This type of sudden, previously unimaginable fall-off-the-cliff data about the lockdown-economy is gut-wrenching.

By Wolf Richter for WOLF STREET:

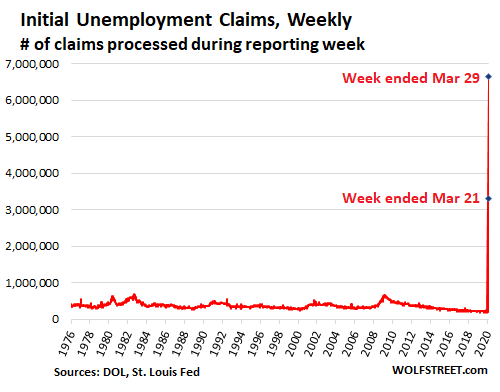

Today, we got another dose of preliminary fall-off-the-cliff data about the lockdown economy: 6.648 million people filed initial unemployment claims in the week ended March 28, seasonally adjusted, about ten times the prior record set in 1982, according to the US Department of Labor this morning. This is on top of the upwardly revised 3.307 million that had filed during the week before. Combined, this makes for nearly 10 million unemployment claims processed in two weeks:

State unemployment offices are inundated by the tsunami of claims, and there are reports that they’re behind in processing them and that what we’re seeing now is only the portion that they were able to process. And these are only the people that qualify to file for unemployment at this point. So, as unreal as it looks, it’s just a foretaste. This is a close-up for the period since September last year:

States indicated in their comments that the breadth of the industries at the epicenter of the unemployment crisis has widened, with sharply rising claims now including:

- Accommodation

- Food services

- Health care (areas not related to treating COVID-19 patients)

- Social assistance

- Manufacturing

- Construction

- Retail

- Wholesale

The biggest states with the largest number of jobs are also the ones with the highest number of unemployment claims. And the states that kicked off their lockdowns early are now showing proportionally higher claims than states that just went into lockdown. The table below shows initial unemployment claims for the 10 states with the most claims, for the past two weeks combined (not seasonally adjusted):

| Top 10 States, Past 2 Weeks of Initial Claims | ||

| 1 | California | 1,065,060 |

| 2 | Pennsylvania | 783,331 |

| 3 | Ohio | 468,438 |

| 4 | New York | 446,402 |

| 5 | Michigan | 439,092 |

| 6 | Texas | 431,023 |

| 7 | Massachusetts | 329,514 |

| 8 | New Jersey | 321,330 |

| 9 | Washington | 317,410 |

| 10 | Florida | 301,313 |

But the lockdowns are still expanding. Florida has just joined the list of at least 34 states with some type of statewide stay-at-home orders, covering around 225 million people, over two-thirds of the US.

And these are the initial claims of Unemployment Insurance (UI). A week after they filed, and if they’re still unemployed, their claims are added to “insured unemployment.” Today’s claims that fall into this category will be added next week to the total “insured unemployment.”

Those who filed their initial claims through the week ended March 21 and are now considered the “insured unemployed” soared to 3.029 million. By next week, the level of insured unemployment, which will then include today’s initial claims of those who are still unemployed, will get painfully close to 10 million people.

With the stimulus package that was signed into law this week, the rules as to who can qualify for unemployment insurance have changed, and restrictions have been eased, and many more people will qualify going forward, including part-timers, free-lancers, and gig workers that have lost income (such as rideshare drivers with no one to drive around). But this expansion of Unemployment Insurance is mired down at the implementation level by the states. Once implemented, unemployment claims will spike further.

How that will work out and who exactly among those workers will be able to receive unemployment insurance remains to be seen. This is a large group of people. In the US economy, gig work has become a broad labor model that even big companies such as Uber and Lyft use as their foundation.

But there is more to it. The self-employed, the free-lancers and entrepreneurs also include well-paid tech workers, engineers, architects, and other professionals who work on a contract basis on various projects. When these projects get cut or put on hold, their work and pay dries up.

It also includes many others, such as comedians and musicians whose gigs were cancelled. It includes actors and singers and artists. It includes Airbnb hosts with no guests.

There are many millions of people in the US who suddenly have seen their income streams dry up. Going forward, some of them will qualify under the new unemployment insurance rules to receive unemployment benefits. But others won’t.

“Nobody has any taste for risk anymore. All of those exotic loan programs have ceased. All investors buying that paper are gone”: mortgage broker. Read… Week Two: How COVID-19 Lockdowns Impact US Housing Market. Mortgages Give Clues: It Gets Uglier

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()

This is an absolute human disaster unfolding in front of us. We are looking at the next Great Depression and yet the stock market is priced like our economy is back at mid 2017.

The stock market has no connection to the economy as long as Jerome can print trillions and buy everything in sight. Eventually the Fed will own the entire thing.

From the latest Fed minutes,

“All your (monetary) base are belong to us”

https://www.bing.com/videos/search?q=meme+all+your+base+are+belong+to+us&view=detail&mid=1A8EC9490586DC1A94C81A8EC9490586DC1A94C8&FORM=VIRE

Printing for his buds in high-FIRE, as well as other CORPSErates, recourse-free … with moldy crumbs tossed aside, for our vaunted Snake of a Treasury $ec. to ‘distribute’ amoungst the dirty plebs … !

This will not end well …. at all .. especially if said ‘relief’ is either insufficient, and/or takes tooooo long to set in motion to keep people even partially whole !

The more greedy the players are, the better the casino functions, especially when the players star getting unlimited house money!

start

Actually no . This is the moment when capital is overthrown by labour . What use a hedge fund manager against a shelf stacker . This is the off with their heads moment .

Your lips to god’s ear!

Silliness.

Without the executives, engineers, designers and other white collar labor to design, fund, coordinate and develop supply chains for products, the shelf stacker will have nothing to put on the shelf.

He will be worse off, since killing the boss, engineers, and other executives means there’s nobody to kick things off when the crisis is over. He will be perpetually without shelves to stack.

Canadian,

IMHO John Hope was addressing capitalists and not engineers, other executives, etc. Capital is proportionately owned by the .1% and 1%. I don’t know many engineers or executives except those in the corner office and immediate surrounding office suites that are part of the plutocratic elites.

Lumping all “white collar labor” in together seems misguided at best… that is not what people mean by capital.

Jeez, a breath of common sense..

Thanks for spanking these envy based schadenfrueders.

Losers love it when winners lose.

Most “capital” is owned by you and me in our retirements, pensions and savings.

I have yet to meet the “burn down market capitalists” sort who is willing to see his own pension, savings, and retirement accounts vaporized by angry rioters.

It’s a tedious game of “not me, someone else.”

You will see a lot more “burn down market capitalists” sorts when their pensions, savings, and retirement accounts are vaporized by economic collapse.

Those sorts are often surprised when they themselves are the first targeted.

“But I marched with you! I donated to you!”

It is the *system* that is rotten. Would you blame the rats for feasting on a rotten carcass/system? You are right. Things need to change. If a pandemic does not do it then one disaster after another will come until change happens. Finally people will be forced to look outside of the illusionous “economic model box” they have been trapped in for so long.

“that is not what people mean by capital.”

The problem is that, as excessively socialized systems break down due to gaming of every sort, the definition of “capital” – as “rich” has been – will be continually defined downward in a doomed effort to save the malfunctioning socialist systems.

Even the limited socialized programs of the US have required ZIRP (which, btw, hits *every* level of capital) to stay alive.

Without ZIRP, DC would have *had to* deal with the now intrinsically dysfunctional US gvt/economy 20+ yrs ago.

If the US gvt could not print money at will (defrauding every earner and saver), it would have had to confront its huge problems over decades…instead of a middle of a pandemic.

Especially the “system” where a committee of central planners decide the price of credit. Whatever else you can call it, it’s not capitalism.

Our committee decided several years ago to create a “wealth effect” by lowering interest rates and driving up asset prices. The owners of most of assets are by definition the wealthy. So it made the rich richer, reverse Robin Hood style.

Even if you accept this was necessary to rescue the economy from the financial crisis, our committee kept the game going for years after the crisis was over.

Now ironically “capitalism” and capitalists gets the blame for our problems.

In my country, Mike, within the first two weeks of our shutdown, new unemployment claims piled up to 10% of the entire work force. We’re seeing an epic rise in unemployment, it’s a global phenomenon, and I suspect we’re still some way from the end of this.

In terms of stock markets it sort of looks like a freebie for anyone with a bit of patience to gradually sink in some more bets against these equity markets, as we have clear data confirming a historically unprecedented decline in economic activity, and yet markets remain incredibly sticky.

The “markets” such as they are .. are as sticky as a Coro na virus protein shell game, and just as deadly !

You have to look at it on a stock-by-stock basis. Some stocks are down 80%. Others are down 10% or not down at all. It’s useless to think about the overall market.

Bobber, I’m not trying to address individual stocks. Personally I’ve just started buying into some ETFs that bet against equity indices as a whole.

But if I were an active shorter, then I guess I would be sorely tempted to now bet against things like e.g. Google and Facebook as their earnings and warnings come out, which are stocks hugely owned by almost everyone who owns stocks, and I imagine such companies will likely see huge drops in their ad income.

Ummm….no. I hope you’re a troll, because if not your just an idjit.

You’re. Who’s the idjit now. ?

The ocean also pulls away from the beach before a tsunami. That does not mean that the tsunami is not coming. The stock market is an index of the expectations for the future of people with limited information and little imagination: the price to earnings ratios of too many companies show that they have unrealistic, fantastical expectation of those companies future earnings growth.

I believe that our corrupt government will bail out the banksters (as the Fed bank cartel has been doing for many weeks), the ultra rich (for whom the $500 billion slush fund administered by the treasury of the $2.2 trillion bail out was intended), and try to bail out all other supporters that they can bail out. Otherwise, the contributions may dry up and there may be a change of government in November.

However, the effects will be different for the ultra rich versus for the middle and lower classes. The ultra rich will see that inflation is the ultimate result of the Fed’s QE to infinity tactics to secretly bail out its dear banksters. They will ultimately sell stocks and non-essential hard assets, because not every company/sector can be bailed out and those can be sold and bought later at much lower prices.

The middle and lower classes will face escalating inflation in months but probably not in 2020 or even 2021. Right now, foreign investors still are too scared by the coronavirus to evaluate whether the US dollar can remain a global reserve currency while the Fed bankster cartel prints US legal tender with abandon to transfer to its little banksters.

Eventually, when things settle down, there will be a huge over-supply of dollars. The countries and foreign companies with US dollar debts are currently in the process of going bankrupt or defaulting, because the US dollar’s value increased so much, so rapidly when investors panicked and bought dollars.

When those are gone, the volatility of the US dollar (which is how sky high) will make more countries and foreign companies want to have debts or transactions in other currency or use some other marker of value owed/traded, such as the IMF basket of currencies. When demand for the US dollar fades, all US goods will dramatically increase in price.

Since Americans have now also realized the dangers of having most of their essential goods and most of the parts for their armed forces produced by foreign countries, there will be more supply chains based in US allies, Mexico, or even automated, US factories. All of these things will make consumer goods increase in price dramatically in the coming years. Thank god that we produce vast quantities of food and can produce most other essential goods.

Matt, when we’re faced with a new virus that we have very little knowledge about or natural immunity against we should be very humble indeed. Our eternal problem as humans is our horrible arrogance.

Even should it in hindsight, after we tally up the data some time into the future, turn out less dramatic than many forecasts have indicated (although developments seem to indicate quite clearly that the effects on even advanced health systems are awful when the disease is allowed to spread without control measures), then, instead of just ploughing on like nothing happened, we should be grateful for the warning shot we got, and stop being so damned unprepared for any faint breeze flowing past our house of cards, and instead start building up solid reserves against both health and financial shocks.

Fat chance that will happen, though… That would require that we readjust our outlook on what wealth really is. Far more likely that we’ll just go back to sucking both our financial and natural balance sheets dry in the name of increased consumption, and having no systemic slack to deal with either future financial promises or any non financial shocks that occur.

Matt, do realize that COVID is already 3rd leading cause of death in the US and barely getting out of the starting blocks.

It’s the leading cause of death in Italy, Spain and France this week.

And if you don’t shut it down, it kills 5x as many by overwhelming the medical care system.

And then people will stay home and kill the economy out anyway, because no one wants to live in that world.

So the cheapest and fastest way through the disaster is to shut the virus down. Then get the economy back up in a smart way that doesn’t give the virus a chance to run wild again.

Keep people safe and well fed, and we’ll be ok for a good while. The economy wasn’t that great anyway. Some would argue, after having been robbed blind by the system in 2008-2010, that it’s long since time the lawyers and accountants finally received their long-overdue nightmares for the crap system they created and inflicted on the rest of us.

Just curious, does anyone here know anyone who knows anyone who has died from this virus?

If you mean today’s record rally in oil leading to a modest stock rally this was all based on Trump’s announcement that he had brokered a deal with Russia and Saudi to cut production. Both deny any such deal. (remember the ‘deal’ with NK’s Kim?)

Saudi had already snubbed Russia’s attempt restart the original talks where Russia refused to share a production cut with Saudi. Then Russia discovered just how much pain Saudi was willing to inflict and suddenly wanted to talk after all.

No dice. Saudi has chartered every available VLCC at 70 K per day. These guys aren’t fooling around. They are especially not giving into the highest cost producers: US shale.

With the Russians basically not getting their calls returned by Saudi, it’s laughable to think this was some master plan of Putin’s, but even more laughable to think that a Trump phone call is going to call a truce in the price war, just as shale is capitulating.

Now oil will give up its bear market rally after a very obvious head fake.

Russia has always been open to talks. The Saudis, not. It is the Saudis who are in a position of weakness. Russia has vast surpluses and outlast the Saudis by decades.

I expect your analysis is further to the truth if what you wrote is reversed.

I think we are just seeing at this point the pull back wave before the tsunami. The extent of defaults on private debt is sure going to hit hard (CMBSes, CDOs, etc) will make the 2008 look like a small radar artifact regarding what is actually coming. A large portion of the western world has been living on high leverage and this era is coming to an end with a bang and a whimper. All that can be expected now is a square root shape recovery , even with money printing and helicopter money that might end the reserve currency status of the USD .

Now the real question is how deep the leverage go ? I would surmise the REIT fiasco we are starting to see is just the pull back , to be followed in quick order by commercial lending to tourist destinations and hotels that carry a pretty decent level of debt too , quickly followed by the AirBnB superhost that set themselves up for a costly refinance on multiple properties and last of all subprime mortgages that have been creeping back since 2012 to be repackaged into “AAA” which now all credit rating agencies are treating as radioactive in all forms , shape and sizes .

Even with the relief package to individual house’s mortgage those loans for their major part are extended to ad-hoc LLCs that the bank will have no issues recalling the loans from (since they are cov-lite).

As Jeremy Irons stated in Margin Call “They pay me for knowing how fast the music plays and for how long , unfortunately gentlemen ,The music stopped!”. And that is when the chaos truly sets in and the fireselling starts.

The money printing was useful to keep kicking the can down the road. In the present situation , we ran out of road. The printing while creating inflationary pressure will not help any form of recovery as consumption will grind to a halt, revenue growth from labor at this point is past the assisted respiration stage even though it was the bedrock of the last expansion of the 1960’s. We are nnow in a very different situation.

iindie, that’s a pretty complete description of the current state of affairs.

Maybe this new “very different situation” will bring Americans together rather than driven apart by the political tribalists.

We are just seeing the first level of layoff’s at this point. Very soon we will start seeing layoffs in the sectors that depend on service and retail such as property management, restaurant supply companies, clothing and sportswear brands, and then the software, accounting and legal firms that are suppliers to all those firms. Its a good time to be a high voltage lineman, a millwright in a toilet paper factory or a sewage treatment plant operator.

Yes, this will get ugly. It’s after all the Everything Bubble bursting. It started a year ago with Germany and South Korea slowing, then things breaking ever more frequently in the financial superstructure, then the last months discretionary spending on eg marketing budgets drying up.

The virus crap is for the hoi polloi to keep their simple minds occupied and away from the criminal central bankers as the cause of their misery. In Northern Europe it’s at worst a mild flu wave, in Spain and Italy in line with a bad flu season and exposing once again their desolate health systems.

I keep coming here for reasoned and balanced reporting and commentary as this disaster unfolds. Thanks Wolves for your great work!

yep….. the next wave will start soon. i know some friends who work at an engineering firm. projects in the pipeline have dropped 90 percent. some hours have been cut back but next will be layoffs. i am talking 35 projects to less than 5.

Leser: care to explain why in Italy the areas with the best healthcare systems are the worst affected while those with the worst healthcare systems are the least affected? Or why mortality in the South (truly bad hospitals) among the infected is well under 1%, in line with Northern Europe, while in North (truly good hospitals) is over 10%, or four time as high as China? Nobody understands this.

As new cases have started to seriously slow down in most of Italy (apart from the city of Milan) the “simple minds” have started to shift from fear to what I can only call anger. Anger at a government that seems far more concerned with extending the lockdown indefinetely for purely political reasons than providing relief to those who have seen their livelihood destroyed and anger at the complete lack of “new normal” and “restart” plans, anger at being mocked with “recovery timelines” that won’t happen because everybody knows in November we’ll still be locked up at home, regardless of the epidemic.

If people are allowed to get back to work, gradually and with precautions, this anger will be turned into productive endeavors, such as sending these aspiring tinpot dictators back home, but if not… that’s what I am truly afraid of.

MCO1,

First, thank you for your ‘boots on the ground’ reporting from Italy and your recent article. I appreciate both as part of extensive daily reading of local news from all over the globe. (going on for past 10 years)

IMO, the answer to the question of delta of results, so far, in various regions of Italy is the same as is happening in USA, so far, and that is mostly age and condition of people being so different.

Italy has reported 95% of deaths are folks over 60 AND 90% had bad health issues (FKA problems) before this virus came along to finish them quickly.

That is kinda sorta my situation at age 75 also: before the virus I had been waiting to see if it was the heart issue that did my dad, the cancer that did my mom, the arthritis that did one grandma, etc., etc….

Having said that, I am as healthy as I can manage, exercising, doing the breathing exercises, eating really well, etc…

I am convinced this biz of pre-existing health problems will come out in every case of every age sooner or later.

Be of good cheer old boy,,, this too shall pass.

MC01: these are good questions, I offer my answers:

Why the North? The badly affected Po area around Milan has three negatives going for it: (1 – presumed) quick parallel spread of the virus from travelling Chinese workers who produce most of the luxury fashion goods in factories in the area (a little known dirty secret), a (2) very old population (one of the highest-average regions in Europe), and (3) decades of very bad air pollution that have damaged lungs all around since childhood, even if from the 1990s onwards things started to improve slightly, though now 30 years later the air is still polluted (traffic, industry and frequent weather inversions).

10% death rate in the North? That’s an overestimate during the acute phase, the Chinese reported similar numbers initially. Now, after having tested more people and getting a handle on the actual number of infections (the large majority of which developed mild or no symptoms and never went to hospital), the Chinese estimate a death rate of around or even below the common influenza, i.e. 0.1-0.2%. The situation in Italy will probably turn out similar.

The South? I know first hand from a GP in a large Southern Italian city that there are few cases and the hospitals can easily cope.

Who dies? Looking at Corona deaths, it kills primarily (a) old people (avg. dead in Italy 81 years), with one or several severe chronical diseases (only a small minority without such), and people with damaged lungs (Milan area, Iran damaged lungs of older men from Iraq war poison gas, Hubei air pollution).

What is a “Corona death”? In Italy and Germany (and likely elsewhere too), it is explicitly all “test-positive” deaths, meaning deceased persons who happen to test positive for Corona upon death, regardless of whether it was the cause of death. On only 12% of Italian Corona death certificates, Corona is even mentioned as a “co-factor”.

The hospitals in the North are better than in the South yes, but were still criticised in a 2015 European Centre for Disease Control report for hygiene problems (=multi-resistant germs). Same as Spain btw. If the heart-lung machines (“ventilators”) are contaminated, getting connected to those as an old person weakened by other diseases and/or damaged lungs is bad news.

After the EU was embarrassed by refusing any help to its Italian brethren while China, Russia, Cuba, Venezuela send help, Germany took in a handful of patients from Italy to Dresden. It was dressed up as (belated) humanitarian action, in reality the German doctors wanted to see Covid victims (not that many to study at home) and learn how to treat them. These severely ill patients develop much better than their left behind compatriots – testament of different treatment conditions.

The Premier in Ontario, Canada allows not paying rent if you need food and has closed the housing ministry section from any evictions.

Same in BC, Joe. Plus, there is a Provincial subsidy for $500 which will ultimately go to the landlords.

Airbnb hosts getting a bailout after distorting the housing market doesn’t sit well with me. It was “free market” all while Denver house prices went through the roof. Let them be entitled to the same foodstamps that the rest of us are.

Yea, but you can’t just bail out part of the Ponzi scheme.

Why not? They did it last time.

Whoever gets the bailouts owns everyone else until the next crisis.

This is probably more about keeping the banks’ mortgage loans afloat than rescuing individuals.

TownNorth, I agree with you regarding, “This is probably more about keeping the banks’ mortgage loans afloat than rescuing individuals.”.

Airbnb hatred seems rather silly to me. Airbnb is not a significant driver of shortages.

Housing prices are distorted much worse by the NIMBY homeowners who also rail against Airbnb. They’re the ones who block development of much needed new housing with restrictive zoning laws to artificially drive up housing values.

There are plenty of developers ready to build affordable high density housing in even the most expensive markets like NYC and San Francisco, but both burghs have sided with NIMBYs and banned affordable housing construction. The same is true of many affluent smaller cities and towns.

That won’t be working so well moving forward; the value of their homes will have collapsed by the time this is all said and done, and they’ll be demanding a bailout of their own when the house or condo is $200K or more underwater.

Yes, but I wager those developers wouldn’t build the “affordable high density housing” in their own neighborhoods. Everybody is a NIMBY, even developers.

I think the concept of high density housing with social distancing rules seems counter-intuitive in tomorrow’s world. A “great decentralization” and ‘self reliance” is what I reckon.

Cesqy,

This is going to be a very hard question going forward.

From a pure cost perspective (which is going to matter like never before) housing density = affordability (shared household infrastructure like pipes, wiring conduits, walls, etc).

But C19 has probably put an end to NYC level density for a long time.

Hopefully somewhere between the NYC 30 story warren of studio broom closets and the LA mcMansion, rationality can be found.

Thinking about it, even shifting from the std two floor garden apt layout to a three story one nationwide, would nearly hike our apt/condo supply by 50 pct – tens of millions of lower cost housing units.

In a big empty country like the USA and Canada, there is no reason why a prefabricated 2BR home on a half acre of land should cost more than $40K, other than NIMBYs and horrific tax policies.

The USA alone could support a billion or more residents with such an approach and still not even feel that crowded.

Canadian,

I absolutely agree (although you have to be of hardy pioneer stock to handle the cold of a lot of Canada and even parts of the US).

I think the main problem is not land scarcity (as you point out, North America still has tons of empty land) but job location – the CEOs of established companies rather live (and site locate, especially for HQs) in the absolutely most expensive metros in the US.

The cost-of-living is irrelevant at their pay grade, and they are even pretty indifferent to the problems it causes their companies (ie, inflated office space costs, somewhat inflated employee salaries) – those are just two line items of many on the expense side.

And if you can’t convince hidebound CEOs to consider even a second tier metro with 33% cost-of-living savings…try getting them to pioneer rural land (hell, even exurb counties) with little existent infrastructure or housing.

They could do it, and they would save their companies a sh*t ton of money after 5 to 10 years of buildout but…it is all too much…work.

People less tied to their jobs (remote workers, freelancers, retirees) could definitely follow your advice…at least out at the edge of existing exurban County infrastructure (truly off grid adds a lot of additional costs and work).

Unfortunately, a lot of shortsighted counties have almost punitive infrastructure hookup and “impact” fees (sometimes to such an absurd extent it is almost like the costly metros are paying them off to make their exurbs unattractive…)

And the “pioneer”/off grid housing marketplace is still pretty nascent – meaning that a lot of wasteful relearning perpetually goes on – there isn’t enough consulting expertise available.

I’m one of those 10 million. On March 22nd I was put out of business by an executive order issued by my state government. No provisions were made to give employers any path forward so it is pointless for me to apply for any PPP loan money at this time. The dates that I can resume business continue to change. We are mired in uncertainty. The last thing I am going to do is take on more debt at this point.

As I am a business owner, I now have the honor of having continuing expenses but no means to pay. So I, as well as my whole staff are unemployed. Never in my life did I think the government would be the cause of my business failure.

@Beans, it wasn’t the government, it was the virus, and those microbes have been wrecking businesses since before there were businesses. We’re just out of touch with nature, having had a good run of ~100 years without this class of pandemic.

You could have stayed in business an extra few weeks without the shutdown – but then you would have watched half your staff get sick, lost a few in panic-stricken overwhelmed hospitals that could no longer care for any medical situation at all, and watched all your customers skedaddle out of fully justified fear. Toss in the panic-driven riots and looting like New Orleans after Katrina.

Better to do the shutdown in an orderly way, making it a community war effort against the virus, than to tough it out.

“an orderly way”

Even completely leaving aside purely medical issues (which people could argue were hopelessly intractable…) the CDC/the G has really, really failed at having in place (in advance) a detailed plan for staged, segmented quarantines at the zip, city, county, and state levels.

(I know the Govs make the final call in our system…put it is the rare Gov that would go against an official CDC recommendation for limited quarantines based on evidence)

The absence of even leaks slamming Trump (who is continually leaked against) strongly argues that the CDC never even had organized quarantine plans, procedures, processes.

Ever.

The CDC (DC standing for f*cking Disease *Control*) might never know in advance the medical specifics of a pandemic.

But their whole existence is predicated upon the fact that epidemcs/pandemics *occur.*

And therefore specific quarantine plans could be developed in advance.

But apparently in its long history (of what had been thought of as a “good” gvt organization doing its claimed job well) the CDC never got around to a detailed plan of national quarantine planning/staging.

Thanks, WS. Is good to read the words of someone reasonable, other than ones who do nothing but rant. No solutions, no legitimate alternatives, just ranting. “Drown it in a bathtub.” Isn’t that simple enough?

My head hurts. Where does all that money for unemployment checks come from? Can this system EVER become bankrupt? I suppose not….not until some version of what used to be the “bond vigilante” comes into play.

$240billion was allocated fir the extra $600 a week.

let’s say there are 10 million unemployed

$600×10,000,000 = $6 billion a week x 4 =$ 24 billlion a month

let’s say there are 20 million unemployed

$600×20,000,000 = $12 billion a week x 4 = 48 billion a month.

$240 billion divided by 48 billion = 5 months

hopefully that is long enough. $240 billion is only 1/8th if the 2 trillion stimulus. they could extend that. the fed used to spend 30 billion a month or 360 billion a year during QE.

1) The trip to the peak : from 667 in 2009 plus 2726 to 3393 in 2020.

2) Apr SPX monthly fooled Mar 2020 large selling tail, gap sharply

lower, on top of the monthly cloud, inside. Chikou in the back between T&K, below price, above the back of cloud.

3) The monthly cloud is green, but the front end is a narrow bottleneck,

above the current price.

4) SPX might be infected by a Wuhan chronic unemployment.

5) If SPX cannot close the gap, “I am falling and I cannot getup”.

6) SPX weekly is losing the battle of Feb 2018(L). It used to be support and became resistance, leaving behind x3 selling tails. The last x3 weeks effort

to move above, so far, is a thud.

7) SPX behavior surprise wall street traditional model makers. They go nuts.

8) If SPX will osc symmetrically above/below the monthly cloud, SPX

will land on top of 2000 & 2007 highs, at around 1,600 – 1,700, where chikou get support from the bottom of the cloud and SPX monthly is still positive. In the middle of Lazer #1 and bounce back up.

9) The trip up to 2020 peak = 2,726. // A potential correction to 1,650 =

[3,400 – 1,650] : 2,726 = 1,750 : 2,726 = 64%.

10) SPX can grudgingly exceed 3,800 – 3,900.

Is that a stream of consciousness or a 10 part voodoo spell? Hard to decipher if you have a point. Why not use paragraphs?

That was funny

I enjoy his posts on technicals. One of my favorite comments here was when a reader asked what language it was, and Wolf replied “Engel-ish.”

A style like channeling Michael Burry, perhaps?

I enjoy his posts as well even if a bit hard to follow. Some of the stuff he covers runs parallel to some macro analysis regarding 3500-4000 as a generational peak possibility for S&P, as unlikely as it may seem at the moment to be able to get there. Deflationary bust soon seems likely, followed by a commodities led inflationary recovery over the next few years?

otishertz,

I’ve resisted the impulse to say this for weeks. It’s like reading a list of negative universe Haiku.

Just google Chikou Spans. Yes, his communication skills suck, but if you understand the jargon that he uses, it can be deciphered.

I sense a Mentat in our midst.

Otishertz, love your comment rotfl !!

still rotfl…. haha

Terrible terrible stats and situation.

Wolf, perhaps you can answer this? Why are Air B&B Hosts considered workers? I thought Air BB were RE speculators, the neighbours no one wants. Plus, they have undercut hotels that actually employ people. We have a few around here and they have destroyed rental availabilty, and have also driven up the overall price of rentals by taking them off the market. Plus, they skim the cream off from hotels and motels, etc.

Confession, I have never stayed in a B&B in my life and don’t plan to.

regards

Hi Paulo, I don’t really think all of them are speculators. I used AirBnB several times last year and one of them was almost the best experience ever. The townhouse we rented in Helsinki was definitely their primary residence, and the lady who rented it did really her best to make our stay as comfortable as possible. I don’t know the exact reasons why they rented it, but I myself would never rent my own residence to strangers in this way – leaving all the family pictures, kids’ toys, other stuff as is. I was even feeling awkward when we got in.

I stayed at many Air B&B’s, namely because my girlfriend has three dogs and they tend to not have a problem with that. Personally, I like hotels, much higher quality, and important for me, quality beds, which is one area where Air B&B’s tend to cut corners. I have dealt with stair cases too narrow for a person to walk up is a standard way, you have to twist, dank carpets, out in the middle of no where, etc. In fairness, I have stayed in some very nice and themed ones (tried to repeat one in Spokane), but I think their main value is they can undercut hotels but cutting corners everywhere and avoid taxation and govt regs (I am positive some do not have basic building permits). In some of my trips, yeah that is good enough, as I just need a place to toss my hat and such. Big bene for the young.

I would agree they are not speculators, but people seeking an alternative stream of income, like smaller scale farmers and such. You know, I had a point but lost my chain of thought during this rant. :)

Not speculators? How about the guy in Nashville with 24 SFHs or the woman in Santa Fe that has approx. 20 Airbnb rentals featured in a CNBC article last week? There are most definitely speculators gobbling up homes that would be available for rent or purchase by other families. Maybe it’s not all of them but in desirable areas there are quite a number of secondary homes being used as vacation rentals. If you start looking at condos it gets insane the number that are purely vacation rentals in desirable spots.

Air BnBoomer rentals are lame. I never want to stay in some old bat’s backyard or basement on vacation.

Ha ha, “…some old bat…”. I think an old battle ax may be worse.

Since the USG can conjure up all the currency needed I’m wondering why the f**k we shouldn’t just stop paying income tax. I smell electronic “money” coming – as long ya takes yer vaccines!

Paulo,

“Why are Air B&B Hosts considered workers?”

I don’t think they’re considered “workers.” But they work, and if they have enough properties listed on Airbnb, it’s a full-time job. They’re entrepreneurs in the hospitality sector and they’re self-employed. And they lost their income stream.

I own single family rental properties, but ZERO AirBnB’s i.e. I am your standard everyday landlord. 95% of America thinks my kind are shameless money mongering CEOs, so when legislative edicts go out stating people do not have to pay rent….it follows this misguided reasoning of the masses, but AirBnB owners get bailout $$$ ???

Most every homeowner with a mortgage is a RE speculator.

They are a powerful force in opposition to construction of affordable housing. In almost every NIMBY situation, you can count on crowds of longterm residents opposing construction of new housing saying “think what it will do to your home value.”

They got an affordable house when they were young, but God forbid someone in the same situation today be able to purchase something affordable — it would blow up their scheme to get rich through holding on to a house in an era of artificially constrained supply!

And yet, in the Bay Area at least, they complain about all the shifty, dirty homeless living on the streets and don’t want to pay for the public restrooms, or have any housing or restrooms built nearby, but then complain about the excrement on the sidewalk.

There seems to be a slight disconnect in many people’s thinking. People have to live somewhere. Working full time on even $15 or $18 per hour will often not cover living expenses even if you can find a place.

You are correct. They ban affordable housing and then complain about “all the homeless.”

“But I’m virtuous on Twitter,” they cry!

Paulo,

Banks, hedge funds, retail investors and business owners are speculators!

On second thought, banks aren’t because they own the politicians so they have invested while minimizing their risk.

Dick

A well run B&B can be a wonderful place to stay in. We’ve had some great experiences along the California coast.

AirBnB is not quite the same.

It is interesting that Pennsylvania has nearly as many layoff as California and was one of the last states to issue a stay at home order.

Thoughts? What sector are those layoff from?

We’ll get better data on this when the state employment data comes out for March and April. This will show jobs by category. And you can see which category lost the most jobs.

I lived in NE PA years ago, it is basically a tourist area year round, skiing in winter, country vacations, summer camps for kids, outlet shopping. Now I understand they have gambling as well. Philly area has gambling, tourism, shopping, and real business sector as well. I would guess the hospitality and retail sector is taking a big hit.

I forgot out in the central and western parts they have oil and/or gas, that could account for job loses.

Could be that PA just has a less-clogged claims pipeline than the others…

All,

This is all from South Eastern PA (Philly area suburbs)

This is week 2 of everything but essential services shutdown in my area. A quick recap.

Friday March 13:

Bucks county closed 5 schools in the district.

Monday March 16:

Montgomery county closed all schools/colleges

Bucks county closed all the schools/colleges.

Stay at home guidelines from the Governor were issued.

WFH unless absolutely essential started for local businesses.

The Court at King of Prussia (major shopping mall) closed.

All other surrounding school districts close the week of March 16.

Colleges across the state started closing down that week as well.

Monday March 23

All, non-essential business shutdowns began in Bucks, Montgomery, and Chester county. And I think Philly shut everything down that week as well.

Grocery stores, local markets, pharmacies, gas stations, and local farm/feed supply stores are all that is open.

Monday March 30

I went to a local grocery store. Plenty of fruit and produce, enough canned goods, meat counters were decently stocked. Not a bottle of cough syrup, Tylenol or Advil (or any generic equivalent) left on the shelves. No bottled water, still no paper products (now there’s signage up that limits the number of TP Packs that can be purchased LOL!) And no cleaning products with disinfectant to be found anywhere. I went for fruit and veg, the rest was just for curiosity.

My original return to the office date was April 13. It is now May 3. That date may change again depending on how PA does in the next 2 weeks. Keep your fingers crossed that we all do well everywhere.

On the upside: The flower gardens are looking great already. Carrots, Peas, Beets and Radishes are going in this weekend. =:-D

Philadelphia is a pretty politically corrupt city (if you look at ntl election stats Phil tends to be absolutely crucial to a certain political party…so a *lot* of graft flows there).

If the huge PA unemployment jump is centered in Phil…it might disproportionately be coming from real layoffs to phony baloney, political “ghost” jobs.

Cas127,

Loved your comment. And let’s not forget all those dead Republicans who suddenly start voting for the other party in every election. Maybe they are applying for unemployment comp as well.

/s

PA has a relatively simple online and phone system to use to file for unemployment claims. The online part of the state government is relatively efficient, and requires little human intervention. Other parts *cough*Penndot*cough* of the state government are less so.

This could mean that PA is getting most claims processed earlier than other states so that a higher proportion of claims are showing up in the statistics in early April rather than mid-April. I have no knowledge of the efficiency of the other 49 states to compare and contrast with PA.

PA has quite a few colleges, and they are all shut down and active only online. Nobody expects them to reopen until fall, as it will be almost the end of the spring semester by the end of April. Staff there that do any work that requires the students to be on campus (cooks, bus drivers, most library staff, most lab technicians, etc.) are out of a job.

I also think that people are watching what has happened both overseas and next door in the state of New York and are expecting that this thing will last at least a month and that things will get worse before they get better. Hence, it makes sense to apply for benefits, as few people expect that all will become blue skies and sunshine by Easter.

you’ve heard it before and now again….

“The Fed can remain solvent longer than YOU can!”

Sad but true.

The Fed can conjure currency out of thin air and that currency is literally an IOUnothing so the Fed will never be insolvent, but it can and will damage or wholly destroy the currency’s value. Once the financial system has been severely distorted central banks ultimately have two choices; deflationary collapse or inflationary collapse.

Until Comet Plebian makes its impact !

.. A rather rare event I grant you, but still …..

On a positive note, even those living on Social Security will shortly be able to afford a maid.

Given that all these unemployed are getting full pay for 4 months, plus a bonus $1200 check, I’ll wait to set my hair on fire until those 4 months have passed. And then one two things will have happened. Either the stay at home directives are over and everyone is back to work or the 4 months is extended another 4 months.

To be honest, I kinda want to be “laid off” myself and take a nice 4 month paid vacay, courtesy of Uncle Sam.

Who gets full pay from unemployment insurance I’ve never partaken personally but I was always under the impression that it was only a fraction of your salary while employed Where am I wrong here

It varies state by state and it’s usually 50-60% of pay. But part of the $2T stimulus package was money to make up the shortfall for up to 4 months. There is some income cap, but for middle class workers, they will get 100% of pay.

In the southern states, it’s a raise.

Yea, Lindsey Graham was crying about that, but didn’t have any problem with hedge funds getting taken care of to the tune of billions.

The last time I had to file for UE, a few years ago, I got the max payout (in California): $1,800/mo IIRC (from losing a $100K+/yr job). Hardly a ‘paid vacay,’ but enough to cover a mortgage and most of my utility bills. It was quite stressful until I got gainfully re-employed, and you had to jump through lots of hoops and prove you were actively looking for work to continue to get it.

Again, the $2T stimulus package is making up the difference. For someone making $100K+ it won’t fully cover it. For someone making $60K a year, it will. And it also varies state by state as each state has its own formula for how much UE gets and what the maximum is.

So, you’re saying–repeatedly–that UE will pay your entire salary (up to $60K/yr). Is that Washington state-specific? I’ve not heard that mentioned in CA and, like I mentioned the max a few years ago was $1,800/mo (though that could have gone up since).

Please link to the article(s) that claim(s) “part of the $2T stimulus package was money to make up the shortfall for up to 4 months”

Come on man, this is like the first hit when you google the stuff. It’s not hard. $600/week on top of UE benefits, for everyone regardless of state. An extra $2600/mo for one and all. And yes it’s $2600 not $2400, more than 4 weeks in a month.

https://www.cnn.com/2020/03/25/politics/senate-stimulus-unemployment-benefits-coronavirus/index.html

In Mississippi it’s $235 max a week. In Louisiana it’s $247 max a week. In Florida it’s $275 max a week.

For blue collar workers unemployment in the south is not great. You have to have a very high income to get the max. What they get doesn’t pay for groceries.

Is this what you’re referring to:

https://www.huffpost.com/entry/paycheck-protection-program_n_5e86364ec5b6d302366cd8e6

If so, it’s $380B, not $2T, and only covers 8 weeks.

Cali Bob,

No. That is something different. Why is this so hard? $600/week from the stimulus bill for the unemployed on top of their state UE payments. Jezuz man come on.

https://www.nytimes.com/article/coronavirus-stimulus-package-questions-answers.html

https://www.wsj.com/articles/unemployment-benefits-what-to-know-about-the-coronavirus-bill-11585256520

re: “Come on man, this is like the first hit when you google the stuff. It’s not hard. $600/week on top of UE benefits, for everyone regardless of state. An extra $2600/mo for one and all. And yes it’s $2600 not $2400, more than 4 weeks in a month.”

$2,600/mo + $1,800/mo from UE (max in California last time I got it; I was making over $120K/year, many won’t get nearly that much) = $4,400/mo, not the $5K you were claiming (for $60K/year salary). But you were close, I’ll give you that.

No one knows how long the economy will be in an induced coma, but I suspect many will be unemployed beyond 4 months, perhaps indefinitely. If anybody is using this time-limited ‘benefit’ for a ‘vacay,’ instead of paying off bills and saving what they can they won’t have my sympathy.

I second that with regard to “paid vacation”, but are you sure the pay is full? In WA I think it’s no more than $3K / month

OK I’ll say it only one more time and then I’m done….the $2T stimulus package makes up the difference. So in WA the max would go to $5500/mo give or take.

And then on top of this, everyone is getting mortgage forbearance of at least 3 months. Ford is delaying payments for up to 6 months. And on and on.

It’s not 1931 where people are out on the street starving after losing their jobs.

Lots of these people will get $600 a month, or something similar. So that’s not a lot of money to go on vacation with plus pay for all the expenses of your home while you’re gone.

As a ”gig” worker since Jan2017, this time, all of a sudden I became eligible for UE for the first time, ever; but only the federal supplement; my understanding is that people will get their state’s usual amount, plus $600 per week.

Please LMK if this is correct, as I have been planning to expand my wine futures considerably.

Thank you.

You are correct VVN. With the caveat that $600/week is only for 4 months. At least initially. When is the last time a govt welfare program wasn’t expanded?

So $2600/mo from the feds, another $2-3K a month from the state. $60-70K a year for sitting around doing nothing. America, what a country!!

I’m not sure why this is a big surprise to so many here. It was widely publicized in the run-up to the passage of the stimulus bill. But I guess the $1200 checks is all everyone remembers from it?

Since I’ve been avoiding news for the last couple of days I’m still trying to figure all this out. I’m a self-employed contractor, occasional musician who gets a 1099 from both. Like VintageVNvet, I have never once collected unemployment. I’m, shall we say, well into my 50’s (one more year and then I’m “high risk” – egads!).

Thankfully I’m one of those weirdo frugal savers with zero debt as well as a lowly renter. I highly doubt my slum, er…I mean…land-lord cares about my ability to pay rent as my yearly rent increase goes into effect on May 1. Dutifully sent in my check for April 1st as I don’t live “hand-to-mouth” due to my lifelong saver instincts. My employment income has been cut in half so far, will possibly dwindle to nothing over the next few weeks/months and with decreasing interest rates, I cannot count on any significant interest income from my savings.

I have no clue if I’m eligible for more than $1,200.

Guess I’ll come here for updated information.

Like VintageVNvet, my future likely does include wine!

The six hundred a week is on top of their regular unemployment insurance payment.

Thank you Marc. Finally someone gets it!! LOL

Plus a one time $1200 check to those making less than 75k a year. If this continues past May 15th everyone gets another $1200 check. Where I am at in NM, this is a significant raise for most folks. Almost double the salary for staying home and doing nothing. I make a salary of 60k, and my take home weekly is less.

What would more likely happen is you get laid off for the 4 months, and then don’t get called back, at all.

Thank you for the great articles. Intuition tells us that the markets are being propped up by the FED. But how exactly? 6.6 million new jobless, and then the markets rally. My sense is that they are keeping it above 20k for psychological reasons. A detailed expose about how this works would be very useful in the coming days.

The financial market has been turned into a monetary junkie, it perks up short term with a new dose but that won’t change the ultimate resolution of profound market distortions extant. The avoid hangovers stay drunk strategy will end in predictable fashion; the only question being deflationary collapse or inflationary collapse. Given that all world currencies are fiat inflationary collapse is likely a safe bet.

Scorecard as of today:

Not-QE or QE4 total: $ 349.044 billion ended 13-Mar-20

QE4++ or QE5 total: $ 901.846 billion as of 2-Apr-20

CMBs: $ 350 billion as of 19-Mar-20 to 2-Apr-20

That’s a $1.6 trillion balance sheet explosion (albeit CMBs go to Treasury TGA).

*SOMA addon rollovers not yet added to these amounts

MBS purchases NOT ADDED to the above.

If anecdotal reports turn out to be true, some states’ UE application capacity can’t meet demand (websites crashing, phone lines permanently jammed, etc.). It’s very possible the current numbers understate the current UE reality.

On the flip side, I spoke to a local economic development director who said H-2A workers are not being allowed across the border. We’re in planting season. If it’s not planted now, it’s not planted for the season.

So we’re headed into a crazy world where UE approaches 30% and farmers can’t plant for lack of labor … and food banks are already cleaned out.

We’re smack in the middle of a Minsky Moment. Our leaders are dazed and confused. They handed out the usual bailouts to the usual well-represented lobbyist clients, then washed their hands of it (literally and metaphorically) and went home.

If big hitters like you Wolf and Jeff Gundlach are closing their shorts, where the heck does that leave us? Sit on the sidelines in cash and wait for it all to blow up?

I think for April that probably makes sense as we look set to re test the lows we hit a few weeks back. Interesting that we haven’t heard much from Warren Buffett because unless he’s made a purchase already he’s probably just sitting there with his elephant gun waiting to make a big buy.

What do you guys think ?

You already know what I think but I’m sure you disagree GOLD

At this moment GOLD and SPX are probably correlated.

Are you referring to digital or physical? Because 1oz of Au still weighs 1oz regardless.

Second that. Physical PM’s are the way to go in this erratic environment, it’s all about preserving purchasing power – no speculation for profit, but straightforward basic insurance. I’ll wager a lot of older Germans still have physical gold in their possession, they haven’t forgotten what happened in their Weimar Republic in 1921-1923.

That and paid off RE. Keep your debt levels as low as possible and try to secure a steady income stream (duh). If this stock market follows the logic of that other great depression,there’s a 90% depreciation in the cards, top to bottom, spread over the coming years. Sure, you can try to time rebounds and make money, but you’re as likely to catch falling knives and IMHO the only long time trend is downwards now. If the stock market is your bread and butter, better start thinking about an alternative trade. The financial environment has become extremely toxic these past 30, 40 years, this disaster was a long time in the making. Fiat? I even don’t trust that concept anymore. In short, I think all bets are off unless we find a cure or a vaccine for this virus within weeks or months.

They managed to kick the can down the road in 2008. I don’t think they will be capable of doing the same thing this time around in the absence of a swift medical solution. Things are simply too overwhelming now.

Just my two cents.

Nobody is going to trade their toilet paper for your gold. Good luck trying to get the dealer who sold it to you to buy it back.

Other than that, the era of financialization is dead. Cash in your chips and go home.

Petunia,

“Nobody is going to trade their toilet paper for your gold. Good luck trying to get the dealer who sold it to you to buy it back.”

You are so correct.

HD,

You mentioned the inflation in the Weimar Republic 1921-23.

Let me give you a story from a family that lived through that period. My friend’s grandfather and his family were very wealthy back then. They ate their food off sterling silver plates, they had servants and a butler. As they saw what was coming to they sold all their possessions, their gold, silver, paintings on the wall and they bought warehouses full of sugar. As long as you keep the sugar dry, it doesn’t go bad. Then, they bartered with the sugar to get their other needs and maintained their wealth.

I have other similar stories as well.

The elephant gun is now a whale gun. As per SEC filings, Berkshire Hathaway issued senior notes in Europe (February) and Japan (March), essentially securing 0% financing to gobble up some companies in the near future.

It depends on the strength of your stomach. My stomach is pretty weak. So essentially cash until I see something I can live with. Yes, I will miss some opportunities, but I want to sleep well and be rested in case the corona jumps on me.

Thanks Wolf and all

I agree with all of the comments TBH. There’s probably a case for a balance between cash, gold and precious metals. The problem with real estate as I see it is there’s far more likely to be deals in future if you see this thing getting worse . I wonder with commercial property especially like warehouses and industrial buildings because businesses that occupy or own them may go bankrupt

That being said Wolf ditto to your comments. I mean not to be alarmist but I have literally just started feeling unwell this morning (here in U.K.). Wish me luck !

David H,

I wish you luck. All the best. I hope it’s nothing serious, and that you’ll get out of it quickly.

I think sp finds supports at this level maybe does a slog crawl up a bit higher. Then tech will lead it lower. Tech has not yet had its reckoning. The fed can’t stop it. I have read from respected sources that in May when markets set a new low in around the fed meeting. The fed may go whole japan and will buy etfs

Didn’t buffet get into airlines after the first big dip in Feb? He’s probably regretting that because he definitely was in the camp of ‘this will blow over soon’. I certainly think he’s singing a different tune now but it’s too late for that transaction.

Brent is at $30 after Trump got Putin and the Saudis to play ball and the realization that the light at the end of the Corona tunnels is closer than people thought. Really good news about a potential vaccine from researchers at the University of Pittsburgh. Not that you’ll hear about it from CNN of course. They have an interest to keep everyone scared and panicking.

I think a lot of you here will be disappointed at how quickly all this goes away and we get back to normal. V shaped recovery is looking more and more likely.

Just Some Random Guy,

I just heard today that there are 18 (!) companies with vaccine projects, and some projects are moving at the speed of light, but even then, under the best circumstances, there won’t be a vaccine that is deemed safe and effective and ready for mass-use until sometime next year, at the earliest. But yes, a huge amount of energy is going into this, and some of the brightest people are on it.

In terms of your last sentence: “we get back to normal.” That train “back to normal” has left the station. And there won’t be another one. However, there will be some trains to some kind of “new normal,” and it’ll be a lot different… some of it for the better, hopefully.

Mayo Clinic and the U of MN (and many other fine schools and labs I’m sure) are working on getting an antibody test to determine if a person has already been infected and “are no longer threats to get or spread the infection.”

“Antibodies are proteins produced by the immune system in response to infections and can be found through tests of blood serum – the clear liquid that separates out when blood clots. In the case of SARS-CoV-2, the virus causing the current pandemic, antibodies don’t show up in sufficient quantities for 8 to 11 days.”

That would, at least on an individual level, get us partly back to normal.

Yes, there will be two parallel “new normals” (really three):

1) Those who pass the antibody test “you had it and you’re free again”.

2) Those who haven’t had it yet and have to continue to avoid getting it.

3) Those who are dead.

The spring-break “COVIDIOTS”, if they get mild cases and come out of it without after-effects, might be the most fortunate – they will be able to get back to work without risks.

Of course, if the virus mutates into a fresh form that isn’t covered by prior immunity, all bets are off.

You’re might need a new antibody next year.

All I ask, is that trestles hold .. as we make our departure in relative safely from a decrepit and broken $tatusquoville .. to a more ‘organic’, and equitable* New Normal.

*as in laws that hold EVERYONE accountable, not just the 80%ers

re: “… Trump got Putin and the Saudis to play ball …”

Please let Putin and MBS know:

https://oilprice.com/Energy/Energy-General/Russia-Oil-Producing-Countries-Not-Discussing-Any-New-Deal.html

Some jobless folks are doing very well.

Via Bloomberg:

Whiting Petroleum Corp.’s board approved $14.6 million in cash bonuses for top executives days before the shale oil producer filed for bankruptcy.

Chief Executive Officer Brad Holly will collect $6.4 million of the total, which will be “paid immediately,” the company said in a filing Wednesday. Four other executives including Chief Financial Officer Correne Loeffler will get the rest.

Reminds me of the WeWork ceo who walked away from that dumpster fire a billionaire Neumann I think his name is I can hear Jerry Seinfeld calling him out

The latest word is SoftBank is trying to stiff Newmann:

“WeWork Founder Loses ‘Billionaire’ Status, Threatens Lawsuit As SoftBank Pulls $3BN Investor Bailout”

It’s on ZeroHedge, but I don’t think Wolf allows links.

It’s a Shark vs a Stingray..

not sure which is which here.

But I’m glad it’s investor money they’re getting and not taxpayer money. I have no pity for investors in Whiting Petroleum.

Except it’s not just investor money the execs stole. Think of all the vendors, creditors, even small businesses who will line up in bankruptcy court for their share of what’s left. There would have been millions more available for them as well. I’m waiting on a refund from a small boat cruise company. While they stonewall me with excuses, their parent company just issued a special dividend three days ago to their investors.

True, but their investors stock value will be completely wiped out.

Fraudulent Conveyance?

Shiloh has it right…if insiders really made a wrongful distribution to themselves within the last yr or two before BK, the BK Court can claw it back.

But what a lot of people here are complaining about are not legally “wrongful” distributions.

Wolf would argue that they were/are reckless.

But in most cases, recklessness is not illegal.

The real “crime” comes in the political ratification of that recklessness via bailouts or ZIRP.

Without the political step, reckless CEOs would have to bear the full wt of their recklessness

Is that Loeffler related to the stock-selling senator on the Senate Health Committee?

Time for some thick necked folks to pay these executives a visit.

So we’ve just established that State Unemployment Insurance can only process about 3.3 million claims per week. One can only wonder how many weeks (or months) of backlog remain.

Hold on…I just got that 10 million unemployment claims were added since last week. My mistake. Much, much worse. And with an almost certain backlog remaining.

They processed 3.3 million claims in the week ending March 21; and they processed 6.6 million claims in the week ended March 28. In other words, they processed about 10 million claims in two weeks.

Submission from the unemployed is online. Then there are automated processes to move the application along. Verification of employment is automated as well, since all the data is available for querying. Very little human input is needed to process the claims. And once an app is approved payments are via electronic funds.

The only real human interaction needed is if something’s missing from the application or fraud is detected, etc and someone has to manually investigate. In those cases there will be a slowdown since it’s impossible to process 10X the number of transactions with the same number of people in the same time span.

But for the straight forward applications, scaling up is easy.

Thanks Wolf. A little slow today.

Guge, huge, numbers of unemployed.

There will be similar trends in other countries, to varying degrees.

A lot has been made of how foolish people have been that have stockpiled food and other stores, but….

Who wants to be out on the streets with bags of groceries when the desperate and starving start hunting around, those haven’t made their way through the system and received social security payments?

I remember reading several opinion articles at the end of 2018 when the market took a dive. Most of those opinions called for a much further sell off in market indexes. Then, for whatever the excuse, the market indexes then turned around and went to a new all-time high.

My belief (borrowed from others), it is not about fundamentals (unemployment claims, financial losses, etc.) but rather about money flows. I am educated enough to know that unemployed people don’t contribute to 401Ks which becomes a market inflow. However a good portion of the trillions being printed or borrowed, needs to find a home and so the gamblers place it in the stock market.

I’m not amazed about the resilience of the stock market but I am amazed that many Madoff type ponzi schemes haven’t been exposed yet.

S –

The money flow from corporations buying back their own shares is gone.

The money from from newly-unemployed people tapping their 401K to tide themselves over is just beginning.

The credit that the Fed unleashed, even if $4T, is to transfuse the bond market, whose chain-of-payments machinery has suffered a gaping wound with millions of monthly payments being suspended indefinitely.

WS,

Well done – looking at the simple, gross money flows at the macro level really simplifies economic dynamics a lot.

1) Public companies won’t have profits to prop up the “relentless bid” for overvalued shares…stock prices drop.

2) Retail investors scared sh*tless/need to draw down narrow savings…stock prices drop.

3) Heavily indebted US economy is an endless, interconnected web of debt obligations easily vulnerable to cascade failures at the best of times…debt/bond/loans prices drop where they don’t default…maybe the bailouts mitigate the domino effect.

It’s like trying to restore a tattered and desiccated Dai$y chain. You can’t.

Gotta wait for new seeds to sprout. Could be a bit of a wait. Some seeds take a while to germinate.

PA is doing great.

You sure ’bout that?

https://www.health.pa.gov/topics/disease/coronavirus/Pages/Coronavirus.aspx

It’s almost like all of labor fled to a remote mountain town and the capitalist CEOs are panicking.

Who is Joe Galt?

Atl- US shrugged

Personally, I pray to Zeus that for once, Sysiphus steps aside .. so that big rock roll on down, letting gravity knock those CEOs down to size !

Difficult to get numbers but it appears about 90% of the deaths are over 60. The people being thrown out of work will predominantly be below that. Are we inflicting more pain with a total lockdown on working age people than the virus causes? Elderly people mostly do not work so are easily isolated. Is there not a more targeted way we could handle this so we don’t destroy the economy at the same time? Strict distancing for younger people but work allowed, unnecessary gatherings banned – sports, museums etc, strict isolation and support for over 60s? If an over 60 is still working they are given a gov supported free pass. Dunno, but what we are doing cannot last till we get a vaccine which is the only sure way out of this.

As a 75 year old who worked up to last year, I totally agree with you.

Absolutely absurd IMO to lock down the entire USA when isolation of targeted population, me for one, can and should be relatively easy.

USA is certainly capable of disseminating thermometers to test every employee in the morning and immediately if showing any symptoms at every workplace.

I have been out once in the last 2.5 weeks, twice in the last 5, to get food and adult beverages, and would be pleased to continue to do that with mask if it would help a gazillion folks keep working.

And yes, I do the detox protocols when arriving home that Wisdom Seeker posted in another thread on this great site of Wolf’s,, not for the first time in my life due to handling asbestos years ago.

BTW, Italy has reported 95% of deaths there so far were over 60, 90% with serious medical conditions previous to this virus. There were similar reports on web weeks ago, but they disappeared quickly for some reason.

The trouble with the thermometers approach is that it misses something like half of the infected. Many people never get a fever, but can still spread. Others are contagious before they later get a fever.

If you’re in a county with over 50-100 cases (per million residents), you pretty much have to assume that everyone out there is potentially infected and unaware of it, including yourself. And behave accordingly. It’s a bit like Schroedinger’s cat…

If asymptomatic spread is real, then a huge percentage of people could have caught C19 months/years ago and never had a clue.

And the low pct of C19 fatalities – in addition to becoming even lower due to the army of asymptomatic – may have been occurring for months/yrs but the cause of death was labelled as something else (since no C19 testing was going on).

Widespread asymptomatic spread seems like very weird behavior for a highly dangerous disease as commonly understood.

Dangerous enough to kill many, but not dangerous enough even to trigger mild immune system response in very, very large numbers?

Hmm.

That asymptomatic claim seems to really point to the role of pre-existing serious conditions (diabetes and heart disease have been highlighted repeatedly) and/or some sort of rare-ish genetic vulnerability in the affected young.

Agree with your summary Cas, and please keep on keeping on here augmenting Wolf’s great fact based articles with your perceptions and humour.

And to report: Just back from grocery and adult bev buying in tpa bay area, and only shortage was my fave vodka, European sourced from same rye fields since 14th century. I suspect I will have to do without that for a while.

Otherwise, every thing needed in stock,, grocery busy, liquor store empty of customers, but i was early to be sure. (And as an aside, I read Deccan that alcoholics have suicided when India stopped all sales, so that NOT a good idea.)

At some point society will open again and the costs will be unwound. Next time (if there is one in living memory) people will be very quick to isolate this as quickly as possible and immediately block international travel and snuff out individual cases rigorously. No advanced society can sacrifice a hundred thousand people even if the majority are older than 70. Lots of the 3rd world will make that trade though.

VintageVNvet, you sold me. If we lockup all the over 60 crowd and quarantine them starting in Washington DC, that would remove people responsible for far greater deaths both past and future than the virus will in a hundred years.

+1

+2

+1000

In a functioning , non-hollowed out and ransacked society/economy, then maybe your theory holds water. There are millions of 60+ that are still working. There are also millions of multi-generational households because of the insane inflation of asset prices (RE) and burdensome debt loads carried by many younger workers. So, no, your idea of isolating older people is not feasible and pretty delusional.

Sooner or later the G will be forced into something like this – ultimately, if nothing else, the food supply chain will require it for at least a segment of the population. And there are other economic activities that may look more and more essential as time goes on.

@Ian – You’re on the right track to describing the restart approach. So long as the virus is out there and there’s no vaccine, every economic activity comes with some level of infection/mortality risk. The recovered cases can get back to normal. The infirm elderly need to be protected as much as possible. Everyone else is in between.

Policymakers will have to decide how much risk they can afford in the local economy, to avoid slamming hospitals and triggering New York or Milan-level body counts. It will be trial-and-error. Some activities will be prioritized over others. How any rules will be enforced is also an issue.

As an over 60 retired individual, I’m playing the long game. I’m hiding out as requested by society, all the while hoping our under-prepared medical system gets up to speed before I become afflicted as I expect all of us will be. I believe society’s reaction thus far is greatly influenced by the 1%’ers or even 10%’ers acknowledgement that they are most at risk. Meanwhile, massive damage and disruption is being visited on the younger generations who may need years to recover. A time might come when the recovered would be expected to step up and look after the yet -to-be afflicted 1%ers, if they are so inclined. That might create a whole new paradigm.

I’m fairly convinced that our government’s handling of this virus, is not only incompetent but also with malicious intent. To best deal with this pandemic for the long haul we need to test test test and isolate the sick. and everyone in public wear a mask. Period. Anyone healthy who wants to work can keep working and whoever wants to isolate can isolate. If the government really cared they would send $1000 monthly check to every citizen so no one would starve. And who cares if the wealthier folks get some pocket change. They are likely to pay it all back in taxes net year.

I gambled on closing SPX Mar/ Apr gap.

With few options :

1) SPX 10 / 30 / 60/ 240 in TR to the resistance, or above to sign of strength.

2) To LPSY, a move much higher, but below Feb peak, to market makers dumping zone

3) On the way > 3,393 to a new all time high.

4) If wrong, max 5% loss, clear position.

Amazon fired the man who led a strike over protective gear for Covid. AOC stood up to Cuomo, who now pleads endlessly, while nurses and doctors are dying. Old school Democrats wanted to hand out huge subsidies for low paying jobs. Fast forward to those same people in Washington, trying to elbow their way into the WH, and overthrow a guy who promised to bring those jobs back. The challengers tossing trillions to the banks in exchange for a couple of unemployment paychecks. None dare blush.

The giveaway package to the big guys was voted in 96-0 in the Senate and only 1 dissenter in the House. That’s all I need to know.

It’s not bothsidersism to understand that working people have no representation in Washington. Nobody in power is on their side. We have one party rule. All the grandstanding and impeachment bills and pointing fingers is just kabuki theater to make people think that the Corporate Identitarians are somehow better for you than the Corporate Libertarians. Sure, they argue mightily over the decorum and pronouns. But when it really counts they have no problem mustering unanimous votes for their deep pocket donors.

Yes, and we had a couple generations who willingly voted for this. They are reaping what they sowed. As long as their home prices went up and their taxes stayed low.

Well said, MF.

MF

Thank you for saying that.

When will the governments worldwide raise the VAT and any other taxes in order to pay for their lockdown? And how much will be the hick?

Contrary to hyperbole, this isn’t the next Great Depression.