Consumers that added $1.3 trillion to their savings last year are not the ones who owe $1 trillion on their credit cards.

By Wolf Richter for WOLF STREET.

This phrase, “consumers in aggregate,” is starting to crop up even in Fed speak, including in Jerome Powell’s press conference this week, to express that they’re not totally blind to what is happening. Consumers “in aggregate” – all of them thrown together into one bucket and summarized with one number – are still doing their job, propping up the US economy.

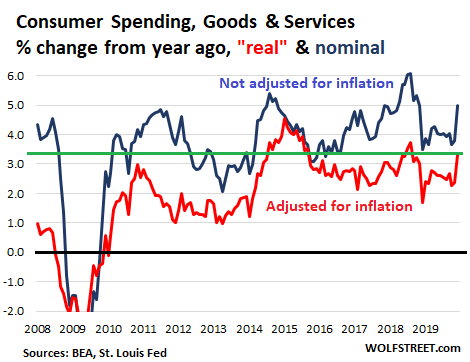

Consumer spending on goods and services, as tracked by the Personal Consumption Expenditures data released this morning, rose 5.0% in December (blue line) compared to a year earlier. For the year 2019, consumer spending on goods and services rose 4.0% to $14.6 trillion, amounting to 69% of GDP. Adjusted for inflation, “real” consumer spending on goods and services (red line) rose 3.3% in December compared to a year earlier. In December, consumers pulled out their wadded-up cash, credit cards, and payments apps and stepped up to the plate:

Consumer spending on services alone rose 4.3% in 2019, to $10.05 trillion. This includes healthcare, tuition, rents, hotel rooms, financial services, haircuts, auto repair services, etc., and accounts for about 69% of consumer spending.

Consumer spending on goods rose 3.3% to $4.51 trillion, accounting for 31% of consumer spending. This includes data that we see elsewhere as retail sales.

And then there’s interest, which is not included in goods and services. Interest payments on mortgages, auto loans, credit cards, and student loans in 2019 rose by 7.4% to $362 billion. This surge in interest payment occurred due to larger mortgage debts and higher consumer loan balances, and despite the plunge in interest rates – except, well, um, on credit card loans and personal loans, where interest rates remain very high.

Total “personal outlays,” which include everything that consumers pay for, from goods and services and interest to sending money overseas ($92 billion in 2019,) rose 4.1% to $15.13 trillion.

So where did consumers get this money?

Personal income from all sources, earned by all consumers combined, rose 3.9% in December from a year ago, and by 4.5% for all of 2019, to $18.6 trillion. Adjusted for inflation, “real” personal income ticked up 2.3%.

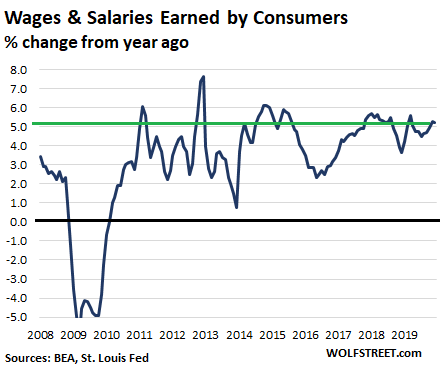

About half of personal income comes from wages and salaries. This is the amount all consumers combined were paid before taxes and other deductions. It’s a function of how many people are working and of what these jobs or side-gigs pay. In December, the total amount consumers received in wages and salaries grew by 5.2% year-over-year. For all of 2019, wages and salaries received grew by 4.9% to $9.32 trillion:

The table below shows the details for personal income by category for 2018 and 2019 and the percent change. Capital gains on investments – which have been hefty in 2019 – are not included. Proprietors’ income and rental income are net of “capital consumption,” which includes depreciation.

All forms of income combined minus taxes and minus contributions to “government social insurance” (such as Social Security) result in disposable income, the line at the bottom of the table, which grew by 4.4% in 2019 to $16.4 trillion:

| 2018, Billion $ |

2019, Billion $ |

% change | |

| Total Personal income | 17,819 | 18,624 | 4.5% |

| Wages and salaries | 8,889 | 9,323 | 4.9% |

| Goods-producing industries | 1,472 | 1,539 | 4.6% |

| Services-producing industries | 6,014 | 6,332 | 5.3% |

| Government | 1,403 | 1,452 | 3.5% |

| Employer contributions | 2,040 | 2,125 | 4.2% |

| For pension & insurance plans | 1,417 | 1,473 | 4.0% |

| For government social insurance | 623 | 652 | 4.6% |

| Proprietors’ income with inventory valuation and capital consumption adjustments | 1,589 | 1,656 | 4.2% |

| Farm | 27 | 31 | 14.3% |

| Nonfarm | 1,562 | 1,625 | 4.1% |

| Rental income with capital consumption adjustment | 757 | 778 | 2.8% |

| Personal income receipts on assets | 2,930 | 2,993 | 2.1% |

| Personal interest income | 1,703 | 1,721 | 1.0% |

| Personal dividend income | 1,228 | 1,272 | 3.6% |

| Government social benefits to persons | 2,918 | 3,118 | 6.8% |

| Social security | 972 | 1,035 | 6.4% |

| Medicare | 731 | 801 | 9.5% |

| Medicaid | 598 | 632 | 5.8% |

| Unemployment insurance | 27 | 26 | -3.7% |

| Veterans’ benefits | 110 | 119 | 8.6% |

| Other | 480 | 505 | 5.1% |

| Transfer receipts, from business (net) | 53 | 55 | 2.6% |

| Less: Contributions for government social insurance, domestic | -1,357 | -1,423 | 4.9% |

| Less: Personal current taxes | -2,078 | -2,186 | 5.2% |

| Disposable personal income | 15,742 | 16,438 | 4.4% |

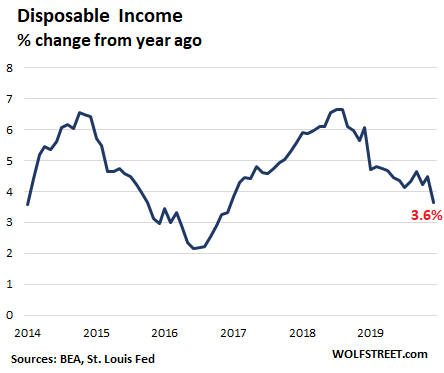

But all last year, the year-over-year growth rate of disposable income was diminishing, after peaking at 6.7% in August 2018. In December, the year-over-year growth rate was down to 3.6%:

The moolah per capita

Disposable income per capita rose 3.9% to $50,036. This number is based on disposable income divided by the population count (328.5 million), and is heavily influenced by the top group of earners with vast incomes. On an inflation-adjusted basis, disposable income per capita rose 2.5%.

How much did folks save?

Personal savings for the year is defined as what is left over of disposable income after all personal outlays have been made. In 2019, the total amount saved rose 8.4% from 2018 to $1.31 trillion. The personal savings rate for the year was 8.0%.

Consumers are in pretty good shape, “in aggregate…”

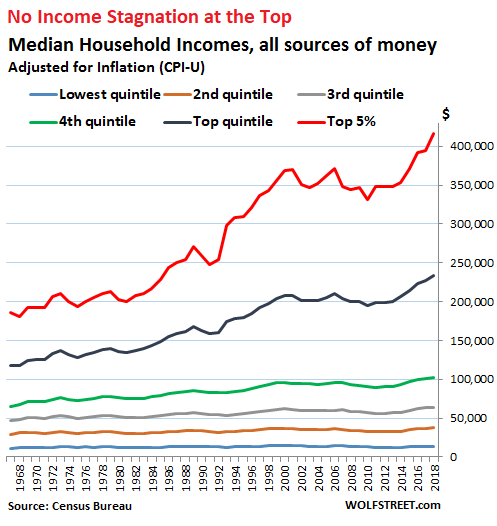

Consumers “in aggregate,” however, are heavily skewed by a small group of very wealthy, very high-income consumers. This statistical skew is caused by the extraordinary income-and-wealth disparity in the current economy, where central bankers have done everything possible to increase this income-and-wealth disparity through the “wealth effect,” as they called it – making wealthy asset holders even wealthier by inflating all asset prices, so that they might spend a little more. This likely helped GDP a little, and it certainly did a wonderful job of boosting incomes at the top:

And this is where these “in aggregate” numbers get in trouble.

For example, American consumers saved $1.3 trillion in 2019 “in aggregate” according to the above data. But survey after survey shows that about half of American households have essentially no savings, and are living from paycheck to paycheck, many of them with big balances on their credit cards. Credit card debt now exceeds $1 trillion.

But those consumers who owe $1 trillion on their credit cards are not the ones that saved $1.3 trillion last year. That’s another group of consumers. And it’s not the top group of consumers that is likely to get in trouble, it’s the bottom 50% or 60% or even 70%. That’s where there are little or no savings, and where people are engaged in a mad dash every month to make ends meet. But “in aggregate,” it looks pretty good.

Dream of 3% economic growth remained a dream despite surge in government borrowing and spending. Read... US GDP Rose by $850 Billion in 2019 as US National Debt Surged by $1.2 Trillion. Debt-to-GDP Ratio Hit 108%

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

How really smart is it to save at 0.001% interest rates?

How smart is it to play Russian roulette with a government owing in excess of 100 pct debt to GDP, that essentially hasn’t seen a trade surplus in 50 years, and prints like a forger to keep itself alive.

True interest rates (sans Fed forged money supply pumped into the system) would be at least double or triple the ZIRP ones.

What will normality do to asset values? See 2009 times 2.

Speaking of which, if ZIRP is the magical equivalent of a unicorn crapping gold…how exactly did the unicorn croak in 2009?

There is a lot of inflationary ruin in a country – but it isn’t infinite – how long before some opportunistic politician (telling the truth!!) will point out the direct link between gvt gutting of bank savings rates (for 20 yrs) and the housing cost inflation harming (not enriching) 45 to 60 pct of the population today.

The core of the country is being doubly screwed by DC policies – expropriation of savings earnings and inflation of housing costs. In exchange they get the asset volatility seat in the last scene of The Deer Hunter.

You can eat well or sleep well – not both.

Trusting in the long term viability of the gvt to forge its way to greatness…is to definitely swallow something.

been watching this slow train over cliff for 50 years

loved the 18% interest during initial fiat years(ie after end brenton woods) late 70’s

then reagan, bush, clinton, bush,obama,trump all realized they could get everything they desired by loading on govt debt higher and higher

today take out wrong pillar and it will crumble

but all politicians for 50 years now have got elected by promising moon

tic toc goes the debt clock

You left out Reagan.

(Fantastic article, Wolf.)

This article actually lead me to believe there are one heck of a lot of people that can neither eat nor sleep well. Now I’m really confused, and you aren’t even an Oracle.

Did notice receipts from personal assets almost equals ALL gov’t “entitlements”, though, and at above mentioned low rates that’s a good sized pile of money. Also could see the Reagan tax cuts clearly in the charts, but only in the top 5% bracket

Some smart savers are doing so in ways that are not counted as savings, e.g, purchases of pms, land, etc.

True.

There are plenty of really smart people who have it figured out ie that the economic situation is beyond all hope, any possible redemption, is heading for utter disaster and as a consequence have bought pms (and land)

Then there are the no-so-smart-people (of whom I am one) who know that they can’t figure it out – but are just smart enough.. to know they aren’t smart enough to figure it out…. and as a consequence, take the easy/only way out for simple, non-smart people and buy pms (and land).

Fortunately I found out that I wasn’t smart quite early.

Fortunately I found out that I wasn’t smart quite early.

The Delphic Oracle named Socrates the wisest of the Greeks, probably for similar reasons.

It said nothing about me. It just sort of snickered.

Well, land and PM’s can be confiscated in the blink of an eye.

But then, one can die in that blink, too…..

It’s certainly wiser than putting one’s faith entirely – long-term -in pension or stocks, and if you do something good with that land, infinitely more satisfying.

As an historical example, the mother of friend had to flee Bolshevik Russia in 1917, and found refuge on her estate in Poland.

This served her very well indeed until 1939, when she lost them for good.

She ended impoverished in England, I think.

The son did inherit a small amount of capital, not from her though.

The moral is diversify and cross your fingers, I suppose.

Read “The Emperors New Clothes” It’s a children’s story but is applicable at any age.

Don’t let them fool you with their false wisdom.Even the top people didn’t see,or I should say time the housing/bank blow up of ’08

Whether it’s a currency crisis,debt,or derivatives bomb,nobody is capable of timing it.These instruments of mass destruction aren’t meant to understand.They are engineered to intimidate.The bankers think of the clientele as”Muppets”.They have respect nor care of your wealth or retirement destruction.They are only thinking about year end bonus for themselves.Greed is Good.

Different people bring different talents to the table.Just because you are not well versed in financial instruments does not mean you aren’t smart.I’m sure that you have other talents and skills that would make these bankers look like children.It takes all kinds to make this world work,but respect,rather than greed is the key to humanity’s happiness.

That damned Oracle told me I should look to the fruit and it’s Hoplites for my answers. I still don’t understand her after being back in Laconia for 3 months now. A wasted investment in time and drachmas (except for the woman I knew on the way)….still a pitiful return.

Absolutely but looking at the statistics regarding teals anyway, there aren’t very many “smart people” in the US anyway Germany and India are another story

Okay, I will bite – what is pms?

…ask your wife!

Precious Metals. Good for industrial purposes and rap star bling. Wealth store use may be questionable.

Took me a while to figure it out, but I believe it is Precious Metals.

In a doomsday scenario, small amounts of gold and other precious metals would come in handy to bribe prison guards and other government officials. In late 1942, my (now) brother-in-law’s mother was able to use them to buy her release from a French internment camp.

Wolf,

An idea for a post –

Solicit readers’ ideas for new era stores of values and pros/cons of each…

There will be a ton of gold/crypto bugs, but if you think about it, there actually are a number of utility goods that share characteristics (portability, storability, standardization, etc) for passable currency in a true dollar crisis.

Look at what happens in prisons where paper currency is banned – things like cigarettes and canned goods become commodity money.

I would guess that Weimar came up with a lot of original ideas – any economic historians out there?

One idea for crisis money that I have not seen before – painkillers (aspirin, etc) – easily portable, divisible, storable, etc. And with direct utility.

Of course, all commodity monies are inferior to a trustworthy fiat currency.

But that T word is the problem…

When I was upstairs in Sac. Co. Jail in ’66 they actually gave out Bugler and papers. But not enough. I butted a tailor made on the floor and got a lot of dirty looks. Then someone pointed out the box on the wall and I squeezed out the last of the tobacco in the butt into the rest of the growing pile.

Jail etiquette, Holmes.

Saving is another way of saying you are spending less than you earn.

OR

living within ones means

and

saving for retirement/rainy days

I save because I spend less than I earn….why? Because after a certain point, one has all the material posessions in life, the rest is ‘experiences’ such as travel, fine food and wine. Debt is slavery.

2banana,

“Saving” here doesn’t mean putting it in a savings account. It means “not spending.” So this could be invested in stocks or bonds or real estate or whatever.

Or PRECIOUS METALS

Yes, that would work.

Wolf is a convert! (took a while)

But can you get an accurate measure of all “not spending”, Wolf?

In this context, it’s disposable income minus total outlays. Whatever is left over is “not spending.”

What ever happened to “Marginal Propensity to Consume”? It’s all I remember from my one Econ class that I never completed, besides Capex.

so sorry wolf – but stock market is

ONE GIANT ponzi scheme run by 1% for 1%

rest GAMBLE on ride will make them few shekels

warren always says you need to own 51% or more

so you are in CONTROL and not whipping boy/girl

It’s not a ponzi scheme — it’s the world’s largest casino, where the high rollers cheat and the house turns a blind eye. Individual investors are the mom, pop and joe gamblers willingly participating in the wealth transfer. Of course, that’s not to say there isn’t any of them who managed to win a few chips playing.

You are on a slippery slope if you Define savings as investments in stocks Etc. Buying stocks is another form of consumption. True savings becomes the source for True borrowing with a promise to repay principal plus interest. Equating lending with a purchase of stocks is at the very heart of the perversion we are experiencing.

I agree. If one treats expenditures on stocks as consumption, as we should, we continue to have considerable inflation. Cash is savings. Stocks and bonds are simply consumable items with resale value. That is how governments hide double digit inflation.

Wolf, curious, do “savings” include pension contributions, or pension plan earnings/growth such as found 401k’s? Also for defined benefit plans is anything included as savings? Income, contributions, benefits that is benefits earned or accrued? I guess also are withdraws, payments, losses seen as a reduction of “savings”? Someone told me once these savings stats don’t include pensions harking back to the days when pensions were purely government/corporate vehicle? Not sure if correct, but some strange spidy thing tells me possible. That is bureaucrats running the same suet of stats since 1922, without regard to whether they reflect current reality.

Penny saved is penny earned, instantenious 100% return. And considering all the taxes it’s more like two pennies earned.

One would hope that they would just be holding the funds temporarily at low interest rates in the hope that the market will collapse and they can then buy securities at bargain basement prices. E.g., I read a report that claimed that the Wizard of Omaha had huge cash reserves.

Indeed, the Wuhan coronavirus might be the black swan that they have awaited to drive stock prices down. It might drive China’s economy to the ground, which may drive down the value of the investments of many ultra rich Americans in China and in countries which provide raw materials (like Australia), oil, etc., to China. That might bring down world consumer spending and bring about the long predicted world recession.

Certainly, various governments, including in China, appear to be downplaying the impact and probably misleading the public to reduce panic. E.g., in a large city like Wuhan, there are a large number of available hospital beds, so the limited number of cases claimed by Chinese authorities would not have filled the hospitals as reported, nor necessitated the construction of a new hospital on an emergency basis, as reports show.

Most importantly, the thing that governments conceal is that our medical systems all have limited resources and beds: the 3% death rate for the Wuhan coronavirus is for patients provided with treatment with respirators and sophisticated nursing care. If no treatment is provided to thousands of secondary victims, because prior cases have filled the hospitals in a spreading pandemic, the death rate will climb steeply.

Let us assume that the Chinese communists have under-counted the number of infected people. Then the Youtube videos of dead people on the streets of Chinese citizens might be of persons who died of heart attacks from fear or from other causes or alternatively, of persons who were sick with coronavirus but too poor and lacked connections, so they could not gain admission to a limited number of hospital beds.

Whatever happens, these events will likely be tragic and cause extreme suffering for the poor and lower middle classes in the world, but might please investors who have been sitting on the sidelines.

The thing is this: I agree that the Coronavirus might be a sort of black swan event that triggers a temporary sell-off.

I think this article covers that quite well: https://frugalinvestors.com/market-timing-model-coronavirus-and-your-portfolio-in-february-2020/

However I don’t see it producing a world-wide or global recession. At the end of the day the impact of the disease simply isn’t potent enough to hang around and disrupt economic output long enough.

The trade war gave it the good old college try – interrupted billions and billions of dollars of capital – but it was far more reaching and involved the world economy. At the end of the day (as the article above references) Coronavirus is not that potent and it’s as you say more of a tragic event that impacts China more than anything.

I think that if anything it will result in a 2015-2016 style slowdown and create opportunities for shrewd and patient investors to get more cash to work

The middleeast slang for cash is “effectif”….all of us need money for “effectif”…waiting for a sale of gold stock when your car needs tires is rather a drag.

Some don’t like credit cards, which are more and more costly…many businesses give discounts for cash as well.

had one business say he didn’t take cash and would penalize me 3% for doing so

seems banksters got to him

Likely Visa or MC take 3% from that buisness owner. Top 4 payment processing corps are now valued at about a Trillion dollars with P/Es north of 40.

Joe Saba,

My favourite hole in the wall restaurant only takes cash, as well as the store where I buy my fishing tackle. I just bought a bunch of plexi glass for some lamps I am building and the window place told me to be sure and bring cash for a big discount. Today, I am hauling lumber from a local sawmill. I will pay for it on Monday….cash. The bill is approx $1500.

Legitimate stores with receipts and records prefer debit (which to them is like cash) and I often get a 15% discount because I am in ‘their system’. Cash.

Cash speaks loudly.

Yep! When I was having off grid heavy equipment work done by owner/operators I told them beforehand I was paying cash, no receipts needed. The rest, as they say, is between them and the governor.

Don’t underestimate the effect of the novel Coronavirus. It already exceeds SARS infections and is just getting started.

I’m in Australia and inbound passengers from China have been reduced from an expected 7,000 to 700.

Apple has shuttered all its China stores. The Baltic Dry index collapsed on Friday. If the virus continues even for a few more weeks the straitened global economy will be further weakened.

I see severe corrections on equity markets this week starting with China.

King dollar rules all, nothing beats a crisp stack of Benjamins, no matter where you are in the world.

That’s right, no harm in asking for a cash discount. Any discount is good!

In the 70’s people were paying off their debt with inflated dollars. At that time, borrowing was expensive. Right now, I’m buying silver with my spare cash.

If everyone in the world divided up the physical silver, we could all only own less than 1/4 of an ounce. Why would anyone want to own something where supply could literally lockdown overnight? Oh well.

Yeah. “What’s the biggest joke in LA?” back then was, “the Benz is paid for, I can get all the money I want at 9%, and it’s only a cold sore.”

I bought silver back in 2010 — it’s still under water …

It is safer to save at 1/1000% than 10%. Just saying

I don’t understand, can you explain?

2banana:

How “unsmart” is it not to save if u can???????

Many, many decades ago I read from a higher muckety muck in the FED: “Don’t chase interest rates!”

If u don’t save if u can then get ready to fall thru the mouse traphole……

Do we have these measured in median numbers?

The problem with aggregates for anything other than consumption or the like is the rich can skew the data.

I hope I am asking this correctly when we measure how good consumers are doing.

Yes, median numbers would be very helpful. And we get some median numbers separately, such as the income numbers from the Census Bureau. But all these numbers in the PCE report are national totals. And they’re heavily skewed.

Yes, the academic and govt economists (govt economists/bankers get their cred from the academic backing) use average numbers. This lets them do all their dense math so the little people can be told they are not smart enough to understand.

Then, when the median result isn’t good (too much wealth inequality), they propose forced wealth redistribution.

It’s basically crony capitalism (=socialism for the rich) + redistribution (socialism for everybody else).

The legal structure of the markets need reform on various levels.

International trade, financial risk taking/moral hazard based on bailouts, etc. all need a lot of work.

Wolf,

That is an excellent big picture spreadsheet – it makes it easy to weigh the distortions that government policies have imposed upon the macro economy – you should post it at least monthly so your readership can grasp how the Feds are twisting the levers in their control of the big machine.

Ratio analysis of the various line items (and their evolution across decades) will tell us a lot about US economic decline.

In other words … pretty much all the savings by all the folks in the USofA were offset by the increase in the national debt (made far worse by the tax cuts … that likely added to savings of the rich). Not sure how sustainable this is. After all Trump is known for his ability to make things go bankrupt.

“After all Trump is known for his ability to make things go bankrupt.”

That is going to be the storyline that the DC establishment pitches when the ruin comes – everything is 100 pct the last guy’s fault…pay no attention to 60 years of relentless government incompetence and corruption that accumulated into cancerous ruin…everything is the fault of the last five minutes…

A good taste of this came in 2011 when Rictus (Pelosi) pointed at the GOP budget hardliners and said they are ruining the country with a shutdown…a shutdown designed to slow down the habitual deficit spending of DC Statists. After decades of grotesque DC economic failure.

Utterly shameless and utterly DC.

Watching Rictus’ face is to see the essential face of DC hypocrisy – bottomless, shameless deceit – and it existed long, long, long before Trump.

Yes, he is the perfect ‘agent’ for a corrupt system.

Yep. It’s as if the entire system produced a figurehead to finally reveal itself and dare you to stop it.

Trump does deserve a good share of the blame for the deficit because he chose to reduce government income (tax revenue) in an already expanding economy. It just wasn’t expanding fast enough for his political needs and ego.

Regarding the government shutdown, your comment overlooks the fact that few of the GOP hardliners you mention have ever voted to reduce spending in the areas that matter to them politically. Blowing past the “debt ceiling” is the symptom, not the problem.

@james wordsworth

Um, yeah — that’s how the sectoral balances work: net private sector savings in $USD ALWAYS equals the net US Federal debt!

My bet is Federal government is among the largest groups of consumers. In my county, the county itself is the largest employer.

I consumed less than $200 of gasoline last year and my property taxes exceed my electric bill (which consists largely of taxes) by a wide margin.

I don’t plan to purchase or own a hydrogen generator, lol.

I love statistics.

I have two chickens and you have none.

Statistically, each one of us has one chicken.

What are you complaining about?

That statistically speaking, I only have one, hahahaha

If Jeff Bezos walks into a room with 100 other people, then statistically they are all billionaires.

That’s the low-quality logic that the Fed uses when it aggregates numbers. This aggravates normal people. Their aggregation is our aggravation.

BTW, the increasing disparity in wealth is getting so bad that now it’s literally starting to depopulate the country, as youngsters can’t afford to have kids. The total fertility rate for the USA is now 16% below the replacement rate. This is low enough that the decline is now self-reinforcing, putting the US on the same demographic trajectory as Japan and Western Europe.

Not to mention our declining life expectancy. And the, uh, “aging out” of the baby boomers. So much for investing in land.

If we had the habit of using median instead of mean, we’d be a lot less gullible.

The mean is rarely typical. In this context the mean always helps the elite to create false impressions.

The scariest part of this is that the highest growth rate of all sources of “income” is… government handouts.

Obviously not sustainable.

It all trickles up to the rich, one way or another. The only problem is that it doesn’t flow upwards directly, but that problem will soon be solved.

Like Twain’s argument for helicopter money. “…sure, just give it to the poor for free, the rich will have it before nightfall, anyway”

Dogbert consulting:

“You need a dashboard application to track your key metrics. That way you’ll have more data to ignore when you make your decisions based on company politics.”

“Will the data be accurate?”

“Okay, let’s pretend that matters.”

Ok I have a question. At what level do I go in the stock market. I’m still waiting to deploy my dry powder. Still patient. Waiting for the Chinese to get back to work later this and next week. I’m sure you have the same question.

Nobody with half a brain wanted to be long going into the weekend, including me. The buy-in point is not clear at this time, and it will be a while, probably a few months. We will likely get population control and a vaccine, and by then a massive amount of liquidity will have been gushed by central banks.

If your feet are frozen in a block of ice and your hair is on fire, In aggregate, you are comfortable.

With all due respect, this is one of those “meh” articles. Anybody that pays attention to these reports and stats knows what the Fed is implying with “in aggregate,” and we all know the Fed speaks with forked tongue. Also, we’ve been living with massive deficit spending and irresponsible consumer debt for decades and will do so for decades to come. The data update is great, the rest is just an old tired story. Let’s talk about Wolfe’s big short instead. Nailed it! Just needed a catalyst, and boy did you get one.

You can actually look at that median household quintile income chart and say

“MEH” ???!!!!!!!!! He didn’t even show 1 and .1%!!!

Would median net wealth grouped similarly affect this “meh” of yours?

What GINI index level might possibly give you some concern?

To the above comments about the fallacy of ‘savings’, if you have ever been broke or on a very restrictive budget, the quality of sleep one achieves by having some cash on hand is lovely, indeed.

So, pick your appreciating asset. However, just be sure you can flip it into something useful when you need some readies. You can quickly borrow cash with your PMs as collateral, but then people know you have PMs. My buddy has a bunch of silver bars. He is starting to make jewelry with them. :-)

That meme about, “No use saving, we don’t get anything for it”, is just the last process of the rich taking everything you own. The next step is to pull out the credit card because you don’t have enough available cash to do what you need to do. It reminds me of people saying there is no use to buy a home, just rent, because….. And after awhile you realise your locked in payments have become less than renting as housing inflation and currency debasement works its black magic. Yes, I realise housing depends on location location location, but after awhile you have paid off your home and you have no monthly bill beyond utilities and a tax account to top up.

My father-in-law, 40 years ago, said to me, “Get your house paid off as soon as you can and it’ll be like you get an extra pay cheque every month. You’ll see. You will go from having an empty wallet to always having $100 bucks in there”. He was right.

Then you take that extra ‘worthless cash’, and buy another house, and another……. and find reliable tenants to help pay it all off.

As for Wolf’s short, yesterday’s 603pt drop was very very interesting. I thought he nailed it at the time, and I still think he nailed it. Sure, it might seesaw a bit, but even the dumbest investor will eventually grasp that 1.9% growth when interest rates are virtually free, will twig onto the fact the Market is nothing more than hype chasing yield.

There will be an ‘accepted’ downturn one day. And, the price of housing in various locations will once again be dirt cheap, (so to speak). It would be nice to have some cash on hand to make your move when it happens. Just an opinion. Otherwise, you’ll have to borrow just like everyone else who thought saving was for schmucks.

Some stocks go down 4% a day during a panic, but the price of food seems to remain the same. They raised the price of food slowly so it is hard to notice.

I heard a Fed speech about 1.5% inflation. It is like someone kept false account ledgers. The price a car goes up. They say it is not inflation because you get a better car.

A trip to the emergency room costs thousands, whereas it used to cost hundreds. Americans pay more for healthcare than any other nation, but die younger than those in most developed nations. One guy died during a hot dog eating contest. Obesity is rampant.

The stock market dives like a black swan. Hundreds of thousands died of the flu every year in all the world. Mainly old people died of coronavirus. China closed shops and ordered infectious disease protection masks, gloves and plastic suits.

Some US companies sold goods and services overseas. This reduced the current account deficit and helped lift the dollar.

My last asset held at Treasury Direct just matured and I put into a bank CD because they have notably higher rates even factoring state taxes. I hope the Federal Government doesn’t default and go bankrupt now that I no longer lend it money.

timbers,

If you insist on having something in your Treasury Direct account that currently pays more than bank CDs, and that is indexed to inflation, check out i-bonds (purchase limit $10,000 per year). They pay a minuscule base rate (something like 0.1% at the moment, but it was higher last year) PLUS whatever the annual rate of CPI is in the period (CPI is now 2.3%). The rate each i-bond pays changes over time with CPI. So if CPI goes to 5%, your i-bond that today pays 2.3% will pay 5% during that period. There are all kinds of details about this, so if interested read the description on the Treasury Direct website. But given the $10,000 a year purchase limit, it’s not useful for larger investments.

Thsnjs. That 10k yearly limit is puzzling.

These i-bonds are relatively speaking a great deal for investors — inflation protection, no interest-rate risk, decent liquidity if you need the money, etc. — but expensive for the government, and it cannot inflate them away, unlike 30-year bonds, which yield about the same today. To keep uncle Buffett et al. out of the cookie jar, they put a lid on it.

The I-bonds limit is 10k per SS number, so you can buy multiple I-bonds worth 10k each per family per year. Also, they aren’t taxed until you choose to redeem.

I have a ladder that covers a few years’ expenses.

A caveat about I-bonds, from the horse’s mouth:

“I bonds earn interest for 30 years unless you cash them first. You can cash them after one year. But if you cash them before five years, you lose the previous three months of interest. (For example, if you cash an I bond after 18 months, you get the first 15 months of interest.)”

https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds.htm#irate

https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=billrates

One year T-bills are at 1.45%, the I-Bonds are at 2.22%, so cashing out an I-bond after a year yields nine month’s interest, at 2.22% * 0.75 = 1.665%. The I-Bond is a bit better.

For anything less than a year in duration, a normal T-bill is probably a better investment, as you can’t even cash out the I-bonds before one year. The six-month T-bill rate is about 1.54%.

If you are planning a large purchase that most likely won’t be made for a year or more, this is a rational choice.

i-bonds are designed for inflation protection and long-term holding. They’re not designed for cash management, though they also provide liquidity when you need it. T-bills, as you point out, are designed for cash management, but their yield is currently a lot lower. And cash management is the only thing T-bills are good for.

There may be a period when i-bonds yield less than T-bills: when the Fed raises its policy rates above the rate of CPI. Not sure how much of that we will see, though :-]

I like to think I-Bonds are designed for low net worth savers, hence the $10K/yr limit. To me it’s all money I hope I won’t have to use and can pass on to nieces, nephew.

Just bought my yearly. BTW, for this 6 mo period it’s .20% + CPI-U.

\\\

Wolf, if I may suggest.

I know this is vague, but could you by any chance correlate the plots of the consumer credit vs. 5th quintile and top 5% over the same timespan? And also, these charts would be great with a ratio of earnings vs. credit held by each quitile (I am not sure this data is possible to obtain). I am currious how much more “credit stressed” the individual is with the same amount of income over time.

\\\

Thanks for the article.

\\\

The largest increases are in Medicare and Veterans benefits. The two opposing political parties are symbiotic. (At some point one of them decides to stop playing the game) 1T plus deficit and no adults in the room. There used to be a metric called “discretionary spending”. Where is that?

“The two opposing political parties are symbiotic.”

Really just two mafias fighting over the protection racket money.

With the one shared value that power should only reside in DC.

Look at medical system fixes – 6 decades of DC oriented money flows and theoretical, essentially impotent oversight of the relentlessly inflating industry.

Upfront pricing disclosure (like every other business)? Tried in the last 5 minutes after everything else has failed.

That isn’t an accident – DC wants all power/money to pass/issue through its hands.

I’ve always felt the VA should be a full fledged part of the Military. Sort of a of a you break it you own it medical force. Call it the United States Trashed Warrior Maintenance Force….or something…..crossed crutches logo…..can’t imagine any generals advancing by cutting it’s DOD budget……anyway, it sure beats hell out of a “space force”.

1) The gov cut taxes, but personal current taxes collection were up 5.2%, why ?

2) There is correlation between SPX vertical rise in 2019, up from

2,444 to 3,248, or + 33% and the meteoric rise of the top 5% of

house income (not saving).

3) The total personal income is x2 larger than wages and salaries. What’s the rest ?

4) Somebody was exercising stock options, cashing in, in 2019, at peak QQQ bubble, when options value were high.

4) Somebody else, an old investor, was selling long term stocks holding, just in case, before the stock markets drop.

5) That might explain why the top 5% of the household income is

taking off, since 2014, with a rest stop in 2016 and why tax collection

is rising, despite the tax cut.

6) SPX monthly shooting star candle indicate that tax collection in the

first quarter of 2020 will exceed the previous quarters. It might cont during the first half of 2020.

7) The top 5% quintile lifted personal taxes by 5.2%, while disposable

personal income rose only by only 4.4%, because

the bottom 50% gap lower, down below, in comparison to Soho or San Mateo income.

8) Bill Gates, large assembly of stocks donations from wealthy friends,

might be selling parts of his collections, in buyback campaign,

without paying any taxes.

The TGA account of the government at the Fed hit 450 billion per h.4.1. That’s huge. If tax rates went down, then what’s the for? Tariffs or Increased Treasury auctions???

Gotta say, that with prices in the things that matter for day-to-day dying, er, living .. you know, like food, energy, home maint. reaching toward unobtainum, PLUS the ever-upward bloat in taxes, fees, rents, levies, assessments etc. … those ‘aggregates’ are as house-sized boulders to be gingerly negotiated, with the added effect of slipping on my ass-ets, and getting raked naked ,sliding down that course & bumpy Fed Scree d field.

OUCH !

1) Diversion : in the first half of 2020 SPX might go south, while the

the income of the top 5% quintile will be rising.

2) If US economy will hit a bump, both the top 5% quintile and SPX

will plunge.

When TGA at the Fed plunge, the cause might be that the US gov warchest is transferred to an off the books, secret account, lifting Total Gov Account, when the debt ceiling jump.

Seems I remember an instance where they were hiding money in places like DOD and SSN. The purpose of the shell game may have been to keep money away from Congress??

I have always wondered, why per capita income has been calculated based on the population numbers that exclude all kinds of immigrants, illegal workers, temporary visitors, overseas students, etc. We are talking of 30 to 50 million people.

DV,

Population numbers in the US attempt to include everyone who resides in the US, from US citizens to illegal immigrants and the homeless. But they do not include tourists.