? Why then did Ronnie’s master’s start serious labor cost cutbacks, and the deficit spending that continues today?

This is the best website I know of about Vietnam. But I guarantee you, the whole truth including dollar cost and human cost numbers, will NEVER be known. It was IKE’s parting warning to us in Spades. I met, and knew many of those “policy makers” behind the scenes.

https://thevietnamwar.info/how-much-vietnam-war-cost/

Make that easy quick website….wikipedia, as usual, is tops, but real thorough and cited reading, and not prone to simplistic narratives, which I’m often guilty of. Still stand by mine, though.

Willy2,

“deepest recession since the 1930s” happened in late 1973, early 1974.

That was the infamous period of stagflation.

In Dec 1972, inflation was 3.4%. By Dec 1974 it was 12%.

The 1970s were actually a decade with very good growth rates. And the growth was driven by WAGE growth, NOT by the growth of debt.

Between 1980 and 2021 economic growth was predominantly driven by the growth of debt.

Willy, no economist here, but IIRC the 70s were also when the Boomers hit the job market in earnest, driving demand way up. From ’77 just out of college to ’81 my income almost quadrupled! It’s been pretty much downhill since ?

I am old enough to remember the 70’s stagflation conundrum.

I remember well the short-lived price controls with their WIN slogan (Whip Inflation Now).

Regarding unemployment, by the second half of 70s decade it averaged 7.9 percent and some years saw the rate reach more than 9 percent, according to the BLS.

That was due to a number of factors, including a flood of baby boomers entering the job market then– supply and demand.

Willy2, you are spot on as I recall Money Market accounts paying north of 20% to buyers who had spare cash and wanted to invest in Mexico, also home mortgage’s were in the teen”s, 14% or higher for all the baby boomers who wanted their first family home. If you had spare cash you made a killing, if you needed cash watch out,

Willy-because circa-1980 wage growth’s brakes slammed on, replaced, for the average worker, by the explosion of (as you indicated) waay-too-easy consumer credit.

may we all find a better day.

Arthur Burns put on wage and price controls then.

That was called an emergency action to combat inflation.

An important point.

Nixon did the wage/price controls. Fed didn’t/doesn’t have the power. Burns occupied the Chairmanship. But I get your drift. Gold went from around 240 to over 800. Afterwards being in debt became the thing to do for many.

Situation was createdby goldstandard end and oilcabal price manipulation.

Today really looked like reflation. Everything went up together — even as the dollar rose as much as 50bp.

I still say deflation, but I was scratching my head today.

I read something today where Goldman Sachs says last week was the largest short deleveraging event since Feb 2009. Hedge funds sold there liquid longs to cover shorts.

Holdups in customs likely related to “COVID absenteeism” has been a huge probem. Containers sit in port for 2-4 weeks longer than anticipated. Eating a surprise air freight bill stinks amd I can’t pass those on.

Construction materials on the BC coast are darn near double over last year. I’m in the process of ordering materials for a future job and just shrug my shoulders. Oh well, only money.

Replacing a washer/dryer for my rental this week. Buying reconditioned used instead of new. And if new construction costs are skyrocketing, it simply sets the floor for all RE sales. In our valley there are a total of 9 listings, and the prices are 1/3 higher over last year. No raw land is for sale. Outsiders are discovering us and have brought rising prices with them as they don’t flinch at the new asking prices. One place just sold for 1.3 million. Another large property next door is in negotiation. A rich stock broker family are buying it as an add on. They have roots here, and already bought the 160 acre homestead adjoining. They built a custom home, spent hundreds of thousands fixing the fields, new fencing, built a beautiful barn and giant chicken run. They have a total of 4 boutique cows on 160 acres. A local couple has been hired for years to maintain the place and work on improvements. The owners visit for 2 weeks every summer and like their fresh farm eggs. :-)

It’s great if you already own a place. Not so nice if you are looking to get in to the market.

No new construction projects this year, like in 2020!

Back to just maintaining what I already have!

In the neighborhood I rented a room in after getting laid off in 1980, (20% prime and all. So we, being a year old 15% profit upscale (laser engraved) widget maker were shut down by our backers, a big outfit in NYC that owned widget/trinket makers all over the country.) we took great pride in replacing worn out stock dryer bearings with industrial grade ones. Belts, motors, and heating elements were child’s play, as were temp control switches.

We could have designed and built a forever dryer, with easy owner replaced heating elements…it’s not rocket science.

NBay – I have been thinking along the lines of “forever” appliances for some time…and it’s an idea whose time may be approaching. I would like to write – or co-write – a few articles on the subject.

Can you take a moment to find me on the Web and get in touch?

Thx.

Tom-just to add, remember the old engineering joke/verity: “…if something works REALLY well, it doesn’t have enough ‘features’, yet…”.

good luck going forward, and-

may we all find a better day.

(p.s. NBay-that wasn’t Lasercraft you were referencing, was it???).

I agree with you Tom, and that vision includes most “durable’ goods. However, the “rentier biz model” dominates. Why should corps allow anyone to cut in. For example, only 500 originally constructed vehicles (cars and motorcycles) are allowed in CA per year, (supposedly chosen by lotto), and just putting in a different motor puts you in that category, unless pre-1975, and even then I think they go by whatever is newest, motor or chassis….it all goes to BAR for adjudication.

During that room rental time I described, we built a totally enclosed (doors, windows, side by side seating, grocery storage, easy to fix, replaceable power train motor cycle, 50 mph flat out on freeway, 16hp Tecumseh 500cc OHV, Salisbury CVT drive, wipers, lights, etc, etc) and Licensed and drove it for 3 years…later turned it into a cross between tractor and ATV for off grid chores. Used a VW transaxle then, so it could back up, and really deliver some pulling power to oversize truck tires with tire chains.

Anyway, ya can’t do that anymore, and I imagine the reason cited is safety, as not everyone builds well. When I got it licensed at CHP, the inspector spent most his time on where to pop rivet the VIN number.

Our idea was to sell plans for it in the back of popular mechanics. Retired Sheriff across the street loved driving it around.

Anyway, you would be better off tying in with someone who is more current on what is available now in electro/mechanical land, I just used the stuff of the times and had equipped garage, fabrication/vehicle savvy HS pals helping me. Plus I don’t do any social media (except here, if this counts) and pretty much hate all consumer electronics, it’s all menu and connector/box memorizing to me, a pain in the butt.

But thanks, and good luck, however you choose to go at it, even if it’s for yourself. I do laundry over at sisters and damned little of it. Once every 3 mo, have simple life. Seems like replace every 7-8 years is their chosen rentier cycle on those.

91B20-

No, Lasergraphix. I was hired at Lasercraft ’73 as aide to project engr, when the outfit first moved up from LA (already had good biz selling CO2 laser accessories, called Optical Engineering) to start laser engraving expensive upscale widgets. Went from maybe 8 of us to 250+ in 5 years.

“Anyone who sticks this out with us will be well rewarded” was the big lesson there for all, except 2 brothers and father owners, now all in family Hawaii compound, or dead.

So after I came back jaded from Pharmacy School, me and the L/C marketing manager (who had family connections) set up a biz, he handled money/sales, I handled tech, and we had just hit break even 20-25 people when 20% prime made our money guys dump us. But yeah, I saw the whole show, and even landed consulting gigs in LA, SSF, and Toronto.

91B20-

You mentioned growing redwoods, and you knew about Lasercraft.

You aren’t up there with Jack, Mara, Jazza, Raina, Judy, etc, are you? Simple yes/no, will do it.

And sorry Wolf, but I couldn’t resist, and won’t do any more FB like crap here, I promise.

Reopen please! :-)

Actually was more like beer drinking redneck entertainment than a biz. But thx.

NBay-haven’t seen Jazza in many, many, years, but-yes. (Sorry, Wolf!).

may we all find a better day.

Yep. The rising house prices are leaving a giant sector behind…

prices running away from others at a RAPID pace….not really a good thing IMO. Gradual increases over time, okay. Leaping away and leaving people with the realization they can never own a home is not a good thing.

It just drives home to an entire population that you are a renter, and the rentier class controls you. Feels like Victorian England.

SimFarm?

Paulo,

Reconditioned washing machine, or much better free:

We have gotten two free washing machines, a dryer, even a free 50 gallon water heater this way. Fools rush in to buy new when others are abandoning items.

“Vancouver, BC > free stuff… « » press to search craigslist. save search. free stuff. options close. search titles only has image posted today bundle duplicates include nearby areas cariboo, BC (cbo) comox valley, BC (cmx) fraser valley, BC (abb) kamloops, BC (kml) …”

They can inflate to end of hell no one to buy

The latest data points on the ISM chart are concerning…but I’m maybe more curious about those from late 2017 to 2018, which we’re similarly soaring…only to be deflated with the arrival of rate hikes for the first time in nearly a decade.

My possible point being that under similar inflationary conditions circa 2017/2018 the Fed creakily unwound ZIRP a tiny bit.

Now, with arguably a greater acceleration…but Covid…

We would probably need higher resolution on the 2017+ ISM data pts to be more entirely confident of inflationary cause/Fed effect, but rough eyeballing looks like we are living through a period as bad (or worse) from an inflationary pt of view as that which triggered tiny ZIRP cessation in 2017/18.

But, now, Covid.

What’s wrong with a little air? Yeesh. How are we supposed to pump up our bicycle tires anyway.

Air pressure in bike tires is something that’s been looked at closely.

Old-school thought is that higher PSI = lower rolling resistance = faster. But there is a balance where higher PSI doesn’t doesn’t yield less rolling resistance. Instead it creates fatigue in the rider and slows them down – more so in longer races.

Road racers are also going to slightly wider tires, and they roll fast with lower PSI as they get wider. Rim shapes have changed to accommodate wider tires and be more aerodynamic by making the rim slightly wider than the tire. 28 mm is the new 25 mm these days.

So, Sir Eduard, the answer to your question is: 92 PSI in the rear & 90 PSI in front for riding the road on my Bianchi.

My neighbor just picked up a sweet carbon fiber fat-tire bike with a narrow Q (width of bottom bracket) and studded tires. Made by mechanical engineers in Burnsville, MN, OTSO has a few month long back log as demand has outstripped manufacturing capacity.

Here’s a link on the subject:

https://blog.silca.cc/part-4b-rolling-resistance-and-impedance

The other reason that wider lower pressure tires can roll faster is that the contact patch is a narrow oval oriented in the direction of travel. On very thin high pressure tires the contact patch goes crosswise where the tire meets the ground.

Interesting, Dan/Seneca. Thx.

Ok, that was funny ;)…well played Dan. Know anything about sump pumps!?

The best ones run in an oil bath housing to exclude water, at least in early 80’s.

Dan-suspension of any type, properly developed, is a wonderful thing…(go faster with more control/comfort coming from moto-racing, myself).

may we all find a better day.

Yeah. Borrowed kid’s 600 thumper (Honda?) up on the hill….think it had 10″ travel up front….smooth predictable travel. Even with me almost age 60, and had only been putting around on Yamaha 500SR (my classic), it inspired confidence to try some off road things I probably wouldn’t have gotten away with when much younger. Torque on demand. On way back to his house took it up to 40-45 on shale road and locked up front and rear….straight as an arrow.

Copper

Corrugated Boxes (for 3 months)

Freight, trucking

If these make it into the CPI, maybe the Fed could hedonic adjust that inflation away:

Copper – now being produced with a deeper, more and better pleasing coppery sheen.

Corrugated Boxes – new and improved because happy face smiles are prominently affixed to all four sides.

Trucking, Freight – the new hires are now required to bath once a day and use hair gel and work out, and are generally much more handsome that past hires.

Copper hedonic adjustment: -20%

Corrugated Box hedonic adjustment: -35%

Trucking, Freight hedonic adjustment: -25%

“the new hires are now required to bath once a day and use hair gel and work out, and are generally much more handsome that past hires.”

Hedonic, porn scenario adjustment (“Sorry, strapping delivery boy, I don’t have any *cash* to pay you with…as you can see, I can’t even afford bath towels…”)

And the large cardboard boxes also can double as homeless shelters.

That is worth at least an additional 30% downward inflation hedonic adjustment.

Yes, but one fabricated out of corrugated metal (galvanized steel or even fiberglass) will raise you to middle class status. That was the family housing progression when I was working in Trinidad for a while.

AA,

Sure, yeah, but it will triple your property tax assessment in NY.

Colorful paint for waterproofing and reducing blighted look, 5-10% more?

Ha ha, yes, you should work for the Fed!

There is a lot of cash out there, a good reason to jack up prices every bit you can. It’s a new science. Coming stimulus and sweet unemployment extras mean quick bucks available if you are in the right business.

Want to see some inflation? About 3.5 years ago, my friend bought a house at 2400 Cliff Drive in Newport Beach. He paid a little less than 3M. Last few years, he put about 500K into updating the home … He put it up for sale a few days ago at just under 7M, and he got multiple offers in 1 day. Yes sir, that is more than inflation. That is scary inflation.

Where’s the listing?

Yes, address please.

Address is in my post. I will repeat it here …

2400 Cliff Drive, Newport Beach, CA, 92663.

Also notice how the agent claims the street is coveted … actually, it is busy as heck.

Another big suprise is

1827 Galatea, Corona Del Mar, CA, 92625 … Corona Del Mar is a village in Newport Beach. A complete piece of trash was in a bidding war at 5.4M. Just 3 or so years ago, same location but with a home in better condition was in the low 3Ms.

These rapidly escalating prices are not good.

Thanks.

Well, all things considered…I rather have ultra high valuationists driving up prices on individual single family homes in Newport than trying to corner the ntl wheat mkt…

(The house is less than .5 miles from the ocean, with an elevated view)

Although I also anticipate the future whining, cringing, complaining demands for a bailout from whichever banks are making these excessive mortgages…

(At these prices, great big bundles of cash are sometimes surprisingly used too – sans mortgages – from various international buyers engaged in foreign exchange…creativity, such as parking export proceeds in US to avd forced Yuan conversion back in China).

Dad and I spent 18 years trying to corner the national wheat market. Didn’t cornered it all, but got a nice chunk of change out of the effort when we sold our brand to a French farmers’ co-op (Limagrain Cereal Seeds) eleven years ago!

Corona Del Mar was considered sissy safe beach when I was a kid, and in mid 80’s it was for Thurs nite beach parties, where folks watched yachts go in and said, “That’s the one I’m gonna get someday”.

Big LA, y’all can have it, just quit trying to take more of our water, salt is moving further inland…deal with it.

The inflation rate you just described in your example, helps make one realize just how potentially DE flationary a rise of minimum wage to mere $15 in 4 or 5 yrs, could be. Because that wage would be going up very much slower than real inflation.

At the rate we are going, a $15 min hourly rate hike in five years will have the same purchasing power of the present $7.25.

Why? My employer was only giving out 2-3% wage increase again this year. Someone else is going to have to start making a lot more money than I do if they want to drive inflation. Meanwhile if I fall behind to where I’m only making twice minimum wage and UI starts continually paying $1k a week, maybe I’ll just start listening to audiobooks all day with my feet up and see how they like that. If everyone starts doing it then we’ll really see some nice stagflation.

Yes. Exactly. Time line has been a moving target but let’s call a spade a spade $15 is peanuts.

Wow, I live in the evil fly over land.

Out here with the newly classified

Domestic terrorists, it has been over a decade since I paid that low…even for seasonal help.

Of course, no shortage of comments from potential clients that they know a guy who works on side for cash…who is so much cheaper.

Hey Wolf will that be a plus or negative if we go all digital on currency? Or will the tax cheats always be out there.

Huge negative…just look at the scam India is pulling (“High tech gvt issues e currency!! Outlaws all others…”)

The G has been saving itself from the consequences of its own policy f*ck ups for decades by manipulating the money supply.

By DC going to “Monopoly Fiat 2 – Electric Boogaloo” DC will have *much* greater power to simply reach in and “adjust” private savings according to DC’s opinion of “macroeconomic necessity” (ie, the Liquidation of Recalcitrant Savers…who screw up the Keynesian pulleys and levers).

If you think such things beyond the pale, you haven’t been paying to the G’s ongoing series of inconceivable things for the last 20 year…

1) Multi decade wars against the equivalent of Barstow…

2) ZIRP Treasuries for two decades…as debt to GDP soared…

3) Pandemic

4) Two to three divisions worth of troops in DC to defend against rioters led by men in Viking hats

5) Sudden discovery that half the country are unreconstructed racists who should have their civil rights abridged

6) Rediscovery of wall effectiveness by popularly elected Congress

Don’t underestimate the G’s willingness and ability to sell rank absurdities and undertake the unthinkable to retain its power.

The history of the world is 90% the history of bullsh*t governments.

trucking rates have been sliding since the beginning of the year. The lane I run SoCal to South East is already down 50cents thats 1000 bucks less per trip since December. And now the clueless Democrats want to raise insurance coverage from 750k to 2million. Per truck. Guess who’s going to eat that?? First it will be the insurance companies, then the trucking companies, then the consumer. Shit really does roll downhill…

Vilos, the cost to replace the load, clean-up, and liability of who may be involved in a occurrence can easily be above $750,000 these days. Perhaps you need a umbrella policy, or as a business entity you can file bankruptcy and pass the losses on to others and start again, a lot of business pass on their legal responsibility via bankruptcy, and re-open the next day. Sorry, I can’t feel for you.

not asking for sympathy.

Just letting you all know how it is out here in the real world. I wasn’t fortunate enough to get in on the Game Stop short squeeze. I actually work for a living. Since your quoting figures I guessing your a lawyer/insurance rep. Only purpose is to screw working people over…

Are you nuts? Government edict increases his costs and you’re annoyed with him?

Thats the point!Less trucking=less pollution.

Everything you own. everything you eat. The gas you put in your car. The wood used to build your home. The clothes on your back. All of it came in on a truck. Until someone invents a transporter like in Star Trek thats the way its going to be.

This may be slightly off-topic but I wonder if “inflation” factors into my home owners insurance going up 30% this year? No claims made (ever) in fact my policy went down by $300 last year. But the 2021 bill came in at over $5000…

a $1200+ increase from 2020.

Now that you say it, my car insurance was up about 8%, but I didn’t think much of it…

Increased car thefts in various cities,especially Chicago.Chicagoblockclub.c did an article or two about people arming themselves and forming citizenwatch groups,etc. Trying to combat huge increases in violence and car thefts.Maybe the wokesters should stop trying to defund the police and fight crime alongside them.

Yes, insurance figures into inflation (CPI), under the services category.

No wonder my auto insurance premium is up. Those bastards at GEICO decided to pass on the cost.

Talked about screwed up. I’m sure next our taxes are going up again in CA, cause, you know, inflation.

Dear JP, screw you.

My rate at Geico stayed the same.

“cause, you know, inflation.”

Yeah, gotta love the G’s self licking ice cream cone of tax driven inflation tax increases.

The more you think about this stuff, the more you realize that the architects of Gvt spend most of their hours envisioning gerbils and wheels.

I keep getting rebate checks from my company. Hey nobody is driving! Geico raises your rates so they can make more cute lizard commercials and sponsor Jeopardy?

State Farm gave their auto policy holders a price reduction break last year– due to their insured drivers driving less during pandemic.

At some point insurance companies (and pension funds, etc) are going to be bleeding income profusely as their bond laddered investments roll over into current minuscule interest rate returns.

I look for house/auto insurance premiums to shoot skyhigh sometime in not-too-distant future in attempt to keep these companies solvent.

“as their bond laddered investments roll over into current minuscule interest rate returns.”

This is a very good point…and it is worth asking about why 20 yrs of ZIRP haven’t already caused insurance cos. big problems.

One unnerving thought revolves around just how much phoney baloney BBB debt they’ve invested in “reaching for yield” greater than 2%…

AIG

NBay,

I think of AIG’s blowup as a result of its role as a risk guarantor/”risk sink” for a lot of pre 2009 CDOs, etc.

But ZIRP should have been screwing up insurance Co operations (which requires invt returns as well as premia to pay for claims) in more plain vanilla ways (insufficient invt revenue).

But taking dumb*ss, ZIRP inspired chances may have delayed the day of reckoning.

True. But it’s still all about “money instruments” invented/used by people with no fear.

“Moral Hazard” is too weak a term, as are the punishments.

Depending upon the co.,it may also be attributed to the huge payouts the co. Had to part with due to numerous weather events,riots,arson,carcrashes,covd liabilities,you name it Ask the co. To detail in writing the reason for the increase,shop around,and maybe call the state’s insurance regulator.

Certainly there are elements to the surge in prices that are Covid related such as people buying freezers to store more food at home to avoid human contact in the supermarket line. But items that involve inputs from overseas where Dollars are used to buy product in local currencies are going to see progressively higher Dollar prices as the year goes on.

Construction costs and home prices are merely waiting for the personal earnings implosion to occur since we are hardly out of the woods with the Bat Flu and the economy shows no signs of getting back to 4th Quarter of 2019 levels any time soon. The ceiling on free money for all is close at hand, forced upon a country by the value of its domestic currency.

Very cheap mortgages are great (below the rate of inflation for You and Me), but divide the principal borrowed by 30 or 15 and that is your minimum annual amortization that you must come up with hook or crook. Interest rate could be zero, but you still have to amortize the loan. This crazy housing market where a gopher hole in CA goes for seven figures will come down to earth by summer. Price increases of 30% for the last 12 months are more indicative of a market top than a sustainable trend.

Many of the shifts in demand and supply sources will be permanent because this pandemic has shown everyone how unprepared we were and given everyone a pause as to how they are spending their money. A progression of new vaccines will not be a cure-all in a world still dependent on international travel, even if it is in the belly of an air freighter.

Yeah, much of what we think is “inflation” is just a giant savings glut that’s worming its way through the real economy seeking yield. Monopolists gonna (near) monopolize.

My friend who works for the elevator industry says that private equity is gobbling up firms for existing service contract portfolios. Because it’s one of those businesses that are highly specialized and can’t be started by some dudes w/ a van, the companies can name their price to the property management company, who just pass the cost to the tenants.

I continue my austerity. Everybody’s spending, I’m saving. I’m not a believer in this economy. I think the whole thing’s a sham. The idea that you have almost a million new UE claims a week ongoing for nearly a year, yet everybody and their mother is buying new cars and houses is a bunch of horsesh!t.

You hit the nail on the head. It is as big a sham as everything financially that has transpired over the last 18 months under the fog. There are going to be a lot of disappointed when the next tranche of free stuff from D.C. doesn’t come through.

The green shoots of inflation may be starting to appear but when we get back to normal the price increases will “reverse”. Such a simple solution. Is that the same thing as going on a diet to lose weight? Hey we all do that, no problem.

My experience with inflation, since the sixties, is that general prices don’t “reverse”. They just increase more slowly. Big capital expenditures like real estate and businesses do go up and down due to the large effects of the changing value of the dollar (interest rates).

As long as wages don’t rise dramatically I don’t see how any serious (price) inflation could take hold.

Most of the magic money was not given out as wages. Worker joe got $600. Big business got $billions. It is still fake money created and swooshed into the economy. According to Von Mises, the biggest inflationary distortions occur where the new money enters the economy.

Sustainable CPI inflation has to be driven by wage increases. But I expect that to happen, because the political and social climate is ripe for it. The pandemic has put the growing wealth gap into even higher gear, but I think we are close to the peak of that now, because deprivation has now crept too far into the middle class and now that it has happened to themselves, they are becoming more activist.

The coming “temporary” shock to inflation will be very visible and this will spark more anger if wages don’t rise and not enough free stuff is offered. I expect governments to play along. They have the Magic Money Tree now and they will keep harvesting from it until something breaks.

I think stagflation is a very real scenario, because most of this massive expenditure isn’t invested into productive assets that would raise productivity and hence future growth. The “growth” we see now is mostly consumption which, by the way the GDP is calculated, adds to GDP but doesn’t increase actual productive wealth generating capacity. Rising cost/ expenditure but no matching increase in productivity is a recipe for stagflation. And stagflation will trigger more social unrest, which will pressure politicians into more spending and possibly higher taxes on corporations.

Stagflation is not a good scenario for stock- and bond markets. Lots of “wealth” will evaporate if it were to happen. So I would expect an increase in CPI inflation but deflation in asset prices. The young will be fine, because they don’t own much and they have most of their lives still ahead of them. If I were young, I would loathe all the extend and pretend and hope for a big reset sooner rather than later. But the older generations should be very worried as their nest egg gets decimated and they can never rebuild.

YuShan – I completely agree that stagflation is a high probability event in the next few years, and have been hedging my business and other financial matters towards such an outcome. What we have is a global central bank cartel that will not allow deflation on any level, at any time, not matter how badly it hurts the bottom 99%. And on the fiscal side, we now have a govt, somewhat globally, that is going to print money and hand it to the bottom 50% and extreme accleration of debt and money supply has no unintended consequences, and somehow if there is a consequence, it can be fixed by doing the same exact thing that caused the consequences to begin with.

So deflation is outlawed, infinite money printing will be given to the bottom 50% (who will spend it instantly) so basically this is the way…so how exactly could this not create inflation for things people need, versus just art, land, stocks, residential properties, and precious metal “Asset inflation” of the past,

Look the economy is abut $280ish billion behind where it should be in 2020 due to the pandemic, according to Bloomberg. So if we send out “TRILLIONS” direct to local govts, schools, bottom 50%, etc in one single year, how naive do we have to be to not believe this will magically NOT create unnaturally higher inflation in things people need, and that such inflation will be “fixable” by the past method of raising interest rates, which is not an option as raising interest rates would collapse the entire global money ponzi scheme.

Central banks are in a pickle…they unleashed the Magic Money Tree becasue 2009 proved trickle down asset inflation does not work for the bottom 90%. So at this point it looks like only extremely negative unintended consequences will stop the fantasy that infinite debt causes minimal consequences.

Fed money printing is basically the adult version of the tooth fairy…I try to enjoy it while it lasts, and hedge for the inevitable consequences…

How do you hedge the collapse of a country’s economy? Lots of guns?

Bazookas?

The Fed has a tendency to lose control when asset prices and speculation are high. See 2000 and 2008. That is all we need to know.

Same in the UK

and we have a problem with the Loony French and the Loony EU causing all types of silly supply chains problems…but as usual we will cope……

If of course you are rooting for inflation so your economic suppositions can be verified, the explanation citing a “temporarily pandemic driven world” will seem specious.

This is what I’m seeing where I live. I was talking to my neighbor who sales luxury houses up the hill and he state.

1. Inventory in our town is down 60% last year; neighboring town down 50%

2. Properties not even worth looking at are going for over asking if they have and additional dwelling.

3. Ridiculous monstrosities are selling for premium

4. Mobile home and low in are selling fast and with rapid increases. 3% Down with PMI

5. Land is mostly sitting: 250,000 dollar lots next too a million dollar home/land sits. The cost to build is probably 400,000 average but it is an area where you can build whatever you want.

6. 1 million is considered middle tier

7. 2 million on up are stagnant.

8. unconventional loans for mobiles on land north of a million sit.

It may be just a matter of timing….or…which came first, the chicken or the egg. The market always seems to adjust. Couple of Wolf’s recent headlines sums it up. Not sure which of these observations is currently in the lead. Is “passing it on” merely that peaceful time when the sun bathers are out gathering pretty shells just minutes before a Tsunami rolls in?

2/1/21:

“Inflation Galore at Manufactures, amid Massive Shifts in Demand, Supply-Chain Snags, Shortages, Lack of Shipping Capacity. And They’re Passing it On.”

1/29/21:

“Americans Cut Back as Income from Wages & Salaries Hit Record as 10 Million People Still out of Work: Weirdest Economy Ever.”

Had some trouble getting a product on Amazon, they cancelled twice, finally offered a bit of explanation. Seems they don’t have the distribution in my area. The items are weighty and they probably can’t afford the tare across country. Seen other notices, item not available in your area.

Does it mean that FED would be forced to increase the interest rate ?

Powell said that they will do it like last time, in the same sequence: 1. stop QE then 2. a while later raise rates, and then 3. another while later start whittling down the balance sheet. What they haven’t said is when that sequence would start.

If they stop QE then who would buy UST unless UST increases the coupon rate/interest ? Currently FED is printing money to buy treasury bonds on monthly basis..

Scott Peng said he expects the 10yr to rise 1.6 bps this year and the same next year and the Fed would have to quadruple its QE, and 300B would not be sustainable. I always figured that retail investors would take up the slack if offered a decent return, but it may be the rise isn’t enough to float the entire issuance, which makes we wonder what yields would the market need in order to buy all of Treasury issues, without Fed holding anything.

Ambrose, I think Scott is saying 106 basis points, 1.6 basis points is a yield sneeze. Stay safe.

Me, bad, Scott is saying 160 basis points which would almost be a doubling from here, but in this environment of crazy Monetary Printing and Uncle Empty Pockets Spending, not out of the realm of possibilities.

Ambrose Bierce,

There is going to be HUGE demand for 10-year Treasuries at a yield of 3%. So for the yield to rise further, that demand will have to be sated first.

If the yield goes over 4% (1.1% +160 basis points + 160 basis points) in 2022, People would sell everything, including their stocks and firstborns, and get in line to buy the 10-year to lock in a 4% yield for 10 years.

Unless we get 6%+ inflation and the Fed makes no effort to tamp down on it, then all bets are off.

Working for a US commodity manufacturer, we have seen huge inflation in the scrap steel index (our agreed barometer for steel prices) and also the price of steel we buy. This will need to be passed on and eventually will make it’s way to the consumer, killing demand until employment and wages rise. The consumers that can afford it will continue to buy, but that number has got to be trending down.

America cannot continue to import the way we do and allow rampant inflation.

Personal debt will be absorbed as public debt and paid off slowly. I’ve been a fortunate middle classer, personally, but I know how it works, the second you get behind financially all it does is compound for the worse. More people fighting over scraps while multi millionaires become billionaires using overseas labor could make the 2020/21 social unrest a walk in the park.

One shortage having a drastic result is the lost auto production due to chip shortages. This one is hard to figure out for someone who doesn’t know the specifics. Does a car need the super- duper fast micro-processor at the heart of a computer? I assume the ‘fast’ speeds for electronic ignition and fuel injection are relatively slow compared to the needs of the latter.

Here is what seems odd: if autos share the same chips as consumer electronics, wouldn’t the auto maker just outbid the outfit making stereos etc. because the auto maker is losing production of a 40K unit, not a few hundred buck unit.

I don’t pretend to know anything about this. It just seems odd to read of several auto cos halting production because of a chip shortage.

Just had one of those paranoid thoughts I accuse other commenters of having: could this be Chinese stockpiling ahead of possible sanctions?

Not an expert on this, but I believe the situation arose because the chip makers prioritize cell phones over cars in the event of a material shortage. Plenty of phones selling right now as well.

Automotive chips are a whole other thing from the chips that are in consumer electronics. Same silicon but vastly different packaging, temperature, failure requirements.

Also the industry is dominated by relatively few players; Bosch is a big one.

Apparently a lot of the chips are produced by a big player in Taiwan (TSMC). Lead times for the chips are long, and automotive is generally a just in time industry, so the Tier 1 suppliers that use the chips like Bosch who canceled their orders amid the shutdowns couldn’t jump to the front of the line when they realized demand was strong. Or, at least, it was reported that way.

nick kelly,

Cars today are computers on wheels.

This started three decades ago with electronic engine management systems (black boxes) that were connected to all kinds of sensors in the engine, the exhaust system, the transmission, etc. The idea was to govern the engine in a way that it performed better and ran more cleanly. This was how automakers finally overcame the drag that emission control systems put on raw performance.

Today, sophisticated computers govern every aspect of the powertrain, including the 10-speed transmissions. As a result, engines are more powerful, responsive, and cleaner than ever.

Now, just about everything in a car is governed by computers, your climate control system, your tire pressure monitoring system… every little thing is governed by a chip and software. And your dashboard IS a computer.

Then you have the big things, such as dynamic cruise control, self-parking aids, automatic emergency braking, driving assist functions that allow you to cruise down the highway hands-free, etc. These are standard functions on many cars today. They’re all computerized and require a lot of real-time processing power.

Google (Android), Apple, and others are vying to provide the operating system for the driver-facing portions of the car. Tesla developed its own software. But it too has problems procuring chips for its systems.

At the risk of being a broken record, motorbikes are also now computers on two wheels. Mine needs a battery tender to maintain its systems and have enough juice to start after resting in the garage for more than a just a few days.

The payback, as Wolf says, is more power, performance and efficiency.

That’s sad. Like when I first saw evap systems 250cc bikes! Think you get more evap when just filling tank, unless there is some sort of grommet there now. No credits for just using far less fuel, oil, rubber, etc, and way less pollution than a car, not to mention the road crowding reduction?

Miss the days when (having never had a garage until off grid and built one), you just bought a new batt when weather got good.

Everyone has so much money, it’s not surprising. Amazon with another blowout quarter.

Lots of money swishing about, from the stock market to retail to everything really.

Mister Richter,

No 4Q and CY2020 Earnings Swan Song for TSLA?

They were just included into the S&P500.

IIRC, they made 1.3BillionUSD in Earnings Reporting Profits, while making 1.58 BillionUSD in Carbon Credit Revenues…

Still not making money as an Automobile Maker…

Inflation seems to be just about everywhere. One area which has seen a rather dramatic increase is the cruise industry. These companies are apparently trying to recoup their epic losses over the past year. Prices for travel bookings for December 2021 are about up about 100% year over year.

Two key inflation/social instability metrics – firearms and ammunition. Both are at a historically unprecedented level of demand.

Firearms sales should slow down once buyers find out there is no ammunition to be had any-where unless you want to pay 4 to 5 times more than this time last year.

The transportation chains are breaking down, as well. Wal-Mart’s supply chains are starting to break, especially food; visit any Wal-Mart and notice how certain shelves are depleted, and don’t get replenished quickly as they once did.

Yes… gradually… then all at once.