$157 Billion in Debt. A reckoning of sorts. “Asset impairments and abandonments,” AT&T calls it.

By Wolf Richter for WOLF STREET.

After a horrendously expensive acquisition spree of legacy companies that included DirecTV and Time Warner – with the purpose to disrupt, one would suppose, but disrupt what exactly? – AT&T today disclosed that it wrote off $16.4 billion in assets in Q4, for a total $18.9 billion write-off in the year 2020. The billions are going over the cliff so fast these days it’s hard to even see them.

Today’s disclosure includes $15.5 billion in write-offs for its DirecTV business. “Asset impairments and abandonments,” AT&T calls them.

A write-off is an expense on the income statement that crushes net income. For Q4, AT&T ended up with a net loss of $13.8 billion. For the year 2020, it booked a net loss of $5.2 billion.

AT&T called this write-off a “non-cash” expense – to insinuate that it doesn’t matter, and Wall Street analysts go along with this view because they’re hyping AT&T’s stock and they don’t want write-offs to matter. And true, today’s act of writing off those assets was an accounting entry that didn’t today involve cash, but acknowledged a reality that did involve cash at the time – lots of cash.

Back when those assets were purchased, lots of cash was involved, including the company’s own form of cash, namely its shares.

AT&T had acquired DirecTV for $67 billion, including the assumption of DirecTV’s debt, in 2014. The deal closed in 2015. It paid shareholders of DirecTV a total of $48.5 billion, or $95 a share, in a mix of cash and AT&T shares. The cash was borrowed, therefore saddling AT&T with more debt; and the AT&T shares were freshly issued, thereby diluting existing shareholders.

So this cash was spent on the acquisition back then, not today. It wasn’t accounted for as an expense back then because it was considered an investment. But some of this cash that AT&T incinerated on the DirectTV deal was counted as an expense today. Today was a form of catch-up accounting of the money AT&T incinerated back then.

Then in 2018, AT&T acquired Time Warner for $108.7 billion. These and other deals saddled AT&T with a gigantic mountain of debt, $157 billion. S&P rates AT&T’s debt “BBB,” which is two notches above junk (my cheat sheet for corporate credit rating scales).

In today’s earnings release, AT&T reported that quarterly revenue in its legacy-video units, which includes DirecTV, fell and that it lost 617,000 subscribers in premium TV; and it reported that revenues in its WarnerMedia units also fell.

But revenues in AT&T’s wireless phone division rose, driven by a 28% surge in equipment sales. Americans went on a record-breaking binge in durable goods purchases, and AT&T got its share.

It remains unclear why exactly AT&T had bought DirecTV in the first place – outside of CEO megalomania, a drive for endless corporate concentration of power, and seemingly endless availability of cheaply borrowed money. And it remains even more unclear why it paid $67 billion for it, a legacy company in the pay-TV sector, in the era of rampant cord-cutting as people were switching to newer technologies and services, such as Netflix and other streaming services.

These acquisitions also ballooned AT&T’s biggest asset category, “goodwill.” Goodwill includes the amounts that the company estimated it had overpaid for acquisitions. It’s an expense that has been parked temporarily as an asset on the balance sheet, where it is patiently waiting to become an actual expense. And some of this goodwill became an actual expense today.

In Q3, 2020, AT&T carried $143.7 billion in goodwill. Today’s impairment charges (an expense) contributed to reducing goodwill by $8.2 billion from Q3, and by $11 billion from Q4 2019, to $135.5 billion. Goodwill is reduced when a portion of it is considered “impaired” and gets written off as an expense.

And there is more. Another asset that is patiently waiting to become an expense is an account called “Other intangible assets.” Today’s charge-offs reduced the balance of intangible assets to $15.4 billion, down by $2.1 billion from Q3 ($17.5 billion) and down by 5.4 billion from Q4 2019 ($20.8 billion).

There are still $135 billion in goodwill and $15 billion in “other intangible assets” sitting on AT&T’s balance sheet, and so there are plenty more opportunities for AT&T to write off more of the money it blew on its acquisitions.

The other thing that’s left behind on the balance sheet is the debt, and it cannot just be written off, it needs to be serviced or paid off, and it’s a majestic pile.

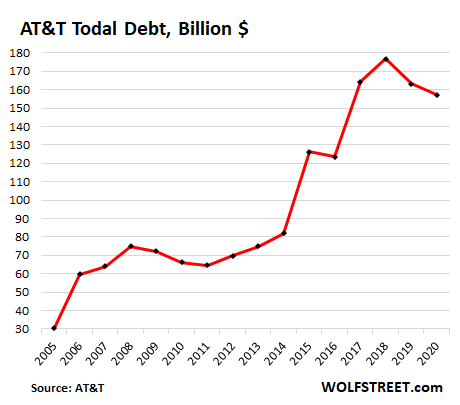

AT&T’s debt peaked at $176 billion in 2018. Since then, AT&T has been trying to whittle down that pile of debt, including by selling some assets, to avoid getting downgraded to “junk.” It’s trying to sell a portion or all of DirecTV, and the prices bandied about would entail a big loss. The write-off today was foreplay.

But the acquisition binge since 2014, starting with DirecTV, more than doubled AT&T’s debt from an already substantial $80 billion to a blistering $176 billion by 2018. This was cash that the company borrowed and then blew on acquisitions. Now it’s writing portions of these acquisitions off as “non-cash” charges – non-cash only today because the actual cash was incinerated years ago, and the debt is left behind:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

It’s good to see the zoo in full animal spirit mode….this kind of write off, no one even blink an eye, stock is barely down 2% today….that B is more like M now in terms of getting trader’s attention

“AT&T today disclosed that it wrote off $16.4 billion in assets in Q4, for a total $18.9 billion write-off in the year 2020”

Actually, may be it’s time to spark a short squeeze on T. I would think that might actually be a little more consequential than GME or AMC

But I forget, someone will be looking into those short squeezes soon, and it would not surprise me if there was Russian involvement somehow….

I wouldn’t bet on that strategy…we’re now in a new paradigm of Reddit mob rule combine with everyone think they’re the next Dave Portnoy. It’s a mix of disgusting cult worshiping as we seen in Tesla and sticking it to the old wall street ruling class with Gamestop and AMC. Perhaps Cruise line stock, Harley Davidson, other downbeaten retailers will be the next on their radar. In some way, I like what they are doing to the pro short sellers but on the other hand having to hear about these “investors” all think they’re the next oracle of Omaha really makes me want to go jump off the golden gate.

And…ultimately there are going to be a lot of latter stage bag holders among the longs, who joined up with the short squeeze initiators…but who won’t be able to find subsequent Gamestop buyers at a 328 PE. Or 128. Or 28.

The shorts (who at least did their homework on the underlying stocks) are getting crushed…but so will the second/third stage squeezers…who, for all their giddy fervor, did nothing more than go long on companies rapidly acquiring room temperature.

Is it possible that some of the “squeezed” stocks will be able to take advantage of their extra-high prices to recapitalize and reinvent their businesses … thus surviving and proving the shorts wrong after all?

For every winner, there must be a loser.

Depending on how you look at that sentence, the glass is either half full or half empty.

Here is the thing though, would you rather have rule by Reddit mob or hedge fund manager. It’s a false choice really if one thinks about it. Either way, the retail guy is nibbling at the fringes to take what profit there is. The sooner the retail guy realizes this, the better off.

My 2 cents worth:

o True, a couple hundred thousand Reddit/RobinHood boys and girls may indeed give Wall Street a black eye on GME and a couple other pieces of low-hanging fruit, but this same mob will take significant losses as GME stock backs down to it’s normal $15-$17/share.

o This is pretty wild (aka: destructive) stuff, so it remains to be seen how regulators respond

o Reddit/RobinHood boys and girls might want to think about how many times hey want to lose 3 & 4-figure money poking Wall Street in the eye.

Don’t know where to post this so I’ll do it here. Don’t use any social media but I do visit this occasionally. I’m in the oil and gas industry. Whispers of a big oil or gas “crisis” nationally of some sort in the works abound. Bigger than 73 most likely to push “alternative” fuel sources. I expect the media to do it’s part in the shilling.

Thanks..I’ll be sure not to toss out my spare quart of SAE 5W-30. In this environment it might go up to $350 overnight!

the earth is burning thanks to oil or gas chief

to JC below

the EARTH is BURNING because of that big thing in SKY

our little vibrations here ON EARTH mean very little

your part of problem ‘thinking’ (not very well) that people have much they can do to stop big guy in sky

Obvious consequence of halting polluting keystone pipeline combined with reduced oil exploration,refinement,etc. The last couple of years.Most f.fuel co.s have some vestment in so-called alt. Energy.This being said,Syria,apparently is seeing more of u.s. Troops and things are heating up with Iran,mmmmm?????????

The accounting term ‘goodwill’ has always puzzled me.

It could make sense if a product has a well- known name, or is even thought of affectionately by the public. Here ‘goodwill’ means value of ‘brand’. If you are buying a popular bar or restaurant it would be silly to rename it. So the name alone has value.

But who has any feelings (except possibly negative ones) about AT@T, or really any of the mega-corps like Time Warner etc. ? (The only exception where there is a warm fuzzy halo around a tech mega, may be Apple)

As a good first step to cleaning up accounting, how about removing the term ‘goodwill’ from legal GAAAP terminology and not allowing it by another name?

Where there is value in a brand, that could be allowed. It would not be easy to value like a fixed asset, but it would be harder to use as an all purpose, infinitely adjustable spring to cook balance sheets. It would be harder to say: ‘we would be broke but we have all this goodwill so we are very valuable’.

nick kelly

Goodwill is essentially the difference between what you pay for an acquisition’s hard assets, and the purchase price. On the day you buy it, it’s highly intangible but easy to calculate.

Brands do have value, and more than you seem to give them credit for. You may not like AT&T, but tens of millions of people do business with it. That said, I generally agree with your feeling about goodwill.

As an old CFO, I’d prefer to get that stuff off the balance sheet as fast as possible, which clobbers earnings and gums up the business case for “goodwill heavy” acquisitions. Downstream, figuring out if & how much goodwill is impaired is a royal political pain in the spreadsheet.

I always though “goodwill” was just a loyal customer base, and the company’s “good reputation”. Similar to when a Doc or Dentist bought a practice.

Maybe the nasty large scale corporate bean counters have found a way to mystify it more since those simpler small biz days.

Like a Rockefeller friend told Bucky Fuller, “Why make business simple when you can make it complicated”.

I can think of one (maybe smallish) reason why T might have bought Direct TV, not that I have any love whatsoever for ANY corp or it’s financial games, just disgust and sadness. Hatred hurts me, so I avoid it.

Many homes and especially apts in this area have for 40+ years had coax for cable installed in them during construction. For a long time there was no other choice if one couldn’t get good, reliable, RF broadcast out of SF (hills, skips, antenna problems, etc), and then, of course, the cable only shows (that were good at first) came along. Comcast had a monopoly and really stuck it to us accordingly for years.

So now that the satellite tech has been worked out, T wants a bigger piece of the TV action. After countless battles with Comcast, I even considered it as I like some (less all the time) TV and internet (which I get cheap from T since phone lines in my apts aren’t set up for anything higher than 768kbps, which is fine with me because I mostly read on the net, and watch tiny low res video sometimes).

Anyway, there are a lot of dishes all over now, and that is Comcast losing pissed off customers to satellite, even if it costs more or choices are worse, since cable hatred runs so deep here. Also some people just don’t want to get involved in any more corporate “systems” than they have to, or have the money or interest in learning new consumer gadgetry….like the crap in vehicles we are all supposed to be clamoring for.

Wolf,

Yes I remember AT&T was like in the low twenties around 2003 or so. They have the wire all bad moves by CEO.

AT&T stock been on a steady decline for some time. Many participants know the company’s investments are junk and simply hold on for the dividend. Not a bad play if the price can be sustained…

Shame T couldn’t invest better. They are a dinosaur of a “tech” company (more like a utility, really) that lacks savvy.

They are a utility but they see the future of their cable TV service and the cool media service companies. They want in to that field but it requires a whole other company culture.

As an A.T.&T. Retiree, have have closely followed its adventures for many years. Plagued by poor leadership and middle management you forgot one folly that just about finished them. That was when they hired a consultant, I believe McKinsey if memory serves to do a top down strategic review. Their advice was for A. T.& T to ignore the wireless fad and focus on other opportunities. They actually did this, but eventually spotted the obvious and bought McCauw cellular which eventually proved their salvation.

Ted,

Eh, no. That’s not exactly how it went down. It was actually even more twisted than you think.

McCaw Cellular was the one of the more successful of the early cellular pioneers in the US, having smartly licensed bigger chunks of the cellular spectrum than others.

ATT, which had no cellular business, purchased a third of McCaw Cellular in 1992, and then purchased the rest of it in 1994.

And then in 2002, in its infinite wisedom, ATT SPUN OFF its cellular division as ATT Wireless Services! No doubt to concentrate on its legacy core business of landline long distance service.

Another cellular pioneer, Cingular Wireless, which had been formed by a consortium of SBC (Southwestern Bell Corporation) Communications and Bell South, gobbled up ATT Wireless in 2004, becoming, with Verizon, one of the dominant cellular providers in the US. It was around that time that I first signed up for cellphone service, and it was with Cingular.

Well, by 2005, ATT had atrophied so much that SBC Communications BOUGHT ATT (not the other way around). SBC was originally one of the regional “Baby Bells” formed after the anti-trust breakup of ATT in 1982, and had become the most aggressively successful of the Baby Bells. So, now it was eating its own parent company. It chose at this point to take on the parent name “ATT”.

It would later merge with Bell South, which consolidated ownership of the wireless division (Bell South had part ownership of the Cingular part of the new ATT).

Cingular was a good cell phone company. The wireless division of ATT is still well run. The rest of the company is completely disjointed.

ATT is no longer even interested in running out landlines to new homes, as far as I can tell, even though they are still the only ones doing it. I’ve had to do this twice, once at a rental home that did not have a copper wire landline set up, and again at a new home I moved into six years ago. Both times required going through a morass of bureacracy at ATT before I found the actual local office of ATT that was supposed to physically come out and install the landline and told them to please come out and install a landline. Simply scheduling a new landline service startup online on the ATT website did absolutely nothing. Nada.

The monthly cost of a landline through ATT’s copper wire landline service turned out to be higher than getting similar phone service through the local internet service providers. Long distance over this internet phone service is free also.

The only good thing about the copper landline phone service is that it doesn’t go out during internet service outages.

Yep!!!Looked into landline here in IL. Several times for the same reason.People should wise up.EMP,solarflare/burst,bad actors-all enemies of functional comms.Get your landline,if you can.So I have an old phone,but still no landline,but will not give up. Re. The creative accounting and disclosure used by A.T.T.,Really?I do not call it a + or asset when I realize I overpaid for something,insanity!! Rather have commonfolk,Redditmob git some than more of the same privelaged a.holes.

Back in the 1980-90s, I think the CEO was Robert Allen. AT&T was famous for having huge “non-recurring” losses every quarter…for years. “Non-recurring” losses that reoccur every quarter for a few years tend to sort of look like…well…recurring losses.

Anybody who’d touch Time Warner with anything other than a pooper-scooper is nuts.

Another reason for a landline: if a person can dial 9-1-1, but can’t talk, they will still know what address to go to.

I’m amazed ATT bought Time Warner. They never heard of AOL Time Warner? That sure was a comical fiasco.

Burning money and calling it “Goodwill” is an interesting accounting obfuscation. I always appreciated the irony of it myself. Destroying money this way tends to counteract the Fed’s endless printing, a tiny bit, so there’s that. I feel bad for Grandma who’s still counting on receiving dividends.

Does the phrase “blue chip stocks” still exist? Seems so last century…

Megalomania, that’s really all the reason you need.

But, I am honestly surprised at you, Wolf. T actually loaded the company up with debt for a good reason, Megalomania (in the name of expanding their capabilities) rather than share buy back to boost prices.

So in the pantheon of financial sins, I thought you might have been a little more forgiving.

Next thing I know you’ll complain about TSLA’s quarterly miss… which by the way, should be accompanied by a WTF chart if you actually have the word Tesla in the title.

:)

I looked it up, they bought McCaw cellular in 1984 for $11.5 Billion, one of their few good moves.

1994. Fair enough. But McCaw was spun off from AT&T earlier on. Just like SBC which bought AT&T. Debt mostly serves to keep management sharp. It has to be a stick for that. Not pudding from Powell.

People love those dividends. How long will that keep happening? AT&T can’t print money but would appear to be able to do so.

WOLF

Appropriate typo:

“…AT&T’s debt “BBB,” which is two notches above CHUNK (my cheat sheet for corporate credit rating scales)….”

It sure is a “chunk” of junk – hee hee :-)

BBB is a triple-Buy rating, right? Buy, Buy, Buy! or is it like that NSYNC song, Bye Bye Bye?

Investing is like going to Vegas the house usually wins all board of directors need to be reviewed and held accountable no longer for investors on to enrich top management when chaos comes they will simply fly away to private retreats people are dumb like cattle

Apple had a pretty good quarter though. AT&T should think about remaking itself.

Consumers pretty strong across the board.

Yep, consumers flush with stimulus cash and no restaurants or bars to spend it at splurged on iPhones and iPads. Who would have thunk?!

So we can expect a consumer good sales crash once restaurants and hotels re open – diverting the money…back?

I think so. Especially when you consider so much retail consumption has been pulled forward.

I think so too. Restaurants around here (north side of Houston, TX) are open and most have a half hour to hour’s wait, even during the week.

We all know going back to restaurants won’t happen anytime soon.

Happening.Problems are:less customers feeling financially secure to want to blow $ for overpriced restaurant food since many have become used to cooking and gardening,canning,making own jerky,yogurt,beer,whatever and there Are far less open bars/cafes/restaurants due to covd.

Read my post above.

FL restaurants & bars are open

To find out about management at DirecTV, all you have to do is look at how AT&T’s DirecTV misclassified its satellite installers as independent contractors. After losing its Labor Law case at the 4th Circuit, AT&T squandered more money on appealing the case to the U.S. Supreme Court, which did not accept the case.

https://www.ca4.uscourts.gov/Opinions/Published/151857.P.pdf

Home satellite dishes are a great technology but everyone knows that home dishes are second-rate when it comes to getting high speed internet connections.

As for Time Warner, AT&T’s other acquisition, the less said about that company, the better. All Time Warner is good at, IMHO, is paying off politicians. When I had Time Warner cable service, its set top boxes sucked.

Customers have wised up about media technology for the most part, with the exception of those cult followers of the iPhone.

To be fair, most Android phones are crap.

*Some* aren’t. But most buyers fail to really take advantage of the more open ecosystem.

I used to be an iPhone hater too, and I would never get one for myself, but I gotta give it to Apple, they aren’t junk.

Goodwill is an accounting number , which results from acquisitions and generally can not be sold . I like to value goodwill as having a value of zero. Intangibles are items like patents , copy rites and brand names , basically non physical intellectual assets.

T vastly overpaid for Direct Tv and is currently paying the price.

It may or may have overpaid for Time -Warner if Covid 19 had not hit. But Covid 19 made it impossible to bring movies to theaters and Trumps loss has reduced the value of CNN.. T has the assets that it has acquired , but also has much of the debt

As long as it can still service the debt and pay its current dividend , it is a cheap stock

I wonder how much of that “strong spending” on cellular phones was due to the series of messages that AT&T was putting out telling people that their phone was going to stop working.

I got one of those, not because my phone doesn’t support VoLTE, but rather because AT&T refuses to allow it to do VoLTE because it hasn’t been “certified” by AT&T. The list of phones they have “certified” is very short, and heavily dominated by Samsung.

Not interested in owning another Samsung Fire-Starter phone. The day my phone stops working on AT&T is not the day I’ll buy a new phone, but rather the day I get a new carrier.

Switch to a prepaid company. It was a good day when I left ATT, an even better day when I left VZN. My bill is now half what I used to pay. They all have several affordable phones to purchase and the plans are about half the price of the big names. My only regret is that I didn’t do it years ago.

Forgot to add that the reason I switched to one of these prepaid companies in 2019 is because VZN also sent me those VoLTE messages saying my phone wouldn’t work any longer (as far as I know, they actually haven’t cut VoLTE yet). Unintended consequences!

Are the frequencies they license from the government the Other intangible assets?

Go big. They need a product. A robot named Ma. She cooks. She cleans. She answers your calls. She does your homework and types your papers. She gets your job, handles all your cannings, and picks up your ever continuing unemployment checks. She bids on houses and condos for you. She’s everything and nothing. And finally she terminates you when the big bill arrives. She then steals your i.d. and collects those benefits for “call us back, we’re lunching ATT home”.

Ma is owned by google (or apple or Facebook) , not by AT&T. They could only come out with the stepmother version. and as the fairy tale says you don’t want that

There is nothing wrong with buying a “legacy” technology company. It is sometimes surprising how long the “legacy” will last. I have an article that I snipped and saved in 1991 with some smart Wall Street analyst raving that Blockbuster Video was a sure short because CableTV was going to put it out of business. Which it did… twenty years later.

The problem is that you have to NOT OVERPAY for a legacy technology. Something that “buyout specialists” tend to be unable to do.

PS: For the life of me I never figured out why Blockbuster didn’t just copy-and-past the RedBox business model… or the ROKU model. It is pretty rare that a brand name lie that just goes dark.

Blockbuster did attempt the Roku model, way back in 2000. Unfortunately, Blockbuster partnered with Enron Broadband Services, which was actually all just smoke & mirrors.

Blockbuster then pivoted to Redbox/DVD by mail. Unfortunately, investor Carl Icahn fired Blockbuster CEO John Antioco for wasting money on this crazy new idea and instead had the company double down on it’s still profitable brick & mortar business.

AT&T pays a dividend and bond interest to their creditors. I suppose they have felt the pain of cord cutting, but are solvent and paying down debt.

The US government froze oil and gas drilling on Federal property. Some energy investors felt the pain of these new regulations. I have not heard of a plan to unwind stimulus and forbearance.

In Cuba medicine is supported with government subsidies, but few can afford it. Most Cuban families do not have cars either. Venezuela had cheap subsidized gasoline, but bare food market shelves. Under Soviet era communist rule, Russians spent much of their time in lines waiting to buy bread. The govt. regulated prices and production quotas.

I’m surprised AT&T has any ‘goodwill’ to write off. It’s one of two companies–the other being Wells Fargo–that need to be banished from the planet.

That list need to get a whole lot longer…

Comcast

Twitter

Facebook

all of those pharmas down in South SF

The list should start with A and end with Z:

Amazon

.

.

.

Zoom

I’ll give Comcast a pass; I’ve had their TV and internet services for at least a decade, and their service has been passable (internet speeds have increased considerably without cost rise). Cost is high, but I don’t think it’s all their fault–IIRC, it’s the ‘content providers’–insistence we have to ‘bundle’ hundreds of useless channels in order to get the dozen or so worth watching. Comcast actually lowered my service cost while they settled a dispute with some of the content providers. Tech support was better before they started automating actual humans out of the process.

My mom has AT&T DSL, and the service is abominable (barely better than dial-up). They keep trying to get her to spring for an ‘enhanced experience,’ which isn’t even available in her area.

Try cutting the cord.

I have an RCA Over The Air (OTA) antenna, Sling, and an Amazon Prime subscription. My oldest daughter has a Netflix account which she shares with me (I still pay her monthly cell phone bill).

The OTA local stations still have lots of decent content, and pretty good hi def, and it’s FREE

My mom is elderly, and eventually I’ll be moving into her place to look after her. I’ll be looking at wireless providers, at least for internet. There’s a cell tower less than a half-mile from her house but, so far, I haven’t found a 5G router for home use (the fees will likely be excessive, too). May have to go with one of Elon’s satellites.

BofA and (especially) Citi Corp are’t too far behind

Dear Wolfe Street Bank:

I am very pleased to announce this quarter your “loan” to us has now been reclassified as “goodwill” on our balance sheet!

In future quarters it is possible your “goodwill” may be temporarily parked as an “other intangible asset” on our balance sheet as it waits patiently to be transferred to “asset impairments and abandonment” on our balance sheet.

The reason for this balance sheet disclosure is our megalomania CEO was smitten by an attractive “two notches above” legacy asset. Company shares and your loan were exchanged for her acquisition which, at the time, considerablely balloned “goodwill” as the biggest asset category on our company’s balance sheet.

Soon after acquiring use of this asset, the CEO deemed it desirable to double the size of this legacy’s assets. Accounting reported this expense as an investment, doubling “goodwill” on our balance sheet.

Please with his success in doubling his first legacy’s assets, while quickly doubling the size of the company’s balance sheet, our CEO went on an acquisition spree, acquiring a second legacy asset.

Naturally her legacy’s assets were also badly in need of considerable upgrading. These expenses were classified as investments further balloning “goodwill” assets on our balance sheet.

To reduce the size of “goodwill” on the company’s balance sheet, legacy expenses classified as investments, are being “written off” as a “non-cash” charge on the income sheet which temporarily crushes “net income” this quarter but really doesn’t matter, as it is only an “accounting entry”.

The good news is your loan is now backed by four times the amount of legacy “goodwill” on our solid balance sheet!

Please rest assured, we will promptly inform you of any further movement of your “loan” on our balance sheet.

Your Trusted “Goodwill” Partner

Wile E. Coyote

Don’t let AT&T get away with abandoning your copper wire land line, if you still have one. It works in a power failure, if you have a phone with a jack that you can plug in. None of their internet based, VOIP, cell or internet over copper works when the lights go out in an emergency of programmed outtage. They are regulated, cry me a river over “inefficiencies”, i.e. loss of profits.

From Techwire, 2016

“According to AT&T, 85 percent of households in California no longer have a conventional landline phone from a traditional provider. But AT&T is required by state law to maintain and operate its 600 central switching offices across California as if the lines were being used at 100 percent capacity.”

“However, some of those offices are running at just 2 percent, wasting massive amounts of energy and water to cool equipment and human resources to run them, said Ken McNeely, president of AT&T California.”

“That is money that could be spent on the more efficient, virtual and software-controlled Internet services that the majority of Californians use, he added.”

“Every dollar a company spends on old technology is a dollar it can’t spend on new technology,” McNeely told Techwire in an interview. “Consumers want new technologies.”

Bullshit, it’s a dollar less profit to America’s largest destroyer of traditional jobs: AT&T.

Gavin,

We got rid of our copper line 12 years ago. We have broadband via wireless and broadband via cable. Nothing more needed. If power goes out in a wider area, then the Internet access servers go out that copper cables use to connect you to the internet, and you cannot get online. Yes, you may still be able to make voice calls, but I’m down to about 5 voice calls a month, and I’m fine with zero. What I need is the Internet.

Set up tethering as backup! It seems that the LTE towers have some kind of battery backup.

I have a land line with a 500 series dial telephone. It always works during power failures. My central office has battery backup and generators so my copper-wire DSL internet always works during power failures. Handy. All my outgoing calls are non-AT&T cellular, unless I need to use the dial telephone.

Swore off AT&T in the 90’s due to their cellular contract of adhesion; recently back in their fold as an ISP customer. Where available (mainly apartment complexes) their gigabit fiber internet service is incredible. (Was an early FIOS fiber client, this is 10x faster.)

I worked with AT&T Datacenters, etc. The servers have power from two separate UPS power sources. The power fromm the local utility has two separate feeds in case one is cut. Then on top of this they have backup generates and back up battery UPS power sources.

What is also interesting, during the summer, the local utility company asks AT&T to turn their backup generators to help power the grid. Kid you not

I was a kid back then, so my memory is hazy, but when VOIP first came out, my dad refused all the overtures from the cable company to ditch the POTS line. He wanted phone service in case the power went out. But anytime we had to get the POTS serviced, the company had to send a different technician; the POTS guys were old-school union techs.

Anywho, I also learned that there’s an entirely different regulatory scheme with POTS/VOIP because when POTS came out, the government actually cared about people as citizens, and not consumers.

Dear Gavin,

We in the state of California value our resources, the extra energy required to run those landlines is forcing us to consume energy from unclean sources like coal and natural gas and nuclear. The laws were put in place at a time when people were not conscious of these issues, and done by a bunch of self serving Republicans.

For the good of the future, and for our children, we must move away from this antiquated technology.

because you know… the children are the future, and such, I think there is even a song…

Signed… your California State Government Overlords.

:P

Did you forget the sarc tag?

Ross,

MCH He never uses the sarc tag. That’s part of this sarc

Re the short squeeze…. Love it! Love to see those hedgies getting schooled by the muppets.. They can dish it but they sure can’t take it.

Whimps. Gotta call mommy to save their hypocritical little patoots.

Looks good on ya lambo-boys. They be big – so big that Blackrock got the SEC to relist China Mobile for one day – just long enough for the shwartzies to bail – and the rest of the civilians were just collateral damage. Do I sound a trifle annoyed? Yes indeed. Keep ’em coming robinhoods.

It seems that Trump’s move against Chinese companies with ties to the Chinese military will cost American investors millions of dollars in losses as the stocks in question are dumped by Americans and repurchased by Chinese investors at distressed levels. The Chinese companies certainly won’t be going out of business. What was the whole point of the exercise?

Troop’s should read Trump’s.

Anon1970,

I fixed it for you. Next mutilation of Trump’s name will cause your comment to be deleted. I don’t have time for this.

Anon1970

“…The Chinese companies certainly won’t be going out of business. What was the whole point of the exercise?”

Wlid-assed guess: bad idea to have American retirement funds supporting Chinese military; do I win a prize?

It seems that DirecTV was a poor acquisition. They haven’t got much coming. AT&T should sell it’s assets and rent them back. Pay the proceeds to some banks and the board. Go two notches lower on that debt.

Ah, “goodwill” … I prefer “spackle” … the stuff that fills the yawning crack between what you demonstrably paid and what you demonstrably got.

When I last did the math, AT&T’s assets were 27% spackle.

Seems like a lot.

The cable apocalypse realization hadn’t fully hit the media/telecom conglomerates by 2015.

The DirecTV acquisition seems utterly stupid now, but for those who were not tech savvy in 2015, it seemed a *little* more reasonable back then.

Maybe they should have someone a little nerdier vetting these acquisition decisions?

I’d posit 2020 is the ideal year to bring your skeletons out of the corporate closet and declare as many losses as you can … at the worst it’ll go under with the majority of corporate losses the government mandated corona measures caused and maybe there’s even a juicy government bailout for them …

AT&T sounds like a similar story to BT here on the other side of the pond. The former monopoly provider making big, bad bets and trying to move into other areas and seeing the share price stagnate as a result

Having to borrow for the $20 billion or so it spent for 5G spectrum at the FCC auction won’t help either.

Harvey Cotton,

At least there will be a long-term return on investment. G5 will be a big money maker for the carriers, not just on mobile phone subscriptions and data plans, but also on the Internet of tings (including cars) that will be connected to it, which are all subscriptions that carriers will get paid for.

I agree. There will be a moat around that business.

Also, AT&T and Verizon are both U.S. owned companies so the government will favor them over T-Mobile for any big defense or security type contacts….such as Firstnet.

The stock symbol for ATT is T

I don’t have any specific or insider knowledge, but the cable industry in general is a series of local monopolies/monopsonies.

DirecTV with its satellite model in theory could disrupt those – not at all clear how well it actually does.

In tech its, you snooze, you loose. I gave up on an ATT land line because of ATT’s run around. We have unlimited prepaid cell phones. Our vidio is antenna or streamed over a wifi hotspot. T-Mobil says it will be cheeper when 5g hits my location. If this becomes a trend, what does ATT plan to sell?

What did Buffet say? Eventually even the best business will be run by idiots. Well, wireless communication is a money machine, but in the case of T and VZ, managements can’t leave well enough alone. Instead of giving all the free cash generated by wireless, they blow it on stupid acquisitions. DirecTV, Yahoo, etc. etc. etc.

why did At & T buy Time warner and Direct TV ? now , it is trying to dispose of them? this waste where was the board of directors? has any management been fired over this fiasco?

“write-offs for its DirecTV business.”

Worthless service. Had a commercial account and got a letter the equipment had to be upgraded. Called them to come upgrade. They said “Naw, keep the equipment.” Switched to an internet streaming service out of Japan at 1/10 th the cost. Also customers are happier.

Which brings up “$143.7 billion in goodwill”. LOL. Now there’s an asset that’s on an accelerated depreciation schedule.

it shows you should not trust corporate management. We have a shortage of skilled managers. A T & T bought Direct tv and Time Warner and was applauded. Now, it has put Direct tv for sale and …is being applauded. what a waste of resources.

Now, Time Warner has these expensive movies it can not monetize due to the pandemic.

Dune, Tenet, Wonder Woman and others.