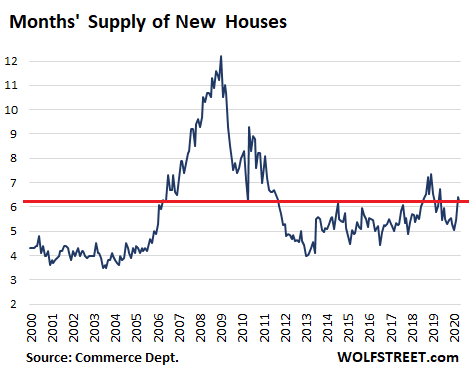

More than plenty of supply: 6.3 Months’ unsold inventory of speculative houses.

By Wolf Richter for WOLF STREET.

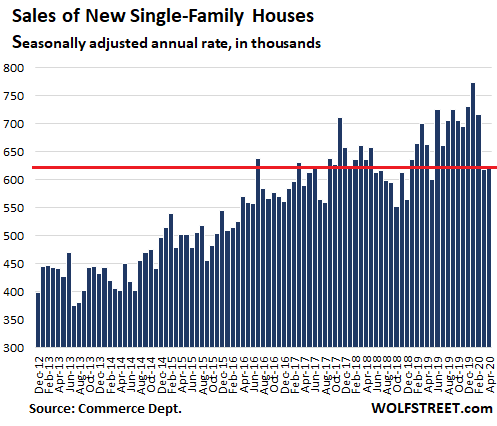

Sales of new single-family houses in April dropped 6.2% from a year ago, after having dropped 11.6% in March, to a seasonally adjusted annual rate of 623,000 houses, down nearly 20% from the peak in January:

This decline in sales has occurred despite record low mortgage rates in April, with the average 30-year fixed rate dropping to 3.23% in the week ended April 30, the lowest ever, according to Feddie Mac data.

And the median price fell.

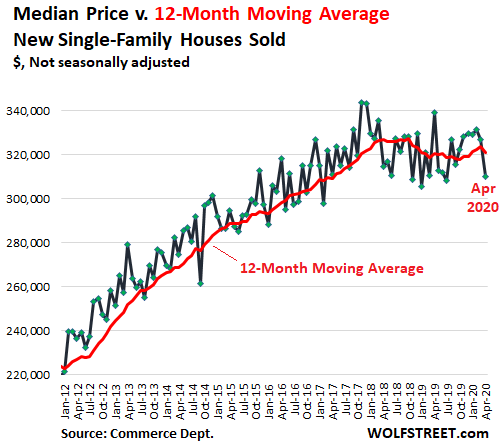

The median price of new houses in April fell 8.6% from April a year ago to $309,900, according to the Commerce Department, based on data produced jointly by the Census Bureau and the Department of Housing and Urban Development. The peak in prices occurred over two years ago in November and December 2017, at $343,000.

This median-price data is “volatile” on a month-to-month basis. The twelve-month moving average of these median prices – which indicates longer-term trends amid the volatility – smoothens out the volatility and shows a downward bias since its peak in October 2018.

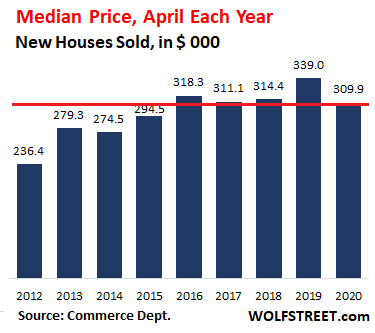

The median price in April of $309,900 was the lowest median price for any April since April 2015:

The median price – which means half of the houses sold for more, and half sold for less that month – is also impacted by the “price mix” of houses that sold in that month. If there is a larger number of lower-priced houses – lower-priced by design – in the mix that month, it helps push down the median price. The multi-year trend shows that, as an industry, builders have run into price resistance, and that they’re losing sales if they push beyond it, and in order to maintain their volume the best they can, they have to meet the market.

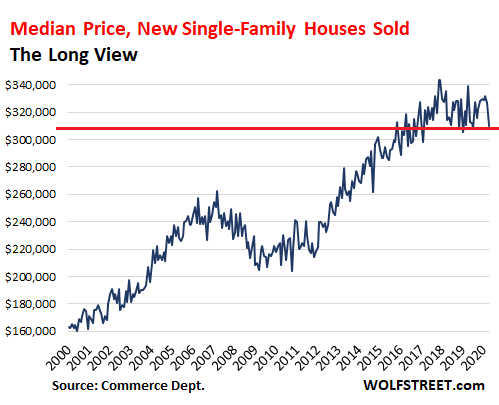

Prices of new houses had a turbulent history over the past 20 years. During the Housing Bust, the median price dropped 22% in the two years from the peak in March 2007 to the bottom in March 2009, then surged by about 55% through November 2017, to top out 31% above the peak of Housing Bubble 1, where it hit that ceiling and has since then dropped about 10%:

Plenty of Supply.

Inventory of new houses that have not sold yet, at 325,000 houses, was roughly flat with March, and provided 6.3 months’ supply at the current rate of sales. Four months’ supply would be more than enough for speculative houses, as it was the case before the Housing Bust – but that hasn’t been the case in years:

Homebuilders, the pros in the housing market, are not hung up for too long on aspirational prices of houses in their core segment. Unlike homeowners, they have no illusions about the market. When they build speculative houses – houses for which they have no buyers lined up yet, and that’s what the 6.3 months’ supply represents – they have to meet the market in order to sell those houses. They constantly adjust what they build, from price levels and floorplans down to the finishes. And then, they cannot sit on their speculative houses for long. They have to do what it takes to sell them. And they’re working on it.

Holy cow, Los Angeles. The California economy is gradually opening up. But the exodus has started hard and heavy. And the influx has stopped. Read… Catastrophic Plunge in Jobs & Labor Force in Los Angeles, San Francisco/Silicon Valley Smacks into Housing Bubbles

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

That pig looks fattened up to me, do I smell a barbecue in the distance?

Maybe I’m living in a bubble but up here in Seattle it still seems like homes are getting gobbled up in short order. I’d love for there to be a little bit more balance in the market but doesn’t seems like that’s happening yet.

What part of Seattle, exactly?

Sorry, Normandy Park. Suburb just south of Seattle.

Same in LA.

Same in Ventura County, CA

This article is b.s. Prices have gone up in San Diego. They rose at the fastest pace in California during first month of covid. Limited supply. Most houses going at ask or above ask with multiple offers.

Matt,

Your comment is b.s.

If you refer to the Case-Shiller index released today, you should know that today’s release was the three-month moving average for sales that had been entered into public records in January, February, and March – entered into public records! So this takes a while. Practically none of these sales were deals that originated in the second half of March – which is when the lockdowns started. So this index is irrelevant now.

The Case-Shiller won’t show the real impact until two months from now (deals entered into public record in March, April and May).

According to the California Association of Realtors, condo sales in San Diego in April plunged 27.8%; house sales plunged 27.0%.

April is normally part of the selling season when the median price rises from March. This April, the median dipped from March. Here is the median price chart for houses. The seasonal peaks that you see are in the summer, with April being a big part of the seasonal up-movement. But not this year.

I live in San Diego near SDSU (a 650-900k neighborhood) and there’s virtually nothing for sale. Of the three neighborhoods I follow (Rolando, El Cerrito, and Talmadge) there’s only about 8 desirable houses for sale of more than 3000. Sales here are clearly lower because things aren’t coming on the market and prices are definitely reflecting the lack of supply combined with increased demand for a yard to play in instead of sitting in a covid quarantine box in downtown. I’m a general contractor so ended up knowing several realtors and they’re all saying the same thing: no inventory, multiple offers, sold over asking price in short order. There’s no doubt that the numbers being reported are general and macro in nature. All that being said, I have a bad feeling that the marginal areas of town along with the long drive suburbs will probalby have some issues going forward as so many working class folks are probably not going to have a job to come back to.

Your perception of my comment may be valid. All I am going on is the anecdotal experience of my wife and I looking for a home. In our price range of 550-600 we have constantly seen homes go above ask with multiple offers. Specifically, in the last two months. And while the Shiller metric may be true for this article, other sources suggest otherwise:

https://www.google.com/amp/s/www.lajollalight.com/news/story/2020-05-26/san-diego-home-sales-nosedive-price-mostly-unchanged%3f_amp=true

In any case, I cant imagine the majority of those unemployed in this city (servers, bartenders, etc.) Owned any real estate anyway.

Amen. Most importantly, the income and savings of the post-baby boom generations become worse, anecdotal evidence suggests, as they get younger. Many older persons in those generations are still repaying student loans!

The RE prices will start to fall more at the higher half and would have eventually even without the virus. Reports are that people are increasingly leaving Southern California and other metropolitan areas. Thus, while the inflation that will follow the oncoming depression or recession will keep the prices of the lower end from collapse, higher priced, metropolitan homes will lack buyers in coming years.

Their prices will fall, except in remote towns if reports of an exodus there and telecommuting are true. It would be nice to live far away in a rural town and all paper can be scanned. I am not sure such a utopian society is possible, but another, similar pandemic would force one.

Truly, I hope all the best experts are wrong about this coming winter or fall or that some miracle cure arrives. This is not a good life and I find it impossible to fall into the blissful ignorance of so many people partying this week — and envious if they survive

I am in San Diego and I can tell you from the ground that homes are having difficult times to sell for the asking price

The market has softened a lot and this is just the beginning

I am not sure what future holds but currently the inventory is low and the prices are not holding up

My friend out his small sfr home for sale in the most desirable area of San Diego although not coastal .. he starred with 950k now at 870k but still not sold in last 2 months

I’m curious what neighborhood your friends house is in. With regards to prices, the college area is on fire (no inventory, though). I don’t much look at other areas but I should to get a better picture of what’s going on city/countywide.

Scripps Ranch and Carmel Valley area

I can only suspect that we still have the inner city feel (walkable, bars, restaurants, etc) here but also offer the single family lifestyle. It’s strange times, no doubt.

In Phoenix area, prices are going up. Our neighbors sold house for 10K more than what it was going for in January just now. Where are the prices going down?

Connecticut Fairfield County especially and I would think Illinois As well

Phoenix is a target of the mega landlords, expect the houses to be gobbled up especially at the first signs of distress. I think the ebuyers bill be there as well.

Good comment Petunia,,, and I think that is what is/has been generally missing in the current analyses of RE mkts generally, and specifically SFR,,, have read similar in multi and multi multi, etc, though may not be true in ”flyover” and similar locations.

PEs and the ”hedgies” have already distorted the SFR markets that I know about starting after the last crash, where they were buying, for cash, anything that looked like a potential errbnb, etc… as well as just a likely good profit via inflation,,, as has clearly happened between 2010 and late last year almost everywhere.

Now even more likely to continue with all the free fed funds fueling these kinds of entities to make it difficult for anyone else to buy now, and almost impossible for our working folks to buy ever, going forward. SO, one of the basic foundational policies of USA, maybe the most important in terms of stability, home ownership, going down the long slipper slope due to the PE and hedgie folks, eh???

I certainly hope not, as it is very clear that home ownership shapes every neighborhood, and that shapes the children coming out of those hoods both good and otherwise.

IMO, the first thing is for all the states to make law that only ”natural persons” can own more than X (some single digit SFRs, or, possibly, same number of other than the multi multi type of residential properties where they belong.

The clear alternative is for massive amounts of rent control type laws and regulations, which I do not like, think it reduced new and better housing, etc… BUT, fair is fair, and if the rich folks continue to steal our housing along with our wages etc., they will reap what they sow sooner or later…

How about we expand that to “natural person citizens”?

I have been commenting for years that rent control was coming. It will come because parasites never stop on their own, they have to be stopped. If we don’t start to enact rent control against these mega landlords we will all land up living in tents, all of us.

To those of you who think, it won’t happen to me, think again. Once these mega landlords become owners in a city, town, or county, their influence will far outweigh the influence of individual owners. They will control HOAs, local school boards, mayors, and all manor of local officials. I have already seen this happen in south Florida.

You need to wait for atleast a year or so as housing is a slow moving ship.

With all these remote work campaign going on, am sure, people would like to move out of congested urban centers like seattle, sfo , bay area etc.

BTW, during last down turn, it took 4 years for housing to find bottom.

Excellent points, jon.

Especially your last one. It might take many years.

Great point. I was building beach houses on the Florida panhandle in 2006. Market dried up in April, but prices stayed sticky for another year before the bottom fell out. Ended up moving to Birmingham, Al. Prices in Bham didn’t come down until well into 2008/early 2009.

Weird listing dynamics going on. I watch Zillow for my area everyday and here is the trend I have seen ( for listings). First the listings dropped way down to a trickle when Covid first hit and no one was going to open houses. Then everyone with houses ready to sell got some kind of virtual reality ( matterport etc.) and listings went back up for the first three weeks in may. But they dropped to just a few dregs over memorial day weekend and almost nothing today ( should be the start of the summer sales season). My guess is that anyone that did not have their house almost ready to sell before the Covid hit is stuck now with services, and repairs hard to come by. We may see a period with really low listings as people figure out how to get a property ready to sell in times of full or partial lockdown.

Much less houses being sold, for significantly lower prices as the housing supply is climbing…

Even with 50 year record low mortgage rates.

And this the 2nd inning.

Wonder how this ends.

My friend just purchased a modest place as a second home at a NC beach. Homes are selling quickly if they are listed close to market value. The virus has spurred some activity. She has a corporate job and will be working from home probably from now on, so she wanted to be able to work from beach home.

Seller had a small business that had been severely hurt by shutdown. He was trying to monetize the beach house. Win, win for both as he sold it for a reduced but agreeable price.

I think when things become normal and things are open there would be a long drawn process of price discovery.

The sellers are still expecting the March prices but the circumstances on the ground has changed drastically in the last 3 months.

The price discovery would be interesting to watch I guess.

Richter,

Stop trying to blow up the narrative on Wall Street, which is “New home sales edge upward in April despite coronavirus stay-at-home orders” (ripped straight from the headlines of Marketwatch)

Stay positive on your message, the stock market needs to hit an all time high this year. It doesn’t help if you keep trying to tell the truth about year over year. When the positive news is a slight edge up from March to April, just like the fact that airline numbers have improved from week to week starting from April to May. Don’t be a downer with the objective truth about how travel has collapsed 80+% year over year. Be positive, be happy. Just shade the headlines a little.

Unless of course, you happen to be shorting the market again. :)

Oh, and while we’re at it, don’t forget about all of the positive vaccine news over the last few days, Covid-19? What Covid-19?

@MCH: We don’t need no stinkin’ positive-housing-spin headlines to rally – all we need is an endless lather-rinse-repeat cycle of BS-but-market-moving Covid-19 vaccine hopium. Today was classic – Another day, another “Dow Jones Surges 600 Points On Coronavirus Vaccine Hopes” headline over at Yahoo Finance. But today the above was followed by a – scary! – “…But Cuts Gains”, it seems there was a teensy bit of profit-taking into the close, leaving the Holy DJIA30 up a mere 500 points and change for the day. I’m sure the folks at the Fed are busily considering whether more $trillions in liquidity should be firehosed in the direction of Wall Street, as 1000-point-plus rallies on the latest “vaccine hope!” rumors or PR from Big Pharma firms looking to boost their share price so the insiders can cash out their shares before it becomes clear that their trial vaccine is not up to snuff or will in fact be years away from possible use have become shockingly scarce in recent weeks.

Today’s Wall Street Bubblemania insta-betting pool: On which date will the product of [HolyDJIA in 1000s] x [latest U-6 unemployment rate in %] surpass 1000?

You got your headlines right, hopium sells well these days. Lancet study of hydroxychloroquine treatment significantly increasing the mortality rate? You would imagine this is major news after all the hype of repurposing that plasmodium medication as an antiviral without anyone having a clue of the mechanism of action and all those super smart doctors claiming it would be unethical not to give it to patients immediately because its the gratest thing since sliced bread… But very little reporting in the major news channels. Improvement of outcome in remdesivir trial not statistically significant and little effect on viral load? The market was rallying by 5 percent when Gilead was hyping their failed Ebola antiviral. But the trial discontinuation by the NIH hardly made the headlines.

Don’t worry, the market is soooo high on Hopium, any regular person would’ve overdose on it weeks ago. At this point, an asteroid can hit us and destroy half the population, or Thanos snaps its fingers again and half the population of the entire universe disappear, the market will just look at the silver lining (at least half survived) and rally up. It’s full on FOMO nuttiness combine with generous heap of FED blessing. Heard an interesting line said by Howard Mark recently. A market that doesn’t allow for bankruptcy is like Catholicism without hell, I thought that perfectly capture what’s going on right now.

With RE it’s probably even worse, there’s more cult like thinking behind the price will never go down crowd. Most regular joe aren’t into investing in the market but almost everyone aspire to be a property owner and when you have some physically tangible like RE, it’s hard to convince the non-believers their asset is just as valuable as everything else and there’s always a bigger force at play. Not to mention simple search of google with ROI calculator you can see general market return beat RE in a long run even in hot area like LA and SF, yet you’ll find the believers balk at that with such strong counterpunch as “but stock is so risky…”

In my days at an insurance company and probably still true, RE was viewed as an equity in terms of risk reserves. That was commercial real of course.

Yah, totally.

I mean, the interents already told me the housing market bottomed.

I blinked and missed it.

And that’s so five minutes ago.

–> Dlep

I know what you mean, San Diego RE is similar, sh*t is selling like hot cakes, maybe it’s just a matter of time but if this trend doesn’t change, why even bother trying to buy home. The fix is in and it ain’t meant for those that are looking for a place to call home.

“The fix is in”. They drove away the Chinese buyers, and the govt subsidized first time buyers, low and no down. Now is time for the fat cats to play. Keep the unwashed masses away from the market until the inflationary turn, oil and gold are the leading indicators. In the meantime use loose cash to buy property on the spec. If I were “them” I would be taking an option to buy, and extended escrow. You never know maybe the Fed will screw things up?

Not sure where you live, but in San Francisco, bike prices are on fire for the sub $2.5 million price point. It’s nuts! I’ve been renting for 8 years and feel no hope.

Help Wolf!

I keep hearing this “like hot cakes” stuff, but it’s just not supported by the data. Closed sales in SF plunged 60% from mid-March through April. Volume is now trying to tick up, but it’s far from normal.

Prices take a long time to adjust – measured in years. So nothing is going to happen overnight.

and nothing goes to heck in a straight line either…

Nevermind.

“So nothing is going to happen overnight.”

But nothing went to heck. The market dropped what, 20%, just a minor adjustment back to a still pumped up over valuation. And now it’s back up again.

If heck is ever reached, this is proof of Wolf’s phrase.

Wolf,

If you have colluding Realtors, they can make all kinds of magic happen from fake price wars to get togethers in open events. The games rigged to encourage higher prices at all costs…it’s their bread and butter to have high commissions and prices.

I am always suspicious of assertions that are not referenced.

However most people accept them as truths.

I hear ya, price adjustments take years and well, how many years have we been seeing price increases?

I’m beyond certain you have more familiarity with the numbers than I will ever have but here in San Diego, does it matter if closed sales plunge if prices are still going up?

If we’re living through a global pandemic but stocks are still sky high, a shitty house in SD with shitty schools still cost around $600k, add another 150k to that if you want good schools. I consider myself fortunate that I can live in Tijuana and work in the US, the house we live in is paid off and the wife and I are just saving for a down payment in the future.

The frustrating part is that we would love to have a home where we could have a family but we know that bigger pockets are also competing for those same houses. Makes us just consider not playing that game.

Wolf,

Some people feel the price is still going up in Bay Area is because supply suddenly drops by 50%. At the same time, the demand just drops by a certain % that makes them feel the market is still in good shape. What they don’t know is , those 50% listings (Shadow Inventory) that pull off the market for the last 2 months will relist again. Then the market will become ugly. Real Estate market usually takes 4 to 6 months to see the trend. I would say right now is the “calm before the storm” moment.

Wait until the forbearance period ends and the IPO bubble continues to explode. I can tell you there is no shortage of overpriced supply living in the bay area.

I’m more of the man on the street type of observations. I tend to check Redfin/Zillow daily and my wife and I take walks all through our neighborhood. I’ve never seen so few for sale signs and all the talk is of how expensive the sold one are. My theory is that things have to cost more by the sheer fact that Uncle Sam is printing way too many little pieces of paper to back it all up. I’m an optimist by nature but this doesn’t seem to be playing into a good ending.

There are few (practically no) “for sale” signs because open houses are now virtual. I did see a “for sale” sign… it didn’t even have an address on it, just a code to scan on your cellphone to go do a virtual tour. Everything has changed.

Those must be some very nice bikes you’re looking at.

Are they collectibles? :)

Right Linda, selling like hot cakes?

http://socketsite.com/archives/2020/05/inventory-levels-continues-to-tick-up-in-san-francisco.html

Should have saved those commission checks, right?

I don’t know…the housing mkt has been ZIRP addled for so long, it is hard to tell how hard a slap it will take to awaken it to reality (look at the FAANG addled stock mkt).

And since the new home sales market is maybe only 750k sales per yr nationally…it may not be that hard to find the latest batch of suckers/dreamy speculators.

Maybe a bigger question…when will the 25 million homes with paid off mortgages start coming back onto the market as seniors age out of them?

The youngest baby boomers are 75 yrs old…

I’m really curious how things will play in the Retirement Fantasy Acres, like where I live — where boomers come to die. Gotta live in the country, gotta have an inspirational view, gotta have my little mansion surrounded by the pines, and where people speak English. Pick your western state hot spot.

On the main street of my little town, half the shops on main street are real estate offices. Curious to see how they’ll survive this new landscape.

I am just wondering, keep hearing that with all the Fed QE, we will have asset inflation and so on, like the stock market. Why should not the same happen to the real estate market? If you buy a house, you may have a good spot of land with it, is land no hard asset? Should it not increase with time, if you value it with a de-based dollar?

The baby boom generation is usually defined as being born 1946-1964.

Making the youngest baby boomer 55 years old.

“The youngest baby boomers are 75 yrs old…”

Thanks for clarifying that. I was worried there for a while :-]

2banana,

Right you are…meant to say “oldest baby boomers” – but that 1955 median cohort is 65…

Regardless, there is a huge group of homeowners (with paid off mortgages and therefore arguably less insistent on getting maximum dollar) at least theoretically looking to exit homeownership and its burdens.

At some point, these sellers-in-the-wings are going to put downward pressure on the mkt. As I said, 25 million homeowners have paid off mortgages (that is about 1/3rd of all SFH)

Baby boomers are tough to pigeon hole.

Some, like you said, paid off their houses and have massive equity. And, if they had no children, would try to sell to help finance a nice retirement.

Many others used it like an ATM to finance a lifestyle way above their pay grade. And have nothing saved.

America still has a growing population. And despite the millennial hype, a nice house in a nice neighborhood with good schools is still very attractive.

So, cheap and easy money with ZIRP is a much bigger variable…IMHO.

2b,

America’s population is still growing, but that growth has slowed way, way down (between the exit of Baby Boomers from child bearing years and the one to two decades of economic stagnation/occasional ruin America has seen).

It boils down to relative size, the exiting baby boomers are just a much bigger cohort than the economically whiplashed X’ers and Mil’s…

That said, I would have thought the Boomer sell-off would have started at scale some time ago…but Boomers have been economically hit too and delaying retirement in unprecedented numbers.

But that can’t go on forever…working to 70 or 75 is one thing, but working to 80 or 85 is another (at least at scale)

Yup I’m one of them Sold in 2015 and bought gold but I still own three properties in Europe

I do not think the baby boomers are holding paid off mortgages. We have been chasing declining interest rates our whole lives. First home 12.5% 1983. Often the only way you could get a cash flow raise to help get your kids through college was another refi. I would love to refi for major home improvements but cashout loans are difficult to get no matter how much money you have sitting in the bank. Liquidity is not going to the over 65.

I’m a 72 year old boomer, born in 1948. I see us as the pig in the python. As we retire we start removing money from the market. Also, we downsize and the flood of homes we bought as our second or third houses flood the market. This pushes prices down. It won’t be over for another decade.

Maybe, only now you put things in trust, and assets can stay there for years after you have died. Especially if the trustees don’t see any advantage in selling and don’t need the money. The funnel down effect, smaller families, means son of baby boomer is going to have more assets than his parents. I see more homes becoming rentals. I could easily turn my 50s built add on ranch style home into a duplex or triplex. The purpose of converting a home is not to generate income per se, but to hold the property until such time as the market rebounds, or the kids retire. In the pre-industrial economy wealth was land, cattle and gold. In the post industrial dystopia, it may be pot, gold, and soybeans. Soylent green is money.

“Making the youngest baby boomer 55 years old.”

Mandatory: “OK Boomer.”

Cas, my daughter will need my home when I check out, so it will be left to her. I’m 76 and she has a good job with no pension but will have a modest inheritance.

Many other oldsters will be doing likewise with their paid for homs.

Some fraction will be willed to heirs (who frequently turn around and sell them – especially if they live in different metro) but with 25 million paid off homes in a 75 million SFH universe, there will inevitably be a lot of homes sold off so that seniors can reduce homeownership burdens, finance a move to a warmer climate, finance assisted living, etc.

I don’t think the mkt can possibly be unimpacted…the only question is why it has taken so long.

Oldsters don’t want to leave their homes. LTC facilities are very costly. We live in a 55+ community and it’s rare here that oldsters leave for an $8,000/month LTC facility. They usually die in their home (or hospital) under daily care help (or from family members)

Anthony A,

Assisted living is not nursing home/LTC and it isn’t 8k/mt…closer to 33% of that.

And that isn’t counting Northern senior homeowners who simply want to move somewhere warmer, a trend that has been going on…forever.

I think it is possible to argue about the size of the senior-selloff threat, but much, much harder to argue about its existence. Simply too many baby boomers in too many paid off homes.

I have talked with many seniors about home ownership burdens and usually leave them with this. Hiring a lawn and yard maint company, with window washing and gutter clean out is probably 25% of what a condo strata fee is. Remember, the condo is hiring all their maint out as well. Then, RE agent fees coming and going, plus moving expenses would pay your maint expenses for the rest of your life.

Paulo,

Would not argue with cost logic…condo association fees have tended to get absurd.

But that said, there is still the “better climate” argument which has driven the NYC to FL trade for decades. And there are now more and more “Sun Cities” in more and more states.

“Aging in place” is definitely a thing…but not enough to offset wholesale Boomer aging/exits…the cohorts are just too large.

“Then, RE agent fees coming and going, plus moving expenses would pay your maint expenses for the rest of your life.”

And you live in an apartment instead of a house. Just what every 70+ year old wants in the age of ‘Rona right? What 70 year old will sell the SFH on 1/2 an acre to move into an apartment (err excuse me a condo) and be surrounded by 100 people 24/7?

As for maintenance, meh. My inlaws sold their house a couple of years ago to downsize. But they bought another smaller house. They had no intention of moving to a condo or townhome or loft or whatever. They bought a 1700 sq ft home on an acre. My FIL bought a John Deere thing that doubles as a lawn mower and a riding snow blower and loves using it. He’s 70.

Anthony Can you blame them I’ve seen some of those LTC facilities No thanks I’m staying home

No, they are not 60 yet – the youngest boomers! (Rough bracket of DOB between 1944 & 1964)

I think you mean the oldest boomers are 75.

And 75 in 2020 isn’t 75 in the 80s or 90s. Someone who is a healthy 75 year old will most likely live well into their 80s or even 90s. My wife has an uncle who is 87 and you’d think he’s 60 by his lifestyle. My parents are both in their early 70s and live no differently than they did in their 50s. My daughter has a friend who celebrated her great grandfather’s 100 year birthday recently. If you’re hoping for mass deaths of boomers to get some cheap houses, you have 10-20 years of waiting left.

And then just as they do start dying off, Zoomers will be in their 30s, getting married, having kids and ready to buy all the boomers’ houses.

Your assuming Medicare & SS will still be funded.

Medicare/SS will always be funded. Eat all you want, we’ll print more.

A more interesting idea is when they will start taxing Roth withdrawals as they did with SS in 1984.

Actually Cas,

the oldest boomers are just reaching 74 this year,,, as the term is properly applied to those born 1946 to 1964, when our owners let us keep a bit more of the fruits of our labor as thanks for our hard work and willingness to be cannon fodder again in WW2 and Korea.

I have several close relatives in that group, so always try to keep my powder dry and my wit as sharp as possible to have at them (for fun of course) anytime possible.

We of the ”pre-boomer” generation, sometimes called, ”War Babies” or ”The Silent Generation” do our best to inform folks that we are NOT boomers,,, and therefore NOT subject to this ”boomer zoomer” virus, not to mention all the other ills of these younger boomer people…

my wife is the youngest baby boomer and she is 55 1964 is the cuttoff.

@Cas – perhaps you meant the oldest baby boomers are 73 (1946).

The youngest baby boomers are 56 years old. (1946-1964).

@cas

The “youngest” baby boomers are 56. Do you mean the oldest?

Yep, see above.

If the Government genuinely wanted to stimulate the market and not just for homes, there’s a simple answer.

Pay off all the existing student loans and cancel all of the existing student loan programs.

It would give a huge boost to household formation almost instantly.

Oh, and give full ride scholarships to the top 10% of HS graduates.

Grants. not loans.

Come on Tom, to the SJWs every student is in the top 10%. They’d holler if this totally logical plan was made law.

Gee. What happens after that?

No one ever again pays on their student loans ever again.

Then, in five years, you have an even bigger debt problem. Because they know another debt jubilee is coming!

And FYI, plenty of folks scrimped and saved and went to less expensive schools or joined the military and paid off their student loans (or never had them to begin with).

How are you going to help them “stimulate the market?”

You should run for Senate. Free ride for top 10%. Grants, not loans. Houshold formation.

I agree. The government should also reimburse everyone for all of the student loans they already repaid. That would add even more household formation!

Tom Stone,

“Pay off all the existing student loans and cancel all of the existing student loan programs.”

The same can be said for car loans. Or loans taken out to gamble. Any loan.

The median student loan of former students who have recently started to pay is $17k. Meaning half of them owe less than $17k.

That’s the amount of a low-end new vehicle. It’s not the end of the world to pay that off over 10 years, come on.

Students loan balances are heavily skewed to a very small group, mainly graduate students, med students, and the like, who hold very large loans ($100K+) — this skew pushes up the average or student loans.

But the median amount is a much better indicator of the indebtedness for the majority of students – and it’s not unmanageable, especially if paid over 10 years.

Here’s an idea. Take 10% of the Corporate Welfare they tell us is for “ Defense “ expenditures and make all higher education free. I dare anyone to tell me we can’t afford it. Take another 10% and rebuild national infrastructure thus jump starting the housing market through job creation. Another 20% and implement Medicare for all, leaving

$ 450 billion for Corporate welfare, I mean

“ Defense “. After that we can start talking about taxing corporations and the Ruling Class at a higher rate.

Stuart:

+++++++++++

Hey Tom,

Not really against any of your ideas against the student loan industry/debacle that is currently hobbling so many young folks, but the summary Wolf reports rings pretty true to me.

“Working your way through college” was a ton easier when my apt across Bancroft from Sproul was $50 a month instead of $2500 as it is today, etc.

Even with GI Bill ($90/mo at the time), and working as much per week as I could, and borrowing privately, it was still necessary for me to drop out and work full time, twice, and I think it would be damn near impossible today to go to school full time and work enough just for rent, not to mention the luxury of eating.

As to the full ride scholarships, I agree completely: IMO, every single top 10% grad of every fully certified HS should be offered a full ride, at least to in state colleges and without regard to grades in their first full year of college; after that year the same should be ”available” but dependent on continuing excellent performance.

When you refer to Sproul, it sounds like are talking about UCLA? (That’s a far travel for a Florida boy) Rents were very affordable in the Los Angeles basin during anf prior to the 70’s. Long gone!

Also, the student housing game has greatly grown in many parts of the country. Like shooting fish in a barrel; a “must have” product coupled with parent and government support, inflation, loans with government assisted little downside, etc.

A great way to produce debt/wage slaves for the plantation called the USA, managed by the FED.

The Government has been stimulating the housing market, full bore, for years. Bad practice.

Hmmmmm. Aren’t there betting markets in the UK and Ireland?

I wonder what the odds quoted are for a C-19 vaccine before Labor Day? How about before Christmas?

I wonder if they are quoting odds on a US housing collapse. . .

There’s a lot of uncertainty out there, but homes I was looking at in the East Bay were going pending very fast. Every home I followed on Redfin is now pending. I am in escrow on a beautiful home that I got for a chunk below asking. I’m betting a year from now COVID will be under control and my home will be worth more than I paid.

TrojanMan,

You’re starting to sound like a broken record on this topic. But I just looked on Zillow. There are 1,100 homes listed for sale on Zillow in San Francisco alone, including a bunch of auction units. All kinds of stuff below $1 million. Then I looked in Oakland, over 700 homes listed for sale. I checked a few. They had been listed for sale, pulled, relisted, etc. And the Zestimate has dropped, and they’re still for sale. So something is wrong with your comments.

One begins to wonder if these posts hyping the property market… are not being posted by paid trolls….

Wolf,

When discussing SF prices, using the term “homes” confuses things. That could include tiny apartments being sold via income restristions, etc., subsidized by the city. A million does buy much in SF.

A million does not buy much in SF

He’s gambling on shack and just lost. Trying to get more Hopium but congrats! You brought at or near peak Bubble.

Maybe, but I can afford it. Long term buying real estate in the Bay Area has paid off, so I’m not worried about forecasting the short term. But if I had to make a call, I think prices are higher a year from now and I put my money where my mouth is.

Wolf, thanks for your reply. I don’t doubt your numbers and I recognize the uncertainty in the market. I think you have to recognize there was a big shift from April (closed market) to May (open market), so my comments are coming from a different place than your numbers. There is inventory, no doubt, but in my experience the inventory that’s aimed at growing families moving from SF to the suburbs, which is relatively turn key and marketed correctly, is moving quickly. Also, to be fair to me, “crash around the corner” has been a broken record in these comments for a while, so I’m just balancing it out :-)

Here is what I’m talking about (it will be interesting to see the prices on these) – and this is a small sample:

6 days to pending – https://www.redfin.com/CA/Danville/373-Laurel-Dr-94526/home/1792491

9 days to pending – https://www.redfin.com/CA/Orinda/469-Tahos-Rd-94563/home/1735810

4 days to pending – https://www.redfin.com/CA/San-Ramon/109-Wycliffe-Ct-94582/home/2106618

11 days to pending – https://www.redfin.com/CA/Lafayette/1146-Upper-Happy-Valley-Rd-94549/home/1878913

2 days to pending and SOLD in May – https://www.redfin.com/CA/Danville/201-Scotts-Mill-Ct-94526/home/1733670

6 days to pending – https://www.redfin.com/CA/San-Ramon/5097-Athens-Dr-94582/home/1028173

This is just a small sample of what’s selling in East Bay. In my experience, the listings above and the speed at which they moved were the norm in the $1.0 – $1.5 million range. Maybe the market will crash, but I would not count on it in the Bay Area. I’m a long term buyer so I’m really not concerned about it, although I believe in a year my house will be worth more than I paid for it.

Quit looking at the few homes that are pending. Start looking at the thousands of homes in the East Bay that are listed for sale.

Inventory in SF jumped 50% and is now at a nine year high. So I wouldn’t look at the few homes that sold; I’d start looking at the ones that haven’t sold.

Are you like ….. NoCalJim i.e. SoCalJim’s long lost brother?

No, I bought because I need a home with a growing family. I recognize prices could go down or even crash, but I’m willing to take that risk and believe long term the Bay Area is a great investment.

I agree.

This is the right reason to buy

If you can ride it out then great

Personally I am happy not to he in bay area and currently looking to move out of California

Congratulations

Thank you, Jon. We are excited.

Thanks for the laugh, I needed that!

Do you have a short position open on the housing market?

Well according to Google Ads, now is the best time to buy your dream home!

No thanks! The home I already have, is falling apart faster than I can fix it!

I am already missing the buxom lingerie ads…

Hasn’t the average middle class income made a round trip to 1970 buying levels? Why not real-estate? Isn’t it due? Just like a pandemic or rapid sea-level rise?

Buying a home now is a fools mistake. The real estate market will eventually reset back to early 1990 levels. At least a 50% haircut. People don’t understand that all of this debt is unsustainable. It’s a complete joke. 39 million Americans unemployed & they keep ramping the stock market only because they can print $10 trillion in stimulus to bailout themselves & continue their Ponzi scamdemic.

Most Americans think the free ride will continue into perpetuity but they’re in for a very rude awakening. They’ll continue to voluntarily donate their money to government every year in form of taxation like the blind, hypnotized, propagandized sheep they are & enable the thieves to continue the charade for much longer than they could have. It’s time to wake up to reality.

DD –

1) At 0% yield debt is sustainable.

2) Taxes are not voluntary. Try not volunteering.

3) Buying treasuries at near 0% yield is voluntary, speculative and perhaps dumb.

I live in a sort of vacationy place with a lot of richer border states near us that probably bought a lot of our houses and rented them out on Airbnb in the past. I’m starting to see ads with some houses talking about their “great rental history”. Not a lot yet but more than is normal.

I didn’t realize until recently that this was why I couldn’t afford a home on the water. Sorta praying it continues.

Waterfront homes have their own drawbacks like extremely high property taxes and homeowners insurance if they will even write you a policy I was 200 yards from the bay , 6 feet above mean high water and the bastards doubled my premium And I never had a claim during 35 years of homeownership

National numbers are meaningless as long as some states/cities run by power hungry tyrants are still under lockdown. Those places will skew the overall numbers down. Look at places where the economy is open and you will see real estate is booming. Dallas, Houston, Boston, Atlanta, Denver, Seattle Portland. All are seeing record pricing and homes going pending in a matter of days. 70% of homes in Boston are getting multiple offers.

I just looked on Zillow. There over 1,300 homes listed for sale in Boston. I randomly checked 10. One had been listed for sale on Zillow 15 days. All others had been listed for sale between 20 days and 405 days. Lots of choice available. I’m not saying the market is dead. But it doesn’t look hot to me either.

Sure, if there is a beautiful house in a great location priced to sell instantly, it might trigger multiple offers. But the homes I looked at hadn’t triggered any offers that had led to a closed deal.

Wolf,

Not sure about Boston. But for where I live Zillow is useless. There are houses for sale there from 5 years ago. I don’t know how that happens since it gets the data from the MLS like all other r/e sites. But for some reason their data is never accurate.

I just looked at Redfin, and in Suffolk County, Ma, which covers Boston and some of the suburbs, more homes are pending than available listings. That is what you call a hot market.

Do you realize in the 1918 pandemic that Oct. was the deadliest month?

The best time to list a house is in the first few weeks in May and there’s not much in the way of new listings as far as I can see.

Seller’s are in trouble for the foreseeable future. Fewer buyers are lined up to make one of the largest purchases of their lives. Who would put it all on the line right now with a new home purchase?

Housing and real estate is key part to keeping this financial bubble going. If it is allowed to fail, then everything comes down too including the stock market. So some how, I keep thinking they are going to try and prop this up. When I say “they”, I don’t just mean the as government, as there are lots of people in Finance, Real Estate, Education, etc.. who need this debt financed bubble to continue to survive. In then end, I think it will be Real Estate that brings the whole thing down. In my lifetime, all the real bad, longterm downturns have centred around real estate failures rather than the Stock Market, which is where everyone is focused. No real expertise here, just a guess, that is, its what you are not looking at that gets you.

A,

It all boils down to leverage, and real estate is the most accessible avenue to leverage for the mass of Americans, at $ scale.

The borrowed money (at G distorted interest rates) creates an equally fictional valuation environment (in everything, re, equities, etc)…household incomes may have been stagnant for 20 years, but halved interest rates allow for a doubling of home prices at the same monthly payment.

Nothing has really improved in the real economy…the G has just printed money, gutting rates, and luring in diminishing numbers of borrowers who only look at monthly mtg pmts (never asking who in the hell will be able to afford the house after them if interest rates are ever allowed to go up much at all…back to levels that prevailed for decades and are certainly justified by the G’s accumulated debt).

Quite right. RE bubbles track back all the way to the 1840’s and have been tied in to most of the economic walkbacks of the past. Even had some in the 1920’s as part of the prelude to the black eye event which then took it all down. The main difference now is the population pressure around the booms which give support all the way from rentals on up. But so much of it is resting upon people taking on more than they can ever service and a great fake economy providing their income. Pull out a few too many bricks and the roof may come down (the roofing company has a limited warranty).

I thought it was the opposite The stock market being key and if that collapsed so goes the housing market

You have half of it. The Fed hasn’t missed a beat. After GFC they were ready to plug the mortgage leak immediately. In the process they laid open access to a huge volume of equity, or liquidity, by promoting the REFI market. Then they invited the fox (Blackrock) into the hen house. First shoe to drop might be the mortgage deduction. Then the great mortgage reset. Those people who had REFIs but didn’t really need them, will be forced to buy them out. This market isn’t about home buyers, it’s about home owners who leverage their equity, and those who manage that money for them.

For a large portion of the middle and lower-class homeowners in the US the mortgage deduction was absorbed into the standard deduction in 2018. They don’t see it anymore. The more well to do had their deduction capped.

Population and salary growth is the blood supply of the exponential growth debt tumor managing the economy.

More people are leaving The Bay Area, with their once high salaries, and tax payments, than are arriving.

Keep your eye on Craigslist home and apartment rentals where you live. Week over week, rents have dropped by about 12% from April. Small employer PPP loans become forgiveness if all employees are kept on the payroll until June 30th. Then what? Large firms get to keep the money if they retain employees until September 30th. The day after that? Mega layoffs, on top of the unemployment disaster already out there.

There’s a part of the country I look at House and land sales. People still trying to sell lots they bought for like $85k three years ago at $200k+ prices.

This isn’t an area that warrants that kind of pricing in this kind of market.

If my trading continues at the current pace, and the land prices soften a bit, I may yet get one of those at prices from 3 years ago.

Funny part is, you look all over the ‘valley’ and there is an incredible amount of land for sale.

Going to take reality a bit of time to catch up I guess…

“This isn’t an area that warrants that kind of pricing in this kind of market.”

Where I live I can’t count the number of times I’ve heard people moan about how 30 years ago you could buy an acre for $50K and now that acre is $250K. Yeah, well things change. 30 years ago nobody wanted to live here, and now lots of people want to live here. It doesn’t get more basic supply/demand stuff that that.

As for “this kind of market” if you haven’t noticed the market today is back to pre ‘Rona levels.

2.5x the price in 3 years is not the same as 2.5x in 30 years.

Let me just cite the tropes here, I think I can summarize the the Wall Street optimism in a few line:

1. The economy is re-opening, lock down is ending.

2. There is a vaccine/cure/biologic on the way, it’ll be the fastest ever.

3. The Fed has got our backs.

4. The data (insert your favorite here… housing market edging up, TSA check ins higher this weekend than last…) supports a V shaped recovery.

One of these, or some of these variations are going to be predominant in the headlines unless ET shows up and drops asteroids on the Earth.

I live in an amazing city. It’s known as the Paris of the South. The only problem with such a great city is that prices are unaffordable. In 85, the median price was around 70k. It is now approaching a million dollars. I am quite angry about being priced out of my own city. The RE mafia rules with an iron fist to maximize the bubble.

What really pisses me off is that a city that is both residential and industrial has been used like a casino to give a minority much wealth while pricing out the people who work in the factories that make this city so rich. The biggest insult is the median salary of 50k.

My area depends on winter tourism and homeowners who stay for the winter. The hospitals hired traveling nurses for the winter season. They left with the snowbirds in the spring. It is more difficult to find renters during the summer season.

@David – Even more so this year with the flight restrictions from Europe. If Dieter and Nigel don’t come to Fort Myers, a lot more pain will ensue.

You mean the CB mafia? No worries, the stupidity of it all is being laid bare by they day. As the massive deflation coming at us starts to pick up steam the median price will come down by 60 to 70 percent. It may take a few years but the trend is down. If you can keep your job and build up a down payment of 20% based on the future reduced priced you may be able to buy a home in the “Paris of the South” once again.

The most distorted economy in the history of the world will not last. This time is different but the end is always the same.

Nmae of the City please?

“Paris of the South” most likely means Asheville, NC.

I take the nickname comes for 1)the large number of art galleries 2)the fact both cities have some not exactly pleasant nor safe areas.

It’s Melbourne, Australia.

@ MC – I thought that, too — but Asheville doesn’t have any factories unless you count the artisan brewers and such. The same thing has happened with real estate though. In the 20+ years I’ve spent time there, it’s become shockingly expensive and way overcrowded with aging hippies and halfback Floridians.

Just took a look at your city’s situation on Zillow FC, and it is somewhat more heavy in the more expensive homes than near me in tpa bay area, but not way out of line.

IMO you are going to have some great opportunities to buy in the next couple of years, so hang in there if you are still wanting to buy. Already there were quite a few listings down $10+K in recent weeks.

And I will add that there appears a huge variety of prices per SF at both the higher end and the lower end, with one of what we used to call, ”tearer-downer” (beyond fixer upper) at around $600/SF that made no sense at all.

Lower priced homes here, older or not, are somewhere around $200 per square foot, and have gone there from approx $100/SF just last 3-5 yrs based on new construction sales, as well as older in good shape.

IMO, we will be back under $100/SF by the end of this RE crash, and I suspect Asheville area will also.

1) When Repo @ 0.06% < IOER @ 0.10% there is plenty liquidity & tranquility.

2) US Treasury General Account (saving account) in the Fed is $1.2T. Its x3 time as large as the previous one. Secret SPV (Special Purpose Vehicle) special garbage can might exist.

3) US built a large war chest.

Hi Wolf,

I’m wondering where the pressure from foreign investment comes into picture with current situation. If I recall correctly, one of the reasons many families were priced out of San Francisco Bay area and many similar metros from 2013 on has been the (artificial or not) demand on RE by foreign investors…. one would think with Covid19, that has gone south but has it really? I don’t find any report in the news recently.

I think at the end, the new pricing equilibrium will take place where the inflation caused by massive $ printing, local demand, foreign demand, and existing inventory meet.

As far as my family’s decision, we’ll give it another 3 months or so and if no price softening happens, we’re ready to pull the plug for good and leave for a more affordable pasture.

It seems odd to allow non-Citizens to buy real estate ……

It goes both ways

Chinese buyers have priced out Americans in many usa cities

Similarly American buyers have priced out many locals all over the world

Locals should take care of themselves, to the extent they can, whereever they are. It doesn’t seem prudent for citizens to allow themselves to become an income source for outside rentiers.

BM,

Agree with you about the ”eventual” equilibrium; however, IMO there will also be quite a lower low and quite a while between now and that low; but, ”ya never can know the bottom,” while an old saw, is still as sharp a saw as it ever was, especially in RE for various reasons including lagging reporting, still the case in spite of the websites, etc.

So, as another old saying goes, keep your powder dry, and be ready to move quickly when the time comes for you.

I remember reading that the condo RE mkt in areas of FL, that had gone to heck in a straighter line than the local SFR markets, came zooming back above the previous high in just a few months last time.

I heard a commentary out of Australia which might interest you. The conversation was mainly that plane tickets from China to Australia are now about A$5K each way, which means investors can no longer get there easily. Covid might make international travel incredibly difficult. And the economy in China might cause investors to dump what they already own for the cash.

All of these points apply to foreign investors in SF.

That will bring some relief, but one of the pull factors is that this city is still working. A vast number of workers have been designated as essential here. Who would have thought that toilet paper manufacturing was an essential service? Yet it is, really. But so are plenty of the things we do here.

Oz is an island and we shut the borders relatively early so covid has not affected us so badly. It’s lucky, since most of Australia and NZ would have faced massive shortages of goods had we shut down.

With so many natural pull factors, the last thing needed was the nightmarish artificial pull factor of ZIRP speculation.

Just a reminder to check out Mortimer’s Vancouver RE site. It’s a twitter site but anyone can read it. Quite witty at times. Bottom line: Van RE is in big trouble. Many reasons but out of control spec is prob main. Of course big China factor. Also prices are like Silicon Valley but although Van is pretty, SI it ain’t in terms of income.

But to facts: govt assessments are way down, maybe back to 2016. And selling prices below assessment common. When a big loss occurs Mortimer has KABOOM! and a bunch of exploding cannon ball emojis. It takes 7 figures for one of these and there are lots.

Mort just pounds Van City over illegal Air B&B. Just effing pounds them. Gives addresses, photos of rooms with numbers on them, proves that owner doesn’t live there, etc. etc.

Mort adds stuff like: Dear Van: I reported this a year ago, still operating.

Van gets so much of its budget from RE taxes etc. that the mayor opined it could go bust in a big RE recession, no doubt an exaggeration aimed at the province for later money.

Mort reports on so many Chinese with their names that if I was him I would take care.

I searched for Mortimer. There is no ‘site’. It’s just a twitter account. Since I never have and never will use twitter, I guess I miss out on that.

I don’t use twitter either. It says in my comment ‘anyone can read it’

You only need a twitter account if you want to comment. BTW: a ‘site’ is defined as a location.

If you won’t read anything on Twitter on principle (?) there is a bonus in that you miss the tweets of the head tw%t.

Well not to nitpick, but in the world of the internet, ‘site’ means “website” generally”. Anyway somehow I missed completely the part where you already said it was a twitter account, so sorry about that.

But yeah, there are so many benefits to ignoring twitter and other social media, I’m not changing course now …

Just click on Mortimer

Mortgage applications up 9% last week. That is the 6th week in a row of increases. And last week’s volume was higher than the same week in 2019.

Whatever effects the ‘Rona had on real estate is ancient history.

Well maybe a bit of positive Real Estate news. Bloomberg is reporting that Chinese investors are back on the prowl for expensive real estate.

Although given how the offshore Yuan has been dropping, it’s possible that those “investors” are simply front running the rest of the population in saving their wealth.

I honestly don’t know… people are just too scared in China right now. The government is trying to push people to go out and spend some money but everybody is so scared about the future. Scared people don’t like spending money.

To make matters worse international travel is extremely difficult and likely to remain so for very long, so what’s the point in buying a “bolthole” on the Internet if you cannot get there?

Finally there’s another point: with everything the Chinese government has been doing this year I fully expect there will be “consequences”. The West just cannot pretend to be outraged and carry on like before anymore: we have tens of thousand dead, a devastated economy, a divided society and our democratic system is on life support if not clinically dead already thanks in no small part to the Chinese government. Now they are taking the occasion to strangle Hong Kong: where are the economic sanctions that have become the norm in these cases? Are we going to turn the other way for a bunch of crummy facemasks? At least Judas got thirty pieces of silver for his betrayal.

Will “investors” from China still be welcome? I don’t want to be in Toronto or Vancouver when somebody will blame the local “unaffordability crises” on Chinese nationals.

I have read for many years the Vancover “unaffordability crises” being blamed on Chinese nationals. Nothing new.

Most of the mainstream media are real estate bulls may be they are getting paid to be bullish

1) The monsoon season start on May 25. It will last 3-5 months.

2) Chinese troops sought shelter from the heavy rain on the Indian side of the Himalaya.

3) Doll face Xi-Xi will use the crucible of the Monsoon to storms Taiwan & HK.

4) When the heavy typhoon intensify, between July and Oct, wall street raiders will “purchase” Fu Fu islands.

5) The Chinese Locust flew from China to US + Europe to escape the Monsoon season.

He can storm HK anytime. Taiwan not so easy, and I don’t mean just because of US response. Taiwan would be no push over all by itself.

PS: It is very unlikely that Xi is crazy enough to risk it and a larger war and even if successful, incinerate all China’s ‘soft power’ or influence dreams. Xi has got enough problems.

I will give ten to one odds to anyone predicting a 2020 invasion of Taiwan, monsoon or not.

1) Trump-Modi flirt was discussed in Modi-Xi summit in Wuhan in Oct 2018

and Xi-Modi in southern India on Oct 2019. Trump-Xi trade deal is on the verge of collapse.

2) India is no match to China economically and in military power. Xi bully HK freedom fighters, push hard in south China sea, spank the Himalaya, but isn’t spilling blood !! ==> China have no interest to be sandwiched between US unsinkable aircraft carriers and the Himalaya.

3) Doll face Xi misbehave badly, but his tantrum is not deadly. He act like an invincible teenager, after being caught spreading the virus. He need to be stopped, before he will use the cv19 crucible to bully even more.

4) Trump is the only one who can stop Xi without a bloodshed.

5) A decade or two after Trump is gone, it might be different.

I don’t recall anyone mentioning the discontinuance of home equity lines of credit by WF and Chase, which they did about 4 weeks ago. BofA still has them, at 1% above 30-year fixed rates, although the HELOC rates are variable. So it makes no sense to stop offering them, especially to their own customers.

Considering how important it is for many home owners to tap into their equity that way, and regardless of the Covid-related explanations the banks gave for stopping them, I’m curious whether those banks are actually worried about debt-deflation, a rationale they haven’t mentioned.

Those programs weren’t being used. The REFI market achieves the same purpose. Take your mortgage which has maybe ten years left, and push it to thirty at near zero rates and three free months forbearance. When the helicopter drops money why waste time picking up the change?

Starting to see serious shortages of stuff from China. Was in Harbor Freight which has been open entire time. Lots of holes on shelves, racks empty (92261 zip ). Saw same thing at Lowes just not as bad. Wal mart also.