“Extend and pretend” works wonders for a little while. But with auto loans, it gets dicey in a hurry. And then what?

By Wolf Richter for WOLF STREET.

Nearly all current or former taxpayers below certain income levels received the $1,200 stimulus payment. For a couple, it came to $2,400. If they had kids, more money was added. These moneys arrived in bank accounts in April, May, and June. In addition, there are currently over 32 million people who claim unemployment benefits under state and federal programs. They not only get their regular unemployment benefits but also the extra $600 a week in federal funds. For many laid-off workers, this adds up to more than their wages. This money has been a godsend to people who were behind on their subprime-rated auto loans.

And there was another godsend: “Extend and Pretend.”

Many lenders entered into forbearance agreements with borrowers who couldn’t pay. Much of the publicity about forbearance has been on mortgages, but this also happened with credit card loans and auto loans.

Forbearance means that the lender agrees not to pursue its legal rights to deal with a defaulted loan. With auto loans in forbearance, the lender agrees not to repossess the vehicle as long as the borrower sticks to the terms of the forbearance agreement.

Forbearance means delay in payments – the interest is normally added to the outstanding balance that is to be dealt with later.

There is another thing that happens with a loan in forbearance: It gets marked as “current” on the lender’s books, even when it was delinquent before. Forbearance agreements lower the delinquency rates. Borrowers don’t make payments. But lenders still accrue the monthly interest as income that they’re not getting paid now but hope to get paid later.

The reality is that the borrower has stopped making payments; but the accounting says that everything is hunky-dory. It is now a vast national version of the old banking scheme of “extend and pretend.”

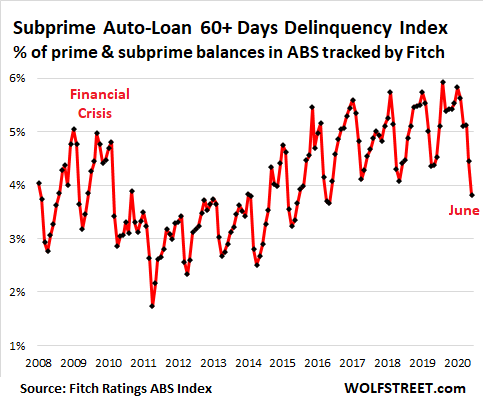

This mix of stimulus money and forbearance has had a magical impact on subprime auto loan balances that are 60-plus days delinquent.

April had been a fiasco for subprime auto loans, with a historically high delinquency rate. But then, instead of seeing the further seasonal surge in delinquency rates that normally happens from April to May and June, delinquency rates dropped in May and June, according to Fitch’s Subprime Auto Loan 60-plus Day Delinquency Index, which is based on subprime auto loans packaged into asset-backed securities (ABS) that Fitch tracks and rates.

In Fitch’s update of the index for June, something very unusual cropped up. This is a highly seasonal index, where every year going back to at least 2004, April or May is the low point in the delinquency rate, and January or February the high point. And every year, June shows a significantly higher delinquency rate than April.

In April, the rate of subprime auto loans that were 60 days or more delinquent – instead of falling from March as it usually does – rose to 5.13% of total auto loan balances, the highest rate for any April going back to the 1990s.

This means that 60-plus day delinquent subprime auto loans accounted for 5.13% of the total prime and subprime auto loan balances in the ABS tracked by Fitch (delinquent prime auto loans accounted for only 0.27% of total balances):

OK, let’s take a look at this phenomenon under the microscope.

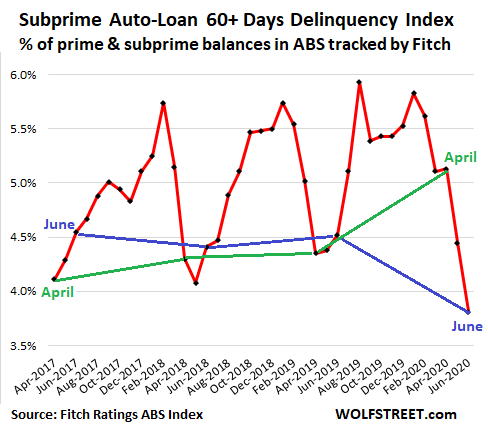

The chart below shows a detailed section for the period from April 2017 through June 2020. The blue line connects the four Junes. The green line connects the four Aprils. Note the year-over-year surge in delinquencies from 4.35% in April 2019 to 5.13% in April 2020, the highest for any April in the data going back to the 1990s, and then, instead of the expected seasonal rise, the miraculous drop in June to 3.81%, the lowest delinquency rate since June 2015:

“Extend and pretend” works wonders.

This is the miraculous result of stimulus money, the $600 a week in extra unemployment compensation, and forbearance, none of which are permanent features of our economic landscape.

Stimulus money eventually runs out, and the extra $600 a week expires at the end of July. Extensions or different versions might get concocted in Congress. But even those, if they happen at all, will end.

And “extend and pretend” can get stretched for a while, like a rubber band, but at some point, there is a reckoning. And with auto loans, it gets dicey in a hurry. Forbearance is just a delay, and during the delay, the auto loan balances grow as interest is added to the principal. With subprime auto loans, the interest rates are high, usually into the double digits, and the interest that is added to the principal adds up quickly. But the vehicle – the collateral for the loan – just loses value. With auto loans, lenders cannot play this game for long before they’re even more deeply in the hole.

Over the next few months, during the worst unemployment crisis in a lifetime, we might well see a further miraculous decline in the subprime auto loan delinquency rates, as auto loans in forbearance are market “current.” But then, when stimulus runs out and forbearance ends, it will come unglued with a vengeance.

The time for deals on new vehicles has arrived. Read… Moving the Iron amid Sagging Demand: Tesla Cuts Price of Model Y, after Cutting Prices of Model 3, S & X, as Other Automakers Offer Record Incentives.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

“When stimulus runs out and forbearance ends, it will come unglued with a vengeance.”

What makes you believe they will stop the stimulus? I believe this crisis is so bad it’s going cause hyperinflation through universal basic income. I believe the fed wants to crash the dollar and issue in a new world crypto currency to replace the SDR.

Hyperinflation is the worst outcome and the Fed won’t allow it.

Our society will break down and we would have to resort to barter if hyperinflation happens.

The more probable outcome will be some deflation on things you don’t need, inflation on things you need, austerity, more taxes and tougher times ahead.

Worst outcome for whom?

The banks and everyone who extend credit would rather be paid in full as opposed to having to take a writedown or go to bankruptcy.

Seems like you haven’t been paying attention.

Not necessarily mb,,

banks and other lenders can take a tax deduction for losses, including any write downs, and from what banksters have told me, suffer very little, if at all

don’t have the kinds of facts and or statistics that Wolf is SO good at to back this up,,, just what old retired folks have told me.

have also been told that they will make sure to profit sooner or later from selling ”bad debt” combining that with the tax breaks…

since the ”banksters” apparently own both the FED and most, if not all of the federal employees, elected and appointed, it seems almost a ‘no brainer’ that our laws would enable the banks to profit from any situation,, OH, wait,,, is it or is it not?

VintageVNet, our big banks are leveraged, or did you not pay attention to the 2008 crisis?

Sure leverage levels have come down, but if things go to hell, I guarantee you most banks are insolvent.

It’s not a matter for the Fed to allow or disallow. The Congress is the source of the helicopter money, financed by massive deficits. If the Fed attempts to ‘control inflation’ by, for example, interest rates, the helicopter money may just keep flowing despite the promise to end it. If interest rates rise, just put more money out there and postpone more debt.

Hyperinflation is a lack of confidence in the money itself. Stocks that are almost or actually worthless, bought fractionally by people receiving helicopter money, and trading at multiples of earnings approaching infinity may be one early symptom.

The end result is economic collapse, revaluation of currency by knocking off some zeros, and start over. Interesting question: if revaluation of currency is relative, and usually currencies are revalued to the US dollar, what would the US dollar revaluation be relative to? Gold? It has worldwide acceptance and recognition of value. A ‘gold standard’ is not feasible though; a gold standard is only feasible with convertibility, and many countries of the world, whether 3rd world, or even Canada, have no gold.

Then we end up with the One World Currency dream which becomes the new reserve currency of settlement backed by ‘contribution’ of gold reserves held by sovereign nations. The starter gold is already with the IMF, about 2800 tonnes, but convincing nations to contribute theirs may be difficult. Think of the Euro experience/mess for an example of this conundrum.

Hyperinflation in this environment is 2% yield and 4% inflation. It’s programmed in, the Fed is already planning this, under the auspice of their double down inflation target compensation policy. Inflation misses have to be compensated x2 higher in order to achieve their target. The catalyst for inflation is new (low paying) manufacturing jobs, the end of paycheck programs, and general welfare payments. Govt is broken and after 45 leaves GOP will return to their role as debt ceiling obstructionists. Miserly Monetary Theory. Or Great Depression II.

*Looks at public debt.

*Falls out laughing.

Here we go again. Modern Monetary Theory, until we go north of 2% inflation

“When stimulus runs out and forbearance ends, it will come unglued with a vengeance.”

Also, most of us are more interested to see the effects of the end of the forbearance on mortgages than on car loans.

Imho it will be great when it comes to making housing more affordable again. Wondering what the timing on the housing crash will be.

Absolutely. Had the Fed not stepped in and if defaults would have followed, people would be in homes with much lower mortgage balances. Instead, the Fed stuck their finger in the pie by selling large blocks of houses off-market to blackrock and the like. It restricted the supply of homes for owner-occupants and distorted price discovery. Now with the run-up in prices, even with low IRs, renters are paying as much for rent as they could have spent servicing a mortgage at much lower price-point.

Totally agree. The Fed going into the Repo market is just postponing. The government should block institutional investors like Pretium from entering in the SFR market place to allow Americans to own affordable homes. With interest rates declining and home prices rising due to shortages caused by investors how will sellers be able to sell their homes if interest rates increase? Since most owners obtain a mortgage based on monthly payment the only way this happens is if home prices decline because wages are not increasing except for top earners.

James,

They will probably keep trying to use stimuluses, but, they will likely try different kinds. UBI is extremely unlikely. Unlimited term unemployment is possible, but, will likely be for a reduced amount. They will likely never say the unemployment benefits is permanent (for the duration of the recession), but, they will just keep extending it.

I see absolutely nothing to suggest the Fed wants to replace the dollar. Crypto-currencies can never be the default global currency, although, digital currencies could. No country in a good position would ever support crypto-currencies as their currency, as they can be easily attacked and have little security and never can.

Serious inflation needs a war. Why? Because a lot of people are paid to do war related work which doesn’t produce typical market goods, a lot of resources are diverted, and a lot of production and trade is destroyed.

Replacing lost incomes doesn’t cause inflation – it merely prevents or postpones a demand collapse for things already being produced.

Central bank lending to boost asset prices causes deflation elsewhere – both by creating enormous loads of unproductive debt, and by driving up costs of living as wages and jobs lag behind. The CPI mostly measures consumer discretionary purchases after all.

The idea of universal basic income is often misrepresented… it is generally a top-up payment that isn’t enough to live on, combined with a welfare restructuring to enables or even incentivizes those stuck on existing programs to be able to seek employment without losing their security.

We have an enormous economic hole to cover, and deflation is a very likely outcome. It took about 6 years following the great financial crisis (2009) for the number of jobs to come back. Many were forced out of the economy entirely and homelessness soared. This time will be much worse unless we either get radical political change or a war – we either stop treating “labor” as a disposable commodity, or we suddenly get the national will to find a use for our economically unviable population in wartime.

It is a war, although it’s flipped or inverted. That is to say, the assholes live in houses and the people that are doing the ‘work’ live in their cars, on the street, or in homeless shelters.

Homelessness is already worse this time, worse than last time. I lived at and through the ground zero collapse in Florida. At no time did I see the tent cities that now exist in California.

It rains too much and too frequently to build a decent tent city in Florida. Thankfully.

“Serious inflation needs a war.” — Afghanistan? Iraq? Syria? Libya? Venezuela? South China Sea?

From Wikipedia: “The military of the United States is deployed in more than 150 countries around the world, with approximately 170,020 of its active-duty personnel serving outside the United States and its territories.”

How much more “war” do we need?

Damn, James.

You are savage.

If UBI were perpetually increased by some large amount, sure. If they usher it in as a fixed amount that is held constant for a few years we’d maybe see an initial surge in inflation expectations -> real inflation, but then it would probably peter out to whatever the new equilibrium would be. Where the inflation stops and settles back to would be a good indicator of how much “slack” exists in the system and could be used to estimate an appropriate ratio to real income that avoids inflation. It would maybe need to be an experiment that takes place once or twice a decade, but if done carefully would not cause hyperinflation. The government could do that just as easily by running huge deficits, which we have been, and yet still very moderate inflation exists outside of asset speculation, which means there is probably plenty of slack. Do I trust politicians to roll out ubi in a rational way? No. However, the economy could probably tolerate a $600 a month ubi without causing much inflation.

Besides the debts currently wracked up as fake income need to be diluted unless you want another decade of piss poor economic growth. Ask yourself who are the major creditors in the world and do they spend money. This is deflationary. The real question is how do we stop businesses and consumers and governments from going into so much debt in the first place.

And with delinquent loans, the asset (the car) decreases in value the longer the ‘owner’ drives it while not paying on the loan.

Any stats on percent of auto loans in forbearance (“defaults in waiting”)?

And I imagine the rise of ABS “special servicers” having to handle these millions in loan mods according to fairly rigid contractual documents (as opposed to direct lending banks) probably makes a higher number of ultimate defaults more likely (ie, direct lending banks can play snakier games longer a la extend-and-pretend).

About 25% of Ally’s auto loans were I’m forebearance and that was in March. They report earnings soon so I’m sure that will be updated. They’re the largest auto lender and take on a lot of subprime auto loans.

Ally, formally known as GMAC, cost US taxpayers a $17 billion bailout.

History doesn’t repeat…but it rhymes.

Always hated Ally for its BS name alone…especially due to taxpayer ripoff.

What can’t be paid, won’t be paid.

And, interesting, there is no forebearance for property taxes.

“But then, when stimulus runs out and forbearance ends, it will come unglued with a vengeance.”

Amazing how much of the stimulus money ends up back with the financial institutions. Still, better to pay down debt than not. Wolf, I read somewhere that because of rent and mortgage deferrals that people are paying down credit card debt. Is that true? Sounds better at least than ordering more junk from Amazon….

It could be logically argued – just another bank bailout.

My Tesla just drives itself back to the warehouse every time I’m past due.

Soon it will be programmed to take your TV, microwave, and home title with it under cross-collateralization…

*Snicker*

Andy – that’s the funniest thing Ive read all week

You see, that’s how we get through this crises, with a sense of humor

I don’t plan on getting behind on any bills, but, if I get a Tesla. I’ll have to keep it locked up at night.

Alternatively, if I do start to get behind, I can stash some “candy” in it and call the cops if it re-possesses itself.

If you are more than 60 days in arrears, it runs you over when you go outside. That would be a good movie. I wouldn’t want to live in a smart house and behind on mortgage payments.

No way, roddy. That would initiate a need to write off the remaining debt. Instead it’ll drive you straight to work, and it won’t drive you back home until you’ve worked enough hours to pay the bill.

“I wouldn’t want to live in a smart house and behind on mortgage payments.”

For you 70’s Sci fi fans…”The Demon CMO”

No problem. Just take the batteries out when you park it. ;-)

“Stimulus money eventually runs out, and the extra $600 a week expires at the end of July. ”

I think it’s likely the stimulus will continue up until the election. At least one more stimulus check in the mail, if not a second after that. Maybe tuition forgiveness, who knows. It will likely get jaw dropping crazy. Trump is a man who likes things ‘big’.

Powell wants to print, Trump wants to print, treasury wants to print, the democrats want to print and the people certainly want to print. No one to stop it really.

Money from heaven.

Don’t forget, Powell can only lend money that needs to be paid back. He can’t spend and can’t forgive loans.

What Fed is doing is not much different than what they did in 1929 , but it didn’t help.

It won’t work this time, Fed can alleviate liquidity problems but can’t deal with insolvency.

And lots of bankruptcies are in the pipeline.

This will get worse before it gets any better, the real crisis hasn’t started yet, give it one year and we will be in the midst of it.

Fed is just making things worse with it’s liquidity, treating debt like it’s nothing, worthless. We need anti- liquidity. Liquidity needs to end and rates need to rise. The correct way to handle debt as if it was worthless is to forgive it, dissolve it, bankrupt it, and stop handing it out.

The Fed’s balance sheet shrunk in 1929 and 1930, only really started growing after 1932 and at a snail’s pace compared to today. No unemployment insurance, no FDIC insurance, no Medicare, Medicaid, Social security, stimulus checks in the mail, forbearance etc…FDR never ran a deficit over 6% of GDP. We may do over 15% this year the crisis is barely 6 months old.

People lost their retirment savings in the market crash, then lost their jobs, and then their banks closed their doors and zeroed out any other savings they had left. Then there was the dust bowl etc….

For better or worse, this crisis is occurring in a very different environment than the great Depression. Might end up being just as bad, but probably not in the same ways

I am buying lottery tickets for mine.

All the forbearance on loans is going to impact social credit scores. I already hear credit limits have been slashed on credit cards, and with all the store closings all those store credit cards are also useless.

Credit is contracting in every sector, mortgages, cars, and retail. Now that you need a credit card on file to get a haircut, this is definitely going to be a problem. You can add unattractive to your bad social credit score.

Real inner beauty is living within your means.

Even if that means a bad haircut and a brewed at home coffee.

2banana (and others)

I’ve learned to cut my own hair and just with a beard trimmer and a pair of scissors.

Getting better at it.

Bye-bye all those sooper-dooper kuts!

Seriously it can only get worse before it may get better.

Too many support payments so far and rightly so; if the gov (state/fed) mandate conduce then they better find a way to support the common folk that lose jobs etc.

The biggie will be the food supply. Those lines are far to distance from major urban areas for comfort. Any further disruption to either source growing, packing or distribution will devastate whole areas.

We can stand all kinds of “hard goods” disruption but not food.

The FED (and the politicians) have chosen their path and they will stay the course onto the rocks.

Protect yourselves and families as much as possible. There will be no-one to save you.

Sorry, but I like looking my best.

Most men would spend a lot more on grooming, if they understood how much better they look when they are well put together. I wouldn’t look twice at a sloppily dressed guy with messy hair. Don’t care if he’s rich or famous.

cool, social credit without intrusive monitoring. We are going to be beating China yet again. Without the benefits of intrusive monitoring.

Progress

I think I’m a rebel of sorts, but my social credit score went up 15 points yesterday.

It’s amazing when presented with the choice of some pain now vs much more pain later, the collective decision is always the latter. Figuring if we kick the can down the road enough, may be the can will get lost along the way.

One wonders what happens when the bill finally comes due.

There are plenty of examples throughout history.

It usually doesn’t work out well.

A close parallel to today is the history of the French Assignat.

Napoleon came next.

Land of the Brave. Why face consequences now if you can leave it to the next generation?

It’s one of those truisms that holds at both the individual and collective levels. The most expedient route for our political leaders is to simply kick the can down the road. Give those hurting and hemorrhaging a $1200 painkiller and get back to focusing on the messaging, the posturing, the blaming and the preaching to get re-elected. It takes real leadership to make the hard choices and there’s not a scintilla of that on the horizon.

I honestly think the 4-year term is a curse. The two years before that is spent tooting your horn and demonizing your opponents to get elected. The last two years are spent tooting your horn and demonizing your horn and get re-elected. And if you don’t get elected, then you toot your horn and demonize your …. anyone seeing a pattern here?

“the choice of some pain now vs much more pain later, the collective decision is always the latter”

Not exactly.

Unfortunately underlying strategy it is “your pain now” vs “somebody else’s pain now or later”.

Optimistic people always hope for shift of pain to somebody else – children, politicians, neighbours..

Yup, that’s the point. Make someone else pay for this stuff. I think somewhere there must be a calculation on the debt owed by future generations (let’s say 30 years out) and it’s graphed vs time. I would bet that chart is always up and to the right, and the rate of change would’ve accelerated tremendously over the last few weeks.

I’m trying to imagine what it looks like or the consequences of the bill finally coming due..

At what point is the FED’s balance sheet to big?

At what point is the Treasury debt to big?

Is that when most all the income from taxes and tariffs and fees will not cover the roll over and current expenses? Aren’t we there? So at what point is to much actually to much?

What does that look like?

“At what point is the FED’s balance sheet to big?”

$18,446,744,073,709,551,616 (assuming the Fed has not moved to 128 bit computers first)

“At what point is the Treasury debt to big? ”

When the annual income of the Fedgov isn’t enough to pay the interest on the debt and the US has to borrow just to service the existing debt. Maybe. I say maybe because the other countries of this planet keep giving the US a kitchen pass to generate (as Wolf says it) debt out the wazoo.

The problem is not the size of Feds balance sheet, it is its performance. If the Fed ends up with a bunch of non performing, worthless paper on its books, who do you think is going to be on the hook for it? It would not be the first time the Fed got in trouble gambling on bad investments, and the public was fleeced to pay for it.

Chairman of the Congressional Banking and Currency Committee for more than 10 years, claimed the gold confiscation during the depression was to prop up the bankrupt Federal Reserve…… and he was in a position to know.

2 years after he made those claims and after 2 assassination attempts, he was found dead of a “heart attack”.

Jdog, the who that they will try and push the responsibility of the debt off to is the same who that will have no meaningful income due to their NIRP and debt up the wazoo policies. Killing the golden goose comes to mind or eating your seed corn… With a dead economy, there is no productive enterprise that can re-pay..

What I think we have is a bunch of big Monopoly games going where the outcome is to just start over. But what that means in reality is the known unknown or is it the unknown known?

Just saw a thing on the new Bronco.Although I”m

cautious these days it did get my tired heart pumping.

All bout the sizzle.

There is a war going on in the west between those who buy these kinds of vehicles and want to re-create the ad images. The more people drive them off road, the more damage is done to our ecosystems and the more the USFS and BLM and private owners are locking us out. If everyone who buys one of these off road vehicles took them out to play, our back country would be just one big desert with no life. It is a good thing that most of these vehicles are just for image and never leave the pavement.

economicminor:

Sympathize with your attitude…..

“…. our back country would be just one big desert with no life.”

That’s the direction humanity is heading anyway. The big, off road aggravation will just give it a further nudge.

The economic/social system we choose to live means only complete devastation of our “nest”.

We really don’t deserve this crust of dirt hurtling thru space to some random distant point not yet imagined!

“What Fools These Mortals Be!” (Puck)

The “hope they get paid later” reminds me of a popular cynical expression. Hope in one hand and shit in the other one and see which one fills up first.

At least the shit can be used for fertilizer and grow something.. Can’t say that about the hope (which is just a single word for Magical Thinking).

Hope is a doomed strategy and a disastrous tactic.

I hope the new Bronco comes with a “roll over button” so you can plan your accident . Not knowing when that happens is very alarming.

Extend and Pretend, I like that.

+1

So we had a tenant who played us and “couldn’t pay they’re rent”. Eventually they did pay but in the mean time entered escrow on a house and gave us 2, TWO days notice and moved out. I figure they got all their unemployment, stimulus, etc and bought a place. We filed with our bank for forbearance but have stayed current. A lot of forbearance has been filed but is actually current. No one really knows how far behind the country is or isn’t, but I suspect it’s a lot and inside of 12 months it’s gonna be a real **** show. That’s housing side forbearance comments, but as for cars, I suspect there are going to be a lot of repo’s and new car discounts in short order. Too many folks bought cars they couldn’t afford, and then added many thousands in rims and tires (that they couldn’t afford). Gonna be interesting to watch and all we can do is hope it all ends well.

As an aside, Jeep totally screwed Bronco today with their v8 and 37 inch stock tires in their new offering.

” I figure they got all their unemployment, stimulus, etc and bought a place. ”

Huh??!! They got a mortgage while on unemployment??

It makes no sense but a realtor friend of mine confirmed it last night in the public records. They played me by using the pandemic no eviction laws and simply stayed on a month to month basis and refused to sign the lease extension until they bought a house. She’s out of work and he likely used his va loan. Neighbor tenant indicated that mommy and daddy stepped in to help them. When they “proved” to me their financial hardship all they included was her unemployment cover sheet but not their bank account info, which was obviously full of money.

All my point here is that there’s a lot of free money out there and it’s being sent out without any oversight and some folks are really using the system to their advantage. This obviously isn’t the norm and many folks are truly suffering, but there are scammers both big time and little. In CA the lockdowns will continue until there’s no more free money, then all of a sudden the virus will get better and whoever actually has a job left will go back to work. I’m not quite sure what will happen to the rest.

Thanks for the reply, interesting shenanigans. Something (possibly) similar happened in my neighborhood: house appeared to be bought, buyers moved 4 fairly expensive cars (2 Mercedes sedans and 2 large SUVs) into the driveway and in front of the house. I spoke to the ‘owner’ once; seemed nice enough, but never saw him again, and the cars never moved. The cars got tagged for towing and the seller’s apparent wife/GF arranged to have them towed, to where I have no idea. Then, notices started appearing on the front door; one fell off and I grabbed it and notified the wife/GF–I’d offered to ‘keep an eye’ on the place and we exchanged phone numbers–that the notice was, essentially, an eviction notice. The owner appeared to be in arrears for about $275K, roughly the selling price (according to Zillow). I wondered ‘How the hell did someone buy a house without a) a mortgage or b) a ton of cash. So, apparently, strange stuff happens. I keep recalling all the ‘hoops’ I had to jump through to buy a house, with a good job, 10 years of steady employment, etc. (I had to get a 2nd mortgage to avoid PMI, but refinanced and paid it off with equity within a couple years).

The Bob,

You never know who co-signs unless you see the documents as a party to the sale.

The Fed’s going to own a lot of cars in the future.

The Fed Car Corporation.

Used car auction prices are setting records. All the predictions of a collapsing car market turned out to be wrong. Bears are batting right around .000 these days.

Just Some Random Guy

Premature predictions. The Hertz rental cars haven’t shown up at auction yet, and as I predicted a while ago, based on court dates, won’t show up until later this summer.

Auction volumes have already backed off from the peak a couple of weeks ago, and the prices you cited where wholesale prices at auction. On the retail side, it’s a different ballgame. Used retail sales were down 12% yoy in June, according to Manheim.

Yeah, a lot of dealers anticipated a regular recession and put off purchasing used inventory in March and April to hoard cash. They got caught on the wrong side of the $1200 checks and are now tripping over one another at auction.

You think people are using $1200 checks from April to buy $30K used cars in July? Do you realize how ridiculous that sounds?

There’s always a bear excuse and a “just wait a while” prediction. That has been going on for close to a decade with real estate, and longer for stocks.

“Bear excuse?” Your thinking is tainted by I don’t know what. Lower wholesale prices in the used vehicle market is exactly what dealers (higher profit margins) and consumers (buy more) need. No one other than rental-car ABS holders and rental car companies need higher used vehicle prices. Lower used vehicle wholesale prices are bullish for the used vehicle industry.

Dealers stop buying when prices go too high. You can see that right now. Volume at auctions are already dropping because wholesale prices are too high. A dealer cannot make money when they buy too high.

Demand destruction is the biggest problem right now with a severely damaged job market and shattered consumer spending. Being deathly afraid of mass transit will sell you some cars as a used car salesman, the cheaper prices from the mass rental fleets might help too. But this is all a drop in the bucket that is demand destruction.

I have been noticing a ton of 30 day tags on vehicles.

If your moniker is also your location, I believe that’s because the lefty locals expect big things – lots of money in the Federal slop jar after the next election.

RD Blakeslee,

“…lots of money in the Federal slop jar after the next election.”

It’s going to be hard to beat the money in the slop jar under this administration: budget deficit of $864 billion just in the single month of June.

I suppose the reports that come out quarterly about the average American family being unable to afford a $400 emergency, because they have no savings whatsoever, aren’t relevant to the auto loan industry, mortgage industry, and the economy in general. I recall reading quite a few articles throughout 2019, about the potential tsunami of subprime auto loans that could pose a risk to the financial and investment institutions that underpin the auto loan industry. One article in particular stands out because it asserted that people are more likely to default on rent or their mortgage during hard times, rather than defaulting on car payments, because without a car people can’t get to work and, therefore, won’t have income. If unemployment doesn’t crater, my gut tells me that once the eviction moratoriums are lifted, we will see defaults on mortgages rise before seeing auto loan defaults ratchet up. Should unemployment hold steady at the current rate or increase, we’re going to see an unprecedented calamity.

“…without a car people can’t get to work and, therefore, won’t have income…”

Indeed. And a small cheap car won’t do, one needs at least a V8 truck to negotiate the trails to work.

Here in Europe the popularity of motorbikes and (electric) scooters for commuting is on the rise. Do these also exist in the USA?

I’m originally from Italy. I remember one summer, circa 1999, I was visiting my family back home and my uncle, who is in the logging industry, asked me what kind of cars people drive in the States. I rember telling him that my dad’s first car when he moved to the US was a Ford Taurus station wagon with a 5 liter V8, and he thought I was joking around, since most of his rigs didn’t have that kind of displacement.

My wife and I, along with my mom and dad, are the only two single-car-households among my circle of friends and acquaintances.

I agree that most, maybe all, vehicles made for the American market are vastly overpowered. However, folks in Europe somehow overlook the population distribution and density of the US – once you’re outside of the core downtown areas of large cities, and especially the peripheries of smaller towns, scooters and the like become a little impractical for a number of reasons. Why most Americans haven’t come around to commuting to work in a 1.8L beater is a topic of curious debate.

Jay Leno would give you the simple explanation that the American A*s is always getting fatter and they need somewhere to park it. Only partially true for some, and the European toosh is exploding just as fast, which makes sense given the gentic heritage that links so many. The truth is it goes back to our railroad history and the national mindset to get more out of less. In settling on rail gauges, we did indeed pick a standard which was too narrow. Had it been slightly wider we could move more tonnage and get costs down. Regardless, we shifted from small cars and power to ever increasing size and it became a mindset from farm to factory. It ignores the fact that narrow gauge railroads could be built cheaper and go through almost any terrain without all the environmental destruction and extra costs to build and maintain. But this would require having everything scaled down as it was in Europe. Trains never really did move all that fast for cargo here, and the distances were a factor more related to how far a crew moved during a shift before “dying on hours”. Basically, we went for crude profit without looking at the greater problems of going big. That all translated into our kar kulture, houses, diet, guns, etc.. We tuck ‘n roll on our way to final tuck ‘n roll.

Now do Germany. This is where this argument always falls apart. Yeah Italians drive cheap POS cars. That’s because Italians are poor. Go to Germany and it’s a never ending parade of E class MBs and 5-series BMWs. No 1.8L beaters to be found. You know why? Cuz Germans are rich. Like Americans. And so they drive nice cars. See also Paris where you’ll see more Audis and BMWs per capita than you will in most American cities. Why? Again. Because Parisians are rich.

Just Some Random Guy,

“Go to Germany and it’s a never ending parade of E class MBs and 5-series BMWs. No 1.8L beaters to be found.”

Good lordy, where are you hanging out in Germany? Bestselling cars in Germany in 2019:

1. VW Golf

2. VW Tiguan

3. VW Polo

4. Ford Focus

5. Mercedes-Benz C-Class

6. VW T-Roc

7. Skoda Octavia

8. Audi A3

9. Audi A4

10. VW Passat

There is no BMW on this list, not even a cheapo. The standard engines on an Audi A3 are 1.6L and 1.8L. The Mercedes on the list, the C-class in Germany comes with these engine options at the lower end: 1.6 L Turbo and 2.0 L Turbo

There is also a vibrant used car market, where the old beaters with 1.6L engines get sold that still make it through the TÜV.

re: “… my dad’s first car when he moved to the US was a Ford Taurus station wagon with a 5 liter V8…”

Um, no. The Taurus was never available with a V8; largest engine offered by Ford was a 3.8L V6 (the Yamaha engine that powered the 1st Gen SHO Taurus was also a V6). V8 ‘swaps’ are popular with the ‘hotrodding’ crowd, who sometimes stuff them in really small cars–just for the ‘hell of it’ I suppose–but I’ve never heard of anybody stuffing a V8 into a Taurus, generally considered a “housewife’s car” (except for the SHO).

http://autotrends.org/2019/06/27/end-of-the-road-ford-taurus/

https://en.wikipedia.org/wiki/Ford_Taurus_(first_generation)

https://en.wikipedia.org/wiki/Ford_Taurus_(second_generation)

Sure, we carry them in the back of our V8 trucks. ;-)

Cali Bob,

My dad bought the burgundy beast from a mechanic in Frederick, MD. I don’t think my dad knew what he was buying at the time and this was confirmed during a family road trip to WV. The car overheated and was towed to a repair shop where the mechanic assed that that the radiator wasn’t able to provide enough cooling for the engine. I just asked my dad and he does remember that it was indeed a 5L engine. My guess now is that the mechanic he bought it from had an old 302 Windsor that he stuffed under the hood, more likely, however, no body remembers accurately.

Anyone have thoughts as to why smaller displacement, turbo charged Diesel engines still haven’t gotten very much traction here in the States?

BuyHighSellLow,

“Anyone have thoughts as to why smaller displacement, turbo charged Diesel engines still haven’t gotten very much traction here in the States?”

The high price of diesel fuel, compared to gasoline has had a big effect on gas model vehicles. It was a different story before diesel fuel was jacked up.

My father was a dentist and we lived in a very upscale suburb of NYC and starting in 1966 he always drive a VW beetle to his office everyday But he was the exception obviously Most of his colleagues drove Mercedes and Lincoln’s

Jos,

Your comment about people not needing a truck to get to work is very wrong because of regional considerations. When I lived in Florida it rained almost every day and often heavily without any flooding. Where I am now, all you have to do is spit on the street to get a flood. Without a truck or other high vehicle, most people would not be able to get to work when it rains and worse, would lose their vehicles.

Don’t be so fast to make judgements. People are mostly rational, but often forced to do things because the situation demands it.

Petunia,

The “who needs a truck” crowd has never stepped foot outside Los Angeles typically. Has never driven down a dirt road. Has never driven in snow. Has never had to tow anything. Probably lives in an apartment and has never been to Home Depot to buy materials for a DIY project at home.

That all applies to me. I use my truck for “trucky” things all the time. But the #1 reason I own a truck…and this is the most important one….because I WANT one. And as much as they want me to, I won’t ask their permission. :)

… and just try to get along without some sort of heavy-duty 4WD vehicle in the Appalachians in wintertime …

Right on P, and rndm,,,

Had to ”chain up” my old fave ’84 3/4 T chevy to take spouse to work in the snow and especially when it iced over several times.

Cobalt, with front wheel drive did OK with light snow, better than many rear drives, even pick ups, but with heavy snow and ice, forgettabout it…

In spite of being stuck in tpa bay area these days, now I have one set of chains for the new pick up 4×4, and will likely be able to buy another set to go to MT and WY ASAP virus wise,,,, likely into snowtime,,, which I have seen is or can be every month in some of the most beautiful places in our beautiful USA. (Studies show 4×4 with all chains the most able.)

OTOH, used to park vw bug as close as the heavy snow would allow to our cabin in the high cascades so that I could dig it out and it could roll at least long enough to start when the battery was frozen,,, and, with snow tires alone it would go amazing well, as good as any 2wd pickup with chains — bug just rode on top of most snow, though not always,,, but I could walk 20 miles easy in those days,,,LOL…

Petunia, RD,

I am sure there are situations where people really can’t do without a 4×4 truck to get to work. However, I can’t shake the feeling that these are not the majority of commuters.

I actually own a 4×4 (Toyota Land Cruiser) myself, because I live in the countryside in the middle of nowhere, on a dilapidated farm, and regularly have to tow big trailers full of builders’ stuff. But this thing is a far cry from the kind of trucks I see advertised every day. For serious work one doesn’t need wide alloy wheels (that often don’t fit serious all-terrain tires), chrome trim all over, superduper running boards, LED contours and whatnot.

I am not judging, just observing. And I observe lots of trucks that are more posh than utilitarian, and have never been through seriously difficult terrain.

BuyHighSellLow,

“…about the average American family being unable to afford a $400 emergency, because they have no savings whatsoever…”

Actually, you do not need savings to buy a car, you need a job. Credit takes care of the rest. But if you don’t have a job, you might still be able to buy a cheaper used car with the stimulus money as down payment, and with the lender forgoing to verify your stated income. There are some lenders that routinely skip income verification.

Have you ever noticed that if you are a ‘pay it with cash’ kind of guy you don’t buy expensive vehicles? I have cash and last year had to replace my ’86 Toyota PU. My son gets a great discount from his workplace and I could piggyback. He even had a ‘relationship’ with the car sales hottie. (cough cough). But I just wasn’t going to to shell out 35K for something that stays parked most of the time. Instead, I bought a great used PU for 4K.

Same with a tractor. I would really like to get a small track excavator and would use it….lots. Instead, I crunch the numbers and call a friend who has a working machine. Maybe $500 per year on average. I pay him cash with a big tip and he smiles all the way home.

However, if you think in terms about what is affordable every month on something financed, people often pull the pin and buy; I know many of my friends do. That works just fine until there is a job loss, illness, recession, pandemic………

Actually, with some lenders, all you need is a pulse, they will lie about everything else. Sub prime auto loans are the new liar loans….

Mr. Richter,

Thank you for elaborating on how some in the auto loan industry make it possible for just about anyone to take on a car payment.

I did a poor job of illustratig why auto loans might be less likely to default, if, and this is the kicker, unemployment gets better. At the point where people are stretched so financially thin that the decision need to be made whether to skip paying the rent/mortgage or skip the car payment, is it true, as I’ve read, that more will choose to keep paying off their car during hard economic times?

As we used to say: “You can live in your car but you can’t drive your house to work”.

Sometimes you don’t even need a job, child payments will suffice

If you get $600 a week + unemployment, at what point would you get yourself fired? It seems like at minimum a $40.000 salary. Half an accountant or lawyer would seem able to keep you working while receiving this money.

You can’t get unemployment–at least in California–if you’re fired ‘for cause.’

Even $600 a week is only one trillion in a year for 32 million people. It seems that the target is a 1-10 trillion deficit.

As far as unemployment benefits reduced from $600 plus state, they will realize that a capped benefit to past wages will still breed less work interest. There are a lot of costs like childcare and transportation that will make going back to work unattractive. I can see this morfing unto a form of UBI with the underclass getting a low basic benefit that will supplement a minimum wage job. Combined with social credit you will have a hybrid China system. Got to get the consumer debt train back in motion!

The states are barely getting the checks out now. How long is it going to take them to figure out capping the benefit to your wages. I see a long line of H1Bs self deporting.

As California Bob says, you can’t get UI benefits in California if you have been fired for cause.

Also, in California, if you have been offered work and refused it, you don’t qualify for benefits for that week.

An employer offering his former employee his job back would have to inform EDD of that fact, but if the employee refused to return to work, he would be ineligible for UI benefits.

The Fed UI benefits might keep chugging along, but I am not sure of that.

What did we expect? So many people are debt slaves to start with. If 40% of the population are living- close to the edge, week to week/ paycheck to paycheck with many barely paying on loans they should never have received in the first place, either you provide stimulus helicopter money or let the system crash. Same with corporations.

I personally would be kicking myself in the butt if I had to use the stimulus $1200 to help pay down some subprime loan on an overpriced vehicle I didn’t need in the first place. When I was young, you couldn’t get any loan if your credit wasn’t in good standing.

The stimulus cash let me buy a new energy star 17 SEER air conditioning unit, which led to a nice utility rebate, which will lead to a nice tax deduction. Thank you America!

The Class of 2020 graduated to fewer job openings and no unemployment benefits.

Bank earnings are down due to forbearance. When the forbearance ends will there be repos and foreclosures?

Utilities are shutting off power to people’s homes as they did not pay their bills.

Did all of these people who received these grants lose health insurance if their work paid for them?

DEBT spending as a panacea for all our financial problems along with the ‘smoke & mirror’ show of ‘extend & pretend’ seems to be a general accepted policy all over the world.

That narrative has carried on, successfully in some way or the other since ’09! Why change any thing now? They will fight all the way against the needed RESET!

I live in Medford Oregon, on Interstate 5, halfway between San Francisco and Portland. My wife and I moved here right after 9/11 (2002). We bought our 2,100 sq. ft. house, built in 1988, in a nice neighborhood with sidewalks for $200,000. All the houses selling right now on my street are going for the low to mid $300,000’s. The buyers are all from Ca. I walk my dog every morning and EVERY single house that has been bought and moved into the last year has two NEW vehicles in the driveway because the two cars garages all filled to the roof with God knows what.

My point is….things are shitty in a lot of places but not here. People that can afford it are getting out of the cities…big time. The Cali’s are cashing out, downsizing and buying new vehicles up the wazooo around here. Sad but true.

When I was still working, we bought a study from one of the automotive consulting groups several years back…. and the upshot of the entire document is that people will buy a new car within a few months of buying a new home – the logic was that the “old clunker” didn’t look good in front of the new digs. Don’t remember all the details (it’s been probably 20 years ago) but it was amusing.

A garage in California is called a “California basement”. It’s usually full of all the junk people would stow in a basement if they had one….. When we (sadly) lived in SoCal, we were one of the few people on our block that could park our cars in the garage. Of course, it was an oversized 3 car garage and we only had two cars…….

The FED will backstop all the banks that they care about. If they are a small bank they may go tits up with no help. Thinking about the Bank of the Ozarks, ties to Walmart founders and real estate in Miami…

The stimulus should be increased rapidly to allow Americans the first shot before the Ponzi scheme goes bust. At the current point we are allowing foreigners to cash in and this is starting to rip the seams of the United States apart.

Talked to someone I know in twin cities…has to drive 20 miles to find a store for groceries after the riots. People are still flying high because the Chinese have not pulled the plug.

When everyone is forced to show their hands we will see the real fireworks. On the other side will be gold and silver in their non-rehypothecated physical forms…