Demand is a lot weaker in some places than in others.

By Wolf Richter for WOLF STREET.

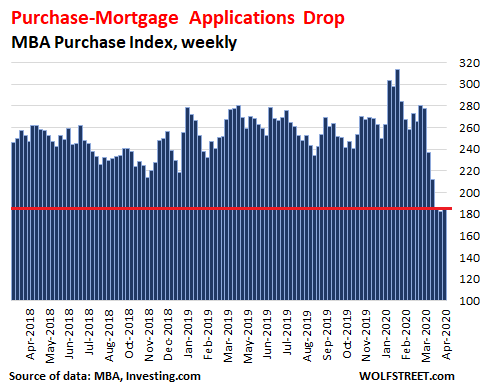

Mortgage applications to purchase a home in the US during the week ended April 17 plunged by 31% from a year ago, and by 41% from the peak in January, the Mortgage Bankers Association reported today. It was the fifth week in a row of year-over-year plunges and the third week in a row in the minus 31-35% ZIP code. The purchase mortgage applications data – based on weekly surveys of banks, nonbanks, and thrifts that cover 75% of all residential mortgage applications – is an early indication of demand by regular people trying to buy a home:

But it’s worse: previously prolific buyers are gone.

Demand by nonresident foreign investors, who come in with their own cash or finance their purchase overseas, is not reflected in purchase mortgage applications, even during good times. And now, those nonresident investors have largely been locked out due to flight bans and limits on border crossings, and demand by them has collapsed.

Demand by large US investors, such as REITs, that fund their residential property purchases at the institutional level, is also not reflected in purchase mortgage applications. But these investors are now struggling with a liquidity crisis and turmoil in the mortgage-backed securities market. Their own shares have plunged, and they have other things to worry about.

Demand by “instant buyers” or for short “iBuyers” is also not included in the mortgage applications data. And this demand has collapsed to zero. These “iBuyers” are companies that buy homes and flip them at what has turned out to be steep losses. These newfangled home flippers with an app include Zillow [Z], Redfin [RDFN], Opendoor, iBuyer, and others.

All of these companies were losing money on their home flipping even when the market was still hot and prices were rising. Now the market has turned on them. They have frozen all home-buying activities, and they’re stuck with the homes they have bought and now have a hard time selling. Opendoor, one of SoftBank’s fake-valuation stars, and iBuyer have already announced laying off about 35% of their staff.

None of these three sources of demand – nonresident foreign investors, large US investors, and iBuyers – are reflected in the plunging purchase mortgage applications. But demand from those three sources has evaporated. So the drop in demand is likely larger than the 31%-35% drop depicted by mortgage applications, which reflects mostly regular folks trying to buy a home.

Demand is a lot weaker in some places than in others.

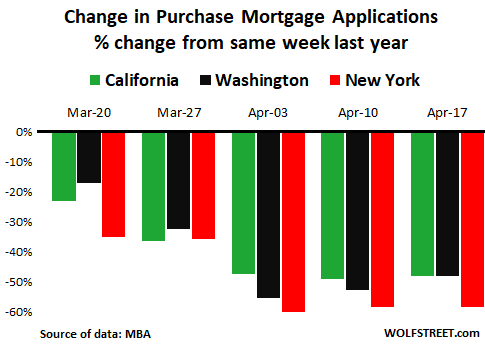

Purchase mortgage applications have plunged a lot more in California, New York, and Washington than the national average. These states have kicked off the lockdowns before others.

In addition, their largest markets are among the most expensive in the US, where even modest homes can exceed the limits for conforming mortgages that would be backed by the government. In many of these markets, a home with a median price would have to be funded with a “jumbo” mortgage, which banks have to deal with on their own. Credit standards are now tightening across the board, as lenders are getting cold feet in the era of forbearance, and the availability of jumbo mortgages has plunged.

For the survey week ended April 17, purchase mortgage applications in California and Washington plunged by 48% year-over-year, and in New York by 58%, according to the Mortgage Bankers Association. This is the progression over the past five weeks for each of the three states:

Drilling down by metro shows sharp differences. The American Enterprise Institute’s AEI Flash Housing Market Indicators used purchase mortgage “rate locks,” based on Optimal Blue data, to get an advance indicator of home sales volume. A rate lock occurs when a lender and a borrower agree to lock in a specific interest rate for the period from the offer of the mortgage through closing.

The AEI report found:

- “During the first eight pre-COVID-19 weeks of 2020, rate lock volume was up robustly across all price tiers compared to 2019. However, volume was up the most for the medium-high (+20%) and high (+17%) price tiers.

- “Post COVID-19, rate locks have decreased across all price tiers compared to a year ago. What stands out is the decline of 35% in the high tier.

- “Given the bumper start to the year and subsequent decline, taken together, purchase rate lock volume has collapsed across all price tiers with the largest declines coming in the medium-high and high tiers – the tiers for higher credit quality move-up buyers.”

The table below shows the 20 metros where year-over-year volume of rate locks for weeks 15-16 (lumped together to keep Easter in both data sets) has dropped the most compared to the same weeks last year:

| “Rate Locks” volume, % change, weeks 15 and 16 YoY | |||

| 1 | Detroit | MI | -64% |

| 2 | Pittsburgh | PA | -58% |

| 3 | San Francisco | CA | -38% |

| 4 | Chicago | IL | -32% |

| 5 | Philadelphia | PA | -32% |

| 6 | Boston | MA | -31% |

| 7 | Denver | CO | -29% |

| 8 | Seattle | WA | -29% |

| 9 | Miami | FL | -28% |

| 10 | Las Vegas | NV | -24% |

| 11 | New York | NY | -23% |

| 12 | St. Louis | MO | -22% |

| 13 | North Port | FL | -22% |

| 14 | Sacramento | CA | -22% |

| 15 | Indianapolis | IN | -21% |

| 16 | San Diego | CA | -21% |

| 17 | Los Angeles | CA | -20% |

| 18 | Washington | DC | -20% |

| 19 | Portland | OR | -18% |

| 20 | Baltimore | MD | -18% |

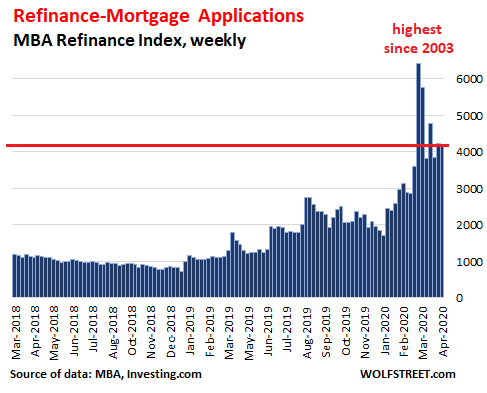

But refi applications are red-hot.

Homeowners with existing mortgages are salivating over record-low mortgage rates and are scrambling to refinance their mortgages. Refi applications in the week ended April 17 nearly tripled from a year ago, and now account for 75% of all mortgage applications:

Mortgage standards are tightening, and the availability of jumbo mortgages plunges as lenders pull back. Read… Going to be Tougher for Lots of People to Even Get a Mortgage. Expensive Housing Markets Most Affected

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Partying like is ‘99 has ended. Time for field work for Realtors.

The funny part is I still see/ read on forums RE saying “is still a good time to buy” ?

My Question: With whose money? Mine or Theirs?

Dudu:

Their money ran out! That is why they desperately need your money!

Aw, gee whiz…does that mean those annoying postcards wanting to buy for cash will cease and desist?

Hmmmm, I wonder where those postcards went. Up until, oh, six weeks ago, I got them on a regular basis.

I won’t miss them.

I still got them a week ago. Some naive, Japanese investor wants my home. Good bless them. They do not understand economics well.

I may sell later this year if they offer enough and a coronavirus treatment is found. Living in the middle of a city seems unwise because I anticipate at least one second wave. Sadly, I have to avoid the states with rash, stupid governors.

A local RE agent put this on his website, I burst out laughing…

“Will home prices continue to climb in 2020? With our underlying local housing shortage, strong economy and low mortgage rates, I think home prices still could rise. This is a buying opportunity for first-timers.”

Fed would prefer to freeze the RE market rather than allow market price discovery. They put a bid under the market (low rates far as the eye can see) while various lending programs game the prospective borrower with enhanced assessments, RevMos, Helocs, (and higher rents by the way) Remember things went to hell in the 70’s, but RE was boffo. The agent isn’t just talking his book.

Why are you laughing?

I wouldn’t be surprised if in a year or so, the stock markets are back to record highs, and home prices, etc. also continue rising.

20% unemployment? massive shift in consumer sentiment?

Don’t forget that stock buybacks won’t be there either to reduce share supply.

That’s what will happen, in a year home prices will go up.

But what will fiat currencies be able to buy? All that money printing is devaluing them.

Well, that was the sucessful dot.com v2 business plan.

“All of these companies were losing money on their home flipping even when the market was still hot and prices were rising…”

Eisner shorted Zillow a few months ago on the basis of Zillow stupidly buying houses.

Reading chatter about something might be up with the derivative market again. It makes since with people out of work and 30% taking the forbearance route either to save up, or because they really can’t pay the mortgage.

No wonder the fed reserve was trying to get out of the MBS market. The banks not doing jumbos due to the higher risk with no backing from the Mae twins. Swans mate for life. Is there another on the horizon?

Implicit:

Funny how no one wants to make Jumbo mortgages because they are not backed by the government combined with an expected drop in housing prices!

Those that make Jumbo mortgages don’t want to make them because they are afraid they will be unable to sell them to someone else and thus get stuck with the jumbo mortgages on their own balance sheet!

Exactly, so what will happen with the mortgage tranches in a few months when there is a backlog of monthly forbearance non payments.

Some people will pay it after three months, others will extend it further, and many will never pay it and walk away, just like 11 yrs. ago.

The great inflated housing market will head south and could blow up the derivatives market again. Let’s face it the gambling never stopped.

Because derivatives are first in line, the Fed will bail them out just like they did in 2008!

Rate lock shock!

31% – What happen to boston bidding wars?

SF #3! Detroit # 1? How they can even share a top 3 list.

SF #3 – Maximus Real Estate-3000 unit SF complex seeks forbearance on nearly $1B loan.

Detroit has the reputation to being a cheap town. My guess is that jobs that in SF could not even dream of renting a house are high enough pay a house mortgage in Detroit. And those kinds of jobs are the ones that have been let go at the moment.

Imagine that. Banks with skin in the game

Yup, those Agency backed trash is gonna be highly suspect if cashflow on that trash approaches 0, and you got people in the repo market daily lending against that trash. Jerome can only blow so much smoke up our assess.

Fed has been slowing down lately , almost like a mini-taper. hmm

And so has the stock market. Hmm

prices have to come down but alas this will cause muni defaults and more taxes….debt sleeps with the devil and its not fun when you wake up naked with it…

Mitch McConnell said ‘drop dead’ to states seeking bailout. Maybe they’ll get a bailout after all, but you can bet that after all this settles it’ll be taxes up and services down either way.

Yes. If the Fairy Godmother Of Pension Bailouts came to Illinois does anybody think that their property tax would go down?

Here’s a nice example: 90 year old frame house, 1306 Vinewood, Willow Springs IL. 1900 square feet. List price $196,000, annual Property Tax $12,000. Its ok, though, I hear that the law firm of Madigan & Getzendanner is great in the property tax appeals racket.

Property taxes are regressive when they go beyond rent (the economical term, not house).

@Char, yes very much so. The house would have negative economic value in the example I gave.

Waiting for SRG to post on here to tell us house prices won’t be going down much after this…tick tock tick tock…

Not sure who SRG might be, but in flyover country, where a lot of people live within their means, people are hunkering down. No demand, no supply, flat market. There is no way there will not be some dropoff in market prices, but the sand states’ dropoffs will be more than the rest of the country, as usual. No crystal ball, but I would say when all said and done, 30+ percent drops in the sand states and more like 10-15% in flyover country.

Not SRG, mean to say JSRG (Just Another Random Guy)

Just a quick look at San Francisco on Zillow.

Sold in the last 7 days:

1.82 M

1.15 M

2.50 M

1.4 M

4.10 M

2.75 M

1.05 M

1.5 M

1.54 M

1.31 M

1.11 M

2.31 M

1.20 M

1.08 M

3.25 M

I keep expecting to see close to zero sold homes since at least a month after the shut downs yet people are still buying. I keep reading about mortage meltdowns and bank tightening lending standards and cutting off jumbo loans and yet people are still buying. Would anyone in their right mind who currenty reads WolfStreet, and has been reading, like myself for several years, be buying a 2 M house in San Francisco right now? Of course not. So am I missing some thing? Do the people purchasing these clearly over priced homes know so much more than we here at Wolf Street? Im assuming that some one whom is able to close a 3.25 M home must be aware of what is going on in the world right now. Are these people simply so much smarter than me? Do they know some thing about this situation that I am simply too dumb to recognize even after reading about the housing markets every day for the last 10 years? Help.

East Bay:

1. What we don’t know is when those homes “sold.” What you’re showing is when the deals closed. The sale might have taken place a month ago.

2. In a typical April in San Francisco, there are 500-600 home sales that close. You listed 15 sales in a 7-day period. So if this is all that has sold in those 7 days, extrapolated over the entire month of April, it means 64 homes would be sold in all of April. That’s an 89% plunge from April last year (590 sales). If that’s actually the case (I doubt it), this market is deader than a door nail.

So they all went through with these purchases so they wouldnt loose their deposits? San Francisco went into shelter in place on March 17. Im assuming these big deals( relative to my universe) take at least a month or 2 to close. All of these people had to have known that a pandemic was on the horizon and would have at least a little forsite to realize that this was a terrible time to go through with their offer. Am I just giving them too much credit because I could never comprehend such a purchase, especially knowing what has been transpiring over the last 2 months?!?!

I think this is all overdone – the people that can afford these homes in the higher priced markets aren’t really getting laid off. In fact, those that couldn’t afford a home at a $1m, can’t afford it at $500k anyways…there’s such a large gap. Tracking the prices would be helpful rather than these false “omg mortgage apps going down.” People are rational, they won’t sell at a massive discount on Zillow, they will just stay until prices recover. Prices aren’t going to drop massively my friends. Is amazon or msft laying off massive amounts of people? No! And these people supported the upper middle class housing markets now and in the future. I’m sure there will be a 10% dip, but man people are still buying and will just buy and move once lockdowns move. This is a financial crisis for the unfortunate minimum wage earners, never those that participated in the “hot” housing markets followed here.

These are the folks who comment in here hoping they can finally get that bay dream for 2 million. These are not the other 97% of

Americans.

Reality is moving much faster than perception here. Every hour there is reported a new truth which does not fit in the mainstream models

You absolutely go through with the purchase especially if the economy is crashing down around you. Maybe you over pay 10pc by going through with it…. the risk is that in three months you can’t even get a mortgage or you’ve lost your job.

We learned last time around that the gov will go to extraordinary lengths to keep you in your home. Get in the right side of that trade before you can’t.

RE going forward: deader than Woodrow Wilson.

Maybe those sales were include buyers who were downsizing.

Another topic: the stock markets that have had the greatest appreciations have been those with currency crises like Argentina. But we don’t want to go there. As a reserve currency I don’t see a rally unless major inflation with flight away from cash. We are going in the opposite direction for now.

Those people buying aren’t stupid. They have been reading the same bearish blogs as you but have drawn different conclusions.

What if we were to experience an hyperinflation event given the reckless printing going on?

What better situation to be , house owner with a worthless mortgage.

Not saying that is what will happen but different people read the situation differently.

An inflation hedge now? When defation is crashing down apon this market at least for the next several months if not years?

It will not be distributed equally.

Deflation in some parts of the real estate market, inflation in others.

Yacht sales will probably explode. Island sales and prices are already increasing. David Geffen has been on his mega yacht for a month by now, I bet he’s already purchased an island to ride out the pandemic on.

BOATS

Captain here, most marinas are locked down all over USA, and the world, meaning you can’t go to your boat. You also can’t go sailing in your boat, technically you can’t leave port, unless of course you were already under sail, and on arrival would have to go to 2+ weeks quarantine prior to customs clearance.

IMHO boat will absolutely drop to less than zero, back in the day in Canada ( Puget Sound North ), we had $1 boats where you paid somebody $1 to take your boat. The reason was to decommission a boat was 10’s of 1,000’s of USD ( getting rid of toxic fluids,… lead/zinc)

The lockdown will mean 1,000’s of abandoned boats in marinas, new tentants will have to ‘buy’ the boat and store, prior to accessing a new slip.

When I rode by the large Bayport, MN marina on the St. Croix river yesterday, I saw that the dry-dock storage was full of boats, and nice ones at that, but there wasn’t really any action going on. Normally, at this time of year they would be tied up on the river at the owner’s dock.

I must admit to being oblivious yesterday as to the why. Thank you Captain, now it makes sense.

Water is high and fast on the St. Croix and Mississippi with no-wake rules on the St. Croix.

Printing money only matters if the money ends up in the hands of a lot of people who then demand more goods than can be supplied. America has crippling economic inequality and nothing coming out of Washington suggest a wave of money coming to actual people.

The elite have beaten the mule (working Americans) to death. Jerome Powell can shock some asset prices upward, but underneath all of this is — a dead mule.

Buying rental property now as an inflation hedge is crazy, IMHO.

Buying anything now as any type of hedge is crazy. How do you hedge a pamdemic other than securing a bug out shelter with lots of food? Every one is trying to front run this like its 2008 but this is not 2008. There is no precedent for whats next.

Cap Oblivious,

The marinas in New York, Connecticut, and New Jersey are open. It’s just the parks in New Jersey that are closed for the plebes.

You’re giving too much credit to these buyers. Many of these people are smart in their line of work, and have money coming out of their ears, but have no idea the economics behind what is happening… or don’t care.

There’s always someone to catch the falling knife. Buying as an inflation hedge isn’t a bad bet, but better to buy after the deflationary period ends. Hyperinflation won’t happen, but I do expect strong inflation to take hold in around 2-3 years.

Hyperinflation only seem to happen to (semi-) official enemies of the current global currency. The dollar is safe from that as long as the Yuan has not taken over.

Asset inflation and general goods inflation don’t line up. As assets like housing have had a lot of inflation in the last decades it could be decades before they will experience inflation

I don’t think anyone can time the market. If people buying now have enough resources to see this crisis through, they will come out as winners.

Don’t worry, the property taxes will more than make up for it.

Taxes will drive most people to walk away because they won’t be able to sell it or carry it

Reminds of the woman in the Peloton.

They gotta have a house. They deserve their dream. Credit.

Hyperinflation is not a risk. Anyone who thinks it is does not understand basic economics.

Basic economics would consider that the massive printing of government IOUs (money) would make these dollars available to spend. At the same time the current supply logistics would indicate dwindling output. So, if you take these into consideration you have a lot more dollars chasing dwindling supply. Basic economics would lead one to believe this leads to inflation.

Depending on the severity of these two factors the case can be made that hyperinflation will result; the more coveted the goods (quality food for example) the greater the inflation “spread”.

So what basic economic principle comes into play that makes hyperinflation improbable? Just trying to understand basic economics here.

Jdog,

As Mark Twain said, “It Ain’t What You Don’t Know That Gets You Into Trouble. It’s What You Know for Sure That Just Ain’t So.”

MarkInSF,

With ~30% unemployed there will be less dollars chasing increasing number of goods resulting from opening up the economy? Deflation?

For those arguing about hyperinflation, what do you think happens to all of the debt overhang? It just disappears overnight? That debt has to be paid back and the extra cash being thrown into the system will go to that repayment.

The fed probably brought down their balance sheet of MBS a while ago, and recently started buying them again, because they know that they would have to jack up their MBS buying again soon, real soon.

Been watching beach property at a beach I like. Small single family on the island starts at about $300,000. Saw my first distressed sell this week as price dropped from $295,000 to $250,000, that’s $45,000 in one day. Had an offer in two days. Better prices coming most likely.

All this inflation isn’t going to exhale slowly, and the balloon take off haphazardly, but mildly. It’s gonna bust loudly because there was way too much empty air in it. Your probably seeing the start of it down your way. We’ve been there and done that already. This will start happening soon me thinks. Good luck!

Hey Old-school, is this beach perhaps anywhere in the Carolinas? Just curious.

Yes. Holden Beach.

Who is the bigger dummy: the guy who buys a million dollar three bedroom home at 4x income, or the guy who lends him the money non-recourse at 3.3%? Just wondering.

Or the taxpayers who vote for the a-hole politician who backstops the lobotomized lender with the taxpayers’ life savings…

This is presuming that “the taxpayers” even have a conceptual understanding that that is happening.

Will this be the first year money printing is actually more than tax receipts for the Fed gov? Yay, another first. Taxpayers move over. Green ink is king.

Many voters don’t really pay taxes.

Everyone in USA who buys anything pays taxes kleen. Even in states with no direct sales tax, we are still paying for property tax on the store, along with payroll tax or income tax for any personnel, etc., etc…

Don’t know where you are coming from with that statement, but, to the above, you can add all the RE taxes, (no matter what they are called.) And then the taxes on every utility, from sewer to internet to cell phone services.

The only way I have heard of NOT to pay taxes is live on a sailboat anchored so far out there (or continuously sailing) that no ”tax jurisdiction” will bother to claim your boat,,, and even then, you will be paying taxes unless you can figure out how to get food and liquidity without buying them…

Grandpa set out to do it in mid 50s, ended up on the hook way out in the boonies of another country; even anchored out, the tax man caught up with him after 5 years or so, not to mention the hassle of trying to buy food and fuel. And that was 60+ years ago, when you could anchor out many places in USA, and sometimes get away with it for a year or so.

“How many times do we have to teach you this lesson, old man?”

Houses are for living in, not speculating in. If the middle class can’t afford a house then it’s a bubble that going to pop.

“Houses are for living in, not speculating in”

That was always my belief, though it has earned me the hatred of the local RE agents who believe churning is an owner’s responsibility to the economy. And a responsibility to want to “move up” every year or so. If I ever sell again, it will be “by owner.” And home prices would go down if the agents and all the other associated ticks weren’t living off sale commissions and incentivized to drive the price up.

My house and land are just ‘Our Place’. I plan on leaving it to my adopted grandson. I’m drilling into him to not let someone make a loan against it when I’m gone, like some other family or future spouse. He doesn’t want to be in this rat race looking for a place to live. I hope he doesn’t find out the hard way.

I think our generation has to seriously think about where our kids are going to live or at least give them a good head start.

Good for you. Utilizing equity means having a home, IMHO.

Portia and Brant,

Yup, you folks are right on. The funny thing is, as someone who has owned a home for over 40 years, through thick and thin/up and down times, the value of my home has only increased as lots became smaller and decent property more scarce. I can’t say the same for other investments I’ve made. :-) My Kids and our nephew will inherit a lovely place on a river with additional property. I hope they use it as a vacation home or that one buys out the other 2. Whatever, we’ll be here until they take us out on a stretcher or wheelbarrow. One thing we never did was have a mortgage on it, just built as we could afford while working full time. After losing a job in my twenties I vowed to always have a bastion of safety and security for myself and family.

I wanted to mention I have a relative in the US in the mortgage business, going flat out doing refi applications. I am assuming people are using the current low rate attraction to pay bills during the pandemic. And when that money is gone?

Cash out refinances are much harder to do Paulo. Most of the current refinances are just for a lower interest rate and lower overall payment.

Hey A, good luck telling a Baby Boomer that. Home “Ownership” being the true religion of these Folks. That and “STAWKS”. Fuckers are about to learn the hard way.

Housing prices are going to collapse at least 50% & Real Estate usually lags the real economy by about 6 months. So look for stuff to start getting ugly in the Fall. Think back to 2009. My house that appraised for $735k in 2007 was worth $280k in mid 09. The banks won’t renegotiate. They’d rather kick you to the curb & take a bigger loss. Only this time there will be exponentially more foreclosures & will there be an adequate level of bailout money this time around? Cash is king & those with the most of it will prosper. That is until the $USD takes a crap & then everyone better have precious metals & crypto.

It’s time for people who have a large mortgage balance on a house that will decline 50% in value to seriously consider whether they should continue to dump their hard earned money into a money pit that’s going to sink into oblivion. The alternatives are less than appealing until you’re forced to make an alternative appealing.

Agreed !!

Repressed memory syndrome is spreading fast and our last lesson was little over ten years ago.

Experience holds a dear school but a fool will learn in no other – So wise old Ben said.

I am not sure. They might kick the can another decade. Some say 10 year going to 0.25% which might mean 30 year mortgage around 2.25%. It might be a coin flip how this is going to end up.

Surely THEY will kick that can as far and as long as they can! Watching the RE market since dad got caught with 3 properties mid 1950 era, and was quite chatty about it for eva after, never buying again, etc…

But IMO, it’s still the best game in town for a lot of us peons,,, or was until last crash when the hedgies and PE folks were buying everything they could with the taxpayer money, etc., as has been thoroughly described here previously.

So, my take is that this time will involve ”all of the above” again. Smart money will wait for at least a somewhat clear bottom as folks either over their head/upside down or dead will sell out cheap by current prices, and then the inflation will kick in again, and, as said, the amount of both fall and rise will be considerably different in different areas of USA.

And BTW Wolf, I think #13 on the chart is North Port, FL, not North Point? North Port is where there is still somewhat affordable housing for working folks, that is close enough to commute into Sarasota.

Thanks for the typo alert.

No can kick here my friend. At least not past the next 3-6 months. After that, it’s La Quebrada & the Clavadistas start the high dive show-with torches and from the high platform on the cliff.

Like the stock market, isn’t housing one of the untouchable sectors that needs to be propped up? New rules may replace the old rules in this market and surprise us all. Trying to keep up with the alterations of everything we believe is like try to nail Jello to a wall’

@Double D – If 2008/2009 hadn’t already happened, I would agree with you.

Governments at *all* levels learned their lesson back then about how precariously dependent they were on property taxes and will do anything and everything to prevent housing prices (and therefore, tax revenues) from falling very much.

Housing will be propped up at all costs, even if it means selling every unit to PE firms.

We will be surprised how quickly we will go to the old ways once this pandemic is over.

Provided the pandemic will stay with us till next summer on off , I think there might be opportunities in Multifamily apartment as landlords are forced to sell with no possibility to evict or collect rents from tenants that have every incentive not to pay rent, it will be an untenable position. I think Multifamily will become so toxic that we might see great cap rates for the brave investors willing to deal and be patient with the deadbeat tenants.

Single residential is a different animal, banks know that foreclosures are not the solution, so they will keep people in their houses for years and probably the Fed will cover the losses in one of her alphabet soup special vehicles while buying time to inflate the bubble again. I will not bet on a significant decline if at all.

I thought the same about sfr in 2008 n 2009 but we all know how sfr ended up in 2011

Do you own bunch of sfr?

“Zillow, Redfin, Opendoor, iBuyer”… and the other one too, OfferPad, funded by Blackstone.

They really only work in an upwards market. No contingency plans for a downturn. Although it should have been obvious a plan would eventually be necessary.

One in four renters spent more than half their income on rent. Some renters and mortgage holders are behind on their payments.

A lady got a notice from her landlord. While her eviction is postponed, she now owes late fees, eviction costs and unpaid rent. This might ruin some credit ratings.

I imagine auto repos continue.

Lawyers make money, judges make money. Banks make money. Innocent people pay the price. My home went under foreclosure 10 years back. Fought through lawyers. Finally lost appeal in applet court because u can ask justice in this country anymore. Judges take the side of banks. Even plantiff brought fake affidavit and won the case. My lawyer went bankrupt. My servicer went bankrupt due to shoddy paper work. My remaining mtg was only $79,000.00 I spent $40,000.00 on litigation cost. Still lost because plantiff and judges knew each other. Shame on these lawyers and judges in America. How they steel money from defendants. I could not pay my mtg due to hardship in 2008 recession in america. Finally with all the penalties and court cost now plantiff took $150,000.00 judgement. Nationstar was my last servicer, he also went bankrupt now Mr Cooper took over nation star accounts. The system is so corrupt nobody can raise question? Because all these people are white-collar criminal. But God will for sure punish these corrupt people. They will pay the price. It’s very funny. In this country if u even steal $10.0$ from any store u can wnd up in jail. These law abiding educated professionals r stealing billions of dollar from average hard working people and u cannot fight in any court in America. No lawyer can take my case because three judges sign the same judgement which brevard county did. The law is blind. Banks lie make fake papers and won. Banks never had the original note that’s why they were loosing the case twice in eight years. Finally they won because govt change the law and give favour to banks. Because judges bread and butter comes from banks not from little people like us. I lost my life saving g on this litigation. I am 75 year old man. Banks trying to steal my home. I de9leted all my assets. I write all because I think some good honest person can understand me and get me justice in America. I am not living in 3rd world country . God will get me justice one day. The amount of pain and suffering I been through. My lawyer Stopa law firm from Tempa was saving my house upto 10vyears. When he went bankrupt then two aggressive lawyer won from me because they knew the judge. This is wrongful judgement somebody must help me to get my home back from corrupt banks. Bank already got bailout. Still they like to steal your home and make money. God bless america.

Mr Kohli, America has the best justice money can buy. Sorry for your loss.

Debt is hazardous to your financial health. It cuts both ways but most people only see the upside.

My parents were spendthrifts. They blew through a small fortune and went through two bankruptcies, which was one of the best lessons I ever learned. I own my house and car free and clear and I have done so for years. I pay off my credit cards every month and gladly accumulate the points.

The rentiers, the money lenders, their legal henchmen and their purchased politicians: may they all burn in the lowest circles of hell for eternity.

Credit Card companies don’t like people like you. You would be considered a “dead beat” to them.

I am a “dead beat” too!

Harvey Mushman,

“Credit Card companies don’t like people like you.”

Actually no. Credit card companies charge the merchant a fee for each transaction. This fee can be 3% of the transaction amount.

So when you buy a $1,000 sofa on your credit card, your bank charges the merchant a fee, perhaps 3% depending on the size of the merchant. So if you pay off $1,000 with the next credit card statement, there is no interest. But the bank earned the fee it charged the merchant.

This is why banks offer certain people, such as Michael Gorback, you, and me, incentives to use credit cards (1% cash back etc.), because they keep the spread between the incentives and the fee they charge the merchant.

The only thing banks hate is if you do not use your credit card at all. Then you’re just an expense.

Thank you Vijay for sharing your personal story.

I recall hearing JPM is pulling out of the HELOCs altogether, or rather, they aren’t accepting new HELOCs. One would have though that this environment would’ve been not too bad if you had a HELOC already. But good luck getting a new one.

As for banks taking possession of housing, would they really want to? Or is it more in their interest to try to work out something.

I guess it was all rotten from the start, a tiny little kick from a bat virus, and it all came tumbling down.

Many of your commenting readers lack an understanding on the real estate and lending markets. Re loans… The jumbo market has dried up because the secondary marketplace that purchases that paper (unlike government backed loans) dried up. Why? Because they want liquid cash to either cover other debts or commitments or cover short positions etc. Sure some are concerned the value of the assets securing the debt will drop and they get stuck with loans they are upside down on but for most jumbo borrowers in particular their 20% down payment offsets that risk by 20% to the downside. (Unlike Government loans like FHA which only require as little as 3.5% down and therefore at a much higher Risk of default) Does anyone really think we are in store for a greater than 20% drop on the heals of an historically low inventory market where the demographics of the finally starting household formation millennial buyer population combined with the age in place phenomenon are only going to tighten the market further? Someone mentioned Blackstone. Blackstone owns 1000’s of home hasn’t been a big player in buying since around 2012 when they and American Homes For Rent bought home sin the thousands and of which none are selling now or anytime soon. So they will not be flooding the market… ever because their assets are rented. No, tight inventory is here to stay unless… banks foreclose like they did 2008-2012. But that does not appear likely, at least not at this point and it doesn’t appear the government wants that either.

As for the premise that rate lock in is later in the process, that is simply not correct. Any mortgage broker worth their salt locks in right away especially when the market is low and volatile like now so I wouldn’t read to much into that data.

Might prices soften this year? I would expect soMe unless we bounce back rally quickly which doesn’t appear probable. So the question then is, when to buy? Answer: when you find the home you want. If the price is more negotiable maybe you make a little deal. But if it’s not on the market today, you’re basically waiting for it to come up, along with a few other people. That’s because we have low inventory and with low supply, almost any demand will, prop up prices.

Didn’t Blackstone sell everything last year? September I recall.

I don’t believe your sentiment regarding millennial. After declining for a decade homeownership rates have been on the rise, bottoming out in Q2 2016. I suspect much of that will be reversed now because of the pandemic, with all the job losses and the massive paradigm shift underway in the economy. But even in the good times, homeownership opportunities have not improved over the last year for millennials because they simply can’t afford it. Student debt is a major factor with 57% percent of college-educated millennial’s report having outstanding debt. Also, nearly half of millennial renters have no down payment savings. Then there is affordability with a whopping 70% saying they can not buy because property is too expensive. All of these factors will only get worse over the coming months if not years.

You know if this financial system or this society is based on sound fundamentals then absolutely 20-30% is on the card. However, I personally don’t know what to think anymore. 50% of me think there will be a major price adjustment coming then the other half of me think maybe you’re right, price might go sideway for a long time. Sure do feel like up is down, down is up. Case in point, 26M unemployed, market rally beyond 400 pts at one point today, Tesla still over $700 a share, shows me how detact we are from reality and much like religion, the show can go on for a very very long time, even if it’s far remove from reality.

Sorry, but thanks for giving me a laugh. You spent half your posting on showing your disconnect from reality and confused and then finish up saying religion is unrealistic and how detached “we” are from reality.

Make up your mind, do you know what reality is currently or are you confused and willing to admit you don’t know what reality is and therefore can’t confidently criticize others for being unrealistic.

I am amazed how comforting a long walk after a home cooked dinner. I thank God for the things man can’t make proprietary.

It’s realistic not to know what reality is, I think. There are the rules, but they get thrown out the window these days on an hourly basis.

Hmmm, 20-30 million + unemployed and things will be ok? Lender credit standards have tightened up and will not be loosened back up again so quickly. Personal bankruptcies will be going up soon as well and we know what that does to a mortgage application.

Real estate pricing is sticky on the way down and down it will be headed. People’s appetite to consume has been thrown out the window.

I believe it will all come down to how many people get their jobs back and how fast.

Most state legislatures convene in January or February which is when the cuts will begin. Hiring freezes and cancelled projects. That is when the next wave of real pain will kick in so get ready because a lot of people are going to get squeezed. Housing is in trouble.

Wolf,

I hope this virus clears and people don’t lose their homes. What I think they ought to do is, pause with the mortgages and restart payments, like a time out. What’s wrong with that? Like a reset.

John, that’s exactly the spirit of the forbearance part in the CARES Act.

What many people fear is that at the end of the forbearance period the lump sums owed will be either forgiven or will have to be paid in one big fell swoop but not even politicians are so stupid to do either.

There will be “additional assistance”, probably meaning several different solutions will be made available, from simply lengthening the mortgage duration at no penalty to spreading the lump sum over several monthly payments, again at no penalty.

But now this is in the future: this is a problem that will have to be dealt with in 4-5 months when the forbearance period will be running out. Remember the “up to 12 months” part only applies to very particular cases.

There’s of course the big question of FICO scores, which form the basis of US consumer credit.

Those playing by the rules, meaning suspending their payments because they really need the cash or just want to set aside a small “rainy fund day” and will then speedily take up one of the option plans to deal with the lump sum won’t notice a thing: their FICO scores won’t be affected.

But those planning to milk the system will be in for a rude awakening: unless they are really smart or have very good advisors a lot of people will be left with a lump sum too large for them to handle and will pick up the wrong option plan. An express elevator to subprime.

MC01,

We all know there is good and bad in everything, thanks for the reply, it does seem workable for those doing the right thing, extending the mortgage, money doesn’t have to solve it, it seems it would just cost more.

MC01, John, Being able to extend the mortgage term seems like a reasonable approach to me also. But I am sure some group(s) is probably going to be strongly opposed. Being an old IT(Information Systems) guy, I ponder over the speed this needs to be done. I wonder how well mortgage servicing systems would be capable of handling this. Without intervention, automation is already issuing late fees, delinquency notices, credit rating down-grading automation, etc. Businesses need some time to evaluate changes and develop processes, if not system changes. Ideally, changes would be done immediately, but if not, then there will be a lot of manual “unwind” to make things “right”. Can we count on mortgage service providers to honestly carry out the intent of this law even though the expense will all be on their side to help mortgagees out during this employment crisis. Hopefully we won’t see problems along the lines Vijay Kohli experienced.

The banks set the rules and control the funds. They will want their money back sooner or later.

I am very sympathetic as young families usually have to stretch to get in a home. If this crisis teaches us nothing else maybe it will teach everyone to do what financial planners have been paying my whole life which is always keep at least 3 months living expenses in liquid savings.

Vijay,

Lawyer & a judge are not friends, they might be partners. Example :

A lawyer buy a house, on his name and judge name, win the case

and collect rent.

If the tenant is smart, there will no eviction notice with large rent discount. until the tenant leave or die.

How true. I would never put my money in a house for a stranger to live in. Let him buy his own house. Now if I owned a dilapidated warehouse in Brooklyn, maybe.

Sam Zell, how are u doing today ?

His nickname is The Gravedancer. Will it be his own grave this time?

Sam sold out with great timing. https://www.wyattresearch.com/article/sam-zell-chicago-billionaire-sell-real-estate-buy-gold/

“Post COVID-19, rate locks have decreased across all price tiers compared to a year ago. What stands out is the decline of 35% in the high tier.”

This may simply reflect the geography of coronavirus hitting expensive markets hardest…but per ZH, credit card spending has dropped the most among high-income borrowers. This is not what you would expect, given these households’ greater resources, and suggests that “wealth effects” from a declining stock market are starting to bite.

Or it may be simply that the wealthier people are locked in their houses and don’t have much to spend money on. You know, things like first class plane tickets To exotic destinations, $1000 a night hotel rooms, $250 per head restaurant visits etc.

You can’t spend your money in a restaurant when the restaurant is closed. Big spenders hit this problem faster than small spenders. Expensive items are also more face-to-face. Something you don’t want to do with Covid.

I thought that all the shoppers grabbing toilet paper and other food necessities were misunderstood as hoarders. Half of them were realizing they couldn’t eat out 7 nights a weeks so they needed to build up restaurant replacement. Family style eaters at restaurants need more TP then the rest of us. :)

Guys, I am looking to buy, I want to pick your (collective) brain. Reason to buy is I am tired of living in apartments, want more space, especially if we are dealing with pandemics!

I am looking to build a new house, at 600k but I want to see if I can negotiate to 500k-550k. It is 4000 square foot and my understanding is that builders minimum cost to build is $100/sq foot so I doubt I can negotiate that much even with this madness going on.

I can easily drop 20-40% down

Still a good idea? Any tips on how to negotiate with banks etc. (I am a first time home buyer)

That’s a lot of “more space”. You may want to be sure it’s where you want to be, and you set it up so you can weather any financial upsets. It’s great to own, but a lot different than an apt where you can pick up and leave on short notice with maybe only losing a deposit.

>>I can easily drop 20-40% down<<

IMHO, never do that. Real estate is a high low game where a middle hand is worthless. Which means, you either highly leverage it or not at all. The middle of the road with 40% equity risks losing it all if something goes wrong and there is a foreclosure.

Just remember that the county/taxing agent will tax that house based on square footage and value. Big house is good until tax bill comes every year.

If you can find small acreage within commuting distance to work then land cost should be lower than a city lot.

You will need an interim loan when building the house (usually short term and higher interest) and then final loan when complete (negotiated interest). There may be ways around this.

Advantage in placing 20% down is you do not have to pay the dreaded PMI (private mortgage insurance) that increases your monthly mortgage payment.

You might just wait for the inevitable foreclosures described above and pick up a used house for cheap. Just be ready with lender letter of approval.

Thanks for your replies. I’ll keep the deposit lower but enough to get rid of the PMI. It will be a homestead where I’m at so that will reduce the housing taxes.

Unfortunately I think wife and I are set in building the new house, but hopefully the wave of foreclosures will help shave the price.

This is just for living, not an investment property.

I’m assuming I should go for 30 year mortgage?

I’d wait at least six months to see if prices begin dropping and put down as much as possible. Debt is nobody’s friend.

If you have been waiting for a chance to get into the housing market, you may want to take advantage of any near term disruption in your local market because it won’t last long. Same goes for the stock market. Here’s why…

Health records from 5,700 patients hospitalized within the Northwell Health system — which housed the most patients in the country throughout the pandemic — showed that 94 percent of patients had more than one disease other than COVID-19, according to the Journal of the American Medical Association (JAMA). Data taken from March to early April showed that the median age of patients was 63 years old and 53 percent of all coronavirus patients suffered from hypertension, the most prevalent of the ailments among patients. In addition, 42 percent of coronavirus patients who had body mass index (BMI) data on file suffered from obesity while 32 percent of all patients suffered from diabetes.

Invest in yourself by staying as fit and healthy as possible.

I recently looked at an area in Southern California. The median HH income within 1-mile radius of the property was <$40,000. The median home list price was almost $1.2MM. The fed caused this… I was surprised last time that values didn't decline further, but I doubt this time resolves without major price reductions. BTDIK, I am debt-free, mortgage-free and paid for both my children to attain graduate degrees including law skool abroad. Now I get to pay for the stoopid, imprudent and reckless at all levels: private, corporate, municipal, state, national.

1) Hospitals ER are busy thanks to covid-19, but the rest, the more

profitable departments are at the bottom of the freezer.

2) Cardio on furlough or pay cut.

3) I can’t see without CT’s, are cost centers doing nothing all day.

4) Doctors offices are empty.

5) Dentist stopped drilling.

6) After spending hundreds of thousands on med schools, the schools

are closed and there are no….

No way!! The MSM keeps telling me I have to celebrated all those OVERWORKED HEALTH CARE WORKERS!!!!!

You don’t suppose the MSM is lying to do you?

Just Some Random Guy,

BS. And Michael Engel nailed it. I can’t believe that you, Just Some Random Guy, are still posting this clueless stuff. What you need to belatedly wrap your brains around is that healthcare for elective procedures (dentists, hip surgery, eye surgery, ophthalmologists, etc.) is essentially SHUT DOWN. Entire clinics are SHUT DOWN. Doctor’s offices are SHUT DOWN. ER visits are WAY DOWN. The poor and homeless and those without health insurance that used to show up at the ER don’t go there anymore. People stopped going to the ER for anything but life-threatening issues. That end of the healthcare industry is in deep trouble and is included in the bailout funds.

But anything having to do with Covid-19 is near capacity, at capacity, or over capacity, or is ramping up furiously to NOT BE overcapacity (when triage would set in).

My daughter in law who works in a hospital needed emergency surgery and could not get anyone’s attention in NYC. My son drove her here to Stamford, CT straight to ER, operated on the next day.

Has to come back for follow up visits, tests, etc.

This was hell.

Yes, this is a huge issue — and that was an emergency! Now imagine what you go through if it’s not an emergency. You just have to wait for a few months. Toothache? No problem. Just buy a big supply of ibuprofen.

Good’Ol Wolf….Your site is so popular now you got your regular visitor troll. JSRG is one of those I can always count on :)

ME,

Your comment of: “Hospitals ER are busy thanks to covid-19, but the rest, the more profitable departments are at the bottom of the freezer.”

This really made me stop and look twice as this situation is exactly opposite in our public single payer system in Canada. Here, ER visits are down and just this week the BC public health officer had to remind people and encourage people to remember to use the ER when they need to. Elective surgeries are down, but scheduled to reopen early May. People here are wondering, what happened to strokes and cardiac patients, anyway?

In the UK people with other serious conditions are either dying or toughing it out at home, or turning up at hospitals way to late.

Quite a lot are dying of COVID at home too; and, of course in ‘care homes’.

Also an increase in people applying their own ‘stimulus’, turning up at hospitals with ‘things in their bodies which ought not to be there’.

Well, that’s one way to pass the time.:)

Paulo, I’ve enjoyed your normally well thought out comments over the years, but have a different take on the current BC situation.

BC adopted both an effective and early response to the virus. The reason the BC health ministry is encouraging ER visits is because non-Covid patients are afraid to go to the ER, and have been dying at home. The current government figures suggest 4000 plus beds set aside for Covid, but less than 200 admitted. Patients are actively discouraged from going direct to ER, and requested to phone triage first.

Dentists are closed except for limited emergencies.

My clinic is closed, but will take an appointment for a phone consult only. Specialists are not open, even for evaluation of future surgery. Electives are cancelled with NO rescheduling to date.

Even in the Canadian single payer system, most doctors are paid under a fee for service model, and need to see a patient in order to bill for it.

All these people must be suffering financially. ME has it right.

Frightened people with reduced income are unlikely to be buying real estate, and risk loosing what they already have.

“Rate Locks” volume, % change, weeks 15 and 16 YoY

1 Detroit MI -64%

2 Pittsburgh PA -58%

3 San Francisco CA -38%

4 Chicago IL -32%

Three of the top 4 are in the upper Midwest. Media reports abound detailing people’s flight from these jurisdictions. Perhaps the virus just tipped the balance for a lot more of them and they are now transitioning to housing elsewhere.

We jumped on the opportunity to refinance, from a 30 yr at 3.75% to a 15 yr at 2.75%, no cash out. Lender (WF) will roll closing costs into new loan to make underwriting less complicated. Because of COVID making in person appraisal not possible, appraisal fee will be refunded upon closing. So no out of pocket costs to get 1% lower. If other refinances are similar to my experience, can see why they make up 75% of current number of mortgage applications.

Here’s an update from inside the industry.

Things are feeling like they are actually loosening back up..in many ways.

Example 1:

My warehouse/credit line that I use to fund loans that are “banked” as opposed to “brokered”, was very restrictive the past 4-6 weeks. Slow on wires, added restrictions and capped amounts per loan which meant that my company had to cover the difference out of pocket. This morning I got an email that they were loosening the restrictions and normalizing the coverage amounts per loan, similar to pre-Covid. Not 100% back, but, pretty close.

Example 2:

One of my top lenders 2 weeks ago changed to a minimum of 700 credit score on ALL refinances (conv, FHA, VA), however, late last week that was brought back down to 680 minimum. Now; they used to go down to 600, so the surge to 700 was shocking. Now it’s pulled back to 680.

Example 3:

Quicken (wholesale) 3 weeks ago instituted a policy whereby they would only allow the broker & borrower to “LOCK” their rate once the file is Clear to Close. That meant, you had to “float” or be unable to know what the final interest rate would be for 4-8 weeks while you go through the process. Very risky for the borrower. Today they announced the policy was reverting back to pre-Covid, and you can “lock” at any time.

Example 4:

I received 2 new purchase contracts this week and 5 new buyer pre-approvals. By far the most I have seen in the past 2-3 months. Refi’s have continued to be very strong, but, buyers disappeared completely until this week. I was kind of in shock with all the new buyer referrals, it was a pleasant surprise.

I will continue to report what I see.

Given the massive amount of credit and assurances the Fed has unleashed this is not surprising in the least.

My guess is you will see credit get easier and business ramping up a bit for three to six months and then credit will start to tighten and business will start to deteriorate in a slow downward grind for about a year or two.

Of course the Fed could perform a bailout every three to six months which means massive stagflation is upon us. I do not believe the will do this but then again I did not believe they would do what they have done. Have we become Japan?

Could very well happen. At least there is a little bit of stability now in the capital markets so our rates are not all over the place.

Volatility has decreased significantly.

Is loosening credit when a recession is assured good economic policy?

This basically mirrors the stock markets. Panic selling for a few weeks. Then a slow move back up, and on path to get back to where we were. The super duper greatest most worstest economy ever predicted by the hysterics out there isn’t happening. This will be a short lived recession followed by a massive pent up demand boom.

I still think it’s crazy that sub-700 ficos are getting mortgages, covid or no covid. But that’s a whole other discussion.

New Development.

Wells Fargo is stopping ALL cash-out refinances.

Rumours that the GSE’s may follow suit.

I thought WF had stopped that a couple of weeks ago.

Bunch of dogs fighting over a bone in a burning house.

Prices aren’t sky-high just because they want your money. They want your debt peonage to provide them with a lifetime income stream.

Suckers.

HA HA HA my thoughts exactly………these “suckers” are planning home renovations, unaware the house is on fire

Paulo,

covid-19 have better targets than areas where the deer population is higher than people.

Whatever that means. If anything.

He’s saying that it’s an urban problem primarily

The problem is when the urbans have 2nd homes in the sparsely populated areas and bring the infection with them when they think they will take advantage of “lower risk” areas.

All this analysis is well done (as usual) but is meaningless to me. I’m done with cities and suburbs. I am now focused intensely on the next big thing which is Exburbs. IMHO, going forward, the dynamics of new Exburbs will have no resemblance to the financial chaos coming to cities and suburbs, including out of control pensions.

Exburbs will have no resemblance to the financial chaos coming to cities and suburbs, including out of control pensions.

Translation: “Screw those old people. I want that money!”

Next you’ll be complaining about how minimum-wage workers are overpaid.

Unamused that is your interpretation.

S is suggesting there will be far greater pressure on taxes and pensions in larger entities, town and cities than in the county where there is less overhead. Seems to be a reasonable deduction to me whether you like it or not.

Depending on the community some will survive but a lot of small towns will crumble. The large communities always get first priority over the small communities when it comes to public spending projects and so far it looks like government has all the money.

The real estate market if facing the following pressures.

1. Massive job losses, unemployment above 20%

2. Massive wealth losses. Both equity and bond markets down.

3. Poor business environment. Low purchasing in both retail and service sectors. Supply chain disruptions. Massive business closings and job losses.

4. Cash flow problems in income property.

5. Unrealistic perceived property values in relation to incomes.

6. High delinquency and default rates going forward.

7. Massive lender loan losses in commercial real estate.

8. Higher qualification requirements for loans results in millions of people unable to qualify.

9. Income disruptions from lock downs making income qualifications and employment stability requirements not possible for many.

10. Loss of confidence in economy and financial security resulting in more caution and less willingness to make big investments.

How anyone can look at this situation and be optimistic about real estate values going forward would require a complete disconnection from reality.

How anyone can look at this situation and be optimistic about real estate values going forward would require a complete disconnection from reality.

You underestimate PE guys. They’re licking their chops at the prospect of scooping up RE for cheap so they can rent it out to wage slaves for nosebleed prices.

You’re just not up on the latest predatory business models.

groan. pe-owned services, more services. like health care–dentristry, hospitals, more “charter schools”, social engineering into the toilet, shareholder tyranny.

How would they be able to demand bleeding edge rent when a lot of folks are unememployed ?

They’ll rent out their kids to do piecework. When that’s not enough the banks will extend them credit. Then when they default the banks get bailed out.

Don’t you know anything about finance?

Has anyone read this?

“https://www.restaurantbusinessonline.com/operations/half-nations-chinese-restaurants-have-closed-study-finds”.

Based on credit card merchant transactions, they figured:

51% of Chinese restaurants were closed as of last week, the study found. The next highest mortality rates were for sandwich concepts (23%), Indian restaurants (21%) and burger specialists (20%).

Omg this is a disaster.

Way too many restaurants. I once lost a bundle shorting PF Chang, they failed, went private and bought out the shares at a huge premium. My est is that Wall St will come ahead in this crisis. Even when they lose they win.

Omg this is a disaster.

The disaster hasn’t even started. You don’t even have old people dying in the streets, much less food riots. People haven’t even started eating their pets.

There was talk on this site a few days ago about bailing out the states, which isn’t going to happen. Wanna bet on which ones go bankrupt first?

My est is that Wall St will come ahead in this crisis. Even when they lose they win.

They win even bigger when everybody else loses. They’re going to make a killing auctioning off states’ assets and privatising state services.

That’s exactly what will happen; privatizing state services. Follow examples of “austerity programs” in Southern Europe. PE firms swooping down to buy portfolios of apartments and houses to rent to debt slaves is so yesterday. Getting their mitts onto what were previously government revenue streams is where the big money is. There will not need to be any ballot initiative to raise your property taxes to the point of maximum consumer pain. I’m thinking this has been in the master plan all along

Reagan started it in U.S. The European Union pointed the way to this. Make representational government superfluous.

From Greg Palast’s site:

“The imposition of the euro had one true goal: To end the European welfare state.

For Mundell and the politicians who seized on his currency concept, the euro itself would be the vector infecting the European body politic with supply-side Reaganomics. Mundell saw a euro’d Europe as free of trade unions and government regulations; a Europe in which the votes of parliaments were meaningless. Each Eurozone nation, unable to control neither the value of its own currency, nor its own budget, nor its own fiscal policy, could only compete for business by slashing regulations and taxes. Mundell said, “[The euro] puts monetary policy out of the reach of politicians. Without fiscal policy, the only way nations can keep jobs is by the competitive reduction of rules on business.”

My bet is that the first state to go bankrupt is Nevada.

I am a real estate agent in Rhode Island. There are pockets of our market which are holding up extremely well. On a typical day this time of year we are used to seeing between 150-200 new homes hit the market each day and right now the number of new homes hitting the market is between 30-50. Because the inventory is still extremely low prices have held up but I believe that we are going to see a massive downturn in the market over the next couple of years. Many of these lost jobs will not come back and that is going to put massive pressure on prices in the future.

I would not count on a significant drop in prices in the Bay Area. The market may be on pause, but I do not think there are many “desperate” sellers out there. I am applying for a jumbo mortgage shortly to maybe buy something in the next few months. We may see some softness as some folks lose income over the next few months, but I would be surprised to see a big crash. Lots of folks flush with cash out here. Once the virus is contained, whenever that happens, I would expect a significant step up in prices.

I have been waiting for a significant crash in real estate prices here for almost 10 years. At some point trying to time it just doesn’t make sense anymore.

Once the virus is contained, whenever that happens, I would expect a significant step up in prices.

The virus will never be contained. The political will do so simply isn’t there because there’s more profit to be made exploiting it. Instead, information about the plague will be contained, just as it was during WWI with the Spanish flu.

If you can stay put for next 10 years then makes sense to buy if it increases your quality of living.

Having seen many bubbles burst, I would be surprised if the prices don’t crash in many expensive areas including bay area.

The bubble is bursting in many areas and housing would be just one of the dominos to fall given its bleeding valuation.

During last down turn, it took 3 plus years for housing to bottom up.

Very few people are able to see these events with their colored glasses taken off including me.

If people has SFR, they’d say SFR won’t go down but condos/multifamily would

If people have many homes, they’d deny that housing would go down

If people have no home, they’d argue that it’d go down.

For realtors, it’s always the best time to buy or sell.

I’m definitely going to be cautious since we are still in the second inning but I’m going to have my credit lined up just in case. I’m not going to sit on the sidelines while prices double again. In the Bay Area that 10 year timeline is more like 5 although this is uncharted territory.

If you’ve waited 10 years then for God’s sake wait another 6 months. You can handle success.

I think that’s the plan but going to get preapproved for as much as I can now. Thx.

-Demand by nonresident foreign investors

-Demand by large US investors, such as REITs

-Demand by “instant buyers” or for short “iBuyers”

Love to see it

Looks like a Property market crash is soon on the horizon and this applies globally

Hi Wolf,

I work in the Mortgage Industry and a rate lock is an application that has decided to reserve a rate. Yes, the fallout is less on rate locks, however they are not approved loans. Optimal Blue does allow to “screen” locks requests before they come in or “qualify” Borrowers based on Underwriter Overlays. Also many require Underwriting findings before locking. That being said, you do lose locks when documents come in during certain milestones or other factors.