The Covid-19 crisis combined with the oil price war is about to trigger the largest ever monthly drop in U.S. fracking activity.

By Rystad Energy, via Oilprice.com:

The Covid-19 pandemic has ravaged global oil demand and, coupled with the extremely low price levels brought on by the wide supply surplus, is likely to cause the largest monthly drop in fracking activity ever recorded in the US, a Rystad Energy analysis shows.

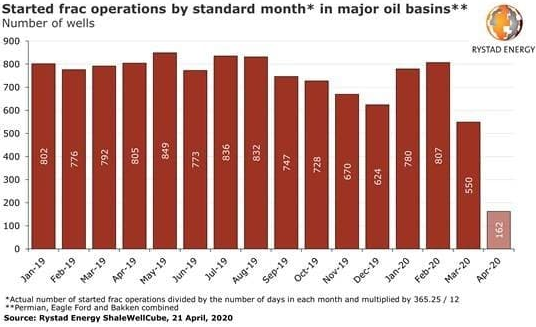

We estimate that the total number of started frac operations will end up below 300 wells in April 2020; close to 200 in the Permian and less than 50 wells each in Bakken and Eagle Ford. This translates into a 60% decline in started frac operations between the peak level seen in January to February 2020 and April 2020, as the majority of public and private operators implement widespread frac holidays.

In March we observed an extreme 30% monthly decline in the number of started frac jobs in these three major oil basins, a fall from 807 in February to just 550. Also, nationwide fracking activity, on a completed jobs basis, might have already declined by around 20% in March 2020, according to our estimates.

“With such a rapid decline in fracking already visible, very little activity will be happening in the oil basins during the remainder of the second quarter of 2020. The natural base production decline, which we have seen as an absolute floor for production, therefore becomes an increasingly relevant production scenario,“ says Rystad Energy Head of Shale Research Artem Abramov.

If we assume that no new horizontal wells are put on production from April 2020 onwards, total LTO production will decline by 1 million barrels per day (bpd) by May, 2 million bpd by July and by 3 million bpd by October to November, with the Permian Basin accounting for more than half of nationwide base decline.

US light oil operators, which are now announcing voluntary production curtailments, will try to deliver on these cuts as much as possible from the natural production decline, as opposed to shut-ins of producing wells (though some of the marginal, least economic volumes are being shut in, too).

The magnitude of the base decline for US LTO sounds extreme in the context of what we see for other supply sources globally. But ironically, the steep decline is actually too late to save prices; despite the oversupply issue, standard operation patterns prevent operators from simply turning the faucet off. These days Permian wells require about two months from the moment frac operations start until they produce first oil, and require about three months before they reach peak output.

Hence, the decline in started jobs which began in March will result in a lower number of wells put on production in May, which ultimately will lead to a drop in peak production in June if normal operational patterns are maintained.

“On the demand and storage side, the market is already moving through its toughest challenge yet, and the WTI front-month sell-off emphasized how broken the physical market might be already. We are therefore concerned that significant production shut-ins will be required in the next few weeks to bring the market into the balance in a brutal manner,“ adds Abramov.

In addition to our standard analysis of frac activity, based on incomplete FracFocus reporting in recent months and empirical reporting delay adjustment factors, we are now rolling out a brand new way of filling the gaps left by official reporting. We have begun using satellite data to systematically monitor more than 40,000 permitted and drilled locations across the US, continuously identifying the presence of any activity taking place.

Our methodology is based on monitoring the equipment intensity on each pad or permitted location and then analyzing the evolution of this intensity over time to identify the main pre-production activities in each well life cycle, from pre-spud to main drilling and fracking. By Rystad Energy, via Oilprice.com

This is a moment for historic reflection and head-shaking. Read… Holy WTF Moly: WTI May Contract Collapses to Negative -$37

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Uh, why frac with nowhere to put the oil, and quite frankly, larger losses than layoffs and laydowns?

Just like blading in a subdivision, why bother unless you really think we are still building in six months?

LoL

Mark to market has now become suicide…

Now, all that debt is going to dollar heaven in Chapter 11,

And momma still got no beans on the stove,

So you ain’t gonna move on up to the East Side,

To that deluxe Trump Apartment in the Sky!!!!

We will never be the same after this trip up the river, and what survives is going to be very different.

Someday this war’s gonna end…

The USA should purchase US oil for its national reserve. Otherwise, Saudi and other countries may later raise prices dramatically after bankrupting US production. Giving low interest loans in exchange for convertible bonds would also be wise. It would enable taxpayers to profit when oil prices go up eventually.

I know transportation isn’t the only use of oil, but we SHOULD be diversifying more/faster into EV. Like the rest of the world is doing. So that a cold and flu season doesn’t wreak havoc with our energy infrastructure. But then we’d have to endure all of he EV haters calling us hippies.

Standard production and supply. Government-forced demand reduction. Oil companies should adjust accordingly. That’s life and free market economy. Ups and downs, good years and bad years. If a company(s) can’t adjust to $20/barrel oil, they should not be in business.

Empty planes and cruise ships are not government-forced. To many people have the idea that the state is creating the problems, it is not. It is the disappearance of demand because people stay home for safety is the big problem.

Char:

Really? Not where I live. People are gnawing at the bit to get out. If the pubs and parks were open, they would be packed on an average day like today.

Oil is toast for awhile at least in part because of lockdowns.

Yes really, Suburban mall here is quiet which is weird because most people would normally work in the city and shop partly there. Now they have free time and are not shopping in the city so it should be packed, it isn’t.

It is more that people won’t travel long distances and a lot more work from home than the lock down

It is 100% government forced. If it wasn’t for the travel bans people would have still went to holiday resorts, I know of many people who traveled to Mexico right up until the government stated fines would handed out to those not cooperating. I have even heard people say they will gladly hop on a cruise ship this fall, they don’t even care about a vaccine not being available that soon. The herd isn’t very smart, that’s why the outbreak is so wide spread.

I would put it more 60/40, more people accepting the guidelines (which Federal Gov was slow to adopt) and government coming in after the fact and supporting that position. Government wasn’t prepared for lock downs, and didn’t want them at any rate (any more than they want to wade into a riot with looting) They protect and serve and for a change they had a chance to do both. Other than being infected, being a cop and fireman is probably a much nicer job right now.

I know you would take a plane ride to take a cruise. It is just the government that is forcing you to stay home. Bad government.

You have always idiots that return to a burning house to pick up their wallet. But that is a minority.

I have even heard people say they will gladly hop on a cruise ship this fall, they don’t even care about a vaccine not being available that soon.

The cruise line crowd would rather risk a horrible lingering death on a plague ship than have to put up with their own needy ungrateful spawn. It’s a family values thing.

its why the Widow Maker’s time has come..

NG will double from here by November

GS is front running that trade, so epic bull traps will also be part of run north….

Gas is used for heating and electricity production. But we don’t know how the winter of 2021 will look like? Crashed economy? A locked in population? How many death? How many flee to better places?

Oil is now cheap because demand crashed. Who said the same won’t happen to gas. Also a awful lot of gas is used to make/pump oil and oil products.

Natural gas is used to make plastics and other similar chemicals. Try living without plastics and derivatives of it. Oh, it is used to make some common pharmaceuticals too. And don’t forget packaging materials and insulation. Etc..

Plastic and Nitrogen are important but smaller customers of gas. They are also very price sensitive on a global and daily scale. Unlike electricity or heating up buildings.

ps. NG in the US will likely double in price, but that is due to it being so incredible cheap at the moment. In absolute numbers the rise will be minor.

Natural gas markets are a complete mess right now, chiefly due to the massive glut in supply in traditional good money markets like Europe and Japan.

And it’s about to get a whole lot worse: Qatar Petroleum has just announced development of the massive North Field East (NFE) will go ahead as planned despite hopes it would be delayed or even cancelled altogether due to the massive glut in supply worldwide. The only problem is Covid-19 is making hiring outside contractors harder right now, but Qatar Petroleum executives sound unfazed.

When fully developed NFE should bring Qatar’s annual LNG production from the present 77 million tons to a monstrous 125 million tons.

And Sempra Energy and their Japanese partners announced yesterday the announced expansion of the huge Cameron LNG export terminal (Louisiana) will go ahead as scheduled. When completed Cameron will be able to export 12 million tons per year alone.

On top of this Sempra has four other LNG export terminals under construction for a total yearly capacity of 45 million tons.

This glut in supply won’t go away.

And speaking of things that won’t go away, the Saudi supertankers Jana and Awtad are still ominously moored in front of Houston.

Except you can’t store NG the same way you store crude. You cut off the well and your storage runs out more quickly.

Yes, natural gas can and is indeed stored all over the world, starting from the US East Coast where some of the largest facilities in the world are located.

Generally depleted gas fields, acquifers and salt formations are used for storage: it’s a very fascinating part of Earth Sciences.

The USDA has been pouring a lot of money into researching new technologies for NG storage such as cooling salt formations to increase capacity and the use of hydrates.

Storing NG (and CG, Coal Gas) is old technology: gasometers, albeit long decomissioned, are still relatively common sights around here. In fact there’s a relatively well preserved one about six miles as the crow flies from where I am typing. This particular one was chiefly used to refuel vehicles converted to run on CG after the war, so the site is heavily contaminated by byproducts, but with NG has no such issues.

GS has double the price of today in forecast, there is a ton of NG shorts who had it great last 4 years, ripe for money taking and it has begun…..

NG will find 3 before December, the Futures curve points it out and now all production in shale is shot…..could be spikes to $4-5 dollars…..its widow maker time

we now export a ton of LNG to Japan and now China….

‘One energy banker says that losses on senior secured bank debt could reach as high as 10% in a very unlikely “long term meltdown,” with larger losses down the chain. He assures that loans are “overwhelmingly secured” by oil and gas reserves, though cautions that at oil prices in the $30s virtually no U.S. drilling is economic.’ Via Forbes

Don’t know when the guy said this but I guess ‘before’

So the loans are secured by reserves that, in the here and now, are worthless.

At this rate there are bank runs looming. Sure, all 5000 of them are FDIC insured but in a bank run folks want cash and they want it NOW.

The US may regret its banking patchwork- quilt, which as Canadian outsider I assume has something to do with some aspect of ‘states’ rights’ .

One example of the vulnerability of these Mayberry banks:

When Paul Manafort was still a player in Trumpland, he got a RE loan of a few million via a bribe that he would make the bank manager Secretary of the Army. The US Army.

The poor bastard actually showed up at Army HQ, greeted by ‘who are you?’

The point: this loan of a few million actually endangered the bank’s viability.

PS: to be clear, of course all FDIC deposits are safe, but the number of these small banks creates a possibility of a domino effect, requiring more FDIC rescues than fewer, larger banks would need. There shouldn’t be any such thing as a shale bank.

Must be urban legend

‘Stephen Calk manager of Federal Savings Bank indicted on charges he helped Paul Manafort get 17 million in loans in return for a job in the Trump Administration’ May 23, 2019.

This was the majority of the bank’s capital. Check it out.

Oil and gas demand is also influenced by the weather…..When it is really cold you use more. The problem is people see the weather as a local thing. Here in England we have just had a very mild but very wet winter. They say 2019 was the warmest year in Europe but I do know large parts of Russia and the USA had a bad year in 2019. At the moment the USA and Canada has large parts still with snow yet here in England (since the lockdown lol) its just been wall to wall sunshine. One of the big export markets for USA natural gas is the UK, so as we have had a mild winter and a very sunny spring we must be buying less USA natural gas and oil just at the time when the USA needs us to buy more…..life’s a beach, then you fry

what a mess!

why?

no free market that’s why.

big government that act as a god.

central bank and fiat money.

1) The global demand suddenly plunged 30%. It took time until Trump ripped apart the handkerchief secret deal between Putin and the sand kingdom.

2) WCS-WTI from (-) 44 to (-) 9.25 yesterday, at Apr 2017 peak level, approaching zero from below

3) Venezuela is down.

4) The Dr. will prolong life of old wells, until the Permian die.

5) Gravity with negative WTI is pulling the next paper oil contracts down.

6) Covid-19 will osc in waves, but the largest pulse is ahead of us.

7) When US will open for business it will move from 30%-50%

capacity to 40%-60% capacity, but negative waves of BK will halt

demand.

8) When the old will die, after US will be dissect from the global trade, US

rejuvenation will demand oil.

9) WCS few acres of snow will become the most expensive sand RE in the world, because pipelines supply is constricted.

1) WTI sunk.

2) US sunk speed boats.

3) Iran sunk WTI black swan.

Iran sunk WTI? No I heard that it was Saudi Arabia Why the fake news Engel ?

1) $NATGAS weekly Apr 2nd 2020(L) @ 1.52 AUg 2019(L) @ 2.03.

What’s all this to do with corporate investment. Forget the lost jobs, Wall St did. Revenue is more important in these credit leveraged deals? You float your business on high yielding bonds you better pay the interest?

Is it a good time to stay away from oil and gas stocks during next few days and opportunity to buy at lower levels.

Government to the rescue time….they are now thinking of taking equity stakes in companies..

Treasury Secretary Mnuchin says the government is considering equity stakes in the oil & gas sector. source us Reuters Jeff Mason

““We’re looking at a whole bunch of alternatives,””

The president encouraged Mnuchin to look at buying oil for later use.

Imagine them now drawing up the requirements for the must save group..

let us see now which company is more American and did not abuse the other subsidy programs,

and lastly but most important which Republican senators and house members will benefit the most from this pork-barrel.

or which American banks will this bail out at the same time…

Go figure!