If the pandemic changed where Americans want to live – dense urban centers or suburbs – it will be one of the most far-reaching developments.

By Wolf Richter for WOLF STREET.

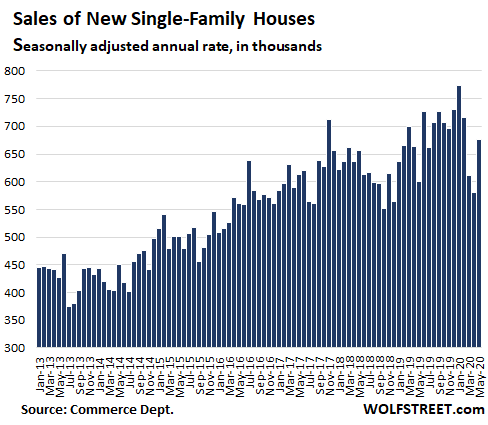

Sales of new single-family houses rose 12.7% in May, compared to May last year, to a seasonally adjusted annual rate of sales of 676,000 houses, according to the Commerce Department this morning. There has been reporting by homebuilders on interest in new houses, as some home buyers sought to avoid buying someone else’s home due to the issues of the pandemic, such as social distancing requirements and the fear of spreading or catching the virus. The pandemic-induced “move to the suburbs” is also said to contribute to interest in new houses.

This increase in new house sales occurred even as sales of existing homes plunged 26.6% in May, the steepest plunge since 2008, to 3.91 million homes seasonally adjusted annual rate, the lowest since the depth of the Housing Bust in October 2010, with house sales -24.8% and condo sales -41%.

Then there’s the coming revision. In the new house sales data, revisions the following month tend to be large, and so today, April’s new house sales were chopped from 623,000 reported a month ago to 580,000 today, the worst April since 2016. So, May sales will have to be looked at again in revised form a month from now.

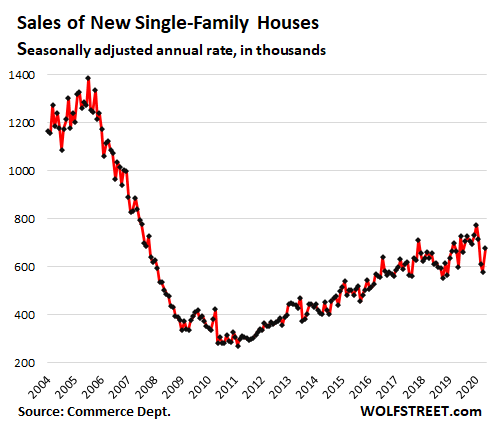

Over the longer horizon, the massive boom in multi-family housing – including the condo and apartment towers that have sprouted like mushrooms in urban centers around the US – has replaced a significant portion of demand for single-family houses.

Single-family house sales in May 2020 were on par where they’d been in the 1970s. The sales peak occurred in July 2005, at 1.39 million houses sold, seasonally adjusted annual rate. Long-term, this hasn’t exactly been a booming business, in terms of numbers of units sold:

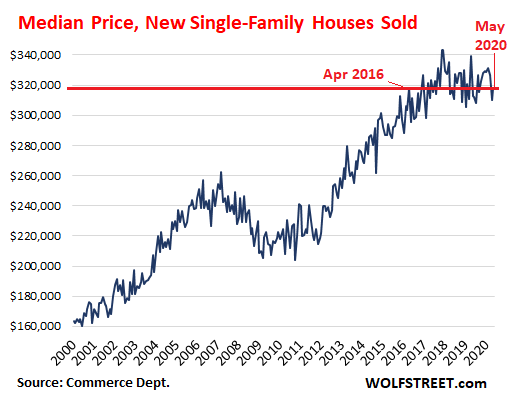

Median price below where it was in May 2017.

The median price of new houses has been in the same range since 2016, with the high occurring in late 2017. In May, the median price ticked up 1.6% year-over-year to $317,900, below where it had been in May 2017 ($323,600). The first time the median price exceeded that level was in April 2016:

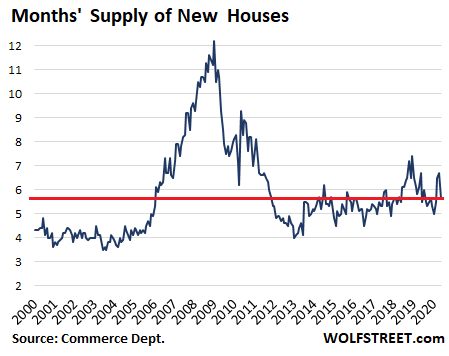

Plenty of inventory of Spec Homes

The supply of unsold new houses declined to 318,000 seasonally adjusted, for a supply of 5.6 months at the current rate of sales. Four months’ supply of spec homes has historically been more than plenty:

Whether this much-discussed pandemic-induced mass-exodus from condo towers and other high-density multifamily housing in urban centers to single-family houses in suburbs or even distant smaller towns – empowered by working-from-home – becomes a real trend with staying power remains to be seen.

There are certainly some people who made this move recently. Some of it has been happening for years as people start families and want to live in a house. And the reverse has been happening for years as empty-nesters and others move from a house into a condo or apartment tower to enjoy the panoramic views, be in the middle of urban life, and walk to work.

Whether the pandemic changes these dynamics in a visible way and over the longer term – not just for a month or two – will be one of the most far-reaching developments, with big implications far beyond the housing market.

First signs of a very slow-moving mess. Read… Home Sales Plunged Most since 2008, Condos -41%. First-Ever April-May Price Drop in Normally Red-Hot Spring Selling Season

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Before the covid crisis, last year, I heard the mega landlords were buying out entire new construction developments for rentals. This might be happening still. It is cheaper to manage a large number of homes in a single place, than houses all over a city. Who else has this kind of money?

At that point, why wouldn’t they just build them and cut out the middleman?

A neighborhood version of an apartment building… that would be odd, given that neighborhoods usually like some kind of stability in between all the renters.

When mega landlords compress their business to an area, they have more political control over the area. They can buy more influence in local govt, control taxes, zoning, etc. This limits the influence of the renters, who no longer have a voice in their own communities.

“they have more political control over the area”

Can you explain how landlords get political control. How do they influence local governments, control taxes, and zoning? Renters influence their communities, how so? Last I checked, legislators control everything.

Owners would probably sell if a significant % of neighbors were renters. And as that happens, investors buy, causing more renters, causing more owners to leave. Eventually you end up with an entire area of homes that are rentals. Maybe not by design, but organically it happens a lot.

Renters do not make good neighbors since they don’t care about their surroundings. Not a knock against renters, just reality. When I rented, I couldn’t have cared less what happened to the neighborhood since I knew in a year or two I was out of there. I didn’t go out of my way to mess the place up or anything but I didn’t exactly strive for a better neighborhood either.

The banksters have that kind of money from the Federal Reserve which they control and getting new, discounted-price, medium to low-income houses which they can then rent would be an ideal business for them. They have a motive to try to raise RE prices to keep power.

Imagine that someone would lend you a billion dollars at 2-5% without worrying about security or other things that other borrowers would have to provide. You can make huge profits at those rates with most investments.

Your organization’s internal rate of return only has to be 6% to make huge profits, since the homes can be depreciated, and all management costs can reduce the income (including inflated salaries for your family and cronies to have their names on the entity to maximize your deductions.) That is what the “Federal” Reserve provides its crony banksters as a key benefit and the banksters are desperate for the public not to notice the control that they have over the “Federal” Reserve.

Right now, if they want to keep the RE market from collapsing, with the resulting public anger and the public going informed about their shenanigans, they must try to keep prices up. The manufacturers of new homes, on the other hand, have an interest in disposing of inventory that may depreciate in value more and more in the coming months. Each executive wants to limit losses in their manufacturing corporations and/or try to report an annual profit.

I don’t know if this situation applies to the States, but Condo sales in Canada are going rapidly down and flushed due to astronomical rises in insurance rates and deductibles. This is in addition to all the Covid complications in a crowded urban setting/lifestyle.

Homes in established city neighbourhoods are already too expensive, plus looming tax increases and unaddressed urban social problems.

Hence, might as well buy new and away.

You must not live in Ontario, Canada where condo sales are still rising exponentially even with the huge increases in insurance rates. For first time buyers its either a condo or nothing.

Location always matters, size and age of house as well of course.

Not sure about the condos across America, they are doing well in my area last time I heard. In many areas in America, the maintenance fees or rules, are just too ridiculous though for condos. Depending on where you live, they can just raise the fees or introduce new rules at any time, as much as they want. In America, it’s usually pretty easy and cheap to find people to do yardwork anyways. I would say condos almost never make much sense to buy for personal use. Airbnb and new hotel developments can also replace condos that are second homes. I know of a few older people that use Airbnb and no longer have interest in or have sold their condo “that was a second house”. For second homes, Airbnb apparently is a better competitor than a hotel, for many people. Not sure about the social life at an average condo with amenities.

But, for everything there are a lot of areas in America that have just, become, too expensive. Income inequality (between age groups), hurts the younger generations, especially hard, because, the prices for everything are based off what the people 40+ can afford, and the younger people are getting priced out.

Alot of the houses that are unsold for awhile near me, are either old houses that may have undesirable traits like shared driveways, very small backyards, or POS Garages. And expensive houses that are weirdly located, have strange layouts or some other quicks. A very small amount of old houses, are totaled, and the real estate agencies won’t touch them.

The garages can get pretty ridiculous, they are often holes in them, that nobody bothers to patch, and are poorly lit. Some houses sit unsold, for basic easy to do stuff like this or are in desperate need of being repainted.

Houses are still selling well in my area, for reference, I live in an average midsized Midwest city, an average newer house goes for about 230,000usd. Prices have been rising though ever since the 2008 recession ended.

As working from home becomes more prevalent, and the social scene in cities remains restricted, the suburbs become appealing.

I have colleagues trying to work from home in small apartments- not fun.

Yeah, but, the lockdown isn’t forever. It has to be something else than just that.

Being able to get the big city job anywhere, if that lasts, could be a much bigger deal. Also, being able to move somewhere, without having to switch jobs, makes moving alot easier. Even if you were offered a job in a new area, keeping your current job, would be easier and less stressful.

For some people in NYC, especially, I could never imagine living there after people were imprisoned in their own apartments/homes. The psychological impact of being told, when you are allowed outside your residence, will have a more substantial, potentially lifelong impact. In my city, the city wouldn’t ever dare ever to do something like that. In the whole Midwest, only probably Chicago, could get away with that. In Michigan, although they tried, the cops refused to play along. I’m not aware of anything like that being tried anywhere else in the Midwest.

Went with coworkers to Tysons mall to grab lunch at one of our favorite spots. The mall was jumping. The parking garage we were in, there was a lot of cars swarming around trying to find spots. Once you got away from the entrance level there was a lot of spots available which shows that there is still weakness. Looking at the shoppers, there was a lot of bags in hand so transactions were happening. Not sure if it’s pent up demand. It’s a Tuesday, a workday although summer. No where near as busy as the old days but it felt super hectic. It shocked us, and was kind of annoying as we are used to having everything empty and to ourselves. There weren’t many tables in the food court but there were outside tables in the roadway that was closed off.

Signs of life in the economy, at least here where many are fed by the government teet.

Tysons is a special place – tons of high earning government contractors – Booze Allen, SAIC, PWC, and many others when I was there. I use to live down Greensboro Dr. from the Mall. Not quite has crazy in those days (90’s).

My wife’s workplace in on the edge of the portland metro area where there is still land for building single family homes. A very large ( largest in Oregons history in a single location) development got going about 5 years ago, and the homebuilders starting building and selling homes in ernest about 2 years ago. Now they are flooded with inventory of new homes at all price points ($375-$975) and are desperate to find buyers. Three quarters of the Zillow listings on this end of town are for new homes ( easy to tell because they are renderings and not photos). My guess is that they are discounting and putting together financing schemes that have resulted in extra sales compared to the existing homes. The existing sellers are not as motivated and not discounting much yet.

It’s obvious shutdowns are good for the economy.

Great review of the data Wolf. As always…

I think that we’re in for interesting times viz. the housing market. The charts will reflect this. But I’m especially interested if the movement from urban to less urban really takes place. Many more factors involved than simply desiring to move — unless people actually being to abandon their homes and hand them over to lenders. Fear will do that.

It will be a couples years before the dust settles.

A key difference is timing: the New House data have much less lag.

Many of the May “existing house” sales were contracts signed in March-April, in the depths of the COVID shutdowns, market swoon, and peak anxiety.

The May “new house” sales were actual transactions in May.

The feed back DATA on the Economy and sectors including housing is distorted with vested interests, hopium about re opening and blind faith in the Fed. Trillions tricking through the economy, holding up hope!

only after the end of 3rd qtrs, the numbers will become more clear. Until then no conclusion can be made re 6 -12 months ahead!

The flight to the suburbs is more likely hype than reality. A knee jerk reaction.

Most people simply don’t have the resources to suddenly up and go. They have roots and are tied down by previous commitments and jobs.

Ironically if you lose your job, and roots, the lack of resources means you may not be able to stay in the city because it is too expensive!

@ WES “They have roots and are tied down by previous commitments and jobs.”

Urban Renters don’t have deep roots. Job might tie a person to a city/region but not to a specific urban vs. suburban housing location.

The first point with COVID is that many people have been freed to work from home, so the job doesn’t constrain their housing location anymore. They’re not necessarily moving far away, just out from the troubled urban cores.

The second point is that with COVID, a crowded urban commute is now often riskier than a suburban commute, and certainly riskier than no commute at all.

Third point is that some of this is just accelerating an inevitable demographic shift: younger people, getting married, soon want to live in child-friendly locations. Meanwhile, older folks who might have moved to downtown condos for an easy retirement lifestyle are going to stay out because of the health risks.

In a market with low turnover rates, it doesn’t take that many movers to temporarily sustain suburban housing prices at the expense of urban prices.

One interesting thing about the last 4 months was seeing how fast the tourist and student units went to the homeless tenters. You know you have a problem when some of the most productive and intelligent people in society are saying: phuck it, and moving into tents. And the unproductive dopes, malcontents and conceited warholes? they live in houses.

Here is a challenge for those who are bullish on the housing market. Show me one single example of a time when a recession with a 20% unemployment rate resulted in higher property values a year, or two, or three later….

You are right but this time is different and my locality San Diego is special

I just escaped San Diego, after living there 50 years, it is not special, and this time is not different, people who say this time is different, have not been around long enough to know that phrase is repeated in every boom bust cycle and it is never true…

People forget that we live in the SoCal oasis for the climate. Not needing heating or air conditioning, with beach, mountains, beautiful views and no worry about mosquitos is the ultimate luxury. And at one time it was even reasonably safe and the schools were not indoctrination camps. Now we pay to the Sacramento Mafia and their cronies in government jobs through the nose to be allowed to live here. One wonders when the ransom we pay is becoming too much. Eventually it will end up like Monte Carlo or other exotic places with ultra rich and their servants in the surrounding desert.

San Diego is the new San Francisco, so you might want to come back. After Covid “Bio” will be the new tech. Military has a much lower profile. O’side was a dump even ten years ago, I told people buy prime beachfront property at half what Del Mar costs. TJ and San Diego form an urban megacity with cultural crossovers, like LA without the mind numbing expanses. (Just tear down that wall) Farther down Baja there are plans for a port larger than the port at LA. The demographics are changing as well. City may have a gay Latino Mayor.

OK Challenge accepted

1. It’s 13% not 20%

2. It’s temporary as you very well know, as do all bears, but for some reason pretend you don’t.

Just Some Random Guy,

It’s not 13%. Even the BLS said it made an error and that its rate is 16% when the error is corrected. And even that is wrong. There are 29.2 million people on state and federal unemployment insurance (per DOL), plus many more people lost their jobs/work that don’t qualify for unemployment insurance. So that’s about 20% of the labor force that got laid off and is now without work.

Well than explain why RE in my local is booming the most i have seen in the last 20 years. Maybe a peak or maybe a continuation of a trend. I have also heard some saying dont buy big tech… that was 10 years ago and now i say ‘told yeah so’.

All it takes is “pent up” demand from a narrow slice of buyers for it to appear booming.

FOMO, fear generally, new paradigm from WFH for many.

Even if just 1% have the cash and inclination to move, they’re all picking the same time to do it, and boom… mega sales.

It’ll be the inverse in September as reality bites.

Anyone over-paying now, on something they don’t intend to keep forever, is a risk I won’t be taking.

Issue is if you are a cash buyer and don’t buy, the risk is on your cash savings instead.

Greater fools and FOMO. Cashed up retirees probably. When that golden goose stops laying, things will show themselves truthfully. You get massive lag with RE. Chances are listings up, sales volume down and prices still high. Watch the sales volume because price follows that trajectory given time.

Whenever I point out that houses in my area are selling for much more than they should be and typically in short order I’m told it’s not happening. I checked on Zillow today and there are 32 SFR’s available in the entire zip code of 92115. There’s thousands of homes here and only 32 are active, most of which are junk. (I didn’t include multi family, condos, etc in the search) The good ones go in a few days, the not so good ones go in a few weeks, and the way overpriced junk pretty much sits, but it’ll be going soon as it’s all that’s left. Things that would’ve fetched mid 600’s pre-scamdemic are now handily getting over 700, sometimes well over. Every neighborhood is different so I can’t speak to the whole city or county but things are in very short supply over here and when something comes up it goes fast if it’s half way decent. For what it’s worth, my wife’s cousin from San Francisco is looking to buy here for an eventual move from there, more like an eventual escape. I’ll wait now for everyone to tell me this isn’t what I’m actually seeing here.

Agree. The prices in Orange County are still climbing. In Tustin in our neighborhood condos are going for 750 to 1 million and that is with monthly fees in the 500 dollar range. And that is with the loss of the Chinese and Persian buyers who were always a large source of all cash offers. We are seeing a lot more Indian, Pakistani and African buyers though and they bring cash. We see very few Anglo buyers now. For wealthy people in the global south a lily pad in California is cheap life insurance for when the Taliban or Boko Haram come calling. And when a Boko Haram or Taliban warlord wants to retire and enjoy his wealth and send his kids to Cal or UCI what better place than Irvine or Tustin. And Biden will open up immigration from China and Iran again and bring back the SALT deduction which will have a postiive impact as well.

Sorry,can also confirm here in San Diego. Houses don’t last more than a few days on the market if they’re in any decent condition. My wife and I basically have up. Over the last month all the homes we went to look at already had 5-6 offers in on the table and that was only 1-2 days after being listed. Most homes are going for over ask on what I’m seeing on Redfin. I don’t care what these charts show, that’s not what’s happening on the ground level. Inventory is down. Way down. But prices are up to the moon right now.

Back on May 29, so nearly a month ago, “Bob” posted a comment here, in a similar thread, with a house for sale in San Diego, asking $769k, and a link to the Redfin page for that house. I didn’t allow the comment because it might have been his house he is trying to sell — but the comment is still here in moderation and I can see it and follow the story.

And that house, nearly a month later, is still listed for sale, and Redfin still exhorts you to make an appointment. I might write a brief article about it when it finally sells or gets pulled off the market because it hasn’t sold.

Here is what Bob said on May 29 (link partially removed):

………

“Let’s see what happens, posted 13 hours ago: https://www.redfin.com/CA/San-Diego/…

“It’s a boring looking house on a quiet street in a nice neighborhood. I really only pay attention to college area neighborhoods near SDSU so admittedly don’t know how the rest of the city is doing. I’m not sure I want to be feasting on popcorn while so many struggle but do agree that these are strange times and it’s been very interesting to watch. There have been very very few listings here which is why sales are so low here; maybe not elsewhere, but here it’s been the case. I would’ve pegged this house at 625k a few months back. So much paper money being printed has to be affecting the craziness as well.

“I guess we’ll see in a few days if Captain Renault comes knocking at my door.”

I was wondering why you never posted that comment. I figured it was my snarky Captain Renault reference. I couldn’t open the Redfin link so went to Zillow instead (easier to find from map function). This house falls into what I consider the not so good category of house that should’ve gone for low 6’s pre scamdemic (last sold for 586k in 2017). Drumroll please… Zillow shows it listed on 5/28 and pending on 6/15. Back in May when my wife and I were walking around the hood I saw the coming soon sign, so called the realtor. She happily called back and told me that given what she saw houses doing here she was going to list it at 769k and even referenced a few others houses for me to use as comparables; her tone suggested even she couldn’t believe the price she was about to list it at. It was then that I really started to keep an eye on things. In that time a few other houses have come up and have gone into pending at stupid high prices. I actually know of another that’s about to come up at a really stupid high price in July as I put the word out to the neighborhood busy bodies that my wife’s cousin is looking to buy here. Quite frankly, this house should never have gone into pending at that price and by all rights should fall out of escrow for not appraising, but it’s been pending for a month now. When one looks at LTV’s, normal incomes, etc nothing in this hood should sell for over 700 or so, but they are. This, to me, means that a higher income of folk is flooding our neighborhood and driving up prices. This is also backed up by the nanny meter. We never had nanny’s pushing around baby strollers but we have them all over the place now.

Wolf, you have my email, I can send you links to places here that went for way more than they should’ve and give you more of my background here if you want. I enjoy your posts.

Okay, so I’m replying twice, but I have info. Just walked by the place today and there’s a pod in front (old owners moving out). I also did some digging and it appears that the only thing that may hold this up is inspections and the back and forth that goes with that. Big news, though, is that it appraised and the offer was in that range of asking. For various reasons I could only obtain so much info as there’s so much liability in anyone telling anyone anything anymore until it actually closes escrow. If all goes well should close mid July.

I also walked by the other place that’s coming on the market and it’s being painted (lipstick on a pig as far as I’m concerned) and will be on the market for 799k soon.

I don’t see how this ends well.

When it comes to housing the ONLY thing I’ll ever believe is that I’ll never be able to comfortably afford one within a hundred mikes of an available job. Jobs and housing prices go together. Work from home is an option for a tiny few high tech people.

Look who has interest in keeping home prices HIGH: real estate sales (bigger commissions), Bankers (bigger loans), governments (bigger/more taxes & higher costs of building permits), developers, (more profits), Federal Reserve (numbers look good), present owners (feel rich),.

Look who has an interest in LOWER prices: buyers, notably first time buyers.

A generation or more, screwed out of home ownership; turned into debt slaves. The fix is in.

Being a homeowner is never impossible, but it can be difficult. When I was young, I purchased a home in one of the countries most expensive markets with a very low income. The key is sweat equity. The home I purchased was basically a wreck. It needed everything and no one else would even consider it. I worked every night and weekend on it for several years. In the end, due to the low purchase price I was able to pay it off early, and because it was basically completely remodeled I was able to get a good price for it. I learned to do everything from framing to drywall and paint, and gained an invaluable education. I repeated this process a few times and it made early retirement possible…

@Jdog None of this works when home prices are massively inflated above their build costs. The amount you can save from doing a renovation yourself is fixed, so as the value of homes increases, the percentage saving from your sweat equity becomes increasingly insignificantly.

Further, the fiscal benefits of paying off the mortgage faster are lost when interest rates are zero. You do not get any interest compounding from living like a pauper while young to pay it down quicker. In fact, with negative real rates, it costs you more in the long run.

Housing is in upside down lala land. I suspect it won’t end until a ridiculously small number of people own all the housing and the remaining existing home owners finally realise that their standard of living has not risen with their nominal paper wealth.

Good luck with that. Wrecks sell for more than new in Australia. I can’t compete with fools.

Once elevators are replaced by the teleporter, expect apartments to be in demand.

One thing from those graphs.. if you cut your production in half, the prices go up.. and up.. and up..

I am guessing the prices are in nominal dollars, and not real dollars Wolf? If so it would be interesting to see how much the median price has gone up in real dollars.

For now, the lack of listings is keeping prices high. The Elite, the Flippers, Hedge Funds and Government Employees have money and are still buying. That may change if the inventory grows from coming foreclosures and evictions. It’s not the average Joe six-pack that is buying. His FICO is weak, his employment uncertain and he’s out of cash. The buyers now benefit from Socialism while the average private-sector worker is reeling from Feudalism. We are definitely seeing a coming class war. You either suck off the Govt or you are disadvantaged.

There were a lot of people that pulled out of the house shopping market when the market crashed because they were using stocks as down payments. Market is back up now so there are plenty with money for a payment if they played their cards right.

What gives? Easy. New home sales are booked instantly. ie you buy today, that sale counts for June. With existing sales, the “sale” is counted when the deal closes, which is 30-60 days from when the buyer and seller agree on a price.

May existing home sales are really sales that happened in March/April and closed in May. March/April was peak ‘Rona hysteria so there were few sales. May sales will close in June and July and you better get ready for a huge increase for those months, which will correspond with new home sales in May that shot up.

Yet 30% of homeowners did not make a mortgage payment in June…..

But they are going to catch up…. Yea, I believe that…. Like I said, the effects of this are not going to begin to be seen for another 6 mos. But I can tell you right now that anyone buying a home now will very sorry in a year or 2.

Won’t matter if Newsom says no covid related foreclosures.

“But I can tell you right now that anyone buying a home now will very sorry in a year or 2.”

Bears have been saying this for at least 10 years.

A house is a liability unless it generates positive cash flow, according to the Rich Dad, Poor Dad guy.

You can still buy 40 acres for under 100K in the Ozarks(Arkansas/Missouri) and build an absolutely beautiful huge home for well under 500k. It’s an option if you can work from home complete with forest, wildlife(both kinds), fishing, farming, complete privacy.

Are you old enough to remember the movie Deliverance? I thought not

So according to Bloomberg no less than 13 companies sought bankruptcy protections last week, highest since May 2009.

Bullish?

Bullish for big tech. This has pushed AI into overdrive!

Sure. Where’s the so called self driving car?

there is a loop in my city here in Canada for testing. Not yours? Patience is a virtue. If someone told you 20 years ago you would be talking to alexa and there would emerge a computer in your pocket with built in Neural processing 1000 times more powerful than the largest computer at the time you would probably have a hard time believing that too. Its coming the virus and environmental agenda will make it happen faster than we think. In the meantime drones can deliver your packages from amazon! ;). Keeping an open mind and understanding political agendas has been very good to me the last 20 years. With quantum processing and AI at the doorstep i think i have at-least another 15years of exponential growth.

It’s lost with the Amazon drone (and my package). Still better than the Post Office though!

LOL @Upside down. I live in SF, tech capital of the world. Tons of self driving cars here, and they are all nowhere near ready.

Alexa is rubbish.

The increase in computing power was predicted by Moore’s law more than 40/50 years ago. Nothing new. But of course you forgot to mention that hardware engineers can no longer scale processors the way they used to, they’ve run to some real physics.

I work in the tech industry as a programmer so I know the difference between hype and BS.

There were 2 “AI winters” already, not unlikely we can have another one due to this crisis

13 bigger companies. And a lot more companies that are smaller ones.

Even more bullish!!!

According to housingwire.com:

“U.S. mortgage delinquency rate rises to 7.76% in May“ 12/22/20 article by Kathleen Howley.

+12.7% YoY, but looks like easy comps and hardly breaking out of trend. A breakdown of price points for these sales would be interesting.

Also, the bulk of home sale are existing homes — like 7x – 8x new construction.

It took several years for housing to bottom during the GFC. We haven’t yet seen the fallout from the cascade of defaults, bankruptcies, layoffs, and the end of UIC and mortgage moratoriums. I see considerable risk for housing (and economy and markets) to decline for a while.

Cheers!

It’s simple, with existing homes ,buyers can only come in and make offers above asking price when the home actually exists. But in my little burg the high income ,white collar, two income professionals can roll in and make offers and bid up prices before the house is even on the drawing board.

Your burg sounds exactly like mine. Let me guess….small city but big enough to have “stuff” you need, low crime, limited ‘Rona cases and either no or next to no recent protesting? This is where everyone is moving to. And real estate in places like this is skyrocketing.

3 more motivators for home sales:

1) Interest rates are exceptionally low. So it’s easier to borrow to buy.

2) Interest rates are exceptionally low. So rental income looks more attractive compared to bond investments.

3) The Fed and FedGov have shown they will print-and-spend their way out of any future “issue”, with no financial discipline or fiscal responsibility. So, looking long-term, inflation is inevitable. In that case, shorting credit (borrowing) and owning tangible assets has far more long-term upside than holding dollars or bonds.

Here in Sonoma County I can tell where the supply will come from, it’s the demand that is the question.

There will be less local, organic demand because the economy has been hard hit and tourism won’t come back quickly. That’s officially 10% of our economy.

The increase, if any, in demand will come primarily from other Bay Area Cities where people sell their existing home and buy here, or where they have either a big down payment or enough dash to buy outright without selling first.

Job losses are moving up the economic ladder, people who are unsure about their future incomes do not buy homes.

It’s a drought year and Sonoma County has had significant wildfires recently.

People are aware of the risks here and the cost and difficulty in obtaining fire insurance are factors potential buyers consider.

Although SF is the only Bay Area County without serious wildfire risks, that is not the perception and perception is what counts.

So, what do I expect?

Nice homes with a bit of land (2-5 acres or so) should continue to sell quickly and for a good price for a while longer, the low end will die and the in between will..be in between.

Keep in mind that Every County in California is hurting financially and there will be cuts in essential services and that is true at the State level as well (CalFire).

My opinion is no more than an informed guess, that’s the best anyone can do at this point because there are simply too many unknowns and too many variables.

The exploding Covid cases might threaten the US

dollar reserve currency status.The Senate will act

to prevent this.

The Senate cannot prevent anything This is happening and WILL happen and the only thing people can do is prepare for the eventual demise of fiat currencies, especially the USD

Got GOLD? If you don’t, you should

This is a good article that puts it into perspective. I saw headlines this morning and they were very dramatic in stating, “New Home Sales Skyrocketed This Month!” but Wolf put it into perspective showing the range/levels reflected from 2016. Thanks, Wolf. The the transparency on Wolf Street is priceless.

As all roads use to lead to Rome – now all roads lead to the FED…and they have for a while. At first gradually, then suddenly will all their cheap money flooding the landscape with the excuse of helping the economy. You want a house? Well, you’ve come to the right place !!! You no longer need to toil and put away a 20% down payment (like in old fashioned times) as 5% will do nicely. I guess that is an improvement from 2008 when there was 0% down. This, along with all other FED meddling on a grand scale has put our economy and society in some kind of “altered state” as I really don’t know what to call it. This “altered state” will be painfully cleansed by the runaway depression train that is traveling toward all developed countries in including the USA and Canada. The various administrations, Treasury and FED, all working as one unholy cabal, have been borrowing for years from our kids, now their kids and possibly even their grandchildren as the “hit” parade just keeps on going. Girding the loins has become a full time job, but those with too much debt will be smacked down pretty hard. Simply beyond despicable !!!

“There has been reporting by homebuilders on interest in new houses, as some home buyers sought to avoid buying someone else’s home due to the issues of the pandemic, such as social distancing requirements and the fear of spreading or catching the virus. The pandemic-induced “move to the suburbs” is also said to contribute to interest in new houses.”

This beggars belief.

I rather more suspect that “buyers of new homes” (aka “buyers of new mortgages”) are reflective of the insane degree of HOPE out there. They are not in any fear of losing their jobs. They are confident their choice will attract a higher price when later sold to a greater fool. And they think things will only get better…

They say people go mad in herds but only regain sanity one by one. This economy desperately NEEDS job losses: it might bring back reality.