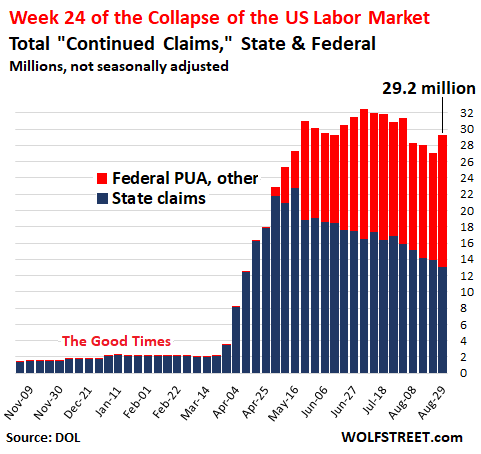

Continued unemployment claims jumped by 2.2 million to 29.2 million, worst since Aug 1, as claims by gig workers under federal PUA program soar. State plus federal initial claims jumped to 1.59 million “not seasonally adjusted.” 18.3% of labor force on unemployment insurance.

By Wolf Richter for WOLF STREET.

Powered by a nasty jump in continued unemployment claims under the federal Pandemic Unemployment Assistance (PUA) program for contract workers, established under the CARES Act, total continued claims under all state and federal programs jumped by 2.2 million, “not seasonally adjusted,” to 29.2 million people on unemployment rolls, the highest since August 1, according to the Department of Labor this morning.

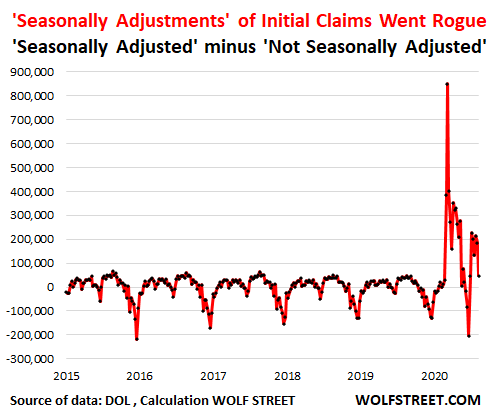

The Labor Department last week announced a major change in how it would figure “seasonally adjusted” unemployment claims because they’d gone rogue during this crisis. I stopped reporting “seasonally adjusted” claims in May for that very reason, and focused exclusively on “not seasonally adjusted” claims. So what you have seen here since May, and what you see here today, are “not seasonally adjusted” claims and they were not impacted by the Labor Departments Change (more in a moment):

These 29.2 million people, “not seasonally adjusted,” who continued to claim unemployment insurance (UI) under all programs translate into 18.3% of the civilian labor force (160 million, according to the Bureau of Labor Statistics).

Blue columns – continued claims under state programs:

The number of people who continued claiming UI under state programs fell by 764k to 13.1 million (not seasonally adjusted), along the downtrend that began in May.

Red columns – continued claims under federal and other programs:

The number of people on UI under all federal programs established by the CARES Act and some other programs soared by 2.97 million (not seasonally adjusted):

- Federal PUA claims soared by 2.60 million to 13.57 million. The Pandemic Unemployment Assistance program covers contract workers, the self-employed, gig workers etc. who’d lost their work. This was driven by a 2.3-million jump in continued PUA claims in California.

- Federal PEUC claims ticked down to 1.39 million. The Pandemic Emergency Unemployment Compensation program covers workers not covered by other programs.

- State Extended Benefits declined by 46k to 168k.

- State STC / Workshare fell to 270k (employer avoids layoffs by reducing the number of regularly scheduled hours of work; employees receive some wages plus a pro-rata share of weekly benefits).

- Federal Employees ticked up to 14.0k continued claims.

- Newly Discharged Veterans ticked up to 13.7k continued claims.

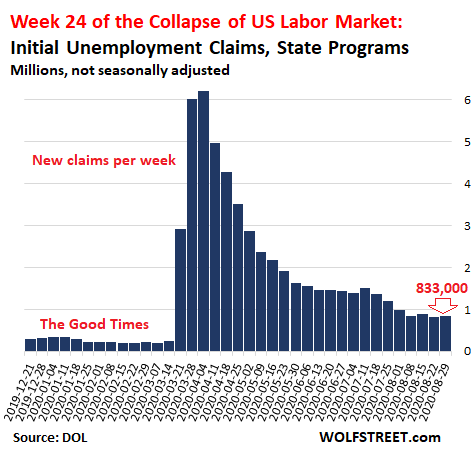

The newly-laid off workers: Initial UI Claims, state & federal:

Initial claims under state programs rose by 7k to 833k, “not seasonally adjusted,” in the week ended August 29. They’ve been in the same range over the past four weeks, with no improvement.

Initial claims under the federal PUA program for contract workers jumped to 759k, from 608k in the prior week (not seasonally adjusted).

State plus federal PUA initial claims combined jumped to 1.59 million people, not seasonally adjusted, who’d newly lost their work and filed for unemployment insurance during the week. This translates into a monthly rate of 6.8 million people who newly lost their jobs!

Labor Department’s fix of “Seasonal Adjustments” that had gone rogue.

In May, it became clear to me that seasonal adjustments were wildly distorting unemployment claims, and I switched to discussing only “not seasonally adjusted” unemployment claims, which is what you see here. Last week, the Labor Department explained why these adjustments had gone rogue and how it would change its method of figuring “seasonally adjusted” claims starting today. And it did.

Just how rogue these seasonal adjustments had gone is demonstrated by this chart that shows the difference between “seasonally adjusted” initial claims and “not seasonally adjusted” initial claims. The difference should be in line with the seasonality of the labor market. The largest seasonal factor is the surge in unemployment claims in late December and January (the big dips in the chart), following the surge in hiring during the holiday shopping season. But during the current unemployment crisis, those adjustments went rogue:

In the chart, you can see that the entry for this week dropped as a result of the new system of figuring seasonal adjustments, and is now about where it was last year in this week. So it seems the fix of “seasonal adjustments” is working. However, I will continue to report “not seasonally adjusted” claims at least until the dust settles.

A sort of sector rotation of layoffs, and it’s not a good sign, even as millions of lower-wage workers are being hired back. Read... The Second Wave of Layoffs is Here, Now Hitting Well-Paid Jobs

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

What on earth does “seasonally adjusted” mean? It appears that prior to this year, the DOL just adjusted the graph to look like all prior years, data be damned. Did they do this by sliding data back and forth to make the fluctuations all look the same?

Do they provide a methodology for their calculations?

gnokgnoh,

I explained some of this last week. Go down to the heading that starts with “Data Chaos”:

https://wolfstreet.com/2020/08/27/unemployment-data-chaos-labor-dept-admits-seasonal-adjustments-went-haywire-during-pandemic-why-i-stopped-using-them-in-may-week-23-of-u-s-labor-market-collapse/

It’s wild that the weekly claims reported in the MSM are 882k. Thanks for keeping it real here Wolf and explaining your methodology. What about accounting for people who are no longer taking unemployment but are no longer working? Also for the people who made their living through grey or black market stuff. Any way to account for that? What kind of % do you think would we be looking at?

Wait til next months numbers

remember if you aren’t on unemployment then you are counted as

NOT IN WORK FORCE

with just 100,000,000 counted this way what could be wrong with this

been like this since 2009(the obama years)

Those come out in the national survey data “Employment Situation Summary”. The August survey from a couple weeks ago comes out tomorrow. Here are the dates for the rest of the year – it’s usually the First Friday of each month.

August 2020 Sep. 04, 2020 08:30 AM

September 2020 Oct. 02, 2020 08:30 AM

October 2020 Nov. 06, 2020 08:30 AM

November 2020 Dec. 04, 2020 08:30 AM

Thank you Wisdom Seeker

So much for that “V” shaped recovery Markets tanking on the news Buy opportunity in metals coming up

Those markets are rigged as well

They may be but over the long term you can’t go wrong with gold and silver for wealth preservation and that’s what I’m looking for Not looking to get rich

I was surprised to see something actually trigger a down day!

Indeed I thought the FED had the equities market covered

Guess you can’t deny reality forever after all

They do, but the FED has to let the “machines” cash out every once in a while in order to suck in more retail buyers.

I have a new theory: the stock market gains were fueled mostly by people who normally did not participate in the market but took the free money from the fed and put it into the ‘hottest’ stocks with the idea that they would ride it while it rose and then sell at/before the crash.

These people know that they are on thin ice being already unemployed or in danger of unemployment so they want to maximize their money while they can so that they can live on it during as long as possible during the lean times coming.

Today something tipped and now they’re all taking their money out and will sit on it/live on it during the lean times.

It explains why all the money was going into the ‘sexiest’ stocks only, none of these people had any intention of long term investing. I wish I had recognized that TSLA was the leading indicator of this and seeing the downward trend two days in a row should have tipped me off that a wider sell off was coming.

Zantetsu: yes and no.

my sister’s circle of friends all did 401ks and some retail investing, but because of the shutdown, have a ton more money to invest now (~5K/month). All the money that used to go to eating out, concerts, vacations, etc goes straight into stocks.

But yes, there is the BarstoolSports investor bro now, who used to spend 1-5K/week sports gambling, but now does Robinhood calls. Buying TSLA calls is the same as picking the Pats -10.

The action is a reallocation, to stronger hands. Wouldn’t be surprised if WB didn’t nibble at some airlines stocks. Some of these should start to show signs of accumulation. If money flows away from TSLA back into GM it should provide price stability to the indexes. The market was overbought, due to a few bad (AAPL)es (sic). Options premium is out of control. When the Fed opens it doors to hedge funds and leveraged corporate bond buying, they are opening a pawn shop in the bad part of town.

The markets don’t trade on rationality so I doubt that’s what did it. I’m a fan of the idea that ai algos trained to manipulate market sentiment have finished goosing this round of drunken exuberance and maybe now they’re taking this dog out back to shoot it. The image of robinhood schmucks being led off a cliff by a robot instead of independently valuing a few tech stocks at world gdp soothes my cynicism.

Btw, labor force participation ticked down after the rebound. Something tells me this will continue the downtrend that existed prior to the lackluster plateau that occurred over the last few years.

The change at the DOL makes sense because multiplier seasonal adjustment for this situation is problematic, as you said. But the economic news media reporting of the numbers is horrific. Case being Jeff Cox of CNBC with the headline:

“Weekly jobless claims total 881,000, better than expected as labor market continues to heal”

The next to last line of the article is:

“The total for workers receiving benefits, a number that is a week behind the current data, rose to 29.22 million for the week ended Aug. 15, up about 2.2 million from the week before.”

Wow.

Classic doublethink in that CNBC article! I read that this morning and thought the exact same thing.

I think a sharp rise in PUA claims could be in part due to a lot of self employed (single owner LLC types) running through all of their PPP money, still not able to function as a business in this economic climate and being forced to sign up for unemployment through the federal programs.

I know of many people switching back and forth between PPP and PUA and this may help to explain such a sharp rise in those “red bars”.

Either way, the MSM is still sugar coating the numbers and it a nice to see some factual observations here on this website. Hopefully these numbers make it into a history book at some point and not the BLS/ DOL B.S.

People are also rolling off the 26 week state benefits and into the Federal program for the next 13 weeks. So the headline continuing claims will go down (state benefits), but it will be more than made up by continuing claims for all programs. Meanwhile the market cap of Apple will probably exceed the GDP of the UK.

CNBC is a bunch of cheerleaders, starting with Rick Santelli, who nearly wet his pants with excitement on-air at 8:30 am ET this morning, when he breathlessly reported that initial claims were “down” to only 882k!

I find the reporting on Bloomberg TV to be a bit more reality based..

I am trying to understand the California numbers- is this just a lot of independent contract workers and small business owners etal running of CARES funds with California still largely shut down for all practical purposes? It otherwise doesn’t make sense to see this large a jump in just one state.

Tech workers are often 1099’s and the likes. When I worked at Google, was offered at Apple, etc. In 2010-18 it never was the actual firm highering you…

But instead some contracting company at a slashed rate. Those jobs I’ve felt for a while would role off as I was outsourced from that multiple times.

I often replaced folks making 80k with $17 an hour myself. Then they found an indian guy for $5.

I live in Central California. For all ‘practical purposes’ we are not ‘largely shut down.’ To drive around town, go to stores, etc. you wouldn’t know there is any sort of ‘shut down’ except now everybody is wearing masks. Bars are still shut down, but restaurants are surviving on pickup, delivery and outdoor dining. Salons opened last Tuesday, and I got a much-needed haircut (and one today in the market).

I can’t speak for the BA and LA, but they are obviously much more population dense. With the exceptions I noted, it’s ‘business as usual;’ and gun stores are cashing-in.

Congress has to pass additional compensation for the unemployed. Most states average a high payment of $250 a week and it’s taxed too. The current extra $300 is not enough to support anybody these days.

All the landlords want their rents but don’t understand that the money has to come from somewhere. Most landlords commenting here say they are mostly getting paid. Wait until the first to claim unemployment fall off the rolls, that’s maybe two weeks away. The vacancy rates are up because people have to double and triple up. The food lines are miles long. Food stamps have been cut.

Any wonder the natives are restless.

Those falling off the regular state rolls qualify for the Federal program of 13 more weeks of benefits. But as you said those benefits are a pittance.

That’s very unfortunate but the natives if they had any intelligence should have seen this coming at least a decade ago But no instead all I was reading was about 60k dollar pickup trucks and young couples buying 500k dollar homes The pain is going to be epic this time around and the gubmint cannot possibly come riding to the rescue unfortunately Bucket up folks

I could envision something catastrophic happening eventually. But what I could never envision is the stupidity of govts worldwide reaching a peak all at once.

Aw, come on Petunia, whenever did the stupid play by the rules! :)

I just read a long, interesting article from ‘The Atlantic’ about the banks situation. They have largely loaded up on Collateralized Loan Obligations (think CDOs only based on commercial real estate). One repeat offender, who I won’t name–*cough* Wells Fargo *cough*–has over a trillion $$$ of these, on and (sorta) off the books. This could be another, slow-rolling GFC.

California Bob,

That article in the Atlantic was a gross exaggeration. Most of these CLOs aren’t held by US banks but by investors, such as hedge funds, bond mutual funds, life insurers, Japanese banks, and the like. Here are some actual numbers:

https://wolfstreet.com/2020/06/29/who-will-get-hit-when-collateralized-loan-obligations-clos-blow-up-banks-or-unsuspecting-market-participants/

“…all I was reading was about 60k dollar pickup trucks and young couples buying 500k dollar homes”

That might be the problem. Companies I work with have many ex restaurant employees and similar service people applying for jobs they have zero skill set for. Many people ARE are trying. Guess what… these companies aren’t hiring and are all scaling back substantially.

How dare the “gubment” help its citizens. We pay taxes for them to rescue the job creating corporations and PE gangsters. I guess these desperate people should have planned better and been bankers.

This ridiculous line of argument is really getting tiresome.

Outside of a very select few industries in a few areas, most businesses are open. To the extent that those segments of the economy are “idled,” it’s because DEMAND is gone. You can’t FORCE people to go to restaurants (I won’t!). You can’t FORCE people to fly (I won’t!). Where I live, restaurants are allowed to be open at 50% capacity, and have been since May or June. I rarely see any individual restaurant above 25% or so.

It’s not the government shutting down businesses to protect the “vulnerable.” It’s consumers staying away from certain businesses and reducing spending.

Until the virus is under control and people are no longer worried about their health, that will continue.

I’m not trying to be rude here, but honestly…

Get your fear under control. Why are you afraid to eat at a restaurant or fly on a plane?

Seriously. Snap out of it.

You really think that the 6 month lockdown of the economy/society has nothing to do with federal, state and local government actions?

Do you think the restaurants (and all other businesses for that matter) want to run at 50% capacity (25% where I’m at). The government makes them do it.

History will document the Cytokine Storm of government overreaction as one of the biggest follies of this era.

Consider this…

“Inaction breeds doubt and fear. Action breeds confidence and courage. If you want to conquer fear, do not sit home and think about it. Go out and get busy.”

–Dale Carnegie

Agreed, very tiresome to explain this again and again. I notice that schools and universities are closing about as fast as they open.

I don’t want to eat at restaurants because I don’t want to put not just myself but also the servers unnecessarily at risk.

The fear is easily explainable: one is risking not just a bad couple of weeks with a tiny chance death, but also an uncomfortably high chance of long-term health complications, and moreover one is also risking that for the people around us that we care about. Beyond individual choices, we as a society risk overwhelming our healthcare systems.

Sorry, buddy, we have a real disease with real consequences on our hands. I wish it weren’t so, but it is.

Kamikaze, who said anything about me? The fact is, the American people are largely not willing to eat at a restaurant or get on a plane. The numbers prove that.

We didn’t have a “six month lockdown of the economy/society” and I’m really tired of this flagrant dishonesty. I live in Fort Lauderdale. Our restaurants were allowed to reopen in May, so the shutdown of restaurants was more like 5-6 weeks. They’ve now been open for three and a half MONTHS, and they’re nowhere near at the 50% capacity they’re allowed to be.

Whether or not YOU think it’s justified to be “fearful,” a lot of people are. And they are governing their lives, and their spending/consumption, accordingly. And it will remain that way until the virus is under control.

MarMar, exactly. To me, the benefits to eating indoors at a restaurant (I’m still doing plenty of takeout) is so far outweighed by the risk to me and others that I choose not to take it. Could I do it and have everything be fine? Sure. But why take the chance? Is it really that important to people to eat at restaurants? Is your life really going to suffer if you have to eat at home?

It’s equally if not more likely that any drop in demand can be explained not by fear of the virus but fear of the recession or a coming depression.

By the way, these “long-term health consequences” of the virus I keep hearing about; does anyone have a link to the evidence?

If you continue to subsidize unemployment, you will continue to get more of it. The only way to begin to reduce unemployment is to continue to taper off unemployment benefits until that reduction forces people to work.

Jdog,

How do you figure that? Trying to “force” people to work only works when there is work. Since large chunk of the economy including restaurants, retail stores including mom-and-pop stores, air travel, hotels and all of their supporting industries have upped and died, just where are of these ostensible slackers supposed to get work? Demanding people find work under such circumstances is a nonsensical demand that will fail.

Honestly, this sound like just telling people to go and die, including their families. No work, no unemployment, no money, no food, and no shelter for tens of millions of people sound like a prelude to civil war for desperate people do desperate things.

There are two types of people, winners and losers. Winners make their own luck, and their own way in life. Losers sit around waiting for someone else to hand them something.

If you are waiting for someone to “give” you a job, then you deserve to be unemployed. There is plenty of work, and there is even more opportunity. You do not need a job to make money, you just need a little drive and ambition. If you do not have these things then perhaps you should not be part of the gene pool….

I suppose he’ll plenty of those lazy ‘unemployed’ to built up the log ramparts and dig out that ‘mote’.

Yo jdog – Three types of people:

1. People who make things happen

2. People who watch things happen

3. People who wonder what happened

I am reminded of the winter ice storms in nebraska when a farmer was on the radio saying his farm was destroyed. He said he used to have no pity for people who suffered in natural disasters and thought they should have been more prepared. Then when disaster struck him, he admitted on the radio that he was thinking differently now that he was in the same situation and was hoping for help because he had nothing left.

Unemployment should not generally pay enough to serve as a disincentive from working or investing in oneself, but Jdog better hope he never finds himself in the position where he is the loser. I imagine him gasping at his words and being the stoic last neanderthal. RIP

Jdog:

What an obscene post.

“There is plenty of work, and there is even more opportunity. You do not need a job to make money, you just need a little drive and ambition.”

Is there plenty of work?

Really?

How about one’s health?

Is a person physically capable of working?

And if all one needs is ‘drive and ambition’, why aren’t you as rich as Buffet?

JBird4049:

Reminds me of the classic ditty during the “Great Oklahoma Exodus”

Goes something like this:

“Dear Oakie,

If you see Arkie

Tell Him got a job for him out in California!

Picking up prunes,

Squeezing oil out of olives!”

You really have to have the tune to follow but I think you get the drift!

Problem is, so much of that “pruneland” has been paved over for those $60,000 pickups and $500,000 homes!

What Civil War? I don’t think many people would fight for the government. I don’t think soldiers would.

paul easton: if they can, people will steal whatever they need to survive especially when it comes to food. Too much of our ruling class is concerned with order and keeping their wealth instead of having a society in which people can live.

Since the military and the police serve the state, that will bring both sides into conflict. Whether or not the military will be very enthusiastic about crushing their fellow hungry Americans is a very good question.

Ahhh…the ole “I’ve got mine so fark you” .

I was told disasters bring out the best in people, but evidently, not everyone.

Jdog, you think you’re special and you’ll never need any help. That’s okay. But people with nothing to lose won’t hesitate to take your stuff.

My sister-in-law is going to get the $300 a week. However, she pays $1333 a month for health care (premiums + deductible). That Obamacare sure is a good deal. Not.

$300 a week. Back in the day I had bigger bar tabs.

I never thought the shutdowns were a good idea.

Petunia Don’t forget the Repo crisis last September This situation is multi faceted and long in the making

We didn’t dig ourselves into this hole overnight you know

Petunia – Do you think it’s time to tack a new course and move through this?

KS,

Yes, I think they should open up everything. Let people decide what they want to do, take the unemployment, stay home, or live a normal life. The reality is we live in a dangerous world each and every day. So what’s new now? Nothing.

The wealthy hate the indigenous population, this is a good opportunity for them to cull the herd and allow new settlers to take over. These new settlers worker harder for less.

Harder , not always but for less , almost always I retired at 50 rather than try to compete with 18 year old “ settlers” I prepared for this starting in 1980 because I felt in my gut it couldn’t be sustained forever

True – especially when the newest workers can telecommute from lower rung countries. ‘Course that will decimate consumer demand in first world countries.

“In the midst of chaos, there is also opportunity” Sun Tzu.

Software devs in India make $12k a year.

The software dev job in America pays about 80K vs. the 12K in India. However, 12K in Bangalore is is good pay. They are comparable to the Yuppies of the Eighties. They live in nice homes, drive nice cars, and have all the toys and night life they want.

Even in India there’s no way to do all that on twelve grand a year Just try pricing a new Beemer convertible over there and you will see what I’m saying

The wealthy do not hate the indigenous population any more than a rancher hates his cattle. You are livestock, and have value as such.

Wonder when the “cattle” are going to go off the reservation and do some really seriously stampeding ? My guess is it won’t be long now from the looks of things but what do I know

Won’t happen this generation. It will be the next one that will do it.

Americans are sheep, so it will be circumstances that will teach the new generation of Americans.

Herd Immunity vs. Herd Mentality.

The lemmings seem to be ahead…

Cliff diving and base jumping seem to be trending.

They won’t. If they had any courage and drive, they would not be struggling for survival to begin with.

Jdog, you might benefit from googling The Role of Luck in Life Success. Your viewpoint seems a little short on data.

For some reason most American white people don’t know how to manage anger, but now the younger ones are training in that with black protesters. I think soon they will start dealing with their own problems.

I’ve never seen someone enjoy role-playing on a message board as much as Jdog.

jdog

My mother, the mildest of women, told me something that has resonated throughout my life.

“Son, don’t hate the rich so long as they provide decent jobs for the rest of us because that is their purpose…..However should they fail to do so, remember that they are mortal and will easily bleed and their posessions will burn.”

Wolf,

Thanks again.

This surge in continued claims tells us that the expiration of the $600/week in UI benefits had only a limited beneficial shelf life. A few short weeks was all.

A number of pundits were predicting that folks would get off the couch and reclaim either their old job or find another one once the juice ran dry. Didn’t believe it since there are few jobs available.

POTUS’ Executive Orders won’t do much to resolve the situation either as there is limited funding to be siphoned off from the FEMA budget. Might enable further payments for a matter of weeks/months. Besides only a handful of states have even signed up with FEMA to obtain funding.

Claims really get ugly starting in Q4.

Oops,

Misspoke. Majority of states have been approved by FEMA for POTUS unemployment insurance funding with the $300 weekly bonus. They’re calling this the Lost Wages Assistance (LWA) program.

Sounds as if payments may have already started in a couple states (AZ and LA). Haven’t heard of any states forking over the additional $100 bonus as POTUS planned. One state, South Dakota, turned down the offer since their economy never shut down completely and they’ve regained 80% of the jobs that were initially lost.

Still this new program won’t last long. Limited funding behind it. Might last a month or so before the money runs out.

Government data of all types is worthless if politicians are involved. And they ain’t much that they are not involved with. Pour out milk and one politician blames another in a failed policy on how much got poured out. UI is some where between 20 to 50 million, maybe .Pick your number that makes you comfortable. One brother in law says it is less than 10%. Another said it was more like 25%. The local MSM news outlet parrots have been all exictied that 2 taco dives re-opened in my burg. One thing for sure . If I get into the snoot juice a little heavy I can throw out some govt. data that sounds good at + or – 50%. Wolf is as good as the data he has plus a premium for being Wolf. My 2 cents is That it is worse for certain people that have never had it good to begin with. It’s starting to not be good for those that had it good.

Even the labor department says unadjusted claims are the key right now. Growth really slowed in August.

I hope this sell off settles down so I can start a short position. This feels like a MASSIVE 1987 crash is coming precipitated by NO MORE STIMULUS MONEY once this extra $300 per week unemployment benefit runs it’s gonna be hard times!

I was really hoping for TSLA to have an up day after announcing $5BB stock offering but no such luck, that just goes to show you how weak this rally really is. TSLA has been getting hammered ever since they announced plans for a stock sell……..and such a little bit of money. LOL

Gov’t will most likely do another stimulus at the end of the month.

PPP and PUA will be revived in order to deliver the defibrillator treatment to tamp down the chronic case of economic arrhythmia.

I don’t agree with it personally, but it’s practically built into this year’s election theatrics.

Hey, what’s another Trillion or two in 2020?

(or for Pelosi… 3T!)

Absurd.

You really still see things in red and blue color channels? Squint your eyes and take another look at those colors side by side. If you look hard enough you’ll start to hear this sound…

brrrrrrrrrrrrr

There will be more printing.

Senate is not even in session. McConnel has said no stimulus until after the election.

Harrold:

McConnel is a corpse….

He would need the, “paddles” multiple times just to wake him………sad.

Raise your hand if you thought you could “get out” of the market in time but weren’t able to….

What are you talking about? The market’s only been set back by a week, one which was clearly a technical aberration needing to be corrected.

The sky might be about to fall – that’s always true – but a single down day does not make a bear market.

See my comment below. I don’t think this is “it”. I agree that this is just a down day and not the start of the snowball rolling, at least I think. :) However, if you couldn’t resist FOMO and got in in the last few months or weeks, you could be hurting. TSLA down 23%, ZM down 23%, AAPL down 11% from ATH’s…. From some of the comments here, it seems that there are a few people in this boat.

The Marlboro man died of cancer. His widow sued Phillip Morris alleging smoking multiple packs of cigarettes for advertising filming contributed to his death.

I “got out”. Yes I was down a collective 7% yesterday but that only wiped out the ridiculous 7% gain from the previous day or two. Still up considerably since I started buying in mid July after all of it got cashed out.

Then I decided to make a bet at the end of the trading day yesterday, bought $100,000 of AAPL in the last 5 minutes hoping for a pop today. Didn’t happen, there was a drop, but the price is slowly coming back up to my break even point at least.

Interesting, the carnage continues today. I’m looking to get some PM’s but not sure if there will be further downside on Tue.

Wolf,

Little less in the red today from that short? Lol, you’ll get your day but despite how nasty it is today (1000+ plus in the DOW and 700 in NASDAQ), I don’t think this one is it…but what do I know…

Hafta admit, it’s been a little rougher than expected ?

Back in the single-digit red :-]

Hang in there. No worries. Reversion to the mean takes time :>{)

Ditto here Wolf. Need another few days like today for my short to pay off. ?

A little less rough today still. :)

Wolf,

As I commented couple of days ago, Nasdaq trading 4 standard deviations from 200-week average was writing on the wall (hat tip to Lance Roberts).

Went all in on puts last week, this week and even today. Jan-June with usual suspects, FAANNGM + Alibaba + Tesla + Shopify.

Let the games begin.

Sign was that testing puts started to show green even with the stocks still going up. Same happened in Feb.

I saw that too on Monday. It’s like the tide receding before the Tidal wave rushes in

Why the market ran up into one of the worst recessions is truly a mystery. The Fed can’t keep printing money b/c their member banks will basically be repaid with worthless script. IMO

It was interesting to see how everyone was saying – “oh no, the Fed CANT stop the extra $600” to “yes they did”

higher up people in banking have been advising Congress to SLOW DOWN the presses.

Florida has some of the least unemployment benefits in the nation. The $300 a month of additional Federal assistance for Florida was approved this week, but the funds may not be enough to last until the end of the month. Congress is on vacation.

V shape Friday tomorrow? Market down 800pts today, bet tomorrow will be 1k pts back up…buy the dip right? Plow right in retailers, Daddy Jerome got you covered.

As for these unemployment numbers, I know we live in a highly disconnected world while half or more of the population live in fantasy land, the other half get label as fear mongering for pointing out the ever so obvious bubble. But man, after how many weeks now and these unemployment numbers are looking as ugly as ever, how do people justify everything is right around the rosy corner outlook? Even a relatively well pay white collar guy like myself are really worry what’s going to happen over the next 3-6 months and if I would still have a job by then. Much like what Wolf stated in his recent video and article…just feels like the disconnected crowds are about get a taste of what it feels like when novocaine stop working. I see friend’s Instagram’s post on that newly purchased house or actually going on vacation and living life like it’s 1999 all over again..some people must feel they have an ironclad white collar job…wish I can share that same optimistic feeling.

Futures are down.

I was going to post a picture of my WA representative talking about all the wonderful things she is doing to get people to work. She was in front of a huge hoe with a tongue – the depth of the bucket higher than she is tall. But the paint is still unscratched.

Of course this high demand equipment is just not yet transferred to the field and brand new? And for a machine that size I don’t know one way or another but it irks me. It really irks me. A photo opp can only happen in front of new equipment unused?

LOLLOLLOL…….sounds like another tv ad for JamieB….She certainly has a lot of people fooled ???

Wolf,

You got your short working out. Congrats! Thanks for your writings. Those stock splits were telling too, not at first though.

“This was driven by a 2.3-million jump in continued PUA claims in California.”

So the entire report was skewed by what happened in California.

Maybe Nacy should visit the hairdressers more often.

UBER and LYFT drivers saw the writing on the wall.

Remember way back when… California tried to make them W2 instead of 1099. Wow such a long time ago – last week.

Thankfully they are all still working in their Corporation’s home state of California. That state particularly has its own set of challenges to climb out of this.

Probably will get bail doubt.

So people are rolling off of state benefits to federal benefits (PUA) in CA. Likely this will happen to the rest of the states over the next few weeks. Don’t understand why you comment is pertinent. It is better to analyze stuff than just do a knee jerk response.

Yesterday SPY hit the resistance with PE at 27.3 level akin to 2000 dot com bust. This (chart) is also similar to Sept 3, 1929 (h/t sven Hendrick)

Suddenly call to put ratio got completely reversed 180 degree. This is the early warning with mkts facing unprecedented uncertainty until election day!

It was a PURGE day for all my longs.

I have been swing trading between calls/puts with dominant on calls until today. Here afterwards puts will get the priority.

WINTER is coming!

No surprise here. Incentives work. You only need to to have earned, or be eligible for $100 in unemployment benefits per week to reek in $400 per week. That’s free money for many who are only marginally attached to the labor force.

Wolf,

Your prior posts on employment pointed out very astutely the churn in employment whereby higher paid white collar workers were loosing jobs and lower paid “retail” workers were hired back. I remember a figure of 5 million workers discussed. Say the lower wage workers get half the monthly pay of laid off white collar workers, or 5million/160million times one half less = .03 X .5 = .015. Based on this calculation, I predict Ave Hourly Earnings in tomorrow’s Employment report will fall 1.5%.

If you read the small print of the monthly jobs reports, seems like good jobs had been disappearing for a long time before Covid, and replaced by more low-end jobs without benefits.

I blew the forecast. I can only quote a statement by Jeff Cox at CNBC

“Average hourly earnings rose 4.7% from a year ago, though comparisons are difficult due to compositional effects from the pandemic.”

Thanks Wolf, good article. Regardless how you cut it, the numbers are terrible, reflecting real devastation in the economy and human suffering. Hopefully, things will come back faster, but I expect there is a limit of how much the economy can come back until there is a vaccine.

Not to mention compliance with taking vaccine. This is going to become another one of those massive debates on efficacy of the medicine that has been rushed through the system.

But imagine how bad it could be if there was no modern medicine, or no government mandates to make us all safe.

from last weeks ‘everyone has a plan until’ comments, ahem .. phils curve has flattened out so were going w/ the screwball and the slider. those of you that find yourselves between opportunities, well that is to say.. youre having job problems I feel bad for you son, you got 535 problems, and the tool box is another one. (ty m/j)

Wondering if you could ship Jdog over to Australia as we need some ‘help’ here:

“We have no clarity at all, we don’t know how to roster our team, what our new working environment looks like, how many clients we are allowed to have, or when we can book them in,” Ms Kourtidou said.

Guess that business owners here only need ‘drive and ambition’ in order to get ahead regardless of government laws and orders that prevent them from operating.

Honest question: If 18.3% of the labor force is on unemployment insurance then how does the BLS report 8.3% unemployment rate?

https://www.bls.gov/news.release/pdf/empsit.pdf

The BLS gives me a headache. Pretty soon, we will have a negative unemployment rate :-]

Could someone please explain something to a noneconomist who nonetheless tries to comprehend these issues? Specifically, why is everyone else saying unemployment is now 8.4 percent, whereas Wolf says 18.3 percent of the workforce is unemployed? I thought unemployment was defined as the percentage of the workforce that was unemployed. I read the part about not presenting seasonally adjusted claims, but could that really account for such a huge difference?

Two different measures – same government.

1. What you saw today was survey-based (of households and companies) and came from the Bureau of Labor Statistics. There are huge problems with these surveys and how they’re tabulated and interpreted and how the categories are defined, and how they’re converted into the seasonally adjusted figures you saw today. There could also be political pressure on the BLS to make the numbers look good, which is easy to do, given the survey-based nature of this.

2. What I reported on yesterday is from the Department of Labor, the actual unemployment insurance claims submitted by the state unemployment offices. This is transactional data, involving the unemployed getting paid their unemployment insurance. This is difficult for the government to muck with because states know what they submitted. There are 29.2 million people in the US on unemployment insurance. There are about 160 million people in the labor force, so 18.3% of the labor force is on unemployment insurance. That’s the most realistic number out there (though it has some problems too.)

A+++++++++++

the pandemic will last 3 years in eastern europe

A friend of mine told me many are lieing about there self employment status and filing for the federal benefits for self employed workers thats why ur seeing an increase. They submit bogus spread sheets like being a baby sitter or selling on ebay etc.

Paul C,

That’s fraud, and it’s dumb fraud, because it’s the easiest thing in the world to track via tax returns and 1099s. I’m sure some people are dumb enough to do this. But I don’t know how many.