The market is facing a historic mess.

By Wolf Richter for WOLF STREET.

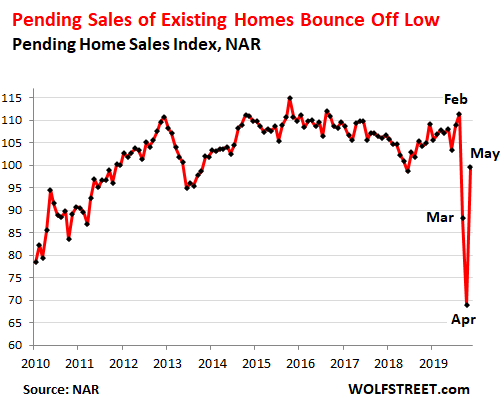

Pending sales of existing houses, condos, and co-ops in May – these are contracts that were signed in May but didn’t close in May – bounced off the brutal pandemic low in April, but remained down 10.6% from February 2020 and down 5.1% from May 2019, according to the National Association of Realtors this morning:

The index of pending sales was set at 100 for the average contract activity in 2001. Pending sales in May are an indication of what closed sales might look like in June and July.

That sales volume collapsed in this historic manner in March and April was a sign that amid the uncertainty, the market had essentially frozen up, with sellers pulling their homes from the market or not listing them in the first place, and buyers staying away in droves.

While many potential sellers still remain reluctant to put their homes on the market, the market is functioning again. The industry has figured out how to deal with the requirements of social distancing, with sellers’ worries about having potentially infected strangers traipse through their home, and with the concerns of everyone else involved in the transaction.

And according to the NAR, “More listings are continuously appearing as the economy reopens, helping with inventory choices.”

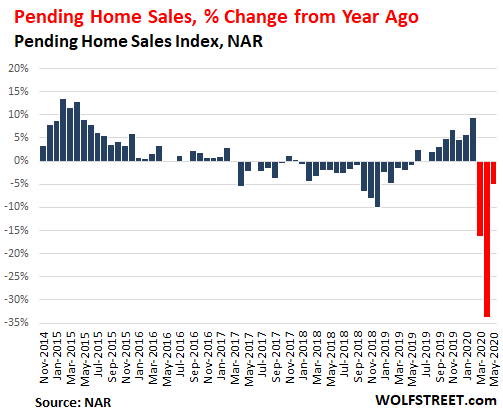

The chart below shows the year-over-year percentage change in pending sales. The three months of year-over-year declines during the pandemic – March, April, and May – are marked in red:

In terms of US regions: Pending sales fell in May 2020 compared to May 2019 in three of the four regions:

- Northeast: -33.2% year-over-year to an index level of 61.5.

- Midwest: -1.4% year-over-year to an index level of 98.8.

- South: +1.9% year-over-year to an index level of 125.5.

- West: -2.5% year-over-year to an index level of 89.2.

This market is facing a historic mess.

Over 30.6 million people are on unemployment compensation, meaning 20% of the labor force, and they’re now out of the housing market.

In addition, 8.5% of all mortgages, or 4.2 million mortgages, are now in forbearance, according to the Mortgage Bankers Association, meaning these homeowners have stopped making payments after getting their lenders to agree not to exercise their rights under the provisions of default.

In the rental market, eviction halts and deals with landlords allow renters to forego paying rent.

Auto lenders too have entered into forbearance agreements with their borrowers rather than repossessing the vehicles due to non-payment.

“Extend and pretend” has become the national policy. No one knows how to get out of it. But extend and pretend doesn’t work forever. And it causes all kinds of long-run damage.

Part of the economy is running on stimulus payments, the extra $600 a week in federal unemployment benefits, massive bailouts of all kinds, and nearly $3 trillion that the Fed threw at the financial markets in a span of three months to inflate stocks and bonds – though those efforts have now halted. So this is a sick puppy we’ve got here.

Household income drops from a historic spike, consumer spending bounces off a historic plunge but remains low. Income from wages & salaries remains crushed. Read… A Federal-Money-from-the-Sky Story

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Just read an article over at studyfinds.org.

“A survey of 2,000 American homeowners found that 52 percent are constantly concerned about making their mortgage payment on time. Forty-seven percent of the poll say they’re considering selling their home because they can’t afford their mortgage anymore.”

MonkeyBusiness,

If homeowners can’t afford their mortgage at the moment, they can just try to work out a forbearance agreement with their lender and stop making payments for the duration of the agreement. What comes afterwards is another story.

I think many people confuse forbearance with forgivable.

Homeowners are still on the hook, and must pay later. The unpaid mortgage doesn’t just disappear.

Here in California it does. This is a non-recourse state.

MarkinSF, that only means that the lender can’t seek a deficiency judgment against the borrower post-foreclosure. The temporarily forgiven amount is still added to the loan balance, to be satisfied from the collateral.

Forbearance increased last week I think after dropping.

Why would you not just automatically tell your lender you can’t pay, get the 4 months tacked onto the end then use the money to pay down the principal?

Because that is not how it works. They are only allowing forbearance for 6-12 months and at the end of that period all the money that was not paid is due in full.

“Survey” data could say anything, depending on how the question is asked and which subpopulation answers the survey. Timing would be a big issue here since the shutdown/restart is very dynamic process. Need to know a lot more to assess reliability.

Forbearance is free money. The idea is that you have the option of not paying your mortgage for a year and instead pay it at the end of the loan’s duration, which is often decades away. In the meantime, you can invest the money that you saved by not making mortgage payments. (For a detailed explanation search for “Change to $0 Mortgage Mortgage” by Kevin.) It makes financial sense for a very large percentage of the population to request forbearance. For once, a law was passed that financially benefits the little guy. Watcha gonna do? Feel guilty for taking advantage because only Bezos and Blankfein are deserving of bailouts and handouts?

How about those people that rent? How about those that decided to wait on the sidelines to buy a house because they wanted to actually be able to afford it! How about those of us considered essential that weren’t able to stay home with our kids and have had to spend $1000+ extra a month on childcare? Homeowners in America are some of the most self absorbed people and have this “NIMBY” attitude when it comes to losing their homes. That’s the way life goes. People should better prepare for a job loss at any minute in this day and age and if they lose their home there will ALWAYS be someone to snatch it up. That’s what makes and made America great. All this government bailout and safety net for home ownership is what drives up the damn prices and gets people complacent and abdicates personal responsibility. That and the FED propping everything up as usual. I don’t feel sorry for anyone losing their home. I see WAY too many Americans, especially white collar, living high on the hog with their fancy SUVs/trucks/new boats/garage full of toys, copious consumerism and kids activities etc. then when the rug gets pulled out from underneath them for whatever reason they cry victim. BS!!! The inequity in this country is getting disgusting. Working people and labor has been gutted and plundered……..I hope the white collar immunity people think will stick around forever gets gutted and plundered as well. Maybe Americans will finally wake up and realize the complete fraud their little bubble economy is.

Why have any urgency to buy when 10% of homedebtors are not paying their mortgage for a year?

What do people think it’s going to happen when they cannot keep on squatting?

I can tell you what’s not going to happen: The powers that be will notallow the pain of foreclosing on 10% of homeowners. They’ll kick the can forever into the future first…

I beg to differ with you. The reason mortgages require 20% down is not because it’s good for the home owner. The truth is that is the cushion the banks need to make money when they foreclose on you. And both parties are in on the looting.

Petunia,

It is rather surprising that more people don’t understand the function of down payments…to provide a financial cushion for collateralized lenders in case they have to foreclose (or call the loan due to collapsing value of the collateral).

People really don’t understand how very little of their home they own (and how volatile its value) until their mortgage is completely paid off.

They are sorta like people buying stock on margin, who don’t understand how margin works.

Of course, all the low down pmt schemes do come with their own pathologies (it is pretty amazing given the mediocre to poor performance of the US economy for 20 yrs, that median home prices have doubled…all hail the mighty ZIRP, low low DPs, and other short term schemes…)

Please stop it with the Boomers trashtalk. So, you are obviously ignorant of the following:

–Not all boomers are wealthy and secure

–Many Boomers are still taking care of kids and grand kids

–Boomers were never an entitled generation – there is a very wide variety from boomers who were drafted to fight (and die) in Vietnam to many tail end boomers (like myself who had to work hard for everything we have)

–Assuming boomers can hang on to their homes, their children ‘just may’ inherit the homes and not have to live in the street or rent a very expensive 1 bedroom shack

–Some boomers are in terrible health and will not be living as long as their parents (btw, I do agree that this is their fault for not taking better care of themselves)

The privileged life of the boomer is a myth. Some boomers have done very well (like myself) and some have failed miserably, sometimes not entirely their fault.

Don’t use ‘boomer’ as a catch-all term. It’s not!

Thanks for your comment Stephen,

As an older than boomer person with younger siblings and spouse in that group, I find that there is absolutely NO generalizations for/about the boomers that ‘ring true’ as of this writing, SO similar to the ”greatest” generation and those folks, similar to my fil who were drafted into ww2 AND Korea wars.

Fil died in Jan at 93.5 yo, with full support from the first day his children asked VA, because he never would ask for any help…

WE the PeedONs really and truly need/have to honor all the older folks of EVERY gen,,, and, now in the middle of my 8th decade, it certainly seems to be a very good idea for us to ask for their wisdom any time we have the chance/opportunity! ( not to say we either ”should” or must follow their, or any other mandates)…

And we all know who the Boomers voted for in 2016.

> And we all know who the Boomers voted for in 2016.

A bare majority voted for Trump. Just like most groups, they were fairly evenly split (53% – 44%).

Which goes to Stephen’s point: “boomer” is not very useful as a catch-all term.

Boomers are the single largest voting body by far. They happen to be at the point where they have already earned the bulk of the money they stand to make in their lifetimes. Compared to other generations, they have significantly more wealth/assets (both by age and on absolute terms). That has massive political implications. We are seeing the results play out with our elected leaders (not party specific) and the federal reserve.

The government is literally taking my money from the future and using it as a weapon to force me to pay more for housing, equities, healthcare, education today.

The poor depression babies like my mother. They were born into a depression and guess they’ll go out the same way. What a ride it had to be.

Sorry, but his generalization is correct. When the SS fund is depleted, it will be paid at a rate of 75%. The boomers are collecting at 100% at the moment.

Savers within the boomer generation have enjoyed better interest rates, better job opportunities, and lower inflation than what subsequent generations face/will face. I have yet to see a study that states that subsequent generations will do better than their parents.

Well said!

@Harrold

And we all know who the Millennials voted for en mass in 2008 and 2012. How did that work out for them?

Eight years of awesome unbeatable progress where the Millennials had improved their fortunes by leaps and bounds, right?

Just saying, generalizations like usually didn’t do any generation much good.

Wrong. Most boomers have their homes paid off. It’s Gen x and millenials that are getting bailed out.

Only if you considered Gen X and Millennials to be corporations because it is they who have been bailed out..

Thank you folks for the retorts to BrianC’s “boomer bash” illogical statement. If this kind of mindless slamming does not cease, perhaps we should just let the Communist Chinese regime take over and show them the kind of bashing that a wooden stock AK-47 can do to the upper jaw of those who don’t tow the line set by dictators. Or did they think they would get everything handed to them on a platter?

Yes this is correct, and I am in middle of GenX.

The main advantage boomers and older part of GenX had was being able to buy property or stocks 20-40 years ago at a low price and high interest rate, and then benefit from asset appreciation as interest rates came down. Also had opportunity to refinance real estate to bring down interest rate on original mortgage.

I’m wondering what the Fed will cook up for GenX and millennials. There could be a lot of quantitative easing and dollar devaluation to cause a similar appreciation of property.

“The main advantage boomers and older part of GenX had was being able to buy property or stocks 20-40 years ago at a low price ”

You could say that about any generation. Prices for everything goes up. So every generation will buy “stuff” for more than their parents paid. Everyone kidn of understand this, well except for millenials who have to be explained this very basic concept over and over and over.

My parents paid I think $70K for the first house they bought. My grandparents couldn’t have paid more than $20K. I paid $300K. My kids will probably pay $600K. See a pattern? What I nor parents did though was whine about how unfair life is. We just kind of did our thing. Try taking that approach it will do wonders for your net worth.

“Boomers win again. ”

Why stop at age? Why not use other ascriptive identities like race, gender, and even height?

Anything to avoid talking about class and wealth inequality. amirite? Divide the working class, and they stay conquered.

Yes, your last paragraph @two beers. Unbroken trend for about 40+ years.

Trump and Pelosi epitomize dived and conquer. When the sleeping giant known as the Working Class wakes up and sees the giant con game known as Capitalism the world will be saved.

Brian,

The boomer bashing is so tiresome. You made a choice to be a renter and stay out of markets. You chose poorly. The big bad mean old boomers had nothing to do with your choices.

Boomers as a block are at least consistent….

“It’s not my fault, I am just smarter and work harder than you.”

Taking it to the grave no doubt. Bye!

To quote my old DBA coworker “Man I don’t know how anyone would buy my house today. I could never afford it if I had to buy it again now.”

I’m a younger boomer and I lost everything, house, cars, savings, retirement. So spare me the boomers are fine agenda. There are many women retired and in poverty, it’s the norm for women, low wages lead to poverty for the rest of your life.

If you look at people living in vans or leaving the country, it’s the old and the young. Truth is the financialization of everything killed the economy for most of us.

Petunia, what happened that you lost everything and retirement? What could you have done better?

Andy,

The GFC cost us our income, home, and savings. Bear Stearns going bust cost me my retirement.

What you are referring to is Capitalism, the biggest con game in history.

Andy: “What could you have done better?”

Not been born in the country with the most extreme wealthy inequality in the world?

How do you know she did anything wrong? Tens of millions of people were wiped out in the GFC due to no fault of their own, while the poor, oppressed John Galt financial elites were made whole, and then bought up assets like Petunia’s for pennies on the dollar.

Why do you blame the victim?

The attack on the wage earner has been relentless. The Federal Reserve chart showing the percentage of wages paid vs GDP shows it clearly, dropping from 51.6% in 1970 to 43.2% in 2018. Perhaps this is what was meant by “trickle down”.

https://fred.stlouisfed.org/series/W270RE1A156NBEA

Generational-Bias language is every bit as insidious, and wrong, as racist language.

Yes, it’s ridiculous over-generalization about trees while ignoring the forest. Why people humiliate themselves on the internet remains a mystery to me.

I like it, I think we have a new Wolfism. “Extend and Pretend”

The final point is the same, the bill will come due, and then things will fall apart. I think the bricks and dam analogy works well here, you have all the risks piling up on one end of the spectrum with this forbearance and that, eventually, the people at the end of the line has to be paid. So the flood water is rising, and our elected officials are running out of bricks on their financial engineering damn. Then, at some point, this all collapses into a disastrous heap.

After all, at this point, I don’t see states and municipalities giving up on tax collections. So, one wonders who will get squeezed at the end.

The GSE’s will east most of the losses and then be bailed out by the gov/fed (with newly printed money either way).

“Extend and Pretend” is even older than Wolf (heh heh) so we can’t grant him authorship of that one.

Sure we can…. haven’t you heard. We are doing away with history and rewriting it wholesale. :)

I listen to Lakshman Achuthan (ECRI WLI) last week and he forecasts a very short recession. He says his WLI’s are trending positive (consumer sentiment, etc.

Lakshman, imo, is not the worst. He has less of an incentive to constantly bias one way or the other.

Cleanest dirty shirt economics 101. Universities in the USA should give a class in it. It is more relevant than the economic theory I had to learn back in the day.

Dollar hegemony all the way. Stimulate the economy to S&P 3600 by year end. The cleanest dirty shirt has incredible firepower. The Dollar has so much presige. Thank you China.

Get the citizens spending, not protesting. I am already looking forward to the Santa Rally.

I used to respect Lakshman Achuthan but less and less these days. The one thing that is needed in economic forecasting is someone or some agency or some publication to publish a reconciliation of major economists’ forecasts versus what eventually happens.

“Get the citizens spending, not protesting. I am already looking forward to the Santa Rally.”

As far as I can tell from my circle of friends, this is failing. We are having fun competing on who saves the most. Who would have thought that savings rates above 75% were feasible? Not me just a few months ago :-)

Frugality is super cool now. :-)

That leads to zero money velocity and really crashes things hard,at least support small local businesses when you do spend

I don’t understand how to reconcile the “recover” in sales with massive unemployment. Do these sales continue at this rate? Do 50 million newly unemployed matter?

It’s the economists’ equivalent of we don’t need no stinkin’ masks.

People who weren’t laid off REALLY improved their cashflow the past 3 months. My friend received $3900 stimulus, plus she saved a lot from: not eating out, not vacationing, no music/sports lessons, no summer camp fees, no makeup/hair, very little automotive costs. Probably +20K during the lockout.

There’s a lot of middle-class people who’ve always struggled financially, despite having solid incomes, due to bad financial habits. COVID could be an eye-opener for many. After the virus subsides, will they keep their new habits and become savers, or will they revert back to their advertising-addled impulse-spending ways?

They weren’t struggling then. Just undisciplined.

Doesn’t matter lol. Should be good for 2000 points up in the Dow. Sales don’t matter when there are enough people who can still buy homes and little inventory. Prices up. Seller’s market right now. If anyone is that convinced of a housing bubble they’d be selling now, sitting in cash, and buying a few houses when it all comes down. Wait that’s not happening.

This is short term optimism. Reality hasnt set in yet. Economic closures have been reversed because of a spike in cases.

All the adrenaline the market needs today for a rally, that and also for the housing bulls to rub it in your face to say “told you so….market is in red hot recover, FOMO buy now or miss the wild ride up forever”. I can think of two posters here chiming in with that sentiment very soon.

Counter to what Wolf pointed out here, this is all the market is listening to at this point

“Pending home sales in May jumped 44.3% from April, according to the National Association of Realtors, marking the largest one-month jump since the survey began in 2001. Very low mortgage rates were spurring homebuyers.

“The outlook has significantly improved, as new home sales are expected to be higher this year than last, and annual existing-home sales are now projected to be down by less than 10% – even after missing the spring buying season due to the pandemic lockdown,” said Lawrence Yun, NAR’s chief economist.”

Phoenix…..

Anecdotal story:

Family member in mortgage brokerage business for many years Santa Clara Valley CA:

“Business has never been better right now”

Having their best month in ages!

Go figure!

Lowest rates ever due to fed pumping and buying everything in sight. Wonder how much Hertz debt they bought on the dip?

The RE pumpers always like to reference the white collar professionals that are still bidding up prices, or moving to the suburbs and bidding up prices there. I can think of lots of professional groups that are not doing well in these times such as orthopedic surgeons, dentists, commercial landlords, restaurant owners, car dealership managers, etc. But for the life of me I can’t come up with a list of white collar folks outside of amazon and microsoft executives that are doing well enough to spring for an expensive new home. Can anyone help me with this?

Dunno but stuff around me sells fast. I’ve heard there are bidding wars and crap on houses, these are the cheap ones in the area (less than $1 mil.)

I’m seeing lots of 30 day tags on cars around me.

Coworkers wife is a realtor, supposedly crazy busy.

Stock market perhaps?

NoVa? Federal employees and contractors aren’t suffering a bit.

The MSMs see it differently (big surprise):

AP – “US pending home sales see record-breaking rebound in May”

CNBC- “Pending home sales spike a record 44.3% in May, as homebuyers rush back into the market”

MarketWatch – “Pending home sales staged a historic rebound in May, meaning the worst may have already come for the real-estate market”

Chicago Tribune – “US pending home sales see record-breaking 44.3% rebound”

Barron’s – “Pending Home Sales Rose 44% in May, the Biggest Leap on Record”

San Diego Union-Tribune – “US pending home sales bounce back huge in May”

Fox Business News – “US pending home sales bounce back with May surge”

and on and on, ad nauseum, with no headline acknowledgement of ANY drop year over year or otherwise. Typical algo baiting garbage while simultaneously blowing tremendous amounts of sunshine up the collective keisters of the retail stock buyers. Got SPF 2000 to protect your anal orifice from skin cancer?

Many thanks to you Wolf for your enlightening, balanced reporting and commentary!

I would say MSM is doing a rather good job in being on the message without people wanting to dig deeper. More steeples you get, the more will buy into the hype. How else are you going to drum up demand otherwise? It’s certainly more effective than taking out an AD on TV to convince people to buy a house now.

Take a look at the estimated monthly payments on homes in Los Altos, Palo Alto and Menlo Park, they will blow you away. 48K/mo is nothing! With the economy in such disarray and so much unemployment where are buyers coming up with this kind of money? It’s not just one or two high-end homes for sale with these kind of payments, it’s ALL of them! To get something really “nice” you must spend 5 million and UP, mostly UP.

This seems like a good recipe for crash and burn to me. You think the younger generation will buy at these prices? They’ll be too busy paying off their college loans, unless the FED has bought all those up too. And who’s going to pay these tuition fees going forward?

Those regions print millionaires. Sorry to say but it has attracted so much capital its ridiculous. It will take a long time to burn off the money printing machine of Silicon Valley. Though these policies are doing there best to accelerate that / for now its still the epicenter. Thousands of new jobs, almost no new housing, huge amount of wealth creation, worlds best schools. That does not turn on a dime.

We are in Texas. Home prices are fairly normal around here (north side of Houston). This is not silicon valley. $48K monthly payment? With 6 of those payments, one can buy a 2,000 square foot brick ranch here and have change left over for a new SUV!

Anthony,

I spent some time in Houston 2015-7. I was surprised to see how expensive the high end is there. The area around Rice University and Galleria mall is not much cheaper than a comparable area somewhere on the coasts. Houston as a whole is cheap but there is a lot of nasty parts of town in Houston as well which drags the median/average down. But if you want to live in a nice area, you have to pay up. At least that is the impression I got.

Any without the ZIRP bullsh*t, it would only take three payments.

Which it did, in the pre ZIRP 90’s.

My son lives in a county in northern Idaho and has been in a casual search for just the right plot of land to buy and build a home. Not now! He just told me that virtually every available piece of land (rural — not in towns or cities) is either sold or sales pending. All of this happened in the last three weeks. He’s a contractor so he has his ear to the ground and the word he’s heard is that these are folks primarily from western Washington (Seattle), western Oregon (Portland) or…drum roll please…California.

Sounds like panic buying.

There will be a lot of bubbly talk about this ‘recovery’ or bounce from a low level.

I think there is some opportunity here for the psychological study of ‘relief’. Remember the crash after Navarro replied ‘yes’ to the question: ‘is the trade deal dead?’ (In his walk- back he said he was ‘taken wildly out of context’. Guess he thought he was being asked if he wanted coffee.)

So there was a relief rally when, with a gun pointed at his head by Mnuchin, he announced the trade deal was alive and well. But here is the odd thing : it rallied higher than before the bad news, not back to where it was. So maybe we need an announcement of made up bad news every week and the rebound rallies will take the market ever higher?

The problem arises when the bad news turns out to be true, and the rallies were all part of what Galbraith called the ‘confidence game’, or in today’s lingo the ‘con game’.

Bigger picture: after lots of rallies the Dow is 2000 points lower than just 21 days ago.

May was the transition month. Half teh country was open half was closed. And still sales soared. By June with the exception of a few holdouts, the entire country was open. June numbers will be massive and even the biggest bears will have to finally throw in the towel.

Wolf,

I’m waiting for these leagues with high overhead start to fold team by team. It will be a long while before, if ever recover in any small way.

I notice that the majority of large arenas and golf venues are owned by banks and insurance companies. I don’t see them failing for a long while as they are protected with government regulations.

Boots on the ground, Houston, Texas

Been a Business owner here for over 25 years involving residential/commercial construction.

I am totally blown away by the amount of activity going on around here, it’s been crazy for years, but nothing like now. Restaurants / stores packed

30 minute checkout at big box home improvement stores , multiple offers immediately on newly listed homes.

Homes on lake Conroe that are in the 1.5 million and above range that have been sitting around, some of them literally for years are starting to sell like hotcakes, all this in a supposedly weak economy with tons of layoffs in the oil field. Any trade , skilled/ unskilled begging for any kind of help.

Trucking companies will hire a ham sandwich if it can pee clean ( a big challenge)

Traffic so bad you want to rip your hair out at the end of the day.

Monthly property tax payments that would have equaled the entire mortgage just a few years ago.

100 year floods every 24 months

95 degrees with 85% humidity until about 8 o’clock in the evening, then awesome mosquitoes large enough to carry away small children.

Beaches so crowded, you can’t even put out a lawn chair, while waiting to take a dip in the chocolate milk beach water.

Been here my whole life, and never seen anything like it, don’t know from where or why they are coming here, but definitely not seeing any pain here.

Take away the humidity and chocolate milk beach (eeeewww) and that’s my area as well. I was on the freeway Saturday around noon and it was 40-45 MPH. Which is unheard of on a weekend. I figured there must be an accident or something, but there wasn’t. Just volume. There is a house here that has been for sale for 5+ years. Asking price, 8 figures (which for this area is at the very very top of the market, unlike say LA where $10M is middle class territory :). It sold this spring. 30-60 minute wait for a restaurant table at everything from franchise stuff like Olive Garden to the all organic vegan place and everything in between. You want a tradesman do some work on your house? Some painting? Yard work? Renovate a bathroom? Call today to get the work done sometime in August or September when they may have some free time.

There is no recession. There never was a depression. It was all MSM made up garbage.

Just Some Random Guy,

Please read the data I posted on Houston (just below), in reply to Fast GT. I hope your region is doing better than Houston.

The plural of anecdote is not data. You sound like Reagan.

Let’s see if you’re singing the same tune by Oct-Dec. My guess is no. It’s not a hoax, tens of millions of jobs are gone.

The govt just spent several trillion dollars to prop up the stock market. RE is a lagging indicator.

We’re like an airplane that just ran out of fuel….aloft, running on fumes. To say it’s all “made up garbage” is utter nonsense. You know it, I know it, everybody knows it.

Down here deep in the trenches. Few remaining open stores. No customers. No lines at checkout. No tourists. No airplanes flying. No cars at stoplight at rush hour. Rush hour gridlock is now a sprinkle of cars doing 90 on the HW. No smog. Quiet. 50% unemployment. Young fit working age men begging at intersections. Bleak outlook on everybody’s faces. Schools closed. Students lost the year. Beaches closed. Parks closed. Bars closed. Exponential growth of infected number. 5pm-5am curfew. House and car prices still way too high. Local junta obediently raising taxes on the poor to get that sweet IMF+WB money. I’m stacking bundles for the bottom dropout this winter to scoop a rental.

GT,

Are these buyers locals or from out-of-stater?

MiTurn: I can answer from my data which is the area north of Houston (Montgomery County: Conroe, The Woodlands, etc). Seems like people in Houston are migrating out of Harris County to our communities to the north and others to the west. This is to get away from congestion, crime, taxes, etc.

There are also a good number of retirees from California and the PNW who are cashing out or just getting away from the west coast madness. I can’t forget the Michiganders who just come here for the weather (LOL).

Fast GT,

OK, Mr. “builder.” I happened to be on the mailing list of Houston.org. So here is a dose of reality:

Residential building permits in May: -33% year-over-year

Nonresidential building permits: -17.8%

YTD total building permits: -15.8%

12-months total building permits: -9.8%

https://www.houston.org/houston-data/monthly-update-building-permits

276,000 jobs in May lost from “pre-covid level”

https://www.houston.org/houston-data/monthly-update-employment

Sales tax collections in April (latest available): -17.2% year-over-year

https://www.houston.org/houston-data/monthly-update-sales-tax

Houston Purchasing Managers Index (PMI) for May: 40.2 (below 50 = decline). May and April were the two worst readings in the data ever.

https://www.houston.org/houston-data/monthly-update-purchasing-managers-index

Houston home sales (all types) in May, year-over-year, in units: -20.7%; and $: -25.9%

Average price of houses: -7.4%; median price -0.4% yoy

https://www.houston.org/houston-data/monthly-update-home-sales

Catastrophic office vacancy rates: 24.5%, according to JLL, “the highest level in recent history.”

https://www.us.jll.com/en/views/leasing-construction-vacancy-houston-office-market

SO PLEASE SPARE ME YOUR BS.

Wolf, GT references north of Houston where we live. That is so much different than Houston proper (Harris County). This is the fastest area of growth in Texas (and maybe the U.S.) and real estate is selling.

Plus, the population of Montgomery County (where we are) seems to think the virus is a non-event. My wife and I have been eating out pretty regularly and the restaurants are jammed. We had a 1/2 hour wait at Saltgrass steakhouse last Saturday night.

Yes, that’s right, My comment for the most part reflects what’s happening on the north side, woodlands, lake Conroe, montgomery, magnolia area.

There are pockets in and around Houston that are also seeing similar craziness, but nothing like the north side.

And your correct, lots of people dismissing the virus and going full speed ahead. Not sure of the ramifications of this yet, but I’m sure we’re going to find out real soon.

I bought my first home just outside the Woodlands right after I got married in 1993 , this was a brand new home, had been sitting for about a year from a small builder that had built about 6 homes that weren’t moving. According to him, because financing was difficult.

We both had perfect credit, no bills, and combined about 80k a year, still took a month to get approval (countrywide , if you can believe it) and they required 20% down, we had to provide proof of 6 months of payments in the bank, AND still paid mortgage insurance for 5 years.

We locked in at 7 percent interest on a straight 30 year mortgage. We we a nervous wreck, as everything we were looking at up to that point was in the 40s ( and yes, there was lots out there in that range in decent areas)

Now fast forward to today, I’m seeing

“Starter” homes in the 350 to 400k Range. And property taxes here are off the chain, mud taxes as well.

I have a friend living in a good neighborhood that was annexed by the city of Conroe a few years ago, his water bill in the summer can run over 400 dollars a month. Don’t know how this story ends, but I know it’s going to be nasty.

Wolf, I wasn’t disputing your research, I agree that things are not going to end well, just giving some insight to the craziness going on in what used to be a pretty sane area.

Also need to add, the new home that we bought in 1993 in the Woodlands as discussed in my previous comment, we paid $ 74,000. 00

This was a spec home about 2000 square feet, 3 bedroom, 2 bath with custom cabinets, 13 foot ceilings in the foyer and living/ kitchen areas.

Dang Wolf, your site must be getting more popular now than ever. Noticed more of these posters trying to argue against your data. Must be ruffling some NAR peeps feather for them to come here to sell their talking points.

Nevermind your data, I say traffic is back to normal so everything must he A ok..funny how I drove on the 405 from LA to OC at prime rush hour traffic to work and got here in half an hour vs 1 1/2 it took during a normal time. Must be damn liberal California being the exception to the our V shape super duper recovery.

Wolf,

You know very well May sales is for homes that went under contract in March and April, which was the peak of the Corona times. And 0.4 drop YOY, given that 2019 was one of the best years ever for real estate is some kind of evidence of a crash? Come on man. March/April was the low and prices didn’t budge.

You also seem to forget that there are millions of people (including many in Houston) who are staying unemployed until July 31 when the $600/week runs out. They make more not working than working. Those people are still spending money. As soon as Aug 1 they will go back to work. Look for August job numbers to be bug eyed big.

Thank you.

Maybe we need to call in Lawrence Yun to settle this. He’d know…

GT, I’m in The Woodlands and house sales are ripping. I have a friend who is a mortgage broker here and he has 80+ refi’s and new mortgages in process right now.

In the last three weeks, in our neighborhood (400+ SFH), which is a 55+ age community, I have seen three houses put up for sale and sold in that time period.

The last time it was crazy like this was 5 years ago when Exxon built the $4 Billion complex here and brought 8,000 new jobs in.

This “Houston is booming” nonsense just does not pass the smell test. The oil patch ( especially fracking) is falling apart like a $3 watch with historically low oil prices and volumes. The Healthcare business is bleeding cash with elective stuff shut down, and travel is in the tank. I am seeing auctions of machine tools and equipment from the Houston area flooding my inbox. I think the pumpers are just trying to talk things up long enough to sell and get out.

“The oil patch ( especially fracking) is falling apart”

At $40? Nope.

“Around 80% of shale DUCs currently have break-even oil prices below $25 West Texas Intermediate ($30 Brent), Rystad Energy’s data show.”

https://www.rystadenergy.com/newsevents/news/press-releases/us-drilled-but-uncompleted-wells-first-to-feel-fright-as-oil-price-bungee-jumps/

Just Some Random Guy,

Interesting article, but I think you misread it (it’s not the clearest article I’ve ever read, for sure).

These DUCs that the article is discussing are “drilled but uncompleted wells” — they have the initial drilling costs already sunk into them (sunk capital). Now there are costs to complete the wells and frack them. These costs to complete the wells require $25 a barrel to make this a break-even affair. At less than $25 a barrel, those DUCs will just sit there because the incremental cost of completing the well will over $25 a barrel produced by that well. That’s my reading of what the article is saying.

Demographics have not been discussed enough when talking about re and other investments. Take a quick look at how many people were in the us post ww2.. look today.. extrapolate.

Pee’d clean today at 330pm start at 445am tomorrow. If my blood pressure was lower(had medical card) could beon road in hours

Moral hazard is now no longer just a corporate phenomena, it has now infected the public in general…..

In my subdivision of a few hundred homes there is not a single home for sale. I have never seen this in all the time I’ve lived here. The new ones being built can’t keep up with demand. I think realistically my home has appreciated $50K since the Corona days began.

JSRG,

Just curious, what part of the country are you located?

Your unfettered optimism based on anecdotal evidence is awesome. I honestly wish I had more of it.

As long as the world governments can outrun the virus fear and out print and defer the massive debt that is everywhere with asset values that are so misaligned compared to average earnings then everything will be awesome and all assets will continue to the moon.

Down in reality land I have my doubts.

It’s not just anecdotes. Look at data. Everything from job creation to real estate to TSA daily checkpoint. The trend is positive. Of course if you look hard enough you can always find bad news. You could do that 6 months ago or 6 years ago. At no time is everything perfect. Difference between me and most commenters here is I focus on the majority good stuff, you focus on the minority bad stuff.

It is amazing what one can and cannot see from such lofty ivory towers.

Michael Hudson’s latest article “Remarks from the Systematic Crises…” says we are facing an era of severe debt deflation. He seems to make very good sense.

Great to see this I-shaped recovery in house sales. But..

Feels like the stock market has lost momentum and is slowly turning. Accelaration down could be breathtaking.

I have really never put much faith in what “all the people” are doing.

Only about 5% of “all the people” have enough money to give them the credibility that they have been actually making smart money decisions. In addition, they are usually doing just the opposite of what “all the people” are doing.

The other 95% are simply lemmings lining up to run to the cliff and get their backsides handed to them one more time.

Jdog-akin to what I learned in the moto biz in the early ’80’s, when the demographic and general wage of the ’60’s-’70’s had made it easy to do well by hanging out a ‘motorcycle’ shingle to young Boomers. So well, in fact, that many then believed in their own indisputable financial genius (including the Japanese manufacturers who embroiled themselves in a market-share war of massive overproduction) only to slip in the bloody streets of wage stagnation, stagflation, residual national debt from the Southeast Asian conflict, and, perhaps moreso, the young Boomers’ pretty young wives pronouncing: ‘…I’m pregnant and we’re buying a house-you’re not spending another cent, or making me a widow, by riding that thing…’.

The U.S. motorcycle market didn’t recover until the ’90’s. It was still possible to buy ’82-3 vintage machines new in the crate until ’88-9.

May we all stay well and find a better day.

So what two jobs did you work to support six kids in America? I would love to know. Let us compare your jobs and what they supported compared to the equivalent job today and what it would support.

I am not saying this is true for you but one of the things that angers the younger generations is older folk comparing the golden days of America to the current realities of America. They ARE NOT THE SAME.

This is why “okay boomer” has become a thing.

and Okay boomer will counter that with “Why don’t you pull yourself up by the bootstraps?” every time and the cycle goes on and on….Don’t think Millennials will have the luxury of doing the finger pointing to generations that follow. They have the pleasure of dealing with two financial destruction in one lifetime. As a Gen Xer myself, I have a lot of sympathy for that.

I don’t subscribe to most the generational BS but that’s right on. This perfectly exemplifies the reason “okay boomer” came to be. Boomers in the US simply grew up with more tailwinds than headwinds. That’s nothing to demonize, but a little humility is often in order. We millennials have it great compared to most folks in history just like our parents.

This debate always reminds me of the concept of self serving bias, which is the idea that people tend to attribute their wins to their own actions, and attribute their losses to external factors.

I’m a big fan of personal responsibility, hard work, and saving money for a rainy day. But every time I hear some old fart yammering about bootstraps I just roll my eyes. It’s not that simple.

Capitalism has worked in my favor so far but it’s not the same experience for everyone. It has some warts that are looking pretty ugly right now.

I have put my mountain house for sale. I believe there’s still a small window of time to sell.. with California stabbing the landlords in the back and bad tenants trashing my house.. I’m done with that.. I have no problems paying the mortgage, but I fully expect that the property taxes will increase as well..my money can be of better use elsewhere.

Good move….

I am looking at the same in Marin. Are you in Pacifica? Will you stay or is this a get out of Cali move?

In the Twin Cities, this weekend was full of moving vans all over the place – saw at least 6 around here and people over in Uptown/Lake Street (where the riots and shootings were) saying the vans were EVERYWHERE with people leaving and no one coming in. More on the highways. Downtown is a ghost town. People either moving further out to suburban units or back home to their parents’ place. High-end houses going up for sale but see no sale pending, at least it this particular corner of the metro.

Everyone talking about the city council abolishing police – lots of unanswered questions. Lots of concern.

A couple miles east in the Longfellow neighborhood, homes are on the market and turning over. The typical, nice, entry level Craftsman that’s a 100 years old is pulling down some reasonable numbers from what I’ve seen.

https://www.startribune.com/it-s-a-dogfight-out-there-buyers-facing-an-even-tighter-twin-cities-housing-market/571343082/

I had standard union job driving a big rig and worked 55 hours plus a week, 15 of those hrs overtime money.. when the overtime disappeared, then it was a second job. Not a fancy house and we had two used cars.. after my daughters grew up, I completely paid off the second loan on the house eight years ago as well as 18k in credit cards 10 years ago. With only a small mortgage cost and just 73k left to pay it off, I can do quite well now. The less debt you have, the more freedom..I’m going to sell that house now..

Also I’m just 3 years retired, so it wasn’t that far back..things are tougher now for everyone , but there’s always opportunities to succeed. Expecting the government to take of you isn’t really a great solution. Hi we’re from the government and we’re here to help..there’s always a price

True agency is impossible.

The government + the private sector. They are conspiring to make things harder for regular citizens of this country. The cost of our health care alone can cause someone to fall into the abyss.

The OP is lucky, that’s all.

Like the first Depression this one seriously affects a relatively small number of people. The people who are not bothered don’t come to these websites, have no issues with the economy, or the stock market. In between those who continue to prosper and those who don’t is a large group which is hanging on, mostly expecting that the crisis will never get to them, because it never has. The real change in modern finance, is the crowd with financial herd immunity, which has a gov or quasi gov. job or pension or contract. Really since Reagan is that the case.

Looks like a few didn’t get the memo, read a paper, watch the news…

Many of the states that opened up are hitting new infection records and the governors are ordering new lock downs of bars etc. I believe some counties in Texas included. One official opining that at present rate of increase, half the US will have it by Xmas.

My numbers say that we get to 50% infected in 12 weeks.

That would be around October 1.

Ground truth: I am no longer in Sonoma County.

I am now in NW Pennsylvania (Mon Valley).

The stores require masks and the Home Depot has a bouncer (!),

at least on the weekends. Except for the stores requiring them,

only about 1/4 of the people are wearing masks.

Many people have asked me if the virus is for real.

The county has had 4 (four) people die of Covid-19,

and that means that pretty much nobody has had it around here.

When the virus gets to the rural areas, it will be ugly,

but I don’t think that is going to happen any time soon.

Can’t disagree on that Brian

Interesting little story how it’s starting to crack on the white collar front…unfortunately I get the feeling this will get worse over the next 6 to 12 months as companies looking to cut cost in other creative ways. Which brings a question to mind, for all those FOMO buyers that just bought and for all those that think we’re on the up swing to recovery, good luck when you’re out of a job all of a sudden and staring with a new mortgage.

https://www.yahoo.com/news/fear-job-loss-uncertainty-stalls-113839008.html

Yes, I’m a Boomer, my parents were members of the Greatest Generation. And yes I was lucky, and I took advantage of my luck and got a college degree on the GI bill after a Vietnam era stint in Korea. And yes I took advantage of 401 K plans when available and IRA plans when not. And yes, I watched the ups and downs of the California housing market and finally jumped in at the bottom of a cycle (1994), bought a few houses, and eventually consolidated into one house owned free and clear. And yes I’ve been retired for 17 years, and have enjoyed it so far. I’m sorry about subsequent generations not having the advantages I had, but there’s nothing I can do for you. You have to make the best of the lot you find yourself in. It has been that way since the beginning of humans on the earth, and many generations were a lot worse off than yours.

The young are wising up, a ton are living in vans, traveling around the world, uploading their adventures in youtube for me to enjoy.

Let’s face it, that’s a better deal than what California can offer its young. Why serve the system when it’s not serving you?

I just don’t get it. Why is all the anecdotal evidence so contrary to the data you present? Why is there such a disconnect?

There is plenty of anecdotal evidence to support the data.

Imho, it’s because the people on the comment boards represent a very tiny slice of reality. Observations are interesting and can also be utterly meaningless.

I learned from a man who got his FL Real Estate Appraiser’s license in the ’40s that RE is a trailing indicator of the economy. I was punched hard in the groin by the ’07-08 financial crisis and hence just sold my RE. I’ll gladly sit on the sidelines for the prices to come back down to reasonable before I dip my toes in again.

I’m not a boomer but it is a fact that for most people, wealth is accumulated over 20-40 years of steady savings. It’s hard to see that when you are young.

I think the biggest problem for young people now is real estate inflation, which has been massive in popular places for several decades.

Something is fishy. I have a feeling a lot of hidden bailout money is going to people or entities that are buying up more housing stock. Again. Yup, I get people are moving out of cities and out of high priced places, but still. IDK, to me it just doesn’t add up.