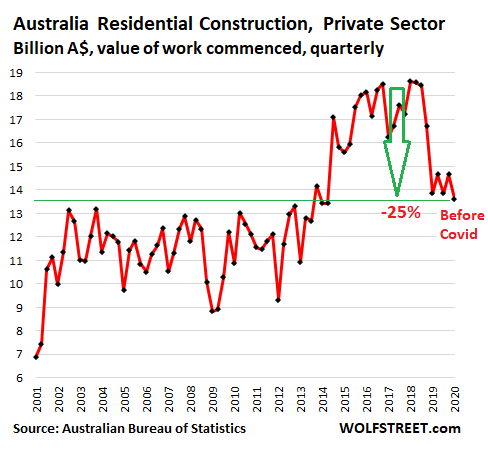

Alas, the housing construction bubble burst long before the Pandemic.

By Nick Corbishley, for WOLF STREET:

Australia’s construction industry accounts for 13% of GDP, and for one in ten jobs. It has been on a huge multi-year boom. And it has a huge amount of influence in Canberra. And it’s now clamoring for a bailout.

Activity in residential construction started to decline in Q4 2018 and by the first quarter this year, according to the Australian Bureau of Statistics, the value of work commenced had plunged by 25% from the prevailing levels in 2016 through Q3 2018, to A$13.6 billion. This occurred before the pandemic. Q2 data is not yet available, but the industry lobby is now wailing:

The pre-Pandemic difficulties of the residential construction industry are a result of a confluence of factors, including the housing bubble that led to overbuilding, a reliance on an endless flow of Chinese buyers — non-resident investors and immigrants — that then abated, turmoil in the banking sector due to exposure of widespread mortgage fraud, and the disruptions caused by the extensive bushfires. But then covid came along, bringing with it a whole new world of financial pain, disruption and uncertainty.

For years Melbourne has been the fastest growing city in Australia. Now, it is one of the most tightly locked-down cities on the planet. Since early July most shops, factories and other so-called “non-essential” businesses have been forced to close while the number of staff allowed to work on large construction projects has been slashed to a “practical minimum” of no more than 25% of the normal workforce.

The lockdown is another blow to the city’s construction sector. In the second quarter of this year, even before the second lockdown came into effect, there were approximately 15,900 apartments under construction, 12.6% less than in the second quarter of 2019 (17,900), according to JLL’s 2nd quarter market commentary.

The Victorian government tried to make up for the shortfall by fast tracking a tranche of projects in June. But most of those projects have been moving at snail’s pace since the latest lockdown, as most workers have been stood down.

An even bigger problem is the long-term uncertainty hanging over the economy. Businesses, cities and economies loath uncertainty. For developers, it makes it much more difficult to commit to new projects.

“The reality is that it is going to remain very difficult for buyers to commit to purchases several years ahead of completion in the current environment of very high uncertainty and this will keep pre-sales rates slow and prevent developers reaching pre-sale hurdles for finance,” said JLL national head of residential research Leigh Warner.

In addition, “residual unsold stock in recently completed or still under construction projects” is also making it harder to move new projects forward, Warner said.

Things are not looking much better in Sydney, which together with Melbourne was ground zero for Australia’s housing bubble. Combined, the two metros account for around two-thirds of residential property value in Australia. Sydney has not been through the grinder of a second lockdown and most advanced-stage projects have so far suffered little in the way of delays, says JLL.

But the number of apartments under construction in the inner city area in the first half of 2020 was down 35% compared to the first half of last year and is at the lowest level recorded by JLL. The apartment supply pipeline in the inner city peaked in 2018 and has been falling ever since, with apartment approvals slumping year over year by 57% in the twelve months to May.

“Our industry is facing a bloodbath, there is simply no other way to describe it,” wailed Denita Wawn, the chief executive of the Master Builders Association, one of Australia’s most powerful construction lobby groups. In a newly published document, the business association warns that new house construction could plunge this year by as much as 27% to 125,000 units, from 170,000 units in 2019.

“Private sector investment is evaporating, and the government must step in to save businesses and jobs,” Wawn said. The Australian government has already earmarked billions of Australian dollars to support the industry. But it’s not enough, says Master Builders Association, which is asking the government to stump up an additional AUS$5.1 billion.

One has to marvel at the chutzpah of these lobbyists screaming for a bailout! The industry floated along a two-decade long property bubble, interrupted by only a few dips. It has been helped along by the Reserve Bank of Australia’s downward trending interest rate, now at 0.25%, and the fraudulent lending practices of the big banks. Developers hawked Australian homes to Chinese investors. And the government created the first-time-buyers grants, a subsidy launched ostensibly to give cash-strapped first-time buyers a leg up onto the property ladder, but which is really a taxpayer subsidy for builders building new homes. And builders overbuilt, hoping for an endless flood of Chinese non-resident investors and immigrants to sell these units to.

But now the builders have a big problem on their hands: Many of the conditions that made the last bubble possible have expired or lost their impetus — and that started well before the Pandemic. And in recent months, thanks to the Australian government’s closure of national borders, the cashed-up Chinese and other Asian investors that helped to fuel the bubble are no longer able to visit Australia, let alone buy properties. As demand wanes, the industry is dialing back construction of new supply. Makes sense. What doesn’t make sense is the clamoring for more bailouts and handouts. By Nick Corbishley, for WOLF STREET.

It was a Big Gamble that was hot for years but has gone sour after Turkish lira’s plunge amid a surge of defaults on bank debts denominated in foreign currency. Read... Turkey’s 2nd Financial & Currency Crisis in 2 Years Blossoms. Heavily Invested European Banks Look for Exit. But Not the Most Exposed Bank

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Lets face it, aside from a bit of remodeling, and some building retrofits the construction industry is probably toast world-wide for a decade or more. Bailing it out now would be a waste of resources. Lets get those folks busy where we will need them, low energy/low input agriculture etc. Perhaps retrofit the equipment for farming. A 2 decade building bubble has its consequences and it is better to face up to them now.

There will always be a need for new construction, the question is how much new construction and of what kind, where. Some/most construction companies will go out of business and many will have to downsize, many of them will have to use bankruptcy, to reach the next era in their respective companies.

Each country has its own situation, but yeah, I wouldn’t want to be in the large construction business right now.

Australia`s Builders should be booming to replace all the structures lost in the Bush Fires. Canberra should get it`s head out of the Indian Coal Merchant`s Back Door.

More fake news – there were only about 3500 houses lost in the last bushfires. there were twice as many ‘outbuildings’ lost.

3500 houses is just a blip when looked at in terms of total numbers of houses built in one year here.

What did hurt was the huge amount of smoke generated that caused a drop in economic activity and increase health care problems.

– There are still some 1 million empty homes/dwellings in Australia.

They still have a lot to learn from the US.

Just take existing home sales. Forget the volume bounce, and just look at the new high price wise.

Not impressed. So 3% of the economy bounced back on debt. Big whoop. Even Wall Street is snoozing.

Free money is the best kind.

Yay, a Nick article!

I wonder if the growing tension between the Chinese and Australian governments will see a permanent decline in Chinese real estate buyers and investors? Already seeing a decline in the number of Chinese students at Australian universities. If so, there’ll be a fundamental shift in demand for new homes.

That explains the high housing prices in Sydney when I visited there a little over a year ago. Strikingly expensive housing from my point of view coming from Central Florida.

One of the first “reforms” I would make in America with housing is banning it from being a asset. That would end any real bubbles left to ponder in the real estate industry, the debtest of debt whores.

Bobby,

How do you ban RE as an asset? Thanks.

Legislate the builders which should have been done decades ago in Australia. Instead of the builders raising prices they just build more houses and any prices increases by the builders are capped by the Australian government to the annual inflation rate. Just like wage and price controls from the late 1970’s.

The only idea in your plan I agree with is building out more of the country. They could have been doing this for decades, but instead restricted building to increase prices. This goes on in Canada too, a huge country with about 5 major cities, ridiculous.

Dare I suggest a capital gains tax (GST) designed to capture increases in property values above & beyond those due to inflation etc ? Such a tax could include any investment/commercial property, including residential. It could have a lower bound (ie not applicable to property under a certain figure, adjusted for its location — ie the difference between Sydney & the “back of Burke”.

Might also have the advantage of getting buyers to hesitate before ever increasing property prices.

As to the building industry: 40 years of neoliberal ideology has seen Australia’s public housing stock dwindle every year. It’s now time to rectify this glaring social welfare deficiency — to everyone’s advantage.

As possible reason for the apartment building side of the industry slowing may be the terrible public relations disaster which was the Opal Towers (& others). I personally wont forget the vision of families literally on the street with their carry possessions, homeless due to their building suddenly becoming unsafe due to (probably) faulty building.

Read “Progress and Poverty” by Henry George. Written just before 1900. It was so popular that George became a strong candidate for president. George blames nearly all economic problems on rise in the asset value of land, which goes to the owner with no effort. He proposed (among other things) a 100% tax on the increase in value of a chunk of land. He separated the increase in value of human created assets such as homes, but if put in place at the time would have changed the world for the better.

Thanks for mentioning my man Henry George. Parts of Australia (as well as NZ, Japan, Korea, Taiwan, Denmark, etc) prospered for decades by implementing aspects of George’s recommendations, but Australia largely abandoned it in recent years.

And, just a technical but important emendation, his proposal was for collecting close to 100% of the annual land rent, not exactly the increase in value. And this covers not only the ground, but minerals and other natural resources, EM spectrum, etc. And abolishing all other taxes.

Fairhope, AL was founded on George’s

ideas. Pretty prosperous town.

Interesting: I will try to find it.

BTW: as a young realtor in the early 80’s I had some listings of lots in a not bad area of North Nanaimo in the low 20K range. The lots were serviced and were 60 x 120

To meet the Building Scheme you would need to spend 60K on construction. Total=80 K

Recently (2019 ) a young couple I know bought a 2 bed ranch in a not as nice area on a 50 x 100 lot for 405, 000

Having built not that long ago and keeping a eye on 2×4 prices etc. I know what it takes to build a 2 bed ranch of about 1000 sq. ft. About a 100K C$.

So they paid around 300 K for the lot.

Comparing the two, before and after: in the first case the lot was one quarter of the package.

In the second it’s 3/4 of the package.

In the case of materials and labor there has been inflation, but most of the RE inflation has been in the land, which in British Columbia (land mass of Western Europe, population of Paris) is hard to understand.

George’s ideas led to what was known as The Single Tax Movement. I believe the Henry George Foundation is still active in D.C.. The early Progressives worked with his ideas as part to their actions to try to implement changes, but they were largely defeated by the wave of politics occuring in the WWI Wilson administration. The original plan to use an income tax against war mongers profiteering backfired, and soon the Committee for War Preparedness was able to turn the tax bills against the public itself and make them pay the costs of the big war machine. And that’s the beginning of how we all got screwed.

Then what happens when the value of an RE purchase declines? Tough titty? Or the value increases due to sweat equity?

The reason why I ask this is due to our family following the ant method of living vrs the grasshopper. I’ll give you our example. We scrimped and saved a down payment for a pretty crappy house when I was 24. Fixed it up and paid it off while all my millworker friends were living pretty high. I did this again in my 30s with a slightly better home, and did a shitload of work on it. At age 49 I did it again with cash, sold the house in town and relocated buying up more land. I now own 16 acres zoned residential that appreciated in value since I bought it and a renovated home that has increased 5X what we paid for it solely because of the work I did on it. Every day off, every weekend, my wife and I fixed up and rebuilt our home. (I am a carpenter)

During this same time frame my tenant, (who is also one of my best friends), made 2X the money I did and bought a new truck every 2 years, always trading in and making payments. At age 65 (my current age) he was evicted from his trailer pad rental. I built him a 640 sq foot cottage which I currently rent to him for the princely sum of $400 per month, about 1/2 the going rate. Why? Because he is a senior citizen with poor health and my friend. My wife and I consider it our community and personal responsibility to help him out. When I visit him and have a few drinks he likes to wax on about how he was offered this piece of property or that one, and says he probably should have bought them. (you think?) Apparently, the shack I paid 112K for he could have bought for 5K way back when. He didn’t, obviously.

When I bought the chunk of raw land right next door to my home locals laughed at me. The current owner at the time did not pay income taxes for about 10 years and the Govt demanded he finally file. (He was a logging contractor who liked to drink, snort coke, and buy new trucks). He came to me and asked if I wanted to buy it for the assessed value + improvements and I did. My friends thought we were nuts. Not so much these days.

So, I could have taken this same money and invested it in the stock market, or bought shares in some weapon systems company or robotics, maybe software? and that would be okay to make a profit? But buying property isn’t?

If you can’t make money on sacrifice and hard work how else is a working man like myself supposed to get ahead?

Here’s another example. When I dropped off fish to some folks a few years ago their first question was, “They’re not cleaned”? I roto-till up an extra 1/2 acre every year and offer free potatoes to who ever wants to dig them up and come and get them. I haven’t had a taker yet. Not one, not once.

There are many many people who buy RE and lose their shirts. The news is full of the stories every downturn, maybe any day now but who knows if, when, or maybe? I guess they’ll ask for a bailout which my taxes will help pay for.

As a builder I want to reply to Nick’s comment down below. With current code requirements new construction is about $300 per square foot on Vancouver Island, excluding land. My contractor friends tell me they cannot do it for $225 per square foot. But yes, I agree….property is crazy high in price. That is why my nephew will not be able to live down Island even though he works there. If he wants to buy a home he will have to move to at least as far west as Campbell River, and he will need help from family (us) to make it happen. Or, he could move even farther out where we live.

The answer to your question is communism or a form of its lesser cousin socialism.

When they are finally given the chance, they will do what is happening here. Those with $$ will flee oppression.

In business close to 30yrs. Recessions, Great housing depression, housing booms, none of these compare to what we are witnessing now. The flight from leftist cities to rural or suburbs is incredible. There is no way I would have expected a record year back in March. Covid, and govt reaction to it & looters, has created the most rapid transformation that I have experienced.

Flee where? Outer space?

1. No maids.

2. Lack of Oxygen.

3. Lack of creature comforts.

For now.

The threat of American billionaires fleeing the US has as much bite as what will happen if the Chinese stops buying US Treasuries.

New Zealand is supposedly the destination of choice for US billionaires, but I am pretty sure they’ll end up being taxed heavily over there too.

Nothing screams billionaire like moving on an island with 12 active volcanoes . Where do you think kiwi’s get their fertile soil?

Spend a year there for work recently. The sun cooked you, the water was icy cold but very clear. Its an amazing place on paper and in photos.

I’ll stick to soCal. I’m not even a millionaire what would i know.

as the cycle turns, i’d rather live somewhere where you can combat the heat with a fan, instead of an air conditioner. Electricity prices will eventually jump.

SoCal was paradise on earth…right up until about 10 million people discovered it. If you can get them all to take a long swim toward Hawaii it could be wonderland all over again.

Billionaires? Hell I live and work in flyover. There is not a billionaire or telsa in sight. They don’t have to flee. They have their own security.

These are families moving out here. Buying a 180K – 300K home.

They are not fleeing taxes.

financial advisor to Individuals: save for that rainy day. Have at least 6 months of living expenses saved in an account for the inevitable emergency.

financial advisor to corporations: Spend with reckless abandon, grab as much market share as possible, become too big to fail no matter what. Take all profits and use that for CEO bonuses and stock dividends, load up on debt….and when the emergency arrives retire and petition the government for a bailout. Rinse and repeat.

Tax policy affects economic behavior. Politics affects tax policy. This was all done on purpose to please financial institutions and Wall Street.

I live in Melbourne, more accurately I live in Mount Waverley, a hub of Chinese investment. There is still a huge amount of construction around, places are being finished at a remarkable rate, much faster than in recent years. There are still plenty of demolitions happening and my neighbor (a pig headed property developer) actually called and asked if I’d give him my block and he would build me a 3 bedroom apartment for free. Nice try mate, I’m not bleeding.

I’ve been looking for a small apartment in a different area and sellers are still demanding huge pre Covid prices. No one is willing to accept conditions.

The commercial side of real estate is being crucified, Clayton, where many large offices are located is plastered with for lease signs while huge construction sites in the area are building offices to the sky.

I can assure you that the money that drives this town is 80% from construction work. Which is great, until it isn’t. Luckily we have a good state government that isn’t scared of big infrastructure spending and supports trade unions. And the over expanded reaches of Melbourne are in desperate need of infrastructure.

Luckily we have a good state government ,that was sarcasm I hope. State budget a mess but no worries just borrow billions from China a government of no accountability but hay leave the bill to our grandchildren ,politics as normal no responsibility.When the true costs of the ( covid lockdown ) are calculated in the years ahead none of these politicians will be there to accept responsibility , but we will be there to pick up the bill.

Bill from Australia, not sure what you are talking about here. Yes governments borrow, all governments are borrowing at the moment as the economies are frozen, but not from China specifically. No accountability, but Dan Andrews (victorian premier) has fronted the media every day for how many months now? And they will face elections in a few years, just as they always have. Costs of the lockdown? vs. thousands dead and the economy in recession still, just like Sweden and the UK? I suspect the government is doing what is supposed to do. You may not like it, maybe your business or livelihood is now gone, but a decision to do something is better than doing nothing and letting thousands die. Your business and job may come back in the future, while dead people usually don’t.

Dan Andrews, “Call me Dan”, is an imbecile, a megalomaniac, and a serial liar who heads a corrupt Labor state government that used government employees and funds to win the last election and undertakes branch stacking in picking its candidates.

The governments policies and procedures are the reason the virus escaped into the community and specifically into the aged care sector.

Even the left wing rag has blamed the government for the virus problems and the exposed the corruption in the Labor Party when it came to branch stacking.

They are responsible for the current curfew, lockdown, and deaths: they screwed up and now everybody in Victoria and Australia is suffering.

@Poncho

Given the current abysmal building standards in Australia it was probably very wise to turn down the new apartment offer, it might have collapsed around you. Was he one of the contractors for the Opal Tower in Sydney?

And greetings to Melburn in the People’s Socialist Republic of Victoria!

It’s nice to know it’s not just in the US where everyone wants a hand or bail-out.

Is it about being first in line, what you know or who you know? I hope nobody feels left out.

Australia and the other commonwealth countries seem to be selling out to the Chinese one house at a time. This has been going on for over a decade with no acknowledgement that citizens were being priced out of their own countries.

I doubt the Chinese will stay out of the commonwealth countries for very long. They buy properties in these countries sight unseen in the hundreds. It looks like China is pushing them into a corner and will land up winning the monopoly game.

The same exact thing has been happening in the US. We just have a better propaganda machine to distract us. It has entirely ruined the moral of the country as working people often do not have homes.

China can only stockpile foreign dollars for so long. We send them over for stuff by the boat load. They got to trade back eventually and IF the only thing you have to sell is real estate, then there you go. Simple and nothing questinable about it at all. Inflation? Of course but, who’s printing the money in the first place. Tough to look in the mirror at the trouble maker.

With China’s flooding of most of their farmland, their dollars are coming home to buy our food products. This is going to make our food inflation worse.

Canada, Vancouver, British Columbia, big time.

This is all part of China’s plan for world dominance. Don’t need wars, just buy up everything then get elected into office and eventually run the place.

The US plan, after WW1 — at least flood the world with cheap comsumer goods.

In 5000 years, China dominated its neighbors, but never had any desire for world domination. Show me one proof where the later’s true.

World domination is a stupid Western idea and more importantly an American idea. Why do we have hundreds of military bases around the world?

China has invaded or attempted to invade many of its neighbors throughout history, the size and shape of China, have changed pretty drastically, and continually, for your statement to be true. Also, you ever heard of the Mongol Empire? Invading others lands has always been a part of human history, in every corner of the globe.

China is very constrained by geography and geology — surrounded by formidable mountain ranges and deserts, completely unattractive to a culture whose staple food is rice. Until the Japanese started developing it, Han Chinese didn’t even move into relatively unpopulated Manchuria, because it’s not a good rice growing area. They did at various times move against Vietnam, which is rice country.

Nah MB,,, Ever hear?

“The Sun Never Sets on the British Empire,”

And then just as TR said, start with the great Khans, Alexander, etc., and it has gone on for eva since, and likely before written his or her story …

Then, before the Americans were able to mobilize our entire country to focus on WW2, we had the nazi folks planning to take over the entire world, with the Japanese being the last to be conquered after Russia, USA, etc…

Certainly one of the most salient extremes of the whole, “Central Authority Figure” error of basic human propaganda, and maybe the last to go, but it’s not any more native ‘murrican’ than any of the other garbage activities going on in our streets now.

Thomas Roberts, I did say “China dominated its neighbors”

And Mongolians are not Chinese. In fact China was conquered by the Mongolians for a while. WTF. You seem uneducated.

China NEVER invaded any country beyond its surroundings. That’s not even close to WORLD domination.

The US has hundreds of bases around the world. Justify that.

Vintage VNet, you too seem uneducated. Mongolians are not Chinese.

MonkeyBusiness,

You are the uneducated one, I never implied the Mongol Empire was Chinese, I was referring to be fact a non-western country tried to dominate as much as it could, using any means necessary.

Many countries across the world throughout human history, tried to dominate as far as they could, western ones were simply the only ones who could pull off a world spanning empire.

Also, China was dominated by it’s neighbors many times, that’s the Big reason why, it’s borders have shrunk many times. In more recent times, little ol’ non-western Japan managed to conquer China, China needed the United States and the Soviet Union to free it. Many of the neighbours China did dominate at various points in history were sparsely populated.

Anthony A.,

The CCP does want to control everything everywhere, but, individual home purchases made by Chinese throughout the world, are not really a part of this. it’s Chinese people (often individual CCP members and their families) getting money out of China, often in case they (or a family member) upset the party (or their faction is getting hit), or if sh*t hits the fan in China, they evacuate. It also can merely be they want themselves or family members to leave China or they just don’t trust having their money in China. The CCP doesn’t like this, as it is money (and sometimes people) fleeing the country.

Top CCP members to some extent have to tolerate other top CCP members doing this, because, they often themselves, do it as well (it’s very common, probably most at the top) but, they are very likely to clamp down hard and soon on people (including CCP members) not at the top.

There are 90+ million CCP members.

My brother went though an unhappy phase where he was going to leave Quadra Island and buy in Ecuador or Costa Rica. I listened to it for years and looked through countless property listings ‘for feedback’. Finally, one day I said to him, “The problem boyo, is no matter how wonderful you think it is you will always be an outsider. A gringo. And if sugar turns to shit you will be a victim”.

He didn’t move and now is glad he stayed put.

The same goes for Chinese foreign buyers. If they integrate, whatever. If they remain foreign investment buyers, good luck with that, and that goes for whatever country they buy in if a big downturn hits. Oh, they might be able to retain ownership of the property, but they will soon tire of keyed vehicles, threats, and not belonging. It happens. You have to be ‘of community’, and not take from community if you want to survive. It can get pretty tribal when the going gets tough. Just saying.

“This is all part of China’s plan for world dominance. Don’t need wars, just buy up everything then get elected into office and eventually run the place.”

Yer, that plan is a shoe-in. What with the US forbidding the chinese to buy this OR sell that, in the US & its “allies”.

As for the “getting elected” to “run the place” it strikes me as fairly imaginary, at least at the moment….

If I understand the fiat system, when the USA purchases Chinese goods those dollars eventually have to end up back in the USA via purchases of goods, services or assets.

The US has a huge trade deficit with Germany and Mexico as well, and there are no signs that the dollars “have to end up back in the USA.” Germany and Mexico don’t hold a lot US Treasury debt, and Germans are not big home buyers in the US. Mexicans buy more homes in the US, but it’s not huge compared to buying by Chinese investors. So I have my doubts about this theory.

Who cares, we are winning in America, record home sales, record high average selling price, its the roaring 20’s!!

WOOOOHOOOOOOO

Number one in housing

Number one in covid deaths

Number one in covid cases

AMERICA!!!!!!!!

Don’t forget the tech bros!!!

Meanwhile, they are having massive water parties in Wuhan.

Please, please, if any of you guys do one thing this weekend, look up Martin North and his u tube broadcast ‘soup to nuts’.

Before he gets taken down by vested interests.

Has there been a freeze on foreclosures and evictions in Australia like the US? I often wonder how this factors into the current US housing boom and if Australia could be an example of what reality is provided they don’t have the same intervention..

Australia is a ponji economy based on more & more immigration growth from new brown (read india,nepal,srilanka etc) & asian (read china )people entering the country as students or workpermit routee. They make only dirt (ores) , agriculturual produce (fruits,grains,veg) & cattle (sheep& beef) exports. There is no manaufacturing of any kind. 90% of products in the shelves of supermarket is imported from china or else where. It is too expensive too . In the year 2000 I visited down under (when the A$ was 50 cents compared to 77 cents now) Even then food was expensive compared to usa . every one is specualting on housing which is the main wealth builder . when immigration stops there will be a reality(REALTY) check.

What you say is expanded on at great length by Matt Barrie (an Aussie entrepreneur) in an article entitled “Australia’s economy is a house of cards”-websearch

it.

Written at the end of 2017 but even more true today. Barrie’s twatter feed is also quite infomative

Quote “This is what the Australian press more commonly holds up as a role model to young people. Not a young engineer who has developed a revolutionary new product or breakthrough, but an over-leveraged train driver with a property portfolio on mostly borrowed money where a 1% move in interest rates will wipe out the entirety of this cash flow.”

The global economy can look out of whack in any one geographic location. Not much mining around me in eastern USA. Worked at an auto oil filter plant once that was producing about 5 filters per second. You think no way can there be that much demand. There was another large manufacturer 100 miles away.

Thanks to covid, immigration, including students & work permits has now essentially stopped. The consequences will be interesting to see.

I’m not against immigration per se, however Australia has, arguably had a quite high rate over the last 20-30 years. A pause in immigration — for national reflection — is no bad thing in my view.

Most aussies understand why we ‘need’ immigration, just don’t want it at the current high rates.

OECD avg around 0.7%, Aust at 1.6%+ for the best part of last 15-20 yrs.

GDP per capita flat or going down, plus all sorts of other rorts that go with it to lower stds of living.

Universities now being found out with all sorts of issues, lowering stds and being degrees for dollars.

On the economy, its immigration, houses and dirt. Nothing else ! With two out of three heading down, and only Brazil’s covid issues holding iron ore up, we could be headed for a deep depression.

We have nothing else. We are lazy and think rising house prices is all due to our ‘hard work’ and superior investing skills. Its been plain dumb luck, with a healthy dose of corruption.

We need this wake up call !

And Scott Morrison will fold like a cheap tent, & throw yet more $billions he doesn’t have at the construction industry.

‘Neo’Liberals through & through.