International air passenger volume still down 96.8%.

By Wolf Richter for WOLF STREET.

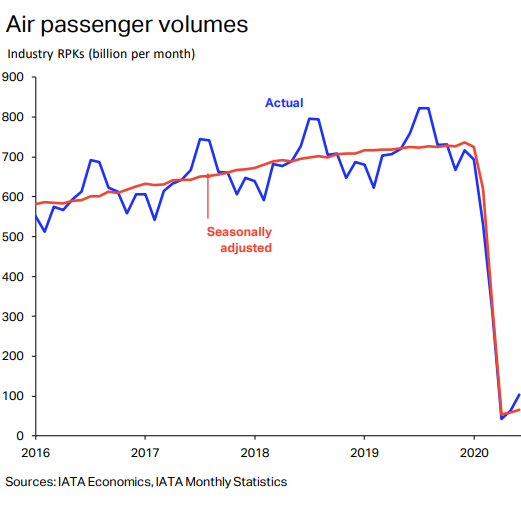

Globally and industry-wide, a measure of business for airlines, “revenue passenger-kilometers” (RPKs), in June was still down -86.5% compared to June last year, but a smidgen less bad than in May (-91.0%), according to the IATA’s newly released analysis. By comparison, during the six months following the 9/11 attacks – “considered to be the most severe aviation crisis prior to 2020” – revenue-passenger kilometers declined by 12% (the next three charts below via © International Air Transport Association, available on IATA Economics).

Passenger volume. Worldwide, the recovery, so to speak, occurred mostly in domestic air travel, which in June was down -67.6% compared to June last year, an improvement from May (-78.4%).

But international air passenger volume in June was still down -96.8% from June last year, and only a minuscule 1.5 percentage points up from May (-98.3%), which had been as close to zero traffic as you can get without actually reaching zero.

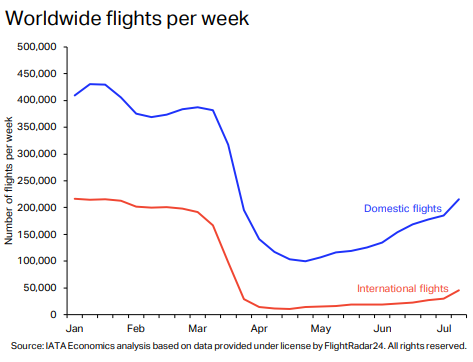

International flights have been handicapped by travel restrictions many countries have still in place. Even if people wanted to fly to some distant destinations either on business or vacation, they might not be able to, or would have to subject themselves to long quarantine periods, coming and going, making shorter trips practically impossible.

The number of flights on domestic routes worldwide rose in June and into July but remained down by about half from January pre-Covid. The number of flights on international routes ticked up in late June and into July as the EU’s Schengen Area lifted border-crossing restrictions, but remained dreadfully low:

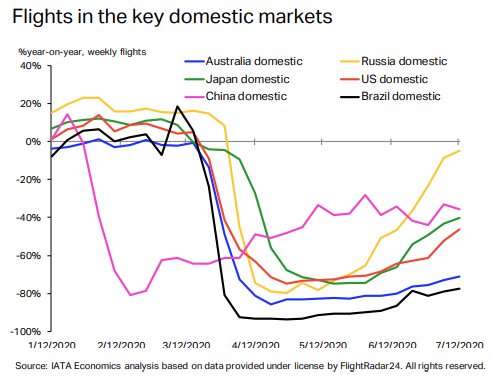

By country, the number of domestic flights recovered more in some countries than in others. In Russia, local carriers resumed all of their domestic flights in June, and in terms of the number of flights, air traffic by mid-July was nearly back to normal (yellow line). Chinese airlines started to add domestic flights in late March, but then renewed outbreaks occurred, which has put the recovery of flights into a holding pattern since May. US airlines were adding flights in May and June for summer travel season (red line):

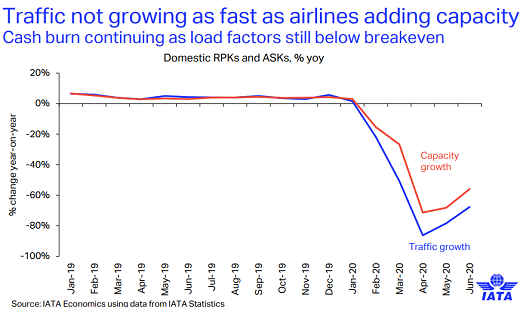

Industry-wide capacity has been slashed radically starting in February, as airlines tried to grapple with the collapse in air-travel demand. Then, from the low in April, airlines started to add some capacity. In June, industry-wide capacity, as measured in available seat-kilometers (ASKs) was still down -80.1% from June last year, but a slight improvement from May (-86%).

Airlines have been adding capacity on domestic flights (red line) faster than air travel has grown (blue line), widening the gap and contributing to the cash burn (the next two charts below via IATA’s Presentation, © International Air Transport Association, available on IATA Economics):

The industrywide passenger load factor – the percentage of available seats filled – remained at an all-time low in June, at 57.6%, down by 26.8 percentage points from June last year, despite the aggressive reductions in capacity in February, March, and April.

Every region but Latin America experienced record low load factors in June. Latin America experienced its record low in May (54%), which rose to 66.6% in June. In North America, 52.4% of the seats were filled, in Europe, 55.5%, in Asia Pacific, which includes China, 63.8%. The load factor of Africa’s airlines plunged to 16%.

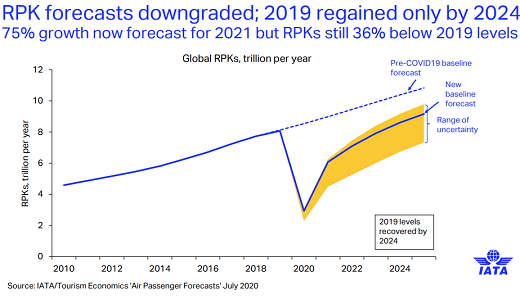

The IATA forecasts a funny-looking V-shaped recovery in revenue passenger-kilometers (RPKs) which sees the 2019 level of 8 trillion RPKs to be “regained only by 2024”:

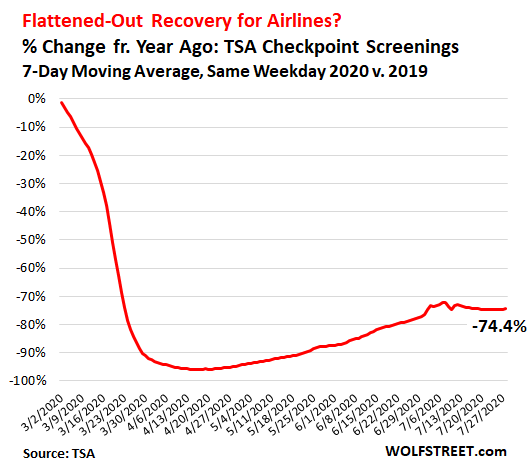

The data for the IATA report reaches into mid-July. But in July, renewed outbreaks in the US have started to hit the air travel recovery in the US, and since early July, major US airlines started warning about renewed declines in ticket sales.

TSA checkpoint screenings, which measure on a daily basis the number of people entering into the security zones at US airports, were down -78.0% yesterday (Tuesday) compared to Tuesday in the same week last year, according to TSA data this morning. This was the biggest year-over-year decline since June 28.

The seven-day moving average, which smoothens out the day-to-day volatility but by definition lags a few days behind, has edged down from its “peak” in early July and has now been essentially flat for July, with the recovery of passenger volume having started to backpedal slowly since early July:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Thanks for the article Wolf. How dire! I can’t imagine that there’ll be a single carrier solvent by this time next year.

Amazing and stupefying.

What is amazing to me is how the wags called out Warren Buffet for dumping his airline stocks !

On international air travel, I am waiting for a comment about how this is going to hurt globalism, except air cargo volume is up a lot. We use to need people for globalism, now we can have globalism without the people. That, comrades, is progress.

?

Politicians and their staff made a huge volume of that air travel. The mayor of Toronto barely made it back when air travel was locked down from his business trip to China.

The Spice must flow!

Well air cargo may be up, but postal services between countries is still down.

EMS and airmail from Japan to Australia has been stopped. SAL has been stopped too.

Many companies in Japan will no longer will ship stuff to Australia at all.

Mail from the USA to Australia takes anywhere between three and seven weeks.

I had one letter from the USA take seven weeks to get here. It spent over half of that time floating around the USA. It then took between 11 and 14 days to get from Sydney to Melbourne. (Australia Post said the letter arrived on one date and USPS claimed another!!).

Domestic mail here isn’t much better with local mail (letters) taking a week to go 20 miles and “express” post packages taking anywhere from 3 days to a week to go from one suburb to another.

I find it amazing that way back in 1885 you could get a postcard from Vienna, Austria to places in Australia (Melbourne or Adelaide) in 35 days. And they did it without airplanes or losing the mail.

Today service is still suspended between Australia and Austria (and Japan and Austria as well.) But you can get mail service between Japan and Greenland!!

Basically ridiculous……………..

Not sure what’s going on with Japan. Nowadays if I want something from there, I’ll have to use DHL.

All I can say is China Post is pretty much back to normal when it comes to shipping to the US. At the beginning of the pandemic, a package would take close to TWO months and you had to pay more for the same level of service. Nowadays, it’s pretty much like before the pandemic.

Hong Kong Post on the other hand is dead in the water when it comes to normal mail. Like don’t even bother ordering anything from Hong Kong. They still offer surface mail, but that’s like 44 – 73 days to the US.

All I can surmise from the above is, there’s still demand for air freight from China to the US. And I have to believe on the way back some of those planes are carrying Chinese students back to China.

Seems like China’s ‘free seeds’ are getting through without any problems.

DHL from Japan to other countries must be expensive, but the places we buy tea and dried seaweed have stopped all overseas shipments. Wonder if they will ever start again…………

I’d like to buy other stuff on Yahoo Japan auctions, but most sellers won’t ship overseas and won’t take Paypal.

You can use some of those services that will bid and pay for you, but that costs more than the stuff I want to buy!!

I’ve shipped a couple of parcels from the US to Australia. Following the tracking – both parcels have been held up in Australia longer than it actually did than getting from place of origin to the Australian post office.

So far two weeks.

A parcel from the UK arrived less than seven days from sale.

I bought something from France on Tuesday and it’s on the plane on the way to Australia.

You must be having bad luck.

Well here in Oz we are basically prohibited from leaving the country.

And if you do want to leave you have to have a ‘good’ reason such as going to a funeral, legal reasons, or ‘medical care (no joke on that one.)

You have apply for a permit to leave and then wait for approval.

And if you are thinking that if you are a dual national with another citizenship, well guess what – sorry – your Australian citizenship over rides that and you still can’t leave.

Then you have the problem of actually finding a flight. There aren’t that many airlines flying in and out of the country anymore.

Sorry that you folks agreed to give up your guns and your

liberties. There is no better way to keep a government under control than to put them 6 feet under.

Well right now they won’t evenlet you go to your vacation house in another part of Victoria from melbourne if you own won.

State borders are closed to people from Victoria too. So if you own a vacation house in Queensland you can’t use it.

Seems to me that the goverment is doing what it’s supposed to – governing.

When you can’t trust individuals to follow reasonable advice of staying in place to stop the spread of disease, then enforcement is required to keep the majority of the population safe.

Imagining that the best response to a government attempting to save the population is to shoot them is so beyond rational that it is incomprehensible to anyone (outside of the US).

Lee there are signs that the Victorian government have thrown in the towel. They’ve admitted community spreading can’t be stopped. It looks like they are going to try and concentrate on protecting the elderly and the vulnerable.

What this means for lockdowns etc will be interesting. It’s obvious they aren’t working.

I think the government might be swinging around to the economic impact

They built railroads to move people; immigration and vacations, with the sophisticated users going into real estate development. It evolved into the primary method of transporting bulk commodities overland.

Don’t worry. Powell has committed to doing “whatever it takes”. I suppose the Fed will end up owning a couple airlines.

It will difficult soon to distinguish between FedAir and Fedex

The autopilot on FedAir will start printing money in the event of a crash.

Think the blow up doll from the movie Air Plane.

Some speculators will scoop them up for fractions of pennies on the dollar and have a lot of scrap to sell…

What are they made of now?

Certainly not aluminum any more.

QE 20 trillion within a yr or 2? From Hawkish Gradualism to Instantaneous Super Ultra Dovism in a split second…FOREVER and EVER and EVER. Whatever it takes for as long as it takes. You’d think Powell would have a glimmer of recollection of Mario Dragi…isnt he now a punching bag for saying that?

The fed had no choice but to print, and print, and print. See it was unprecedented and I believe they promised they would only do it this once or twice time. Ever. So the alternative is certainly much much worse. Less zombies

“regained only by 2024”

Unless IATA got insider’s information from the “Deep state”, I see no basis for this forecast.

(sarcasm, of course)

Currently authorities avoid to make COVID related forecasts exceeding 3 months.

Indeed. It is ridiculous for anyone to make any predictions regarding the pandemic. The U$A will be the last place to recover. Zero leadership, anti-science worldview, premature reopening of everything, lack of social discipline, no socialized Medicine, and a President who tells us to shoot up Lysol and drink bleach.

Domestic air travel back to normal, 5% interest rates, no money printing, 2300 tonnes of physical gold, virtual no government debt. Sounds like a country ran by someone who knows what he’s doing.

if it’s not intended to be a sarcasm, I suggest asking the opinion of some real people who live in this paradise.

So which of the above points are incorrect?

do, tell

Shorter Powell today at FOMC: As much free money for Wall Street as you’all want forever and ever and ever!

2024? Better buy those airline stock now at a dip before the next spike up. With daddy Jerome as your ultimate backer, how can these airline or zombie stock ever lose?

I don’t see how they could possibly expect to raise much more due to the massive debt burden and business losses that won’t allow this as governments scrambling for more and more money to cover their debts too.

Nobody is talking about write offs of planes yet. But the 2nd hand market for used boeings or Airbuses must be horrendous. There will be some big write offs of assets for some operators – those who lease short term rather than own have a big advantage (though perhaps run on less capital).

I’m wondering how Wolf feels about his SPY short, following Powell’s promise of infinite riches to the market.

I too would like to know that.

Nasdaq by the way is up 15% YTD. Not bad for a supposed depression we’re experiencing.

Just Some Random Guy,

Yes, measuring the economy by how much the Nasdaq rises is the new litmus test for brain dysfunction.

Wait for morning for the # of claims for unemployment benefits.

The indexes are in roller coast mode, depending upon news of the DAY!.

Gold and Gold mining are north bound with big hiccups along the way. I am using various ETFs and option trading( long and short0 to navigate this chaos.

Never I have witnessed a volatility in mkts (indexes including Gold) like today. All the Corp credit ETFs Bonds supported by Fed are in steady up mode! Corp Credit mkt will get continued support. So riding along.

Yesterday SPY was down but today up! NOT easy to short this mkt, when Fed has determined to back it up!

Fine. He didn’t say anything new in that respect. What matters is what the Fed does. The balance sheet shows what the Fed does. The balance is down over $200 billion from the peak six weeks ago.

Would be interesting to see what the traffic is like in Russia where domestic flights almost fully resumed.

Though Russians, like Americans, aren’t known for being good at taking care of their health, still might show changes in consumer behavior.

Wolf, have you find any interesting pattern in the Case Shiller index released on Tuesday?

I still think the relevant releases will arrive from October on.

Thanks!

Yes, we’re looking at deal data that was March and before. I did check the CS sales pairs for San Francisco, and there is a big year-over-year decline. So the impact is starting to creep into it. I think two months from now should give us solid Pandemic pricing data.

2024?

That predicates there is a normal economy in operation by then as opposed to debt flotation. I see businesses fail all the time. We have all seen whole industries left in the dust as the World changes. I refer to the latest WS article on coal. Why is the airline industry any different? Or cruise lines? Time shares? Whatever?

A return to 50% would be optimistic imho. I have no crystal ball stats to back this up, but I do think our recent history of instant gratification and those bucket list experiences are long gone.

I see us as poorer going forward. And that isn’t necessarily a bad thing. Consumption values are pretty shallow.

A member of the Theodore Roosevelt just had to change stations. Had to drive. Praying for safe transit…. Survived the problems on the ship. Can they survive the trek to the new station?

Airlines will have a lot of customers holding back until they can put up trustworthy data showing that their protocols are safe.

Given the obvious conflicts of interest and dysfunctional national politics, “trustworthy” will a bit of an issue for half the population regardless.

Question Regarding “passenger load factor – the percentage of available seats filled”: Does this include the empty middle seats which many airlines are maintaining in order to give customers a modicum of physical distancing onboard? Be hard to get above 65% loads without filling middle seats.

Instead of trying to bail out the airlines, perhaps the fed should just buy up all the airplanes, and repurpose some shopping malls with big enough parking lots to use as runways to store them. Then retrain the TSA agents to maintain the mothballed airplanes. Then in 4 years or so when air travel comes back they can take em off the blocks, wax em up and sell them to start up airlines.

With the service sectors being the main business of the U.S. I suppose we’re in some deep hurt in the economy when so many people are already struggling to get by. I hope the FED can continue to support corporations and banks because the people are going to worry about eating first.

I can confirm that the airlines are going to be in big trouble.

I just flew back from Bangkok to London with Etihad.

95% of flights on the departure board at Bangkok were cancelled.

The Boeing 787-10s that I flew on (seats 330) had only 28 passengers on the Bangkok to Abu Dhabi flight and 23 passengers on the Abu Dhabi to London flight.

I already hated travelling with the “Terrorism Threat security checks” but now with the Corona Virus fiasco (temperature testing and form filling in and wearing a mask), it is even worse.

I cannot see people bothering to fly (especially if you will require a medical certificate) so bankruptcy for the majority of the airlines and a lot of lease/banks are going to be hit financially big time.

I’ve got this idea: How To Fly without the Caboose, but not everyone in the industry is going to like it. First we get rid of that nasty distillafe engine. I know, I know, you’re all nostalgic, and it’s practically sacrilegious to go there right now…

Well with the situation here in Victoria getting worse evey day despite the lockdown, I doubt if we’ll be doing much air travel at all.

We’ve had our worst day so far with 723 new cases and 13 deaths.

Of course the Australian stock market was up before the news was out and then moved higher after the news was released……..

And for those that like interesting news, the Australia CPI was negative by 1.9% for the last quater and negative for the year – just barely by 0.3%.

Of course these are kind of fake numbers. For example, they reflect the price of childcare going to zero with the government paying for all of it now.

International travel is a made up number as there basically isn’t any. (How can you measure the price of something that basically disappeared??)

And then gasoline plunged during the quarter and is now higher than before.

Oh, and the biggest increase in the CPI?

Tobacco. It increases every year because of higher government taxes.

Up 17% over the year.

So as a result there probably won’t be any increase in the national pension in September, but then those people don’t use childcare which makes the measure totally useless.

Yes, and the braindead MSM eats up this bullshit. It must be really difficult to breathe in a mask when your breath smells like bullshit.

The globalization is over, the airlines will not resume but more as before, the new cold war between the US and China will prevent the movement of millions of people to travel the world.

2024?

Might as well make the sign of the cross over the industry.

Google said it would not be bringing personnel back from WFH until June 2021. How many tens of thousands of support/service workers will be terminated before then because of all those empty offices????

The reality is that if these conditions prevail and the predictions mentioned in the article bear fruit…..what the hell is left of this economy????????

There’s not enough money in the world to pay for any “support” of any importance……

The “crash” will be heard even in vacuous space!!

There is plenty of money to pay “support” !

You simply get the Central Banks to print more money; they don’t even have the cost of printing it; they just put more pixels on the screen.

And there isn’t any devaluation of the currency because all the Central Banks just print at the same rate.

Maybe more are starting to realise this and hence the price of gold has been rising.

Wolf,

Thanks.

IATA appears to be using the demise of the virus as its main driver for recovery in passenger traffic. Wrong move. Global economy was heading for depression prior to the outbreak. We’ll need to see bad debt written off before any true recovery arrives. So far, no one wants to go there.

BTW, read the IATA report but couldn’t find where they moved the goalposts out to 2024. Eyes ain’t what they used to be so maybe missed it (probably in a footnote). Regardless of whether the organization believes passenger traffic arrives in 2023 or 2024, they’re still being overly optimistic. Recovery likely takes the better part of a decade.