Just can’t catch a break: Friday after hours, United disclosed it abandoned its junk-bond offering after investors balked. Shares fell.

By Wolf Richter for WOLF STREET.

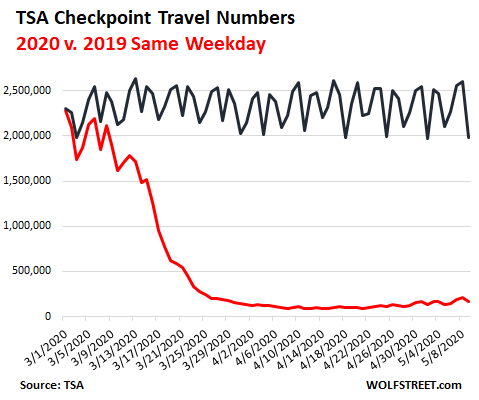

Here’s what US airlines are going through: The TSA has been reporting the number of daily checkpoint screenings. This is the number of people in the US who got on a plane for at least the first leg of a trip. A connecting flight would not trigger another screening. This is a rough indication of passenger air traffic.

Between March 1 and May 9, 2019, the TSA checkpoint screenings ranged between 2 million and 2.6 million per day. This year between March 1 and May 9, they have collapsed to as low as 90,000 screenings, and though they have ticked up, they remain abysmally low:

Airlines reported that some flights have only a handful of passengers, some just one passenger. On these flights, crew members outnumber passengers. And this comes despite massive cuts in flight schedules. For example, United Airlines has cut its original schedule from the beginning of this year by 90%.

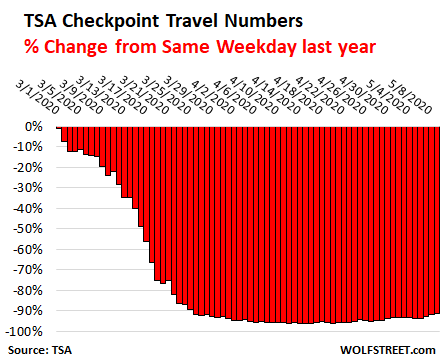

During the worst days, screenings were down 96% from the same weekday last year. Friday was the best day so far, with 215,444 screenings, down “only” 91.7% from Friday a year ago. Saturday, screenings, at 169,580, were down 91.5% from the same Saturday last year. So a tad up from abysmally low levels, but still at abysmally low levels:

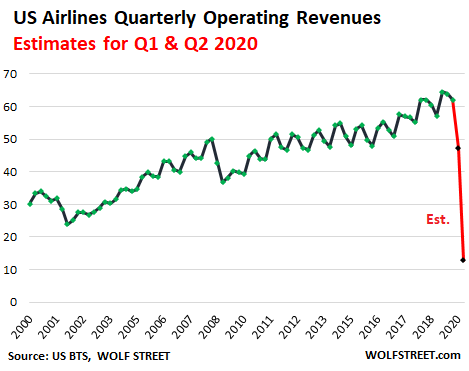

And this plunge in passenger volume has already had an impact on airline revenues in the first quarter, though the plunge in passenger traffic didn’t start until early March. Revenues for the top seven airlines in the US combined fell by 17.5% in Q1, largely due to the collapse of the last three weeks of the quarter:

| Revenues by Airline | Q1 2020, $ billion |

Q1 2019, $ billion |

% YOY | |

| Delta | DAL | 8.59 | 10.47 | -18.0% |

| American | AAL | 8.52 | 10.58 | -19.5% |

| United | UAL | 7.98 | 9.59 | -16.8% |

| Southwest | LUV | 4.23 | 5.15 | -17.9% |

| Alaska | ALK | 1.64 | 1.88 | -12.8% |

| JetBlue | JBLU | 1.59 | 1.87 | -15.0% |

| Spirit | SAVE | 0.77 | 0.86 | -9.8% |

| Total | 33.32 | 40.40 | -17.5% |

In the second quarter, the full brunt of the collapse in passenger traffic will be felt. TSA screenings so far in the second quarter, from April 1 through May 9, have plunged by 94.8%, from 91.1 million screenings last year to 4.8 million this year.

The chart below shows operating revenues by all US airlines, including domestic and international flights, provided by the US Bureau of Transportation Statistics. The BTS has not yet updated its data for Q1. So I estimated Q1 based on the actual year-over-year revenue decline at the top seven US airlines in Q1 of 17.5%, assuming that this would be the combined percentage decline of revenues at all US passenger airlines combined (there are dozens).

And to get a feel for where Q2 might be, I assumed that passenger numbers will increase somewhat in the remaining part of the second quarter, and that the total year-over-year revenue decline in Q2 would not be 94.8%, as the quarter-to-date screenings suggest at the moment, but only 85% year-over-year. My estimates for Q1 and Q2 are in red:

Note in the chart above the two prior events that caused sharp revenue declines: 9-11 and the Great Recession. And in each case, it took years to recover:

- From the pre-9-11 peak in Q3 2000 of $34 billion, it took nearly four years to get back to $34 billion, which happened in Q2 and Q3 of 2004.

- From the pre-Great-Recession peak of $50 billion in Q3 2008, it took nearly three years to get back to $50 billion in Q2 2011.

But those two declines were mere dimples compared to what airlines face today, and it took three and four years to recover. In other words, the recovery from the lows in Q2 this year could take an amazingly long time and could be terribly rough.

Case in point: United Airlines.

On Friday after hours, United Airlines disclosed in an SEC filing that it had abandoned its private $2.25-billion junk-bond offering that it had announced on May 6. It failed to attract sufficient interest from investors at the original terms.

Upon the news, United shares [UAL] dropped 5% within minutes in after-hours trading and then retraced a portion of the loss to end at $24.93. They’re down 72% year-to-date.

Moody’s rates United Ba2, two notches into junk, and put the airline on review for a downgrade. Moody’s rated the secured notes that United abandoned Ba1, one notch into junk (my cheat sheet for corporate credit ratings). The collateral for those notes is a pool of 360 older planes.

But investors were not amused by that collateral. According to Bloomberg, citing sources familiar with the matter, investors were concerned that the planes weren’t valuable enough given the risks United faces.

To overcome that lack of interest, United raised the yield to 11% in pricing discussions. And it added a “make-whole” clause under which it would have to repay the bonds at a substantial premium over face value if it files for bankruptcy. In the end, under these terms a deal was reached, but United pulled the offering and will try to obtain better terms.

United is already getting a $5 billion bailout from the US government in form of payroll assistance under the CARES Act and can get a loan of an additional $4.5 billion from the US government.

In terms of the payroll-assistance bailout, United announced in a memo to employee last Monday that it would lay off at least 3,400 management jobs, or at least 30% of its white-collar workforce. The layoffs would take effect October 1. In addition, all management employees have to take 20 days of unpaid leave between May 16 and September 30. Some will also be assigned a four-day workweek.

Turns out, the $5 billion in payroll assistance requires that United would have to keep the workers on the payroll till September 30. So OK, on October 1, bye-bye. United is probably not the only company that will do that.

Withing minutes of United’s Friday after-hours SEC filing about the abandoned bond offering, as UAL fell 5% before retracing part of the decline, the shares of Delta [DAL], American [AAL], and Southwest [LUV] also fell.

United had already raised over $1 billion via a surprise stock offering of 39.25 million shares on April 21, at $26.50 per share, a discount of 4.9% to the prior day’s close. The offering came with a 30-day option for up to 3.925 million additional shares. After hours on Friday, UAL ended at $24.93.

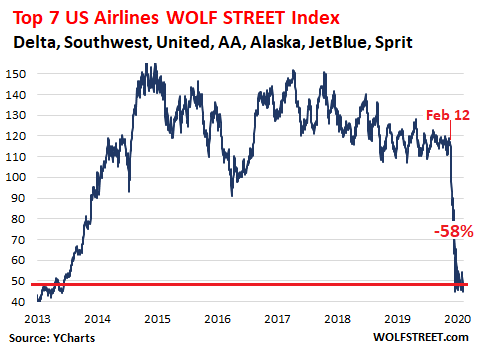

My market-cap weighted index of the seven largest US airlines has been in the same beaten-down trading range since March 18, despite the blistering rally in the S&P 500 index (market cap data via YCharts):

Warren Buffett likely made similar calculations, in addition to whatever else he looked at, when he sold all his airline stocks in mid-crash in March. My airline index is down 58% from February and 67% from the spring in 2015. Blood is on the tarmac – which should have been a clear buy-signal for Buffett, but he didn’t buy – he sold the entire stake and washed his hands off the entire industry.

Some think that there will be a V-shape recovery for airlines, and they’re baffled that Buffett sold the entire stake in mid-crash, but the airlines themselves don’t expect any kind of serious recovery any time soon. They’re struggling with all their might to hang on, and they’ll be raising money any way they can to survive this historic collapse of travel patterns – and for them, survival is what this is all about.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Trickle down economics…

All the TARF, is it now called CARES?

Let it be… CARES landed on the lap of the executives. They already have Golden Parachutes. Now, its time for the money to trickle down to the middle and low level workers and…and… the fliers on Group H. Don’t worry, Pilots, cabin crew and air traffic controllers will not be laid off.

Makes me wonder.. we need charts and graphs for… How many Bureaucrats, and Government workers have been laid off or fired.. bet that is an eye opener… “We share your Pain” – How many Pensions and Benefit Plans and Pay Scales have been reduced?

Inquiring Minds – Are wondering…

M cubed (if I may call you that):

The answer is zero.

If you’d like a more accurate number, it’s

0.000000000000000000 (rounded).

My local government has laid off most airport staff including friends of mine, and hundreds of people in other departments, so your resentment fantasies need a reality check.

RE: “Government workers laid off……”

If I recall just recently there are/were approx. 900,000+ “government” workers laid off so far due to the corona virus impact.

Lots of news stories available on line…….

Sierra7,

Link or Google keywords to get to 900k gvt employee layoffs?

Btw, 900k would be about 3% of the 30 million or so gvt employees (who are in turn about 20% of all employees).

Private sector layoffs to date…15% to 20%+.

So, even under your claim, we are not seeing shared sacrifice by “public” “servants”.

Private sector layoffs are running 4 to 6 times hired…even under your unexamined claim.

There should be a Dept. of Labor report somewhere that clearly states these stats, no? May not be released yet, but it will at some point

City of Dallas is furloughing (no pay, but can keep health insurance if they have the money, time does not count for seniority, pension, etc.) 500 employees until July 31st, that is the end of the fiscal year. If tax revenues don’t improve until then, the furlough will be permanent.

Also friend who works there told me additional RIF, reduction in force, measures are being planned!

Here is a link also mentioning FT. Sorry and San Antonio:

https://www.wfaa.com/article/news/health/coronavirus/as-coronavirus-shutdowns-sink-city-budgets-dallas-furloughs-500-employees/287-6b4767ab-4de8-48e3-8480-405b3fbbafc7

FT.Worth not FT. Sorry- stupid autocorrect :(

Since you mentioned, “trickle down to….the flyers, I’ll give my personal situation :

I had booked a round trip ticket from Manila to Philadelphia back in January. The flight was to take place between June and September. I paid over a thousand dollars in January.

Delta changed my two stop over flight to Philly to a three stop over but the flight into Minneapolis St. Paul arrived an hour and a half after the flight to Philly left.

About five days ago I tried to cancel the original flight in the morning and rebook a new one that would have been one hundred and fifty dollars cheaper but couldn’t figure out how to do it.

That afternoon I got on my laptop and and hour later, mission accomplished. Oh, and now that same flight was two hundred and fifty dollars cheaper.

Praise God.

I have $1,500 credit with United for some flights that I had booked for June and they they cancelled. Now I am worried that if I don’t fly within the next month or two, I may lose the credit as the airline goes bankrupt.

United has plenty of cash plus access to that government loan to stay in the air for a while longer. It’s not going to run out of cash “within the next month or two.” I’d say it has enough liquidity to get through this year.

Several have mentioned in the past being in moderation jail. I’m curious how you get out? Do you have to buy a mug? Or is it life without parole?

You get out of it due to good behavior :-]

This is too funny!

From CNBC ‘Pro’ today May 13 ( it’s ‘pro’ so you have to pay to read further about this gem)

From Bill Miller: ‘If you don’t own airlines you are betting against a vaccine’

Exactly Bill. And since no one thinks a RELIABLE, tested vaccine can be widely available in less than a year, why should you own airlines NOW? ( ‘If you don’t own airlines’ is in the present tense’)

This is CNBC, the hub of Trading Nation!

Bill is hinting in blunt terms that you should own airlines now in the expectation of a vaccine that may be effective in two years.

So it’s Bill or Buffet. Or to quote Buffet’s partner: ‘we just want to ride out the storm.’

I don’t think Bill’s ‘pro’ advice is worth paying for.

Buffett sold SU (Suncor Energy) at the bottom of 2016, got SU again, because SU forever was paying great div.

On Mar 18 2020 SU plunged to 9.61 and popup fast to 19.16.

SU cut dividends from 0.465 CAD to 0.21CAD. SU is misbehavior is driving Buffett nuts.

Don’t know in general, but a friend of mine who travels extensively for his company speculates that he will not travel again (he almost always flies) until August.

Moreover, I would suspect that companies will reduce travel in the future, having become more adept at conducting activities online.

At Google, teams are often split across different sites and many (if not most) of us travel about once a year to see what people look like outside of a video conference. There won’t be much of that until 2021 and maybe not even then.

Any business that depends on travel, whether it be business or tourism, is likely going to feel incredible pain for another year, best case.

?

Alternative opinion:

Buffett owns Suncor Energy because it is an integrated producer, meaning it owns production (pulling stuff out of the ground) , pipelines and refineries. Commodity oil & refinery prices frequently move in opposite directions, somewhat shielding from massive price swings in commodity oil prices.

Hell, for all I know, Suncor undoubtedly benefits from Canada’s self-imposed pipeline capacity shortage.

DOn’t get me started on Canada’s self-imposed everything!

I was working on a contract at SU in 2019/2020 when their intranet propagaga announced that W Buffet sold all his shares in the company.

A few week later SU bought back shares to the tune of 0.5 billions…

United should really go to hell. https://www.sfgate.com/bayarea/article/SF-doctor-returning-from-helping-in-NY-plane-15259851.php

From dragging customers off the plane to false advertising with respect to social distancing within an aeroplane, these guys should just go bankrupt.

Well, considering where we are NOW, the blood in the streets may end up staying in the streets for a long time. I think this is why Buffet is not buying. He sees a long term trend of deflation, not a short to medium term opportunity to buy and hold.

Normally, things get handled over a period of time, but we have idiots running the federal and state governments that are going to make things even worse. I am sometimes in shock by some of the stuff I hear out of these governors and mayors. Talk about not being on this planet!

I’m not surprised Buffett sold his airline interests. What I’m surprised at is that airline stocks still have such high valuations. The airlines are basically a bunch of leased aircraft, leased gates, expensive labor, in an over regulated business, for very little cash flow. Now that they have no cash flow, their only real asset. They should be worth almost nothing.

Meh, I don’t get the point of this point. Well duh, of course the cash flow is down. It’s why for structurally cash breeders like brick retail and frackers bonds mean little.

Since they can’t generate cash, you don’t much love.

P,

Well, at least they owned hundreds of older planes, which was the proposed collateral, per Wolf’s post.

I was sort of surprised too, thinking that leasing’s share was more complete.

But odds are that the airlines pick and choose what to buy/lease depending on price/age and when used aircraft come on the mkt – so the reality may be more of a mix between leasing and ownership.

In the end, the airlines probably have some of the leading insight into demand trends/aircraft supply, so they can time actual purchases accordingly.

Aircraft leasing companies are definitely a thing, but they may not be as thoroughly dominant as was thought.

Wolf,

And btw, excellent, detailed post on the details/dynamics of the debt offering (collateral, incremental increase in offered interest, ultimate failure, etc.)

Going forward, such excellent play by plays of large debt offerings will be very, very valuable – each one may make or break large companies, pushing them into BK if they can’t be closed and large existing debt loads rolled over, year by year.

Please keep these individual bond offering profiles up – there will be no shortage of them…and their individual dynamics will reveal the on-the-ground realities facing many industries and the fixed income mkts as a whole.

Thanks again.

Your description of the business sounds like a utility, which is a great business model. No capital investment, pass on your costs to the consumer, while you perform a service everyone wants. Then of course owning a utility during an EMP might not be so good.

Right, the last thing I want when flying in an aluminum can at 30,000 feet is “over-regulation.”

Yeah Boeing is so over-regulated

Those aircraft are necessary for the military and to keep a state unified so it is not completely foolish to suspect state subsidies for the airlines

Lets not forget the +$40B the 4 big airlines spent on buybacks since 2012, Boeing probably doubles that number. Air travel sucks and I don’t miss being treated shabbily at all.

Back in the day Boeing owned United.

D,

“Lets not forget…”

That isn’t going to be a problem on this site…

Even if/when, the airlines go BK, their successor owners/shareholders are going to have to figure out how to cobble together a viable industry…and you may like those results even less than you liked the historical ones.

The airlines are just another symptom of American waste and arrogance. Brats traveling all over the place for very little reason on the corporate and personal dime justified by such silly phrases and……I just tired out and needed a break…….they needed to see me to buy something nobody else makes…..etc…….tired…….wonder how those dudes that worked in the coal mines felt after a month. Need to see you……for a generation that loves their 1200 dollar phones they seem to not be able to just use zoom. Just another reason to goof off on the company.

A green generation that burns more co2 in one trip to Maui than my dad did in his entire life…..funny how when that trip to Maui comes all their global warming concerns seem to disappear.

They should get off your lawn too.

He wears an onion on his belt because that was the style back then.

They didn’t have white onions because of the war, the only thing you could get was those big yellow ones.

Z,

Damn right – standing on my lawn kills the grass…and how do you think CO2 gets turned into oxygen?

Between pontification and practice falls a lot of…hypocrites.

Yes. Most of the virtue signaling Fortune 500 had been paying lip service to work from home and mitigating air travel, but they did a great job of brainwashing the Millennials they hired along the way.

I don’t have a lawn per se, just hostas. No chemicals, no panzer-division crew coming in every week. My “Lazy Guy’s Way To Save The Environment”.

Lawns are detrimental in so many ways – chemical usage/runoff, wasting water, landscapers paid cash under the table, noise pollution from leaf blowers and lawn mowers. When’s the last time you saw a kid rolling around on their front lawn? Personally I think a nice xeriscaped yard looks much better.

Not a lot of love for this opinion on this site. Maybe if you contained the post to just the whiny kids, and left out the stuff about our insane system that has outgrown our ability to manage.

Only logical thing is to go for bankruptcy. management, shareholders get wiped out. Debtors what’s left over and the airlines can restart.

Agree DW, for the sake of the people who really must fly for any of various good reasons, let’s just go back to the days when the entire industry was carefully regulated so every town had one flight per day, or one in the morning and one in the afternoon,,, and then, the ”red eye” flights redistributed the planes and crews where they needed to be…

And that was before computers were common,,, so maybe just some talented person? Now a days, with some really simple program on a phone we should be able to service every town and city with reliable service for, what, one tenth of what has been the cost lately, both in dollars but perhaps more importantly in wasted energy resources,,, eh?

OK, reliably out of date, no doubt,,, but as LBJ (not one of my faves for sure) said when picking cotton as a youngster, “There has got to be a better way.”

That would be the usual procedure if the problem was one of the usual problems. This is different: there is no market for the airlines to restart. Why are they flying planes with more crew than passengers? Because they are scheduled. They have to fly, it’s a condition of their permit and airport slots.

It costs a very substantial amount to take over a bankrupt airline and commit to a schedule, maintenance, fuel, airport fees, staff, etc.

In this environment the only viable option is freight.

In this environment the only viable option is freight.

I hear rumours that DHL are now chartering their own planes, because: They load up a plane in China or Vietnam, then some Russian, Arab or Yankee shows up with fist-fulls of money and the DHL shipment is unloaded again or the entire cargo is basically hijacked and takes off in a different direction entirely.

Either way, it’s a huge load of crap for the logistics to clean up and it pisses of the customers and the insurance!

Air piracy!

I cannot confirm nor deny that specific rumor, but Amazon is extremely displeased with how DHL handled the crisis and how they are handling the post-emergency phase: Amazon is by far DHL’s biggest customer.

Amazon had already decided to bring Amazon Air in Europe late last year and this situation will undoubtedly hasten their decision: Jeff Bezos’s company is already working directly with ASL Airlines (formerly known as Air Contractors) and West Atlantic and these two companies are prime candidates to operate Amazon’s European fleet.

As I think I said before the winners and losers of this crisis were decided over a month ago, and DHL most likely belongs to the second group.

I believe it was Warren Buffet who said, 20 or 30 years ago, “Airlines have destroyed more capital than Lenin ever imagined to.”

I guess you see who is swimming naked when the tide goes out. Be greedy when other are fearful. My favorite holding period is forever. Derivatives are weapons of mass destruction. I am sooo tired of his bs.

635

Always of interest to see purportedly sentient beings reject distilled wisdom.

I’m not arguing with your opinion (you’re entitled to it), but I’d appreciate your giving a specific example and explaining why (25 words or less) you consider it “his BS”.

Like the large loss he just took on said derivatives, wmd. Is that short enough for you

Sitting on 130B in cash, says loud and clear, the market is over valued. Look at what they do, not what they say.

Yea, thanks.

It was derivatives that almost took down the world in a prelude to the GFC. Long Term Capital Management was a two-bit outfit in 1998 compared to Lehman but using their paltry 100 million (a guess) via derivatives they had managed to tie up hundreds of billions. The math of the Nobel winners behind LTCM looked great but they hadn’t counted on Black Swan Russia defaulting. (we may not have heard the last from that swan)

The Fed had to unwind the positions.

So ya, the economy could probably soldier along without some of the critters in the derivative zoo.

I’m based out of Taiwan.

I’m looking at two weeks quarantine landing in another lightly-affected Asian country. Then two weeks quarantine returning home in Taiwan.

Three day business trip and four weeks in quarantine.

That’s assuming you can even get a travel visa now.

Business travel is basically dead until Europe and USA reach herd-immunity and Asia gets a vaccine.

So V shape recovery then?

How do I immigrate to Taiwan ?

I think travel to/from the US will soon be tightly controlled as the US will quickly have the vast majority of Covid-19 cases.

Let’s see who blinks first, and I am not even joking.

Asian governments are having a lot of fun in “blaming the foreigner” (especially in China and Singapore) but soon enough the reality of the carnage they have helped create will dawn unto them.

Singapore faces the most serious crisis of her existence: let’s see how long they can keep up with their usual shenanigans.

Actually, Asian governments are well-run and have done a great job of controling the pandemic. Taiwan has 7 deaths, Singapore as 20 deaths, Korea has 256 deaths, Japan has 6343.

You could add up the total deaths in all of Asia’s democracies and it wouldn’t equal how many die in a day in America.

I’ll give them one thing: if I cooked the books like they do I would land in jail in under 24 hours.

But us Westerners have always looked at Asia with our jaws resting on the floor. Simon Leys is still absolutely right: we believe absolutely everything their governments tell us without question and, much more frighteningly, without cohercion.

Too bad the mystical powers of Asian governments do not extend in cutting off transponder signals (must be those pesky Greek shipowners!) because those row, lines and clusters of oil tankers and bulk carriers around Singapore are something nobody could ever imagine. The crack of Hin Leong, whose shady accounting and lending practices were fully abeted by the local government, was just the ouverture. I am one of those who won’t shed a single tear for anything that happens to that rotten city, I am just sorry for all the poor folks trying to make a living there.

But I have no doubt we will be served amazing tales of how Asian economies are growing without consuming iron ore, coal and crude oil, and we will believe everything while at the same time blasting our own governments for not being like China, Korea or Vietnam.

Let me tel you a secret: one cannot ‘control’ a pandemic.

But one can always cook the books…..

Wolf…Buffett was the dog that didn’t bark.

OK…I’ll say it: He was the Wolf that didn’t howl!

(Forgive me)

Anyone who has flown very much knows that US airlines are the worst on the planet for customer service. I try to fly on foreign flag carriers as much as possible. I hope every US carrier goes bankrupt and disappears to be replaced by the foreign (especially Asian) airlines that deserve the business.

Escierto:

So I went to this airline customer ranking website (https://www.airhelp.com/en/airhelp-score/airline-ranking/) to get global airline rankings, and this is what I found for the world’s roughly 525 airlines:

o 1 US (American Air @ #2), and 0 Asian airlines in global top-10

o United & Delta ranked 16th & 17th; 0 Asian airlines in global top-20

o China Southern is the highest ranked Asian airline at #27

@Javert Chip

Airhelp is a scam. From the Guardian:

AirHelp is one of a myriad claims management companies (CMCs)that take advantage of the large payouts that passengers, whose flights are cancelled, delayed or denied, can claim under EC Regulation 261/2004. The rule entitles passengers to up to €600 if a flight is delayed by more than three hours, unless the reason for the delay is an “extraordinary circumstance” outside the airlines’ control.

For a fee that can exceed 50% of the payout, these companies will contact the airline on behalf of the passengers and, since 2014 when the supreme court allowed passengers to claim for delays caused by technical faults, dozens of firms have sprung up across Europe. Now, it seems, online travel agencies are also cashing in.

In a deal signed with AirHelp, Expedia receives a commission for every customer it refers if the compensation claim is successful.

AirHelp has also recruited what it says is a “large number” of other online travel agencies to tout for custom, although it refuses to name or number them, and neither its website nor Expedia’s make any mention of the relationship.

AirHelp makes no secret of the fact that it’s milking a cash cow. “A partnership with AirHelp can turn flight disruptions into opportunities” its website tells potential business partners, adding that it gives their customers “someone to turn to”.

Funny, I don’t see many asian airlines in their reviews. I too hope that amercian airlines shrink into non existence. They are terrible and I will continue to foreign carrier at every oppountinty as I don’t like to pay to be mistreated unlike many of my fellow americans.

TonyMike

I concede your point about AirHelp. Then I went back to Google for more global airline rankings.

Yikes!

There are a whole bunch of them (>15), all claiming to be definitive, and all VERY different.

So what to make of this? I ‘m retired and travel extensively (86 countries so far). Excluding US domestic airlines, even I only travel on 3-4 international carriers in a year. My a priori assumption is there are so few “qualified” voters flying multiple international carriers that the geography for whomever conducts the survey (Europe, Asia, Middle East) powerfully skews the results.

OK folks,, NOT flying anymore unless some drastic emergency emerges, but gotta say, a few years back, flew AA and SWA and a couple of the very low priced, a lot, and SWA was far and away the best!

The staff of SWA treated me and everyone in my hearing and observation very well; competent, polite and helpful, and perhaps most importantly, the individuals working for SWA seemed very well aware of the difference between nominal rules and chickenshit… all the others were long on the poop, and short on common sense, very likely because upper management made sure of that policy.

7 flights in 7 days in 2017 on three different airlines just one example of how much I used to have to fly for biz.. (Not including hiring CEOs or CFOs FWIW, they in general too similar to PhD types.)

There is the truism, “you get what you pay for”. For years the fares have been too cheap, and even then low cost startups appear on scene to skim the gravy. If you want total deregulation then you’ll have more crashes and incidents. If you want cheap tickets, then don’t expect legroom or in flight food. If it were possible, cheapo startups would lower the fares even more and get the pax to smash their own bags on the way to the boarding stairs.

“According to a study by Compass Lexecon, commissioned by Airlines for America, the average flight from L.A. to Boston in 1941 was worth $4,539.24 per person in today’s money, and it would have taken 15 hours and 15 minutes with 12 stops along the way. By comparison, a nonstop flight in 2015 would cost $480.89 and take only six hours. Thanks to intensifying low-cost competition, we can find airfares as cheap as $283 today.”

Bus fare is $200 La to Boston.

Like I said, you get what you pay for.

How does that apply when the Asian airlines fares are consistently lower then U.S. domestic carriers?

I don’t want deregulation, I want sensible regulation. Flying an empty plane because it’s scheduled is F’ing Stupid.

I want high speed rail. I wanted it 50 years ago.

The problem is US airlines are an oligopoly of different flavors of crap. It’s not like you can choose to pay more for an overall higher quality airline experience because all the majors are atrocious.

Flying to Europe, Asia or the Pacific is different.

“If you want total deregulation then you’ll have more crashes and incidents”

Historical data really disproves the crash/deregulation link…multiple large scale crashes were significantly more frequent in the decades before deregulation started in the early 80’s.

In the last couple of decades, large scale crashes have become so infrequent that the CNNs of the world spend *months* chewing over the details on each one.

Very good point. Passengers are very price sensitive. The Asian ones are subsidized by much lower wages, government help. Let us hope our airlines with their significant cost structure can survive. They are providing relatively high paying jobs and benefits and retirement for many of my friends. The service is not the best but entitled Americans are not desperate to please the customer especially customers that whine. I want a nation of workers, not a nation of serfs and peasants. Unfortunately it looks like I am going to get the latter.

Why not fly airlines you like exclusively? Budget?

People want Cathay Pacific service at Ryanair prices and if they don’t they’ll take to the Internet to protest.

Old story that’s getting even older in the present climate.

No, no,.most definitely not.

You just.dont have Ryanair over there…

It depends, the three legacies suck, but I have used both SW and Alaska, and found them to be pretty good, the same is true for Hawaiian, now those are domestic routes, well, except for HNL to SYD, but the service is not that bad. Now having flown Singapore, ANA, and even Hainan in international, they beat the US legacies when it comes to economy hands down.

But would be interesting to see ANA and Hainan on domestic and compare. Actually, now that I think about it, Qantas and Air China both had decent domestic setups. I would say though that Alaska and Hawaiian aren’t that far away.

It was a break from “sell when others are greedy and buy when others are scared” for a good reason – the calculation that no amount of largesse is going to return airlines to viability let alone profitability when the demand side has collapsed in two important ways: 1) I can’t afford to fly (on the reduced number of seats/planes available, as I’m one of the 100m income-insecure Americans), and 2) I’m scared of the virus, still. Affordability and fear will drive a massive downward wedge into effective demand.

What should have been studied is whether Buffett also bought into Gillette or Schick at the same time. Because there’s only one place half the airline fleet is going – razor blades.

C

Maybe a new aluminum can market too?

Razor blades are steel not aluminum. I don’t say this to trivialize yr apt remark about planes but to make the point that Gillette is one of the lucky recipients of a waiver from the tariffs on imported steel. Hershey gets a waiver from the ultra-thin AL foil chocolates are wrapped in. These guys have big legal/lobby outfits, not like the other 25,000 (last time I looked, 2 months ago) applicants who haven’t got one.

After things starting getting better there will be even bigger Airlines monopolies than before. There is gonna be a lot of crashes, merges and so on.

So customer service will get even worse.

Hey buddy…. wanna buy an airplane… cheep?

Bloomberg’s Gary Shilling, April 30, 2020:

> The gigantic monthly and fiscal

> stimulus employed so far, with more to

> come, are unlikely to offset the

> massive disruption of the coronavirus

> pandemic.

>

> Recall that the Federal Reserve’s

> decision to cut its benchmark

> interest rate to essentially

> zero coupled with the huge

> quantitative easing after the Great

> Recession did little to spur the

> economy, which grew at the slowest

> rate of any post-World War II

> expansion.

>

> Ditto for the gigantic 2009 tax cuts,

> rebates and massive federal spending

> that together amounted to 6% of GDP.

Gary Shilling was negative on the economy and the S&P 500 in Q2 2009. He said the worst was yet to come. I can dig the interview up for you if you manage to twist my arm.

He is a perma gloomer like most others. There are more of them out there than ever. Their numbers grow every year, but not even remotely as fast as market share grabbing, high qulity tech stocks, mind you.

“akiddy11”:

> Gary Shilling was negative on the economy

> and the S&P 500 in Q2 2009.

Considering the growing extent of

the zombie apocalypse since then,

despite 15+ trillion $ of freshly minted

money, I’d say: he was right.

Male participation in the workforce has been

diminishing ever since World War II;

the flight to safety, away from stocks,

and towards the long bond, isn’t over.

Sooo, in light of the crash in airline traffic … what with contagion, fear .. and that ever trendy ‘social distancing’, what better time then to disband the TSA & UBERLAND SECURITY … I mean really, who needs them after what’s now transpired? They’re 2 now useless governmental appendixi!

Transfer the defunct departmental proceeds to the now #bygov.fiatshutdown wind-twisted small “true”businesses desparate for help, instead of these bloated grift-engines.

Repeat by excising moarr useless ‘organs’ as needed.

Is Untied a subsidiary of United, or is that how you describe it.

“Untied is not the only company to do that”

That would have been a great title by the way “United comes Untied”.

Yes!!! Gonna purloin it from you next time :-]

You can’t steal what your subconscious already created :)

Not so much on the subject of stealing, but rather using, Id suggest making your wolfstreet.com label on your charts a bit bigger. Your charts get used on YouTube and elsewhere, and it couldnt hurt to make it a bit bigger so people can see it easier (usually it is windowed within another window) on a mobile device.

You could even have some fun with that. Increase the font size by .1 each time you make a chart. See when someone actually notices it.

Thanks. Noted. Been thinking about that. Good to get confirmed.

Stockman uses your charts regularly, though he also promotes the site. I assume it’s mutually beneficial. However, Stockman just cancelled my lifetime subscription, so I’ll probably get all of your charts from you in the future!

How the proud keep falling and the stock market is the only thing flying high now. If the Dow adds another 1000 or so this coming week, we’re all living on a funny farm.

Brant. How can I break this to you gently? Here goes: we’re all living on a not-so-funny farm!!!!!!!! Watch out below!!!

Interesting information Mr. Richter, being that it took 3-4 years for the airlines to recover after the last downturn. Based on the severity this time it doesn’t look like they will have a partial recovery for a long time let alone a complete recovery, which is very doubtful.

What’s ahead, “Flytrak”?….they were asking this one five decades ago.

Saw a story a few days ago about a group of nurses being flown back home from NYC after volunteering to help with the pandemic there. They were horrified (and terrified) that their United flight was full. The airline did NOT keep the middle seats empty, despite having put out a release 10 days earlier saying they would uphold “social distancing.”

They just never stop finding new ways to screw things up.

Agree. So much for safest way to travel.

After the incident in the 80s where a bunch of people got sucked out of a malfunctioning door hatch – which blew apart a bigger hole – the slogan in my neck of the woods was : fly United, die United.

Of course we could smugly book Qantas as if nothing calamitous would ever happen because it never had.

C

I remember blue star airlines, it was the manufactures fault, Gordon made a fortune thanks to bud and his dad

Yes, they cut 90% of their capacity in order to fill the few planes left flying. That’s the idea for airlines: pack the sardines into the can and seal it.

Buffet couldn’t get a free ride on the tax payer and C19 is real bad for the airline business. Warren’s Wilshire 5000 divided by GDP buy meter is blinking red for the overall market. He is gonna sit tight on his 100+ Billion of cash and let the beast thrash around in its death throes. When the moment is ripe He and Sanchez will safely move in and slip a ring in its nose and lead it off to the Berkshire Hathaway compound.We will all applaud and declare Buffet and the other guy the greatest of all time. The universe will be back in alignment.

Buying the dip is not always profitable. Buying when there is blood on the tarmac, same thing. Tomorrow there might be dried blood on the tarmac, and next year, the tarmac might be used to park all the unsold cars and a tent city of homeless.

My wife and I worked for the JCP supply chain the for our last ten years before retiring. We were loaded up on company stock in our 401Ks when it was going up (for no reason). The day it failed to rise we sold it all, at $82. Yesterday it was 27 cents. So much for buying the dip.

Not much training needed since they are experienced at giving cavity searches already.

I have heard that they are intended to do temperature screening at airports, but that won’t stop transmission if a person can be asymptomatic for a few days or a week.

I think with all of the fear going on, what else will go. This is going to leave scarring for a generation.

Why do I get the feeling that we are going to live through a repeat of the 20th century again. From the beginning…

In all the airports in Asia, they have been doing this for decades. As soon as you enter the airport, you are on the screen of an IR scanner. I first noticed this in 2009. If you are sick, you can’t go into their country.

Yeah, I noticed the IR scanners the last couple of time in China too, if you pay attention, you see it. A legacy of SARS, whereas in the US, those were pulled off after a year or less.

And you know what the 20th century had in terms of wars… The perfect American cure for all malaise. Tried and tested.

Yep, that’s the entire problem. I also wouldn’t call it the American cure, because the major conflicts in the first half of the century was stirred up by the Europeans. The second half, well, the US will have to take responsibility for a lot of those.

But the powder keg we’re sitting on now isn’t too much different from the one the Europeans were sitting on at the beginning of the century, except this is a world wide powder keg where any number of little spark could touch off a conflagration. It’s hard to think of one spot where the major powers do not come into conflict now because of differences.

I’ve been trying to think outside my comfort zone and figure out what people are going to do over the next 12 months. And it isn’t going to be flying.

Driving, RVs, camping. So find those stocks. Does way more driving offset the loss of no flying for oil prices? I’m not sure.

Also possibly AirBNB cause who wants to be in a hotel?

CCC. Sharing a room with some unfortunate homeless person in a commandeered hotel in LA could be good for the soul!!!!!

They clean hotels.

AirBnb? Who knows?

RV’s if you have cash but some great deals should be around the corner soon as these “toys” will be the first to go.

3 to 4 years to recover? I think it will likely last longer than that and probably result in some major consolidation and restructure to come. Funny how the entire market still betting on V shape recovery and yet clear evidence like this is right in front of their face. I guess some people can see those magical unicorn better than I can. We will be lucky to get a U shape recovery with the U pretty stretched out to say the least.

Looking at 1 month OMXSX30 chart I see three V-shaped recoveries :)

“The Market” doesn’t give a shit about what happens in the future, it cares about what happens Now. Volatility Plays is where the action is.

I’ll probably regret shorting this sucker if it goes above 1600 but I will anyway, and then reverse below 1300. There is nothing else to do here.

Volatility is great if you time things right which is not possible all the time. So that’s a pretty high risk game you’re playing.

> The collateral for those notes is a pool of 360 older planes.

> But investors were not amused by that collateral. According to Bloomberg, citing sources familiar with the matter, investors were concerned that the planes weren’t valuable enough given the risks United faces.

And just imagine, all those junk leveraged companies out there that have NO collateral… FRBNY cant print collateral :P

Back in 2008, when investors were racing for the exits amidst a global economic meltdown, Warren Buffet coolly threw a lifeline to a few companies even though their stock prices were dwindling.

Now that the economy is on the road to recovery, Buffett’s returns are coming in. And surprise, surprise — the deals paid off.

The profits from the Oracle of Omaha’s crisis-era deals have raked in “$10 billion and counting,” says The Wall Street Journal.

The deals Buffett’s Berkshire Hathaway made from 2008 to 2011 involved giant, blue-chip companies like Mars, Goldman Sachs, Bank of America, and Dow Chemical. Taking advantage of the general atmosphere of panic, Berkshire Hathaway was able to use its “gigantic cash hoard to move swiftly and exact lucrative terms that created a stream of payments from the borrowers,” says the Journal.

Buffet bought into Goldman in the manner of Walter Bagehot’s advice to the Bank of England in the late 19thC – lend, against good collateral, at a penalty rate.

He was positioned to do so, because he hadn’t been greedy or a fool on Wall St levering up on RMBS and CBMS, and was in cash at that point in the business and credit cycle. This makes sense. I can’t see anything in his actions around the GFC that are anything other than “this is how capitalism works”. If a distressed company goes to a lender and gets charged a penalty rate, my view is that if the alternative was better, they should have taken it – go bankrupt, or don’t get so deeply in the mire in the first place.

C

Nothing short of breathing. Airline traffic in the US is down 90+ percent. I can only speak for myself but I’ve got a lot of neighbor’s who fly regularly and somehow I don’t see them in the near term driving an hour away to hop on a plane.

Traffic on the roads? Like a ghost town although people are out and around tending to the basics. Things are opening back up slowly. Tourism is toast for awhile….

I see you got the red/yellow hammer/sickle theme going on in your howling wolf logo. Nice going comrade! :D

Huh?!?

I think that comment may be referring to an ad that sometimes shows up on your website. The banner ad shows up beneath your WolfStreet® logo and has this Soviet style bear with a yellow and red background. It has nothing to do with your site. Whatever the ad agency you use happen to put it there for certain users at certain times.

Oh, thanks. I saw that ad. I thought it was the muzzle of a wolf … “contextual advertising.” I’ll look at it again. Maybe it is a bear. That would work too.

Thanks Branden. Yes, that’s it. Now that I look at it on my computer as opposed to the phone, it’s neither a logo, nor is it a wolf. :D

Buffet is a sock puppet, Munger is the brains, I think everybody knows this

Look at KHC (ketchup) everything Buffet touches turns to feces, think about WFC (bank), where buffet turned the bank into a casino

It was buffet that destroyed the USA insurance industry, ‘collect premium, deny claims’ ( buffets model ), invest premium in stock-market – get rich with OPM ( other peoples money ), AmeriKKKan way all the way

Buffet is a grifter, but its the USA people that lionize this parasite

The airline business will be one of the first sectors of American life to learn what it’s like to live within their means and put quality first.

Eventually, it will spread to every sector.

The era of premium-level pricing for garbage, fueling debt payments for ever more, is over.

That’s true whether it’s airlines charging $1K for a cramped middle seat on a domestic flight, American tech companies charging $1K for electronics assembled with slave and child labor in the supply chain, or automakers seeking to sell someone a car or truck that costs more than they make in a year with a heinous 70+ month loan.

Why would anyone worried about the virus ever put themselves into a test tube to travel

Reminds me of smoking and non smoking seats, how did that work again

International travel may be curtailed by quarantine measures (14 days after arrival from a risk zone) even after borders have been opened for the normal traveler.

Maybe Buffet sees the next downleg.

Keep the powder dry.

Time to create a national carrier, say Air America, and shrink the TSA to match. Buy it out of bankrupt aircraft leasing company. Use the planes to begin the massive repatriation of our foreign military commitments. Imperial overstretch is now over, like so much of the world.

Survival is now the name of the game

The first half of a “W” looks like a “V”. Plus the second half of that “W” might not become a “V” for a very long time. The cracks and fissures C-19 is opening up are spreading throughout whole segments of the economy. Nothing will recover very well until we can work our way around C-19. All of the FED support and the CARE support just kicks the can down the road for a few months. The next wave of layoffs will hit October 1st.

Another thought, what happens if/when the airlines go through bankruptcy? Do their pension programs get handed off to the federal pension protection program? Will all those loyalty miles, which have decreased in value over the years, go away? It would seem that the depth of the chasm this industry faces will give them the excuse to make massive adjustments, despite the negative PR. Then again, who wants to fly or even can find a place to fly to for now?

Much of business travel will never recover. It won’t be like the movie “Up in the Air,” but I see more and more being done online. I’m retired now, but when I was working for the DoD as an auditor, every two years our group within the agency would schedule a week long conference in Southbridge, MA. It could have been done by Skype. When I asked why it wasn’t, I was told that it was for “team building.” However, as auditors we worked independently. With turnover, I saw many people once and never again. Also, there were courses held first in Memphis at our agency’s institute, then later in Atlanta when the institute moved there. Most of those courses could have been held online.

Gene,

Those conferences are never about the courses or the material. It’s about being together, networking, building relationships, getting away from the wife and kids for a week (only 1/2 joking about that one).

You can’t do any of that over Skype.

Humans are social by nature. We want to be with other people. Living in isolation at home with nothing but Skype all day long doesn’t work.

Yesterday, a doctor from SF tweeted that he was SHOCKED!!!! his flight was full. How dare United allow people in middle seats??? And he was “scared” so many people were on his flight. And of course the MSM ran with that tweet and scolded United for having full flights.

So airlines can’t win. If they fly with 1/2 full planes, they can’t make money. If they fly with full planes, they get scolded by the MSM.

What I find funny is a doctor thinking flying with 50 people or 150 people in an enclosed tube for 5 hours make a difference. Of course he knows this, but his thirst for attention overrides his knowledge of science.

Just Some Random Guy,

United cut its capacity by 90%, as I said in my article.

The idea is to pack them sardines into the cans, and if you don’t have enough of them sardines for them cans, you still pack them into the cans, but use fewer of them cans.

Wolf said: “Why Buffett Dumped His Airline Stocks Though There Was Blood on the Tarmac, Which Should Have Been a Buy Signal:

__________________________

Wolf, He recognized the blood was his own, and the bleeding was continuing, so he stopped it. What interests me is when did he know he was going to sell. As memory serves, on March 7th he expressed confidence in Airline stock. Shortly after, he sold. Was there any pump before the dump?

The blood from the airlines may not be spilling into the housing market.

In todays CNBC site, google the article with the title:

“As states reopen, homebuyers rush back out, but sellers are staying on the sidelines”

Not looking so bad. Perhaps the stock market has this right.

If sellers are on the sidelines its because they are not getting their price. We know someone building a house, who lost a buyer on the old house, because the old house no longer appraises at the sale price.

I heard the ebuyers will be making offers in the formally hot markets. They will be low balling the short sellers and scooping up the foreclosures, again.

The housing market is toast. The inventory will spike as soon as forbearance runs out. Everyone can afford free, the problems start when the bill comes due…..

I heard a banker say he expects half the forbearance accounts to turn into defaults…and he was smiling.

SoCalJim:

One street away from me a house went pending in 10 days. Your standard 4 bedroom, 3 bathroom, suburban 1/4 acre lot, in a safe quiet neighborhood with top rated schools nearby. Corona, no Corona, recession, boom times, doesn’t matter. Demand for this never goes away.

Now stuff like condos and lofts in urban centers, yeah I can see those plummeting 50% in value easy. There is going to be a massive shift away from highly dense urban areas where one must take a bus or subway to get around. Elbow room from your neighbors is going to carry a premium from now on, like never before. And vacation homes too. Demand for that will dry up with fear of flying still prevalent among a majority of people.

SocalJim,

hahahahaha… ? I’ll have an article for you in a little while with real numbers instead of RE promo pieces.

Meanwhile, here’s another data point: In San Francisco — this data comes from Compass — closed sales in April collapsed by 60% from a year ago

April closed sales went pending in March. So of course it will be low since the govt told the population to sit at home staring at walls. Now that most states have stopped that silliness, May will be much better.

Any data from April or March is meaningless right now.

SocalJim,

And yes, there’s a concept now playing out: PENT-UP SUPPLY ?

I think companies are waking up to the fact that they don’t have to send people all over the country or even world on meetings, saving time and money. I am retired now, but I hated the Fly Out Monday, Fly Back Thursday night crowd, two wasted travel days plus hotels, taxis/cars, meals, for a bunch of useless meetings, not only wasting their time but of the staff that had to play to the high flyers needs. Zoom, Skype, Conference calls, etc….Goodbye Airlines.

Watched episode of South Park from 2001 and the subject was the Airlines being financially affected by the ‘IT’ transportation machine. Untill the Govt came in and shut IT down…..LOL LOL LOL LOL

Ralph Waldo Emerson “Traveling is a fool’s paradise…” Business travel is something else I suppose. While the world gets smaller, the stock market gets bigger.

Re Buffet, UAL, etc, …

In the 1960s I was a young lad on a visit to an old family member, who happened that evening to be playing bridge with friends. That is the scene for my introduction to what an “insider ” is.

Of the 4 players, 3 had long ago started their manufacturing businesses and over the years been successful, albeit modestly. Their businesses were not public stock companies

The 4th was “Joe”, a close friend of 1 of the 3. He was a key vice-prez of a forestry products giant, whose income/benefits/pension was likely larger than the other 3, but differed in that he did not own his employer, as did the other 3.

Altho I was in the room that eve, I was busy and not listening to their conversation, nor did I play bridge.

When the others had gone, my relative told me: Joe mentioned that they [his employer] were buying XYZ [small, public stock, food products] company and in 6 months the stock price of XYZ would double.[I.e., a done deal but not yet public knowledge]. My relative added, “I won’t buy any [XYZ], but I’ll buy some for the {his employees’] pension fund. That’s all he said, and very casually.

I was kinda staggered that he would confide that to me.; seemed pretty obvious I should buy, too. Tempting! I was making less than $10k/yr salary from my employer {a giant].But I knew I could not do it…if s/g went wrong and my action led to criminal charges [insider buying] on my relative…well, out of the question.

The reason I relate this for you all: I understood over 50 years ago this was “insider trading”. Just like most of you understand. But it was only many years later that the magnitude of “insider trading” expanded to be nearly all-encompassing in scope. Perhaps others will not take so long before they realize that “scope” is far beyond the initial “insider trading” moment that was a breadcrumb in the dynamics of economics, if not the dynamics of our current fumbling of Earth’s civilization.

Yes, I checked 6 months later and the stick price had doubled [so just before or after public announced.]