Loading up on Treasury securities, mortgage-backed securities, repos, “central bank liquidity swaps,” and “loans” to keep the Everything Bubble from imploding further.

By Wolf Richter for WOLF STREET:

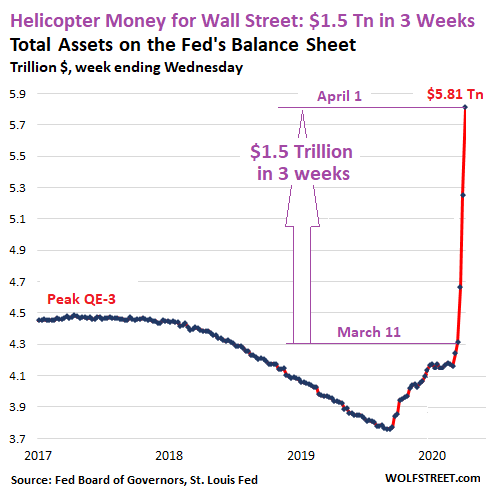

Total assets on the Fed’s weekly balance sheet – mostly composed of Treasury securities, mortgage-backed securities (MBS), repurchase agreements (repos), “foreign central bank liquidity swaps,” and “loans” – spiked by $557 billion in just one week, to $5.81 trillion, according to the Fed’s release Thursday afternoon.

This doesn’t yet include about $200 billion in MBS that the Fed bought over the past three weeks but whose trades have not yet settled (the Fed will book them later when they settle). With those MBS included, the Fed now holds over $6 trillion in assets. Since the Fed started this whole shebang of Wall Street bailout programs three weeks ago, total assets have exploded by $1.5 trillion:

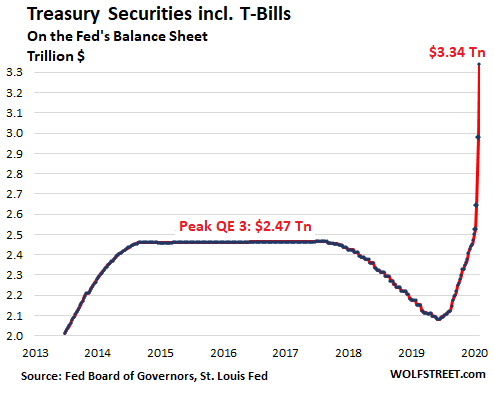

Treasury securities spike

During the week of the balance sheet, the Fed added $362 billion in Treasury securities, spread over all types and maturities, except T-bills, which have remained flat since March 11, after soaring at a rate of $60 billion a month starting in October.

The Fed is now adding exclusively Treasuries with longer maturities. The total balance of Treasuries soared to $3.34 Trillion.

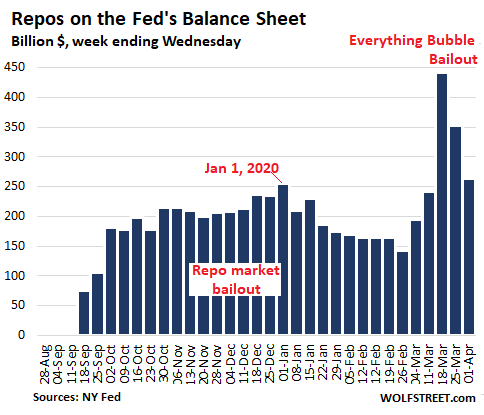

Repos go from sizzle to fizzle.

The Fed is now offering a gazillion dollars in repos every day – $1 trillion per day in overnight repos plus over $1 trillion a week in term repos – but there are essentially no more takers. Over the past few days, repos accepted ranged between $0 and $5 billion.

There are no more overnight repos on the Fed’s balance sheet because no one wants them anymore. What’s left are term repos from prior periods, and when they mature, that repo account will likely drop to zero, as it had done during Financial Crisis 1, when the Fed started QE. For this week, repo balances dropped to $263 billion, down 40% from three weeks ago:

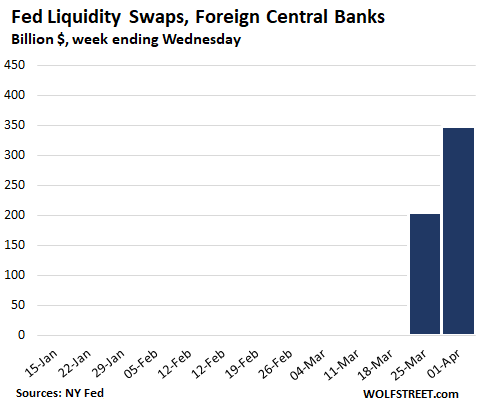

Liquidity Swaps: red-hot and newly active

As part of its whole bailout shebang, the Fed expanded its standing “dollar swap lines” with major central banks and opened new swap lines with a gaggle of other central banks, such as the Bank of Mexico. This was the second week after these lines had gone live, and they exploded.

Their purpose is to supply dollars to foreign governments and foreign companies that have borrowed in dollars – which they don’t control and cannot inflate away, a huge gamble – so that they can now service their dollar debt and don’t need to default. It’s a foreign-gambler bailout.

Liquidity swaps work like this: The Fed lends out dollars and takes the other central bank’s domestic currency as collateral. The exchange rate is the market rate at the time. For example, the Fed sends $10 billion to the Bank of Mexico, which posts 243 billion pesos as collateral. This is done under an agreement with a maturity date at which the Bank of Mexico sends those dollars back to the Fed; and the Fed sends those pesos back to the Bank of Mexico, at the same exchange rate set at the outset of the swap agreement.

The Fed carries these swaps on its balance sheet priced in dollars at the exchange rate set in the agreement. And these swaps exploded from almost zero two weeks ago to $349 billion currently. The chart is on the same scale as the repo chart above:

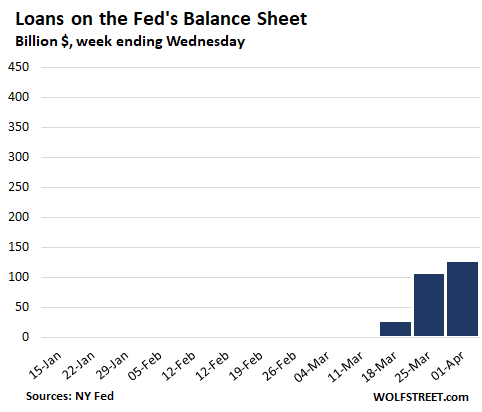

“Loans”: The newly hot bailout

“Loans” is a group of asset accounts on the Fed’s balance sheet that had been essentially asleep since Financial Crisis 1. But over the past three weeks, they jumped from near-zero to $129 billion. This is what the Fed has lent out as part of its new bailout liquidity programs and direct lending programs, by category:

- Primary credit: $44 billion

- Primary Dealer Credit Facility: $33 billion

- Money Market Mutual Fund Liquidity Facility: $53 billion

The chart is on the same scale as the charts for swaps and repos above, giving these loans room to grow into as Wall Street gets more of its helicopter money:

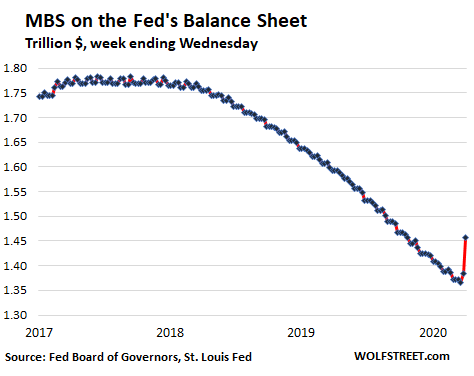

MBS still not fully reflected.

Over the past three weeks, since this whole bailout shebang has commenced, the Fed disclosed $319 billion in gross purchases of MBS. This MBS market was blowing up, mortgage REITS with leveraged bets on MBS were blowing up, and the Fed stepped in to bail everyone out. But MBS trades take a while to settle, and the Fed books them only after they settled. This week, we’re seeing the first leg of those $319 billion MBS purchases. The total balance of MBS rose by $73 billion during the week to $1.46 trillion:

Since the beginning of this bailout shebang three weeks ago, the Fed created $1.5 trillion and handed it to Wall Street either as loans or to purchase financial instruments. If the Fed had sent that $1.5 Trillion to the 130 million households in the US, each household would have received $11,538. But no. That $1.5 trillion was helicopter money for Wall Street.

The Fed is propping up nearly every asset class directly or indirectly, to make sure that investors, from stockholders of overleveraged airlines to highly leveraged speculators in Commercial Mortgage-Backed Securities, don’t get their faces ripped off after having run up the Fed’s handiwork, the greatest Everything Bubble there ever was.

“Nobody has any taste for risk anymore. All of those exotic loan programs have ceased. All investors buying that paper are gone”: mortgage broker. Read... Week Two: How COVID-19 Lockdowns Impact US Housing Market. Mortgages Give Clues: It Gets Uglier

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

Well it’s reassuring to know there’s plenty of trillions to roam the landscape with, and purchase “distressed assets” like small businesses and repossessed homes by the boatload.

/s

I’m still waiting for the term “carpetbaggers” to be resurrected in the common vernacular. It has been sorely missed by many of us for far too long!

Hear, Hear!

So what’s to keep this from working and propping up the Everything Bubble?

Let’s fast forward through this horror movie – how does this end?

i may be going out on a limb here, but: badly?

I feel like there is a “correction” happening, but not going to hurt the banks and financial sector. I am having bad dreams about getting a letter saying, ” Sorry, but no money for Social Security payments any more.”

That is coming. Social security won’t go to zero, but that’s the natural outcome of spending on tax cuts and bailouts.

Something is going to be cut. Maybe in a sensible world, the U.S. would face reality and give up on policing the whole world. That’s got a serious downside but it is better to adjust sooner than later.

holy crap, Ed, “natural outcome”?

I’m trying to get my head around swaps. Is it I pay you Tuesday for a hamburger today I shit it out give it back to you as collateral for a new loan in a different currency?

One scenario: You’ll get your benefits, but their real value will wither away as inflation adjustments fail to keep up with reality.

It’s more than plausible given that it’s already established practice. The next act will just take it to a whole new level.

Ha, ha, Portia, yes, it sounds awful. But that should be the expected end game when all the money is spent elsewhere and the debt goes up to $25 Trillion or $30 Trillion.

Social security may not be the first thing cut, but entitlements have already been mentioned as possible cuts in the next four years. Choices. Most people don’t say it at the time they happen, but a tax cut or 50 cruise missiles fired at an empty airstrip or bailouts for reckless companies, those are choices. :(

When you receive that letter, your first action should be to get together with your fellow Americans and agree to stop paying taxes…or any bills whatsoever. Be prepared to defend against debt-police by any means necessary.

I’m trying to figure out if there is any place left where I can park my money without losing it.

What can a little guy do with an extra $5000 or $10000 that he wants to put aside for a rainy day, after he’s maxed out the contributions to his retirement plans, i.e. IRA and 401(k)?

Money markets pay so little that they can’t match inflation. Ditto saving account or CDs at banks.

Bond funds were once a boring but safe way to invest money and get returns that were about the same as the inflation rate, i.e. over the long term the value of the money was stable, and perhaps a little more risk would yield a correspondingly modest increase in real wealth.

Stocks are definitely a high-risk strategy in the current year. ‘Nuff said.

Now the Fed is plotting to more or less seize control of the bond markets by buying enough bonds to control the markets. The experience of Japan suggests that once the central bank owns about half of the government bond market, trading asymptomatically approaches zero and interest rates are frozen at just above zero. Once that happens, government bonds are effectively dead as investments.

If they do the same thing to corporate bonds and municipal bonds – and it looks like they plan to do this – then investments in anything other than junk or foreign bonds will yield close to zero.

What’s left? TIPS? I-series bonds? Go long on ammo, even if you don’t own a gun? Buy booze, even if you don’t imbibe?

you cant go wrong with booze, its a very liquid asset. might be worth something down the road too, so long as you don’t use it up on the way.

You know, Ensign, I have heard that concern for a long time, the idea of simply not making any money by keeping cash in the bank in one form or another. In fact, the last guy who kept telling me this no longer speaks to me. Why? I still have my cash and he lost his. Sometimes, it is that basic.

No one is really going to tell you where you can make some profit. There are two reasons for this. One, they need you to invest so they can make money for themselves, or two, they just don’t know. I may be wrong but I just wouldn’t risk what took so many years to make.

The other day I saw a very funny cartoon. It showed a guy scratching his head and speaking to his wife about Facebook. “Isn’t it amazing”, he said. “A month ago all my ‘friends’ were constitutional experts, now they’re epidemiologists”. (But 3 months ago they were all Market savants). Like my buddy.

If we are in crash mode, what is valuable will be basic things to maintain life for your family or self. It won’t be about making profit, it will be about surviving until it blows over. And normal does not included the excesses of the recent past. That, was the outlier. The other day I had to go to town. I found myself watching to see what stores were open. On the hour long drive into town, on a work day, I could count the cars on one hand.

Thank you, Paulo. I smiled a little bit for the first time today.

Gun dealer can’t legally buy your ammo once you have bought it, it becomes ‘used ammo’ even if new in box. Insurance reasons you see. Even cases of new boxes in the carton is ‘used’, if the ammo’s manufactured date is out a year, its used. I know this is petty, but the ‘idiot’ who buys your ammo and shoots his foot off can later sue a dealer who sold ‘old/used ammo’.

People who invest in ammo will be surprised a few years ago I had $10k or more in real good ammo, I had preserved for years. All combat.

No dealer would touch, the internet people only buy by the box, I had 1,000’s of boxes of all cartridges. I couldn’t find a ‘one size fits all buyer’, it took months, finely found a local ‘dealer’ who bought all for $500. I really just wanted to get rid, as I had moved off-shore.

The guns were a little easier, but I only got 10% of what I thought I would kit, again had to auction, but they did get rid of all in bulk. But they will not touch ammo.

In summary guns&ammo is a lousy investment, just go to a gun show, and look at the same guys trying to sell the same guns & ammo every month, and they’re lucky to even cover cost of the table at the gun show.

Sure once&awhile these panics appear, and the ‘dealers’ can offload, the stuff but the fact is ‘real cash’ is short for most people, real buyers are non-existent, sure you can sell a box of bullets or a hand-gun to a newbie, bu they’re a pain in the tail.

Back in 1998-2000 Deutsche Telekom was privatised here in Germany and floated. The shares were massively oversubscribed and the price was very high, 90 EUR as I recall – the price now is 11EUR and has been lower.

We have bottle deposits on beer bottles here and if you had invested all of your money in beer and now tokk all of the empty bottles back and collected the deposit you would have more money than if you bought Telekom shares.

So beer is the way to go.

Cheers

LOL… that’s the spirit!

In wine there is wisdom, in beer there is strength, in water there is either bacteria, o,r in USA, various and sundry chemicals that we are instructed by guv mint not to worry about…

So, for the thinking person, perhaps wine,,, for the active person at least trying to help, beer IS the only way to go,,, for now…

just like Dutch KPN

At this point, invest in your health, and skills that will keep you employed. Electronic (aka paper assets) are going to have no context in a society where getting a good meal or maintaining decent shelter over your head is the focus. A new chapter in human history is being played out. Also, skills vs. ‘education’. I don’t have kids, but if I did, I would emphasize to them the need to obtain a needed skill, not just paying for a useless degree. Some of the changes are going to be very welcome!

“Skills that will keep you employed”

This.

Knowledge is the asset that corrupt gvts have the hardest time seizing.

Ironically, in the Internet Age it is also commonly given away for free (Wikipedia, etc).

In my humble opinion I think you are in a good position if you have not been invested and will now have an opportunity to wait for prices to get really cheap. Whatever your level of optimism is maybe buy in 25% increments and just stick with a few of the index funds…VTI, VNQ and NOBL come to mind. Nothing that pays decent interest is risk free although you might still be able to buy market rate CD’s in the 2% range that guarantee your principal (FDIC). Any CD’s from banks usually just have you forfeit 6 months interest if you need to cash them out.

Those are our questions, too.

At what point does the FED reach for the stars and becomes defunct? If it reaches that pinnacle, then does the Capitalist System in America die?

What past empires crumbled under such pursuits to maintain its hegemony?

Seems like two reasonable questions to answer. We’ll be happy to read your responses.

Invest in the rich. Always a safe bet. Until an uprising comes, but those take seriously motivated people. Furious “liking” and retweeting won’t cut it. So ya, invest in the rich.

Ensign_Nemo:

“I’m trying to figure out if there is any place left where I can park my money without losing it.“

The key is to realize no one asset will do it.

Cash and Treasuries may get you there, or at least close, but only in nominal dollar terms. Inflation could eat them up. US stocks still have a lot of hot air to lose before offering anything like the returns previous generations enjoyed. Gold has held its real value over multi-decade time frames, but can be a loser over anything shorter. Much the same goes for other physical commodities. Non-US stocks are more reasonably valued than their US counterparts, but can also lose in the near term.

Put these together in the right proportions though, and you at least have a shot.

Difficult to say how it will play out exactly but I see one sobering and inescapable necessity in the future: the world has to purge itself of unsustainable debt levels. Basically, there are two ways of doing so: pay everything back in an orderly and civilised manner, honouring the gentlemen’s agreement – which IMHO has become downright impossible – or simply walk away from it by inflating the monster into oblivion. Deposit a giant financial jingle mail in the mailbox so to speak. The dollar as a reserve currency might or will go the way of the dodo in the process, our Euro certainly won’t replace it (frankly, I’ll be happy if we still have a functioning banking system in the EU after all is said and done). But who knows, maybe they’ll resuscitate the SDR’s to keep a semblance of a functional economy.

Someone told me in a reply to a former comment that you can’t eat physical gold. I get that, but I’m afraid fiat will become even more indigestible. I’m not a financial wizzard, truth be told I’m rather unsofisticated as far as money management is concerned, but the way I see it, out of control debt is the root of our predicament. And we lost the option of escape velocity to deal with it in a proper way.

Loss of confidence in the value of heavily debased currency resulting in price inflation.

Notice rates at all time lows….and the Fed finds themselves the only buyers at these levels. They have stuck their heads in their own guillotine.

The Treasury will backstop them.

Rates are not really are at all-time lows. Treasury rates are in flight-to-safety panic mode, but other rates are not changed. You can’t refi the mortgage at an all-time low, for instance. And the banks’ “Prime Rate” is still 3.25% (matching the prior low from 2008 panic) even though the 5-year and 10-year Treasury rates have dropped by over 2% since 2008.

What will buy a loaf of bread. Paper fiat toilet paper? Or silver coins that have intrinsic value

At least for the seller

WS,

Good catch…there are different rates for different contexts.

The biggest honking “context” is when the Fed is involved.

So long as the Fed has the power to print money, it can drive Treasury borrowing rates to zero – simply by printing whatever amount the Treasury is asking for.

As a result, the Treasury has no need to ramp up offered interest rates to draw in existing private sector capital.

The Fed’s new money fits the Treasury’s bill perfectly, costlessly (ie, at zero interest).

Only problem? The amount of real world assets have not changed…but are now represented by an inflated pool of money…

No private mkt player could or would do this for the Treasury.

That is why it is funny when people think the G (in the form of the Treasury) does not tell the Fed what to do ultimately.

Twenty years of ZIRP should have made everyone experts on how the dollar interest rate sausage gets made.

Rates are at all time lows.

Never have the ten year or thirty year been this low in yield.

And three month treasuries went negative for the first time ever.

What color is the sky in your world?

@Gandalf

How it ends- your enslavement.

It does, if your way of life has relied heavily on money. If not one will REMAIN (NOT become) relatively free

@ RD Blakeslee

Congratulations on not being dependent on money. All your enslaved neighbors just voted for rulers who suddenly imposed capital controls, seized all your non-monetary assets, and revoked your bill of rights and also your travel privileges. But be happy, the Fed will issue you the same amount of tokens as everyone else to be spent on things the wise rulers approve of. Enjoy your enslavement.

Agree with you once again RD: as a now certifiable elder,75,,, (just one step before, ”elderly” ,, apparently 80 + these days,) it has been made clear to me that a happy ”civil union”, formerly known as ‘wedded bliss’ is not really based on sex, but rather on respect and appreciation to and from both parties to such happiness.

Took this old boy a long long time to know the difference, mainly because of so many willing and helpful partners doing their best to keep me doing my best in the former category.

Suspect the reported/alleged spike in divorce ”over there” and likely to be reality here after the lock downs now and future will mainly be the result of folks who confused ”in lust” with ”in love.”

Agree with you once again RD: as a now certifiable elder,75,,, (just one step before, ”elderly” ,, apparently 80 + these days,) it has been made clear to me that a happy ”civil union”, formerly known as ‘wedded bliss’ is not really based on sex, but rather on respect and appreciation to and from both parties to such happiness.

Took this old boy a long long time to know the difference, mainly because of so many willing and helpful partners doing their best to keep me doing my best in the former category.

Suspect the reported/alleged spike in divorce ”over there” and likely to be reality here after the lock downs now and future will mainly be the result of folks who confused ”in lust” with ”in love.”

Gandalf:

The movie ends when shale oil runs out and the price of oil spikes. Everything else can be can-kicked.

The Fedanimator finally gets it’s comeuppance, pukes out all those glowing-$creen green$ that its been oozing in one last humoungus burst .. dying, as it turns insideout like a sea cucumber, never to QE again?

@polecat

Regret to inform that the Fed will not die, it’s masters are very pleased with what it is doing- it is more useful than ever.

Well, perhaps .. but what keeps it all together, are the various MICs scattered across the planet, several with fleets of functional nukes. Frankly, the way this corona bio-econo clusterf#ck is playing out .. with our own Navy et. al. succumbing to this virus whilst our government is showing vailed signs of panic & looking for a tail to wag .. as the plebs simultaneously do a grand-mal AAA+ Freakout now that the circus has stopped and the bread shelves thinning; impoverishment showing fixed in their sights .. it clearly does not bode well for things to come.

The Devil himself only knows what’s gonna shake down ?

The problem is once everything is backed by the FED then everything has correlated risk. Which means, as wolf has documented “everything” goes up. But when it breaks it won’t be one thing that breaks, or a group of things that break, it’ll be everything that breaks simultaneously. Hence the “everything bubble.”

Why do people always say “the everything bubble” instead of “runaway inflation”? What are the differences?

basis of just one of the Wolf’s basic paradigms for us wolverines/peons…

welcome to WolfStreet CM:

many deltas, as longer term reading, or even back reading many articles/posts still up and available, that I, and many other commenters on here have reviewed…

“Bubble” instead of “inflation” because it seems benign or positive when “asset” values increase (which occurs because money printing guts interest rates, which causes asset values to rise because existing asset cashflows become more valuable relative to gutted rates).

But A’s key point is that in a gutted Zero Interest Rate Policy world, different companies in different industries facing different circumstances see their valuations sync up in overvaluation…all keyed to nothing more “real” than ZIRP/money printing.

Bubble valuations are not built on improved productivity but rather a debased common currency.

Everything becomes correlated to the Fed manipulated money supply…which is deadly because the risk mitigation made possible by diversification (almost always a savior) fails when stocks all become correlated to a single factor (interest rates)

So those valuations are as fragile as the faith in habitually defiled dollars…because no real improvements are behind the inflated valuations.

That is the best part: it is a mystery, because we have no idea what new, even more foolish steps will or will not be taken by our national “leader.” No doubt our markets will continue to enjoy the suspense, which will continue for months.

There is an article that suggests a very good set of steps, which doubtless will also be ignored by our “leader.” See https://www.livescience.com/can-covid-19-be-crushed.html. The article summarizes the recommendations of Dr. Harvey Fineberg, president of the Gordon and Betty Moore Foundation, a philanthropic organization in Palo Alto, California, and past president of the U.S. National Academy of Medicine, who wrote them in an editorial published Wednesday (April 1) in the New England Journal of Medicine. He explained his recommendations: “The goal is to crush the curve.”

The only alteration that I think is necessary is that without enough testing kits being available for weeks due to the failure to compel their production by the defense production act, a temporary national lock down in addition to those wise steps is unavoidable weeks ago. We really have no idea which states/counties are incubating clusters of asymptomatic, infected persons, who will soon inadvertently start their own epidemics in their individual states.

Sadly, the likelihood that we can now rapidly produce enough testing kits in a few weeks to ascertain which of our hundreds of millions of Americans and other persons within the USA is asymptomatic but infected in a short time is zero. See https://www.politico.com/news/2020/04/03/lamar-alexander-coronavirus-tests-163460.

Thus, shutting down the whole country now, like Dr. Fauci recommended yesterday, is the only viable remaining option. It will reduce the number of total persons infected this year in the most rapid way possible. Even some of this president’s former, chief supporters from his own party also recommend it.

If our “leader” locks down the whole country and is followed by his loyal governors, who have listened to him and not locked down their states enough, these persons who are asymptomatic but infected reportedly will remain at the peak of their infectiousness only for 10-15 days. Locking down will reduce the R0 of the virus, because the persons who are infected but asymptomatic will each infect fewer persons: only their immediate relatives, who are quarantined with them. (Those known to be infected due to their symptoms/testing can be readily treated or quarantined.)

(We also have to assure free treatment for all infected including those among the poor or those who do not have insurance or medical aid available will not get tested, quarantined, and treated.) That is the fastest way to limit the nationwide spread of this coronavirus rapidly. That is the fastest way to limit the grievous, ongoing harm to the US economy.

I do not understand what is so hard about those facts for our “leader” to understand.

One more thing: this will only work if the government prints enough dollars for two months to pay all persons here a basic income and also to pay for enormous medical bills of all uninsured, so the uncovered poor do not become virus reservoirs, including billions for mass produced testing kits.

The alternatives will require intermittent shut downs by one county/state after another as their infection clusters grow and then weeks/months later, (when some person from another state/county reignites infections in a county that had ceased their lock down) repeated lock downs again in those very same counties/states later. This will continue on and on for months, until a vaccine or treatment or herd immunity finally stops the spread of this coronavirus.

If the MBS buys take time to settle and SPG SLG REG MAC are all crashing now, buy them now because the fed’s purchases will show up soon??

I’m just glad the fed found an effective vaccine!

Oh. wait.

they haven’t yet thrown enough liquidity at the problem. yet. it will happen, don’t you worry.

Naaaawwww we don’t invest in things like that – that would be socialism.

And as has been noted for the last decade – socialism (and planning) are only good when they help the wealthy financial speculator and usurer; the gilded ones who need to be isolated from the effects of their own greed.

The 500B+ increase in the money supply on their balance sheet which was 300% more than before will be at the grocery store a whole faster than a swap.

What causes prices to rise at the grocery store is not the money given to Wall Street, that causes asset bubbles and unproductive businesses but actual supply and demand of food.

IF there is adequate supply, throwing lots of dollars at it doesn’t actually make the price go up. In fact it could cause the price to go down as it could easily fuel over production. Unless of course we have no one to plant and pick it.

If the supply is limited, then you can have huge spikes in prices. That has nothing to do with the FED but thru politics and the willingness of the population to work at such jobs.

The problem with the FED adding liquidity is that it often ends up in very unproductive endeavors or fueling over production.

What we are dealing with currently is to much over production and to much unproductive debt. Adding more isn’t going to make either situation improve. Allowing the system to clean itself out is the only solution. But those in charge do not want that because at this point of extreme overly leveraged systems means massive repositioning of leadership. Many of the owners of the overly leveraged corporations will no longer be leaders. Many might just be broke. Bankruptcy does harmful things to ownership and wealth.

Most people have never read about the last great Depression or its beginnings but many people committed suicide rather than face humiliation and poverty that they would have to endure due to the collapse of so many leveraged businesses back then. I imagine this time won’t be different.

Today’s bankrupt CEO is tomorrow’s president!

I believe suicide sits as the #9 cause of death in the US, since the last collapse. Compared to 20-something in Mexico. That’s excluding “accidental” overdoses and death by social behavior, like threatening harm to police, etc. And it’s spiking, along with domestic violence.

So I’ll say it again, Covid is an overblown distraction. CA had direct weekly flights to Wuhan for MONTHS before lockdown. Death toll? 140 something? Covid will peter out, meanwhile we’ve all been robbed blind, and Trump will blame the (unavoidable) crash on Democrats, handily defeating Biden.

I’d bet a mug on it, but if I’m wrong I’d have to wear a fake mustache and lay low. Change my handle to CoinDispenser. :)

Edit: Death by SOCIAL (not social) behavior. Although socializing now MIGHT get you terminally ill.

Daily death rate is now close to 1500 nation-wide and will most likely grow fast, very fast in some areas.

The real question is how much the deficit will grow? 2 trillion, 3 trillion. The collapse in tax receipts is just starting.

Bill Gates is now saying the nation-wide lockdown for 10 weeks will be required to deal with the virus. The country will be producing very little during that period. Who is going to provide supplies? China?

Did I even screw up my edit? That should read suicidal, not social.

Spot on…end the hysteria…this is NOT smallpox.

Yes you are right with logic but the creed have no logic I feel the same way you do brother may God bless us

How can we ever imagine that Capitalism will ever return to our Nations. The market demands that when excessive risks are taken and things go wrong, then failure follows, to clear out the dead wood so as to allow for new people / companies to grow and succeed.

If nothing is allowed to fail …. then Capitalism is dead.

For the companies that spent billions on share buy backs and huge dividends when they couldn’t afford it…. they should now be allowed to die, so that new responsible companies can grow.

Oh and while I am here – I would ban ALL short selling. It adds no value to a society, it just increases the odds of a roulette wheel economy.

Capitalism’s greatest enemy is not socialism…it’s capitalism. This is how the game ALWAYS ends…because it IS a game. And games have winners and losers. That nobody seems to grasp this is the greatest tragedy of our time.

– WRONG, WRONG, WRONG.

– The USD swaplines are NOT meant to “bail out” other countries but it’is meant to save the “rear end” of a person called Uncle Sam from getting “roasted”.

– States outside the US DO have reserves denominated in USD, as a result of the USD being the world’s reserve currency and the US running a Current Account Deficit & running a Trade Deficit.

– But these reserves (denominated in USD) are invested in US securities, predominantly US T-bonds. To get their hands on USDs these countries must/are forced to sell those US T-bonds. Just guess what happens when those T-bonds are sold by the truckload. Rising US interest rates any one ?

– Again, the swaplines are meant to save Uncle Sam’s “rear end”.

“To get their hands on USDs these countries must/are forced to sell those US T-bonds”

So the Fed does “foreign REPOs” to keep that supply from hitting the market? Correct?

And how long can that last?

Willy2,

Nonsense. If these foreign central banks have US Treasuries, they don’t have to sell them to the market if they don’t want to. They can do repos in the open repo market that is backed by the Fed. But that’s not the issue here.

The Fed’s swaps take DOMESTIC CURRENCY as collateral — so euros and pesos etc. It allows these central banks to create their domestic currency and convert it into USD — in other words, with the help of the Fed, they have just indirectly created USD for their own use.

So, Wolf, can you isolate what the Fed has swapped with the 2 BoC’s ?

Bank of Canada

Bank of China?

kam,

The Fed doesn’t have a swap line with the People’s Bank of China (btw, it’s PBOC not BOC).

Here are the countries/regions with Fed swap lines: Canada, the UK, Japan, the Eurozone, Switzerland, Australia, Brazil, South Korea, Mexico, Singapore, Sweden, Denmark, Norway, and New Zealand.

Also swap lines swap local currency (Canadian dollars for example) for US dollars. The Fed takes local currency as collateral, and hands out USD, and at the fixed date, the swap is reversed, the Fed gets its USD back, and the Bank of Canada gets is CAD back.

Couple of ”typos” in your reply to Kam above Wolf,,, or so it appears??

Wolf,

This is an interesting, high level argument…worthy of an independent post.

If you are right, it sounds like the swap lines empower foreign central banks to create US dollar inflation (ie, they print, we exchange equivalent dollars…which come from…).

That is politically explosive.

My recollection is that in 2009 one of the things the Fed fought hardest to avoid disclosing (compelling lawsuits) was the actual scale/operation of the intl swap lines.

Of course, such swap lines keep “alive” the USD as worldwide reserve currency.

But if Willy2 is right, forestalling foreign sell offs of US Treasuries is *also* aimed at keeping the USD as worldwide reserve currency.

I wonder if you can’t both be right.

And in either case, the swap lines point to a global level of domestic currency f*ckery-pokery that the Central Banks just don’t want to get into

Any chance you can help me understand why the reverse repos have exploded higher? Almost every action the Fed has taken is in regards to adding liquidity, but at 0% interest the reverse repos are doing $200B+ per day. What’s going on?

Monk,

Too much liquidity floating around out there? If you look at the long-term chart, you see that huge spikes in reverse repos have occurred many times since 2009 as QE was raging. Reverse repos a liability on the Fed’s balance sheet. They effectively do the opposite of repos – they remove liquidity from the market. Much of this is by foreign central banks where they can park their dollar cash at the Fed in exchange for Treasuries.

My understanding is that there are 2 streams to Reverse Repo :

as of Apr 1, 2020

Reverse repurchase agreements 494,427

Foreign official and international accounts 286,599

Others 207,828

The international is NOT part of Domestic Market Operations – Repo and Reverse Repo. ON-RRP is done with an Expanded Set of Counterparties; but most of these funds really come from Federal Home Loan Banks and the MMFs.

The Foreign OFFICIAL accounts are international Central banks that have a deal with the Fed known as the Foreign Repo Pool.

https://www.newyorkfed.org/aboutthefed/fedpoint/fed20

Anyone else notice that secondary credit line in the report?

Zeros…

FRBNY through its SPV has not bought any corporate bonds… just moving its mouth since march 23 convinced the suckers lol

Even primary is zero.

Huh? I see primary credit, in the week ending April 1st column, at $49,578 million, just above secondary credit which is 0, which is above seasonal credit which is 0

https://www.federalreserve.gov/releases/h41/current/

You’re correct. Looked at the wrong line. Bad eyes, need checkup.

Wolf can you clarify in the past these ‘bailouts’ were cheap loans, but I’m hearing more about outright gifts like the $1200 / person, but to corporations that are essential.

Like airlines that were BK a year ago are now essential to COVID.

I have heard Trump Hotels & Resorts could get $100’s of Million’s in outright grants. Also they’re proposing of bringing back the 10 martini lunch as a ‘tax writeoff’ in order to stimulate bar’s.

Something sounds fishy

The government and Fed bailouts for businesses are a mix of cheap/free loans, outright grants, forgivable loans, and most importantly, the Fed’s buying assets, such as bonds, CMBS, outright trash, etc. that prop up their value and keep yields down so that these companies can issue new bonds into that market.

We may never fully know who got what.

Individual taxpayers will get $1,200 as a “gift,” to use your term.

Except no “gifts” for taxpayers making enough money to actually pay taxes. (Or at least be out of the 12% bracket in a meaningful way.)

And apparently small businesses can’t get a loan unless they already had one, since the banks haven’t got workforce to do the due diligence required by FedGov on fresh corporate loans.

Amen. If you think about it, those small businesses that already have a loan represent risks for the banksters. If a lot of those small businesses fail, those loans will be losses that will have to be reported by the banksters’ banks.

Such amazingly short sighted, selfish decisions will mean that our economy will likely go into another great depression. Perhaps, congress is even now drafting some bill that will prevent this. I can hope.

However, if the present trends continue, huge numbers of small, well-run businesses, which represent the majority of tax-paying, US businesses, will go bankrupt. This is particularly the case if we keep having periodic lock downs every few months in this county or that state and then again later and again later — without a national lack down now to allow infected clusters to burn out.

Of course, the over-leveraged businesses that engaged in stock buy backs are toast, unless they wisely purchased a politician or have close ties to the “Federal” Reserve bankster cartel, so they will receive direct or indirect aid.

“We may never fully know who got what.”

Yes since the recently passed CARES act removed the Sunshine Act passed after 2008 that allowed visibility (and FOIA) into the FED actions.

You heard wrong. All members of the administration and congress are precluded from getting any stimulus money.

Including the biggest recipient so far in the last few years since January 2017???

Get over the illusions of adequacy that you apparently are experiencing, this is a full on example of the reaping of we the people by the oligarchy, in spite of any PR work indicating otherwise.

“Clean House, Senate Too” should be the voting mantra of all voters of USA until we get able and honest politicians who keep their vows to represent We the People and not the oligarchy.

“Including the biggest recipient so far in the last few years since January 2017???”

Who are you referring to?

No, JSRG, you heard wrong. The New York Times found an “easy-to-overlook provision” that Republicans snuck onto page 203 of the 880-page economic bill, which naturally benefits the President and his son-in-law.

https://www.nytimes.com/2020/03/26/business/coronavirus-real-estate-investors-stimulus.html

Wolf…

Why are dollar denominated debt instruments, issued by foreign entities, thus creating a dollar shortage, our problem?

Why does the Fed feel a need to cure a currency translation event created by others who put themselves at risk?

Your thoughts please.

Who generated the loans for those foreign firms? American banks. If these folks can’t pay those loans back, who suffers? American banks. Who controls the Federal Reserve? American banks.

It’s “our” problem because “we” don’t want the executives and shareholders of American bank to suffer financially, because “we” feel that they are the people who are actually important in this country.

Kent…

Did they put themselves in this position?

Did they create a risk event that had a return they were seeking?

Are they immune from loss?

Is the Fed, by doing these swaps now having the risk of currency translations placed on them?

Sometimes these people who are geniuses need to take a loss once in a while.

Cause they then use that debt to buy US treasuries, US stawcks and US corporate bonds… you dont see why that could be a when it comes time to deal with margin/colllateral calls of assets that million of other americans own?

NVM let those foreigners hit bids at pennies on the dollar while marking down assets in peoples 401k/on bank balance sheets at the same time lol

Here is the thing: Who owns that dollar-denominated foreign debt? US institutional investors, from hedge funds and pension funds to the EM bond fund in your portfolio.

Those investors are getting bailed out. As with all bailouts, it’s investors that are getting bailed out.

An investor looking at the monthly 401K report isn’t feeling like they were bailed out. ‘ Thanks for the $1000 check but for my portfolio losses I need to add two zeros.

My portfolio keeps going up relative to the dollar. I learned my lesson the last financial crisis. Diversify into Gold & Silver. Just look at the detachment of the spot price to physical…

Think of how many zeros you would otherwise have to add, no?

might have been a lot worse without the FED intervention.

The chase for yield, thanks to interest rate suppression by the FED, sucked a lot of people into a dangerous situation.

It’s there so that U.S. banks can get paid and relend.

Though the REPOs are quiet, isn’t the Discount Window being resurrected?

It seems the activity has been shifted to that facility.

But, the Window is supposed to come with an increased interest rate to act as a penalty fee, 50 bps as described by the official web site.

Also, there is supposed to be transparency, a record of who is using the Window.

Yet, the posted Discount Window rate is .25. (where did the 50 pt penalty go?)

And, the last record of users is 2017.

What gives with the Discount Window?

Historicus, The discount window in a matter of public record and utilizing it would be the financial equivalent of yelling I have coronavirus in a crowded theater. No one will touch you with a 10 ft pole. Basically getting the cure lets the world know you are sick. I suspect this is the prime driver behind all the repo market shenanigans. The fed doesn’t want the market at large to know just how many zombie companies there are because it would immediately cause a bond market implosion. (Bond market is likely to implode regardless)

shizz….

That’s obvious.

But it is not the stated rules of the operation.

Wolf. “It’s a foreign-gambler bailout”

It’s not. It’s not about gambling, it’s about the USD as a reserve currency and a Fed that has no mandate to do anything about it. To characterize this as a bailout is absolutely false. It is more akin to the world being held hostage. The Fed is using swaps to send USD to foreign central banks that have seen their eurodollars evaporate, in return they get local currencies until the swap is reversed. This is about USD shortage and a moronic global reserve system we have in place that puts everybody at a disadvantage and favors US companies who have access to USD cheaply. These companies and governments need access to USD to buy their wheat their spare parts etc, to conduct business and the eurodollar market which the Fed has no control over is not a real liquid market it’s mostly claims to USD rather than USD money proper, hence the shortages every time there is a crisis. This allows US banks also to scalp the rest of the world and put a premium to USD funding which is vital for international business and reserve not because of the quality of “King Dollar” which is shit, but because of it’s status as a reserve currency (not that other currencies are any better). It can be settled in two ways either the US relinquishes it’s status as reserve currency and a new global system is designed swift and all, and everything that comes with being a reserve currency, or the Fed get’s a new mandate and acts as a central bank of a reserve currency and not as a local broker dealer for big banks in the US. The alternative is too horrendous to contemplate.

“….Fed that has no mandate to do anything about it.”

And they shouldn’t. The Fed keeps drawing outside the lines and nobody says a word.

Entities that choose to write debt agreements in dollar denomination do so at their own peril. They create a currency translation risk. They own that risk.

It seems the Fed assuaging the dollar shortage situation is more of a globalization event, a Davos friendship move, rather than a true obligation.

The Fed must be reigned in, held to some limits, IMO.

I absolutely agree with you the Fed is far too significant in the minds of many and especially in their own minds, and have crossed the boundaries of what logic law and finance allow. However the one job that is central to their “central banking” is currency elasticity ( Check out Jeff Snider of Alhambra he has a ton of work on this and the eurodollar), and it is this basic function that they are not fulfilling. Meaning they are doing everything else except their job. So yes the everything else part absolutely should be rained in, but that should not prevent them from doing their job ie providing currency funding where funding is required.

These entities that issue USD bonds do so because it is expensive to get USD funding in any other way. The system is such that an African company has to buy wheat in USD from the Russians regardless of what you and i think of it, it is how global finance is structured around the reserve currency, so they need USD funding. They don’t issue USD bonds because they like USD, but because they need them to conduct business. Yes a world without USD as an international trade currency and some form of crypto reserve currency as Jim Bianco suggests is a better world but for now it is what it is.

Sir.PiratePapirus,

Your logic is off — I’m going to kind of repeat here what I said below because you’re repeating your wrong logic.

Almost every country that the Fed has opened swap lines with has a huge trade surplus with the US. They GET more dollars than they need to trade. They don’t need more USD for trade.

OK, so some African country needs USD. You said… “The system is such that an African company has to buy wheat in USD from the Russians

Guess what, the Fed does NOT have swap lines with any African countries. For your info, here are the countries/regions whose central banks the Fed has swap lines with:

Canada, the UK, Japan, the Eurozone, Switzerland, Australia, Brazil, South Korea, Mexico, Singapore, Sweden, Denmark, Norway, and New Zealand.

The Fed itself said that these swap lines are designed to reduce the stress in the overseas US dollar funding market (USD denominated debt issued by foreign countries and companies).

In addition, as far as trading currencies is concerned, the euro is at near parity with the USD. Europe can buy oil and other commodities in euros just fine. It may be priced in dollars but they can pay with euros.

In addition, the USD is NOT the only reserve currency. Where does this BS come from? The dollar’s share of total reserve currencies is down to 62%. The euro is the second largest reserve currency. Read up on it here:

https://wolfstreet.com/2020/01/02/us-dollar-as-global-reserve-currency-chinese-renminbi/

@ Wolf

“Almost every country that the Fed has opened swap lines with has a huge trade surplus with the US. They GET more dollars than they need to trade. They don’t need more USD for trade.”

Then why would they want to do currency swaps? Is it solely to create more fiat, under cover?

SirPirate

“These entities that issue USD bonds do so because it is expensive to get USD funding in any other way.”

Oh, so as a result of them seeking a cheaper way to do something with more risk, the Fed now has an obligation to save them?

They could have raised money the “expensive” way without the currency risk, but THEY chose not to do so. A market decision.

Additionally, once the bonds are issued, the issuer can begin to hedge himself…the maturity is not a surprise.

Prevailing guideline is that Fed policy helps the incumbent, on the assumption that political continuity begets better economic growth, and that Fed never interfere’s in a election year. In 2008 there was no incumbent. Those in charge of oversight are afraid of doing forbearance. They are afraid of doing the right thing, out of fear of being labeled partisan, by a highly partisan incumbent. These are the fault lines, not financial leverage, or derivatives. The Fed will have enough rope to hang itself, probably. If not now, next time.

This is nuts.

The US dollars coming from these currency swap lines will be used by central banks such as the Banco Central do Brasil to bail out local corporations that have gorged on foreign currency denominated debt.

The European Central Bank and the Bank of Japan have similar emergency swap lines in place as well to provide euro and yen at highly discounted prices (free when all will be said and done) for the same purposes: bailing out foreign companies.

Of course, all these Australian, Brazilian, Mexican etc companies could simply offer a debt restructuring deal to their bondholders. Some may even default altogether. It’s not the end of the world.

But what central banks are trying to do is the first capital sin of strategy: they are defending everything at the same time. This includes asset bubbles outside their own jurisdictions: that’s why Wolf speaks about bailing out “foreign gamblers”.

This also leaves open the very interesting question of what, say, Banco de Mexico is offering the US Federal Reserve in return for the help, or what benefits will the ECB obtain by giving euro to Brazil practically for free.

There’s also another very interesting question: Turkey, possibly the country which gorged the most on foreign currency-denominated debt over the past decade, has been left out of emergency swap lines by the Fed, the ECB and the BoJ. Their last hope is the UAE may open one to provide relatively valuable dirhem in return for increasingly worthless liras.

The Turkish economy was already shaky before this fiasco started, caught between the death throes of an epic real estate bubble and the burst of the automotive bubble worldwide. Now it’s literally imploding.

Let’s hope at least they emerge from the lockdown relatively quick.

“.. they are defending everything at the same time”

It seems the Fed doesnt believe in the discipline of the market place.

The central bankers try to iron out all cycles, cycles that periodically flush excesses. But by preventing cycles, excesses are pent up, flushes become systemic threatening.

As Jim Gran said in an interview to a CNBC interviewer…”Why do they call them “corrections”? What do they correct? They separate the well financed from the poorly financed and over leveraged.”

Which is a health giving event, not a tragedy. The central bankers should realize this. Dont let everybody off the hook, you will foment more bad behavior.

Well, in fairness, they did let hundreds of energy cos BK post 2014.

The bailouts seem to really occur when the congenitally shaky ZIRP based world threatens to take almost *everything* down at once.

Now, if America’s rotted thru industries would only fail sequentially…then we might see some integrity from gvt…

MC01,

You are not cynical enough. There is speculation out there that one of the swap lines is with China. I wouldn’t be a bit surprised.

The ECB has had a direct and effectively unlimited swap line with the People’s Bank of China since 2013 and the Bank of Japan had the same agreement since 2011. This is absolutely normal for countries with huge commercial ties nowadays and I wouldn’t be surprised if a similar swap line existed between the Fed and the PBOC.

This kind of open or “ordinary” swap lines are not an issue since the risk of default is truly minimal, if it exists at all.

The problem is all these “emergency” swap lines since not only the risk of default is very very real, but also because collaterals are accepted at fixed value, and that value was set by the Fed at March 13. To give an example on that day $1 bought MXN21.9. Today $1 buys MXN24.6.

This means the Fed, the ECB, the BoJ and to a much lesser extent the UAE Central Bank will be stuck with huge piles of collaterals that in the real world are worth far less than book value. The true definition of a rotten deal: the only winners here are the foreign companies that get bailed out.

To set the record straight the Fed has set up emergency swap lines with the central banks of the following countries: Australia, Brazil, Denmark, Korea, Mexico, Norway, New Zealand, Singapore and Sweden.

The ECB is usually pretty cavalier about making their swap lines public in normal times already, but it’s known they have set up emergency swap lines with Bulgaria, Denmark and Romania.

So instead of giving our businesses here a fighting chance we are bailing out people from half a world away… let’s hope they’ll buy plenty of BMW’s and iPhone’s out of gratitude if we emerge from this disaster.

I’m not surprised neither. Can you imagine if China decided to sell off that trillion $ of treasuries that they hold.

MC01,

The bailouts of bankrupt economies reminds me of the political scandal, now forgotten, in the Ukraine. We send them loads of aid and it lands up back in the good ole USofA. I expect that money to make its way back to DC, Miami, NY, and whatever the new in place is now. Wall St. guys just can’t help themselves, it’s cultural.

Petunia,

Here are the countries/regions with Fed swap lines, and China is not one of them: Canada, the UK, Japan, the Eurozone, Switzerland, Australia, Brazil, South Korea, Mexico, Singapore, Sweden, Denmark, Norway, and New Zealand.

Also, China has a HUGE trade surplus with the US and globally and gets a lot more dollars than it needs for its imports. It’s awash in dollars as a country. Of the $3 trillion in foreign exchange reserves at the PBOC, over 1/3 is in USD.

Now, a Chinese company that issued dollar bonds five years ago and now they’re maturing, and it needs US to pay them off, but it’s teetering and doesn’t have any cash, USD or otherwise, to pay off the bonds, it has a shortage of USD, just like I have a shortage of USD when I want to buy something I cannot afford. That company is ripe for bankruptcy and shouldn’t get a bailout.

Sir.PiratePapirus,

“These companies and governments need access to USD to buy their wheat their spare parts etc,”

Oh lordy. The Eurozone has a huge trade surplus with the US and thus gets more dollars from exports than it needs for imports. Almost every major country has a trade surplus with the US. They GET more dollars than they need to trade. They don’t need more USD for trade. That is such nonsense. Your whole logic is off.

In addition, as far as trading currencies is concerned, the euro is at near parity with the USD. Europe can buy oil and other commodities in euros just fine. It may be priced in dollars but they can pay with euros.

In addition, the USD is NOT the only reserve currency. Where does this BS come from? The dollar’s share of total reserve currencies is down to 62%. The euro is the second largest reserve currency. Read up on it here:

https://wolfstreet.com/2020/01/02/us-dollar-as-global-reserve-currency-chinese-renminbi/

Wolf

‘To see what is going on beneath the dollar-euro battle, it’s useful to look at the currencies without the dollar and the euro. The chart below shows that the yen’s share, having surged to 5.6%, has pulled away from the other currencies, including the RMB; and that the pound sterling’s share, despite the Brexit turmoil, has held roughly steady.’

Thank you for putting such articles forward.

Allowing for many factors, many beyond my economic or financial acumen, is it possible that middle rank currencies like sterling may become more easy to use than ‘safe haven’ currencies like the USD and murky currencies, like the renminbi?

Most finance professionals I respect declare their is a global shortage of US dollars. The recently discontinued trade weighted dollar index shows this phenomena pretty clearly. Maybe they’re wrong, but the underlying data seems to support that thesis.

I think what the other posters are alluding to is that the rising price of the dollar is stressing the global exchange system. Yes, you can hedge with forwards, but there’s a roll to this process (think buying oil futures in contango). Hence global exchange becomes more expensive over time, regardless of the underlying fundamentals. It seems that without a decline in the dollar, global reflation will never happen.

I’m not an expert, just on observer.

https://fred.stlouisfed.org/series/TWEXB

Denver Dan,

The issue is that they borrowed in a foreign currency (USD) and now they need to pay back the USD but cannot print it…. If a retailer in Mexico issues dollar bonds because the interest rate is lower, and then gets all revenues in pesos, and then the peso drops against the dollar (which it nearly always does … look at a long-term chart), and the retailer is not making any money, and doesn’t have any money, but lives off borrowed money (that’s why they borrowed in USD in the first place), well, then they cannot come up with enough PESOS to exchange for dollars and pay off the dollar debt.

These are leverage companies and governments whose debt is in foreign currency. They need to STOP BORROWING IN FOREIGN CURRENCY.

There is no “dollar shortage.” But these companies cannot come up with enough local currency to convert into dollars to pay off their dollar debt.

Corporate America has the same problem – they can’t pay off their dollar denominated debts either and default. Nothing to do with a “dollar shortage.”

“Most finance professionals I respect declare their is a global shortage of US dollars.”

How much do most “finance professionals” really know. “Half” of the system is based on frauderism.

The world is awash in dollars. It is also awash in debt. Creditors could get burned. That is often the real reason for bailouts.

Good Start SirPP: 1. please keep on keeping on here and other threads on this site, including your best ”boots on the ground” reporting where you are located.

2. Please elucidate the concepts you propose in this post.

Thank you

I agree to pay you in dollars at a future date.

I just created more demand for dollars. I have a risk. I struck this arrangement because it is cheaper for me to do it this way, and I understand the risk, but will accept it because I wish to have the money I would not have if I did it the other way.

Now why must the Fed let this entity off the hook when they get caught?

Goes a long way in explaining why Dow currently is at 21,000 and S&P at 2,500, while during March 2009 Dow was sub 7,000 and S&P was sub 700. The Fed is practicing “social distancing” and staying 6 feet away (and then some) from that prior 2009 downturn.

US markets and economy are just so resilient! Take a bow Jerome, you are the cats pajamas!

The only other question we have is: as the US$$ remains worldwide, then explain why China, Russia, Others have been purchasing gold for years now. We’ve read, they are slowly removing themselves from the US$

We also know Western Banks are doing the same thing, perhaps for other reasons.

Doesn’t it seem feasible that more nations are trying to rid themselves from the $$ because the veracity of the US $$ is becoming questionable?

Yes, it is more than feasible.

In the end, it makes the most sense to hold the currency of the country with the most productive capacity.

That is China. Either now or shortly.

People don’t hold currency for yucks…they hold it to buy goods with utility.

The country with the highest productive capacity presents the largest/widest array of utility goods, therefore creating the highest demand for *its* currency (which it has the power to manipulate…looking at you, USA).

Further, there is a virtuous cycle that goes on…higher domestic+export demand = higher economies of scale = lower marginal costs = more demand.

Rinse and repeat.

With huge domestic demand and huge export demand…China is a fearsome competitor because of its economies of scale/ultra low marginal costs.

Sooner or later, currency demand *has to* follow product origin demand.

When that day arrives for China, America will lose its reserve currency dilution privilege and life in the US will be very, very different.

As a follow up to the one above. The rest of the world is also to blame for this, not just US banks. They have created a toxic environment with 0% rates that is very difficult to get out from. For instance say a Japanese bank needs few hundred million USD by afternoon, they contact JP Morgan, who is willing to swap with them but the problem is that JP Morgan can’t do anything with JPY, they can’t buy JGBs because JGBs are negative so they don’t make money, they can’t buy anything with JPY that is secure enough to make the swap attractive for JP Morgan as well, so the only alternative for JP Morgan is to take more risk by holding JPY, hence the premium on USD funding. The same story with Europe as well. There is a difference though, now that the US has reached the promised land of negative yield now the fun begins in earnest because unlike Japan and EU the USD is a reserve currency, but equally susceptible to the same dynamics as the other two.

“… say a Japanese bank needs few hundred million USD by afternoon,..”

as if they don’t see things like this coming….

I don’t get it…if you have the obligation coming months in advance, don’t you start positioning yourself right away?

The market disciplines the inept…..get out of the way Fed.

Maybe this is a great reason why the BOJ should not support negative rates.

What a tremendous waste of money.

It’s like they want to destroy their credibility.

From all reports this virus will only have a short-term impact. The response is out of all proportion.

I don’t believe that is what all reports indicate, Julian. Even my government admitted today that this will highly likely not be over for a very long time yet, and that social distancing restrictions will almost certainly be maintained through this year, and most likely through most of next year as well. I reckon they will cautiously try to ease up on a few of the restrictions as we go along to see how it works, but I fear we are not going back to business as usual any time soon.

The reports saying “short term impact” are only doing that because they need to gradually lead public opinion in the right direction. If they went with plain unvarnished truth, the mass psychology would trigger dire panics. Reality is we’re going to get through it somehow, most of us anyway, but it’s going to take a long time. It’ll be weeks yet before the daily case growth is small enough to think about sending meaningful numbers of people back to work. But that work won’t look like it used to, it’ll be full of new precautions. I expect it’ll be at least a year before anyone opens up a stadium and fills the stands again. China tried reopening movie theaters and then realized that was a Really Bad Idea ™.

1) US30 SPX futures 15 min.

2) A lot of accumulation between Apr 1st 2.15AM and this morning.

US500 SPX futures 15 min.

Didn’t the FED step into the REPO market because rates jumped when banks would no longer lend overnight to the mortgage lenders who were borrowing short in at the REPO and lending long. Isn’t that why the demand for REPO has vanished that borrow short lend long business model is now dead?

I think the Fed enjoyed the lending to REITs….in the REPO market…for the REITs took this money to pound down long rates by buying long term mortgages…which flattened the curve, which made people think it was predicting a recession, which gave the Fed more reason to cut rates. In fact it was nothing but loose money to speculations, the Fed was accommodating the reckless.

Discount window is the new provider of cheap money at .25 posted rate…with no apparent penalty (as there should be) and no transparency, as there should be.

All this to keep the music playing so credit does not freeze up. Meanwhile we 10 million lost paychecks and that has frozen up.

When this is past us, our leaders will self righteously inform us unformed irrelevant folks that all these bailouts and such were “paid back every cent, in fact we MADE money for the taxpayers!” just like they did in 2008, and the stenographers called the News Media will repeat it constantly as truth…which means we’ll hear it from our friends and be constantly annoyed.

I read the Fed couldn’t do a lot this QE and intervention until it was legalized in response to 2008. That power was never taken back and now is SOP in good times and bad.

Still, a bit hard to believe buying up Mexico’s currency is legal. Not that legal matters anymore except the THEY want it to.

I have an older lawn mower. Can I give it to the Fed as collateral in exchange for dollars which I can use to buy a new lawn mower?

Timbers..

“That power was never taken back …”

And the Fed continues to color outside the lines and they will accrue more power after this is over.

QE in bad times is defensible, but with new highs in the stock market everyday (any one remember?) and record low unemployment….what were they thinking?

The same policy to “save” an economy can not be wise at the other end of the spectrum of conditions.

It seems self-evident, and in economics it’s preached as fact, that everything has a trade-off. What is QE’s trade-off? There is no mainstream consensus. The fed would have one believe it is miraculously without a trade-off.

In 2008/09 I and many others thought it would be inflation. We haven’t really seen that except in assets (owned by the already rich mostly), so again we have mass QE that mostly helps maintain asset prices, but also helps fund the government, which uses some of it to help the poorer wage earners.

I don’t think anyone knows if we’ll see general inflation from this (I say not much). I mean look at commodities! 30 year lows, you’d think life has never been more affordable looking at those charts. Yet, for so many it’s a struggle that just became far worse.

If the fed won’t admit it, and keeps pursuing policies that increase income/wealth inequality. What is the ultimate trade-off going to be besides increasingly hostile socialist/communist attitudes among the lower classes?

Are you reading this stuff fed people? Rich people? Government types? You’re actions are begging for political upheaval that you’re going to get burned by. I’m calling it now, unless the system becomes more fair to all and passifies the frustration, then more young Bernies will start to show up and threaten to take your system away completely. Who knows what that world would actually look like.

Inflation, in general in USA last 5 or more decades hidden behind various and sundry ”tweaks” to definitions and assignments in official BLS statistics and so forth.

Inflation, in fact, an ongoing theft from savers and earners in USA, without any doubt for those of us in those categories.

While the oligarchy, with planning in front, have not been hurt financially or otherwise, so far, they will be going forward unless and until they understand that it is, in fact, in their best interests to stop the continuing ongoing inflation in favor of stable and steady and safe interest on savings, and keeping par with wages…

Anything less is, sooner or later, going to cost the oligarchs as much or more than any savings against inflation that keeping their assets in non dollar denominated assets might accrue.

You answered your own question – the tradeoff for QE is in an adverse wealth distribution. Legal and financial inequality. Leading inexorably to political upheaval.

rhodium said:

“I don’t think anyone knows if we’ll see general inflation from this (I say not much).”

Please stop repeating FED and Government propoganda. There has been huge and continuous inflation for decades. That is why there are so many dollars and so much debt in the system. That is why a candy bar is $1.29, that used to cost 10 cents. That is why it cost tens of thousands of dollars a year to attend college, and why housing and rents are exhorbitant. The little people can no longer afford assets. Let us all keep the “there is no inflation” out of our heads. It is Brainwash!

(And lets not call money printing, QE)

I understood QE1 and QE2. They were emergency measures to prevent the collapse of the economy. History may debate whether there were better choices but at least they seem justifiable at the time.

QE3 confused me. As far as I can tell, it was done to increase the economy rather than save it. Like the desperate inventor: “It’ll work! I just need MORE POWER!” It was desired but not necessary and there was no consideration about what bad practices it might promote.

Brian said:

“I understood QE1 and QE2. They were emergency measures to prevent the collapse of the economy.”

Complete Propoganda. They were measures to bail out bankers and well connected. The measures only seem justifiable to the propogandists, the gullible and those who were bailed out.

These currency swap lines work very similarly to repo, the main differences being the collaterals accepted are foreign currencies (at March 13 exchange rates: $1 bought MXN21.9 back then, now it buys MXN24.6) and that it’s extremely unlikely the Banco de Mexico will be able to return all the US dollars it’s getting under these swap lines, so the Fed will be stuck with billions and billions at MXN they effectively overpaid for. Nobody wins but the mexican companies that get bailed out.

So unless the MXN miraculously reverts course over the next few months the Fed will be losing a ton of money on face value alone: that’s why I suspect if we ever emerge from this thing these swap lines will be quickly and quietly forgotten and those piles of increasingly worthless currencies will simply disappear in the digital vaults used by the Fed, the ECB and the BoJ.

Regarding your old lawn mower: we can accept it as a collateral for our new “Scrap Metal Repo Swap Lines” for up to $500.

The only problem is you need to wheel it to the nearest Fed Primary Dealer to have it appraised and obtain your cheque and since you are stuck home in full lockdown mode you need to obtain a special permit for that. Sadly we cannot hand them out and the government still hasn’t signed the decree authorizing that kind of movement. In fact they may never do… so how about this old fashioned loan instead?

Thanks.

Just thinking out loud…

If the Fed reverted back to 2008 law – meaning it could not do QE – I estimate (perhaps incorrectly) that it could still buy it’s own debt to fund the government, as that part is in the constitution regarding the U.S. currency…something to the affect the U.S. shall not default. So Federal default would never be an issues because it can’t happen with Fed buying it’s debt.

So, if the QE door and these other Fed liquidity programs were shut forever, what remains? I guess that would leave only fiscal stimulus as the remaining option.

Fiscal stimulus would at least have to work through our representative bodies (for good or ill). At face, that sounds better than having a bunch bankers deciding secretly amongst themselves which wealth folk and corporations and investors get the free money.

I’m going to say fiscal stimulus would probably go to lower income folks and those who actually need help, at a higher rate than the Fed doing QE and all it’s other stuff.

It might bring us closer to an FDR-like response from our government.

MC01 says:

“Nobody wins but the mexican companies that get bailed out.”

How about the creditors of the mexican companies that get paid back in US dollars. These swaps are done to bail out banks and favored creditors. The FED wants more dollars in the system and they don’t care if it erodes the value of your savings. These swaps, and Mexican companies to the extent there are any, are just trickle through to bailout the creditors.

Feb 20

“At this point, we are assuming the coronavirus impact will be relatively small, and more importantly, temporary. So whatever drag there is in the first quarter will largely be reversed in the second,” said Jim O’Sullivan, chief U.S. macro strategist at TD Securities

There is a line from The Big Short I came across today (while looking for a different quote):

A thought crossed Ben’s mind: These people believed that the collapse of the subprime mortgage market was unlikely precisely because it would be such a catastrophe. Nothing so terrible could ever actually happen.

Seems applicable to COVID-19, too.

So moral of this story (article) is to buy emerging markets ?

Just checked my T-bills, they’re now paying .06%. I fear negative rates are next, that’s what the President said he wants; I’m cashing out. Thru a glitch possibly of my own making I was only able to start withdrawing half of them. It can take awhile to cash out depending on how long they run.

It was a great idea while they paid decent interest, that time has passed.

Now I’m afraid of that money being eaten up while I’m not looking. Negative rates would wipe out savers.

Cash out indeed. Not long ago they were reducing supply of $100 bills. You practically had to make an appointment for anything greater than $20 bills. That better change. And when you want your cash they have laws to make you feel like a criminal. Like the criminals THEY are.

Use $50’s, not $100’s. Merchants have no prob breaking $50’s. $1k in $50’s fit in a billfold. Call the bankster a day ahead and they’ll usually be able to vend $5k in $50’s next day.

Cask is the last bastion of freedom. Use it liberally.

Starve the banks, use cash…

And stop touching those atm terminals everyone operates with thier booger finger.

Re. ATM touch screens & boogies,

That’s what those blue glove thingies are for ..

Re: Just checked my T-bills, they’re now paying .06%.

Check again. They are almost 0.1% approaching IOER.

Put another way, if banks lend the Fed, at Reverse Repo, at a rate close to 0.00*%, then you are really lending the Treasury at an extremely low rate (close to zero) to keep a Return OF Capital.

I have a hard time understanding why QE belongs in a “stimulus” bill. You get stimulus from spending, not from elevated asset prices.

In fact, QE artificially props up asset prices and old investments, and by keeping existing asset prices high it discourages new investment and new capital formation.

The government is shooting the economy in the foot with more ill-conceived counter-productive measures.

+1000. Abolish QE forever. It’s legalized theft and a diversion from policy proven to work – robust fiscal stimulus.

“Their purpose is to supply dollars to foreign governments and foreign companies that have borrowed in dollars – which they don’t control and cannot inflate away, a huge gamble – so that they can now service their dollar debt and don’t need to default. It’s a foreign-gambler bailout.”

Yes, debtors can/will no longer be allowed to “default” on their debt. We’ve seen the pattern in Greece for years. Nor can wars be allowed to “fail”. They’re now TBTF. Why?

Unfortunately for the banks, corporations, governments and financial markets- If the peons aren’t working and grubbing out a living per the rules of all above, it’s gonna implode from bottom to top.

The 99% have been conditioned to not save, stay in debt and live via week to week paychecks. Of course, the government is going top-down, trickle-down once again for the solution but now, day by day, most people are beginning to hurt. They get behind, they stay behind. The states can’t issue unemployment soon enough and many may never see it.

Maybe savers will finally get thier day in the Sun, after 20 years of profligate debt fueled debauchery that made prudence into a mockery.

It was always the only safe path to be a saver and to have enough cash stashed to live out a 6 month downturn. I guess it was different this time.

My bitter consolation is at least I am not dependent on the government to pay my bills. As much as I will be and have been penalized for being a saver, I’d rather not be in a debt fueled lifestyle with a three paycheck margin of error.

I’d like to see 80% of the trillions in bailouts go straight to the people.

otishertz said:

“I’d like to see 80% of the trillions in bailouts go straight to the people.”