YRC, one of the largest less-than-truckload carriers, wheezes under the strain.

By Wolf Richter for WOLF STREET.

The hope is that April was the bottom, that volumes can’t fall further, that factories and retailers will gradually open and that consumers and businesses will buy these goods, and that trucks and railroads will roll again. That’s the hope. It might take a long time to get back on track, but at least the hope is that the plunge in the demand for transportation services bottomed out in April.

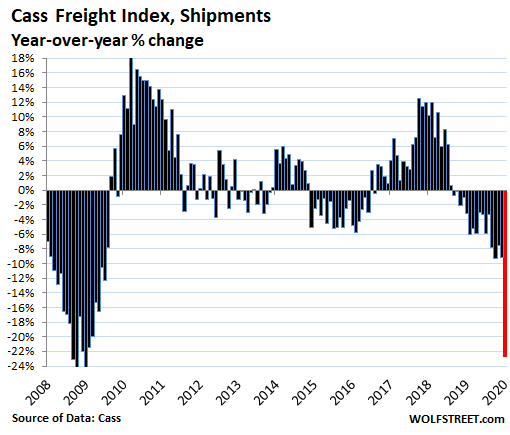

Shipment volume in the US by truck, rail, and air collapsed by 22.7% in April compared to April last year, and is down 25% from April 2018, according to the Cass Freight Index for Shipments today. It was the 17th month in a row of year-over-year declines, where the Covid-19 crisis came on top of a harsh freight recession that had started in late 2018. April was also the steepest plunge since the Great Recession, but not far behind:

The transportation business was split in two: trucking companies in the ecommerce supply chain, including package carriers such as UPS, and those in the supply chain for supermarkets, warehouse clubs, home improvement stores, and the like were busy. UPS reported that its mix had shifted dramatically, with business-to-business shipments plunging, and with business-to-consumer shipments surging due to the boom in ecommerce.

For trucking companies carrying other goods, it was terrible.

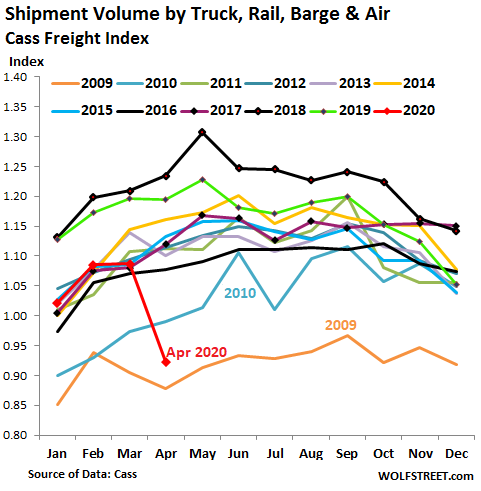

In the stacked chart below, the top black line represents 2018 with its historic shipping boom when companies were front-running the potential tariffs. The green line represents 2019, which deteriorated throughout the year. The red line represents 2020 which started out weak and the plunged. The index for April was the lowest reading since April 2009 (light brown at the bottom):

The Cass Freight Index tracks shipment volumes of consumer goods and industrial products and supplies by all modes of transportation, but is more focused on trucking. It does not track bulk commodities, such as grains or coal.

Rail traffic in April, according to the Association of American Railroads, plunged by 21.2% compared to a year ago, with carloads down 25.2%, the worst decline in the data going back to 1989; and container and trailer (intermodal) volume down 17.2%, the worst decline since 2009.

Carload categories that saw the steepest declines included motor vehicles and parts (-86.3%), long-suffering coal (-38%); and chemicals (-11.9%).

“Coal and autos were by far the worst-hit commodities in April, but declines spanned the industrial spectrum, hitting finished steel and steel scrap, chemicals, petroleum products, sand and stone, and much else,” the report said.

“We don’t know exactly when it will happen, but our economy – and rail traffic – will rebound,” said AAR Senior VP John Gray.

Now the question floating through the trucking business is which carrier will be next, after Celadon collapsed messily, ceased operations, and filed for bankruptcy in December last year, the largest truckload-carrier bankruptcy in US history. But that was just a regular freight recession that had tripped up the carrier which had been tangled in accounting fraud and other issues. Now trucking companies are trying to maneuver through the deep crisis.

Stifel Financial equity research analyst David Ross, in a note to clients on Tuesday, cited by FreightWaves, said that he has suspended his rating and estimates for YRC Worldwide [YRCW], one of the largest less-than-truckload (LTL) carriers in the US.

In its quarterly earnings report on Monday evening, YRC announced that it may not be able to comply with two debt covenants in the future. The covenant of its term loan requires a $200-million minimum trailing-twelve-month Adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization); it had been able to waive the covenant for 2020, with the interest rate being reset to 14% for the first six months of 2020. But it does “not believe” that it will be able to comply with the covenant after January 1, 2021.

And it said that it may not able be to comply with the liquidity covenant of the term loan. “While a number of actions are being taken to manage liquidity, the duration of the current economic slowdown is uncertain, and these actions may not be sufficient if the economic environment is impacted for a sustained period of time,” it said.

A bailout remains more than uncertain: It said concerning any Covid-19 emergency loan from the government for the Fed: “Even if we were able to qualify for such assistance, we cannot predict the manner in which any assistance would be allocated or administered and we cannot assure you that we would be able to access such assistance in a timely manner or at all.” So for now, nada.

YRC’s volume for April was down 24%. And during the earnings call, executives refused to take analysts’ questions due to a “tremendous amount of uncertainty surrounding COVID-19 and the rapidly changing environment.”

Stifel’s Ross pointed out that other trucking companies experienced smaller declines in LTL volumes than YRC in April, including Old Dominion Freight Line (-15.3%), ArcBest (14) and Saia (-13%).

On Tuesday morning, after the earnings announcement – with some metrics beating “analysts’ expectations” – the stock surged 20% initially. But today reality began to set in once again; shares of the long-troubled carrier dropped 7.6% during regular hours and another 1.9% after hours to $1.54. The company’s market cap is down to just $63 million.

So now the hope is that April was the bottom, that freight volume will pick up in May as factories and retailers begin reopening. Trucking rates have started to tick up in May in many regions.

DAT Freight & Analysis in a blog post points to improvements in the produce regions of California, Texas, and the Southeast, and at port markets that are “gaining traction, even in the Northeast,” and at other key markets where things are beginning to stir. “Obviously, we still have a long way to go, but it’s a step in the right direction toward providing some much-needed relief for carriers.” And that’s the hope, that April was the bottom, and that the improvements, however small and insufficient they may be, will continue.

Some prices collapsed, others skyrocketed, and the Consumer Price Index went haywire. Here’s what I’m seeing beyond the near term — and it’s not “deflation.” Read…. A Word About the Current Chaos in Prices and Inflation

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Not going to happen. I deal with freight daily for surface movement (Ocean going vessels). It’s very thin already into AUG, and I doubt it will get better this year. Tankers may be sitting around full, but cargo vessels are eliminating ports from their normal schedules because there’s not enough freight to support the costs involved in making berth. More and more cargoes are being combined (condensing two sailings into one trip). Add to that the fact that delivery times are growing longer due to delays various countries have enacted to try and contain the virus, and it’s not pretty.

Is Hellenic shipping news a good source of information for this?

This topic in general.

Find a good maritime traffic tracking website (plenty to choose from, from free for the enthusiast to very expensive professional ones to get live vessel tracking): it’s all you need to be absolutely horrified.

Singapore right now is something that literally defies belief: mooring space ran out weeks ago and now ships have been moored east of the Straits Settlements, off Berut and beyond. Even my mother, who knows nothing of the business, was horrified by seeing the snapshots.

As KGC wrote, Chinese ports have big clusters of container carriers in front of them, waiting for orders to load: Chinese factories have been in business for a few weeks now but orders have been scarce, as proven by dismal PPI data from China. A classic case of plentiful supply but scarce demand.

Same thing about ARA (Amsterdam-Rotterdam-Antwerp): ships are moored off the coast waiting for orders to load and sail.

Special mention is given to all the ro-ro vehicle carriers languishing off Korea and in the Bosphorus, to the fleet of UASC ships moored off Dubai and to the forgotten boys: bulk carriers. While oil tankers get all the press, bulk carriers languish alone and unloved everywhere, from Singapore to Hamburg. Commodity traders should really start paying attention to the real world and not just to the silly rumors concocted by the Chinese government.

Thank you.

It’s always interesting and useful to learn about what’s just-out-of-the-general-view.

Shame on you, MCO1, horrifying your poor dear Mamma like that. :)

What I find really interesting is the smaller ships seem to be the ones being kept busy. The super sized ones are more likely to have trouble finding enough cargo to make the trip worthwhile. There’s got to be a point of diminishing return…

At least China owns their own ports.

Just use MarineTraffic.com. Always remember not all vessels are going to be visible. (Navies and rogue countries routinely turn off their tracking.) It’s amazing the info available these days…

KGC – did you put your ocean lanes out to bid. I am going to refrain and re-sign with my NVOCCs (2) for contract cycle. The blank sailings driving up false demand and the lack of reductions on the BAF are worrisome. I did see where CMA got a $1.7 bil/loan on the JOC a couple of days ago.

as for the surface market in the USA: our team is in the middle of the truckload/flatbed/intermodal bid and we believe our rates will fall an additional 5%.

The economy is slowly reviving despite all the doom and gloom.

Life always goes on.

Wolfe now needs to replace his red ink with black ink!

“Shipment volume in the US by truck, rail, and air collapsed by 22.7% in April compared to April last year, and is down 25% from April 2018,”

And the SP 500 is just down 10% to 12% ytd. Peak loss was about 30%…

Hard for two gross aggregate measures to be so out of sync…my money is on the real world trucking/rail metrics being more accurate.

Q2 GDP figures will be off about 20 to 25% yoy and the SP 500 will drop another 10% to 15% starting in late July…the mega companies of the SP 500 (in gross) simply aren’t going to see their financials diverge that much from the aggregate economic measures.

I was also thinking of challenging Wolf to write a positive article.

(Not that I don’t enjoy his constant insights over the years…)

Would you like reality to assist you in making informed decisions or convenient lies to support your point of view?

I’ll take Wolf’s informative, balanced written truth anyday.

I second that. Wolf has one of the very best sites available today. He tells it as it is, which at present is not very good. We have the MSM to blow sunshine up peoples backsides, we need Wolf to tell us the truth…

hidflect

You’ll see a positive article when ecommerce data for Q1 is released in a few days. Ecommerce is booming, and it’ll be a very positive article about ecommere. However, the loser is brick-and-mortar, but you can just skip those sections.

I used to post “positive” articles about strong consumer spending and the strong services sector and a bunch of other stuff. Just because you didn’t read it doesn’t mean it didn’t write it. Of course, now, those sectors have gone to heck in a straight line.

Here are some examples I could quickly fish out:

https://wolfstreet.com/2020/02/20/ecommerce-spikes-by-most-ever-brick-mortar-melts-down-department-stores-are-toast/

And this is an amazingly positive article, where I contradict the media, because the media said that retail sales “fell” when in fact they were pretty strong:

https://wolfstreet.com/2019/10/16/braindead-or-willfully-manipulative-how-the-media-reported-retail-sales/

About the strength of the HUGE service sector, by category:

https://wolfstreet.com/2019/03/21/finance-insurance-hits-it-out-of-the-ballpark-no-slowdown-in-the-huge-services-sector/

Or more on strong consumer spending:

https://wolfstreet.com/2020/01/31/in-aggregate-consumers-doing-pretty-good-making-spending-money/

Oh, and my entire series about the splendid housing bubble, with lots of charts … housing bubbles mean prices rise/surge. So that would be “positive” in your book, I assume. Here is an example:

https://wolfstreet.com/2020/02/25/the-most-splendid-housing-bubbles-in-america-february-update/

The difference between a bang and a firework is good chemistry, irony and timing.

On the contrary, the disintegration is accelerating and deepening.

Ever harder to get orders fulfilled here in the UK.

Kindly give me the address of your planet, I’d dearly love to visit.

Life always goes on.

Yes, with 20% less economic activity.

WES, perhaps you’re new hear, but it’s quite clear, the worst is yet to come.

Q2 lows might be a tad lower. That red ink might run dry. Not sure how wide the FED can open up the taps, but Covid-19 will give ’em a run for the money so to speak.

WES, you really think its all going to bounce back like a rubber ball? To me Mister Softy is looking like a short. AAPL too.

A train wreck!

Nope. The structural damage will take years to recover from. By July, you will capitulate.

Dream on. We are still during the time before people jump out of windows. Sadly, that is coming later despite all denials and false hopes absent a real, available, cheap cure.

Are your feet wet? You are in de Nile. :)-) Buckle up. This rollercoaster ride just started.

Car rental agencies have cancelled most of their orders and everyone in the world has a year’s supply of toilet paper. And no jobs. Not the bottom.

It must be the bottom for toilet paper?

Always is

What the beating is giving this bug to humans…

The US is a service economy who needs freight anyway?

Can I grant you a loan, can I sell you some insurance?

How long can the US consumer go without such vital services…

All the US economy needs is another tattoo, a massage would be nice, perhaps a yoga lesson to settle things down. A haircut and a trip to the zoo is all that is needed for economic bliss to resume.

You’re thinking too much in tangible, physical terms. No, we just need to inflate asset values – and maybe even earnings and spending – with QE. Ask any politician or central banker, money from the fed solves all economic problems.

finally, a voice of reason. and here we all were getting worried about the glorious future we had been promised by our betters!

So how is SYSCO doing?

I’m certain Central Banks will sort things out promptly and easily…

The Baltic Dry Index is down.

“Is This the Bottom?”, Only if there are pharmaceutical interventions and a vaccine!

It’s a social imperative that drugs and a vaccine must be available. The effectiveness and price is another matter.

They saved lives, what did they detonate. Do you mean the economy? They sent the youngest most vital to die for oil in the sands of Iraq. Now they want Americans to die on US soil for the ‘economy.’ This crisis has shown what a repugnant death machine America really is. Way way beyond disappointing!

There was a time when a person could make a decent living owning his own truck. The little factories producing goods dotting the U.S. landscape are long gone now like the independent trucker. Let’s hope the FED props the service industries for at least another generation because there is no way in heck corporations will ever stop buying overseas. It’s a pleasure paying 400% markup for knock-off junk that falls apart. Long live the lobbyists.

Brant Lee:

“Markets” need “Consumers” even for the junk. Only when humans realize that all that “material” they have accumulated does not equate to “happiness” will the charade cease.

I’m continually amazed at the number of households that can’t even put one of their multiple vehicles in the garage for which it was built. And, then it is time to rent some off site storage for more junk!

********************

What is happening now is amazingly scary! CA had a approx 3-5 B$ surplus last January; today it is estimated we have a $50+B deficit!

How the heck does anyone believe that we can crawl out of this hole?

So many businesses not paying into tax base to support our infrastructure?

Many small service businesses returning to “open offices” with hardly no customers to service? When local, state or fed assistance ceases then the rubber will really “screech” on the road!

The global shipping industry will need a purgative to clean out the system!

And, Beejesus! What about the airline industry???? Who’s gonna save that building monstrosity????

The fed. gov. continuously slopping money into the system will not be enough. That will lead to civil disorder in short order.

It’s hard to stay “positive” when Mt. Shasta is rolling over you!!

They were dead by 1924 frankly. The consolidation of factories was part of the reason the great depression was so brutal.

Continued claims showing an apparent plateau at last this week. 22,800,000 vs 22,300,000 last week.

Sadly, initial claims also plateauing – too high. 2,600,000 this week vs. 2,800,000 last week.

All data subject to eventual revision, but perhaps the worst is over in terms of “sharp drop off the employment cliff”. Now we just have to deal with the hard landing.

I am sure these statistics will be remedied by time–people whose jobs disappeared will just drop off eventually…and those pesky numbers will get better. Plus, don’t forget, if you don’t trundle back to your ncovid hellhole job, you lose your benefits! It’s all good.

Our imperious leader is working on that. He thinks they are giving him the launch codes, so he keeps pressing the buttons and thus the tweets which seem like random nonsense. How many more chance combinations before he accidentally runs into the authentication and does us all in? Please don’t tell him it’s just a phone…let him play with his noisy toy. Plenty more of those to fill the container ships.

Yesterday, I dropped off some scrap steel and took a drive down to our local log sort. Three trucks were unloading and a tow was being prepped. As I write this the wind is just right for hearing a few log trucks hauling on the mainline. These include ‘fat trucks’, off hwy rigs with 16′ bunks for old growth.

Someone is buying this wood. Plus, last night on the news an agreement was reached (announced) between our local woodworker union and a large multi-national private lands forestry company to allow ramped up raw log sales to overseas customers. They are asking the Feds to approve the agreement as they control the amount of raw logs that can leave Canada.

These are all 100K+ per year jobs; skilled jobs and skilled workers.

My son is asking for a leave of absence from his ‘Patch’ job, (200K per year salary) as his electrical company is booked solid for the next year, 12 hour days doing flood remediation electrical work. This is all privately funded as insurance is not picking up the tab. What flooded? Think WalMart super centre, a Cdn Tire, grocery stores, houses galore, etc etc. Thats a lot of new services to install, and usually upgrades are made at the same time. He is planning on expanding and talked about renting houses for crew. All this work is done with social distancing protocals in place, and is engineered and signed off to industry standard.

You guys jumped on Wes earlier for saying life goes on, but it does and will for those who produce/create value products and services that people need. Tourism and tatoo parlours, not so much. Haircuts are not essential, but grocery stores are. Wood is needed to make things. Wheat will still be hauled across the prarries to Vancouver and shipped out. The TMX pipeline is still under construction and is in progress, as is the new coastal gas pipeline and the multi-billion dollar LNG plant in Kitimat.

You know what happened to our coal country towns? They were abandoned by workers after the mines were mothballed, and bought up by retirees and continue to live on, happily ever after. They have expanded and been re-purposed.

I bought a truck load of topsoil this year and the driver informs me the company cannot keep up to orders due to a resurgence of victory gardens. Our local post office is going flat out delivering online purchases. My friend is post mistress and she says every day is like Christmas deliveries.

The charts and data provided in the article are what they are and reflect an ugly reality. When we somewhat recover the economy will not be the same. No new airline jobs, no event planners needed, maybe less plastic crap from overseas. Maybe things will tick over at 60-70% instead of full bore buy more more more on credit which we think is normal.

We’ll figure it out. I do know this for sure. Wealth disparity and totally wrong income distribution will not be so easy to hide going forward. Gone will be the days of the super rich paying less every year. People won’t put up with it forever. Taxation will look more like 1960 than yesterday. Maybe life will look more like that, too.

All the great economic activity you are talking about is from the tail end of the “good times” with a dollop of “return to normal” all helped along by MASSIVE amounts of debt.

There will always be winners and losers, of course, but the trend is down from here for the next few years while the massive leverage unwinds. There is still a credit cycle and the CBs of the world can only do so much.

Come back in six months to a year and let us know how things are going.

Sorry, but nope. Your mumbling. I see nothing like this. Booked solid??? Ok, it was booked solid in 2008-9 as well. I see no proof. All demand is down and will stay down.

1) 2018 closed at the open.

2) 2019 closed below the open.

3) 2020 opened at 2019 close, moved up til Mar and lurched down.

4) Typically the trend is up until June.

5) 2020 plunge might cont until Oct/ Sep, before a rush to recover to a lower high.

6) The DJT reached its peak in Sep 2019. 2020 bear market rally was stopped at Dec 2018 low level.

5) 2020 plunge might cont until Oct/ Sep, before a rush to recover to a lower high.

Till Nov. 4th.

“Hope” is not a strategy!

Yet it seems that’s all these companies have.

Consumer package delivery is at a virtual stop. The companies can’t find anyone to package the shipment and then it takes two weeks to move across country. The virus problem is becoming a labor problem. More than 300 USDA meat inspectors have Covid. Meanwhile political animus is ramping up.

“Consumer package delivery is at a virtual stop.”

Nobody told ups and fedex drivers who deliver packages to my house every day.

YRC’s guidance on qualifying for a possible CARES bailout illustrates the folly of targeted bailout schemes. Only the lucky, the connected and the banks get goodies. But how does a CFO come up with projections for lenders on YRC’s likelihood of getting lucky?

It would have been better, easier and cheaper to send out a UBI. This way, nobody is favored, more families can make rent, and companies like YRC can come up with a strategy for attracting households’ surplus cash flows in their pivoted business plans.

But no. God forbid anyone “undeserving” (a.k.a.: not rich) get anything free.

You guys need to know the difference between structural damage and shutdown damage which will reverse quickly. My guess by the 4th quarter, you permabulls nostril flare will be brutal.

I wouldn’t be so sure.

Even the most sanguine airline CEO’s, CFO’s and presidents envision a 70/50 recovery by the end of Q4 2020: this means 70% of domestic flights and 50% of international flights, not passenger volumes. Passenger volumes won’t recover (meaning at least 75% of pre-crisis level) before the end of Q3 2021 at very earliest, and the extra problem is many airlines such as Lufthansa and Qatar Airways are taking the occasion to axe the least profitable parts of their fleets, meaning their carrying capacity will be below pre-crisis levels for years, possibly well into 2024. And let’s be honest: many airlines won’t emerge from the crisis or will be so heavily maimed as to be unrecognizable.

Ryanair and Wizz Air, two of Europe’s largest airlines, are in negotiations with Boeing and Airbus respectively to delay and possibly cancel future deliveries: Wizz’s maxi-order for 263 members of the A320neo family in particular will most likely be trimmed. Almost every other airline is doing the same.

And I’ll stop here: if you want more structural damage in just one sector of the economy I’ll be happy to oblige.

Trucking freight volume (dry van and reefer) has been increasing since late April. Obviously still at a depressed level, but clearly on the uptick.

Just the hilltop observation above an echo chamber corridor on the West Coast. None of the I-5 woosh. None of the heavy train movements. Few planes in any lanes. Hell, even the ambulance, police & fire noise is nil. We’re in Phase 1 now, and parking lots at re-opened ex-thrift/now-“retail” are more full than before-WTH!! Markets stayed 1/2-to-full lots all along. Maybe freight is moving on expectations, but is there demand for that supply? Or just false hopes?