Repos & dollar liquidity swaps on their way out. SPVs declined. Hardly bought any corporate bonds & ETFs. MBS flat. Treasuries ticked up.

By Wolf Richter for WOLF STREET.

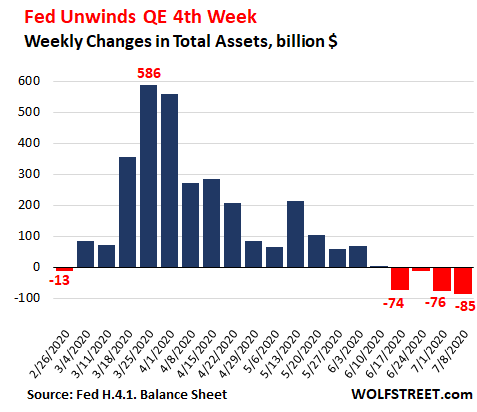

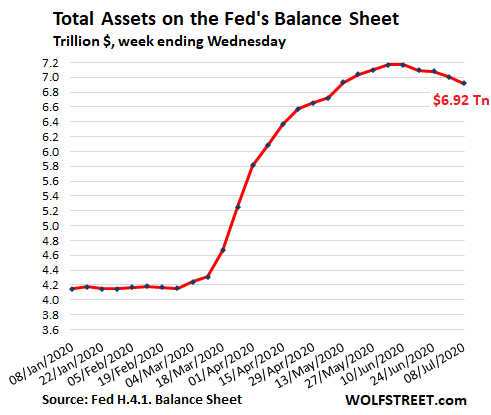

OK, this balance-sheet shrinkage, now in its fourth week, is going faster than I’d expected. Total assets on the Fed’s balance sheet for the week ended July 8, released this afternoon, dropped by -$85 billion, the fourth week in a row of declines. This brought the four-week total drop to -$248 billion:

Back on April 9, when markets were just emerging from chaos after the Fed had thrown $1.5 trillion at them in the span of four weeks, Fed Chair Jerome Powell said in a webinar at Brookings that “when private markets are once again able to perform their vital functions of channeling credit and supporting economic growth, we will put these emergency tools away.”

This matched what he and other Fed officials had said in the year or so before the Crisis, that at the “next crisis,” they would throw all the Fed’s might at the problem up front, and then they’d back off, rather than let QE drag on for years. And they did.

By peak-QE in early June, the Fed had increased its assets by $2.86 trillion. It has since then whittled this increase down by $248 billion. Note the systematic front-loading then tapering the asset purchases and letting assets top out at $7.16 trillion, and then letting them decline, now down to $6.92 trillion:

Assets by category.

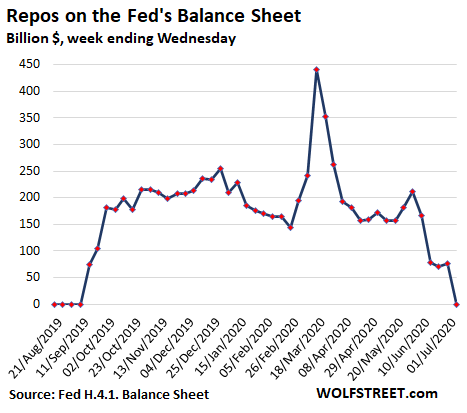

Repo balances dropped to Zero. The Fed made repos less attractive over time. On June 16, it raised the bid rate, and for market participants there are now better deals available in the repo market. The Fed is still offering theoretically huge amounts of repurchase agreements every day, but there are no longer any takers:

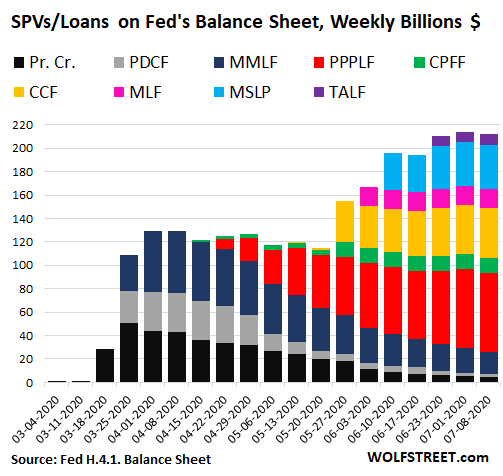

SPVs & Loans declined by $2 billion, flat for three weeks.

The Fed’s gaggle of Special Purpose Vehicles (SPVs) have been one of the most media-hyped “tools” of the Fed, and yet, they have remained small, in terms of Fed-sized quantities. The Fed claims that these SPVs are authorized under Section 13 paragraph 3 of the Federal Reserve Act, as amended by the Dodd-Frank Act.

The way these SPVs work: The Fed creates an LLC. The Treasury Department puts in equity capital – taxpayer money as loss protection for the Fed. The Fed then lends to the LLC at a leverage ratio of 10 to 1. The LLC buys securities or lends, secured by collateral. The alphabet-soup list has been growing over the weeks:

- Primary Credit (abbreviated “Pr. Cr.” on the chart below); loans made directly to lenders.

- PDCF: Primary Dealer Credit Facility

- MMLF: Money Market Mutual Fund Liquidity Facility

- PPPLF: Paycheck Protection Program Liquidity Facility

- CPFF: Commercial Paper Funding Facility

- CCF: Corporate Credit Facilities: includes the SMCCF (Secondary Market Corporate Credit Credit) and PMCCF (Primary Market Corporate Credit Facility).

- MSLP: Main Street Lending Program

- MLF: Municipal Liquidity Facility

- TALF: Term Asset-Backed Securities Loan Facility

The total combined balance at these entities declined by $2 billion from the prior week and has now been roughly flat for three weeks. The original three entities (dark blue, gray, and black) are being unwound. And new ones have been added.

The largest SPV is the PPPLF (red), at $68 billion, down a smidgen from the prior week. It buys forgivable PPP loans from banks. These loans are now starting to unwind as they’re being forgiven (taxpayers pays) or paid back by the borrower.

The second largest, the CCF (yellow), edged up $700 million from the prior week to $42.6 billion. This entity buys corporate bonds, bond ETFs, and corporate loans. This was the most ballyhooed of all SPVs, and it has essentially remained flat for four weeks.

Third largest, the MSLP (baby-blue) has remained flat for the third week in a row, at 37.5 billion. It buys loans from banks that they extended to small and medium-size businesses.

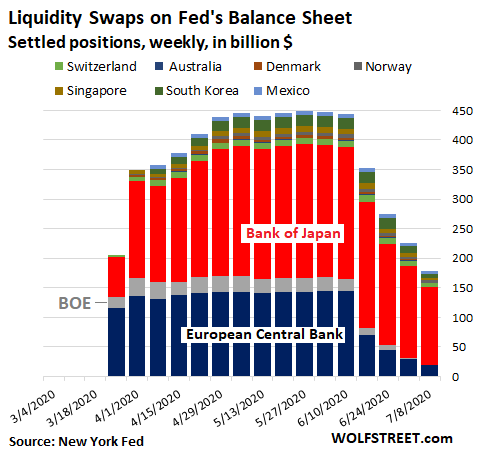

Central-bank liquidity-swaps dropped by $46 billion.

The Fed’s “dollar liquidity swap lines” were designed to provide other central banks with dollars. The Fed lends newly created dollars to another central bank and takes their newly created domestic currency as collateral. The swap lines drop when swaps mature and the Fed gets its dollars back.

Total swaps fell by $46 billion to $179 billion, lowest since March 18. This indicates that the dollar panic overseas has dissipated. The lion’s share of the Fed’s swaps remains with the Bank of Japan – $132 billion, or 74% of the total. The Bank of England (BOE) and the Reserve Bank of Australia have essentially unwound their swaps with the Fed:

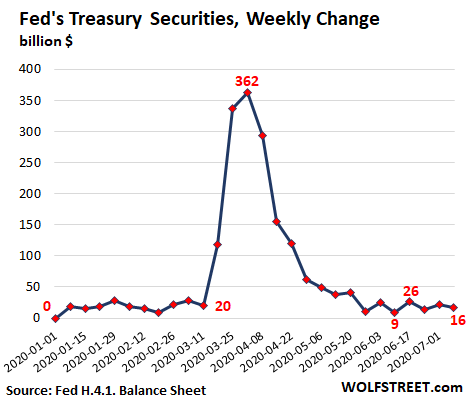

Treasury securities rose by $16 billion.

The increases in the balance of Treasury securities have been range-bound over the past seven weeks between $9 billion and $26 billion a week. This is where the Fed did a lot of heavy lifting up front:

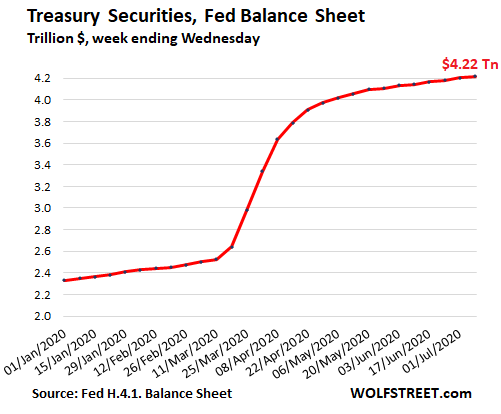

Treasury securities, now at $4.22 trillion, are by far the Fed’s single largest asset category. In its huge Treasuries portfolio, securities mature every month. The increase in the balance sheet is the net of new purchases minus redemptions. Since early March, the Fed has added $1.7 trillion in Treasury securities:

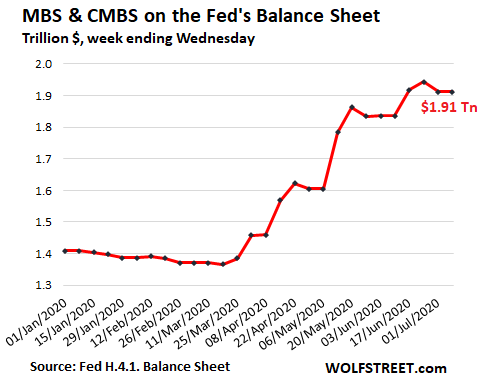

MBS remained flat.

Mortgage-backed securities have two characteristics that cause erratic movements on the Fed’s balance sheet:

Pass-through principal payments. Holders of MBS receive pass-through principal payments as the underlying mortgages are paid down or are paid off. Mortgage interest rates have plunged to record lows, which motivated homeowners to refinance their mortgages, triggering a torrent of principal payments that are passed through to the holders, including the Fed, thereby reducing its balance of MBS. Just to keep that balance level, the Fed would have to buy large amounts of MBS.

MBS trades take months to settle. The Fed says they usually settle within 180 days. But most of the time, they settle in 1-3 months. And the Fed books MBS trades after they settle.

So what we see on the balance sheet are not this week’s purchases, but a mix of pass-through principal payments and MBS purchases from weeks or months ago that settled this week. Hence the erratic chart. This week, MBS have remained flat at $1.91 trillion:

That $248-billion drop in assets in four weeks is a pretty good chunk, even for the Fed’s gigantic balance sheet that was $7.17 trillion four weeks ago.

I lambasted the Fed for this massive bailout in March, April, and May of the riskiest hedge funds and mortgage-REITs, and the biggest asset holders in the world, to protect them from capitalism’s way of cleaning up those kinds of things. I lambasted the Fed for bailing out asset holders and making sure they don’t have any skin in the crisis while America was in turmoil. So I support the Fed’s backing off this craziness. But obviously, the Fed can turn around on a dime. And every week, the balance sheet may offer unexpected twists and turns.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

The Wolf Shorting Theorem is still in place.

Very tempting to jump on that train.

“OK, this balance-sheet shrinkage, now in its fourth week, is going faster than I’d expected. Total assets on the Fed’s balance sheet for the week ended July 8, released this afternoon, dropped by -$85 billion, the fourth week in a row of declines. This brought the four-week total drop to -$248 billion”

I actually disagree on shorting the SPY and I’m thinking of taking the opposite side by playing MSFT and AAPL as a momentum trade on the next dip (with hard stop-losses of course). He’s fighting big tech and passive investing – the first place a wall of liquidity heads.

Note that I do have a significant short position- but it’s mainly in IWM with some in EEM. The Russell 2000 doesn’t benefit as much from fed largesse, and EEM involves countries with large dollar debts that are hit hard by Covid. A lot of EEM is also China, but that has unique risks as well as many countries including ours are pushing to de-couple. The US still hasn’t reacted to the Hong Kong law, but once the election is over there will be no reason for the White House to continue stalling on that front.

Biden’s polling and his promise to raise capital gains will control the markets for a while. IMO

Yeah, even SPY is largely big tech now, and thats what many will pile into. What you’d really want to short is some kind of tech-free index.

With the ARM announcement, I really like AAPL’s long term prospects in particular, but I suppose sensible business plans hardly matter in this market.

ok $248 in that span of time is a big number but from 22 Jun to 30 Jun fed bought $1.33 billion in corporate bonds including in aapl ford and Disney, amazn market cap jumped 50 billion in the past 24 hours and tsla jumped 16 billion just in the past hour….mom and pop smith love jerome because clearly he cares about the average American.

i think tsla jumped because trump said phase 2 china deal is dead /sarc

check out the PANIC BUYING on the $TSLA July 17 call spread…lol wtf… xD

i swear, between the fed pomo and robinhood fomo this market is a hoot i tells ya!

It’s gonna be interesting to see if people with no jobs or even people with jobs but with economic insecurities would have appetite to buy expensive Apple phones. OI know they have cheaper phones but margins are razor thin there

I am mystified as to why they are doing this. There usually is a delay between the “Fed” banksters’ actions and the resulting effects on the economy. Nevertheless, given the latest spikes, which will prompt self-quarantining even if there is no order, they have to know that this will eventually lower many stock prices.

Could there be political reasons for what they are doing? I predict that the economy now is like an avalanche, so it may start going down in minimal ways then this will build and build.

Why does this feel like a game of three card monte ?

Does this mean that the Fed have completed bailing out thier friends and now they don’t need to prop up the market any more except perhaps to support President Pump?

Courtesy call-“We noticed you’re excess consumption of butt food. Please put the Cheetohs back on the shelf or we’ll have to get the clerk to cut your cards. Have a nice day. Come back soon.”

I’ve seen this movie before. Just wait till the next 10-20% drop. By which time your short will be covered and you can refresh your previous articles with proper dates and math.

So Wolf is no different than the analyst who talks up or down positions he’s holding?

I’ve always thought about analyst ratings and musings and their effect on prices behaving subsequently in a self-fulfiling way.

Of course it’s the reasoning, if any, behind said musings is what matters and if that has any noticeable effect on prices, I guess that comes with the territory. With Wolf, I find the reasoning to be accurate far more than not.

My meaning was meant to be:

The Fed will reverse course immediately, upon a 20% or so drop in the stocks. QE to the moon.

Wolf is the canary in the coal mine.

Greenies tell us canary numbers are declining and coal mines are on the way out.

Wonder what the metaphor will be, next generation.

DeerInHeadlights,

My site is way too small to have any effect on anything, including the largest stock market in the world. So you can take this off your worry list.

The influence of a great mind on the zeitgeist should not be minimized.

I understand what you’re saying Wolf but you crossed that line of non-interventionism in the markets when your very public short position was vindicated back in March. If your second short is similarly successful, you’ll be achieve the status of a real market force.

DeerInHeadlights,

I think you said this as a form of bone-dry humor. And it’s hilarious ??? moi, a “real market force” ???

P.S. I haven’t even been on CNBC yet to hype my trades! Uncle Warren gets to do that, not me.

You can look at it the other way around … Wolf puts his money where his mouth is.

I agree with Wolf but I don’t have the stomach to short the market. I may not be long but.. not short either.

The wolf is shorting the market based on sound logic and reasoning but the problem is: Market is not reasonable..

and in advance, and publicly. Courageous.

If you are using technical analysis, you don’t have to short too early. Wait for a good set up. You want to get the big part of the move. You don’t have to get the exact top nor the exact bottom but the fat piece in between. It’s very hard to get either of the extremes. Also, you want to risk manage your trade. You don’t want to take a full position on your first entry into the trade. Doing that will make you an emotional trader. You will feel like a genius or an idiot.

Having skin in the game shows conviction of beliefs more than just saying it.

If it drops 20% my shorts will be full.

If the Feds balance sheet shrinks how is the government deficit spending going to be funded?

They are still buying treasuries according to the charts.

But not at the rate required to fund another trillion dollar stimulus..

the catholic church just got a $3.5 billion dollar bailout from the USA government;

4 out of the Top 6 US treasury holding countries are TINY majority Catholic countries, which include (descending order):

at #3 – Excluding the U.K., which some people argue is a catholic country regardless of the official state religion; more people go to catholic mass on sundays than anglicans. the uk owns the third most us debt. California has a higher gross domestic output that the UK.

here it gets interesting:

at #4 – Ireland, which is 80% catholic, is the 4th highest US debt holder after the UK, china and Japan(who is #1). Ireland owns roughly 90% of its gdp in US treasuries.

at #5 – In Brazil, the 5th highest holder of US debt, the Catholic Church is the largest denomination, where 123 million people or 65% of the population self-declare as Catholics.

at #6 – EU member Luxembourg (population 12 million, gdp $70billion, per capita income or purchasing power parity $120K) owns roughly 4 times its GDP in US debt and is 64% Catholic.

what this tells me is a HUGE bet on the dollar…by a lot of small players…

like a bunch of mice riding rotted cinderella coat tails in a hyper-real more-real-than-real disney movie…

PS Belgium (see luxemburg)

meanwhile back on earth, there are now ‘storms’ not hurricanes threatenitng h the same damage as hurricanes! as we cross 2Celcius and pass 5000 parts per million Co2 equivalent in the air part of earth..i ownder when the dow will fuking finally hit 30,000 thousand!!!!!! i got my july 17th tsla calls in up my ass!

Small changes. Also end of July is approaching. Expect an addition of a trillion or more same time next month when the government passes another round of stimulus.

BlackRock will manage the FEDs account when the time comes (and it will) in the meantime foreign central banks like the Swiss National Bank has been buying up stocks hand over fist since March- take a look at its recent quarterly 13F filing with the SEC.

blackrocks AI Aladdin aka WOPR

Fed strategy is to let the market react and then restore the liquidity. The gap between action and reaction is swift. The market strategy anticipates the Fed, and keeps buying the market. By then the money comes in at the highs, (corporate buybacks are back) which is why you buy every dip, to be in the market when it makes new highs. The dips are cursory. We are in the Fed’s sweet spot, pushing the market through new (interim) highs. The impetus toward selling will someday be a shrinking monetary base, (not for the last twenty years). For the moment is it only buyers who want lower prices (and cannot get them) and sellers who want higher prices, and have no reason to sell.

Wait… did you just call JP a genius?

MB was shrinking before the crisis. Money velocity tends to inversely correlate with monetary expansion. The cause of the loss of monetary expansion, not really known, and the end game where money leaves the economy faster than it can be created. MB is shrinking and velocity is falling, is the description of a collapse.

Shrinking GDP has put the breaks on M2 velocity,

look at M1

does restoring liquidity mean expanding balance sheet? coz’ bruh, i think this is -$248billion in 6 weeks is a panic move; the question is why?

either mmt is right; or

mmt is right and the fed is wrong; or

the fed is fucking stupid and wrong: or

the fed and mmt are both wrong: or

mmt is right, fed was wrong; or

eat a bullet, dick cheney was right!

Jan 1, 2007 t-bills were about 5% and the big 4 central banks had 5 trillion balance sheet. Today t-bills are about zero and the big four central banks assets are at 25 trillion. The way I understand it is 25 trillion in zero earning cash out in the marketplace. What good is it doing except pulling forward asset prices a decade or two? It’s not going to be sustainable.

Agreed.

The central bankers have suspended the fundamental of supply/demand price discovery……….certainly where it applies to debt, and as the effects spread to asset evaluations.

Why is it not sustainable? What is the alternative to to a .62% 10 year treasury yield? and as long as the FED can buy all they want, way can’t the yield be pegged at a very low rate?

Corporate America needs a 15-20% drop in order to prime another round of stimulus.

That’s what I thought as well.

The problem now is that the Fed has gotten some big stocks so high that there is no way earnings can ever grow into the stock price. A lot of market participants know this and have one eye on the exit and will pull the sell trigger quick.

I’m curious to know if people here have any guesses as to how low of a drop they expect, if indeed this scenario comes to pass. Also, what’s the level of confidence people have that the Fed’s reaction/stimulus will provide the rebound.

All things be equal, in another three weeks or so, when the repos and swaps are more or less completely drained off the Fed’s balance sheet, it should start growing again at roughly $18 billion a week (treasury buys) and whatever they do for MBS (a lumpy $10 billion?).

That’s works out to something in the ball park of $125 billion a month or $1.5 trillion a year (probably less if the SPVs wind down, and MBS plateau)

While that is a far cry from peak Coronavirus printing speed, it’s a full blown QE program. Given the stark economic realities that we face, it will likely be going for a long time.

Central banks and institutional investors collude to keep stocks, bonds et al, at certain pre-determined prices on a daily basis. As one central bank balance sheet shrinks so another expands, but the objective of achieving and maintaining certain price controls remains the same. The subjects of these price controls are stocks of companies listed on the SNB’s most recent quarterly 13F filing with the SEC.

Great reporting, thank you!

“The Fed creates an LLC”

And how is this allowed? How about if the LLC goes out and creates another LLC, or a host of LLCs? When will the Fed ever be held to some standard, honor their mandates, be reined in?

What if the EPA created an LLC?

Like a virus mutating …..

Does the Fed have an LLC to just buy up all the coronavirus out there?

Like all other national problems, just hide it behind a balance sheet acronym and pretend it doesn’t exist!

Concise and clear.

Thanks!

Clearly the Fed is projecting a democrat sweep of the government in the election. Then it’s SPV for municipals to bail out local cities and states would not be required as the government would tax to do that.

Or the Fed is just worried about saving it’s own skin, and the devil take the hindmost.

I don’t know. maybe moving to an Indian managed reservation/nation in Oklahoma might be a good idea.

Exactly how a “put” should work. There if “needed” but rolled back over time. Not saying its the right thing, but they’re at least doing the wrong thing right.

Surprising absolutely nobody, the $600/week UE benefits will be extended. For millions of people this is the best summer ever, earning more to not work than work. Which is why all the unemployment numbers are meaningless. Who in their right mind would give up unemployment in order to work for less?

And before anyone says that only a few earn more on UE than working, look up the BBO study that found 5/6 people getting that $600, are earning MORE on UE than their previous income.

Ok, you have convinced me. They’re getting it and I’m not. So, what’s your plan? And what rugs are you going to pull out from this whole shebang? My savings are waiting to hear how wealthy I will be after you initiate the full on implosion. I’m for real and not an agent of the Chinese or Russian governments. Will you declare the same here and now? My trigger finger is just itching to be used when you bring on Omega Man.

i also have been mostly convinced, though i would like to see some clear data NOT ”managed” by anyone but Wolf…

but, the only thing that is proven by any such information is that the vast majority of actual ”workers” in USA have been underpaid relative to the cost of living for many many years…

and that only supports the concept that there are way way too many workers in USA ???

and that supports the question as to why USA has been ”importing” workers, legal or otherwise, for the last 30-40 years or so???

and that supports the notion that the public education system is nothing of the sort, but, rather, much like the welfare system and other similar guv mint systems is, in fact, designed only to support the bureaucracy, and has very little to do with education, welfare of the people ,e t c

this really should be obvious to anyone with ability to do arithmetic at the elementary level,,,

SO, ”elementary my dear Watson” eh (which tells ya how far some of us will go to put a play on a pun in place, eh)

What strikes me above all else is that we have utterly incompetent and corrupt people running the government who have totally failed to properly manage a health crisis, the economy, and won’t even try it talk about reforming our worst in the world healthcare system is a big part of what’s happening now.

Luckily I am not on UE and also didn’t qualify for stimulus check but I totally support putting $$ in common people hands when we have been doing so much corporate handouts for decades in various forms.

Excuse me, but I have got to call BS on this one. The industries which have the largest numbers of unemployment are food services, transportation, entertainment, and hospitality. The vast majority of the workers in these industries are on the lower end of the income spectrum. Also, the $600 is in addition to the regular UI benefits paid by the individual States. That means the current average benefit is probably closer to $1000 than to $600. According to the Labor Secretary that is all going to end with the expiration of current benefits with the maximum being equal to former pay. The days of free lunches is coming to an end…. fast.

If they stop those payments, then landlords would have to *gasp* evict people and find other people to pay the rent. With the pool of employed getting smaller, how easy is that going to happen?

Extending UI benefits goal is to keep the property markets propped up.

Hate to inform you, but 23% of mortgages and/or rent are not being paid, with the blessings of Federal and local governments.

Where are you getting that information? From what I see in the news, the extension of the $600 is far from certain. The belief that working is virtuous and more work is more virtuous is still deeply entrenched in our society. Until people start protesting the need to work, I see this stimulus as a fluke. Before women joined the workforce, one person was able to earn enough to support a family. Let’s cut the workforce by 80%. We’ll be able to retire at age 35, on average. The only catch is that you have to adopt the Machiavellian virtue of parsimony for this to work.

Nope. Your wrong. Ppp going away is worse.

Jerome’s 248B “unwind” blew off 3.5% of frothy foam and is not material. If the dollar keeps dropping America will get the real news from their wallet talking to them.The FRED report is front runned way before the sheeple’s eye balls get to look at it.Money Printer has to go Brrrrrr……..There is no more Fed Silly Talk of normalizing interest rates. Jerome will bop till he drops and then declare victory with the result of me and you holding worthless fiat dollars.

” … me and you holding worthless fiat dollars.”

Only if I hold ’em. The age old practice will work again; buy hard assets with the dollars.

That works till the government/the mob confiscates your hard assets.

Gold? Remember Roosevelt.

A house? Property taxed till death

Your vegetable garden? Your “neighbors” on NextDoor will post pictures on Instagram, and pretty soon there will be a mob in front of your house.

Bullets? You are not Rambo. You will be overwhelmed.

New Zealand is your answer. If our billionaires are thinking of escaping there, can’t be a bad place right?

Better yet, we use our warship fleet and take New Zealand. Then we transport our gazzilionaires to their new colony so they can start to f**k that place up too. We keep the hard assets and redeem the Reserve’s coupons for a real backed money. No questions asked about how you got them (earned or stimulus) and no damn taxes. The ex-rich guys can take their lawyers on their long journey and support them like family. It’s up to the New Zealander’s to provide their own program of fencebuilding workfare to contain this disease.

Nah, it’s more likely our fleet will join New Zealand as their newest citizens. Why wouldn’t they?

Jack Daniels, hostage families, and threat of “On The Beach” scenario. I’d add jelly donuts, but you can probably get them just as easily there.

“A house? Property taxed till death”

Ugh, this tired trope again? OK cool, rent instead which only lasts for what, 10 years and then it’s free until death? You have to live somewhere. If you rent or if you buy, you will pay for that housing. Your choice is do you want to pay to a landlord or to a a group of entities including mortgage companies, insurance companies and county assessors? For some renting is better, for some buying is better. But this notion that you never really “own” your house because you have to pay taxes is one of the dumbest things ever. I pay registration fees every year on my cars, along with all sorts of taxes through gas taxes and tolls. I guess I don’t really own those either huh? I own a boat (free and clear), yet every year I pay insurance, registration fees, and moorage fees. Guess I don’t own that either.

Bummer.

Tired trope? Have you heard of the great state of Illinois? Another respected blogger just escaped that state. He was paying 15K annually in property tax for a property that was worth 380K.

People from Illinois are fleeing. That’s fact.

But hei for a permanent real estate bull, every day is a great time to buy. Are you like Lawrence Yun?

Property tax in some states is a big deal, in others less so

So it’s started.

– Nashville Mayor John Cooper is openly proposing raising property taxes by 32% in order to correct an estimated $250 million budget shortfall.

– Dallas, TX is looking at a proposed 8% increase in property taxes, and is having to work a loophole that allows them to ignore state law which would prevent them from raising taxes more than 3.5%.

– CNBC reports that many states across the nation will be looking at tax increases in many areas, including corporate income taxes, online purchases, excise and sales taxes, property taxes, and gross receipts taxes.

Some people just don’t get it. They are still thinking business as usual. More headwinds for the property market.

Lol, your hard assets are only created by the government. Gold is worthless. At least a greenback turns into a factory. Stop thinking Roman and Hellenic. To us Germans, gold was bling. Money is tribal.

The Oregon & California RailRoad used gold to aquire land. The German bondholders sold their position to the English who then traded it all to the Southern Pacific Company of Kentucky for stock in the Central Pacific Railroad, a subsidiary holding. The Southern Pacific never went bankrupt. Through many changes, the Southern Pacific was used to absorb the Union Pacific (the post-1890’s company organized by Harriman) and was then itself renamed Union Pacific Railroad controlled by Union Pacific Corporation with massive holdings. It is the steel backbone of a nation still capable of kicking the living sh*t out of anything if it puts it’s mind to it. In the meantime, Germany has destroyed itself twice already. Small people got together and sent huge amounts of relief by those rails to your country. And we still like you. Best to remember who your real friends are, while we work out the problem of our own jerks.

NZ is where a lot of these luxury survival bunkers are that the ultra rich have been procuring.

Executive Order 6102 complied with the “takings” clause. That meant the Govt paid market price for gold. $20.67 /tr.oz.had been the price since 1842. Before the ink dried on 6102 it was at $32 and floated quickly to $35. You were allowed 5 coins . No age limit. Family of 6 could have 30. In today’s fiat that’s $90,000. Also the Govt paid you in silver certificates if “confiscated” and those could be exchanged for silver dollars. Coin collections were exempt. Not many people had a gold coin . The same holds true today. “Thats eatin’ money son”as my grandad would say when he flipped a gold eagle on the glass cover on his roll top desk,and say “freedom is a’ringing , and a’singing ” . On that Mob thing. I doubt most Mobs would get very far without Mcdonalds and the Government. There are 40 families on the 4,5 mile road coming into the cove where I live . Them would be 4.5 rough miles on that narrow road ,bordered with heavy cover and timber and a rough rocky bold stream. Everyone is armed . The Government can come and get the vegetables and the cows to boot. a Mob won’t.

The sad problem with those worthless fiat dollars is that SOMEONE has to hold them at all time. You can buy something but that just sticks someone else with the dollars. Someone always has to hold the hot potato while running around the disappearing supply of musical chairs…

Thanks Wolf, for all the info.

I’d like to join in short as well, but, I think that we’re in a bent or broken state now.

All of the fed and fiscal stimulus has actually done nothing for us as a nation. We have a national problem upon us, of depressed activity, willfully. Nothing in our current system accommodates this.

Early on, my guess, is that policy officials came up with these remedies by extrapolating the course of the pandemic from other countries. The major difference is, we are not other countries, we do not have any expectation of national welfare, health or otherwise.

When this pandemic took hold, we as a nation had as our political leader, someone who got to his position by crooked dealings. He leaned into this nature, and wrote checks to people and businesses rather than attempting to modify the system to accommodate our new reality. This cannot be bent back by current leadership, or it will break completely.

We cannot provide health and welfare to the nation by writing checks to what would be defunct businesses.

We cannot sustain an economy by writing checks to every American, regardless of their needs.

What can happen next?

Either, we sustain at this level, hoping the donkey’s carrot does the trick somehow. Or, corruption furthers, justifications used to write checks will become more perverted while more people die of this wretched illness.

There would be no additional drop and bounce back from this. We would have to consciously address systematic institutions of what? Of distribution of income, of basic human rights, of equality.

Tell me, do you really think that the ethnicities of the classes of the American people that provide luxury for the other classes of American people is going to change because of this? Not a chance, so I’m avoiding the short, and the markets entirely, while expecting the good old, American, same old.

Undoubtedly, the carrot will prevail, because we the donkeys are all institutionalized, anyway.

Nothing.personally, but stimulus, that was not. Most of it was pandemic transfer replacements.

@porque – fish cannot avoid water and for humans there is no avoiding “the markets”. One can avoid some markets, but not all.

Employment takes place in a job market.

Personal spending takes place in a retail market.

Investing takes place in capital markets – and if you avoid stocks, that just means you’re in something else. Money in the bank is participating in the credit market, whether you like it or not. Even paper cash under a mattress has a market impact since it means less in circulation.

Fixing the issues is the only way forward, there’s no escaping the fishbowl.

Some would say that gold is that escape from the markets, especially in the era of unlimited money printing. I think to an extent that is true. It’s why it’s part of most serious investors’ portfolios.

There is still a market for gold, sentiment that drives prices up and down. Terrible mistake to buy when up, great to buy when down. Similar to other assets in that regard. Main difference I se is that good, unlike a corporate stock or bond, cannot go bankrupt.

Good points. Since I’m not an elder nor a day sleeper, I’ll always be in some sort of labor market, though.

In terms of the others, I’m actually too cynical to short this market right now, and any other markets I join will be those that provide the less friction to them being diminished (banks and inflation.)

It’s still an almost $7T balance sheet, so way to soon to read much into a relatively small decline – in my opinion. Plus, covid19 hospitalizations going up fast which could lead to shutdowns/longer shutdowns and a “need” for more QE in the months ahead (rather than less).

Gerome Powell is going to be remembered in the history books as the creator of the intermittent QE program IMHO.

So investing in teh markets is a big gamble now…..the fed could turn off the tap when ever they like and you could lose a lot of money….if they print you make money…..if they stop printing you lose money….no price discover….maybe I might buy bitcoin and gold instead.