All kinds of weird records are being broken. But it’s scheduled to expire, and then what?

By Wolf Richter for WOLF STREET.

The New York Fed released a doozie of a household credit report. It summarized what individual lenders have been reporting about their own practices: If you can’t make the payments on your mortgage, auto loan, credit card debt, or student loan, just ask for a deferral or forbearance, and you won’t have to make the payments, and the loan won’t count as delinquent if it wasn’t delinquent before. And even if it was delinquent before, you can “cure” a delinquency by getting the loan deferred and modified. No payment, no problem.

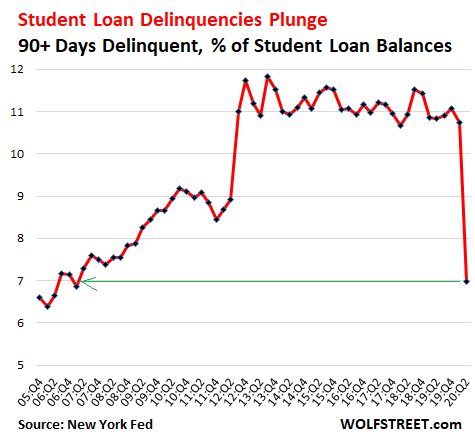

Nearly all student loans go into forbearance, delinquencies plunge.

Student loan borrowers were automatically rolled into forbearance under the CARES Act, and even though many students had stopped making payments, delinquency rates plunged because the Department of Education had decided to report as “current” all those loans that are in forbearance, even if they were delinquent. Yup, according to New York Fed data, the delinquency rate of student loan borrowers, though many had stopped making payments, plunged from 10.75% in Q1, to 6.97% in Q2, the lowest since 2007:

Student loan forbearance is available until September 30, and interest is waived until then, instead of being added to the loan. In a blog post, the New York Fed said that 88% of the student-loan borrowers, including private-loan borrowers and Federal Family Education Loan borrowers, had a “scheduled payment of $0,” meaning that at least 88% of the student loans were in some form of forbearance. Until September 30. And then what?

Delinquent loans are “cured” without catch-up payments.

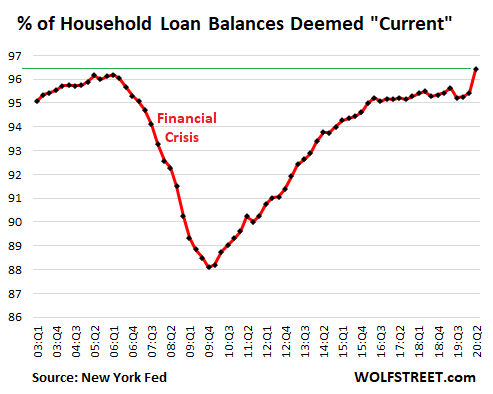

And because delinquencies in student loans, auto loans, credit card debt, and mortgages are being “cured” by putting the loans in deferral programs and modifying the delinquent loans, they become “current” loans even though no catch-up payments have been made.

Still, about 32 million people are claiming unemployment insurance. A much smaller employment shock during the Financial Crisis caused the percentage of delinquent loan balances to soar, and the percentage of “current” loan balances to plunge, to bottom out at 88% in Q4 2009. Not this time. As the percentage of delinquent loan balances fell, the percentage of “current” loan balances jumped to 96.4%, a record high in the New York Fed’s data going back to 2003:

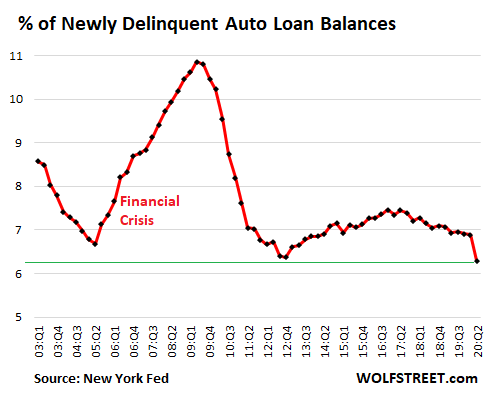

No payment, no problem for auto loans.

Yup, crazy world. Ally Financial reported in its 10-Q filing with the SEC for the second quarter that about 21% of its auto-loan customers were enrolled in its deferral program where they don’t have to make payments for 120 days. “The vast majority of our loan deferrals for customers in the program are scheduled to expire by the end of August 2020,” it said. And then what?

Lenders like these types of programs because they can kick the can of delinquencies down the road, and instead they have “performing loans” for which they can accrue interest which makes their investors happy, even though the customers don’t make any interest or principal payments.

Bank regulators normally get nervous about deferral programs. But it appears that bank regulators have been told the shelter at home until further notice.

Across all lenders, about 5.9% of the $1.34 trillion in auto loans – so close to $80 billion – are in forbearance, according to the New York Fed. And as a result, borrowers who cannot make the payment, don’t have to make it, and their loans are still deemed “current,” and the percentage of auto loans that are newly delinquent dropped to 6.29%, a record low in the data – while during the last crisis, the delinquent balances were above 10% for nearly two years:

Cars lose value as they age, and when the loan balance grows as the collateral value declines, lenders are exposing themselves to greater losses when they finally have to grapple with those delinquencies.

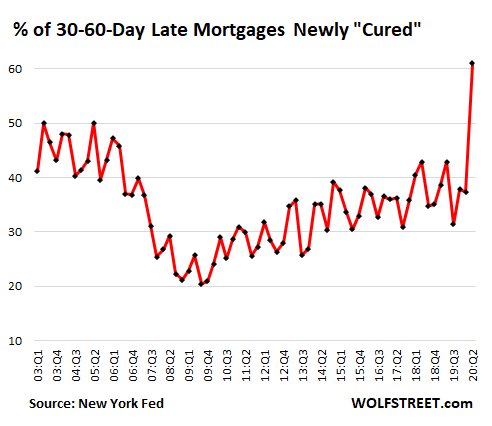

Mortgages turn into ATMs by not making payments. Delinquencies “cured” at record pace.

Wells Fargo reported $44 billion of consumer loans in deferral at the end of Q2. This includes $35 billion in mortgages. In total, 12% of its first mortgages and 10% of its second mortgages where in deferral. Nearly 9% of JPMorgan’s home mortgages were in deferral. According to the Mortgage Bankers’ Association, 7.8% of all home mortgages are currently in forbearance.

According to the New York Fed, $730 billion in mortgages are in forbearance, and the payments that are being deferred amount to about $6 billion a month – “a significant transfer to homeowners that may be used to increase consumption elsewhere or to pay down other types of debt.”

And mortgages that had been 30 to 60 days delinquent were “cured” at record pace. They were brought to “current” not because borrowers made catch-up payments, but because these mortgages were modified and rolled into forbearance, and thus were once again deemed current and thus “cured.” A record 61% of the 30-60-day late mortgages were thusly “cured” in Q2:

The CARES Act provides mortgage forbearance for 180 days for federally guaranteed mortgages. And then what?

Will collection agencies go out of business if there are no collections?

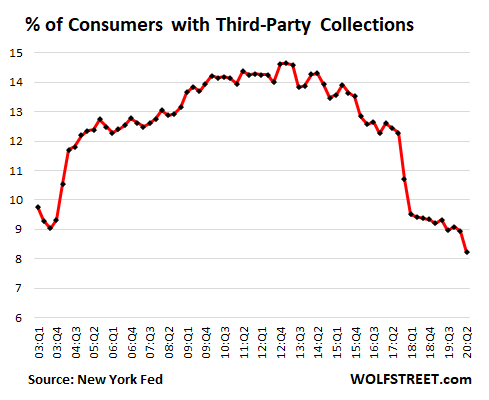

As these troubled auto loans, credit card loans, and other consumer loans are being moved into deferral programs and modified and the delinquencies “cured” without payments being made, the percentage of consumers with third-party collections – when a bank throws in the towel and sells the delinquent loan for cents on the dollar to a collection agency – has dropped (oh, you surely guessed it) to a record low, despite the worst employment crisis in a lifetime:

This is the utterly bizarre new world of no-payment-no-problem-credit, where debt payments are being put on ice, and were delinquencies are routinely cured by modifying loans, and then by sheltering the loans in forbearance programs. The missed interest payments are added to the principal balance of the loan, and the burden of those debts grows, even as the banks book the interest income of those payments that haven’t been made.

And it’s not like consumers are putting this money-not-spent-on-debt-payments into a savings account to use for the required future debt payments; they’re spending this money, and it’s gone. In this way, they’re using their mortgages and other loans as an ATM for spending money.

This spending of debt-payments-not-made has been a powerful part of the huge stimulus to the economy, as people shopped online instead of making car payments or mortgage payments. But all these programs are scheduled to end. And then what? That was a rhetorical question; surely, we’ll come up with another magic trick so we don’t have to open that can of delinquencies.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Back before Covid, many people were speculating that the next step for the fed would be helicopter money dropped directly to consumers. Well that next step is here, but the fed is doing it in the form of deferred debt payments and not money dropped from the sky. Except in this version people who were frugal and have little or no debt miss out.

As well, there is the common misperception known as the “Affluenza Argument” wherein governments pay out subsidies as a percentage of prior wages. Better that all the payments were alike, based on the subsistence cost of living, so that no one would starve. Instead, the philosophy was to prop up people as they were accustomed (like the defendant who pleaded “affluenza” that he could not tolerate punishment because he was not used to it).

Interesting point…there does seem to be a huge component of “status quo ante” as to how the G is structuring its massive bailouts…no matter how insanely dysfunctional (and causative) the “ante” was.

Would like to hear more about the “argument” if this is an area of pre-existing academic research (in poli sci?).

The one component that seems most insane is the habitual abuse of savers – going on 20 yrs – that by this time has solidified an intrinsic distrust of DC/the USD, in a way guaranteed to increase capital flight…and a long term diminishment of DC’s power.

“…in a way guaranteed to increase capital flight…”

Flight to what? The dollar remains the world’s reserve currency…the best house on a bad block. Gold is rising, and bitcoin appeals though.

C Smith, the argument for the hegemony of the dollar is that it is a reserve currency, and thus a value store. But if the government is going to continually devalue it, and offer savers nothing for holding it, why NOT hold gold, precious art, or something else?

I think this is inevitable in modern economic thinking. Basically the thinking is to pump as much money into the economy as needed to get to 2% inflation. The thinking is that as long as there is some return on investment higher than the interest rate government borrows at all is fine. I think the end result is there becomes so much malinvestment that productivity drops and therefore median income stagnates. Over the long term it’s number of people working productively that determines overall wealth of country.

Dream on about dollar collapse. Treasury prices are still sky high. In case you didn’t know, Treasuries are top shelf collateral. That will. NEVER end. Like I said, dream on.

Geru, with all due respect, anyone who can claim to make a prediction about the future in perpetuity is not making a serious argument. Treasury prices are still sky high, RIGHT now. I bet during the heyday of the Roman Empire, people thought that would never end. People DID think that about the British Empire at the turn of the century as well. We have major structural problems that are not being fixed. In my view, we’re riding off our past coattails. To say that that will NEVER change is just silly.

Then there’s the woman who, after murdering both her parents, threw herself on the mercy of the court because she was an orphan.

You missed the point. deferred interest is not forgiven but added to the principal of the loan. How people are going to pay the new bigger balance is a good question. They must think they are getting their jobs back.

If you are frugal with no debt you have not missed out on anything except getting your car repossessed.

“…If you are frugal with no debt you have not missed out on anything…” Wrong. There’s a huge opportunity cost of not participating in the “party” in a levered way. If there is never a real reckoning, this cost is very real. How do you think private equity has been able to subsume nearly 1/3 of the U.S. economy??? Classic “heads I win” – “tails I win” behavior.

Good plan if you are 60 years old with a new 30 year mortgage.

SORRY had to do 15 year mortgage

have son on UI right now and he has big cc debt – chase bank said they’d cancel card and only discount 10% and put on 5 year plan

surely they won’t ding his credit[sarcasm]

Wrong. This has been costing my retirement $1500-2000/month for the past 10 years.

With debt at the moon at federal, state, muni and county governments in addition to corporate and individuals, all they can do is play these games that are simply variations on the theme of extend and pretend. Society as a whole feels and will feel even worse like a big fibromyalgia disorder. At some point all hades breaks lose…when that music stops is anybody’s guess.

For an immigrant who believes in savings, no debt and keeping things simple and consumption at a minimum, I truly find this situation beyond disgusting as there are no words that I can put in print on this fine website. Too many disgusting grasshoppers out there and gov’t and corps encourage this behavior. Sorry to be so blunt. Tough to have compassion for so many people that constantly insist on shooting themselves in the foot.

I wonder when it will finally be “oh sh..” time? Surely we have to get there at some point?

Furthermore, I taught college for 30 years and many students would make every excuse in the book why they had to delay buying the book(s) for the course. Meanwhile, they had all the other trinkets including a better cell phone than mine (and I could afford it). I had to bite my tongue real hard. Truly a question of misguided priorities. But this is what it gets society as a whole. Furthermore yet…I would also deliver groceries as a volunteer for Saint Vincent de Paul. Ironically, I would notice that many of the folks to whom I delivered groceries had better electronics than me – who again, could afford them….helps explain via concrete examples in part how we got here.

Berkshire Hathaway has a market Cap of $0.5 trillion and took 53 years to build. When you have politicians throw out negotiating positions that are $2.5 trillion apart you have given too much power to government to spend.

In history the biggest wins came from the risk-taking.

Overleveraging is a risky game…

Unethical, but not illegal.

This is not risk. If it were risk, many of these folks and companies would have gone BK or TU (whichever your prefer) a long time ago. That is true capitalism, not the crony stuff where the FED bails out these criminals.

@Trinacria

The ultimate risk I see is to grow up a crisis of biblical size that will finally wipe out our way of life.

The economy would take decades to recover. No place on our planet will offer a protection against such a crisis.

That is the risk.

Some take it seeking their very personal benefits.

A consumption tax will cure that….the income tax can’t be sustained if there are no jobs….

why be credit smart and prudent, its bizzaro world big time…

being prudent has been ugly since 2009…….the fed has enabled a bunch of credit criminals and debtpushers…

the drug of choice for those who party big…

debt..

What shall we name this “new” powerful drug?

Green Crack? AGB? FED Sugar? Green Rock? Happy Spend Fun Time? Green Paper Brick? New Car Paper? Buy Now Pay Never Paper? Invisible President Paper? President Rectangles? Paper Hydro? Green Heaven? Shopping Cart Lettuce? FED Heroin? Dream Bills?

What’s anyone’s else’s suggestions?

Last i checked, they were calling it ‘stimulus’.

Thomas Jefferson called it many years ago: “I believe that banking institutions are more dangerous to our liberties than standing armies,” Jefferson wrote. … The issuing power of currency shall be taken from the banks and restored to the people, to whom it properly belongs.”

Unfortunately, will end badly as the masses are simply not prepared as evidenced by the fact that most can’t even make it two months without pay.

One could argue that the people don’t need to have savings for a rainy day, and perhaps not even own assets. They pay taxes, and the government acts as a Big Savings Bank. “From each according to his ability, to each according to his needs” (German: Jeder nach seinen Fähigkeiten, jedem nach seinen Bedürfnissen)

So far we’ve only had Socialism for the rich, an inverse Robin Hood scheme by the captured institutions. Maybe now it’s time for the G to make it rain over the masses, too. They certainly have bigger needs.

For my virtual friends here Duke University released results of masks: Best in order N95, medical, 3 layer cloth with one layer different material, single layer and bandana no good, single layer fits around neck popular style worse than no mask. N95 only best if you fit it up with no gaps. Stay safe.

Old School,

This is one of those distortions that present 25% as the whole thing.

The single most important reason to wear a mask is TO PROTECT OTHERS. Cloth works fine. Protecting others is the human, manly, and patriotic thing to do. Stay 6 feet away and wear a mask, and you’ll protect others.

To protect yourself, your lineup is about right. But that’s not the reason we need to wear a mask out on the street or inside a store. We need to wear a mask to PROTECT OTHERS, and cloth works fine for that. And if everyone wears a mask when they’re near others, then everyone is reasonably well protected.

But if you work closely with potentially infected people (as a dentist, doctor, or nurse might), you need to protect yourself with a lot more than just an N-95 mask.

The results of the study was you are protecting no one with a single ply cloth mask. Surprising they found when you sneeze or cough in a single ply the air borne spray pattern is worse. It’s kind of gross but it breaks up the spray into more dangerous pattern. I like research on these things because I think masks are giving people a false sense of security. I wear a cloth multi-layer, but mainly try to keep my circle small and do grocery shopping only twice per month.

That’s just effing BS.

https://www.wsj.com/articles/face-masks-really-do-matter-the-scientific-evidence-is-growing-11595083298

Wear a mask — any mask — and save lives.

How long do we wear masks for? 1 year? 3 years? until death is cured?

Joe,

Until infection rates are low enough.

If the US had done its job properly in February, March, and April, with everyone wearing masks and social distancing at the time, under the wise leadership in the White House, with everyone taking it seriously rather than calling it a “hoax,” then there would likely no longer be a need to wear masks today. This is already the case in some other countries.

Then when you get a local outbreak, you wear masks again locally until the outbreak abates. What this White House has done in managing the pandemic will enter into history as one of the biggest f**k-ups ever. Case studies will be written about it, using the US response at the federal level as a detailed example of how NOT to do it.

The White House has now come partially around, to its credit, but it’s too little too late.

Is anyone gutsy enough to put a number on “low enough”?

Wolf, I had to reply here. The Duke University physics department research is now posted on the CNN web site. It’s research. You can disagree with it, but it’s not bs. Wear a N95, a medical 3 layer or a cloth 3 layer.

Tests using a heavy cough show that the worst most ineffective face coverings (bandana-type) allow droplets to travel 1-3.5 feet. Without masks, droplets travel on average 8 feet and up to 12 feet.

Read the WSJ article I linked. It gives you the actual numbers in inches and feet. You should be able to read it without subscription.

If you’re within 1-3.5 feet to someone, you’re already way too close! 6 feet is the number. That’s why ANY mask is a lot better than no mask, and effective when combined with social distancing, which is the rule.

Wolf,

Actually I think the biggest screw up in the USA and in many other countries around the world has been with regard to allowing the virus into long term and aged care facilties.

That is a state and local resposibility and has nothing to do with the US Federal government or national governments.

Over half or more of the deaths in many countries and states has been at or in these locations.

And it could have easily been prevented. Of the seven facilities in our local area not one has had one case of a patient getting the virus. One worker has been diagnosed in some home I don’t know of. Out west the homes there have had hundreds of cases and numerous deaths.

And in regards to masks, please remember that even the WHO was initially not in the wearing a mask category either.

Here in Australia “THE MASK’ was first derided by the medical profession and they even had announcements posted in pharmacies stating that ‘masks don’t help’.

I’ve been wearing one ever since I got sick.

I wore one when I went/go out to stores, doctors, or pharmacies. I was loooked at like I was something strange and at one doctor’s office they actually moved me from the waiting room to another office as and I quote ” You are scaring other people by wearing a mask.”

When I went to get my last xray I was the ONLY one in the waiting room at the clinic wearing a mask, but all the people working there were wering them.

And now the entire city of Melbourne has a mask requirement when you go out. Even at night, before our 8:00pm curfew, when the street is completely empty.

And as far as ‘getting everybody to do the right thing’ – you have to be joking. You can’t even get people to stop drinking and driving.

Getting them to wear a mask?

They should, but won’t.

Not even here in Melbourne where police are fining people A$200 for not wearing one.

In the words of Scooby Doo: “Ruh Roh”

Poor collection agencies, my heart bleeds.

Perhaps they know that the Fed will make them,whole. Fill up one of them SPV’s with fiat and give Biack Rock its customary cut and Bada Boom, Bada Bing the fix is in. C’mon Man , hit the Big Red Fed Easy Button.

Nigh. This data is massaged by payment stops. Student loans will skyrocket in the 4th quarter.

The Fed is irrelevant as much of this is subprime.

Kick-the-can-istan, new American Republic

Lol. Love it.

The end game of Western “capitalism”.

All loans are in essence taken over by the government . Next will come state and local pension obligations. No one believes that those areas such as ILL, Ct,Nj, NY state can come close to generating sufficient funds to pay their pension obligations , so the Federal government will allow”forbearance “and will pay these debts. Of course there will just be the little detail of the resulting currency collapse , but that is only in the future and can be pretended and extended .

Do not let giant corporations off the hook on pensions. They do not keep sufficient reserves to cover big layoff volumes, nor do they have qualms about filing bankruptcy and “arbitrating” the lower pension payments. Older workers who did their homework on planning can still have the rug pulled out from under them–thanks to new style corporate raiders aka “activist stockholders” finding new sources of revenue inside the corporation. Even if contracts are in writing, their deep pockets allow legal appeals of lower court decisions until retired employees drop out.

Don’t forget that the Feds have backstopped many company pensions in the past. And still has a mechanism for covering private pensions now:

https://www.investopedia.com/articles/retirement/06/pbgc.asp

It can for awhile, but, the Federal government won’t be able to back pensions for long once the stock market crashes. The PBGC is already in deficit, as it is. The one’s already claiming those pensions will clear them out fast (at the agreed rate, but, coffers won’t last long, it varies by type of pension, many will still get a fraction of agreed upon amount). I definitely think, all things considered, that pay as you go social security type systems are the only realistic type of retirement plan for the masses. If America was a financially responsible country, this would be no issue. While the government isn’t always a voice of the people, average joes without any kind of real understanding of money, throwing their money into plans controlled by various private individuals and companies with little oversight, that won’t be seen for decades, will lead to …

On paper, a healthy retirement system. In reality, a ponzi scheme. Ponzi schemes work great, until, they run out of money.

A BIG issue is that no one wants to actually fund the well-off retirements many want. So they throw their money into a magical piggy bank (The Stock Market), that even after inflation, exponentially grows their money, even though, all things considered. The economy hasn’t really grown all that much in 20 years (except for population growth, but that’s zero sum), and that GDP growth isn’t something, the average person can actually capture. The richer and more knowledgeable will take most of those gains for themselves.

Even storing large amounts of money long-term is difficult. Say for instance everyone invested in real gold (i.e. not paper gold). If everyone buys in, the price will skyrocket, however, when large amounts of people cash out, the value plummets and even gold, the real store of value that it is, cannot work for this purpose on a large scale. Gold as it then continually starts to lose value, will cause everyone else to lose confidence in it.

I don’t agree. The endgame of western capitalism was 1933. GDP was heading to 0 as the debt ponzi had ended in 1929. All the government did was create hospice care and a somewhat functional government regulated rules market until the mid-70’s. Then it was adding drugs into the mix so you don’t have to follow any rules.

Thomas,

You understand that the stock market and gold are Ponzi schemes as well.

Everything financial is a Ponzi scheme.

Gold is a Ponzi scheme? You either don’t understand what a Ponzi scheme is, or are unfamiliar with gold’s performance over several THOUSAND years.

That should finally eradicate the sleazy pest among us known to the ancients as savers. Double win, amirite!?

Tinky

I understand the unstable nature of the value of gold.

It’s value ( like fiat ) is assigned by people.

And it’s supply is hit or miss…reliant on the efforts of miners.

You’re showing your ignorance of gold again. Its value is based on its above ground scarcity, not underground potential. Its scarcity and immutability are what have allowed it to remain the most consistent store of value of any substance on earth over the past several thousand years, and imagining that it is somehow “like” fiat currencies is to miss the point entirely.

The Federal government already has a mechanism for this:

https://www.pbgc.gov/

Make State and Local pensions eligible, and problem solved.

Tinky

Nonsense……As population expands so must the money supply.

If gold truly is “money” you need more of it the more people are on earth.

The supply of gold is random geology.

Like a Ponzi scheme, those that got the goodies (nice pensions, nice paper shuffling job) while the bubble is being blown are the winners. When the bubble bursts, you better have a politician to fund the boat (bust out another trillion).

That’s what I read is going to happen. As long as the government guarantees a debt it does not count against the deficit. The pension obligations are still counting on a 7% return when most experts say it is going to be closer to zero the next ten years. That is why a crisis is a politician’s friend as you can grab a trillion of printed dollars to shore up the collapsing finances.

Everything is upside down.

This has also created challenges in business conversations. Many financially successful people are being led to the water to drink the contaminated kool-aid and eventually will find out the water poisoned their organs.

Apparently facts regarding our economic situation has gotten mixed up in with politics now too.

I feel like I’m the guy walking into a room screaming the red coats are coming the red coats are coming and everyone is like hahaha get back on your horse buddy no doom and gloom is not coming.

Or better yet how about when someone actually didnt head the warnings of a new political threat and his beliefs rising to power in eastern Germany until he crossed the western borders it was too late. They could have stopped him from rising to power but no one heeded the warnings. Sadly today our warnings are being drowned out by fake all is well signals. Buy buy buy!

psy·cho·sis

/sīˈkōsəs/

noun

a severe mental disorder in which thought and emotions are so impaired that contact is lost with external reality.

Psychosis born from sexual dysfunction my friend. Half the country at a minimum.

Mr. Wake Up. If only someone could hear you.

This is what it looks like when all planet governments are threatened by a small minority. And now we can all see very clearly who is the small minority. The MBA university business school approach to doing business is now officially invalid. Business practices are openly and unapolagetically corrupt challenging a system which was intentionally broken by the minority. Its now in the hands of the majority. See Aug 13 17. Their view we built it we break it. But we all know that does not stand in truth.

When are responsible people going to make some noise and revolt against all this!?!?

I’m just so sick of not being able to invest my money knowing the markets are so overvalued and meanwhile all of the most irresponsible get breaks at every turn and keep coming out on top. There is genuine hardship now but people also need to learn that emergencies are bound to happen and they need to save up and prepare for them instead of my taxes constantly bailing them out instead of paying for infrastructure, healthcare or other worthwhile benefits.

That’s what I wonder. At what point has the middle class had enough and just stops paying their mortgage, rent, etc. What would happen?

What happens is they don’t give you credit cards for like 3 years. Brutal.

Agreed. The most responsible get hammered.

Work your butt off, work in excess of 40 hours a week and make more than 99k, you get nothing.

Work for $12 an hour at number of places and watch as your piers collect $20-30 sitting at home.

Should be peers, but there are good many who would make good piers

You CHOSE to work like that.

And now we have to listen to you whine ?

Buy Gold and, it’s a total anathema for me to say, silver.

Then hold your balls through the next 1-2, possibly 3 corrections.

1= spoofing by the colossal vampire squid ( that criminal organisation that, unlike Goldman Sacks, has hooks they rotate to catch more of the unsuspecting, hence I did not say ‘giant vampire squid’) and others…

2= Haha COMEX, Haha, Emperor’s New Clothes.

3= central banks trying to mirror the current program in China of state-backed digital currency that is being trialed in a few areas at the moment as, well, you know already.

1+2 can be lived with. 3 will see a flight.

Let me know what you think.

3 would have held in a world john couldn’t talk to

My apologies, last line about john, please disregard.

If you’d payed some attention you would have been buying precious metals since 2013, after the euro-crisis, like i have. I’m on an average 51% gains right now.

Also, if you got into PM miners half a year ago, when COVID kicked in, you would be looking at +45% by now. If got into juniors in june, just before the Robinhooders, you would be looking at +40% today.

The investment opportunities are there, if you dare to go unconventional.

But beware, there’s always a risk and a catch. PM’s might be outlawed for the ordinary people. You never know what ‘they’ come up with next. And you might be unable to sell your PM’s when you need to. So only invest what you can do without at this moment.

Retail investorsB tend to buy the expensive hyped stuff instead of the cheap unloved stuff.

So if you want to invest, look for unloved items. To give one example: uranium. It might be the ‘clean fuel’ of the future. It might not, if something amazing is invented.

Why do you feel ENTITLED to an investment opportunity ?

I have to assume that the institutions providing forbearance have the strategy of trying to make it so bad that the government will step in to “save” them. That is kind of what they’ve gotten used to.

J.

“Still, about 32 million people are claiming unemployment insurance.”

And 1/2 or more of that 32M people are earning more than then did before going on the dole.

Citation please. That sounds like an assertion, and not a fact.

“According to studies that have been done, including by the University of Chicago, about 68% of the people on unemployment insurance are making more money on unemployment insurance than they were making at work,” Sen. Rob Portman (R-Ohio) said Tuesday on the Senate floor.

I know, I know. That’s called trickle-up, unlike most ‘stimulus’. At least it goes into the economy someway, unlike the corporate tax cuts did. You would think the public would finally get something after the government already blew away 27 trillion. Congress and the Fed are going to print anyway, right?

Don’t worry, the stock market will continue to be pumped.

Funny how if the upper classes make out with some “free money” it’s ok….Like all the crooks that got bonuses and millions in tax breaks and had their companies saved in ’08-’09…..

But, let the masses get a break and holy moley!

It’s a “crime”!!!!

Disgusting.

Payroll taxes are not paid by people who are no longer on a payroll. If the absence of payroll taxes, transportation costs to get to work, etc. are considered then even more people had a greater net income when unemployed than they did when they were employed.

It’s absolutely a fact. Employers/businesses that are re-opening can’t find employees because the former employees are getting paid more to NOT work.

Wonder why you can’t hail an Uber anymore? Or why your favorite local shop/restaurant isn’t open despite the ability to? Now you know.

Please tell me how this is not a perverse incentive.

Awwwww……Look all the ENTITLED employers who believe they are ENTITLED to pay employees low wages.

Compete for labor…..pay more.

After decades as a certifiable ”wage slave” i gotta agree with OTB:

Time and enough for ALL,,, and I do mean all of the wage slaver types of companies in USA, perhaps others with which i am not knowledgeable, to pay honest living wages, period, full stop…

Stop already with all the propaganda otherwise, and make it universal so that SO many,,, way TOO many, can stop trying to get out of their low wage areas of all kinds and wager their very life against the low and getting lower possibility they can do better elsewhere…

OutsideTheBox you want small businesses to compete for labor against the government, who can print whatever they want whenever they want? $600 plus state unemployment is a great salary to do nothing. You think someone working as a cashier should make that much money?

“Can of delinquencies”, brilliant. In other words, a pressure cooker on the stove with the top tightly shut, the burner on full and the kitchen full of people munching on…

MattA

I think everyone who works deserves a living wage.

If ANY business can’t provide a living wage to its employees….it has a faulty business plan and need not exist.

If you can’t afford a cashier your business will have to learn to live without one.

An employer is not ENTITLED to inexpensive lanor.

OTB:

What in the hell is ‘inexpensive lanor’ (sic)? I think you meant ‘labor’, but what is inexpensive labor?

What in the world is a living wage?

Is that determined by age, experience, education, a person’s health?

Does an E-1 in the US military deserve a ‘living wage’?

They get US$1733 a month basic pay going up to a whopping US$2043 when they get to be a PFC. (Hey that’s more than twice as much as when joined as a 2LT!!)

Can a person in the USA live on US$1733 a month and should they only get US$1733 or US$2043 a month for being shot at or for working 80 hours a week?

Typo: lanor should be labor

You are posting quite a few straw man arguments. Try again.

A living wage is not the current minimum wage.

Working a standard work week should provide for shelter, food clothing, transportation and health care.

If you don’t pay employees enough to cover these items then the employees are SUBSIDIZING that business.

Employers aren’t ENTITLED to cheap labor.

Lee, it depends on non-coms getting food paid for, clothing paid for, housing paid for, haircuts paid for, medical care paid for, etc. etc. Without those expenses $1733 for incidentals is pretty cushy. Of course you don’t have to remain an E1 or E2. You can become a sergeant, they pay someone with 3 rockers pretty well. You might even become a warrant officer. You can also qualify for a number of additional ratings that kick in an additional $50 to $500 a month, each.

OTB: I do agree with the living wage argument for people above a certain age (high school kids don’t generally need 15+ $/hr). I don’t agree with businesses having to compete with the government.

I think there needs to be larger restructuring of minimum pay vs highest pay (Bezos net worth 190 BILLION). I get the dream of having so much money you and the next 10 generations never have to work, but at what expense? The equality in America is astonishing.

MattA

Thanks for your reasoned response.

I agree with you that high schoolers merit a different standard. Eighteen years and up would be subject to the living wage requirement.

Business and government already compete. AKA meteorologists at NOAA vs those at AcccuWeather.

IRS can easily handle your last idea. All companies have a multiplier….C suiters can only earn 10 times the lowest paid employee ( including contractors ).

IRS receives all monies above this ratio ( salary and perks combined )

Billionaires would become extinct…..as they should be.

@OTB – It depends on what you’re working at. Obviously the skill of talking (politicians, actors financial advisors) is much more highly valued than production line jobs sent overseas.

Democrats have been promising to forgive student loans anyway. Eventually they will run things. Maybe not in 2021 but some day they will. So the delinquency rate will be 100%. Who cares what happens before now and then?

Total student loans outstanding US:

1.6 Trillion. Do it over ten years @ $160 billion per year. That’s a drop in the bucket compared to the last stimulus, or the next one.

If we forgive student loans then we’ll not only (theoretically) raise inflation, but supercharge degree inflation to the extent that college degrees have become zero-sum – which I think they mostly are. On the other hand, 1.6 trillion doesn’t sound like something that’s going to be paid back in a world where, for example, only 27% of graduates are in a job that’s related to their degree. Seems like we’re kind of screwed no matter which way you slice it.

actually it will create a huge discrimination lawsuit as degrees can’t be required by a company or government to get the position since the college dope is after 8 years of school getting it and every party for free by the govt.

born and bred sheep of America, what’s next from the debtpushers…

“On the other hand, 1.6 trillion doesn’t sound like something that’s going to be paid back in a world where, for example, only 27% of graduates are in a job that’s related to their degree. ”

LOL. So what? Are you suggesting everyone with a PoliSci degree who isn’t a politician, should have their loans forgiven? How about Philosophy degreed people who aren’t philosophers? Are you starting to understand how irrelevant that statistic is?

My sister’s degree is in physics. You want know she does for a living? She’s a VP at an investment bank. Percent of her daily job involving physics: zero point zero. I guess using your criteria, her debt is wiped out though, since she’s in the 63% of people who don’t work in the same field as their degrees.

Obviously I’m NOT a math major since it should have said 73%.

If we forgive student loans , then we will just encourage even higher inflation in an area with the highest rate of inflation .Pretty soon ( with government encouragement) a regular textbook will be $1,500/ copy

Less than 10 years ago, Democrats did run things.

Supermajority in the house.

Filibuster proof senate.

Obama in the White House.

No confederate bases renamed and no student loan give aways.

Yeah and did any bankers go to jail, debt issuance subside from the bailouts or any responsible fiscal regulations? Nope. Same bird different wing. Its kinda depressing watching this shit show go on and on, no matter who is in charge.

I do love how, after the Tea Party and such, the call for basic fiscal responsibility has gone out the window on *both* sides of the isle. And that was before COVID.

It was like, hey, we elected Trump! Or hey, we elected Obama! We won and the bankers lost and thats that.

the admin were banker fluffers at that time…..Heck, Holder was BofA legal counsel before becoming a gun runner for cartel and AG

I was dismayed by the lack of prosecution of the bankers during both the Bush and Obama administrations. It finally dawned on me that the financial industry (read G.S. JPM, et. al) most likely turned to those administrations and said ‘if you come after us, we’ll burn the house down. We will of course survive, the rest of you will be ashes’. I remember Eric Holder even saying as much about Jamie Diamond.

There is a big difference between Obama and Trump.

At over 400m,twice as many guns

ANd until all the defund the police BS started with riots, changes to bail laws in NY, the crime rate fell as the number of increased.

Imagine that.

More guns – less crime and murder.

Lax enforcement of laws – more crime.

Those people that elected the nutters that want to ddefund the polcie get exactly what they deserve.

Just Some Random Guy,

Once a politician gives you, what you want, they have to give you something else, it’s much better to never give the constituents what they want. And instead, create a partisan divide, where neither party gives the average joe what they want/need and instead just keeping pushing the same issues back and forth forever, while, sinister stuff happens slowly in the background.

For a significant portion of the population Corona is a dream come true. Making more money NOT working than working, and no more mortgage/rent to worry about. Throw in a free car payment and what else do you need in life?

And we all know that these “temporary” programs will never end. Name the last welfare program that went away. You can’t, because no such thing exists.

For a significant portion of the population, war is a dream come true, isn’t it? But if it is Dick Cheney and Halliburton making more money off tax dollars than they did when they did honest labor, is that really good for the USA? In terms of scale, no. The people making “more than the dole” are the lowest paid and most income insecure citizens. Why is PPP based on a percentage of former income? Why does it not make more sense to use the cost of living (modestly) as a level base, and grant equal amounts to ensure no one starves due to the disruption? Where is the equality in life, liberty and property in giving more relief to the one with more. That is the affluenza argument.

Where is the equality in life?

Life and nature abhors equality.

You are not equal to yourself in any given day.

what percentage of other peoples income do you think you are entitled in the name of fairness and equality?

Life is unfair – get used to it.

JSRG:

The FED for the financiers and corporations when in trouble?

Alan Greenspan in the late ’08’s fire-hosing money into the system to save his banking pals????

A fed tax system that has gone from a decent fairness in the 1960’s to what it is today????

The “….last welfare payment that went away was during the Clinton Administration’s gutting of the basic “welfare” system………that’s one for starters……What’s with all the short memories??????

You’re gonna make ZH look good!!

(That’ll be the day!)

Welfare is a welfare program that ended. Bill Clinton abolished it. And abt those making more doing nothing…are you referring to Wall Street?

Throw in elected officials…..ask anyone of them what they do all day while getting pid big bucks.

This is going to turn into the Medicaid gambit. First they rush to the hospital, perform a life saving operation, and then hand you the bill. What no insurance? Well just sign on the dotted line….

The payroll tax cut is likely to hurt a lot of workers when they retire. The closer you are to retirement the more it will hurt. Losing credit for earnings at the end of a career is going to lessen the amount of social security soon to be retirees will get. If they don’t give you credit for the quarters, they also don’t count them.

Don’t worry, they’ll change the rules for retirement. Haven’t they already?

Didn’t it go to some kind of average over your lifetime instead of the previous way it worked for social security?

And with the military – they did the same. IIRC they went from the highest earning year to an average of some kind.

Retired military used to get free healthcare and now they have to pay a monthly fee too.

Australia messes with retirement where it can too. When you retire here all of the sudden instead of being counted as ‘individuals’ you are now part of a ‘family unit’ and calculations made accordingly.

And then you have them messing with areas where there isn’t going to be much push back.

For example, the basic requirement for getting an old age pension here is 10 years residence. So what happens is Mr and Mrs XYZ move here when they are 55 and when they turn 65 or 67 depending on their birthdate, can qualify for the basic pension even if they never worked a day in their life here.

Then Mr and Mrs XYZ decide to go back to their home country.

Their age pension will be reduced. This is based on the number of years they spent in Australia before the age of 65.

When the Labor Rudd/Gillard/Rudd government came into office the number of years you lived in Australia was divided by 25 as the basis. So in the case of MR and MRS XYZ their pension would be paid at 10/25 or 40% of the rate and then of course subject to any other reductions from other income. All the allowances paid to only Australia residents would end too and the cut would come into effect six months after they left Australia.

(This 6 month period would see lots of people go back and visit their home country for part of the year and still be able to collect their full pension. People from Greece would do this a lot as the cost of living there was cheaper than Australia and they also were getting their pension from Greece too!)

So the R/G/R government decided to increase the number of years from 25 to 35. Well they were voted out of office and I thought that the new conservative government would end the changes, but no, they made them worse.

They not only kept the 35 year requirement, but the reduction now comes into effect after 6 weeks. So if MR and MRS XYZ want to leave and go back home their pension will be paid at 10 divided by 35 or 28.5% of the normal rate.

And there are even more rules at work too.

For those who were granted an Age Pension and left Australia prior to 1 July 2014, the 25-year Australian working life residence will be applied. Should you return to Australia and then depart (after 1 July 2014), the new 35-year rule will be applied.

As long as you remain eligible, your Age Pension will continue to be paid fortnightly. If you are moving long term (over 12 months) or permanently, your Age Pension will be paid every four weeks.

However, if you returned to reside in Australia within the last two years and were transferred to or granted an Age Pension within that time, your pension will be stopped when you go overseas.

Should you be granted an Age Pension, you have to remain in Australia for two years, otherwise your Age Pension will be cancelled.

So a quick example if both were to qualify for the full pension at around $35,000 in Australia, first their allowances would be cut and the pension calculation amount would fall to around $30,000.

So if they left before the changes were made they would have received A$12,000.

Under the new changes the amount would be A$8500.

So under the above scenarios the result would be:

1. Stay in Australia and make $35,000 a year from the pension (All tax free up to a total of something like $50,000 total income or so for the both of you and zero reduction of the pension amount up to that limit.)

2. Old rules: A$12,000 if you left Australia

3. New rules: $8,500 if you left Australia and or come back after having left.

Quite big changes in amounts for a couple on the pension.

I was employed for a considerable number of years (to me 9 years was considerable) by a well known organisation.

A very well known organisation that becomes armed villages on the sea.

When I left, they said, ‘Thank you, Sir’.

Then they said, ‘We can only contribute our part of your pension to half of your years of service, because, Sir, we’ve changed the rules, you see..’

Bastards. The above sounds funny, but honestly, C**Ts.

But, when you’ve flailed around a bit, worn out your spleen to whoever will still listen, what’s left?

A grim sense that fixed income for retirement is nothing more than a post second world war construct that holds absolutely no reference for anyone under the age of, right now, 60.

TimTim,

Gee, well at least you got something!!

I had some active duty time and a bunch of reserve duty, but as I married a Japanese lady I was no longer considered ‘trustworthy’…………..End of career.

And now when you look around at the BS going on and the people who can get and keep TS/SCI compartmented clearances and access one has to wonder……….

Look no further than the star from the NSC with all sorts of foreign connections and family. How in the hell did he ever get a clearance let alone be able to work there?

Times have changed.

I seriously doubt that will happen.

If you have any moribund relatives, without an estate, unless it’s in a trust that benefits others, and would make collecting from it impossible, make sure that their credit cards are maxed out to buy useful things like food and real things for the benefit of their dear relatives and friends.

What’s the point of dying with all your bills paid when you can give one last middle finger to the Moloch.

Holy Smokes. People are now becoming ‘accustomed’ into believing there are no consequences….at least from the top down. That is why Guido or Paulie broke legs for the vig, to send a message. That is why people don’t borrow on the street from a Guido or Paulie. The message from the 2008-9 bank bailouts were there are often no consequences for poor decisions. At least for some.

Covid is different, but still……

I did a Costco run last week. At till time I received the usual spiel about a Capital One Mastercard, and would I like one? I always say no, and pay by cash (debit card). The checker often asks about not using a CC and all I say is, “I don’t like getting the bills in the mail”. I’ll stick with that explanation. It seems to work.

I keep asking them no to, but every so often my bank puts up my credit card limit….

Debit card purchases are obviously as easily tracked as credit cards. If you use a debit card or cash/check, you’re just paying everyone’s credit card fees with no benefits. The best choice is to load up on debt and then vanish. Eg get all your elective Healthcare done, go to the most expensive schools, spend on credit to buy assets (metals), and then move abroad. Plenty of sunny places. Or just die, like someone said.

Yeah…but….

In the Britain we are already seeing banks start to protect themselves (which I, for one, think it is in the wider interest that they do).

Some banks are not passing delayed payments on forborn mortgages, as a negative mark, to credit rating agencies (such as Experian or Equifax)..God forbid… but they are taking them into account when considering mortgage renewals and other applications for their existing customers (who may have nowhere else to go as the range of mortgage products available has drasrically contracted over the past 6 months)

The Banks are also entitled to demand the full amount that was ‘forborn’ for a few months in a lump sum payment at the end of that forbearance period. That’s the difference between payments forborn and payments ‘deferred’ The latter being where the debt is added on to the end of the loan repayment agreement, which means no initial lump sum demand, but ‘simply’ a resumption of monthly payments at a higher amount.

Our Chancellor of the Exchequer (Head UK Government Finance Politician) has in the last couple of days stated that Government program of wage subsidy is unlikely to continue after October. As I believe he put it; the subsidy of jobs that in all likelihood no longer exist cannot go on.

I cannot tell you the scale of this problem, but I cannot see how it ends well for many households.

At the minute we are reportedly having a ‘mini-boom’ in housing sales.

Why would anyone with an ounce of sense buy now?

Even the wage subsidy fell into the “Affluenza Argument” by paying out as a percentage of prior wages. Better that all the payments were alike, based on the subsistence cost of living, so that no one would starve. Instead, the philosophy was to prop up people as they were accustomed (like the defendant who pleaded “affluenza” that he could not tolerate punishment because he was not used to it).

There is one very sensible reason to buy a house right now. There are still many no money down and finance the closing fees programs out there. (I just sold a house to someone who most likely ended up paying less to move into her own home than she would have paid to move into a rental property, since that requires a security deposit). It seems pretty stupid not to buy under those circumstances, no? Who knows how long it will take before she gets evicted if she decides to defer the mortgage payments as much as possible?

So the sensible reason to buy a house is not to pay a mortgage or a rent? Why not.

When house prices plunge and you owe the bank 30% more than you can sell it for, you will have buyer’s remorse on an epic scale. In the late Eighties, I was so confident about the real estate market that I did a cash out refi on my home. ( I was a Realtor and RE was my religion). Before the ink dried, prices went into freefall. I got to run in the financial trifecta of foreclosure, bankruptcy, and divorce. Fun is.

The new home next to me was listed for 80K more than the house should be sold for, based on comps in Ada County, Idaho. As it was being built, I watched one of the drunken contractors stand on the roof with a cigarette dangling out of his mouth while three toddlers helped him move wood. Just cringe worthy.

Three couples recently bid on it, like fools. I cannot imagine how any of these individuals purchased the place without a no money down scheme. A young couple wound up buying it. When I saw them, thought, hmm, they will be here about two years, tops. Because property taxes will go up twice in that time period, along with HOA fees. The first time may be shocking to them, as here property taxes are 100% of assessed value, meaning they probably will owe about 3-4K more next year since they missed an exemption cutoff. They do not seem like the type to plan for such things. One already looks high strung. It probably doesn’t help when the senior next to us welcomes them to the area by complaining about their tree in her yard.

With the mortgage period over, I am seeing houses open for sale surge and I am not along the coasts.

So what you’re saying is…stop paying on my house, buy a jet ski, have fun.

We’re all doomed

Nintendo profit is up 6 fold from the same period last year. That’s strictly in the discretionary spending category, especially if you already have a smartphone.

Wolf,

Thanks Wolf, so forbearance and deferred are different in the banking system. Banks are well capitalized they say, pundits, J Powell. So is this what goes around comes around for the banks? I invested in one, before yesterday, the conference call I thought was good, I believed it. You have always kept me cautious Wolf, thanks again and stay safe. A regional bank. Not too much oil like last time.

I agree with Paulo that the mindset “I can’t pay so I won’t” will become normalized. I mean, what’s not to like? Financial victimhood.

We hot enough victimhood rapant in our society, what’s a little more?

Is there no market for a bank to offload “performing” loans?

Those that lend money have responsibility for this.

They know if one is making 10 an hour they can’t afford

any of it,They deserve not to be repaid.

Actually, it is those who borrow who have the responsibility…. Everyone is responsible for their own actions… That seems to be something as a nation we have forgotten.

Lloyds Bank shares down to 27p (they were about £6.30 20 years ago). I think the London Stock Market is more realistic in its pricing compared to Wall Street.

The shares of US banks are down massively too but aren’t penny stocks yet. For example, JPMorgan, the biggest one, is down 27% from February, to $99.38. Wells Fargo is down 50% from January, but is still $25.

They have also cut their loan origination substantially. I wonder how long it will take for that to work it’s way into the data…..

Look at it this way. NON US banks might have MASSIVE dollar liabilities (I actually don’t know whether this is true). Where are they supposed to get dollars? UK Central Bank might set up a dollar swap line with the Fed and then in turn loan the dollars to the banks, but presumably this can’t be forever.

You can’t count on the Special Relationship to save the day in the end.

I think US banks have massive dollar liquidity problems as well, hence the REPO bail out for one of the biggest in September. I think the UK government will have to nationalise the biggest banks at some point (they are nearly there with NatWest/RBS, whatever its called this week).

Yeah, but US banks are backed by the Fed. They can be recapitalized easily.

The student loan forbearance is different than the others because they are not accruing interest in the forbearance period. Those that are still paying are actually ahead because the full amount of the payment is going to principle. What this means is that the total of student debt is actually falling with each payment made.

With the other loans, it’s the exact opposite. The debt pile is growing and the lenders benefit from the forbearance because the outstanding debt is an asset for them.

The mini-housing boom is going to bust in a incredibly fast fashion as banks start taking losses. The Forbearance for mortgages ended July 31st and I am already seeing the effect in my neighborhood with people moving out.

The ridiculous NYC apt prices are getting less ridiculous, fast.

Where is this?

What do we tell other countries to do: austerity? Don’t fudge the data? No centralized government manipulation of markets? The hypocrisy astounds.

You really think it is the government??? I got a surprise for you……..its not.

Wow, this is just another reason why government intervention most time is a bad idea. The ham fisted way our elected officials are wading in head first shows why political office attract such morons. And the media are filled with D players who do nothing but pontificate and cheer things on.

The $600 a week UI basically completely ignored economics, and the consequence of providing entitlements, and that’s largely egged on by the ****** in Congress. Coupled with all this forbearance and eviction moratoriums, it’s like party, and everyone is getting high on whatever drugs the government is handing out.

When the inevitable occurs and the natural consequences of the law of economics occur, there will be just another round of gigantic bail out, and for what. I think it’s not too far to say that the country is becoming too entitled because our elected officials are too stupid to do anything but enable this entitlement. And when the party is finally over, we’ll end up with another depression.

JFK said: “ask what you can do for your country.” The people in his party today would call him an unfeeling elitist who doesn’t understand the pain and suffering of BIPOC and should be censored for being so out of touch and being so enamored with his white privilege. And those comments would come from the so called moderates.

When the inevitable occurs and the natural consequences of the law of economics occur,

Natural laws went out the window and the text books during The GFC.

Automation wasnt taken into account.

Free college OK then what? What do you do with that degree? Clean the robots who do your job or better yet maybe you qualify for a better free apartment.

We are headed towards a society of very few jobs thanks in part to automation and big tech and the never ending capital raising sports events for more tech replace more workers world.

Covid helped to “mask” the rapid fire transformation.

No ambitions nothing but entitlement give me give me it’s a sad joke. Greek tragedy that Homer himself couldn’t fathom.

The laws of economics will be

A) stay on the grid: track and trace your every move every thought and word. Every dollar spent Every dollar earned. Social credit score, for those with no assets no money = $2000 MMT, free apartment, free meds of all sorts, free, free, free.

B) stay off the grid = free free free.

“Free college OK then what? What do you do with that degree? Clean the robots …”

You could get an engineering degree and design the next generation of robots?

Americans like to make money with money, but we hate to build things. Science and engineering seem to be be anathema to our perception of reality.

“Americans like to make money with money, but we hate to build things. Science and engineering seem to be be anathema to our perception of reality.”

That’s certainly true with the current generation. My company is looking for a very specific type of engineer, and believe it or not, none of the potential candidates were US citizens or even permanent residents. It’s like we’ve taught somehow raised an entire generation to be a bunch of entitled self absorbed social media junkies.

With companies like SpaceX, at least there seem to be some that are trying. But that’s ok, Google, Facebook, and Twitter will throw far more money at you to join them. And look what they’ve done with that money.

“You see things; and you say “Why?” But I dream things that never were; and I say “Why not?””

– George Bernard Shaw

We used to have this spirit in America, too. Now we don’t.

lol, the 600 is for pandemic unemployment. You sadly, don’t get that. With long term unemployment 80% of the financial crisis and rising, that will suck money right out of the economy.

Sure, the forbearance is a financial handout sucks, but they are being phased out with little whining over it. Banks had their time to prepare, they better or face liquidation.

Wait, are you actually thinking pandemic unemployment is going to unwind itself before the year ends?

No matter what happens, the money is going to go out of the economy because of the choices that were made. The only question is how bad things are going to get. Because all of this bailout and stimulus is just going to make the inevitable crash that much worse, it is only a matter of timing. Unless you think we’re going to magically get out of this by priming the pump even more.

Once Vaccinations start and normalcy returns, people will return to work and jobless claims will crash outside structural issues left over. They did in the financial crisis as well when they were extended for a couple of years.

I prefer this to anymore “stimulus” checks or bailouts”.

Bobby,

the structural issues are going to be massive. This is not going to turn out like 2008. This is order of magnitude worse.

The problem with putting local and state politicians and so called medical experts in charge of the various remedies to fix this problem is that they have little or no actual expertise or experience when it comes to things financial or economic.

The economy is a massive set of inter-related actions and interactions that have all been gummed up, messed up, and basically perverted by those people.

The economy just won’t magically start up again when things get better. Connections, supply chains, wealth, and jobs have been permanently broken and lost.

And as I have posted here before, the responce and actions by state and local governments in regards to elderly people in aged care and long term care has been pathetic and negligent.

Too many people in those situations have died and most of it could have been prevented. The USA isn’t alone in this situation with Sweden, Canada, GB, and now Australia joining the club.

Here in Victoria we are now learning from leaked government emails that contract tracing is taking up to two weeks in some cases and that the program implemented to secure quarantine at hotels (where the virus escaped into the wider community and caused the current curfew and lockdown) was modeled to increase ‘social diversity’.

All that meant was when proper management and oversight of the program lapsed (social interaction by the guards up to and including them having sex with the people in quarantine) the virus spread through the ‘diverse social community’ from where the guards and others were hired: the low socio-economic areas of Melbourne which are primarily out west and in the north west.

These areas were first locked down and then the entire city followed. The spread of the virus followed these people into the wider community and into places such as aged care where many of them work in low paying jobs.

Here in Victoria you can follow the number of cases by postcode and see how the virus has taken hold in these areas.

In my postcode we have a total of 20 active cases and zero new cases since the 1st of August. We have at least seven aged care facilities/establishments in the local area and so far only one worker has tested positive. Probably becuase none of the people that worked in the hotel quarantine program came from our area. (Its too far away and housing here is too expensive.)

Go to the next post code area over and the number of cases is much higher and continue over to the other two next to them going towards the city – all have higher absolute numbers and numbers per 1000 residents. They are also areas that have lower incomes and a more ‘diverse’ population than our postcode.

Another way to look at the correlation between the virus outbreak this time is to look at the price of houses in various areas. No guess as to the result: areas with lower real estate prices during this spread of the virus have higher numbers.

Those areas also rely more on public transport than other areas as well.

I wonder if that is the case in the USA as well? The second wave that started in Singapore is somewhat similar to the situation here in Melbourne in the target population.

@ Bobby Dents

‘Once Vaccinations start and normalcy returns’

You appear to be optimistic about vaccination within 12-18 months. I am not sure. A lot of rhetoric without any scientific back up since there has been no vaccination of any kind against any kind of corona viruses in human history!

Not that easy to get rid of that nasty virus.

Gee post that up and the local rag puts up an article about it:

https://www.theage.com.au/national/victoria/a-city-divided-covid-19-finds-a-weakness-in-melbourne-s-social-fault-lines-20200807-p55ji2.html

I just heard this period is being referred to as the pandemic depression by some prominent economists.

Probably a good name. Financial crisis, Tech bust, S&L crisis, Volcker recession, Oil embargo recession, Vietnam withdrawal recession, Eisenhower recession, Flu recession, Korean draw down recession, Truman recession………they are like marketing names.

We’ll need a sound track too, like they had up and running 30 minutes after the Twin Towers came down.

DJT doesn’t need to ask anyone anything. He writes his own laws of economics. Of course, in his smaller big business experience, he used bankruptcy as a tool to “restructure” and settle rough waters. It may not work on a national scale, with only the global economy to take ten cents on the dollar. At that scale, a collapse is the extrapolated outcome.

Look at Australia: compared to the USA you haven’t done a thing.

MCH:

“JFK said: “ask what you can do for your country.”

Answer:

Join one of the many street protests going on in many parts of this country!

Soon the hoi paloi will begin to panic…….

That’s when you want to be solvent and as physically secure as possible………far away…..

Yep, great idea, I haven’t had the pleasure of trashing the local Starbucks and taking bricks to small businesses. Where do I go to buy my armor and shields and gas masks again?

?

“Ask not what you can do for your country. Ask what’s for lunch.” – Orson Welles

Why pay when you don’t have to? Dem leaders say stay inside. Take that $$ and let it run in stocks.

#ddtg

September 30 might as well be called doomsday. Not only are student loans foreborn, forebeared? until then, and thus payable Oct 1st, but companies with over OVER 500 employees who got PPP loans, get to keep the money as a grant, not a loan payable, as long as they kept employees on the payroll until September 30.

October 1st is going to be the real beginning of the end.

Think you are on the exactly correct track t4..

Except, as I have mentioned elsewhere on Wolf’s wonder site, IF and only if the oligarchs/masters/rulers have decided by then that the current pres is going to do a better job of protecting both types of their assets than the ‘other team.’

And that IMO depends on if the current violent rioting, by any name one wishes to call it, continues and especially if it continues to expand into more locations and violence.

Seems clear enough that some dim folks don’t understand that by continuing the violence they are playing directly into the hands of the reactionaries, of both sides of the aisles, who will have us in some semblance of martial law sooner, perhaps by early fall 2020, and/or later.

Let’s be real clear that every recent potus election has been decided by the team that spends the most money to brainwash us peasants, and the sources of the vast majority of that money is still very carefully concealed, in spite of some folks bragging about large numbers of small donations.

lol… one molotov into the eccles building while jerome et al are convening will quickly dispel any notions of their 60 minutes public masturbatory exercises achieving the desired effect…

Check out youtube videos of “giant slingshots” used by the Hong Kong protestors. Basically just giant rubber bands held by a couple people on either side. Can launch a brick or a molotov cocktail a city block at least.

“New Speak” has become our official language. Delinquent is now current. Insolvent is now solvent, and dystopia is the new normal….

We have as a country gone down the rabbit hole and reality is something to be completely ignored… We have become the people of Idiocracy….

I don’t believe any of these bullshit reports and statistics anymore, especially from the BLS (Bureau of lies and statistics). 10.2% current unemployment rate? Do these people ever go outside?

Everything is FAKE!!

Money, the economy, news media, government, leadership, healthcare, education, culture, frankenfood, stop me any time……..

But the biggest problem is Denialism.

Denialism is abdication of responsibility. First towards others , but ultimately towards self.

When problems mount in every direction , society has a choice to face those problems or to ignore them. The easiest path to take is to rationalize them away. Pretend they don’t exist. Create an entirely new genre of Fake-Believe that spends it’s entire time discussing topics that are totally irrelevant to the major problems at hand. All to extrapolate the impossible and give the sheeple a false sense of confidence about the future. Good luck to us all…we are going to need all we can get.

What’s so hard to believe?

We just saw the initial claims come in at a million and a half PER WEEK for the last four weeks. Today we learned that 1.7 million people got their jobs back IN A MONTH. And Trump thinks he’s doing well. The country is being ruined.

Thank’s for making my point.

Someone who actually gets it…

Aren’t all the months of “deferred” mortgage payments due immediately at the end of the moratorium? If you couldn’t scrape together ONE mortgage payment, how the hell are you going to come up with SIX at once? Those people who spent their mortgage payment on a trip to Bezos Land may find out that they don’t have a house in which to store all that junk. The banks are going to end up owning a lot more properties come 2021.

Not in the US. The mortgage will be modified, with missed payments added to the end of the mortgage or terms of the mortgage changed in other ways so that the monthly payment does not rise. These are government-backed mortgages, and Fannie Mae, Freddie Mac, et al. have issued rules for lenders about these mortgage modifications.

so basically we had a 6 month mortgage jubilee? No wonder Amazon’s stock tripled!

Right, accept the mortgage must be paid. When it isn’t ……..

Could these end up being restructured into 100 year leases or something like that?

Wolf,

Why couldn’t all major debts like mortgages and even credit cards be put into forebearance and extended indefinitly into the future, with the sums and interest rolled into extensions, like the U.S. National Debt?

This is a serious question.

I mean, you could really do anything. You just gotta live with the consequences.

Wasn’t there an old saying in the USSR that went something like this –

“You pretend to pay us and we pretend to work”.

I guess the new American saying is now –

“You pretend to pay us (a living wage) and we pretend to pay back our debts”.

Substituting debt for wages only works for so long. Covid-19 just sped up the collapse.

The rules are simple: they lie to us, we know they’re lying, they know we know they’re lying, but they keep lying to us, and we keep pretending to believe them.”

― Elena Gorokhova, A Mountain of Crumbs

The parallels with the end stages of the Soviet Union and the US/EU/UK today are stark. Is Covid our Chernobyl moment?

are you saying Chernobyl triggered the collapse of the Soviet Union?

As soon as reality becomes a casualty, system collapse is not far behind……

Want to talk about weird? Broken?

You can now send airmail letters to Pitcairn from Japan and surface mail to Bhutan.

But there is still no mail from Japan to Australia!!!

What is this “mail” of which you speak?

Letters – you know …………………………

Packages with goods in them sent through the normal post office………………

What’s a letter? Is it like a video chat? a phone call? a text message? an email? A voice message?

Who sends letters?

Fedex and UPS and a hundred other companies do a better, cheaper job than the USPS for parcels.

You wanna give me the cost of a simple letter sent by Fedex from Japan to Australia for me that contains $5 worh of stuff?

Or a box of tea that costs $A25 and A$4 by Japan Post to Australia, but $A50 by Fedex?

Extend and Pretend for ever.

Soon to be followed by restructuring loans for all just roll all of that nasty debt into one new easy to manage loan.

On the latest and newest whizzbang loans O% Interest 84 months term and low low zero payments required.

Its never in arrears or defaults and renews with increases possible @84 months or anytime you need more money. Brought to you by Bank of Fed, ECB or Central Bank of your choice. Money they way its meant to be worthless and free.

SF supervisor is proposing 50% back-rent forgiveness. Because you know, landlords should be invested in stabilizing tenants. It’s only logical.

I read a local article about that. I think it was the landlord company that offered 50% off the rent owned, but the tenants group and the supervisor said they wanted 100%! This is San Francisco, after all.

I had to laugh when you wrote about the expectation of the next magic trick. Oh surely we will find a way to play extend and pretend a little longer, it should be the motto of the 20th century Unites States. At some time, there will be a day of reckoning, the day way where we run out of hands to play our manifold bluffs. I thought we were there 12 years ago, but the resilience of this beautiful scheme has made me look a fool. As Keynes said, ‘In the long run we are all dead’, so the best case scenario is that we will all be long gone before our children will curse us for the (by then) absolutely unique universal CF we left behind.

that will be about Nov 12th……..

they are holding everything up until election….

then hell comes…..no matter the winner

In place of investing in college education these same students should’ve bet all funds on Facebook dot com, or Amazon dot com, or any dot com. And be set for retirement now.

yes, all this is pure fraud and madness

but the craziest part is to believe that there will be no consequences for the country and the people when you tweak the financial system in creating more new issued debt 24/7 to paper over delinquencies to prevent mass insolvencies when people stop paying stop saving and get everything for free forever

Do the future of the country and the people still count and who will pay for?

This unstoppable and growing debt monster can buy more assets for the already richest ones close to the power and getting DIRECTLY the free money leaving everybody else holding the bag because of a destroyed purchasing power of the currency.

The very rich do not care about the stagflation or high level of inflation but the 90% of the population will suffer hugely and this is only one of the terrible consequences of this collective lunacy.

One massive forgiveness of debt coming?

and the bigger in debt you are, the more you benefit?